Mississippi Insurance Department

Report of Examination

of

SOUTHERN FARM BUREAU CASUALTY

INSURANCE COMPANY

as of

Decemb

er 31, 2020

TABLE OF CONTENTS

Examiner Affidavit ..................................................................................................................... 1

Salutation .................................................................................................................................... 2

Scope of Examination ................................................................................................................. 3

Comments and Recommendations of Previous Examination ..................................................... 3

History of the Company .............................................................................................................. 3

Corporate Records ...................................................................................................................... 5

Management and Control ............................................................................................................ 5

Stockholders ................................................................................................................... 5

Board of Directors .......................................................................................................... 5

Committees ..................................................................................................................... 7

Officers ........................................................................................................................... 8

Conflict of Interest .......................................................................................................... 9

Holding Company Structure ....................................................................................................... 9

Organizational Chart....................................................................................................... 9

Affiliated and Related Party Transactions .................................................................... 12

Fidelity Bond and Other Insurance ........................................................................................... 14

Pensions, Stock Ownership and Insurance Plans ...................................................................... 14

Territory and Plan of Operation ................................................................................................ 14

Growth of Company ................................................................................................................. 15

Mortality and Loss Experience ................................................................................................. 16

Reinsurance ............................................................................................................................... 16

Accounts and Records............................................................................................................... 19

Statutory Deposits ..................................................................................................................... 19

Financial Statements ................................................................................................................. 20

Introduction .................................................................................................................. 20

Statement of Admitted Assets, Liabilities, Surplus and Other Funds - Statutory ........ 21

Statement of Income - Statutory ................................................................................... 22

Reconciliation of Capital and Surplus - Statutory ........................................................ 23

Reconciliation of Examination Adjustments to Surplus .............................................. 24

Market Conduct Activities ........................................................................................................ 25

Commitments and Contingent Liabilities ................................................................................. 25

Subsequent Events .................................................................................................................... 25

Comments and Recommendations ............................................................................................ 26

Acknowledgment ...................................................................................................................... 27

EXAMINER'S

AFFIDAVIT

AS

TO

STANDARDS

AND

PROCEDURES USED

IN

AN

EXAMINATION

State

of

Miss

i

ss

ippi,

Co

unty

of

Madison,

R.

Dal

e Miller, being

duly

sworn

, stat

es

as

fo

ll

ows:

I. I h

ave

authority to repr

ese

nt

the Mississippi Insurance D

epartment

in the

exa

mination

of

So

uthern

Farm

Bureau

Casua

lty Insuran

ce

Company

as

of

December

31,

2020.

2.

The

Mississippi Insuran

ce

Department

is

accredited

und

er

the

Nat

ional

Assoc

i

atio

n

of

I

nsurance

Co

mmi

ss

ioners Financial R

eg

ulation

Standards

and

Accreditation.

3. I h

ave

reviewed

the

exa

min

at

i

on

wo

rk

papers

and

exam

in

at

i

on

r

eport

,

and

the

exa

mina

ti

on

of

So

uthern

Farm

Bureau

Casua

l

ty

[nsurance

Co

mpany

was

performed

in a

manner

co

nsi

stent

with the sta

ndard

s

and

procedur

es

required by the

National

Association

of

Insurance

Co

mmissioners

and

the

Mississippi In

sura

nc

e Department.

The

affiant

says

nothing further.

f2ilzbJti.J!L

My

commission

exp

ir

es

();}obP,r-

/0

1

;J.0:)3/ [date]

I

So

uthern

Farm

Bur

eau

Cas

ualty Insuran

ce

Co

mpany

MID

Exa

min

at

ion

as

of

December

31,

2020

day

of

Page

I

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2020 Page 2

June 15, 2022

Honorable Mike Chaney

Commissioner of Insurance

Mississippi Insurance Department

1001 Woolfolk Building

501 North West Street

Jackson, Mississippi 39201

Dear Commissioner Chaney:

Pursuant to your instructions and authorization and in compliance with statutory provisions, an

examination has been conducted, as of December 31, 2020, of the affairs and financial condition of:

SOUTHERN FARM BUREAU CASUALTY INSURANCE COMPANY

1800 East County Line Road

Ridgeland, Mississippi 39157

License #

NAIC Group #

NAIC #

FEETS #

7700932

0483

18325

18325-MS-2020-1

This examination was commenced in accordance with Miss. Code Ann. §83-5-201 et seq. and was

performed in Ridgeland, Mississippi, at the statutory home office of the Company. The report of

examination is herewith submitted.

MIKE CHANEY

Commissioner of Insurance

State Fire Marshal

MARK HAIRE

Deputy Commissioner of

Insurance

MAILING ADDRESS

Post Office Box 79

Jackson, MS 39205-0079

TELEPHONE: (601) 359-3569

FAX: (601) 576-2568

MISSISSIPPI INSURANCE DEPARTMENT

501 N. WEST STREET, SUITE 1001

WOOLFOLK BUILDING

JACKSON, MISSISSIPPI 39201

www.mid.ms.gov

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2020 Page 3

SCOPE OF EXAMINATION

We have performed our full-scope financial examination of Southern Farm Bureau Casualty

Insurance Company (“SFBCIC” or “Company”). The last examination covered the period of

January 1, 2011 through December 31, 2015. This examination covers the period of January 1,

2016 through December 31, 2020. This examination was coordinated with Mississippi as the lead

state and Arkansas, Florida, and Louisiana as participating states.

We conducted our examination in accordance with the National Association of Insurance

Commissioners (“NAIC”) Financial Condition Examiners Handbook (“Handbook”). The

Handbook requires that we plan and perform the examination to evaluate the financial condition,

assess corporate governance, identify current and prospective risks of the Company and evaluate

system controls and procedures used to mitigate those risks. An examination also includes

identifying and evaluating significant risks that could cause an insurer’s surplus to be materially

misstated both currently and prospectively.

All accounts and activities of the Company were considered in accordance with the risk-focused

examination process. This may include assessing significant estimates made by management and

evaluating management’s compliance with Statutory Accounting Principles. The examination does

not attest to the fair presentation of the financial statements included herein. If, during the course

of the examination an adjustment is identified, the impact of such adjustment will be documented

separately following the Company’s financial statements.

This examination report includes significant findings of fact, as mentioned in the Miss. Code Ann.

§83-5-201 and general information about the insurer and its financial condition. There may be

other items identified during the examination that, due to their nature (e.g., subjective conclusions,

proprietary information, etc.), are not included within the examination report but separately

communicated to other regulators and/or the Company.

COMMENTS AND RECOMMENDATIONS OF PREVIOUS

EXAMINATION

There were no comments and/or recommendations made by the Mississippi Insurance Department

(“MID”) examination team in the previous examination report, which covered the period from

January 1, 2011 through December 31, 2015.

HISTORY OF THE COMPANY

In 1947, the Farm Bureau Federations located in the states of Arkansas, Florida, Mississippi and

Texas organized individual investment corporations for the purpose of organizing the Company.

On September 25, 1947, the Company was formed under the laws of the State of Mississippi as a

as a property and casualty insurance company, with business commencing on September 30, 1947.

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2020 Page 4

Subsequently, the Louisiana, South Carolina and Colorado Farm Bureau Federations acquired

equal shares of the Company’s capital stock and Florida sold its interest back to the Company.

Through December 31, 2008, the outstanding shares of SFBCIC were owned by the Farm Bureau

Federations in the states of Arkansas, Colorado, Louisiana, Mississippi, South Carolina and Texas.

Each entity held 666.6 shares or 16.67% of the 4,000 authorized shares of SFBCIC. The Texas

parties withdrew from SFBCIC as of December 31, 2008, and surrendered its 666.6 shares of stock

in exchange for shares of SFBCIC’s wholly owned subsidiary operating in the State of Texas

formed for purposes of the withdrawal. Because of the withdrawal of the Texas parties, SFBCIC

and its remaining shareholders desired to amend the Articles of Association, the Bylaws and the

Amended Membership Treaty under which it had operated. On December 14, 2009, the Treaty

was terminated and a new organization structure for the Company was created (the “original

reorganization”). Subsequent to the original reorganization, there were 10,428,000 shares of $1

par value common stock authorized and 1,082,842 issued. Of the issued shares, 2,640 shares were

voting shares and 1,080,202 were non-voting shares which were owned by the following

shareholders:

• Arkansas Casualty Investment Corporation,

• Colorado Farm Bureau Investment Company,

• FFBF Investment Corporation,

• Louisiana Farm Bureau Investment Corporation,

• Mississippi Farm Bureau Holding Corporation and

• South Carolina Farm Bureau Investment LLC

(collectively referred to as the “Investment Companies”). The Investment Companies were

majority owned by their respective Farm Bureau Federation/Organization (“Farm Bureau

Organization”).

Effective February 3, 2015, SFBCIC’s ownership structure underwent another change whereby a

new holding company, named Southern Casualty Holding Company (“SCHC”), was inserted

between SFBCIC and its previous shareholders as part of a reorganization. The 2015

reorganization was done for regulatory purposes and did not impact the financial condition, e.g.,

the capital and surplus of SFBCIC remained the same immediately before and after the

reorganization. In connection with the 2015 reorganization, the previous shareholder agreements

between SFBCIC, the Farm Bureau Organizations and the Investment Companies were terminated

and new shareholder agreements between SCHC, the Farm Bureau Organizations and the

Investment Companies were entered into with substantially the same terms as the original

shareholders agreement.

Subsequent to the 2015 reorganization, SFBCIC had 1,082,842 issued and outstanding shares of

one class of common stock, all of which was owned exclusively by SCHC. The Investment

Companies owned the following number of SCHC shares, which was the exact same number each

investment company owned of existing shares in SFBCIC prior to the 2015 reorganization.

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2020 Page 5

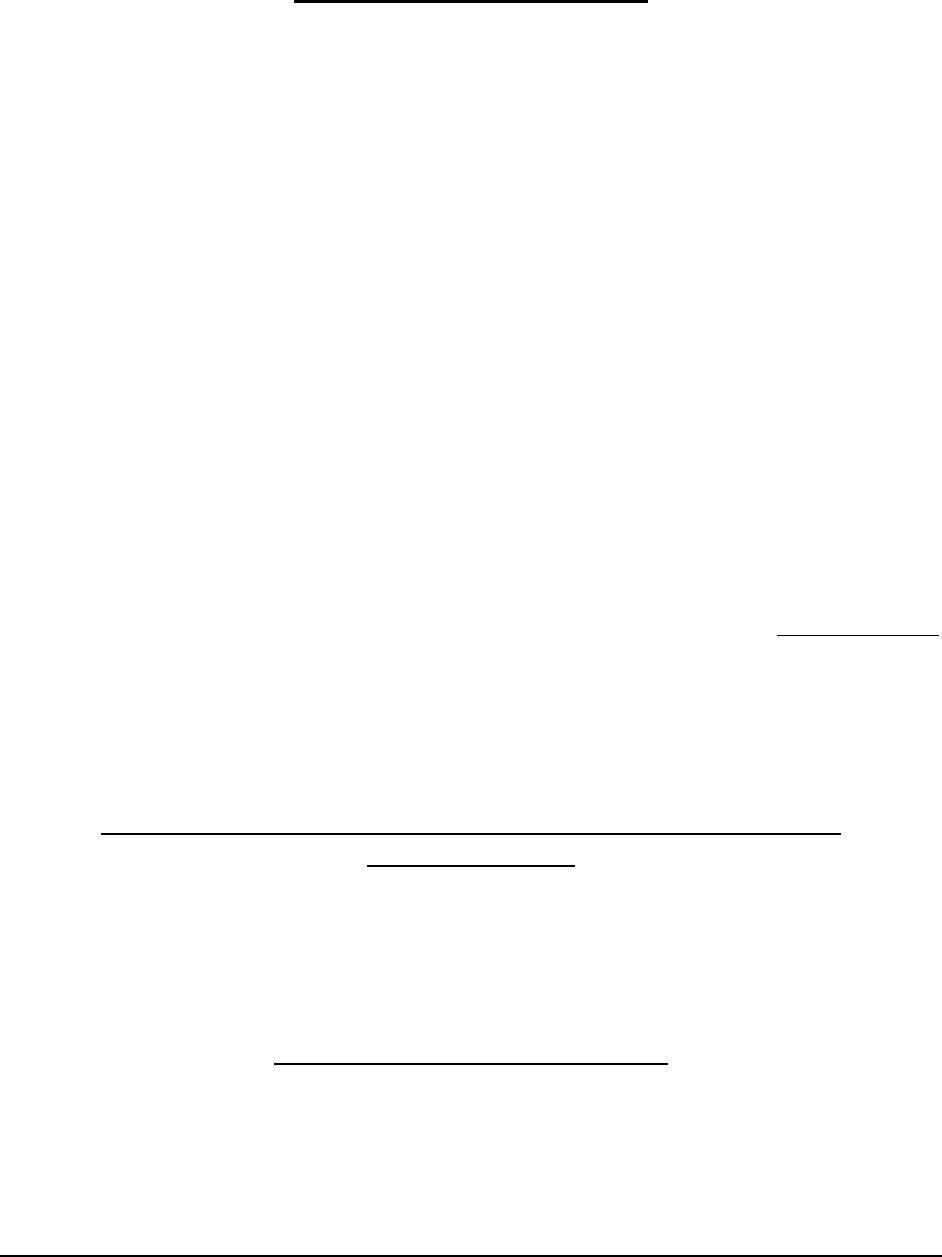

Shares

Outstanding

Investment Companies

Arkansas

Colorado

Florida

Louisiana

Mississippi

South

Carolina

Total

Class A

220

220

220

220

220

220

1,320

Class B

371,315

1,316

--

322,333

229,324

157,234

1,081,522

Total

371,535

1,536

220

322,553

229,544

157,454

1,082,842

Class C shares were automatically converted to Class B shares at the end of the reorganization

transition period in December 2019. At December 31, 2020, there were 1,081,522 Class B shares

and no Class C Shares outstanding.

CORPO

RATE RECORDS

The Articles of Incorporation, Bylaws and amendments thereto were reviewed and duly applied in

other sections of this report where appropriate. Minutes of the meetings of the Stockholders, Board

of Directors (“Board”) and various committees, as recorded during the period covered by this

examination, were reviewed and appeared to be complete and in order with regard to actions

brought up at the meetings for deliberation and appropriate action, which included the approval

and support of the Company’s transactions and events, as well as the review of the audit and

examination report.

MANAGE

MENT AND CONTROL

Stockholders

As of December 31, 2020, the Company had 10,428,000 shares of $1 par value common stock

authorized with 1,082,842 shares issued and outstanding. All issued and outstanding shares were

voting shares. SCHC owned 100% of the shares issued and outstanding. The Company paid the

following amounts as dividends to stockholders during the examination period.

2016

$52,800

2017

$52,800

2018

$52,800

2019

$52,800

2020

$52,800

Board of Directors

The Articles of Incorporation and Bylaws vest the management and control of the Company’s

business affairs with the Board. The members of the duly elected Board, along with their place of

residence, year elected/appointed, and principal occupation, at December 31, 2020, were as

follows:

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2020 Page 6

Name and Residence

Year

Elected/Appointed

Principal Occupation

Ronald Roy Anderson

Chairman of the Board

Ethel, LA

1985

Farmer and President of

Louisiana Farm Bureau

Federation

John Lawrence Hoblick, Sr.

Vice Chairman of the Board

DeLeon Springs, FL

2000

Farmer and President of Florida

Farm Bureau Federation

Richard Bryan Fontenot

Ville Platte, LA

2016

Farmer

Harry Legare Ott, Jr.

Orangeburg, SC

2016

Farmer and President of South

Carolina Farm Bureau

Carlyle Wallace Currier

Molina, CO

2011

Rancher

Thomas Michael Freeze

Keo, AR

2014-2018: 2020

Fish Farmer

Rodney Roscoe Land

Mayo, FL

2020

Farmer

George Newton Bryant

Easley, SC

2016

Farmer

Danny Russell Wright

Waldron, AR

2018

Poultry Farmer

Louis Joseph Breaux, IV

Kiln, MS

2019

Farm Manager

Richard Edward Hillman, II

Carlisle, AR

2009

Farmer and President of

Arkansas Farm Bureau

Federation

Steve Allen Johnson

Wauchula, FL

2015

Citrus Grower/Cattle Rancher

Theodore Hastings Kendall IV

Bolton, MS

2011

Farm Manager

Constance Jean Hass

Trinidad, CO

2020

Rancher

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2020 Page 7

David Michael McCormick

Union Church, MS

2015

Farmer and President of

Mississippi Farm Bureau

Federation

Michael Gerard Melancon

Breaux Bridge, LA

2015

Sugar Cane Farmer

Donald James Shawcroft

Alamosa, CO

2010

Farmer and President of

Colorado Farm Bureau

William Keistler Coleman

Blair, SC

2016

Farmer

Committees

During the period covered by this examination, the following Board appointed committees were

utilized by the Company to carry out certain specified duties: Audit Committee, Compensation

Committee, Executive Committee and Investment Committee.

Audit Committee:

The Audit Committee had six members, all of whom were outside directors, which met the

requirements set forth by the Model Audit Rule. The Audit Committee’s responsibilities included

reviewing the audit report prepared by the outside accounting firm and making recommendations

to the Board regarding the audit report and the selection of an outside accounting firm. The Audit

Committee was also responsible for overseeing the Company’s compliance with the Annual

Financial Reporting Model Regulation and for making sure management established,

implemented, and monitored the system of internal controls over financial reporting.

Compensation Committee:

The Compensation Committee was comprised of the Presidents from each of the Farm Bureau

Federations. The Chairman of the Board was also the Chairman of the Compensation Committee.

The Compensation Committee duties included reviewing and making recommendations to the

Board with respect to compensation and to perform such other duties as appropriate for the

committee or as delegated by the Board.

Executive Committee:

The Executive Committee consisted of the Presidents from each of the Farm Bureau Federations

who serve on the Board. The Chairman of the Board was also the Chairman of the Executive

Committee. The Executive Committee had the power to exercise, conduct and control the business

of the Company between meetings of the Board. The Executive Committee had the sole and

exclusive power and authority to declare additional dividends.

Investment Committee:

The Investment Committee was comprised of Board and non-Board members; however, one

member of the committee must be the Chairman of the Board. The committee delegated to the

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2020 Page 8

Investment Department the authority to transact the routine day-to-day investment duties

including, but not limited to, the sale, purchase, and transfer of stocks, bonds, securities, and other

investments, both real and personal. The Investment Committee reported to the Board regarding

the condition of the funds, securities and investments of the Company.

The following members served on the committees mentioned above at December 31, 2020.

Audit

Compensation

John Lawrence Hoblick, Sr., Chairman

Ronald Roy Anderson, Chairman

Ronald Roy Anderson

John Lawrence Hoblick, Sr.

David Michael McCormick

David Michael McCormick

Richard Edward Hillman

Rich Edward Hillman

Donald James Shawcroft

Donald James Shawcroft

Harry Legare Ott, Jr.

Harry Legare Ott, Jr.

Executive

Investment

Ronald Roy Anderson, Chairman

Ronald Roy Anderson, Chairman

John Lawrence Hoblick, Sr.

John Lawrence Hoblick, Sr.

David Michael McCormick

Robert Duff Wallace

Rich Edward Hillman

Max Turner Courtney

Donald James Shawcroft

Thomas Herndon Arthur

Harry Legare Ott, Jr.

Officers

The senior officers of the Company as of December 31, 2020 were:

Name of Officer

Number of

Years with

Company

Title

Robert Duff Wallace

36

President and Chief Executive Officer

Max Turner Courtney

29

Senior Vice President – Chief Financial Officer

Richard Ross Sims

30

Senior Vice President – Chief Operating

Officer

Lydia Catherine Warren

35

Senior Vice President – Legal and Secretary

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2020 Page 9

Jerry Joseph Keating, Jr.

35

Senior Vice President – State Manager (MS)

Blaine Vernon Briggs

34

Senior Vice President – State Manager (LA)

Steven Clay Murray

39

Senior Vice President (Florida)

Kevin Eugene McKenzie

33

Senior Vice President – State Manager

(Arkansas)

William O’Neil Courtney

35

Senior Vice President – State Manager (South

Carolina)

Duane Burton Hardy

32

Senior Vice President – Claims

Laura Sorey Watkins

34

Senior Vice President – Human Resources

Conflict of Interest

The Company had formal procedures whereby disclosures were made to the Board of any material

interest or affiliation on the part of any officer or director that was, or would likely be, a conflict

with their official duties.

HOLDING COMPANY STRUCTURE

During the time period covered by this examination, the Company reported as a member of an

insurance company holding system as defined by Miss. Code Ann. §83-6-1. For each year of the

examination period, Holding Company Registration Statements were filed with the MID in

accordance with Miss. Code Ann. §83-6-5 and §83-6-9.

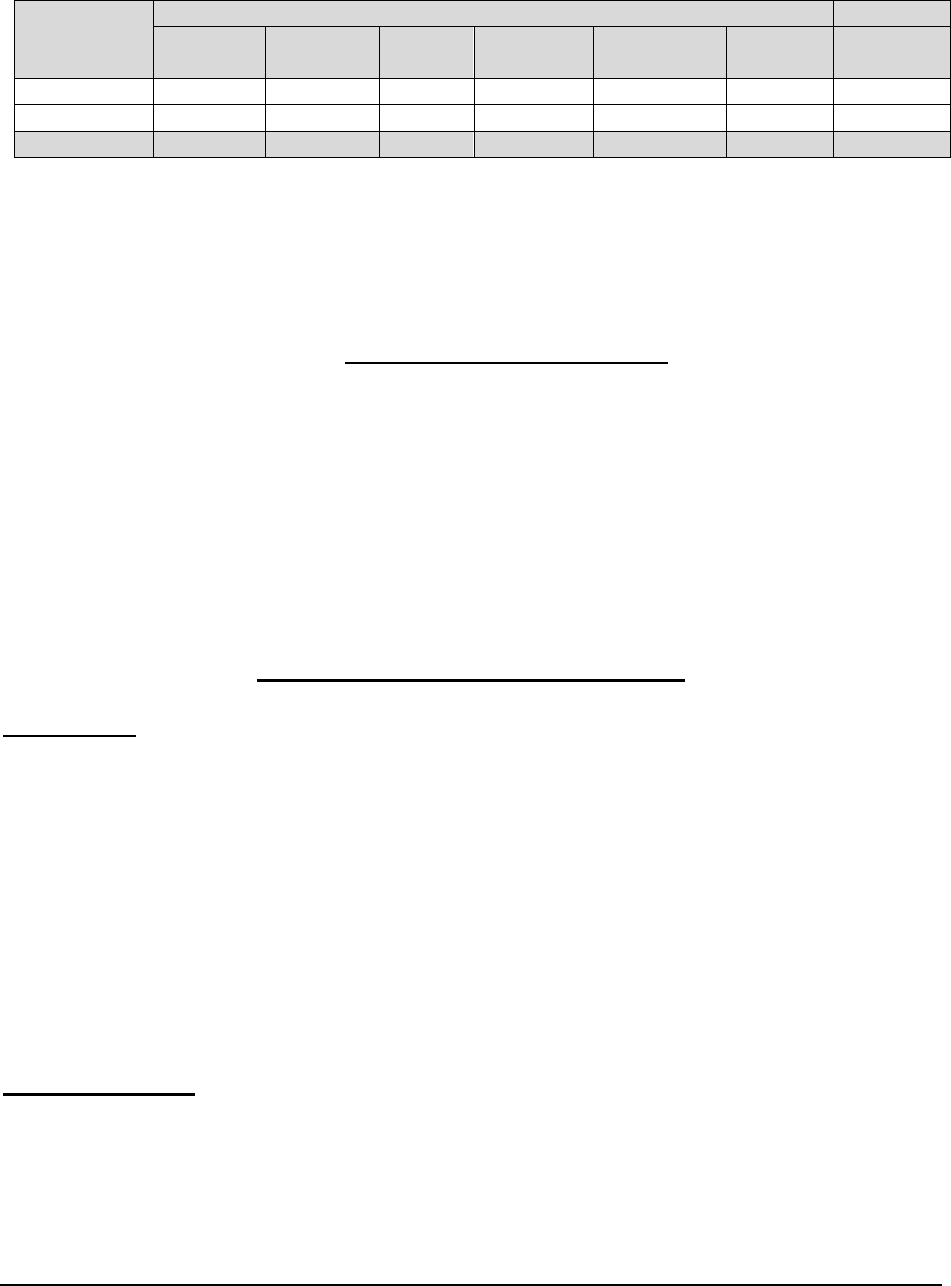

Organizational Chart

The organizational chart below displays the identities of the members of the holding company

structure that included the Company, and is followed by a brief description of the Company’s other

subsidiaries and interests.

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2020 Page 10

SCHC was reported as the ultimate controlling person in the Holding Company Registration

Statement filed with the MID as of December 31, 2020. SCHC was formed in 2015 for the sole

purpose of holding all of the voting stock of the Company, the lead insurer in the group.

Below is a description of the Company’s wholly owned subsidiaries at December 31, 2020:

Arkansas Farm Bureau Casualty Insurance Company (“AFBCIC”) was incorporated on

February 6, 2004, under the laws of the State of Arkansas and its principal business purpose was

providing casualty insurance in the State of Arkansas.

Colorado Farm Bureau Insurance Company (“CFBIC”) was demutualized and converted to a

stock company effective July 1, 2019 thereby becoming a wholly owned subsidiary of SFBCIC.

Its principal business was providing property and casualty insurance coverage in the State of

Colorado.

Florida Farm Bureau Casualty Insurance Company (“FFBCIC’) was incorporated in Florida

on April 16, 1974, under the laws of the State of Florida. Its principal business, in association with

its wholly owned subsidiary, Florida Farm Bureau General Insurance Company (“FFBGIC”), was

providing property and casualty insurance coverage (principally automobile, property and general

liability) in the State of Florida. FFBCIC was also the parent of Florida Farm Bureau Agency, Inc.,

a noninsurance brokerage operation that provided an outlet for placing business for customers in

Florida which its parent did not wish to write.

Louisiana Farm Bureau Casualty Insurance Company (“LFBCIC”) was incorporated on

February 16, 1981, under the laws of the State of Louisiana, and its principal business was

providing casualty insurance coverage (principally automobile) in the State of Louisiana.

Southern Farm Bureau Casualty Insurance Company

Florida

Farm Bureau

Ins. Agency

Florida

Farm Bureau

General Ins. Co.

21817

Colorado Farm

Bureau Insurance

Company 13641

Louisiana

Farm Bureau

Casualty Ins. Co.

40924

Florida

Farm Bureau

Casualty Ins. Co.

31216

Mississippi

Farm Bureau

Casualty Ins. Co.

27669

Arkansas

Farm Bureau

Casualty Ins.

Rural Insurance

Agency

100% interest

Southern Casualty Holding Company

South Carolina

Farm Bureau

Insurance Company

14114

Grants Ferry Parkway LLC

49% Membership interest

Highland Colony Land

Company, LLC 33%

Membership interest

Venture Properties

50% Partnership

interest

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2020 Page 11

Mississippi Farm Bureau Casualty Insurance Company (“MFBCIC”) was incorporated on

May 19, 1986, under the laws of the State of Mississippi, and its principal business was providing

property and casualty insurance coverage (principally automobile and homeowner) in the State of

Mississippi. Also, the Company was an authorized surplus lines writer in various other states.

South Carolina Farm Bureau Insurance Company (“SCFBIC”) was incorporated on February

11, 2011, under the laws of the State of South Carolina to provide casualty insurance, primarily

private passenger automobile. Effective April 1, 2014, SFBCIC purchased 100% of the company’s

outstanding common stock from South Carolina Farm Bureau Mutual Insurance Company.

SCFBIC began writing business during 2015.

Below is a description of the Company’s wholly owned subsidiaries that were dissolved during

the exam period:

Southern Farm Bureau Brokerage Company (“SFBBC”), in 1994, a noninsurance company

was organized and incorporated in the state of Mississippi as a wholly owned subsidiary of

SFBCIC. SFBBC was a noninsurance company formed primarily for conducting certain

investment and reinsurance brokerage activities for the Southern Farm Bureau group. In 2020,

SFBCIC’s management reviewed the group’s operations and organizational structure, and

concluded that operational efficiencies and expense reductions could be achieved if SFBBC

transferred its operations to SFBCIC. SFBBC’s Board approved the dissolution of the entity on

October 9, 2020. On November 30, 2020, SFBBC ceased operations and transferred all assets and

liabilities to SFBCIC, its parent and sole shareholder.

As a result of the dissolution of its former subsidiary, SFBBC, SFBCIC directly owns the

following:

• 100% of all the issued and outstanding voting securities of Rural Insurance Agency

• 33% of the membership interest of Highland Colony Land Company, LLC

• 49% of the membership interest of Grants Ferry Parkway, LLC

• 50% of the partnership interest of Venture Properties

Southern Farm Bureau Property Insurance Company (“SFBPIC”) was formed in August 1994

as a wholly owned subsidiary of SFBCIC to write property and casualty reinsurance for certain

associated Farm Bureau mutual companies in Arkansas, Mississippi, Louisiana, and South

Carolina. SFBPIC ceased assumption of new business after 2005 and entered into a “dormant”

state while managing run-off of outstanding claims related to the 2005 tropical storms and

hurricanes. Effectively all outstanding claims that were assumed by SFBPIC were settled in 2011.

As a way to eliminate operating costs, SFBCIC management sought permission from the MID to

dissolve SFBPIC in 2019. On October 4, 2019, the MID approved the Articles of Dissolution,

which terminated all operations and transferred all assets and liabilities to its parent, SFBCIC.

SFBCIC realized a loss of $21.1 million in investment income from the dissolution.

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2020 Page 12

Affiliated and Related Party Transactions

The Company’s transactions with its related parties were reviewed and the following items were

deemed notable for purposes of this report.

The Company, along with its subsidiaries and affiliates, filed a consolidated federal income tax

return. The method of allocation among the companies was made primarily on a separate return

basis with current credit for any net operating losses or other items utilized in the consolidated

return. Intercompany tax balances were settled annually in the subsequent year.

Surplus debentures of related companies were purchased by SFBCIC to strengthen the issuer’s

financial position. These investments are carried at cost and reported as other invested assets.

Repayment of the surplus debentures (including interest) and certificates was permitted when and

if the issuing company met certain surplus requirements and required approval of the domiciliary

Insurance Department of the issuing company. Below are the surplus debentures with related

parties held as of December 31, 2020:

• On April 19, 2006, MFBCIC issued a $25,000,000 surplus note to SFBCIC with an interest

rate equal to the interest payable on twenty year U.S. Treasury Bonds as of the date of the

note. The interest rate was adjusted every second anniversary date and at December 31,

2020, the stated interest rate was 3.27%. The note was for a twenty year term with interest

due annually. The principal balance owed was $25,000,000 at December 31, 2020.

• On December 22, 2005, Louisiana Farm Bureau Mutual Insurance Company (“LA

Mutual”) issued a $15,000,000 surplus note to SFBCIC with an interest rate of 4.70% per

annum. The note is for a twenty year term with interest due annually. LA Mutual retired

$1,000,000 of the principal balance during 2015 reducing the carrying value to

$14,000,000. During the exam period, an additional $10,000,000 in principal payments

were received by the Company leaving an outstanding principal balance of $4,000,000 at

December 31, 2020.

• On March 29, 2013, South Carolina Farm Bureau Mutual Insurance Company (“SC

Mutual”) issued a $12,500,000 subordinated surplus note to SFBCIC with an interest rate

of 6.00% per annum. The note was for a twenty year term with interest due annually.

During the exam period, SC Mutual retired $2,500,000 of the principal balance leaving an

outstanding principal balance of $10,000,000 at December 31, 2020.

As result of the dissolution of its former subsidiary, SFBBC, the following notes were assigned to

SFBCIC in connection with the transfer of various levels of ownership in the following entities:

• Rural Insurance Agency note with an unpaid principal balance of $1,800,000 at December

31, 2020.

• Brandon Land, LLC note with an unpaid principal balance of $3,126,819 at December 31,

2020.

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2020 Page 13

• Grants Ferry Parkway LLC note with an unpaid principal balance of $822,750 at December

31, 2020.

• Shiloh Land, LLC note with an unpaid principal balance of $2,826,052 at December 31,

2020.

On May 4, 2020, MFBCIC entered into a $10,000,000 line of credit and promissory note with

SFBCIC with an interest rate of 3.75%. The note has a maturity date of May 31, 2021. At

December 31, 2020, there were no amounts outstanding on the note.

As part of the 2009 original reorganization which was approved by the MID, SFBCIC issued notes

to certain shareholders in 2009. Each note bore interest at 8.00% based upon a 365-day year, with

interest and principal paid annually on December 1st of each year. The notes were paid in full

during 2019.

During 2019, as part of the demutualization and re-domestication of CFBIC to become a wholly

owned subsidiary of SFBCIC, the Company received an extraordinary dividend whereby nearly

all assets and liabilities were transferred. The extraordinary dividend received by the Company

had an approximate fair value and carrying value of $41,000,000 and $32,000,000, respectively.

The Company had joint expense allocation agreements with MFBCIC, its wholly owned

subsidiary, and the mutual companies in the states of Arkansas, Louisiana, and South Carolina.

Joint expenses allocated under this agreement were those expenses which were for the mutual

benefit of the companies. All joint overhead expenses were allocated pursuant to the formula

prescribed in one of the following four categories: loss adjustment expense, information system

expense, other routine/reoccurring joint expenses and other expenses. Under the terms of the

agreements, the joint expenses were paid by SFBCIC and subsequently reimbursed by MFBCIC

and the mutual companies. The total amount of joint expenses reimbursed to the Company for

2020 was $33,685,793.

The Company had expense allocation agreements with MFBCIC and FFBCIC in which certain

home office expenses were allocated to the subsidiaries each month. This allocation was performed

because of the support functions that the Company performed in the areas of legal, accounting,

claims, underwriting, information services, etc., for the subsidiaries. Under the terms of the

agreements, the expenses are paid by SFBCIC and subsequently reimbursed by the subsidiaries.

The total amount of expenses reimbursed to the Company for 2020 was $6,308,777.

The Company had licensing agreements with the various Farm Bureau Federations in the states of

Arkansas, Colorado, Louisiana, Mississippi, and South Carolina to use the “Farm Bureau” name

and logo in connection with selling, placing and underwriting of property and casualty insurance

products and services in the various states. In return, the Company paid royalty fees ranging from

0.95% to 1.07% per year on adjusted direct premiums written, less premiums collected from

residual market pool policyholders and dividends declared by the licensees. Payments made by the

Company under this arrangement for 2020 were $11,036,440. In addition, the Company

maintained sponsorship agreements with these same Farm Bureau Federations to make single

annual payments for SFBCIC’s recognition as a corporate sponsor of certain Farm Bureau events

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2020 Page 14

such as conventions, meetings, and fundraisers. Payments made by the Company under this

arrangement for 2020 were $625,915.

The Company had service and cost sharing agreements with the various Farm Bureau Federations

or their subsidiaries in the states of Arkansas, Colorado, Mississippi, Louisiana, and South

Carolina by which the Farm Bureau Federations or their subsidiaries agreed to provide services or

furnish facilities to the Company based on the terms of the agreements. Services and costs shared

varied state by state. Payments made by the Company under this arrangement for 2020 were

$4,260,721.

The Company had agreements with other Farm Bureau companies and related mutual insurance

companies that provided for the rental of office facilities, equipment, automobiles, data processing

as well as the allocation of certain operating and underwriting expenses. Management believed

that such agreements were beneficial to SFBCIC in providing operating efficiency and prompt

service to policyholders.

Additionally, the Company had reinsurance agreements in place with various subsidiaries and

affiliates. These agreements are discussed further within the Reinsurance section of this report.

FIDELITY BOND AND OTHER INSURANCE

The Company was insured under various insurance policies to protect its interests. In particular,

the Company maintained directors and officers coverage, professional liability coverage,

electronic and computer crime coverage, and fidelity coverage. The Company had a financial

institution bond with a $5,000,000 single loss limit of liability and a fiduciary liability policy with

a $10,000,000 single loss limit of liability which exceeded the NAIC’s suggested minimum

amount for fidelity coverage.

PENSIONS, STOCK OWNERSHIP AND INSURANCE PLANS

The Company provided a noncontributory defined benefit retirement plan, a 401(k) plan, a flexible

spending plan, as well as various insurance coverages, which included group term life, medical

and dental, accidental death, long-term disability and worker’s compensation. Provisions were

made within the financial statements for obligations in regard to the benefits and welfare programs

provided.

TERRITORY AND PLAN OF OPERATION

As of December 31, 2020, the Company was authorized to transact the following lines of business

in the State of Mississippi:

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2020 Page 15

Accident & Health

Home/Farm Owners

Automobile Physical Damage/Liability

Inland Marine

Boiler and Machinery

Ocean Marine

Casualty/Liability

Plate Glass

Fidelity

Surety

Fire/Allied Lines

The Company was a multi-line regional property and casualty insurance company and operated

through decentralized operations in the following six states: Arkansas, Colorado, Florida,

Louisiana, Mississippi and South Carolina. The Company specialized in personal lines, primarily

casualty insurance coverages with an emphasis on private passenger auto and farm general liability

coverages.

The Company issued automobile business in the states of Arkansas, Louisiana and South Carolina

with a small portion of assigned risk policies directly written in Mississippi. Further, the Company

assumed automobile business from Farm Bureau mutual companies in the States of Colorado,

Louisiana and South Carolina in addition to their wholly owned subsidiaries, LFBCIC, MFBCIC

and SCFBIC. The Company also assumed property business from CFBIC.

GRO

WTH OF COMPANY

2020 2019 2018 2017 2016

Total admitted assets 2,472,114,695$ 2,484,472,672$ 2,365,724,018$ 2,269,349,649$ 2,161,621,215$

Total liabilities 1,015,124,355$ 1,031,149,153$ 970,361,682$ 931,483,402$ 874,185,224$

Surplus as regards policyholders 1,456,990,340$ 1,453,323,519$ 1,395,362,336$ 1,337,866,247$ 1,287,435,991$

Net cash from operations 81,102,254$ 118,443,214$ 98,302,739$ 28,354,554$ (13,337,519)$

Total adjusted capital 1,456,990,340$ 1,453,323,519$ 1,395,362,336$ 1,337,866,247$ 1,287,435,991$

Authorized control level risk-based capital 143,545,184$ 107,888,291$ 98,811,657$ 94,665,625$ 84,577,356$

Direct premiums written 296,195,673$ 308,027,468$ 304,280,527$ 280,945,078$ 249,005,753$

Premiums assumed 758,057,263$ 762,253,756$ 744,803,122$ 718,363,278$ 658,483,427$

Premiums ceded 47,770,522$ 36,812,185$ 35,111,866$ 38,055,042$ 37,510,301$

Net premiums written 1,006,482,414$ 1,033,469,039$ 1,013,971,783$ 961,253,314$ 869,978,879$

Net underwriting gain (loss) 7,759,757$ 17,359,709$ (970,676)$ (33,842,088)$ (111,296,879)$

Net investment gain 67,588,699$ 23,827,734$ 42,838,418$ 45,151,185$ 39,848,432$

Net income (loss) 72,533,836$ 32,277,639$ 43,256,458$ 79,552,919$ (50,322,367)$

Return on equity 5.0% 2.2% 3.1% 5.9% -3.9%

Net loss ratio 79.5% 79.3% 81.3% 83.8% 92.2%

Expense ratio 20.0% 19.0% 18.5% 19.3% 20.5%

Investment yield 1.8% 1.9% 1.8% 1.8% 1.9%

Liquidity ratio 39.6% 56.8% 61.8% 62.5% 61.0%

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2020 Page 16

MORTALITY AND LOSS EXPERIENCE

The MID contracted with Merlinos & Associates, Inc. to review the actuarial analysis supporting

the Company’s carried loss and loss adjustment expense reserves. Based on the examination

actuarial evaluation, the Company’s estimates for gross and net unpaid loss and loss adjustment

expenses appeared to be reasonably stated in all material respects.

REINSURANCE

The Company had various reinsurance agreements with their wholly owned subsidiaries as well

as other related and non-related entities.

Assumed:

At December 31, 2020, SFBCIC assumed 100% of the following lines of business from its

affiliated and related entities:

• All premiums and exposures for automobile, farm liability, flood, and other general

liability business written by MFBCIC through a multi-line agreement.

• All business written by SCFBIC through a multi-line agreement.

• All business written by CFBIC through a multi-line agreement.

• Automobile business written by LA Mutual.

• Automobile and other liability lines of business written by LFBCIC and SC Mutual.

• Farm liability and farm package policies, including endorsed limited farm pollution and

equipment breakdown coverage written by SC Mutual and Farm Bureau Mutual Insurance

Company of Arkansas, Inc. (“AR Mutual”).

• Umbrella business written by MFBCIC, AR Mutual, LA Mutual, and SC Mutual net of

facultative and other inuring reinsurance.

• Flood business written by LFBCIC and SC Mutual.

• Flood business written by FFBGIC that is retroceded by FFBCIC to the Company.

Additionally, for homeowner and other property lines business, the Company assumed the ultimate

net loss for Section II Liability in excess of $750,000 written by AR Mutual, LA Mutual, and SC

Mutual. Section II Liability (also referred to as excess casualty) was the portion of the general

liability coverage provided in a package policy that also offers property insurance.

The Company also assumed business from American Agricultural Insurance Company (“AAIC”)

for various lines of business as well as mandatory assumptions from various states mandatory

pools. In addition, the Company entered into Multiline Aggregate Excess of Loss and Expense

Ratio Retrocessional Agreement with AAIC through which the Company assumed a portion of the

loss and defense and cost containment expenses of the exposures carried by AR Mutual, LA

Mutual, and SC Mutual.

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2020 Page 17

At the examination date, the principle companies with which business was assumed and the

respective premium amounts assumed for year ended 2020 were as follows:

Ceding Company

Assumed

Premiums

Florida Farm Bureau Casualty Insurance Company

$ 6,082,000

Louisiana Farm Bureau Casualty Insurance Company

$ 249,391,000

Mississippi Farm Bureau Casualty Insurance Company

$ 247,951,000

South Carolina Farm Bureau Insurance Company

$ 121,125,000

Colorado Farm Bureau Insurance Company

$ 73,916,000

Farm Bureau Mutual Insurance Company of Arkansas

$ 9,358,000

Louisiana Farm Bureau Mutual Insurance Company

$ 24,335,000

South Carolina Farm Bureau Mutual Insurance Company

$ 8,629,000

American Agricultural Insurance Company

$ 17,256,000

Ceded:

The Company limited the maximum net loss that can arise from large risks or risks in concentrated

areas of exposure by reinsuring (ceding) certain levels of risk with other insurers or reinsurers,

either on an automatic basis, under general reinsurance contracts known as “treaties,” or by

negotiation for substantial individual risks. The Company maintained various forms of reinsurance

on essentially all lines. Ceded reinsurance was treated as the risk and liability of the assuming

companies.

The liabilities for losses and loss adjustment expenses at December 31, 2020 were reduced for

reinsurance ceded of approximately $14,583,000. These amounts would represent a liability of the

Company if the reinsurers were unable to meet their obligation for existing unpaid losses ceded

under reinsurance agreements.

At the examination date, the principle reinsurers and respective premium amounts ceded for year

ended 2020 and total amounts recoverable at December 31, 2020, were as follows:

Assuming Company

Ceded

Premiums

Recoverable

Partner Re US

$ 180,000

$ -

Renaissance Reinsurance U.S. Inc.

$ 240,000

$ -

Transatlantic Reinsurance Company

$ 180,000

$ -

American Agricultural Insurance Company

$ 23,041,000

$ 11,763,000

National Flood Insurance Program

$ 23,876,000

$ 15,714,000

Factory Mutual Insurance Co.

$ 253,000

$ 280,000

For the Company’s umbrella exposures that were either written directly by SFBCIC or written by

a related or associated Farm Bureau entity and 100% ceded to SFBCIC, the Company had the

following reinsurance agreements in place at December 31, 2020:

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2020 Page 18

• An umbrella excess of loss agreement with a $1,000,000 retention for umbrella policies

with limits of $1,000,000 to $5,000,000.

• A facultative reinsurance agreement for umbrella policies with limits of $5,000,000 to

$15,000,000 and a retention of $5,000,000 and $10,000,000 which was subject to the

umbrella excess of loss reinsurance agreement previously discussed.

• An umbrella quota share reinsurance agreement regarding Colorado exposures that applied

to umbrella policies with limits of $1,000,000 up to $5,000,000 with SFBCIC retaining

10% of the first $1,000,000.

For the Company’s primary casualty lines of business (automobile liability, general liability and

farm environmental liability) that are either written directly by SFBCIC or written by a related

Farm Bureau entity and ceded to SFBCIC, the Company had a liability excess of loss reinsurance

agreement in place with a $1,000,000 retention for each loss event at December 31, 2020. The

2020 reinsurance structure had five layers, with aggregate limits applying only to layers 4-5.

Layer

Retention

Per Occurrence Limit

1

$ 1,000,000

$ 2,500,000

2

$ 3,500,000

$ 5,000,000

3

$ 8,500,000

$ 5,000,000

4

$ 13,500,000

$ 7,500,000

5

$ 21,000,000

$ 9,000,000

All layers

$ 29,000,000

During 2020, all of the direct and assumed flood exposure was ceded 100% to the National Flood

Insurance Program.

Additionally, the Company, along with its wholly owned subsidiaries, had property and auto

catastrophe excess of loss reinsurance agreements with an initial company retention of $10 million

and total coverage of $1.05 billion in place at December 31, 2020.

Layer

Retention

Per Occurrence Limit

*Underlying

$ 10,000,000

$ 40,000,000

1

$ 50,000,000

$ 50,000,000

2

$ 100,000,000

$ 200,000,000

3

$ 300,000,000

$ 400,000,000

**Next Layer

$ 700,000,000

$ 200,000,000

Over Other Protections

$ 900,000,000

$ 150,000,000

*The underlying layer includes a $10 million aggregate annual deductible.

**This layer includes a top and drop of $50 million.

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2020 Page 19

ACCOUNTS AND RECORDS

The Company utilized a computerized accounting system on which general ledger information

was maintained. Detailed general ledger information was traced to the trial balance and the

December 31, 2020 annual statement, without material exception. The Company was audited

annually by an independent CPA firm.

The primary data center was housed at an outside location with the backup storage center located

at the Home Office. The Company continues to have the mainframe in operation for some legacy

systems but those systems are continually being transferred from the mainframe to the distributed

network. The Company was responsible for physical security, computer operations including,

backups and disaster recovery over the mainframe and distributed network servers, as well as the

applications which resided on them.

STATUTORY DEPOSITS

The Company’s statutory deposits with the State of Mississippi complied with Miss. Code Ann.

§83-19-31(2). The following chart displays the Company’s deposits at December 31, 2020.

State Par Carrying Fair

Description Deposited Value Value Value

State Bond Mississippi 2,000,000$ 2,284,656$ 2,519,940$

T

otal Held in Mississippi 2,000,000 2,284,656 2,519,940

State Bond Arkansas 175,000 185,506 206,623

State Bond South Carolina 200,000 203,159 208,018

Total Held in all Other States 375,000 388,665 414,641

Total of all States 2,375,000$ 2,673,321$ 2,934,581$

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2020 Page 20

SOUTHERN FARM BUREAU CASUALTY INSURANCE COMPANY

FINANCIAL STATEMENTS

EXAMINATION AS OF DECEMBER 31, 2020

Introduction

The following financial statements reflect the same amounts reported by the Company and consist

of a Statement of Admitted Assets, Liabilities, Surplus and Other Funds - Statutory at December

31, 2020, a Statement of Income - Statutory for year ended December 31, 2020, a Reconciliation

of Capital and Surplus - Statutory for examination period ended December 31, 2020, and a

Reconciliation of Examination Changes to Surplus - Statutory at December 31, 2020.

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2020 Page 21

Statement of Admitted Assets, Liabilities, Surplus and Other Funds – Statutory

December 31, 2020

Admitted Assets

Bonds 1,286,467,688$

Common stocks 797,902,361

Mortgage loans 2,792,304

Pro

perties occupied by the company 16,540,523

Properties held for sale 266,327

Cash, cash equivalents and short-term investments 46,709,980

Other invested assets 66,236,808

Investment income due and accrued 12,983,656

Uncollected premiums and agents' balances in the course of collection

1,272,215

Deferred premiums, agents' balances and installments booked but deferred

and not yet due

166,291,690

Funds held by or deposited with reinsured companies 5,557,637

Current federal and foreign income tax recoverable and interest thereon 13,629,055

Net deferred tax asset 40,303,764

E

lectr

onic data processing equipment and software 3,618,587

Receivable from parent, subsidiaries and affiliates 1,797,055

Other receivables 9,745,045

Total admitted assets 2,472,114,695$

Liabilities, Surplus and Other Funds

Losses 375,137,781$

Loss adjustment expenses 70,606,176

Commissions payable, contingent commissions and other similar charges 10,208,818

Other expenses 5,380,760

Taxes, licenses and fees 1,798,492

Unearned premiums 305,934,396

Advance premium

8,870,494

Ceded reinsurance premiums payable 2,499,000

Amounts withheld or retained by company for accounts of others

44,859,464

Payable to parent, subsidiaries and affiliates 4,515,516

Derivatives 746,981

Payable for securities 8,821,642

A

ccrued

benefit cost 85,714,765

Liability for benefits 74,219,665

Other payables 15,810,405

Total liabilities 1,015,124,355

Common capital stock 1,082,842

Gross paid in and contributed surplus 620,491

Unassigned funds (surplus) 1,455,287,007

Surplus as regards policyholders 1,456,990,340

Total liabilities and surplus as regards policyholders 2,472,114,695$

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2020 Page 22

Statement of Income – Statutory

For the Examination Period Ended December 31, 2020

Underwriting Income

Premiums earned 1,017,368,481$

De

ductions:

Losses incurred 693,260,746

Loss adjustment expenses incurred 115,064,914

Other underwriting expenses incurred 201,283,064

Total underwriting deductions 1,009,608,724

Net underwriting gain (loss) 7,759,757

Investment Income

Net investment income earned 40,731,641

Net realized capital gains (losses) less capital gains tax 26,857,058

Net investment gain 67,588,699

Other Income

Net loss from agents' or premium balances charged off (586,505)

Finance and service charges not included in premiums 25,341

Aggregate write-ins for miscellaneous income 4,275,704

Total other income 3,714,540

Net income before dividends to policyholders, after capital gains tax and

before all other federal and foreign income taxes 79,062,996

Federal and foreign income taxes incurred 6,529,160

Net

Income 72,533,836$

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2020 Page 23

Reconciliation of Capital and Surplus – Statutory

For the Examination Period Ended December 31, 2020

2020 2019 2018 2017 2016

Surplus as regards policyholders,

beginning of the year $ 1,453,323,519 $ 1,395,362,336 $ 1,337,866,247 $ 1,287,435,991 $ 1,317,833,159

Net income 72,533,836 32,277,639 43,256,458 79,552,919 (50,322,367)

Change in net unrealized capital

gains or (losses) (42,758,147) 29,205,348 25,330,754 25,758,272 32,162,548

Change in net deferred income tax 306,501 (632,105) (10,730,224) (86,830,840) 15,822,917

Change in nonadmitted assets (14,598,439) (6,279,042) 8,150,205 52,514,648 (24,312,255)

Dividends to stockholders (52,800) (52,800) (52,800) (52,800) (52,800)

Change in liability for benefits (11,764,130) (28,652,126) (8,027,092) (16,528,139) 3,233,227

Extraordinary Dividend from - 32,094,269 - - -

Subsidiary

Recognition of Transition Liability

under SSAPs 92 and 102 - - (431,212) (3,983,804) (6,928,438)

Surplus as regards policyholders,

end of the year $ 1,456,990,340 $ 1,453,323,519 $ 1,395,362,336 $ 1,337,866,247 $ 1,287,435,991

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2020 Page 24

Reconciliation of Examination Adjustments to Surplus

For the Examination Period Ended December 31, 2020

There were no changes made to the assets, liabilities or surplus balances reported by the Company

for the year ended December 31, 2020. The surplus as regards policyholders, which totaled

$1,456,990,340 as of the examination date, was determined to be reasonably stated and in

compliance with Miss. Code Ann. §83-19-31.

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2020 Page 25

MARKET CONDUCT ACTIVITIES

A full scope market conduct examination was not performed; however, limited procedures were

performed on certain areas of the Company’s market conduct. The areas in which limited

procedures were performed included operations/management, complaint handling, producer

licensing, underwriting and rating, and claims. No significant exceptions with regard to the limited

procedures performed were noted.

COMMITMENTS AND CONTINGENT LIABILITIES

During and subsequent to the examination period, the Company was not involved in litigation

outside the normal course of business.

SUBSEQUENT EVENTS

On February 22, 2021, John Lawrence Hoblick was elected Chairman of the Board of the

Company, replacing the retiring Ronald Roy Anderson. On this same date, David Michael

McCormick was elected Vice Chairman of the Board of the Company replacing Mr. Hoblick who

was elected Chairman.

On May 31, 2021 Arkansas Farm Bureau Casualty Insurance Company, a wholly owned subsidiary

of the Company, was dissolved.

Lydia Catherine Warren retired effective June 1, 2021. Johnny Victoria Sargent, Jr. was elected to

replace Mrs. Warren as Senior Vice President – Legal & Secretary of the Company, effective June

1, 2021.

John Faulkner Bonner was elected as Senior Vice President – State Manager effective September

1, 2021.

On November 30, 2021, Florida Farm Bureau Agency, Inc., a wholly owned subsidiary of Florida

Farm Bureau Casualty Insurance Company, was dissolved. FFBCIC is a wholly owned subsidiary

of the Company.

During 2021, the Company and MFBCIC submitted a multiline quota share reinsurance agreement

to the MID for review and approval. Per the terms of this agreement, MFBCIC would cede 100%

of its risks to the Company. This agreement was approved by the MID on October 29, 2021.

Additionally, on May 17, 2022, MFBCIC filed an extraordinary dividend request related to the

multiline agreement which was approved by the MID on June 9, 2022.

On January 3, 2022, the Company received the outstanding surplus note of $25 million from

MFBCIC. At the examination report date, all outstanding interest related to this surplus note has

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2020 Page 26

been paid.

On February 21, 2022, David Michael McCormick was elected Chairman of the Board of the

Company, replacing the retiring John Lawrence Hoblick. On this same date, Richard Edward

Hillman was elected Vice Chairman of the Board of the Company replacing Mr. McCormick who

was elected Chairman.

COMMENTS

AND RECOMMENDATIONS

There were no comments and/or recommendations deemed necessary for purposes of this

examination report.

ACKNOWLEDGMENT

The

examiners representing the Mississippi

In

surance Depa11ment and participating m this

examination were:

Examiner-in-charge:

Supervising Examiner:

Lead Actuary:

Lead IT Specialist:

Examiner:

Examiner:

Examiner:

R. Dale Miller, CPA,

CFE

, CFF

Joseph R.

May

,

CPA

,

CMA

, CFE,

CIE

Robert

P.

Daniel,

ACAS

,

MAAA

David E. Mills, CISA,

CTGA

,

CGEIT

,

MCSE

Andrea J. Harbison,

CPA

Sophia Tran,

CPA

Britain Welzien

The courteous cooperation

of

the officers and employ

ees

responsible for

as

sisting m the

examination is hereby acknowledged and appreciated.

Respectfully submitted,

R. Dale Miller,

CPA

,

CFE

, CFF

Examiner-in-charge

Mark

Coo

ley,

CFE

Mississippi Insurance Department Designee

Southern Farm Bureau Casualty

In

surance

Company

MID

Exam

in

ation

as

of

December 31, 2020

Page 27