THE ROLE OF FINTECH IN

UNSECURED CONSUMER LENDING

TO LOW

- AND MODERATE-INCOME

INDIVIDUALS

Ambika Nair

Eldar Beiseitov

November 2023

Key Takeaways

• Unsecured personal loan balances reached $232 billion by 2023, up $40 billion from 2022

and $86 billion from 2021, indicating a significant market need for this type of credit. 2021-

2023 saw increases in loans originated for below prime borrowers, with FinTech being key in

driving this growth.

• Some FinTech players are providing or enabling various alternatives to traditional small-dollar

loan products and/or products targeted at improving financial health for their LMI, below

prime borrower base.

• Alternative data, particularly the use of cash-flow-based underwriting and the history of

utility/telecom/rental payments, have some potential to extend access to credit for low- and

moderate-income consumers with thin or no credit files.

1

NONCONFIDENTIAL // EXTERNAL

Table of Contents

INTRODUCTION ……………………………………………………................................................................................ 2

ABOUT THE DATA …......................................................................................................................................

3

THE MARKET FOR FINTECH UNSECURED PERSONAL LENDING .............................................................. 4

POPULATION OF INTEREST........................................................................................................................ 12

HOW ARE LOW- AND MODERATE-INCOME BORROWERS USING UNSECURED PERSONAL LOANS? .. 14

FINTECH MODELS AND THEIR APPLICATIONS TO LMI HOUSEHOLDS.................................................... 17

ALTERNATIVE DATA AND UNDERWRITING ……………………………………………………………………………………18

CONCLUSION …………………………………………………………………………………………………………….……………… 21

______________________________________

The views expressed in this paper are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of

New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

2

NONCONFIDENTIAL // EXTERNAL

Introduction

Historically, low- and moderate-income individuals have relied on short-term, small-dollar credit

products (such as payday loans, bank overdraft protection, and more) due to difficulties in access to

traditional credit products, income uncertainties, limited household savings, and geographical

constraints in accessing banking services. Over the past decade, FinTech firms have begun to offer

alternatives in unsecured consumer loan products to address short-term credit needs. Additionally,

the proliferation of alternative data to assess creditworthiness outside of FICO-based indicators has

worked to expand the pool of borrowers that can access unsecured consumer credit.

Economic conditions prior to 2022-2023, including several years of low borrowing costs, created an

ideal environment for FinTech firms to increase their loan originations. Since stimulus payments and

the debt repayment moratoria during the COVID-19 pandemic allowed many people to pay off credit

card debts, FinTech lenders expanded their portfolios into new customer segments, including low-

and moderate-income (LMI) borrowers, particularly those with no-file or thin-file credit histories. The

growth in this market has provided alternative loan options for low- and moderate-income borrowers

— particularly those who are subprime and have thin-file/no-file credit histories — who may have

traditionally relied on more expensive small-dollar products or been denied credit by traditional

banks. However, the rise in borrowing costs and in the cost of living in late 2022 and throughout

2023 has challenged FinTech firms’ ability to extend credit; more critically, the availability of

unsecured personal loans to LMI borrowers, whose credit needs are growing, has contracted.

This brief will describe how FinTech activity in the market for unsecured consumer loans grew

substantially over the past few years, particularly for those in the below prime category, and then

contracted during the most recent interest rate environment in 2022-23, how alternative data and

underwriting have been key drivers of this growth, and what the impact has been on the pace and

quality of access to unsecured personal loans for LMI individuals.

1

Although we do not include BNPL products in this report, it must be acknowledged that the BNPL loan market has been growing very

rapidly, particularly in 2021 and thereafter, and is another debt product accessed by LMI populations.

We will use the term “unsecured consumer/personal loan” to refer to cash loans used by

individuals for non-business purposes. They are not collateralized by real estate or any financial

assets. For this report, we are excluding buy now, pay later (BNPL) loan products.

1

We will use the term “FinTech” to refer to firms and lenders that integrate technology and data

innovations to modify, enhance, or automate financial services to consumers.

3

NONCONFIDENTIAL // EXTERNAL

Acknowledgements

The authors, Ambika Nair (Federal Reserve Bank of New York) and Eldar Beiseitov (Federal Reserve

Bank of St. Louis), would like to thank the external reviewers who provided crucial guidance on this

report, Kelly Cochran of FinRegLab and Todd Baker of Columbia Business School. Additionally, we

would like to thank the people who participated in our industry outreach and provided their insights

on the market for FinTech-originated unsecured personal loans for LMI borrowers and the role of

alternative data and underwriting in this market.

About the Data

This brief uses data from the 2022 and 2023 TransUnion Credit Industry Insights Report, which

contains metrics on personal loan balances, loan originations and balances by lender type, loan

originations to borrowers of different credit score tiers, and delinquencies. We also use data from

Prosper to calculate shares of unsecured personal loans by loan purpose across different income

groups, loan sizes among different income groups, and loan sizes as a share of income across

income groups.

Additionally, the Federal Reserve Bank of New York's Community Development team conducted an

outreach effort to interview FinTech lenders in the unsecured personal loan space about the lending

models and underwriting approaches taken to extend unsecured personal credit to low-and

moderate-income borrowers. The team also reached out to academic researchers within the Federal

Reserve System and externally to understand the impact of FinTech-originated unsecured personal

credit products on low- and moderate-income borrowers. Lastly, the team spoke with current and

former regulators to understand the extent of regulatory oversight of FinTech lenders in the

unsecured consumer credit market.

4

NONCONFIDENTIAL // EXTERNAL

The Market for FinTech Unsecured Personal Lending

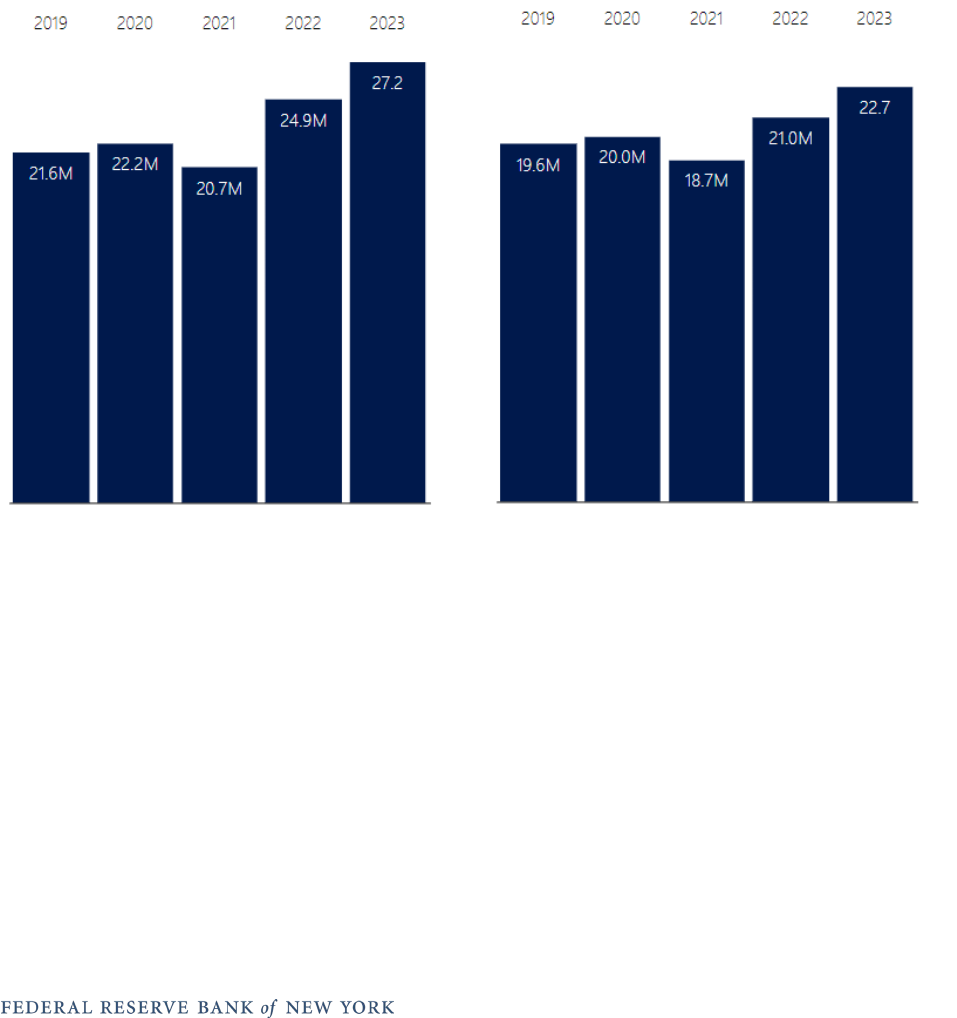

There were 22.7 million American borrowers with an outstanding unsecured personal loan at the end

of the second quarter of 2023, a record number. Compared to 2021, this is an increase of about 4

million consumers. Similarly, there were 27.2 million unsecured personal loans originated by the

second quarter of 2023, an increase of 21% from 2022. Figure 1 shows a rapid growth in unsecured

personal loans originated and borrowers with unsecured personal loans from 2021 to 2023.

Figure 1: Trends in Unsecured Personal Lending from 2019 to 2023

Source: TransUnion Credit Industry Insights Report, September 2023

Nationally, as shown in Figure 2, unsecured personal loan balances reached $232 billion by 2023,

up $40 billion from 2022 and $86 billion from 2021, further indicating a significant market need for

this type of credit. For comparison, 166 million Americans have at least one credit card, and the

nation’s total outstanding balance on credit cards has exceeded $1 trillion. Not only were more

consumers taking on more unsecured personal loans, but the balances held on these loans were

also increasing.

Number of loans originated in the second quarter of

each year

Number of consumers with unsecured personal loans at

the end of the second quarter of each year

5

NONCONFIDENTIAL // EXTERNAL

Figure 2: Total Balances on Unsecured Personal Loans by Q2, 2017-2023

Total balances in the second quarter

Source: TransUnion Credit Industry Insights Report, September 2023

The rate of growth in unsecured personal lending from 2021 to 2022 was faster than that in some

other types of consumer credit, including auto, mortgage, and student debt.

Figure 3: Credit Cards and Unsecured Personal Loan Balances, Q4 of 2022

(YoY % Change)

Source: TransUnion Credit Industry Insights Report, February 2023

6

NONCONFIDENTIAL // EXTERNAL

Historically, banks and credit unions have been the most active in offering most of the unsecured

personal loans, while specialized finance firms have provided a smaller share. When borrowers have

tried to manage their debt, personal loans were often considered the last option. FinTech, or

financial technology, changed that.

FinTech lenders have been responsible for the rapid growth in unsecured personal loans in the last

decade. Since 2013, much of the growth in personal lending has been driven by loans originated by

FinTech firms. Traditional banks continue to offer unsecured personal loans, but the levels have

varied over the past few years.

However, 2022 and 2023 saw different trends in unsecured personal loan originations. FinTech saw

its highest levels of loan originations in 2022, with an average 1.9 million loans originated per

quarter, making up about 38% of all unsecured personal loan originations in the second quarter.

However, this share dropped dramatically in 2023, to 1.14 million loans originated and about 26.5%

of all unsecured loans, while the share of loan originations by banks and credit unions jumped to

over 50%.

Figure 4: FinTech’s Role in the Origination of Unsecured Personal Loans by

Q2, 2017-2023

Number of loans originated per quarter, Millions

Share of loan originations in second quarter, by

source

Source: TransUnion Credit Industry Insights Report, September 2023

7

NONCONFIDENTIAL // EXTERNAL

This shift in originations from 2022 to 2023, and historically, the smaller shift during the initial

downturn during the pandemic from 2020 to 2021, can be attributed to the struggle to manage the

rising cost of capital faced by many FinTech lenders in this market. This has led many FinTech

lenders to cut down on loan originations, shift their credit boxes to prime and above-prime

borrowers, or move into non-credit business lines.

The COVID-19 Pandemic and Unsecured Personal Lending

Just before the outbreak of the COVID-19 pandemic, personal lending continued to proliferate. But,

in March 2020, FinTech lenders were forced to implement drastic measures in response to the

pandemic and the unprecedented lockdowns.

As a result, FinTech firms' machine learning algorithms and data collected during the period of

economic growth could not provide meaningful underwriting predictions. Many lenders introduced

stricter underwriting standards. Marketing to and solicitation of prescreened candidates ceased.

Personal loan originations dropped sharply. FinTech and traditional lenders introduced forbearance

programs that curbed delinquencies.

Borrowers and lenders feared delinquencies would jump in the following months without government

intervention. Several consumer surveys conducted in the spring of 2020 showed that the majority of

Americans were dealing with the negative impacts of COVID-19 on household finances.

2

Respondents indicated that household income had decreased, and many were concerned that they

would have difficulty paying bills and repaying loans, and nearly half had reached out recently to

creditors to discuss payment options.

By the end of the second quarter of 2020, despite increased financial hardship, borrowers were

aggressively paying down their credit balances. (Creditors assign financial hardship status based on

multiple factors, including deferred payments, frozen accounts, or past-due payments.) High levels of

uncertainty were driving consumers to increase their liquidity cushion. Consumption also declined

dramatically.

All these developments translated into a decline in personal loan balances. By one measure, in

March of 2020, borrowers paid $194 over their average payments, and those payments jumped to

$215 in April of that year. By the end of summer 2020, consumer credit health had stabilized:

2

See the surveys on the COVID-19 Pandemic’s Financial Impact on Consumers conducted by TransUnion in the first months of the

pandemic, as well as Survey of Household Economics and Decisionmaking conducted by the Federal Reserve Board.

8

NONCONFIDENTIAL // EXTERNAL

serious delinquencies (bills that were 60 to 90 days past due) revealed improvements across most

credit products.

Overall, the first months of the COVID-19 pandemic had a significant impact on unsecured personal

lending: the number of borrowers with a personal loan balance fell for the first time since FinTech

firms started entering the market. FinTech lenders quickly tightened underwriting standards, just as

borrowers became more prudent with additional credit.

As households of all income levels increased their savings rates and repaid credit card balances,

there was a decrease in demand for debt consolidation. FinTech lenders were especially cautious in

originating new loans in the second half of 2020: most loan originations were extended to borrowers

in prime or super-prime risk tiers. However, lenders and borrowers still worried about whether

forbearance programs, especially mortgage programs, would continue and whether economic growth

would return. An alternative would be the depletion of savings, especially for those in lower-income

brackets, and a resulting rise in late payments and charge-offs for lenders. The economic picture

brightened at the end of 2020, with lower-income households receiving additional stimulus.

Unemployment numbers also stabilized at the end of 2020.

Recovery and the Market Growth for FinTech-Originated Unsecured

Personal Loans

Unsecured consumer lending started to recover in the second half of 2021. Delinquency rates on

personal loans dropped to lows not seen since 2015. A positive economic environment and

decreased borrower risk (in part due to the development of vaccines, extensions on mortgage and

student loan forbearance programs, and rental relief programs) allowed FinTech and traditional

lenders to increase the origination of unsecured personal loans, albeit very slowly. The pick-up in

consumer consumption began translating to a slight increase in personal loan balances. Credit cards

and auto loans followed a similar trend. As states announced or started implementing reopening

plans, consumer credit began recovering.

9

NONCONFIDENTIAL // EXTERNAL

By the end of 2021, unsecured personal lending metrics returned to normal ranges, and the

personal loan balances exceeded the pre-pandemic aggregate levels. Particularly, FinTech lenders

showed confidence in consumer credit health by increasing originations to borrowers of all risk

stripes.

The increase in personal loan originations was especially pronounced for borrowers with lower

incomes and those in the below-prime category. Loans to consumers with below prime credit nearly

doubled by 2022 (Figure 5.1).

Figure 5.1: Unsecured Personal Lending to Borrowers of Varying Credit

Score Tiers, 2017-2022

3

Source: TransUnion Credit Industry Insights Report, February 2023 (Loan originations in the first quarter of each year)

Many consumers also changed credit score bands as credit scores improved due to stimulus

programs that increased savings/income and moratoria policies that prevented impacts on credit

scores from late payment of student loans, mortgages, and rents. By 2022, the share of borrowers

with credit scores below prime reached 66%. (Figure 5.2)

3

2023 data was not available for this chart.

10

NONCONFIDENTIAL // EXTERNAL

Figure 5.2: Share of Unsecured Personal Lending to Above Prime, Prime,

Below Prime, and Subprime Borrowers, 2017-2022

4

Shares as of the second quarter of each year

Source: TransUnion Credit Industry Insights Report, February 2023

The average size of new personal loans and personal loan balances also increased at the end of

2021. In the fall of 2021, most respondents reported being extremely concerned about the rise of

inflation: the worries about inflation and the rising cost of living were reported by respondents from

both low- and high-income households. Interestingly, the actual consumption levels and retail

purchases did not see a decline despite consumer sentiment about inflation.

5

By the end of 2021,

most financial accommodation initiatives had expired. Still, borrowers continued to repay their loans

in a timely fashion. To the relief of FinTech and traditional lenders, personal loans originated during

the pandemic performed as well as or even better than pre-pandemic loans.

4

2023 data was not available for this chart.

5

See Consumer Pulse US Q3 2021 survey results.

11

NONCONFIDENTIAL // EXTERNAL

The Impact of Rising Borrowing Costs and Costs of Living on FinTech

Lenders and Borrowers

FinTech lenders continued to grow their origination volumes in the first half of 2022, and much of

the growth came from loans to non-prime borrowers or those new to credit. The same subset of

borrowers saw their personal savings dwindle and recorded an increase in credit card debt,

reflecting the rising household costs associated with persistent inflation. These circumstances led to

a spike in delinquencies, although they remained below pre-pandemic levels. The small but

increasing signs of deterioration in consumer credit health occurred in the context of a robust labor

market and historically low unemployment rates. Another significant development affecting

consumer credit was the Federal Reserve’s decision in March of 2022 to start gradually increasing

interest rates.

Figure 6: Share of Borrowers with Unsecured Personal Loans Facing

Delinquencies, 2017-2023

% of borrowers 90+ days past due

% of borrowers 60+ days past due

% of borrowers 30+ days past due

Source: TransUnion Consumer Credit Database

In the second half of 2022, serious delinquencies jumped above pre-pandemic levels, reaching rates

not seen since 2014. In another sign that consumers increasingly turned to credit to pay for their

purchases, personal loan originations and balances grew above 2019 levels. Increased interest

rates on credit cards made debt consolidation using personal loans more attractive to borrowers.

Personal loan balances rose for all risk tiers, with the highest growth rates in the below-prime sector.

These delinquency rates persisted through the first half of 2023, remaining at about the same levels

as in 2022.

12

NONCONFIDENTIAL // EXTERNAL

Our Population of Interest:

The Intersection of LMI Borrowers, Subprime, and No-File/Thin-File

Borrowers

FinTech lenders in the unsecured personal loan market that aim to serve low- and moderate-income

consumers have developed several models of loan product offerings that target different LMI

borrower profiles. In this report, and in the ensuing discussions of the implications of FinTech-

originated unsecured personal loans for LMI borrowers as well as the models of loan products

relevant to LMI borrowers, we will focus on the population of underserved borrowers that are LMI

and subprime.

Within the subprime category, there is a subset of borrowers with no-file/thin-file credit histories.

According to the Consumer Financial Protection Bureau (CFPB), about 40% of low-income borrowers

and about 30% of moderate-income borrowers are either credit invisible, stale unscored, or

insufficient unscored.

6

These borrowers are more likely to access FinTech-originated unsecured

personal loan products and to be deemed more creditworthy than borrowers that are LMI and

subprime but have poor credit histories when alternative data are used in the underwriting of their

6

https://files.consumerfinance.gov/f/documents/201612_cfpb_credit_invisible_policy_report.pdf

LMI Borrowers

Subprime

Borrowers

No-File & Thin-File

Borrowers

13

NONCONFIDENTIAL // EXTERNAL

loans. The latter type of borrower may benefit more from non-credit products developed by FinTech

firms to improve financial health and ultimately build credit.

LMI Borrowers’ Considerations with FinTech-Originated Unsecured

Personal Loans

The growth in FinTech-originated unsecured personal loans and loan balances suggests that on the

one hand, FinTech firms have contributed to increased access to loan products for individuals who

may have had fewer credit options through traditional banks. On the other hand, increases in

delinquencies may also suggest that some FinTech-originated unsecured personal loan products

pose risks to consumers from a cost-transparency standpoint.

In many cases, LMI borrowers still face issues with the general affordability of FinTech loans. While

FinTech loans generally have substantially lower APRs than payday loan products, there is still a risk

that the rates offered can remain very high. The Government Accountability Office found that for

loans offered through a FinTech-bank partnership, some borrowers may have received loans that

were more expensive than allowed by their state’s usury laws.

7

Additionally, in higher-rate

environments where the cost of living is increasing, low- and moderate-income borrowers may seek

additional credit lines but may be vulnerable to taking on unsecured personal loans at higher rates.

In the high interest rate environment of 2022-2023, some FinTech lenders that aim to reach

underserved populations have opted to originate fewer unsecured personal loans to these

populations, due to the cost of capital, and shift to other non-credit business lines and product types,

leaving the credit options for low- and moderate-income borrowers even more limited.

Underserved borrowers also access personal loans through options outside of FinTech lenders,

including smaller credit unions, community banks, or Community Development Financial Institutions

(CDFIs).

8

However, FinTech lenders outpace these institutions in the speed and reach of their

products.

7

https://www.gao.gov/assets/gao-23-105536.pdf

8

In some cases, there is overlap between FinTech and CDFIs/CUs/community banks, as there are a number of FinTech lenders with CDFI

designations and CDFIs/CUs/community banks exploring the use of FinTech or partnering with FinTech firms for their lending business.

14

NONCONFIDENTIAL // EXTERNAL

How Are Low- and Moderate-Income Individuals

Using Unsecured Personal Loans?

The proliferation of FinTech firms in the unsecured personal loan space and the growing use of

alternative data in credit underwriting have made more loan products available to borrowers with

limited credit histories. Often, low- and moderate-income borrowers are excluded from traditional

forms of credit and are reliant on less secure and more expensive forms of small-dollar credit.

FinTech firms have the ability to offer unsecured personal loans to LMI borrowers and underwrite

and fund these loans very quickly, with the use of alternative data and online lending

platforms/applications.

In this section, individual loan data from the Prosper API are used to break down by loan purpose the

share of unsecured personal loans originated by Prosper. Prosper Marketplace is a peer-to-peer

lending marketplace. Borrowers request unsecured personal loans on Prosper and investors

(individual or institutional) can fund loans anywhere from $2,000 to $50,000 per loan request.

Investors can consider borrowers’ credit scores, ratings, payment histories, alternative data, and

loan purpose. Prosper services the loans and collects borrowers’ payments and interest and

distributes them back to the loan investors.

Figure 7: Borrower-reported Unsecured Personal Loan Purpose by Income

Tier (% of all loans), 2017-2022

9

Below $25,000

$25,000 - $50,000

All income tiers

Source: Prosper, individual loan data, 2017 through 2022

9

Note: “Household” includes expenses for repairs, home improvements, family, etc. “Health” includes medical and dental expenses.

“Other” covers vacation, taxes, and other miscellaneous expenses.

15

NONCONFIDENTIAL // EXTERNAL

One caveat with the data from Prosper is that people with a credit score below 600 may not qualify

for a loan unless a co-applicant applies with them. As a result, the count of individuals represented in

the below $25,000 and the $25,000 to $50,000 income distributions is not as high as in the other

income categories, and several have co-applicants.

It is clear in Figure 7 that across all income groups, most of the demand for personal loans is coming

from customers who are refinancing the high variable rate debt on their credit cards into a fixed rate

personal loan or who are consolidating debt. In the early part of 2023, the share of unsecured

personal loans used for debt consolidation by those in the below $25,000 income category

increased to 66%. Debt consolidation has been an option for consumers who are becoming

overextended on their credit accounts to reduce monthly payments relative to their original loans.

However, when the general financial health of these consumers deteriorates, new loans can be

expensive to take on, which could explain the decrease in the demand for debt consolidation from

2017-2022.

10

11

Additionally, the share of borrowers in the below $25,000 income category taking out medical loans

reached a high of 7%, indicating that borrowers in this income category have an acute need for credit

to finance higher and unexpected health expenses, particularly in the wake of the pandemic.

Figure 8: Average Unsecured Personal Loan Size ($) by Income Tier, 2017-

2022

Below $25,000

$25,000 - $50,000

All income tiers

Source: Prosper, individual loan data, 2017 through 2022

10

Some research also suggests that debt consolidation may exacerbate debt distress if these loans add to the overall cost of credit – in

the most recent high interest rate environment of 2022-2023, this might become a more relevant concern for low- and moderate-income

borrowers with debt consolidation loans.

11

https://finreglab.org/wp-content/uploads/2022/10/DB-MarketContext_FINAL-1.pdf

16

NONCONFIDENTIAL // EXTERNAL

The lowest-income borrowers, particularly those with incomes below $25,000, took on larger

personal loans in 2021 and 2022 (Figure 8).

Among borrowers with incomes below $25,000, the sizes of personal loans increased over the years,

up to $4,725 in 2021, and $5001 in 2022. In contrast, borrowers with incomes between $25,000

and $50,000 saw decreases over time, down to $7314 in 2022, and across all income groups, the

average loan size has decreased. We separately calculated loan size over the first four months of

2023, and Prosper data indicate that in the below $25,000 category, loan size has continued to rise

to $5800.

Figure 9: Average Loan Size as a Share of Annual Income by Income Tier,

2017-2022

Below $25,000

$25,000 - $50,000

$75,000 - $100,000

Source: Prosper, individual loan data, 2017 through 2022

Above, we see that low-income borrowers borrow relatively large amounts when compared to their

annual income. For borrowers with incomes below $25,000, a personal loan could exceed 40% of

their annual income in 2022, indicating that there are growing credit needs for this category given

the rising costs of living and borrowing. In contrast, borrowers with income between $25,000 and

$50,000 experience loan shares of about a fifth of their annual income, and borrowers with income

above $75,000 and $100,000 maintained a steady ratio of loan to income. This raises the question:

are the loan options being offered by FinTech lenders affordable, particularly in comparison to credit

cards and other types of lenders?

The market for FinTech-originated unsecured personal loans is composed of a diverse set of models

that include not only credit products but also products and services targeted at credit building, cash-

flow management, banking and savings solutions, and more. In the next sections of this brief, we

17

NONCONFIDENTIAL // EXTERNAL

explore the existing models in the unsecured personal lending space, as well as the alternative data

and underwriting methods influencing the reach and precision of these products.

FinTech Models and Their Applications to LMI

Households: Which Models Serve Which Needs?

In his paper, “FinTech Alternatives to Short-Term Small-Dollar Credit: Helping Low-Income Working

Families Escape the High-Cost Lending Trap,” Todd Baker, a senior fellow at Columbia Law School

and Business School, developed a framework that categorizes the existing market for a FinTech

product ecosystem that is most relevant to LMI individuals.

12

These categories are the following:

• Digital Credit Access/Cost Improvement Lenders: Companies that lend money to consumers for

short-term needs but seek to do so in a less costly/better structured manner than traditional

short-term small-dollar credit providers and/or lend at a lower cost to people with thin-file credit

profiles.

• Digital Credit Builders: Companies that primarily seek to help consumers improve their credit

score to be able to access lower-cost credit in the future, by (i) lending credit to borrowers short-

term and/or (ii) helping lenders identify creditworthy consumers using alternative data and

underwriting.

• Digital Cash-Flow Management Applications: Companies that provide online services to guide

consumers toward financially healthy behaviors and outcomes.

• Alternative Digital Banks: Companies that, although technically not banks, create mobile

transaction deposit solutions for consumers through bank partners.

• Earned Wage Access/Expense Variability Management: Companies that provide employers with

liquidity solutions to help employees manage variability in their expenses with early income

access or other means.

• Digital Savings: Companies providing mobile apps that facilitate consumer savings for liquidity

management and other purposes.

Our team’s stakeholder interviews with FinTech firms encompassing these models showed that no

FinTech firm is restricting its business to one of the categories above; several FinTech lenders are

12

See Todd Baker, “FinTech Alternatives to Short-Term Small-Dollar Credit: Helping Low-Income Working Families Escape the High-Cost

Lending Trap,” Harvard Kennedy School, M-RCBG Working Paper No. 75.

https://www.hks.harvard.edu/centers/mrcbg/publications/awp/awp75

18

NONCONFIDENTIAL // EXTERNAL

developing financial health and cash-flow-management businesses to improve the credit health of

their customers.

Underpinning some of these models are alternative data and underwriting methods, which many

FinTech firms have adopted to improve the targeting of their small-dollar loan products and the

identification of borrowers who may have limited or no credit histories.

Alternative Data and Underwriting

Traditional underwriting methods based on credit scores have not always captured the full picture of

a borrower's ability to repay. Alternative data and underwriting methods can provide additional

insight into a borrower's creditworthiness, enabling lenders to offer loans to borrowers who may have

been rejected by traditional underwriting methods. FinTech lenders have suggested that alternative

data may allow lenders to precisely target creditworthy borrowers while widening their consumer

base more precisely to those borrowers who have no-file/thin-file credit histories.

Alternative data are defined as any data that can be used to enhance consumer lending decisions,

many of which are not traditionally included in the credit databases of the national credit reporting

agencies.

13

Examples of alternative data and underwriting methods include the following:

• Income and employment information;

• Consumer banking information;

• Utilities/telecom payment history;

• Rental payments;

• Inquiries to specialty lenders (like payday lenders);

• Peer-to-peer (P2P) lending history;

• Social media.

This additional information can open the door to lower-interest credit options for those who are low

and moderate income as well as those who have been underserved by traditional credit options.

However, it is important to consider the ways in which alternative data are used in lending decisions,

given that LMI individuals are more likely to face acute financial shocks that may be more

pronounced in alternative data such as utilities/telecom/rental payment histories and cash-flow

information.

13

Many lenders also collect more traditional financial information like income data through other automated channels.

19

NONCONFIDENTIAL // EXTERNAL

An Overview of the Opportunities and Risks of Using Alternative Data and

Underwriting

OPPORTUNITIES

RISKS

• Alternative data may improve the speed and

accuracy of credit decisions.

• Consumers may or may not have full

transparency around the information they

are sharing with lenders.

•

Alternative data may also help firms

evaluate the creditworthiness of consumers

who currently may be no-file or thin-file, and

struggle to obtain credit in the traditional

credit system.

•

If not used responsibly, alternative data

has the potential to widen existing

inequities in credit access. Alternative

data could potentially amplify the acute

financial shocks faced by low- and

moderate-income borrowers.

• Alternative data and underwriting may

enable consumers to obtain a broader set

of unsecured loan products, as well as more

favorable pricing/terms based on better

assessments of the ability to repay.

• More clarity is needed around how to

regulate the use of alternative data under

the existing consumer protection

framework (i.e., Equal Credit Opportunity

Act, Fair Credit Reporting Act).

Alternative data come with several opportunities and risks, and as such, FinTech firms and

consumers must consider the types of information and underwriting processes that serve both

lenders and consumers fairly. Alternative data create opportunities to improve the assessment of

creditworthiness by providing information about a borrower's payment history or other data in

addition to his or her credit score. Alternative data also provide more timely, up-to-date information

about a person’s most recent financial activities. Lastly, alternative data have the potential to lower

costs for lenders, and thereby reduce borrowing costs for consumers.

14

The use of alternative data also poses some risks to consumers. Consumers may not have full

transparency over how their data are being used and the extent of the information shared with

lenders, given a lack of formal governance standards around alternative data. Certain types and

uses of alternative data, like some types of non-financial data, could also widen existing

socioeconomic disparities in access to credit, since these data may amplify the effects of the

financial shocks that underserved groups are vulnerable to and make it more difficult to improve

their credit standing. Non-financial data, like social media data, also raise concerns about data

privacy as well as questions about whether or not there is a true link between credit performance

and certain non-financial data types.

14

See Brian Kreiswirth, Peter Schoenrock, and Pavneet Singh Using alternative data to evaluate creditworthiness, Consumer Financial

Protection Bureau, https://www.consumerfinance.gov/about-us/blog/using-alternative-data-evaluate-creditworthiness/

20

NONCONFIDENTIAL // EXTERNAL

The next sub-sections provide an overview of alternative data and underwriting methods for FinTech

unsecured personal loans, focusing on two key alternative data types: cash-flow-based underwriting

and the use of utilities/telecom/rental payment data.

Cash-Flow-Based Underwriting

Cash-flow information focuses on borrowers’ cash flow, looking at income and expenses to identify

creditworthy applicants. Cash-flow-based underwriting provides a more detailed and timelier picture

of how applicants manage their finances than traditional credit reports. This approach is especially

useful for borrowers who may have a low credit score but a steady income stream. More than 96% of

American households have bank or prepaid accounts, and account records are increasingly easy to

access electronically.

Research

15

on the use of cash-flow-based underwriting for FinTech unsecured personal loans has

found that this type of underwriting can significantly improve the accuracy of credit risk assessment,

especially for borrowers with limited credit histories. Research

16

has also found that using cash-flow

data can lead to better long-term loan performance for borrowers who have no-file or thin-file credit

histories and such data may also indicate a low propensity for default. This is because cash-flow

data provide a more comprehensive view of a borrower's financial situation, enabling lenders to

identify borrowers who are likely to repay their loans. Cash-flow-based underwriting has also led to

FinTech innovations in point-of-sale lending, where FinTech firms in the market for emergency small-

dollar loan products can seek permission to access a borrower’s bank account information and

assess his or her cash-flow history instantaneously before extending a line of credit.

Studies of cash-flow data used by some lenders have found that its predictive ability was relatively

consistent across different demographic groups, rather than acting as a proxy for socioeconomic

characteristics such as race, gender, or ethnicity, and that the FinTech firms using cash-flow-based

underwriting may improve credit access for those in underserved populations.

17

15

See FinRegLab, “The Use of Cash-Flow Data in Underwriting Credit: Empirical Research Findings.” https://finreglab.org/cash-flow-data-

in-underwriting-credit-empirical-research-findings

16

See Marco Di Maggio, Dimuthu Ratnadiwakara, and Don Carmichael, “Invisible Primes: Fintech Lending with Alternative Data,” Harvard

Business School Working Paper 22-024, October 2021. https://www.hbs.edu/faculty/Pages/item.aspx?num=61316

17

See FinRegLab, “The Use of Cash-Flow Data in Underwriting Credit: Empirical Research Findings.” https://finreglab.org/cash-flow-data-

in-underwriting-credit-empirical-research-findings

21

NONCONFIDENTIAL // EXTERNAL

Utilities, Telecom, and Rental Payments (UTR) Data

UTR payment histories provide direct information about whether consumers have the financial

capacity to take on additional expenses or, in the case of rent when underwriting a mortgage loan,

substitute expenses. Payment history also reflects consumers’ general propensity to meet continuing

obligations.

These records are particularly relevant to LMI borrowers because they can expand credit to renters,

who are about seven times more likely than homeowners to lack sufficient credit history to generate

a credit score under certain models. This population includes disproportionate numbers of Black and

Hispanic consumers, low-income households, and young adults. Preliminary reviews of initial

research suggest that some no-file and thin-file consumers would be able to satisfy many lenders’

minimum credit score thresholds if their UTR payments were considered, but estimates show that

only 2% to 5% of consumers who make these payments have these data reflected in their credit

reports.

18

In terms of the predictive ability of UTR data, research is limited at this point in time for the

unsecured personal loan market, but stakeholder interviews and studies show that UTR used in

combination with other data can improve predictive accuracy and expand access in mortgage

underwriting.

19

However, UTR data are not widely available in credit bureau files today, and credit

scoring models (particularly older versions) vary in the extent to which they account for such payment

histories.

20

Conclusion

FinTech models for lending offer an important alternative to higher-cost traditional credit that is often

inaccessible to low and moderate-income borrowers and less secure small-dollar loan options. An

environment of lower interest rates allowed FinTech firms to grow their businesses in the unsecured

lending space, and the use of alternative data allowed them to efficiently target products to LMI

borrowers. However, as inflation rose and interest rates tightened, delinquencies began to rise in this

18

See Kelly Thompson Cochran and Michael Stegman, with Colin Foos, “Utility, Telecommunications, and Rental in Underwriting Credit,”

Urban Institute and FinRegLab.

https://finreglab.org/wp-content/uploads/2022/03/utility-telecommunications-and-rental-data-in-

underwriting-credit_0.pdf

19 See Jung Hyun Choi et al Reducing the Black Homeownership Gap through Underwriting Innovations, Urban Institute,

https://www.urban.org/research/publication/reducing-black-homeownership-gap-through-underwriting-innovations

20

Newer credit scoring models will account for data wherever it is available, but it is unclear the extent to which this data will be optimized

the way it has been for loan repayment.

22

NONCONFIDENTIAL // EXTERNAL

space. FinTech firms have now begun to expand their business in cash-flow management and

financial health and savings products and to diversify the suite of products offered to LMI borrowers.

Several FinTech firms have tightened underwriting standards during this period of high interest rates

and reduced the credit box for unsecured personal loans available to LMI borrowers as a result.

FinTech firms will continue to be tested in their ability to consistently provide LMI borrowers with an

alternative credit option, particularly in economic environments that are difficult for LMI borrowers to

navigate. Caution should also be taken with the use of alternative data in such economic

environments, given LMI borrowers’ likelihood of facing financial shocks that will affect their cash-

flow management and their ability to make UTR payments on time.