Introduction: time for

production integration

• Integration is a multidimensional process encompassing

economic, political, social, cultural and environmental issues.

• The document focuses specifically on the production

dimension

, identifying it as a strategic element of regional

integration for the coming years.

• Central thesis: in order to move towards structural

changes for equality, the region must forge closer regional

production ties.

• Tackling inequality as well as social policies calls for a

change in the production and export structure and the

creation of good quality and progressively more

sophisticated activities.

• The regional space is the most conducive

to this transformation

The dynamics and emphasis of regional integration

have changed greatly in the past decade

Several Governments had a new vision of the type of integration that prevailed

in the 1990s, especially the emphasis on commercial issues.

The political and social dimensions are reaffirmed as being of the utmost

importance along with concern for achieving greater production integration

New entities have emerged (CELAC, UNASUR, ALBA-TCP, the Pacific Alliance) in

response to traditional integration schemes; multiple memberships add to the

complexity of the institutional integration architecture

Traditional deficiencies persist (sluggish intraregional trade and production

integration), which coexist with growing de facto integration (investments,

migration, tourism, etc.)

Special challenges to integration

in the Caribbean

The Caribbean is different:

• The small size of the subregional market

• Heavy external debt burden. Fiscal and external disequilibria

• Lack of complementarity between the various economies

• High dependency on : (i) external markets and (ii) a limited range of

commodities and services

• Island status, major challenges with connectivity

• Heightened vulnerability to natural disasters and

environmental damage

In this context, the recommendations are as follows:

• Closer integration between CARICOM and Central America, Cuba,

Dominican Republic and Panama given their strong complementarity

• Strengthened and coordinated cooperation towards the Caribbean

from the rest of the region, defined within the framework of CELAC

A COMPLEX GLOBAL

ECONOMIC ENVIRONMENT

As a group, the developing economies continue

to grow the fastest and the gap with the

developed countries has narrowed

2010 2011 2012 2013 2014 2015

World

5.1

3.9 3.2 3.0 3.6 3.9

Developed countries

3.0

1.6 1.4 1.3 2.2 2.3

United States

2.4

1.8 2.8 1.9 2.8 3.0

Eurozone

2.0

1.4 -0.7 -0.5 1.2 1.5

Japan

4.5

-0.6 1.4 1.5 1.4 1.0

Developing and

emerging economies

7.4

6.3 5.0 4.7 4.9 5.3

China

10.4

9.3 7.7 7.7 7.5 7.3

India

10.1

7.9 4.7 4.4 5.4 6.4

Latin America and

the Caribbean

5.9

4.3 3.1 2.5 2.7 3.0

WORLD AND SELECTED ECONOMIES: GDP VARIATION

(Percentages)

Source: FMI, World Economic Outlook, abril de 2014, excepto CEPAL para América Latina y el Caribe (2010-2014). Los datos para 2014 y 2015

son proyecciones.

United States: Will grow by 2.8% in 2014

(versus 1.9% in 2013)

Concern at the timing of the gradual withdrawal

of quantitative easing, high public debt

Eurozone: At the end of 2013 these countries emerged from

a six-quarter-long recession, but are expected to grow by

just 1.2% in 2014, with high levels of unemployment

Concern at deflationary pressures and the complexities

of the banking union

Japan: Is experiencing growth of about 1.5% thanks to

macro-heterodox policies and the devaluation of the yen

The high public debt and scant advances with structural

reforms remain a cause for concern

Higher but modest growth rates

in the developed countries

The growth gap is narrowing: In 2014-2019, the difference between

the average growth rate of the developed and developing countries

(2.3% versus 5.3%) is expected to be the lowest since 2002

Phasing out of quantitative easing in the United States

Slowdown in China as from 2012, due to lacklustre demand

in the developed countries and the rebalancing of the growth model

The external context is more challenging for

the developing countries:

-Less liquidity (due to withdrawal of quantitative easing in the United States)

-Lower commodity prices (due to lower demand in China)

Slowdown in the

emerging economies

World trade has been sluggish

although it is starting to recover

GROWTH IN THE VOLUME OF GOODS EXPORTS AND WORLD GDP, 2005-2015

a

(Annual percentage variation)

Source: Secretaríat of the World Trade Organization.

a

The figures for 2014 and 2015 are projections.

Growth has been slowing since 2011 (2.5% in 2013)

• The slowdown has been marked: the region grew on average

by 4.8% in 2003-2007 and 4.1% in 2010-2013

• Latin America and the Caribbean is expected to continue to be

the developing region with the least dynamic performance in

the period 2014-2019

• Exports slowed sharply in 2012 and 2013

• Increasing external vulnerability, reflected in a deterioration in

the balance-of-payments current account position

• This brings to a close an international cycle that had been very

favourable for the region, in particular for South America.

• In the coming years, greater emphasis will have to be placed

on the regional market

Impact of the global situation

on Latin America and the Caribbean

With investment and net exports contributing little,

GDP growth has depended to a great extent on

growth in consumption

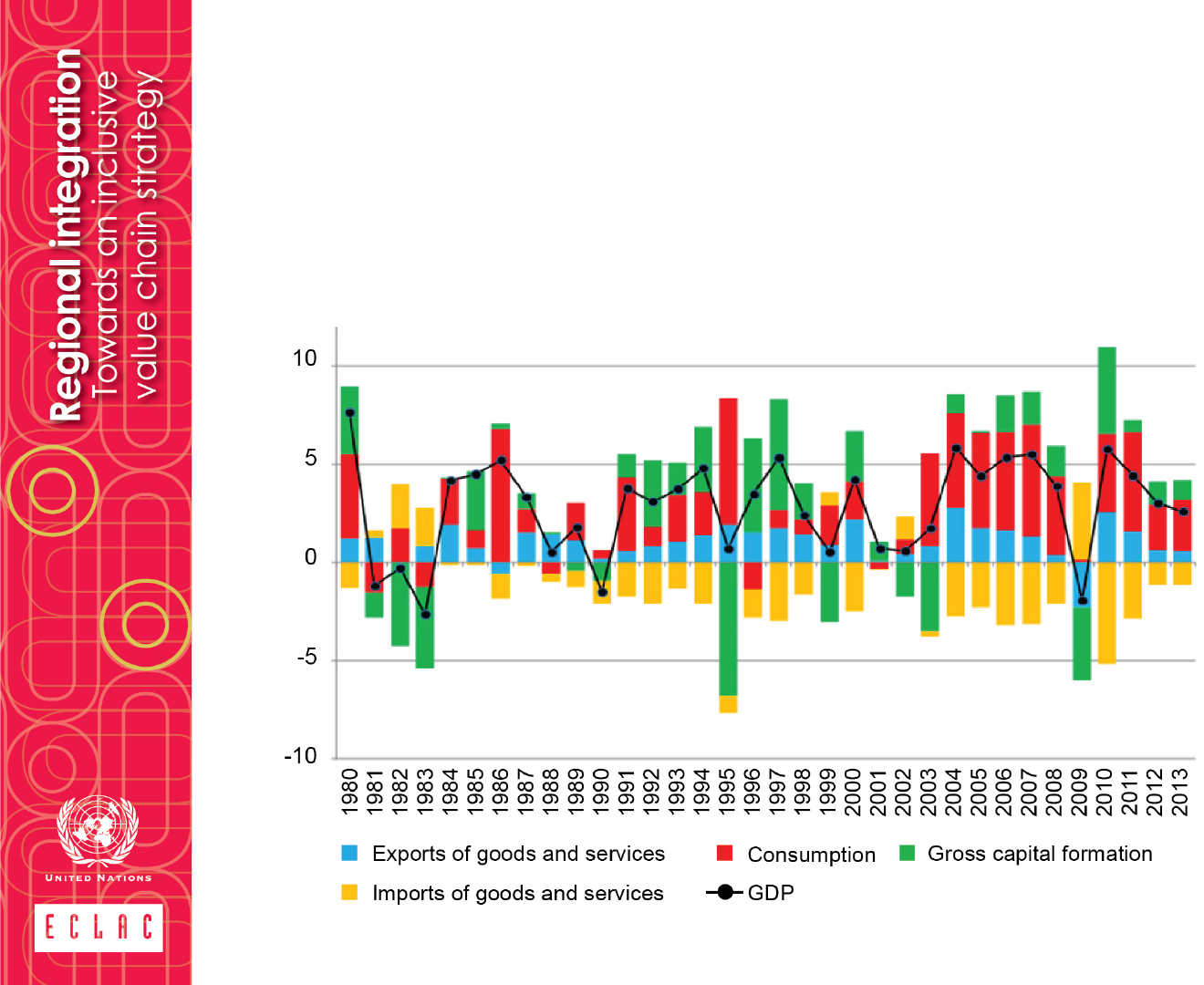

LATIN AMERICA: GROSS DOMESTIC PRODUCT AND CONTRIBUTION TO GROWTH OF THE

COMPONENTS OF AGGREGATE DEMAND, 1980-2013

(Percentages of GDP)

Source: Economic Commission for Latin America and the Caribbean (ECLAC), on the basis of official figures.

Regional exports slowed sharply

in 2012 and 2013

LATIN AMERICA: ANNUAL GROWTH OF THE VALUE OF EXPORTS, 2000-2013

(Percentages)

Source: Economic Commission for Latin America and the Caribbean (ECLAC), on the basis of official figures .

Energy

Minerals and metals

Oils and oilseeds

Food

Forestry-related

raw materials

Tropical beverages

Commodity prices continue to trend

downwards

EXPORT COMMODITY PRICE INDEX, WEIGHTED BY THE VALUE OF EXPORTS

(Index 2005=100)

Source: Economic Commission for Latin America and the Caribbean (ECLAC) on the basis of figures provided by the United Nations Conference on Trade

and Development (UNCTAD) and the Netherlands Bureau of Economic Policy Analysis (CBP).

LATIN AMERICA: ESTIMATED RATE OF VARIATION IN THE TERMS OF TRADE, 2011-2013

a

Source: Economic Commission for Latin America and the Caribbean (ECLAC) on the basis of official figures

a

The figures relating to 2013 are projections.

The region’s terms of trade are declining

(Percentages)

Very modest growth is predicted for the

region for the remainder of the decade

DEVELOPING REGIONS: PROJECTED ANNUAL GDP VARIATION, 2014-2019

(Percentages)

Source: International Monetary Fund, World Economic Outlook database, April 2014.

SUMMARY OF THE MAIN

TRANSFORMATIONS TAKING

PLACE IN THE GLOBAL ECONOMY

Main trends in the global context

Rapid technological

change

• Informátion

technology, ICTs,

cloud computing,

cyber-servicies,

“smart cities”

• 3-D printing,

robotics, remote-

controlled vehicles

• Biology,

nanosciences and

information sciences

interface

• Energy, water and

natural resources

complex

Emergence of the

developing countries

• In growth, trade,

FDI, rise of the

middle class,

patents, new

technologies

• A process that is

highly concentrated

in China/Asia

Value chains

• Three major

factories:

• North America

• Europe

• East Asia

Mega-trade

agreements

• TPP

• TTIP

• EU-Japan

• ASEAN+6 (Regional

Comprehensive

Economic

Partnership)

Need to address climate change

and ensure that growth is compatible with greater environmental sustainability

Drastic increase in inequality

The contribution to global growth has been on the

decline in the industrialized countries , on the rise

in Asia and stable in Latin America

SELECTED GROUPINGS: CONTRIBUTION TO WORLD GDP GROWTH, 1990-2012

(Percentages)

Source: CAF/ECLAC/OECD, World Economic Outlook 2014.

The crisis has accelerated convergence between

the per capita income of China and

that of the developed countries

SELECTED COUNTRIES: PER CAPITA GDP GROWTH, 2014 Y 2019

(Percentages in relation to the 2007 level)

Source: Economic Commission for Latin America and the Caribbean (ECLAC), on the basis of International Monetary Fund, World

Economic Outlook, April 2014. The data for both years are projections.

By the end of this decade, South-South trade

will surpass North-North trade

Source: Economic Commission for Latin America and the Caribbean (ECLAC) on the basis of United Nations Commodity Trade

Statistics Database (COMTRADE).

a

The figures from 2013 onwards are projections.

DISTRIBUTION OF WORLD GOODS EXPORTS BY GROUP OF ORIGIN AND DESTINATION, 1985-2020

a

(Percentages)

Developing countries already absorb

more than half of all FDI worldwide

Source: ECLAC, Division of International Trade and Integration, on the basis of figures from UNCTAD.

WORLDWIDE FDI FLOWS, 1980-2013

(Billions of dollars)

In 2030, 80% of the world’s middle-class population will

be living in countries currently defined as developing

and Asia will be home to two thirds of them

WORLD: MIDDLE-CLASS POPULATION, 2009, 2020 AND 2030

a

Source: ECLAC, on the basis of Homi Kharas, “The Emerging Middle Class in Developing Countries”, OECD Development Centre

Working Paper 285, January 2010.

a

The figures for 2020 and 2030 are projections.

The developing countries in Asia, unlike

our region, hold an ever larger stake

in global knowledge generation

1990 2000 2012

Developed countries

a

87.3 75.2 52.4

Rest of the world 12.7 24.8 47.8

China 1.0 3.8 27.8

Republic of Korea 2.6 7.4 8.0

Latin America and the

Caribbean

1.9 3.5 2.5

WORLD PATENT APPLICATIONS

(Percentages)

Source: World Intellectual Property Organization (WIPO).

a

Includes Europe, United States and Japan.

GLOBAL TRANSFORMATIONS

ACCENTUATE THE NEED FOR REGIONAL

INTEGRATION IN LATIN AMERICA

AND THE CARIBBEAN

The region’s strengths and weaknesses

as an international economic actor

• Attractive and growing consumer market;

expansion of the middle class

• Abundance of renewable and

non-renewable natural resources

Strengths

• Limited involvement in

the knowledge economy

• Strong emphasis on exports: (i) raw

materials and assembly manufactures;

(ii) a small number of large companies

• Limited internacionalization of SMEs

Weaknesses

In this context, the regional market

plays a key role

For the large majority of Latin American and Caribbean countries,

intraregional trade is qualitatively superior to exporting

to other markets:

It is the most

conducive to

export

diversification

as it absorbs

the greatest

number of

export

products

It is the main

outlet for

manufacturing

exports

It is the main

market for

most export

companies,

especially

SMEs

The region is

the natural

platform for

growth of the

trans-Latins

and for the

creation of

plurinational

production

linkages

Intraregional trade has made scant progress

since its peak at the end of the 1990s

(a) Total exports

(b) Manufacturing exports

a

LATIN AMERICA AND THE CARIBBEAN: INTRAREGIONAL EXPORTS

AS A SHARE OF WORLDWIDE EXPORTS, 1990-2012

(Percentages)

Source: ECLAC, on the basis of COMTRADE.

a

Includes high-, medium- and low-technology manufactures. Excludes natural resource-based manufactures.

The regional market is more conducive to

export diversification

NUMBER OF PRODUCTS EXPORTED BY LATIN AMERICAN COUNTRIES TO SELECTED MARKETS, 2012

Source: ECLAC, on the basis of COMTRADE.

Latin

America and

the

Caribbean

United States European

Union

China Japan

Argentina 3 591 1 465 1 712 407 388

Brazil 3 929 2 762 2 991 1 389 1 247

Chile 3 014 1 275 1 296 362 313

Colombia 3 239 1 708 1 250 253 201

Costa Rica 2 821 1 792 1 095 260 188

El Salvador 2 522 1 004 396 45 35

Guatemala 3 274 1 321 721 142 155

Jamaica 607 888 467 73 44

Mexico 3 857 4 164 2 803 1 367 1 272

Peru 3 037 1 796 1 602 266 575

Excluding Mexico, the regional market is the main outlet

for manufactures exported from Latin America

and the Caribbean

LATIN AMERICA AND THE CARIBBEAN: SHARE OF MEDIUM- AND HIGH-TECHNOLOGY MANUFACTURES

EXPORTED WITHIN THE REGION, 2012

a

(Percentages)

Source: ECLAC, on the basis of information from the United Nations Commodity Trade Database (COMTRADE).

a

The figures for the Bolivarian Republic of Venezuela, Panama and Suriname are from 2011.

However, intermediate goods account

for a small share of intraregional trade

in the region

SELECTED GROUPINGS: PARTS AND COMPONENTS AS A SHARE OF INTRA-GROUP EXPORTS, 2000-2012

(Percentages)

Source: ECLAC, on the basis of information from the United Nations Commodity Trade Database (COMTRADE).

a

North American Free Trade Agreement.

b

Includes China, Japan, the Republic of Korea, the 10 member countries of the Association of Southeast Asian Nations (ASEAN),

Hong Kong Special Administrative Region of China and Taiwan Province of China.

Some gaps in the region’s

export performance

Source: ECLAC, on the basis of official information from the

customs services of the respective countries, OECD, World Bank

and specialized studies.

LATIN AMERICA (10 COUNTRIES): DISTRIBUTION OF

EXPORTING FIRMS BY NUMBER OF MARKETS AND

PRODUCTS, AROUND 2010

(Percentages)

EXPORT SHARE OF THE TOP PERCENTILE OF

EXPORTING FIRMS, AROUND 2010

(Percentages)

Source: ECLAC, on the basis of official information from the

customs services of the respective countries.

Agro-industry

- Fruit and nuts

- Oilseeds

- Leather

manufactures

Agro-industry

- Dairy

- Meat products

- Cereals and animal feed

- Fruit and vegetables

- Unmanufactured tobacco

Metal manufactures

- Precious metalwork

- Gold, silver and copper

Some examples of potential intraregional linkages

Metal products

- Wire products

- Iron and aluminium structures

- Metal manufactures

Chemical products

- Polymers and

copolymers

- Heterocyclic

components

- Cosmetics

- Wood pulp

Central

America

and Mexico

South America

The region’s countries are already participating

in a wide variety of service chains

Business

process

outsourcing

Health

services

Creative

industries

industries

Information

technology

Other services

Accounting and

finance

[ARG, BRA, CHL, CRI,

MEX, URY]

Health tourism

[BRA, CUB, COL, CHL,

CRI, PAN]

Audiovisual industry

[ARG, BRA, CHL, MEX]

Software development

[ARG, BRA, CHL, COL,

CRI, URY

]

Education

[ARG, BRA, CHL]

Process management

and development

[ARG, BRA,

CHL, CRI,

MEX, URY]

Clinical trials

[ARG, BRA, CHL, COL,

MEX, PER]

Advertising

[ARG, BRA, CHL, MEX]

Consulting and

information

technology services

[ARG, BRA, CHL, CRI,

URY]

Research,

development and

innovation

[BRA, MEX, CHL]

Human resources

[ARG, BRA,

CHL, CRI,

URY]

Telemedicine

[ARG, BRA, COL, MEX]

Content industries

[ARG, BRA, MEX]

Management,

Integration and

application

maintenance

[ARG, BRA, CHL, COL,

CRI, URY

Engineering and

construction

[ARG, BRA, CHL, MEX]

Call, contact and

customer service

centres

[Central America

countries, CHL, COL,

DOM PER, URY]

Telediagnostics

[BRA, MEX]

Architecture

[ARG, BRA,

CHL

, MEX]

Infrastructure networks

[ARG, BRA, CHL, CRI,

JAM, URY]

Outsourcing of

knowledge-intensive

services (legal

services, financial and

market research

[BRA, CHL, CRI, MEX]

Back office services

[ARG, CHL, BRA, COL,

CRI, MEX, URY]

Analysis and

interpretation of

medical results

[BRA, URY, MEX]

Design

[ARG, BRA, MEX]

Video games, animation

and simulation

[ARG, CHL]

Financial services

[BRA, CHL, CRI, MEX]

Shared service centres

[ARG, CHL, BRA,

COL,CRI, MEX, URY]

Source: Hernández, René, and others (ed.), Latin America’s emergence in global services: A new driver of structural change in the region?, ECLAC, 2014.

Bottlenecks in infrastructure constrain growth,

competitiveness and equity

LATIN AMERICA (SELECTED COUNTRIES): SECTORAL INVESTMENT IN INFRASTRUCTURE

(Percentages of GDP)

The region would need to spend 7.9% of annual GDP on infrastructure to close by 2020

the infrastructure gap measured in the region in 2005 compared with a group of growing

economies in East Asia (Republic of Korea, Malaysia, Singapore and Hong Kong SAR).

Source: ECLAC and Perrotti, Daniel, and Ricardo J. Sánchez (2011), “La brecha de infraestructura en América Latina y el

Caribe”, Series Recursos Naturales e Infraestructura No. 153.

Dimensions that complement regional

production integration

Financing

• Take steps

towards a

regional reserve

fund (building on

the success of

FLAR)

• Boost credit from

the subregional

banking system

for productive

development

• Support for

intraregional

trade, introducing

more flexible

payment

mechanisms

• Foster integration

of capital markets

Environment

• Management of

transboundary

areas and shared

ecosystems

• Joint programmes

on measuring and

reducing the

carbon footprint

• Natural disaster

risk management

Digital

cooperation

• Concerted action

to reduce the cost

of broadband in

the region

• Regulatory

harmonization on

the Internet

• Close the digital

gap, with

emphasis on

remote areas and

vulnerable sectors

• Mass use of ICTs

in health,

education and

SMEs

Social agenda

• Transboundary

production

programmes

• Addressing

growing

intraregional

migration: making

migrants’right and

benefits in health

and pensions

portable;

standardization of

university

curricula;

certification of

competencies

• Mainstreaming

the gender

dimension in all of

these initiatives

AN INDUSTRIAL POLICY

FOR REGIONAL VALUE CHAINS

The role of an integrated regional market

in fostering production linkages

1. The region has made substantial

progress in reducing tariff barriers

to intraregional trade

2. However, much less progress has

been made on regulatory issues,

which are key to modern value

chains: investment, services,

technical standards, trade

facilitation, etc.

3. Critical issues:

- Intellectual property

- Government procurement

and contracts

- Gradual convergence

4. Some first steps could include:

(i) Regional cumulation of origin;

(ii) Harmonization and mutual

recognition of technical and sanitary

standards;

(iii) Coordination of steps taken at the

national level to facilitate trade

(eg. single-window systems)

5. Support from Mexico,

Colombia and the Bolivarian

Republic of Venezuela

to the Caribbean

in strategic initiatives

The centrality of industrial policy

The region needs a modern industrial policy

that fosters:

• Participation in regional and global value chains

• Moving up the chain hierarchy, transitioning to more sophisticated activities

in goods and services

The promotion of regional value chains opens up scope

for industrial policy with plurinational components

One area with great potential is support for the

internationalization of SMEs through:

• Programmes to provide support in meeting the quality, safety, and

sustainability requirements of their potential buyers

• Joint programmes for the development of specialized human resources

Another area that has great potential is joint

research and development of technology hubs in

shared areas of interest :

Renewable energy, biotechnology applied to agriculture

and mining, management of water resources, etc.

None of this means setting aside natural

resources, rather it means adding

knowledge and value, and strengthening

linkages with the rest of the economy

The centrality of industrial policy

MAIN MESSAGES AND

RECOMMENDATIONS

Ten recommendations

for regional integration

1. The integration process must be regional in scope

2. Significant transboundary and subregional

components must also be recognized

3. The convergence between integration schemes

is necessary, but it will be a gradual, non-linear

process

4. There is no single or best model of integration, so

plenty of flexibility is needed in designing the

emerging regional space

5. The commitment and political will to converge

towards an integrated regional space

is indispensable

6. Value chains and public policies to promote them

can be a powerful instrument

for regional integration

7. A common agenda for the near term is

a good starting point

8. Integration must rely more on civil society

9. Equality must be the hallmark

of regional integration

10. Integration must be regarded as a State policy

Ten recommendations

for regional integration