Board of Supervisors

Hilda L. Solis

Supervisor, First District

Holly J. Mitchell

Supervisor, Second District

Lindsey P. Horvath

Supervisor, Third District

Janice Hahn

Supervisor, Fourth District

Kathryn Barger

Supervisor, Fifth District

Fesia A. Davenport

Chief Executive Officer

Arlene Barrera

Auditor-Controller

County of Los Angeles

2023-24

Recommended

Budget

Submitted to the

Board of Supervisors

April 2023

Volume One

Board of Supervisors

Hilda L. Solis

Supervisor, First District

Holly J. Mitchell

Supervisor, Second District

Lindsey P. Horvath

Supervisor, Third District

Janice Hahn

Supervisor, Fourth District

Kathryn Barger

Supervisor, Fifth District

Fesia A. Davenport

Chief Executive Officer

Arlene Barrera

Auditor-Controller

County of Los Angeles

2023-24

Recommended

Budget

Submitted to the

Board of Supervisors

April 2023

Volume One

“To Enrich Lives Through Effective and Caring Service”

County

of

Los Angeles

2023

-

24

Recommended

Budget

April 2023

Submitted

to the

County of Los Angeles

Board of Supervisors

by

Fesia A. Davenport

Chief Executive Officer

and

Arlene Barrera

Auditor-Controller

Hilda L. Solis

Supervisor, First District

Population: 1,953,841

Square Miles: 269

County of Los Angeles

Board of Supervisors

Holly J. Mitchell

Supervisor, Second District

Population: 1,966,545

Square Miles: 177

Lindsey P. Horvath

Supervisor, Third District

Population: 2,009,756

Square Miles: 446

Janice Hahn

Supervisor, Fourth District

Population: 2,045,655

Square Miles: 411

Kathryn Barger

Supervisor, Fifth District

Population: 1,868,392

Square Miles: 2,785

Enriching Lives

April 18, 2023

The Honorable Board of Supervisors

County of Los Angeles

383 Kenneth Hahn Hall of Administration

500 West Temple Street

Los Angeles, California 90012

Dear Supervisors:

2023-24 RECOMMENDED COUNTY BUDGET

(3-VOTES)

The 2023-24 Recommended Budget marks Los Angeles County’s first spending blueprint

since the end of the COVID-19 emergency and the start of the local emergency for

homelessness—two defining milestones of this transformative moment in which we are

also addressing longstanding racial, social, and economic inequities; realizing the Board’s

Care First, Jails Last vision; and delivering extensive safety net services to our residents.

Guided by the priorities established by your Board, this Recommended Budget sustains

the ambitious work underway across multiple County departments and strengthens the

County workforce as it serves the public with expanding and existing programs. It does

not include significant funding to launch new programs at this time, although critical needs

may be considered later in the budget process as a fuller picture of our revenues and

obligations becomes available.

This $43.0 billion budget reflects a decrease of $1.6 billion when compared to the

2022-23 Final Adopted Budget (approved in October 2022). It increases the total number

of budgeted positions by 514, for a total of 114,106.

The Recommended Budget—the first step in the County’s multi-phase budget process—

was developed against a backdrop of growing fiscal uncertainty, including a looming State

budget deficit, a significant slowdown in local real estate transactions, and an unsettled

economic environment in which recession remains a very real possibility.

Kathryn Barger

Fifth District

COUNTY OF LOS ANGELES

Kenneth Hahn Hall of Administration

500 West Temple Street, Room 713, Los Angeles, CA 90012

(213)

974-1101 ceo.lacounty.gov

C

HIEF EXECUTIVE OFFICER

Fesia A. Davenport

Janice Hahn

Fourth District

BOARD OF

SUPERVISORS

Hilda L. Solis

First District

Holly J. Mitchell

Second District

Lindsey P. Horvath

Third District

"To Enrich Lives Through Effective And Caring Service"

The Honorable Board of Supervisors

April 18, 2023

Page 2

As always, funding requests far exceed available resources. Although, we are

recommending $551.7 million in new funding, there are more than $1.9 billion in unmet

needs requests. Of this amount, we are deferring $813.2 million funding requests to

future budget phases, leaving $1.1 billion as an unmet need.

Among other actions, the 2023-24 Recommended Budget focuses on funding some of

the County’s most urgent priorities—including homelessness, Care First and Community

Investment (CFCI) programming, addressing unacceptable conditions in the County jail

system, and setting up reform and compliance mechanisms within the Sheriff’s

Department—in the following ways:

Mobilizing an emergency response to the humanitarian crisis of homelessness.

The Recommended Budget includes $692.0 million in resources, including

extensive investments in mental health outreach, supportive services, and a wide

range of housing programs to increase the supply of affordable housing and move

people off the streets and into safe living conditions.

Delivering on the County’s commitment to allocate a full 10 percent of its locally

generated unrestricted revenues to direct community investment and alternatives

to incarceration by providing an additional $88.3 million, for a total ongoing

investment of $288.3 million, for Year Three of CFCI projects and programs to

address racial disparities in the justice system. Approval of this amount will allow

the County to reach the 10 percent target by June 2024, as originally specified in

Measure J and later memorialized in the Board’s budget policy.

Advancing the Care First, Jails Last vision and improving mental health services

and unacceptable conditions in the County's jails. Ongoing funding of $49.6 million

is recommended for Integrated Correctional Health Services (ICHS) and the

Sheriff’s Department to work toward meeting the terms of the U.S. Department of

Justice (DOJ) consent decree and Rutherford settlement with the support of the

County’s new DOJ Compliance Officer.

Supporting Sheriff’s Department reforms, from addressing deputy gangs to

providing more transparency. This budget recommends funding for the Sheriff to

establish the Office of Constitutional Policing to, among other things, oversee and

monitor consent decrees and investigate deputy gang issues.

The Honorable Board of Supervisors

April 18, 2023

Page 3

This year’s Recommended Budget reflects modest increases in property and sales tax

revenues, although at markedly lower growth rates than reflected in the prior year’s

budget. This lower anticipated rate of revenue growth coupled with unavoidable rising

cost increases and existing County commitments made it challenging to balance this

year’s budget. Following are the primary cost drivers in the 2023-24 Recommended

Budget:

Rising employee wages and benefits;

Increasing public assistance caseloads;

Addressing a few departmental structural deficits;

Existing Board/County policies/commitments; and

Paying all contractual and legal settlements.

Going forward, the County faces sobering budget challenges and pressures. The

County’s $1.9 billion in American Rescue Plan Act (ARPA) funding is required to be fully

expended by 2026, and with no similar federal funding program expected to take its place,

important programs will not be sustainable. A significant overhaul of the County’s

Probation system is anticipated, potentially leading to the need for greater investments in

facilities, programs, and staff.

Perhaps the most significant long-term challenge is posed by the liability and settlement

costs associated with Child Victims Act (AB 218) claims discussed in more detail later in

this letter. Early and preliminary estimates of this liability are in the billions of dollars. The

cost to settle these claims will have a profound impact on the County budget for decades.

Since costs associated with this law, which extends the statute of limitations for

prosecution of childhood sexual assault cases, are still emerging, we will return at a later

date to provide budget recommendations to the Board.

On the more immediate horizon, the housing market in the County has cooled

considerably after the rebound in home sales in the early months of the pandemic.

January and February home sales for 2023 were at their lowest levels in more than a

decade due to higher mortgage interest rates driven by Federal Reserve (Fed) Board

increases in the federal funds borrowing rate. If this trend continues, the County property

tax growth for 2024-25 budget year will be at risk and may require us to downgrade our

property tax forecast for that year, which would significantly curtail the amount of locally

generated revenue available to fund key programs and services.

The Honorable Board of Supervisors

April 18, 2023

Page 4

BUDGET OVERVIEW

As displayed below, the 2023-24 Recommended Budget total of $43.0 billion reflects a

decrease of $1.6 billion in total financing uses when compared to the 2022-23 Final

Adopted Budget from October 2022. This is due to decreases in the Total General County

Fund group (comprised of the General Fund and Hospital Enterprise Funds) and Special

Districts/Special Funds.

Fund Group

($ in billions)

2022-23

Final Adopted

Budget

2023-24

Recommended

Change

%

Change

Total General County $33.333 $33.099 -$0.234 -0.7%

Special Districts/

Special Funds

11.309 9.897 -1.412 -12.5%

Total Budget $44.642 $42.996 -$1.646* -3.7%

Budgeted Positions 113,592 114,106 514** 0.5%

*Though this represents nearly a four percent reduction from the Fiscal Year (FY) 2022-23 Final Adopted Budget,

additional funding may be allocated over the coming budget phases.

**The net increase in position count is primarily funded with outside revenue sources, including State and federal

funding.

The total number of budgeted positions increased by 514, bringing the total number of

budgeted positions to 114,106. The new budgeted positions are largely offset by federal

or State revenue and special district funding and include:

195 positions within the Department of Mental Health (DMH) to support community

care in the Hollywood and Antelope Valley communities; expand urgent care

mental health services, reentry services for women, and outreach to homeless

veterans on skid row; and increase the number of System-wide Mental Evaluation

and Response Teams (SMART) that partner DMH mental health clinicians with

Los Angeles Police Department personnel, among other roles;

86 positions for clinicians at various levels to fill various roles in the County’s

hospital and clinic system;

The Honorable Board of Supervisors

April 18, 2023

Page 5

70 positions for the Department of Children and Family Services (DCFS), more

than half of which will support the expansion of the Upfront Family Finding

Program, which seeks to place children with relatives or family friends;

60 positions to support wildfire suppression; and

29 positions for the Justice, Care, and Opportunities Department to continue to

fulfill staffing plan commitments and provide Care First services consistent with

your Board’s classifications approvals for the Department on November 1, 2022.

ECONOMIC OUTLOOK

At the start of 2023, the U.S. economy showed continued strength from strong hiring and

consumer spending that was resilient in the face of rising prices, while the Fed’s rate hikes

have made borrowing more expensive. Although the economy remains strong, there is

much economic uncertainty from continuing high inflation that may lead to a slowdown in

the economy.

The forecast for our statewide sales tax and locally generated revenues reflects moderate

growth based on current revenue trends and in relation to the 2022-23 Final Adopted

Budget. For the 2023-24 Recommended Budget, the Proposition 172 Public Safety sales

tax revenue reflects a projected increase of 2.6 percent, or $26.1 million, while local sales

and use tax collected in unincorporated areas reflects an estimated increase of

8.3 percent, or $6.7 million. These revenues have remained positive from sustained

consumer spending despite higher prices and a strong labor market that has raised

wages.

Over the past year, the Fed’s rapid hikes in the federal funds borrowing rate to combat

inflation have led to significant increases in both interest earnings rates and mortgage

rates. On the positive side, the average interest earnings rate on our cash deposits has

increased by approximately 2.8 percent from February 2022 to February 2023. As a

result, we are projecting an additional $101.5 million in interest earnings revenue for fiscal

year 2023-24.

However, mortgage rates have also surged, making it more expensive for prospective

buyers to borrow, while applying downward pressure on home prices. In consultation

with the County Assessor, we are forecasting an approximate five percent increase to the

2023 tax assessment roll, which results in a $385.7 million increase in property tax

revenue. This forecast is preliminary as the Assessor is scheduled to issue its official

forecast in May 2023 and release the final roll in the summer of 2023. Our office will

continue to work with the Assessor’s Office and, if needed, update assessed value

projections in future budget phases.

The Honorable Board of Supervisors

April 18, 2023

Page 6

Despite strength in recent consumer spending and employment reports, persistently high

inflation poses a significant risk to the economy. The Fed’s rate hikes to control inflation

have yet to effectively reduce inflation to their two percent target. Consequently, they are

now expected to increase rates again and for longer than previously anticipated. The

Fed’s monetary tightening actions are aimed at bringing down prices by curbing

investment, spending, and hiring. However, the Fed acknowledges that this could result

in economic contraction as demand falls and further result in job cuts as business slows.

In turn, a pullback in consumer and business spending could lead to a risk of a recession

if the Fed’s monetary policy proves to be too aggressive.

Additionally, the recent failure of two large U.S. banks has stirred further economic

uncertainty and market volatility. The fallout of these bank collapses has prompted fears

of a potential banking crisis and added complexity to the Fed’s future monetary actions.

We are aware that some economists and financial institutions have continued to forecast

a recession later this year or in 2024. Our office is closely monitoring the latest economic

data and remains vigilant to address any signs of an economic slowdown or increased

risk of a recession.

ABOUT THE BUDGET PROCESS

The Recommended Budget is the first step in the County’s multi-part budget process,

which includes Public Hearings in May; deliberations leading to the approval of the

Adopted Budget in June; and the Supplemental Budget culminating with the approval of

the Final Adopted Budget in the fall. This multi-part process enables the County to

respond nimbly to fiscal and economic changes and opportunities that may not be

available at the start of the budget year. In some cases, funding is set aside in the

Provisional Financing Uses (PFU) budget unit as part of the Recommended Budget, while

program implementation plans are being developed and finalized.

Most of the County’s budget is funded from State and federal sources or from charges or

fees for services provided to contract cities or the public. These revenues are tied to

specific programs and may not be repurposed. Similarly, the bulk of locally generated

revenues is committed to ongoing programs and services previously approved by the

Board. As a result, the Recommended Budget highlights below focus primarily on

programmatic changes rather than ongoing operations.

HIGHLIGHTS OF SIGNIFICANT PROGRAM CHANGES

Below are some notable changes included in the 2023-24 Recommended Budget.

The Honorable Board of Supervisors

April 18, 2023

Page 7

Continued Momentum for Care First, Jails Last

This Recommended Budget marks the final year of a three-year plan to allocate a full

10 percent of ongoing locally generated unrestricted revenues to CFCI programs that

carry out the Board’s vision of a justice system rooted in Care First, Jails Last. As directed

by Board budget policy, our office calculated the amount equivalent to 10 percent of

ongoing locally generated unrestricted revenues for 2023-24, which totals $288.3 million.

As a result, the Recommended Budget includes an additional allocation of $88.3 million

in ongoing funding for the CFCI budget unit. This new funding, along with the

$200.0 million currently allocated to the CFCI budget, brings the total ongoing

commitment for 2023-24 to $288.3 million and the Board’s total investment in CFCI since

2021 to $676.0 million.

It should be noted that CFCI is the only budget entity which by Board policy automatically

rolls over all unspent funds from year-to-year. Together with $197.7 million in one-time

carryover funding being advanced in this budget phase, the total recommended

investment in CFCI programs is $486.0 million for 2023-24.

Funding set aside in the CFCI budget is aimed at addressing racial injustice in the criminal

justice system by providing direct community investments and alternatives to

incarceration. Specific recommendations for these investments, reflecting the input of the

CFCI Advisory Committee, are scheduled to be presented to the Board for approval later

in spring 2023 and, upon Board approval, to be included in the Final Changes Budget in

June 2023. The 10-percent “set-aside” will be recalculated every year, in accordance

with the Board’s budget policy.

Homelessness, Mental Health and Affordable Housing

Measure H Homeless Services and Housing – Reflects a total budget of

$692.0 million, to fund the County’s New Framework to combat homelessness.

The New Framework is divided into five categories of action to urgently drive results:

Coordinate – Create a coordinated system that links critical infrastructure and

drives best practices;

Prevent – Provide targeted prevention services to avoid entry or a return to

homelessness;

Connect – Link and navigate everyone to an exit pathway;

House – Rapidly rehouse using temporary and permanent housing; and

Stabilize – Scale services critical to rehousing and stabilization success.

The Honorable Board of Supervisors

April 18, 2023

Page 8

The budget includes $25.5 million to support city-specific programs and services through

the Local Solutions Fund and Cities and Council of Governments Interim Housing Fund.

The focus for these funds is helping individuals experiencing homelessness move out of

encampments and into housing and to pay for supportive services at interim housing

sites.

The budget also supports Board-directed housing developments and the administration

of various homeless programs and services.

Mental Health Services Act (MHSA) Spending – Adds $60.2 million and

168 positions needed for various mental health services, including the following:

68 positions to expand Full-Service Partnership services needed to ensure

adequate capacity in the mental health care network; 54 positions for the

Hollywood Mental Health Cooperative, a new, comprehensive approach to serving

those with severe and persistent mental illness in the Hollywood community; and

32 positions for the new Antelope Valley Children and Family Mental Health Clinic,

focused on providing mental health services to children and families.

Affordable Housing – Provides $30.0 million to maintain a total of $100.0 million

for the development and preservation of affordable housing. This funding will

support affordable housing for very low- and extremely low-income households,

individuals and/or families experiencing homelessness, as well as other supportive

services such as eviction defense, mortgage relief, rapid re-housing,

homeownership, and acquisition.

Veterans’ Services – Provides $0.4 million in MHSA funding from DMH to the

Department of Military and Veterans Affairs for 2 positions to support the Veterans

Navigator Program, which assists veterans as they transition from military to

civilian life.

Health Care Delivery

Sexually Transmitted Infections (STI) – Allocates $2.5 million in Tobacco

Settlement funding to the Department of Public Health to support the County’s

response to the rise in STI.

Martin Luther King, Jr. Outpatient Center (MLK) Urgent Care Expansion –

Provides $1.5 million and 10 positions for the Department of Health Services

(DHS) to support the MLK Urgent Care expansion.

The Honorable Board of Supervisors

April 18, 2023

Page 9

Clinical Social Work Staffing – Adds $2.5 million and 16 positions, fully offset

with DHS revenues, at various departmental facilities to oversee clinical social

work operations.

Other Justice-Related Programs

Establishing the Office of Constitutional Policing – Adds $6.6 million and

24 non-sworn positions to the Sheriff’s Department for the establishment of the

Office of Constitutional Policing, which will oversee and monitor consent decrees,

deputy gang issues, audit and investigations, compliance, risk management, and

policy development. Also restores the Assistant Sheriff, Administration position.

DOJ Consent Decree – Sets aside $49.6 million in ongoing funding to improve

the conditions and mental health services in the County’s jails under the terms of

the DOJ settlement. This amount is allocated to the PFU budget unit for ICHS and

the Sheriff’s Department.

Academy Classes – Allocates a net $1.8 million in one-time funding to the

Sheriff’s Department to hold four academy classes initially funded in FY 2022-23,

and support recruitment efforts. These classes are needed to address the recent

DOJ consent decree and the Department’s significant sworn vacancy gap, as well

as to train a new generation of deputies. The related budgeted positions were

previously approved as part of the FY 2022-23 budget.

Jobs and Workforce Development

Youth@Work Program – Provides $16.0 million to the Department of Economic

Opportunity (DEO) to continue the Youth@Work Program. This Program is

committed to the development and success of young people, providing them with

first-time work experience and supporting their development as part of our future

adult workforce.

Regional Equity and Recovery Partnership (RERP) Program – Allocates

$3.3 million in State funding to DEO for the RERP program, which provides job

training and placement opportunities targeting the underserved,

underrepresented, and most vulnerable populations.

The Honorable Board of Supervisors

April 18, 2023

Page 10

Re-Entry Employment, Navigation, Engagement and Well-Being (RENEW)

Program – Adds $2.6 million to DEO for the RENEW program. This Program

assists justice-involved individuals with employment and training services,

transitional subsidized employment opportunities, supportive services, incentives,

and peer mentorship.

Prison to Employment Program – Allocates $2.2 million in State funding to DEO

to support the integration of workforce, re-entry and supportive services to formerly

incarcerated and justice-involved individuals, with the goal of preparing them for

and helping place them in unsubsidized employment.

Public Services Cost Increases

Foster Care Caseloads – Provides $17.5 million to the DCFS to pay for rate

increases to foster families, as well as to make up for the loss of federal funding

due to the expiration of the Title IV-E Waiver. Foster care assistance is paid on

behalf of children in out-of-home placements who meet the eligibility requirements

specified in applicable State and federal regulations and laws.

General Relief (GR) Caseloads – Adds $25.8 million to the Department of Public

Social Services (DPSS) for projected GR caseload increases.

In-Home Supportive Services (IHSS) Providers – Adds $51.6 million to DPSS

to pay for a $1.00 an hour wage supplement for IHSS providers who provide

at-home assistance to older and/or disabled residents.

Support for Children, Families, Seniors and People with Disabilities

Medical Hubs – Provides $2.0 million for DCFS to maintain medical hub services.

These services are critical and include forensic evaluation and other health-related

needs for children in the child welfare system.

Upfront Family Finding – Adds $8.3 million to DCFS to continue and expand

Upfront Family Finding services. These services are designed to identify relatives

and family friends who may be able to care for a detained child or youth. Such

placements have been shown to result in better outcomes.

Bringing Families Home – Allocates $1.5 million in State funding to DCFS to

provide case management and outreach services to families in the child welfare

system experiencing homelessness.

The Honorable Board of Supervisors

April 18, 2023

Page 11

Dependency Court Expansion – Provides $4.2 million in State funding to DCFS

for 4 positions and County Counsel services needed for two additional dependency

courtrooms located at the Edmund D. Edelman Children’s Court.

California Work Opportunity and Responsibility to Kids (CalWORKs) Stage

One Child Care Program – Adds $65.7 million to DPSS, fully offset with State

and federal revenues, to meet projected caseload increases for full-time childcare

services for CalWORKs participants.

Housing and Disability Advocacy – Provides $3.9 million to DPSS, fully offset

with State revenues, for DHS-provided services designed to expand interim

housing opportunities and community outreach.

Adult Protective Services (APS) – Provides an additional $3.4 million in State

funding to the Department of Aging and Disabilities for the expansion of the APS

programas the minimum eligibility age shifted from 65 to 60 years old.

Recreation

Water Awareness, Training, Education and Recreation (WATER) Program –

Adds $0.5 million and 4 lifeguard positions, fully offset by Marina and grant

revenues, to the Department of Beaches and Harbors to fully staff the WATER

Program, which teaches ocean safety skills to youth from diverse, underserved,

and special needs populations.

Critical Voting Systems

Voting Choice Act (VCA) – Sets aside $8.7 million in ongoing funding in the PFU

budget unit for the Department of Registrar-Recorder/County Clerk’s (RR/CC)

Voting Solutions for All People system and to ensure compliance with California’s

VCA of 2016. This adjustment is a down payment on a multi-year funding plan

needed to support the County’s election model with ongoing funding, which will

require an additional $34.8 million in ongoing funding in future years.

Election Management System (EMS) – Provides $5.9 million to RR/CC for the

new EMS that contains critical election information including voter registration,

candidate filing, and vote center and election worker management data; the new

EMS also provides a direct interface to the State’s voter registration database. The

Recommended Budget also sets aside a contingency of $3.6 million in PFU.

The Honorable Board of Supervisors

April 18, 2023

Page 12

Investing in Public Assets

Capital Projects (CP) – Allocates $2.0 billion for continued development, design,

and construction of CPs in support of Board-directed priorities. This investment

will improve the County’s ability to serve the public and protect the County’s real

estate portfolio. The CP budget unit reflects a decrease of $23.2 million and the

completion of 45 projects included in the 2022-23 Final Adopted Budget.

Environmental Stewardship – Provides $214.6 million for continued water

conservation projects, including 44 stormwater projects, which are part of a

countywide program to capture, divert, and treat polluted stormwater runoff and

comply with federal and State clean water regulations. Since October 2022, the

County has captured more than 93 billion gallons of stormwater within its dams

and spreading grounds — enough water to meet the needs of 2,284,800 people

for a full year.

Enhancing Public Interaction with Recreational Opportunities – Includes

$176.3 million to enhance and expand access to County facilities, such as the

Ruben F. Salazar Park multi-phase remodeling project and various pool lighting

projects, which will provide safer and enhanced recreational opportunities, as well

as extend pool hours.

Reinvesting in County Facilities – Provides $303.0 million for the rehabilitation

of County facilities funded by the Extraordinary Maintenance (EM) budget unit and

long-term financing to support goals of the Strategic Asset Management Plan,

primarily through the Facility Reinvestment Program. This program includes the

highest-priority projects to sustain and/or rehabilitate County-owned facilities. This

recommended allocation will:

Extend the useful life of County facilities and reduce facility replacement costs

in the long run;

Allow the County to undertake the highest priority deferred maintenance

projects to optimize the use of assets in their highest and best uses;

Establish stronger connections between County service priorities and asset

decisions, better aligning our CPs with the most pressing needs of County

residents; and

Create a better enterprise-wide understanding of asset needs and priorities.

The Honorable Board of Supervisors

April 18, 2023

Page 13

FOLLOW-UP BUDGET ACTIONS

The Board requested the Chief Executive Officer (CEO) to report back on the following

items during the 2023-24 Recommended Budget.

Cooling Strategies in Our Parks

On October 4, 2022, the Board directed the CEO and the Director of Parks and Recreation

to consult with the Chief Sustainability Office and report back in the

2023-24 Recommended Budget with high-priority locations for new park cooling features

in alignment with the Climate Resilience Initiative, and to develop a funding plan to erect

shade structures, install hydration stations, and plant trees in line with County

Sustainability goals in County-operated parks. As part of the 2023-24 Recommended

Budget, the Department of Parks and Recreation (DPR) will submit a comprehensive

examination of correcting shade deficiencies in parks in underserved communities. The

CEO will work with DPR to determine the financial viability of a phased approach to

funding the proposed cooling features. We will make a recommendation in the

2023-24 Supplemental Budget phase, which will allow our budget recommendations to

be made within the context of the overall budget and numerous competing requests.

Sustainably Expanding Eviction Defense Services in Los Angeles County

On September 27, 2022, the Board directed the CEO to report back during the

2023-24 Recommended Budget with funding recommendations to make the Stay Housed

LA program permanent, including but not limited to the feasibility of utilizing existing

funding sources intended to prevent residents becoming unhoused and to support

housing stability.

Stay Housed LA is a partnership between the County, tenant-led community

organizations, and legal aid organizations to provide low-income tenants living in the

County with free, limited, and full-scope legal representation; short-term rental assistance;

and other complementary services to stabilize their housing while facing potential eviction

and/or homelessness due to financial hardship. The Department of Consumer and

Business Affairs (DCBA) currently has $40.6 million in one-time funding allocated to the

program, comprised of ARPA and State funds. DCBA is expected to expend

approximately $13.0 million by June 30, 2023, and expects to carry over and fully spend

the remaining $27.6 million in 2023-24.

In response to this September 27, 2022 motion, DCBA is finalizing its report back to the

Board. However, given the 2023-24 Recommended Budget production timeline and the

necessity to review the as-yet-unfinished DCBA report, our office is unable to provide any

The Honorable Board of Supervisors

April 18, 2023

Page 14

cost estimates or funding recommendations at this time. DCBA’s report will include

projected implementation, administrative, and any program-related costs tied to making

Stay Housed LA a permanent program. Once the report is completed, we will work with

DCBA to refine cost estimates and DCBA can subsequently submit a budget request to

the CEO for consideration during the 2023-24 Final Changes budget phase. Funding

consideration will be based on available resources and reviewed within the context of the

larger countywide budget. The CEO will report back in the 2023-24 Final Changes with

funding recommendations.

Strengthening the County’s Permanent Protections for Unincorporated

Los Angeles in Response to Lessons Learned during the COVID-19 Crisis

On September 27, 2022, the Board directed DCBA, as the lead department, to: 1) develop

an ordinance to limit discriminatory and/or arbitrary landlord screening practices;

2) amend County Code Chapters 8.52 – Rent Stabilization and Tenant Protections, and

8.57 – Mobile Home Rent Stabilization and Mobile Home Owner Protections, to

temporarily cap allowable rent increases; and 3) identify opportunities to provide financial

support to low-income tenants and mom-and-pop landlords with rental arrears;

recommend a framework to provide relocation assistance to tenants who will be displaced

due to unaffordable rent increases; assess the need to reevaluate the current cost

recovery model to account for any increased costs associated with support of these

initiatives; and develop a plan to support incorporated cities seeking to create/adopt their

own permanent tenant protections, including a cost recovery model for programmatic

services. In addition, the Board: 4) provided DCBA with delegated authority to enter into

agreements with consultants/contractors and to support incorporated cities interested in

creating/adopting tenant protections; and 5) directed the CEO, in consultation with DCBA

and County Counsel, to identify overall proposed cost and funding sources to implement

Directives Nos. 1 through 4 and report back in the 2023-24 Recommended Budget.

The following are status updates on Directives Nos. 1 through 5:

Directive No. 1: DCBA is currently developing their report back to the Board with a draft

ordinance to establish certain limitations on landlord screening practices.

Directive No. 2: DCBA has completed ordinance amendments, approved by the Board on

November 15, 2022, for Rent Stabilization and Tenant Protections (County Code

Chapter 8.52), and Mobile Home Rent Stabilization and Mobile Home Owner Protections

(County Code Chapter 8.57); these ordinances became effective on December 15, 2022,

and had no fiscal impact.

The Honorable Board of Supervisors

April 18, 2023

Page 15

Directive No. 3: DCBA is currently developing their report back to the Board on

opportunities to provide financial assistance to low-income tenants and mom-and-pop

landlords and supporting other jurisdictions looking to establish their own tenant

protections.

Directive No. 4: DCBA has not exercised its delegated authority to enter into agreements

with consultants to develop a plan to support incorporated cities; it is unclear if the

department will exercise this authority given that they are still developing their report back

to the Board.

Directive No. 5: As stated above, DCBA is currently developing reports for Directives Nos.

1 and 3, which will also provide information on Directive No. 4. Given the CEO’s

2023-24 Recommended Budget production timeline and the necessity to review DCBA’s

report backs, we are unable to provide proposed cost estimates and potential funding

sources at this time. DCBA’s report backs will include any applicable projected

implementation, administrative, and program-related costs tied to Directives Nos. 1

through 4. As such, once the reports have been completed, the CEO will work with DCBA

to refine the cost estimates and DCBA can subsequently submit a budget request to the

CEO for consideration as part of the 2023-24 Final Changes budget phase. Funding

consideration will be based on available resources and reviewed within the context of the

broader countywide budget impact. The CEO will report back in 2023-24 Final Changes

with funding recommendations.

Implementing the Priority Strategies of the Equity in County Contracting (ECC)

Project Team

On August 9, 2022, the Board directed the CEO to identify staff and resources to develop

and operationalize a Centralized Contracting and Procurement Office (Office) within the

Internal Services Department (ISD), effective in 2023-24. The proposed centralized

contracting unit would be both an internal resource to County departments and an

external resource to small employers looking to more easily contract with the County. As

outlined in the Board motion, the new office would, among other priorities, institutionalize

the work of the ECC process; lead continuous, equitable and efficient improvements to

the County’s contracting and procurement processes; develop and provide contracting

training; develop recommendations to address barriers to equitable reimbursement and

compensation of contractors; and meet regularly with community-based organizations

and nonprofit stakeholders on issues related to County contracting. The

2023-24 Recommended Budget includes the addition of $3.4 million in ongoing

appropriation for 12 positions as well as services and supplies for the initial creation and

establishment of the Office within ISD. Key priorities to establish in the first year will

include detailed planning and assessment of the Office’s structure and needs, while also

The Honorable Board of Supervisors

April 18, 2023

Page 16

institutionalizing and continuing to address the ECC findings and recommendations.

Upon full build-out of this Office, the CEO will work with ISD to consider an additional 6

positions and include appropriate funding recommendations in future budget phases.

Review and Assessment of County Commissions’ Needs

On August 9, 2022, as part of the Establishing Our Commitment to the Los Angeles

City/County Native American Indian Commission motion, the Board directed the CEO to

review and assess County commissions’ needs, including administrative staff, funding,

and other needs and report with recommendations to ensure all commissions are

supported and effective. On November 18, 2022, the CEO report back indicated

additional staffing resources would need to be considered based on specific needs

identified by each department to ensure effective support. The CEO committed to report

back with funding recommendations, as appropriate, based on competing budget

priorities and available funding as part of the 2023-24 Recommended Budget. These

departments requested: 5 positions to support the Executive Office of the Board,

Commission Services Division; 1 position to support the Civil Service Commission; and

2 positions to support the Los Angeles Beach and Small Craft Harbor Commissions and

the Small Craft Harbor Design Control Board. After careful consideration and review

within the context of the larger countywide budget impact, the requests have been

deferred to the 2023-24 Final Changes budget phase for further consideration.

POTENTIAL STATE AND FEDERAL BUDGET IMPACTS

A significant portion of the County budget is comprised of revenues from the State and

federal governments. State and federal budget highlights and anticipated impact on the

County budget are outlined below.

State Budget

On January 10, 2023, Governor Gavin Newsom released his 2023-24 January Proposed

Budget (Proposed Budget). At the time of its release, the $297.0 billion Proposed Budget

forecast that State General Fund revenues will be $29.5 billion lower than projected, with

an estimated budget gap of $22.5 billion. (The latest estimates since then indicate that

the budget gap might be closer to $40.0 billion). To close the projected revenue shortfall,

the Proposed Budget includes a combination of funding delays, inflationary adjustments,

and fund payments; fund shifts, trigger reductions, limited revenue generation and

borrowing; as well as the use of resiliency measures included in the 2022 State Budget

Act. None of the State budgetary reserves, whose combined balance is projected to be

$35.6 billion at the end of 2023-24, are proposed to be used to address the projected

$22.5 billion revenue shortfall to preserve the State’s ability to address a potential

recession if economic and revenue conditions continue to deteriorate.

The Honorable Board of Supervisors

April 18, 2023

Page 17

Despite the projected revenue shortfall, the Proposed Budget sustains key investments

made in prior fiscal years of importance to the County, including but not limited to:

$44.0 billion for infrastructure investments;

$10.0 billion for California Advancing and Innovating Medi-Cal (CalAIM);

More than $8.0 billion to expand the continuum of behavioral health treatment and

infrastructure capacity;

More than $2.0 billion annually to expand subsidized child care;

$1.2 billion to improve services for the developmentally disabled;

More than $1.0 billion to provide increased cash assistance to individuals with

disabilities and older adults in the Supplemental Security Income/State

Supplementary Payment program, and low-income children and families in the

CalWORKs program;

$844.5 million to continue expanding Medi-Cal to all income-eligible Californians,

regardless of immigration status; and

More than $200.0 million for safe and accessible reproductive healthcare.

The Proposed Budget also includes the following County-supported State budget

proposals:

$646.4 million to cover the costs of the Providing Access and Transforming Health

and CalAIM justice initiatives;

$76.5 million over three years to pursue security upgrades and Electronic Benefits

Transfer (EBT) card technology to prevent theft of EBT benefits and $198.0 million

over two years for reimbursement of stolen benefits;

$200.0 million to support access to family planning and related services, system

transformation, capacity, and sustainability of California’s safety net;

$93.0 million in additional Opioid Settlement Funds over four years to support

youth- and fentanyl-focused investments;

$87.0 million, to reflect a 2.9 percent increase to the CalWORKs Maximum Aid

Payment levels;

$83.4 million increase to the Medi-Cal County Administration allocation to reflect a

projected 3.68 percent increase to the California Consumer Price Index;

$74.6 million increase for Stage One Child Care to reflect 0.5 percent growth in the

projected monthly caseload;

The Honorable Board of Supervisors

April 18, 2023

Page 18

$35.8 million statewide increase to the Local Child Support Administrative

allocation for increased caseload/workload, increased call volumes, and increased

personnel costs;

$17.0 million statewide increase to the CalFresh State Administration allocation to

reflect growth in the projected monthly caseload; and

$13.6 million statewide increase to the IHSS County Administration allocation to

reflect growth in the projected monthly caseload.

Since the State Budget plays an important role in funding many important programs

administered by the County, we will continue to monitor State Budget activities and

advocate for County-supported proposals currently being considered by both the

Governor and the Legislature.

Federal Budget

On December 29, 2022, President Joseph R. Biden, Jr. signed into law H.R. 2617

(Connolly), the Consolidated Appropriations Act, 2023, which contains $1.7 trillion in

omnibus spending consisting of all 12 Federal Fiscal Year (FFY) 2023 appropriations bills,

as well as $44.9 billion in emergency assistance to Ukraine and North Atlantic Treaty

Organization allies. In total, the omnibus package provided $772.5 billion in non-defense

funding and $858.0 billion in defense funding. Additionally, H.R. 2617 contains five of the

County’s Community Project Funding and Congressional Directed Spending requests

(also known as earmarks).

The measure includes additional funding to: 1) continue programs authorized by the

Infrastructure Investment and Jobs Act (P.L. No. 117-58); 2) make investments in health

care and research including President Biden's initiative to fight cancer; 3) support nutrition

programs for men, women, and children; 4) provide housing assistance for people

experiencing homeless, the elderly, and persons with disabilities, and for incremental

Section 8 Housing Choice Vouchers; 5) invest in education to help low-income first

generation students to get into college and succeed ; 6) support child care; 7) help families

address the rising cost of energy; and 8) combat violence against women.

On March 13, 2023, President Biden released his $6.9 trillion budget request for

FFY 2024. The budget request proposes $839.7 billion in non-defense discretionary

funding, a $90.0 billion or 5.5 percent total increase above the FFY 2023 enacted level,

and $842.0 billion in defense and security-related spending, a $26.0 billion or 3.2 percent

increase from the FFY 2023 enacted budget.

The Honorable Board of Supervisors

April 18, 2023

Page 19

The President’s budget proposes new spending to extend the solvency of Medicare, build

affordable housing, invest in climate resiliency, fund national paid family leave, and

subsidize childcare. The proposal also seeks to reduce the federal deficit by nearly

$2.9 trillion over the next decade, by proposing tax increases on wealthy households and

corporations. While the Budget Request is not binding and will not be enacted, it provides

a preview of the proposed investments the Administration would make in the areas of

health care and public health, climate change, housing/homelessness, education,

justice/civil rights, immigration, energy, and other domestic priorities. The looming debt

ceiling debate, which likely will begin in earnest in May or June, will undoubtedly impact

overall spending and the timing of the appropriations process. The Congressional Budget

Office forecasts that the federal government will reach the limits of its borrowing authority

sometime between July and September 2023, depending on revenue collections in the

coming months.

The House and Senate Appropriations Committees will begin their budget hearings on

appropriations for FFY 2024 in March 2023. Additionally, Members of both chambers are

accepting Community Project Funding and Congressionally Directed Spending requests

for FFY 2024.

SHORT- AND LONG-TERM BUDGET ISSUES

As we begin another budget year, the County is again faced with the difficult task of

balancing the increased demand on its services with limited available resources. This is

made more challenging as providing these services is becoming more costly, while

financing sources are not growing at the same pace to offset the increases.

The County has prepared to address a few long-term budget issues by taking several

actions:

Implementing the Board-approved, multi-year plan to prefund retiree healthcare

benefits.

Augmenting the Rainy Day Fund annually to reach a healthy balance of

$854.9 million.

Setting aside $67.2 million, in accordance with County budget and fiscal policies,

in Appropriations for Contingencies as a hedge against unforeseen fiscal issues

throughout the fiscal year.

Increasing the EM budget unit to help address deferred maintenance needs

throughout the County. This budget phase we are adding another $5.0 million for

this effort.

The Honorable Board of Supervisors

April 18, 2023

Page 20

However, many long-term budgetary issues will require significant investments by the

County through a longer, multi-year funding approach. Outlined below are some of our

more significant budget issues:

Child Victims Act - AB 218 – The County is facing one of its most serious fiscal

challenges in recent history – impending claims spurred by AB 218. Also known

as the Child Victims Act, AB 218 extended the statute of limitations for reporting

childhood sexual assault claims and opened a three-year window for victims of any

age to file civil lawsuit claims through December 31, 2022. Early information

estimates that the County’s financial exposure ranges from $1.6 billion to more

than $3.0 billion from more than 3,000 claims alleging childhood sexual assault at

various County and non-County facilities. Because of the gravity of these claims

and the staggering potential liability, we are assessing the impact this will have on

the County’s finances and future programmatic funding needs. Any outcome from

these claims will put further pressure on the County’s budget, which is already

strained by increased costs and slowing revenue growth.

Additional County Liability – The State legislature recently introduced two bills,

AB 452 and AB 1547. AB 452 would remove all time limitations for childhood

sexual assault survivors to file lawsuits, while AB 1547 would allow claims arising

out of assaults by an employee of either a juvenile probation camp or detention

facility owned and operated by a county, or a youth facility owned and operated by

the Division of Juvenile Justice to file their lawsuits in 2024. If enacted, these bills

would further increase the County’s potential liability.

Other Postemployment Benefits (OPEB) – The Recommended Budget adds

$62.3 million in pre-funding contributions to the OPEB Trust Fund. This is the ninth

year of a multi-year plan to reach the $1.5 billion actuarially determined

contribution (ADC). The ADC is recognized as the measuring stick indicating that

we are adequately funding OPEB. Based on current projections for the OPEB

prefunding plan, the OPEB ADC will be fully achieved by 2026-27.

The Honorable Board of Supervisors

April 18, 2023

Page 21

DCFS – With the prior expiration of the Title IV-E Waiver and federal bridge funding

under the Families First Transition Act Funding Certainty Grant, coupled with rising

staff and placement costs, and the substantial expansion of State-mandated

services for children and youth through age 21, DCFS is forecasting a structural

deficit of more than $200.0 million. The Department continues to be actively

engaged in planning efforts to ensure a seamless integration of enhanced

prevention and aftercare services under the Families First Prevention Services Act.

The Department also is advocating with the State to maintain additional funding to

assist in meeting service delivery requirements under the State’s mandates,

including expanding programs and populations to be served per these mandates.

Information Technology Systems Replacement – The unfunded cost to replace

and modernize the County’s critical information technology legacy systems is

expected to exceed $450.0 million.

Deferred Maintenance – The Facility Reinvestment Program is a $750.0 million

program approved by the Board to address deferred maintenance of existing

County buildings and facilities. The $750.0 million is an initial plan to address a

larger backlog of the highest-priority deferred maintenance and building systems

replacement projects.

Seismic Safety – In order to improve the County’s ability to survive a major

earthquake and to provide public services following an earthquake, additional

funding to upgrade County buildings and facilities will be determined following the

completion of the ongoing assessment and prioritization of high-risk buildings.

Additional requirements might also be needed as a result of the report back for the

February 28, 2023 Board motion for Equitable Earthquake Resilience in the

County.

Stormwater and Urban Runoff – To address regulatory stormwater and urban

runoff compliance in unincorporated areas, we estimate that $362.7 million will be

needed over the next five years. This amount may be partially offset with

Measure W tax revenue.

Structural Deficits for Special Fund/District Departments – Two County

departments, which are separate from the County general fund because they

receive a dedicated portion of property taxes for services provided, are projecting

structural deficits. These deficit amounts are continuously being evaluated and

updated as new information is known.

The Honorable Board of Supervisors

April 18, 2023

Page 22

o LA County Library – Historically, the amount of property tax revenues

collected for services in the unincorporated areas and the 49 cities served

by the County’s library system has been insufficient to fully offset the

Department’s operating costs. The Library’s operating deficit is projected

to be $9.5 million for 2023-24.

o Fire District – Revenue from property taxes and other sources does not

sufficiently fund ongoing operating costs and required investments in

equipment, facilities, and vehicles. The projected deficit is $27.7 million for

2023-24.

BUDGET TIMETABLE

Below is the schedule for budget hearings and deliberations.

Board Action Approval Date

Adopt Recommended Budget; Order the Publication of the

Necessary Notices; Distribute the Recommended Budget;

and Schedule Public Hearings

April 18, 2023

Commence Public Budget Hearings May 10, 2023

Commence Final Budget Deliberations and Adopt Budget

Upon Conclusion of Deliberations

June 26, 2023

Prior to deliberations on the Budget Year 2023-24 Adopted Budget, we will file reports on:

May 2023 revisions to the Governor’s Budget and updates on other 2023-24 State

and federal budget legislation and the impact on the County’s Recommended

Budget;

Final revisions reflecting the latest estimates of requirements and available funds;

Issues raised in public hearings or written testimony;

Specific matters with potential fiscal impact; and

Other issues as instructed by the Board.

The Honorable Board of Supervisors

April 18, 2023

Page 23

APPROVAL OF RECOMMENDED BUDGET

The matter before the Board is the adoption of the Recommended Budget.

The documents must be available for consideration by the public at least 10 days prior

to the commencement of public budget hearings.

Adjustments to the budget, including revisions to reflect the Board’s funding priorities

and State and federal budget actions, can be made during budget deliberations, prior

to adoption of the Budget.

Pursuant to State law (the County Budget Act), the Board may make changes to the

Recommended Budget with a simple majority (3 votes) until adoption of the Budget, if

changes are based on the permanent record developed during public hearings

(e.g., Recommended Budget, budget requests, and all written and oral input by

Supervisors, County staff, and the public).

Changes not based on the “permanent record” require four votes.

THEREFORE, IT IS RECOMMENDED THAT THE BOARD:

Approve the Recommended Budget for 2023-24; order the publication of the necessary

notices; and set May 10, 2023, as the date that public budget hearings will begin.

Respectfully submitted,

FESIA A. DAVENPORT

Chief Executive Officer

2023-24 Recommended Budget Volume One County of Los Angeles

Table of Contents

General Information

Strategic Plan . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .i

Financial Summary - Total County . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ii

Financial Summary - General County . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .iii

Budgeted Positions by Major Functional Group . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .iv

Recommended Budgeted Positions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . v

Children and Family Services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . vii

Detention Population . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .viii

Health Services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .ix

Public Assistance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . x

Unincorporated Area Services Program Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .xi

Reader’s Guide to Understanding the Budget . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . xii

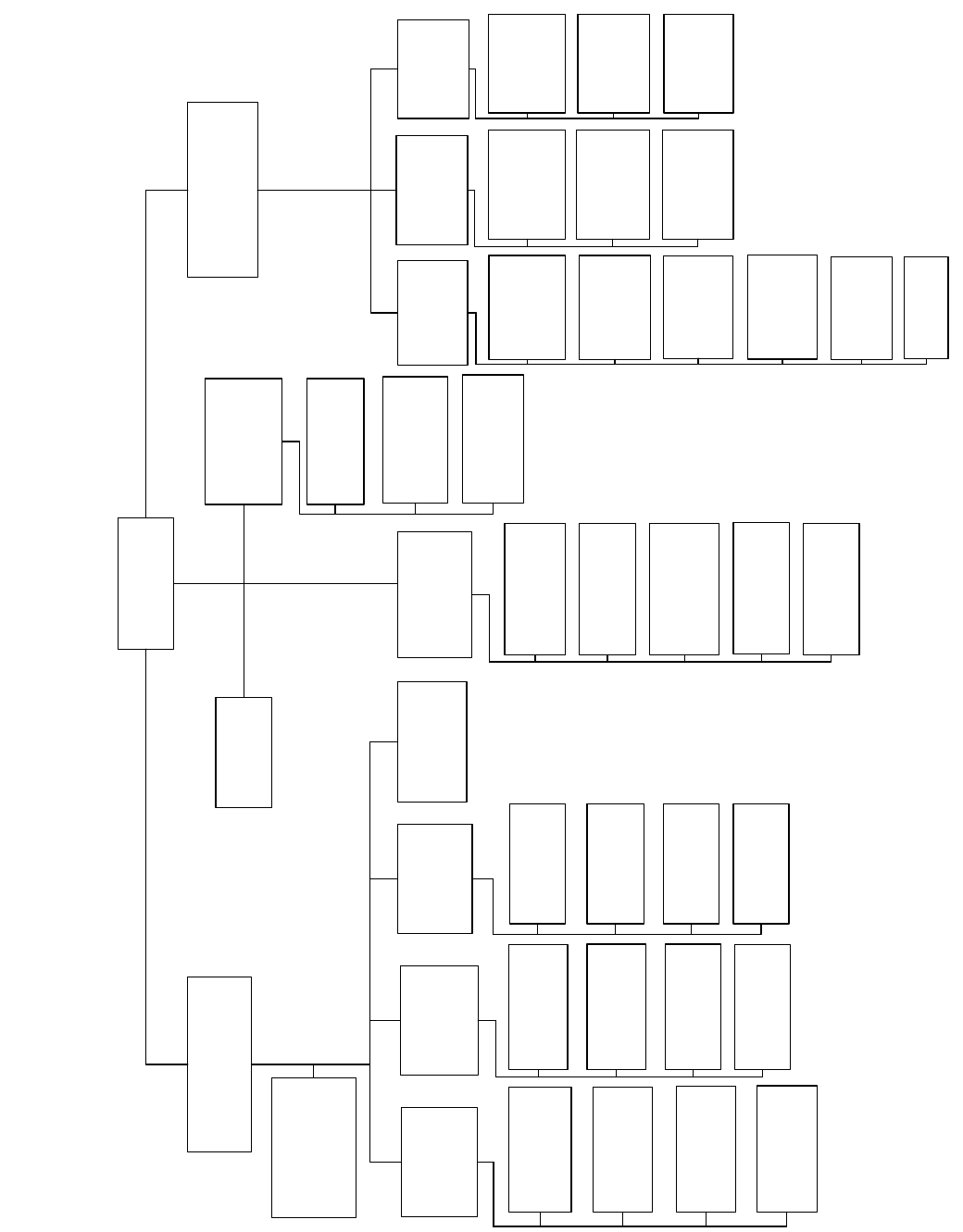

Organization Chart . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .xiv

Budget Summaries

Affordable Housing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.1

Aging and Disabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.1

Agricultural Commissioner/Weights and Measures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.1

Alliance for Health Integration . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.1

Health Services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.1

Mental Health . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.1

Public Health . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.1

Alternate Public Defender . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.1

Animal Care and Control . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.1

Arts and Culture . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.1

Assessor. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11.1

Auditor-Controller . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12.1

Beaches and Harbors. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.1

Board Initiatives and Programs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14.1

Board of Supervisors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15.1

Capital Projects/Refurbishments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16.1

Care First and Community Investment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17.1

Chief Executive Officer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18.1

Child Support Services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19.1

Children and Family Services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20.1

Consumer and Business Affairs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21.1

County Counsel . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22.1

District Attorney . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23.1

Diversion and Re-Entry . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24.1

Economic Development . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25.1

TABLE OF CONTENTS

2023-24 Recommended Budget Volume One County of Los Angeles

Economic Opportunity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26.1

Employee Benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27.1

Extraordinary Maintenance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28.1

Federal and State Disaster Aid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29.1

Financing Elements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30.1

Fire . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31.1

Grand Jury. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32.1

Grand Park . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33.1

Homeless and Housing Program . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34.1

Human Resources. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35.1

Internal Services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36.1

Judgments and Damages/Insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37.1

Justice, Care and Opportunities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38.1

LA County Library . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39.1

LA Plaza de Cultura y Artes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40.1

Los Angeles County Capital Asset Leasing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41.1

Medical Examiner - Coroner . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42.1

Military and Veterans Affairs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43.1

Museum of Art. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44.1

Museum of Natural History . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45.1

Music Center . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46.1

Nondepartmental Revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47.1

Nondepartmental Special Accounts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48.1

Parks and Recreation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49.1

Ford Theatres . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 50.1

Probation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51.1

Project and Facility Development . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 52.1

Provisional Financing Uses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53.1

Public Defender. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 54.1

Public Social Services. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 55.1

Public Works. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 56.1

Regional Planning . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 57.1

Registrar-Recorder/County Clerk . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 58.1

Rent Expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 59.1

Sheriff. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 60.1

Telephone Utilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 61.1

Treasurer and Tax Collector . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 62.1

Trial Court Operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 63.1

Utilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 64.1

Utility User Tax - Measure U. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65.1

Vehicle License Fees - Realignment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 66.1

Workforce Development, Aging and Community Services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 67.1

Youth Development . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 68.1

TABLE OF CONTENTS

2023-24 Recommended Budget Volume One County of Los Angeles

Appendix/Index

Statistics . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 69.1

Estimated Population of the 88 Cities of the County of Los Angeles. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 70.1

Cultural and Recreational Opportunities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 71.1

Glossary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 72.1

Index. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 73.1

General Information

STRATEGIC PLAN

General Information

2023-24 Recommended Budget Volume One i County of Los Angeles

KhEdzK&>K^E'>^

ʹͲͳǦʹͲʹͳ

ƌĞĂƚŝŶŐŽŶŶĞĐƚŝŽŶƐ͗WĞŽƉůĞ͕ŽŵŵƵŶŝƚŝĞƐ͕ĂŶĚ'ŽǀĞƌŶŵĞŶƚ

VISION

ǀĂůƵĞĚƌŝǀĞŶĐƵůƚƵƌĞ͕

ĐŚĂƌĂĐƚĞƌŝnjĞĚďLJĞdžƚƌĂŽƌĚŝŶĂƌLJ

ĞŵƉůŽLJĞĞĐŽŵŵŝƚŵĞŶƚƚŽ

ĞŶƌŝĐŚůŝǀĞƐƚŚƌŽƵŐŚĞĨĨĞĐƚŝǀĞ

ĂŶĚĐĂƌŝŶŐƐĞƌǀŝĐĞ͕ĂŶĚ

ĞŵƉŽǁĞƌƉĞŽƉůĞƚŚƌŽƵŐŚ

ŬŶŽǁůĞĚŐĞĂŶĚŝŶĨŽƌŵĂƚŝŽŶ

MISSION

ƐƚĂďůŝƐŚƐƵƉĞƌŝŽƌƐĞƌǀŝĐĞƐ

ƚŚƌŽƵŐŚŝŶƚĞƌͲĚĞƉĂƌƚŵĞŶƚĂůĂŶĚ

ĐƌŽƐƐͲƐĞĐƚŽƌĐŽůůĂďŽƌĂƚŝŽŶƚŚĂƚ

ŵĞĂƐƵƌĂďůLJŝŵƉƌŽǀĞƐƚŚĞƋƵĂůŝƚLJ

ŽĨůŝĨĞĨŽƌƚŚĞƉĞŽƉůĞĂŶĚ

ĐŽŵŵƵŶŝƚŝĞƐŽĨ>ŽƐŶŐĞůĞƐ

ŽƵŶƚLJ

VA LU E S

/ŶƚĞŐƌŝƚLJ͗tĞĚŽƚŚĞƌŝŐŚƚ

ƚŚŝŶŐ͗ďĞŝŶŐŚŽŶĞƐƚ͕

ƚƌĂŶƐƉĂƌĞŶƚ͕ĂŶĚĂĐĐŽƵŶƚĂďůĞ

/ŶĐůƵƐŝǀŝƚLJ͗tĞĞŵďƌĂĐĞƚŚĞ

ŶĞĞĚĨŽƌŵƵůƚŝƉůĞƉĞƌƐƉĞĐƚŝǀĞƐ

ǁŚĞƌĞŝŶĚŝǀŝĚƵĂůĂŶĚ

ĐŽŵŵƵŶŝƚLJĚŝĨĨĞƌĞŶĐĞƐĂƌĞ

ƐĞĞŶĂƐƐƚƌĞŶŐƚŚƐ

ŽŵƉĂƐƐŝŽŶ͗tĞƚƌĞĂƚƚŚŽƐĞ

ǁĞƐĞƌǀĞ͕ĂŶĚĞĂĐŚŽƚŚĞƌ͕ƚŚĞ

ǁĂLJǁĞǁĂŶƚƚŽďĞƚƌĞĂƚĞĚ

ƵƐƚŽŵĞƌKƌŝĞŶƚĂƚŝŽŶ͗tĞ

ƉůĂĐĞŽƵƌŚŝŐŚĞƐƚƉƌŝŽƌŝƚLJŽŶ

ŵĞĞƚŝŶŐƚŚĞŶĞĞĚƐŽĨŽƵƌ

ĐƵƐƚŽŵĞƌƐ

*2$/,

0DNH,QYHVWPHQWV

7KDW7UDQVIRUP/LYHV

*2$/,,

)RVWHU9LEUDQWDQG

5HVLOLHQW&RPPXQLWLHV

*2$/,,,

5HDOL]H7RPRUURZ¶V

*RYHUQPHQW7RGD

\

ĚĚƌĞƐƐƐŽĐŝĞƚLJ͛ƐŵŽƐƚ

ĐŽŵƉůŝĐĂƚĞĚƐŽĐŝĂů͕ŚĞĂůƚŚ͕ĂŶĚ

ƉƵďůŝĐƐĂĨĞƚLJĐŚĂůůĞŶŐĞƐďLJ͗

/͘ ϭ /ŶĐƌĞĂƐŝŶŐ

ŽƵƌĨŽĐƵƐŽ

Ŷ

ƉƌĞǀĞŶ

ƚŝŽŶŝŶŝƚŝĂƚŝǀĞƐ͖

/͘ Ϯ ŶŚĂŶĐŝŶŐŽƵƌĚĞůŝǀĞƌLJŽĨ

ĐŽŵƉƌĞŚĞŶƐŝǀĞ

ŝŶƚĞƌǀĞŶƚŝŽŶƐ͖ĂŶĚ

/͘ ϯ ZĞĨŽƌŵŝŶŐƐĞƌǀŝĐĞ

ĚĞůŝǀĞƌLJǁŝƚŚŝŶŽƵƌũƵƐƚŝĐĞ

ƐLJƐƚĞŵƐ͘

ƌĞĂƚĞƚŚĞŚƵďŽĨĂŶĞƚǁŽƌŬ

ŽĨƉƵďůŝĐͲƉƌŝǀĂƚĞƉĂƌƚŶĞƌŝŶŐ

ĂŐĞŶĐŝĞƐƐƵƉƉŽƌƚŝŶŐǀŝďƌĂŶƚ

ĐŽŵŵƵŶŝƚŝĞƐďLJ͗

//͘ ϭ ƌŝǀŝŶŐĞĐŽŶŽŵŝĐ

ĚĞǀĞůŽƉŵĞŶƚŝŶƚŚĞ

ŽƵŶƚLJ͖

//͘ Ϯ ^ƵƉƉŽƌƚŝŶŐƚŚĞǁĞůůŶĞƐƐ

ŽĨŽƵƌĐŽŵŵƵŶŝƚŝĞƐ͖ĂŶĚ

//͘ ϯ DĂŬŝŶŐĞŶǀŝƌŽŶŵĞŶƚĂů

ƐƵƐƚĂŝŶĂďŝůŝƚLJŽƵƌĚĂŝůLJ