1Money for Nothing

MONEY FOR NOTHING

How private equity has defrauded Medicare,

Medicaid, and other government health

programs, and how that might change

Eileen O’Grady

eileen.ogrady@PEstakeholder.org

FEBRUARY 2021

2 Private Equity Stakeholder Project

Key Points

• The False Claims Act (FCA) is a federal law that establishes liability for individuals or companies that defraud

government programs in the US. It is commonly used against health care companies that defraud Medicaid,

Medicare, and related programs.

• Thereissubstantialoverlapbetweentheprot-seekingbehaviorexhibitedbyprivateequityownersofhealth

care companies and fraudulent activities targeted by the FCA.

• Untilrecently,privateequityownersofhealthcarecompanieswererarelyimplicatedinFCAactions.However,

recent cases, as well as statements from the U.S. Department of Justice (DOJ), suggest that FCA enforcement

againstprivateequityrmsisrampingup.

• TheU.S.DepartmentofJusticehassignaledthatitwillplaceparticularfocusonprivateequityrmswhose

companies have illegally collected CARES Act funds.

• Since 2013, at least 25 health care companies have paid settlements totaling over $570 million for allegedly

violatingtheFCAwhileunderprivateequityownership.Theprivateequityownersofthosecompaniescurrently

ownaround200otherhealthcarecompaniescombined.Exceptinahandfulofcases,theprivateequityowners

were not included in the settlements.

• SeveralcasestudiesdemonstratethevariouswaystheFCAhasbeenenforcedagainstprivateequity-owned

companies,andhowprivateequityhashistoricallybeenimplicatedindefraudingthefederalandstategovernments:

• Diabetic Care Rx(DCRX),aspecialtypharmacyservicescompanyanditsprivateequityownerRiordan,

Lewis & HadensettledanFCAlawsuitthatallegedDCRXengagedinakickbackschemetogenerate

referralsofexpensiveprescriptionsandotherproducts,regardlessofpatientneed,whichwerereimbursed

by TRICARE, the federal health care program for military members and their families.

• South Bay Mental Health Center, a mental health provider owned by H.I.G. Capital, settled an FCA lawsuit

allegingthatSBMHCusedunqualied,unsupervisedmentalhealthworkersandunqualiedsupervisorsto

treatitspatientsinMassachusetts,andthenfraudulentlybilledMassHealth.LitigationagainstH.I.G.forits

role in the alleged fraud is ongoing.

• ImmunotherapydevicemakerTherakos and previous owner The Gores Group together paid to settle allegations

thatTherakospromoteditssystemsforunapprovedusesinpediatricpatientsbetween2006and2012.

• In December 2020, Apria Healthcare a home respiratory services provider owned by the Blackstone Group,

settledallegationsthatitengagedinseveralschemesinviolationoftheFCArelatedtotherentalofnon-

invasive ventilators.

• Benevis (d/b/a Kool Smiles), a dental services organization previously owned by Friedman Fleischer &

Lowe,paid$24milliontosettleallegationsthatitknowinglysubmittedfalseclaimsforpaymenttostate

Medicaid programs for medically unnecessary dental services performed on children insured by Medicaid.

• CRC Healthcare, a behavioral health company previously owned by Bain Capital, paid to settle allegations

that it violated the FCA by providing substandard treatment to adult and adolescent Medicaid patients

suffering from alcohol and drug addiction.

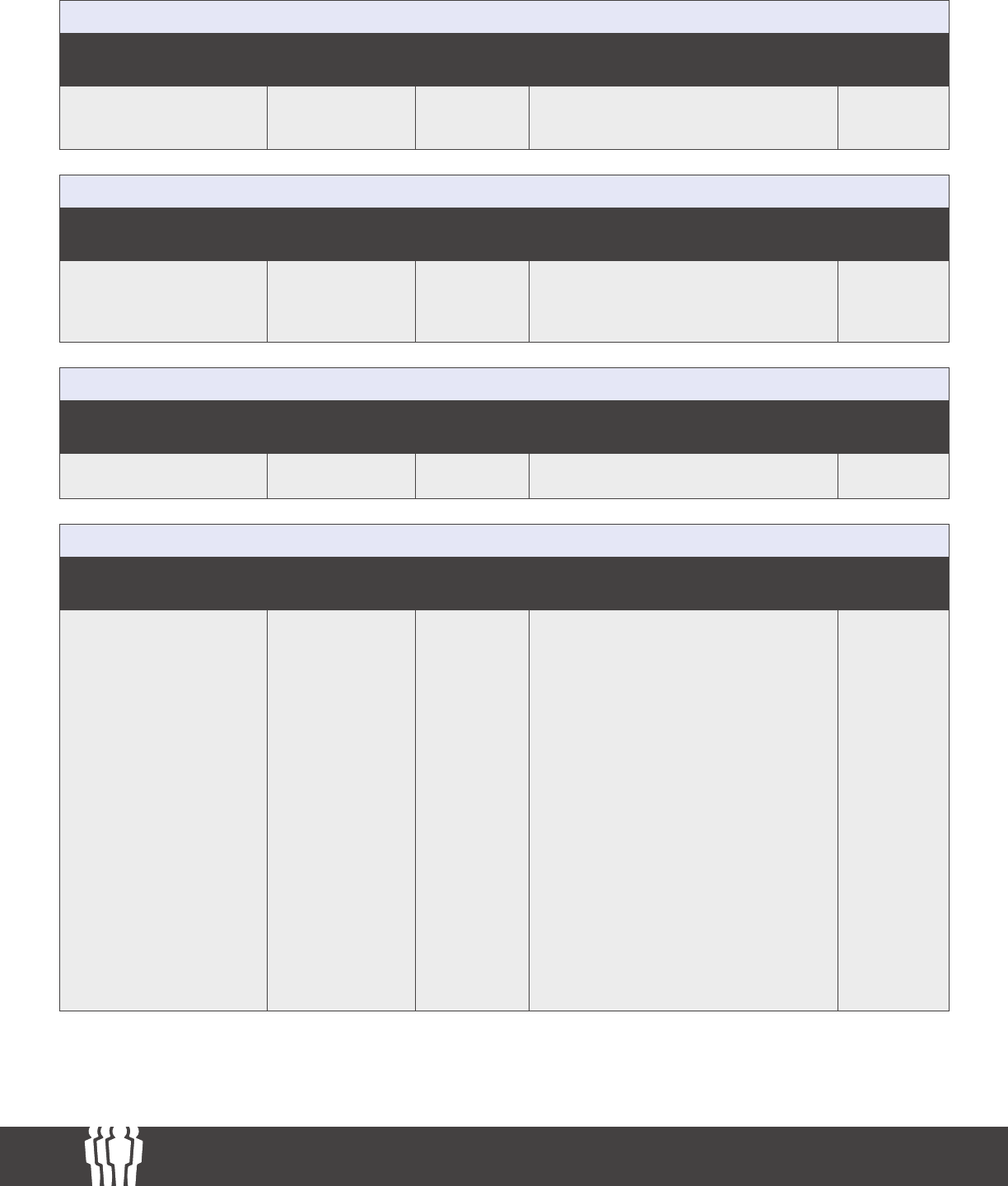

• AppendixAisalistofFCAsettlementsfromthelasteightyearsthatinvolvedprivate-equity-ownedhealthcarecompanies.

3Money for Nothing

Introduction

The health care industry has increasingly been a target

forprivateequityinvestment.Thisisdespitethefactthat

privateequityinvestmentinhealthcarecompaniescarries

substantialrisktopatients,workers,andinvestors.Firms

typicallytakecontrollingownershipstakes,multiple,if

notamajority,ofboardseatsatacquiredcompanies,

andsubstantiallyinuencethehealthcarecompany’s

operationsandgrowthstrategy.Thetypicalprivateequity

investmentplaybook—pursuingoutsizedreturnsover

shorttimehorizonswhileusinghighlevelsofdebt—may

lead behavior that jeopardizes patient care.

Forexample,privateequity-ownedhealthcarecompanies

haveseenthefollowingissues:

i

• Reducedstafng,orllingbedswithoutadequate

stafngratios

• Overreliance on unlicensed staff to reduce labor costs

• Failuretoprovideadequatetraining

• Pressure on physicians to provide unnecessary and

potentially costly services

• Violationofregulationsrequiredforparticipants

inMedicareandMedicaidsuchasanti-kickback

provisions,creatinglitigationrisk

Privateequityinvestmentinhealthcareisexpectedtocontinue.

In2020,healthcareprovedresilienttotheCOVID-19pandemic

and investment in health care outpaced the broader industry.

Additionally, asset managers have record levels of available

capitalearmarkedforhealthcareinvestment;asof2019,private

equityrmshad$29.2billionindrypowerforhealthcare.

1

Privateequityrmsbenetfromthetrillionsofdollars

ofgovernmenthealthcarespending.In2019,Medicare

spendingreached$799.4billionandMedicaidspending

reached$613.5billion.Together,theyaccountedfor

37%ofnationalhealthcareexpenditure.

2

TheCOVID-19

pandemichasincreasedopportunitiesforprivateequityto

collect federal health care dollars.

As of January 21, 2021, the Federal government has

distributed hundreds of billions of dollars to providers

under the Coronavirus Aid, Relief, and Economic Security

Act(CARESAct):$142.8billioningrants,$548.6billionin

loans, and $12.2 billion in contracts.

3

Asprivateequityownershipofhealthcarecompanies

growsandcontinuestobenetfromtaxpayerfunded

healthcarespending,regulatorsareseekingouttoolsto

mitigate the impact of business practices that put patients

andworkersatriskandstrainpublichealthcareresources.

One new tactic used by the regulators to hold private

equityaccountableistheFalseClaimsAct.Thereis

substantialoverlapbetweentherisksassociatedwith

privateequityownershipofhealthcarecompaniesandthe

activitiestargetedbytheFalseClaimsAct;inaneffortto

achievethehighreturnsoftenexpectedbyprivateequity

investors,companies’aggressiveprot-seekingmayresult

in fraudulent activity.

i

See prior reports by Private Equity Stakeholder Project for case studies documenting these risks: Adverse Reaction: How will the ood of private equity

money into health care providers impact access to, cost and quality of care? (November 2019); Understaffed, Unlicensed, and Untrained: Behavioral

Health Under Private Equity (September 2020); Raiding the Safety Net: Leonard Green & Partners Seeks to Walk Away from Prospect Medical Holdings

after Collecting $570 Million in Fees and Dividends (January 2020)

4 Private Equity Stakeholder Project

The False Claims Act

The False Claims Act (FCA) is a federal law that establishes

liability for individuals or companies that defraud governmental

programs. It includes liability for collecting money from the

federal government to which the individual or company may

not be entitled, using false statements to retain that money.

4

The FCA is commonly used to prosecute health care companies

that defraud Medicaid, Medicare, and related programs by

submitting false claims for a variety of activities. Fraudulent

activities may include providing substandard care, providing

medicallyunnecessaryservices,receivingkick-backsforservices

provided,lingclaimsforservicesnotprovided,andproviding

services by unlicensed or improperly licensed providers.

5

Federal FCA actions may be brought by the U.S.

Department of Justice (DOJ) Civil Division. An individual

whistleblowermaybringaquitamaction,linganaction

on behalf of the government.

6

Until recently, the DOJ rarely intervened in FCA cases against

privateequityrmsforactionscommittedbytheirportfolio

companies.Instead,private-equity-ownedcompanieshave

typically assumed full liability for settlements related to alleged

fraudulent behavior, regardless of the level of involvement in

operationsbythecompany’sprivateequityowners.

However,thisappearstobechanging.Severalrecent

cases underscore a new willingness by the federal

governmenttopursueprivateequityownersofhealthcare

companies that may be violating the FCA.

Now,theCOVID-19pandemicandthemassivefederal

spending to support health care providers has ushered in a

newcauseforFCAactionagainstprivateequity.

US Department of Justice expected to ramp up FCA

enforcement amid COVID-19 pandemic

TheCOVID-19pandemicmayhaveprofoundimplications

for the way the DOJ litigates FCA cases against private

equityownersofhealthcarecompanies.Inaspeechto

theUSChamberofCommerce’sInstituteforLegalReform

in June 2020, then Principal Deputy Assistant Attorney

GeneralEthanDavisindicatedtheDOJwillholdprivate

equityrmsliablefortheirportfoliocompanies’actions

where applicable, especially related to CARES Act funds.

“Our enforcement efforts may also include, in

appropriate cases, private equity rms that sometimes

invest in companies receiving CARES Act funds. When

a private equity rm invests in a company in a highly-

regulated space like health care or the life sciences, the

rm should be aware of laws and regulations designed

to prevent fraud. Where a private equity rm takes an

active role in illegal conduct by the acquired company,

it can expose itself to False Claims Act liability. A

pre-pandemic example is our recent case against the

private equity rm Riordan, Lewis, and Haden, where we

alleged that the defendants violated the False Claims

Act through their involvement in a kickback scheme

to generate referrals of prescriptions for expensive

treatments, regardless of patient need. Where a private

equity rm knowingly engages in fraud related to the

CARES Act, we will hold it accountable.”

7

Thespeechraisesquestionsaboutwhetherprivate

equity-ownedhealthcarecompanieswillbeatincreased

riskforregulatoryactionrelatedtocollectingCOVID-19

stimulusmoney.Privateequityownedcompaniesare

“Whereaprivateequityrm

knowingly engages in fraud

related to the CARES Act, we will

hold it accountable.”

— Principal Deputy Assistant Attorney General Ethan Davis

5Money for Nothing

generally considered ineligible for the Small Business

Administration’sPaycheckProtectionProgram(PPP)loans,

which were designed to provide relief to small businesses

duringthepandemic.Despitethis,manyprivate-equity-

owned companies have collected stimulus funds.

The Data

The lawsuit referenced in the Davis speech is one of the

clearestexamplesoftheDOJbeginningtopursueprivate

equityrmsinrelationtoallegedFCAviolations.Other

FCA lawsuits shed light on the ways in which private

equityownershipofhealthcarecompaniesmayleadto

activities that defraud government programs.

Manyoftheseprivateequityrmsarefrequenthealth

care investors, suggesting that there are substantial due

diligence and operational failures that have enabled the

allegedfraudulentbehavior.Thisraisesquestionsabout

whatstepsinvestorsaretakingtoensurethatotherhealth

care portfolio companies are in compliance with applicable

laws and regulations.

Withahandfulofexceptions,mostofthesecasesdidnot

nametheprivateequityrmsthatownedthecompanies

during the alleged fraudulent activity.

Injustthreecases,privateequityownerswerenamedinthe

settlementagreementsandagreedtopay:DiabeticCare

Rx(Riordan,Lewis,&Hayden),Therakos(TheGoresGroup),

andHolidayRetirement(FortressInvestmentGroup).

8

LitigationagainstH.I.G.Capitalforitsallegedroleinfraud

byitscompanySouthBayMentalHealthCenterisongoing.

Inothercases,theprivateequityrmsortheirexecutiveswere

named in the complaints, but were not named in the settlement

agreements:Benevis/KoolSmiles(Friedman,Fleischer&Lowe),

GenovaDiagnostics(LevineLeichtmanCapitalPartners).

9

The following case studies attempt to analyze how private

equityownershipofhealthcarecompaniesinavarietyof

specialties may have impacted FCA compliance, and how

those FCA actions were litigated.

“Wefoundthatsince2013,atleast25privateequity-ownedhealthcarecompanieshave

paidatotalofatleast$570milliontosettlefalseclaimsactsuitsrelatedtoallegedbilling

fraudthattookplaceunderprivateequityownership.Altogether,theprivateequityrms

thatownedthosecompaniescurrentlyownnearly200otherhealthcarecompanies,many

ofwhichalsobillMedicare,Medicaid,andothergovernmenthealthprograms.”

6 Private Equity Stakeholder Project

Case Studies

Diabetic Care Rx (d/b/a Patient Care America)

Riordan, Lewis & Haden

Specialty pharmacy

TheDOJ’slandmark2019settlementwithDiabetic

CareRx(d/b/aPatientCareAmerica)anditsowner,

LosAngeles-basedprivateequityrmRiordan,Lewis&

Haden(RLH),marksashiftinthefederalgovernment’s

willingnesstoholdprivateequityrmsaccountablefor

their companies that defraud public programs.

InacasesettledSeptember2019for$21.26million,the

DOJallegedthatRLHwasinvolvedinaschemewith

DiabeticCareRx(DCRX)todefraudTRICARE,which

provideshealthinsuranceforactive-dutymilitary,veterans,

and their families.

10

DCRX is a specialty pharmacy operator specializing in renal

nutrition therapy and compounding pharmacy products.

11

Accordingtothecomplaint,DCRXallegedlypaidkickbacks

tomarketerstotargetmilitaryveteransandtheirfamiliesfor

medically unnecessary creams and vitamins. These creams

were“manipulatedbytheDefendantsandmarketersto

ensure the highest possible reimbursement from TRICARE.”

DCRX allegedly paid doctors to prescribe the creams and

vitaminswithoutphysicallyexaminingpatients.

12

Additionally,DCRXanditsmarketerallegedlyimproperly

paid copayments on behalf of patients referred by the

marketerforprescriptionswithoutmakinganeed-based

determination,andsuchpaymentsweremaskedas

originatingwitha“shamcharitableorganization”afliated

withthemarketer.AccordingtotheDOJ,“Thepurposeof

paying or waiving copayments was to induce patients to

purchasemedicationbyeliminatinganynancialbarrierto

their purchase of the drugs.”

13

TheDOJallegedthatRLH“knewofandagreedto”the

DCRXschemeand“nancedthekickbackpaymentsto

themarketers.”

14

“At all relevant times,” the DOJ wrote,

“RLHmanagedandcontrolledPCAonbehalfofthe

privateequityfundthroughtwoRLHpartners,Michel

GlouchevitchandKennethHubbs,whoservedasofcers

and/ordirectorsofPCAandofaholdingcompanywithan

ownership interest in PCA.”

15

ThecomplaintfurthersuggeststhatRLH’shighreturn

expectationsinuenceditssupportforthefraudulentactivity:

“At the time DCRX was acquired, RLH planned to

increase DCRX’s value and sell it for a prot in ve

years….Shortly after DCRX was acquired, Medicare

reimbursement rates dropped for the nutritional

therapy that DCRX provided to End Stage Renal

Disease patients, and DCRX’s revenue correspondingly

dropped. Restoring DCRX’s protability became RLH’s

primary objective.

…In November 2013, RLH initiated DCRX’s entry into

the business of non-sterile compounding of topical

creams for ‘pain management’ to capitalize on ‘the

“Asaninvestorinhealthcarecompanies,RLHkneworshouldhaveknownwhen

it acquired PCA in July 2012, that health care providers that bill federal health

careprogramsaresubjecttolawsandregulationsdesignedtopreventfraud,

including the [Anti-Kickback Statute].”

19

7Money for Nothing

extraordinarily high protability of this therapy,’ which

RLH anticipated could result in a ‘quick and dramatic

payback’ on its investment in DCRX.”

16

The“painmanagementinitiative”wasledbyRLH’s

representativesonDCRX’sboard,Glouchevitchand

Hubbs.

17

AsofJanuary2021,Glouchevitchremainsa

ManagingPartneratRLH.

18

RLHownsmultipleotherhealthcarecompanies,including

SilveradoSeniorLivingandtheChartisGroup.

20

Riordan, Lewis & Haden Health Care Investments

COMPANY TYPE

SilveradoSeniorLiving Elder care

theChartisGroup Healthcareadvisoryservices

RLH’sSilveradoSeniorLivingisfacingongoinglitigation

for wrongful death and elder abuse and neglect related to

COVID-19infectionsatitsSouthernCaliforniafacility,where

close 100 residents and staff tested positive for the virus

and14died.ItwasoneofCalifornia’sworstoutbreaksatan

assisted living facility. Silverado also received a PPP loan of

between $5 and $10 million dollars.

22

South Bay Mental Health Center – H.I.G. Capital

Mental health

TheDOJ’spendingFCAlawsuitagainstH.I.G.Capitalrelated

totherm’smentalhealthcompanyrepresentsanother

landmarkcaseforFCAactionagainstprivateequityrms.

In2012H.I.G.createdmentalhealthcompanyCommunity

Intervention Services (CIS), which it used to buy up mental

health providers and addiction treatment centers. It

subsequentlyacquiredMassachusetts-basedSouthBayMental

Health(nowknownasSouthBayCommunityServices

23

).

24

InFebruary2018,SouthBayMentalHealthCenter

(SBMHC)agreedtopay$4milliontotheCommonwealth

of Massachusetts to settle allegations of billing fraud that

occurredunderH.I.G.’sownership.

25

The whistleblower

lawsuit,joinedbyMassachusettsAttorneyGeneral

MauraHealey,allegedthatSBMHCfraudulentlybilled

Massachusetts’MedicaidProgramformentalhealthcare

servicesprovidedtopatientsbyunlicensed,unqualied,

and unsupervised staff members at 17 clinics across the

state.Inastatement,Healey’sofcewrotethatthecompany

“provided substandard care to many vulnerable patients and

fraudulentlybilledthestateforitsinadequateservices.”

26

Inararemove,thelawsuitalsonamedH.I.G.Capitalasa

defendant.AttorneyGeneralHealeyallegedthatH.I.G.

“knewthatSBMHCwasprovidingservicesinviolation

ofregulatoryrequirementsanddidnotbringSMBHC

operationsintocomplianceormakeanyattemptstorepay

themoneyowedtoMassHealth,asrequiredbylaw.”HIG

allegedlycitedthelargeprotmarginsasareasonto

acquirethecompany.

27

8 Private Equity Stakeholder Project

H.I.G.hasfailedinmultipleattemptstohavethecase

againstitdismissed.“BecauseitisallegedthatH.I.G.

members and principals formed a majority of the C.I.S.

and South Bay Boards, and were directly involved in the

operationsofSouthBay,themotiontodismisstheH.I.G.

entities is also denied. A parent may be liable for the

submission of false claims by a subsidiary where the parent

had direct involvement in the claims process.”

28

The U.S. District Court for the District of Massachusetts held

thatH.I.G.couldbeliablebecauseits“membersandprincipals

formed a majority of the C.I.S. and South Bay Boards, and were

directly involved in the operations of South Bay.”

29

AsofSeptember2018,themajorityofC.I.S.’sve-

memberboardofdirectorswereH.I.G.executives;board

membersEricTencer,NickScola,andStevenLoosewere

allprincipalsormanagingdirectorsatH.I.G.(Scolaisnow

atprivateequityrmAbryPartners).

30

AsofJanuary2021,thelawsuitagainstH.I.G.isinmediation.

BeginninginOctober2020,H.I.G.beganquietlywinding

down operations at CIS. It sold three of its subsidiaries to

anotherprivateequity-ownedmentalhealthcompany:

Access Family Services (AFS), Family Behavioral Resources

(FBR) and Autism Education and Research Institute (AERI).

31

ThenonJanuary5,2021,CISledforbankruptcy.Itsold

itsremainingmentalhealthproviders,SBMHCandFutures

BehavioralHealth,toadifferentprivateequity-owned

mental health company.

H.I.G.ownsnumerousotherhealthcompanies,

32

including

St.CroixHospiceandPinnacleGIPartners,whichitacquired

inthenalmonthsof2020.

33

H.I.G.alsoownsWellpath,a

prison and detention healthcare company that has made

headlines for the numerous lawsuits, complaints, and federal

enforcement actions against it related to patient care.

34

H.I.G. Capital Health Care Investments

COMPANY TYPE

Apollo Endosurgery Endoscopic surgical products

Arvelle Therapeutics Biopharmaceuticals

BarnetDulaneyPerkins Eye care

BioVectra Pharmaceutical CDMO

CardioFocus Medical devices

Clarify Medical Laserhairremoval

Clarus Therapeutics Biopharmaceuticals

Community Intervention Services Behavioral health

CrothallLaundryServices Healthcarelaundryservices

Eruptr Healthcaremarketing

Exagen Marketingforrheumatologists

HalexIstar Pharmaceuticals

HealthSTAR Pharmaceuticalmarketing

Iconic Therapeutics Biopharmaceuticals

Intact Vascular Medical devices

InterDent Dental services

Iron Bow Healthtech

Jenny Craig Weight management

JustHomeHealthcareServices Behavioral health

COMPANY TYPE

MedPro Advantage Dermatology

Medusind Revenue cycle management

Neurana Pharmaceuticals Pharmaceuticals

Nevakar Pharmaceuticals

Nutrinia Pharmaceuticals

OnTargetLaboratories Pharmaceuticals

Orbus Therapeutics Pharmaceuticals

PinnacleGIPartners Digestive health

Reliant Rehabilitation Physical therapy

RxSight Medical devices

SageHospice Hospice

SoleoHealth Pharmaceuticals

Southwestern Eye Center Eye care

St.CroixHospice Hospice

Taconic Biosciences Pharmaceuticals

TLCVision Eye care

US MED Medical supplies

Vernacare Medical supplies

Wellpath Correctional health

9Money for Nothing

Therakos – The Gores Group

Immunotherapy treatment manufacturer

Therakosisamakerofimmunotherapytreatmentdevices

usedinthetreatmentofbloodcancer.TheGoresGroup

purchasedTherakosfromasubsidiaryofJohnson&Johnson

in 2012 and owned it until 2015.

35

In November 2020,

Therakos’formerowners,includingtheGoresGroup,agreed

to pay $11.5 million to resolve False Claims Act allegations.

TheUSgovernmentallegedthatbetween2006and2015,

Therakosmarketedandpromotedadevice/drugdelivery

system to treat pediatric patients for uses not approved

bytheFDA.Becausethebulkoftheallegationsreferred

toactionsthattookplacepriortotheGoresGroup’s

ownership,theprivateequityrmwasmadetopaya

$1.5 million settlement to resolve allegations that the

prohibited sales and promotion practices continued after

itpurchasedTherakos.

36

“Whilephysiciansarefreetoexercisetheirindependent

medical judgment to prescribe medications for uses

beyond FDA approved indications, pharmaceutical and

devicecompaniescannotinterferewithdoctors’judgment

by allegedly pushing the sale of their drugs or devices

fornon-FDAapproveduses,especiallyinvulnerable

populations,” said U.S. Attorney William McSwain said in

November 2020. “That is what allegedly happened here,

andmyOfcewillcontinuetoinvestigatesuchcasesand

hold companies accountable when there could be an

effect on pediatric or other vulnerable patients.”

37

InDecember2013,theGoresGroupcollectedadebt-

fundeddividendfromTherakos,takingoutatleast$73.5

millioninnewdebtonTherakostopayitselfa$74.2

million dividend.

38

Apria Healthcare – The Blackstone Group

Respiratory home health

ApriaHealthcareprovideshomerespiratorytherapy,home

infusiontherapyandhomemedicalequipment.Private

equityrmtheBlackstoneGrouphasownedApriasinceit

tookthecompanyprivateinOctober2008.

39

On December

21, 2020, the US Attorney for the Southern District of New

YorkannouncedthatApriaagreedtopay$40.5millionto

settle allegations of fraudulent billing practices.

40

According to the lawsuit, Apria engaged in several

schemes in violation of the FCA related to the rental of

non-invasiveventilators(NIVs).Apriaallegedlyexpanded

itsuseofNIVsbecauseprogramslikeMedicaidpaidas

much as $1,400 per month to cover their costs.

41

In a press release announcing the settlement, the US

Attorney’sOfcewrote:

“…while Apria knew that it was responsible for

monitoring patients’ utilization of their NIVs and to

stop billing when NIVs were no longer being used, it

did not have enough staff, or “respiratory therapists,”

to conduct such monitoring. As a result, Apria

routinely billed Medicare and other programs when it

10 Private Equity Stakeholder Project

did not know whether NIVs were still being used by

patients and, therefore, remained medically necessary.

Further, even when Apria had information indicating

that patients were no longer using their NIVs, it often

continued to bill the federal health programs.”

42

ThoughBlackstoneownedApriaforthedurationof

theallegedfraudulentactivityandmultipleBlackstone

executivesserveonApria’sboard,

43

it was not a party in

the lawsuit.

InApril2020,ApriaCEOStarckapplaudedthefederal

CentersforMedicare&MedicaidServices’(CMS)’

relaxationofMedicarebillingrulesforhomerespiratory

therapiesinresponsetotheCOVID-19pandemic,noting

that“burdensomepaperworkandproof of delivery

requirementshavebeenrelaxed,”(emphasisadded)

and further urged CMS to delay implementation of a

competitive bidding payment system.

44

Despite the impending fraud settlement, on December 11

Apriacompleteda$260milliondividendrecapitalization,

takingondebttopaya$210dividendtoprivateequity

ownerBlackstoneandotherowners.

45

ThedividendsfaroutstripApriaHealthcare’sprots.Since

2018(throughSeptember2020),Apriahasgenerated

$84.7milliontotalinoperatingprots.

47

Additionally,ApriaappearstohavepaidBlackstonemillions

of dollars in fees. Under a fee agreement signed when

BlackstonetookoverthecompanyinOctober2008,Apria

paysBlackstoneanannualmanagementfeeofequaltothe

greaterof$7millionor2%oftheCompany’sEBITDAfor

the preceding year, as well as a $1.2 million fee for the year

endedDecember2008(duringwhichBlackstoneowned

April for less than three months). Under the agreement,

Apriaalsopaysatransactionfeeequalto1%thevalueofany

transactions(e.g.acquisition,divestiture,disposition,merger,

Recent dividends collected from Apria:

46

DATE

AMOUNT FUNDING

Dec-20

$200.3milliondividendtostockholders+$9.7millionto

stockappreciationrights(SARs)holders(i.e.execs)

$260millionofIncrementalTermLoans.

Jun-19 $175milliontostockholdersandSARsholders

$150millionTermLoanfromCitizensBankandsyndicate

of lenders

Jul-18 $75 million

11Money for Nothing

consolidation,restructuring,renancing,recapitalization).

The agreement was set to terminate twelve years from the

dateoftheagreement—October28,2020.

48

NeilSimpkins,aSeniorManagingDirectoratBlackstone,

ledthecompany’sacquisitionofApriaandhasbeenon

Apria’sboardsinceBlackstoneacquiredthecompanyin

2008.

49

SimpkinsalsoledBlackstone’s2004acquisition

ofVanguardHealthSystems,whichin2015settledFalse

Claims Act allegations for upcoding Medicare billings and

violatingtheAnti-KickbackStatute.

50

Blackstoneisoneofthelargesthealthcareinvestorsinthe

US,with55healthcareinvestmentstotaling$26.2billion

since 2007.

51

Kool Smiles/Benevis – Friedman Fleischer & Lowe

Dental services organization

InJanuary2018,dentalservicesproviderBenevis(d/b/a

KoolSmiles)paid$23.9milliontosettleFCAallegations

that it performed and billed for medically unnecessary

dental services performed on children insured by

Medicaid.

52

Theallegedactivitytookplaceentirelyunder

theownershipofprivateequityrmFriedmanFleischer&

Lowe(FFL).

The DOJ alleged that Benevis facilities submitted claims

forperformingmedicallyunnecessarytoothextractions

and root canals on babies, and sought payments for baby

root canals that were never performed. The DOJ also

alleged that Benevis “routinely pressured and incentivized

dentists to meet production goals through a system

thatdisciplined‘unproductive’dentistsandawarded

‘productive’dentistswithsubstantialcashbonuses

based on the revenue generated by the procedures they

performed.”

53

TheDOJfoundthatthefraudulentactivitytookplace

at130ofBenevis-afliatedclinics,whichsubmittedfalse

claims to 17 different state Medicaid programs.

54

FFLacquiredBenevisin2004.

55

Theallegedfraudtook

placebetweenJanuary2009andDecember2011.

56

The Blackstone Group Health Care Investments

COMPANY TYPE

ApriaHealthcare Respiratory care

ChangeHealthcare Revenue cycle management

PrecisionMedicineGroup Precision medicine

Sema4 Healthtech

AnnexonBiosciences Biopharmaceuticals

Reata Pharmaceuticals Pharmaceuticals

Alnyam Pharmaceuticals Pharmaceuticals

Geo-Young Pharmaceuticals

AYUMI Pharmaceutical Pharmaceuticals

Center for Autism and Related

Disorders

Behavioral health

Med Imagem Medical imaging

NantPharma Pharmaceuticals

NUA Surgical Medical devices

TeamHealth Physician staffing

XinRongMedicalGroup Medical devices

“ The DOJ alleged that Benevis

facilitiessubmittedclaimsfor

performingmedicallyunnecessary

tooth extractions and root canals

onbabies,andsoughtpayments

for baby root canals that were

neverperformed.”

12 Private Equity Stakeholder Project

WhileFFLultimatelywasnotapartytothesettlement,the

amendedcomplainthighlightshowthecompany’shigh

returnexpectationsplayedaroleintheallegedfraud:

“Not only did FFL’s interest in the prots of portfolio

companies provide a signicant incentive to maximize

those prots, FFL also intended to sponsor additional

private equity funds, and its success in attracting

investors in subsequent funds would depend greatly

on the returns earned by investors in existing funds

managed by it.”

57

“FFL…established the business requirements necessary

to attain the desired rate of return from the Kool Smiles

clinics and directed [Benevis] to undertake these steps

necessary to achieve those returns knowing that those

returns would and did include the submission of false

Medicaid claims. Accordingly, FFL and Capital Partners

II are liable for the submission of those false claims as

detailed herein.”

58

The almost $24 million settlement Benevis paid was

reportedly the second largest FCA dental settlement in

history.InMarch2018,twomonthsafterthesettlement,

BeneviswasrecapitalizedbyprivateequityrmsLittlejohn

&Co.andTailwindCapital.

60

BenevisledforChapter11

bankruptcytwoyearslater—inAugust2020.

61

AsofDecember2020,FFLownssixotherhealthcare

companies:AutismLearningPartners,EyemartExpress,

OrthodonticPartners,SummitBehavioralHealthcare,

VersantHealth,WellstreetUrgentCare.

62

Friedman Fleischer & Lowe Health Care Investments

COMPANY TYPE

AutismLearningPartners Behavioral health

EyemartExpress Eye care

Orthodontic Partners Orthodontic services

SummitBehavioralHealthcare Behavioral health

VersantHealth Eye care

Wellstreet Urgent Care Urgent care

CRC Healthcare - Bain Capital

Addiction treatment

InApril2014,BainCapital-ownedCRCHealthcareagreedto

pay$9.25milliontosettleanFCAlawsuit.CRCHealthcarewas

a behavioral health company specializing in addiction treatment

foradultsandyouth.TheDOJallegedthatforsixyears,a

CRCfacilityinTennesseeknowinglysubmittedfalseclaimsby

consistently providing substandard care to adult and adolescent

patients suffering from alcohol and drug addiction.

63

BainCapitalacquiredCRCinFebruary2006,theyearthe

alleged fraudulent activity began.

64

13Money for Nothing

Allegations against CRC included admitting patients in

excessofstatecapacitylaws,failingtomaintainadequate

staff-patientratios,havingservicesprovidedbystaffthat

werenotproperlylicensed,failingtomakealicensed

psychiatristavailabletopatients,anddouble-billing

Medicaid for prescriptions given to patients.

65

A former CRC employee acted as whistleblower for the

lawsuit in response to a patient death at the Tennessee

facility.Thewhistlebloweralsodescribednding12

patientssittingontheooroutsidethenurses’station

becausetheyweresickandtheofcewasclosed.

66

The

state of Tennessee effectively closed the facility in 2011

after three patients died over the span of a year. In

October2014,sixmonthsaftersettlingtheallegationsof

fraud,BainreachedanagreementwithAcadiaHealthcare

toacquireCRC.

68

As of December 2020, Bain lists ten health care companies

initsportfolio:AveannaHealthcare,Cerevel,GrupoNotre

DameIntermédica,IQVIA,KestraMedicalTechnologies,

QuVa Pharma, Stada, Surgery Partners, U.S. Renal Care,

and Zelis.

69

Bain Capital Health Care Investments

COMPANY TYPE

AveannaHealthcare Homehealth

Cerevel Neuroscience

GrupoNotreDame

Intermédica

Healthanddentalplans

(Brazil)

KestraMedicalTechnologies Medical devices

QuVa Pharma Pharmaceuticals

STADA Pharmaceuticals

Surgery Partners Surgery centers

U.S. Renal Care Dialysis centers

Zelis Healthtech

14 Private Equity Stakeholder Project

Appendix A:

PE-Owned Health Care Companies that Paid FCA Settlements

Below is list of health care companies that have paid settlements within the last eight years for allegations of violating

theFalseClaimsActwhileunderprivateequityownership.

AccentCare/Guardian

OWNER TYPE

SETTLEMENT

YEAR

OTHER HEALTHCARE COMPANIES

OWNED BY PE FIRM

SETTLEMENT

AMOUNT

OakHillCapitalPartners Homehealthand

hospice

2015 AscensionHealth,Vetcor,KansasMedical

Center,CannonCountyHospital,Vantage

Oncology

$3,000,000

Advanced Pain Management

OWNER TYPE

SETTLEMENT

YEAR

OTHER HEALTHCARE COMPANIES

OWNED BY PE FIRM

SETTLEMENT

AMOUNT

ChicagoGrowthPartners Pain management 2020 Advanced Pain Management, Caprion,

EndoGastricSolutions,ScribeAmerica,

Zogenix

$1,000,000

Apria Healthcare

OWNER TYPE

SETTLEMENT

YEAR

OTHER HEALTHCARE COMPANIES

OWNED BY PE FIRM

SETTLEMENT

AMOUNT

BlackstoneGroup Respiratory medical

supplies

2020 ApriaHealthcare,ChangeHealthcare,

PrecisionMedicineGroup,Sema4,Annexon

Biosciences, Reata Pharmaceuticals,

AlnyamPharmaceuticals,Geo-Young,

AYUMI Pharmaceutical, Center for Autism

and Related Disorders, Med Imagem,

NantPharma, NUA Surgical, XinRong

MedicalGroup,TeamHealth

$40,500,000

Athenahealth

OWNER TYPE

SETTLEMENT

YEAR

OTHER HEALTHCARE COMPANIES

OWNED BY PE FIRM

SETTLEMENT

AMOUNT

Veritas Capital, Evergreen

Coast Capital (Elliott

Management)

Medical billing tech 2020 VeritasCapital:Athenahealth,Cotiviti,

GainwellTechnologies

$18,250,000

15Money for Nothing

Benevis/Kool Smiles

OWNER TYPE

SETTLEMENT

YEAR

OTHER HEALTHCARE COMPANIES

OWNED BY PE FIRM

SETTLEMENT

AMOUNT

Friedman,Fleischer&Lowe Pediatric dental

services

2018 AutismLearningPartners,EyemartExpress,

Orthodontic Partners, Summit Behavioral

Healthcare,VersantHealth,Wellstreet

Urgent Care

$23,900,000

Community Intervention Services

OWNER TYPE

SETTLEMENT

YEAR

OTHER HEALTHCARE COMPANIES

OWNED BY PE FIRM

SETTLEMENT

AMOUNT

H.I.G. Mental health 2018 Apollo Endosurgery, Arvelle Therapeutics,

BarnetDulaneyPerkins,BioVectra,

CardioFocus, Clarify Medical, Clarus

Therapeutics, Community Intervention

Services,CrothallLaundryServices,Eruptr,

Exagen,HealthSTAR,IconicTherapeutics,

Intact Vascular, InterDent, Iron Bow, Jenny

Craig,JustHomeHealthcareServices,

MedPro Advantage, Medusind, Neurana

Pharmaceuticals,Nevakar,Nutrinia,On

TargetLaboratories,OrbusTherapeutics,

PinnacleGIPartners,ReliantRehabilitation,

RxSight,SageHospice,SoleoHealth,

SouthwesternEyeCenter,St.CroixHospice,

TaconicBiosciences,TLCVision,USMED,

Vernacare, Wellpath

$4,000,000

Compassus

OWNER TYPE

SETTLEMENT

YEAR

OTHER HEALTHCARE COMPANIES

OWNED BY PE FIRM

SETTLEMENT

AMOUNT

Cressey&Company Hospice 2014 Concentra,D4C,HHAeXchange,People

PetsandVets,RestorixHealth,Verisys,

VetCor

$3,920,000

Consulate Health Care (fka La Vie Rehab)

OWNER TYPE

SETTLEMENT

YEAR

OTHER HEALTHCARE COMPANIES

OWNED BY PE FIRM

SETTLEMENT

AMOUNT

Warburg Pincus Skillednursingand

rehab

2017 AlignmentHealthcare,Amcare,Apteki

Gemini,CityMD,EverCare,HaiHe

Pharmaceutical,Helix,HTDK,Hygeia,Jinxin

Fertility, Modernizing Medicine, Outset,

Polyplys Transfection, Qualifacts, Quantum

Health,SOCTelemed,SoteraHealth,

Vertice, WebPT

$225,000,000

16 Private Equity Stakeholder Project

Cordant Health Solutions

OWNER TYPE

SETTLEMENT

YEAR

OTHER HEALTHCARE COMPANIES

OWNED BY PE FIRM

SETTLEMENT

AMOUNT

Waud Capital Drug testing 2020 APDerm,Apotheco,ConciergeHomeCare,

CordantHealthSolutions,Heart+Paw,

Health&SafetyInstitute,IvyRehab,

PharmacyPartners,GIAlliance,Unifeye

Vision Partners

$11,900,000

CRC Healthcare

OWNER TYPE

SETTLEMENT

YEAR

OTHER HEALTHCARE COMPANIES

OWNED BY PE FIRM

SETTLEMENT

AMOUNT

Bain Capital Addiction treatment 2014 AveannaHealthcare,Cerevel,Grupo

NotreDameIntermédica,KestraMedical

Technologies, QuVa Pharma, Stada, Surgery

Partners, U.S. Renal Care, Zelis

$9,250,000

Curo Health Services

OWNER TYPE

SETTLEMENT

YEAR

OTHER HEALTHCARE COMPANIES

OWNED BY PE FIRM

SETTLEMENT

AMOUNT

GTCR Homehealthand

hospice

2017 AMRI,Ceba-TechSpecialtySolutions,Cole-

Parmer,CorzaHealth,MaravaiLifeSciences,

Regatta Medical, Riverchase Dermatology,

SoteraHealth/Sterigenics,TerSera

Therapeutics, Transaction Data Systems

$12,210,000

Diabetic Care Rx/Patient Care America

OWNER TYPE

SETTLEMENT

YEAR

OTHER HEALTHCARE COMPANIES

OWNED BY PE FIRM

SETTLEMENT

AMOUNT

Riordan,Lewis,&Hayden Specialty pharmacy 2019 SilveradoSeniorLiving,theChartisGroup $21,360,000

Diagnostic Imaging Group

OWNER TYPE

SETTLEMENT

YEAR

OTHER HEALTHCARE COMPANIES

OWNED BY PE FIRM

SETTLEMENT

AMOUNT

Evercore Capital Partners Outpatient

diagnostic imaging

2014 No current health care investments $15,500,000

Early Autism Project (Chancelight)

OWNER TYPE

SETTLEMENT

YEAR

OTHER HEALTHCARE COMPANIES

OWNED BY PE FIRM

SETTLEMENT

AMOUNT

Trimaran Capital Partners Autism treatment 2018 No current health care investments $8,800,000

17Money for Nothing

EmCare/Envision

OWNER TYPE

SETTLEMENT

YEAR

OTHER HEALTHCARE COMPANIES

OWNED BY PE FIRM

SETTLEMENT

AMOUNT

Onex,ClaytonDubilier&Rice Physician staffing 2017 Onex:AcaciumGroup,Carestream,SCPHealth $29,600,000

Encore Rehabilitation

OWNER TYPE

SETTLEMENT

YEAR

OTHER HEALTHCARE COMPANIES

OWNED BY PE FIRM

SETTLEMENT

AMOUNT

GlencoeCapitaland

StockwellCapital;

RevelstrokeCapitalPartners

Rehabilitation

therapy

2020 Revelstroke:Carrus,CEIVisionPartners,

CrossroadsTreatmentCenters,DataLink,

Encore Rehabilitation Services, Family Care

Center,FastPaceHealth,OrthoAlliance,

Sound Physicians, The Care Team, US Renal

Care, Upstream Rehabilitation

ClaytonDubilier&Rice:Aglion,Covetrus,

Cynosure,DriveDevilbissHealthcare,Healogics,

HuntsworthHealth,SmileDirectClub

$4,030,000

Genova Diagnostics

OWNER TYPE

SETTLEMENT

YEAR

OTHER HEALTHCARE COMPANIES

OWNED BY PE FIRM

SETTLEMENT

AMOUNT

LevineLeichtmanCapital

Partners

Clinical laboratory

services

2020 GenovaDiagnostics,CaringBrands,Capsa

Healthcare,MonteNido,Suvet,Therapeutic

Research Center

$43,000,000

Golden Living

OWNER TYPE

SETTLEMENT

YEAR

OTHER HEALTHCARE COMPANIES

OWNED BY PE FIRM

SETTLEMENT

AMOUNT

Fillmore Capital Partners Skillednursing

facilities

2013 AlixaRx,GoldenLivingCenters $613,300

Greenway Health

OWNER TYPE

SETTLEMENT

YEAR

OTHER HEALTHCARE COMPANIES

OWNED BY PE FIRM

SETTLEMENT

AMOUNT

VistaEquityPartners Electronic health

records systems

2019 Alegeus,Allocate,GreenwayHealth $57,250,000

Holiday Retirement

OWNER TYPE

SETTLEMENT

YEAR

OTHER HEALTHCARE COMPANIES

OWNED BY PE FIRM

SETTLEMENT

AMOUNT

Fortress Investment Senior living 2016 HolidayRetirement,BrookdaleSenior

Living,WatermarkatLoganSquare,

HealthSmart

$8,860,000

18 Private Equity Stakeholder Project

Interim Healthcare

OWNER TYPE

SETTLEMENT

YEAR

OTHER HEALTHCARE COMPANIES

OWNED BY PE FIRM

SETTLEMENT

AMOUNT

HalifaxGroup;Levine

LeichtmanCapitalPartners

Homecare,

hospice, and

healthcare staffing

2020 HalifaxGroup:ChanceLightBehavioral

Health,Burke,PromptCare,FamiliaDental

$1,750,000

Reliant Rehabilitation

OWNER TYPE

SETTLEMENT

YEAR

OTHER HEALTHCARE COMPANIES

OWNED BY PE FIRM

SETTLEMENT

AMOUNT

DWHealthcarePartners Rehabilitation

therapy

2018 360BehavioralHealth,Aequor,Champion,

CareXM,Cefaly,EHE,Hydrafacial,Med-

PharmexInc.,PentecHealth,SoClean,

Spectrum Solutions, Willow Wood

$6,100,000

Therakos

OWNER TYPE

SETTLEMENT

YEAR

OTHER HEALTHCARE COMPANIES

OWNED BY PE FIRM

SETTLEMENT

AMOUNT

TheGoresGroup Immunotherapy 2020 No current health care investments $11,500,000

TridentUSA

OWNER TYPE

SETTLEMENT

YEAR

OTHER HEALTHCARE COMPANIES

OWNED BY PE FIRM

SETTLEMENT

AMOUNT

AudaxGroupandFrazier

HealthcarePartners;

Formation Capital

Diagnostic services 2019 AudaxGroup:42NorthDental,Active

Day, Altasciences Clinical Research, Aspen

SurgicalProducts,AxiaWomen’sHealth,

BelmontMedical,theChartisGroup,

Corrona,GastroHealth,GlobalNephrology

Solutions,HOPco,KatenaProductsLifemark

Health,MediridanBehavioralHealth,

PhoenixPhysicalTherapy,StatLabMedical

Products,UnitedUrologyGroup

FrazierHealthcarePartners:AccuityDelivery

Systems, Adare Pharma Solutions, Alteon

Health,AppianRx,CaravelAutismHealth,

Comprehensive Pharmacy Services, Safe

Global,EptamPrecision,Leiters,Matrix

MedicalNetwork,MedData,Northfield

Medical,OHI,Parata,PCIPharmaServices,

PentecHealth,theCoreInstitute,United

Derm Partners, United Digestive, Vein

Clinics of America

FormationCapital:TridentUSA,HC-One,

Extendicare,ConsulateHealthCare

$8,500,000

19Money for Nothing

Vanguard Health Systems

OWNER TYPE

SETTLEMENT

YEAR

OTHER HEALTHCARE COMPANIES

OWNED BY PE FIRM

SETTLEMENT

AMOUNT

BlackstoneGroup Healthsystem 2015 ApriaHealthcare,ChangeHealthcare,

PrecisionMedicineGroup,Sema4,Annexon

Biosciences, Reata Pharmaceuticals,

AlnyamPharmaceuticals,Geo-Young,

AYUMI Pharmaceutical, Center for Autism

and Related Disorders, Med Imagem,

NantPharma, NUA Surgical, XinRong

MedicalGroup,TeamHealth

$2,900,000

20 Private Equity Stakeholder Project

References

1. “TheHealthcarePEInvestmentLandscape,”PitchbookQ32020healthcareanalystreport,September2020.

2. https://www.cms.gov/les/document/highlights.pdf

3. COVIDStimulusWatchdatabasebyGoodJobsFirst.https://covidstimuluswatch.org/accessedJanuary21,2021.

4. CentersforMedicareandMedicaidServicesFalseClaimsActprimer.https://downloads.cms.gov/cmsgov/archived-downloads/

SMDL/downloads/SMD032207Att2.pdf

5. JohnsHopkinsMedicineFederal&StateFalseClaimsAct/WhistleblowerProtectionsPolicy.https://www.hopkinsmedicine.org/

johns_hopkins_healthcare/providers_physicians/health_care_fraud_and_abuse/Federal_State_False_Claims_Act_Whistleblower_

Protections_Policy.html

6. Ibid.

7. DepartmentofJustice“PrincipalDeputyAssistantAttorneyGeneralEthanP.DavisdeliversremarksontheFalseClaimsActat

theU.S.ChamberofCommerce’sInstituteforLegalReform,”June26,2020inWashingtonD.C.https://www.justice.gov/civil/

speech/principal-deputy-assistant-attorney-general-ethan-p-davis-delivers-remarks-false-claims

8. DiabeticCareRx:DepartmentofJustice,“CompoundingPharmacy,TwoofItsExecutives,andPrivateEquityFirmAgreetoPay

$21.36MilliontoResolveFalseClaimsActAllegations,”September18,2019.https://www.justice.gov/opa/pr/compounding-

pharmacy-two-its-executives-and-private-equity-rm-agree-pay-2136-million

Therakos:DepartmentofJustice,“FormerOwnersofTherakos,Inc.Pay$11.5MilliontoResolveFalseClaimsActAllegations

ofPromotionofDrug-DeviceSystemforUnapprovedUsestoPediatricPatients,”November19,2020.https://www.justice.gov/

usao-edpa/pr/former-owners-therakos-inc-pay-115-million-resolve-false-claims-act-allegations

HolidayRetirement:DepartmentofJustice,“UnitedStatesRecoversover$8MillioninFalseClaimsActSettlementsforFraud

AgainsttheVAandMedicare,”May5,2016.https://www.justice.gov/usao-or/pr/united-states-recovers-over-8-million-false-

claims-act-settlements-fraud-against-va-and

9. Benevis/KoolSmiles:UnitedStatesofAmericaet.al.vNCDRLLCetal.ThirdAmendedComplaintPursuanttotheFederal

FalseClaimsAct.CivilActionNo.4:11-cv-792.https://bergermontague.com/wp-content/uploads/2018/01/Kool-Smiles-Third-

Amended-Complaint.pdf

GenovaDiagnostics:UnitedStatesofAmerica&StateofNorthCarolina,exrel.DarrlLandis,M.D.vGenovaDiagnostics,Inc.,et

al.1:17cv341.https://www.scribd.com/document/459200338/Genova-Complaint

10. DepartmentofJustice,“CompoundingPharmacy,TwoofItsExecutives,andPrivateEquityFirmAgreetoPay$21.36Millionto

ResolveFalseClaimsActAllegations,”September18,2019.https://www.justice.gov/opa/pr/compounding-pharmacy-two-its-

executives-and-private-equity-rm-agree-pay-2136-million

11. PatientCareAmericawebsite:https://pcacorp.com/services/.AccessedJanuary2021.

12. UNITEDSTATESOFAMERICAexrel.MARISELACARMENMEDRANOandADALOPEZv.DIABETICCARERX,LLC,d/b/a

PATIENTCAREAMERICAetal,UnitedStatesofAmerica’sComplaintinIntervention,CASENO.15-62617-CIV-BLOOM.https://

media.mcguirewoods.com/publications/2019/US-ex-rel-Medrano-v-Diabetic-Care-Govt-Compl-in-Intervention.pdfpg.2.

13. U.S.vDCRX.https://media.mcguirewoods.com/publications/2019/US-ex-rel-Medrano-v-Diabetic-Care-Govt-Compl-in-

Intervention.pdf. p.g. 22

14. DepartmentofJustice,“CompoundingPharmacy,TwoofItsExecutives,andPrivateEquityFirmAgreetoPay$21.36Millionto

ResolveFalseClaimsActAllegations,”September18,2019.https://www.justice.gov/opa/pr/compounding-pharmacy-two-its-

executives-and-private-equity-rm-agree-pay-2136-million

15. U.S.vDCRX.https://media.mcguirewoods.com/publications/2019/US-ex-rel-Medrano-v-Diabetic-Care-Govt-Compl-in-

Intervention.pdf. pg. 3.

21Money for Nothing

16.U.S.vDCRX.https://media.mcguirewoods.com/publications/2019/US-ex-rel-Medrano-v-Diabetic-Care-Govt-Compl-in-

Intervention.pdf. pg. 10.

17. Ibid.

18.RLHEquityPartnersemployeebio.http://www.rlhequity.com/team/michel-glouchevitch/.AccessedJanuary2021.

19.https://media.mcguirewoods.com/publications/2019/US-ex-rel-Medrano-v-Diabetic-Care-Govt-Compl-in-Intervention.pdfpg.28.

20. RLHEquityPartnerswebsite.http://www.rlhequity.com/portfolio/.AccessedJanuary20,2021.

21. HarrietRyan,“UpscalehomefordementiapatientssuedoverdeathsinCOVID-19outbreak,”LosAngelesTimes,December15,

2020.https://www.latimes.com/california/story/2020-12-15/upscale-dementia-home-sued-covid-19-deaths

22. COVIDStimulusWatchdatabasebyGoodJobsFirst.https://data.covidstimuluswatch.org/individual-record/silverado-senior-

living-holdings-inc.AccessedJanuary2021.

23. “BehavioralHealthOrganizationAnnouncesRebrandtoSouthBayCommunityServices,”PressreleasebySouthBayCommunity

Services,May3,2016.https://southbaycommunityservices.com/behavioral-health-organization-announces-rebrand-to-south-bay-

community-services/

24. “H.I.G.GrowthPartnersAnnouncestheFormationofCommunityInterventionServicesandCompletestheAcquisitionofSouth

BayMentalHealth,”HIGCapitalpressrelease,April17,2012.https://www.businesswire.com/news/home/20120417005989/

en/H.I.G.-Growth-Partners-Announces-the-Formation-of-Community-Intervention-Services-and-Completes-the-Acquisition-of-

South-Bay-Mental-Health

25. OfceofAttorneyGeneralMauraHealey,“MentalHealthCentertoPay$4MillionunderAGSettlementforIllegallyBilling

MassHealthforUnlicensedPatientCare,”Pressrelease,February8,2018.https://www.mass.gov/news/mental-health-center-to-

pay-4-million-under-ag-settlement-for-illegally-billing-masshealth-for

26.https://dlbjbjzgnk95t.cloudfront.net/0999000/999329/https-ecf-mad-uscourts-gov-doc1-09518463625.pdfOfceofAttorney

GeneralMauraHealey,“AGHealeySuesMentalHealthCenterforIllegallyBillingMassHealthforUnlicensedandUnsupervised

PatientCare,”Pressrelease,January9,2018.https://www.mass.gov/news/ag-healey-sues-mental-health-center-for-illegally-

billing-masshealth-for-unlicensed-and

27. OfceofAttorneyGeneralMauraHealey,“AGHealeySuesMentalHealthCenterforIllegallyBillingMassHealthforUnlicensed

andUnsupervisedPatientCare,”Pressrelease,January9,2018.https://www.mass.gov/news/ag-healey-sues-mental-health-

center-for-illegally-billing-masshealth-for-unlicensed-and

28.Massachusettsexrel.Martino-Flemingv.S.BayMentalHealthCtr.,Inc.,CivilActionNo.15-13065-PBS.https://casetext.com/

case/united-states-ex-rel-martino-eming-v-s-bay-mental-health-ctr-inc

29.Massachusettsexrel.Martino-Flemingv.S.BayMentalHealthCtr.,Inc.,CivilActionNo.15-13065-PBS.https://www.bclplaw.

com/images/content/1/6/v2/162247/Martino-Fleming-US-Decision-2018-09-21-PACER-version.pdf

30. Massachusettsexrel.Martino-Flemingv.S.BayMentalHealthCtr.,Inc.,CivilActionNo.15-13065-PBS.https://casetext.com/

case/massachusetts-ex-rel-martino-eming-v-s-bay-mental-health-ctr-inc

31. “PathwaysAcquiresThreeSubsidiariesofCommunityInterventionServices,Inc.(CIS),”Pressrelease,October6,2020.https://

www.businesswire.com/news/home/20201006005812/en/Pathways-Acquires-Three-Subsidiaries-of-Community-Intervention-

Services-Inc.-CIS

32. H.I.G.Capitalwebsite.https://higcapital.com/portfolio/sector/83/active/all.AccessedJanuary,2021.

33. “H.I.G.GrowthPartnersCompletesStrategicTransactionwithTheCenterforDigestiveHealthandPinnacleGIPartners,”Press

release,December1,2020.https://www.businesswire.com/news/home/20201201005243/en/H.I.G.-Growth-Partners-Completes-

Strategic-Transaction-with-The-Center-for-Digestive-Health-and-Pinnacle-GI-Partners;“TheVistriaGroupReachesAgreementto

SellSt.CroixHospice,”Pressrelease,October19,2020.https://www.prnewswire.com/news-releases/the-vistria-group-reaches-

agreement-to-sell-st-croix-hospice-301154947.html

34. MarshaMcLeod,“ThePrivateOption,”TheAtlantic,September12,2019.https://www.theatlantic.com/politics/archive/2019/09/

private-equitys-grip-on-jail-health-care/597871/

22 Private Equity Stakeholder Project

35. ChadBray,“MallinckrodtPharmaceuticalstoAcquireTherakosfor$1.33Billion,”TheNewYorkTimes,August10,2015.https://

www.nytimes.com/2015/08/11/business/dealbook/mallinckrodt-to-acquire-therakos-for-1-33-billion.html

36.DepartmentofJustice,“FormerOwnersofTherakos,Inc.Pay$11.5MilliontoResolveFalseClaimsActAllegationsofPromotion

ofDrug-DeviceSystemforUnapprovedUsestoPediatricPatients,”November19,2020.

https://www.justice.gov/usao-edpa/pr/former-owners-therakos-inc-pay-115-million-resolve-false-claims-act-allegations

37. DepartmentofJustice,“FormerOwnersofTherakos,Inc.Pay$11.5MilliontoResolveFalseClaimsActAllegationsofPromotion

ofDrug-DeviceSystemforUnapprovedUsestoPediatricPatients,”November19,2020.

38.https://www.justice.gov/usao-edpa/pr/former-owners-therakos-inc-pay-115-million-resolve-false-claims-act-allegations

39.Moody’sInvestorService,“Moody’ssaysTherakos’dividendrecapiscreditnegativebuthasnoratingimpact,”Dece,ber5,2013.

https://www.moodys.com/research/Moodys-says-Therakos-dividend-recap-is-credit-negative-but-has--PR_288127;Pitchbook,

accessed December 2020.

“BlackstoneCompletesAcquisitionofApriaHealthcareGroupInc,”Blackstonepressrelease,October28,2008.https://www.

blackstone.com/press-releases/article/blackstone-completes-acquisition-of-apria-healthcare-group-inc/

40. DepartmentofJustice,“ActingManhattanU.S.AttorneyAnnounces$40.5MillionSettlementWithDurableMedicalEquipment

ProviderApriaHealthcareForFraudulentBillingPractices,”December21,2020.https://www.justice.gov/usao-sdny/pr/acting-

manhattan-us-attorney-announces-405-million-settlement-durable-medical-equipment

41. Ibid.

42. Ibid.

43. MichaelAudetandNeilSimkins,ApriaHealthcarewebsite.https://www.apria.com/investor-relations/board-of-directors/,

accessed Dec 31, 2020.

44. “Here’sSomethingFedsDidRightonCOVID-19,”MedpageToday,Apr6,2020.

https://www.medpagetoday.com/infectiousdisease/covid19/85803

45. Apria,Inc.S-1lingtotheSecuritiesandExchangeCommission,January15,2021.https://www.sec.gov/Archives/edgar/

data/1735803/000119312521010085/d62545ds1.htm

46.Apria,Inc.S-1lingtotheSecuritiesandExchangeCommission,January15,2021.https://www.sec.gov/Archives/edgar/

data/1735803/000119312521010085/d62545ds1.htm

47. Ibid.

48.APRIAHEALTHCAREGROUPINC.S-4lingtotheUSSecuritiesandExchangeCommission,July16,2010.https://www.sec.gov/

Archives/edgar/data/820609/000119312510160027/ds4.htm

49.Blackstonewebsite:https://www.blackstone.com/people/neil-simpkins/.AccessedFebruary2021.

50. DepartmentofJustice,“VanguardHealthSystems,Inc.AgreesToPay$2.9MillionToSettleFalseClaimsActAllegations,”June

15,2015.https://www.justice.gov/usao-mdtn/pr/vanguard-health-systems-inc-agrees-pay-29-million-settle-false-claims-act-

allegations

51. Pitchbook,“TheHealthcarePEInvestmentLandscape”Q32020report.

52. DepartmentofJustice,“DentalManagementCompanyBenevisandItsAfliatedKoolSmilesDentalClinicstoPay$23.9Million

toSettleFalseClaimsActAllegationsRelatingtoMedicallyUnnecessaryPediatricDentalServices,”January10,2018.https://

www.justice.gov/opa/pr/dental-management-company-benevis-and-its-afliated-kool-smiles-dental-clinics-pay-239

53. Ibid.

54. Ibid.

55. FFLPartnerswebsite.https://www.fpartners.com/investments/benevis.AccessedJanuary2021.

56.DepartmentofJustice,“DentalManagementCompanyBenevisandItsAfliatedKoolSmilesDentalClinicstoPay$23.9Million

toSettleFalseClaimsActAllegationsRelatingtoMedicallyUnnecessaryPediatricDentalServices,”January10,2018.https://

www.justice.gov/opa/pr/dental-management-company-benevis-and-its-afliated-kool-smiles-dental-clinics-pay-239

23Money for Nothing

57. Benevis/KoolSmiles:UnitedStatesofAmericaet.al.vNCDRLLCetal.ThirdAmendedComplaintPursuanttotheFederal

FalseClaimsAct.CivilActionNo.4:11-cv-792.https://bergermontague.com/wp-content/uploads/2018/01/Kool-Smiles-Third-

Amended-Complaint.pdfpg.16.

58.Benevis/KoolSmiles:UnitedStatesofAmericaet.al.vNCDRLLCetal.ThirdAmendedComplaintPursuanttotheFederal

FalseClaimsAct.CivilActionNo.4:11-cv-792.https://bergermontague.com/wp-content/uploads/2018/01/Kool-Smiles-Third-

Amended-Complaint.pdfpg.20.

59.“Berger&Montague,P.C.WhistleblowerTeamLeadsSecondLargestEverFalseClaimsActDentalCase,RecoveringMoreThan

$23.9Million,”pressrelease,January10,2018.https://www.prnewswire.com/news-releases/berger--montague-pc-whistleblower-

team-leads-second-largest-ever-false-claims-act-dental-case-recovering-more-than-239-million-300581018.html

60.“BenevisAppointsIndustryVeteranRichBeckmanasChiefExecutiveOfcer,”pressrelease,April12,2019.https://www.

businesswire.com/news/home/20190412005087/en/Benevis-Appoints-Industry-Veteran-Rich-Beckman-as-Chief-Executive-Ofcer

61.MichaelW.Davis,“BenevisFilesforChapter11Bankruptcy,”DentistryToday,August13,2020.https://www.dentistrytoday.com/

news/todays-dental-news/item/6793-benevis-les-for-chapter-11-bankruptcy

62.FFLPartnerswebsite.https://www.fpartners.com/portfolio.AccessedJanuary2021.

63.DepartmentofJustice,“TennesseeSubstanceAbuseTreatmentFacilityAgreestoResolveFalseClaimsActAllegationsfor$9.25

Million,”April16,2014.https://www.justice.gov/opa/pr/tennessee-substance-abuse-treatment-facility-agrees-resolve-false-

claims-act-allegations-925

64.“BainnalizesCRCpurchase,”InfrastructureInvestor,Mar20,2006.

https://www.infrastructureinvestor.com/bain-nalises-crc-purchase/

65.DepartmentofJustice,“TennesseeSubstanceAbuseTreatmentFacilityAgreestoResolveFalseClaimsActAllegationsfor$9.25

Million,”April16,2014.https://www.justice.gov/opa/pr/tennessee-substance-abuse-treatment-facility-agrees-resolve-false-

claims-act-allegations-925

66.WalterFRoche,“NewLifeLodgewhistlebloweractedafterdeathofpatient,”TheTennessean,April22,2014.https://www.

tennessean.com/story/news/health/2014/04/21/woman-whose-complaints-led-state-federal-investigation-new-life-lodge-says-

death-patient-led-act/7982135/

67.NateRau,“AcadiatobuyCRCHealth,ownerofNewLifeLodge,”TheTennessean,October29,2014.https://www.tennessean.

com/story/money/industries/health-care/2014/10/29/acadia-buy-crc-health-owner-new-life-lodge/18146249/

68.Ibid.

69.BainCapitalwebsite.https://www.baincapitalprivateequity.com/portfolio.AccessedJanuary2021.

pestakeholder.org