Systematix Research is also available on Bloomberg SSSL <Go>, Thomson & Reuters Systematix Shares and Stocks (India) Limited

Investors are advised to refer disclosures made at the end of the research report.

1

Aadhar Housing Finance Ltd.

Prominent affordable housing player at attractive valuations

Aadhar Housing Finance Limited (AHFL) is a leading player (with ~4% market share

in overall HFC group) in affordable housing finance space with AUM of Rs 198bn.

The company is majorly owned by BCP Topco VII Pte. ltd (Blackstone Group) and

benefits from its strong parentage and expertise and have access to funding

at competitive rates. The company mainly focuses on low income housing segment

(< Rs 1.5mn loans) serving low to mid income segment. The average ticket size of

loans are Rs 1 mn with average LTV of ~58%. Salaried segment comprises ~57% of

total AUM while self employed segment comprises of ~43% as of Dec’23. As of

Dec’23, Aadhar has presence in 20 states through a network of 487 branches and

offices. The distribution network is widely spread with no single state contributing

more than 14% AUM as of Dec’23. Top 5 states Maharashtra (14%), Uttar Pradesh

(13%), Rajasthan (13%), Gujarat (11%) and Madhya Pradesh (10%) together

constitutes >62% of AUM. NII grew at 32% CAGR over FY20‐23, led by 15% CAGR in

AUM and healthy NIMs. Aided by lower credit cost (< 50bps), earnings grew at 46%

CAGR over FY20‐23. As a result, the company made a healthy RoA / RoE of 3.6% /

16.5% in FY23 and 4.2% / 18.4% in 9MFY24. A seasoned & experienced

management team with strong corporate governance enhance confidence.

Recommend – SUBSCRIBE.

Favourable demographics + low mortgage penetration = Huge growth opportunity

India’s housing loan industry is in a sweet spot and should continue to benefit from

the country's favourable demographics. Rising urbanisation (from 17.6% in 1955 to

35.0% in FY20), b) increasing number of households (2% CAGR) due to nuclearisation

and c) higher share of earning population in India (~60% are in the age bracket of 18

to 59 years) will likely continue to drive demand for housing loans. Individual housing

loans now constitute ~16% share in the overall systemic credit (Rs 180trn), having

meaningfully improved from ~11% a decade ago. Despite healthy pace of growth,

mortgage penetration (mortgage to GDP ratio) in India remains sub optimal at ~11%,

presenting a huge growth opportunity for HFCs.

AHFCs strong business model is a cocktail of high pricing power and low credit cost

Affordable Housing Finance Companies (AHFCs) cater to a relatively riskier customer

profile which leads them to charge a premium on interest. This is why they have

higher yields compared to normal housing finance players. Despite their riskier

segment focus, AHFCs' asset quality was healthy even during the COVID period

bearing testimony to their robust underwriting practices. This explains why these

companies’ RoA profile ranges at a healthy 3%-7% (Ex CANF), which in our view

should stay largely intact over FY23-26E. As these companies scale up their

businesses, their leverage should improve and boost their RoE profiles.

Significant player in AHF segment; well placed to capture market share

Aadhar Housing Finance Limited (AHFL) is a leading player (with ~4% market share in

overall HFC group) in affordable housing finance space with AUM of Rs198bn. It has

diversified presence with 487 branches spread across 533 districts in 20 states. The

branches are evenly spread across states which reduces geographic concentration

risk as no single state contributes >14% of AUM. Loan growth and subsequently

improvement in market share to be aided by a) rising urbanization and continued

expansion of its physical and digital presence across India b) increasing

customer base.

Systematix

Institutional Equities

07 May 2024

IPO Note

Sector: NBFC

SUBSCRIBE

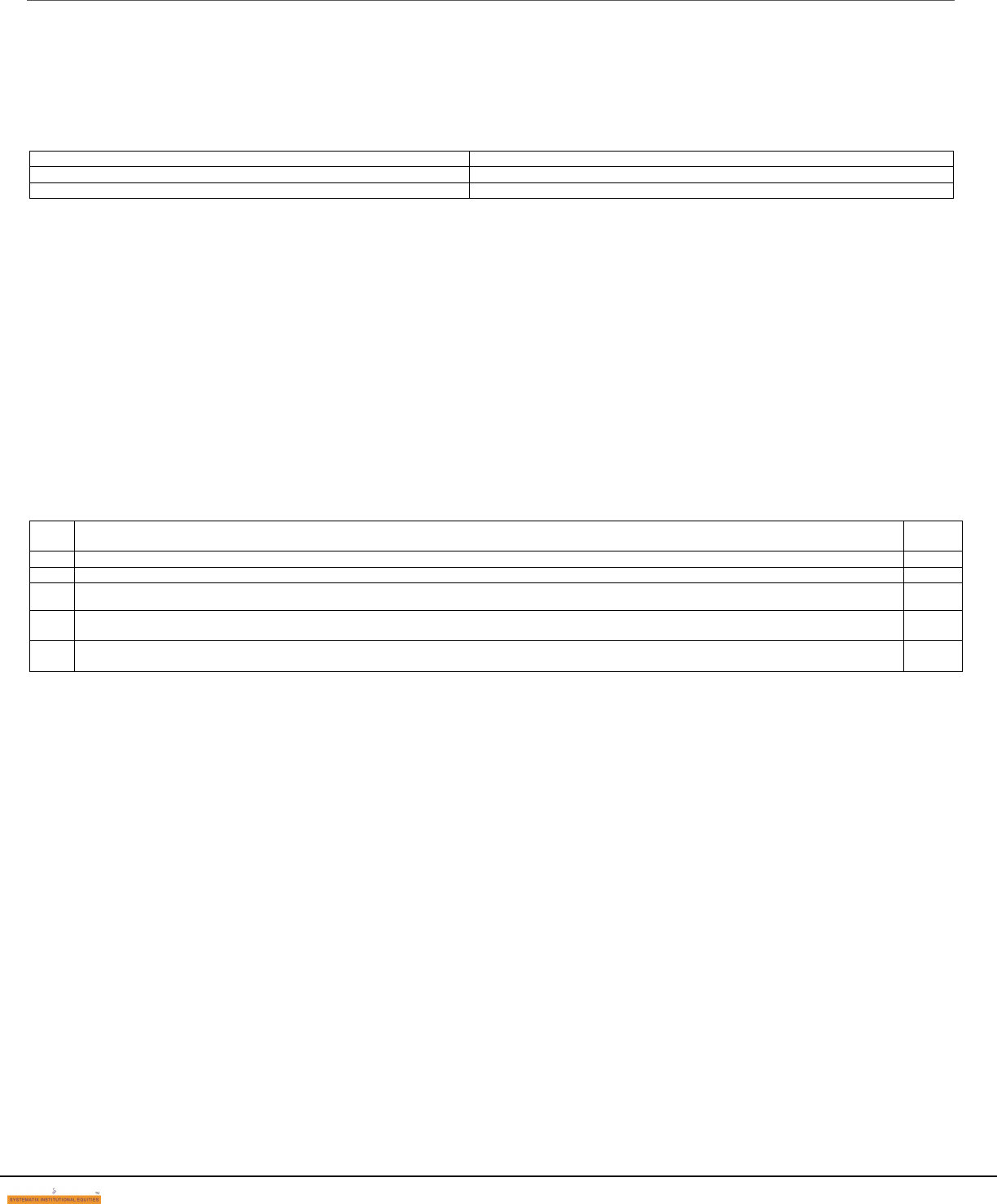

Company data

ISSUE OPENS

8

th

May 2024

ISSUE CLOSES

10

th

May 2024

PRICE BAND

Rs 300 - 315

PRE- ISSUE EQUITY SHARES

394mn

POST- ISSUE EQUITY SHARE

426mn

FRESH SHARES TO BE ISSUED

31mn

OFFER FOR SALE

63mn

ISSUE SIZE

Rs 30bn

MKT CAP (at upper band)

Rs 134bn

Financial Snapshot (Rs mn)

Y/E March

FY21

FY22

FY23

FY24P

NII

6,110

7,771

9,771

12,768

PPP

4,875

6,161

7,700

10,148

PAT

3,401

4,449

5,948

7,839

EPS (Rs)

8.0

10.4

13.4

17.8

EPS Gr. (%)

79.6

30.8

33.7

31.8

BV/Sh (Rs)

63

74

87

103

Ratios

NIM (%)

4.9

5.5

6.1

6.7

C/I ratio (%)

35.8

36.3

38.1

36.4

RoA (%)

2.6

3.2

3.7

4.3

RoE (%)

13.5

15.2

16.6

18.7

Payout (%)

0.0

0.0

0.0

0.0

Valuations

P/E (x)

39.5

30.2

23.6

17.7

P/BV (x) *

5.0

4.3

3.6

3.1

Note: FY24P based on 9MFY24; *P/BV at ~2.5x (post capital raise)

Shareholding pattern (%)

Pre-Issue

Post-Issue

BCP Topco VII Pte. Ltd.

98.7

76.7

ICICI Bank

1.3

1.3

Public

0.0

22.0

Total

100.0

100.0

Pradeep Agrawal

pradeepagrawal@systematixgroup.in

+91 22 6704 8024

Pravin Mule

pravinmule@systematixgroup.in

Ronak Dhruv

ronakdhr[email protected]n

dddddd

07 May 2024

2

Systematix Research is also available on Bloomberg SSSL <Go>, Thomson & Reuters Systematix Shares and Stocks (India) Limited

Aadhar Housing Finance Ltd.

Strong promoter, experienced & seasoned management team enhance confidence

The company is backed by Blackstone Group (global investment firm) through BCP

Topco VII Pte. Ltd and will continue to hold ~77% stake post offer. Hence, benefits

from blackstone’s resources, relationships and expertise. The company also has a

strong, experienced and dedicated management team, having an average experience

of more than two decades in the financial services industry.

Valuation: Affordable Housing Finance Players have managed to maintain/ improve

their return profiles through higher yields, lower cost of funds and well managed

asset quality. Continued branch expansion in existing and newer geographies

coupled with government focus would continue to support their growth. Aadhar

Housing Finance (AHFL) is a bet on low ticket size affordable housing segment. Given

the current size of AHFL, the company is well positioned to capture the huge

untapped opportunity in <Rs1.5mn ticket size segment, via deeper penetration in

new geographies. In addition, experienced management team with strong track

record along with backing of Blackstone boost confidence. At the upper end of the

price band (Rs 300-315), the issue is valued at ~2.5x Dec’23 BV (including capital

raise) with RoA of ~4% and RoE of ~18%, which looks attractive. Hence, we

recommend investors to subscribe this issue.

07 May 2024

3

Systematix Research is also available on Bloomberg SSSL <Go>, Thomson & Reuters Systematix Shares and Stocks (India) Limited

Aadhar Housing Finance Ltd.

Snapshot of key players in the affordable housing segment

Exhibit 1: Business profile

Particulars (FY23)

AADHAR

APTUS

HFFC

AAVAS

India Shelter Finance

FY23

9MFY24

FY23

FY24

FY23

9MFY24

FY23

FY24

FY23

9MFY24

AUM (Rs mn)

172,230

198,650

67,380

87,220

71,980

90,137

141,667

173,126

43,594

56,090

1-year growth (%)

16.5

19.9

30.1

29.4

33.8

33.5

24.8

22.2

41.8

41.9

3-year CAGR (%)

14.6

-

28.4

29.0

25.8

-

22.0

22.3

42.1

-

5-year CAGR (%)

16.7

-

36.7

31.2

39.6

-

28.3

23.8

40.3

-

AUM mix - by

product (%)

Housing loan

78

76

58

60

87

86

70

69

57

58

Non - housing loan

22

24

42

40

13

14

30

31

43

42

AUM mix - by

customer (%)

Salaried and

professionals

59

57

29

26

70

68

40

40

30

29

Self-employed

41

43

71

74

30

32

60

60

70

71

AUM mix - on book/

off book (%)

On book

100

100

100

100

85

-

100

100

100

100

Off book

0

0

0

0

15

-

0

0

0

0

Network details

Branch (Nos.)

479

487

231

262

111

123

346

367

183

215

Employee (Nos.)

3,663

3,885

2,405

2,918

993

1236

6,034

-

2,709

3,319

Customers (Nos.)

172,228

198,625

107,000

133,499

77,512

90,851

187,149

-

58,552

-

No. of States

20

20

5

6

13

13

12

13

Key States as %

of AUM

Uttar Pradesh –

14%

Uttar Pradesh –

14%

Tamil Nadu –

43%

Tamil Nadu –

37%

Gujarat –

33%

Gujarat –

33%

Rajasthan –

30-35%

Rajasthan,

Maharashtra,

Gujarat & Delhi

contribute

~80-82%

Rajasthan –

31%

Rajasthan –

31%

Maharashatra –

14%

Maharashatra –

14%

Andhra Pradesh –

35%

Andhra Pradesh –

40%

Maharashtra –

14%

Maharashtra –

13%

Maharashtra –

~15%

Maharashtra –

18%

Maharashtra –

17%

Gujarat –

11%

Gujarat –

11%

Tamil Nadu –

14%

Tamil Nadu –

14%

Madhya Pradesh

– ~15%

Madhya Pradesh

– 15%

Madhya Pradesh

– 13%

Madhya Pradesh

– 10%

Madhya Pradesh

– 10%

Telangana –

9%

Telangana –

9%

Gujarat –

~15%

Product details

ATS (Rsmn)

0.9

1

0.8

1

1

1.14

0.8

1.02

1.1

1

Portfolio yield (%)

12.8

14

17

17.3

13.1

13.5

13.1

13.1

14.9

14.8

Company details

Year of incorporation

2010 *

2009

2010

2011

1998

Year of listing

-

2021

2021

2018

2023

Promoter stake

Total Stake:

100%

Total Stake:

100%

Total stake:

62.2%

Total stake:

61.1%

Total stake:

30.2%

Total stake:

23.6%

Total stake:

39.1

Total stake:

~27

-

Total stake:

48.3

BCP Topco VII

Pte.Ltd

(an affiliate of

Blackstone) –

98.7%

BCP Topco VII

Pte.Ltd

(an affiliate of

Blackstone) –

98.7%

Munuswamy

Anandan –

19.3%

Munuswamy

Anandan –

19.3%

True north

fund VLLP –

18.2%

True north

fund VLLP –

14.2%

Kedaara

capital –

23.0%

Kedaara

capital –

16.0%

-

Anil Mehta –

1.5%

ICICI Bank –

1.3%

ICICI Bank –

1.3%

Padma

Anandan –

4.5%

Padma

Anandan –

3.2%

Aether

(Mauritius)

Limited –

12.0%

Aether

(Mauritius)

Limited –

9.4%

Partner group –

16.1%

Partner group –

10.9%

-

West Bridge –

20.1%

Westbridge

crossover fund

LLC – 34.5%

Westbridge

crossover fund

LLC – 34.5%

Aravali

Investment

Holding –

26.6%

JIH LLC – 2.2%

JIH LLC – 2.0%

Auditor

Walker Chandiok & Co LLP

T R Chadha & Co LLP

Deloitte Haskins & Sells

Walker Chandiok & Co LLP

T R Chadha & Co LLP

Credit Rating

CARE:

AA/Stable

CARE:

AA/Stable

ICRA:

AA-/Stable

ICRA:

AA/Stable

IND RA:

AA-/Stable

IND RA:

AA-/Stable

ICRA:

AA/Stable

ICRA:

AA/Stable

CARE: A+

CARE: A+

ICRA:

AA/Stable

ICRA:

AA/Stable

CARE:

AA-/Stable

CARE:

AA-/Stable

CARE:

AA-/Stable

CARE:

AA-/Stable

CARE:

AA/Stable

CARE:

AA/Stable

ICRA: A+

ICRA: A+

BRICKWORKS:

AA/Stable

ICRA:

AA-/Stable

ICRA:

AA-/Stable

Source: Company, Systematix Institutional Research, Note: Aadhar Housing Finance Private Ltd was incorporated in 2010

07 May 2024

4

Systematix Research is also available on Bloomberg SSSL <Go>, Thomson & Reuters Systematix Shares and Stocks (India) Limited

Aadhar Housing Finance Ltd.

Company Background

• Aadhar Housing Finance Private Limited was incorporated in 2010 and later

amalgamated with DHFL Vysya in 2017 and subsequently its name changed to

Aadhar Housing Finance Limited (AHFL). In June 2019, BCP Topco VII Pte. ltd

(which is controlled by a private equity fund managed by Blackstone Group)

acquired majority stake by infusing Rs ~13bn and currently holds 98.7% in AHFL.

• Aadhar Housing Finance Ltd (Aadhar) is the largest (in terms of AUM & Networth)

affordable housing finance player focused on low ticket size loans (Rs < 1.5mn)

primarily housing loans and LAP. Aadhar offer loans for residential property

purchase and construction; home improvement & extension loans; and loans for

commercial property construction & acquisition.

• Aadhar has ~4% market share in overall HFC group with AUM of Rs 198bn as of

Dec’23. The company mainly focuses on low income housing segment serving low

to mid income segment. The average ticket size of loans are Rs 1 mn with average

LTV of ~58% (as of Dec’23). Salaried segment comprises ~57% of total AUM while

self employed segment comprises of ~43% as of Dec’23.

• As of Dec’23, Aadhar has presence in 20 states through a network of 487

branches and offices. The distribution network is widely spread and no single

state contributes more than 14% AUM as of Dec’23. Top 5 states Maharashtra

(14%), Uttar Pradesh (13%), Rajasthan (13%), Gujarat (11%) and Madhya Pradesh

(10%) together constitutes >62% of AUM.

Exhibit 2: Key Milestones of Aadhar Housing Finance

Year

Particulars

FY11

Incorporation of Pre-merger AHFPL

FY12

Pre-merger AHFPL Crossed 1,000 home loan disbursements

FY14

AUM of pre-merger AHFPL crossed Rs 5bn

FY15

AUM of pre-merger AHFPL reached Rs 10bn

FY17

Pre-merger AHFPL opened 100th branch customer base reached 49,000

FY18

Merger of DHFL Vysya Housing Finance Ltd with Pre-merger AHFPL

FY19

AUM crossed Rs 100 bn raised Rs 7 bn through a maiden public offering of NCDs

FY20

Customer base crossed 1,50,000; acquired by the Blackstone Group in June 2019

FY22

Customer base crossed 2,00,000; reached Rs 148bn AUM

Dec-23

AUM Reached Rs 199bn AUM

Source: RHP, Company, Systematix Institutional Research

07 May 2024

5

Systematix Research is also available on Bloomberg SSSL <Go>, Thomson & Reuters Systematix Shares and Stocks (India) Limited

Aadhar Housing Finance Ltd.

Exhibit 3: Key financial parameters

Particulars

FY21

FY22

FY23

9MFY23

Live Accounts (including assigned and co-lent loans) (nos)

182,471

204,135

233,228

255,683

Number of branches and sales offices (nos)

310

332

469

487

Average ticket size (Rs mn)

0.9

0.9

0.9

1.0

AUM (Rs mn)

133,270

147,780

172,230

198,650

- Retail AUM (Rs mn)

133,252

147,767

172,230

1,98,650

- Retail AUM as % of total AUM (%)

85

82

78

76

Gross Retail NPA (%)

1.1%

1.5%

1.2%

1.4%

Net Retail NPA to Retail AUM (%)

0.7%

1.1%

0.8%

1.0%

Net Worth (Rs mn)

26,928

31,466

36,976

42,491

Profit after tax before exceptional item (Rs mn)

3,401

4,449

5,643

5,479

Profit after tax (Rs mn)

3,401

4,449

5,448

5,479

Return before exceptional item on Average Total Assets (%)

2.6%

3.2%

3.5%

4.2%

Return before exceptional item on Equity (%)

13.5%

15.2%

16.5%

18.4%

Debt to Total Equity ratio (x)

3.9

3.4

3.3

3.1

CRAR (%)

44.1%

45.4%

42.7%

39.7%

Average yield on Gross Loan Book (%)

13.2%

12.8%

12.8%

14.0%

Average cost of Borrowing (%)

8.2%

7.2%

7.0%

7.6%

Net Interest Margin (%)

5.8%

6.9%

8.0%

9.0%

Cost to Income Ratio (%)

35.8%

36.3%

38.1%

36.2%

Source: RHP, Company, Systematix Institutional Research

Exhibit 4: Key Management

Name

Designation

Profile

Mr Deo Shankar

Tripathi

Executive Vice

Chairman

• Bachelor’s and master’s degree in Science and cleared the examination for a diploma in Public Administration.

• He has been associated with the company since January 17, 2015 and prior to joining Aadhar he was associated with pre-

merger Aadhar Housing Finance Private Ltd. (AHFPL)

• Earlier he held the position of MD & CEO Aadhar Housing Finance Ltd.

Mr Rishi Anand

MD & CEO

• Post Graduate Certification in Business Management

• He has over 25 years of work experience in financial services. Earlier he was associated with Aadhar as COO.

• Prior to joining Aadhar, he has worked with ICICI Bank , GE Countrywide Consumer Financial Services Ltd, BHW Birla Home

Finance Ltd, Reliance Capital & AIG Home Finance India Ltd.

Mr Rajesh

Viswanathan

Chief Financial

Officer

• Bachelor’s degree in commerce and he is a qualified chartered accountant cost and works accountant.

• He has several years of experience in accounting, finance, strategy, planning, taxation, treasury, audit, and managing

investor relations.

• Prior to joining Aadhar, he was associated with A F Ferguson & Co, Mahindra & Mahindra Limited, DSP Financial

Consultants Limited, KPMG Bahrain, Bajaj Allianz Life Insurance Corporation Limited, Bajaj Finance Limited & Capital Float.

Mr Sreekanth V N

Chief Compliance

Officer

• Bachelor’s degree in commerce and law. He is a qualified CS and has several years of experience in handling secretarial

functions.

• Before Aadhar he was associated with ICICI Bank, Firestone International Private Ltd. He has also worked for Bureau of

Police Research & Development, Ministry of Home Affairs and Department of Supply, Ministry of Commerce

Mr Anmol Gupta

Chief Treasury

Officer

• Bachelor’s degree in commerce (Hons.) and is a qualified chartered accountant.

• Prior to Aadhar he worked with BHW Birla Home Finance Limited and as the Accounts Officer.

Mr Nirav Shah

Chief Risk

Officer

• Bachelor’s degree in commerce and qualified Chartered Accountant. He has cleared the exam of Certified Information

Systems Audit.

• He has worked with Deloitte Haskins & Sells, ICICI Prudential Life Insurance Company Limited and Tata Capital Housing

Finance Limited.

Mr Hayyaksha

Ghosh

Chief Data

Officer

• Master’s of science degree in physics and post graduate diploma in management

• He has earlier worked with various organizations like Infosys Technologies Ltd, Mindwave Solutions Pte. Limited

(Singapore) etc.

Mr Anil Nair

Chief Business

Officer

• Master’s degree in commerce and business administration

• He has previously worked with Bata India Ltd, MIRC Electronics Ltd, ICICI Bank , DHFL, Aspire Home Finance.

Source: RHP, Company, Systematix Institutional Research

07 May 2024

6

Systematix Research is also available on Bloomberg SSSL <Go>, Thomson & Reuters Systematix Shares and Stocks (India) Limited

Aadhar Housing Finance Ltd.

Offer details

• The issue: Fresh issue of 31.7mn shares (Rs 10bn) and Offer for Sale of 63.5 mn

shares (Rs 20bn).

• Primary objective: Augmenting equity capital base to meet future capital

requirements towards onward lending and general corporate purpose.

Exhibit 5: Shareholding pattern

Shareholding

Pre Issue

Post Issue

BCP Topco VII Pte. Ltd.

98.7

76.7

ICICI Bank

1.3

1.3

Public

0

22.0

Total

100.0%

100.0%

Source: RHP, Company, Systematix Institutional Research

07 May 2024

7

Systematix Research is also available on Bloomberg SSSL <Go>, Thomson & Reuters Systematix Shares and Stocks (India) Limited

Aadhar Housing Finance Ltd.

Industry overview

Housing scenario in India

Housing Finance segment to clock 13-15% CAGR over FY23 to FY26

The Indian housing finance market grew at a healthy ~14% CAGR over FY18-FY23 led

by rise in disposable income, healthy demand coming from smaller cities markets,

attractive interest rates and government impetus on housing. Despite a healthy pace

of growth, mortgage penetration (mortgage to GDP ratio) in India still remains sub

optimal at ~11%, presenting a huge growth opportunity for bank and HFCs. Schedule

commercial banks (SCBs) command the highest market share in the housing loan

market at ~68%, followed by HFCs at 31%, and NBFCs having miniscule 1% share. As

per CRISIL, Housing Finance segment to clock 13-15% CAGR over FY23 to FY26.

Exhibit 6: Size of India’s housing loan industry Exhibit 7: Housing Finance market of loans upto Rs 1.5mn

15

18

19

21

25

29

32

44

0

13

25

38

50

FY18 FY19 FY20 FY21 FY22 FY23 9MFY24 FY26P

(Rs trn)

Housing Loans outstanding

3.7

3.9 3.9

4.1 4.1

4.3

4.4

5.7

0

2

3

5

6

FY18 FY19 FY20 FY21 FY22 FY23 9MFY24 FY26P

(Rs trn)

Low Income Housing Loans

Source: RHP, Company, Systematix Institutional Research Source: RHP, Company, Systematix Institutional Research

Growth in low income housing segment to bounce back in long run

During FY18-FY23, the growth in the low income housing segment was subdued at

~3% (CAGR), compared with overall housing loans, which has grown by 14%. This was

primarily due to slowdown in economic activity, funding challenges due to NBFC

crisis and the pandemic. Further, the increasing hybrid work model and working from

home led to an increase in demand for bigger residential homes (large ticket size).

Hence, sale in affordable housing segment was subdued while high-end and mid-

segment housing gained the maximum in past couple of years. As per CRISIL, the

growth in low income segment to bounce back strongly going ahead driven by 1)

Economic recovery post pandemic and return to office initiated by employers 2)

Government focus on housing and incentives 3) Rising demand for affordable homes

as consumers increasingly work out of Tier 3/4 cities. Further, this segment is

expected to pick up gradually and reach Rs 5.4-5.7 trn by FY26 resulting in 8-10%

CAGR during FY23-FY26 (As per CRISIL).

High regional concentration with greater skewness at the state level

Geographically, housing loan market is relatively skewed towards South and Western

region with share of 35% and 31% respectively. North region has ~26% share while

Eastern region accounts for balance 6% share in outstanding housing loans. Based on

home loans outstanding in the low income housing segment, top 10 states account

for ~80% of the market size as of Dec’23. Maharashtra tops the list with the highest

share of 16%, followed by Gujarat (12%), Tamil Nadu (9%), Rajasthan (7%) and

Madhya Pradesh (7%).

07 May 2024

8

Systematix Research is also available on Bloomberg SSSL <Go>, Thomson & Reuters Systematix Shares and Stocks (India) Limited

Aadhar Housing Finance Ltd.

Exhibit 8: Region-wise AUM breakup Exhibit 9: Share of top 10 states in housing loans

26%

31%

35%

6%

1%

1%

North

West

South

East

North-East

HLs not allotted to any

State

0%

25%

50%

75%

100%

FY18 FY19 FY20 FY21 FY22 FY23 9MFY24

Maharashtra Gujarat Tamil Nadu Rajasthan

Madhya Pradesh Uttar Pradesh Kerala Karnataka

Andhra Pradesh West Bengal Others

Source: RHP, Company, NHB, Systematix Institutional Research Source: RHP, Company, Systematix Institutional Research

Exhibit 10: Low income housing segment typically comprise of underserved customers

Source: RHP, Company, Systematix Institutional Research

Exhibit 11: Large HFCs continue to have dominant share, however mini HFCs have increased their market share

Market share

of HFC groups

Disbursement Mix

AUM Mix

FY19

FY20

FY21

FY22

FY23

9MFY24

FY19

FY20

FY21

FY22

FY23

9MFY24

Large HFCs

66%

62%

67%

65%

55%

66%

66%

69%

68%

70%

65% *

63%

Medium HFCs

12%

16%

12%

16%

20%

12%

15%

12%

12%

10%

14% *

15%

Small HFCs

15%

15%

13%

10%

12%

15%

15%

14%

15%

14%

14%

13%

Mini HFCs

7%

7%

8%

8%

14%

7%

5%

5%

6%

6%

8%

9%

Total

100%

100%

100%

100%

100%

100%

100%

100%

100%

100%

100%

100%

Source: RHP, Company, Systematix Institutional Research; Note: Large HFCs - Avg AUM for FY22 and FY23 more than Rs 500 bn (LICHF, PNBHF, Indiabulls Housing, Bajaj

Housing, Piramal Capital etc), Medium HFCs - Avg AUM for FY22 and FY23 between Rs 175 bn and Rs 500 bn (CANF, ICICI Homes, IIFL Housing, TATA Capital Housing etc),

Small HFCs - Avg AUM for FY22 and FY23 between Rs 70 bn and Rs 175 bn (Aadhar, Aavas, Repco, Aditya Birla Housing, Sundaram Housing etc) Mini HFCs - Avg AUM for FY22

and FY23 less than Rs 70 bn (Aptus, Capri Global Housing, India Shelter, HFFC etc); Note: * the significant change in market share of large HFCs and Medium HFCs in FY23 was

due to merger of HDFC Ltd into HDFC bank.

07 May 2024

9

Systematix Research is also available on Bloomberg SSSL <Go>, Thomson & Reuters Systematix Shares and Stocks (India) Limited

Aadhar Housing Finance Ltd.

The HFC focused on low income housing segment consists primarily of small and mini

HFCs. They were able to increase their market share from 14.9% as of March 2018 to

19.5% as of December 2023 in terms of home loan outstanding. The defining

characteristic of these HFCs is their strong focus on their target segment (i.e.,

housing loans lower than Rs 1.5 million ticket size to low-income customers), deep

understanding of the micro- markets they operate in, and relatively lower focus on

other products such as loans against property (LAP) and developer loans. Their credit

assessment processes are finetuned to serve their target segment. According to

CRISIL MI&A estimates, direct sales teams as a sourcing channel account for 65-70%

of the loans of these HFCs. Aadhar has a diversified origination mix with DSTs,

Aadhar Mitra (12,451) and DSAs (5,152), contributing 33.5%, 20.8%, 45.7% to

disbursements in 9MFY24. Aadhar Mitras are individuals engaged by the company

who are in non-allied industries (hardware stores, for example) and act as lead

providers to its DSTs.

Exhibit 12: Market share of HFC focused on low income segment is at ~20%

14.9

17.1

18.9

19.7

19.2

20.0

19.5

0

5

10

15

20

25

FY18 FY19 FY20 FY21 FY22 FY23 9MFY24

(%)

Source: RHP, Systematix Institutional Research

State wise market share in low income segment

States like Gujarat, Rajasthan, Tamil Nadu, Maharashtra & chattisgarh have more

than 50% market share within their respective states in low income housing

segment. Gujarat is at the top with 62% market share followed by Rajasthan (56%)

and Chhattisgarh (54%) for 9MFY24.

Exhibit 13: State wise market share in low income segment

51%

56%

53%

62%

42%

35%

47%

39%

38%

40%

54%

31%

20%

35%

28%

0%

18%

35%

53%

70%

Maharashtra

Rajasthan

Tamil Nadu

Gujarat

Madhya Pradesh

Uttar Pradesh

Andhra Pradesh

Karnataka

Telangana

Delhi

Chattisgarh

Haryana

Punjab

Kerala

Uttarakhand

Source: RHP, Company, Systematix Institutional Research

07 May 2024

10

Systematix Research is also available on Bloomberg SSSL <Go>, Thomson & Reuters Systematix Shares and Stocks (India) Limited

Aadhar Housing Finance Ltd.

Investment Rationale

Well placed to capture growth led by deeper penetration in key states

and expanding customer base

Aadhar Housing Finance Limited (AHFL) is a leading player (with ~4% market share in

overall HFC group) in affordable housing finance space with AUM of Rs198bn. It has

diversified presence with 487 branches spread across 533 districts in 20 states. The

branches are evenly spread across states which reduces geographic concentration

risk as no single state contributes >14% of AUM. Loan growth and subsequently

improvement in market share to be aided by a) rising urbanization and continued

expansion of its physical and digital presence across India b) increasing customer

base.There is an immense potential in the housing market, driven by significant

shortage of housing loans. As per CRISIL, ~95% of housing shortage expected to be

driven by EWS / LIG segments.

Aadhar is primarily focused on the low income housing segment (ticket size less than

Rs 1.5mn), and target first-time home buyers in economically weaker and low-to-

middle income segments. The salaried segment constitute 57% while self-employed

segment constitute 43% of gross AUM respectively as of Dec’23. The company offers,

home loans, loan against property, loans for renovation and property extension and

loans for purchase of commercial property. Home loans constitute ~76%, while non-

home loans constitute ~24% of gross AUM respectively as of Dec’23. As Aadhar cater

to low income segment, the loans also classify for various affordable housing

schemes promoted by the Government of India, such as the Pradhan Mantri Awas

Yojana (PMAY). These loans constitute ~24% of live accounts and ~20% of Gross AUM

as of Dec’23. Out of total Disbursements, ~12% are new to credit customers and

average ticket size of loan is Rs 1mn with Avg LTV of 58%. As of Dec’23, the branch

network stood at 487 branches spread across 533 districts in 20 states. The branches

are evenly spread across states which reduces the geographic concentration risk with

no single state contributes >14% of AUM.

Exhibit 14: State wise AUM mix

14%

13%

13%

11%

10%

8%

7%

4%

4%

16%

MH

UP

RJ

GJ

MP

TN

TL

AP

KTK

Others

Rs 199bn

AUM

Dec-23

Source: RHP, Company, Systematix Institutional Research

The branch expansion is done in a calibrated and systematic manner by reviewing

factors like demographics and competitive landscape before establishing a branch.

Thus, Aadhar has strategically expanded to geographies where there is substantial

demand for housing finance in low income segment. Going ahead, rising urbanization

and continued expansion of physical and digital presence across India expected to

drive the growth. The current operating model, which Aadhar is following is scalable

and it will assist in expanding the operations with lower incremental costs to drive

efficiency and profitability.

07 May 2024

11

Systematix Research is also available on Bloomberg SSSL <Go>, Thomson & Reuters Systematix Shares and Stocks (India) Limited

Aadhar Housing Finance Ltd.

Exhibit 15: Size of the branch is linked to disbursement potential

Source: RHP, Company, Systematix Institutional Research

In addition with deeper penetration, Aadhar aims to focus on increasing its share of

low income housing segment and economically weaker and low-to-middle income

group segment and expand its customer base with the help of co-lending

arrangements with banks (2 PSUs and 1 private). As of Dec’23, Aadhar has more than

255000 live accounts.

Exhibit 16: Majority of housing shortfall expected to be driven by EWS / LIG segment

Source: RHP, Company, Systematix Institutional Research

Tech enabled solutions to improve cost efficiency in long run

In FY20, Aadhar invested in an integrated loan platform by TCS and launched a digital

transformation program which provides a more integrated digital platform for

various stages of a loan cycle onboarding, loan origination, accounting and reporting.

These tech enabled solutions are further expected to improve systems, processes

and controls. Operationally, tech solutions / digitization benefits through improved

underwriting processes, increased productivity, cost reduction and improved

collections through data-driven early warning systems. Its fully built distribution and

collections infrastructure is a key source of operating leverage and will help reduce

the operating expenses and credit cost in long run.

07 May 2024

12

Systematix Research is also available on Bloomberg SSSL <Go>, Thomson & Reuters Systematix Shares and Stocks (India) Limited

Aadhar Housing Finance Ltd.

Exhibit 17: Scalable tech & digital platform

Source: RHP, Company, Systematix Institutional Research

Exhibit 18: Focus on business transformation through data science…

Source: RHP, Company, Systematix Institutional Research

Exhibit 19: Branch efficciency comparison

Branch Efficiency (3QFY24)

AADHAR

AAVAS

APTUS

HFFC

INDIA

SHELTER

AUM per branch (mn)

408

458

308

733

261

Disbursement/ Branch (mn)*

143

155

117

328

126

Employee per branch (no.)

8

18

11

10

15

Opex per Branch (mn)*

12

15

8

20

11

Employee cost/ branch (mn)*

8

10

6

13

9

Other Opex/ branch (mn)*

3

5

2

6

2

Profit per branch (mn)*

17

13

24

26

12

Source: RHP, Company, Systematix Institutional Research,; Note: * Annualised

07 May 2024

13

Systematix Research is also available on Bloomberg SSSL <Go>, Thomson & Reuters Systematix Shares and Stocks (India) Limited

Aadhar Housing Finance Ltd.

Extensive underwriting and healthy collections leading to robust asset

quality

Aadhar has implemented a robust and comprehensive credit assessment, risk

management and collections framework to identify, monitor and manage risks in

operations. The company primarily caters to retail segment, a majority of whom are

salaried individuals purchasing residential properties. Thus, asset quality has been

largely maintained healthy. The company has streamlined its sanction, pre-

disbursement and post disbursement processes on IT platform, which cover the

entire lifecycle of the customer from lead generation, credit underwriting, legal and

technical processes to loan disbursement and monitoring and collections. Its in-

house technical team comprises of civil engineers which assess property valuation

which enables Aadhar to make accurate valuations of the properties that they are

financing. In addition, it has in-house collection team which ensures timely

collections. During pandemic, management changed its strategy and focused more

on salaried customers and conducted additional due diligence on customers to

assess the impact on their employment. Such measures helped in the improvement

of their collection efficiencies. Aadhar’s effective credit risk management policies and

framework is reflected in its portfolio quality indicators such as high repayment rates

(20-22%) and low rates of GNPAs and NNPAs across cycles. As of Dec’23, its gross

stage 3 and net stage 3 stood at 1.4% and 0.9% respectively and all the outstanding

loans are secured by mortgage over property or other security. Since past three

years, credit cost was maintained at < 50bps.

Exhibit 20: Credit assessment by in-house team…

Source: RHP, Company, Systematix Institutional Research

Improved share of non housing loans supported NIM expansion

AHFL’s funding profile is fairly diversified and comprises of loans from banks (55%),

refinance from NHB (27%), NCDs (18%), and others (2%) as of Dec’23. In terms of

fund raising, post the change in ownership, its has been able to raise funds regularly

from diversified funding sources and relatively at low-cost rates from NHB. Despite

the systemic hardening of interest rates, its cost of borrowing has been steadily

declining due to its proactive and flexible fundraising strategy. With an aim to

expand its NIMs, managenment aim to diversify its funding sources, identify new

sources and pools of capital, and implement robust asset liability management

policies. The share of home loan segment (yields at ~12-13%) declined to 76% in

9MFY24 from 84% in FY19, while share of non-home loan segment (yields at 15-17%)

07 May 2024

14

Systematix Research is also available on Bloomberg SSSL <Go>, Thomson & Reuters Systematix Shares and Stocks (India) Limited

Aadhar Housing Finance Ltd.

gone up to 24% in 9MFY24 from 15% in FY19 thereby maintaining spreads. Hence

going ahead, with increasing share of relatively higher-yielding non-home loan

portfolio and increase in lending rates, AHFL expected to protect its spreads,

resulting in healthy NIMs (~7% in 9MFY24).

Exhibit 21: Share of high yield non-housing book is increasing

84

85

85

82

78

76

15

14

15

18

22

24

0.95

0.37

0.02

0.01

0

25

50

75

100

FY19 FY20 FY21 FY22 FY23 9MFY24

(%)

Home loan LAP Project Loans

Source: RHP, Company, Systematix Institutional Research

Exhibit 22: Higher yields and lower cost has been aiding NIM expansion

14.3

14.3

14.6

13.6

13.8

14.9

10.0

8.9

8.2

7.2

7.0

7.8

4.3

5.4

6.5

6.4

6.8

7.1

4.1

3.9

4.9

5.5

6.1

6.8

0

5

9

14

18

FY19 FY20 FY21 FY22 FY23 9MFY24

(%)

Yields Cost of Borrowing Spread NIMs

Source: RHP, Company, Systematix Institutional Research

Strong parentage provides access to diversified and cost efficient

borrowings

AHFL is backed by BCP Topco (managed and advised by Blackstone Group Inc) which

currently holds 98.7% and hence benefit from blackstone’s resources, relationships

and expertise. Over the years, AHFL have secured funding from various sources

including term loans; proceeds from loans assigned; proceeds from the issuance of

NCDs; refinancing from the NHB; and subordinated debt borrowings from banks,

mutual funds, insurance companies and other domestic and foreign financial and

development finance institutions.

AHFL’s funding profile is fairly diversified and comprises of loans from banks (55%),

refinance from NHB (27%), NCDs (18%), and others (2%) as of Dec’23. In terms of

fund raising, post the change in ownership, Aadhar Housing Finance has been able to

raise funds regularly from diversified funding sources and relatively at low-cost rates

from NHB.

07 May 2024

15

Systematix Research is also available on Bloomberg SSSL <Go>, Thomson & Reuters Systematix Shares and Stocks (India) Limited

Aadhar Housing Finance Ltd.

Its cost of borrowing has steadily declined (from 10% in FY19 to 7% in FY23) led by

proactive and flexible fundraising strategy. The Company intends to continue to

diversify its funding sources, identify new sources and pools of capital, and

implement robust asset liability management policies with the aim of optimising its

cost of borrowings and aid its NIMs. It also intends to further increase the share of

NHB refinancing in its total borrowings and access international sources of funding to

reduce its overall cost of borrowing.

Its average cost of borrowings reduced from 8.2% in FY21 to 7.0% in FY23 and

increased slightly to 7.6% for 9MFY24.

Exhibit 23: Diverse funding mix with low short term exposure

Source: RHP, Company, Systematix Institutional Research

Exhibit 24: Borrowing mix…

66

72

62

60

54

20

18

21

17

21

11

8

16

22

25

1

1

1

1

1

3

1

0%

25%

50%

75%

100%

FY19 FY20 FY21 FY22 FY23

Term loans from Banks/FI NCD NHB Refinancing Subordianted Liabilities Cash credit Others

Source: RHP, Company, Systematix Institutional Research

Experienced and seasoned management team enhance confidence

Aadhar has a strong, experienced and dedicated management team, with senior

management team together having an average experience of more than two

decades in the financial services industry. The management is headed by Mr Rishi

Anand (MD & CEO) who has a vast experience of more than 27 years in the financial

services sector. Prior to this he held position of the COO of AHFL. Mr. Rajesh

Viswanathan is a Chief Financial Officer (CFO) of AHFL and he is a Chartered

07 May 2024

16

Systematix Research is also available on Bloomberg SSSL <Go>, Thomson & Reuters Systematix Shares and Stocks (India) Limited

Aadhar Housing Finance Ltd.

Accountant with overall experience of over 25 years. Mr. Anmol Gupta is Chief

Treasury Officer (CTO), has over 20 years of experience in Planning & Control. Its

promoter, BCP Topco (managed and advised by Blackstone Group Inc) currently

holds ~98.7% and it will sale ~22% stake, but continue to hold majority in the

company. Hence, AHFL strengthened its corporate governance framework, with the

induction of three independent directors, one of whom serves as Non-Executive

Chairman. Operational oversight has been reflected through the undertaking of

various measures such as overhaul of the IT systems and technology and

consolidation of branches to bring in operational efficiencies.

Key risks

Geographic concentration in certain states: ~50% of AUM and ~45% of branches

are concentrated in four states viz. Uttar Pradesh, Maharashtra, Madhya Pradesh

and Gujarat. Any significant social, political or economic disruption, or natural

calamities could disrupt their business operwations, which will require the company

to make a significant expenditure and change in business strategies. The occurrence

or inability to effectively respond to any such event, could have an adverse effect on

the business and results of operations.

Highly competitive market: The housing finance industry in India is highly

competitive and Aadhar competes other HFCs, small finance banks and NBFCs in

each of the geographies in which it operates. Competitors may have more resources,

a wider branch and distribution network, access to cheaper funding, superior

technology and may have a better understanding of and relationships with

customers in these markets. The ability to compete effectively will depend on ability

to maintain or increase margins.

Higher dependency on direct selling agents (DSAs): Over past few years, Aadhar’s

dependency on DSAs for sourcing of loans has been increased from 28.7%

(contribution to total disbursements) in FY21 to 45.7% in 9MFY24. Higher

dependency on DSAs could lead to increase in balance transfers (currently at 6-6.5%)

Valuation

Aadhar Housing Finance (AHFL) is a bet on low ticket size affordable housing

segment. Given the current size of AHFL, the company is well positioned to capture

the huge untapped opportunity in ticket size below Rs 1.5mn via deeper penetration

in new geographies and increase in potential customer base. Wide distribution

network and strong underwriting practices bodes well for growth and asset quality.

In addition, experienced management team with strong track record along with

backing of Blackstone boost confidence. At the upper end of the price band (Rs 300-

315), the issue is valued at ~2.5x Dec’23 BV (including capital raise) with RoA of ~4%

and RoE of ~18%, which looks attractive vs peers which are trading at ~3.5x BV

(Avg.). Hence, we recommend investors to subscribe this issue.

Exhibit 25: HFCs peer valuations

Loan Book (Rs bn)

RoA (%)

RoE (%)

BV (Rs)

P/BV (x)

FY22

FY23

FY24E

FY22

FY23

FY24E

FY22

FY23

FY24E

FY22

FY23

FY24E

FY22

FY23

FY24E

AADHAR *

133

147

172

2.6

3.2

3.7

13.5

15.2

16.6

63

74

87

5.0

4.3

3.6

AAVAS

113

141

173

3.6

3.5

3.3

13.6

14.1

13.9

355

413

476

4.5

3.8

3.3

HFFC

53

71

96

3.9

3.9

3.7

12.6

13.5

15.7

179

206

236

5.0

4.3

3.8

APTUS

51

67

87

7.3

7.8

7.6

15.1

16.1

17.2

59

66

75

5.5

4.8

4.3

INDIA SHELTER

31

43

60

4.5

4.1

4.5

12.8

13.4

13.2

100

116

211

5.7

5.0

2.7

Source: RHP, Company, Systematix Institutional Group, Note: # P/BV at ~2.5x (post capital raise); * FY24 figures for Aadhar are Projected based on 9MFY24

07 May 2024

17

Systematix Research is also available on Bloomberg SSSL <Go>, Thomson & Reuters Systematix Shares and Stocks (India) Limited

Aadhar Housing Finance Ltd.

Peer comparison

Exhibit 26: Peer Comparison - Key Financial parameters

Particulars (Rs mn)

Aadhar

Aavas

HFFC

Aptus

FY23

9MFY24

FY23

9MFY24

FY23

9MFY24

FY23

9MFY24

Asset Under Management (AUM)

172,228

198,652

141,667

160,795

71,980

90,137

67,383

80,717

Disbursements

59,026

49,041

50,245

36,891

30,129

28,615

23,950

21,590

Profit After Tax

5,643

5,479

4,296

3,482

2,283

2,223

5,030

4,479

Average yield on Loan Book (%)

12.8%

14.0%

12.6%

14.0% *

13.3%

13.8%

17.7%

17.8% *

Average cost of borrowings (%)

7.0%

7.6%

6.6%

7.5% *

7.3%

8.1%

8.5%

8.8%

Spread (%)

5.8%

6.4%

6.0%

6.5% *

5.9%

5.7%

9.2%

8.9% *

Operating Expenses /

Average Total Assets (%)

3.1%

3.3%

3.8%

3.6% *

2.9%

2.9%

2.6%

2.5%

Cost to Income Ratio (%)

38.1%

36.2%

45.0%

46.1%

35.5%

35.7%

19.4%

20.0%

Return on Total Assets (%)

3.6%

4.2%

3.5%

3.2% *

3.9%

3.8%

7.8%

7.7%

Return on Equity (%)

16.5%

18.4%

14.1%

13.5% *

13.5%

15.4%

16.1%

17.0%

Gross NPA to AUM (%)

1.2%

1.4%

0.9%

1.1%

1.6%

1.7%

1.2%

1.2% *

Net NPA to AUM (%)

0.8%

1.0%

0.7%

0.8% *

1.1%

1.2%

0.9%

0.9%

Net worth

36,976

42,491

32,697

36,314

18,173

20,318

33,393

37,014

Debt to Net worth ratio

3.3

3.1

3.0

3.3 *

2.6

3.4

1.1

1.2

CRAR (%)

42.7%

39.7%

47.0%

45.0%

49.4%

40.9%

77.4%

70.5%

Number of branches

469

487

346

351

111

123

231

262

Number of States

20

20

13

13

13

13

5

6

Source: RHP, Company, Systematix Institutional Group, Note: * Average figures

Exhibit 27: DuPont Analysis

Particulars (FY23)

Aadhar

Aavas

HFFC

Aptus

Interest Income

11.5

11.4

12.2

16.5

Interest Expense

5.2

4.8

5.1

4.3

Net Interest Income

6.3

6.5

7.1

12.2

Other income

1.7

1.8

1.2

1.1

Total Net Income

8.0

8.3

8.3

13.3

Total operating expenses

3.1

3.8

2.9

2.6

Pre-provision profit

5.0

4.6

5.3

10.7

Provisions

0.3

0.1

0.4

0.5

Profit before tax and

exceptional items

4.7

4.5

5.0

10.2

Profit before tax

4.8

4.5

5.0

10.2

Tax total

1.0

1.0

1.1

2.3

Reported Profit after tax

3.8

3.5

3.9

7.8

RoAE

16.6

14.1

13.5

16.1

Source: RHP, Company, Systematix Institutional Research

07 May 2024

18

Systematix Research is also available on Bloomberg SSSL <Go>, Thomson & Reuters Systematix Shares and Stocks (India) Limited

Aadhar Housing Finance Ltd.

Key charts

Exhibit 28: AUM growth gained momentum over last 3 years Exhibit 29: Non Home loan share has risen since FY21

100

114

133

148

172

199

26

14

17

11

17

20

0

10

19

29

38

0

63

125

188

250

FY19 FY20 FY21 FY22 FY23 9MFY24

(%)(Rs bn)

AUM YoY (RHS)

84

85

85

82

78

76

15

14

15

18

22

24

0.95

0.37

0.02

0.01

0

25

50

75

100

FY19 FY20 FY21 FY22 FY23 9MFY24

(%)

Home loan LAP Project Loans

Source: RHP, Company Source: RHP, Company

Exhibit 30: Disbursements growth has been strong Exhibit 31: Yield, cost of borrowing, NIMs

32

32

35

40

59

17

(18)

(0)

11

13

48

17

(25)

0

25

50

75

0

18

35

53

70

FY19 FY20 FY21 FY22 FY23 9MFY24

(%)(Rs bn)

Disbursement YoY (RHS)

14.3

14.3

14.6

13.6

13.8

14.9

10.0

8.9

8.2

7.2

7.0

7.8

4.3

5.4

6.5

6.4

6.8

7.1

4.1

3.9

4.9

5.5

6.1

6.8

0

5

9

14

18

FY19 FY20 FY21 FY22 FY23 9MFY24

(%)

Yields Cost of Borrowing Spread NIMs

Source: RHP, Company Source: RHP, Company

Exhibit 32: Asset quality healthy and stable Exhibit 33: Healthy RoA profile

1,310 1,350 1,837 1,626 2,308

1.4

1.2

1.5

1.2

1.4

0.9

0.9

1.1

0.8

0.9

0.0

0.4

0.8

1.2

1.6

0

625

1,250

1,875

2,500

FY20 FY21 FY22 FY23 9MFY24

(%)

(Rs bn)

Gross stage 3 GS3 assets (RHS) NS3 assets (RHS)

2.0

1.7

2.6

3.2

3.7

4.6

22.3

11.8

13.5

15.2

16.6

19.7

10.9

6.8

5.2

4.8

4.5

4.3

0

7

14

20

27

FY19 FY20 FY21 FY22 FY23 9MFY24

(%)

RoA RoE Leverage

Source: RHP, Company Source: RHP, Company

07 May 2024

19

Systematix Research is also available on Bloomberg SSSL <Go>, Thomson & Reuters Systematix Shares and Stocks (India) Limited

Aadhar Housing Finance Ltd.

FINANCIALS

Profit & Loss Statement

YE: Mar (Rs mn) FY21 FY22 FY23 FY24P

Net interest income 6,110 7,771 9,771 12,768

Other income 1,486 1,903 2,672 3,177

Net Income 7,596 9,674 12,443 15,944

Operating expenses 2,721 3,513 4,743 5,796

Preprovision profit 4,875 6,161 7,700 10,148

Provisions 549 487 492 568

Profit before tax 4,325 5,674 7,458 9,830

Tax 924 1,225 1,511 1,991

Tax rate 21.4 21.6 20.3 20.3

Reported Profit after tax 3,401 4,449 5,948 7,839

Source: Company, Systematix Institutional Research, Note: FY24P based on 9MFY24

Balance Sheet

YE: Mar (Rs mn) FY21 FY22 FY23 FY24P

Equity 3,948 3,948 3,948 3,948

Reserves 22,981 27,519 33,029 40,084

Net worth 26,928 31,467 36,977 44,032

Borrowings 103,745 106,746 121,535 137,091

Others 5,630 5,545 7,668 8,018

Total liabilities 136,303 143,758 166,179 189,141

Cash 21,713 17,102 19,180 14,473

Investments 4,971 3,380 4,594 4,962

Loans 106,133 119,603 138,515 165,223

Others 2,956 3,122 3,257 3,722

Total assets 136,303 143,758 166,179 189,141

Source: Company, Systematix Institutional Research, Note: FY24P based on 9MFY24

Key Ratios

YE: Mar FY21 FY22 FY23 FY24P

Yield on portfolio 14.6 13.6 13.8 15.0

cost of borrowings 8.2 7.2 7.0 7.7

Interest Spread 6.5 6.4 6.8 7.3

NIM (on AUM) 4.9 5.5 6.1 6.7

Cost/ Income (%) 35.8 36.3 38.1 36.4

Credit cost (%) 0.4 0.3 0.3 0.3

RoA(%) 2.6 3.2 3.7 4.3

RoE(%) 13.5 15.2 16.6 18.7

Leverage (x) 5.2 4.8 4.5 4.4

Gross NPA (%) 1.2 1.5 1.2 1.4

Net NPA (%) 0.9 1.1 0.8 0.9

Provision coverage (%) 32.1 29.7 34.2 37.0

Source: Company, Systematix Institutional Research, Note: FY24P based on 9MFY24

Dupont (as % of Average Assets)

YE: Mar FY21 FY22 FY23 FY24P

Interest Income 11.0 11.0 11.5 12.8

Interest Expense 6.3 5.4 5.2 5.6

Net Interest Income 4.7 5.5 6.3 7.2

Other income total 1.1 1.4 1.7 1.8

Net Income total 5.8 6.9 8.0 9.0

Operating expenses total 2.1 2.5 3.1 3.3

Preprovision profit 3.8 4.4 5.0 5.7

Provisions 0.4 0.3 0.3 0.3

Profit before tax and exce. items 3.3 4.1 4.7 5.4

Profit after tax 2.6 3.2 3.8 4.4

Source: Company, Systematix Institutional Research, Note: FY24P based on 9MFY24

Growth

YE: Mar (%) FY21 FY22 FY23 FY24P

Net interest income 45.1 27.2 25.7 30.7

Net Income total 27.7 27.4 28.6 28.1

Preprovision profit 43.1 26.4 25.0 31.8

Profit before tax 87.3 31.2 31.5 31.8

Profit after tax 79.6 30.8 33.7 31.8

Loan 19.1 12.7 15.8 19.3

Disbursement 11.1 12.6 47.9 22.0

AUM 16.6 10.9 16.5 20.0

Source: Company, Systematix Institutional Research, Note: FY24P based on 9MFY24

Valuation ratios

YE: Mar FY21 FY22 FY23 FY24P

FDEPS (Rs) 8.0 10.4 13.4 17.8

PER (x) 39.5 30.2 23.6 17.7

Book value (Rs) 63.1 73.8 86.7 103.2

P/BV (Rs) 5.0 4.3 3.6 3.1

Adjusted book value (Rs) 61.0 70.8 84.2 99.7

P/ABV (Rs) 5.2 4.5 3.7 3.2

P/PPP (x) 27.6 21.8 17.4 13.2

Dividend yield (%) 0.0 0.0 0.0 0.0

Source: Company, Systematix Institutional Research, Note: FY24P based on 9MFY24,

P/BV at ~2.5x (post capital raise)

07 May 2024

20

Systematix Research is also available on Bloomberg SSSL <Go>, Thomson & Reuters Systematix Shares and Stocks (India) Limited

Aadhar Housing Finance Ltd.

Nikhil Khandelwal Managing Director +91-22-6704 8001 nikhil@systematixgroup.in

Equity Research

Analysts Industry Sectors Desk-Phone E-mail

Dhananjay Sinha Co Head of Equities & Head of Research - Strategy & Economics +91-22-6704 8095 dhananjaysinha@systematixgroup.in

Abhishek Mathur FMCG +91-22-6704 8059 abhishekmathur@systematixgroup.in

Ashish Poddar Consumer Durables, EMS, Building Materials, Small-Mid Caps +91-22-6704 8039 ashishpoddar@systematixgroup.in

Himanshu Nayyar Consumer Staples & Discretionary +91-22-6704 8079 himanshunayyar@systematixgroup.in

Manjith Nair Banking, Insurance +91-22-6704 8065 manjithnair@systematixgroup.in

Pradeep Agrawal NBFCs & Diversified Financials +91-22-6704 8024 pradeepagrawal@systematixgroup.in

Pratik Tholiya Specialty & Agro Chem, Fertilisers, Sugar, Textiles and Select Midcaps +91-22-6704 8028 pratiktholiy[email protected]

Sameer Pardikar IT & ITES +91-22-6704 8041 sameerpardikar@systematixgroup.in

Santosh Yellapu Capital Goods +91-22-6704 8094 santoshyellapu@systematixgroup.in

Shweta Dikshit Metals & Mining +91-22-6704 8042 shwetadikshit@systematixgroup.in

Sudeep Anand Oil & Gas, Logistics, Cement, Wagons +91-22-6704 8085 sudeepanand@systematixgroup.in

Vishal Manchanda Pharmaceuticals and Healthcare +91-22-6704 8064 vishalmanchanda@systematixgroup.in

Chetan Mahadik Consumer Staples & Discretionary +91-22-6704 8091 chetanmahadik@systematixgroup.in

Deeksha Bhardwaj Strategy & Economics +91-22-6704 8017 deekshabhardwaj@systematixgroup.in

Devanshi Kamdar IT & ITES +91-22-6704 8098 devanshikamdar@systematixgroup.in

Hinal Kothari Metals & Mining +91-22-6704 8076 hinalkothari@systematixgroup.in

Jennisa Popat Oil & Gas, Logistics, Cement, Wagons +91-22-6704 8066 jennisapopat@systematixgroup.in

Kalash Jain Midcaps +91-22-6704 8038 kalashjain@systematixgroup.in

Krisha Zaveri Consumer Durables, EMS, Building Materials, Small-Mid Caps +91-22-6704 8023 krishazaveri@systematixgroup.in

Mahek Shah Consumer Durables, EMS, Building Materials, Small-Mid Caps +91-22-6704 8040 mahekshah@systematixgroup.in

Nirali Chheda Banking, Insurance +91-22-6704 8019 niralichheda@systematixgroup.in

Pashmi Chheda Banking, Insurance +91-22-6704 8063 pashmichheda@systematixgroup.in

Pravin Mule NBFCs & Diversified Financials +91-22-6704 8034 pravinmule@systematixgroup.in

Prathmesh Kamath Oil & Gas, Logistics, Cement, Wagons +91-22-6704 8022 prathmeshkamath@systematixgroup.in

Purvi Mundhra Macro-Strategy +91-22-6704 8078 purvimundhra@systematixgroup.in

Rajesh Mudaliar Consumer Staples & Discretionary +91-22-6704 8084 rajeshmudaliar@systematixgroup.in

Ronak Dhruv NBFCs & Diversified Financials +91-22-6704 8045 ronakdhruv@systematixgroup.in

Rushank Mody Pharmaceuticals and Healthcare +91-22-6704 8046 rushankmody@systematixgroup.in

Swati Saboo Midcaps +91-22-6704 8043 swatisaboo@systematixgroup.in

Vivek Mane Pharmaceuticals and Healthcare +91-22-6704 8046 vivekmane@systematixgroup.in

Equity Sales & Trading

Name Desk-Phone E-mail

Vipul Sanghvi Co Head of Equities & Head of Sales +91-22-6704 8062 vipulsanghvi@systematixgroup.in

Jignesh Desai Sales +91-22-6704 8068 jigneshdesai@systematixgroup.in

Sidharth Agrawal Sales +91-22-6704 8090 sidharthagrawal@systematixgroup.in

Rahul Khandelwal Sales +91-22-6704 8003 rahul@systematixgroup.in

Chintan Shah Sales +91-22-6704 8061 chintanshah@systematixgroup.in

Pawan Sharma Director and Head - Sales Trading +91-22-6704 8067 pawansharma@systematixgroup.in

Mukesh Chaturvedi Vice President and Co Head - Sales Trading +91-22-6704 8074 mukeshchaturvedi@systematixgroup.in

Vinod Bhuwad Sales Trading +91-22-6704 8051 vinodbhuwad@systematixgroup.in

Rashmi Solanki Sales Trading +91-22-6704 8097 rashmisolanki@systematixgroup.in

Karan Damani Sales Trading +91-22-6704 8053 karandamani@systematixgroup.in

Vipul Chheda Dealer +91-22-6704 8087 vipulchheda@systematixgroup.in

Paras Shah Dealer +91-22-6704 8047 parasshah@systematixgroup.in

Rahul Singh Dealer +91-22-6704 8054 rahulsingh@systematixgroup.in

Niraj Singh Dealer +91-22-6704 8096 nirajsingh@systematixgroup.in

Corporate Access

Mrunal Pawar Vice President & Head Corporate Access +91-22-6704 8088 mrunalpawar@systematixgroup.in

Darsha Hiwrale Associate Corporate Access +91-22-6704 8083 darshahiwrale@systematixgroup.in

Production

Madhu Narayanan Editor +91-22-6704 8071 madhunarayanan@systematixgroup.in

Mrunali Pagdhare Production +91-22-6704 8057 mrunalip@systematixgroup.in

Vijayendra Achrekar Production +91-22-6704 8089 vijayendraachrekar@systematixgroup.in

Operations

Sachin Malusare Vice President +91-22-6704 8055 sachinmalusare@systematixgroup.in

Jignesh Mistry Manager +91-22-6704 8049 jigneshmistry@systematixgroup.in

Hiren Patel Assistant Manager +91-22-6704 8056 hirenpatel@systematixgroup.in

Institutional Equities Team

07 May 2024

21

Systematix Research is also available on Bloomberg SSSL <Go>, Thomson & Reuters Systematix Shares and Stocks (India) Limited

Aadhar Housing Finance Ltd.

DISCLOSURES/APPENDIX

I. ANALYST CERTIFICATION

I, Pradeep Agrawal, Pravin Mule, Ronak Dhruv; hereby certify that (1) views expressed in this research report accurately reflect my/our personal views about any or all of the subject

securities or issuers referred to in this research report, (2) no part of my/our compensation was, is, or will be directly or indirectly related to the specific recommendations or views

expressed in this research report by Systematix Shares and Stocks (India) Limited (SSSIL) or its group/associate companies, (3) reasonable care is taken to achieve and maintain

independence and objectivity in making any recommendations.

Disclosure of Interest Statement

Update

Analyst holding in the stock

No

Served as an officer, director or employee

No

II. ISSUER SPECIFIC REGULATORY DISCLOSURES, unless specifically mentioned in point no. 9 below:

1. The research analyst(s), SSSIL, associates or relatives do not have any financial interest in the company(ies) covered in this report.

2. The research analyst(s), SSSIL, associates or relatives collectively do not hold more than 1% of the securities of the company(ies) covered in this report as of the end of the

month immediately preceding the distribution of the research report.

3. The research analyst(s), SSSIL, associates or relatives did not have any other material conflict of interest at the time of publication of this research report.

4. The research analyst, SSSIL and its associates have not received compensation for investment banking or merchant banking or brokerage services or any other products or

services from the company(ies) covered in this report in the past twelve months.

5. The research analyst, SSSIL or its associates have not managed or co-managed a private or public offering of securities for the company(ies) covered in this report in the previous

twelve months.

6. SSSIL or its associates have not received compensation or other benefits from the company(ies) covered in this report or from any third party in connection with this research

report.

7. The research analyst has not served as an officer, director or employee of the company(ies) covered in this research report.

8. The research analyst and SSSIL have not been engaged in market making activity for the company(ies) covered in this research report.

9. Details of SSSIL, research analyst and its associates pertaining to the companies covered in this research report:

Sr.

No.

Particulars

Yes /

No.

1

Whether compensation was received from the company(ies) covered in the research report in the past 12 months for investment banking transaction by SSSIL.

No

2

Whether research analyst, SSSIL or its associates and relatives collectively hold more than 1% of the company(ies) covered in the research report.

No

3

Whether compensation has been received by SSSIL or its associates from the company(ies) covered in the research report.

No

4

Whether SSSIL or its affiliates have managed or co-managed a private or public offering of securities for the company(ies) covered in the research report in the

previous twelve months.

No

5

Whether research analyst, SSSIL or associates have received compensation for investment banking or merchant banking or brokerage services or any other

products or services from the company(ies) covered in the research report in the last twelve months.

No

10. There is no material disciplinary action taken by any regulatory authority that impacts the equity research analysis activities.

STOCK RATINGS

BUY (B): The stock's total return is expected to exceed 15% over the next 12 months.

HOLD (H): The stock's total return is expected to be within -15% to +15% over the next 12 months.

SELL (S): The stock's total return is expected to give negative returns of more than 15% over the next 12 months.

NOT RATED (NR): The analyst has no recommendation on the stock under review.

INDUSTRY VIEWS

ATTRACTIVE (AT): Fundamentals/valuations of the sector are expected to be attractive over the next 12-18 months.

NEUTRAL (NL): Fundamentals/valuations of the sector are expected to neither improve nor deteriorate over the next 12-18 months.

CAUTIOUS (CS): Fundamentals/valuations of the sector are expected to deteriorate over the next 12-18 months.

III. DISCLAIMER

The information and opinions contained herein have been compiled or arrived at based on the information obtained in good faith from sources believed to be reliable. Such information

has not been independently verified and no guaranty, representation of warranty, express or implied, is made as to its accuracy completeness or correctness.

This document is for information purposes only. This report is based on information that we consider reliable; we do not represent that it is accurate or complete and one should exercise

due caution while acting on it. Description of any company(ies) or its/their securities mentioned herein are not complete and this document is not and should not be construed as an

offer or solicitation of an offer to buy or sell any securities or other financial instruments. Past performance is not a guide for future performance, future returns are not guaranteed and

a loss of original capital may occur. All opinions, projections and estimates constitute the judgment of the author as on the date of the report and these, plus any other information

contained in the report, are subject to change without notice. Prices and availability of financial instruments are also subject to change without notice. This report is intended for

distribution to institutional investors.

This report is not directed to or intended for display, downloading, printing, reproducing or for distribution to or use by, any person or entity that is a citizen or resident or located in any

locality, state, country or other jurisdiction where such distribution, publication, reproduction, availability or use would be contrary to law or regulation or what would subject to SSSIL or

its affiliates to any registration or licensing requirement within such jurisdiction. If this report is inadvertently sent or has reached any individual in such country, especially USA, the same

may be ignored and brought to the attention of the sender. Neither this document nor any copy of it may be taken or transmitted into the United States (to U.S. persons), Canada, or

Japan or distributed, directly or indirectly, in the United States or Canada or distributed or redistributed in Japan or to any resident thereof. Any unauthorized use, duplication,

07 May 2024

22

Systematix Research is also available on Bloomberg SSSL <Go>, Thomson & Reuters Systematix Shares and Stocks (India) Limited

Aadhar Housing Finance Ltd.

redistribution or disclosure of this report including, but not limited to, redistribution by electronic mail, posting of the report on a website or page, and/or providing to a third party a link,

is prohibited by law and will result in prosecution. The information contained in the report is intended solely for the recipient and may not be further distributed by the recipient to any

third party.

SSSIL generally prohibits its analysts, persons reporting to analysts, and members of their households from maintaining a financial interest in the securities or derivatives of any

companies that the analysts cover. Additionally, SSSIL generally prohibits its analysts and persons reporting to analysts from serving as an officer, director, or advisory board member of

any companies that they cover. Our salespeople, traders, and other professionals or affiliates may provide oral or written market commentary or trading strategies to our clients that

reflect opinions that are contrary to the opinions expressed herein. Our proprietary trading and investing businesses may make investment decisions that are inconsistent with the

recommendations expressed herein. The views expressed in this research report reflect the personal views of the analyst(s) about the subject securities or issues and no part of the

compensation of the research analyst(s) was, is, or will be directly or indirectly related to the specific recommendations and views expressed by research analyst(s) in this report. The

compensation of the analyst who prepared this document is determined exclusively by SSSIL; however, compensation may relate to the revenues of the Systematix Group as a whole, of

which investment banking, sales and trading are a part. Research analysts and sales persons of SSSIL may provide important inputs to its affiliated company(ies).

Foreign currencies denominated securities, wherever mentioned, are subject to exchange rate fluctuations which could have an adverse effect on their value or price or the income

derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies, effectively assume currency risk. SSSIL, its directors, analysts

or employees do not take any responsibility, financial or otherwise, of the losses or the damages sustained due to the investments made or any action taken on the basis of this report

including but not restricted to fluctuation in the prices of shares and bonds, changes in the currency rates, diminution in the NAVs, reduction in the dividend or income, etc.

SSSIL and its affiliates, officers, directors, and employees subject to the information given in the disclosures may: (a) from time to time, have long or short positions in, and buy or sell, the

securities thereof, of company (ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation (financial interest)

or act as a market maker in the financial instruments of the company (ies) discussed herein or act as advisor or lender / borrower to such company (ies) or have other potential material

conflict of interest with respect to any recommendation and related information and opinions. The views expressed are those of the analyst and the company may or may not subscribe

to the views expressed therein.

SSSIL, its affiliates and any third party involved in, or related to, computing or compiling the information hereby expressly disclaim all warranties of originality, accuracy, completeness,

merchantability or fitness for a particular purpose with respect to any of this information. Without limiting any of the foregoing, in no event shall SSSIL, any of its affiliates or any third

party involved in, or related to, computing or compiling the information have any liability for any damages of any kind. The company accepts no liability whatsoever for the actions of

third parties. The report may provide the addresses of, or contain hyperlinks to, websites. Except to the extent to which the report refers to website material of the company, the

company has not reviewed the linked site. Accessing such website or following such link through the report or the website of the company shall be at your own risk and the company

shall have no liability arising out of, or in connection with, any such referenced website.

SSSIL will not be liable for any delay or any other interruption which may occur in presenting the data due to any technical glitch to present the data. In no event shall SSSIL be liable for

any damages, including without limitation, direct or indirect, special, incidental, or consequential damages, losses or expenses arising in connection with the data presented by SSSIL

through this presentation.

SSSIL or any of its other group companies or associates will not be responsible for any decisions taken on the basis of this report. Investors are advised to consult their investment

and tax consultants before taking any investment decisions based on this report.

Systematix Shares and Stocks (India) Limited:

Registered and Corporate address: The Capital, A-wing, No. 603 – 606, 6th Floor, Plot No. C-70, G Block, Bandra Kurla Complex, Bandra (East), Mumbai – 400 051

CIN - U65993MH1995PLC268414 | BSE SEBI Reg. No.: INZ000171134 (Member Code: 182) | NSE SEBI Reg. No.: INZ000171134 (Member Code: 11327) | MCX SEBI Reg. No.:

INZ000171134 (Member Code: 56625) | NCDEX SEBI Reg. No.: INZ000171134 (Member Code: 1281) | Depository Participant SEBI Reg. No.: IN-DP-480-2020 (DP Id: 34600) | PMS SEBI

Reg. No.: INP000002692 | Research Analyst SEBI Reg. No.: INH200000840 | Investment Advisor SEBI Reg. No. INA000010414 | AMFI : ARN - 64917