2023 Speed

Campaign

Media Buy Summary

2

Table of Contents

Executive Summary ........................................................................................................................................ 3

Media Strategy and Campaign Details ............................................................................................................ 5

TV—Linear (Traditional) and OTT/CTV............................................................................................................ 9

Radio ............................................................................................................................................................ 17

Digital ........................................................................................................................................................... 26

Out-of-Home ................................................................................................................................................ 45

Campaign Summary ...................................................................................................................................... 49

3

Executive Summary

Speeding endangers everyone on the road. Speed limits are implemented to enhance safety by reducing

risks imposed by drivers' speed choices. Unfortunately, only some follow the speed limit and one of the

biggest challenges in addressing the danger of speeding is its widely accepted behavior nationwide. A

2014 NHTSA research study concluded that regular speeders use posted speed limits as their

"benchmark" or "threshold." They know the risks of speeding, both a citation and a crash. Further, they

willingly accept those risks because they perceive both as extremely low.

Habitual speeders often comment on how they make driving decisions depending on weather/road

conditions and try to avoid distractions. In general, they believe that they drive safely. They need to be

aware that speeding is unsafe and increases crash risk. Once they have that realization, the human

impact of their actions becomes more tangible. They don't want to be responsible for inflicting pain and

suffering from a crash on others.

Through a national social norming campaign, NHTSA seeks to help states and partners communicate

about the dangers and consequences of speeding. The creative will communicate how speeding

increases the risk of getting into a crash and the consequences to themselves and others as a result.

MRI-Simmons, a research tool that provides insights into consumer behavior, indicates that males ages

18 to 44 years old are most likely to enjoy risk-taking behaviors and prefer vehicles that offer spirited

performance and powerful acceleration. As a result, males in this age group are the primary target

audience for this campaign. National paid advertising will run for 22 days, beginning Monday, July 10,

through Sunday, July 31, 2023, and will be supported by an $9.6 million paid media budget.

The campaign will use video, audio, digital, paid social media and out-of-home (OOH) media to reach the

target audience. Media selection will be based on usage among the target audience and strategies will

be considered based on current consumer research.

This document provides an overview of the research and trends that inform NHTSA's national paid

media plan for the 2023 Speed Prevention social norming campaign. State departments of

transportation (SDOTs) and state highway safety offices (SHSOs) may reference this paid media strategy

and subsequent media buy details to develop their media plans. Campaign materials will be made

available at TrafficSafetyMarketing.gov.

4

The campaign will aim to quickly establish broad reach and a high frequency to drive message

penetration. Research shows that advertising effectiveness increases as additional media channels are

added to the paid media plan. Media universes are not measured equally, nor does the entire target

audience consume any single channel, such as digital, radio or TV. Therefore, it is essential to determine

a channel mix that will frequently engage the target audiences. NHTSA will use a multi-channel, multi-

platform paid media strategy consisting of digital, video and audio tactics and OOH advertising to reach

more than 50% of the target audience on their preferred channels multiple times throughout the

campaign.

The strategy will focus on the most efficient, high-reach tactics to meet reach and frequency goals. The

demographic comprises two distinct generations—Gen Z (18- to 26-year-olds) and Millennials (27- to 42-

year-olds). Gen X technically still falls within the targeted demographic, but will age out of the

demographic next year and should not be a primary focus of the current plan. The plan will seek to

reach each generational audience where they consume media the most, relying on content to connect

the Speed message to each specific generation. As we observe the current media environment and

usage by the target audience, we see a shift in how time is spent consuming media. At the same time,

consumers are using multiple methods to view content. As a result, a well-rounded strategy for reaching

the target audience must include a combination of linear (traditional) TV, terrestrial radio advertising

and digital media, including streaming video and audio. Mediums selected for campaigns should consist

of multiple touch points with consistent creative across each tactic to reach consumers and build brand

awareness.

Because nearly 100% of the target audience is connected to the internet, the plan relies heavily on

digital tactics. It will be led by mobile delivery methods, with a second-screen strategy to reach the

target audience when they are using multiple screens simultaneously, which will aid in generating the

maximum number of unduplicated impressions. The digital media plan will explore custom native

content via direct publisher partners, programmatic video, display and paid social media channels.

Video viewership continues to cross over linear networks and streaming services, which are key to brand

awareness. While linear TV is still needed to reach audiences, particularly in live sports and local

programming, connected TV (CTV) and over-the-top (OTT) is becoming the primary placement to reach

the target audience. Linear TV will be primarily bought programmatically to reach the target audience

on their most-watched networks and programming.

Audio tactics, including terrestrial (AM/FM) radio and digital streaming, are another dominant reach

vehicle and will be vital to the campaign. Podcasts will also be considered to reach the audiences in their

motor vehicles when they may be speeding.

Finally, OOH options will be utilized to extend the campaign's reach in the places where the target

audience lives, works and plays.

5

Media Strategy and Campaign Details

The 2023 Speed Prevention social norming campaign aims to communicate to 18- to 44-year-old male

drivers that speeding is unsafe and increases crash risk. With a relatively short campaign window, the

primary media strategy is to quickly build reach and frequency to connect the target audience with our

message five to nine times throughout the campaign as was requested on all vendor RFPs. Digital tactics,

paid social media and broadcast (audio and video) will all be activated to ensure the campaign meets

reach and frequency goals.

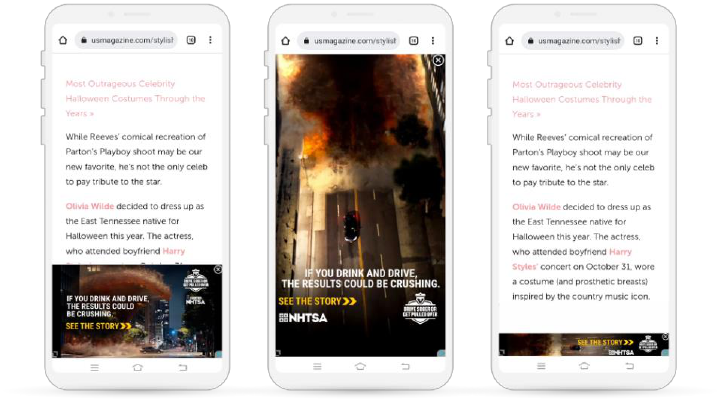

Figure 1: Campaign Assets

Language

Asset

Where Used

English

Look at the Damage

Broadcast TV

English

Look at the Damage

Radio

English

Look at the Damage

Banner Ads

English

Look at the Damage

Digital Video

Spanish

Ve Todo El Daño

Broadcast TV

Spanish

Ve Todo El Daño

Radio

Spanish

Ve Todo El Daño

Banner Ads

Spanish

Ve Todo El Daño

Digital Video

Advertising Period

Paid advertising will run starting Monday, July 10, through Monday, July 31, 2023. The campaign is

national in scope.

Figure 2: Campaign Calendar

M

T

W

Th

F

Sat

Sun

July

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

Working Media Budget

The total media budget for the 2023 Speed campaign is $9.6 million.

6

Target Audience

The primary target audience is 18- to 44-year-old males. The secondary target audience is 18- to 44-

year-old Hispanic males who primarily speak and consume Spanish media at home.

Generation Overview

The 18- to 44-year-old adult male cohort is seeing rising generational shifts. Millennials hold a bulk of

the Speed campaign audience, but Gen Z now makes up 25.3% of the demographic within the general

market and 21.3% within the Hispanic male target audience (Figure 3).

Figure 3: Age Breakdown of 18- to 44-Year-Old Males

Source: 2022 Doublebase GfK MRI Weighted to Population (000)

MRI-Simmons indicates that although media consumption is shifting, the 18- to 44-year-old adult male

audience still indexes very high (150) as heavy internet users (Figure 4). Social media is next, with 38.8%

of the demographic seeing themselves as heavy social media users. While only 21% are heavy TV users,

there is still an 83.4% reach into the target audience. Light viewership indicates that they watch

selectively and supports an ongoing strategy of buying specific programming and employing audience

targeting, which performed very well in 2022. The internet is the best way to reach the target audience;

however, linear (traditional) TV and terrestrial radio are essential players in ensuring NHTSA's message

reaches all platforms.

7

Figure 4: Media Usage General Market 18- to 44-Year-Old Males

Source: 2022 Doublebase GfK MRI Weighted to Population (000)

Comparing media usage between the generations shows some nuanced differences (Figure 5, Figure 6)

that are important to consider. While both generations consume the internet, social media, radio and

TV, in that order, Gen Z is more than twice as likely to be the heaviest users of the internet and social

media.

Rapid technological changes lead this generation to gravitate towards digital media more than any

previous generation. Gen Z over-indexes as high social media users, at 207, and the internet as a whole

at 202 (Figure 5). Millennials are also heavy users of both platforms, but the index for this generation is

considerably lower, with social media at 102 and the internet at 133 (Figure 6). Nearly 60% of Gen Z

adults consider themselves heavy internet users, while only 42.3% of Millennials are heavy users. That is

now a 17.7% difference, which grew from 11% last year. This is significant and indicates this trend will

continue as Gen Z ages more into the Speed target demographic.

8

Figure 5: Male Gen Z (Born 1997–2003) Media Usage

Source: 2022 Doublebase GfK MRI Weighted to Population (000)

Figure 6: Male Millennials (Born 1977–1996) Media Usage

Source: 2022 Doublebase GfK MRI Weighted to Population (000)

9

Figure 7: Hours Spent on the Internet Comparison Between Gen Z and Millennial Adults

Source: 2022 Doublebase GfK MRI Weighted to Population (000)

As Millennials still make up over 70% of the 18- to 44-year-old adult male audience, NHTSA will

continue to run across digital, TV and radio media platforms due to the diversity of Millennials’

preferred forms of entertainment. As Gen Z increases its proportion of the target audience in the

coming years, resource allocation may concentrate even more on internet-based tactics to align

with their media consumption habits.

To ensure that the entire target audience receives the Speed messaging, NHTSA will select media

channels with a slightly higher reach into the Millennial cohort while also seeking specific opportunities

that reach Gen Z.

TV—Linear (Traditional) and OTT/CTV

Linear (traditional) TV refers to watching a program on the network it's presented on at its scheduled

time. For example, watching "NCIS" on CBS at 9 p.m. on Monday when it premieres is considered a

linear (traditional) TV viewing experience. Streaming TV is platform-specific content across CTV, OTT and

sometimes even linear (traditional) TV. MRI-Simmons reports that 43.9% of males 18 to 44 years old can

be found watching linear (traditional) and streaming TV. In comparison, 8.7% only watch linear

(traditional) and 39.2% only watch streaming TV (Figure 8), reiterating that the best way to reach the

2023 Speed demographic will be to run the message on both tactics. Working alongside each other,

linear (traditional) and programmatic TV allows the buy to reach the viewer wherever they may be

watching while generating high impressions.

10

Figure 8: Where Men 18 to 44 Years Old Are Watching TV

Source: 2022 Doublebase GfK MRI Weighted to Population (000)

General Market Linear TV

Ampersand

Ampersand is a data-driven cable TV advertising sales and technology company that reaches 80 million

households, providing viewership insights and planning on 42 million households in 200+ DMAs across

more than 165+ networks and in all dayparts.

The plan will be executed and measured to the target audience over a cross-screen TV campaign,

meaning they can input on TVs, mobile devices and tablets while also being aware of frequency caps per

household. Ampersand offers audience-based buying and automation through a single interface that

supports local and national cable TV buying.

The platform supports every step of the media plan to:

• Define and find an audience using Nielsen demo or custom audiences

• Plan and execute with an optimized schedule across the cross-screen TV supply

• Measure and report both reach and frequency to the custom audience

Ampersand will run nationally on high-indexing networks for 18- to 44-year-old males, such as ESPN, TBS

and USA. The plan will also include a streaming counterpart to reach viewers beyond the linear

(traditional) market.

In addition to running the NHTSA messaging, the Ampersand plan will include a :10 taggable, which

will be added to the end of a network ad on FS1 promoting the NASCAR Cup Series. At the end of the

spot, NHTSA’s 10-second copy will run alongside the campaign's logo to get the message in front of

viewers who have an increased interest in racing which ties nicely to the dangers of speed awareness.

Wording on the finalized taggable will move away from the word sponsorship and change to a

partnership with NHTSA.

11

Ampersand will deliver an estimated 6.9 million impressions and 900,000 added value impressions.

In total Ampersand will deliver 7.8 million impressions.

ESPN

ESPN is still a go-to destination for unmissable live sports moments, storytelling and sports community

fandom. The 2023 ESPN Speed buy will reach the target audience by having the message surround high-

profile sporting events during the July flight. These events include Wimbledon, MLB: Baseball Tonight,

Sportscenter Primetime and the ESPY Awards. Having the message run around the ESPY Awards will be a

great way to reach 18- to 44-year-old male fans of other sports that are currently not in season.

The ESPN plan will deliver 4.1 million paid impressions.

YouTube TV

YouTube TV is a subscription TV service that lets the audience watch live TV from major broadcast and

popular cable networks through the YouTube TV app; this is a separate app from the online video

Youtube app, focusing on live TV. Viewers can watch local and national live sports, breaking news and

must-see shows the moment they air.

YouTube TV offers over 100 channels, including the AMC, ESPN, TNT, TBS, NBC Sports and USA

networks. All networks will be utilized to reach the 2023 Speed targeted demographic as these channels

over-index with the Speed target audience.

This is the second time NHTSA will be running on YouTube TV, with the 2023 Click it or Ticket campaign

being the first, and campaign results will be monitored to ensure success and that the plan KPIs of ad

view-throughs are being met.

YouTube TV will deliver 9 million impressions.

12

Spanish-Language Linear (Traditional) TV

Linear (traditional) TV is still a vital part of the Hispanic target strategy, as 47.8% of users consume

television on both linear (traditional) and digital mediums. The 2023 Speed campaign will utilize a

multi-screen video approach to increase visibility by broadening the reach amongst the Hispanic

target audience.

Figure 9: Linear (Traditional) Television vs. TV Streaming and Video Services Viewing for 18- to 44-

Year-Old Hispanic Males

NBC Universal—Telemundo

Telemundo will reach the 18- to 44-year-old adult Hispanic male target with 30-second spots. The plan

will run spots in commercial breaks across sports and entertainment programming, including highly

watched Liga MX soccer matches as well as shows like “Titulares y Más” and “Hoy Dia.” The daypart

mix includes early morning, day time, early fringe, prime time, late fringe and weekend. Some

programing include:

• “Liga MX Chivas” is a famous Mexican professional soccer club with an exclusive agreement with

Telemundo to broadcast their home matches across their platforms.

• “Titulares y Más” is Spanish television's number-one sports and entertainment program and

runs from Monday through Sunday.

• “Hoy Día” is a popular morning show focusing on entertainment and essential daily news. In its

third season, the show is hosted by Adamari López, Penelope Menchaca, Andrea Meza, Lisette

"Chiki Bombom" Eduardo and Nicole Suarez.

Telemundo’s plan will deliver 1.8 million guaranteed impressions.

13

Simulmedia

Simulmedia’s plan will exclude Telemundo for unduplicated delivery to broaden the reach of the TV plan

across other Spanish-language broadcast and cable networks. The campaign will comprise 85% 30-

second units, while the remaining 15% will include 15-second ad units. Spots will be optimized across

various networks, including sports like BeIN, ESPN Deportes and Fox Deportes. The daypart mix includes

early morning, daytime, fringe, prime time, late night, overnight and weekend, with heavier weight on

prime time and weekends.

The Simulmedia plan will deliver 795,000 impressions.

General Market Over-the-Top/Connected TV (OTT/CTV)

GlassView

GlassView is a digital video advertising platform built to drive measurable outcomes for brands at all

levels of the marketing funnel. Through premium inventory, innovative targeting and advanced

algorithmic optimizations, GlassView delivers best-in-class video advertising. This platform guarantees

100% viewability; advertisers only pay when users actively engage with the ad.

Throughout the buy, GlassView will utilize its CTV and OTT capabilities to deliver the video to the NHTSA

target audience wherever they may be streaming. GlassView will insert the Speed message into

premium streaming services such as NBC, Comedy Central and ESPN at lower CPMs than a direct buy.

Glassview is once again being recommended due to the strong performance and in-depth reporting they

have provided on past NHTSA campaigns. For the 2023 Distraction campaign, they delivered a video

completion rate (VCR) of 97.3% and allowed the message to be watched in full over 16 million times.

Glassview will deliver 21.7 million paid impressions and 1 million added value impressions.

In total, the Glassview plan will deliver 22.8 million impressions.

Roku TV

Millions of consumers use Roku streaming devices in North America. They connect users to the

streaming content they love, and content publishers can build channels that monetize to large

audiences. Roku’s top streaming channel is The Roku Channel, providing consumers free, ad-supported

content. It contains a wide variety of licensed, original, on-demand and linear content. Roku is the

number-one TV streaming platform in the United States, Canada and Mexico by hours streamed

(Hypothesis Group, Oct 2021).

14

Roku TV will be utilized during the 2023 Speed campaign to target 18- to 44-year-old males who are

movie fans. This will be accomplished through 2023 Speed messaging surrounding Roku's Go Big Movie

Pass. The pass will allow viewers to enjoy a free blockbuster movie on the Roku Channel with limited

interruptions presented by NHTSA. Past Roku NHTSA campaign data has shown that the 18- to 44-year-

old male audience over-indexes as movie lovers. Roku will build a custom movie guide to connect the

message to the surrounding content. NHTSA will have final approval over the movie and the look of the

custom unit. The custom content will be similar to the NHTSA microsite the vendor built for the Rail

campaign in 2022.

Example of the Rail 2022 Microsite

Along with the Movie Pass content, the Roku plan will include a title card, Roku channel tile, pause ad

and in-content NHTSA video ads, all at added value. Roku will build out all elements, with assets running

once they have been approved by NHTSA.

15

Examples Roku of Ads

Channel Tile Ad

Pause Screen Ads

Screensaver Ads

16

The 2022 Rail Roku campaign over-delivered on promised impressions and held a video ad view-through

rate of 99.09%. Given the strong performance and engagement the past Roku campaign provided, it is

recommended to continue hitting the Roku viewer that falls into the NHTSA target audience.

Roku will deliver 20 million impressions.

Sinclair Sports Group

Sinclair Broadcast Group, Inc. is a diversified media company and national sports and news leader. The

company owns and operates 21 sports network brands nationwide, providing services to 185 television

stations in 86 markets. Sinclair's content is delivered via various platforms, including over-the-air, multi-

channel video program distributors and digital streaming.

Through Sinclair partnerships, NHTSA can run on Bally Sports. Bally Sports is a sports network running

across the United States. For the 2023 Speed campaign, ads will run during live-streaming MLB

throughout the country.

The Sinclair buy will include ads on the Wave Sports social platforms, Facebook and Instagram. They are

a one-stop platform for viewers looking for sports highlights and news. Their videos host 6 billion

monthly views and have advanced targeting capabilities, allowing the Speed campaign to directly target

males ages 18 to 44 years old who are sports fans. During the 2023 Speed flight, NHTSA messaging will

surround MLB and All-Star Game content.

Sinclair Sports Group was first utilized during the 2022 Rail campaign, where they over-delivered on

promised impressions by 20%. The 2023 Speed campaign has a similar audience target to the Rail

campaign. Sinclair is being recommended due to past performance, proving it is a tactic that can reach

the NHTSA target audience.

Sinclair Sports Group will deliver 6.3 million impressions.

Spanish Language Over-the-Top/Connected TV (OTT/CTV)

Like the general market, the Hispanic target is more likely to be a light television viewer and, as such, the

strategy will mirror the general market. Linear TV is still a vital part of the Hispanic target strategy as

47% of users consume television on both linear and digital mediums (Figure 9).

GlassView

GlassView will also be used to target the Hispanic target audience through high-placement CTV ads on

Hispanic streaming services such as Univision. This will allow NHTSA to hit popular network inventory at

a lower CPM.

Glassview will deliver 6.5 million paid impressions and 326,000 added value impressions.

In total, the Glassview plan will deliver 6.8 million impressions.

17

MiQ

MiQ is a programmatic media partner that uses Automatic Content Recognition (ACR) partnerships to

access over 40 million smart TVs within households nationwide. They identify opportunities to optimize

the reach and frequency of NHTSA's existing linear buys with digital impressions.

MiQ's advanced audience targeting allows the buys to target by demographic, behavior and interests.

This approach ensures the message is delivered at the right time to the right audience against relevant

content to create awareness and engagement with the Speed messaging.

MiQ's technology can identify potentially over-exposed audiences and redirect impressions to those

subsequent viewers through connected data and screens, including linear TV, desktop, OTT and mobile

devices.

MiQ will deliver more than 2.8 million paid impressions and 147,000 added impressions to the Hispanic

target audience.

The plan will also include a make-good from the 2022 Speed campaign. Last year, MiQ over-delivered on

paid impressions, but did not fully deliver on the added value impressions that were promised. To make

good on the promised impressions from 2022, MiQ will run an additional 1.9 million impressions.

In total MiQ will deliver a total of 4.8 million impressions.

Sinclair Sports Group

Using the Sinclair Wave Sports social platforms of Facebook and Instagram, Sinclair can also target the

18- to 44-year-old Hispanic male audience who are sports fans. The platform has partnerships with

Hispanic sports leagues, such as the Premiere Hispanic MMA franchise and, through that, their Hispanic

audience continues to grow.

In total, the plan will deliver 1.7 million impressions.

Radio

Terrestrial radio remains a cost-efficient way to reach the target audience. In addition to low CPMs, it is

one of the only remaining tactics where partners can offer large added-value packages to NHTSA in the

general and Hispanic markets. MRI Simmons shows that the male 18- to 44-year-old audience can still

be found on terrestrial radio, with 46.5% of the demographic listening to AM/FM (Figure 10).

18

Figure 10: Where Men 18 to 44 Years Old Are Listening to Audio

Source: 2022 Doublebase GfK MRI Weighted to Population (000)

When divided down to the radio formats, Millennial adults over-index across the most popular radio

genres, with current hits, country and adult contemporary formats holding much of their listenership.

Gen Z adults are much more selective with their music genres, with only current hits, hot adult

contemporary, Tejano and urban over-indexing for the generation. Even though Gen Z does not index as

high as their Millennial counterparts, across the board, Gen Z listeners can still be found on other

formats (Figure 11). This allows the radio buys to continue to have a cross-generational pull.

19

Figure 11: Top Radio Formats for Gen Z and Millennial Adults

Radio Formats

Gen Z Adults

Millennial Adults

(OOO)

Index

(OOO)

Index

Adult Contemporary

3,007

88

10,089

109

Adult Hits

355

60

1,743

108

Alternative

1,030

80

4,272

122

Current Hits

5,238

146

14,536

148

Classic Hits

699

45

2,914

69

Classic Rock

819

47

3,560

75

Country

2,455

68

10,103

103

Hispanic

1,432

94

5,787

139

Hot Ac

1,548

116

4,726

129

Tejano/Ranchera

640

101

2,637

152

Rhythmic

1,436

173

3,574

158

Rock

671

57

4,139

130

Sports

411

42

2,181

82

Urban

2,775

115

8,105

124

Urban Contemporary

2,129

134

6,258

145

Source: MRI Simmons Insights 2022

This cross-generational pull holds with in-car listening as well. MRI Insights showcases that terrestrial

radio still has the highest number of in-car listeners for both Speed generations while digital streaming

over-indexes for the age groups (Figure 12). The Speed plan focuses on terrestrial and digital audio to

extend reach and frequency for a well-rounded audio buy.

Figure 12: What Gen Z and Millennial Adults Listen to in the Car

Audio Platform Listened to in Car

Adult Gen Z

Adult Millennials

(OOO)

Index

(OOO)

Index

FM Radio

14,184

83

48,612

104

Siriusxm Radio

1,936

37

9,742

69

Digital Audio Streaming

7,572

127

22,149

136

Source: MRI Simmons Insights 2022

20

General Market Radio

ESPN Radio

ESPN Radio is an extension of the ESPN TV network where listeners can listen to live sports and sport

news highlights. The 2023 ESPN Speed plan will run :30 in-game spots within MLB regular season games

and around the All-Star game. Alongside the :30 spots will be :10 and :05 live-reads during the games

that connect the Speed message with trusted sports announcers.

ESPN Radio also has numerous sports programming opportunities with high-profile personalities within

the sports community. 2023 Speed messages will run in the following programs:

• “Keyshawn, JWill & Max” is hosted by the number-one pick in the NFL Draft, Keyshawn

Johnson, and number-two pick in the NBA Draft, Jay Williams, as well as Max Kellerman, who set

the sports table for the day.

• “Greeny” is hosted by Mike Greenberg, who brings his unmatched depth of sports knowledge,

fun and entertainment back to ESPN Radio daily.

• “Bart & Hahn” is a show in which former NFL linebacker Bart Scott and longtime New York

broadcaster Alan Hahn tackle the sports stories that matter most to the sports community.

• “Canty & Carlin” put together the talents of Super Bowl champion Chris Canty and Emmy-

winning host Chris Carlin to form the duo "Canty & Carlin." Chris and Chris are your tickets to an

informative, opinionated, entertaining drive home every weekday afternoon from 3–7 p.m. ET.

ESPN Radio will deliver 93.8 million impressions and 32.8 million added value impressions.

In total, ESPN Radio will deliver a total of 126.7 million impressions.

ESPN Podcast

Alongside the ESPN Radio terrestrial buy, the plan will also have coverage on high-rating podcasts across

the ESPN network. Podcasts are available to listeners through the ESPN Radio website, Apple Podcast,

Spotify and SiriusXM. Live-reads with Speed messages that will run in the following podcasts:

• “Baseball Tonight” goes through baseball analytics with top ESPN MLB analyst Buster Olney.

• “The Adam Schefter Podcast” talks with the biggest names in and around football, taking you

inside what makes them tick and how they got to where they are.

• “Get UP Podcast” is a show that focuses on Sports news, opinions and analysis with Mike

Greenberg and ESPN analysts.

• “The Mina Kimes Shows” talks about all things football with her unique humor and insight. Her

friends join each episode to talk about the NFL's latest storylines and her football-loving dog,

Lenny, making frequent contributions.

• “Paul Finebaum Show” is a show in which Paul Finebaum provides his unique takes on the SEC

and college football world.

• “NFL Live” scoops the latest news and information deep inside the NFL.

21

• “Always College Football” is a show in which ESPN college football analyst Greg McElroy takes a

deep dive into the sport with the biggest names on and off the field.

• “ESPN College GameDay Podcast” is hosted by Kirk Herbstreit, David Pollack and Kevin

Negandhi, joined this year by Matt Barrie, Rece Davis, Paul Finebaum, Booger McFarland and

Joey Galloway. From the weekend reaction on Monday mornings to rankings reveals on Tuesday

nights to game previews late in the week, ESPN's College Football podcast has it covered by the

voices and perspectives you want to hear.

• “The ESPN Daily” airs Monday through Friday and is hosted by Pablo Torre, who brings listeners

an inside look at the most exciting stories at ESPN, as told by their top reporters and insiders.

With ESPN being owned by Disney, it ensures that the messages will be delivered to the correct

demographic with brand-safe talent.

The ESPN Podcast plan will deliver 1.4 million paid impressions and 93,000 added value impressions.

The entire ESPN Podcast plan will deliver 1.5 million impressions.

Focus 360

Focus 360 brings programmatic audience targeting to the terrestrial radio level using a radio

programmatic-based platform, allowing custom-built networks for any target at a national level. Focus

360 also can track individual ad plays, resulting in real-time air checks and reporting. This platform will

supplement the traditional radio networks to add highly targeted frequency to the plan.

The terrestrial radio portion of the plan will be bought against the adult 18- to 44-year-old male target

audience and optimized to the top-rated genres of rock, adult hits, country and sports.

The plan will include :30 and :15 spots distributed equally across all prime dayparts with the largest

audiences. The plan also consists of the SportsMap platform, affiliated with 550 radio stations

nationwide.

Focus 360 will deliver an estimated 37 million paid impressions.

Added Value

Focus 360 is offering sports live reads voiced by the host of the following sports talk shows as

added value:

• "Wake up Call" with Tonny D and Ronn Culver

• "Rundown" with Jeff Michael

• "Fred Nation" with Fred Faour and Greg Frank

• "Coast to Coast" with Scott Ferrell

• "Gametime Decisions" with Gabriel Morency and Cam Stewart

22

The plan will deliver an estimated 8.7 million added value impressions.

In total, Focus 360 will deliver an estimated 45.8 million impressions.

Skyview Networks

Once known primarily for sports, Skyview now reaches 113 million listeners each week.

With stations across the country, Skyview is able to hit every radio DMA in the United States. Radio

weight will be scheduled nationally through Skyview’s music platform via radio personality influencers,

sports (MLB), summertime special programs (throwback nation) and short-form content adjacencies.

Multicultural Influencers

Radio personality influencers will provide voiced spots, in-program features and social media posts

across Skyview’s various lineups. This diverse cast of multicultural personalities reaches across multiple

formats and audiences.

• “La Vale Show” is hosted by Angelica Vale, a beloved actress, singer, comedian, entertainer and

a significant influencer in the Latino community. From her top-rated flagship radio station in Los

Angeles, Vale connects to Hispanic consumers in an environment of trust and authenticity,

reaching multicultural audiences.

• “The Dana Cortez Show” has run successful campaigns for NHTSA, speaking to the general

market and Hispanic listener base.

• “XYZ with Erik Zachary” creates a multimedia experience through host Erik Zachary, who makes

content focused on pop culture and music.

In addition to the music-driven programs listed above, the Skyview plan will also run in MLB games with

:10 live reads that relate the ball's speed to speed safety.

The paid portion of the Skyview plan will deliver an estimated 61.2 million impressions.

Added Value

Added value will be provided through featured content and social media posts from the shows

mentioned above, Country Top 40 countdown, B-Dubs Radio (Buffalo Wild Wings digital radio network)

and MLB affiliate rotators.

The most recent 2023 Skyview Distraction campaign dedicated the entire week of their show

programming to the NHTSA message. This effort showcased a solid partnership in spreading awareness,

while also providing low CPMs to stretch the media budget to increase the reach of NHTSA's campaigns.

The added value portion of the Skyview Networks plan will deliver 1.3 million impressions.

In total, Skyview Networks will provide approximately 62.6 million impressions.

23

iHeartMedia

iHeartMedia (iHM) is a leading multi-platform media company offering traditional radio broadcasting

through Premiere Networks, online, mobile, digital social media, podcasts, personalities and influencers.

iHM serves 150 local markets with 858 terrestrial radio stations and its digital radio platform on 260+

platforms and over 2,000 devices.

This plan is built for efficiency, returning a comparatively low CPM while achieving reach. The terrestrial

radio schedule will focus on Premiere Network at a national level and run on stations that index the

highest with the targeted audience. Running alongside the terrestrial radio will be the iHeart

SmartAudio platform, which is bought programmatically. SmartAudio is created by modeling iHM’s first-

party digital data and third-party data from social networks to identify what broadcast radio stations the

audience listens to. That data is then utilized in an algorithm to reach the target audience wherever they

may be listening with brand-safe targeting set by NHTSA.

The paid portion of the iHM plan will deliver approximately 24.4 million paid impressions.

Added Value

The added value portion of the plan represents 101% of the iHM plan. Added value includes influencer

integrations with bonus distribution on the following networks:

• Summer Safety Experience will be a PSA radio experience running throughout the speed flight

and will extend messaging through live-reads using iHeart Radio top talent and PSAs targeted to

local markets. The talent list will be received closer to campaign launch and will be send to

NHTSA for client-approval.

• Action Network is a custom network built for the 2023 NHTSA Speed target audience. It will run

the campaign's messaging nationally on high-profile sports programming, such as Fox Sports

Gametime and The Ben Maller Show.

• SmartAudio dual casting extends the reach in the digital space by running the same units within

the station’s digital audio asset.

The added value portion of the iHM plan will deliver an estimated 24.5 million impressions.

In total, iHM will deliver more than 48.9 million impressions.

Spanish-Language Radio

For the Hispanic market, AM/FM radio is the highest audio source, with 68.6% of 18- to 44-year-old

Hispanic males currently listening to terrestrial radio, which is significantly higher than digital

radio. Digital currently only holds 13.7% of the Hispanic male target audience.

24

Figure 13: Radio AM/FM vs. Radio Any Internet App/Satellite Usage Amongst 18- to 44-Year-Old

Hispanic Males Who Speak Only or Mostly Spanish at Home

Source: 2022 Doublebase GfK MRI Weighted to Population (000)

SBS AIRE

SBS AIRE allows NHTSA to target the Spanish-speaking target audience across their Advantage, Reach,

MEGA and AIRE networks. AIRE will serve ads across top-performing stations like “La Mega,” “Latina”

and other highly rated shows, such as “Alex Sensation” and “El Terri Show.”

• “Alex Sensation” is a show hosted by Alex Sensation, an award-winning radio DJ and recording

artist who has become one of the most influential taste-makers in the music industry. His

weekend show was one of the first syndicated radio programs to feature one of the most

powerful Latin DJs, and it spotlights Alex’s top Latin and pop music mixes of the week.

• “El Terri Show” includes a variety of engaging segments that connect with the Hispanic

community. One of the most influential radio personalities, Alberto "El Terri" Cortez, hosts the

show. It has become a top Spanish-language morning show across key Hispanic markets.

The paid portion of the SBS AIRE plan will deliver 12 million paid impressions.

Added Value

The added value of the plan includes the following:

• 120x “El Terri Show”—Presenting Show Sponsor with 360,000 impressions.

• 279 added value units with an estimated 8.6 million impressions.

AIRE has been a strong partner on past NHTSA campaigns due to their high-profile talent and the added

value they continue to increase with each campaign.

In total, SBS AIRE will deliver approximately 20.9 million impressions.

25

Entravision

Radio formats such as Spanish contemporary, Spanish hits, Cumbias/Grupero and Latin urban are

included in the plan to reach the Speed Hispanic target audience. The plan will run :30 spots on

"Somos Cultura.”

• “Somos Cultura” is a year-long, heritage-branded content series that celebrates Hispanic

culture's most important and noteworthy aspects.

The paid portion of the Entravision plan will deliver 22.3 million paid impressions.

Added Value

The added value of the plan includes the following:

• 15 vignette units: Somos Cultura and Nuestra Pachang: 880,000 added value impressions

In total, Entravision will deliver approximately 23.2 million impressions.

Hispanic Radio Network

With over 300 U.S. radio affiliates, Hispanic Radio Network (HRN) will reach the 2023 Speed audience at

a very efficient CPM. Along with the radio affiliates, the plan will include the "Soccer Republic with

Fernando Fiore" show for sports programming coverage to reach the Hispanic target.

• “Soccer Republic with Fernando Fiore” is hosted by Fernando Fiore, one of the most

recognizable personalities in the Spanish-speaking sports world. “Soccer Republic” dedicates

100% of its content to soccer and covers a variety of international games and events that are

extremely popular amongst the Hispanic audience.

The paid portion of the Hispanic Radio Network will deliver 34 million paid impressions.

Added value includes:

• 39 units

• 15 units —“Soccer Republic with Fernando Fiore”

HRN will deliver 9.6 million added impressions.

HRN's low CPMs and high-indexing soccer content makes it an excellent choice for the plan. Also, in past

campaigns, including 2022 Speed, HRN has delivered in full on promised impressions while providing

NHTSA with new tactics year over year.

In total, HRN will deliver approximately 43.6 million impressions.

26

Univision

The Univision plan recommendation includes all major Spanish radio networks, including Futbol Liga

Mexicana news coverage, top-indexing music networks and The Univision Deportes Network (TUDN).

TUDN covers all things soccer with breaking news, highlights and team standings. For the first time, Liga

Mexicana will play in the 2023 Leagues Cup. With its opening group-stage matches starting during the

2023 Speed campaign, Univision will serve the campaign's message to the target audience around a

sport they love.

Univision will deliver 23.6 million paid impressions.

Digital

As a demographic, 18- to 44-year-old males are using the internet, are active on social media and are

avid players of video games. On average, 18- to 44-year-old males spend 5.2 hours daily on the internet,

with heavy users indexing 147 in usage (Figure 14).

Figure 14: Time Spent Using the Internet by 18- to 44-Year-Old Males

Source: 2022 Doublebase GfK MRI Weighted to Population (000)

27

General Market Digital

Publisher Direct

Arena Group—NEW VENDOR

In 2022, The Arena Group acquired the brand license to become the digital publisher for Sports

Illustrated as part of their media portfolio. The Arena Group is a digital media company that publishes a

variety of high-profile digital media brands, including the three featured within this plan: Sports

Illustrated, The Street and Men's Journal. These three sites combine for 16.8 million unique visitors each

month, which matches the Speed target audience of males 18- to 44-years-old. Targeted in-stream

video and the cross-platform display will run across all three sites. Through Sports Illustrated, NHTSA will

receive five Daily Cover Sponsorships throughout the flight that surround the top story of that day with

display and pre-roll units. Sports Illustrated will also feature a homepage takeover that utilizes all display

advertising space to promote awareness of the dangers of speeding.

This will be the first time running with Arena Group on media brands such as The Street and Men's

Journal; however, last year, the 2022 Speed campaign ran with Sports Illustrated. Sports Illustrated

delivered the speed messaging to 19.3 million viewers, and in-stream video delivered a .10% CTR.

Utilizing the homepage takeover, it is the hope to reach this audience again to remind them about the

dangers of speeding.

The Arena Group will deliver an estimated 20.4 million paid impressions.

Added Value

As an added value, Arena will serve an estimated 1 million display impressions.

In total, the plan will deliver an estimated 21.4 million impressions.

Bleacher Report

Bleacher Report (B/R) is a collection of sports journalists and bloggers covering NFL, MLB, NBA, NHL,

MMA, NCAA, NASCAR, fantasy sports and sports culture. B/R will deliver the Speed message through

targeted display and video across all B/R sources, including YouTube. Display media will include the run

of site (ROS) and streaming video banner headers.

Bleacher Report will deliver an estimated 3.5 million paid impressions.

ESPN

The sports calendar for the ESPN campaign will include the PGA 150

th

Open, Tennis Wimbledon and MLB

All-Star Week. ESPN will surround this coverage with non-skippable video-on-demand pre-roll, premium

high-impact units and mobile display banners. The assets will run on all cross-devices to reach the target

audience.

ESPN will deliver an estimated 7.3 million paid impressions.

28

Added Value

ESPN will deliver an estimated 750,000 display added value impressions.

In total, ESPN will deliver an estimated 8.1 million impressions.

IGN

IGN is the leader in games and entertainment media, with a cross-platform reach of 57.6 million for the

target audience of males 18 to 44 years old. The IGN male 18- to 44-year-old audience also over-indexes

for "interest in racing," "consider myself a risk taker" and "car owner." Targeted and high-impact video

and the cross-device display will run across the IGN network. For the 2022 Labor Day Impaired

campaign, IGN over-delivered 121% of paid impressions on top of the significant added value offered

that was pre-negotiated into the plans.

IGN will deliver an estimated 11.5 million paid impressions.

Added Value

IGN will deliver an estimated 2.7 million added value impressions.

In total, the plan will deliver an estimated 14.2 million impressions.

WWE

WWE is a year-round entertainment event popular with the male 18- to 44-year-old target audience.

The WWE YouTube channel is one of the most subscribed channels, with 93.6 million subscribers. Speed

messaging will reach the target audience with a dedicated WWE YouTube pre-roll video. To further

reach the WWE audience online, there is a cross-platform video on all WWE-owned properties, two

homepage takeovers and display banners on the WWE website. WWE delivered 115% of paid

impressions for the 2022 Labor Day Impaired campaign, including strong performance from the

homepage takeover that provided 117% of guaranteed impressions.

WWE will deliver an estimated 7.4 million paid impressions.

Added Value

WWE will deliver an estimated 1 million added value impressions.

In total, the plan will deliver an estimated 8.4 million impressions.

Streaming Audio/Podcasts

Spotify

The Spotify plan will use Audio Everywhere for streaming audio, podcasts and sponsored playlists. The

Audio Everywhere package (audio and banner) reaches the target audiences on any device, in any

environment, during any moment of the day. The audio ads are played between songs during active

sessions. In conjunction with the audio spot, the plan includes a clickable companion display unit that

takes users to the desired campaign’s landing page.

29

The companion banners will not appear while a user is driving. Additionally, utilizing Spotify's Podcast

Audience Network will allow NHTSA to ensure the target audience is reached with a continuous

delivery on budget throughout the campaign. Spotify users reached through podcast ads include both

subscribers and non-subscribers. Adding Spotify's Podcast Audience Network increases Spotify's reach

in the United States by more than 30%. Spotify became the number-one podcast player in the country

last year.

The plan also features two Sponsored Playlists that over-index for the Speed audience: "Top Gaming

Tracks" and "Hip Hop Controller." For one week each, the Sponsored Playlists feature the NHTSA logos

in-playlist and cross-device display overlays. These also include in-playlist audio spots and companion

banners. "Top Gaming Tracks" is one of the most popular playlists for Spotify.

As the top audio platform, Spotify provides consistent delivery with a high reach due to its audience size.

In the 2022 Labor Day Impaired campaign, streaming audio had a unique reach of over 2.27 million. The

Spotify plan had the highest average click-through rate of any audio element by optimizing towards the

top audience segments like automotive and socialites/partiers.

Audio Everywhere/Sponsored Playlist will deliver an estimated 40.1 million impressions; podcasts will

serve an estimated 3.4 million impressions.

In total, Spotify will deliver 43.5 million paid impressions.

Pandora/SXM

Pandora is part of the SiriusXM (SXM) audio network that includes Pandora, Soundcloud, SiriusXM's app

and a range of digital audio publishers with access to 80% of the digital audio ecosystem. SXM will utilize

Streaming Everywhere audio to reach the target audience. Additionally, this tactic will extend the Speed

message past mobile to reach Pandora listeners where they are, including on their smart speakers, TV

apps and tablets. The plan will consist of an accompanying clickable display banner to help drive traffic

to the website and run :30 NHTSA ads. Podcast advertising is also included across the SXM Podcast

Network. Subscribers of SiriusXM will have access to podcasts through the SXM app and online only.

The SiriusXM audio network provides significant reach, with 150 million unique users per month

between their ad-supported offerings. Utilizing both SXM and Spotify extends NHTSA messaging across

all significant audio platforms while maintaining inherently de-duplicated reach between the two based

on their separate audio inventory. Pandora and SXM have demonstrated consistent delivery, including

108% of paid impressions on the 2022 Labor Day Impaired campaign and optimization towards unique

reach delivering ads to 4.5 million unique users for Impaired.

Streaming Everywhere will serve an estimated 11.9 million impressions, and podcasts will serve

approximately 2.9 million impressions for an estimated total of 14.8 million impressions.

30

Digital Video/Online Video (OLV)

The Trade Desk OLV

OLV will run programmatically to reach the target audience across all sites being consumed to increase

the reach and frequency. In addition to the male 18- to 44-year-old targeting, secondary targeting for

dating apps, video games, sports and financial news users is included. OLV will be served on mobile apps

through the open exchange with access to the majority of inventory and will run on the private

marketplace, accessing inventory not available through the open exchange. The Trade Desk does not

include Google inventory.

In addition to the standard video, an in-article custom video unit will begin playing when the user scrolls

to that piece of content.

Utilizing a real-time bid strategy to secure advertising space through the Trade Desk allows for taking

advantage of market efficiencies and often buying inventory at lower rates. When these efficiencies are

achieved, media can be purchased at lower CPMs, allowing more impressions for the same investment.

As a result, the 2022 Labor Day Impaired campaign achieved 163% of planned impressions for Trade

Desk OLV.

TTD OLV will deliver an estimated 16.8 million impressions.

31

YouTube

YouTube offers custom and curated targeting to ensure this campaign reaches the adult 18- to 44-year-

old target audience through various interests, habits and demographics. During the last decade,

YouTube has made strides in brand safety to ensure advertiser ads run in programming that reaches the

demographic, but aligns with the client's values. Their brand safety investments allowed YouTube to

receive Media Rating Council (MRC) accreditation last year.

Direct advertising through YouTube utilizes a similar buying strategy as Trade Desk that can result in

significant bonus impressions. Within the 2022 Labor Day campaign, YouTube had nearly 2.3 million

additional general market impressions.

YouTube will deliver an estimated 18.6 million impressions to the target audience.

Digital Display

Adludio

Adludio delivers high-impact and high-engagement sensory mobile advertisements. Adludio was first

utilized during the 2022 Impaired Holiday Season campaign and provided the largest click volume of any

media partner (264,755). Additionally, Adludio delivered 4.5 million bonus impressions during that

campaign. Adludio uses its first-party data and a combination of contextual, cross-device, look-alike and

interest targeting to reach the right audience with a unique and engaging ad experience while the user is

on their mobile device. See below for examples of the two ad units within this plan.

The plan will deliver an estimated 7.3 million paid impressions.

32

Added Value

Added value as additional impressions for each unit will serve an estimated 733,333 impressions.

In total, Adludio will deliver an estimated 8 million impressions.

The Trade Desk

Display banners will be served to the target audience through TTD for potential CPM savings and the

ability to optimize cross-channel for optimal results. The targeting for programmatic mobile display

will include the target audience and the secondary interest targeting outlined in the OLV section through

the open exchange with access to most inventory and utilizing the private marketplace to access

inventory not available through the open exchange. In addition to the standard display, the plan has

two rich media units. The first begins as a banner at the bottom of the user's screen and then moves to

the bottom corner for an easy click after interacting with content. The second is an enhanced native ad

appearing in content as the user scrolls down the webpage. Adding these two new units will increase

engagement, inherent to rich media units, and display Speed messaging in unique formats to

drive interest.

In the 2022 Labor Day Impaired campaign, TTD Display was able to achieve impressive efficiency, adding

over 65 million bonus impressions through an optimized bid strategy that secured lower CPMs.

Digital display via TTD will deliver an estimated 29.5 million impressions.

Undertone

Using Smart Optimization of Responsive Traits (SORT) technology, Undertone can create specialty

targeting and optimizations to reach the target audience in real-time using cookieless data. SORT places

consumers in SmartGroups based on what they are interested in and Undertone's proprietary data.

Undertone will utilize this data to serve display ads on high-viewability areas of websites where the

message is more likely to be seen while also surrounding premium content.

33

For the 2022 Speed flight, Undertone over-delivered on promised impressions, and the page

grabber had a CTR on tablets at 6.27% and 2.23% on mobile devices. Due to its strong showing last

year, it is recommended once more to deliver this high-impact tactic to raise clicks and awareness of

the campaign.

Undertone will leverage high-impact units to increase awareness and reception of the Speed message.

High-impact units will include:

Page Grabber Cross Screen: A cross-screen full-page unit that responds to user interaction.

Brand Reveal: A cross-screen unit that shows upon user-initiated scroll, encouraging interaction with a

highly viewable display or video integration.

Expandable Adhesion: A mobile high-impact unit that auto-expands to one-third of the screen before

collapsing to a smaller unit that remains as the user scrolls.

34

These Undertone units can achieve high interaction and engagement time. The three units included here

ran on the 2022 Labor Day Impaired campaign. Combined, they reached an average interaction time of

nearly a minute per individual and a total of 41.5 weeks of engagement during the flight.

The plan will deliver an estimated 10.2 million paid impressions and 1 million added value impressions.

In total, Undertone will deliver an estimated 11.2 million impressions.

MobileFuse

MobileFuse specializes in mobile advertising and was the first company to develop a “mobile moments”

strategy to reach the right audience at the right time. Audience targeting leverages first-party data,

exclusive partnerships and real-time triggers like locations and environmental factors to identify key

moments based on when the audience is most receptive to the messaging among their user base of over

191 million unique individuals. Targeting for this plan will also include third-party targeting and app

affinity targeting for users with phone apps relating to automotive, dating, vehicle insurance, finance,

sports and gaming to reach the audience. This plan utilizes standard mobile units and two rich media

units: one expandable display ad unit and one interactive ad unit.

The plan will deliver an estimated 20.8 million paid impressions.

Added Value

MobileFuse will deliver an estimated 2 million added-value impressions.

In total, the plan will deliver 22.9 million impressions.

35

Spanish-Language Digital

Like the general market audience, the Hispanic male target audience is digitally active. Those on the

internet are medium to heavy users (Figure 15), spending an average of 4.9+ hours online. Developing a

multi-platform digital approach improves messaging awareness by speaking to Hispanic users on the

digital sites they actively frequent.

Figure 15: Hours Spent on the Internet Yesterday by Hispanic Males 18 to 44 Years Old

Source: 2022 Doublebase GfK MRI Weighted to Population

Streaming Audio

Pandora/SXM

The Spanish-language plan with SiriusXM (SXM) and Pandora will also use Streaming Everywhere audio

to reach males 18 to 44 years old. Inventory sources include Sonos, TuneIn, SoundCloud, Pandora,

Spanish Broadcasting System (SBS), Idobi, Audiomack and SiriusXM. Targeting also includes Spanish-

language-only audio. As with the general market plan, the assets will consist of audio messages and a

clickable 300x250 companion (display) banner. Audio streamed while driving will not feature a display

banner. The 2022 Labor Day Impaired campaign delivered 107% of contracted impressions due to the

extensive network reach with Spanish-language audio and consistent performance.

The Pandora Spanish plan will deliver an estimated 4 million impressions.

36

Spotify

The Spanish-language plan with Spotify will also use Audio Everywhere to reach the target audience

wherever they are streaming. Audio streamed while driving will not feature a display banner. Targeting

will include Spanish-language audio-only. In the 2022 Labor Day Impaired campaign, Latin streaming

audio was the second-most-listened-to genre, including general market audio. Spanish-language also

delivered one of the highest click-through rates among genres, indicating a high portion of the target

audience is listening to Spotify. Utilizing both SXM and Spotify allows for NHTSA messaging across all

major audio platforms while maintaining inherently de-duplicated reach between the two based on

their separated audio inventory.

Spotify Spanish will deliver an estimated 3.6 million impressions.

OLV

MiQ

MiQ will utilize its proprietary multi-leveled targeting technology to reach the Spanish-language

audience with an OLV component of its plan. MiQ now has access to "Fanatics" sports retail e-commerce

data, allowing additional targeting to sports fans of a specific group to reach a new, highly focused

audience. Fanatics is an online retail website affiliated with all major sports teams that serves as the hub

to purchase any team-branded gear and accessories. MiQ OLV in the 2022 Labor Day Impaired campaign

delivered in total with 106% of the contracted impressions.

MiQ OLV will result in an estimated 2.5 million impressions.

MyCode Media

MyCode acquired HCode and now owns the HCode first-party Hispanic market data and uses the HCode

platform, which has performed successfully on past NHTSA campaigns. In the 2022 Labor Day Impaired

campaign, this OLV had the highest click-through rate of any OLV vendor and over-delivered on

impressions by 0.64%. HCode has access to over 400 publisher partners to reach over 32 million of the

U.S. Hispanic audience. NHTSA will utilize sites that index high for the target audience spanning topics,

including food, pop culture and automotive on sites like Kiwilimón, LaVibra and SiempreAuto. Through

OLV, MyCode/HCode will reach Hispanic male viewers ages 18 to 44 years old and drive awareness to

reduce speeding incidents with premium video units.

MyCode OLV will result in an estimated 1.6 million impressions.

37

Unanimo Deportes

Unanimo Deportes is a digital-first, multi-platform media company specializing in sports news and

entertainment relevant to Spanish-speaking fans. Unanimo will use its cross-platform digital video

surrounding suitable sports, lifestyles and entertainment to reach the target audience. In the 2022 Labor

Day Impaired campaign, Unanimo OLV delivered in full to the Spanish sports audience and had a

respectable CTR of .15%.

Unanimo OLV will deliver an estimated 800,000 impressions.

YouTube

YouTube offers custom and curated targeting to ensure this campaign will reach the adult 18- to 44-

year-old target audience. It will maintain a cost-effective CPM and brand safety placement. The

projected Spanish audience groups for 2023 are sports fans, music lovers, social media apps and vehicle

owners. Spanish-language YouTube surpassed the click performance of general market YouTube in the

2022 Labor Day Impaired campaign, including a higher CTR at .1%.

YouTube will deliver an estimated 10.7 million impressions.

Digital Display

MiQ

MiQ will utilize its proprietary multi-leveled targeting technology to execute a display component of the

plan. MiQ now has access to "Fanatics" sports retail e-commerce data, allowing additional targeting to

sports fans of a specific group to reach a new, highly focused audience. MiQ consistently delivers in total

and provides a guaranteed solution to reach the target audience at scale.

MiQ display will result in an estimated 17.5 million impressions.

Added Value

Added value for the plan will deliver an estimated 2 million display impressions.

In total, MiQ display will deliver an estimated 19.5 million impressions.

MyCode Media

MyCode acquired HCode and now owns the HCode first-party Hispanic market data, and can still use the

HCode platform, which has performed successfully on past NHTSA campaigns, including the 2022 Labor

Day Impaired campaign that had the highest CTR (0.91%) of any Spanish-language display partner.

HCode has access to over 400 publisher partners to reach over 32 million in the U.S. Hispanic audience.

NHTSA will utilize sites that index high for the target audience spanning topics, including food, pop

culture and automotive, on sites like Kiwilimón, LaVibra and SiempreAuto. MyCode/HCode will reach

Hispanic males 18- to 44-years-old and drive awareness to reduce speeding incidents with various

display units.

38

MyCode will deliver an estimated 7 million impressions.

Added Value

Added value for the plan will deliver an estimated 1 million display impressions.

In total, the MyCode display will deliver an estimated 8 million impressions.

Unanimo Deportes

Unanimo Deportes is a digital-first, multi-platform media company specializing in sports news and

entertainment relevant to Spanish-speaking fans. Unanimo will utilize its cross-platform digital display

surrounding relevant sports, lifestyle and entertainment to reach the target audience. In the 2022 Labor

Day Impaired campaign, the Unanimo display was delivered in full to the Spanish sports audience and

had a high ad interaction rate of 2.93%.

Unanimo display will deliver an estimated 4.4 million impressions.

General Market Gaming Publisher Direct

Not only are 18- to 44-year-old males tuning into traditional sports, but they also watch and attend

esports tournaments. Gen Z and Millennial males over-index the highest for watching esports, although

it is the media vehicle to reach Gen Z the most, with that demographic over-indexing at 319. Gen Z also

indexes higher than Millennials when attending and playing in an esport event (Figure 16). When an

audience shows indexing that high for a tactic, it shows that the core audience of that tactic falls within

that demographic.

Figure 16: How Gen Z and Millennial Males Connect With Esports

Gen Z Males

(B.1997-2010) [Only Includes

Respondents Aged 18+

Millennials Males

(B.1977-1996)

Index

Index

Watched An Esport Event On Tv/Online

319

191

Attended Esport An Event

187

138

Played In An Esport Event

298

167

Source: 2022 Doublebase GfK MRI Weighted to Population (000)

Dexerto

Dexerto is an entertainment media group that engages over 100 million monthly fans in trending topics

across gaming, esports, TV, movies, tech and social media. Their team of experienced gaming, esports

and entertainment journalists helps millions of fans get the most out of their passion, providing expert

assistance with top gaming tips and guides and recommending the best tech that helps players reach

the pinnacle of their game, like their favorite esports pros or streamers.

39

Dexerto speaks directly to the Speed targeted demographic, with 76% of their fans being male and 70%

falling between 18 and 34 years old. This allows the campaign to speak directly to the younger part of

the Speed targeted demographic. The 2023 Speed plan will have three main tactics to reach the

audience: custom video content, coverage around gaming tentpole events and digital amplification. See

below for a more in-depth look into these tactics:

Convo In 60 Secs

• Dexerto/NHTSA will team up with video game streamers to shoot three “Convo in 60 Secs”

episodes in a studio with the influencers in person. The one-on-one conversation between the

Dexerto host and influencer will cover many topics, from entertainment to lifestyle, hitting

contextual themes that align with the Speed messaging, like the importance of protecting their

success and others that have helped them get there on their journey.

• Talent will be given a series of rapid-fire questions to uncover insights into their success,

challenges and advice for aspiring content creators. The project aims to inspire individuals to

embrace a more thoughtful approach to achieving their goals/destinations rather than

constantly seeking the fastest path.

• Dexerto understands the importance of brand-safe influencers and will engage some of the

biggest influencers within the esports and gaming community while keeping brand safety in

mind.

Livestream Activations: “Slow Ride: Take It EZ Streams”

• Dexerto and NHTSA will team up with video game streamers personalities who specialize in

speed runs, commonly referred to as speed runners. A speed run is when gamers try to beat a

game as quickly as possible, usually finding glitches in games that help them skip ahead. These

streams receive millions of views as players try to beat personal or world records.

• During the streams, the speed runners will share their experiences and insights on the speed-

running community and how speed is better left to the digital landscape. They will highlight the

importance of safety on the road and the consequences of speeding.

Editorial Alignment—“Lan Speed Records”

• Dexerto will offer five written editorials running around Dexerto.com and their social media

platforms. The editorials will seamlessly tie in with the NHTSA Speed message and highlight

content creators/gaming influencers holding the fastest or unbeatable speed run records. This

series of editorials will be named Lan Speed Records, and NHTSA will have 100% media SOV

across the published articles onsite for the duration of the 2023 Speed flight.

Speed Prevention Landing Page

• The Dexerto plan also includes a custom-made Speed Prevention landing page to give all assets

their own hub on Dexerto.com.

40

Digital Amplification: Targeted Video and Display Ads

• Dexerto will target 18- to 44-year-old males on the main webpage through :15 pre-roll and

standard display ads. All tactics will have over 71% viewability as a benchmark.

• The plan will also include a more prominent display unit called the Skybox that will take over the

top of the page of a Dexerto news article, allowing for 90% viewability. This ad can be animated.

• Lastly, the display units will include an interscroller ad. These are ads that readers must scroll

through to continue reading an article. This tactic also has a benchmark of 90% viewability and

can be animated.

With these tactics, NHTSA will cover all of Dexerto’s brand-safe social sites. For custom content, Dexerto

will work closely with NHTSA to ensure creators, videos and shows have client approval before running.

Dexerto will deliver 42.2 million paid impressions and 6.5 million bonus impressions.

In total, Dexerto will deliver 48.7 million impressions.

Game Informer

Game Informer is the top gaming digital magazine and one of the leading gaming websites, reaching

over 4.4 million unique visitors. The plan features a variety of tactics across Game Informer properties to

get the Speed target audience, including cross-device display overlays and a rotational takeover

targeting the homepage and category pages, standard display banners, video targeting trending news

content and sponsorship of “The Game Informer Show” and “All Things Nintendo.” These two shows are

available on the Game Informer website, YouTube and all podcast platforms. Show sponsorships include

a pre-roll and mid-roll live read with the NHTSA logo. Additionally, the plan consists of a full-page spread

promoting the Speed messaging in the magazine's digital edition on July 28 that reaches their database

of over 5 million readers. Those impressions are not included in the total below, as Game Informer

cannot provide audience demographics for the digital edition due to cookie changes on the website.

Based on a readership survey, the digital edition has a 72% male audience, with 51.3% aged 18- to 34-

years-old and 44.7% aged 35-years-old and above. Within the 2022 CIOT campaign, Game Informer

achieved a high CTR among clickable units of .52%, which the mobile overlay unit headlined at a 2.39%

CTR.

Game Informer will deliver an estimated 1.3 million paid impressions.

Added Value

The buy will also include a display ad on their weekly newsletter that is delivered to Game Informer

subscriber inboxes that highlights gaming news. This will deliver an estimated 320,000 added value

impressions.

In total, the plan will deliver an estimated 1.7 million impressions.

41

GlassView

In addition to CTV, the Glassview buy will include English and Spanish displays integrated into in-game

video environments. Glassview can input standard banner ads into iOS, PC and console games. Below is

an example of how the ads will look while playing the game. Glassview understands that ads must run in

brand-safe games, and the buy focuses on sports and puzzle games that connect with the target

audience.

This tactic allows the Speed message to be integrated organically into a captive gaming audience. Games

will be chosen based on how well they tie back to the campaign's messages with a focus on racing and

sports games.

Glassview will deliver 6.7 million paid impressions and 338,000 added value impressions to the

general market and 2 million paid impressions and 101,000 added value impressions to the

secondary Hispanic target.

In total, the Glassview gaming display plan will deliver 9.2 million impressions.

Go Media

Go Media is a premium digital publishing company that houses brand sites focusing on viewers'

passions, lifestyles and pop culture. Across their brands, Go Media has received 99 million unique

visitors, 334 million video views and 46 million social followers. The 2023 Speed plan will target 18- to

44-year-old males who are gamers and sports enthusiasts. Run of site video pre-roll and banner ads will

run throughout the campaign on the Go Media sites of Deadspin, Kotaku, Gizmodo, and Jalopnik. See

below for brief overviews of each site:

42

• A.V. Club—The A.V Club is pop culture obsessives writing for the pop culture obsessed with the

site focusing on all things film and TV.

• Deadspin—Deadspin is the ultimate fan-first destination for comprehensive sports coverage,

delivering daring sporting scoops and game analysis.

• Kotaku—Kotaku examines video games, game creators and players through their inescapable

influence on culture and is committed to proving that gaming is for everyone.

• Gizmodo—Gizmodo covers the world of tech, science and design with insights and technical

accuracy—including io9, a designated hub for all things gaming and geek culture.

• Jalopnik—Jalopnik is the ultimate destination for auto enthusiasts, going beyond makes and

models to cover the culture that matters to car lovers.

In addition to the run of site assets, the campaign will include multiple high-profile first impression

takeovers. NHTSA messaging will hold high-visibility placements for the entire day; an example can be

seen below. The plan consists of one day of takeovers on Deadspin, Jalopnik, Gizmodo, AV Club and

Kotaku. All of these topics are of interest to the 2023 Speed 18- to 44-year-old demographic, allowing

the message to meet the target audience when they are looking for news and highlights about their

favorite sports/hobbies. Dates will be picked closer to the flight to ensure takeovers are running during

key dates during the flight, including the MLB All-Star game, significant game/movie releases and

esporting events.

Example of First Impression Takeover Placements

43

Go Media will deliver 17.1 million impressions.

General Market Gaming OLV

Twitch

Twitch is a leading platform for e-gaming and entertainment streams among young adults. Twitch

reaches people within the target audience with an affinity to gaming and esports, utilizing non-skip

premium video ads directly in broadcasts. Each placement is layered with Amazon audience targeting to