GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

PREPARED BY:

CREDIT REFORM SUBCOMMITEE AND

GENERAL LEDGER AND ADVISORY BRANCH

FISCAL ACCOUNTING OPERATIONS

BUREAU OF THE FISCAL SERVICE

U.S. DEPARTMENT OF THE TREASURY

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 2 of 153 August 2017

Overview

This guide is designed for those who:

Formulate and execute Federal credit program budgets, including accounting for assets, liabilities, net position, income, and

expenses, and budgetary resources;

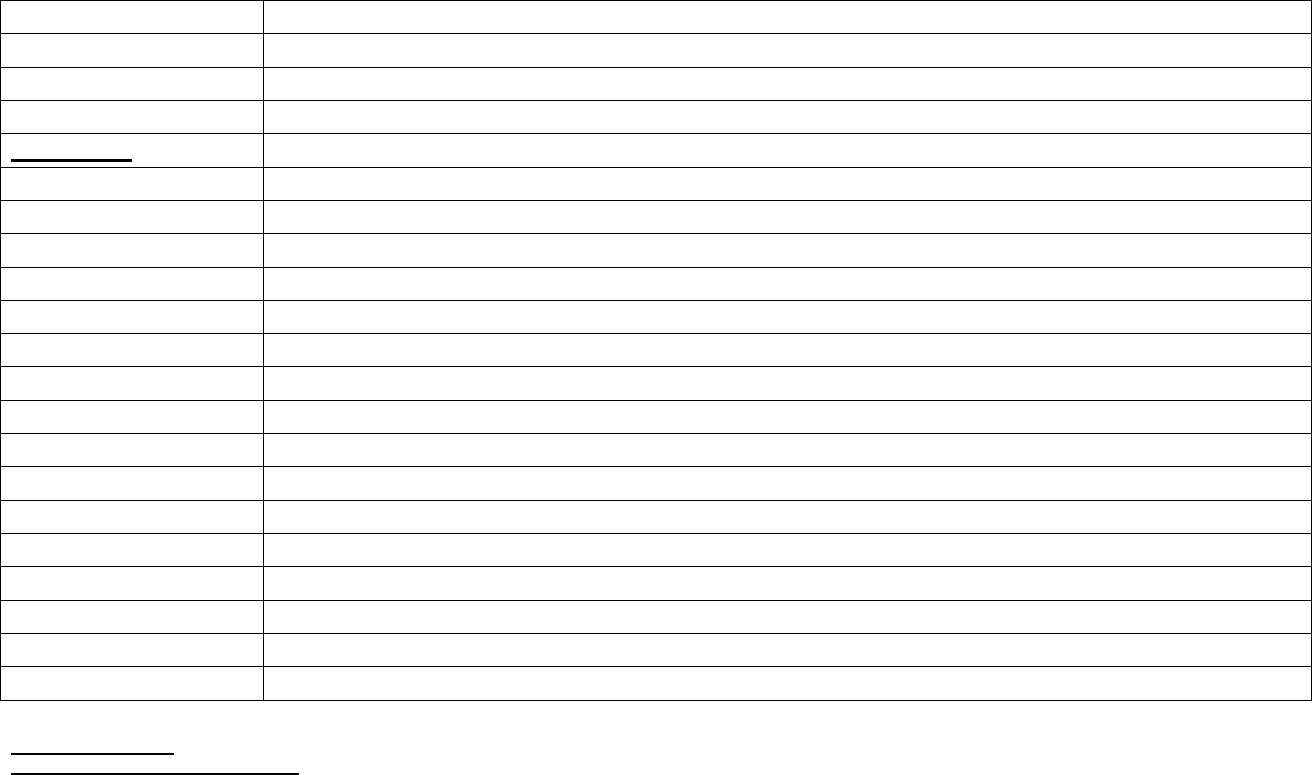

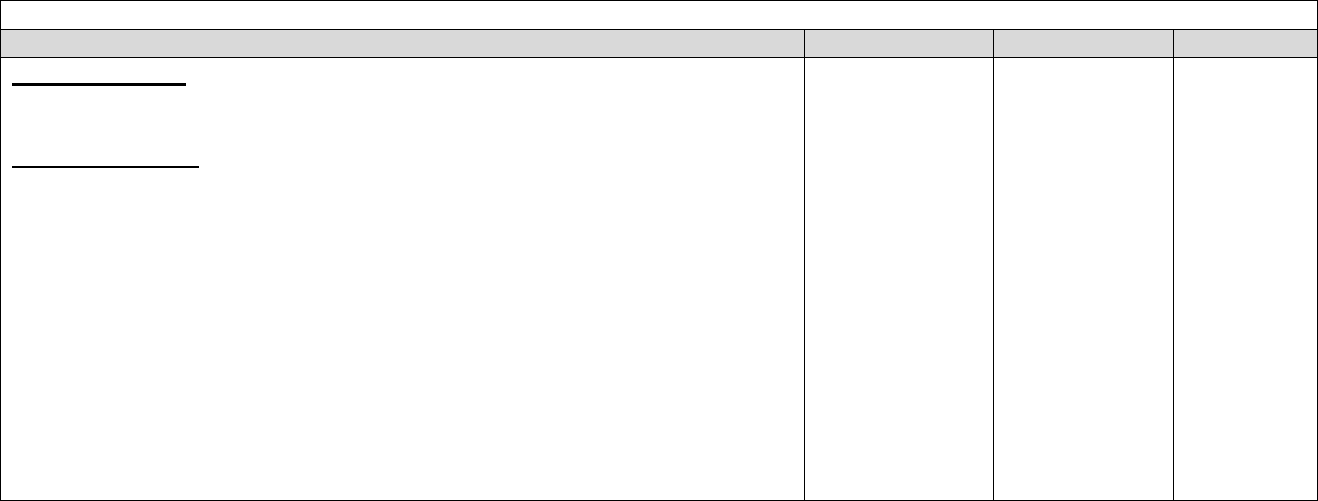

Version Number

Date

Description of Change

Effective

USSGL TFM

1.0

07/2004

Original Version

S2-04-01

2.0

09/2012

Updated case study (account numbers and titles, Transaction

Codes, crosswalks) in accordance with T/L S2-12-03. Added

MAT, cohorts, changed disbursement schedule. Added new

Appendix 2.

S2-12-01

3.0

08/2017

Updated Transaction Codes, financial statements and

appendices.

2017-06

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 3 of 153 August 2017

Prepare agency financial statements;

Audit the agency financial statements;

Manage or provide service to participants in loan guarantee programs;

Design and maintain computer systems for financial programs;

Instruct others in basic accounting and reporting for loan guarantee programs without collateral.

The guide is illustrative, rather than authoritative, and is categorized as “other accounting literature” in the hierarchy of accounting

principles for Federal entities.

1

It supersedes the original and subsequent loan guarantee scenarios. Users may download the guide

from the Bureau of the Fiscal Service (FS) Web site at www.fiscal.treasury.gov/fsreports/ref/ussgl/ussgl/ussgl_htm.

In order to understand and gain the most from the guide, users must have a working knowledge of the following:

Budgetary and proprietary accounting, reporting, and terminology;

The United States Standard General Ledger (USSGL) accounts for basic annual operating appropriations and revolving funds;

and

The Federal Credit Reform Act and other requirements established by the Act;

The concepts of Federal credit program accounting and reporting, fund structures, and terminology.

This guide is a study in accounting and reporting for a discretionary loan guarantee program under the Federal Credit Reform Act of

1990, as amended, for loan guarantees obligated after September 30, 1991. Loan guarantees are any guarantee, insurance, or other

pledge for the payment of all or a part of the principal or interest on any debt obligation of a non-Federal borrower to a non-Federal

lender, except for the insurance of deposits, shares, or other withdrawals in financial institutions. Loans that are financed by the

Federal Financing Bank pursuant to agency loan guarantee authority are treated as direct loans rather than loan guarantees.

2

Transactions are presented over a 3-year period for a fictitious Federal agency with a single annual loan guarantee program with no

risk categories. Transactions for fiscal year 2 show the disposition of the upward re-estimated subsidy accrued in fiscal year 1, as well

1

See §II.4, Instructions for Annual Financial Statements, OMB Circular A-136.

2

OMB Circular No. A-11, Section 185.3(e)

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 4 of 153 August 2017

as additional transactions to demonstrate the use of cohorts, borrowing authority, negative subsidy rates, and interest accruals in

relation to inter-governmental eliminations and downward re-estimates. Transactions for fiscal year 3 show the disposition of the

downward re-estimated subsidy accrued in fiscal year 2 and repayment of debt. Common transactions and reports are covered in

addition to transactions unique to Federal credit program accounting. However, since accounting for certain accruals and undelivered

orders with advances are not unique to credit reform accounting, they are not presented. In addition, transactions involving collateral

are excluded, since they are covered in a separate guide. Entries are made in general journal form, using USSGL accounts, and are

summarized in trial balances for each year.

The transactions covered are:

Formulation, apportionment, and allotment of the budget;

Receipt of subsidy and administrative expense appropriations;

Payment of administrative expenses;

3

Commitment to make loan guarantees;

Transfer of subsidy from the program to the financing fund;

Transfer of negative subsidy from the financing fund to the general fund

Collection of guarantee fees;

Payment of interest supplements;

Payment of default claims;

Assuming defaulted guaranteed loans and interest for direct collection

Collection of loan principal and interest on defaulted guaranteed loans;

Modification of guarantee terms, with resulting adjustment to program level;

Collection of interest from Treasury;

Accrual of interest from borrowers;

Accrual of inter-governmental interest;

Write-off of bad debts without receiving collateral;

3

The illustration is for the payment of administrative expenses without prior obligation through undelivered orders or accounts payable. Though administrative

expenses will usually be obligated before payment, there is nothing about the transactions unique to credit program accounting, and they are not shown.

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 5 of 153 August 2017

Recording the interest accumulation factor on the loan guarantee liability and loan assets;

Recording of data on guaranteed loans supplied by third-party lenders;

Accrual, receipt and disbursement of upward and downward subsidy re-estimates and related interest; and

Closing entries.

While financing funds may borrow money if there is not enough Fund Balance With Treasury to meet requirements for disbursements,

in general, financing funds obtain money for disbursements primarily from:

Offsetting collections, including those from the program fund (for basic and upward re-estimated subsidy);

Treasury (for interest); and

Non-Federal sources (such as guarantee fees from program participants or collections of defaulted guaranteed loan

principal and interest from borrowers).

The yearend agency reports are listed below:

Balance Sheet;

Statement of Net Cost;

Statement of Changes in Net Position;

Statement of Budgetary Resources;

Financing Footnote

Fund Balance with Treasury Footnote

Program and Financing Schedule (Schedule P); and

Credit Program Footnote (including the Schedule of Changes in the Allowance for Subsidy).

An SF 132: Apportionment and Reapportionment Schedule report is furnished at the beginning of each year. These SF132s represent

single year funding of subsidy.

This guide includes two appendices. Appendix 1 discusses basic differences encountered in mandatory programs. Appendix 2

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 6 of 153 August 2017

provides a listing of key references related to credit program accounting. If the references change, this document will be updated

accordingly and published on the USSGL Website at https://www.fiscal.treasury.gov/fsreports/ref/ussgl/creditreform/casestud.htm

Users may send questions to the USSGL Website at www.fiscal.treasury.gov/fsreports/ref/ussgl/form-issues.htm by using the online

USSGL Issue Form. This Website also provides a list of the General Ledger and Advisory Branch representatives and their telephone

numbers.

Listing of USSGL Accounts Used in This Scenario

Program Fund

Account Number

Account Title

Budgetary

411500

Loan Subsidy Appropriation

411700

Loan Administrative Expense Appropriation

411800

Reestimated Loan Subsidy Appropriation

412000

Anticipated Indefinite Appropriations

420100

Total Actual Resources-Collected

445000

Unapportioned Authority

451000

Apportionments

459000

Apportionments - Anticipated Resources - Programs Subject to Apportionments

461000

Allotments - Realized Resources

465000

Allotments - Expired Authority

480100

Undelivered Orders – Obligations, Unpaid

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 7 of 153 August 2017

487100

Downward Adjustments of Prior Year Unpaid Undelivered Orders- Obligations, Recoveries

490200

Delivered Orders – Obligations, Paid [Re-estimated Subsidy and Interest]

490200

Delivered Orders – Obligations, Paid [Other]

Proprietary

101000

Fund Balance With Treasury

131000

Accounts Receivable [Subsidy Receivable From Financing Fund]

217000

Subsidy Payable to Financing Account

310000

Unexpended Appropriations – Cumulative

310100

Unexpended Appropriations – Appropriations Received

310700

Unexpended Appropriations – Used

331000

Cumulative Results of Operations

570000

Expended Appropriations

579100

Adjustment to Financing Sources – Credit Reform

610000

Operating Expenses/Program Costs [Administrative Expense]

610000

Operating Expenses/Program Costs [Basic and Modified Subsidy]

619900

Adjustment to Subsidy Expense

4

680000

Future Funded Expenses [Subsidy Re-estimate – Technical]

5

680000

Future Funded Expenses [Subsidy Re-estimate - Interest Rate]

719000

Other Gains

729000

Other Losses

Financing Fund

4

This relates to downward re-estimates and negative subsidies.

5

This relates to upward and downward re-estimates.

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 8 of 153 August 2017

Account Number

Account Title

Budgetary

404700

Anticipated Transfers to the General Fund of the U.S. Government – Current Year Authority

406000

Anticipated Collections From Non-Federal Sources

407000

Anticipated Collections From Federal Sources

412000

Anticipated Indefinite Appropriations

412500

Loan Modification Adjustment Transfer Appropriation

414100

Current Year Borrowing Authority Realized

414200

Actual Repayment of Borrowing Authority Converted to Cash

414300

Current Year Decreases to Indefinite Borrowing Authority Realized

414500

Borrowing Authority Converted to Cash

414800

Resources Realized from Borrowing Authority

415100

Actual Capital Transfers to the General Fund of The U.S. Government, Current Year

420100

Total Actual Resources – Collected

422100

Unfilled Customer Orders Without Advance

426100

Actual Collection of Business-Type Fees

426200

Actual Collection of Loan Principal

426300

Actual Collection of Loan Interest

427100

Actual Program Fund Subsidy Collected

427300

Interest Collected From Treasury

428300

Interest Receivable from Treasury

445000

Unapportioned Authority

451000

Apportionments

459000

Apportionments - Anticipated Resources - Programs Subject to Apportionments

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 9 of 153 August 2017

461000

Allotments - Realized Resources

480100

Undelivered Orders – Obligations, Unpaid

490200

Delivered Orders – Obligations, Paid [Other]

Proprietary

101000

Fund Balance With Treasury

131000

Accounts Receivable [Subsidy Receivable From Program Fund]

134100

Interest Receivable - Loans [Defaulted Guaranteed Loans]

135000

Loans Receivable [Defaulted Guaranteed Loans]

139900

Allowance for Subsidy [Defaulted Guaranteed Loans]

214100

Accrued Interest Payable – Loans

218000

Loan Guarantee Liability

251000

Principal Payable to the Bureau of the Fiscal Service

299000

Other Liabilities without Related Budgetary Obligations [Re-estimate payables]

310100

Unexpended Appropriations – Appropriations Received

310700

Unexpended Appropriations – Used

331000

Cumulative Results of Operations

6

531200

Interest Revenue – Loans Receivable/Uninvested Funds [Treasury] and Non-Federal [Borrower]

531300

Interest Revenue – Subsidy Amortization [Defaulted Guarantee Loans]

570000

Expended Appropriations

576600

Nonexpenditure Financing Sources – Transfers Out – Capital Transfers

577600

Nonbudgetary Financing Sources Transferred Out

6

Cumulative Results of Operations must be zero after closing because the financing fund cannot have a net cost of operations or net position. Under FCR the net

cost is captured in the program fund, so cumulative results of operations is always zero. OMB A-11, Section 185, Exhibit E illustrates that the financing fund is

designed to break even and thus have a zero results of operations.

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 10 of 153 August 2017

579100

Adjustment to Financing Sources – Credit Reform

631000

Interest Expenses on Borrowing From Bureau of the Fiscal Service and/or Federal Financing Bank

634000

Interest Expense Accrued on the Liability for Loan Guarantees

801000

Guaranteed Loan Level

801500

Guaranteed Loan Level - Unapportioned

802000

Guaranteed Loan Level - Apportioned

804000

Guaranteed Loan Level - Used Authority

804500

Guaranteed Loan Level - Unused Authority

805000

Guaranteed Loan Principal Outstanding

805300

Guaranteed Loan New Disbursement by Lender

806500

Guaranteed Loan Collections, Defaults and Adjustments

807000

Guaranteed Loan Cumulative Disbursements by Lenders

Conceptual Framework

Pre-closing equation: 801000 = 801500 + 802000 + 804000 + 804500

805000 = 805300 - 8065000

Post-closing equation: 801000 = 804000 + 804500

805000 = 807000

Miscellaneous Receipt Account

Account Number

Account Title

Budgetary

No Entries

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 11 of 153 August 2017

Proprietary

101000

Fund Balance With Treasury

131000

Accounts Receivable [Subsidy Receivable From Financing Fund]

298500

Liability for Non-Entity Assets Not Reported on the Statement of Custodial Activity

575600

Nonexpenditure Financing Sources – Transfers In – Capital Transfers

577500

Nonbudgetary Financing Sources Transferred In

599300

Offset to Non-Entity Collections – Statement of Changes in Net Position

599400

Offset to Non-Entity Accrued Collections – Statement of Changes in Net Position

Scenario Assumptions

This guide uses numbers and titles for USSGL accounts. When necessary, titles for USSGL accounts are expanded by using brackets

to capture, clarify, or add specific information, for illustrative purposes only. For example, administrative expense, “[Administrative

Expense]” is included after the title for USSGL 610000 account, “Operating Expenses/Program Costs.” In the same manner, for

interest supplement expense, “[Interest Supplement],” is included after the title for the USSGL 610000 account. The USSGL TFM

Supplement, Section II, contains definitions for USSGL accounts.

Entries are in general journal form, using USSGL accounts, and are summarized in trial balances for each year. Note that the financing

fund is used only in the transactions for Post-Credit Reform scenarios, and the liquidating fund is used only in the transactions for Pre-

Credit Reform scenarios.

USSGL accounts that, by themselves, do not directly provide the reporting that is illustrated, are supplemented with additional detail.

The entries made and the method chosen to illustrate the detail provide only one-way of accounting. Agencies may have other ways of

structuring their ledgers and making journal entries to accomplish the same result.

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 12 of 153 August 2017

USSGL Scenario

Loan Guarantee Program

Fiscal Year 1

The loan guarantee Agency has been authorized to guarantee loans beginning in fiscal year 1. It has authority to guarantee 80 percent

of the principal and related interest of $100,000 in loans. The agency has a single, discretionary loan guarantee program with no risk

categories.

7

For fiscal year 1, Congress has authorized annual appropriations for basic subsidy, modified subsidy, and administrative

expenses and provided that the program is subject to the Federal Credit Reform Act of 1990, as amended.

Transactions To Be Recorded in the Program and Financing Fund

1. The agency’s subsidy model indicated that, for the $100,000 of loan guarantees, a 21.5

percent subsidy was indicated as follows:

• Present value of expected defaults is 20 percent, or $20,000;

• Present value of guarantee fees to be collected is (.5) percent or $500 (all anticipated this year), and

7

Programs that have risk categories must maintain separate financing fund accounting for each risk category. While annual appropriations for basic and modified

subsidy, which are common in discretionary loan guarantee programs, are illustrated, some programs may have multi-year or no-year authority appropriations

provided for these purposes in their underlying legislation. Accounting for these types of appropriations is essentially the same as it would be for basic operating

appropriations or revolving fund. See Appendix 2 for examples

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 13 of 153 August 2017

• Present value of interest supplements to be paid to third-party lenders as loans are guaranteed, to buy down interest

rates, is 2 percent or $2,000.

2. The agency has appropriated administrative expenses for fiscal year 1 in the amount of $5,000.

3. The agency estimates the following financing fund collections for the year:

• $21,500 of subsidy from the program fund;

• $1,200 of interest from Treasury on unused balances in the financing fund;

• $510

8

for program participants for guarantee fees; and

• $50 for principal and $200 for interest on defaulted guaranteed loans.

4. The agency expects to use financing fund resources as follows:

• $3,500 for payment of default claims (80% Guarantee of $4,375 Default); and

• $2,000 for payment of interest supplements.

Based on the above information the agency has prepared the following requests for apportionment:

8

Note that this is higher than the $500 of fees in the subsidy model, because $500 is the present value of the fees, and $510 is the actual amount of fees expected

to be collected.

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 14 of 153 August 2017

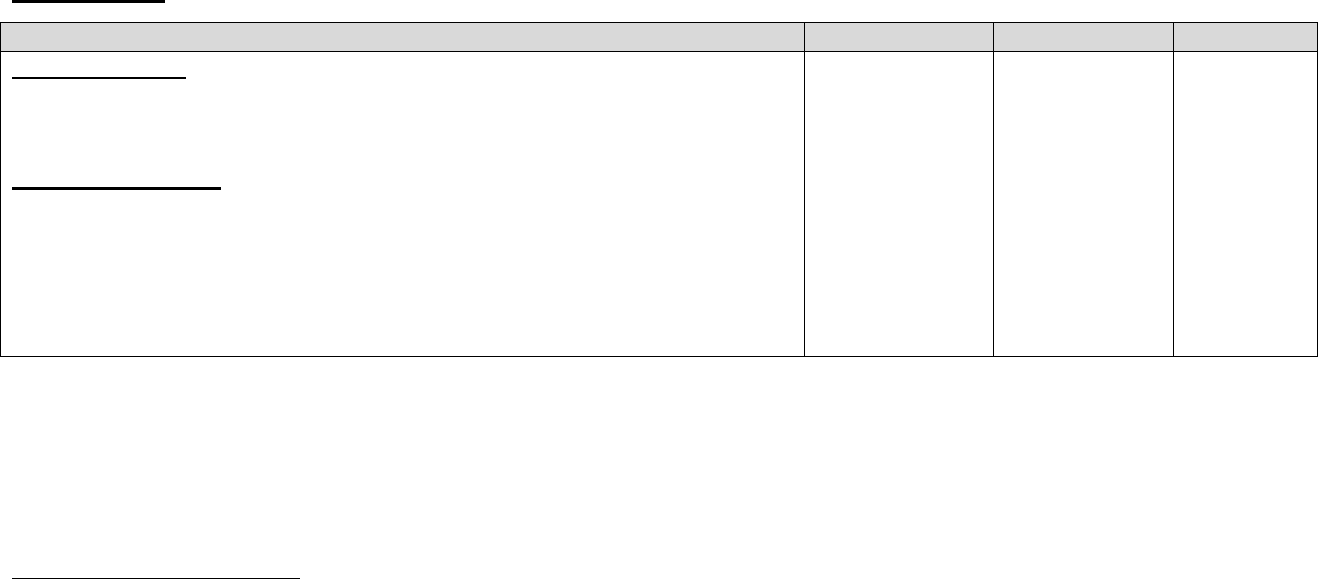

Loan Guarantee Agency

Fiscal Year 1

9

9

OMB Circular A-11 Exhibits 185N through 185U shows examples of various SF132s

SF 132 Apportionment/Reapportionment Schedule

BUDGETARY RESOURCES

Program

Fund

Financing

Fund

Budget authority:

Appropriations, discretionary:

1100

Appropriation

26,500

Spending authority from offsetting collections,

mandatory:

1840

Anticipated Collections, Reimbursements, and Other Income

23,460

1920

Total Budgetary Resources

26,500

23,460

APPLICATION OF BUDGETARY RESOURCES

Category B (by project)

6011

Direct Loan Subsidy

21,500

6012

Default

3,500

6013

Administrative Expense

5,000

6014

Interest Supplements

2,000

6182

Unapportioned Balance of Revolving Fund

17,960

SF 132 Apportionment/Reapportionment Schedule

6190

Total Budgetary Resources Available

26,500

23,460

GUARANTEED LOAN LEVELS AND APPLICATIONS

8100

Program Level, Current Year

100,000

8211

Guarantee Loan Program

100,000

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 15 of 153 August 2017

Illustrative Transactions for Year 1

1-1 To record the enactment of appropriations.

Program Fund

10

DR

CR

TC

Budgetary Entry

411500 Loan Subsidy Appropriation

21,500

411700 Loan Administrative Expense Appropriation

5,000

445000 Unapportioned Authority

26,500

Proprietary Entry

A104

101000 Fund Balance With Treasury

26,500

310100 Unexpended Appropriations – Appropriations Received

26,500

10

Note that these entries maybe done as two separate steps as warrant and signing of appropriations bill do not always coincide.

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 16 of 153 August 2017

Financing Fund

DR

CR

TC

Budgetary Entry

406000 Anticipated Collections from Non-Federal Sources

407000 Anticipated Collections from Federal Sources

445000 Unapportioned Authority

Proprietary Entry

None

760

22,700

23,460

A140

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 17 of 153 August 2017

Memorandum Accounts - Loan Guarantee Level

11

DR

CR

TC

Budgetary Entry

None

Proprietary Entry

None

Memorandum Entry

801000 Guaranteed Loan Level

100,000

801500 Guaranteed Loan Level – Unapportioned

100,000

G102

1-2 OMB approved the agency’s request for apportionment, and the agency recorded the apportionment.

Program Fund

11

Although the agency is guaranteeing 80 percent of the loans made by third-party lenders, Federal budget rules provide that the 100 percent figure would still be

used as the loan level even if the guarantee was for less than 100 percent. The figure also would be 100 percent of principal only even if defaulted interest was

guaranteed as well. See OMB Circular A-11, Preparation, Submission and Execution of the Budget (June 2003), §185.11(c).

DR

CR

TC

Budgetary Entry

445000 Unapportioned Authority

26,500

451000 Apportionments

26,500

A116

Proprietary Entry

None

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 18 of 153 August 2017

Financing Fund

12

DR

CR

TC

Budgetary Entry

445000 Unapportioned Authority

5,500

459000 Apportionments - Anticipated Resources-Programs Subject to

Apportionment

5,500

A118R

Proprietary Entry

None

Memorandum Accounts - Loan Guarantee Level

DR

CR

TC

Budgetary Entry

None

Proprietary Entry

None

Memorandum Entry

801500 Guaranteed Loan Level - Unapportioned

802000 Guaranteed Loan Level – Apportioned

100,000

100,000

G104

12

$5,500 needed to pay defaults and interest supplements, $3,500 and $2,000 is apportioned.

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 19 of 153 August 2017

1-3 Issued a blanket authorization to allot anticipated resources as they were realized, not to exceed the amount of the apportionment.

Program Fund

DR

CR

TC

Budgetary Entry

451000 Apportionments

26,500

461000 Allotments - Realized Resources

26,500

A120

Proprietary Entry

None

Financing Fund

13

DR

CR

TC

Budgetary Entry

None

Proprietary Entry

None

13

Note that in accordance with §145.6 of OMB Circular A-11, only realized resources may be obligated.

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 20 of 153 August 2017

1-4. The agency paid administrative expenses of $4,000 for salaries and $950 for rent to GSA. It placed no undelivered orders nor

made accruals before payment.

Program Fund

14

This transaction can vary depending upon Agency treatment of Administrative Expenses.

DR

CR

TC

Budgetary Entry

461000 Allotments - Realized Resources

4,950

490200 Delivered Orders – Obligations, Paid [Other]

4,950

B106

Proprietary Entry

14

610000 (NF) Operating Expenses/Program Costs [Administrative Expenses]

101000 Fund Balance With Treasury

310700 Unexpended Appropriations – Used

570000 Expended Appropriations610000 (F) (TP 47-Main-XXXX) Operating

Expenses/Program Costs

570000 Expended Appropriations

4,000

4,000

950

4,000

4,000

950

B134

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 21 of 153 August 2017

1-5 The agency agreed to make $90,000 in guarantees, subject to the third-party lenders and their borrowers meeting conditions placed

on them.

Program Fund

15

Obligated subsidy to be transferred to financing fund.

DR

CR

TC

Budgetary Entry

461000 Allotments - Realized Resources

480100 Undelivered Orders – Obligations, Unpaid

19,350

19,350

B306

Proprietary Entry

None

15

$90,000 in loan commitments x 21.5 percent subsidy = $19,350.

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 22 of 153 August 2017

Financing Fund

To recognize the subsidy to be transferred from the program fund.

DR

CR

TC

Budgetary Entry

422100 Unfilled Customer Orders Without Advance

19,350

407000 Anticipated Collections From Federal Sources

Proprietary Entry

None

19,350

C101

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 23 of 153 August 2017

Financing Fund

To record allotment of realized subsidy.

16

DR

CR

TC

Budgetary Entry

459000 Apportionments - Anticipated Resources

- Programs Subject to Apportionments

461000 Allotments - Realized Resources

Proprietary Entry

None

5,500

5,500

A122

16

Note that the unfilled customer order from the program fund constitutes a realized resource. Only the $5,500 apportioned in transaction 1-2 can be allotted.

Also note that there is no cash related to this authority at this time. If a disbursement needed to be made prior to the cash being received, borrowing authority

would need to be used to make the disbursement. See year 2 for an example.

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 24 of 153 August 2017

Memorandum Accounts - Loan Guarantee Level

DR

CR

TC

Budgetary Entry

None

Proprietary Entry

None

Memorandum Entry

17

802000 Guaranteed Loan Level – Apportioned

804000 Guaranteed Loan Level – Used Authority

90,000

90,000

G106

17

Some Agencies add an allotment step in the memorandum entry. The end result for all Agencies should be for USSGL Account 804000 to be increased to

reflect the use of existing authority.

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 25 of 153 August 2017

1-6. Third-party lenders disbursed $87,000 of the guaranteed loans, and the agency transferred subsidy from the program to the

financing fund.

Program Fund

18

To record payment of subsidy to financing fund.

DR

CR

TC

Budgetary Entry

480100 Undelivered Orders – Obligations, Unpaid

490200 Delivered Orders – Obligations, Paid [Other]

18,705

18,705

A146

Proprietary Entry

610000 Operating Expenses/Program Costs

[Basic and Modified Subsidy Expense]

101000 Fund Balance With Treasury

310700 Unexpended Appropriations - Used

570000 Expended Appropriations

18,705

18,705

18,705

18,705

B134

18

$87,000 in guaranteed loans disbursed x the 21.5 percent subsidy rate = $18,705.

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 26 of 153 August 2017

Financing Fund

19

DR

CR

TC

Budgetary Entry

427100 Actual Program Fund Subsidy Collected

422100 Unfilled Customer Orders Without Advance

18,705

18,705

Proprietary Entry

101000 Fund Balance With Treasury

218000 Loan Guarantee Liability

18,705

18,705

C103

Memorandum Accounts - Loans Disbursed

DR

CR

TC

Budgetary Entry

None

Proprietary Entry

None

Memorandum Entry

805000 Guaranteed Loan Principal Outstanding

805300 Guaranteed Loan New Loan Disbursements by Lender

87,000

87,000

G108

19

Note that no additional allotment is made, because the full $5,500 that OMB apportioned was allotted in transaction 1-5.

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 27 of 153 August 2017

1-7. The agency collected fees of $480 from the program participants as a condition of making the guarantees

20

.

Financing Fund

To record collection of fees.

DR

CR

TC

Budgetary Entry

426100 Actual Collection of Business-Type Fees

406000 Anticipated Collections from Non-Federal Sources

Proprietary Entry

101000 Fund Balance With Treasury

218000 Loan Guarantee Liability 480

480

480

480

480

C117

20

Some fees may be collected and deferred before earned/ loan disbursed. To record collection of fees before earned, debit USSGL Account 426100 and credit

USSGL Account 406000 for the budgetary entry and debit USSGL account 101000 and credit USSGL Account 232000 (C116) for the proprietary entry. Once

loan is disbursed or fees are earned, debit USSGL Account 232000 and credit USSGL Account 218000(C118).

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 28 of 153 August 2017

1-8. The agency paid interest supplements of $1,940 to the third party-lenders. It had made no previous accrual.

Financing Fund

To record interest supplements

DR

CR

TC

Budgetary Entry

461000 Allotments - Realized Resources

490200 4902000 Delivered Orders – Obligations, Paid [Other]

Proprietary Entry

218000 Loan Guarantee Liability

101000 Fund Balance With Treasury

490200 Delivered Orders – Obligations, Paid [Other] 480

1,940

1,940

1,940

1,940

B104

*****Though separated here for purposes of illustration, agencies would normally record transactions 1-6 - 1-8

simultaneously.******

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 29 of 153 August 2017

1-9. The agency paid third-party lender claims of $3,500 to honor 80% guarantee of $4,375 of defaulted loan principal.

Financing Fund

DR

CR

TC

Budgetary Entry

461000 Allotments - Realized Resources

490200 4902000 Delivered Orders – Obligations, Paid [Other]

Proprietary Entry

218000 Loan Guarantee Liability

101000 Fund Balance With Treasury

490200 Delivered Orders – Obligations, Paid [Other] 480

3,500

3,500

3,500

3,500

B104

Memorandum Accounts - Loans Disbursed

DR

CR

TC

Budgetary Entry

None

Proprietary Entry

None

Memorandum Entry

806500 Guaranteed Loan Collections, Defaults, and Adjustments

805000 Guaranteed Loan Principal Outstanding

4,375

4,375

G110

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 30 of 153 August 2017

1-10. The agency acquired receivables for loans of $3,500 and interest of $1,250 in conjunction with the defaults. The agency will

attempt to collect this money directly from the borrowers. The present value of cash flows related to the loans is estimated to be

$3,000.

21

Financing Fund

To establish accounts receivable for defaulted loan.

DR

CR

TC

Budgetary Entry

None

Proprietary Entry

134100 (N) Interest Receivable -Loans [Defaulted Guaranteed Loans]

135000 (N) Loans Receivable [Defaulted Guaranteed Loans]

139900 (N) Allow. for Subs. [Defaulted Guaranteed Loans]

218000 (N) Loan Guarantee Liability 1,750

3,000

1,250

3,500

1,750

3,000

C428

* * * * * Though separated here for illustrative purposes, agencies would normally record transactions 1-9 and 1-10

simultaneously. * * * * *

21

The present value of defaulted guaranteed loans and remaining guaranteed loans must be split. This can be done on agency determined schedule but at a

minimum, year end.

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 31 of 153 August 2017

1-11. The agency collected principal of $40 and interest of $200 on the loans acquired in transaction 1-10.

Financing Fund

22

DR

CR

TC

Budgetary Entry

426200 Actual Collection of Loan Principal

426300 Actual Collection of Loan Interest

406000 Anticipated Collections From Non-Federal Sources

Proprietary Entry

101000 Fund Balance With Treasury

134100 Interest Receivable - Loans [Defaulted Guaranteed Loans]

135000 Loans Receivable [Defaulted Guaranteed]

40 48

40

200

240

240

200

40

C109

22

If interest receivable at the time of default had been recorded as part of loans receivable, the entire $240 would be credited to 135000. See transaction 1-10.

Note – the principal and interest breakdown are for illustration purposes only. According to the Debt Collection Improvement Act (DCIA), unless there is some

other contractual agreement, the payments must be applied to penalties, administrative costs, additional interest, financing interest and finally principal. If DCIA

was applied in this example, no principal would be paid as there is a balance $1,250 in interest.

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 32 of 153 August 2017

1-12. After consultation and agreement with OMB, the agency decided to exercise a clause in the program’s legislation allowing it to

modify the terms of the guarantees because of economic downtrends. (OMB Circular A-11 185.7) In this example a positive subsidy

between the calculation of the NPV of the remaining pre-modification ($21,500) cash flows and the calculation of the NPV of

remaining post-modification cash flows ($20,500) resulted in the Government incurring an additional $1,000 subsidy cost due to the

modification. The agency also calculated a modification adjustment transfer of $10.

The agency submitted a new request for apportionment (SF-132) for the financing fund, showing the reduced loan guarantee level, and

OMB approved it.

,

Since the agency had already apportioned subsidy monies in the program fund, a new request for apportionment of

program fund resources may not be required.

23

23

A new request for apportionment of program fund resources is normally not required, but in some instances it should be done in order to comply with the Data

Act and the change in Category B items.

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 33 of 153 August 2017

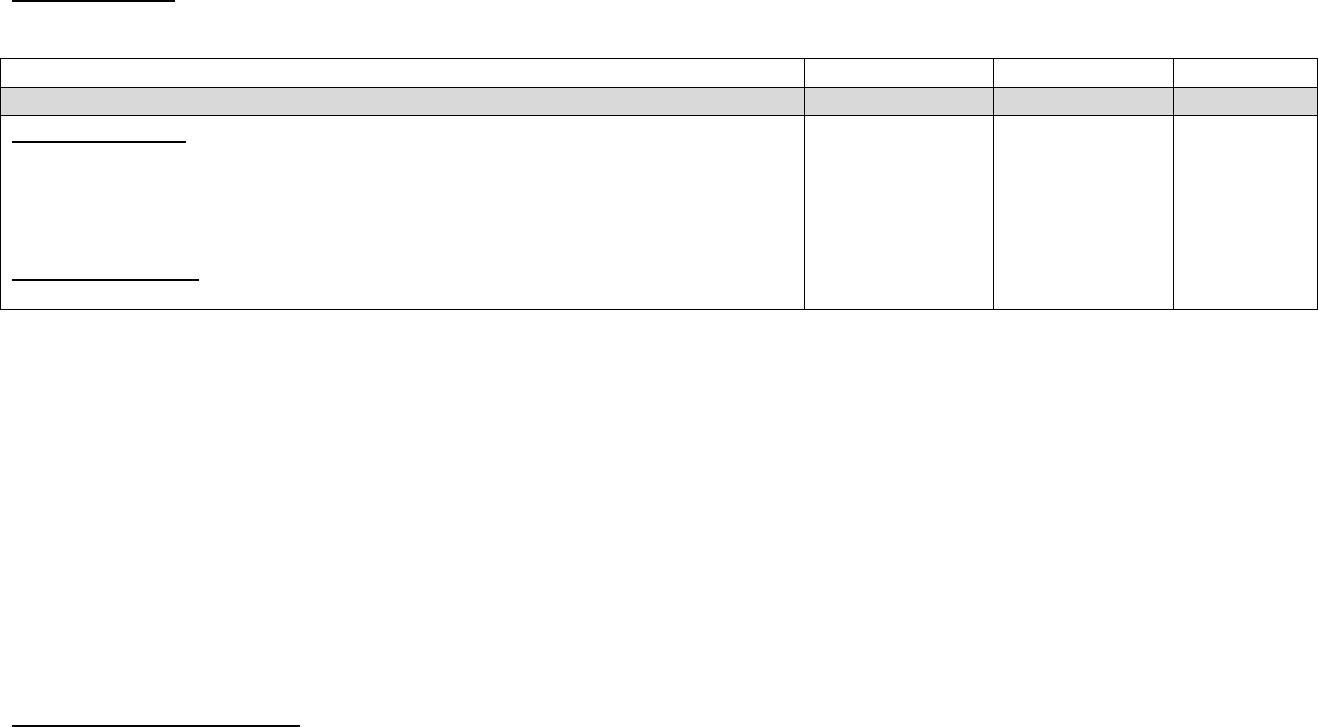

Loan Guarantee Agency

Fiscal Year 1

SF 132 Apportionment/Reapportionment Schedule

BUDGETARY RESOURCES

Financing Fund

Program Fund

Budget authority:

Appropriations, discretionary:

1100

Appropriation

26,500

Appropriations, mandatory:

1250

Anticipated Appropriation

10

Spending authority from offsetting collections, mandatory:

1800

Collected

19,425

1801

Change in Uncollected Payments, Federal Sources

645

1840

Anticipated Collections, Reimbursements, and Other Income

3,390

1920

Total Budgetary Resources

23,470

APPLICATION OF BUDGETARY RESOURCES

Category B (by project)

6011

Direct Loan Subsidy

20,500

6012

Default

3,500

6013

Admin Expense

5,000

6014

Interest Supplements

2,000

6015

Modifications

1,000

6182

Unapportioned Balance of Revolving Fund

17,970

6190

Total Budgetary Resources Available

23,470

GUARANTEED LOAN LEVELS AND APPLICATIONS

8100

Program Level, Current Year

24

95,349

8211

Guarantee Loan Program

95,349

24

20,000/ 21.5%= 95,349

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 34 of 153 August 2017

1-12. Transactions for 1–12 are following:

Program Fund

To transfer funds to financing funds for modification

DR

CR

TC

Budgetary Entry

461000 Allotments - Realized Resources

490200 Delivered Orders – Obligations, Paid [Other] 1,000

Proprietary Entry

610000 (N) Operating Expenses/Program Costs

[Basic and Modified Subsidy Expense] 1,000

101000 Fund Balance With Treasury 1,000

310700 Unexpended Appropriations - Used

570000 Expended Appropriations 1,000

1,000

1,000

1,000

1,000

1,000

1,000

B106

B134

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 35 of 153 August 2017

Financing Fund

To record collection from program fund.

DR

CR

TC

Budgetary Entry

427100 Actual Program Fund Subsidy Collected

407000 Anticipated Collections From Federal Sources

Proprietary Entry

101000 Fund Balance With Treasury

218000 Loan Guarantee Liability 1,000

1,000

1,000

1,000

1,000

C103

Financing Fund

To record new SF132 entry

DR

CR

TC

Budgetary Entry

412000 Anticipated Indefinite Appropriation

445000 Unapportioned Authority

Proprietary Entry

None

10

10

A102

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 36 of 153 August 2017

Program Fund

To record warrant received for modification adjustment transfer

DR

CR

TC

Budgetary Entry

None

Proprietary Entry

729000 (N) Other Losses

579100 Adjustment to Financing Sources – Credit Reform

10

10

A206

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 37 of 153 August 2017

Financing Fund

DR

CR

TC

Budgetary Entry

25

412500 Loan Modification Adjustment Transfer

26

412000 Anticipated Indefinite Appropriation

Proprietary Entry

101000 Fund Balance with Treasury

27

310100 Unexpended Appropriations - Received

579100 Adjustment to Financing Sources – Credit Reform

218000 Loan Guarantee Liability

310700 Unexpended Appropriations – Used

570000 Expended Appropriations

10

10

10

10

10

10

10

10

A202

A104

D147R

B134

25

This warrant must be specifically requested by an agency in order to be processed by Treasury.

26

The use of USSGL Account 412500 is required per OMB Circular A-11 Section 185.7 (b) for the Financing Fund.

27

For FY 2012 – use 579000 for 310100 and do not do the 310700/570000 entry. The correction for FY 2013 is needed to properly reflect warrants in the

intergovernmental elimination process

.

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 38 of 153 August 2017

Memorandum Accounts - Loan Guarantee Level

28

DR

CR

TC

Budgetary Entry

None

Proprietary Entry

None

Memorandum Entry

802000 Loan Guarantee Level - Apportioned

4,651

G102R

801000 Guaranteed Loan Level

4,651

G104R

28

Original loan level, $100,000, less revised loan level, $95,349 = $4,651.

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 39 of 153 August 2017

1-13. Treasury credited $1,160 to the financing fund for interest the fund earned on its unused Fund Balance With Treasury during the

year.

Financing Fund

DR

CR

TC

Budgetary Entry

427300 Interest Collected From Treasury

407000 Anticipated Collections from Federal Sources

Proprietary Entry

101000 Fund Balance With Treasury

531200 (F) TP 020 Main 1880 Interest Revenue – Loans Receivable /

Uninvested Funds

1,160

1,160

1,160

1,160

C109

C420

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 40 of 153 August 2017

1-14. The agency accrued loan interest of $5 on the defaulted guaranteed loan principal.

Financing Fund

DR

CR

TC

Budgetary Entry

None

Proprietary Entry

134100 (NF) Interest Receivable- Loans [Defaulted Guaranteed Loans]

531200(NF) Interest Revenue – Loans Receivable / Uninvested Funds

5

5

C420

1-15. The agency determined that it could not collect $10 of loan principal and $20 of loan interest and wrote off the receivables

.

29

29

This determination of uncollectibility would be made only after attempting to collect the receivables under provisions of the DCIA.

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 41 of 153 August 2017

Financing Fund

DR

CR

TC

Budgetary Entry

None

Proprietary Entry

139900 (NF) Allow. for Subsidy [Defaulted Guar. Loan Assets

134100 (NF) Interest Receivable -Loans

135000 (NF) Loans Receivable [Defaulted Guaranteed]

30

20

10

D414

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 42 of 153 August 2017

1-16. The agency accrued interest of $1,160 on its loan guarantee liability and $5 on the subsidy amortization present value calculated

at reestimate of its loans. Note: The interest accumulation factor

30

must equal the amount of interest income received from Treasury–

$1,160 (see transaction 1-13).

Financing Fund

DR

CR

TC

Budgetary Entry

None

Proprietary Entry

531300 (NF) Interest Revenue – Subsidy Amortization

139900 (NF) Allowance for Subs. [Defaulted Guar. Loan Assets]

634000(NF) Interest Exp Accrual on Liability for Loan Guarantee

218000(NF) Loan Guarantee Liability

5

1,160

5

1,160

E118

E122

30

The FCRA requires that the rates for discounting cashflows, financing account borrowing, and financing account interest earnings be identical and based on the

Treasury rate in effect during the period of loan disbursement. If your loans disburse in segments over several years, several interest rates will be applicable to an

individual loan or group of loans. The correct interest rates are provided for you in the OMB Credit Subsidy Calculator available from your OMB representative.

For loan guarantee financing accounts, the interest rate for cash accumulations relate to each loan guarantee is determined by the date that the commercial lender

disburses the loan being guaranteed. Because commercial lenders may not report to your in a timely manner, you can use an estimated fourth quarter amount for

disbursements and collections when you report to Treasury at the end of the fiscal year, adjusting this estimate as actual lender data is accumulated.

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 43 of 153 August 2017

1-17. Third-party lenders reported that they had collected $10,000 on guaranteed loans in the cohort.

Financing Fund

Memorandum Accounts for Loans Disbursed

DR

CR

TC

Budgetary Entry

None

Proprietary Entry

None

Memorandum Entry

806500 Guaranteed Loan Collections, Defaults, and Adjustments

805000 Guaranteed Loan Principal Outstanding

10,000

10,000

G110

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 44 of 153 August 2017

1-18. At year-end the agency determined that an upward subsidy expense re-estimate related to the loan guarantee of $23 was

required. Since the loans were over 90% disbursed an interest rate re-estimate is required as well as a technical re-estimate. The

breakdown was as follows:

Interest Rate Reestimate (13)

Technical Reestimate 33

Interest on Technical Reestimate 3

Total Reestimate 23

Program Fund

31

DR

CR

TC

Budgetary Entry

None

Proprietary Entry

680000 (NF) Future Funded Expenses

[Subsidy Expense - Re-estimates – Technical]

217000 (F) (Agency Main gtd) Subsidy Payable to Financing Account

32

36

23

B420

680000 (NF) Future Funded Expenses

[Subsidy Expense – Re-estimates – Interest Rate]

13

B420

31

The interest rate re-estimate is a reporting requirement for the credit supplement of the President’s budget and the credit footnote of the agencies statements.

Agencies may have other ways of tracking the breakdown than what is presented here.

32

The Trading Partner should be the agency and the Trading Partner Main should be the Guarantee Financing Fund when the re-estimate is due. For example,

Department of Energy would use Trading Partner 089 and Trading Partner Main 4486.

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 45 of 153 August 2017

Financing Fund

33

DR

CR

TC

Budgetary Entry

None

Proprietary Entry

131000 (F) (TP Agency Main) Accounts Receivable

[Subsidy Receivable from Program Fund]

34

23

139900 (NF) Allow. for Subs. [Defaulted Guar. Loans Rec.]

218000 (NF) Loan Guarantee Liability

7

30

C438

In requesting SF132 and in President’s budget the Interest Rate Re-estimate and Technical Re-estimate are added together. If this

amount is positive in total, it is an upward re-estimate. The interest is looked at by itself and includes any financing account

adjustments. If this amount is positive in total, it is an upward re-estimate. If either of the pieces are negative, that piece is a

downward re-estimate (See year 2 for downward re-estimate entries)

33

The agency must determine the present value breakdown between the defaulted guarantee loan and the remaining guarantees outstanding as only a total re-

estimate is calculated and approved by OMB.

34

Use appropriate Trading Partner. For example, Department of Energy would use Trading Partner 089 and Trading Partner Main 0209.

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 46 of 153 August 2017

Pre-Closing Entries

1-19

Financing Fund

To close anticipated resources

DR

CR

TC

Budgetary Entry

445000 Unapportioned Authority

406000 Anticipated Collections from Non-Federal Sources

407000 Anticipated Collections from Federal Sources

1,230

40

1,190

F112

Proprietary Entry

None

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 47 of 153 August 2017

Year 1

Pre-Closing Adjusted Trial Balance

Program Fund

Debit/(Credit)

Financing Fund

Debit/(Credit)

Accounts

Budgetary

411500 Loan Subsidy Appropriation

21,500

411700 Loan Administrative Expense Appropriation

5,000

412500 Loan Modification Adjustment Transfer Appropriation

10

422100 Unfilled Customer Orders Without Advance

645

426100 Actual Collections of Business-Type Fees

480

426200 Actual Collections of Loan Principal

40

426300 Actual Collections of Loan Interest

200

427100 Actual Program Fund Subsidy Collected

19,705

427300 Interest Collected From Treasury

1,160

445000 Unapportioned Authority

(16,740)

459000 Apportionments - Anticipated Resources - Programs Subject to Apportionment

-

461000 Allotments - Realized Resources

(1,200)

(60)

480100 Undelivered Orders - Obligations, Unpaid

(645)

490200 Delivered Orders – Obligations, Paid [Other]

(24,655)

(5,440)

Total

0

0

Proprietary

101000 Fund Balance With Treasury

1,845

16,155

131000 (F TP Main) Accounts Receivable (Subsidy Recv.)

23

134100 (NF) Interest Receivable – Loans

1,035

135000 (NF) Loans Receivable

3,450

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 48 of 153 August 2017

Pre-Closing Adjusted Trial Balance (Continued)

139900 (NF) Allowance for Subsidy

(1,718)

217000 (F TP Main) Subsidy Payable to the Financing Account

(23)

218000 (NF) Loan Guarantee Liability

(18,945)

310100 Unexpended Appropriations - Appropriations Received

(26,500)

(10)

310700 Unexpended Appropriations - Used

24,655

10

531200 (F TP 020 Main 1880) Interest Revenue - Loans Receivable/Uninvested Funds

(Treasury)

(1,160)

531200 (NF) Interest Revenue- Loans Receivable/Uninvested Funds

(5)

531300 Interest Revenue - Subsidy Amortization (Int. on PV Assets)

(5)

570000 Expended Appropriations

(24,655)

(10)

579100 Adjustment to Financing Sources - Credit Reform

(10)

10

610000 (NF) Operating Expenses/Program Costs (Admin.)

4,000

610000 (F TP 047 Main XXXX) Operating Expenses/ Program Costs (Admin.)

950

610000 Operating Expenses/Program Costs (Subsidy)

19,705

634000 Interest Expense Accrued on the Liability for Loan Guarantees (Int. on PV of LGL)

1,160

680000 Future Funded Expenses (Subs. Reest. Tech.)

36

680000 Future Funded Expenses (Subs. Reest. Int.)

(13)

729000 Other Losses

10

Total

0

0

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 49 of 153 August 2017

Pre-Closing Adjusted Trial Balance (Continued)

Debit(Credit)

Loan Guarantee Level

Memorandum Accounts

801000 Guaranteed Loan Level

95,349

801500 Guaranteed Loan Level - Unapportioned

802000 Guaranteed Loan Level - Apportioned

(5,349)

804000 Guaranteed Loan Level - Used Authority

(90,000)

804500 Guaranteed Loan Level - Unused Authority

Total

0

Loans Disbursed

Memorandum Accounts

805000 Guaranteed Loan Principal Outstanding

72,625

805300 Guaranteed Loan New Disbursements by Lender

(87,000)

806500 Guaranteed Loan Collections, Defaults, and Adjustments

14,375

807000 Guaranteed Loan Cumulative Disbursements by Lenders

Total

0

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 50 of 153 August 2017

1-20 The agency made closing entries.

Program Fund

To consolidate net cash resources

DR

CR

TC

Budgetary Entry

490200 Delivered Orders – Obligations, Paid

420100 Total Actual Resources – Collected

24,655

1,845

F302

411500 Loan Subsidy Appropriation

411700 Loan Administrative Expense Appropriation

Proprietary Entry

None

21,500

5,000

To close unobligated authority

DR

CR

TC

Budgetary Entry

461000 Allotments - Realized Resources

465000 Allotments - Expired Authority

Proprietary Entry

None

1,200

1,200

F312

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 51 of 153 August 2017

To close financing sources and expenses

DR

CR

TC

Budgetary Entry

None

Proprietary Entry

570000 Expended Appropriations

579100 Adjustments to Financing Sources

331000 Cumulative Results of Operations

680000 Future Funded Expenses

[Re-estimated Subsidy Expense - Interest Rate]

610000 Operating Expenses/Program Costs

[Administrative Expenses]

610000 Operating Expenses/Program Costs

[Basic and Modified Subsidy Expense]

680000 Future Funded Expenses

[Re-estimated Subsidy Expense – Technical]

729000 Other Losses

24,655

10

23

13

4,950

19,705

36

10

F336

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 52 of 153 August 2017

To consolidate unexpended appropriations

DR

CR

TC

Budgetary Entry

None

Proprietary Entry

310100 Unexpended Appropriations – App. Received

310000 Unexpended Appropriations - Cumulative

310700 Unexpended Appropriations - Used

26,500

1,845

24,655

F342

Financing Fund

To consolidate net cash resources

DR

CR

TC

Budgetary Entry

490200 Delivered Orders – Obligations, Paid

420100 Total Actual Resources – Collected

426100 Actual Collection of Business-Type Fees

426200 Actual Collection of Loan Principal

426300 Actual Collection of Loan Interest

427100 Actual Program Fund Subsidy Collected

427300 Interest Collected From Treasury

412500 Loan Modification Adjustment Transfer Appropriation

Proprietary Entry

None

5,440

16,155

480

40

200

19,705

1,160

10

F302

F314

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 53 of 153 August 2017

To close unobligated authority

DR

CR

TC

Budgetary Entry

461000 Allotments - Realized Resources

445000 Unapportioned Authority

Proprietary Entry

None

60

60

F308

To close financing sources and expenses

35

DR

CR

TC

Budgetary Entry

None

Proprietary Entry

531200 Interest Revenue –

Loans Receivable/Uninvested Funds [Treasury]

531300 Interest Revenue – Subsidy Amortization

570000 Expended Appropriations

634000 Interest Exp Accrual on Liability for Loan Guarantee

[Interest Accumulation Factor on PV of LGL]

579100 Adjustments to Financing Sources

1,160

20

10

1,160

10

F336

35

Note that the cumulative results of operations from this activity are zero. The financing fund cannot have a net position after closing. Assets must equal

liabilities.

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 54 of 153 August 2017

To consolidate unexpended appropriations

DR

CR

TC

Budgetary Entry

None

Proprietary Entry

310100 Unexpended Appropriations – Appropriations Received

310700 Unexpended Appropriations – Used

10

10

F342

Memorandum Accounts

Loan Guarantee Level

DR

CR

TC

Budgetary Entry

None

Proprietary Entry

None

Memorandum Entry

802000 Guaranteed Loan Level – Apportioned

804500 Guaranteed Loan Level - Unused Authority

804500 Guaranteed Loan Level – Unused Authority

36

801000 Guaranteed Loan Level

5,349

5,349

5,349

5,349

F346

F352

36

Since loan authority was available only for one year, there are no unused amounts to carry forward

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 55 of 153 August 2017

Loans Disbursed

DR

CR

TC

Budgetary Entry

None

Proprietary Entry

None

Memorandum Entry

805300 Guaranteed Loans New Disbursements by Lenders

807000 Guaranteed Loan Cumulative. Disbursements by Lenders

807000 Guaranteed Loan Cumulative. Disbursements by Lenders

806500 Guaranteed Loans Collections, Defaults, and Adjustments

87,000

14,375

87,000

14,375

F348

F350

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 56 of 153 August 2017

Year 1

Post-Closing Trial Balance

Program Fund

Debit/(Credit)

Financing Fund

Debit/(Credit)

Accounts

Budgetary

411500 Loan Subsidy Appropriation

-

420100 Total Actual Resources – Collected

1,845

16,155

422100 Unfilled Customer Orders Without Advance

645

445000 Unapportioned Authority

(16,800)

465000 Allotments - Expired Authority

(1,200)

480100 Undelivered Orders - Obligations, Unpaid

(645)

Total

0

0

Proprietary

101000 Fund Balance With Treasury

1,845

16,155

131000 (F TP Main) Accounts Receivable (Subs. Recv.)

23

134100 (NF) Interest Receivable – Loans

1,035

135000 (NF) Loans Receivable

3,450

139900 (NF) Allowance for Subsidy

(1,718)

217000 (F TP Main) Subsidy Payable to the Financing Account

(23)

37

Post-Closing Trial Balance (Continued)

218000 Loan Guarantee Liability

(18,945)

310000 Unexpended Appropriations - Cumulative

(1,845)

331000 Cumulative Results of Operations

23

Total

0

0

37

This amount will eliminate on the Balance Sheet.

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 57 of 153 August 2017

Post-Closing Trial Balance (Financing Fund Only)

Debit

Credit

Loan Guarantee Level

Memorandum Accounts

801000 Guaranteed Loan Level

90,000

801500 Guaranteed Loan Level - Unapportioned

-

802000 Guaranteed Loan Level - Apportioned

-

804000 Guaranteed Loan Level - Used Authority

90,000

804500 Guaranteed Loan Level - Unused Authority

-

Total

0

0

Loans Disbursed

805000 Guaranteed Loan Principal Outstanding

72,625

805300 Guaranteed Loan New Disbursements by Lender

-

806500 Guaranteed Loan Collections, Defaults, and Adjustments

-

807000 Guaranteed Loan Cumulative Disbursements by Lenders

72,625

Total

0

0

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 58 of 153 August 2017

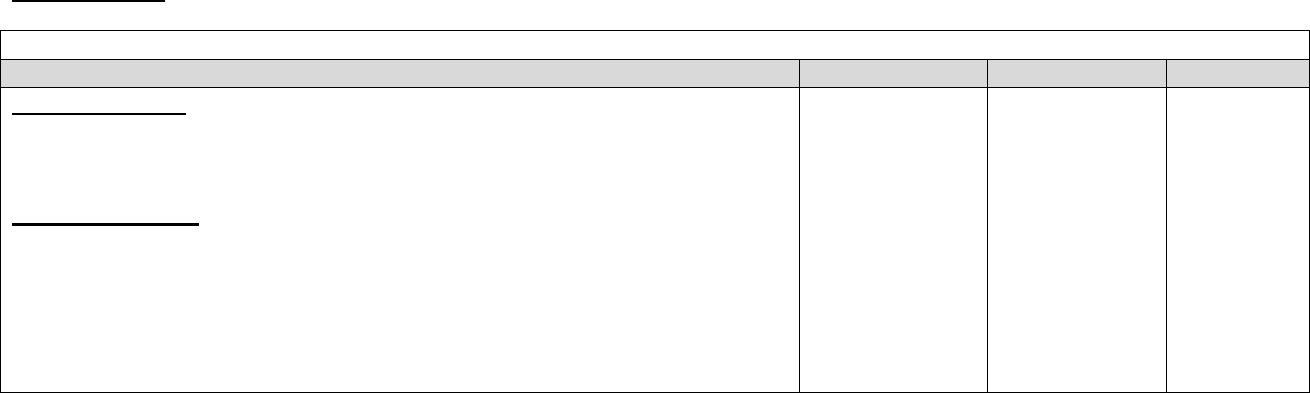

Loan Guarantee Agency

September 30, FY-1

BALANCE SHEET

Program

Fund

Elim

Financing

Fund

Total

Assets:

Intragovernmental

1.

Fund Balance with Treasury (101000E)

1,845

16,155

18,000

3.

Accounts Receivable (131000E)

(23)

23

6.

Total Intragovernmental (calc.)

1,845

(23)

16,178

18,000

11.

Direct Loan and Loan Guarantees, Net (134100E, 135000E, 139900E)

2,767

2,767

15.

Total Assets (calc.)

1,845

(23)

18,945

20,767

Liabilities:

17.

Accounts Payable (2170000E)

23

(23)

20.

Total Intragovernmental

23

(23)

22.

Loan Guarantee Liability (218000E)

18,945

18,945

28.

Total Liabilities (calc.)

23

(23)

18,945

18,945

Net Position:

31.

Unexpended Appropriations – All Other Funds (310100E, 310700E)

1,845

1,845

33.

Cumulative Results of Operations - All Other Funds (531200E,

570000, 579100, 610000E, 634000E, 680000E, 729000E)

(23)

(23)

35.

Total Net Position – All Other Funds (calc.)

1,822

1,822

36.

Total Net Position (calc.)

1,822

1,822

37.

Total Liabilities and Net Position (calc.)

1,845

18,965

20,787

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 59 of 153 August 2017

Loan Guarantee Agency

for Fiscal Year Ended September 30, FY-1

STATEMENT OF NET COST

Program

Fund

Financing

Fund

Total

Gross Program Costs:

1. Gross costs (610000E, 634000E, 680000E, 729000E)

24,688

1,180

25,868

2. Less: Earned Revenues (531200E, 531300E)

1,180

1,180

3. Net program costs (calc. 1-2)

24,688

8. Net cost of operations (calc. 5+6-7)

24,688

24,688

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 60 of 153 August 2017

Loan Guarantee Agency

for Fiscal Year Ended September 30, FY-1

STATEMENT OF CHANGES IN NET POSITION

Program Fund

Financing Fund

38

Total

Cumulative

Results of

Operations

Unexpended

Appropriations

Cumulative

Results of

Operations

Unexpended

Appropriations

Cumulative

Results of

Operations

Unexpended

Appropriations

Cumulative Results of Operations:

Budgetary Financing Sources:

5.

Appropriations Used (570000E)

24,655

10

24,665

13.

Other (579100E)

10

(10)

14.

Total Financing Sources

24,665

24,665

15.

Net Cost of Operations (+/-)

24,688

24,688

16.

Net Change (calc. 14-15)

(23)

(23)

17.

Cumulative Results of Operations (calc.

3+16)

(23)

(23)

Unexpended Appropriations:

Budgetary Financing Sources:

21.

Appropriations Received (310100E)

26,500

10

26,510

24.

Appropriations Used (310700E)

(24,655)

(10)

(24,665)

38

Note that the column for unexpended appropriations would normally not be applicable, because the financing fund does not have appropriations. However,

positive modification adjustment transfers are indefinite appropriated funding.

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 61 of 153 August 2017

STATEMENT OF CHANGES IN NET POSITION

25.

Total Budgetary Financing Sources (calc.

21..24)

1,845

1,845

26.

Total Unexpended Appropriations (calc.

20 + 25)

1,845

1,845

27.

Net Position (calc. 17 + 26)

(23)

1,845

(23)

1,845

Loan Guarantee Agency

for Fiscal Year Ended September 30, FY-1

39

STATEMENT OF BUDGETARY RESOURCES

Budgetary

Non-Budgetary

Financing

Account

Total

Budgetary Resources:

1290

Appropriations (discretionary and mandatory) (411500E, 411700E,

4125000E)

26,500

10

26,510

1890

Spending authority from offsetting collections (discretionary and

mandatory) ((426100,426200, 426300,427100,427300,422100E-422100B))

22,230

22,230

1910

Total budgetary resources

$26,500

$22,240

$48,740

39

Statement of Budgetary Resources is a combined report. Inter-entity eliminations are not allowed.

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 62 of 153 August 2017

STATEMENT OF BUDGETARY RESOURCES

Status of Budgetary Resources:

2190

New obligations and upward adjustments (total) (480100E-480100B,

490100E-490100B, 490200E)

25,300

5,440

30,740

Unobligated balance, end of year:

2204

Apportioned, unexpired account (461000E)

1,200

60

1,260

2404

Unapportioned, unexpired accounts (445000E)

16,740

16,740

2500

Total budgetary resources

$26,500

$22,240

$48,740

Change in obligated balance

3012

New obligations and upward adjustments

25,300

5,440

30,740

3020

Outlays (gross) (-) (490200E)

24,655

5,440

30,095

3050

Unpaid obligations, end of year

645

0

645

3072

Change in uncollected pymts, Fed sources (+ or-) (422100E-

422100B)

(645)

(645)

3090

Uncollected pymts, Fed sources, end of year (-)

(645)

(645)

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 63 of 153 August 2017

STATEMENT OF BUDGETARY RESOURCES

Memorandum (non add) entries

3200

Obligated balance, end of year (+ or -)

645

(645)

Budget Authority and Outlays, Net:

4175

Budget authority, gross (discretionary and mandatory)

26,500

22,240

48,740

4177

Change in uncollected, pymts, Fed sources (discretionary and mandatory)

(+ or -)

(21,585)

(21,585)

4178

Recoveries of prior year paid obligations (discretionary and mandatory)

(645)

(645)

4180

Budget authority, net (total) (discretionary and mandatory)

26,500

10

26,510

4185

Outlays, gross (discretionary and mandatory)

24,655

5440

30,095

4187

Actual offsetting collections (discretionary and mandatory) (-)

(21,585)

(21,585)

4190

Outlays, net (total) (discretionary and mandatory)

24,655

(16,145)

8,510

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 64 of 153 August 2017

Loan Guarantee Agency

for Fiscal Year Ended September 30, FY-1

40

FUND BALANCE WITH TREASURY FOOTNOTE

Program

Fund

Financing

Fund

Total

A. Fund Balance

3. Revolving Funds

16,155

16,155

4. General Funds

1,845

1,845

Total

1,845

16,155

18,000

B. Status of Fund Balance

1. Unobligated Balances

(a) Available (461000)

1,200

60

1,260

(b) Unavailable (445000)

16,740

16,740

2. Obligated Balances not yet disbursed

(a) Unpaid Obligations (480100)

645

645

(b) Uncollected customer payments from federal sources

(422100)

(645)

(645)

Total

1,845

16,155

18,000

40

Note: Footnotes are not supported by the USSGL crosswalks.

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 65 of 153 August 2017

Loan Guarantee Agency

September 30, FY-1

Note 8: Credit Program Note

I. Defaulted Guaranteed Loans from Post – 1991 Guarantees:

Defaulted Guaranteed Loans Receivable, Gross (135000)

3,450

Interest Receivable (134100)

1,035

Less Allowance for Subsidy Cost (139900)

(1,718)

Value of Assets Related to Defaulted Guaranteed Loan Receivables, Net

$2,767

J. Guaranteed Loans Outstanding:

J1. Guaranteed Loans Outstanding:

Outstanding Principal of Guaranteed Loans, Face Value (805000)

$72,625

Amount of Outstanding Principle Guaranteed (805000* gtd %)

$58,100

J2. New Guaranteed Loans Disbursed (Current reporting year):

Principle of Guaranteed Loans, Face Value (805300)

$87,000

Amount of Principle Guaranteed (805300 * gtd %)

$69,600

K. Liability for Loan Guarantees:

K1. Liability for Loan Guarantees

Liabilities for Post-1991 Guarantees, Present Value (218000)

$18,945

L Subsidy Expense for Loan Guarantees by Program and Component

41

:

L1. Subsidy Expense for New Loan Guarantees

Interest Supplements

1,740

Defaults

17,400

Fees and Other Collections

(435)

Total

$18,705

41

The components of some of the disclosure in the Credit Program note cannot be derived from the standard USSGL accounts.

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 66 of 153 August 2017

Note 8: Credit Program Note

L2. Modifications and Reestimates (Current reporting year):

Total Modifications

1,000

Interest Rate Reestimates (680000)

(13)

Technical Reestimates (680000)

36

Total Reestimates

1,023

L3. Total Loan Guarantee Subsidy Expense:

(equals 610000 + 680000 for subsidy & modification)

$19,728

M. Subsidy Rates for Loan Guarantees by Program and Component

42

Budget Subsidy Rates for Loan Guarantees for the Current Years Cohorts:

Percent

Defaults

20.0

Interest supplements

2.0

Fees and Other Collections

(0.5)

Total

21.5

N. Schedule for Reconciling Loan Guarantee Liability Balances (Post-

1991 Loan Guarantees)

43:

a. Interest supplement costs

1,740

b. Default costs (net of recoveries)

17,400

c. Fees and other collections

(435)

Total of the above subsidy expense components

$18,705

Adjustments:

a. Loan guarantee modifications

1,000

b. Fees received (426100)

480

c. Interest supplements used

(1,940)

42

This information is obtained from the subsidy model.

43

The information presented here is for the applicable sections of note 8 Direct Loans and Loan Guarantees, Non-Federal Borrowers in OMB’s Circular A-136,

Financial Reporting Requirements . A reconciliation of subsidy cost allowance for guaranteed defaults is not required in A-136 so it is not presented; however,

some organizations present it for consistency with the presentation of direct loans.

GUIDE FOR BASIC ACCOUNTING AND REPORTING

FOR LOAN GUARANTEE PROGRAMS

WITHOUT COLLATERAL

IN FEDERAL CREDIT PROGRAM

Loan Guarantee Page 67 of 153 August 2017

Note 8: Credit Program Note

d. Foreclosed property and loans acquired

3,000

e. Claim payment to lenders

(3,500)

f. Interest accumulation on liability balance (634000)

1,160

g. Other (412500)

10

Ending balance of the loan guarantee liability before reestimates

18,915

Add or subtract subsidy reestimates by component:

a. Interest rate reestimate (prorated based 1399 & 2180 pieces)

(17)

b. Technical/default reestimate (prorated based 1399 & 2180 pieces)

47

Total of the above reestimate components

30