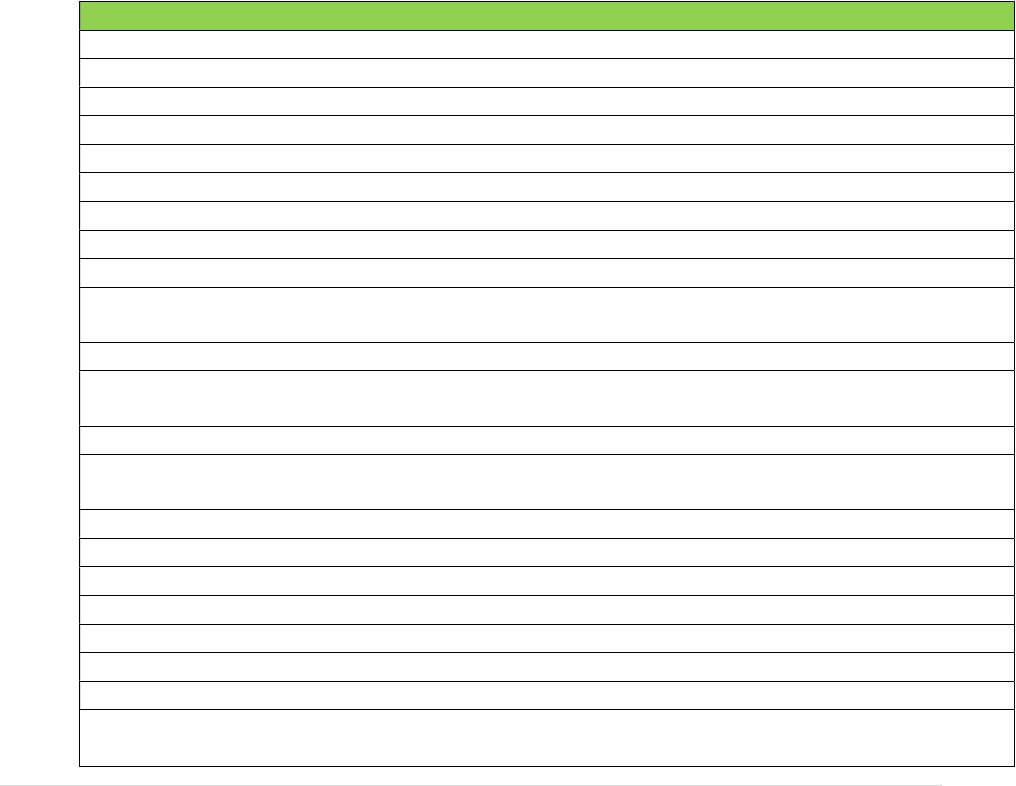

Clayton State University Travel Policy

and Procedures

Budget & Finance Office

CLAYTON STATE UNIVERSITY | REVISED June 2020

1 | P a g e J u n e 2 0 2 0

TABLE OF CONTENTS

INTRODUCTION .......................................................................................................... 5

1.0 TRAVEL ............................................................................................................... 5

1.1 GENERAL POLICIES AND RESTRICTIONS .................................................... 6

1.2 TRAVEL REGULATIONS.................................................................................... 7

1.3 TRAVEL AUTHORIZATION ................................................................................ 7

Prior Approvals

Approval Requirements

Business Purpose Justification and Explanation Statements

Standing Authorization to Travel Within the State of Georgia

1.4 SUBSISTENCE (MEALS & LODGING) ............................................................ 9

Purchase of Food Using Institutional Funds

Reimbursement Claims

Limits on Meal Allowances

Meals Associated with Overnight Travel

Meals Associated with Non Overnight Travel

Day of Departure and Return

Meals Included in Registration Fees

Per Diem Allowance for Meals Associated with Overnight Travel outside of

Georgia

Meals Not Associated with Overnight Travel

Documentation Relating to Meals

Meal Expenses Incurred While Taking Leave

Employee Group Meals

Employee Group Meals Involving Multiple Institutions

Non-Employee Group Meals

Special Meals

Regulations Governing Lodging Costs

Authorization for Lodging within the 50-mile Radius

Georgia’s “Green Hotels” Program

2 | P a g e J u n e 2 0 2 0

Georgia Excise Tax

Shared Lodging

Lodging Expenses Incurred While Taking Leave

Other Charges on Lodging Receipts

Required Documentation

Receipt Requirements

1.5 TRANSPORTATION ............................................................................................ 24

Vehicle Transportation

Use of Rental Vehicles

Reimbursement for Use of Personally Owned Vehicle

Limitations and Requirements for the Use of Personal Vehicles

Determination of Business Miles Travelled

Prohibited Mileage Reimbursement

Recording Mileage Driven

Parking/Tolls

Rental Vehicles

Ride Share

Travelers with Physical and/or Medical Conditions

Commercial Air Transportation

Baggage Charges

Upgrades to Non-Coach Travel

Airline Cancellations

Fees for Changes in Flights

Airline Departure and Return

Airline Reservations

Fly America Act

Private Aircraft Transportation

Travel by Railroad

Mass Transportation

Required Documentation of Expenses

3 | P a g e J u n e 2 0 2 0

1.6 MISCELLANEOUS EXPENSES ......................................................................... 36

Registration Fees

Baggage Handling Services

Telephone/Telegraph/Fax Expenses

Stationary/Supplies/Postage Expenses

Visa/Passport Fees

Internet Usage Charges

Non-Reimbursable Expenses

Restrictions Upon Combining Personal Travel with State Business Travel

1.7 REIMBURSEMENT PROCEDURES .................................................................. 39

Responsibility for Processing

Prior Approval Amount Limits

Submission by Employee and Time Constraints

Processing Time by the Travel & Expense Analyst

Distribution of Funds

1.8 TRAVEL PROCEDURES FOR EMPLOYEES...................................................... 40

Request for Travel Authorization

Travel Cash Advance

Internal Revenue Service Requirements

Travel Advances- Purpose and Intent

Travel Advance Request

Timing and Amount of Cash Advances

Accountability and Responsibility for Funds Advanced

Travel Advance and Expense Reconciliation

Recovery of Cash Advances for Continuous Travel

1.9 TRAVEL EXPENSE REPORT .......................................................................... 45

1.10 REGISTRATION FEES AND ASSOCIATED MEMBERSHIP FEES ................ 46

Registration Fees Prepaid by the University

Registration Fees Paid by the Employee

Registration Fees Paid Using the Departmental

Purchase Card

4 | P a g e J u n e 2 0 2 0

1.11 PROVISIONS FOR AUTHORIZED NON-EMPLOYEES ................................... 47

Student Team and/or Group Travel

1.12 STUDENT EMPLOYEE TRAVEL .................................................................... 49

1.13 INTERNATIONAL TRAVEL .............................................................................. 49

Air Travel

International Meals & Incidentals Reimbursement

Other International Travel Expenses

Foreign Currency Conversion

1.14 FREQUENTLY ASKED QUESTIONS ............................................................... 51

REPAYMENT AGREEMENT ........................................................................... 66

5 | P a g e J u n e 2 0 2 0

CLAYTON STATE UNIVERSITY

TRAVEL POLICY & PROCEDURES

Introduction

The purpose of this Policy is to provide guidelines to state agencies for

payment of travel expenses in an efficient, cost effective manner, and to enable

state travelers to successfully execute their travel requirements at the lowest

reasonable costs, resulting in the best value for the State. Teleconferencing

instead of travel should be considered when possible. Each agency is charged

with the responsibility for determining the necessity, available resources and

justification for the need and the method of travel.

1.0 Travel

The Statewide Travel Policy applies to all State Agencies, including Units of the

University System of Georgia (USG), therefore, USG institutions shall be guided

by general travel regulations set forth in this section when employees are

required to travel away from headquarters in the performance of their official

duties. Therefore, all USG employees, especially those responsible for

authorizing, approving and paying travel costs, should establish a good working

knowledge of the travel regulations in the Statewide Travel Policy. The Sections

below will provide additional narrative and guidance on various areas of the

Statewide Travel Policy in order to provide more clarity, especially if USG applies

a more stringent interpretation of travel requirements. The State Accounting

Office (SAO) provides as follows:

“Agencies are not authorized to set more lenient policies than the Statewide

Travel Policy; however, agencies may establish policies that further restrict an

employee’s travel if the agency determines that stricter policies are necessary,

except that a mileage rate that is different than the rates established by

SAO/OPB in accordance with O.C.G.A. § 50-19-7 may not be adopted”.

Note: Guidelines for requesting exceptions to the Statewide Travel Policy are

found in Section 8 of the Policy. SAO and OPB are responsible for issuing any

exceptions. Any requests for exceptions for the USG must be handled through

Fiscal Affairs.

Note: The Policy is based on travel industry best practices and with total cost

management in mind. As such, it is important for employees to understand the

intent of the Policy and work with their management on managing work related

travel, accordingly. “Institutions of the University System of Georgia shall be

guided by general travel regulations developed by the State Accounting Office in

6 | P a g e J u n e 2 0 2 0

cooperation with the Office of Planning and Budget, and as set forth in the

Board of Regents Business Procedures Manual.

The travel policies and regulations of Clayton State University conform to the

regulations and procedures referenced above, and also incorporate more

specific procedures and limitations which apply to the employees of the

university. The responsibility for appropriate audit, approval, and reimbursement

of travel expense statements is vested in the appropriate institutional officials.

Clayton State University officials may impose additional requirements for travel

expense reimbursement and reporting at their own discretion.

The processing and review of all travel approvals and reimbursements are

managed by the Clayton State University Budget & Finance Department. The

University utilizes PeopleSoft Financials for processing Travel Expense

Reports; however, obtaining prior approval to travel remains a manual process.

1.1 General Policies and Restrictions

Clayton State University reimburses travelers for reasonable and necessary

expenses incurred in connection with approved travel on behalf of the State.

A necessary expense is one for which there exists a clear business purpose and

is within the State’s expense policy limitations. A clear business purpose

contains all information necessary to substantiate the expenditure including a list

of attendees, if appropriate, and their purpose for attending, business topics

discussed, or how the expenditure benefited the university.

Establishing policies and procedures for travel expenses enables the

university to effectively comply with federal and state regulations.

These policies and procedures apply to reimbursements from all State

fund sources.

These policies are intended to be guidelines for the reimbursement of all

university approved travel expenses. There are several key points to remember

when incurring expenses on behalf of the University:

• Under no circumstances should an individual approve his/her own

expense report. In most cases he/she should not approve the

expense reports of a person to whom he/she functionally or

administratively reports. The State Accounting Office does grant a

specific exemption for presidents of institutions. The exception is

quoted below:

Exception – Presidents of institutions under the umbrella of the

University System of Georgia or the Technical College System of

Georgia are excluded from the requirement that their expense report

must be approved by their immediate supervisor or higher

7 | P a g e J u n e 2 0 2 0

administrative authority. However, processes should still be in place for

their expense reports to be reviewed for appropriateness and

reasonableness.

• A large number of exceptions or policy violations will increase the

likelihood of expense report audits.

• The State/University will not pay for personal expenses.

1.2 Travel Regulations

In requiring employees to travel in the performance of their duties for which

there exists a clear business purpose, Clayton State University will

reimburse those employees for reasonable and necessary expenses that are

incurred (and are within the university’s and the state’s expense policy

limitations) while traveling away from their official headquarters and places of

residence. In cooperation with regulations promulgated by the State

Accounting Officer, in cooperation with the Office of Planning and Budget,

and the Board of Regents, Clayton State University has adopted the

following regulations regarding travel of employees on official business of the

University. It is believed that these travel regulations will protect the best

interest of the employee and Clayton State University. Teleconferencing

instead of travel should be considered when possible. The State Accounting

Officer is responsible for establishing Statewide Travel Regulations for all

agencies, boards, and commissions of the State. Complete information

about the Statewide Travel Regulations is available from the State

Accounting Office web site at http://sao.georgia.gov/state-travel-policy.

The Board of Regents has further defined the travel regulations for all units

of

the University System of Georgia. These regulations are detailed in the USG

Business Procedures Manual, Section 4. The USG Business Procedures

Manual is available at:

http://www.usg.edu/business_procedures_manual/section4/

1.3 Travel Authorization

Prior Approvals

Employees required to travel in the performance of their official duties and

entitled to reimbursement for expenses incurred shall have prior authorization

from (1) their immediate supervisor/budget manager and (2) other approvals as

required by their department. A travel authorization is required for those

individuals who are required to make occasional trips. The travel authorization

shall be in such form as to indicate the itinerary, the estimated cost of travel,

the mode of transportation, the general purpose of travel, and the name/phone

8 | P a g e J u n e 2 0 2 0

number of a contact person in the requestor’s department to be used when the

employee is on travel status. International travel must be approved by a

higher-level authority.

Employees should fill out the paper Travel Authorization form and acquire

approval from the department head or designated official PRIOR to the travel.

The Travel Authorization must be included with all expenses related to the travel

request. Please do not submit travel authorizations through the Expenses

Module at this time. The Travel Authorization form may be accessed at:

http://www.clayton.edu/accounting-services/expenses/travel/forms and selecting

Travel Authorization Form. The form is an excel spreadsheet and allows on-line

completion and printing of the completed form.

Approval Requirements

A traveler’s immediate supervisor/budget manager must approve a travel

expense report before reimbursement will be issued. Institutions may require

multiple approvers for certain expense reports; in these instances, all approvers

in the submission process are held accountable. The approver should be in a

higher level position of authority that is able to determine the appropriateness

and reasonableness of expenses.

Exception – Presidents of institutions of the USG are excluded from

the requirement that their expense reports must be approved by their

immediate supervisor or higher administrative authority. However,

processes should still be in place for their expense reports to be

reviewed for appropriateness and reasonableness.

The specific provisions of the accounting review process related to

travel expenses will be left to the discretion of each institution. However,

the institution’s accounting review process must meet the following

minimum requirements:

Department heads and Deans should designate a person(s) to examine

and approve claims for reimbursement under these travel regulations

Claims should be reviewed to ensure they are reasonable, accurate,

and cover expenses actually incurred by the employee during the

authorized travel dates and times

Claims exceeding established limits should receive special scrutiny to

ensure the explanations are sufficient to justify the higher amount.

Employees should not assume all expenses exceeding allowable limits

will be automatically approved for reimbursement.

9 | P a g e J u n e 2 0 2 0

By approving travel expenses, the approver is attesting that each transaction

and supporting documentation has been thoroughly reviewed and has verified

that all transactions are allowable expenses. Each transaction must be

consistent with departmental budget and project/grant guidelines.

Business Purpose Justification and Explanation Statements

In cases where a submitted expense does not conform to university policy, or if a

receipt is lost or missing, an explanation is required when submitting the expense

with the Expense module in PeopleSoft. The expense report in PeopleSoft has

an available comment field for explanations or documentation of business

purpose justifications. Comments must be provided in this field explaining why

this exception to policy was necessary, or to describe the missing

documentation. The individual’s immediate supervisor or higher administrative

authority must approve these statements.

1.4 Subsistence (meals and lodging)

Purchase of Food Using Institutional Funds

The purpose of this section is to clarify those instances when food may be

purchased for consumption by students, potential students, volunteers and

employees using institutional funds. This policy addresses instances when food

may be purchased or food expenses may be reimbursed that are not otherwise

addressed in the Business Procedures Manual, Section 4.0 and 19.7.

Food includes meals, beverages, snacks, etc., but specifically excludes alcohol

as an allowable food expense. The purchase of food for resale in connection

with the auxiliary operations of an institution is allowable and is not addressed in

this policy. Snacks are reimbursable items but limited to a daily amount of

$5.00/person.

An individual may be subject to different rules depending on the capacity in which

they are participating in an event. For example, volunteers might include

employees or students if the individual is operating in a capacity separate from

their employee or student role. An employee or volunteer attending a student

event in the capacity of a student would be considered a student. A student

worker participating in an event while being paid would be considered an

employee.

Employees include temporary, part-time, and full-time staff, faculty,

administrators, resident assistants (RAs), student assistants, and other

student workers.

10 | P a g e J u n e 2 0 2 0

Other instances, when food may be purchased for employees or employees

may be reimbursed for food purchased. These instances are addressed using

the following general categories:

• Safety. Water or other hydration products may be purchased insofar as

these products are required by OSHA or are necessary to prevent

serious harm to an employee.

• Academic Programs, Student Events, and Educational or Business

Meetings Involving Predominantly Non-Employees. When conducting

a program, event or meeting involving predominantly non-employees (of

any institution of the Board of Regents) where attendance by the

employee is essential and in furtherance of an official institutional

program, and the meal is an integral part of the meeting, an employee can

partake in the meal and be reimbursed for his or her actual meal cost up

to the per diem limits established in BPM Section 4.4. An employee may

not be paid a reimbursement unless the employee actually incurs a cost.

Clarification of specific instances of allowable reimbursement include:

• Athletic recruiting. An employee may be reimbursed for food purchased

at a meeting whose primary purpose is the recruitment of an individual to

attend the institution. The employee’s participation in this meeting should

be required as part of his or her job duties, and the institution should

strictly control the numbers of individuals who may receive reimbursement

for food purchased at a given recruitment meeting.

• A prior/existing contractual or grant arrangement, which must be quid pro

quo, not gratuitous. For example, an external organization may award

funds to the institution with the specific proviso that these funds may be

used for employee food expenses as it relates to grant activities or

meetings. In this instance, food could be purchased within the contract or

grant guidelines.

However, federal grant funds should NOT be used to purchase food for

employees unless the federal grantor agency, in writing, authorizes this

expenditure and certifies that this waiver is not a violation of applicable

federal regulations.

The business purpose should be clearly indicated on any invoices submitted for

payment. Additionally, the per diem limits of BPM Section 4.4 apply to food

purchased for consumption by employees participating in a program, event, or

meeting or otherwise reimbursed to the employee by the institution.

Per Diem limits apply only to food purchased with institutional funds. Food

purchased by outside organizations does not fall under the scope of this

policy. However, employees must comply with the provisions of Section 8.2.13

of the BOR Policy Manual as it pertains to receiving gifts.

11 | P a g e J u n e 2 0 2 0

Institutional funds may be used to purchase food for students at sanctioned

student events. Sanctioned student events include events and travel sponsored

by recognized student groups, athletic team events, and other campus events

open to the general student body and designed to further the development and

education of students. Additionally, food may be purchased for a class in those

instances where food is an integral part of the instructional methodology. For

example, food could be purchased for students in a food appreciation or

cooking class offered by a Continuing Education unit. While not necessarily in a

travel status, the per diem limits in BPM Section 4.4 should apply to food

purchased for consumption by students participating in sanctioned student

events.

Potential students and their guardians may be provided food at an event

designed to encourage the student to attend the institution. Food for athletic

recruits may be purchased subject to the rules and regulations of the

athletic conference of which the institution is a member.

Institutional funds may be used to purchase food for volunteers in those

instances where a quid pro quo relationship exists. For example, an academic

unit might form a volunteer advisory board for the purpose of obtaining advice,

support, and expertise from members of the community as it relates to an

academic program. It would be allowable to provide food to those volunteers as

part of the advisory board meeting. However, food purchased solely in

connection with volunteer appreciation or volunteer recognition events would

not be allowable under this policy. While not necessarily in a travel status, the

per diem limits in BPM Section 4.4 should apply to food purchased for

volunteers.

Reimbursement Claims

Reimbursement claims for subsistence (meals and lodging) are to be reported

using the on-line expense report (available in the PeopleSoft Employee Self

Service module) by date, location, and amount for each meal and lodging

claimed. Meals are reimbursed on a per diem basis, not on actual meal expense

unless the actual expense is less than the per diem rate. Out-of-state travel

expenses for meals and lodging will be reimbursed up to the maximum as

allowed by the Federal Per Diem Rates. An employee taking annual leave while

away from headquarters on official business is not entitled to subsistence for the

period of the leave.

Limits on Meal Allowances

12 | P a g e J u n e 2 0 2 0

Employees traveling within the State of Georgia or Out of State (United States

and Canada) are paid a per diem amount designed to cover the cost of meals

(including taxes and tips), based on the number of meals per day for which the

traveler is eligible. Gratuity outside of the per diem amounts will be

reimbursed up to 18%. The official State of Georgia meal allowance schedule,

published at:

http://sao.georgia.gov/sites/sao.georgia.gov/files/related_files/site_page/SOG%2

0Meal%20Allowances%202014.pdf, sets the maximum allowable reimbursement

for meals for travel within the State of Georgia. The federal per diem rates will be

used to determine all out of state per diem.

Calculations in examples used for explanation later in this section are based

upon the maximum meal allowances set at the time of publication of this

manual. When these official meal allowances change, this manual may not have

the examples changed immediately. If that case occurs, the official meal

allowances on the web site referenced immediately above will be used in place

of the limits in the examples.

The Meal Allowances provide different limits for standard in-state per diem rates

and for hi-cost area rates. At the time of publication of this manual, the high cost

areas were limited to the following counties: Chatham, Cobb, DeKalb, Fulton,

Glynn, and Richmond counties. If these counties are changed on the official web

site referenced above, then the new list of counties will control what is

considered a high cost area, regardless of examples published in this section.

Meals Associated with Overnight Travel

Employees traveling overnight may be paid a per diem amount designed to

cover the cost of three (3) meals per day. Employees traveling overnight

within the State of Georgia are allowed 100% reimbursement on the first and

last day of travel, less any meal(s) provided. Employees traveling overnight

outside the state of Georgia are eligible for 75 percent (75%) of the total per

diem rate on the first and last day of travel. For example on the first day of

travel an employee has meals that consist of breakfast/lunch/dinner then the

per diem allowance will be ($50.00 x 75%) = $37.50.

For trips involving multiple travel destinations, base the reduction on the

per diem rate in effect where the night was spent as follows:

• Departure Day: Where you spend the first night

• Return Day: Where you spend the night before returning to home

base.

Employees on official business attending luncheon or dinner meetings are

entitled to receive reimbursement for actual costs incurred, provided that:

13 | P a g e J u n e 2 0 2 0

• The purpose of the meeting is to discuss business and the nature

of the business is stated on the travel expense report

• The luncheon or dinner meeting is planned in advance and

includes persons not employed by the university

• The meal is an integral part of the meeting

• The meal is served at the same establishment that hosts the

meeting

Employees who are reimbursed for any of these circumstances are still

expected to remain within the authorized meal limits.

Meals Associated With Non Overnight Travel

Although Statewide Travel Policy 4.5 allows for meal per diem during non-

overnight travel when employees travel more than 50 miles from their

residence and primary workstation on a work assignment AND are away for

more than (12) hours, the USG does not provide meal per diem during non-

overnight travel due to the IRS taxable compensation implications.

Day of Departure and Return

Travelers outside the State of Georgia are eligible for 75 percent of the total

per diem rate on the first and last day of travel. For example, if the per diem

rate allows a $50 total reimbursement, $37.50 [($50 x .75= $37.50] would

be allowable on a travel departure or return day.

For trips involving multiple travel destinations, base the reduction on the

per diem in effect for where the night was spent as follows:

• Departure Day: Where you spend the night.

• Return Day: Where you spent the night before returning to home

base.

When meals are provided at no cost in conjunction with travel events on a

travel departure or return day, the full meals per diem reimbursement rate is

reduced by the full amount of the appropriate meals after the 75% proration.

For example, if the per diem allows a $50.00 total reimbursement, and

lunch was provided at no cost on a travel departure or return day, the total

allowable reimbursement for that day would be $23.50 [($50 x .75) - $14

lunch = $23.50)].

Meals Included in Registration Fees

14 | P a g e J u n e 2 0 2 0

If any meal is included as a part of the cost of a conference registration,

etc., such meal should not be considered eligible in the calculation of per

diem and an employee may not receive per diem for the normally eligible

number of meals. For example, if conference registration includes breakfast

and lunch, the employee will only receive per diem for the dinner meal.

Because most conferences, etc., accommodate a variety of dietary

needs/restrictions, employees are expected to participate in such meals.

In rate circumstances, an employee may be unable to participate in a

conference meal. In such a case, the employee may request the per diem

amount associated with the meal purchased. If requesting such

reimbursement, a receipt documenting the meal purchase must be

attached to the travel expense statement, and a justification for the meal

purchase must be indicated on the statement.

Per Diem Allowance for Meals Associated with Overnight

Travel outside Georgia

Employees are considered traveling outside Georgia when their official

responsibilities must be performed at an out-of-state location.

Note: Employees who are working in Georgia but lodging in another state

are not traveling outside Georgia. Travel to points just beyond the state

border necessary for the accomplishment of in-state business shall not be

construed as out-of-state travel for the purpose of these regulations.

The federal per diem rates and meal amounts applicable to travel outside of

Georgia can be found at the following web sites:

Federal per diem rates for locations within the continental

United States: http://www.gsa.gov/perdiem

Breakdown by meal for federal per diem

amounts: http://www.gsa.gov/mie

Federal per diem rates for foreign travel:

http://aoprals.state.gov/web920/per_diem.asp

Breakdown by meal for foreign per diem amounts:

http://aoprals.state.gov/content.asp?content_id=114&menu_id=8 1

Federal per diem rates for Alaska, Hawaii, and US territories and

possessions: http://www.defensetravel.dod.mil/site/perdiemCalc.cfm

Note: Statewide Travel Regulations do not authorize employees to receive a per

diem-based reimbursement for meals purchased during a “lunch meeting” in

15 | P a g e J u n e 2 0 2 0

which the meal and the meeting are one and the same. The registration fee

serves as the basis for reimbursement, not the per diem allowance.

Documentation Relating to Meals

Receipts for meals are not required, except when requesting reimbursement in

lieu of a meal provided within a conference registration fee due to dietary

needs/restrictions. Times of departure (for the day of departure) and return (for

the day of return) should be noted on the employee expense report to

substantiate meals eligible for payment of per diem. All meals included as a

part of conference registration fees, etc., should be noted on the expense

report. Meal expenses incurred that exceed the authorized per diem amounts

due to travel in high cost areas or out-of-state should be itemized separately

and explained on the expense report and are eligible for reimbursement as

determined by the Budget & Finance Department/Chief Business Officer.

Meal Expenses Incurred While Taking Leave

Employees who take annual leave while on travel status may not be

reimbursed for meal expenses incurred during the period of leave.

Employee Group Meals

Under certain infrequent circumstances, employees may be required to remain at

the work site during mealtime. Such circumstances include emergency

situations, but may also include intra-departmental meetings or training sessions

where the meeting or training session extends beyond the meal times and the

employees are not permitted to leave the premises of the meeting site. Group

meals can only be provided in instances where the meeting is a minimum of four

(4) hours.

Under these and similar circumstances, organizations may purchase meals for

the affected employees. Purchase of such meals should be approved by a

higher level approving authority prior to the date of the event (for non-

emergency situations). Such expenditures are limited to the purchase of meals

and necessary beverages only (this does not include snacks). Meal limits

outlined in the Statewide Travel and Expense Policy must be adhered to. Meal

expenses associated with meetings/training sessions must be documented with

purpose of the meeting/event, receipts and a copy of the formal written agenda

including session times. In all instances, the employee for whom meals were

purchased must include a list of attendees with the request for reimbursement.

16 | P a g e J u n e 2 0 2 0

USG institutions shall use the following standards when deciding whether a meal

may be purchased under this policy:

1. Group meals should be held only to facilitate the effective and

efficient operations of the departments involved. For example, it may

be that scheduling an intra-departmental meeting or training session

is the most effective and efficient use of employees’ time given

teaching schedules, other meeting commitments, etc. In this instance,

requiring employees to participate in a meeting over lunch may be the

best means available to get the required participants in the same

place for the period of time required.

2. Group meals should only be provided in those instances where the

meeting lasts for a minimum of four (4) hours. A meeting less than

four hours could generally be scheduled prior to or after a normal meal

without significantly impacting employees on different work schedules.

2. Group meals held at the start and/or finish of a meeting are not eligible

for payment under this policy. Purchase of a group meal is authorized

solely as a convenience to the employer and in those instances where

employees may not leave for a normal meal due to the time constraints

associated with the meeting or training session. Those events not

starting until the normal meal time should be delayed until after the

normal meal time, or employees may bring employee-purchased

food (“brown-bag”) to the meeting.

4. Purchase of group meals should be approved by the head of the

organization, or his/her designee, prior to the date of the event (for

non-emergency situations).The prior approval request should include:

The purpose of the meeting or event;

A formal written agenda including session times;

A list of attendees with their associated

departments/entities; and,

The expected cost of the meal per person.

All of the documents that were a part of the prior approval

package should be submitted with the payment request

along with the signed prior approval. All documents should

be retained with the voucher package for audit purposes.

5. Per Diem Allowance for Meals, must be followed. Meal limits apply

to the actual food and drink purchased for the meal. Set-up and

delivery costs associated with the group meal shall not be included in

the meal limit calculation. Set-up and delivery costs should be

expensed to other operating expenses (727100).

17 | P a g e J u n e 2 0 2 0

6. Group meals for a “lunch meeting,” in which the meal and the meeting

are one and the same, are prohibited for payment under this policy.

These meals should be charged to the 727700 expenditure account,

“Other Operating Expenses – Special Group Meals.” The “Special Group

Meals” expenditure account should only be used for such meal purchases.

Once again, documentation of the purchase must be retained as outlined

above. This account will be subject to special audit scrutiny, to ensure that

such expenditures are infrequent, rather than routine.

Employee Group Meals Involving Multiple Institutions

Efficient and effective administration of USG institutions may require instances

when various groups of university officials, such as presidents, executive officers,

or employees representing functional areas such as student activities, academic

affairs, business affairs, etc., may be required to meet. The purpose of these

meetings must support the official business purpose of the institutions

represented.

These events are often sponsored by a USG institution or by the University

System Office and are supported through the use of registration fees charged

to participants. These registration fees may be reimbursed by the participant’s

home institution and may be used for expenses such as speaker fees, room

rentals, equipment charges, food for meals and breaks, and items directly

related to the purpose of the meeting. Funds collected by the sponsoring

institution are normally collected in and expended from an agency account

created for that purpose as specified in BPM Section 14.5.1.

It is recognized that these events may often be held at a conference center or

similar facility in order to facilitate these events. Additionally, conference events

are usually scheduled to require participation on-site for the duration of the

conference in order to maximize use of available time. Releasing participants

to purchase off-site meals is time-consuming and does not allow for best use of

limited time resources. As a result, USG institutions and the USO will often

contract with catering services to provide food for on-site meals and snack

breaks.

This policy is being provided to both recognize the legitimacy of these purchases

and to enumerate the requirements governing these purchases. USG institutions

shall use the following standards when deciding whether purchases are valid as

made under this policy:

1. Group meals held at the end of a conference event are not

eligible for payment under this policy. Purchase of a group meal is

authorized solely as a convenience to the employer and in those

instances where employees may not leave for a normal meal due to

the time constraints associated with the meeting or training session.

18 | P a g e J u n e 2 0 2 0

2. Purchases for conference events should include

appropriate documentation to include:

The purpose of the meeting or event;

A formal written agenda including session times;

A list of attendees with their associated institutions; and,

the expected cost of the meal per person.

3. Reasonable purchases may be made for refreshment breaks.

4. Every effort should be made to negotiate reasonable meal

costs. However, it is recognized that catered event charges will often

exceed the per diem limits outlined in BPM Section 4.4. Catered meal

events shall be held only to facilitate conference events and not for

social or entertainment purposes. Under no circumstances will any

institutional funds as defined in Section 19.8 be used to purchase

alcohol.

Employees provided a meal pursuant to this policy shall not be permitted to claim

per diem on their travel expense statement as specified in BPM

Non-Employee Group Meals

Meals may be provided to individuals who are not employed by the State

under the following circumstances (all criteria must be met):

Such individuals are serving in an advisory capacity or providing

pro bono service to a State organization

A meal is required because the timing of the meeting/service is such to

allow for adequate travel time to the meeting site in the morning, and

return to residence in the afternoon, so as to avoid unnecessary travel

expenses (overnight stay) on the part of the participants

The meal is approved by a higher level approving authority prior to the

date of the event. Such expenditures are limited to the purchase of meals

and necessary beverages only (does not include snacks). Meal limits

outlined in the State of Georgia Statewide Travel Policy must be adhered

to

These meals should be charged to the expenditure account, “Group Meals”. A

copy of the meeting agenda or description of the service activity (with appropriate

approval) should be included as backup documentation and attached as a

receipt with the request for payment. Additionally, a general description and the

total number of people that will be attending the activity (e.g., advisory board

members, local government leaders, etc.) should be attached.

19 | P a g e J u n e 2 0 2 0

This account will be subject to special audit scrutiny to ensure that such

expenditures are infrequent, rather than routine. This Policy does not allow the

purchase of meals for a “lunch meeting” in which the meal and the meeting

are one in the same.

Special Meals

Reimbursement designed for those occasions when, as a matter of extraordinary

courtesy or necessity, it is appropriate and in the best interest of the State to use

public funds for provision of a meal to a person who is not otherwise eligible for

such reimbursement and where reimbursement is not available from another

source. Requests should be within reason and may include tax and tips.

Itemized receipts are required.

Examples include:

Visiting dignitaries or executive-level persons from other

governmental units, and persons providing identified gratuity

services to the State. This explicitly does not include normal

visits, meetings, reviews, etc., by federal or local

representatives.

Extraordinary situations are when State employees are required by their

supervisor to work more than a twelve-hour workday or six-hours on a

non-scheduled weekend (when such are not normal working hours to

meet crucial deadlines or to handle emergencies).

All special meals must have prior approval from the Vice President of

Business & Operations unless specific authority for approval has been

delegated to a department head for a period not to exceed one fiscal

year.

Regulations Governing Lodging Costs

Employees who travel more than 50 miles (and outside the county) from their

home office, residence, or headquarters may be reimbursed for lodging

expenses associated with approved overnight travel.

Employees will be reimbursed for the actual lodging expenses, provided the

expenses are reasonable. Employees who stay at a hotel/motel that is holding a

scheduled meeting or seminar may incur lodging expenses that exceed the rates

generally considered reasonable. The higher cost may be justified to avoid

excessive transportation costs between a lower cost hotel/motel and the location

of the meeting. When the conference does not have an official hotel, the traveler

is required to lodge at a hotel/motel within reasonable proximity to the

conference.

20 | P a g e J u n e 2 0 2 0

It is expected that reservations will be made in advance whenever practical, that

minimum rate accommodations will be utilized, that "deluxe" hotels and motels

will be avoided, and that corporate/government rates will be obtained whenever

possible. Many hotels and motels grant commercial rates upon request to state

employees who show identification. These rates may be exceeded, but must be

justified. For example, if an employee stays at a higher cost hotel where a

meeting is held in order to avoid excessive transportation costs between a lower

cost hotel and the location of the meeting, or for the safety of the individual,

then these costs are justified. Rooms available at Airbnb & such are not eligible

for reimbursement.

Authorization for Lodging within the 50-mile Radius

On occasions, the university is required to sponsor conferences, trade shows,

and other functions which require personnel to work at the event. Also on

occasion, the university may sponsor employee retreats that require groups of

employees to be present at an off-site location. In many cases, the employees

involved in these activities reside or work less than 50 miles from the

scheduled meeting site. In addition to mileage, affected employees may be

reimbursed for meals and lodging in accordance with the provisions of the

Travel Regulations.

It should be noted that this provision only applies to conferences and other

institution or USG sponsored events. This provision does not authorize persons

to claim travel reimbursement for activities which are part of their normal

responsibilities. In addition, this provision would not apply for persons who are

required to attend evening meetings as part of their normal responsibilities.

Georgia’s “Green Hotels” Program

The Georgia Department of Natural Resources has developed a program to

identify and certify lodging properties that are taking significant steps to reduce

their demands on Georgia’s natural resources and to act as good corporate

citizens. These certified “Green Hotels” meet a stringent standard for

environmental stewardship and operational efficiency. By using less toxic

cleaning and maintenance chemicals, these hotels provide healthier conditions

for guests and employees.

When traveling on state business and hosting meetings, state employees are

encouraged to explore opportunities to support these properties where cost

competitive. The current list of certified properties is available at the following

web site:

http://www.greenseal.org/FindGreenSealProductsandServices/HotelsandLodging

Properties.aspx.

21 | P a g e J u n e 2 0 2 0

Georgia Excise Tax

Section 48-13-51 of the Official Code of Georgia Annotated exempts Georgia

state or local government officials or employees traveling on official business

within the State of Georgia from paying the county or municipal excise tax on

lodging. However, sales tax should continue to be charged since the payment of

the hotel or motel bill by employees is not considered to be payment directly by

warrant on state appropriated funds. This tax exemption should be explained at

the time reservations are made. Some difficulty may be encountered in

communicating with the hotel or motel that state employees are exempt from the

excise tax. The Georgia Hotel/Motel Tax Exemption form should be presented to

the hotel or motel to provide documentation that the identified employee is on

official state business and qualifies for exemption. The form can be printed from

the Clayton State University-Accounting Services web site. A link to the form is

provided at: http://www.clayton.edu/accounting-services/expenses/travel/forms.

It should be noted that the provisions of this exemption only apply to lodging

expense incurred while traveling on official business and that any personal

lodging expense (even if incurred at the same hotel or motel, before or after the

official business related travel) would not qualify for the exemption.

Additionally, as an employee traveling on official State business, lodging is

eligible for exemption from State of Georgia Sales Tax when the payment

method being used is either direct bill to the agency, or a State of Georgia

issued credit card. Travelers should make every effort to avoid payment of sales

tax when payment method is other than a personal payment method.

If the hotel refuses to accept the tax-exempt form at check-in, the employee

should attempt to resolve the issue with the hotel management before checking

out at the end of their stay. If the matter is not resolved by the time the

employee checks out, the employee should pay the tax. Clayton State University

will reimburse the employee for the hotel/motel tax if the employee provides

CSU with the following information: employee name, date(s) of lodging, name,

address, telephone number of hotel, and documentation from the hotel/motel of

their refusal to omit the excise tax. Employee should classify this tax separately

as “occupancy tax” and/or “sales tax.

Per the Transportation Funding Act of 2015, effective July 1, 2015 hotels in the

state of Georgia will charge a $5.00 per room per night hotel tax to travelers. This

tax is not exempt for State Employees.

Shared Lodging

22 | P a g e J u n e 2 0 2 0

When lodging is shared “the traveler paying for the lodging seeks reimbursement

for the full expense”. However, when employees on travel status share a room,

reimbursement will be calculated, if practical, on a prorated share of the total cost

to reflect each employee’s share of the lodging expense. This allows for a more

accurate cost split, especially for employees funded by multiple sources. When a

state employee on travel status is accompanied by someone who is not a state

employee on travel status, the employee is entitled to reimbursement at a single-

room rate.

Lodging Expenses Incurred While Taking Leave

Employees who take annual leave while on travel status may not be reimbursed

for lodging expenses incurred during the period of leave.

Other Charges on Lodging Receipts

Resort and Other Fees: Some hotels inclu

de a charge for “resort”

or “other fees”. These should be reimbursed as an eligible lodging

expense.

Internet Usage Charges: Employees may be reimbursed for work

related Internet usage charges. These charges should be separately

identified on the itemized hotel/motel bill, but should not be listed on

the travel expense statement as “lodging.” Rather, these charges

should be treated as “miscellaneous expenses”, included in the

“voice/data communications” section of the travel expense statement.

Lodging expenses for hotels/motels outside Georgia may exceed the

maximum reasonable rates set by Clayton State University. Employees

traveling out-of-state should refer to the federal per diem rates to identify high-

cost areas of the United States, and to determine whether higher expenses are

“reasonable and customary”.

Travelers should not book non-refundable rates or rates that require deposits

unless required by conference lodging. It is the employee’s responsibility to

understand cancellation rules. Non-refundable rates cannot be changed or

cancelled; therefore, the employee is accepting the risk of a non-reimbursable

cancellation fee.

If a cancellation fee is charged and all efforts to have the fee removed have been

exhausted, the employee may include it on the travel expense statement with a

thorough explanation. The department head, dean or other responsible official

should review the request and determine if reimbursement is appropriate.

Required Documentation

23 | P a g e J u n e 2 0 2 0

Daily lodging expenses, including applicable taxes, must be itemized on the

employee travel expense statement. Employees requesting reimbursement

for lodging expenses are required to submit paid receipts with their expense

statement.

In addition, any expenses that exceed the maximum reasonable rates

established by the institution should be explained on the travel statement.

Individuals responsible for approving travel expenses should review these

explanations to determine whether the higher costs are justified and

allowable.

Requests for Reimbursement should include the following information:

Location, date and time of departure should be included for single

day trips

Location, date and time of return should be included for single day trips

Listing of meals included in conference registration fees

Itemized listing of expenses related to authorized meals not covered

by the per diem allowance

Explanations of any expenses exceeding the established limits

Explanation of any unusual expenses submitted for

reimbursement

Explanation of the purpose for the trip

Description of the type(s) of transportation used during the trip.

Employees must sign their travel expense report, attesting the information

presented on the form is accurate and complete. Employees who provide false

information are subject to termination of employment, criminal penalty as a felony

for false statements, subject to punishment by fine not to exceed $1,000 or

imprisonment for one (1) to five (5) years.

Receipt Requirements

Employees must submit receipts for the following expenses:

Lodging, with an itemized breakdown of costs such as room charge,

parking, WIFI, laundry, etc.

Airline or railroad fares

24 | P a g e J u n e 2 0 2 0

Rental of motor vehicles

Registration fees

Visa/passport fees

All single expenditures of $25 or greater

If an employee does not have a receipt for one of the items listed above, the

employee must include an explanation of the expense on the travel expense

statement. Credit card receipts are acceptable forms of documentation, provided

they contain complete details of the expenditure. In the absence of actual

receipts, credit card statements may be acceptable in lieu of actual receipts.

1.5 Transportation

The Georgia Legislature in its 2005 special session passed legislation amending

O.C.G.A. § 50-19-7 tying the mileage reimbursement rate for use of a personal

motor vehicle to the rate established by the United States General Services

Administration (GSA) pursuant to the Federal Travel Regulations Amendment

2005-01 as of July 1, 2005, or subsequently amended. These GSA rates are

based on a determination of the most advantageous form of travel.

Advantageous use may be determined based on energy conservation, total cost

to the state (including costs of overtime, lost work time, and actual transportation

costs), total distance traveled, number of points visited, and number of travelers.

Documentation of the determination of “advantageous use” should be retained

for audit purposes.

The timing of the adoption of revised GSA rates is controlled by the State

Accounting Office and the Office of Planning and Budget (OPB). These two

offices are responsible for establishing and updating the Statewide Travel

Regulations. This responsibility was assigned to these organizations through

House Bill 293 which was passed into law during the 2005 legislative

session.

Useful links:

General Services Administration: http://www.gsa.gov/pov DOAS

Vehicle Cost Comparison Tool:

http://www.clayton.edu/accountingservices/Expenses/travel/Link s

25 | P a g e J u n e 2 0 2 0

Vehicle Transportation

A traveler will be authorized to choose between a university owned vehicle, a

personal vehicle and common carrier after careful analysis of the distance,

timeliness and overall costs of a trip. Reimbursement for the most

economical mode of transportation, consistent with the purpose of the travel,

will be authorized.

A university employee is only authorized to use his or her personally

owned vehicle under one of the following circumstances:

A university owned vehicle is not available and the personally owned

vehicle is the least expensive option or the total distance traveled is less

than 100 miles

The supervisor determines, and documents in writing, that use of the

least expensive option is clearly not efficient. Travelers should obtain

supervisory authorization for use of a personally owned vehicle in

advance of such use

While driving your personal vehicle on university business, the university

provides full liability coverage and personal immunity for the employee for

damages and injuries the employee may cause to others. The university does

not provide coverage for damages to your personal vehicle. Cost of repairs to a

personal vehicle, whether or not they result from the traveler’s acts, are not

reimbursable.

Under no circumstance will the university reimburse parking fines or

moving violations.

Any reimbursement of mileage claims paid to an employee in excess of rates

stipulated in the Policy must be refunded to the university or characterized as

taxable compensation to the employee.

Use of Rental Vehicles

When traveling more than 100 miles round trip, employees are required to

complete the DOAS Cost Comparison Tool to determine if the use of a rental

vehicle is more cost effective than the use of a privately-owned vehicle.

Reimbursement for Use of Personally Owned Vehicle

Reimbursement for transportation expenses incurred when using personally

owned vehicles will be at the authorized rate per mile for the actual number of

miles traveled in the performance of official duties. As indicated above, the

reimbursement rate is tied to the rate established by the United States

General Services Administration. The following rates are in effect:

26 | P a g e J u n e 2 0 2 0

Tier 1 Rate. When it is determined that a personal motor vehicle is the most

advantageous form of travel, the employee will be reimbursed for business miles

traveled as follows as of 1/1/2020:

Automobile $0.575 per mile

Motorcycle $0.545 per mile

Aircraft $1.27 per mile

Tier 2 Rate. If a government-owned (CSU owned) vehicle is available, and its

use is determined to be most advantageous to the state, OR if it is determined

(through institution policy or otherwise) that a rental vehicle (Statewide Rent-a

Car contract) is the recommended method of travel, but a personal motor

vehicle is used, the employee will be reimbursed for business miles traveled at

the rate of $0.17 per mile.

The standard per-mile reimbursement rate includes gas, oil, repairs, and

maintenance, tires, insurance, registration fees, licenses, and depreciation

attributable to the business miles driven. If you request reimbursement for

mileage, you will not be reimbursed separately for those costs.

Limitations and Requirements for the Use of Personal Vehicles

For all mileage reimbursements over 100 miles round trip that are

requesting the Tier 1 rate, documentation that a university owned

vehicle was not available for the requested travel dates must be

provided. Also, documentation that a rental vehicle was not the most

cost effective mode of transportation must be provided.

If a personal vehicle was used after determining a university owned

vehicle was available, or after determining a rental vehicle was the most

advantageous to the state, then reimbursement will be at the Tier 2 rate

per mile.

If an employee elects to drive a personal vehicle without checking for the

availability of a university owned vehicle, then the employee will be

reimbursed at the Tier 2 rate per mile.

It should be noted that a change in the GSA rate does not automatically change

the rate for the State of Georgia. The State of Georgia rates are changed only

upon notification from the State Accounting Office/Office of Planning and

Budget via the SAO web site.

The mileage reimbursement encompasses all expenses associated with the

operation of a personal motor vehicle, with the exception of tolls and parking

27 | P a g e J u n e 2 0 2 0

expenses, which are reimbursed separately. Normal commuting miles must be

deducted when calculating total mileage reimbursement. When requesting

mileage reimbursement employees are required to submit a vehicle request

form and cost comparison form with the expense report.

Determination of Business Miles Traveled

Employees may be reimbursed for the mileage incurred from the point of

departure to the travel destination, less the normal miles traveled to work location

each day. If an employee departs from headquarters, mileage is calculated from

headquarters to the destination point. If an employee departs from his/her

residence, mileage is calculated from the residence to the destination point, with

a reduction for normal commuting miles. For the return trip, if an employee

returns to headquarters, mileage is calculated based on the distance to such

headquarters. If an employee returns to his/her residence, mileage is calculated

based on the distance to the residence, with a reduction for normal commuting

miles. Employees whose normal business function requires the use of a personal

motor vehicle for travel from residence to multiple locations in a given day, or

when an employee’s “headquarters” differ from day to day should note on their

Request for Authorization to Travel where their headquarters is located. It should

not differ from one authorization to other authorizations.

Exceptions:

If travel occurs on a weekend or holiday, mileage is calculated from the

point of departure with no reduction for normal commuting miles

If an employee does not regularly travel to an office (headquarters)

outside of his/her residence (i.e., residence is “headquarters”), the

requirement to deduct normal commuting miles does not apply.

Note: This exception does not apply to those operating under the

university’s telework policy.

Employees may also be reimbursed for business miles traveled as follows:

Miles traveled to pick up additional passengers

Miles traveled to obtain meals for which employee is eligible for

reimbursement

Miles traveled to multiple work sites

Example 1:

28 | P a g e J u n e 2 0 2 0

Employee’s normal commute is 15 miles one way. Employee is

required to travel to job site 40 miles from headquarters.

Employee drives to headquarters, then to remote job site, then

back to headquarters before returning home. Employee’s business

miles traveled are 80 miles.

Example 2:

Employee’s normal commute is 15 miles one way. Employee is

required to travel to job site 18 miles from headquarters. Employee

drives to headquarters, then to remote job site, then home, which is

19 miles from remote site. Employee’s business miles traveled are 22

miles, as follows: from headquarters to remote job site, 18 miles;

from remote site to residence, 19 miles minus 15 miles one-way

normal commute.

Example 3:

Employee’s normal commute is 15 miles one way. Employee leaves

from home to attend a conference 200 miles from the employee’s

residence. At the conclusion of the conference, the employee returns

directly home. Employee’s business miles traveled are 370 miles (400

actual miles traveled minus 30 round-trip commuting miles).

Example 4:

Employee’s normal commute is 15 miles one way. Employee leaves

from headquarters on Monday for a remote job site 150 miles from

headquarters. Employee acquires lodging 5 miles from remote work

site. Employee returns to headquarters on Friday. Employee’s business

miles traveled are 340 miles, as follows: from headquarters to remote

site, 150 miles; from remote site to lodging on Monday, 5 miles; from

lodging to remote site and back to lodging Tuesday – Thursday, 10

miles each day (30 miles); from lodging to remote site on Friday, 5

miles; from remote site back to headquarters, 150 miles.

Prohibited Mileage Reimbursement

Employees are not entitled to mileage reimbursement for travel between their

place of residence and their official headquarters, or for personal mileage

incurred while on travel status.

Recording Mileage Driven

Actual odometer readings are not required however a printout from

MapQuest, Yahoo Maps, or Google Maps is required in order to provide

sufficient documentation of the distance traveled. Personal/Commuting

29 | P a g e J u n e 2 0 2 0

mileage will be excluded in determining the mileage for reimbursement.

Claims exceeding mileage computed by the most direct route from the point of

departure to the destination (due to field visits, traffic conditions, picking up

passengers, etc.) must be explained on the on-line expense report.

Parking/Tolls

The authorized mileage rate is to include the normal expenses incurred in the

operation of a personal vehicle. In addition, parking and toll expenses will be paid

for official travel in a personal or state vehicle. Low-cost, long-term parking or

automobile storage should be utilized. Receipts for parking and toll expenses

should be provided when possible. If receipts are not available, an explanation

must be included in the on-line expense report. Receipts are required for parking

and toll expenses if the expense exceeds $25.00.

Rental Vehicles

Use of commercially leased vehicles will be left to the discretion of the

supervisor and must be approved prior to departure. CSU has mandatory

statewide contracts with Enterprise and Hertz rental car companies. Employees

must rent vehicles from one of these vendors when the use of a rental vehicle is

the best value. Travelers are responsible for securing the lowest cost contract

rental available at time of booking.

Approved car rental sizes are Compact, Intermediate or Full Size. Vans (12

passengers only) may be rented when there are more than 4 travelers.

Employees requiring the use of commercially leased vehicles will be reimbursed

for gasoline purchases associated with the business use of such vehicle,

provided appropriate receipts are included. (This excludes renters who are

furnished a fuel card and are billed based on a specific calculation for that

location.) Employees must decline optional fuel offerings offered by the car rental

vendor. Maintenance and oil changes are the responsibility of the rental company

and will not be reimbursed. Rental cars should be returned with the same amount

of gas that it had when it was picked up. Travelers should pay attention to the

fuel amount when they pick up the vehicle to ensure there are no overcharges for

gas upon return of the rental car. Travelers must also document their final

mileage prior to returning vehicle to the rental car company.

Employees will be reimbursed for costs associated with official use of such

vehicles. Personal accident insurance on rental vehicles is not reimbursable.

Employees traveling on state business inside the Continental U.S. in a rented

motor vehicle are covered by the State’s liability policy; therefore, liability

coverage should be declined when renting a motor vehicle. Loss Damage

Waiver/Collision Damage Waiver (LDW/CDW) insurance is included in the

statewide contract at no additional cost. If renting from a company that is not on

the statewide contract, Loss Damage Waiver/Collision Damage Waiver

30 | P a g e J u n e 2 0 2 0

insurance may not be included. When traveling to destinations outside the

Continental U.S. (OCONUS), with the exception of Canada, the State Risk

Management Department recommends that travelers accept collision insurance

when renting cars. DOAS Risk Management Services may be contacted if

additional information is needed.

NOTE: The State liability policy is only in effect while the employee is

using the rented vehicle for official State business. For this reason,

personal use of the vehicle, including allowing friends or family members

to ride in a State rented vehicle, is prohibited.

NOTE: For any exceptions to the policy with regard to Rental Cars please

contact Department of Administrative Services.

In the event of an accident while driving a rental vehicle, contact the Risk

Management Office at (877) 656-7475, as well as the appropriate car

rental vendor, for claims handling.

State of Georgia Policy on Additional Insurance

When to Purchase Additional Rental Car Insurance

Automotive

Physical

Liability Insurance on Vehicle

Damage

Insurance

GA Statewide Rental Car

N

o

No

Contract Vendors

–

All

Locations

Non

-

Contract Rental Car

Yes

No

Vendors

-

All Locations

Employees that elect to rent a motor vehicle (commercially leased vehicle) while

traveling outside the state of Georgia should identify the lowest available rates

when contracting for such a vehicle. Use of commercially leased vehicles will be

left to the discretion of the supervisor and must be approved prior to departure.

Use of a rental vehicle must be justified by cost comparison to alternate public

and commercial transportation, such as bus service, taxi service, airport van

service, etc. This cost comparison must be provided with the travel report.

Ride Share

Employees sharing a ride with another state employee using either a state or

personal vehicle, and not claiming reimbursement for mileage, should indicate

in the automobile record section of the on-line expense report the name of the

person they rode with and the dates of the trips.

Travelers with Physical and/or Medical Conditions

31 | P a g e J u n e 2 0 2 0

The impact of travelers with physical and/or medical conditions, while on

university travel, should be considered on a case-by-case basis. Compliance

with the Americans with Disabilities Act (ADA) is mandatory. Each department

has the authority to provide reasonable accommodations during university

travel for employees with disabilities.

All university employees are to be afforded equal opportunity to perform travel

for official university business even if the travel costs for disabled travelers will

exceed what would normally be most economical to the university.

Commercial Air Transportation

Employees should utilize commercial air transportation when it is more cost

effective and efficient to travel by air than by vehicle. Employees who require air

travel should obtain the lowest available airfare to the specified destination,

which may include the use of the internet or a travel agency (for out of state

travel only).

Below are a couple of sites that provide airfare rates:

http://www.kayak.com/

http://www.priceline.com/flights

http://www.expedia.com/

Reimbursement will be made upon presentation of a ticket stub, receipt, or other

documentary evidence of expenditure along with the on-line expense report

upon completion of trip. According to O.C.G.A. § 45-7-30, officials or employees

traveling by commercial air carrier will not be reimbursed for that portion of non-

coach (first-class, business class) air fare which exceeds the cost of the lowest

fare for the flight on which such official or employee is traveling unless:

Space is not otherwise available

A licensed medical practitioner certifies that because of a person's

mental or physical condition specific air travel arrangements are

required; or

The Commissioner of Public Safety certifies that specific air travel

arrangements are necessary for security reasons. Prior written approval

by the Vice President for Business & Operations is required on the above

exceptions. For medical conditions, the Vice President for Business &

Operations must be provided with the necessary medical certifications for

any employee who requires special air travel arrangements due to

medical conditions. The certification should also specify the expected

length of time such conditions would have an impact on travel needs.

32 | P a g e J u n e 2 0 2 0

These certifications must be available for examination so that auditors

can readily determine who is subject to these special travel provisions.

Note: Employees who choose to travel by personal vehicle when air

travel is more cost-effective should only be reimbursed for the cost of

the lowest available airfare to the specified destination. Department

budget managers are responsible for determining lowest costs.

Travelers on university business may open and maintain frequent flyer/guest

accounts with airlines, car rental companies, and other travel suppliers. Any cost

of these memberships is the responsibility of the traveler and will not be

reimbursed by the university. Travelers may retain promotional items, including

frequent flyer miles, earned on official university travel. However, if an employee

makes travel arrangements that favor a preferred airline/supplier to receive

promotional items/points and this circumvents purchasing the most economical

means of travel, they are in violation of this policy.

Connecting flights should be chosen over nonstop flights when the connection

does not add more than two hours to travel time and the connection saves

$200 or more. Travelers are not required to take a lower fare if a change of

airline at the connection point is required.

Baggage Charges

Most airlines are charging for checked luggage and for curbside check-in. In the

event there is a charge for checking the traveler’s first bag, the university will

reimburse for that charge. The university will not reimburse for additional

luggage unless an appropriate business explanation is provided.

Baggage charges incurred for excess weight will not be reimbursed, unless an

appropriate business purpose explanation is provided.

The university purchasing card may not be used to make payment for

checked luggage.

Upgrades to Non-Coach Travel

State officials or employees may, at any time, use personal frequent flyer

miles or similar programs to upgrade to non-coach travel. In addition, nothing

in this policy shall preclude a state official or employee from personally paying

for an upgrade to non-coach travel.

For purposes of conducting official state business, state officials or employees

may negotiate or arrange for upgrades to non-coach travel with individual

commercial carriers if (1) the flight is international and over five hours in duration,

and (2) the carrier agrees not to charge any additional cost to the state.

33 | P a g e J u n e 2 0 2 0

Indemnification received due to travel inconveniences imposed by airlines may

arise when airlines overbook, change, delay or cancel flights. In these instances,

airlines often offer the impacted passengers indemnification for these

inconveniences. Examples of indemnification that may be offered by an airline

include vouchers for meals or lodging, upgrades to non-coach travel, and credits

toward future flight costs. State employees are authorized to accept such

indemnification if the travel inconvenience was imposed by the airline and there

is no additional cost to the state.

Airline Cancellations

Penalties and charges resulting from the cancellation of airline reservations (or

other travel reservations) shall be the institution's obligation if the employee's

travel has been approved in advance and the cancellation or change is made at

the direction of and for the convenience of the institution. If the cancellation or

change is made for the personal benefit of the employee, it shall be the

employee's obligation to pay the penalties and charges. However, in the event of

accidents, serious illness, or death within the employee's immediate family, or

other critical circumstances beyond the control of the employee, the institution

will pay the penalties and charges.

Fees for Changes in Flights

Most airlines charge an additional fee for changes in flights. Employees

should make every effort to avoid changes, but if an additional fee is

imposed for rescheduling, this becomes part of the travel expense and is

reimbursable. The reason for the change must be documented. If the airline

ticket is not used at all for reasons beyond the control of the employee, the

employee may be reimbursed (with the approval of his/her supervisor), but

this would not be considered a travel expense. The reason for the ticket not

being used must be documented.

Airline Departure and Return

When traveling by common carrier to conduct official state business,

employees traveling to their destination earlier than necessary and/or

delaying their return to avail the institution of reduced transportation rates

may be reimbursed subsistence for additional travel days if, in the opinion of