The Online Library of Liberty

A Project Of Liberty Fund, Inc.

William Stanley Jevons, The Theory of Political

Economy [1871]

The Online Library Of Liberty

This E-Book (PDF format) is published by Liberty Fund, Inc., a private,

non-profit, educational foundation established in 1960 to encourage study of the ideal

of a society of free and responsible individuals. 2010 was the 50th anniversary year of

the founding of Liberty Fund.

It is part of the Online Library of Liberty web site http://oll.libertyfund.org, which

was established in 2004 in order to further the educational goals of Liberty Fund, Inc.

To find out more about the author or title, to use the site's powerful search engine, to

see other titles in other formats (HTML, facsimile PDF), or to make use of the

hundreds of essays, educational aids, and study guides, please visit the OLL web site.

This title is also part of the Portable Library of Liberty DVD which contains over

1,000 books and quotes about liberty and power, and is available free of charge upon

request.

The cuneiform inscription that appears in the logo and serves as a design element in

all Liberty Fund books and web sites is the earliest-known written appearance of the

word “freedom” (amagi), or “liberty.” It is taken from a clay document written about

2300 B.C. in the Sumerian city-state of Lagash, in present day Iraq.

To find out more about Liberty Fund, Inc., or the Online Library of Liberty Project,

please contact the Director at [email protected].

LIBERTY FUND, INC.

8335 Allison Pointe Trail, Suite 300

Indianapolis, Indiana 46250-1684

Edition Used:

The Theory of Political Economy (London: Macmillan, 1888) 3rd ed.

Author: William Stanley Jevons

About This Title:

One of three seminal works published in 1871 (along with Walras and Menger) which

introduced the idea of the marginal theory of utility and thus a revolution in economic

thinking.

Online Library of Liberty: The Theory of Political Economy

PLL v6.0 (generated September, 2011)

2

http://oll.libertyfund.org/title/625

About Liberty Fund:

Liberty Fund, Inc. is a private, educational foundation established to encourage the

study of the ideal of a society of free and responsible individuals.

Copyright Information:

The text is in the public domain.

Fair Use Statement:

This material is put online to further the educational goals of Liberty Fund, Inc.

Unless otherwise stated in the Copyright Information section above, this material may

be used freely for educational and academic purposes. It may not be used in any way

for profit.

Online Library of Liberty: The Theory of Political Economy

PLL v6.0 (generated September, 2011)

3

http://oll.libertyfund.org/title/625

Table Of Contents

Preface to the First Edition (1871)

Preface to the Second Edition (1879)

Preface to the Third Edition By Harriet Jevons

Errata

Chapter I: Introduction

Mathematical Character of the Science.

Confusion Between Mathematical and Exact Sciences.

Capability of Exact Measurement.

Measurement of Feeling and Motives.

Logical Method of Economics.

Relation of Economics to Ethics.

Chapter II: Theory of Pleasure and Pain

Pleasure and Pain As Quantities.

Pain the Negative of Pleasure.

Anticipated Feeling.

Uncertainty of Future Events.

Chapter III: Theory of Utility

Definition of Terms.

The Laws of Human Want.

Utility Is Not an Intrinsic Quality.

Law of the Variation of Utility.

Total Utility and Degree of Utility.

Variation of the Final Degree of Utility.

Disutility and Discommodity.

Distribution of Commodity In Different Uses.

Theory of Dimensions of Economic Quantities.

Actual, Prospective, and Potential Utility.

Distribution of a Commodity In Time.

Chapter IV: Theory of Exchange

Importance of Exchange In Economics.

Ambiguity of the Term Value.

Value Expresses Ratio of Exchange.

Popular Use of the Term Value.

Dimension of Value.

Definition of Market.

Definition of Trading Body.

The Law of Indifference.

The Theory of Exchange.

Symbolic Statement of the Theory.

Analogy to the Theory of the Lever.

Impediments to Exchange.

Illustrations of the Theory of Exchange.

Problems In the Theory of Exchange.

Complex Cases of the Theory.

Online Library of Liberty: The Theory of Political Economy

PLL v6.0 (generated September, 2011)

4

http://oll.libertyfund.org/title/625

Competition In Exchange.

Failure of the Equations of Exchange.

Negative and Zero Value.

Equivalence of Commodities.

Acquired Utility of Commodities.

The Gain By Exchange.

Numerical Determination of the Laws of Utility.

Opinions As to the Variation of Price.

Variation of the Price of Corn.

The Origin of Value.

Chapter V: Theory of Labour

Definition of Labour.

Quantitative Notions of Labour.

Symbolic Statement of the Theory.

Dimensions of Labour.

Balance Between Need and Labour.

Distribution of Labour.

Relation of the Theories of Labour and Exchange.

Relations of Economic Quantities.

Various Cases of the Theory.

Joint Production.

Over-production.

Limits to the Intensity of Labour.

Chapter VI: Theory of Rent

Accepted Opinions Concerning Rent.

Symbolic Statement of the Theory.

Illustrations of the Theory.

Chapter VII: Theory of Capital

The Function of Capital.

Capital Is Concerned With Time.

Quantitative Notions Concerning Capital.

Expression For Amount of Investment.

Dimensions of Capital, Credit and Debit.

Effect of the Duration of Work.

Illustrations of the Investment of Capital.

Fixed and Circulating Capital.

Free and Invested Capital.

Uniformity of the Rate of Interest.

General Expression For the Rate of Interest.

Dimension of Interest.

Peacock On the Dimensions of Interest.

Tendency of Profits to a Minimum.

Advantage of Capital to Industry.

Are Articles In the Consumers' Hands Capital?

Chapter VIII: Concluding Remarks

The Doctrine of Population.

Relation of Wages and Profit.

Professor Hearn's Views.

Online Library of Liberty: The Theory of Political Economy

PLL v6.0 (generated September, 2011)

5

http://oll.libertyfund.org/title/625

[Back to Table of Contents]

PREFACE TO THE FIRST EDITION

(1871)

THE contents of the following pages can hardly meet with ready acceptance among

those who regard the Science of Political Economy as having already acquired a

nearly perfect form. I believe it is generally supposed that Adam Smith laid the

foundations of this science; that Malthus, Anderson, and Senior added important

doctrines; that Ricardo systematised the whole; and, finally, that Mr. J. S. Mill filled

in the details and completely expounded this branch of knowledge. Mr. Mill appears

to have had a similar notion; for he distinctly asserts that there was nothing; in the

Laws of Value which remained for himself or any future writer to clear up. Doubtless

it is difficult to help feeling that opinions adopted and confirmed by such eminent

men have much weight of probability in their favour. Yet, in the other sciences this

weight of authority has not been allowed to restrict the free examination of new

opinions and theories; and it has often been ultimately proved that authority was on

the wrong side.

There are many portions of Economical doctrine which appear to me as scientific in

form as they are consonant with facts. I would especially mention the Theories of

Population and Rent, the latter a theory of a distinctly mathematical character, which

seems to give a clue to the correct mode of treating the whole science. Had Mr. Mill

contented himself with asserting the unquestionable truth of the Laws of Supply and

Demand, I should have agreed with him. As founded upon facts, those laws cannot be

shaken by any theory; but it does not therefore follow, that our conception of Value is

perfect and final. Other generally accepted doctrines have always appeared to me

purely delusive, especially the so-called Wage Fund Theory. This theory pretends to

give a solution of the main problem of the science—to determine the wages of labour;

yet, on close examination, its conclusion is found to be a mere truism, namely, that

the average rate of wages is found by dividing the whole amount appropriated to the

payment of wages by the number of those between whom it is divided. Some other

supposed conclusions of the science are of a less harmless character, as, for instance,

those regarding the advantage of exchange (see the section on "The Gain by

Exchange," p. 141).

In this work I have attempted to treat Economy as a Calculus of Pleasure and Pain,

and have sketched out, almost irrespective of previous opinions, the form which the

science, as it seems to me, must ultimately take. I have long thought that as it deals

throughout with quantities, it must be a mathematical science in matter if not in

language. I have endeavoured to arrive at accurate quantitative notions concerning

Utility, Value, Labour, Capital, etc., and I have often been surprised to find how

clearly some of the most difficult notions, especially that most puzzling of notions

Value, admit of mathematical analysis and expression. The Theory of Economy thus

treated presents a close analogy to the science of Statical Mechanics, and the Laws of

Exchange are found to resemble the Laws of Equilibrium of a lever as determined by

the principle of virtual velocities. The nature of Wealth and Value is explained by the

Online Library of Liberty: The Theory of Political Economy

PLL v6.0 (generated September, 2011)

7

http://oll.libertyfund.org/title/625

consideration of indefinitely small amounts of pleasure and pain, just as the Theory of

Statics is made to rest upon the equality of indefinitely small amounts of energy. But I

believe that dynamical branches of the Science of Economy may remain to be

developed, on the consideration of which I have not at all entered.

Mathematical readers may perhaps think that I have explained some elementary

notions, that of the Degree of Utility for instance, with unnecessary prolixity. But it is

to the neglect of Economists to obtain clear and accurate notions of quantity and

degree of utility that I venture to attribute the present difficulties and imperfections of

the science; and I have purposely dwelt upon the point at full length. Other readers

will perhaps think that the occasional introduction of mathematical symbols obscures

instead of illustrating the subject. But I must request all readers to remember that, as

Mathematicians and Political Economists have hitherto been two nearly distinct

classes of persons, there is no slight difficulty in preparing a mathematical work on

Economy with which both classes of readers may not have some grounds of

complaint.

It is very likely that I have fallen into errors of more or less importance, which I shall

be glad to have pointed out; and I may say that the cardinal difficulty of the whole

theory is alluded to in the section of Chapter IV. upon the "Ratio of Exchange,"

beginning at p. 84 (p. 90 of this edition). So able a mathematician as my friend

Professor Barker, of Owens College, has had the kindness to examine some of the

proof sheets carefully; but he is not, therefore, to be held responsible for the

correctness of any part of the work.

My enumeration of the previous attempts to apply mathematical language to Political

Economy does not pretend to completeness even as regards English writers; and I find

that I forgot to mention a remarkable pamphlet "On Currency" published

anonymously in 1840 (London, Charles Knight and Co.) in which a mathematical

analysis of the operations of the Money Market is attempted. The method of treatment

is not unlike that adopted by Dr. Whewell, to whose Memoirs a reference is made; but

finite or occasionally infinitesimal differences are introduced. On the success of this

anonymous theory I have not formed an opinion; but the subject is one which must

some day be solved by mathematical analysis. Garnier, in his treatise on Political

Economy, mentions several continental mathematicians who have written on the

subject of Political Economy; but I have not been able to discover even the titles of

their Memoirs.

Online Library of Liberty: The Theory of Political Economy

PLL v6.0 (generated September, 2011)

8

http://oll.libertyfund.org/title/625

[Back to Table of Contents]

PREFACE TO THE SECOND EDITION

(1879)

IN preparing this second edition certain new sections have been added, the most

important of which are those treating of the dimensions of economic quantities (pp.

61-69, 83-84, 178-179, 232-234). The subject, of course, is one which lies at the basis

of all clear thought about economic science. It cannot be surprising that many debates

end in logomachy, when it is still uncertain how many meanings the word value has,

or what kind of a quantity utility itself is. Imagine the mental state of astronomers if

they could not agree among themselves whether Right Ascension was the name of a

heavenly body, or a force or an angular magnitude. Yet this would not be worse than

failing to ascertain clearly whether by value we mean a numerical ratio, or a mental

state, or a mass of commodity. John Stuart Mill tells us explicitly1 that "The value of

a thing means the quantity of some other thing, or of things in general, which it

exchanges for." It might of course be explained that Mill did not intend what he said;

but as the statement stands it makes value into a thing, and is just as philosophic as if

one were to say, "Right Ascension means the planet Mars, or planets in general."

These sections upon the dimensions of economic quantities have caused me great

perplexity, especially as regards the relation between utility and time (pp. 64-69). The

theory of capital and interest also involves some subtleties. I hope that my solutions of

the questions raised will be found generally correct; but where they do not settle a

question, they may sometimes suggest one which other writers may answer. A

correspondent, Captain Charles Christie, R.E., to whom I have shown these sections

after they were printed, objects reasonably enough that commodity should not have

been represented by M, or Mass, but by some symbol, for instance Q, which would

include quantity of space or time or force, in fact almost any kind of quantity.

Services often involve time, or force exerted, or space passed over, as well as mass. In

this objection I quite concur, and I must therefore request the reader either to interpret

M with a wider meaning than is given to it in p. 64, or else mentally to substitute

another symbol.

In treating the dimensions of interest, I point out the curious fact that so profound a

mathematician as the late Dean Peacock went quite astray upon the subject (pp.

249-252). Other new sections are those in which I introduce the idea of negative and

approximately zero value, showing that negative value may be brought under the

forms of the equations of exchange without any important modification. Readers of

Mr. Macleod's works are of course familiar with the idea of negative value; but it was

desirable for me to show how important it really is, and how naturally it falls in with

the principles of the theory. I may also draw attention to the section (pp. 102-106) in

which I illustrate the mathematical character of the equations of exchange by drawing

an exact analogy between them and the equations applying to the equilibrium of the

lever.

Two or three correspondents, especially Herr Harald Westergaard of Copenhagen,

have pointed out that a little manipulation of the symbols, in accordance with the

Online Library of Liberty: The Theory of Political Economy

PLL v6.0 (generated September, 2011)

9

http://oll.libertyfund.org/title/625

simple rules of the differential calculus, would often give results which I have

laboriously argued out. The whole question is one of maxima and minima, the

mathematical conditions of which are familiar to mathematicians. But, even if I were

capable of presenting the subject in the concise symbolic style satisfactory to the taste

of a practised mathematician, I should prefer in an essay of this kind to attain my

results by a course of argument which is not only fundamentally true, but is clear and

convincing to many readers who, like myself, are not skilful and professional

mathematicians. In short, I do not write for mathematicians, nor as a mathematician,

but as an economist wishing to convince other economists that their science can only

be satisfactorily treated on an explicitly mathematical basis. When mathematicians

recognise the subject as one with which they may usefully deal, I shall gladly resign it

into their hands. I have expressed a feeling in more than one place that the whole

theory might probably have been put in a more general form by treating labour as

negative utility, and thus bringing it under the ordinary equations of exchange. But the

fact is there is endless occupation for an economist in developing and improving his

science, and I have found it requisite to reissue this essay, as the bibliopoles say,

"with all faults." I have, however, carefully revised every page of the book, and have

reason to hope that little or no real error remains in the doctrines stated. The faults are

in the form rather than the matter.

Among minor alterations, I may mention the substitution for the name Political

Economy of the single convenient term Economics. I cannot help thinking that it

would be well to discard, as quickly as possible, the old troublesome double-worded

name of our Science. Several authors have tried to introduce totally new names, such

as Plutology, Chrematistics, Catallactics, etc. But why do we need anything better

than Economics? This term, besides being more familiar and closely related to the old

term, is perfectly analogous in form to Mathematics, Ethics, Æsthetics, and the names

of various other branches of knowledge, and it has moreover the authority of usage

from the time of Aristotle. Mr. Macleod is, so far as I know, the re-introducer of the

name in recent years, but it appears to have been adopted also by Mr. Alfred Marshall

at Cambridge. It is thus to be hoped that Economics will become the recognised name

of a science, which nearly a century ago was known to the French Economists as la

science économique. Though employing the new name in the text, it was obviously

undesirable to alter the title-page of the book.

When publishing a new edition of this work, eight years after its first appearance, it

seems natural that I should make some remarks upon the changes of opinion about

economic science which have taken place in the interval. A remarkable discussion has

been lately going on in the reviews and journals concerning the logical method of the

science, touching even the question whether there exists any such science at all.

Attention was drawn to the matter by Mr. T. E. Cliffe Leslie's remarkable article1 "On

the Philosophical Method of Political Economy," in which he endeavours to dissipate

altogether the deductive science of Ricardo. Mr. W. T. Thornton's writings have a

somewhat similar tendency. The question has been further stirred up by the admirable

criticism to which it was subjected in the masterly address of Professor J. K. Ingram,

at the last meeting of the British Association. This Address has been reprinted in

several publications1 in England, and has been translated into the chief languages of

Western Europe. It is evident, then, that a spirit of very active criticism is spreading,

Online Library of Liberty: The Theory of Political Economy

PLL v6.0 (generated September, 2011)

10

http://oll.libertyfund.org/title/625

which can hardly fail to overcome in the end the prestige of the false old doctrines.

But what is to be put in place of them? At the best it must be allowed that the fall of

the old orthodox creed will leave a chaos of diverse opinions. Many would be glad if

the supposed science collapsed altogether, and became a matter of history, like

astrology, alchemy, and the occult sciences generally. Mr. Cliffe Leslie would not go

quite so far as this, but would reconstruct the science in a purely inductive or

empirical manner. Either it would then be a congeries of miscellaneous disconnected

facts, or else it must fall in as one branch of Mr. Spencer's Sociology. In any case, I

hold that there must arise a science of the development of economic forms and

relations.

But as regards the fate of the deductive method, I disagree altogether with my friend

Mr. Leslie; he is in favour of simple deletion; I am for thorough reform and

reconstruction. As I have previously explained, 2 the present chaotic state of

Economics arises from the confusing together of several branches of knowledge.

Subdivision is the remedy. We must distinguish the empirical element from the

abstract theory, from the applied theory, and from the more detailed art of finance and

administration. Thus will arise various sciences, such as commercial statistics, the

mathematical theory of economics, systematic and descriptive economics, economic

sociology, and fiscal science. There may even be a kind of cross subdivision of the

sciences; that is to say, there will be division into branches as regards the subject, and

division according to the manner of treating the branch of the subject. The manner

may be theoretical, empirical, historical, or practical; the subject may be capital and

labour, currency, banking, taxation, land tenure, etc.—not to speak of the more

fundamental division of the science as it treats of consumption, production, exchange,

and distribution of wealth. In fact, the whole subject is so extensive, intricate, and

diverse, that it is absurd to suppose it can be treated in any single book or in any

single manner. It is no more one science than statics, dynamics, the theory of heat,

optics, magnetoelectricity, telegraphy, navigation, and photographic chemistry are one

science. But as all the physical sciences have their basis more or less obviously in the

general principles of mechanics, so all branches and divisions of economic science

must be pervaded by certain general principles. It is to the investigation of such

principles—to the tracing out of the mechanics of self-interest and utility, that this

essay has been devoted. The establishment of such a theory is a necessary preliminary

to any definitive drafting of the superstructure of the aggregate science.

Turning now to the theory itself, the question is not so much whether the theory given

in this volume is true, but whether there is really any novelty in it. The exclusive

importance attributed in England to the Ricardian School of Economists, has

prevented almost all English readers from learning the existence of a series of French,

as well as a few English, German, or Italian economists, who had from time to time

treated the science in a more or less strictly mathematical manner. In the first edition

(pp. 14-18), I gave a brief account of such writings of the kind as I was then

acquainted with; it is from the works there mentioned, if from any, that I derived the

idea of investigating Economics mathematically. To Lardner's Railway Economy I

was probably most indebted, having been well acquainted with that work since the

year 1857. Lardner's book has always struck me as containing a very able

investigation, the scientific value of which has not been sufficiently estimated; and in

Online Library of Liberty: The Theory of Political Economy

PLL v6.0 (generated September, 2011)

11

http://oll.libertyfund.org/title/625

chapter xiii. (pp. 286-296, etc.) we find the Laws of Supply and Demand treated

mathematically and illustrated graphically.

In the preface to the first edition (p. xi),1 I remarked that in his treatise on Political

Economy, M. Joseph Garnier mentioned several continental mathematicians who had

written on the subject of Economics, and I added that I had not been able to discover

even the titles of their memoirs. This, however, must have been the result of careless

reading or faulty memory, for it will be found that Garnier himself1 mentions the

titles of several books and memoirs. The fact is that, writing as I did then at a distance

from any large library, I made no attempt to acquaint myself with the literature of the

subject, little thinking that it was so copious and in some cases so excellent as is now

found to be the case. With the progress of years, however, my knowledge of the

literature of political economy has been much widened, and the hints of friends and

correspondents have made me aware of the existence of many remarkable works

which more or less anticipate the views stated in this book. While preparing this new

edition, it occurred to me to attempt the discovery of all existing writings of the kind.

With this view I drew up a chronological list of all the mathematico-economic works

known to me, already about seventy in number, which list, by the kindness of the

editor, Mr. Giffen, was printed in the Journal of the London Statistical Society for

June 1878 (vol. xli. pp. 398-401), separate copies being forwarded to the leading

economists, with a request for additions and corrections. My friend, M. Léon Walras,

Rector of the Academy of Lausanne, after himself making considerable additions to

the list, communicated it to the Journal des Économistes (December 1878), to the

editor of which we are much indebted for its publication. Copies of the list were also

sent to German and Italian economical journals. For the completion of the

bibliographical list I am under obligations to Professor W. B. Hodgson, Professor

Adamson, Mr. W. H. Brewer, M.A., H.M. Inspector of Schools, the Baron d'Aulnis de

Bourouill, Professor of Political Economy at Utrecht, M. N. G. Pierson of

Amsterdam, M. Vissering of Leiden, Professor Luigi Cossa of Pavia, and others.

All reasonable exertions have thus been made to render complete and exhaustive the

list of mathematico-economic works and papers, which is now printed in the first

Appendix to this book (pp. 277-291). It is hardly likely that many additions can be

made to the earlier parts of the lists, but I shall be much obliged to any readers who

can suggest corrections or additions. I shall also be glad to be informed of any new

publications suitable for insertion in the list. On the other hand, it is possible that

some of the books mentioned in the list ought not to be there. I have not been able in

all cases to examine the publications myself, so that some works inserted at the

suggestion of correspondents may have been named under misconception of the

precise purpose of the list. Economic works, for instance, containing numerical

illustrations and statistical facts numerically expressed, however abundantly, have not

been intentionally included, unless there was also mathematical method in the

reasoning. Without this condition the whole literature of numerical commercial

statistics would have been imported into my list. In other cases only a small portion of

a book named can be called mathematico-economic; but this fact is generally noted by

the quotation of the chapters or pages in question. The tendency, however, has been to

include rather than to exclude, so that the reader might have before him the whole

field of literature requiring investigation.

Online Library of Liberty: The Theory of Political Economy

PLL v6.0 (generated September, 2011)

12

http://oll.libertyfund.org/title/625

To avoid misapprehension it may be well to explain that the ground for inserting any

publication or part of a publication in this list, is its containing an explicit recognition

of the mathematical character of economics, or the advantage to be attained by its

symbolical treatment. I contend that all economic writers must be mathematical so far

as they are scientific at all, because they treat of economic quantities, and the relations

of such quantities, and all quantities and relations of quantities come within the scope

of the mathematics. Even those who have most strongly and clearly protested against

the recognition of their own method, continually betray in their language the

quantitative character of their reasonings. What, for instance, can be more clearly

mathematical in matter than the following quotation from Cairnes's chief work:1

—"We can have no difficulty in seeing how cost in its principal elements is to be

computed. In the case of labour, the cost of producing a given commodity will be

represented by the number of average labourers employed in its production—regard at

the same time being had to the severity of the work and the degree of risk it

involves—multiplied by the duration of their labours. In that of abstinence, the

principle is analogous: the sacrifice will be measured by the quantity of wealth

abstained from, taken in connection with the risk incurred, and multiplied by the

duration of the abstinence." Here we deal with computation, multiplication, degree of

severity, degree of risk, quantity of wealth, duration, etc., all essentially mathematical

things, ideas, or operations. Although my esteemed friend and predecessor has in his

preliminary chapter expressly abjured my doctrines, he has unconsciously adopted the

mathematical method in all but appearance.

We might easily go further back, and discover that even the father of the science, as

he is often considered, is thoroughly mathematical. In the fifth chapter of the First

Book of the Wealth of Nations, for instance, we find Adam Smith continually arguing

about "quantities of labour," "measures of value," "measures of hardship,"

"proportion," "equality," etc.; the whole of the ideas in fact are mathematical. The

same might be said of almost any other passages from the scientific parts of the

treatise, as distinguished from the historical parts. In the first chapter of the Second

Book (29th paragraph), we read—"The produce of land, mines, and fisheries, when

their natural fertility is equal, is in proportion to the extent and proper application of

the capitals employed about them. When the capitals are equal, and equally well

applied, it is in proportion to their natural fertility." Now every use of the word equal

or equality implies the existence of a mathematical equation; an equation is simply an

equality; and every use of the word proportion implies a ratio expressible in the form

of an equation.

I hold, then, that to argue mathematically, whether correctly or incorrectly, constitutes

no real differentia as regards writers on the theory of economics. But it is one thing to

argue and another thing to understand and to recognise explicitly the method of the

argument. As there are so many who talk prose without knowing it, or, again, who

syllogise without having the least idea what a syllogism is, so economists have long

been mathematicians without being aware of the fact. The unfortunate result is that

they have generally been bad mathematicians, and their works must fall. Hence the

explicit recognition of the mathematical character of the science was an almost

necessary condition of any real improvement of the theory. It does not follow, of

course, that to be explicitly mathematical is to ensure the attainment of truth, and in

Online Library of Liberty: The Theory of Political Economy

PLL v6.0 (generated September, 2011)

13

http://oll.libertyfund.org/title/625

such writings as those of Canard and Whewell, we find plenty of symbols and

equations with no result of value, owing to the fact that they simply translated into

symbols the doctrines obtained, and erroneously obtained, without their use. Such

writers misunderstood and inverted altogether the function of mathematical symbols,

which is to guide our thoughts in the slippery and complicated processes of reasoning.

Ordinary language can usually express the first axioms of a science, and often also the

matured results; but only in the most lame, obscure, and tedious way can it lead us

through the mazes of inference.

The bibliographical list, of which I am speaking, is no doubt a very heterogeneous

one, and may readily be decomposed into several distinct classes of economical

works. In a first class may be placed the writings of those economists who have not at

all attempted mathematical treatment in an express or systematic manner, but who

have only incidentally acknowledged its value by introducing symbolic or graphical

statements. Among such writers may be mentioned especially Rau (1868), Hagen

(1844), J. S. Mill (1848), and Courcelle-Seneuil (1867). Many readers may be

surprised to hear that John Stuart Mill has used mathematical symbols; but, on turning

to Book III., chapters xvii. and xviii., of the Principles of Political Economy, those

difficult and tedious chapters in which Mill leads the reader through the Theory of

International Trade and International Values, by means of yards of linen and cloth, the

reader will find that Mill at last yields, and expresses himself concisely and clearly1

by means of equations between m,n,p, and q. His mathematics are very crude; still

there is some approach to a correct mathematical treatment, and the result is that these

chapters, however tedious and difficult, will probably be found the truest and most

enduring parts of the whole treatise.

A second class of economists contains those who have abundantly employed

mathematical apparatus, but, misunderstanding its true use, or being otherwise

diverted from a true theory, have built upon the sand. Misfortunes of this kind are not

confined to the science of economics, and in the most exact branches of physical

science, such as mechanics, molecular physics, astronomy, etc., it would be possible

to adduce almost innumerable mathematical treatises, which must be pronounced

nonsense. In the same category must be placed the mathematical writings of such

economists as Canard (1801), Whewell (1829, 1831, and 1850), Esmenard du Mazet

(1849 and 1851), and perhaps Du Mesnil-Marigny (1860).

The third class forms an antithesis with the second, for it contains those authors who,

without any parade of mathematical language or method, have nevertheless carefully

attempted to reach precision in their treatment of quantitative ideas, and have thus

been led to a more or less complete comprehension of the true theory of utility and

wealth. Among such writers Francis Hutcheson, the Irish founder of the great Scotch

School, and the predecessor of Adam Smith at Glasgow, probably stands first. His

employment of mathematical symbols1 seems rather crude and premature, but the

precision of his ideas about the estimation of quantities of good and evil is beyond

praise. He thoroughly anticipates the foundations of Bentham's moral system,

showing that the Moment of Good or Evil is, in a compound proportion of the

Duration and Intenseness, affected also by the Hazard or uncertainty of our

existence.1 As to Bentham's ideas, they are adopted as the starting-point of the theory

Online Library of Liberty: The Theory of Political Economy

PLL v6.0 (generated September, 2011)

14

http://oll.libertyfund.org/title/625

given in this work, and are quoted at the beginning of chapter ii. (pp. 28, 29).

Bentham has repeated his statement as to the mode of measuring happiness in several

different works and pamphlets, as for instance in that remarkable one called "A Table

of the Springs of Action" (London, 1817, p. 3); and also in the "Codification Proposal,

addressed by Jeremy Bentham to all Nations professing Liberal Opinions" (London,

1822, pp. 7-11). He here speaks explicitly of the application of arithmetic to questions

of utility, meaning no doubt the application of mathematical methods. He even

describes (p. 11) the four circumstances governing the value of a pleasure or pain as

the dimensions of its value, though he is incorrect in treating propinquity and certainty

as dimensions.

It is worthy of notice that Destutt de Tracy, one of the most philosophic of all

economists, has in a few words recognised the true method of treatment, though he

has not followed up his own idea. Referring to the circumstances which, in his

opinion, render all economic and moral calculations very delicate, he says,1 "On ne

peut guère employer dans ces matières que des considérations tirées de la théorie des

limites." So well known an English economist as Malthus has also shown in a few

lines his complete appreciation of the mathematical nature of economic questions. In

one of his excellent pamphlets2 he remarks, "Many of the questions, both in morals

and politics, seem to be of the nature of the problems de maximis et minimis in

Fluxions; in which there is always a point where a certain effect is the greatest, while

on either side of this point it gradually diminishes." But I have not thought it desirable

to swell the bibliographical list by including all the works in which there are to be

found brief or casual remarks of the kind.

I may here remark that all the writings of Mr. Henry Dunning Macleod exhibit a

strong tendency to mathematical treatment. Some of his works or papers in which this

mathematical spirit is most strongly manifested have been placed in the list. It is not

my business to criticise his ingenious views, or to determine how far he really has

created a mathematical system. While I certainly differ from him on many important

points, I am bound to acknowledge the assistance which I derive from the use of

several of his works.

In the fourth and most important class of mathematico-economic writers must be

placed those who have consciously and avowedly attempted to frame a mathematical

theory of the subject, and have, if my judgment is correct, succeeded in reaching a

true view of the Science. In this class certain distinguished French philosophers take

precedence and priority. One might perhaps go back with propriety to Condillac's

work, Le Commerce et le Gouvernement, first published in the year 1776, the same

year in which the Wealth of Nations appeared. In the first few chapters of this

charming philosophic work we meet perhaps the earliest distinct statement of the true

connection between value and utility. The book, however, is not included in the list

because there is no explicit attempt at mathematical treatment. It is the French

engineer Dupuit who must probably be credited with the earliest perfect

comprehension of the theory of utility. In attempting to frame a precise measure of the

utility of public works, he observed that the utility of a commodity not only varies

immensely from one individual to another, but that it is also widely different for the

same person according to circumstances. He says, "nous verrions que l'utilité du

Online Library of Liberty: The Theory of Political Economy

PLL v6.0 (generated September, 2011)

15

http://oll.libertyfund.org/title/625

morceau de pain peut croitre pour le meme individu depuis zéro jusqu'au chiffre de sa

fortune entière" (1849, Dupuit, De l'influence des Péages, etc., p. 185). He

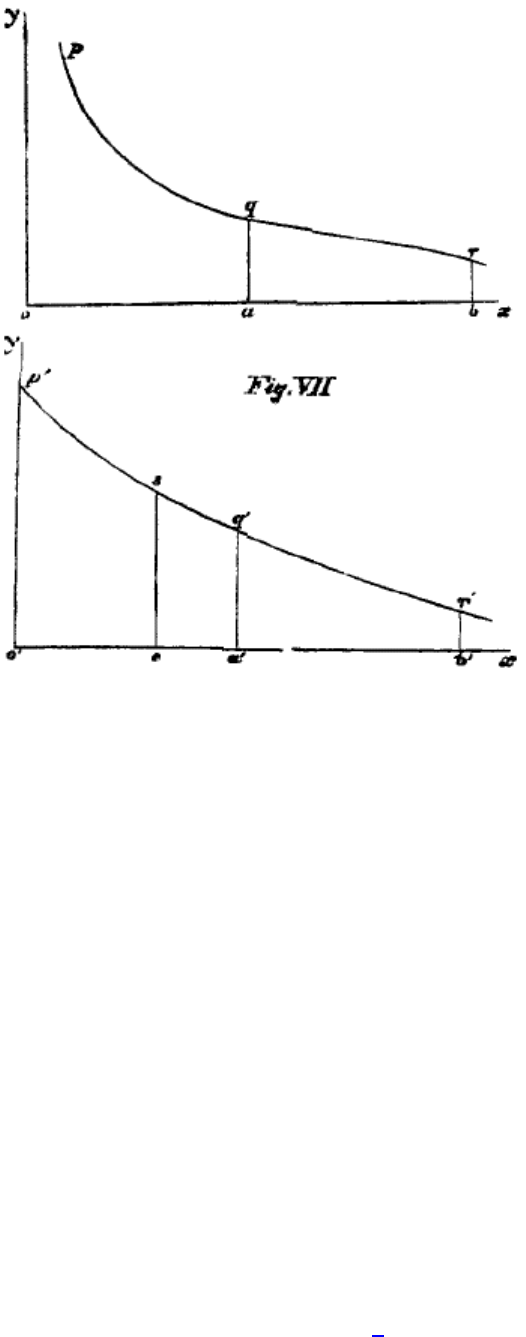

establishes, in fact, a theory of the gradation of utility, beautifully and perfectly

expounded by means of geometrical diagrams, and this theory is undoubtedly

coincident in essence with that contained in this book. He does not, however, follow

his ideas out in an algebraic form. Dupuit's theory was the subject of some

controversy in the pages of the Annales des Ponts et Chaussées, but did not receive

much attention elsewhere, and I am not aware that any English economist ever knew

anything about these remarkable memoirs.

The earlier treatise of Cournot, his admirable Recherches sur les Principes

Mathématiques de la Théorie des Richesses (Paris, 1838), resembles Dupuit's

memoirs in being, until within the last few years, quite unknown to English

economists. In other respects Cournot's method is contrasted to Dupuit's. Cournot did

not frame any ultimate theory of the ground and nature of utility and value, but, taking

the palpable facts known concerning the relations of price, production and

consumption of commodities, he investigated these relations analytically and

diagraphically with a power and felicity which leaves little to be desired. This work

must occupy a remarkable position in the history of the subject. It is strange that it

should have remained for me among Englishmen to discover its value. Some years

since (1875) Mr. Todhunter wrote to me as follows: "I have sometimes wondered

whether there is anything of importance in a book published many years since. by M.

A. A. Cournot, entitled Recherches sur les Principes Mathématiques de la Théorie

des Richesses. I never saw it, and when I have mentioned the title, I never found any

person who had read the book. Yet Cournot was eminent for mathematics and

metaphysics, and so there may be some merit in this book." I procured a copy of the

work as far back as 1872, but have only recently studied it with sufficient care to form

any definite opinion upon its value. Even now I have by no means mastered all parts

of it, my mathematical power being insufficient to enable me to follow Cournot in all

parts of his analysis. My impression is that the first chapter of the work is not

remarkable; that the second chapter contains an important anticipation of discussions

concerning the proper method of treating prices, including an anticipation (p. 21) of

my logarithmic method of ascertaining variations in the value of gold; that the third

chapter, treating of the conditions of the foreign exchanges, is highly ingenious if not

particularly useful; but that by far the most important part of the book commences

with the fourth chapter upon the "Loi du débit." The remainder of the book, in fact,

contains a wonderful analysis of the laws of supply and demand, and of the relations

of prices, production, consumption, expenses and profits. Cournot starts from the

assumption that the débit or demand for a commodity is a function of the price, or D =

F (p); and then, after laying down empirically a few conditions of this function, he

proceeds to work out with surprising power the consequences which follow from

those conditions. Even apart from its economic importance, this investigation, so far

as I can venture to judge it, presents a beautiful example of mathematical reasoning,

in which knowledge is apparently evolved out of ignorance. In reality the method

consists in assuming certain simple conditions of the functions as conformable to

experience, and then disclosing by symbolic inference the implicit results of these

conditions. But I am quite convinced that the investigation is of high economic

importance, and that, when the parts of political economy to which the theory relates

Online Library of Liberty: The Theory of Political Economy

PLL v6.0 (generated September, 2011)

16

http://oll.libertyfund.org/title/625

come to be adequately treated, as they never have yet been, the treatment must be

based upon the analysis of Cournot, or at least must follow his general method. It

should be added that his investigation has little relation to the contents of this work,

because Cournot does not recede to any theory of utility, but commences with the

phenomenal laws of supply and demand.

Discouraged apparently by the small amount of attention paid to his mathematical

treatise, Cournot in a later year (1863) produced a more popular non-symbolic work

on Economics; but this later work does not compare favourably in interest and

importance with his first treatise.

English economists can hardly be blamed for their ignorance of Cournot's economic

works when we find French writers equally bad. Thus the authors of Guillaumin's

excellent Dictionnaire de l'EconomiePolitique, which is on the whole the best work of

reference in the literature of the science, ignore Cournot and his works altogether, and

so likewise does Sandelin in his copious Répertoire Général d'Economie Politique.

M. Joseph Garnier in his otherwise admirable text-book1 mixes up Cournot with far

inferior mathematicians, saying: "Dans ces derniers temps M. Esmenard du Mazet, et

M. du Mesnil-Marigny ont aussi fait abus, ce nous semble, des formules algébriques;

les Recherches sur les Principes Mathématiques des Richesses de M. Cournot, ne

nous ont fourni aucun moyen d'élucidation." Mac-Culloch of course knows nothing of

Cournot. Mr. H. D. Macleod has the merit at least of mentioning Cournot's work, but

he misspells the name of the author, and gives only the title of the book, which he had

probably never seen.

We now come to a truly remarkable discovery in the history of this branch of

literature. Some years since my friend Professor Adamson had noticed in one of

Kautz's works on Political Economy2 a brief reference to a book said to contain a

theory of pleasure and pain, written by a German author named Hermann Heinrich

Gossen. Although he had advertised for it, Professor Adamson was unable to obtain a

sight of this book until August 1878, when he fortunately discovered it in a German

bookseller's catalogue, and succeeded in purchasing it. The book was published at

Brunswick in 1854; it consists of 278 well-filled pages, and is entitled, Entwickelung

der Gesetze des menschlichen Verkehrs, und der daraus fliessenden Regeln für

menschliches Handeln, which may be translated—"Development of the laws of

human Commerce, and of the consequent Rules of Human Action." I will describe the

contents of this remarkable volume as they are reported to me by Professor Adamson.

Gossen evidently held the highest possible opinion of the importance of his own

theory, for he commences by claiming honours in economic science equal to those of

Copernicus in astronomy. He then at once insists that mathematical treatment, being

the only sound one, must be applied throughout; but, out of consideration for the

reader, the higher analysis will be explicitly introduced only when it is requisite to

determine maxima and minima. The treatise then opens with the consideration of

Economics as the theory of pleasure and pain, that is as the theory of the procedure by

which the individual and the aggregate of individuals constituting society, may realise

the maximum of pleasure with the minimum of painful effort. The natural law of

pleasure is then clearly stated, somewhat as follows: Increase of the same kind of

Online Library of Liberty: The Theory of Political Economy

PLL v6.0 (generated September, 2011)

17

http://oll.libertyfund.org/title/625

consumption yields pleasure continuously diminishing up to the point of satiety. This

law he illustrates geometrically, and then proceeds to investigate the conditions under

which the total pleasure from one or more objects may be raised to a maximum.

The term Werth is next introduced, which may, Professor Adamson thinks, be

rendered with strict accuracy as utility, and Gossen points out that the quantity of

utility, material or immaterial, is measured by the quantity of pleasure which it

affords. He classifies useful objects as: (1) those which possess pleasure-giving

powers in themselves; (2) those which only possess such powers when in combination

with other objects; (3) those which only serve as means towards the production of

pleasure-giving objects. He is careful to point out that there is no such thing as

absolute utility, utility being purely a relation between a thing and a person. He next

proceeds to give the derivative laws of utility somewhat in the following

manner:—That separate portions of the same pleasure-giving object have very

different degrees of utility, and that in general for each person only a limited number

of such portions has utility; any addition beyond this limit is useless, but the point of

uselessness is only reached after the utility has gone through all the stages or degrees

of intensity. Hence he draws the practical conclusion that each person should so

distribute his resources as to render the final increments of each pleasure-giving

commodity of equal utility for him.

In the next place Gossen deals with labour, starting from the proposition that the

utility of any product must be estimated after deduction of the pains of labour required

to produce it. He describes the variation of the pain of labour much as I have done,

exhibiting it graphically, and inferring that we must carry on labour to the point at

which the utility of the product equals the pain of production. In treating the theory of

exchange he shows how barter gives rise to an immense increase of utility, and he

infers that exchange will proceed up to the point at which the utilities of the portions

next to be given and received are equal. A complicated geometrical representation of

the theory of exchange is given. The theory of rent is investigated in a most general

manner, and the work concludes with somewhat vague social speculations, which, in

Professor Adamson's opinion, are of inferior merit compared with the earlier portions

of the treatise.

From this statement it is quite apparent that Gossen has completely anticipated me as

regards the general principles and method of the theory of Economics. So far as I can

gather, his treatment of the fundamental theory is even more general and thorough

than what I was able to scheme out. In discussing the book, I lie under the serious

difficulty of not being able to read it; but, judging from what Professor Adamson has

written or read to me, and from an examination of the diagrams and symbolic parts of

the work, I should infer that Gossen has been unfortunate in the development of his

theory. Instead of dealing, as Cournot and myself have done, with undetermined

functions, and introducing the least possible amount of assumption, Gossen assumed,

for the sake of simplicity, that economic functions follow a linear law, so that his

curves of utility are generally taken as straight lines. This assumption enables him to

work out a great quantity of precise formulas and tabular results, which fill many

pages of the book. But, inasmuch as the functions of economic science are seldom or

never really linear, and usually diverge very far from the straight line, I think that the

Online Library of Liberty: The Theory of Political Economy

PLL v6.0 (generated September, 2011)

18

http://oll.libertyfund.org/title/625

symbolic and geometric illustrations and developments introduced by Gossen must

for the most part be put down among the many products of misplaced in-genuity. I

may add, in my own behalf, that he does not seem really to reach the equations of

exchange as established in this book; that the theory of capital and interest is wanting;

and that there is a total absence of any resemblance between the working out of the

matter, except such as arises from a common basis of truth.

The coincidence, however, between the essential ideas of Gossen's system and my

own is so striking, that I desire to state distinctly, in the first place, that I never saw

nor so much as heard any hint of the existence of Gossen's book before August 1878,

and to explain, in the second place, how it was that I did not do so. My unfortunate

want of linguistic power has prevented me, in spite of many attempts, from ever

becoming familiar enough with German to read a German book. I once managed to

spell out with assistance part of the logical lecture notes of Kant; but that is my sole

achievement in German literature. Now this work of Gossen has remained unknown

even to most of the great readers of Germany. Professor Adamson remarks that the

work seems to have attracted no attention in Germany. The eminent and learned

economist of Amsterdam, Professor N. G. Pierson, writes to me: "Gossen's book is

totally unknown to me. Roscher does not mention it in his very laborious History of

Political Economy in Germany. I never saw it quoted; but I will try to get it. It is very

curious that such a remarkable work has remained totally unknown even to a man like

Professor Roscher, who has read everything." Mr. Cliffe Leslie, also, who has made

the German Economists his special study, informs me that he was quite unaware of

the existence of the book.1 Under such circumstances it would have been far more

probable that I should discover the theory of pleasure and pain, than that I should

discover Gossen's book, and I have carefully pointed out, both in the first edition and

in this, certain passages of Bentham, Senior, Jennings, and other authors, from which

my system was, more or less consciously, developed. I cannot claim to be totally

indifferent to the rights of priority; and from the year 1862, when my theory was first

published in brief outline, I have often pleased myself with the thought that it was at

once a novel and an important theory. From what I have now stated in this preface it

is evident that novelty can no longer be attributed to the leading features of the theory.

Much is clearly due to Dupuit, and of the rest a great share must be assigned to

Gossen. Regret may easily be swallowed up in satisfaction if I succeed eventually in

making that understood and valued which has been so sadly neglected.

Almost nothing is known to me concerning Gossen; it is uncertain whether he is

living or not. On the title-page he describes himself as Königlich preussischem

Regierungs - Assessor ausser Dienst, which may be translated "Royal Prussian

Government Assessor, retired;" but the tone of his remarks here and there seems to

indicate that he was a disappointed if not an injured man. The reception of his one

work can have lent no relief to these feelings; rather it must much have deepened

them. The book seems to have contained his one cherished theory; for I can find under

the name of Gossen no trace of any other publication or scientific memoir whatever.

The history of these forgotten works is, indeed, a strange and discouraging one; but

the day must come when the eyes of those who cannot see will be opened. Then will

due honour be given to all who like Cournot and Gossen have laboured in a thankless

field of human knowledge, and have met with the neglect or ridicule they might well

Online Library of Liberty: The Theory of Political Economy

PLL v6.0 (generated September, 2011)

19

http://oll.libertyfund.org/title/625

have expected. Not indeed that such men do really work for the sake of honour; they

bring forth a theory as the tree brings forth its fruit.

It remains for me to refer to the mathematico-economic writings of M. Léon Walras,

the Rector of the Academy of Lausanne. It is curious that Lausanne, already

distinguished by the early work of Isnard (1781), should recently have furnished such

important additions to the science as the Memoirs of Walras. For important they are,

not only because they complete and prove that which was before published elsewhere

in the works described above, but because they contain a third or fourth independent

discovery of the principles of the theory. If we are to trace out "the filiation of ideas"

by which M. Walras was led to his theory, we should naturally look back to the work

of his father, Auguste Walras, published at Paris in 1831, and entitled De la Nature de

la Richesse, et de l'origine de la Valeur. In this work we find, it is true, no distinct

recognition of the mathematical method, but the analysis of value is often acute and

philosophic. The principal point of the work moreover is true, that value depends

upon rarity—"La valeur," says Auguste Walras, "dérive de la rareté." Now it is

precisely upon this idea of the degree of rarity of commodities that Léon Walras bases

his system. The fact that some four or more independent writers such as Dupuit,

Gossen, Walras, and myself, should in such different ways have reached substantially

the same views of the fundamental ideas of economic science, cannot but lend great

probability, not to say approximate certainty, to those views. I am glad to hear that M.

Walras intends to bring out a new edition of his Mathematico-Economic Memoirs, to

which the attention of my readers is invited. The titles of his publications will be

found in the Appendix I.

The works of Von Thünen and of several other German economists contain

mathematical investigations of much interest and importance. A considerable number

of such works will be found noted in the list, which, however, is especially defective

as regards German literature. I regret that I am not able to treat this branch of the

subject in an adequate manner.

My bibliographical list shows that in recent years, that is to say since the year 1873,

there has been a great increase in the number of mathematico-economic writings. The

names of Fontaneau, Walras, Avigdor, Lefèvre, Petersen, Boccardo, recur time after

time. In such periodicals as the Journal des Actuaires Français, or the National -

Oekonomisk Tidsskrift—a journal so creditable to the energy and talent of the Danish

Economic School—the mathematical theory of Economics is treated as one of

established interest and truth, with which readers would naturally be acquainted. In

England we have absolutely no periodical in which such discussions could be

conducted. The reader will not fail to remark that it is into the hands of French,

Italian, Danish, or Dutch writers that this most important subject is rapidly passing.

They will develop that science which only excites ridicule and incredulity among the

followers of Mill and Ricardo. There are just a few English mathematicians, such as

Fleeming Jenkin, George Darwin, Alfred Marshall, or H. D. Macleod, and one or two

Americans like Professor Simon Newcomb, who venture to write upon the obnoxious

subject of mathematico-economic science. I ought to add, however, that at Cambridge

(England) the mathematical treatment of Economics is becoming gradually

recognised owing to the former influence of Mr. Alfred Marshall, now the principal of

Online Library of Liberty: The Theory of Political Economy

PLL v6.0 (generated September, 2011)

20

http://oll.libertyfund.org/title/625

University College, Bristol, whose ingenious mathematico - economic problems,

expounded more geometrico, have just been privately printed at Cambridge.

If we overlook Hutcheson, who did not expressly write on Economics, the earliest

mathematico - economic author seems to be the Italian Ceva, whose works have just

been brought to notice in the Giornale degli Economisti (see 1878, Nicolini). Ceva

wrote in the early part of the eighteenth century, but I have as yet no further

information about him. The next author in the list is the celebrated Beccaria, who

printed a very small, but distinctly mathematical, tract on Taxation as early as 1765.

Italians were thus first in the field. The earliest English work of the kind yet

discovered is an anonymous Essay on the Theory of Money, published in London in

1771, five years before the era of the Wealth of Nations. Though crude and absurd in

some parts, it is not devoid of interest and ability, and contains a distinct and partially

valid attempt to establish a mathematical theory of currency. This remarkable Essay

is, so far as I know, wholly forgotten and almost lost in England. Neither MacCulloch

nor any other English economist known to me, mentions the work. I discovered its

existence a few months ago by accidentally finding a copy on a bookseller's stall. But

it shames an Englishman to learn that English works thus unknown in their own

country are known abroad, and I owe to Professor Luigi Cossa, of the University of

Pavia, the information that the Essay was written by Major-General Henry Lloyd, an

author of some merit in other branches of literature. Signor Cossa's excellent Guido

alla Studio di Economia Politica, a concise but judiciously written text-book, is well

qualified to open our eyes as to the insular narrowness of our economic learning. It is

a book of a kind much needed by our students of Economics, and I wish that it could

be published in an English dress.

From this bibliographical survey emerges the wholly unexpected result, that the

mathematical treatment of Economics is coeval with the science itself. The notion that

there is any novelty or originality in the application of mathematical methods or

symbols must be dismissed altogether. While there have been political economists

there has always been a certain number who with various success have struck into the

unpopular but right path. The unfortunate and discouraging aspect of the matter is the

complete oblivion into which this part of the literature of Economics has always

fallen, oblivion so complete that each mathematico-economic writer has been obliged

to begin almost de novo. It is with the purpose of preventing for the future as far as I

can such ignorance of previous exertions, that I have spent so much pains upon this

list of books.

I should add that in arranging the list I have followed, very imperfectly, the excellent

example set by Professor Mansfield Merriman, of the Sheffield Scientific School of

Yale College, in his "List of Writings relating to the Method of Least Squares."1 Such

bibliographies are of immense utility, and I hope that the time is nearly come when

each student of a special branch of science or literature will feel bound to work out its

bibliography, unless, of course, the task shall have been already accomplished. The

reader will see that, in Appendix II., I have taken the liberty of working out also a part

of the bibliography of my own writings.

Online Library of Liberty: The Theory of Political Economy

PLL v6.0 (generated September, 2011)

21

http://oll.libertyfund.org/title/625

Looking now to the eventual results of the theory, I must beg the reader to bear in

mind that this book was never put forward as containing a systematic view of

Economics. It treats only of the theory, and is but an elementary sketch of elementary

principles. The working out of a complete system based on these lines must be a

matter of time and labour, and I know not when, if ever, I shall be able to attempt it.

In the last chapter, I have, however, indicated the manner in which the theory of

wages will be affected. This chapter is reprinted almost as it was written in 1871;

since then the wage-fund theory has been abandoned by most English Economists,

owing to the attacks of Mr. Cliffe Leslie, Mr. Shadwell, Professor Cairnes, Professor

Francis Walker, and some others. Quite recently more extensive reading and more

careful cogitation have led to a certain change in my ideas concerning the

superstructure of Economics—in this wise:

Firstly, I am convinced that the doctrine of wages, which I adopted in 1871, under the

impression that it was somewhat novel, is not really novel at all, except to those

whose view is bounded by the maze of the Ricardian Economics. The true doctrine

may be more or less clearly traced through the writings of a succession of great

French Economists, from Condillac, Baudeau, and Le Trosne, through J.-B. Say,

Destutt de Tracy, Storch, and others, down to Bastiat and Courcelle-Seneuil. The

conclusion to which I am ever more clearly coming is that the only hope of attaining a

true system of Economics is to fling aside, once and for ever, the mazy and

preposterous assumptions of the Ricardian School. Our English Economists have been

living in a fool's paradise. The truth is with the French School, and the sooner we

recognise the fact, the better it will be for all the world, except perhaps the few writers

who are too far committed to the old erroneous doctrines to allow of renunciation.

Although, as I have said, the true theory of wages is not new as regards the French

School, it is new, or at any rate renewed, as regards our English Schools of

Economics. One of the first to treat the subject from the right point of view was Mr.

Cliffe Leslie, in an article first published in Fraser's Magazine for July 1868, and

subsequently reprinted in a collection of Essays.1 Some years afterwards Mr. J. L.

Shadwell independently worked out the same theory of wages which he has fully

expounded in his admirable System of Political Economy.2 In Hearn's Plutology,

however, as pointed out in the text of this book (pp. 271 - 273), we find the same

general idea that wages are the share of the produce which the laws of supply and

demand enable the labourer to secure. It is probable that like ideas might be traced in

other works were this the place to attempt a history of the subject.

Secondly, I feel sure that when, casting ourselves free from the Wage-Fund Theory,

The Cost of Production doctrine of Value, the Natural Rate of Wages, and other

misleading or false Ricardian doctrines, we begin to trace out clearly and simply the

results of a correct theory, it will not be difficult to arrive at a true doctrine of wages.

This will probably be reached somewhat in the following way:—We must regard

labour, land, knowledge, and capital as conjoint conditions of the whole produce, not

as causes each of a certain portion of the produce. Thus in an elementary state of

society, when each labourer owns all the three or four requisites of production, there

would really be no such thing as wages, rent, or interest at all. Distribution does not

arise even in idea, and the produce is simply the aggregate effect of the aggregate

Online Library of Liberty: The Theory of Political Economy

PLL v6.0 (generated September, 2011)

22

http://oll.libertyfund.org/title/625

conditions. It is only when separate owners of the elements of production join their

properties, and traffic with each other, that distribution begins, and then it is entirely

subject to the principles of value and the laws of supply and demand. Each labourer

must be regarded, like each landowner and each capitalist, as bringing into the

common stock one part of the component elements, bargaining for the best share of

the produce which the conditions of the market allow him to claim successfully. In

theory the labourer has a monopoly of labour of each particular kind, as much as the

landowner of land, and the capitalist of other requisite articles. Property is only

another name for monopoly. But when different persons own property of exactly the

same kind, they become subject to the important Law of Indifference, as I have called

it (pp. 90-93), namely, that in the same open market, at any one moment, there cannot

be two prices for the same kind of article. Thus monopoly is limited by competition,

and no owner, whether of labour, land, or capital, can, theoretically speaking, obtain a

larger share of produce for it than what other owners of exactly the same kind of

property are willing to accept.

So far there may seem to be nothing novel in this view; it is hardly more than will be

found stated in a good many economic works. But as soon as we begin to follow out

this simple view, the consequences are rather startling. We are forced, for instance, to

admit that rates of wages are governed by the same formal laws as rents. This view is

not new to the readers of Storch, who in the third book of his excellent Cours

d'Economie Politique has a chapter1 "De la Rente des talens et des qualités morales."

But it is a very new doctrine to one whose economic horizon is formed by Mill and

Faweett, Ricardo and Adam Smith. Even Storch has not followed out the doctrine

thoroughly; for he applies the idea of rent only to cases of eminent talent. It must be

evident, however, that talent and capacity of all kinds are only a question of degree, so

that, according to the Law of Continuity, the same principle must apply to all

labourers.

A still more startling result is that, so far as cost of production regulates the values of

commodities, wages must enter into the calculation on exactly the same footing as

rent. Now it is a prime point of the Ricardian doctrines that rent does not enter into

cost of production. As J. S. Mill says,2 "Rent, therefore, forms no part of the cost of

production which determines the value of agricultural produce." And again,1 "Rent is

not an element in the cost of production of the commodity which yields it; except in

the cases," etc. Rent in fact is represented as the effect not the cause of high value;

wages on the contrary are treated as the cause, not the effect. But if rent and wages be

really phenomena subject to the same formal laws, this opposite relation to value must

involve error. The way out of the difficulty is furnished by the second sentence of the

paragraph from which the last quotation was taken. Mill goes on to say: "But when

land capable of yielding rent in agriculture is applied to some other purpose, the rent

which it would have yielded is an element in the cost of production of the commodity

which it is employed to produce." Here Mill edges in as an exceptional case that

which proves to be the rule, reminding one of other exceptional cases described as

"Some peculiar cases of value" (see p. 197 below), which I have shown to include

almost all commodities.

Online Library of Liberty: The Theory of Political Economy

PLL v6.0 (generated September, 2011)

23

http://oll.libertyfund.org/title/625

Now Mill allows that when land capable of yielding rent in agriculture is applied to

some other purpose, the rent which would have been produced in agriculture is an

element in the cost of production of other commodities. But wherefore this distinction

between agriculture and other branches of industry? Why does not the same principle

apply between two different modes of agricultural employment? If land which has

been yielding £2 per acre rent as pasture be ploughed up and used for raising wheat,

must not the £2 per acre be debited against the expenses of the production of wheat?

Suppose that somebody introduced the beetroot culture into England with a view to

making sugar; this new branch of industry could not be said to pay unless it yielded,

besides all other expenses, the full rents of the lands turned from other kinds of

culture. But if this be conceded, the same principle must apply generally; a potato-

field should pay as well as a clover-field, and a clover-field as a turnip-field; and so

on. The market prices of the produce must adjust themselves so that this shall in the

long run be possible. The rotation of crops, no doubt, introduces complication into the

matter, but does not modify the general reasoning. The principle which emerges is

that each portion of land should be applied to that culture or use which yields the

largest total of utility, as measured by the value of the produce; if otherwise applied

there will be loss. Thus the rent of land is determined by the excess of produce in the

most profitable employment.

But when the matter is fully thought out, it will be seen that exactly the same principle

applies to wages. A man who can earn six shillings a day in one employment will not

turn to another kind of work unless he expects to get six shillings a day or more from

it. There is no such thing as absolute cost of labour; it is all matter of comparison.

Every one gets the most which he can for his exertions; some can get little or nothing,

because they have not sufficient strength, knowledge, or ingenuity; others get much,

because they have, comparatively speaking, a monopoly of certain powers. Each

seeks the work in which his peculiar faculties are most productive of utility, as

measured by what other people are willing to pay for the produce. Thus wages are

clearly the effect not the cause of the value of the produce. But when labour is turned

from one employment to another, the wages it would otherwise have yielded must be

debited to the expenses of the new product. Thus the parallelism between the theories

of rent and wages is seen to be perfect in theory, however different it may appear to

be in the details of application. Precisely the same view may be applied, mutatis

mutandis, to the rent yielded by fixed capital, and to the interest of free capital. In the

last case, the Law of Indifference peculiarly applies, because free capital, loanable for

a certain interval, is equally available for all branches of industry; hence, at any

moment and place, the interest of such capital must be the same in all branches of

trade.

I ought to say that Mill, as pointed out to me by Professor Adamson, has a remarkable

section at the end of chapter v. of Book III. of the Principles, in which he explains

that all inequalities, artificial or natural, give rise to extra gains of the nature of Rent.

This section is a very satisfactory one inasmuch as it tends to support the view on

which I am now insisting, a view, however, which, when properly followed out, will

overthrow many of the principal doctrines of the Ricardo-Mill Economics. Those who

have studied Mill's philosophic character as long and minutely as I have done, will not

Online Library of Liberty: The Theory of Political Economy

PLL v6.0 (generated September, 2011)

24

http://oll.libertyfund.org/title/625

for a moment suppose that the occurrence of this section in Mill's book tends to

establish its consistency with other portions of the same treatise.

But of course I cannot follow out the discussion of this matter in a mere preface. The

results to be expected are partly indicated in my Primer of Political Economy, but in

that little treatise my remarks upon the Origin of Rent (p. 94), as originally printed in

the first edition, were erroneous, and the section altogether needs to be rewritten.

When at length a true system of Economics comes to be established, it will be seen

that that able but wrong-headed man, David Ricardo, shunted the car of Economic

science on to a wrong line, a line, however, on which it was further urged towards

confusion by his equally able and wrong-headed admirer, John Stuart Mill. There

were Economists, such as Malthus and Senior, who had a far better comprehension of

the true doctrines (though not free from the Ricardian errors), but they were driven

out of the field by the unity and influence of the Ricardo-Mill school. It will be a work

of labour to pick up the fragments of a shattered science and to start anew, but it is a