1

Effective February 20, 2022

Please note: The pricing in this guide applies only to SunTrust accounts transitioning to Truist.

Please review the important dates inside the back cover of this guide.

Personal Services

Product and Pricing Guide

2

At Truist, we stand for better. That means a better overall inancial experience for you.

So how do we achieve that?

• It all starts with listening to you.

• Because we listen, we’re able to understand your needs.

• That all leads to solutions that can mean better outcomes for you.

One thing that really sets Truist apart is our unique combination of people and

technology—seamlessly working together to deliver one smooth experience for you.

We’ve empowered our teammates to connect you with the right people and the right

technology—at exactly the right time.

Ways to bank that it your life

At our Innovation and Technology Center, we’re working directly with clients like you to

develop new ways to manage both your money and your relationship with us, including:

• Contactless banking that’s quicker and safer

• Text-to-speech technology for easier interaction

• A dynamic digital shopping experience

All this and more provides you with more control and convenience when it comes to

every aspect of your inancial life. Tomorrow looks better than ever. And we can’t wait to

share it all with you.

If you have questions, reach out to a Truist teammate at 888-700-7856.

Wealth clients may contact your Truist Wealth advisor, or call Wealth Client Care at

800-321-1997, Monday-Friday, 8 am – 8 pm, ET and Saturday, 8 am – 5 pm, ET.

Welcome

3

Account name change chart ...............................4

Checking accounts .............................................. 7

Standard checking account features .....................7

Truist Wealth Checking ............................................7

Truist Asset Management Account ........................ 8

Truist Dimension Checking .................................... 9

Truist Focus Checking ...........................................10

Truist Bright Checking ............................................11

Truist Fundamental Checking ................................11

Truist Student Checking ........................................ 12

Money market accounts .....................................12

Standard money market account features .......... 12

Truist Wealth Money Market Account ................... 12

Truist Money Market Account ............................... 12

Savings accounts ............................................... 13

Standard savings account features ......................13

Truist Savings .........................................................13

Truist Online Savings .............................................14

Secured Credit Card Savings ................................14

Health Savings Account ........................................14

Certiicates of Deposit (CDs) ............................. 15

Individual Retirement Accounts (IRAs) ............. 16

Loans and lines of credit .................................... 18

Ways to make your life easier ............................ 18

Truist Debit Card ....................................................18

Delta SkyMiles® Debit Card ...................................19

Truist ATM Card ..................................................... 20

Truist ATMs ............................................................20

Truist Deals ............................................................ 20

Truist credit card ................................................... 20

Credit Card Rewards ..............................................21

Truist Online and Mobile Banking ......................... 21

Zelle® .......................................................................21

Alerts ...................................................................... 22

Truist Contact Center ........................................... 22

Important information .......................................22

Arbitration, Jury Trial Waiver & Litigation

Class Action Waiver .............................................. 22

Direct Deposits and Automatic Drafts ................. 22

Truist Overdraft Protection ................................... 22

Truist Overdraft Coverage .................................... 23

How we process your deposits

and withdrawals .................................................... 24

Funds Availability Policy ....................................... 24

Deposit Statements .............................................. 25

Online Statements ................................................ 25

Image Statements ................................................. 25

Checks ................................................................... 25

FDIC Insurance ...................................................... 25

Other services .................................................... 26

Truist Safe Deposit Box ......................................... 26

Wire Transfers ........................................................ 26

Truist Ready Now Credit Line ............................... 26

Fee Schedule ...................................................... 28

Truist Overdraft Decision Notice.......................37

Important dates .................................................38

Table of contents

4

On Sunday, February 20, 2022, your SunTrust account will become a new Truist account. Although the

account names are changing, most accounts will retain the same features, pricing, and beneits. If there are

any dierences between your SunTrust account and your new Truist account, the enclosed letter highlights

those dierences. This guide covers accounts and services oered at Truist. Look through the guide for

information on other Truist accounts that may better serve your needs. If you have any questions, please

visit your nearest branch or contact your Truist branch teammate. One of our teammates will talk with you

about dierent Truist options that you may prefer.

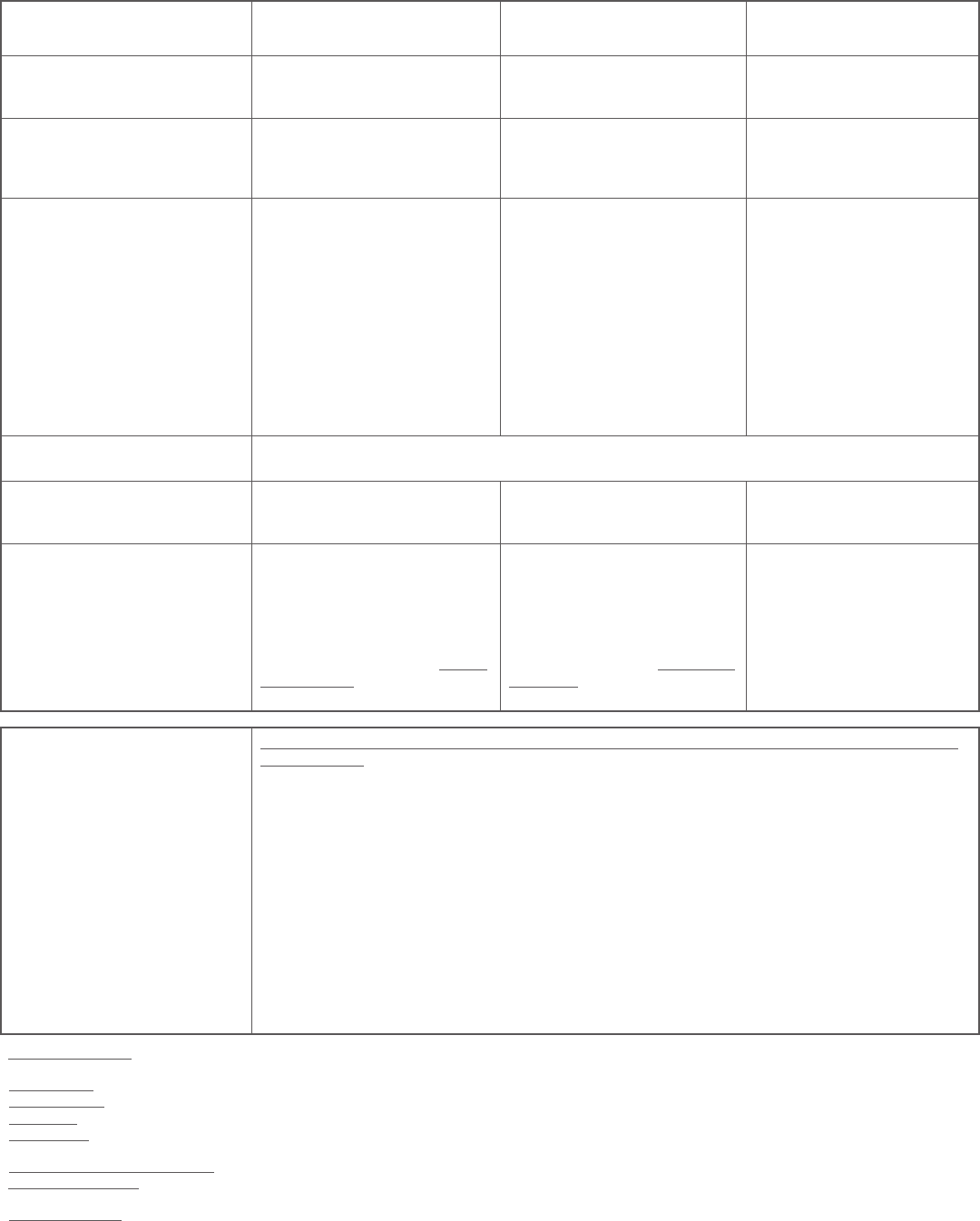

Account name change chart

SunTrust account: New Truist account:

Exclusive Checking Truist Wealth Checking

Signature Advantage with Brokerage Account Truist Asset Management Account

Signature Advantage Checking

Signature Advantage with Brokerage FDIC

Signature Advantage Checking*

Advantage Checking Truist Dimension Checking

SunTrust at Work Professional Banking Truist Focus Checking

Everyday Checking

Personal Checking

Premium Banking

SunTrust at Work Everyday Checking

Truist Bright Checking

Smart Choice Banking Truist Fundamental Checking

Essential Checking (standard) Essential Checking*

Essential Checking (student)

FSU Card Account

Truist Student Checking

Fifty Plus Checking Senior Checking*

Interest Checking Personal Interest Checking*

Checking accounts

* These accounts are no longer oered by Truist, but we will continue to service your account.

5

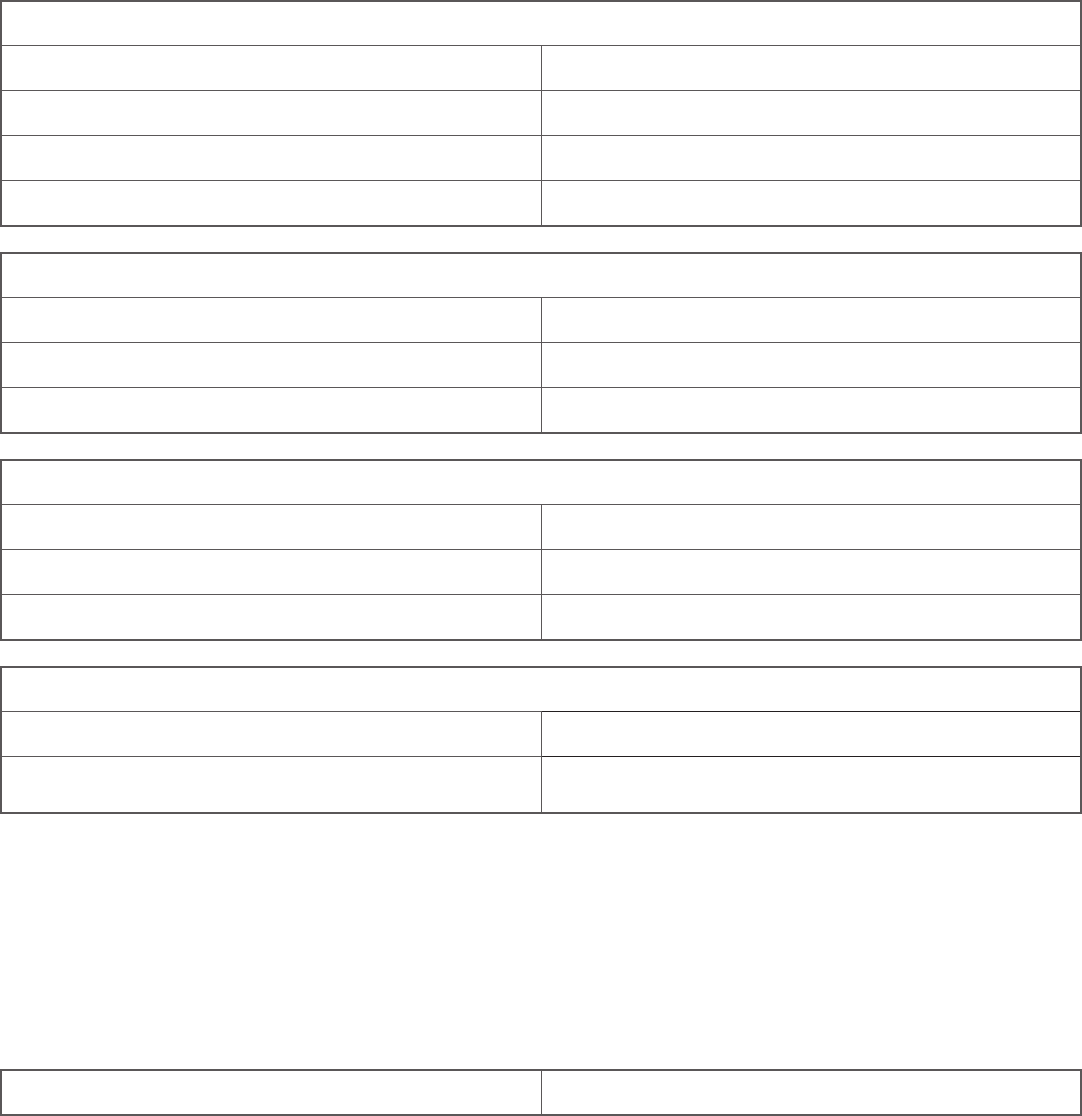

SunTrust account: New Truist account:

Exclusive Money Market Truist Wealth Money Market Account

Advantage Money Market

Signature Money Market

Advantage Rate Money Market Account

Signature Advantage Money Market Account

Money Market Index

Investor’s Deposit Account*

Select Savings

Personal Money Market

Premium Money Market Performance

Money Market Performance Account

Classic Select Savings

First Rate Savings

Live Solid Savings

Money Rate Savings*

SunTrust account: New Truist account:

Youth Advantage Savings

Essential Savings

Vanderbilt Employee Savings

Personal Savings

Get Started Savings

Truist Savings

Secured Card Savings Account Secured Credit Card Savings

SunTrust account: New Truist account:

Personal Certiicate of Deposit

Variable Rate CD

Personal Fixed Rate CD

Fixed Rate IRA Fixed Rate IRA

SunTrust Money Market IRA

Premium Plus Money Market IRA

Money Rate Savings IRA

SunTrust Variable Rate Deposit IRA 18-Month Variable Rate IRA*

Money market accounts

Savings accounts

Certiicates of Deposit and Individual Retirement Accounts

* These accounts are no longer oered by Truist, but we will continue to service your account. Please look through this guide for information on other Truist

accounts that may better serve your needs.

* This account is no longer oered by Truist, but we will continue to service your account.

6

SunTrust account: New Truist account:

Overdraft Coverage Truist Overdraft Coverage

Safe Deposit Box Truist Safe Deposit Box

Online Banking Online Banking

Auto Loan Auto Loan

Boat Loan Boat Loan

Marine Loan Marine Loan

RV Loan RV Loan

Unsecured Loan Personal Loan

Wealth/Premier Personal Loan

Personal Credit Line Plus

Personal Line of Credit

Wealth/Premier Personal Line of Credit

Select Credit Line Secured Line of Credit

Wealth/Premier Secured Line of Credit

CD/Savings Loan CD/Savings Secured Loan

Home Equity Line of Credit Home Equity Line of Credit

Stock Secured Loan Secured Loan

Wealth/Premier Secured Line of Credit

Other accounts and services

7

Checking accounts

Truist oers a variety of checking account choices. All Truist checking accounts provide standard beneits

designed to make banking easier and more convenient for you.

Standard checking account features

• Truist Debit Card with Truist Deals

• Unlimited check writing

• Account access through Truist Online and Mobile Banking with unlimited online Bill Pay

• Unlimited account inquiries through the Truist Contact Center, our automated telephone banking service,

available 24 hours a day, 7 days a week. Our automated system now includes speech recognition and

enhanced authentication methods.

• No fee to transfer between your Truist deposit accounts through the Truist Contact Center

• Truist oers several options for overdraft protection

Truist oers a variety of accounts and credit options that can be linked to your checking account to provide overdraft protection (see page 22). Some products

may be subject to credit approval.

Truist Wealth Checking

If you’re a Wealth client, your advisor can open a Truist Wealth Checking account for you. Or if you’re assigned

to a Wealth advisor, a teammate at any Truist branch can help you. Truist Wealth Checking is a premium

banking package that provides Wealth clients with an unmatched combination of exclusive products, beneits,

discounts, and services. You’ll receive all of the standard features for Truist checking accounts (see above), plus

these additional features:

• No monthly maintenance fee on secondary checking accounts

• No monthly maintenance fee on one personal Truist Savings account or one existing Money Rate Savings account

• No monthly maintenance fee on a Health Savings account

• No overdraft/returned item fees

• Exclusive Truist Wealth Debit Card

• Delta SkyMiles® Debit Card (optional). Annual fee may apply.

• No-fee non-Truist ATM transactions, including international, plus unlimited surcharge rebates

• Increased daily ATM withdrawal limit of $3,000 and daily purchase limit of $25,000

• 3% fee for international currency conversion waived

• No fee on any personal checks (single, duplicate, top-stub or end-stub style)

• No-fee safe deposit box, any size (subject to availability)

• No-fee automatic overdraft protection transfers

• No-fee incoming and outgoing international and domestic wire transfers

• No-fee incoming and outgoing external transfers with online banking

• No-fee money orders and oicial checks

• No-fee Quicken® access

• No fee for duplicate statement

Truist Wealth Checking pricing information:

• The annual maintenance fee is $50 if qualiiers aren’t met on service charge account anniversary date.

You can avoid the annual maintenance fee with any of the following:

• Maintain a minimum daily ledger balance of $25,000 in your Truist Wealth Checking or your Truist Wealth

Money Market account OR

8

• Maintain $100,000 or more in Truist related accounts across personal deposits, all investments, Trust, and/or

personal mortgage, consumer loans/lines, personal credit card or Truist Ready Now Credit Line accounts.

If linked to an eligible Truist Investment Services, Inc. brokerage account the Truist Asset Management

Account pricing will apply. If the linked brokerage account relationship is removed then the account will

revert back to the standard Truist Wealth Checking pricing.

Secondary account fee waiver: The secondary checking account fee waiver excludes Truist Wealth Checking and Private Vantage Checking.

Delta SkyMiles® Debit Card Annual Fee: See the Delta SkyMiles Debit Card Annual Fee section on Page 35 for more details.

Quicken: Quicken is a registered trademark of Intuit, Inc. Truist online banking services, which may be accessed through Intuit’s Quicken software, are

owned by Truist, not Intuit. To use Quicken, Internet access is required.

Truist Wealth Checking Annual Fee: The irst fee will be charged three months after account opening and each year thereafter on the service charge

anniversary date.

Daily Ledger Balance: This is the actual balance in your account on a speciic day, and does not relect any holds or pending transactions.

Related Accounts: Accounts are automatically related based on the primary and secondary owners of the account.

Trust Balances: Balances that are held in the Truist Trust Department or Truist Advisory Services, Inc., an SEC registered investment advisor, provides

discretionary asset management services to the client in a iduciary capacity.

Truist Related Accounts: The sum of current balances from a related mortgage, consumer loan/line/credit card – excluding LightStream®.

Truist Asset Management Account

An Asset Management Account (AMA) helps you meet your everyday transactional needs while putting remaining

funds to work by “sweeping” them into your brokerage account. In addition to the standard checking

account features (see page 7), the Truist Asset Management Account gives you these additional features:

• No monthly maintenance fee on a Truist Bright Checking account

• Increased daily ATM withdrawal limit of $2,000 and daily purchase limit of $10,000

• No-fee Truist design personal checks (single, duplicate, or top-stub style) or 50% discount on any other designs

• No-fee 3x5 safe deposit box or $40 discount on a larger box (subject to availability)

• No-fee automatic overdraft protection transfers

• No-fee incoming domestic or international wire transfers

• One no-fee money order and oicial check per statement cycle

• No-fee Quicken® access

• Exclusive Truist AMA design Debit Card with unlimited non-Truist ATM transactions and surcharge rebates

• Delta SkyMiles® Debit Card (optional) annual fee may apply

• One no-fee overdraft/returned item per statement cycle

Truist Asset Management Account pricing information:

• The monthly maintenance fee is $30.

• Refer to your Truist Investment Services, Inc. Commission and Fee Schedule for commissions and fees

that may apply.

Brokerage

Commission

and Fee

Investment

and Insurance

Products

Refer to your Truist Investment Services, Inc. Commission and Fee Schedule for commissions and fees that may apply.

Investment and Insurance Products: Are Not FDIC or Any Other Government Agency Insured • Are Not

Bank Guaranteed • May Lose Value

Services oered by the following ailiates of Truist Financial Corporation: Banking products and services, including loans and

deposit accounts, are provided by SunTrust Bank and Branch Banking and Trust Company, both now Truist Bank, Member FDIC.

Truist and investment management services are provided by SunTrust Bank and Branch Banking and Trust Company, both now

Truist Bank, and SunTrust Delaware Trust Company. Securities, brokerage accounts, and/or insurance (including annuities) are

oered by Truist Investment Services, Inc. (d/b/a SunTrust Investment Services, Inc.), and P.J. Robb Variable Corp., which are

each SEC registered broker-dealers, members FINRA, SIPC, and a licensed insurance agency where applicable. Life insurance

products are oered through Truist Life Insurance Services, a division of Crump Life Insurance Services, Inc., AR License

#100103477, a wholly owned subsidiary of Truist Insurance Holdings, Inc. Investment advisory services are oered by Truist

Advisory Services, Inc. (d/b/a SunTrust Advisory Services, Inc.), GFO Advisory Services, LLC, Sterling Capital Management, and

Precept Advisory Group, LLC, each SEC registered investment advisors. Sterling Capital Funds are advised by Sterling Capital

Management, LLC.

9

You can avoid the monthly maintenance fee with any of the following:

• Maintain a total combined balance of $50,000 or more in Truist related accounts across deposits and all

investments OR

• Maintain $100,000 or more in Truist related accounts across personal deposits, all investments, credit

cards, and/or consumer loans/lines balances (excludes mortgage and LightStream® loans).

Quicken: Quicken is a registered trademark of Intuit, Inc. Truist online banking services, which may be accessed through Intuit’s Quicken software, are owned by

Truist, not Intuit. To use Quicken, Internet access is required.

Delta Skymiles® Debit Card Annual Fee: See the Delta SkyMiles Debit Card Annual Fee section on page 35 for more details.

Total Combined Balance: This is the sum of all balances within the Truist personal deposit accounts (checking, savings, money market or CDs), IRAs or consumer

brokerage accounts introduced through Truist Investment Services, Inc., and reflected on the last day of the statement cycle.

Related Accounts: Accounts are automatically related based on the primary and secondary owners of the account.

Truist Dimension Checking

Truist Dimension Checking is a multi-tiered solution which oers the Delta SkyMiles® Debit Card and rewards

you with additional beneits based on your balance relationship tier. You’ll receive the standard features for

Truist checking accounts (see page 7), plus these additional features:

• Up to four Truist Bright Checking accounts with no monthly maintenance fee

• No monthly maintenance fee for a Personal Truist Savings account

• Increased daily ATM withdrawal limit of $1,500 and daily purchase limit of $10,000

• $25 safe deposit box rental discount (subject to availability)

• No-fee incoming domestic and international wire transfers

• No-fee money orders and oicial checks

• The $3 fee for standard online external transfers to your accounts at other inancial institutions will be

waived up to three times per month.

• No fee for duplicate statement

• Accounts measured every month to determine balance relationship tier

– Dimension Core Tier < $25,000

- No fee for new account irst order of Truist design personal checks (single, duplicate, or top-stub style)

- One no-fee non-Truist ATM transaction plus surcharge rebate per statement cycle

- Delta SkyMiles® Debit Card (optional) with an annual fee of $95

– Dimension Select Tier $25,000 - $99,999.99

- One no-fee automatic overdraft protection transfer per statement cycle

- No-fee irst order any design personal checks (single, duplicate, top-stub, or end-stub) and 50%

discount o reorders.

- Three no-fee non-Truist ATM transactions plus surcharge rebates per statement cycle

- Delta SkyMiles® Debit Card (optional) with an annual fee of $75 ($20 discount)

Brokerage

Commission

and Fee

Investment

and Insurance

Products

Refer to your Truist Investment Services, Inc. Commission and Fee Schedule for commissions and fees that may apply.

Investment and Insurance Products: Are Not FDIC or Any Other Government Agency Insured • Are Not

Bank Guaranteed • May Lose Value

Services oered by the following ailiates of Truist Financial Corporation: Banking products and services, including loans and

deposit accounts, are provided by SunTrust Bank and Branch Banking and Trust Company, both now Truist Bank, Member FDIC.

Truist and investment management services are provided by SunTrust Bank and Branch Banking and Trust Company, both now

Truist Bank, and SunTrust Delaware Trust Company. Securities, brokerage accounts, and/or insurance (including annuities) are

oered by Truist Investment Services, Inc. (d/b/a SunTrust Investment Services, Inc.), and P.J. Robb Variable Corp., which are

each SEC registered broker-dealers, members FINRA, SIPC, and a licensed insurance agency where applicable. Life insurance

products are oered through Truist Life Insurance Services, a division of Crump Life Insurance Services, Inc., AR License

#100103477, a wholly owned subsidiary of Truist Insurance Holdings, Inc. Investment advisory services are oered by Truist

Advisory Services, Inc. (d/b/a SunTrust Advisory Services, Inc.), GFO Advisory Services, LLC, Sterling Capital Management, and

Precept Advisory Group, LLC, each SEC registered investment advisors. Sterling Capital Funds are advised by Sterling Capital

Management, LLC.

10

– Dimension Premier Tier $100,000 or more

- Unlimited no-fee automatic overdraft protection transfers

- No fee for new and reordered personal checks of any style (single, duplicate, top-stub, or end-stub)

- Unlimited no-fee non-Truist ATM transactions plus surcharge rebates per statement cycle

- Delta SkyMiles® Debit Card (optional) with an annual fee of $25 ($70 discount)

New Truist credit card clients can earn elevated rewards in the form of either a Loyalty Cash Bonus or Loyalty

Travel Bonus based on their credit card product type, the method by which they redeem, and their deposit

relationship(s) at Truist (including Truist Dimension Checking or Signature Advantage Checking account

holders). More information on this rewards bonus option can be found within the Rewards Program Terms and

Conditions applicable to the client’s respective credit card; restrictions apply. Truist credit cards are subject to

credit approval.

Truist Dimension Checking pricing information:

• The monthly maintenance fee is $20.

You can avoid the monthly maintenance fee with any of the following:

• Have $3,000 or more in total qualifying direct deposits per statement cycle OR

• Maintain a total combined monthly average ledger balance

,

of $10,000 or more in Truist related

accounts across personal deposits and all investments per statement cycle OR

• Have a related Truist personal credit card, mortgage, or consumer loan OR

• Have a linked Small Business Checking account

Truist Dimension Checking: We’ll use the highest average monthly ledger balance of the three most previous months to determine your tier. Eligible Truist

consumer deposit balances include all checking, savings, Certiicates of Deposit, Individual Retirement Accounts, and/or all consumer investments through

Truist Investment Services, Inc. titled to the owner’s or the co-owner’s name.

A $3 cap on surcharge rebates applies.

Delta SkyMiles® Debit Card Annual Fee: The annual fee is charged 45 days after the open date of the card. For Truist Dimension Checking accounts, the initial annual

fee will be based on the sum of highest monthly average ledger balance of your combined eligible Truist consumer deposit balances on that date. Eligible Truist

consumer deposit balances includes all checking, savings, Certiicate of Deposit, Individual Retirement Account and/or all consumer investments through Truist

Investment Services, Inc. titled in the owner or the co-owner’s name. Thereafter, for Truist Dimension and Signature Advantage Checking (no longer oered), we will

use the highest average monthly ledger balance of the 3 most previous months to determine your annual fee. Annual fee tiers are deined as follows: a) highest 3-

month average ledger balance of less than $25,000 is charged an annual fee of $95 b) highest 3-month average ledger balance of $25,000 and less than $100,000

is charged an annual fee of $75 and c) highest 3-month average ledger balance of $100,000 or more is charged an annual fee of $25. Annual fee will be calculated

at the end of the month prior to the annual fee being charged. For Truist Wealth and Truist Asset Management Checking account clients, the annual fee will be

discounted to $0. For Delta SkyMiles® cards opened before July 15, 2015, and not associated with a Truist Dimension Checking or Signature Advantage Checking

Account, the annual fee is $95. For clients whose relationship segment changes, the annual fee will be adjusted upon the next annual fee billing date.

Direct Deposits: A qualifying direct deposit is an electronic credit via ACH deposited to your account during the current statement cycle. Preauthorized transfers

made from one account to another or deposits made via a branch, ATM, online transfer, mobile device, debit card/prepaid card number or the mail are not

eligible to meet this requirement.

Total Combined Balance: The sum of all balances within the Truist personal deposit accounts (checking, savings, money market, or CDs), IRAs or brokerage

accounts introduced through Truist Investment Services, Inc. and relected on the last day of the statement cycle.

Ledger Balance: This is the actual balance in your account on a speciic day, and does not relect any holds or pending transactions.

Related Accounts: Accounts are automatically related based on the primary and secondary owners of the account.

Investments: For Truist Wealth Checking and Truist AMA, investments include assets held in a traditional brokerage account, fee-based assets under

management, annuities, and IRAs.

Related Truist Personal Credit Card, Mortgage, or Consumer Loan: The following accounts will qualify to waive the monthly maintenance fee: a Truist personal

credit card, personal mortgage or a consumer loan (including LightStream®).

Linked Small Business Checking Account: Eligible Small Business account types to be linked include Truist Dynamic Checking, Business Interest Checking,

Simple Business Checking, and Business Value 200 Checking (no longer oered).

Truist Focus Checking

Truist Focus Checking is designed for employees and/or associates of companies that are engaged with

Truist’s Financial Wellness, and oers you a host of money-saving perks. Of course, you get the standard Truist

checking features (see page 7), plus, you can also make the most of:

• Four no-fee non-Truist ATM transactions per statement cycle

• No-fee for new account irst order of Truist design personal checks (single, duplicate, or top-stub style) or

50% discount o any other style.

• Two no-fee automatic overdraft protection transfers per statement cycle

11

• Increased daily ATM withdrawal limit of $1,500 and daily purchase limit of $6,000

• No-fee 3x5 safe deposit box or a $40 discount on a larger box (subject to availability)

• No monthly maintenance fee on one Bright Checking account, and no monthly maintenance fee on one

personal Truist Savings account or one existing Money Rate Savings account

• Unlimited no-fee oicial checks and money orders

• No penalty CD withdrawals for medical emergency

Truist Focus Checking pricing information:

• The monthly maintenance fee is $15.

You can avoid the monthly maintenance fee with any of the following:

• Have $750 or more in total qualifying direct deposits per statement cycle OR

• Maintain an average ledger balance of $1,000 or more per statement cycle OR

• Maintain a total combined balance of $15,000 or more in Truist related accounts across personal

deposits and all investments per statement cycle OR

• Have a related Truist personal mortgage of $150,000+ aggregate (original loan amount)

Fees may be charged by ATM owner.

Direct Deposits: A qualifying direct deposit is an electronic credit via ACH deposited to your account during the current statement cycle. Preauthorized transfers

made from one account to another or deposits made via a branch, ATM, online transfer, mobile device, debit card/prepaid card number or the mail are not

eligible to meet this requirement.

Ledger Balance: This is the actual balance in your account on a specific day, and does not reflect any holds or pending transactions.

Total Combined Balance: This is the sum of all balances within the Truist personal deposit accounts (checking, savings, money market, or CDs), IRAs or

brokerage accounts introduced through Truist Investment Services, Inc. and reflected on the last day of the statement cycle.

Related Accounts: Accounts are automatically related based on the primary and secondary owners of the account.

Truist Bright Checking

With Truist Bright Checking, you’ll receive a variety of features and benefits—including our promise to share

the knowledge you need to move you toward a brighter financial future. The account combines all the

convenient standard features available with Truist checking accounts (see page 7).

Truist Bright Checking pricing information:

• The monthly maintenance fee is $12.

• $3 per month paper statement fee. Avoid this fee by switching to free online statements.

You can avoid the monthly maintenance fee with any of the following:

• Have $500 or more in total qualifying direct deposits per statement cycle OR

• Maintain an average ledger balance of $1,500 per statement cycle

Paperless Online Statement: Electronic/online statement provided through online banking each statement cycle. Clients must select the option to no longer

receive paper account statements through U.S. mail or a $3 monthly fee applies. Online banking is required to access paperless online statements.

Direct Deposits: A qualifying direct deposit is an electronic credit via ACH deposited to your account during the current statement cycle. Preauthorized transfers

made from one account to another or deposits made via a branch, ATM, online transfer, mobile device, debit card/prepaid card number or the mail are not

eligible to meet this requirement.

Ledger Balance: This is the actual balance in your account on a specific day, and does not reflect any holds or pending transactions.

Truist Fundamental Checking

Truist Fundamental Checking helps you simplify your financial life. The account combines all the convenient

standard features available with Truist checking accounts (see page 7) with a low monthly fee.

Truist Fundamental Checking pricing information:

• The monthly maintenance fee is $5, $3 in New Jersey.

• $3 per month paper statement fee. Avoid this fee by switching to free online statements.

Paperless Online Statement: Electronic/online statement provided through online banking each statement cycle. Clients must select the option to no longer

receive paper account statements through U.S. mail or a $3 monthly fee applies. Online banking is required to access paperless online statements.

12

Truist Student Checking

Truist Student Checking offers convenient checking account access for clients 23 and younger. Once you

turn 24, or reach the graduation date provided to the bank, whichever is later, your Student Checking account

will convert to a Truist Bright Checking account or Truist Fundamental Checking account, based on your

previous account activity. In addition to the standard Truist checking features (see page 7), Student Checking

offers you the following ways to stretch your budget:

• No monthly maintenance fee

• No minimum balance requirement

• No monthly maintenance fee on a personal Truist Savings account

• Two no-fee non-Truist ATM transactions per statement cycle

• One no-fee incoming international or domestic wire transfer per month

• $3 per month paper statement fee. Avoid this fee by switching to free online statements.

Paperless Online Statement: Electronic/online statement provided through online banking each statement cycle. Clients must select the option to no longer

receive paper account statements through U.S. mail or a $3 monthly fee applies. Online banking is required to access paperless online statements.

Money market accounts

If you’re looking for a higher annual percentage yield on your deposits while still having easy access

to funds, you may want to consider a money market account. We oer several dierent money market

accounts to meet your needs.

Standard money market account features

• Tiered interest rates, rewarding you with higher rates for higher balances

• Interest is calculated and compounded daily on the collected balance and credited to your account

monthly. Fees may reduce earnings.

• Account access through Truist online and mobile banking

• Unlimited automated account inquiry calls to Truist Contact Center (see page 22)

Truist Wealth Money Market Account

If you’re a Wealth client, your Truist Wealth advisor can open a Truist Wealth Money Market account for you. Or

if you’re assigned to a Wealth advisor, a teammate at any Truist branch can help you. The Truist Wealth Money

Market account pays competitive tiered interest rates. In addition to the standard money market features, your

account gives you:

• No-fee package of 40 personal money market checks, 40 single deposit tickets and 30 withdrawal slips

• No-fee domestic and international incoming and outgoing wire transfers

• No fee for duplicate statement

Truist Wealth Money Market Account pricing information:

• The monthly maintenance fee is $25. You can avoid this fee by maintaining a minimum daily ledger

balance of $25,000.

• A withdrawal limit fee of $15 per withdrawal over six, with a maximum of six withdrawal limit fees per

statement cycle.

Ledger Balance: This is the actual balance in your account on a specific day, and does not reflect any holds or pending transactions.

Withdrawal Limit Fee: The withdrawal limit fee applies, regardless of the balance, to all withdrawals and transfers made from a Truist personal savings and/or

money market account including those made at a branch, ATM, by mail or through any electronic means.

Truist Money Market Account

The Truist Money Market (TMM) account is designed for clients with at least $1,000 in savings who would like

to earn a competitive interest rate while building balances. It provides the maximum FDIC insurance coverage

allowed by law, and gives clients easy access to their funds anywhere, anytime. TMM has the following features:

13

• Higher rates for higher balances

• Up to six withdrawals per statement cycle without a fee

• Can be used for overdraft protection when linked to a Truist checking account

• Check writing capabilities

Truist Money Market Account pricing information:

• The monthly maintenance fee is $12. You can avoid this fee by maintaining a minimum daily ledger

balance of $1,000.

• $3 per month paper statement fee. Avoid this fee by switching to free online statements.

• A withdrawal limit fee of $15 per withdrawal over six, with a maximum of six withdrawal limit fees per

statement cycle.

Ledger Balance: This is the actual balance in your account on a specific day, and does not reflect any holds or pending transactions.

Paperless Online Statement: Electronic/online statement provided through online banking each statement cycle. Clients must select the option to no longer

receive paper account statements through U.S. mail or a $3 monthly fee applies. Online banking is required to access paperless online statements.

Withdrawal Limit Fee: The withdrawal limit fee applies, regardless of the balance, to all withdrawals and transfers made from a Truist personal savings and/or

money market account including those made at a branch, ATM, by mail or through any electronic means.

Savings accounts

No matter what your future goals may be, a Truist savings account encourages you to set aside funds for

future needs. All Truist savings accounts provide standard beneits to help you make the most of your money.

Standard savings account features

• Interest is calculated and compounded daily on the collected balance and credited to your account

monthly. Fees may reduce earnings.

• A monthly statement when there are electronic funds transfers (such as direct deposits or ATM

transactions) or if the savings statement is combined with a checking account statement; otherwise, a

quarterly statement is provided

• Account access through Truist online and mobile banking

• Unlimited automated account inquiry calls to Truist Contact Center (see page 22)

Truist Savings

This is a basic savings account that gives you a safe and easy way to set aside money on a regular basis to

achieve short- or long-term goals. In addition to the standard savings account features listed above, Truist

Savings oers these additional features:

• Can be used as selected overdraft protection account

• Up to six withdrawals per statement cycle without a fee

Truist Savings pricing information:

• The monthly maintenance fee is $5 (waived for a minor under age 18).

• $3 per month paper statement fee. Avoid this fee by switching to free online statements.

• A withdrawal limit fee of $5 per withdrawal over six, with a maximum of six withdrawal limit fees per

statement cycle.

You can avoid the monthly maintenance fee with any of the following:

• Maintain a minimum daily ledger balance of $300 OR

• Schedule one monthly recurring preauthorized internal transfer of $25 or more OR

• Clients with a Truist Dimension Checking, Truist Wealth Checking or Truist Focus Checking are eligible for

one Truist Savings account with no minimum balance requirement and no monthly maintenance fee.

14

Monthly Maintenance Fee: Waiver for an account holder under age 18 (minor) requires that the minor is listed as the primary owner. The waiver is applied

automatically at account opening and expires on the 18th birthday of the minor. On the date when the minor turns the age of 18, they are subject to all applicable

fees on this account if they are not meeting the minimum requirements of the account, and the account could be debited the $5 monthly maintenance fee.

Paperless Online Statement: Electronic/online statement provided through online banking each statement cycle. Clients must select the option to no longer

receive paper account statements through U.S. mail or a $3 monthly fee applies. Online banking is required to access paperless online statements.

Withdrawal Limit Fee: The withdrawal limit fee applies, regardless of the balance, to all withdrawals and transfers made from a Truist personal savings and/or

money market account including those made at a branch, ATM, by mail or through any electronic means.

Ledger Balance: This is the actual balance in your account on a specific day, and does not reflect any holds or pending transactions.

Truist Online Savings

Our most popular savings account, available exclusively online. With this account you can enjoy:

• No minimum balance requirement, no monthly maintenance fee, and no minimum opening deposit

• $3 per month paper statement fee. Avoid this fee by switching to free online statements.

• Can be used as selected overdraft protection account

• Up to six withdrawals per statement cycle without a fee

• A withdrawal limit fee of $5 per withdrawal over six, with a maximum of six withdrawal limit fees per

statement cycle.

Paperless Online Statement: Electronic/online statement provided through online banking each statement cycle. Clients must select the option to no longer

receive paper account statements through U.S. mail or a $3 monthly fee applies. Online banking is required to access paperless online statements.

Withdrawal Limit Fee: The withdrawal limit fee applies, regardless of the balance, to all withdrawals and transfers made from a Truist personal savings and/or

money market account including those made at a branch, ATM, by mail or through any electronic means.

Secured Credit Card Savings

The funds in a Secured Credit Card Savings account are used as security for a Truist Secured Credit Card. In

addition to the standard savings account features, Secured Credit Card Savings oers these additional features:

• There is no monthly maintenance fee.

• Withdrawals are not allowed, as the funds must stay in the account as collateral for the Truist Secured

Credit Card.

• If your savings account balance is less than your approved card limit, you have 30 days from the account

opening to make unlimited deposits up to the approved card limit. The minimum deposit for the Secured

Credit Card Savings account is $400.

Health Savings Account

A Health Savings Account (HSA) is an easy, tax-advantaged way to pay for qualiied medical expenses. To qualify

for a Health Savings Account, you must be covered by a high-deductible health plan (HDHP). Enjoy all of these

beneits and tax advantages with your Health Savings Account:

• Unused funds roll over from one year to the next

• The HSA is not tied to an employer; the account stays with you even if you change jobs

• Cash deposits are FDIC insured to the maximum amount permitted by law

• Tiered interest rates

• Truist HSA Beneit Debit Card for eligible HSA transactions

• Check writing allowed

• Exclusive HSA design checks

• Monthly account statements

Tax advantages

• Earnings are tax free when used to pay for qualiied medical expenses.

• Contributions, up to the annual contribution limit, are tax deductible.

• Withdrawals for qualiied medical expenses are tax free.

Consult a tax advisor regarding tax deductibility and eligibility requirements.

15

Health Savings Account pricing information:

• No set-up or transaction fees

• The monthly maintenance fee is $3; $2 in IN, KY, OH.

For more information on Truist Health Savings Accounts, or to determine your eligibility and/or maximum

contribution limit, please visit Truist.com/HSA. Generally, the following criteria need to be met:

• You (and, if you are enrolled in family HDHP coverage, your family members) must not also be covered by

any other health plan other than another HDHP (with certain exceptions).

• You must not be eligible to be claimed as a dependent on another person’s tax return.

• You must not be enrolled in Medicare.

Health Savings Account holders: Please read all disclosures in the enclosed Health Savings Account

Custodial Agreement, Disclosure and Pricing Booklet.

Certiicates of Deposit (CDs)

Truist Certiicates of Deposit (CDs) may provide you with interest rates higher than other accounts. We oer

special CDs designed to help you achieve speciic goals. Please visit Truist.com or your local Truist branch

for additional details about our CD options.

Your current term, rate, accrual method, and early withdrawal penalty routines will remain the same until

your CD matures. Please refer to the enclosed Bank Services Agreement for information on the conditions

that will apply to your CD after renewal.

Standard Certiicate of Deposit features

• After renewal, your interest will be based on your account balance at time of renewal. Interest will be

compounded daily on personal accounts with principal collected balances <$100,000 and simple interest

on personal accounts with principal collected balances =>$100,000.

• Statement available monthly if combined with a checking statement, otherwise no statement is issued

• Provides the maximum FDIC insurance coverage allowed by law

• No monthly maintenance fees; however, early withdrawal penalties may apply

• Varying methods for interest payment, including monthly, quarterly, semi-annually, annually, or at maturity,

by check, transfer to another Truist account, or added to the principal CD balance. Interest must be paid

at least annually.

• Depending on your current interest payment schedule, your interest payment date(s) may reset at the

time of renewal. Please conirm your payment preference at renewal.

• Truist pays interest up to but not including the payment date. Interest for the payment date will appear in

accrued interest and be included in the next interest payment.

• A pre-renewal notice will be mailed at least 10 days prior to renewal on CDs with terms greater than or equal

to 32 days.

• If the CD has a term of 32 days or more, you may change the term of the CD by notice to the Bank during

the 10 calendar day grace period beginning the day after the renewal. Truist allows one change request

during grace. Your account’s grace period will end when a change is made to your CD’s rate or term. If no

change is made, the grace period will end at the conclusion of the 10 days.

• Future dated renewal changes are not available at Truist. Unfortunately, this means that if you had

arranged for a future dated renewal change to your account then you will need to call or visit your nearest

Truist branch to ensure those changes are made.

• If you don’t make any changes during your grace period, your CD will automatically renew with the same

term and with the interest rate in eect for your term and account balance at the time of renewal.

• At renewal, certiicate early withdrawal penalties will revert to the following:

– If term is less than 3 months: all interest that would have been earned on the principal amount

withdrawn for the term of the CD or $25, whichever is greater.

16

– If term is 3-12 months: 3 months of simple interest on principal amount withdrawn or $25, whichever

is greater

– If term is 13-23 months: 6 months of simple interest on principal amount withdrawn or $25, whichever

is greater

– If term is greater than 24 months: 12 months of simple interest on principal amount withdrawn or $25,

whichever is greater

• Truist oers a variety of terms from seven days to 60 months with tiered interest rates based on term and

balance. If your term is greater than 60 months, at renewal the term will become 60 months.

• For single maturity CDs, interest is not earned after the maturity date.

• Simple interest CDs pay interest at maturity for terms less than 12 months. Interest is paid at least annually

for CDs with terms greater than 12 months.

• You can receive a single check for interest payments on up to eight accounts as long as those accounts

pay interest on the same day and share the same name, address and Social Security number.

• Interest cannot be paid by ACH (direct deposit) or by check to another inancial institution.

• Truist CDs are all book entry and therefore actual certiicates are no longer required for redemption.

Personal Fixed Rate Certiicate of Deposit

• Minimum opening deposit for terms of 7-31 days: $2,500

• Minimum opening deposit for terms of 32 days to 60 months: $1,000

• Oers a guaranteed, ixed rate for the term of the CD (terms may vary)

• Flexible terms available, from seven days to 60 months

• During grace period, additional deposits and withdrawals are allowed, as well as changes to your term,

rate, or product type.

Truist Wealth CD

If you’re a Wealth client, your Truist Wealth advisor can open a Wealth CD for you. Or if you’re assigned to a

Wealth advisor, a teammate at any Truist branch can help you.

• Minimum opening deposit for terms of 7-31 days: $2,500

• Minimum opening deposit for terms of 32 days to 60 months: $1,000

• Oers a guaranteed, ixed rate for the term of the CD (terms may vary)

• During grace period, additional deposits and withdrawals are allowed, as well as changes to your term,

rate, or product type.

Individual Retirement Accounts (IRAs)

An IRA can be an important component of your retirement strategy. (Please see your tax advisor concerning

potential tax beneits and eligibility requirements.) Truist oers Traditional IRAs, SEPs and Roth IRAs

designed to help you achieve your retirement goals. Please visit Truist.com or your local Truist branch for

information about IRAs available at Truist.

Your current term, rate, accrual method and early withdrawal penalty routines will remain the same until your

Individual Retirement Account (IRA) matures. Please refer to the enclosed Bank Services Agreement and

Individual Retirement Account Custodial Agreement for important information that will apply to your IRA.

IRAs will be governed by the following agreements:

• Traditional Individual Retirement Account Custodial Agreement

• Roth Individual Retirement Account Custodial Agreement

• Coverdell Education Savings Account Custodial Agreement

17

Fixed Rate IRA

Truist oers a variety of terms from 32 days to 60 months with tiered interest rates based on term and

balance. Additional deposits, up to the annual contribution limit, are allowed at any time.

• Interest compounds daily on collected balances and pays monthly on the last day of the month and at

maturity for all IRAs.

• Oers a guaranteed, ixed rate for the term of the IRA (terms may vary)

• A pre-renewal notice will be mailed at least 10 days prior to renewal.

• If the IRA has a term of thirty-two days or more, you may change the term of the IRA by notice to the

Bank during the ten calendar day grace period beginning the day after the renewal. Your account’s grace

period will end when a change is made to your IRA’s rate or term. If no change is made, the grace period

will end at the conclusion of the 10 days.

• If you don’t make any changes during your grace period, your IRA will automatically renew with the same

terms and with the interest rate in eect for your term and account balance at the time of renewal.

• At renewal, IRA early withdrawal penalties will revert to the following:

– If term is less than 3 months: all interest that would have been earned on the principal amount

withdrawn for the term of the IRA

– If term is 3-12 months: 3 months of simple interest on principal amount withdrawn

– If term is 13-23 months: 6 months of simple interest on principal amount withdrawn

– If term is greater than 24 months: 12 months of simple interest on principal amount withdrawn

• If your term is greater than 60 months, at renewal the term will become 60 months.

• Depending on your current interest payment schedule, your interest payment date(s) may reset at the

time of renewal. Please conirm your payment preference at renewal.

• Truist pays interest up to but not including the payment date. Interest for the payment date will appear in

accrued interest and be included in the next interest payment.

• You can receive a single check for interest payments on up to eight accounts as long as those accounts

pay interest on the same day and share the same name, address and social security number.

• Interest cannot be paid by ACH (direct deposit) or by check to another inancial institution.

• Your IRA may be combined with your Truist checking account and included on your monthly statement;

otherwise the statement is semi-annual.

Money Rate Savings IRA

• This is a variable rate account with no maturity date. Interest rates are subject to change at any time at

Truist’s discretion.

• Unlimited withdrawals and transfers (tax penalties may apply; check with your tax advisor)

• Interest compounds daily and credited monthly on the last day of the month. Interest is paid on principal

of deposit until it’s withdrawn.

• Additional deposits are allowed at any time, and may include your annual contribution limit, and/or IRA

transfers and rollovers.

Truist Wealth IRA

If you’re a Wealth client, your Truist Wealth advisor can open a Wealth IRA for you. Or if you’re assigned to a

Wealth advisor, a teammate at any Truist branch can help you.

• Interest compounds daily on collected balances for all IRAs.

• Oers a guaranteed, ixed rate for the term of the IRA (terms may vary)

IRA fees

• Truist charges no annual maintenance fees on IRAs.

• A $50 administration fee is charged for a direct transfer to another institution and applies to all

depositors, even those over 59½ years of age.

18

• The following penalties and fees apply to all depositors except those who are over the age of 59½:

– IRA Premature Withdrawal Fee. $10 for each premature withdrawal if the funds are withdrawn prior to

the maturity date of a time deposit. The fee for premature withdrawals is charged in addition to any

forfeiture of interest.

Loans and lines of credit

Truist oers you a full range of personal loans and lines of credit. Based on the outstanding balance of your

Truist loan or line of credit, you could qualify for a Truist custom banking package, oering you checking

and a host of other convenient beneits. Stop by your local Truist branch or visit us online at Truist.com for

more details.

• If you currently have a loan or line of credit, you will receive a Truist statement after February 20, 2022,

followed by monthly statements detailing the activity on your account. Monthly statements are not

generated for any statement cycle in which you have a zero balance and no activity.

• Your loan or line of credit account number is changing. You’ll receive your new account number in a separate

mailing after February 20, 2022. If you have automated payments set up from a deposit account, you’ll

want to update your loan or line account number information to ensure the payment is accurately credited.

– For payments made in Online Banking, the payment will immediately show as “Pending”. Once the

payment has posted overnight, the outstanding balance will be updated.

– If you currently have a coupon book to use for your loan payments, you’ll now receive monthly

statements. The monthly statement will contain a payment stub you can use to submit payment via

mail, and you’ll no longer use your coupon book.

– If you currently have your monthly loan payment automatically drafted from your deposit account,

and the loan has been prepaid with no monthly payment due, the scheduled monthly payment will

not be drafted.

– You will have the ability to set up automatic payments for a lat amount that is larger than the

scheduled monthly payment.

Ways to make your life easier

Truist Debit Card

If you’re an active card user, you should receive a new Visa® branded Truist Debit Card by mid-February 2022.

The MasterCard® beneits associated with your SunTrust MasterCard Debit Card will be discontinued upon

activation of your Truist Visa Debit Card. Go to www.mycardbeneits.com for the description of beneits and

instructions on how to ile a claim if needed.

Simply keep using your current SunTrust MasterCard Debit Card until February 21, 2022. Your new Truist

Debit Card will come with instructions on how and when to activate.

What’s staying the same?

• Your PIN for your new Truist Debit Card will remain the same.

What’s changing?

• Your Truist Debit Card will have a new card number, expiration date, and 3-digit security code.

• Update your recurring transactions, such as gym memberships, utility bills, subscriptions, and where your card

information is stored on ile, etc., with your new card number.

• Any customized spending limits will not transfer to your new card.

• When you visit a Truist ATM, remember to reset your ATM preferences.

• Remember to reset your Card Controls’ preferences on your new card.

19

Once your Truist Debit Card is activated, you can begin using and enjoying all these beneits:

• Zero Liability and Proactive Monitoring

• Contactless Technology – Just tap to pay wherever you see the Contactless Symbol at checkout.

• Customize your card capabilities through Card Controls in online banking, including real-time card on/o,

reducing spending limits, and customizing alerts.

• Add your Truist Debit Card to your mobile wallet to securely pay for purchases at many of your favorite retailers.

• Use Visa Click to Pay for easy, smart, and secure online checkout.

• Truist Deals

Please see the Fee Schedule on page 35 for ATM withdrawal and spending limits, fees, and waivers. And

please review the Electronic Fund Transfer Agreement and Disclosures in the Truist Bank Services Agreement

for other important account information.

Truist provides 100% reimbursement for most unauthorized transactions made with a lost or stolen Truist Debit Card. Please refer to your Electronic Fund

Transfer Agreement and Disclosures in the Truist Bank Services Agreement for complete details.

The Contactless Symbol and Contactless Indicator are trademarks owned by and used with permission of EMVCo, LLC.

Click to Pay is a service of Visa.®

Delta SkyMiles® Debit Card

Great news, Truist will continue to oer the Delta SkyMiles Debit Card! You will continue to earn miles just

like you do today. Current cardholders please review your enclosed Terms & Conditions for more information

regarding mileage posting date changes and additional program details.

You’ll receive a new Visa® branded Delta SkyMiles Debit Card by mid-February 2022. The MasterCard® beneits

associated with your MasterCard branded Delta SkyMiles Debit Card will be discontinued upon activation

of your new Visa branded Delta SkyMiles Debit Card. Go to www.mycardbeneits.com for the description of

beneits and instructions on how to ile a claim if needed.

Simply keep using your MasterCard branded Delta SkyMiles Debit Card until February 21, 2022. Your new Visa

branded Delta SkyMiles Debit Card will come with instructions on how and when to activate.

What’s staying the same?

• Your PIN for your new Delta SkyMiles Debit Card will remain the same.

What’s changing?

• Your Delta SkyMiles Debit Card will have a new card number, expiration date, and 3-digit security code.

• Update your recurring transactions, such as gym memberships, utility bills, subscriptions, and where your card

information is stored on ile, etc., with your new card number.

• Any customized spending limits will not transfer to your new card.

• When you visit a Truist ATM, remember to reset your ATM preferences.

• Remember to reset your Card Controls’ preferences on your new card.

Once your Truist Debit Card is activated, you can begin using and enjoying all these beneits:

• Zero Liability and Proactive Monitoring

• Contactless Technology – Just tap to pay wherever you see the Contactless Symbol at checkout.

• Customize your card capabilities through Card Controls in online banking, including real-time card on/o,

reducing spending limits, and customizing alerts.

• Add your Delta SkyMiles Debit Card to your mobile wallet to securely pay for purchases at many of your favorite

retailers.

• Use Visa Click to Pay for easy, smart, and secure online checkout.

• Truist Deals

Please see the Fee Schedule on page 35 for ATM withdrawal and spending limits, fees, and waivers. And

please review the Electronic Fund Transfer Agreement and Disclosures in the Truist Bank Services Agreement

for other important account information.

20

Truist provides 100% reimbursement for most unauthorized transactions made with a lost or stolen Truist Debit Card. Please refer to your Electronic Fund

Transfer Agreement and Disclosures in the Truist Bank Services Agreement for complete details.

The Contactless Symbol and Contactless Indicator are trademarks owned by and used with permission of EMVCo, LLC.

Click to Pay is a service of Visa.®

Truist ATM Card

If you’re an active card user, you should receive a new Truist branded ATM Card by mid-February 2022.

Please keep using your SunTrust ATM card until February 21, 2022. For information on ATM withdrawal and

PIN point of sale limits, please see the Fee Schedule on page 35.

Truist ATMs

Continue to use your current debit or ATM card at ATMs. As a Truist client, you’ll have the convenience of

using our network of over 3,000 ATMs.

• Continue to use SunTrust ATMs as you do today.

• Use any BB&T ATM to make cash withdrawals, balance inquiries, or account transfers.

• As you are able to today, you can withdraw cash at most non-SunTrust or non-BB&T ATMs. (Other service

fees may apply.)

• Starting February 22, 2022: Use any SunTrust or BB&T ATM to make cash withdrawals, deposits, balance

inquiries, transfers, and PIN changes.

• Printed ATM statements will no longer be available at Truist ATMs. You can always access your account

information via online banking and with the Truist Mobile app.

Truist Deals

SunTrust Deals is now Truist Deals. You’ll continue to earn cash back by making purchases with your eligible debit

and/or credit cards at select retailers. There’s no fee for participating and no need to re-enroll. Just click on oers

you like in online or mobile banking and shop using an eligible card any time prior to the oer expiration. Earned

cash back is automatically deposited to your designated account the following month. Please note the following:

• Oers may not be available for several weeks and oers may change at any time.

• Your SunTrust Deals lifetime cash back earnings balance will display in Truist Deals. Your previous

redemption history will no longer be available.

• Truist Deals cash back is deposited to your designated account once per month.

• If we're unable to process your rewards (e.g., your designated account is closed), contact us to request

your reward.

Truist credit card

You can continue to use your SunTrust credit card. The terms and conditions of your card will remain

unchanged. We’ll send you a new Truist credit card at a later date. If you need a replacement card for any

reason, order online, stop by any Truist branch, or give us a call. Please see the phone numbers listed in the

Truist Contact Center section on page 22. Your new card will feature contactless technology—just hold the

card near the payment terminal, which will pick up a signal embedded in your card. Payments are made

instantly and safely. Please note the following changes:

• Recurring Autopay payments scheduled at the branch or through digital channels are changing to

minimum amount due or total balance; ixed payment amounts are no longer an available option through

these channels. Fixed Autopay payment amounts can be scheduled through the Contact Center. Any

existing ixed Autopay payment amounts will remain in eect.

• If your credit card is linked as overdraft protection for a SunTrust deposit account, when that deposit

account becomes a Truist deposit account and overdraft protection is engaged, the transfer amount that

will be advanced to the deposit account will change. Truist will no longer advance funds for overdraft

protection transfers in $100 increments; instead, the transfer amount will be equal to the exact dollar

amount needed to cover the overdraft transaction.

21

Credit Card Rewards

As a Credit Card Rewards client, you’ll continue to earn rewards as you do today, which can be redeemed

for cash back, gift cards, merchandise, and more. And if you have a Truist deposit account, you’ll be able to

redeem cash back into that account beginning February 20, 2022.

If you redeem Cash Rewards through an ACH deposit into an eligible Truist checking, savings or money

market account, you can earn elevated rewards in the form of a Loyalty Cash Bonus based on your deposit

relationship(s) at Truist. For the purposes of this Loyalty Cash Bonus, your deposit relationship will be

determined as of the last day of the month preceding redemption. However, we reserve the right to take up to

ive (5) business days to determine or update your deposit relationship for each monthly review. The eligible

Loyalty Cash Bonus percentage will be adjusted accordingly and will persist until we have completed the

next monthly review. If you completed a cash redemption prior to the next monthly review date, we will not

retroactively review your Loyalty Cash Bonus percentage. Your eligible Loyalty Cash Bonus percentage may

increase monthly but decrease only once every three (3) calendar months.

Truist Online and Mobile Banking

Banking digitally keeps you safe and secure. Now you can cut the paper—not the trees—and enjoy all the

banking beneits you need and want. View your accounts and transactions, transfer money, make payments,

deposit checks, and so much more.

• Pay all your bills from one secure site with one password. Receive electronic versions of your bills online

instead of in your mailbox.

• Transfer funds between your Truist accounts, or to and from your accounts at other inancial institutions.

Fees may apply for external transfers.

• Deposit checks using your mobile device

• Send, receive, and request money with Zelle®

• View your credit score and monitor your credit proile

• Manage transaction controls for your Truist cards

• Capture purchase receipts and keep them for up to 24 months

• Activate merchants’ oers for Truist Deals

• Manage and redeem your Credit Card Rewards

• Receive account activity alerts via email, text message, or push notiications

• Order checks via online banking and via your mobile device

Your existing SunTrust Online Banking Agreement and Initial Disclosures remain in eect until February 20,

2022. After this date, you must review and accept the Truist Online & Mobile Banking Agreement before you

can sign in to digital banking.

Zelle®

Zelle is the quick and easy way to send or receive money without checks, without handling cash. All you need

is an email address or a mobile phone number and you can send or receive funds from friends and family,

regardless of where they bank.

• You can list up to three emails and two mobile numbers in your Zelle account.

• You can send funds from your Truist savings account. Remember, a fee is charged for more than six

savings or money market transactions per month.

• If you have Overdraft Protection on the account you’re sending money from, future dated and recurring

transactions will be covered if the payment amount exceeds the available balance and there are funds in

your designated Overdraft Protection account to cover the overage.

• Transaction history will be limited to 6 months.

• The split payment functionality is being removed, meaning you’ll no longer be able to automatically

split expenses between recipients. You can collect the amount from each recipient using the “Request”

function.

We’ll keep you updated on additional changes to Zelle along the way as we work to enhance your experience.

22

Zelle Limit Information:

• Zelle Consumer send limits: $2,000 per day, $10,000 per rolling 30-day period

Alerts

We encourage you to sign in to online banking at Truist.com to verify existing alert settings or sign up for

account alerts. Provide up to three current email addresses and up to two mobile numbers, and you can

receive security alerts, including notiication of password change and bill payments as well as account balance,

transaction, credit card alerts, and more. Most email alerts will be sent from alertnoti[email protected].com.

Please add it to your list of trusted email addresses.

• Text messages will be sent from new Truist Short Codes for Servicing (TRUIST: 878478), Fraud (TRUACT:

878228), and Deals (TRU411: 878411).

• Alerts from Truist are available for checking, savings, mortgage, loan, debit and credit card accounts. You

can receive email and text message notiications of your account balances and transactions, online proile

changes, statement availability, bill payment, debit card controls, Truist Deals new and expiring oers,

credit card transactions and many others.

• Sign in to online banking, visit your proile and select Alerts to verify your Alert settings. You must opt in

to receive Servicing and Deals text messages. Fraud text messages notifying you of suspicious account

activity will be sent to any mobile phone number you provide.

Truist Contact Center

Truist Contact Center provides automated access to account information and other banking services 24 hours

a day, seven days a week. You can check balances, obtain deposit and loan account information, transfer funds

between linked accounts, initiate a stop payment, activate your Truist debit or credit card, report a lost or stolen

card, obtain tax information and more. In addition, you can receive personal assistance from our client service

representatives during normal business hours.

You may access Truist Contact Center beginning Monday, February 21, 2022. Simply dial 844-4TRUIST

(844-487-8478) and follow the voice prompts to guide you through our easy-to-use, speech-based system.

Until then, continue to use the phone numbers you always have to reach us. If you need to speak with a Truist

teammate before February 21, please call 800-786-8787.

Important information

Arbitration, Jury Trial Waiver & Litigation Class Action Waiver

The Bank Services Agreement (“BSA”) referred to throughout this agreement governing Truist deposit accounts

contains separate Arbitration, Jury Trial Waiver and Litigation Class Action Waiver provisions which govern how

disputes and claims between you and Truist are resolved. Similar provisions are also included within the credit

card agreement applicable to your account. Please carefully review these provisions included within your credit

card account agreement and in the enclosed Bank Services Agreement.

Direct Deposits and Automatic Drafts

Your checking, savings, and money market account number(s) and routing number won’t change. This means

that if you currently receive direct deposits or automatic drafts (ACH transactions), Truist will continue to

accept transactions that have valid information from your SunTrust account(s).

Direct deposit allows you to have your paycheck, Social Security, pension or almost any other type of regular

payment deposited automatically into your Truist checking or savings account. To enroll in direct deposit, visit

online banking or your Truist branch.

Truist Overdraft Protection

It can happen to all of us—you thought your checking or money market account balance was higher, and you used

your debit card or ATM card for more than your account balance. It’s easy to avoid the hassles and some of the costs

of an overdraft. Simply designate any of the following Truist accounts as your source of Overdraft Protection:

23

• Savings account

• Another checking account

• Money Market account

• Credit card

• Personal Line of Credit

• Truist Ready Now Credit Line

• Home Equity Line of Credit

• Wealth/Premier Secured Line of Credit

• Wealth/Premier Personal Line of Credit

• If you’re using a Truist credit card or other Truist loan or line of credit as your protector account, additional

fees may be charged for using that account. Be sure to review your credit card or loan agreement before

selecting a loan account as your protector account.

• If your credit card is linked as overdraft protection, advances for overdraft protection will no longer be

transferred in $100 increments; instead, Truist will transfer the exact dollar amount needed to cover the

overdraft transaction(s).

• Your current Overdraft Protection election will continue with your new Truist account.

• If you have both Overdraft Protection and Overdraft Coverage, Truist will use your Overdraft Protection irst. If

you have neither, everyday debit card and ATM transactions that exceed your account balance will be declined.

• Additional information is available at Truist.com/thefacts.

• Truist may charge a $12.50 transfer fee, per linked protected account, each day an automatic transfer is

required. There’s no fee for transfers less than $5. You can avoid a fee if you transfer or deposit funds (and

no hold is placed on the deposit) to cover the overdraft transaction(s) by the daily cuto time, on the

same business day.

Subject to credit approval.

Home Equity Lines of Credit are not eligible for Overdraft Protection in Texas.

Truist Overdraft Coverage

Please review the Truist Overdraft Decision Notice on page 37 for information about our Overdraft Coverage service.

Overdraft Coverage allows Truist, at its discretion, to authorize and pay transactions on ATM and everyday

debit card purchases (also known as one-time debit card transactions) when you don’t have enough money in

your account. You have the right to decide if you want to participate (opt in), or not to participate (opt out), in

Overdraft Coverage. Your decision to opt in or opt out of Overdraft Coverage will be eective the next business

day. Truist pays overdrafts at its discretion, which means that we do not guarantee that we will always authorize

and pay any type of transaction. If we don’t authorize and pay an overdraft, your transaction will be declined or

returned. Under Truist’s Overdraft Coverage service:

• Truist may charge you an overdraft fee of $36 each time we pay an overdraft on your behalf.

• Truist may charge you a Negative Account Balance fee of $36 if your account balance remains negative

for seven consecutive calendar days.

• Truist limits the total number of combined overdraft and returned item fees to six per day.

• Truist will waive overdraft/returned item fees for transactions that are less than $5.

• You can avoid a fee if you transfer or deposit funds (and no hold is placed on the deposit) to cover the

overdraft transaction(s) by the daily cuto time, on the same business day.

• Please use one of the channels listed on the Overdraft Decision Notice if you would like to change your

Overdraft Coverage decision.

• If you have both Overdraft Protection and Overdraft Coverage, Truist will use your Overdraft Protection

irst. If you have neither, everyday debit card and ATM transactions that exceed your account balance will be

declined.

• Additional information is available at Truist.com/thefacts.

24

How we process your deposits and withdrawals

The ways Truist posts transactions to your account are described in the enclosed Bank Services Agreement under

the Withdrawals and Debits section. Below is a description of the usual order for the most common transactions

that post to an account during nightly processing.

Transactions are processed at the end of each banking day (Monday through Friday except federal holidays) during

what is known as nightly processing. Once your transactions are processed, the results are posted to your account.

Truist will post items to your account based on your available balance which can be impacted by pending

transactions, such as debit card transactions that we have authorized but not yet paid. Once the available balance

is determined, prior day credits and debits will post before current day credits and debits. Once prior day credits

and debits are determined, transactions will be sorted into groups and prioritized by Group (items in Group

1 would post before items in Group 2 and items in Group 2 would post before items in Group 3, etc.). Within

each group, items will be posted by time authorized (e.g., when you got gas with your debit card), performed

(e.g., when you took money out at the ATM), received (e.g., when your gym debited your monthly membership

fee) or processed by the bank. When items are received at the same time, we will post those in "low to high,“

or ascending, dollar amount order. Items sent by merchants for authorization prior to being submitted for inal

payment will post according to the date and the time of the authorization request.