The History of

the Ajinomoto Group

Fiscal Years 2009 - 2019

The History of the Ajinomoto Group

Fiscal Years 2009 - 2019

The History of

the Ajinomoto Group

Fiscal Years 2009 - 2019

Greetings

The Ajinomoto Group celebrated its 110th anniversary in 2019. This history has seen a mountain

of diculties and victories.

Twenty years ago, in 1999, our operating profits were 33 billion yen. In the years that

followed, although bulk businesses such as animal nutrition grew, profits slumped due to

intensifying competition, and we were unable to achieve stable growth. Then in 2009 we marked

our 100-year anniversary.

During the period between 2009 and 2019—this “10-Year History”—we worked to shift

our focus from an over-reliance on bulk business to one that contributes to the enrichment of

people’s lives around the world. This illustrated our aim of becoming a Genuine Global Specialty

Company (GGSC). We then launched strategies such as our “FIT & GROW with Specialty” and

“Open New Sky (expansion into adjacent domains, Open & Linked innovation),” to achieve

growth with a focus on our overseas consumer business.

However, it also became clear that there were challenges to overcome. These included

global digitalization and changes in the macro environment, especially more intense competition

for bulk materials and the rise of local companies. In addition, we faced the internal challenge of

having a business structure that made it dicult to generate economic value because we had a

strong managerial focus on scale. In order to resolve these issues, we believe that improvements

to capital eciency and steady organic growth in our key businesses are essential for the growth

of the Group.

On the other hand, it was during this period that we established ASV (The Ajinomoto Group

Creating Shared Value), which represents our unchanging commitment: with our stakeholders

and businesses, we help resolve society’s issues, which leads to the creation of economic value.

In the midst of the growing need for corporate social responsibility, we have been at the forefront,

with global sustainability, food resources, and Health and Well-being as challenges facing society

in the 21st century that we want to address. Today ASV contains the universal values at the heart

of the Group.

To realize the ASV vision, we strengthened and enhanced corporate governance through

dialogue and cooperation with external parties and implemented measures to develop human

resources from a global perspective.

Our business profits are now 99.2 billion yen (FY2019), almost three times higher than in

FY1999. We believe that our various initiatives in the 2010s and the experience gained from

them are valuable assets for even further sustainable growth. I hope that all of our stakeholders

will read this “10-Year History.”

We have established a “2020 to 2025 Medium-Term Management Plan and Vision for

2030.” Our Group Vision is to become a solution-providing Group for food and health issues

that helps people worldwide lead healthier lives by unlocking the power of amino acids. As such,

we will promote management based on our ASV vision and strive as one to help resolve social

issues. We look forward to your continued support.

Takaaki Nishii

Representative Director,

President & Chief Executive Ocer

Contents

Greetings Takaaki Nishii, Representative Director, President & Chief Executive Ocer

I The First 100 Years of the Ajinomoto Group

1. A Chronicle of the Ajinomoto Group 2

2. Our 100th Year: Where We Were, What We Were Doing 8

II Taking the First Step into the Next 100 Years

- A Roadmap for Becoming a GGSC, Presented by Top Management -

1. Becoming a Global Group of Companies that Contributes to “Food,” a Fundamental for Humanity

- Interview with Chairman of the Board Masatoshi Ito 12

2. Becoming a Solution-Providing Group of Companies for Food and Health Issues by Adapting to Social

Change Driven by Digital Transformation and the Adoption of the SDGs

- A Dialogue Between President & CEO Takaaki Nishii and Keio University Professor Masahiro Okada 21

3. The Ajinomoto Group: The Last 10 Years and Expectations for the Future

- Special Contribution by Professor Masahiro Okada, Graduate School of Business Administration, Keio University 31

III Taking the First Step into the Next 100 Years

- Aiming to Become a GGSC -

The Ajinomoto Group FY2009 - FY2019 36

1. Grand Designs - Four Medium-Term Management Plans 37

2. The Challenge towards Structural Reform and Creating Growth Drivers

- Specic Measures for “FIT & GROW with Specialty” 42

(1) Rapid portfolio transformation through sales of businesses and other means…42

(2) Cultivating new markets and acquiring technology through M&As…43

(3) Cultivating markets utilizing external resources in Japan and overseas…47

(4) Innovating and strengthening R&D to support specialties…52

(5) Market cultivation and business area expansion through global development…57

(6) Organizational reform focused on overall optimization and streamlining…58

3. ESG-Related Initiatives for Becoming a GGSC

- Forging Firm Relationships with Stakeholders 62

(1) Self-reform aimed at creating a better world and group of companies…62

(2) Environmental preservation initiatives…65

(3) A prosperous coexistence with society…67

(4) Strengthening corporate governance and promoting the information disclosure…72

(5) Personnel training, job assignments, and utilization…74

(6) Reforming the organization and awareness to achieve proper operation as a global organization…78

(7) New initiatives for conveying corporate value…80

(8) New nancial and IR initiatives as a global company…82

4. Overview of Main Businesses (FY2009 - 2019) - Towards “Specialty and Global” 84

(1) Food products business…84

(2) AminoScience business…87

5. ASV Management at the Ajinomoto Group

- 2020 - 2025 Medium-Term Management Plan and Vision for 2030 90

IV Data

1. Financial Trends 92

(1) Main consolidated nancial indicators…92

(2) Consolidated statements of nancial position…94

(3) Consolidated statements of income…96

(4) Consolidated statements of cash ows…99

2. List of Director and Auditor Tenures 103

3. Executive Tenures and Changes in Number of Employees 104

(1) List of terms of oce for corporate executive ocers…104

(2) Changes in the number of employees…106

4. Diagram of HQ Organizational Changes and Aliates 107

(1) Ajinomoto Co., Inc. organizational changes…107

(2) History of group companies in Japan…112

(3) History of group companies overseas…115

5. Timeline 121

Postscript

[To Our Readers (“10-Year History” Project Coordination Team)]

As the contents of this publication cover a wide range of subjects, we created the following table for those who wish to read

about specific topics. Please use it as a guide.

Chapter I Chapter II Chapter III Chapter IV

Our Strategy and Specific Initiatives

○○

○○

(III-1, 2)

Our ESG Initiatives

○○

○○

(III-3)

Overview (History) of the Group Since Its Founding

○○

○○

(III-1, 2, 5)

○○

(IV-5)

Summary of Our Businesses

○○

○○

(III-2, 4)

The First 100 Years

of the Ajinomoto Group

I

The History of the Ajinomoto Group

I. The First 100 Years of the Ajinomoto Group

- 1. A Chronicle of the Ajinomoto Group -

2

1

Saburosuke Suzuki in his youth

In the beginning: The iodine business

The Ajinomoto Group s origins lie with Takiya, a grain and

alcohol retailer. It was founded by Saburosuke Suzuki in 1866

just before the Meiji Restoration, on the Miura Peninsula in

Kanagawa Prefecture. After Saburosuke died suddenly at the

end of 1875, his wife Naka took over business operations.

The eldest son, Saburosuke II, was an ambitious man. After

marrying, he became involved in rice speculation but failed.

As the family was having a hard time, they decided to rent

two rooms at the back of their house to summer vacationers

to help pay for their living expenses. One of their guests was

an engineer from a pharmaceutical company. He advised

Saburosuke II to produce iodine from seaweed, which inspired

his new business. Through the eorts of Naka and Saburosuke

II s wife Teru, they successfully produced it in 1888. In the

spring of 1893, they built a new plant and established a new

company, Suzuki Pharmaceutical Co. In 1895, the company

began exporting iodine and, in an eort to utilize its by-

products, began manufacturing saltpeter, the raw material for

gunpowder, for which demand rose sharply during the Sino-

Japanese (1894-95) and Russo-Japanese (1904-05) wars.

Suzuki Pharmaceutical Co. soon became one of the leading

chemical companies in the Kanto region. However, the market

was in turmoil due to a sharp decline in demand for its products

after the war, and in 1907 the company had no choice but to

merge with two of its competitors. Saburosuke II took the

opportunity to embark on a new challenge, establishing Suzuki

Pharmaceutical GSK. as a separate joint stock company with

its Hayama and Zushi Plants. The inspiration for this came

from a 1908 encounter with Dr. Kikunae Ikeda, a professor

at Tokyo Imperial University. Dr. Ikeda had been researching

the component in kelp that provides its umami flavor, which

he identied as glutamine acid. Compounded with sodium, it

became the seasoning Mono Sodium Glutamate (MSG). For

searching a company to commercialize his research, Dr. Ikeda

turned to Saburosuke II. They held a tasting that conrmed

MSG s promise, and Saburosuke II accepted the oer. One of

the motivations for Dr. Ikeda s research was to help improve

nutrition among the Japanese public. Combined with the

entrepreneurial spirit of Saburosuke II, AJI-NO-MOTO

®

and

the Ajinomoto Group were launched, already practicing the

founding aspiration of the Ajinomoto Group Creating Shared

Value (ASV) and contributing to the resolution of social issues

through the Group s business activities.

I. The First 100 Years of the Ajinomoto Group

A Chronicle of the Ajinomoto Group

May 20, 1909 was the day the umami seasoning AJI-NO-MOTO

®

rst went on sale. At that time, Japan was

expanding its power as a modern nation. The industrial revolution was underway in the nation, and Japan had

prevailed in the Russo-Japanese War (1904-05). Since then, the Ajinomoto Group has grown its business,

responding to changing lifestyles while contributing to the enrichment of food and improving quality of life

through diversication and technology with a focus on amino acids. Here we provide an overview of the history

of Ajinomoto Co., Inc. (the Company), including the events leading up to its launch.

Dr. Kikunae Ikeda (1900)

The launch of AJI-NO-MOTO

®

and struggles during

the founding years

Saburosuke II s younger brother, the scholar Chuji Suzuki, was

placed in charge of the establishment of a production method

for the new seasoning. Saburosuke II s eldest son Saburo,

later to become Saburosuke III, was in charge of sales and

advertising. Saburosuke II managed the enterprise as a whole.

The name Ajinomoto was

decided in November 1908, and with a

trademark registered they were ready

to launch. However, as production

involved breaking down wheat with

hydrochloric acid, corrosion of the

vessels used in the process, became

an issue. With no overseas precedents

to learn from, the situation was so

A Domyoji pot

The History of the Ajinomoto Group

I. The First 100 Years of the Ajinomoto Group

- 1. A Chronicle of the Ajinomoto Group -

3

patent, the Great Kanto Earthquake when the head office

burned (1923), and a labor dispute at the Kawasaki Plant (1925).

During that period only 1920 was in the red, but operating

prots remained in the high 4 million yen range from 1926

and grew to about 5.4 million yen in 1931. During this period,

Saburosuke II was commended by the Imperial Institute of

Invention and Innovation in 1926, along with Sakichi Toyoda

(who developed an automated loom), and Kokichi Mikimoto

(who succeeded in pearl cultivation). AJI-NO-MOTO

®

became

known as one of Japan s Three Greatest Innovations.

Business expansion and World War II

In March 1931, Saburosuke Suzuki II died and Chuji Suzuki

became the company s second President. The Manchurian

Incident occurred the same year. Due to the Finance Minister

Takahashi Korekiyo s aggressive scal policy, the country

experienced a brief period of prosperity until the Second

Sino-Japanese War began in 1937. In this context, Chuji,

who had mainly been in charge of technology and production

since the company started, announced a complete reform

of manufacturing technology and the development of related

products and worked on the creation of acid-resistant

technologies and the conversion of raw materials into defatted

soybeans. The transition started in 1934. The company

also processed and commercialized by-products, with the

development and launch of the amino acid solution

AJIEKI

in

1934 and

ESUSAN Fertilizer

in 1936. Sales of

AJI-NO-MOTO

®

also increased due to its price cut etc. and use of the product

spread from urban to rural areas, eventually even being adopted

by low-income consumers. Sales of AJI-NO-MOTO

®

soared,

thanks to the organization of the Ajinomoto Association and

the introduction of new marketing approaches like special sales

with perks, as well as increased exports. In 1937, production

peaked at 3,750 tons before the war, and the total prot of

Ajinomoto

Honpo S. Suzuki &Co., Ltd. (renamed in October

1932) reached 8.85 million yen in 1938. In addition, with a

transition in raw materials and an increase in by-products, the

company also established subsidiaries and affiliated companies

in the elds of sake brewing, pharmaceuticals, the electrical

industry, and edible oil manufacturing to ensure a stable supply

of defatted soybeans, forming the small conglomerate that

could be called a Group. In June 1932, an eight-story head

office building was completed in Takara-cho, Kyobashi Ward,

Tokyo (present-day Chuo-ku, Tokyo).

With the outbreak of the Second Sino-Japanese War

in July 1937 and the National Mobilization Law in 1938,

economic control over the country was increasingly tightened.

With the formation of the Dai-Nippon Industrial Patriots

Society in November 1940, the freedom of corporate activity

was nearly brought to a halt. Ajinomoto Honpo S. Suzuki

& Co., Ltd. had also been forced to reduce production and

sales of AJI-NO-MOTO

®

since the outbreak of World War

II in 1941 in favor of producing military supplies, and

newspaper advertisements were discontinued. Starting in

1942, AJI-NO-MOTO

®

was produced as a by-product of the

dire that at one point Saburosuke II said they had fallen into

a predicament beyond their control that words could barely

describe, the situation being almost too much to handle.

However, after great toil they discovered that Tokoname-yaki

ceramic Domyoji pots could be used, which created a way

forward.

AJI-NO-MOTO

®

was launched in May 1909 after the

national laboratory conrmed its safety. The company set up an

office in Kyobashi (Tokyo City, Tokyo Prefecture, now Chuo-

ku, Tokyo). To make a name for itself, they installed a display

window and electric lights, which were rare at the time. The

company established a sales network by concluding special

dealer contracts with major food and liquor wholesalers and

establishing distributors in local major cities. However, the new

seasoning was expensive; while a cup of soba noodles and broth

at the time sold for 3 sen, a small 14-gram bottle of the product

sold for 40 sen. As a result, sales were dismal. Saburosuke II

sought to advertise in newspapers and market the product to

kamaboko sh cake manufacturers while seeking sales channels

in Taiwan, Korea, and China during Japan s colonial period.

Even so, the company continued to struggle.

In 1912, Suzuki Pharmaceutical GSK. was renamed

Suzuki Shoten GSK., and July of that year issued in the Taisho

era. Suzuki Shoten GSK. s iodine and saltpeter businesses

were solid. The construction of the Kawasaki Plant took place

between 1913 and 1914, made possible in part due to growth

during World War I (1914-1918). Industrial development during

the war encouraged urbanization and the adoption of electricity,

and the economic boom opened the door to a mass consumer

society. Against the backdrop of those developing Taisho

Modern times, Saburosuke II championed more progressive

management. He converted the organization to a corporation in

1917 and set up an office in New York.

Suzuki Shoten GSK. and AJI-NO-MOTO

®

operations were

suspended at the Kawasaki Plant in 1920 due to the failure of

Saburosuke II s stock investments. Further damages occurred

due to rumors surrounding the Ajinomoto Raw Material Snake

Theory (around 1920), the expiration of the AJI-NO-MOTO

®

Domyoji pots

( Cooling crystallization of

hydrochloric acid)

Certificate declaring Ajinomoto “harmless”

The History of the Ajinomoto Group

I. The First 100 Years of the Ajinomoto Group

- 1. A Chronicle of the Ajinomoto Group -

4

amino acid solution used as a substitute for soy sauce. During

this period, Saburosuke Suzuki III was appointed President

in August 1940. The company changed its name to Suzuki

Shokuryo Kogyo Co. in December 1940 and again to Dai-

Nippon Chemical Co. in May 1943. Sales of AJI-NO-MOTO

®

in Asia and the U.S. continued to stagnate or shrink, and by the

end of the war the company was mostly producing items used

in munitions like electrolysis, linings, alumina, etc.

First steps toward postwar reconstruction and

modernizing management

By the end of the war in August 1945, Japan had lost more

than three million lives, major cities had been devastated, and a

quarter of national wealth had been lost. The nation then began

its journey towards reconstruction.

Dai-Nippon Chemical Co. was renamed Ajinomoto Co.,

Inc. in April 1946 under the decisive leadership of Saburosuke

Suzuki III, and resumed production of AJI-NO-MOTO

®

in

May of that year. There was a strong underlying belief that

AJI-NO-MOTO

®

had to be provided to the public during that

post-war period of poverty. Meanwhile, Saburosuke III had

to face the General Headquarter of the Allied Forces policy

of dissolving large industrial groups. In addition to changing

the company name, to minimize disruptions the Suzuki family

retired from management and released their shares. Suzuki III

also resigned as President in May 1947 and the company was

listed on the stock market in

May 1949.

Toyonobu Domen became

President of the Company in

May 1948. He had moved to the

U.S. at a young age, and with

his international experience

ran the New York office of the

Company before the war and

dealt with GHQ in English

afterwards. The production of

the insecticide DDT, which

kept the Company afloat immediately after the war, was also due

to Domen s American network. Under Domen, the Company

took a series of measures to transform itself into a modern

company. These included the introduction of a council system for

meetings, open recruitment of employees rather than the network

of connections that had prevailed until that point, the institution

of overseas inspection tours, and the development of international

offices. These consisted of the re-opened Los Angeles Office in

1951 and New York Office in 1953, along with the establishment

of new offices in Sao Paulo, Paris, Bangkok, Singapore and Hong

Kong in 1954.

During this period, the Company got its system back on

track, with eorts such as resuming advertising in newspapers

and retail store visits to promote sales and establishing offices in

major cities. From August 1950, the Company was once again

able to sell freely. In March 1955, the conscated Ajinomoto

Building was returned, marking the end of the Company s

postwar reconstruction.

Expansion during the high-growth period,

part 1: Product development and changes in

manufacturing methods

With the special procurement demands of the Korean War

(1950-53) as an impetus, the Japanese economy experienced

three major periods of economic growth: the Jinmu Boom (31

months), the Iwato Boom (42 months), and the Izanagi Boom

(57 months) that followed the 1964 Tokyo Olympics. On the

heels of this miracle of reconstruction and rapid growth, in

1968 Japan became the second largest capitalist country in the

world after the U.S.. During this period, domestic consumption

of MSG also continued to grow rapidly, reaching 76,000 tons

(calculated as production minus export volume) or 744.5 grams

per capita in 1968.

In the midst of this rapid growth period, the Company

solved its business challenges while boosting its business

through an expansion of the sales volume of AJI-NO-MOTO

®

under Domen s leadership. This was due to a change in

manufacturing methods.

The extraction method relies on breaking down

agricultural products such as soybeans with strong acids. This

method has problems such as the instability of the price and

quality of raw materials and the deterioration of equipment

due to acids. The need to develop a new manufacturing

method was urgent. In 1956, we established the Central

Research Laboratory and started to develop two new types

of manufacturing methods: a fermentation method that

uses microorganisms and a synthesic method that relies on

chemical synthesis. The fermentation method was earlier

developed by Kyowa Hakko Kogyo Co., Ltd. We developed

our own technology and completed the change to the updated

manufacturing process at the Kawasaki Plant in 1965.

Production with synthesis method began at the Tokai Plant in

1961, and the year after it opened.

Competition intensied at this time when other companies

launched compounded seasonings. They added inosinic acid

(the umami component of dried bonito flakes) and guanylic

acid (the umami component of shiitake mushrooms) to MSG.

After falling behind with its mainstay product, the Company

attempted to regain its footing in 1962 with the launch of

Umami Dashi

Hi-Me

®

. By 1966 it had become the leading

brand. In 1960 we launched

Aji-Shio

®

, rened salt coated

with MSG, which was a big hit. Even so, MSG s market share

gradually declined. It had been 80% in 1955 for both consumer

and commercial use products in domestic and export markets.

By 1968, the domestic market share had fallen to 51%, and

especially the commercial (industry and food service) market

share dropped below 40%.

Expansion during the high-growth period,

part 2: Diversication

Amid intensifying competition for its mainstay products, the

Company made the foray into consommé and ramen soup

Our fourth President,

Toyonobu Domen

The History of the Ajinomoto Group

I. The First 100 Years of the Ajinomoto Group

- 1. A Chronicle of the Ajinomoto Group -

5

through its acquisition of Nippon Shokuhin Kogyou Co., Ltd.

In light of the popularity of instant products, Knorr Foods

Co., Ltd. was established in March 1963 in partnership with

the U.S. s Corn Products International (CPC)

1

. Through the

customization and marketing of

Knorr

®

Soup

in Japan, we

were able to introduce modern American marketing methods

from CPC. In 1968, the Company launched its mayonnaise and

diversied into food products, including edible oils.

Diversication had been driven by technology and sales

capabilities, the latter of which was helped by a powerful sales

network and branding in addition to advanced approaches to

marketing. Domen served as the rst Chairman of the Japan

Marketing Association and contributed not only to the Company

but also helped establish and raise the prole of marketing in

Japan.

Knorr

®

Soup Ajinomoto KK Mayonnaise

Expansion during the high-growth period,

part 3: Internationalization

Domen s genius was in pursuing international expansion in

parallel with diversication.

Domen visited the U.S. three times after the war between

1949 and 1952 and succeeded in selling MSG to major food

companies and other parties. His third trip included Europe

as well. He also worked on changing the mindset of the entire

management team. Directors in charge of overseas business

traveled to Southeast Asia and the U.S. numerous times for

inspection tours. Nine trips to overseas markets were made in

total in the roughly four years from 1949 to 1952. They were all

on Domen s instructions, with an eye towards the Company s

internationalization. From Toyonobu Domen, A Manager

Who Challenged the Times: Another Jiro Shirasu (Economics

Edition), by Tomohide Tsuji.

To help develop markets in Southeast Asia, our employees

visited markets and small shops in the provinces and gave

them free packages of our products to encourage further use.

We were also able to build a successful system for delivery

and payment collection by local employees. The Company

worked to cultivate the European market by setting up a local

plant in Italy and strengthening exports from Japan. As a result,

sales in FY1969 exceeded 100 billion yen. Domen was invited

to participate in the 13

th

World Congress of the Academy of

International Business held in New York City in September

1963 (sponsored by the International Council for Scientic

Management). He gave a speech on the theme of Social

Responsibility and the Managers of Tomorrow, demonstrating

how far his international vision had come.

Domen retired from the

Company in November 1965.

The Company funeral was

held for him when he passed

away in March 1981.

In a special issue of

the Company s corporate

newsletter entitled Honoring

the Late Senior Advisor to

the Board Domen, Bunzo

Watanabe

2

wrote a piece

describing the essence of

Domen s management style.

Domen s motto was In

the spirit of fair play. Common in the American sports world,

including football and Major League baseball, it was known

throughout the Company as its most concise catchphrase.

It also summarized Domen s management philosophy as

follows:

We cannot be satised with our business simply if the

Company prospers, favors its shareholders and treats its

employees well. Given the public nature of our business,

we need to reach the level of a Public Service. This means

contributing to society, not just by streamlining production and

providing people with better quality products at lower prices, but

by improving society itself through our business activities, even

if only a little. I hope we ll always work towards this ideal.

He s referring to the social responsibilitytoday known

as CSRthat companies are obliged to abide by. Watanabe

was surprised yet respectful of the fact that Domen already had

this kind of vision in his management philosophy, which was

decades ahead of its time, and laid out the full story, in the mid-

1950s when the Japanese economy was about to enter a growth

period after its postwar recovery.

Toyonobu Domen now rests with his ancestors in

Hiroshima, where he was from. (See previous citation)

Safety measures and full-scale international

expansion

The Company developed steadily until October 1969, when

it encountered a situation that had the potential to shake the

business to its foundations: MSG was suspected of being

unsafe.

Dr. Olney of the U.S. conducted experiments in which

MSG was administered to newborn mice, which resulted in

brain damage. Based on these results, the president s specialist

on nutrition and health recommended that MSG not be used in

baby food. The Japan Chemical Seasoning Industry Association

(now Umami Manufactureres Association of Japan) argued that

Olney s experiment relied on usage far removed from the norm.

However, there was widespread talk of Chinese restaurant

1. At the time CPC had soup-maker Knorr in Germany and mayonnaise maker Best

Foods in the U.S. under its umbrella.

2. The President of the Company at the time

Saburosuke Suzuki, our third

President, and Toyonobu Domen (left)

The History of the Ajinomoto Group

I. The First 100 Years of the Ajinomoto Group

- 1. A Chronicle of the Ajinomoto Group -

6

syndrome, an unfounded claim that only resulted from massive

overuse. These issues had an enormous eect on the Company.

In response, the Company conducted a series of studies to prove

the safety of MSG under the leadership of two Presidents,

Kyoji Suzuki (1965-73) and Bunzo Watanabe (1973-81). Based

on this data, in 1980 the U.S. s Food and Drug Administration

(FDA) concluded that MSG was Safe at the current levels of

use. In 1987 the Joint FAO/WHO Expert Committee on Food

Additives (JECFA) stated that MSG is not harmful to human

health, so there is no need to specify a maximum recommended

daily intake. This put an end to the problem.

In addition to MSG safety issues, the Company was faced

with problems related to Japan s transition to stable growth.

With the Nixon Shock of 1971 and the 1973 1st Oil Crisis, the

growth due to exports and quantitative expansion reached a

turning point. Japanese companies worked to conserve energy

and downsize, with the economic growth rate falling to less

than half of what it was during the high growth period. Yet the

Company grew in the midst of these severe circumstances. It

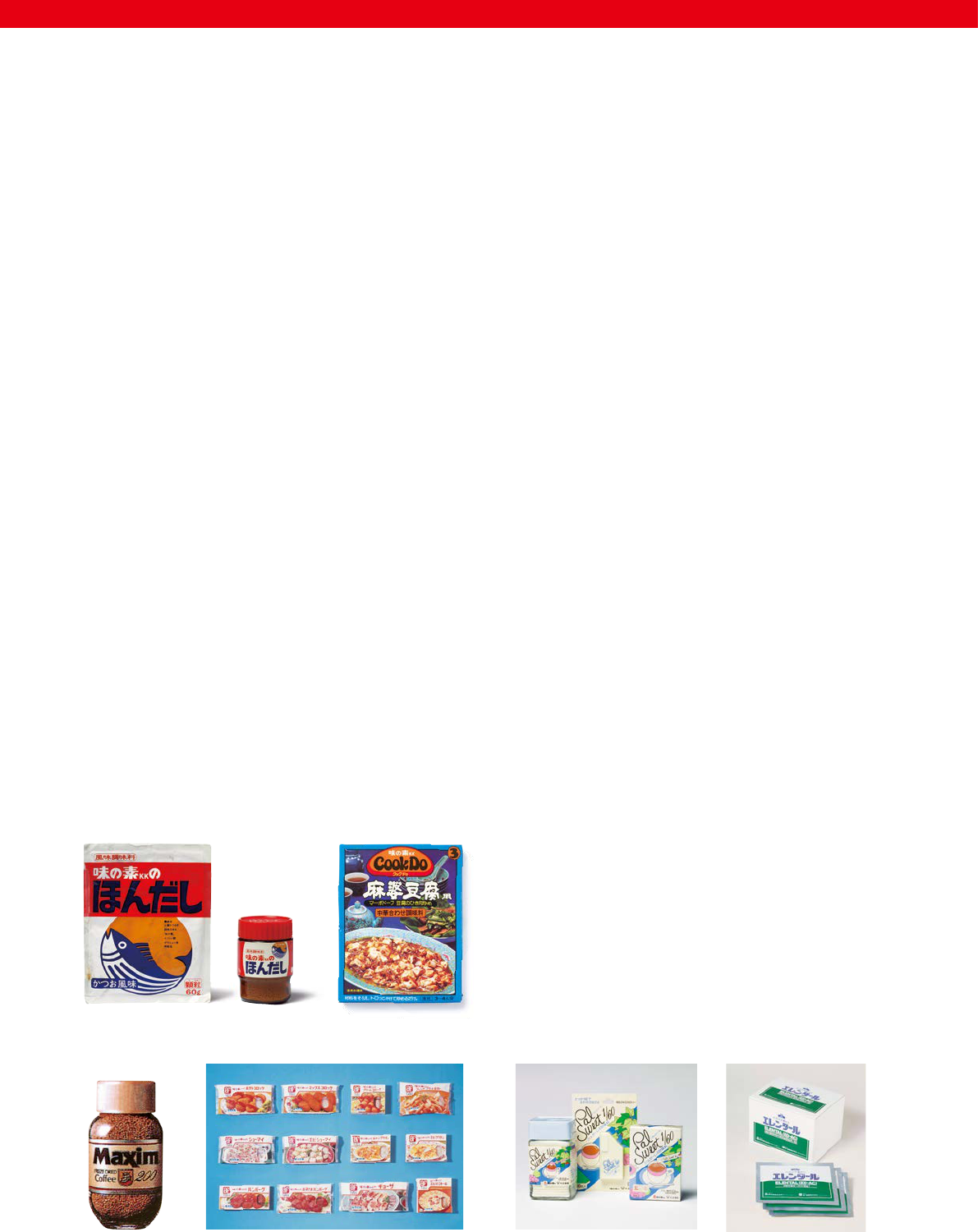

launched the new mainstay flavor seasoning

HON-DASHI

®

in

1970, the Chinese-food seasoning

Chuka Aji

®

in 1977, and the

seasoning for Chinese dishes

Cook Do

®

in 1978. The Company

launched an instant coee in partnership with the U.S. s

General Foods Corporation and established Ajinomoto General

Foods Co., Ltd. in 1973. Ajinomoto Frozen Foods Co., Ltd. was

established in 1970, and full-scale development of our frozen

food business began in 1972. A business tie-up commenced

with Danone S.A. in France in 1980. A License Agreement with

Searle, G.D. Searle & Company was also signed in 1970 for the

sweetener aspartame, which was later commercialized.

In overseas business, the Company established a system

of direct sales in Asian countries with the launch of flavor

seasonings tailored to local cuisine and the manufacturing and

sale of ramen noodles in South America in retail businesses.

The commercial use business shifted to local production in

Peru and Indonesia, and we began a full-scale feed-use Lysine

business with the opening of a production base in Europe

along with other developments. Sales in FY1979 were about

350 billion yen, more than two and a half times higher than

the 135 billion yen in FY1971, the year of the transition to

stable growth. It was during this period that environmental

conservation eorts at our plants began in earnest against a

backdrop of the worsening domestic pollution problems.

Business expansion and restructuring during the

bubble years and after the bubble’s collapse

After the oil crisis, Japanese companies that radically reduced

costs and developed cutting-edge technologies became

dominant in the 1980s in the automotive, consumer electronics,

semiconductor, and other industries. This also caused trade

and economic friction, and the Plaza Accord in 1985 led to

a recession caused by a strong yen. However, due to various

policies like low-interest rates designed to encourage domestic

demand, the economy began to recover in 1986, and the

money that no longer needed to be raised from banks due to a

strengthened corporate structure was invested in land and stocks.

A major bubble economy then grew until stock prices plunged

in 1990. Following the collapse of the bubble, Japan entered a

prolonged recession and continued to stagnate with the rise of

emerging economies and the end of the Cold War.

Having reaffirmed the safety of MSG, the Company

planned to become a world-class company under the leadership

of Presidents Katsuhiro Utada (from 1981) and Tadasu Toba

(from 1989). The WE-21 Plan announced in 1989 set a target

for sales of 1 trillion yen and 3 billion USD for exports and

overseas businesses while promoting diversication of food

products, ne chemicals and services, and expansion of our

operations overseas. In the food products sector, the Company

formed a business partnership with Calpis Food Industry, Co.,

Ltd., expanded into Vietnam and Nigeria, developed its frozen

food business in South Korea and Taiwan, and launched a

full-scale sweetener business. In the ne chemicals sector, the

Company expanded into electronics. In the service sector, our

businesses entered elds as diverse as healthcare, vegetables,

seedlings, packaging, restaurants, and golf courses. However,

many of these eorts had little synergy with our core business,

and coupled with the collapse of the bubble economy, many

had to be shuttered or restructured. The following is a list of

Ajinomoto KK’s frozen foods at the

time of its launch

Maxim

®

coffee at the

time of its launch

The consumer sweetener PAL SWEET

®

Cook Do

®

Mabo Tofu at

the time of its launch

Ajinomoto KK’s HON-DASHI

®

at the time of its launch

ELENTAL

®

The History of the Ajinomoto Group

I. The First 100 Years of the Ajinomoto Group

- 1. A Chronicle of the Ajinomoto Group -

7

new businesses and products that bore fruit.

A sweetener business featuring the low-calorie sweetener

aspartame (adopted by Diet Coke in 1983, launched as

PAL SWEET

®

for Japanese consumers in 1984)

ELENTAL

®

, an elemental diet (1981)

Our pharmaceutical business was solidied with launches

like

LIVACT

®

(1996), a branched-chain amino acid drug

for liver diseases

A frozen bread dough business established by Ajinomoto

Frozen Bakery Co., Ltd. (1993)

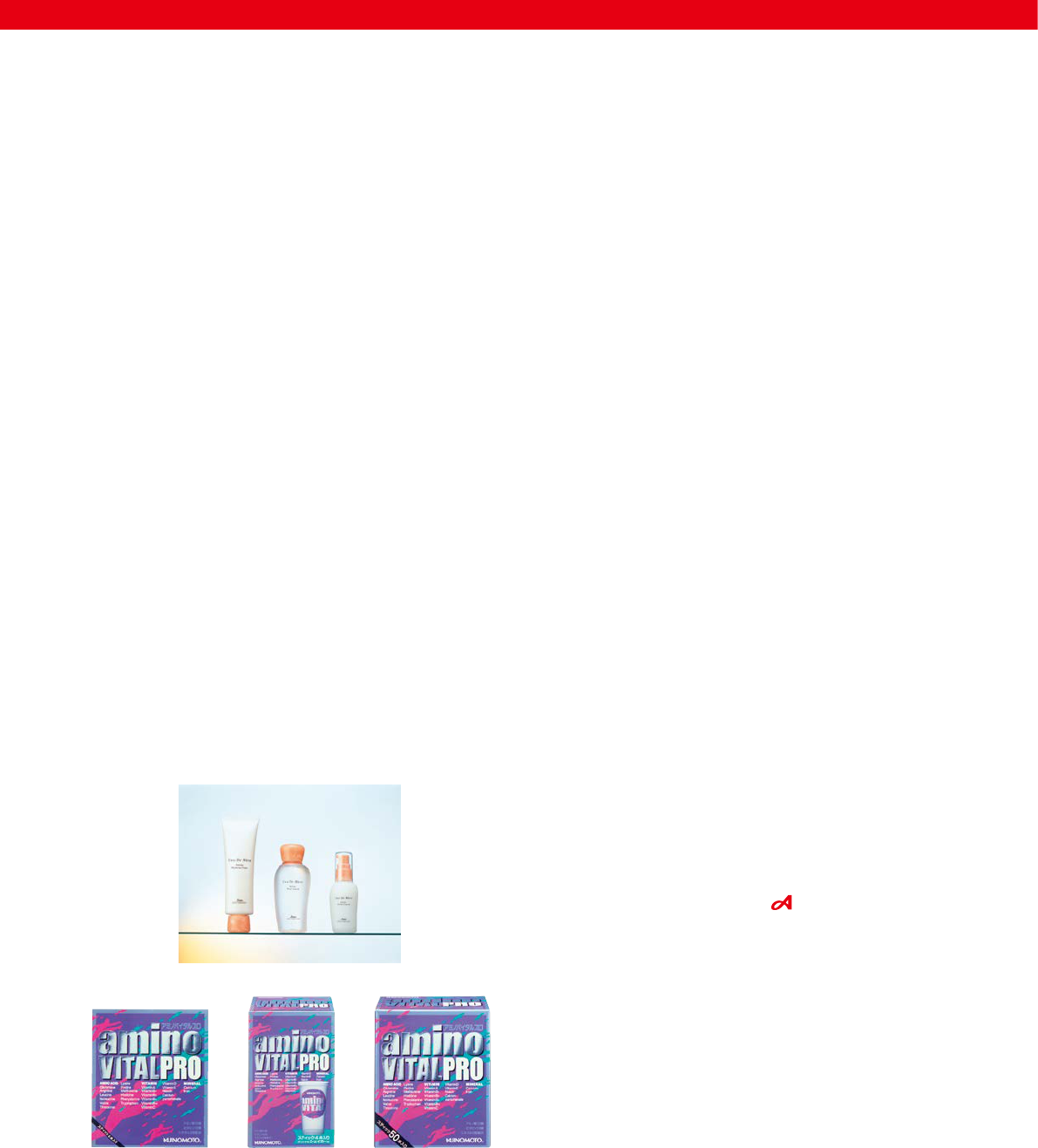

Expansion of our specialty chemicals business into

materials for electronic parts and launch of the cosmetic

JINO

®

(1997)

amino VITAL

®

(1995), an amino acid nutritional food for

athletes

In parallel with these expansions, we proceeded with

business restructuring, which involved consolidation of

production and bolstered manufacture of commercial use

products in the seasonings business (which struggled with

a shift away from Japanese food and a trend towards eating

out), in addition to the edible oils business (which faced the

liberalization of imports from overseas in addition to sluggish

consumption).

Shunsuke Inamori assumed the post of President in 1995.

In light of the bubble s collapse and the failure of many of the

diversied businesses, he sought to correct this trajectory by

formulating the MSG global strategy and introducing other

measures. In March 1997, he was forced to resign due to a

scandal that involved illegal payments to corporate racketeers.

Standards of Business Conduct in April 2000 in light of a

cartel incident involving U.S. subsidiaries. Advancing from

Japan to the global arena as a leader in foods and amino acids,

we practiced the Ajinomoto Way as a technology-driven

company with amino acids at its core. The Company s basic

policies included its Strong No. 1 Strategy, which focused

on businesses and products with the global No. 1 or 2 market

shares and reorganized the others, instituted a fully bottom-

up approach, and involved all employees in management.

Important challenges to allow us to compete with major global

food companies included consolidated management, promotion

of brand strategy, strengthening cost competitiveness,

streamlining research and development systems, and promotion

of corporate citizenship. Specic measures included the sale

of defective businesses, the reorganization and integration of

subsidiaries, a system of 6 business-specic laboratories (1998),

the establishment of the Ajinomoto Group Corporate Citizenship

Committee (1999), the introduction of the corporate slogan

A taste of the future (1999), the Brand Review Committee

(2000), Ajinomoto Stadium naming rights acquisition (2002),

introduction of a virtual company system (2002), introduction

of a Corporate Executive Officer system and a reduction in

the number of Board of Directors (2003). We also built a

foundation suitable for a global food company, including the

acquisition of ISO9000 and ISO14000 series certication,

establishment of a CSR Division, and establishment of our CSR

Vision (2005).

Our overseas businesses saw a focus on business expansion

in China, a joint venture with a Russian research institute,

and establishment of a full scale frozen food business by the

aquisition of a local company in the U.S. (2000). We developed

a variety of other businesses around the world, including

retail seasoning, feed-use lysine, sweetener, and frozen food

businesses.

Norio Yamaguchi was appointed President in 2005, and he

continued this approach. Under the

-dvance10 medium- to

long-term plan, the Company acquired Hong Kong Amoy Food

Group (2006), made GABAN Co., Ltd. a subsidiary (2006),

sold Mercian Corporation (2006), entered a capital tie-up with

YAMAKI CO., Ltd. (2007), sold Calpis Ajinomoto Danone Co.,

Ltd. (2007), and made Calpis Co., Ltd. a fully owned subsidiary

(2007).

As a result of these eorts, consolidated sales surpassed 1

trillion yen in FY2003 and reached 1.21 trillion yen in FY2007.

However, the prot margin on sales did not exceed 5%, and

it was left to the next generation to strengthen the Company s

standing as a global company, including in terms of human

resources.

A century after its founding, the Ajinomoto Group stood on the

threshold of becoming a global food company, responding to

the changing times while looking back to its original mission:

to contribute to people s health and improve dietary habits at

every turn.

amino VITAL

®

PRO at the time of its launch

JINO

®

at the time of its launch

From Japan to the world

Kunio Egashira succeeded Inamori as President in 1997. He

strengthened corporate governance through measures like

the reinforcement of auditing and legal functions and the

establishment of the Ajinomoto Co., Inc. Standards of Conduct

in April 1997, which were revised as the Ajinomoto Group

The History of the Ajinomoto Group

I. The First 100 Years of the Ajinomoto Group

- 2. Our 100th Year: Where We Were, What We Were Doing -

8

2

The Ajinomoto Group at 100 years

In 2009, a century after the launch of AJI-NO-MOTO

®

in May

1909, the Ajinomoto Group was one of Japan s leading food

companies. Sales had exceeded 1 trillion yen for 6 consecutive

years from 2003 and surpassed 1.2 trillion yen in FY2007.

Net prot had remained in the 30-40 billion-yen range, despite

some fluctuation. Further, as indicated by the nal chapter s

title From Japan to the World of our 100-year history, First

100 years of the Group: New Value Creation and the Pioneer

Spirit, we had embarked on full-scale globalization. Although

sales from our international food products business were still

only about 12% of total sales, with overseas sales of umami

seasonings, amino acids, animal nutrition products, and similar

items included, the gure was closer to 30%.

In terms of food products in Japan, consolidated

subsidiaries with established brands included Knorr Foods Co.,

Ltd., Ajinomoto Frozen Foods Co., Inc., Calpis Co., Ltd., and

GABAN Co., Ltd., equity-method affiliates such as Ajinomoto

General Foods Co., Ltd., J-OIL MILLS, INC., and YAMAKI

CO., Ltd., as well as a number of subsidiaries dealing in

amino acids, pharmaceuticals, logistics, and various services

were operated. The Overseas business of the Group was at the

forefront of the global expansion of Japanese food companies.

Entities involved included local subsidiaries doing businesses

of Ajinomoto itself, its consolidated subsidiaries and equity

method affiliates, as well as the Amoy Food Group, led by

Hong Kong Amoy Food, Ltd.

As of the end of FY2008, we had 26,869 employees,

including those at our consolidated companies. In Japan,

business operated from 3 production bases in Kawasaki (mainly

food products), Tokai (mainly sweeteners, food products and

pharmaceuticals), and Kyushu (mainly amino acids). We had

research laboratories (the main one in Kawasaki), 5 branch

offices (Tokyo, Osaka, Kyushu, Nagoya, and Tohoku)

1

and

a sales department responsible for nationwide accounts, as

manufacturing, development, and sales bases. Overseas, we had

a total of 20 offices, including 2 in North America, 2 in Latin

America, 2 in Europe,

9 in Southeast Asia,

and 5 in East Asia. We

sold AJI-NO-MOTO

®

and flavor seasonings

tailored to local cuisine

in over 100 countries,

and we enjoyed a

high degree of market

penetration in Southeast

Asia in particular.

A severe business environment

Nevertheless, as the Group entered its 100th year, the business

environment surrounding it was full of challenges.

One aspect was a detour along our move to globalization

due to setbacks with our WE-21 long-term plan. WE-21 (WE

= World Excellence) aimed to become a 21st century industry

leader in light of intensifying global competition and the

international mergers and acquisitions that have become a

powerful means of competition. We announced the management

I. The First 100 years of the Ajinomoto Group

Our 100th Year:

Where We Were, What We Were Doing

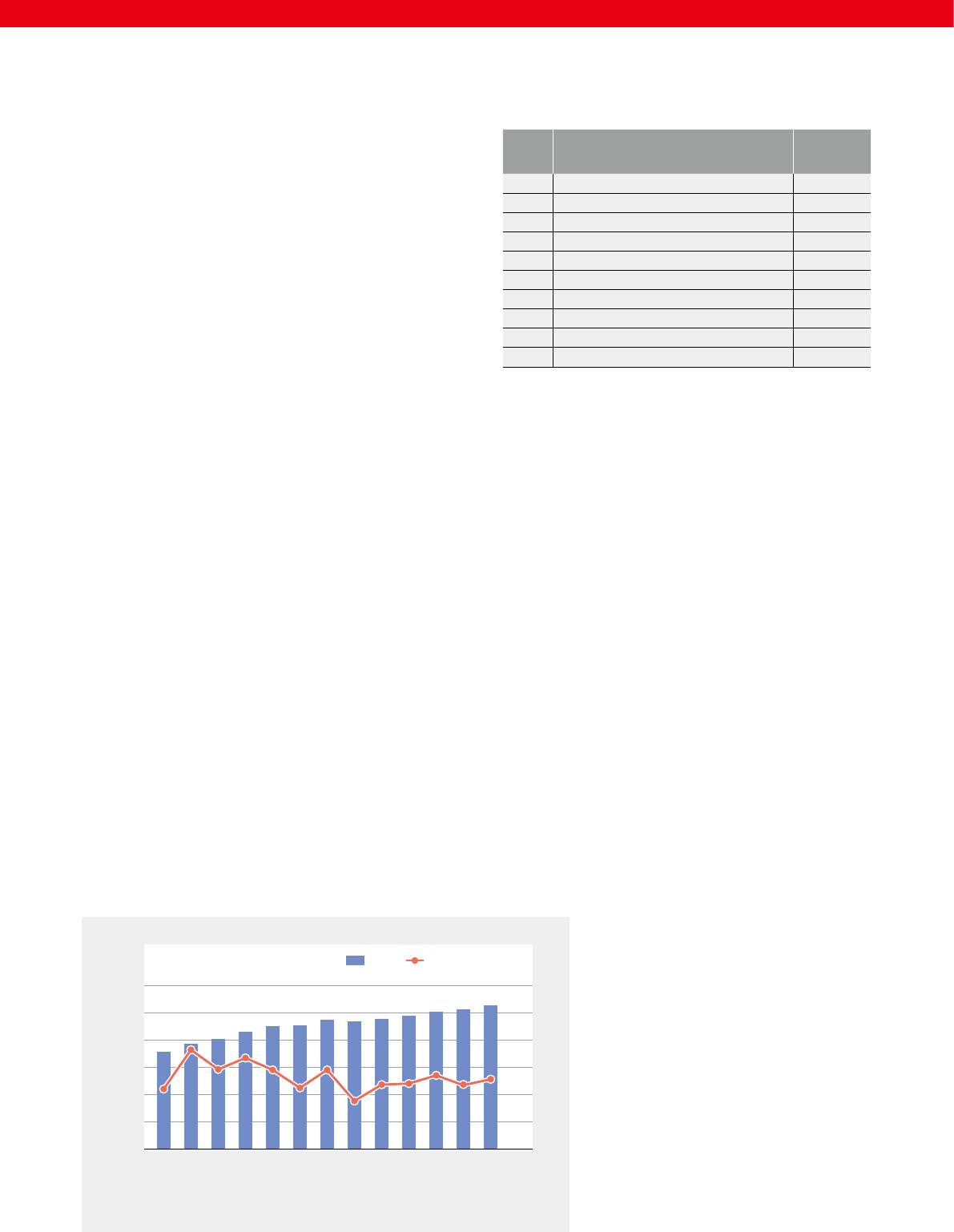

1,190.3 billion yen

Sales

Food Products

in Japan

653.9

International

food products

148.7

Amino acids

246.9

Other business

55.0

Pharmaceuticals

85.7

1,190.3 billion yen

Sales

Japan

843.3

Asia

151.0

Europe

89.4

Americas

106.5

40.8 billion yen

Operating

profit

Food Products

in Japan

16.9

International food products

11.5

Amino acids

9.4

Other business

2.4

Pharmaceuticals

13.6

40.8 billion yen

Operating

profit

Japan

26.9

Asia

16.0

Europe

1.7

Americas

8.6

Figure I-1: Our 100th Year (FY2008 consolidated results)

(Unit: 100 million yen)

Results by segment

Regional results

1. This includes the Kanto Branch under the Tokyo Branch, the Chugoku and

Shikoku branches under the Osaka Branch, and the Hokuriku Branch under the

Nagoya Branch.

Source: Financial statement

26,869 people

Food Products

in Japan

7,117

Amino acids

6,627

Pharmaceuticals

1,870

Other business

3,086

Group-wide (All Segments)

557

International

food products

7,612

Number of employees (by segment)

Note: Operating profit includes an

elimination of 13.2 billion yen

Note: Operating profit includes an

elimination of 12.5 billion yen

The History of the Ajinomoto Group

I. The First 100 Years of the Ajinomoto Group

- 2. Our 100th Year: Where We Were, What We Were Doing -

9

manufactureres in emerging countries such as China were

gradually gaining market share in this business, using low costs

to their competitive advantage. The expansion of the Group was

also having a number of negative eects. For example, there

was a desensitization to the fact that the Ajinomoto Group

common sense was losing touch with the society little by

little, as well as distance growing between management and the

employees.

The 2008 nancial crisis (the Lehman Shock) and

falling into the red

The 2008 nancial crisis (the Lehman Shock) occurred in this

context in September 2008. Since the previous year, there had

been nancial instability due to subprime mortgages

2

marketed

to low-income families in the U.S.

The global economy was in recession from the once-

a-century nancial crisis. Though the damage to Japanese

nancial institutions was not extensive, the export industry

was hit hard by recessions in Europe and the U.S. Japan s real

economic growth rate shrank in FY2008 and FY2009. Japan s

longest post-war growth period (longer than the Izanagi Boom)

came to an end.

As a result, while net sales for the Group s FY2008

nancial results were only slightly reduced, there was a net

decit of more than 10 billion yen due to factors like large

foreign exchange losses of Brazilian subsidiaries. This was

the fourth time the Group had fallen into the red. The rst and

second were during periods of emergency shortly after the

founding and immediately following the World War II. The

third time was when the Group recorded an extraordinary loss

on corporate pensions due to the globalization of accounting

standards in FY2000. This fourth instance was the rst time

loss occurred due to factors that a company could have avoided.

Structural changes in the world and Japan

In addition to these unexpected events, other changes that had a

major impact on the Group s business development were taking

place both in Japan and around the world.

In terms of the global economy, the expansion of emerging

economies was an important change. The response to the Lehman

Shock was discussed among developed nations and at the G20

(a summit of leaders of the 20 countries/regions concerning world

nancial and economic issues). The fact that nancial stimulus by

China, one of BRICS

3

, played a major role in staving o a major

depression was a clear illustration of this.

On the other hand, the Japanese economy had a low growth

plan in 1988 with the goal of laying the groundwork to allow

us to compete with major global food companies, including

milestones like achieving sales of 1 trillion yen. This goal itself

was timely, given the state of global competition. However,

most of these eorts were unsuccessful because the Group

sought to diversify domestically to help achieve the goal,

straying from its core business with restaurants and other

service sector initiatives. Subsequently, we moved in the

direction of growing our umami seasonings business in various

markets around the world, which led to the creation of a new

business model for the Group. The Group s strategy to become

a global food group of companies was back on track, but it took

more than ve years to make the transition.

From then, Ajinomoto Fine-Techno Co., Inc. was

launched in 1998. The next year they released

Ajinomoto

Build-up Film

®

(

ABF

), an interlayer insulating material for

semiconductor packages, which was adopted by major CPU

manufacturers and rapidly became the de facto standard.

Subsequently we worked to establish a system that would allow

us to compete on the world stage while remembering where we

started as a company. The medium to long-term management

plan for scal years 2005 to 2010 sought to accomplish

this through initiatives like -dvance10, revision of the

Ajinomoto

Group Philosophy, and

Ajinomoto

Renaissance,

which reaffirmed our founding mission to improve nutrition

in Japan by recognizing the value of the umami seasoning

AJI-NO-MOTO

®

and bringing it to the world. We set CSR

Management as one of our basic strategies to become a

respected Corporate Citizen worldwide and established our

CSR Division to focus on activities involving dietary education

in addition to our existing initiatives that ensure the safety

and security of our products and manufacturing processes and

respond to environmental issues. All of this is part of aiming to

become a global group of companies that is not solely focused

on scale.

However, the overall performance of the Group has

been greatly influenced by the feed-use amino acids business,

which we focused on as the Group expanded. Moreover,

ABF is used for build-up boards, which form the foundation of CPUs

with their multiple layers of tiny electronic circuits. Laser processing

and direct copper plating on the surface can create micrometer-scale

electronic circuits

IC: Semiconductor

Build-up board

Circuit connected

to the outside

Printed circuit board

2. Against the backdrop of the housing bubble, loans were provided to those who

would not usually be able to secure a mortgage. Securitized receivables became

nancial products which were sold to nancial institutions in order to diversify

risk. However, when the housing bubble burst leaving many unable to pay their

debts, the nancial products that incorporated subprime loans collapsed, and the

nancial institutions that were buying them suered a great blow. With the collapse

of the long-established U.S. securities rm Lehman Brothers, it all came to a head

spurring a global nancial crisis.

3. BRICS is an acronym for the emerging countries of Brazil, Russia, India, China,

and South Africa, which in 2001 the investment bank Goldman Sachs predicted

would experience rapid growth.

Figure I-2: Ajinomoto Build-up Film

®

(ABF), an interlayer

insulating material for semiconductor

packages

The History of the Ajinomoto Group

I. The First 100 Years of the Ajinomoto Group

- 2. Our 100th Year: Where We Were, What We Were Doing -

10

rate even during the period of long-term growth from 2003 and

economic disparity widened. Furthermore, Japan s population

has been declining since 2005, and combined with its aging, the

market for food products had inevitably shrunk.

Issues of corporate governance

In 1997 the Group faced severe criticism of its corporate

governance and its top executive resigned over a scandal

involving illegal payments to corporate racketeers. For this

reason, with regard to corporate governance, we worked to

reinforce our internal auditing and legal functions and made

ongoing eorts to unify the Group through the establishment

of the Group Standards of Business Conduct and our Quality

Policy. The spate of corporate scandals in the early 2000s, when

prestigious companies were instantly discredited and even

dissolved, also made corporate governance essential.

For the Group, it had become even more important from

the perspective of corporate governance to ensure that the

Group s philosophy and policies were fully implemented in

the context of overseas expansion and continuing mergers and

acquisitions. In addition, prompt decision-making with a view

to overall optimization of the Group was required, and we

reached a turning point of the virtual company system which

was ideal for optimizing each individual business.

Furthermore, with the ratication of the Kyoto Protocol in

1997 and the United Nations Millennium Development Goals

(MDGs) in 2000, the Group s response to challenges regarding

the global environment and human society had become more

sophisticated. The time was arriving when Environment,

Society, and Governance (ESG) and Sustainable Development

Goals (SDGs; established by the United Nations in FY2015)

would become an important criterion for investment in

companies. The Group was an early endorser and participant

in the United Nations Global Compact in 2009, but to achieve

CSV (Creating Shared Value) that generates both social and

economic values, it was necessary to go deeper and evolve even

further.

In the midst of such complicated circumstances, Masatoshi

Ito was appointed President & CEO of the Group in June 2009,

and was charged with laying the groundwork for the Group s

next 100 years of global expansion.

The History of the Ajinomoto Group

II. Taking the First Step into the Next 100 Years

- 1. Becoming a Global Group of Companies that Contributes

to “Food,” a Fundamental for Humanity -

11

II

Taking the First Step

into the Next 100 Years

- A Roadmap for Becoming a GGSC,

Presented by Top Management -

The History of the Ajinomoto Group

II. Taking the First Step into the Next 100 Years

- 1. Becoming a Global Group of Companies that Contributes

to “Food,” a Fundamental for Humanity -

12

Masatoshi Ito

1

When the Ajinomoto Group celebrated the 100th anniversary of the launch of AJI-NO-MOTO

®

in June 2009,

current Chairman of the Board Masatoshi Ito was appointed as Ajinomoto Co., Inc.’s 12th Representative Director

and President & CEO. Although the company had recorded a loss in FY2008 and the situation remained dicult

due to factors such as the Great East Japan Earthquake in 2011, President & CEO Ito achieved a recovery in

business results through measures such as reorganization of unprotable businesses and cost reductions. Through

the FY2011 - 2013 and FY2014 - 2016 Medium-Term Management Plans that followed, he formulated the vision

to become a “Genuine Global Company” and by advancing FIT (business structure reform) and GROW (growth

driver development), he achieved record prot in FY2015. While working to realize this, he also focused on

external collaboration and the establishment of a base suitable for a global company in terms of organization,

human resources, and other areas.

Furthermore, the Ajinomoto Group Creating Shared Value (ASV) that was formulated under his leadership

advocates creating both social value and economic values and rearms the philosophy held by the Ajinomoto

Group since its founding. This will be passed on to future management for many years to come.

What are Chairman of the Board Ito’s thoughts and feelings about these various management initiatives that

he led?

Appointment during a time of crisis and promotion

of information sharing

Q: When you were appointed President & CEO, the

Company was marking the 100th anniversary of the

launch of AJI-NO-MOTO

®

. What was your impression

of the situation at the Company and the challenges it

was facing at this time?

Ito:

While publications of the

Ajinomoto

Group s history such

as The First 100 Years of the Ajinomoto Group had content

Masatoshi Ito

Chairman of the Board

Born in Tokyo in 1947. Joined Ajinomoto Co., Inc. in 1971. Served

in positions including General Manager of the Processed Food

Department of the Food Products Division, Representative Director

and President of Ajinomoto Frozen Foods Co., Inc., Representative

Director & Corporate Senior Vice President and President of

the Food Products Company of Ajinomoto Co., Inc. Appointed

as Representative Director, President & CEO in 2009 and

Representative Director & Chairman of the Board in 2015. Also has

important responsibilities outside the Group, including as President

of the Japan Sport Association, Chairman of the Japan Overseas

Enterprises Association, and President of the Japan Advertisers

Association Inc., and serves as an outside director of Japan Airlines

Co., Ltd. and NEC Corporation.

such as looking at the next 100 years, in reality we were not

in a position to look 100 years into the future.

The animal nutrition (referred to as feed-use amino acids

at the time) and pharmaceuticals businesses were struggling.

Under the leadership of President & CEO Kunio Egashira

(1997-2005), the animal nutrition business had been extremely

successful, generating about a third of overall prots. This was

the result of the accumulation of research carried out by the

Company over many years. However, from 2005, although

the rise of Chinese manufacturers had expanded the market,

II. Taking the First Step into the Next 100 Years

- A Roadmap for Becoming a GGSC, Presented by Top Management -

Becoming a Global Group of

Companies that Contributes to

“Food,” a Fundamental for Humanity

–

Interview with Chairman of the Board Masatoshi Ito

The History of the Ajinomoto Group

II. Taking the First Step into the Next 100 Years

- 1. Becoming a Global Group of Companies that Contributes

to “Food,” a Fundamental for Humanity -

13

wasn t being read. However, nobody is going to read a piece

of paper handed to them about events that happened several

months before. For this reason, I urged that we consider why

no one was reading it and what we could do to make employees

take an interest. As a result, we started to post the CEO

Headline in both Japanese and English on the Group s intranet.

We wanted to provide an understanding of the Group s actions

and messages through my activities as President & CEO. As a

result, we started sharing photos and reports around the world

within a week of events. Previously people had no idea about

what the President & CEO did, and they probably thought I just

sat in a chair and checked things. So, I went, I m working and

communicating like this!

There was one more internal communications initiative we

carried out at that time. We made it so that a summary of the

main points discussed in weekly Executive Committee meetings

was shared around the world immediately after the meetings.

Up to that point, explanations had been made orally and only

to the general managers. This was to prevent information

leaks. However, when looking into this, we found there were

inconsistencies in the amount of information that was being

passed down to managers and their subordinates. While some

general managers would pass on 90% of the content, others

would only communicate half. This was not a case of them not

wanting to talk – it is just that they were not able to. There were

some aspects, such as nancial matters, that they did not fully

understand. As a result, the information being passed down

varied and there were many people who did not understand

what the Company was thinking. By putting information into

a document which was only viewable by managers, we greatly

improved this situation.

While these are fairly small details, in this way we

improved the sharing of information and drove reforms

forward.

Q: How did you communicate externally?

Ito:

I took an approach in which we did not disclose

information but shared it. When holding press conferences,

we prepared Q&A materials for anticipated questions. This

included answers to be used when asked about certain things, so

a big drop in price per unit had started to drag prots down.

Furthermore, as a precursor to this, the inability to meet supply

volumes meant that a majority of our capital investment had

been spent on reinforcing animal nutrition, which pushed the

business into the red. The pharmaceuticals business was also

struggling due to its lack of scale. Although it managed to

record operating prots of over 10 billion yen for a time, drug

development generally involves producing one successful new

drug every 10 or 15 years, which puts too much burden on a

small business. Both businesses were suffering due to changes

in structure and environment.

In addition to this, we also faced factors such as the

2008 global nancial crisis (the Lehman Shock) and foreign

exchange losses. As a result, although our share price had been

steady at around 1,500 yen for over 10 years, it had dropped to

about 670 yen when I was appointed.

Q: It must have been a very dicult situation.

Ito:

Before becoming President & CEO, I had started attending

investor relations (IR) events as a Corporate Senior Vice

President, and the rough tone in which we were questioned by

analysts made me realize that we were in an urgent situation.

We were also receiving harsh words from former employees

who held shares, and employees were also starting to question

more seriously whether the Company was all right. The

labor union also pointed out that in this sort of situation, top

management tended to retreat from the front lines.

Therefore, rather than thinking about future aspirations

and the next 100 years, we rst had to do something about the

situation at hand.

Q: What did you do rst?

Ito:

First of all, I thought it was important that we explain

the situation to all stakeholders, both inside and outside the

company, and show them the direction we planned to take. To

do this, it was essential that our understanding of the company s

situation was accurate and that we verify our planned direction,

so I hired a consulting company for the rst time. Up to

that point, there had been very little inclination within the

Ajinomoto

Group to use external resources, and some thought

that it would be meaningless. However, I did not intend to

leave these consultants think or follow their directions blindly.

Rather, I thought it would be worthwhile to receive verication

that our analysis and direction were appropriate, so I actively

met with analysts and management advisors and listened to

their opinions.

Q: What did you do to explain the situation and direction

within the Company?

Ito:

I repeatedly told the Public Communications Dept, Your

work is not just to communicate externally. Our employees

are the most important communications targets. At that point,

employees were not considered targets of communications

activities. While there had been a monthly internal magazine,

its publication had shrunk to four times per year because it

A snapshot in “CEO Headline”

The History of the Ajinomoto Group

II. Taking the First Step into the Next 100 Years

- 1. Becoming a Global Group of Companies that Contributes

to “Food,” a Fundamental for Humanity -

14

it was ne to discuss the content. However, the people in charge

of IR told me not to talk beyond this content or give away too

much. This makes sense when there is not enough time, but

it seemed strange to take an approach of not saying anything

unless asked. So, I decided to talk openly about matters that we

were able to share.

The reasoning behind this approach was that we were in a

crisis situation when I was appointed, and that I had listened to

the opinions of analysts and shareholders and agreed with them.

It is natural that people who have invested in us, are considering

investing in us, or are giving advice to investors want to know

about the state of our business. It would be strange to only give

them the minimum of information. Rather, bad news had better

shared.

In fact, after I became President & CEO, there was

flooding in Thailand in 2011. Thailand was our main overseas

business location, so this was a big negative for the Ajinomoto

Group. We had about 20 plants in the country. People were

naturally worried about the impact of the flooding. To address

this, we provided

investors with

information about

the status of our

plants. Out of the

20 plants, 18 were

still operating and

two had stopped.

We received great

praise for sharing

this information

before we were

asked to.

Financial results briefing for analysts and institutional

investors

Q: You have placed great importance on communicating

openly and fairly.

Ito:

Anybody can give an answer when asked a question. I

remember having a conversation with a person from another

country about what is important for building relationships based

on trust. It is information. How transparent is the exchange of

information? For example, in my house I have a two-month

schedule of meals on our refrigerator, which includes whether

I am planning to go out to eat on a certain day. Naturally my

meal schedule is not secret company information. However,

while I write clearly who I will be going with, I try to make the

location as vague as possible, so that later on, my wife won t be

able to pester me to take her there too.

Q: And you advanced reforms based on these relationships

of trust?

Ito:

That s right. Sharing our management direction also meant

we had to have a clear idea of the roles and responsibilities

of management. Up to that point, Ajinomoto Co., Inc. had

formulated its management plan by combining the plans of

each of virtual company. This meant that the responsibilities of

the top management team were vague, and I felt that decision-

making was unclear. I thought that it would better if top

management created a strategy framework for the entire Group

and then each business division independently formulated their

own plans based on this framework. It is important that top

management leads the way in creating management direction

with executive team members, and this is the job of the

President & CEO.

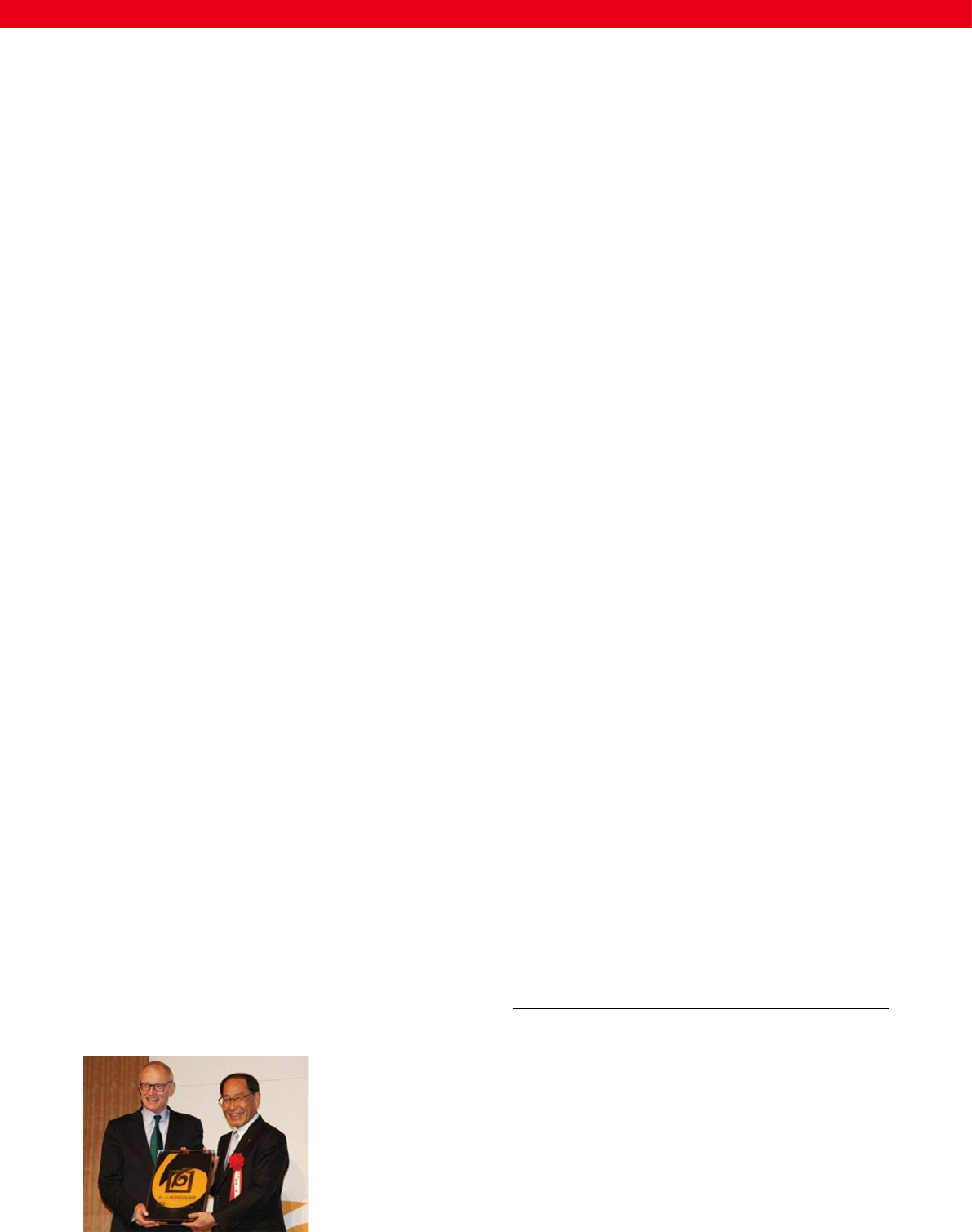

(Billions of yen)

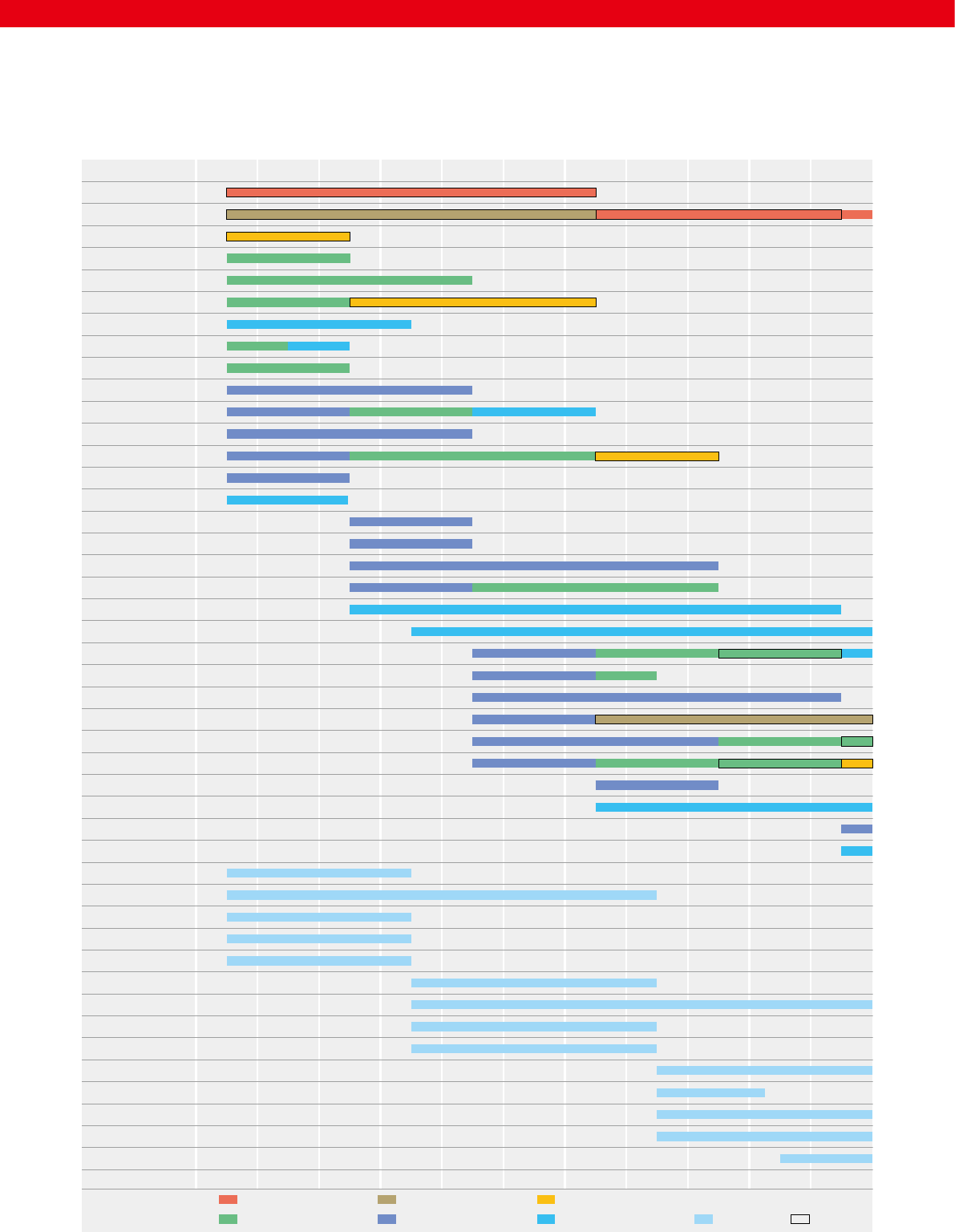

201720162015201420132012201120102009200820072006200520042003200220012000 2018

(FY)

100

80

60

40

20

0

-10

Japanese food products International food products Bioscience & fine chemical business (including animal nutrition) Pharmaceuticals Other business

Figure II-1: Overall business results (FY2000-2018)

Note 1: During this period, there were reclassification of segments, and changes made to the content of segments, accounting systems, and other items, so these figures are provided to give a general idea of

overall business results.

Note 2: Up to FY2015, figures shown are for operating profit and from FY2016 onward they are for business profit.

The History of the Ajinomoto Group

II. Taking the First Step into the Next 100 Years

- 1. Becoming a Global Group of Companies that Contributes

to “Food,” a Fundamental for Humanity -

15

Q: Before I ask about individual measures, I would like to

take a bird’s eye view of your time as President & CEO.

You realized a V-shaped recovery following losses and

then smoothly grew sales and prots to high levels by

FY2015. However, in FY2013, both sales and prots

temporarily fell.

Ito:

I think things went roughly according to plan in terms

of both the numbers and the actual content of our businesses.

The slump in FY2013 was a lull made necessary by structural

reforms, and we had prepared for it. Our plan to reduce the ratio

of bulk business such as animal nutrition meant that for that

year, the business actually made zero prot. It probably turned

out that way because we said it would be ne if it happened.

The sale of Calpis Co., Ltd. and the fall in the pharmaceuticals

business had also been anticipated. Instead, we focused on

expansion of our consumer business overseas, putting effort

into Japanese food products, Ajinomoto Frozen Foods Co., Inc.

and Ajinomoto General Foods, Inc., and these measures led to

growth later on.

Specic measures of FIT & GROW with Specialty

– Focus on consumer business, business headquarters

system, and spinning o companies

Q: Following the key principles of “growth driver

development,” “business structure reinforcement,” and

“foundation building” in the FY2011 - 2013 Medium-

Term Management Plan, for the FY2014 - 2016 Medium-

Term Management Plan you hit upon “FIT & GROW

with Specialty.” You advanced structural reform (FIT)

and growth driver development (GROW) with a focus

on specialty.

Ito:

We decided that our macro-direction would be to shift

away from a weighting towards bulk business. Although

the BtoB market is big, there were a number of competitors

emerging from China as well as from South Korea. So, it would

be dicult to work freely and I felt it might be a problem to

have this area as our core business. Although this is also true of

other businesses, if a product does not have any distinguishing

characteristics, competition will come down to a price war.

In our bulk business in particular, we were creating physical

substances such as lysine which are dicult to differentiate as it

does not matter if they taste good or bad. Therefore, our major

goal was to remove the weighting towards bulk business and

achieve a business structure that we could control. We judged

that price competition was not a good t for us.

Based on this, we set our key principles in FIT as structural

reform centered on a shift from commodities to specialty and

enhance capital eciency to boost shareholder value and

return on equity (ROE), and our key principles in GROW as

R&D leadership and global growth. We also started to

transform the culture of the Group by practicing governance

that accounted for globalization, developing and diversifying

human resources, using external capabilities, and expanding

into adjacent domains.

Q: The year after you became President & CEO, the

Company transitioned from a virtual company system

to a business headquarters system. Was this also to

strengthen internal communications?

Ito:

After we started using a virtual company system, the

barriers between companies grew to the point where you could

say that each company was not aware of what the others were

doing. In such a situation, the disadvantages outweigh the

benets. A virtual company system might work if one business

bears little relation to the others, such as TVs and refrigerators,

but it was not appropriate for the Ajinomoto Group, which uses

amino acids in every business. It got to the point where the

achievement of research into amino acids technology could

not be applied in other areas such as food products. In cases

where we need to focus on the swiftness and agility of decision

1. Growth driver

development

Global growth

R&D leadership

Use of external resources

Global human resource development

Global governance

2. Business structure

reinforcement

From VOLUME to VALUE

From PROFIT (OP)

to CASH (FCF)

Enhance capital efficiency to

boost shareholder value

3. Foundation building

Build a foundation for a global company

Figure II-2: Key principles of the FY2011 - 2013

Medium-Term Management Plan

1. Growth driver

advancement

Corporate governance: “Governing HQ” and “Delegated front”

Solid and large class of global human resources

Open New Sky: Daily efforts to utilize external capabilities

and expand into adjacent domains

2. Further reinforcement

of business structure

3. Evolution of the management foundation

(management innovation)

Pursue specialty

FITGROW

Specialty

Become a food company group with specialties driven

by leading-edge bioscience and fine chemical technologies

Figure II-3: Key principles of the FY2014 - 2016

Medium-Term Management Plan

The History of the Ajinomoto Group

II. Taking the First Step into the Next 100 Years

- 1. Becoming a Global Group of Companies that Contributes

to “Food,” a Fundamental for Humanity -

16

making, it is better to establish a scale of operations and make

it into a separate company, like we did with Ajinomoto Frozen

Foods Co., Inc.

Q: It seems like your policy of strengthening collaboration

transformed the Company.

Ito:

That s right. It was the same with R&D structure. At

rst, we had over 10 R&D institutes, so we took a focused

management approach that brought together small research

institutes to make larger ones and specied the areas in which

we were aiming to develop. Up to that point, it seemed that

individual researchers were performing research in various

areas on their own, and it would be bad if they went too far, so

we decided to clarify the scope of research. We worked to bring

them together and collaborate. We created an environment into

which each researcher could bring the different information

they possessed and

utilize it to create

new knowledge

and value. We have

personnel with a

variety of areas

of expertise and

by combining the

expertise of one

researcher with the

different expertise

of another, we often

generate new ideas.

For example,

in frozen foods,

where I worked

from the 1980s into

the 1990s, we had a structure comprising Ajinomoto Co., Inc. s

Frozen Foods Department and the Ajinomoto Frozen Foods Co.,

Inc. companies in each region (Kanto, Chubu, Shikoku, and

Kyushu), and they were mainly focused on production

1

. This

means that under normal operations, there is a divide between

development and manufacturing. However, when it comes to

creating a product, we cannot achieve anything good or quickly

unless the business department personnel, experts in facilities

and machinery, researchers, and others can work together.

Therefore, they would collaborate on a project basis. People

involved in product development often work in this way, but I

wanted us to be able to do it on an organization-wide level, so

after becoming President & CEO I advanced structural reforms.

Q: Furthermore, you spun o the animal nutrition and

pharmaceutical businesses, which were facing issues, as

new companies. Was there any opposition to these moves?

Ito:

Recognition of the state of these businesses was already

shared, so in the case of the pharmaceuticals business, we had