OIC WA | 360-725-7009 | P.O. Box 40255 Olympia, WA 98504-0255

2017 Earthquake Data

Call Report

January 2018

Mike Kreidler, Insurance Commissioner

www.insurance.wa.gov

2017 Earthquake Data Call Report

2

Table of contents

2017 Earthquake Data Call Report ......................................................................................... 1

Introduction .............................................................................................................................. 3

Who has property insurance? ......................................................................................................... 6

Residential ...................................................................................................................................... 6

Commercial .................................................................................................................................... 8

Who has earthquake coverage? ...................................................................................................... 9

Residential ...................................................................................................................................... 9

Commercial .................................................................................................................................. 10

Who offers earthquake coverage? ................................................................................................ 11

Market Share ................................................................................................................................ 11

Residential .................................................................................................................................... 11

Commercial .................................................................................................................................. 13

How is earthquake coverage offered? .......................................................................................... 15

Residential .................................................................................................................................... 15

Commercial .................................................................................................................................. 16

Where is earthquake coverage offered? ....................................................................................... 17

Residential .................................................................................................................................... 17

Commercial .................................................................................................................................. 19

How large is earthquake exposure? ............................................................................................. 21

Residential .................................................................................................................................... 21

Commercial .................................................................................................................................. 22

What is the quality of earthquake policies? ................................................................................. 23

Residential .................................................................................................................................... 23

Commercial .................................................................................................................................. 24

Methodology .......................................................................................................................... 25

Instrument ...................................................................................................................................... 25

Questions ..................................................................................................................................... 25

Market Data .................................................................................................................................. 26

Data Validation ............................................................................................................................. 26

Implementation ............................................................................................................................... 26

Issuance ....................................................................................................................................... 26

Outreach ....................................................................................................................................... 26

Revisions ...................................................................................................................................... 27

Data cleaning .................................................................................................................................. 27

Conclusion ............................................................................................................................. 28

2017 Earthquake Data Call Report

3

Executive Summary

Washington State has documented earthquake risk, but prior to this study there was no data showing

how many properties are covered by earthquake coverage. In 2017, Commissioner Kreidler directed a

survey of insurers in Washington State. This study found:

• Approximately 21% of all insured structures in Washington have earthquake coverage.

• The market has many insurers and policies are available to buy.

• 90% of the exposure is west of the Cascades and the commercial and residential properties in

this area are more highly insured than east of the Cascades.

• Residential coverage rates for earthquake insurance came in higher than predicted, at 11.3%.

o Counties west of the Cascades have a slightly higher overall coverage rate at 13.8%, as

compared to eastern counties which have just a 1.7% overall coverage rate.

o Residential earthquake deductibles are generally between 10% and 15%.

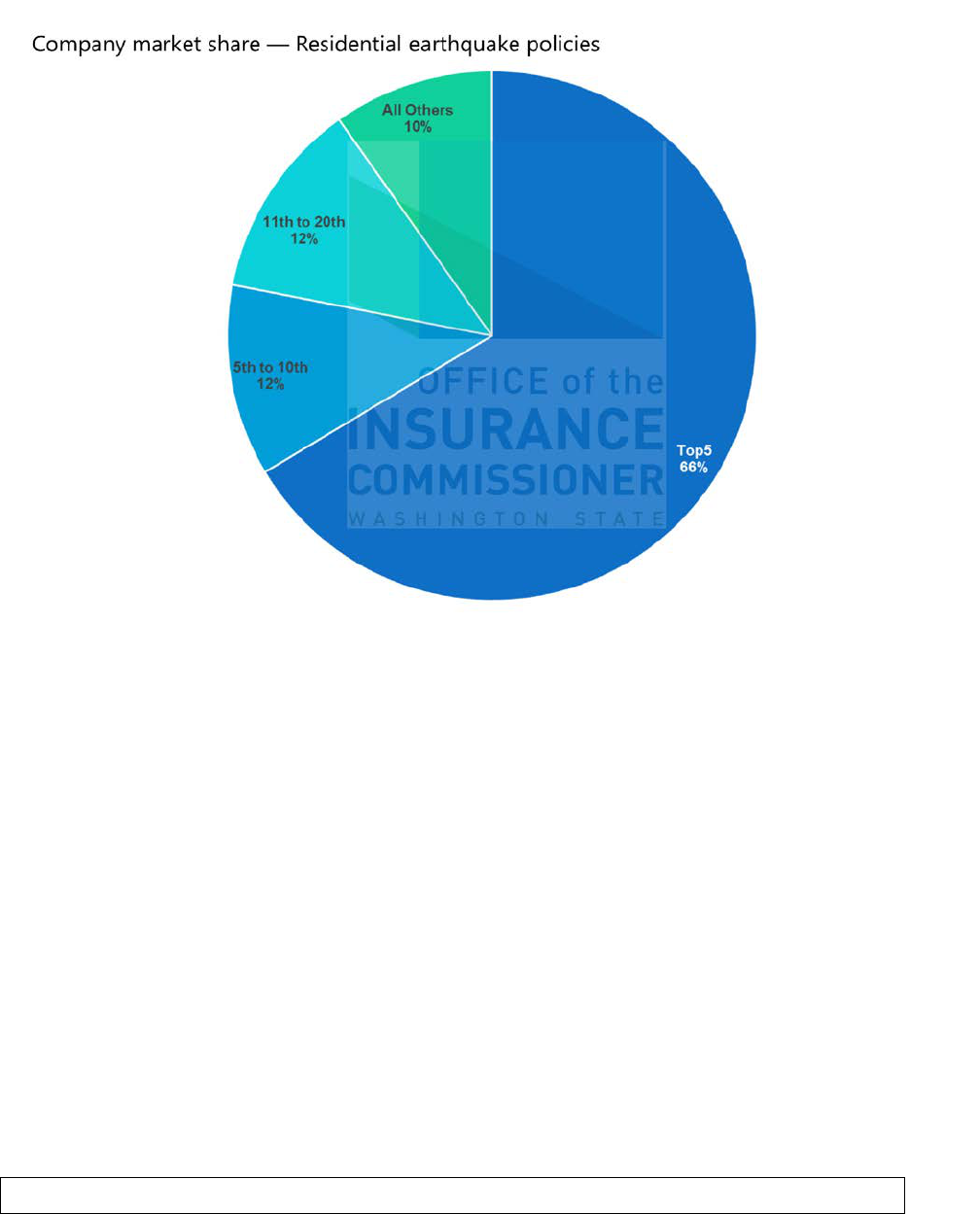

o The top two insurers sell 33.9% and 18.1%, respectively, of all policies with earthquake

coverage and represent more than 50% of the overall exposure.

o Homes with earthquake insurance are 65% more expensive than the average home,

which indicates a potential affordability issue for owners of more modest homes.

• Commercial coverage rates for earthquake insurance statewide is 43.2%

o Of commercial earthquake policies, 83.4% are west of the Cascades.

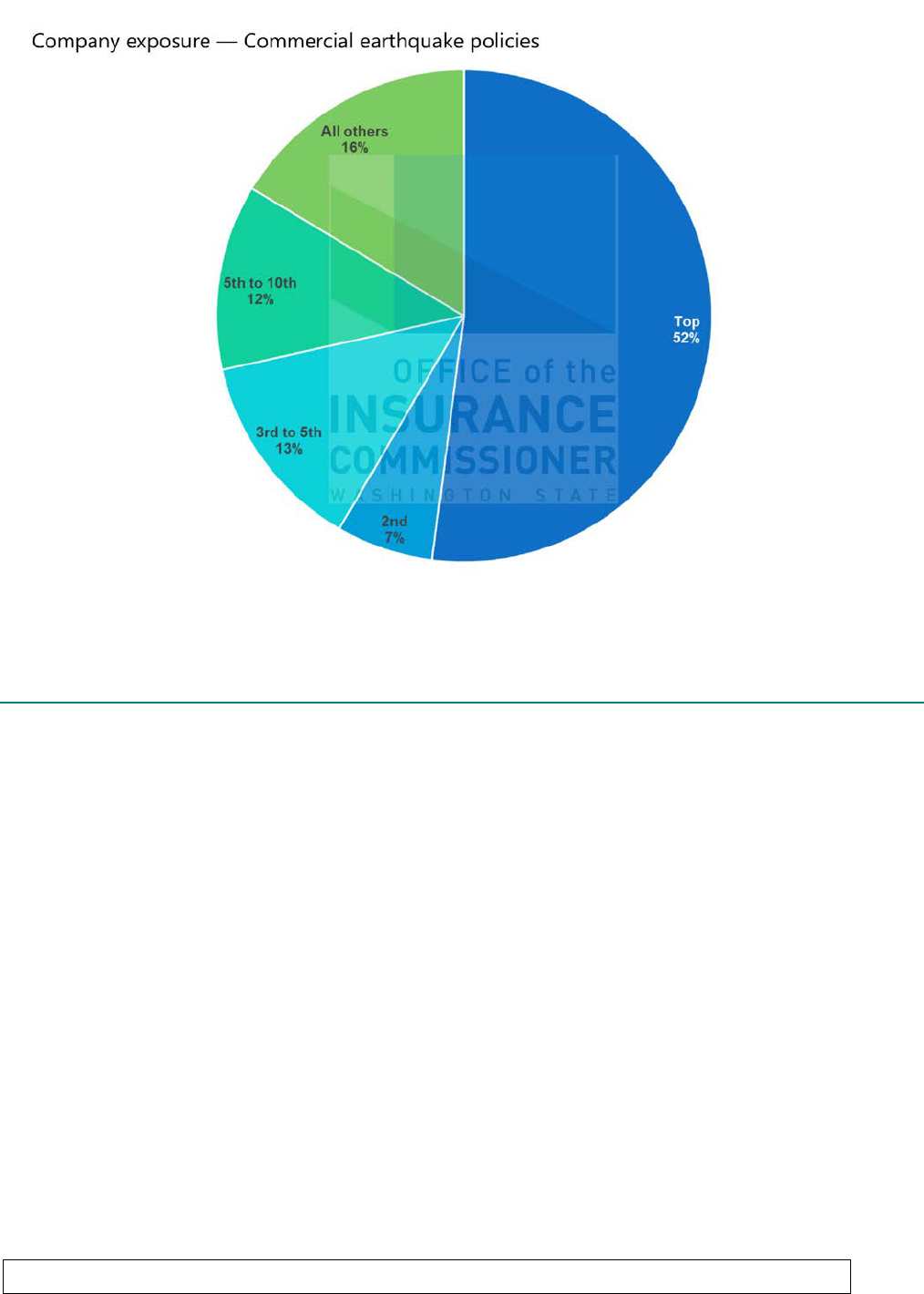

o Three companies sell 49.5% of all policies, while just one insurer holds 52.1% of the

insured exposure.

o Commercial properties with earthquake coverage were 11% more valuable than the

typical commercial property.

2017 Earthquake Data Call Report

4

Introduction

Because of our geologic setting over many active fault lines, Washington state is recognized as one of

the highest-risk areas in the world for earthquake events. Earthquakes occur here nearly every day; most

are too small to cause damage or even be felt. But as recent history demonstrates, the risk of a larger

earthquake is ever-present, with the potential for extensive damage to property and infrastructure.

For example, on Feb. 28, 2001, a 6.8 magnitude earthquake struck the southern Puget Sound region,

with an epicenter northeast of Olympia. The Nisqually quake resulted in more than 400 injuries and

significant property damage. Much of the damage occurred close to the epicenter or in more distant

unreinforced concrete or masonry buildings. In total, the Nisqually quake resulted in approximately

$305 million of insured losses, and $2 billion in damage statewide. In 1999, the slightly smaller

5.8 magnitude Satsop earthquake caused $8.1 million in property damage (including the repair and

retrofit of the historic courthouse in Montesano).

We continue to learn more about the risk of our position on the Cascadia Subduction Zone, which is

predicted to result in a magnitude 9.0 subduction zone earthquake. Comparison with similar subduction

zone fault earthquakes around the world underscore the enormous potential impact of this event. For

example, the cost to rebuild Christchurch, New Zealand, is estimated at over $33.9 billion after the

February 2011 earthquake.

As Washington state’s Insurance Commissioner and Chair of the National Association of Insurance

Commissioners’ Climate Change and Global Warming Working Group, Mike Kreidler has acknowledged

the need to better prepare the state for disasters. Insurance coverage, of both residential and

commercial property, is a key component to recovery from an earthquake event. As part of his effort to

encourage Washington’s resiliency to earthquake events, he has directed an assessment of commercial

and residential earthquake coverage throughout the state. The purpose of this assessment was to

provide baseline data about the coverage

1

rate of earthquake coverage currently purchased in

Washington, and to assess the need for improvement.

2

In October 2017, the Office of the Insurance Commissioner issued an earthquake insurance data call to

108 property and casualty insurers participating in Washington’s homeowner’s and earthquake markets

during the 2016 plan year. We received completed responses from 240 companies (many from non-

admitted insurers selling coverage in the surplus lines market). In total, the data we received represents

more than 80% of the total earthquake insurance market in Washington.

Based on analysis of the data received, we are able to make the following observations and conclusions.

Washington state has a diverse earthquake insurance market with a broad choice of insurers. Although

the highest population counties have the largest number of insurers, policies are available across the

1

The “coverage rate” of an insurance product is the percentage of people who purchase a type of coverage.

2

This data call did not ask for premium cost or demographics of the insured. Rather, we focused mainly on the

property value and location of insured properties.

2017 Earthquake Data Call Report

5

state. Insurers, in general, do not appear to specialize the offering of coverage in certain regions, with

more than 22 insurers offering policies in every county in the state. The commercial earthquake market

is dominated by surplus line insurers, but more than 100 insurers offer policies in the state.

There are a few strong market leaders in both the commercial and residential market. In the commercial

market, one insurer (a surplus line insurer) covers 52.1% of the insured exposure. Three companies issue

49.5% of all the policies in the market. Similarly, in the residential market the top two insurers cover more

than 50% of overall risk exposure.

The coverage rate of residential earthquake insurance is unexpectedly strong; 11.3% of all residential

policies in the state carry earthquake protections. While Washington’s coverage rate does not adequately

mirror the projected risk, our rate can be compared with other high-risk states such as California, which

has a coverage rate of approximately 10%. Residential earthquake deductibles are generally in line with

the industry standards of between 10% and 15%. Almost all the participating residential insurers offered

coverage as a policy rider.

Property value is a strong predictor of which properties are covered by earthquake insurance. Homes with

earthquake insurance are 65% higher in value than the average insured home. Commercial properties

with earthquake coverage were 11% more valuable than the typical insured property. This is true even

though the cost of earthquake insurance is generally based on the value of the property (which results in

less expensive insurance for less expensive property).

And, as expected based on the higher documented risk of earthquake, counties west of the Cascades

buy more insurance. In Western Washington, the residential coverage rate is 13.8%. Counties west of

the Cascades have 18 times as many policies as in Eastern Washington. Of commercial earthquake

policies, 83.4% are in Western Washington.

2017 Earthquake Data Call Report

6

Who has property insurance?

This data call focused mainly on the property value and location of properties, meaning the

demographics of the insured are not fully represented in the submitted model. However, most insurers

seem to base rates on the characteristics of the property more so than on the characteristics of the

individuals applying. As this survey specifically distinguished between rental properties (included in

commercial reporting) and owner-occupied structures (included in residential reporting) OIC assumed

that the insured housing value is directly related to income. Similarly, for commercial structures the OIC

assumed that more expensive structures are held by companies with greater revenue. This correlation is

not quite as strong given that OIC requested structure information, and commercial interests, such as

property management companies and retail chains, will generally have a large number of inexpensive

properties despite being relatively high earners.

Residential

Statewide

Insurers in Washington state reported the average insured residential property was covered for

$469,000. In contrast, the average property in our sample was insured for $512,000, indicating a skew

toward more expensive properties. This is not surprising given that King County represented 27.7% of

our sample, at an average insured value of $687,000. However, the median home value in Washington

during the sample period was only $323,000 (Rumstead

). On a county-by-county basis, the insured

properties in this sample exceeded the median home values by 105%, with some rural counties

exceeding the county average by over 300%.

By county

Most homeowner’s insurance policies cover “structure and contents” under a single policy. This includes

not only the structure appraised value but also an “excess” value, which accounts for differences in

replacement costs and new construction costs, as well as additional contents coverage for items

destroyed during a loss that are considered personal property and not part of the structure. The value

of contents and excess coverage varies by insurer but generally falls at about 20% to 40% above the

appraised value of the property.

In the data collected in this call we observed a 45.2% difference between the average of averages (AoA,

the average value of all county averages) and a 58.5% difference in structure average (by policy

coverage) compared to the median home value. Based on county averages, four counties in this data

set could be argued to have close to representative coverage, with coverage amounts for a general

policy based on the difference between insured value and median property prices. In Jefferson, King,

Snohomish, and Whatcom counties the difference in insured value and median home price is less than

30%. This indicates that for much of the state the covered residential properties are on average more

expensive structures than the average residential property on a county-by-county basis.

Insurer characteristics

At the insurer level, only 17 of 92 insurers that submitted residential data covered structures with an

average coverage amount above the insurer AoA. This is indicative of a distribution of house prices

2017 Earthquake Data Call Report

7

skewed toward lower values in some areas of the state. This is consistent with the generally lower value

of properties in Eastern Washington, but also indicates that there may be some concentration of

policies for higher-priced homes for a few insurers. Examining the insurer average property coverage

makes this distribution even more distinct. Five insurers stated that their average residential coverage

amount exceeded $1 million while nine insurers covered an average structure value of under $100,000.

However, unequal distribution of policy coverage does not imply that any particular county lacked

access to choice for property insurance. This sample contained 35 or more companies with at least one

active policy in every county, and a median of 63 companies with policies per county statewide.

The relatively even distribution of insurers offering policies, combined with the relatively extreme

variance in coverage averages between companies, indicates that property specialization based on

value is occurring in the residential market.

2017 Earthquake Data Call Report

8

Commercial

Statewide

Insurers in the state of Washington reported an average insured commercial property was covered for

$6.5 billion. In contrast, the average property in our sample was insured for $3.1 billion. As with

residential policies, King County represented the largest portion of policies reported, as 29.4% of our

sample with an average insured value of $5.2 billion. The commercial property market is significantly

more diversified than the residential market, making an accurate median value unavailable. Sales prices

are also not of particular use as many commercial buildings are purchased as land transactions, with

customized structures added later.

By county

Unlike the residential market, the commercial market does not have a standard type insured structure.

While residential properties are generally single-family homes, commercial properties range from high

rises in King County, to massive farms in Eastern Washington, to corner stores spread across the state.

This means that comparing counties is exceedingly difficult as each county features a different mix of

structures. Similarly, it is difficult to draw conclusions for the types of properties insured in this market

without a valid median property price to compare to it. However, the data does distinguish between

areas with large industry (King, Pierce, and Clark counties) and those lacking industry (Island and San

Juan counties) based on the average value of insured properties in the county. However, more

diversified economies such as Thurston and Spokane counties are impossible to classify based on

available data.

Insurer characteristics

Insurers selling in the commercial market most often sell policies covering structures with a value below

the data average. For both AoA and county average values, less than 25% of insurers held exposure

above the group averages. This again indicates a skew toward lower value structures. This skew is

exacerbated by three companies whose average coverage value exceeds $100 million, which is more

than three times the average value of the next highest average value company. This is clear evidence of

specialization by property value.

Like the residential market, the commercial market provides for a large selection of insurers in every

county in the state. No county had less than 48 insurers with active polices in 2016, and no county had

more than 91% of the 194 insurers included in the survey with commercial lines with active policies

during the period.

2017 Earthquake Data Call Report

9

Who has earthquake coverage?

The standard coverage policy specifically excludes damage from earthquakes. While a sizeable number

of homeowners and businesses have coverage A policies, relatively few have earthquake coverage. In

this dataset, approximately 21% of all insured structures in Washington have some sort of coverage for

earthquake related damage. However, this coverage rate is higher for commercial properties and is

unevenly distributed across the state.

Residential

The residential market for earthquake coverage is driven by an increased risk for earthquakes in

Western Washington, but policies for this type of coverage are available statewide. Overall, 11.3% of all

residential policies in this data set have some type of earthquake coverage. Western Washington

counties have a slightly higher overall coverage rate at 13.8%, especially compared to Eastern

Washington counties which have just a 1.7% coverage rate. The coverage rate in Western Washington is

led by Thurston County, with 18.1% of policies covering earthquake damage, followed by Clark and

Kitsap counties at a rate of 16.4% and 16%, respectively. The lowest coverage rate in the state is

Columbia County, where just .02% of policies have earthquake coverage.

2017 Earthquake Data Call Report

10

Commercial

The commercial market is primarily covered for earthquake by surplus line companies that sell

earthquake policies as stand-alone products. As such, some commercial structures may be double

counted as having both a policy with earthquake and without earthquake coverage. This data set also

suffers from a selection bias as we received a much larger number of responses from surplus line

insurers than admitted insurers in this market.

Even with these caveats, businesses in general seem to be more risk adverse than homeowners in

Washington state. Statewide, 43.2% of policies in our data have some sort of earthquake coverage. Like

in the residential market, the Western Washington commercial market has a slightly higher rate of

coverage at 45.4% compared to 27.5% in Eastern Washington. Unlike the residential market, the

counties with the highest coverage rate are also some of the smallest with Skamania, Island, Kitsap,

Wahkiakum, and Pend Oreille counties each boasting a greater than 55% coverage rate. Even the much

larger King County, which represents 28.1% of all policies in the commercial market, has a 45.2%

coverage rate.

2017 Earthquake Data Call Report

11

Who offers earthquake coverage?

The earthquake market is competitively distributed among dozens of insurers, with a small number of

insurers holding larger market shares. This is true in both the residential and commercial markets.

However, in the commercial markets the insurers are heavily represented by surplus line (non-admitted)

insurers while the residential market is almost exclusively comprised of admitted insurers. This

discrepancy indicates that the two markets operate in a fundamentally different way. The methods

which insurers offer coverage is important to this distinction.

Market share

In general, a few residential insurers dominate the overall number of policies offered in both markets. In

our data only three companies represent more than 5% of the market (combined residential and

commercial), but these top three companies represent a larger market share than the next 12 largest

companies by number of policies. The largest insurer represents just under 17% of the market while the

top 30 insurers represent only 81.4% of the market. In response to OIC’s data call, 78% of all admitted

insurers and every surplus line insurer indicated that they covered at least one property for earthquake.

Residential

The residential market for earthquake insurance is almost entirely made up of admitted insurers. Of

these insurers, two sell more than half the residential earthquake policies in the state. The top overall

2017 Earthquake Data Call Report

12

seller clearly dominates this market with 33.9% of the general policies and 20% of all earthquake

policies in our data. By contrast, the second-ranked company represents only 1.5% of the overall market

for homeowners insurance, but sells 18.1% of all earthquake policies in our data. This is partially

because they specialize in earthquake coverage, so all of their policies include earthquake coverage, but

also partially because the company is particularly active west of the Cascades.

These same two companies hold an outsized portion of the exposure in the residential earthquake

market. In our data, these companies represent more than 50% of the exposure with both companies

each holding more than four times the exposure of the third-ranked company. However, both

companies hold this exposure more by the volume of policies than by the value of the coverage. In both

cases, the average coverage value of the earthquake insured properties is close to the average value of

covered properties found in our survey. It should also be noted that four companies seem to specialize

in high-value earthquake policies. The average exposure for earthquake policies written by these

companies was significantly higher than most, with all reporting an average insured value for

earthquake in excess of $1.75 million.

2017 Earthquake Data Call Report

13

Commercial

Unlike the residential market, the commercial market for earthquake is dominated by a few surplus line

insurers with numerous admitted insurers operating at a small scale. Seven of the top 10 market share

holders are surplus line insurers, and the top three overall companies (all surplus line insurers) represent

45.9% of the commercial earthquake policies in our data.

2017 Earthquake Data Call Report

14

In terms of exposure, the commercial market is concentrated with one company. One surplus line

insurer holds 21.6% of the policies in the data but 52.1% of the exposure. This is more than eight times

the exposure of the next largest insurer, with the majority of other companies holding less than .05% of

the exposure of this company. Part of the reason for the large exposure is a higher-than-average

insured property value, as well as a large number of policies in King and Pierce counties, two

traditionally expensive markets for commercial real estate.

2017 Earthquake Data Call Report

15

How is earthquake coverage offered?

As part of OIC’s data call, we requested information about how insurers offer earthquake insurance.

Each company was asked which of eight methods they were commonly using when offering coverage

to prospective customers. These methods included offering coverage as a sub-limit, policy

endorsement, stand-alone policy, primary/loss limit basis, excess basis, or on a ground up/full value

basis. Companies were also able to indicate if they did not offer coverage or if they offered earthquake

insurance as a surplus line product through their brokers.

Residential

A fair portion (16.3%) of insurers in the residential market do not offer residential earthquake coverage

in Washington. A small number (3.7%) of insurers in the residential market sold policies as surplus line

products only. Of the admitted insurers offering coverage, the vast majority (96.2%) of insurers offered

earthquake coverage as a policy endorsement, with the remaining insurers offering earthquake

insurance as a stand-alone policy. A minority (42.3%) of admitted insurers selling earthquake insurance

offer coverage in multiple ways, most frequently as a policy endorsement or on a primary/loss limit

basis.

2017 Earthquake Data Call Report

16

Commercial

In the commercial market, 12% of companies did not offer earthquake policies, and 19% of responding

companies offered coverage as a surplus line product. Only 69% of insurers in our data call offered

commercial earthquake policies as enrolled insurers. Those offering policies generally offered coverage

as a policy endorsement (89.9%), sub-limit (82.6%), or primary/loss limit basis (78.3%). A majority

(57.2%) of insurers also offered coverage on a ground up/full value basis but this offering was almost

always paired with an offering on a primary/loss limit basis. The vast majority (88.4%) of admitted

insurers offered multiple earthquake coverage options in Washington.

2017 Earthquake Data Call Report

17

Where is earthquake coverage offered?

Residential

The residential market for earthquake insurance is distributed as might be expected. Western

Washington had over 18 times as many residential earthquake policies in force at the end of 2016 as

Eastern Washington. Large Western Washington counties including King, Pierce, Snohomish, Thurston,

and Clark represent the vast majority of policies. These five counties represent 80.4% of all residential

earthquake policies in Western Washington and 76.2% of all residential earthquake polices statewide.

2017 Earthquake Data Call Report

18

In regards to insurers offering earthquake insurance in the residential market, Western Washington has

far more insurer participation than Eastern Washington. Overall, Western Washington averages twice as

many insurers per county as Eastern Washington. No Western Washington County has less than 26

insurers with residential earthquake policies in force at the end of 2016. Eastern Washington had 10

counties with fewer than 26 participating insurers. The five largest counties in Western Washington also

had the most insurers offering policies, with an average of 66 insurers offering policies in these

counties.

2017 Earthquake Data Call Report

19

Commercial

The commercial market for earthquake insurance is distributed much like the residential market, with a

majority (83.4%) of policies being written in Western Washington. The top five counties with

commercial earthquake policies are King, Snohomish, Pierce, Kitsap, and Clark, representing 73.1% of all

Western Washington commercial earthquake policies and 60.9% of all commercial earthquake policies

statewide.

2017 Earthquake Data Call Report

20

The commercial insurance market is generally less geographically split than the residential insurance

market. On average, 122 insurers sell commercial earthquake coverage in Western, compared to 103 in

Eastern Washington. Instead, the county population is much more highly correlated with the number of

insurers selling in that county.

2017 Earthquake Data Call Report

21

How large is earthquake exposure?

Exposure in the earthquake market is fundamentally linked to the coverage rate in most areas of the

state, but this value is also telling with regard to the type of structure being insured. While some small

counties may have low coverage rates, they often seem to have high rates of coverage for more

expensive properties, pushing the value of average covered structure for earthquake higher than the

typical homeowner’s policy.

Residential

Statewide, the exposure for earthquake-insured properties is $181 billion in this data set. This is

approximately 18% of the over $1 trillion in general coverage reported. Twenty counties represent 95%

of the overall exposure, most of which are in Western Washington.

The residential market exposure shows that there is a bias toward earthquake coverage for more

expensive properties. Properties with earthquake coverage represent an excess exposure of $65 billion,

65% more than would be expected of the typical property in the data set.

Western counties are also well represented in the data. Fully 90% of all earthquake exposure is located

in Western Washington. With the exception of Spokane County, all of the top 10 counties by

earthquake exposure are western counties. This is in line with the policy rate.

2017 Earthquake Data Call Report

22

Commercial

Exposure for commercial properties is significantly larger than that of the residential market, with a

value insured at just under $2 trillion represented in the data set. Approximately 85% of this exposure --

$1.7 trillion -- is represented by policies with earthquake coverage.

Like the residential market, the commercial earthquake market also tends to have a larger exposure

than the average property in the market. In all, the commercial earthquake market has an excess

exposure of $212 billion compared to average policies, which represents about 11% of the overall

market. The difference in excess is in part due to the larger market penetration of earthquake coverage

in the commercial market and in part due to the market penetration of surplus line companies.

The commercial market is also less biased toward the western counties. Only seven of the 10 counties

with the largest exposure are in Western Washington. This almost perfectly mirrors the population

distribution of these counties and cannot therefore be attributed to a differential in risk.

2017 Earthquake Data Call Report

23

What are the deductibles in earthquake policies?

While this data call did not elicit premium information, it did collect information about the deductibles

of the policies issued. In general, earthquake policies have a much higher deductible than typical

homeowner and commercial insurance policies. The deductibles are frequently a percentage of the

insured value of the property. Depending on the company, the insured value is frequently 50% or more

above the appraised value, as these policies also include the contents of the structure.

The net effect of the deductible on many earthquake policies is that they only produce benefit when a

significant portion of the structure is damaged during an event. This makes the “quality” of the policy

important in earthquake prone areas where significant damage is unlikely for a single event but

frequent small impacts are very likely.

Residential

The policies for most structures carry a fairly standard deductible, between 10% and 15% of the insured

value. Three quarters of the companies that reported deductibles reported the most common

deductible for earthquake policies in this range. Policy deductibles ranged from first dollar coverage ($0

deductible) all the way up to 40% deductibles. Several companies also offered fixed-price deductibles

between $100 and $5,000.

2017 Earthquake Data Call Report

24

Commercial

Commercial earthquake policies are much more varied in deductible than residential policies. While

about 20% offer policies with a similar 10% to 15% deductible range to residential policies, 25% offer

policies with a 0% to 8% average deductible. More than half of the companies that offer earthquake

coverage in the commercial market do so with a fixed-price deductible that represents, on a percentage

basis, less than a 10% deductible. However, since many of the companies operating in the commercial

market are surplus line insurers, it is impossible to say that these deductibles are comparable to those

found in the residential market. In fact, the surplus line insurers seem to offer policies with deductibles

across the map. Some offer $0 deductibles while others offer 100% deductibles (described by the

company as “excess loss plans”) with no describable pattern in our data.

2017 Earthquake Data Call Report

25

Methodology

OIC staff was given general guidelines on the design of the data call by Commissioner Kreidler. Staff

was asked to determine the coverage of earthquake insurance in the Washington market with a focus

on both residential and commercial properties, while also minimizing the length and depth of the data

being requested. This posed a challenge given the property and casualty marketplace is highly varied,

with 864 admitted insurers and hundreds of surplus line insurers participating in the market. Staff

eventually decided on a county-by-county data approach, combined with a short questionnaire which

kept the data requirements at a summary level while still providing sufficient detail for analysis.

Instrument

The data call instrument was designed to elicit an assortment of information regarding both general all

perils policies and specific earthquake coverage of a broad variety of insurers. The data call consisted of

a spreadsheet with three tabs (one for questions, two asking for data) which covered “residential” and

“commercial” separately. In each tab, insurers were also asked about both their all perils policies and

earthquake specific coverage. A copy of the instrument is included in Appendix A.

As this instrument was to be issued to both surplus line and admitted insurers, OIC staff chose to

provide a single, broadly worded survey to all insurers rather than customizing the document for the

type of insurer. Using a single survey simplified implementation but made the specificity of the

response form of utmost importance. To attempt to make the wording as understandable and concise

as possible, OIC staff shared several drafts with both industry and policy experts before arriving at final

language. However, even after extensive comments and multiple revisions, the final draft still caused

confusion for contacted insurers. As such, OIC issued a frequently asked questions (FAQ) document and

made staff available to address insurer questions. The FAQ is included in Appendix B.

Questions

There were seven questions on the survey, which were further differentiated by market (residential and

commercial). The first two questions referred only to typical “Coverage A” or “all other perils” policies

and elicited information about the coverage level and deductible of these policies. The remaining five

questions sought to determine if and how earthquake coverage was offered (question three) and the

coverage of those policies.

All insurers were required to answer the first three questions, but only insurers that offered earthquake

coverage were required to answer all seven. For deductible questions, insurers were given a choice

between reporting the nearest whole dollar value or the percentage for the deductible. Capacity

questions were asked in rounded whole dollars. In all questions, insurers were asked to answer

separately for residential and commercial policies.

2017 Earthquake Data Call Report

26

Market data

County level policy data was collected on two tabs titled “residential” and “commercial.” In these tabs

insurers were asked to report the number of policies, number of policies with earthquake coverage, and

the total exposure for each of the state’s 39 counties. For surplus line insurers, it was assumed that

every earthquake policy sold represented a single property and was thus a single policy. This

assumption was provided as guidance as multiple insurers in this market had advised the OIC that they

covered structures in multiple counties with a single policy.

Data validation

The instrument was designed to integrate multiple data validation techniques. Due to the multiple

disparate methods of covering earthquakes available in the market, OIC assumed that there might be

problems with reporting data in both the aggregate (question tab) and by county (data tabs). To

combat this, OIC built in several redundant data reporting questions. These included:

• Asking companies if they offered earthquake insurance and how much.

• Asking companies to provide both a statewide average risk as well as the total risk and number

of policies.

• Asking companies for both an average deductible for earthquake and a range.

OIC also asked insurers to submit data for each of the companies they controlled rather than submitting

aggregated data. This allowed us to cross check between similar companies to ensure that reporting

was internally consistent.

Implementation

Issuance

OIC chose to issue the data call to insurers including surplus line insurers. OIC sent a targeted email to

the 40 largest property and casualty companies based on market share calculated from annual filings

with OIC. OIC also emailed the 40 largest insurers of earthquake specific policies. OIC also recognized

the role that surplus line insurers (non-admitted) play in the earthquake insurance market by requesting

a list of surplus line insurers who may offer earthquake coverage from a large insurer group. The

admitted company groups overlapped substantially, but overall the OIC contacted 108 companies with

a direct requirement to submit data as part of the data call. Other insurers received the data call

through trade associations, postings on the OIC data call website, postings on surplus line associations,

and other insurer groups.

Outreach

Companies that received the data call were given direct contact numbers and emails for OIC staff for

questions relating to the call. OIC also posted a frequently asked questions document (FAQ) to answer

common questions. The FAQ was updated as emails were received. OIC staff also spent significant time

on the phone with insurer representatives working through additional questions and helping insurers

2017 Earthquake Data Call Report

27

report on time. This resulted in a large percentage of cross-checked reporting without any issues and

many timely reports.

Revisions

While the majority of insurers were able to get the answers to their questions before reporting, some

insurers either misinterpreted the instructions or reported the wrong data. OIC expected this because

the data call included many non-admitted companies unaccustomed to reporting data to OIC. To

ensure the cleanest and most accurate data was available to Commissioner Kreidler, OIC staff sent

requests for corrections back to directly contacted insurers based on a series of cross checks, some of

which are listed above. A full list of checks and a sample copy of the email sent can be found in

Appendix C. OIC gave insurers a few days to respond because most of the corrections were minor. The

vast majority were able to meet the short deadline.

Data cleaning

Overall the data came in relatively clean. There were a small number of obvious typos (such as a 150%

deductible) as well as some systematic errors (such as reporting in thousands of dollars) which were

corrected without contacting the company. Other larger errors were either corrected by the company or

removed. OIC chose to exclude erroneous data on a row by row basis rather than wholesale to keep as

much data as possible.

The most common errors were missing values in county total exposure. Most of these were for data

rows with less than five policies reported and thus excluded without significant impact. These rows also

tended to have other missing values, which generally indicated that the whole company report was

invalid. Only three companies had their data excluded for this reason, which removed under 100

policies.

Other errors, such as over reporting of earthquake policies by surplus line insurers, were corrected by

OIC staff by assuming that each earthquake policy was also an “all perils” policy. This was an

assumption made early in the design phase of the instrument when OIC staff became aware that

surplus line insurers frequently covered multiple structures across the state under one policy. After OIC

corrections, only a few insurers needed to update their data.

The most severe issue was a systematic missing value for many insurers on question two of the

questions tab. This questions referred to the “median all other perils deductible.” This was intended to

represent values for all policies, but insurers with significant earthquake coverage would often exclude

this value as these policies were not just “all other perils.” OIC has decided to exclude this variable from

certain companies in our analysis due to this issue. However, this value stands as a rate variable so is

only slightly biased by the removals.

2017 Earthquake Data Call Report

28

Conclusion

On many points, this study confirmed our general assumptions about the Washington earthquake

insurance market. Our market is robust, with many companies offering policies. As in other insurance

markets, there are more insurers and policy choices in the more highly populated counties. In Western

Washington, where higher risk of earthquake is well documented, more commercial and residential

properties are insured.

On a positive note, residential coverage rates for earthquake insurance are higher than predicted, at

11.3%. And, as noted above, the rate in Western Washington is even higher, at 13.8%. This rate

compares favorably with other high-risk states.

But there is work to be done.

Although our residential coverage rate is higher than expected, it does not mirror the level of

anticipated risk of property loss. It does not appear that homeowners experience a barrier in finding

available policies. However, analysis of other potential barriers might prove helpful. We note that higher

value homes are more likely to have coverage; from that, we infer a potential affordability issue for

owners of more modest homes. There may also be value in exploring additional educational outreach

about the risk of earthquake and the value of coverage.

Similarly, although commercial coverage rates are fairly strong in Washington, additional analysis of

barriers and opportunities to increase coverage are recommended.

Given Washington’s geologic conditions, the question is not whether a large earthquake, with the

ensuing damage to lives and property, will occur; the question is when. Insurance is a known key to

resilience after disaster, and the issue merits additional priority in this state.

2017 Earthquake Data Call Report

29

Appendix A

1) What is the average coverage A amount of the properties insured…

(Use only whole numbers rounded to the nearest dollar)

a) … for RESIDENTIAL properties?

$

b) … for COMMERCIAL properties?

$

2) What is the median All Perils (except earthquake) deductible…

(Use only whole numbers rounded to the nearest dollar/percentage)

a) … for RESIDENTIAL properties?

$

or

%

b) … for COMMERCIAL properties?

$

or

%

3) How do you offer earthquake insurance? (Choose all that apply)

Residential

Commercial

□

□

My company does not offer earthquake insurance in Washington.

□

□

My company offers earthquake insurance as a sub-limit.

□

□

My company offers earthquake insurance as a policy endorsement.

□

□

My company offers earthquake insurance as a standalone policy.

□ □

My company offers earthquake insurance as a surplus line product through our

brokers.

□

□

My company offers earthquake insurance on a Primary or Loss Limit basis.

□

□

My company offers earthquake insurance on an Excess basis.

□

□

My company offers earthquake insurance on a Ground Up (or Full Value) basis.

If your company does not offer earthquake coverage <STOP>, do not answer questions 4-7 remaining on

this tab; continue on the next two tabs.

4) What is maximum EARTHQUAKE capacity on single risk?

(Use only whole numbers rounded to the nearest dollar)

a) … for RESIDENTIAL properties?

$

b) … for COMMERCIAL properties?

$

5) What is average EARTHQUAKE capacity on single risk?

(Use only whole numbers rounded to the nearest dollar)

a) … for RESIDENTIAL properties?

$

b) … for COMMERCIAL properties?

$

2017 Earthquake Data Call Report

30

6) What is the median EARTHQUAKE deductible…

(Use only whole numbers rounded to the nearest dollar/percentage)

a) … for RESIDENTIAL properties?

$

OR

%

b) … for COMMERCIAL properties?

$

OR

%

7) What deductible range do you offer for EARTHQUAKE?

(Use only whole numbers rounded to the nearest dollar/percentage)

Residential: $ to $ OR % to %

Commercial: $ to $ OR % to %

Instructions:

Residential policies are defined as owner occupied structures where the insured makes their

residence. This includes second homes and vacation houses that are not covered for rental.

Commercial policies are defined as non-owner occupied structures where the insured is an

individual, business, or other entity. This includes, but is not limited to, business locations,

rental units, commercial properties, and agricultural lands.

2017 Earthquake Data Call Report

31

Residential

A) County Name

B) FIPS

Code

C) Dollar ($) Value of

properties (structure

& contents) insured

D) Number of

residential properties

with earthquake

coverage

E) Number of

residential property

policies written

Adams County

53001

Asotin County

53003

Benton County

53005

Chelan County

53007

Clallam County

53009

Clark County

53011

Columbia County

53013

Cowlitz County

53015

Douglas County

53017

Ferry County

53019

Franklin County

53021

Garfield County

53023

Grant County

53025

Grays Harbor County

53027

Island County

53029

Jefferson County

53031

King County

53033

Kitsap County

53035

Kittitas County

53037

Klickitat County

53039

Lewis County

53041

Lincoln County

53043

Mason County

53045

Okanogan County

53047

Pacific County

53049

Pend Oreille County

53051

Pierce County

53053

San Juan County

53055

Skagit County

53057

Skamania County

53059

Snohomish County

53061

Spokane County

53063

Stevens County

53065

Thurston County

53067

Wahkiakum County

53069

Walla Walla County

53071

Whatcom County

53073

2017 Earthquake Data Call Report

32

A) County Name

B) FIPS

Code

C) Dollar ($) Value of

properties (structure

& contents) insured

D) Number of

residential properties

with earthquake

coverage

E) Number of

residential property

policies written

Whitman County

53075

Yakima County

53077

Instructions:

Residential structures,

replacement value,

rounded to the

nearest thousand

dollars.

Include policies where

EQ included in Package,

Fire, Allied Lines,

Commercial Multi Peril

(non-liability portion),

DIC, or mono-line EQ

Any policy that covers

a building to at least

50% of the

replacement cost.

Count one policy with

multiple buildings as a

single policy.

Commercial

A) County name

B) FIPS

Code

C) Dollar ($) Value of

properties (structure

& contents) insured

D) Number of

commercial properties

with earthquake

coverage

E) Number of

commercial property

policies written

Adams County

53001

Asotin County

53003

Benton County

53005

Chelan County

53007

Clallam County

53009

Clark County

53011

Columbia County

53013

Cowlitz County

53015

Douglas County

53017

Ferry County

53019

Franklin County

53021

Garfield County

53023

Grant County

53025

Grays Harbor County

53027

Island County

53029

Jefferson County

53031

King County

53033

Kitsap County

53035

Kittitas County

53037

Klickitat County

53039

2017 Earthquake Data Call Report

33

A) County name

B) FIPS

Code

C) Dollar ($) Value of

properties (structure

& contents) insured

D) Number of

commercial properties

with earthquake

coverage

E) Number of

commercial property

policies written

Lewis County

53041

Lincoln County

53043

Mason County

53045

Okanogan County

53047

Pacific County

53049

Pend Oreille County

53051

Pierce County

53053

San Juan County

53055

Skagit County

53057

Skamania County

53059

Snohomish County

53061

Spokane County

53063

Stevens County

53065

Thurston County

53067

Wahkiakum County

53069

Walla Walla County

53071

Whatcom County

53073

Whitman County

53075

Yakima County

53077

Instructions:

All non-owner

occupied structures,

replacement value,

rounded to the nearest

thousand dollars.

Include policies where

EQ included in Package,

Fire, Allied Lines,

Commercial Multi Peril

(non-liability portion),

DIC, or mono-line EQ

Any policy that covers

a building to at least

50% of the

replacement cost.

Count one policy with

multiple buildings as a

single policy.

2017 Earthquake Data Call Report

34

Appendix B

Frequently asked questions of the 2017 earthquake data call.

When is the data call due?

The OIC Earthquake data call is due by close of business (5pm PST) on October 13th, 2017.

What date should my data reflect for my submission?

The OIC Earthquake data call is for policies in place as of December 31st, 2016.

We do not sell property coverage in Washington, do we still have to submit?

No. Only admitted insurers with active policies in Washington State as of 12/31/16 are required

to submit data under this data call.

We do not sell plans with “earthquake” coverage in Washington, do we still

have to submit?

Yes. You may skip questions 4-7 on the “Questions” tab but all other portions must be filled in.

We need more time, can we have an extension beyond 10/13/17?

The OIC is not offering extensions beyond the stated date so that we can meet legislative

deadlines for our report.

We do not offer plans in a county, what do we do?

Please enter “N/A” in any boxes where you do not offer coverage. If you offer coverage but have

no active policies during the data call time period please enter “0”.

What is “Coverage A”?

Per the NAIC: “Coverage A provides coverage for a house and its contents, as well as any

structures attached to the premises, such as a garage or deck.”

What does “capacity” mean?

Capacity means the total exposure or maximum loss covered under a particular policy for a

single event within the noted parameters.

2017 Earthquake Data Call Report

35

What is “FIPS Code” in column B?

FIPS codes are numeric codes used by the federal government to represent county names. OIC

uses them to ensure that submitted data is correctly coded in our system. The entered codes

represent the counties listed in the corresponding row in column A.

Column C asks for the dollar value of Commercial Properties insured. Our

company does not capture replacement value, only Total Insured Value.

What do we do?

Please enter Total Insured Value here instead. Exclude any additional coverages beyond

structure/contents where possible.

Can I group several companies together when I submit?

No. Please submit a copy of the data call spreadsheet for each company with a NAIC company

number.

Where do I put my company name on this form?

Please include your company name and NAIC company number in the name of the file like

shown below for fictional company ABC Insurance (NAIC #12345):

“ABC Insurance 12345 EQ Data Call.xls”

We write a mix of earthquake policies and traditional all-perils policies in

the state of Washington. How do we enter our data?

Please make sure to answer questions 1-7 and indicate how you offer this coverage in question

3. In the residential and commercial tabs please count earthquake only polices in column D and

traditional all-perils only polices in column E. Traditional all-perils policies with earthquake

coverage should be counted in columns D and E. Column C should reflect the sum of maximum

exposure for each policy form a single risk. Do not double count exposure from policies with all-

perils and earthquake coverage.

We do not track county as part of our policy information. How do we

report?

If you retain the property address you may utilize the US Census geocoder web-app to derive

the county information for each property (individual or in batches of up to 1000 addresses). The

tool can be accessed at the following web address:

https://www.census.gov/geo/maps-data/data/geocoder.html

2017 Earthquake Data Call Report

36

Appendix C

Below is the email and data call instructions that were sent out to insurers for the Washington state

Office of the Insurance Commissioner’s 2017 earthquake data call.

Sent: Sept. 15, 2017 at 10:33 a.m.

Good morning,

By this email and the attached documents, the Office of the Insurance Commissioner (OIC) is calling for

data with the purpose of determining the current utilization rate of residential and commercial

earthquake insurance in the state of Washington.

This data call is being issued to companies authorized to do business in Washington state under the

OIC’s broad investigatory authority, see RCW 48.02.060(3)(c). We are also requesting responses from

surplus line companies doing business in Washington. We very much appreciate the assistance of

domestic insurers and the Surplus Line Association of Washington who assisted in reviewing a draft of

this data call to improve its clarity and ensure greater accuracy in the submitted responses.

Attached is the data call spreadsheet, and a memorandum of guidance for the response. The

completed data call is due October 13, 2017. Please complete and submit the responses in the

attached spreadsheet to: DataCal[email protected]ov. Questions regarding the purpose and use of data call

may be directed to Stacy Middleton at stacym@oic.wa.gov. Technical questions regarding responses

on the spreadsheet may be directed to Micah Sanders at micahs@oic.wa.gov.

Thank you,

AnnaLisa Gellermann

Deputy Insurance Commissioner of Policy and Legislative Affairs

Washington State Office of the Insurance Commissioner

PO Box 40255 Olympia WA 98504-0255

360.725-7037

annalisag@oic.wa.gov

Protecting Insurance Consumers

www.insurance.wa.gov | twitter.com/WA_OIC | wainsurance.blogspot.com | email/text alerts

2017 Earthquake Data Call Report

37

Memorandum

To:

Earthquake Datacall Insurer

From:

Micah Sanders, OIC Policy Division

Date:

9/7/17

Subject:

Instructions for completing the Earthquake Data call spreadsheet

This earthquake data call includes three specific parts located in tabs within an excel spreadsheet.

Please complete all three tabs of the spreadsheet even if your company does not offer earthquake,

residential, or commercial coverage. Please complete all GREY sections and check any applicable BOXES.

If your company does not offer coverage or you feel that a box does not apply to your company please

fill the applicable spaces with a “NA” to indicate that you do not offer coverage. Entering a “0” will be

interpreted as your company does offer coverage but currently has no enrollments.

Completing the “Questions” tab

1) Please complete all questions for both residential and commercial lines. If your company does

not offer coverage for one of the two lines enter “NA.”

2) Please enter “NA” in either the “$” or “%” boxes if your company does not offer both a total

dollar cap and percentage cap on policy value or deductible.

3) If your company offers property coverage for some perils but no coverage for earthquake

damage you may skip questions 4-7 on the “Questions” tab.

Completing the “Residential” and “Commercial” tabs

Column C: Please enter the total replacement dollar value of structures and contents, rounded

to the nearest thousand dollars for covered properties located in the indicated Washington

county. This value should represent the total maximum exposure by county, not the average

property exposure. Earthquake coverage provided by a secondary party should not be included.

Column D: Please enter the total number of properties in the indicated county that include

earthquake coverage in the form of package, fire, allied lines, commercial multi-peril (non-

liability portion), DIC, or mono-line earthquake coverage. Entered values must be non-rounded,

whole numbers.

Column E: Please enter the total number of properties in the indicated county that covers a

building to at least 50% of the replacement cost. Count one policy with multiple buildings as a

single policy. For properties where multiple individuals policies to cover the structure, count all

policies together as one policy covering the structure.

Definitions

Residential policies: owner occupied structures where the insured makes their residence. This

includes second homes and vacation houses that are not covered for rental.

Commercial policies: non-owner occupied structures where the insured is an individual, business,

or other entity. Generally means insurance pertaining to a business, profession, occupation,

2017 Earthquake Data Call Report

38

nonprofit organization, or public entity for the lines of property & casualty insurance. This

includes, but is not limited to, business locations, rental units, commercial properties, and

agricultural lands.

Replacement value: The total value of structures and contents insured on one property/policy.

This is effectively the total exposure from property loss, excluding medical, loss of use benefits,

legal, or other expenses.

Earthquake Coverage: Coverage for earthquake induced losses in the form of package, fire,

allied lines, commercial multi-peril (non-liability portion), DIC, or mono-line earthquake

coverage.

Questions

If you have any questions regarding how to complete this spreadsheet please contact me at the address

below.

Micah Sanders

Economic Policy Analyst

Washington OIC

MicahS@oic.wa.gov

2017 Earthquake Data Call Report

39

Appendix D

Companies from whom data was requested, which responded

Company Name NAIC

Code

Admitted vs Non-admitted

Ace American Insurance Company

22667

Admitted

AIX Specialty Insurance Company

12833

Non-admitted

Allianz Global Risk US Insurance Company

35300

Admitted

Allied Property & Casualty Insurance Company

42579

Admitted

Allied World Assurance Company Inc.

19489

Non-admitted

Allstate Insurance Company

19232

Admitted

American Automobile Insurance Company

21849

Admitted

American Family Mutual Insurance Company., S.I.

19275

Admitted

American Guar & Liability Insurance

26247

Admitted

American Modern Home Insurance Company

23469

Admitted

Aspen Specialty Insurance Company

10717

Non-admitted

AXIS Insurance Company

37273

Admitted

AXIS Surplus Insurance Company

26620

Non-admitted

Burlington Insurance Company, The

23620

Non-admitted

Country Mutual Insurance Company

20990

Admitted

Crestbrook Insurance Company

18961

Admitted

Depositors Insurance Company

42587

Admitted

Endurance American Specialty Insurance Company

41718

Non-admitted

EVANSTON INSURANCE COMPANY

35378

Non-admitted

Farmers Insurance Company of Washington

21644

Admitted

Federated Mutual Insurance Company

13935

Admitted

First Specialty Insurance Corporation

34916

Non-admitted

Foremost Insurance Company Grand Rapids, MI

11185

Admitted

Foremost Property & Casualty Insurance Company

11800

Admitted

General Security Indemnity Company of Arizona

20559

Non-admitted

2017 Earthquake Data Call Report

40

Company Name NAIC

Code

Admitted vs Non-admitted

Golden Bear Insurance Company

39861

Non-admitted

Grange Insurance Association

22101

Non-admitted

Great Northern Insurance Company

20303

Admitted

Houston Casualty Company

42374

Non-admitted

HSB Specialty Insurance Company

14438

Non-admitted

Indian Harbor Insurance Company

36940

Non-admitted

Insurance Company of the West

27847

Admitted

Ironshore Specialty Insurance Company

25445

Non-admitted

JAMES RIVER INSURANCE COMPANY

12203

Non-admitted

Kinsale Insurance Company

38920

Non-admitted

Lexington Insurance Company

19437

Non-admitted

Liberty Mutual Fire Insurance Company

23035

Admitted

Liberty Surplus Insurance Corporation

10725

Non-admitted

Maxum Indemnity Company

26743

Non-admitted

Mt. Hawley Insurance Company

37974

Non-admitted

Mutual of Enumclaw Insurance Company

14761

Admitted

Nationwide Mutual Fire Insurance Company

23779

Admitted

Pacific Indemnity Company

20346

Admitted

Palomar Specialty Insurance Company

20338

Admitted

Princeton Excess & Surplus Lines Insurance Company

10786

Non-admitted

QBE Insurance Corporation

39217

Admitted

QBE Specialty Insurance Company

11515

Non-admitted

Rockhill Insurance Company

28053

Non-admitted

Safeco Insurance Company of America

24740

Admitted

Safeco Insurance Company Of IL

39012

Admitted

Starr Surplus Lines Insurance Company

13604

Non-admitted

State Farm Fire & Casualty Company

25143

Admitted

Steadfast Insurance Company

26387

Non-admitted

Travelers Excess and Surplus Lines Company

29696

Non-admitted

2017 Earthquake Data Call Report

41

Company Name NAIC

Code

Admitted vs Non-admitted

Travelers Indemnity Company

25658

Admitted

Travelers Property Casualty Company of America

25674

Admitted

Unigard Insurance Company

25747

Admitted

United National Insurance Company

13064

Non-admitted

United Specialty Insurance Company

12537

Non-admitted

Vigilant Insurance Company

20397

Admitted

Westchester Fire Insurance Company

10030

Admitted

Westport Insurance Corporation

39845

Admitted

XL Insurance American Inc.

24554

Admitted