Equipment-as-a-Service

Q3 2023 Market Update

About Our Firm

2

Houlihan Lokey is a leading global investment bank with expertise in mergers and acquisitions,

capital markets, financial restructuring, and financial and valuation advisory.

Our firm is the trusted advisor to more top decision-makers than any other independent

global investment bank.

We invite you to learn more about how our bankers can serve your needs:

Learn More About

Corporate Finance

Learn More About

Financial Restructuring

Learn More About

Financial and Valuation

Advisory

Learn More About Our

Industry Coverage

(1) As of September 30, 2023; excludes corporate MDs. (2) As of December 31, 2023. (3) LTM ended September 30,

2023.

Leading Capital Markets Advisor

CORPORATE FINANCE

No. 1 Global Restructuring Advisor

FINANCIAL RESTRUCTURING

No. 1 Global M&A Fairness Opinion

Advisor Over the Past 25 Years

FINANCIAL AND

VALUATION ADVISORY

1,500+ Transactions Completed Valued

at More Than $3.0 Trillion Collectively

1,000+ Annual Valuation Engagements

No. 1 Global M&A Advisor for

Transactions Under $1 Billion

2022 M&A Advisory Rankings

Global Transactions Under $1 Billion

Deals

Advisor

381Houlihan Lokey1

369Rothschild & Co2

217JP Morgan3

206Lazard4

203Goldman Sachs & Co5

Source: Refinitiv. Excludes accounting firms and brokers.

2022 Global Distressed Debt &

Bankruptcy Restructuring Rankings

Deals

Advisor

58Houlihan Lokey1

30PJT Partners Inc2

29Lazard3

25Rothschild & Co4

21Moelis & Co5

Source: Refinitiv.

1998–2022 Global M&A

Fairness Advisory Rankings

Deals

Advisor

1,232Houlihan Lokey1

1,030JP Morgan2

938Duff & Phelps, A Kroll Business3

725Morgan Stanley4

710BofA Securities Inc5

Source: Refinitiv. Announced or completed transactions.

Fully Integrated Financial

Sponsors Coverage

26

Senior officers dedicated to

the sponsor community in

the Americas and Europe

1,000+

Sponsors covered, providing

market insights and knowledge

of buyer behavior

700+

Companies sold to financial

sponsors over the past five years

Houlihan Lokey Is a Global Firm

AMERICAS

Atlanta Dallas New York

Baltimore Houston San Francisco

Boston Los Angeles São Paulo

Charlotte Miami Washington, D.C.

Chicago Minneapolis

EUROPE AND MIDDLE EAST

Amsterdam Madrid Stockholm

Antwerp Manchester Tel Aviv

Dubai Milan Zurich

Frankfurt Munich

London Paris

ASIA-PACIFIC

Beijing Mumbai Sydney

Fukuoka Nagoya Tokyo

Gurugram Shanghai

Hong Kong

SAR

Singapore

Our Ranking by Service

Key Facts and Figures

2,000+

Clients Served

Annually

311

Managing

Directors

(1)

~2,000

Total Financial

Professionals

37

Locations

Worldwide

$1.8B

Revenue

(3)

$8.2B

Market

Capitalization

(2)

has acquired

a portfolio company of

Buyside Advisor

a portfolio company of

has acquired

Buyside Advisor

a portfolio company of

has been acquired by

Sellside Advisor

has received a strategic investment

from

Sellside Advisor

has been acquired by

Sellside Advisor & Fairness Opinion

has acquired

a portfolio company of

Buyside Advisor

has been acquired by

a portfolio company of

Sellside Advisor

a portfolio company of

has been acquired by

Sellside Advisor

a portfolio company of

has received secondary

investment from

Sellside Advisor

has been acquired by

Sellside Advisor

has received an investment from

Sellside Advisor

a portfolio company of

has been acquired by

a portfolio company of

Sellside Advisor

a portfolio company of

has been acquired by

Sellside Advisor

Based on number of transactions and

according to data provided by Refinitiv,

Houlihan Lokey was ranked the No. 1

investment bank for all global business

services M&A transactions in 2022.*

*Excludes accounting firms and brokers.

About Our Business Services Industry Group

3

130+

Learn More About Our

Business Services Industry Coverage

Houlihan Lokey’s Business Services Group combines extensive industry relationships with

substantial experience to offer a broad array of M&A, corporate finance, restructuring, and

financial and valuation advisory services to companies in the business services sector.

Featured Transactions

Industry Sector Coverage

We cover a broad array of sectors, with bankers dedicated to each of our primary coverage areas.

BPO Services

Engineering and

Infrastructure

Environmental

Services

Equipment-as-a-

Service

Facility and

Residential

Services

HCM Services IT Services Marketing Services

Specialty

Consulting and

Risk Services

Testing,

Inspection,

Certification, and

Compliance

Training and

Education

Transportation

and Logistics

2022 M&A Advisory Rankings

All Global Business Services Transactions

Deals

Advisor

69

Houlihan Lokey1

50

Rothschild & Co2

37

Lincoln International3

34

Goldman Sachs & Co4

26

GCG5

Source: Refinitiv. Excludes accounting firms and brokers.

Key Facts and Figures

Dedicated business

services bankers

69

Completed business services

M&A/private placement

transactions in CY22

$2.9B

In financing deals in CY22

Matthew Hudson

Managing Director, Head of EaaS

Matthew.Hud[email protected]

+1 667.335.0449

Spencer Lippman

Managing Director

Spencer.Lippman@HL.com

+1 832.319.5136

Shane Murrish

Senior Vice President

SMurrish@HL.com

+1 310.789.5725

Andrew Busan

Senior Vice President

Andrew.Busan@HL.com

+1 667.335.0451

Jonathan Harrison

Managing Director

+44 (0) 20 7747 7564

Sebastian Weindel

Director

Sebastian.Weind[email protected]

+49 (0) 89 413 121 26

Equipment-as-a-Service Team

Tombstones included herein represent transactions closed from 2021 forward.

*Selected transactions were executed by Houlihan Lokey professionals while at other firms acquired by Houlihan Lokey or by professionals from a Houlihan Lokey joint venture

company.

• Houlihan Lokey has assembled one of the most experienced senior teams of Equipment-as-a-Service (EaaS) sector coverage bankers with the deepest relationships

and broadest level of expertise. The team operates globally and has earned a reputation for providing superior service and achieving outstanding results in M&A

advisory, capital-raising, restructuring, and financial and valuation advisory services.

• The EaaS team covers a wide range of business models, including traditional equipment rental, specialty equipment rental, route-

based equipment services,

transportation equipment leasing, vehicle fleet management, equipment dealerships, asset pooling services, and infrastructure and municipal equipment services. Our

clients operate across a broad set of end markets, including commercial, construction, industrial, infrastructure, utility, logistics, consumer/retail, oil and gas, mining,

education, healthcare, events and media, refinery/petrochemical, and hospitality.

• We have the only fully dedicated EaaS coverage team with a truly global scale and reach.

North America

Leadership

Europe

Featured Transactions

has been acquired by

Sellside Advisor

a portfolio company of

has been acquired by

Sellside Advisor

a portfolio company of

has been acquired by

Sellside Advisor

has received a minority investment

from

Sellside Advisor*

a portfolio company of

has been acquired by

Sellside Advisor

Request a Meeting Learn More About Us

4

has completed a recapitalization

transaction including a preferred

equity investment led by

and senior debt financing led by

Company Advisor

a portfolio company of

Second Lien Term Loan

Refinancing

Exclusive Placement Agent

has acquired

Buyside Advisor

a portfolio company of a fund

managed by

and

has been acquired by

Sellside Advisor

Broad, Comprehensive Equipment-as-a-Service Business Model Coverage

5

Equipment-as-a-Service defined: Any company that utilizes a core asset base or fleet of equipment coupled with the delivery of

value-enhancing services to provide a comprehensive solution to satisfy its customer application needs.

• Equipment-as-a-Service companies distinguish themselves based on levels of service offerings, including:

– Field-level consultation, complex engineering expertise, telemetrics, GPS tracking, remote monitoring, delivery/transportation, cleaning, refueling, skilled labor,

mobilization/demobilization, ancillary equipment services, etc.

– Breadth and complexity of service/solution offerings add differentiation and enhance valuation.

• Pickup Trucks

• Corporate Vehicles

• Ride-Hail Vehicle

Fleets

• Earthmoving

• Aerial/High-Rea

ch

• General

Construction

• Contractor Tools

• Pallets

• Mats

• Restaurant/Catering

• Kegs

• Returnable

Transport Fixtures

• Trailer (Dry Van)

• Chassis Leasing

• Way Maintenance

• Railcars

• Aircrafts

• Ships/Barges

• Tractors

• Cranes and Lifting

• Hydrovac

Excavation

• Pumps/Fluid Mgmt.

• HVAC/Temp

Con

trol

• Trench Shoring and

Sa

fety

• Airport Equipment

• Street-S

weeping

V

ehicles

• Garbage Trucks

• Utility T&D

Equ

ipment

• Equipment

Dea

lerships

• Automotive

Dea

lerships

• Portable Storage

• Modular Space

• Liquid and Solid

Co

ntainment

• Blast-Resistant

B

uildings

• Workforce

Accommodations

• Portable Restrooms

• Hospitality

Equ

ipment

• Document Mgmt./

Shredding

• Moveable Medical

Equipment

Vehicle Fleet

Management

Traditional

Rental

Equipment

Dealerships

Specialty

Rental

Asset Pooling

Services

Route-Based

Services

Transportation

Equipment Services

Infrastructure

Services

Municipal

Services

Business Models Serve a Wide Range of Customers and End Markets

Nonresidential

Construction

Infrastructure Consumer/Retail Oil and Gas CommercialUtility T&D Mining

EaaS Sector Business Models

Transportation and

Logistics

Industrial, Refining,

and Petrochemical

Events and Media Education HospitalityHealthcare

Telecom,

Test, and Measurement

Equipment-as-a-Service Landscape Overview

6

Note: Asset categories are non-exhaustive.

$100B+

Market

Opportunity

General Construction Equipment

Generators and

Mobile Power Equipment

Safety Equipment

Test and Measurement Equipment

Pumps and Compressors

Trench Shoring

Airport Equipment

Security and

Surveillance Equipment

HVAC and Temperature

Control Equipment

Portable Storage

Modular Space and

Workforce Accommodation

Bucket and Specialty Trucks

Lighting, Audio-Visual, and

Event Equipment

Liquid and Solid Containment

Equipment

Medical Equipment

Cranes and Vertical Access Solutions

Portable Sanitary Solutions

Mats and Pallets

Kegs

Hospitality Equipment

24

12

20

26

32

31

26 26

28

34

33

34

44

38

32

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

2020 2021 2022 2023

Equipment-as-a-Service Market Update

7

EaaS companies continue to experience healthy demand through

government stimulus and secular end-market drivers, though pressure on

rental rates and equipment utilization brought about by supply chain

normalization heralds a “return to normal.”

While M&A activity has declined sequentially after a particularly hot H1 2023, transactions

remain healthy when compared with the prior years. The EaaS sector, along with many

other industries, has seen a “seller’s strike” brought about by a slew of high-valuation

acquisitions over the past few years, combined with depressed historical performance

lingering from COVID-19 and elevated valuation expectations. This has encouraged

lengthened hold periods, despite many potential buyers having locked-in access to a

significant amount of financing capability.

Inflation remains a significant consideration for EaaS companies. After a significant decline

through the first half of the year, annualized inflation has remained above 3% each month

in the quarter. The U.S. Federal Reserve announced a pause in rate increases, though

some investors worry these may continue in the new year. The effect of these

developments is expected to encourage deployment of capital early in the new year

through the combined effects of aging portfolio companies and the risk of further

increases in interest rates to further push down inflation. Operationally, companies are

feeling pressure to keep up rate increases despite slowing ability to do so.

Public EaaS companies have reevaluated offerings and end-market exposure. Willscot

Mobile Mini began its foray into the cold storage space with simultaneous acquisitions of

A&M Cold Storage and Cold Box. Meanwhile, Herc Rentals announced its exploration of

strategic alternatives for its Cinelease Studio segment as the film and TV industry has

shifted away from the company’s growth strategy. Sunbelt, on the other hand, elected to

keep film and TV a part of the company’s specialty offering as announced in their investor

presentation, and the group has acquired Acorn Film & Video as a part of this focus.

Finally, Newpark Resources announced the planned divestiture of its Fluids Systems

segment, which would leave the company solely as a provider of matting solutions to the

infrastructure and utility T&D markets.

1. Executive Summary 8

2. Featured Sector News 9

3. Additional Q3 EaaS M&A Highlights 14

4. EaaS Share Price Performance 15

5. Equity Market Index Performance: North American

EaaS Subsectors

16

6. Equity Market Index Performance: European EaaS

Subsectors

17

Contents Q3 2023 Quick Facts

M&A Transaction Volume

Houlihan Lokey’s EaaS Team Recently Published a

Comprehensive Analysis About Landmark Initiatives

and How They Will Shape the Sector in the Future

Click Here to Read the Full Article Online

32

Transactions in Q3 2023

Source: S&P Capital IQ as of September 30, 2023.

(1) The Houlihan Lokey EaaS Index consists of a diversified set of companies across the equipment-as-service sector. See the footnotes on pages 16 and 17 for a complete list.

Executive Summary

8

▪ The U.S. and European EaaS markets experienced a

small decline over the last quarter; both markets

remain up over the past 12 months.

▪ Growth in the U.S. market is being driven by strong

demand across the construction, infrastructure, and

event sectors combined with the early impact of

recent infrastructure legislation dollars entering the

market.

▪ The market expansion is expected to reach 3%–4%

across both regions through 2024, with the U.S.

market expected to be favorably impacted by the

increasing number of mega projects fueled by recent

U.S. legislative acts ($1.2 billion Infrastructure Act,

$400 billion Inflation Reduction Act, and $280 billion

CHIPS and Science Act).

▪ Long-term secular growth drivers have continued to

positively contribute to the sector’s expansion, with

end users increasingly seeing the benefits of the

EaaS model vs. ownership in terms of cost with

minimal capital outlay in a context of tightening

credit conditions, operational flexibility, lower

environmental impact, and access to a greater

variety of more recent equipment technologies.

▪ Ashtead Group reported a 14% increase in quarterly

rental revenue and 16% growth in the U.S., at the

time quarter ended (July 31, 2022), while adding 40

new locations in North America. However, the group

also recently lowered full-year revenue guidance to

11% –13% growth (from 13%–16%) as well as

EBITDA expectations 2%–3% below market

expectations.

▪ H&E Equipment Services disclosed a 25% increase in

rental revenue and a 36% EBITDA increase in Q3 YoY,

achieved by branch expansion (12 new locations

YTD, 5 in the quarter) and fleet growth with gross

capex of $595 million YTD.

▪ Herc Rentals reported record Q3 financial results

with a 22% and 19% increase in revenue and EBITDA

from Q3 2022, driven by a ~7% rental pricing

increase year over year.

▪ Herc Rentals is exploring strategic alternatives for its

Cinelease studio entertainment, lighting, and grip

equipment rental business.

▪ Newpark Resources announced the company had

launched a sale process for its Fluids Systems

segment in a bid to reposition the company as a

“pure-play, high-growth specialty rental and services

business.”

▪ WillScot Mobile Mini announced that the company’s

senior secured notes offering of $500 million

aggregate principal amount, due 2031, would be

priced at 7.375% and closed September 25, 2023.

▪ United Rentals announced a YoY increase of 18% in

rental revenues with a 23% increase in total

revenues, driven in part by higher sales of new and

used equipment.

▪ Sunbelt Rentals acquired 13 rental businesses, with a

total consideration of $356 million from its fiscal

year ended April 30, 2022, through April 30, 2023.

▪ Announced on August 10, 2023, WillScot Mobile

Mini acquired Cold Box and A&M Cold Storage,

creating one of the largest providers of temporary

cold storage units.

▪ In September, CES Power, backed by Allied Industrial

Partners, announced its eighth bolt-on acquisition,

Euro Touring Power, to expand into Europe.

▪ InProduction, a leading provider of temporary

seating, staging, structures, and scenic production

for the U.S. live events industry, was acquired by

ZMC on September 7, 2023. Houlihan Lokey acted

as the exclusive financial advisor to ZMC.

▪ McGrath RentCorp acquired the ~600 assets of

Inland Leasing and Storage, a regional portable

storage solutions provider in the Colorado market.

▪ Despite headwinds, the Houlihan Lokey EaaS Index

(2)

is up 31.0% LTM, outperforming the S&P 500 and

STOXX 600 indices, which are up 16.6% and 15.2%,

respectively.

▪ On a quarterly basis, the Houlihan Lokey EaaS Index

declined 3.4%, in line with the S&P 500 down 3.8%

and STOXX 600 down 2.3%.

▪ Some subsectors, such as North American traditional

rental (up 32.4% LTM) and RoW rental services (up

22.8% LTM), have significantly outperformed other

subsectors.

Sector Business Conditions

(1)

News Highlights M&A Highlights

Public Comps Highlights

EaaS Market (U.S. and Europe): 2018–2024 in $B

(1) Sources: American Rental Association, European Rental Association, International Rental News, Kaplan.

(2) The Houlihan Lokey EaaS Index consists of a diversified set of companies across the equipment-as-service sector. See the footnotes on pages 16 and 17 for a complete list.

53.0

56.0

50.8

56.3

64.0

71.5

76.6

27.3

26.9

24.1

29.0

31.2

32.1

33.7

80.3

82.9

74.9

85.3

95.2

103.6

110.3

2018A 2019A 2020A 2021A 2022A 2023E 2024E

U.S. Europe

Featured Sector News

9

Date Company Region Description Article Link

9/30/2023

US

Bigge Crane and Rigging Co. has acquired its first all-electric crawler crane, which provides an

environmentally conscious heavy-lifting solution without sacrificing capacity or performance.

Read More

9/29/2023

Kranpunkten, a Swedish provider of aerial work platforms, telehandlers, forklifts, spider cranes,

and other aerial lift equipment, announced the company is adding more all-electric delivery

trucks to its transport fleet. The company aims to be carbon neutral by 2030.

Read More

9/28/2023

Badger Infrastructure Solutions has entered into a partnership with McKay Métis Group to

provide nondestructive excavating services and forge a path for sustainable socioeconomic

prosperity.

Read More

9/28/2023

US

United Rentals was selected to the TIME World’s Best Companies 2023 list, ranking highest

among equipment rental companies for its outstanding employee satisfaction, revenue growth,

and sustainability.

Read More

9/28/2023

US

Elliott Equipment Company’s new D47 digger derrick is a high-performance tool with a 26,000-

pound maximum lifting capacity and 17- to 26-foot digging radius, making it effective for

difficult-to-access jobs. The derrick is provided by the company through its rental partner,

United Rentals.

Read More

9/27/2023

Custom Truck One Source, Inc., has unveiled its Lightning PTO electric and hybrid-electric

chassis and equipment at The Utility Expo, offering customers significant diesel fuel savings,

CO

2

emissions reduction, dramatic maintenance-

cost savings, less hydraulic oil movement wear

and tear, and 85% noise reduction.

Read More

9/26/2023

Ascendum Machinery partnered with Portable Electric to offer Voltstack portable and mobile

electric construction equipment chargers and power stations to customers in the U.S.

Read More

9/21/2023

Adapteo Group partnered with Nordic Circular Hotspot collaboration platform with a mission

to accelerate the transition to a circular economy in the Nordic region.

Read More

9/15/2023

Portakbin, a leading U.K. provider of modular buildings, announced the opening of its latest

location in Cambuslang, Scotland. The £1.75 million investment doubles the size of operations

there and will serve the whole of Scotland.

Read More

Sources: Company website, press releases.

Featured Sector News (cont.)

10

Date Company Region Description Article Link

9/14/2023

US

CES Power LLC has acquired Euro Touring Power to expand its reach overseas, creating a new

hub in Ireland and access to all of Europe.

Read More

9/12/2023

Civeo Corp. has entered into an agreement to sell its McClelland Lake Lodge assets for

approximately $36 million, with expected net proceeds of $30 million, gains of $35 million, and

increased 2023 cash flow of $20 million.

Read More

9/12/2023

Zeppelin Group, a leading provider of construction equipment and agricultural machinery

equipment rental for the construction industry and industrial sector, announced the company

received an “A

-” rating and “robust” outlook by Creditreform, which attests to the company’s

high creditworthiness and low default risk.

Read More

9/12/2023

Sims Crane & Equipment Co. and Liebherr showcased the world’s first battery-

powered crawler

crane at a joint event in Tampa to promote their new emissions-free technology.

Read More

9/12/2023

Black Diamond Group Ltd. is proud to have secured a spot on the 2023 TSX30 list,

demonstrating the value of its unique portfolio, high growth, and market capitalization over

the past three years.

Read More

9/11/2023

Aggreko announced the purchase of a fleet of Uninterruptible Power Supply systems to

provide broadcasting power solutions for major professional sports events.

Read More

9/11/2023

DLR, the French Rental Association, announced revenue growth for equipment rental

companies in France was 7.5% year over year. DLR‘s survey respondents stated they remained

concerned about rising interest rates but approached the future with optimism, especially with

the 2024 Paris Olympic Games expected to accelerate work in the Paris region.

Read More

9/11/2023

Loxam reported a 6% increase in revenues to €642 million for the second quarter of 2023,

hitting a milestone €1 billion annual revenue in the LTM period. Growth in EBITDA was also

strong, growing 10% in the quarter to €238 million.

Read More

Sources: Company website, press releases.

Date Company Region Description Article Link

9/11/2023

WillScot Mobile Mini Holdings Corp. announced that its indirect subsidiary Williams Scotsman,

Inc., plans to offer $500 million of senior secured notes due 2031, which will be used to repay

existing indebtedness and cover related fees and expenses.

Read More

9/7/2023

H&E Equipment Services Inc. has recently expanded its rental branches, introducing new

locations in Kansas, Missouri, North Carolina, and Texas. These branches offer a diverse

selection of equipment, including aerial lifts and earthmoving machinery, from a variety of

manufacturers. By swiftly and effectively serving their respective regions, these new branches

enhance coverage and transportation options for customers.

Read More

Read More

Read More

Read More

Read More

8/31/2023

ModuGo

announced its second acquisition since the company’s recapitalization by Kinderhook

Industries in February 2023. The company acquired Massachusetts

-based Kelcon, a provider of

portable storage container leases throughout the Northeastern United States.

Read More

8/30/2023

Coates Hire announced the company has launched a new specialist power and HVAC services

business in Australia. The company will offer end

-to-

end turnkey solutions across the company

from hubs in Sydney, Melbourne, Adelaide, Perth, and Brisbane.

Read More

8/29/2023

Renta Group announced financial results for the second quarter of 2023, which represented

revenue growth of 16.7% over Q2 2022, driven by the acquisitions the company completed

over the past year.

Read More

8/28/2023

United Rentals has announced that Executive Vice President and Chief Operating Officer Dale

Asplund

is leaving the company on September 29, 2023, and will be replaced by current senior

Vice President of Sales and Operations, Michael Durand.

Read More

8/24/2023

Renta Norge, the Norwegian division of Helsinki

-based Renta Rental Group, announced the

company had acquired Mylift Holding, a Norwegian crane and access rental specialist.

Read More

Sources: Company website, press releases.

Featured Sector News (cont.)

11

Date Company Region Description Article Link

8/23/2023

Tag Tool Hire, a U.K.

-based provider of rental and repair solutions for contractor tools and

equipment, announced the company had entered into a partnership with easyHire

Technologies, expanding the company’s online capabilities.

Read More

8/22/2023

McGovern Plant Hire, a leading U.K.

-based provider of tracked/wheeled excavators, sweepers,

vacuum excavators, and other equipment pieces, announced the company had entered into a

partnership with Xwatch Safety Solutions to enhance its on

-site safety capabilities.

Read More

8/22/2023

Graham Clark, a veteran operations director at Cadman Cranes, announced the establishment

of a new business in the U.K.: South East Lifting Services. The company will provide crane

- and

lift

-related services across the London region.

Read More

8/17/2023

Maxim Crane Works Holdings Capital, LLC, announced the pricing of $500 million aggregate

principal amount of 11.50% second

-priority senior secured notes due in 2028 and intends to

use the proceeds to redeem its outstanding debt, partially repay ABL borrowings, and pay

related fees and expenses.

Read More

8/15/2023

RELAM, a provider of specialty rental equipment for recurring, regulatory

-driven, maintenance-

of

-way work on railroads, received a second lien term loan from Platinum Equity to refinance

existing indebtedness and support the future growth of the business.

Houlihan Lokey acted

as the exclusive placement agent to RELAM

.

Read More

8/11/2023

Vp plc has announced that its CEO, Neil

Stothard, will retire in September 2023, and Anna

Bielby

will take over as CEO from September 1, 2023, with a CFO recruitment process

underway.

Read More

8/7/2023

Kiloutou Signaling, a division of Kiloutou Group, introduced two new traffic light products,

which are designed to meet the requirements of local authorities and professionals and

improve road safety for drivers and workers alike.

Read More

8/3/2023

Empower Rental Group announced the grand opening of its 36th location in Tupelo,

Mississippi, on August 3, 2023, offering competitively priced construction equipment for

professionals, businesses, and DIYers.

Read More

Sources: Company website, press releases.

Featured Sector News (cont.)

12

Date Company Region Description Article Link

7/28/2023

Speedy and AFC Energy are launching a dedicated hydrogen

-powered generator plant hire

business to provide sustainable, zero

-emission temporary power solutions for the off-grid

power market.

Read More

7/28/2023

Zeppelin Group announced the restructuring of its strategic business units, bundling business

activities in two instead of three. The company is now split into SBU Construction Equipment

Germany/Austria and SBU Construction Equipment International.

Read More

7/27/2023

Touax SCA has successfully signed a €40 million senior secured loan with a four

-year maturity,

as part of its strategy to extend the average maturity of the group’s debt and refinance existing

loans.

Read More

7/24/2023

ModuGo

, a portfolio company of Kinderhook Industries, completed its first acquisition since its

recapitalization by Kinderhook in February 2023. The company acquired A1 Mobile Storage

Leasing, based in Michigan.

Read More

7/11/2023

Loxam

announced the acquisition of A Geradora Aluguel de Maquinas, a Brazilian provider of

temporary power generation rental solutions. The company operates a fleet of premium

equipment focusing on backup and off

-grid power solutions. A Geradora Aluguel de Maquinas

maintains a network of 15 branches across Brazil.

Read More

7/11/203

Kiloutou Group, a French rental provider of construction equipment, lifting solutions, material

handling equipment, and more, announced the company was voted “favorite brand of the

French” within the “rental brands of professional construction equipment” category.

Read More

Sources: Company website, press releases.

Featured Sector News (cont.)

13

Date

Acquirer

Acquirer

Country

Target

Target

Country

Houlihan

Lokey

9/29/2023

-

9/26/2023

-

9/19/2023

-

9/7/2023

-

9/7/2023

9/5/2023

-

9/1/2023

8/30/2023

-

8/15/2023

-

8/10/2023

-

8/8/2023

-

8/7/2023

-

8/4/2023

-

8/2/2023

-

7/26/23

-

Additional Q3 Equipment-as-a-Service M&A Highlights

14

• Announced transactions in the YTD period have outpaced pre-COVID-

19 levels, reflecting a healthy market for strategic investments despite

a sequentially slower quarter.

• Noncore acquisitions have been a major theme, as many companies

and financial sponsors seek to enter new segments and geographies,

seeking more attractive end markets. For example, Kaizen Automotive

Group, a large, multi-jurisdictional automotive dealership, acquired

Flex Fleet Rental, the leading national provider of pick-up truck rental

solutions to contractors of all sizes. Houlihan Lokey acted as the

exclusive financial advisor to Flex Fleet Rental.

• Private equity continues to be a strong driver of acquisitions, with

many groups pursuing investment opportunities that present

significant growth opportunities within various specialty equipment

segments of the Equipment-as-a-Service sector. For example, ZMC, a

private equity group targeting the media and communications

sectors, acquired InProduction, a leading provider of temporary

structures for live events. Houlihan Lokey acted as the exclusive

financial advisor to ZMC.

• Record profits in 2021 and 2022 have created pressure for portfolio

companies to “prove out” their growth as more than a temporary

market-wide buoy.

Transaction Value and Deal Volume

Notable Transactions in Q3 2023

$ in Billions

Key Takeaways

$3.0

$2.9

$5.3 $16.6 $4.2 $3.6

105

106

82

115

129

114

2018 2019 2020 2021 2022 YTD 2023

Disclosed Value ($B)

Source: S&P Capital IQ as of September 30, 2023.

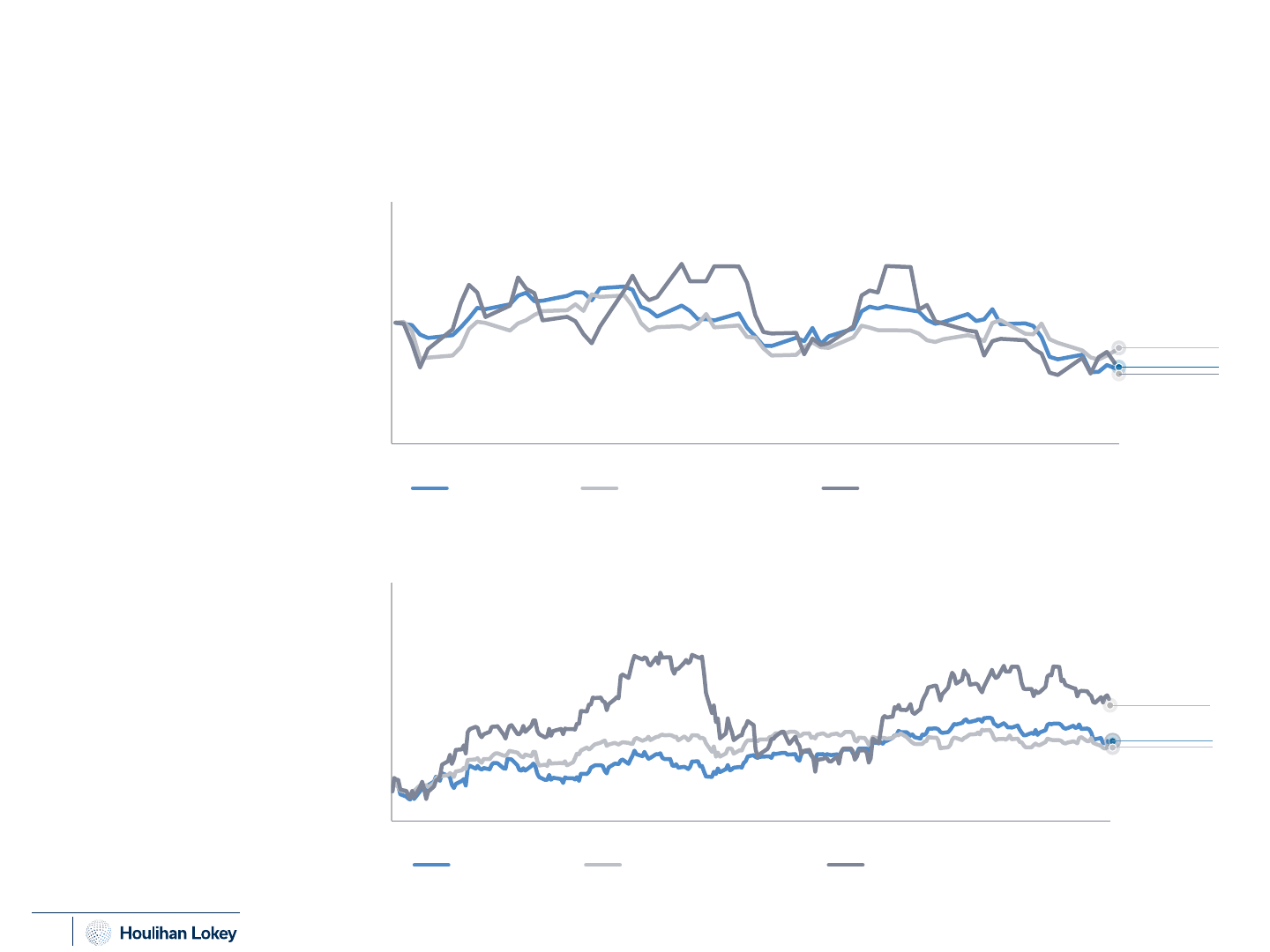

Q3 (July–September) 2023 Share Price Performance

Publicly Traded EaaS Indices Saw a Slight Retraction in Q3 While Still Maintaining

Strong Gains Over the LTM Driven by the North American EaaS Companies

15

Source: S&P Capital IQ. Data as of September 30, 2023. All share prices rebased to 100.

(1) The Houlihan Lokey EaaS Index consists of a diversified set of companies across the equipment-as-service sector. See the footnotes on pages 16 and 17 for a complete list.

• The Houlihan Lokey EaaS Index

experienced a slight downturn

in Q3 2023, while remaining up

significantly over the LTM

period. The index remains

higher compared to both the

S&P 500 and the STOXX Europe

600. Most of the decline came

in August and September, with

the decline in the CPI slowing

and interest rates remaining

high for the period.

• Over the LTM, Civeo Corp. has

significantly underperformed

against peers, dropping 18.6%

from October 2022. This comes

as the company reported that it

was selling its McClelland Lake

Lodge assets in September,

previously reported in Q2 as

“evaluating commercial

alternatives.”

• Over the LTM period, Black

Diamond Group performed

best, gaining 90.9% on the

company’s highest quarterly

rental revenue and EBITDA in a

decade, increasing 25% and

41%, respectively, over the prior

year. The group reported its

addition to the TSX30 list,

which recognizes the top 30

stocks over a three-year period.

90

100

110

120

130

140

150

160

170

Oct-22 Nov-22 Jan-23 Feb-23 Apr-23 May-23 Jun-23 Aug-23 Sep-23

S&P 500 STOXX Europe 600 Houlihan Lokey EaaS Index

(1)

16.6%

15.2%

31.0%

North America: 32.4%

RoW: 22.8%

Europe: (23.3%)

90

95

100

105

110

Jul-23 Aug-23 Sep-23

S&P 500 STOXX Europe 600 Houlihan Lokey EaaS Index

(1)

(3.8%)

(3.4%)

North America: (3.0%)

RoW: (5.4%)

Europe: (22.9%)

(2.3%)

LTM September 2023 Share Price Performance

60

80

100

120

140

160

180

200

Oct-22 Jan-23 Apr-23 Jun-23 Sep-23

North America—Traditional Rental North America—Specialty Rental North America—Workforce Accommodation

Equity Market Index Performance

North American EaaS Subsectors

16

The Houlihan Lokey North American EaaS Index performance was primarily driven by the traditional rental sector—in particular,

United Rentals and H&E Equipment Services with 57.9% and 46.4% increases, respectively.

LTM September 2023 Performance by Subsector

Past Month Performance YTD Performance Three-Year Performance

Source: S&P Capital IQ. Data as of September 30, 2023. All share prices rebased to 100.

North America Traditional Rental Services Companies: Ashtead Group, United Rentals, H&E Equipment Services, Herc.

North America Specialty Rental Services Companies: Badger Infrastructure Solutions, Concrete Pumping Holdings, McGrath RentCorp, Custom Truck One Source, WillScot Mobile Mini.

North America Workforce Accommodation Companies: Dexterra Group, Black Diamond, Civeo Corp., Target Hospitality.

12.3%

42.3%

1.5%

-10.1%

-0.9%

6.7%

12.4%

4.2%

-10.1%

142.6%

58.7%

223.0%

Equity Market Index Performance

European EaaS Subsectors

17

Specialty rental services’ only contributor, Touax, saw a 35.0% stock price decrease over the past 12 months.

-6.0%

-19.9%

-4.3%

-17.1%

-40.2%

12.6%

-18.5%

-22.9%

17.9%

LTM September 2023 Performance by Subsector

Past Month Performance YTD Performance Three-Year Performance

(35.0%)

(18.5%)

22.8%

60

70

80

90

100

110

120

130

140

Oct-22 Jan-23 Apr-23 Jun-23 Sep-23

Europe—Traditional Rental Europe—Specialty Rental RoW—Rental Services

Source: S&P Capital IQ. Data as of September 30, 2023. All share prices rebased to 100.

Europe Traditional Rental Services Companies: HSS Hire Group, General de Alquiler de Maquinaria, Speedy Hire plc, Vp plc.

Europe Specialty Rental Services Company: Touax.

RoW Rental Services Companies: Brambles Ltd., Emeco Holdings Ltd.

QUALIFICATIONS

Matthew Hudson

Managing Director

BALTIMORE

Mr. Hudson is Head of Equipment-as-a-Service within Houlihan Lokey’s Business Services

Group.

With almost 30 years of industry experience providing corporate advisory and financing

services to middle-market growth companies, Mr. Hudson has played an integral role in

building and leading the preeminent advisory practice on Wall Street, serving the

equipment rental services industry. His deal experience includes a wide variety of

advisory engagements, including mergers and acquisitions, public equity offerings, debt

capital raises, private placements, and restructuring transactions. Mr. Hudson has

successfully executed more than 60 completed transactions for his rental services clients,

representing over $20 billion in deal volume.

Prior to joining Houlihan Lokey, Mr. Hudson was a Managing Director and Head of

Oppenheimer & Co.’s Rental Services Investment Banking Group. He also previously

worked with CIBC World Markets, FBR Capital Markets, and Deutsche Bank.

Mr. Hudson holds a B.A. from Gettysburg College and earned his MBA, with high

distinction, from Georgetown University’s McDonough School of Business.

Gettysburg College

B.A.

Georgetown University

MBA

Oppenheimer & Co.

CIBC World Markets

FBR Capital Markets

Deutsche Bank

PAST

18

QUALIFICATIONS

Spencer Lippman

Managing Director

HOUSTON

Mr. Lippman is a member of Houlihan Lokey’s Business Services Group, specializing in

the Equipment-as-a-Service sector.

With more than 15 years of industry experience providing corporate advisory and

financing services to middle-market growth companies, Mr. Lippman played an integral

role in building the preeminent advisory practice on Wall Street, serving the rental

services industry. His deal experience includes a wide variety of advisory engagements,

including mergers and acquisitions, public equity offerings, debt capital raises, and

private placements.

Prior to joining Houlihan Lokey, Mr. Lippman was a Managing Director in Oppenheimer

& Co.’s Rental Services Investment Banking Group. Before that, he was with Genesis

Capital, LLC.

Mr. Lippman holds a B.A. from Hampden-Sydney College.

Hampden-

Sydney College

B.A.

Oppenheimer & Co.

Genesis Capital, LLC

PAST

19

QUALIFICATIONS

Jonathan Harrison

Managing Director

LONDON

University of Sussex

BA

University of Cambridge

MPhil

Baird

Deutsche Bank

HSBC

PAST

Mr. Harrison is a member of Houlihan Lokey’s global Business Services Group, based in Europe.

Mr. Harrison has more than 20 years of deal experience and has been covering the business

services sector for much of this time.

During his time as an investment banker, Mr. Harrison has worked with clients from Asia, the

Middle East, and North America as well as Europe. He has extensive cross-border deal experience

and has also worked repeatedly with multiple clients.

Sectors in which Mr. Harrison has transacted include automotive services, BPO, education, energy

services, facility services, human capital, industrial services, infrastructure services, professional

services, testing, inspection, certification and compliance, and transportation and logistics.

Mr. Harrison joined Houlihan Lokey from Robert W. Baird & Co., where he had been instrumental

in creating and leading a pre-eminent Business Services practice in Europe. Prior to Baird, Mr.

Harrison led the Business Services investment banking sector activities for Deutsche Bank in

EMEA.

Mr. Harrison holds a BA in Economics from the University of Sussex and an MPhil in Finance from

the University of Cambridge.

20

QUALIFICATIONS

Sebastian Weindel

Director

MUNICH

Mr. Weindel is a member of Houlihan Lokey’s Business Services Group. He specifically

covers the Equipment-as-a-Service as well as engineering and infrastructure services

subsectors. In addition, Mr. Weindel gained significant transaction experience in the

environmental services, facility and residential services, industrials, leisure/hospitality,

healthcare, and financial institutions industries.

Previously, Mr. Weindel was a Director at GCA Altium, which was acquired by Houlihan

Lokey in 2021. Prior to joining GCA, he worked at AlixPartners in Munich, where he

advised in buyside M&A transactions, post-merger integrations, and merger

preparations. Before that, Mr. Weindel worked in the M&A departments of UniCredit,

Mediobanca, and Lazard, where he started his career in 2008.

Mr. Weindel holds a master’s equivalent degree (Dipl.-Kfm.) in Business Administration

from the University of Passau.

University of Passau

Dipl.-Kfm

.

GCA Altium

AlixPartners

UniCredit

Mediobanca

Lazard

PAST

21

QUALIFICATIONS

Shane Murrish

Senior Vice President

LOS ANGELES

Mr. Murrish is a member of Houlihan Lokey’s Business Services Group, where he focuses

primarily on the rental services subsector. He works on a wide range of mergers and

acquisitions, financings, and strategic advisory engagements.

Prior to joining Houlihan Lokey, Mr. Murrish worked at UBS Investment Bank as an

Associate in its Generalist Program and was primarily responsible for the execution of

transactions across various industries, including business services, media, and clean

technology, encompassing sellside and buyside M&A, debt and equity financings,

private placements, exchange offers, and restructurings. Previously he spent three years

as an Analyst with UBS Investment Bank.

Mr. Murrish holds a B.A. from Loyola Marymount University.

Loyola Marymount University

B.A.

UBS Investment Bank

PAST

22

QUALIFICATIONS

Andrew Busan

Senior Vice President

BALTIMORE

Mr. Busan is a member of the Equipment-as-a-Service team within Houlihan Lokey’s

Business Services Group. He performs sellside and buyside M&A advisory, debt and

equity financings, valuations, and strategic alternatives engagements to Equipment-as-a-

Service businesses.

Mr. Busan joined Houlihan Lokey in 2022 after previously covering the equipment rental

sector for more than eight years at Oppenheimer & Co. Prior to Oppenheimer & Co. Mr.

Busan worked as an investment banking analyst at Raymond James.

Mr. Busan holds a B.A. in Economics and Commerce from Hampden-Sydney College.

Hampden-

Sydney College

B.A.

Oppenheimer & Co.

Raymond James

PAST

23

24

Disclaimer

© 2024 Houlihan Lokey. All rights reserved. This material may not be reproduced in any format by any means or redistributed without the prior written consent of

Houlihan Lokey.

Houlihan Lokey is a trade name for Houlihan Lokey, Inc., and its subsidiaries and affiliates, which include the following licensed (or, in the case of Singapore, exempt)

entities: in (i) the United States: Houlihan Lokey Capital, Inc., and Houlihan Lokey Advisors, LLC, each an SEC-registered broker-dealer and member of FINRA

(www.finra.org

) and SIPC (www.sipc.org) (investment banking services); (ii) Europe: Houlihan Lokey Advisory Limited, Houlihan Lokey EMEA, LLP, Houlihan Lokey

(Corporate Finance) Limited, and Houlihan Lokey UK Limited, authorized and regulated by the U.K. Financial Conduct Authority; Houlihan Lokey (Europe) GmbH,

authorized and regulated by the German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht); (iii) the United Arab Emirates,

Dubai International Financial Centre (Dubai): Houlihan Lokey (MEA Financial Advisory) Limited, regulated by the Dubai Financial Services Authority for the provision

of advising on financial products, arranging deals in investments, and arranging credit and advising on credit to professional clients only; (iv) Singapore: Houlihan

Lokey (Singapore) Private Limited and Houlihan Lokey Advisers Singapore Private Limited, each an “exempt corporate finance adviser” able to provide exempt

corporate finance advisory services to accredited investors only; (v) Hong Kong SAR: Houlihan Lokey (China) Limited, licensed in Hong Kong by the Securities and

Futures Commission to conduct Type 1, 4, and 6 regulated activities to professional investors only; (vi) India: Houlihan Lokey Advisory (India) Private Limited,

registered as an investment adviser with the Securities and Exchange Board of India (registration number INA000001217); and (vii) Australia: Houlihan Lokey

(Australia) Pty Limited (ABN 74 601 825 227), a company incorporated in Australia and licensed by the Australian Securities and Investments Commission

(AFSL

number 474953) in respect of financial services provided to wholesale clients only. In the United Kingdom, European Economic Area (EEA), Dubai, Singapore, Hong

Kong, India, and Australia, this communication is directed to intended recipients, including actual or potential professional clients (UK, EEA, and Dubai), accredited

investors (Singapore), professional investors (Hong Kong), and wholesale clients (Australia), respectively. No entity affiliated with Houlihan Lokey, Inc., provides

banking or securities brokerage services and is not subject to FINMA supervision in Switzerland or similar regulatory authorities in other jurisdictions. Other persons,

such as retail clients, are NOT the intended recipients of our communications or services and should not act upon this communication.

Houlihan Lokey gathers its data from sources it considers reliable; however, it does not guarantee the accuracy or completeness of the information provided within

this presentation. The material presented reflects information known to the authors at the time this presentation was written, and this information is subject to

change. Any forward-looking information and statements contained herein are subject to various risks and uncertainties, many of which are difficult to predict, that

could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and

statements. In addition, past performance should not be taken as an indication or guarantee of future performance, and information contained herein may be

subject to variation as a result of currency fluctuations. Houlihan Lokey makes no representations or warranties, expressed or implied, regarding the accuracy of this

material. The views expressed in this material accurately reflect the personal views of the authors regarding the subject securities and issuers and do not necessarily

coincide with those of Houlihan Lokey. Officers, directors, and partners in the Houlihan Lokey group of companies may have positions in the securities of the

companies discussed. This presentation does not constitute advice or a recommendation, offer, or solicitation with respect to the securities of any company

discussed herein, is not intended to provide information upon which to base an investment decision, and should not be construed as such. Houlihan Lokey or its

affiliates may from time to time provide financial or related services to these companies. Like all Houlihan Lokey employees, the authors of this presentation receive

compensation that is affected by overall firm profitability.

CORPORATE FINANCE

FINANCIAL RESTRUCTURING

FINANCIAL AND VALUATION ADVISORY

HL.com