A GUIDE TO YOUR INSURANCE PLAN

Guide for Erasmus+ volunteers and

European Solidarity Corps participants

CIGNA

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 2/36

We’ve got you covered!

Welcome! As an Erasmus+ volunteer or a European Solidarity Corps participant, you are covered by a

Cigna Group Medical and Non-Medical Insurance Plan that is free of charge to you. We’re glad to have

you with us!

Your insurance plan covers:

a) Medical expenses following plan specifications (i.e. costs related to medical and urgent dental

treatment, hospitalisation and surgery due to diseases, accidents, pregnancy and childbirth).

Please go to section 1.3 on pages 8-14 for a detailed overview of your medical cover.

b) Non-medical expenses following plan specifications (i.e. death, permanent disability, third

party liability and loss or theft of luggage insurance). Please go to section 2.1 on pages 20-23

for a detailed overview of your non-medical cover.

As a Cigna plan member, you enjoy a wide range of services, such as 24/7 customer support, online

information and services, access to health care providers worldwide and more. You can find more

information on the online information and services available to you in section 3 on pages 24-29.

Why read this brochure?

This brochure contains everything you need to know to benefit from your insurance plan. Read it

thoroughly to discover what it means to be complementary or primary insured, what to do when you

need medical care, and what you should check before leaving on mobility.

The terms in italic are explained on page 36.

Who are we?

Your insurance plan is a partnership between:

- The European Commission Directorate-General for Education, Youth, Sport and Culture

(DG EAC). As DG EAC has the ultimate responsibility for running the Erasmus+ and the

European Solidarity Corps Programmes, it organises insurance cover and monitors that

participants are in a safe environment at all times. For cross-border activities, the European

Commission offers a centralised insurance cover to the participants and determines the plan

specifications.

- The Education, Audiovisual and Culture Executive Agency (EACEA). The Agency has been

entrusted by DG EAC to contract insurance services. As a policyholder, the EACEA is

responsible for ensuring the correct implementation of the insurance contract with Cigna and

the adequate delivery of insurance services to participants.

- Cigna. As the administrator of this plan, Cigna facilitates the plan through claims handling,

reimbursements and fraud detection. Cigna is your point of contact whenever you have

questions or need to submit a claim. Cigna is also the insurer of the Medical and the Life

Insurance Plan.

- Chubb. The insurer of the Disability, Third Party Liability, and Travel Insurance Plan. Even

though most of your non-medical benefits are insured by Chubb, you may contact Cigna with

questions about the claiming procedures, your cover, or a specific claim you sent us. Cigna will

contact Chubb on your behalf and will get back to you directly with answers to your questions.

- VHD. As the evacuation assistance provider, VHD (part of the Europ Assistance network) will

provide the necessary assistance whenever there is a medical need for an evacuation or a

repatriation.

We’re here for you. Whether it’s a question on the benefits of your insurance plan or

a particular claim, don’t hesitate to contact us. You can find detailed contact

information on pages 30-31.

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 3/36

Table of content

1. Your Medical Insurance Plan ........................................................................................................ 5

1.1 Who is covered and when? ............................................................................................................. 5

1.2 Categories of cover ..................................................................................................................... 5

1.2.1 Complementary cover ................................................................................................................. 6

What is the European Health Insurance Card (EHIC)? ........................................................................... 6

How to use your EHIC during your mobility? ........................................................................................... 7

1.2.2 Primary cover ............................................................................................................................... 7

What if I’m not eligible for an EHIC card? ............................................................................................... 7

1.3 Your cover ................................................................................................................................... 8

How do I request Prior Approval from Cigna’s Medical Board? ............................................................ 14

1.4 What if I need medical care? ..................................................................................................... 15

1.4.1 If you are complementary insured ............................................................................................. 15

1.4.2 If you are primary insured .......................................................................................................... 16

For planned inpatient or expensive (>200 EUR) treatment, the procedure is as follows ...................... 16

1.4.3 How and when will your claims be processed? ......................................................................... 18

Here’s how your claims are processed ............................................................................................... 189

How do you know your claims have been settled? ............................................................................... 20

2. Your Non-Medical Insurance Plan ............................................................................................. 20

2.1 Your cover ....................................................................................................................................... 20

2.1.1 Life Insurance ............................................................................................................................... 20

2.1.2 Permanent Disability ..................................................................................................................... 20

2.1.3 Third Party Liability ....................................................................................................................... 21

2.1.4 Travel Assistance ......................................................................................................................... 22

3. Easy access to health care ......................................................................................................... 24

3.1 Your e-membership card ................................................................................................................. 25

3.2 Your personal webpages ................................................................................................................. 26

How to access your personal webpages? ............................................................................................. 27

3.3 Cigna in your pocket ........................................................................................................................ 27

3.4 Worldwide access ............................................................................................................................ 28

3.4.1 If you’re complementary insured .................................................................................................. 28

3.4.2 If you’re primary insured ............................................................................................................... 28

4. Contact Details............................................................................................................................. 30

4.1 Evacuation Assistance .................................................................................................................... 30

4.2 Affiliations ........................................................................................................................................ 30

4.3 My claims, cover and procedures .................................................................................................... 30

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 4/36

4.3.1 Medical Claims Centre ................................................................................................................. 31

4.3.2 Non-Medical Claims Centre.......................................................................................................... 31

5. FAQ ............................................................................................................................................... 32

5.1 What to do when your project or individual mobility is cancelled for any reason? .......................... 32

5.2 How can I get an insurance certificate for a visa application? ........................................................ 32

5.3 When am I covered? ....................................................................................................................... 32

5.4 Where am I covered? ...................................................................................................................... 32

5.5 Where do I find more information on Cigna’s health care provider network? ................................. 32

5.6 What do I need to do in case of a medical emergency requiring evacuation? ................................ 33

6. Your checklist before you leave for your mobility ................................................................... 34

7. Best practices to keep in mind ................................................................................................... 35

8. Terms used in this brochure ...................................................................................................... 36

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 5/36

1. Your Medical Insurance Plan

In this section, you can find more information on the medical cover provided under this insurance plan.

1.1 Who is covered and when?

As an Erasmus+ volunteer or a European Solidarity Corps participant, you are covered during the entire

period of your cross-border mobility.

The European Solidarity Corps promotes social inclusion by facilitating the access to young people with

fewer opportunities, including those young people who need additional support due to the fact that they

are at disadvantage compared to their peers because of disabilities or health problems. This insurance

plan ensures medical cover to all participants on the basis of the principles of equal treatment and non-

pre-existing medical conditions.

You are covered 24 hours from the day you leave home to the host country, until the end of the second

month after the termination of your mobility. This includes any travel from and to the hosting country and

any in-country travel linked to the mobility.

You enjoy worldwide cover during both private and project-related activities. However, a distinction is

made between the cover in your home and hosting country and other countries worldwide:

Home and hosting country: you are covered for all medical treatment based on the plan

specifications, be it planned or unplanned (i.e. emergency treatment).

Other countries: you are covered for unplanned (i.e. emergency treatment) only.

Please find below examples of planned and unplanned treatment:

Example unplanned treatment: a participant with Turkey as home country and France as hosting country

is on vacation in Spain and breaks his leg during a walk. In this case, all medical treatment in Spain is

covered given that it concerns an unplanned/emergency treatment.

Example excluded planned treatment: the same participant is diagnosed with cancer while residing in

France. He opts to be treated in the United States and travels there to receive treatment. The medical

treatment is not covered, since it concerns a planned treatment outside of the home/hosting country.

1.2 Categories of cover

Please take a moment to identify whether you are a complementary or primary insured plan member

(you can also find this information in your Cigna Welcome Email) and read this chapter thoroughly to

review the benefits and procedures which apply to you. Both categories are equally covered by this

insurance plan (i.e. same benefits, same ceilings).

If you have a chronic disease or a disability which requires permanent medical

treatment or medication, you are invited to contact Cigna to enquire about your cover

before you leave on mobility. Cigna’s Medical Board can give you the necessary

advice about the cover of your medical treatment, so that you don’t have to worry

about it during your mobility. You can find more information about this on page 35

of this guide.

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 6/36

Your category of cover is settled at the enrolment phase by your sending/supporting organisation.

Therefore, it is very important that you provide the organisation with the necessary information on your

national insurance situation.

1.2.1 Complementary cover

This insurance plan complements the cover provided by your European Health Insurance Card (EHIC)

and/or national security systems. In other words, Cigna does not replace your national social security

scheme (EHIC) or your primary statutory insurance, but provides complementary cover.

You will be enrolled as a complementary insured plan member:

a) When your home and hosting country are both EU countries (plus Iceland, Liechtenstein,

Norway and Switzerland);

Please note that you need to be in possession of a valid EHIC card before arriving to your

host country when you are entitled to EHIC by your national legislation and the card is free

of charge to you.

b) When you enrolled to another public or private health insurance scheme prior to or during

your mobility;

Please note that you may be obliged to register to the national health system of your hosting

country because of the duration of your mobility or the type activity you will perform (job or

traineeship). In that case, you have complementary cover from Cigna.

As a complementary insured member, you are required to make use of your EHIC card when visiting a

health care provider. The Erasmus+ and European Solidarity Corps’ insurance plan only covers the

remaining eligible expenses that are not covered by the EHIC or by the state healthcare system

in your home country.

What is the European Health Insurance Card (EHIC)?

As a European national temporary residing in another EU country (plus Iceland, Liechtenstein, Norway

and Switzerland), you’re most likely entitled to a European Health Insurance Card that gives you access

to medically necessary, state-provided health care under the same conditions and at the same cost

(free in some countries) as people insured in that country.

It’s important that you request your EHIC card in your home country before you leave

for your mobility since your EHIC card may allow for direct payment in some

countries (meaning you won’t have to advance your medical bills).

Make sure you provide your sending/supporting organisation with the necessary

information on your national insurance situation at the time of your enrolment.

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 7/36

You can obtain your card through your national health insurance provider in your home country. If you

need help with applying for a European Health Insurance Card, you can reach out to your

sending/supporting organisation. You can also find more information here (you can select your home

country at the bottom of the page to consult country-specific guidelines).

How to use your EHIC during your mobility?

You are required to make use of your European Health Insurance Card when you visit a health care

provider. The Erasmus+ and European Solidarity Corps’ insurance plan only covers the remaining

eligible expenses that are not covered by the EHIC. Section 1.4 provides you with more information on

the reimbursement procedure.

Cigna shall make a reimbursement as appropriate, on the basis of the difference between the

costs actually incurred and the reimbursement obtained from your national system.

Upon receipt of written proof that your expenses can’t be covered by your national system,

Cigna will reimburse your eligible expenses as from the first Euro.

More information on how to use you EHIC card as well as health care providers who will accept your

EHIC card can be found here (select your home/hosting country at the top of the page for detailed

information).

1.2.2 Primary cover

You will be enrolled as a primary insured plan member:

a) When your home and/or hosting country is outside of the EU; or

b) When you are not entitled for cover under your national social security scheme; or

c) When you are not entitled to a free of charge EHIC card.

If you are a primary insured plan member, Cigna will reimburse your eligible expenses as from the first

Euro.

What if I’m not eligible for an EHIC card?

Please verify whether you are eligible for a free of charge EHIC card before you leave for your mobility.

In case you are not eligible for a free EHIC card (e.g. because of your age), please contact

clientservice2@cigna.com. Upon receipt of a formal written communication from your social

security office / national system stating the reason why you are not eligible for an EHIC card, your

category will be changed from complementary to primary.

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 8/36

1.3 Your cover

In this section, you will find a detailed overview of your cover.

You are covered for all medical treatment based on the plan specifications, be it planned or unplanned

(i.e. emergency treatment), in your home and hosting country. In other countries, your cover is restricted

to unplanned (i.e. emergency) treatment only.

Please take note of the following important plan conditions:

- The insurance plan will cover the costs related to medical and urgent dental

treatment, hospitalisation and surgery due to diseases, accidents, pregnancy

and childbirth occurring during the duration of the cover following the plan

specifications set out below.

- Cover is limited to medically necessary and reasonable & customary

expenses.

- Avoid unpleasant surprises. If you are in doubt whether or not your treatment

is covered under the insurance plan, please contact us.

- Certain expenses are subject to Prior Approval by Cigna’s Medical Board.

You can find more information on how to request Prior Approval in on page 14.

- An aggregate maximum reimbursement of 250,000 EUR per person is

applicable.

- If you are a complementary insured plan member, you are required to use

your European Health Insurance Card (EHIC) or to claim with your national

system first. For more information, please go to sections 1.2 on pages 5-7 and

section 1.4 on page 15.

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 9/36

Please note that the following expenses and situations are excluded from your

cover:

- Hearing aids and costs of spa-cures;

- Periodic, preventive health examinations;

- The insurance is suspended in time of war for insured persons who are

mobilised or who volunteer for naval, air or military service;

- The results of wounds or injuries resulting from motor vehicle racing and

dangerous competitions; normal sports competitions are covered;

- The consequences of insurrections or riots, if by taking part the insured

person has broken the applicable laws; the consequences of brawls, except in

cases of self-defense;

- Rejuvenation cures and cosmetic treatment. Cosmetic surgery is covered,

however, when it is necessary as the result of an accident for which cover is

provided;

- The direct or indirect results of explosions, heat release or irradiation produced

by transmutation of the atomic nucleus or by radioactivity or resulting from

radiation produced by the artificial acceleration of nuclear particles;

- Aircraft accidents are only covered if the insured person is on board an

aircraft with a valid certificate of air-worthiness, piloted by a person in

possession of a valid license for the type of aircraft in question;

- Elective medical treatment such as IVF (In Vitro Fertilization), AI (Artificial

Insemination), ICSI, Mesa, Tesa, voluntary interruption of pregnancy,

circumcision.

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 10/36

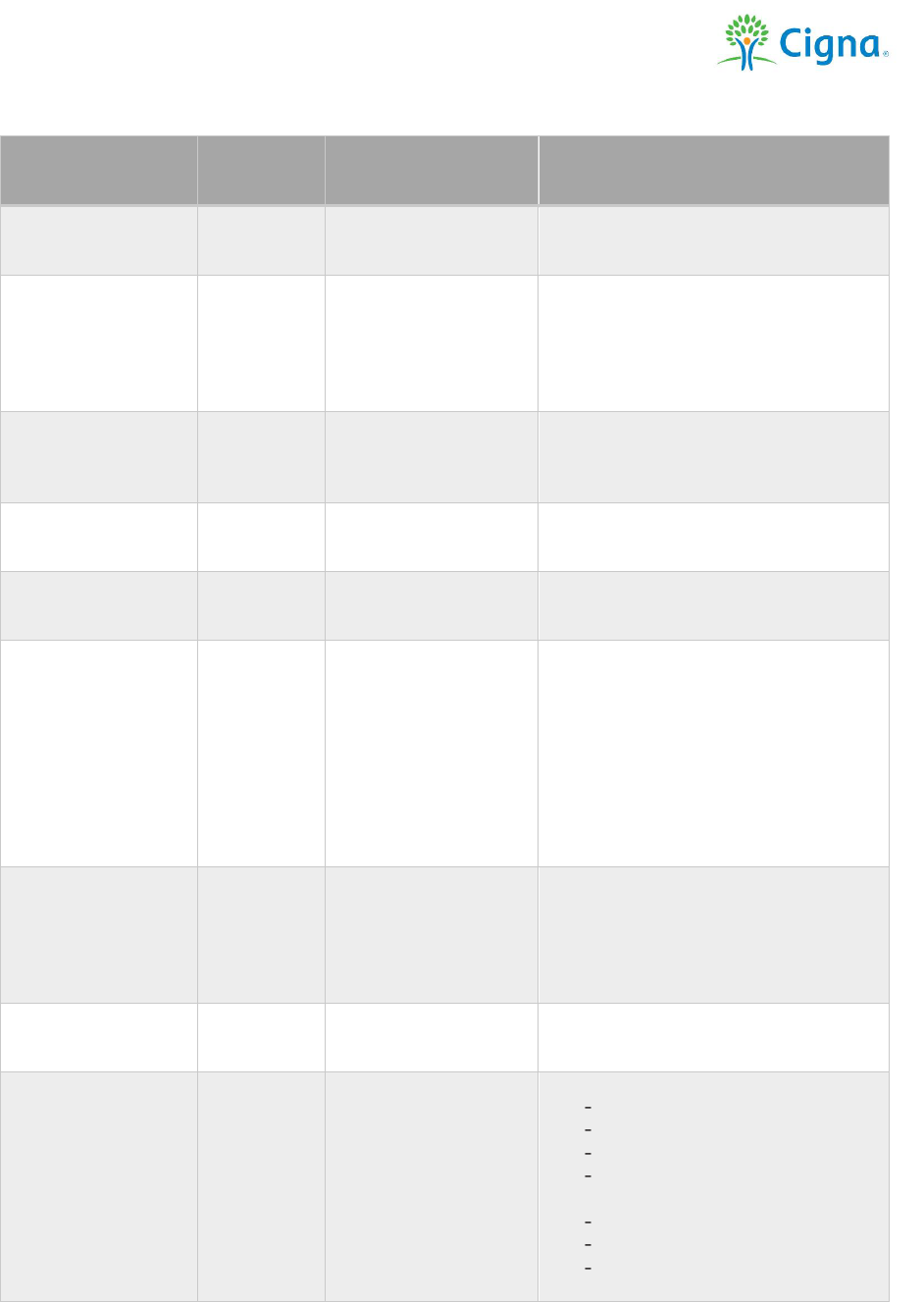

Type of expense

Cover rate

Subject to Prior

Approval

Good to know

General

Practitioners’ and

Specialists’ fees

100%

No

Outpatient surgery

100%

Yes if the surgery is

planned

Outpatient surgery allows a person to

return home on the same day that a

surgical procedure is performed.

Outpatient surgery is also referred to

as ambulatory surgery or same-day

surgery.

Physical

Therapists’ and

Registered

Nurses’ fees

100%

No

Laboratory and

Diagnosis Tests

100%

Yes

X-Rays /

Radiotherapy /

Chemotherapy

100%

Yes

Prescription drugs

100%

No

Only prescribed generic drugs (if

available) with active pharmaceutical

ingredients are covered.

Vitamins, food supplements and

contraceptives are not covered by

your medical plan, unless they are

prescribed to treat a medical

condition. In this case, please request

Prior Approval.

Shipment of

medications or

replacement of

eyeglasses and

contact lenses

abroad

Real

expenses

Yes

Outpatient

medical treatment

in hospital

100%

No

Hospital charges

Surgery charges

100%

Yes in case the

hospitalisation is

planned

These charges may include:

Bed and board

Doctor’s fees

General nursing services

Use of operating rooms and

equipment

Laboratory examinations

X-ray examinations

Drugs and medicine for use

in the hospital

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 11/36

Ambulance

transportation

100%

No

Ambulance from place of

illness/accident to the first hospital

where care can be given.

Other transportation (e.g. public

transport, taxi) is not covered by your

medical plan.

1

Necessary

medical care and

tests in the event

of pregnancy

100%

No

Depending on the established

protocol for pregnancy in home or

hosting country to ensure the health

of the mother and the foetus.

Hospital charges

and

accommodation,

including midwife

and doctor’s fees

for childbirth and

(medically

necessary)

caesarean section

100%

Yes in case the

hospitalisation is

planned

Psychotherapy

100%

Yes

Only medically necessary

psychotherapy (upon diagnosis and

pathology) is covered by your medical

plan.

Subject to a maximum of 30 sessions

or 30 continuous days in case of

inpatient treatment per activity.

Physiotherapy

100%

Yes

Necessary general

dental care and

treatment

100%

Subject to a

ceiling of

1,000 EUR

Yes

Eligible expenses:

Only urgent dental care. In case of

sudden dental complaints, the only

treatment covered is treatment that is

meant to stabilize the dental

complaints.

The urgency of your dental care will

be assessed by Cigna's Dental

consultant against the documents to

be submitted together with your Prior

Approval.

The following documents need to be

submitted to Cigna’s Dental

Consultant to assess the medical

necessity of your request prior to your

treatment:

A detailed report from the dentist

specifying the urgent nature of

In exceptional circumstances, other modes of transportation may be covered if proven medically necessary.

Prior Approval by Cigna’s Medical Board is required.

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 12/36

the treatment, in particular why

this treatment should take place

before the end of your mobility;

An X-ray in case of a root canal

treatment.

Expenses excluded from cover:

Any dental care that can be

postponed until after the mobility;

Preventive dental care (such as

check-up, cleaning, polishing,

whitening, mouth guard);

Elective dental care (such as

change of fillings,

crowns/implants/prostheses,

wisdom tooth removal);

More than 2 root canal

treatments;

More than 3 fillings.

Repatriation in the

event of serious

disease or serious

accident

Real

expenses

Yes

In case of a medical emergency

requiring evacuation assistance,

please call our evacuation assistance

provider VHD via +31 10 289 41 93

(mention policy no. BEBBBY01626).

Accidents linked

to sports and trips

linked to the

mobility abroad

100%

Yes

Medical expenses following an

accident will be covered following

policy guidelines.

The results of wounds or injuries

resulting from motor vehicle racing

and dangerous competitions are not

covered; normal sports competitions

are covered.

Follow-up of

orthodontic

treatment

100%

Subject to

the dental

ceiling of

1,000 EUR

Yes

Only ongoing orthodontic treatment is

covered by your medical plan. To

obtain Prior Approval, you must

submit a confirmation note from your

orthodontist in your home country

stating the start date of your

treatment.

Replacement of a

pair of

prescription

eyeglasses or

contact lenses

that is

deteriorated, lost

or stolen.

100%

Subject to a

ceiling of

300 EUR

Yes

Eligible expenses:

Only one replacement of a pair of

prescription eyeglasses or contact

lenses that is deteriorated, lost or

stolen, will be covered by your

medical plan.

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 13/36

Only single vision glasses without

treatment (e.g. anti-reflective layers)

will be covered.

Expenses excluded from cover:

Damage caused by wear-and-

tear;

Visits to an optician or

ophthalmologist to determine

your dioptre. Optical cover only

applies to ongoing treatments;

Daily/weekly contact lenses;

Cleaning products;

Sunglasses;

Following documents need to be

submitted in order to assess the

medical necessity of your request

prior to your purchase:

1) In case your glasses/contact

lenses are deteriorated or lost:

A medical report/prescription for

your previous glasses/contact

lenses from your ophthalmologist

in your home country, indicating

your ongoing treatment and

his/her contact details for cross-

checking;

Two completed copies of the

optical cost estimate form;

A completed copy of the

Declaration of Honour form

describing the circumstances of

the loss, signed by you and by

the legal representative of your

hosting organisation (including

his/her contact details).

2) In case your glasses/contact

lenses have been stolen:

A medical report/prescription for

your previous glasses/contact

lenses from your ophthalmologist

in your home country, indicating

your ongoing treatment and

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 14/36

his/her contact details for cross-

checking;

A completed copy of the optical

cost estimate form;

A copy of the police report.

The cost estimate and the

Declaration of Honour form can be

found on your personal webpages.

How do I request Prior Approval from Cigna’s Medical Board?

You can submit your request for Prior Approval by providing us with a doctor's prescription stating the

diagnosis, the motivation for the treatment and the recommended number of sessions (if applicable) via

erasm[email protected]. Please refer to the section above to check which additional supporting

documents might need to be submitted with your request.

If you prefer to reach out to a Medical Adviser directly, you can send your request for Prior Approval to

medicalconsultant@cigna.com.

Avoid unpleasant surprises. If you are in doubt whether or not your treatment is covered under

the insurance plan or if you need to incur considerable expenses, we advise you to contact us

before you start your treatment to confirm that your expenses are eligible for reimbursement

under the insurance plan.

Your request for Prior Approval will be processed as soon as possible. The time needed to process your

request may depend on the complexity of your treatment.

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 15/36

1.4 What if I need medical care?

1.4.1 If you are complementary insured

1. You are free to visit your preferred health care provider, but we advise you to visit a health care

provider that accepts your EHIC card. This information can be found here (select your

home/hosting country at the top of the page for detailed information).

Present your EHIC to your health care provider. In some countries, the EHIC card will give you

access to direct payment between the health care provider and your national health insurer (at

the provider’s discretion). As your complementary insurer, Cigna can’t set up direct payment.

If you visit a health care provider that does not accept your EHIC card (e.g. private health care

provider), you may be asked to pay/advance your bill directly to the provider and claim the

expenses afterwards.

If you need urgent or unplanned treatment, your local health authority might be able to help out

by faxing or emailing proof of your health insurance cover to avoid that having to pay the

expenses upfront.

2. Submit a claim with your national system in your home country if your expenses could not

be settled directly with your EHIC card.

3. Submit the claim for reimbursement of the remaining amount via the Cigna personal

webpages or the mobile app. Do not forget to fill in the section ‘Is the claim covered by another

insurance?’ by indicating the amount already reimbursed and ‘European Health Insurance’ as

the insurance company.

4.

4. Cigna shall make a reimbursement as appropriate, on the basis of the difference between

the costs actually incurred and the reimbursement obtained from your national system.

Upon receipt of written proof that your expenses can’t be covered by your national system,

Cigna will reimburse your eligible expenses as from the first Euro.

Please submit a Settlement Note/Explanation of Benefits (EOB)/Payment Slip

from your primary insurer (national health insurance) as attachment to your claim.

Cigna may also ask you to submit a detailed invoice from the provider specifying

the separate price for each expense as well as the proof of payment and any

prescriptions including the diagnosis.

Should a claim need to be reimbursed to the account of a third party (i.e. in the

case your sending/supporting/hosting organisation or a family member has

advanced your medical bill), please submit a signed letter authorising the transfer

as attachment to your claim. This letter should be signed, dated and scanned. You

can also find a ‘Payment Authorisation Form’ on your personal webpages.

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 16/36

1.4.2 If you are primary insured

In case of hospitalisation

Please contact us well in advance before the scheduled date of admission so we can help you with the

necessary administration and arrange direct payment of your medical bills. To arrange direct payment,

we always need to be informed of the planned treatment and cost.

In case of emergency or accident

Sometimes hospital admissions are unexpected and unplanned. Even if you can’t contact us before

being admitted, we can still help you deal with the paperwork and assist you in setting your medical bill.

In case of emergency, show your membership card to your health care provider upon admission and

have someone (e.g. a family member or colleague) call us as soon as possible. The name and telephone

number of the health care provider are enough for our Customer Service Team to initiate the direct

payment procedure and send a Guarantee of payment to the provider within a few hours.

If you sustain injuries from an accident, submit a notification of accident form which can be found on

your personal webpages. Specify the place and circumstances of the accident and mention details of

third parties involved and of any witnesses or legal authorities.

In case of outpatient treatment

When visiting a doctor or another health care provider, simply pay the bill and claim your expenses with

us afterwards. You don’t have to contact us beforehand.

For major outpatient treatment (>200 EUR) you can also obtain direct payment. To arrange direct

payment, we always need to be informed of the planned treatment and cost.

For planned inpatient or expensive (>200 EUR) treatment, the procedure is as follows:

1. You can search for your preferred provider in our network by consulting the provider search

tool on your personal webpages or the mobile app. If your preferred provider is not included in

the list, contact us so we can make the necessary arrangements.

2. Contact us well in advance of your planned treatment or have the provider contact us.

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 17/36

3. Download the cost estimate form from your personal webpages. Ask the health care provider

to fill it in and to return it to us.

4. After we receive the cost estimate form, we’ll send a guarantee of payment to both you and

the provider. This document mentions whether or not the treatment is covered and what portion

of the expenses will be invoiced to us directly.

5. Upon admission, show your Cigna e-membership card and the guarantee of payment to the

provider.

6. We will settle the bill directly with the provider. After we settle with the provider, you will

receive a settlement note.

We can’t set up direct payment with your health care provider if the

expenses incurred are below 200 EUR. Please settle the expenses yourself first

and submit a claim for reimbursement via the personal webpages or the mobile

app afterwards. Upon receipt of your claim, we will process it in accordance with

the conditions of the medical plan.

Please make sure to obtain a detailed invoice form the provider specifying the

separate price for each expense as well as the proof of payment and any

prescriptions including the diagnosis.

Should a claim need to be reimbursed to the account of a third party (i.e. in the

case your sending/supporting/hosting organisation or a family member has

advanced your medical bill), please submit a signed letter authorising the transfer

as attachment to your claim. This letter should be signed, dated and scanned. You

can also find a ‘Payment Authorisation Form’ on your personal webpages.

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 18/36

1.4.3 How and when will your claims be processed?

The sooner you send us your claim form, the sooner we can reimburse you!

We understand that you expect a smooth and swift reimbursement. Therefore, we aim for a quick and

hassle-free settlement of all claims.

Here’s how we process your claims:

After we receive your claim, it will be processed in the currency (EUR) and within the time limits

stipulated by your Group Medical Insurance Plan and according to the benefits set out by the

Erasmus+ and European Solidarity Corps Programme. On average, it will take 7-10 business

days to process and reimburse your claim.

Your claims overview on the Cigna personal webpages or the mobile app allows you to view the

status of your claim (e.g. in progress) and whether or not actions are required by you to finalise

claims processing (e.g. upload missing information).

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 19/36

If more documentation or information is needed to process your claim, your Settlement Note

will mention this. To make sure we can reimburse you smoothly, please always include the

following documents:

o A detailed invoice with the patient’s name, the diagnosis, description of care, a breakdown

of the costs and the doctor’s stamp/signature;

o A proof of payment;

o (Copy of) referrals/prescriptions, if applicable;

o Any relevant additional reports or information regarding the treatment.

The more information we have, the quicker we can process your claim.

Hospitalisations, recurring treatments and accidents require additional documentation. You can

find a full list of documents to add to your claims on your personal webpages in the ‘My Claims’

section.

Once we have processed your claim, we’ll reimburse the expenses into the bank account you have

indicated on your Claim form.

How do you know your claims have been settled?

You’ll always be informed when your claim has been processed so you won’t be kept guessing.

Settlement notes – also called Explanation of Benefits (EOB) – will be sent by email thanks to our Online

Settlements service. If your claim was not or only partially accepted our settlement note will explain

why certain costs were not reimbursed.

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 20/36

2. Your Non-Medical Insurance Plan

In this section, you can find more information on the non-medical cover provided under this insurance

plan.

Even though most of your non-medical benefits are insured by Chubb, you may contact Cigna with

questions about the claiming procedures, your cover, or a specific claim you sent us. Cigna will contact

Chubb on your behalf and will get back to you directly with specific answers to your questions.

2.1 Your cover

2.1.1 Life Insurance

This insurance plan covers you 24 hours a day against the risk of death occurring during the duration of

the cover, whatever the cause.

In particular, this insurance plan covers:

Type of expense

Cover rate

Transport of bodily remains to a place chosen by the family

Real expenses

Funeral costs

Real expenses

Burial costs

Real expenses

Lump-sum payment paid out to a nominated beneficiary or

closest survivor

20,000 EUR

Travel costs of family members to the place of the event

Real expenses

2.1.2 Permanent Disability

This insurance plan covers you 24 hours a day against the risk of permanent disability - total or partial -

resulting from any event occurring during the period of insurance, even if the event that causes the

permanent disability is not linked to the voluntary activities.

Avoid unpleasant surprises. We advise you to contact Cigna via

[email protected] or + 32 3 293 11 27 to enquire about your cover before you

incur any expenses.

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 21/36

Type of expense

Cover rate

(lump-sum payment)

Total or partial permanent disability, resulting from any

event occurring during the period of insurance

Total disability: 60,000 EUR

Partial disability: x% of 60,000

EUR based on the percentage

of disability (x) as established by

the insurer’s Medical Adviser

The benefit in case of permanent disability does not cover the consequences of one of the following

cases:

A voluntary or intentional offence committed by the insured, although the consequences of

attempted suicide are covered;

(Civil) war, riots, brawls, acts of terrorism in which the insured has taken an active part, although

cases of legitimate defence and assistance given to a person in danger are covered;

Nuclear fission.

2.1.3 Third Party Liability

This insurance plan covers the financial consequences of the legal liability of an insured person for

bodily injury, property damage, and consequent financial loss to a third party 24 hours a day occurring

at any time during the period insured. A maximum of 5,000,000 EUR per event applies, including the

sub-limits as stipulated in the table below.

This third party liability insurance also covers the sending/supporting, the hosting and the coordinating

organisations of the project, where they may held responsible for the insured person’s action.

Type of expense

Cover rate

Personal injury

Real expenses with a ceiling of

5,000,000 EUR

Material damage and consequential financial loss

Real expenses with a ceiling of

500,000 EUR

Damage and costs resulting from fire, explosion and

electrical damage for which the insured person is liable as

the tenant, occupant or neighbour of a building

Real expenses with a ceiling of

75,000 EUR

Legal assistance

Real expenses with a ceiling of

15,000 EUR

Detention

Real expenses with a ceiling of

5,000 EUR

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 22/36

Legal deposit, bail

Real expenses with a ceiling of

50,000 EUR

Following risks are excluded from cover:

Liability covered by an insurance made compulsory by Law (as laid down by the legislation of the

country where the losses occurred). Before using a motor vehicle, make sure you check that its

insurance covers your liabilities.

Hunting, navigation, motor boats, gambling games, reckless dares;

Damage caused intentionally, due to serious negligence or under influence of alcohol or drugs;

Material damage caused through fire, explosion and electrical damage, except as indicated above;

Erroneous financial operations, embezzlement, breach of trust, etc.;

Fines or contraventions of any kind;

Participation in wagers or races;

Participation in acts of collective violence (war, strife, terrorism, strikes, riots etc.);

A product supplied by you or work done by you;

Your liability as director or agent of a legal entity;

Your negligence in managing an insured organisation.

Cover for lawsuits also exclude losses when the insured is acting as the owner, tenant or occupant of

premises, except with regard to the premises the insured occupies during his/her mobility.

2.1.4 Travel Assistance

Type of expense

Cover rate

Good to know

Visit by close family members

2

in

case of hospitalisation of an

insured person

100 EUR per day

Accommodation costs per person

per day for maximum 10 days

Earlier return in case of

emergency hospitalisation

(lasting more than 5 days) or

death of a close family member

Real expenses

Provision of a return ticket

(economy class) for the insured

person in case of death or sudden

illness and hospitalisation lasting

more than 5 days of a close

member of your family. Return

ticket (economy class) from hosting

country to country of customary

residence of origin.

Sending urgent messages

Real expenses

2

First or second degree family member

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 23/36

Telecommunication costs

250 EUR

Loss or theft of documents or

travel ticket

Real expenses with a

maximum of 2,500

EUR

The insurance covers the loss and

theft of travel ticket and identity

documents (identity card, passport,

etc.) outside the country of origin.

Loss or theft of luggage on the

way to/back from host country

Loss or theft of luggage is only

covered on the way to/back from

host country.

Deprivation of liberty

Real expenses with a

ceiling as stipulated in

this table

The insurer compensates each

complete period of 24 hours

that an insured person is

forcibly detained while on

mobility as a consequence of

hijacking, abduction or unlawful

imprisonment at a rate of 400

EUR per day, up to a maximum

of 20,000 EUR.

The insurer also pays for

advice in case of abduction

during a mobility – other than

ransom money – in order to

secure the release of the

member, up to a maximum of

125,000 EUR.

Political unrest

Real expenses with a

ceiling of 50,000 EUR

The insurer will pay the costs of an

evacuation.

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 24/36

3. Easy access to health care

In this section, you can find more information on the online information and services available to you.

Your e-membership card

The key to quick, seamless and stress-free support

Your personal webpages

Online information at your fingertips

Cigna in your pocket

Cigna Health Benefits App

Worldwide access

To health care providers and medical advice and support services

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 25/36

3.1 Your e-membership card

Download your e-membership card from your personal webpages or the online app and keep it close to

hand as it’s the key to contacting Cigna. We can easily identify you by your personal reference number

mentioned on the e-card. This number gives you access to our online information and services.

If you are complementary insured, you should always present your EHIC card to your health care

provider. Your EHIC card is the key to accessing medically necessary, state-provided health care

during a temporary stay in any of the 28 EU countries, Iceland, Liechtenstein, Norway and Switzerland,

under the same conditions and at the same cost (free in some countries) as people insured in that

country. In some countries, the EHIC card will give you access to direct payment between the health

care provider and your national health insurer (at the provider’s discretion).

If you are primary insured, the Cigna ID card is the key to accessing health care. Present your Cigna

card to your health care provider in case you are hospitalised so the hospital can contact Cigna to set

up a direct payment arrangement.

You can find more information on your category of cover (complementary or primary) in section 1.2 on

pages 5-7.

1

3

1

3

4

Personal data

- Full name

- Date of birth

- Cigna reference number

(424/xxxxx)

Dedicated contact details to get in

touch with Cigna

Contact details for health care

providers

2

4

2

Your card will have the notice

‘Complementary to EHIC’ if you

are complementary insured

If the data on your e-membership card are incorrect, please let us know. We want

to keep your file up-to-date.

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 26/36

If the data on your e-membership card are incorrect, please let us know. We want to keep

your file up-to-date.

3.2 Your personal webpages

Access all information regarding your insurance plan anytime, anywhere.

Your e-membership card is not a proof of cover. If you need proof of insurance

before the start of your cover period (e.g. visa requirement), please contact

clientservice2@cigna.com. Our Customer Services team will then create an

individual insurance certificate.

If you need an insurance certificate during your cover period, you can download

an immediate proof of cover in your required language from your personal

webpages (under ‘My Plan’). More information on how to access your personal

webpages can be found below.

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 27/36

Through your personal webpages you can:

- Download your e-membership card,

- Download an insurance certificate,

- Submit a claim through the online claiming tool,

- Review and check the status of your claims,

- Find answers to frequently asked questions, and

- View our contact details.

How to access your personal webpages?

Step 1: Go to https://www.cignahealthbenefits.com/ and click on Plan members.

Step 2: Fill in your personal reference number which can be found on your e-membership card or in

your welcome email and follow the guidelines on the screen.

3.3 Cigna in your pocket

With the Cigna Health Benefits mobile app you have quick and easy access to Cigna’s services;

wherever you are, anytime and anywhere, right from your smartphone.

Through the Cigna Health Benefits app you have access to the following features:

- Location-based provider search (see also section 3.4 on pages 28-29);

- Submit claims for reimbursement of medical expenses through photoclaiming (no need to

scan your invoice or supporting documents);

- Review and check the status of your claims;

- View our contact details.

You can download the app for free from the Apple App Store℠ for iOS and from

Google Play™ for Android.

Your personal webpages will not be active until the start date of your cover.

You should treat the log-in details to your personal webpages confidentially. In

order to prevent fraud, you should never share your log-in details.

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 28/36

3.4 Worldwide access

In this section, you can find out how to find a health care provider near you.

3.4.1 If you’re complementary insured

If you’re a complementary insured plan member, we advise you to visit a health care provider who

will accept your EHIC card. You can find a list of these providers here (select your home/hosting

country at the top of the page for detailed information). In some countries, the EHIC card will give you

access to direct payment between the health care provider and your national health insurer (at the

provider’s discretion).

If you decide to visit a provider outside of the EHIC network instead (e.g. a private health care provider),

or you incur expenses not covered by EHIC in your host country, you should advance the expenses

and submit a claim for refund with your national system in your home country. If the national system

covers only part or none of the costs incurred (as indicated on a Settlement Note/Explanation of Benefits

(EOB)/Payment Slip of the national health insurance provider), Cigna will ensure 100% reimbursement

of the eligible expenses.

3.4.2 If you’re primary insured

If you’re a primary insured plan member, you can use the Provider Search on your personal webpages

or the mobile app to look up a provider that is in Cigna’s worldwide network. Depending on your need,

you can search providers by name, location, type of facility and/or specialty. You can also check with

whom we have a direct payment agreement.

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 29/36

Should your expenses exceed 200 EUR, Cigna will try to arrange direct payment with your health care

provider. In this case, please have the health care provider contact us for a Guarantee of payment so

you don’t have to advance your expenses.

If you want to visit an out-of-network provider or can’t find your preferred provider in our list, contact

us and we’ll try to make the necessary arrangements.

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 30/36

4. Contact Details

Wherever you are, help is not far away. Call us or send us an email and we’ll do our best to answer your

question as soon as possible. Please note that the average turn-around time to answer an email is 4

business days depending on the complexity of your question.

In case your question is urgent, we advise you to call us: + 32 3 293 11 27. You can also call us and

ask to be called back by Cigna. We are available 24/7, every day of the year.

You can find our contact details below, as well as on your Cigna personal webpages or on your e-

membership card.

4.1 Evacuation Assistance

In case of an emergency requiring a medical evacuation, use the following contact details. When calling

the Evacuation Assistance (VHD), please make sure to mention policy number BEBBBY01626.

Phone + 31 10 289 41 93 (available 24/7)

4.2 Affiliations

Use the contact details below for questions about affiliations, insurance certificates and to communicate

changes of personal data.

Phone + 32 3 393 10 94

Fax + 32 3 235 01 24

Email clientservice2@cigna.com

Postal address Cigna - P.O. Box 69 - 2140 Antwerpen - BELGIUM

4.3 My claims, cover and procedures

Use these contact details for questions about the claiming and direct payment procedures, your cover,

or a specific claim you sent us.

When you contact us by phone, please make sure you have the following details

ready: your full name, date of birth and Cigna personal reference number.

When you contact us by email, please make sure that the subject line of your

message mentions your Cigna personal reference number to ensure a timely

response. A representative will deal with your query or provide you with a status

update within 4 business days.

If you provide your supporting/hosting organisation with Cigna’s contact details and

your Cigna personal reference number, they will be able to contact us on your

behalf in case of an emergency.

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 31/36

4.3.1 Medical Claims Centre

Use the contact details for questions about your cover, Prior Approvals, a specific medical claim you

sent or about the claiming and direct payment procedures.

Phone + 32 3 293 11 27

Fax + 32 3 663 28 57

Postal address Cigna - P.O. Box 69 - 2140 Antwerpen – BELGIUM

4.3.2 Non-Medical Claims Centre

Use the contact details to send a claim or any question related to the Life, Disability, Third Party

Liability and Travel Assistance insurance.

Phone + 32 3 293 11 27

Fax + 32 3 235 01 24

Postal address Cigna - P.O. Box 69 - 2140 Antwerpen – BELGIUM

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 32/36

5. FAQ

5.1 What to do when your project or individual mobility is cancelled for any reason?

In case your mobility is cancelled, please request your sending/supporting organisation to contact us as

soon as possible by sending an email with the actual date of your return to home country to

clientservice2@cigna.com.

5.2 How can I get an insurance certificate for a visa application?

If you need proof of insurance before the start of your cover period (e.g. visa requirement), please

contact clientserv[email protected]. Our Customer Services team will then create an individual insurance

certificate.

If you need an insurance certificate during your cover period, you can download immediate proof of

cover in your required language from your personal webpages (under ‘My Plan’). More information on

how to access your personal webpages can be found in section 3.2 on pages 26-27.

5.3 When am I covered?

Your cover is active 24/7 from the day you leave home to the host country, until the end of the second

month after the termination of the mobility. This includes any travel from and to the hosting country and

any in-country travel linked to the mobility.

5.4 Where am I covered?

You enjoy worldwide cover during both private and project-related activities. However, a distinction is

made between the cover in your home and hosting country and other countries worldwide:

Home and hosting country: you’re covered for all medical treatment based on the plan

specifications, be it planned or unplanned (i.e. emergency treatment).

Other countries: you’re covered for unplanned (i.e. emergency treatment) only.

Please find below examples of planned and unplanned treatment:

Example unplanned treatment: a participant with Turkey as home country and France as hosting country

is on vacation in Spain and breaks his leg during a walk. In this case, all medical treatment in Spain is

covered given that it concerns an unplanned/emergency treatment.

Example excluded planned treatment: the same participant is diagnosed with cancer while residing in

France. He opts to be treated in the United States and travels there to receive treatment. The medical

treatment is not covered, since it concerns a planned treatment outside of the home/hosting country.

5.5 Where do I find more information on Cigna’s health care provider network?

You’re free to visit your healthcare provider of choice. If you visit one of the providers within Cigna’s

network of more than 10,000 hospitals, doctors and specialists worldwide, you might be able to benefit

from direct payment agreements and discounts negotiated by Cigna.

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 33/36

You can search for an in-network provider by country/city or by speciality through the Provider Search

tool on your personal webpages. This provider search tool is also available on the Cigna Health Benefits

app, which is available to download for free from the Apple App Store or Google Play for Android.

5.6 What should I do in case of a medical emergency requiring evacuation?

In case appropriate medical care can’t be administered at the location of illness/accident, you can be

evacuated to another location or to your home country. In case of a medical emergency requiring

evacuation assistance, please call our evacuation assistance provider VHD via +31 10 289 41 93

(mention policy no. BEBBBY01626).

Complementary insured members are advised to search for a health care provider

that accepts their EHIC card to possibly benefit from direct payment. You can

consult a list of health care providers who accept the EHIC here (select your

home/hosting country at the top of the page for detailed information).

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 34/36

6. Your checklist before you leave for your mobility

Are you eligible for a European Health Insurance Card (EHIC)?

Your medical history

- If you are eligible, have you applied and received your EHIC? Do not forget to take it with

you.

- If you are not eligible, please contact clientservice2@cigna.com with the request to

change your category from complementary to primary. You may need to reach to your

national health insurer to obtain a written communication stating why you are not eligible

and submit it with Cigna.

- If you are not sure about your entitlements to EHIC or in case of doubts, you may contact

your sending/supporting organisation to assist you in this process.

- Did you know that each EU country has at least one National Contact Point who can

inform you on whether or not you are entitled to reimbursement for a specific treatment

under EHIC and whether or not a ceiling may apply? It could be useful to enquire about

this before you incur any expenses.

You can also find more information on this topic in section 1.2 on pages 5-7.

Pre-existing medical conditions are not excluded from cover under this insurance plan.

However, we do advise you to contact us before you leave on your mobility so that we can

make the necessary arrangements. This way, Cigna’s Medical Board can give the necessary

advice regarding the cover of your permanent/ongoing medical treatment or medication and

you don’t have to worry about it during your mobility.

You may also bring along a soft copy of the important medical documents (such as a referral,

prescription or a medical report) regarding your condition for which you may need ad hoc

medical treatment or medicines abroad. These documents can be requested for review by

Cigna’s Medical Board in light of a Prior Approval procedure if need be.

Examples of pre-existing conditions: ongoing orthodontic treatment, diabetes, rheumatism, etc.

If you wear glasses and you break or lose them or they get stolen during your mobility, you’ll

be asked to include a prescription from your ophthalmologist in your home country with your

claim.

You can find more information on your medical cover in section 1.3 on pages 8-14.

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 35/36

7. Best practices to keep in mind

Don’t leave your home country without a valid EHIC card if you’re eligible for one. If you have

questions about your personal insurance status, reach out to your sending/supporting Organisation

or your national health insurance / national system at the enrolment stage.

Check your e-membership card to review what type of cover (primary/complementary) is granted

to you under your Cigna insurance plan. If you’re complementary insured, your e-card will mention

this in the top right corner of the card. You can also find the information on your category of cover

in your Cigna Welcome Email. If you’re not eligible for a free of charge EHIC card, you can request

to change your category from complementary to primary by following the instructions as explained

in section 1.2 on page 7.

If you’re complementary insured, we advise you to visit a health care provider that accepts your

EHIC card. You can find a list of these providers here (select your home/hosting country at the top

of the page for detailed information). Your EHIC card gives you access to free or subsidised medical

care offered in your host country. In some countries, the EHIC card will give you access to direct

payment between the health care provider and your national health insurer (at the provider’s

discretion).

If you’re complementary insured, claim your medical expenses with your primary insurance or

national system first.

Before incurring high medical expenses, check if they’re covered under your insurance plan and

whether they are subject to Prior Approval (see section 1.3 on pages 8-14). Should you still have

questions or doubts after consulting the available information in this Guide, you can contact us for

confirmation on your cover via erasm[email protected]m.

Get a second opinion whenever a surgery or other expensive treatment is prescribed.

Know what’s covered under your insurance plan and who to contact, so you’re well-informed

in case of emergency.

If you interrupt your mobility prematurely or there’s a change in the start or end date of your

mobility, please ask your sending organisation to contact Cigna via clientservice2@cigna.com as

soon as possible.

When you contact Cigna by email, please make sure that the subject line of your message mentions

your Cigna personal reference number (424/xxxxx) to ensure a timely response. A representative

will deal with your query or provide you with a status update within 4 business days.

On average, it will take 7-10 business days to process your claim.

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 36/36

8. Terms used in this brochure

What?

Short description

Day surgery

Surgery performed on an in-and-out, same-day basis without an

overnight stay.

Direct payment

By using this service you only need to pay your own share of the cost.

The part covered by the plan is directly billed to us by your health care

provider.

E-membership card

This is the personal e-card available upon affiliation. It contains all our

contact details and your personal information. You’ll need this e-card

when receiving medical care or when contacting us.

If you are complementary insured, you should always present the EHIC

card when receiving medical care.

Generic drug

A drug that contains the same ingredients and provides the same

therapeutic benefits as an equivalent, higher-cost brand-name drug.

Generic drugs become available when brand-name drug patents expire.

Guarantee of Payment

A letter of guarantee issued by us indicating the plan member’s eligibility,

cover and reimbursement rate per type of cost.

Health care provider

network

We established a worldwide quality network of several thousands of

health care providers (doctors, physicians, pharmacies, hospitals, etc).

This network is continuously being monitored, kept up-to-date and

adapted to your needs. We have direct payment and preferential tariff

agreements with all providers in our network.

If you’re complementary insured, you’re advised to check whether your

health care provider accepts EHIC first.

Inpatient care or

hospitalisation

Treatment given on an inpatient basis, where the date of admission

differs from the date of discharge.

Online settlements

This secure online service shows an overview of all settlement

information, including reimbursement and payment details.

Out-of-pocket

expenses

Out-of-pocket expenses are the portion of the bill that is not covered by

your medical plan.

Outpatient treatment

Treatment given on an outpatient basis, where the date of admission is

the same as the date of discharge.

Personal webpages

We created personal webpages for you which you can access anywhere

in the world and at any time via https://www.cignahealthbenefits.com/. On

these personal webpages you can find all information regarding your

cover and also access our online services.

Reasonable &

Customary (R&C)

Reasonable and Customary refers to the prevailing pattern of charges for

professional and other health services in the country where the service is

provided. Fees for treatments, procedures or services which may be

considered to be excessive compared to prevailing fee levels will be

reimbursed up to the reasonable and customary level.

Guide for Erasmus+ volunteers and European Solidarity Corps participants

Confidential, unpublished property of Cigna. Do not duplicate or distribute.

Last update: January 2020 37/36

Responsible publisher: Cigna International Health Services BVBA • Plantin en Moretuslei 299 • 2140 Antwerpen Belgium •

RPR Antwerpen • VAT BE 0414 783 183

‘Cigna’ refers to Cigna Corporation and/or its subsidiaries and affiliates. Cigna International and Cigna Global Health Benefits

refer to these subsidiaries and affiliates. Products and services are provided by these subsidiaries, affiliates and other

contracted companies and not by Cigna Corporation. ‘Cigna’ is a registered service mark.

This material is provided for informational purposes only. It is believed accurate as of the date of publication and is subject to

change. Such material should not be relied upon as legal, medical, or tax advice. As always, we recommend that you consult

with your independent legal, medical, and/or tax advisors. Products and services may not be available in all jurisdictions and

are expressly excluded where prohibited by applicable law.

Copyright 2020 Cigna Corporation

The following companies provide the insurance cover in Europe:

Cigna Life Insurance Company of Europe S.A.-N.V., registered in Belgium with limited liability, Avenue de Cortenbergh 52,

1000 Brussels, Belgium. Insurance company authorised in Belgium under licence number 938.

Cigna Europe Insurance Company SA-NV., registered in Belgium with limited liability, Avenue de Cortenbergh 52, 1000

Brussels, Belgium. Insurance company authorised in Belgium under licence number 2176.

Cigna Life Insurance Company of Europe SA-NV and Cigna Europe Insurance Company SA-NV., are subject to the

prudential supervision of the National Bank of Belgium, Boulevard de Berlaimont 14, 1000 Brussels (Belgium) and to

the supervision of the Financial Services and Markets Authority (FSMA), Rue du Congrès 12-14, 1000 Brussels

(Belgium)