45

Temporary Duty (TDY) Travel Allowances § 301–11.15

rest stop location when the arrival or

departure affects your per diem allow-

ance or other travel expenses. You also

should show the dates for other points

visited. You do not have to record de-

parture/arrival times, but you must an-

notate your travel claim when your

travel is more than 12 hours but not ex-

ceeding 24 hours to reflect that fact.

§ 301–11.11 How do I make my lodging

reservations?

You must make your lodging reserva-

tions through your agency travel man-

agement system as required by part

301–50 of this chapter.

[FTR Amdt. 108, 67 FR 57965, Sept. 13, 2002]

§ 301–11.12 How does the type of lodg-

ing I select affect my reimburse-

ment?

Your agency will reimburse you for

different types of lodging as follows:

(a) Conventional lodgings. (Hotel/

motel, boarding house, etc.) You will

be reimbursed the single occupancy

rate.

(b) Government quarters. You will be

reimbursed, as a lodging expense, the

fee or service charge you pay for use of

the quarters.

(c) Lodging with friend(s) or relative(s)

(with or without charge). You may be re-

imbursed for additional costs your host

incurs in accommodating you only if

you are able to substantiate the costs

and your agency determines them to be

reasonable. You will not be reimbursed

the cost of comparable conventional

lodging in the area or a flat ‘‘token’’

amount.

(d) Nonconventional lodging. You may

be reimbursed the cost of other types

of lodging when there are no conven-

tional lodging facilities in the area

(e.g., in remote areas) or when conven-

tional facilities are in short supply be-

cause of an influx of attendees at a spe-

cial event (e.g., World’s Fair or inter-

national sporting event). Such lodging

includes college dormitories or similar

facilities or rooms not offered commer-

cially but made available to the public

by area residents in their homes.

(e) Recreational vehicle (trailer/camper).

You may be reimbursed for expenses

(parking fees, fees for connection, use,

and disconnection of utilities, elec-

tricity, gas, water and sewage, bath or

shower fees, and dumping fees) which

may be considered as a lodging cost.

§ 301–11.13 How does sharing a room

with another person affect my per

diem reimbursement?

Your reimbursement is limited to

one-half of the double occupancy rate

if the person sharing the room is an-

other Government employee on official

travel. If the person sharing the room

is not a Government employee on offi-

cial travel, your reimbursement is lim-

ited to the single occupancy rate.

§ 301–11.14 How is my daily lodging

rate computed when I rent lodging

on a long-term basis?

When you obtain lodging on a long-

term basis (e.g., weekly or monthly)

your daily lodging rate is computed by

dividing the total lodging cost by the

number of days of occupancy for which

you are entitled to per diem, provided

the cost does not exceed the daily rate

of conventional lodging. Otherwise the

daily lodging cost is computed by di-

viding the total lodging cost by the

number of days in the rental period.

Reimbursement, including an appro-

priate amount for M&IE, may not ex-

ceed the maximum daily per diem rate

for the TDY location.

§ 301–11.15 What expenses may be con-

sidered part of the daily lodging

cost when I rent on a long-term

basis?

When you rent a room, apartment,

house, or other lodging on a long-term

basis (e.g., weekly, monthly), the fol-

lowing expenses may be considered

part of the lodging cost:

(a) The rental cost for a furnished

dwelling; if unfurnished, the rental

cost of the dwelling and the cost of ap-

propriate and necessary furniture and

appliances (e.g., stove, refrigerator,

chairs, tables, bed, sofa, television, or

vacuum cleaner);

(b) Cost of connecting/disconnecting

and using utilities;

(c) Cost of reasonable maid fees and

cleaning charges;

(d) Monthly telephone use fee (does

not include installation and long-dis-

tance calls); and,

(e) If ordinarily included in the price

of a hotel/motel room in the area con-

cerned, the cost of special user fees

VerDate May<21>2004 04:53 Aug 05, 2004 Jkt 203173 PO 00000 Frm 00045 Fmt 8010 Sfmt 8010 Y:\SGML\203173T.XXX 203173T

46

41 CFR Ch. 301 (7–1–04 Edition) § 301–11.16

(e.g., cable TV charges and plug-in

charges for automobile head bolt heat-

ers).

§ 301–11.16 What reimbursement will I

receive if I prepay my lodging ex-

penses and my TDY is curtailed,

canceled or interrupted for official

purposes or for other reasons be-

yond my control that are acceptable

to my agency?

If you sought to obtain a refund or

otherwise took steps to minimize the

cost, your agency may reimburse ex-

penses that are not refundable, includ-

ing a forfeited rental deposit.

§ 301–11.17 If my agency authorizes

per diem reimbursement, will it re-

duce my M&IE allowance for a

meal(s) provided by a common car-

rier or for a complimentary meal(s)

provided by a hotel/motel?

No. A meal provided by a common

carrier or a complimentary meal pro-

vided by a hotel/motel does not affect

your per diem.

§ 301–11.18 What M&IE rate will I re-

ceive if a meal(s) is furnished at

nominal or no cost by the Govern-

ment or is included in the registra-

tion fee?

Your M&IE rate must be adjusted for

a meal(s) furnished to you (except as

provided in §301–11.17), with or without

cost, by deducting the appropriate

amount shown in the chart in this sec-

tion for CONUS travel, reference Ap-

pendix B of this chapter for OCONUS

travel, or any method determined by

your agency. If you pay for a meal that

has been previously deducted, your

agency will reimburse you up to the de-

duction amount. The total amount of

deductions made will not cause you to

receive less than the amount allowed

for incidental expenses.

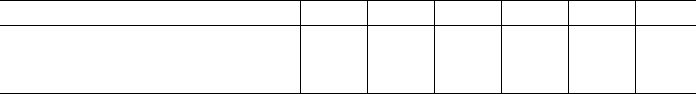

M&IE $31 $35 $39 $43 $47 $51

Breakfast ....................................................................... 6 7 8 9 9 10

Lunch ............................................................................. 6 7 8 9 11 12

Dinner ............................................................................ 16 18 20 22 24 26

Incidentals ..................................................................... 3 3 3 3 3 3

[FTR Amdt. 70, 63 FR 15961, Apr. 1, 1998; 63 FR 35537, June 30, 1998, as amended by FTR Amdt.

75, 63 FR 66675, Dec. 2, 1998; FTR Amdt. 109, 67 FR 56160, Aug. 30, 2002; FTR Amdt. 2003–05, 68

FR 51911, Aug. 29, 2003]

§ 301–11.19 How is my per diem cal-

culated when I travel across the

international dateline (IDL)?

When you cross the IDL your actual

elapsed travel time will be used to

compute your per diem entitlement

rather than calendar days.

§ 301–11.20 May my agency authorize a

rest period for me while I am trav-

eling?

(a) Your agency may authorize a rest

period not in excess of 24 hours at ei-

ther an intermediate point or at your

destination if:

(1) Either your origin or destination

point is OCONUS;

(2) Your scheduled flight time, in-

cluding stopovers, exceeds 14 hours;

(3) Travel is by a direct or usually

traveled route; and

(4) Travel is by less than premium-

class service.

(b) When a rest stop is authorized the

applicable per diem rate is the rate for

the rest stop location.

§ 301–11.21 Will I be reimbursed for

per diem or actual expenses on

leave or non-workdays (weekend,

legal Federal Government holiday,

or other scheduled non-workdays)

while I am on official travel?

(a) In general, you will be reimbursed

as long as your travel status requires

your stay to include a non-workday,

(e.g., if you are on travel through Fri-

day and again starting Monday you

will be reimbursed for Saturday and

Sunday), however, your agency should

determine the most cost effective situ-

ation (i.e., remaining in a travel status

and paying per diem or actual expenses

or permitting your return to your offi-

cial station).

(b) Your agency will determine

whether you will be reimbursed for

VerDate Aug<04>2004 11:45 Aug 11, 2004 Jkt 203173 PO 00000 Frm 00046 Fmt 8010 Sfmt 8010 Y:\SGML\203173T.XXX 203173T