The Mortgage Market

in Sweden

September 2022

REPORT

Mortgages make up a significant percentage of the loan portfolio in Sweden and are an important

component of the household budget for many individuals. The Mortgage Market in Sweden

describes current mortgage and construction trends and how they have evolved over time.

A brief description of general economic trends in Sweden is followed by a discussion of

developments in housing construction. The second half of 2021 was marked by the recovery

of the economy after Covid-19, while the first half of 2022 was marked by extensive disruption

of global value chains and Russia’s war of aggression against Ukraine.

It is also observed that housing prices have been increasing for a number of years, but the

increasing inflation and mortgage interest rates during 2022 have resulted in decreasing

prices for both tenant-owned apartments and single-family homes.

Household indebtedness is outlined, as are implemented and proposed measures to

counteract high indebtedness. Finally, an overview is provided of the main forms of

borrowing for mortgage institutions.

Introduction

3

REPORT

The MorTgage MarkeT in Sweden – SePTeMBer 2022

1. The economic situation in Sweden

The recovery after the pandemic resulted in a strong increase in economic growth from spring 2021 and

the rest of the year. GDP increased by 5.1 percent in 2021. After the strong increase during last year the

economy slowed during 2022 according to NIER (the National Institute of Economic Research). The first

half of 2022 was marked by extensive disruption of global value chains and Russia’s war of aggression against

Ukraine. During the spring and summer 2022, this has resulted in high inflation, dwindling asset prices and

increasing interest rates. This has left Swedish households increasingly pessimistic about the future.

During the first quarter of 2022, GDP fell by 0.8 percent compared to the previous quarter. According to

NIER, production was held back to some extent by shortages of input goods, while domestic demand was

weak. The downturn was not reflected in the labour market, however, with employment continuing to rise

and unemployment falling. Firms report having problems finding suitable employees in most sectors and the

labour shortage is substantial.

Housing investment has been historically high during over the past two years, but the rate of construction

has started weaken during the first half of 2022. High prices for commodities and materials, combined with

rising market interest rates and falling housing prices, will result in construction continuing to decline during

the rest of 2022 and in 2023, according to NIER. However, the large number of housing starts in 2021 will

prop up investment in newbuilds in 2022. The number of housing starts has increased by 22 percent over

the last year. According to the forecast by the National Board of Housing, construction will shrink in 2022

to 58,000 dwellings, a decrease of around 14 percent compared to 2021.

The pandemic initially led to uncertainty on the housing market, although it quickly recovered. Strong

demand, above all for single-family homes and larger apartments, led to significant price increases towards

the end of 2020 and throughout 2021. The increasing inflation and in particular the increasing mortgage

interest rates during the spring of 2022 have resulted in the mortgage market starting to cool down and in

housing prices starting to fall during the second quarter of 2022.

Table 1. The NIER indicators for the Swedish economy, June and August 2022

Annual percentage change and percent, respectively

2021 2022 2023

GDP, market price 5.1 2.4 0.5

Employment 1.1 2.7 0.5

Unemployment

(1)

8.8 7.7 7.8

Commercial productivity

(2)

2.6 0.3 –0.6

CPI 2.2 7.9 4.8

Repo rate

(3)

0.0 2.0 2.0

Ten-year government bond rate

(3)

0.3 1.5 1.9

(1)

As a percentage of labour force.

(2)

Working-day adjusted.

(3)

At year-end.

REPORT

4

The MorTgage MarkeT in Sweden – SePTeMBer 2022

5

The MorTgage MarkeT in Sweden – SePTeMBer 2022

2. The housing and construction market

Residential construction peaked in 2017 with a record 64,000 housing starts, after which the rate of

construction declined for a few years. Many observers expected construction to drop further after the

outbreak of the pandemic. Instead, the demand for single-family homes and large apartments increased

during the pandemic with many people working from home, and housing starts increased to 67,600 during

2021. This represents the highest number of housing starts since 1990. During 2022, however, construction

has started to slow down and, according to the forecast by the National Board of Housing, construction

will diminish somewhat in 2022 and amount to 58,000 new dwellings, a decrease of around –14 percent

compared to 2021. This forecast is based primarily on assessments made by Swedish municipalities in the

Board’s housing market survey, taking into account factors such as current trends in prices, sales, building

permits and residential construction.

Chart 2.1. Housing starts 1980–2022

Note: The number of housing starts fell sharply in 2007. This is largely explained by the Government decision in 2006 to abolish

general housing subsidies for dwellings (multi-family homes) started after 31 December 2006. This meant that many property

developers accelerated the start of construction to begin before the end of 2006 in order to receive subsidies.

Source: Statistics Sweden and 2022 forecast from the National Board of Housing

1980

1982

1984

1986

1988

1990

1992

1994

1996

1998

2000

2002

2004

2006

2008

2010

2012

2014

2016

2018

2020

2022

0

10,000

20,000

30,000

40,000

50,000

60,000

70,000

■ Multi-family homes ■ Single-family homes

A significant percentage of new construction is taking place in metropolitan areas. In 2021, the Stockholm,

Gothenburg and Malmö metropolitan areas accounted for 50 percent of housing starts in Sweden. The larger

cities have accounted for 50 to 60 percent of new construction in Sweden since the mid-1990s. The change

is significant compared with 1990, when 25 percent of housing starts were in the above three urban areas. In

2018 to 2020, there was a drop in the construction figures in the larger cities and especially in Stockholm. For

a number of years, Stockholm alone accounted for 30 percent of Swedish housing starts, but in 2018 to 2020

that share dropped to around 25 percent. In 2021, the share of total construction taking place in Stockholm

increased to 28 percent.

Another change in the home construction market is that multi-family dwellings account for a larger share

of new construction. From 2010, the proportion of multi-family dwellings in relation to total housing starts

has, on average, amounted to 76 percent. During the 1980s, multi-family dwellings accounted for almost 50

percent of new construction, and during the 1990s and 2000s they represented around 60 percent of new

construction. The substantial demand for single-family homes during the pandemic, however, has led to an

increase in construction starts for one-family homes and the share of single-family homes among total housing

starts is expected to increase in 2022. One explanation for the increased demand for single-family homes

during the pandemic was need for more housing space because of increased working from home and the

sharp drop in overseas travel.

Several negative events in 2022, such as Russia’s war of aggression against Ukraine, sharply increasing infla-

tion and increasing mortgage interest rates, have created uncertainty on the housing market. Housing prices,

which increased significantly during the pandemic, have started to cool off rapidly during the spring and

summer of 2022. During the second quarter of 2022, prices of tenant-owned apartments and single-family

homes have dropped by 6.4 and 5.5 percent respectively (see Table 2).

4

The MorTgage MarkeT in Sweden – SePTeMBer 2022

5

REPORT

The MorTgage MarkeT in Sweden – SePTeMBer 2022

Table 2. Price trend for housing during the second quarter of 2022,

percentage change compared to previous quarter, percent

Q2 2022

Sweden index –5.8

Tenant-owned apartments Sweden –6.4

– Stockholm –8.2

Single-family homes Sweden –5.5

– Stockholm –7.9

Källa: HOX-index / Valueguard.

There has been a significant difference in price trends for single-family homes and tenant-owned apartments

for several years. The HOX-index (Valueguard / KTH) presents price trends for both single-family homes and

tenant-owned apartments (see Chart 2.2). For several years, the prices of tenant-owned apartments have

risen more than the prices of single-family homes, according to the HOX-index. From the beginning of 2016,

the price increases for tenant-owned apartments have slowed down significantly and, in addition, the price

increases have been lower than for single-family homes. After price decreases for both tenant-owned apart-

ments and single-family homes in 2018, prices recovered somewhat in 2019. During the pandemic in 2020

and 2021 there was a significant change in demand on the housing market in favour of single-family homes,

which was followed by significantly stronger price increases for single-family homes than for tenant-owned

apartments. As the price increases have slowed down in 2022, the difference in price trends between tenant-

owned apartments and single-family homes has also decreased.

From the end of the 1990s, housing prices in Sweden have increased almost continuously for many years

(see chart 2.3). There are a number of reasons for the price increases, including both low supply and

increasing demand. Demand has risen as a result of several factors, such as relatively favourable economic

growth in Sweden, increasing household incomes, low interest rates, good access to credit, changed tax

rules, a growing population and rapid urbanisation.

Chart 2.2. Housing prices, annual percentage change, quarterly values

–15 %

–10 %

–5 %

0 %

5 %

10 %

15 %

20 %

25 %

Tenant-owned apartments Single-family homes

Dec ’05

Dec ’06

Dec ’07

Dec ’08

Dec ’09

Dec ’10

Dec ’11

Dec ’12

Dec ’13

Dec ’14

Dec ’15

Dec ’16

Dec ’17

Dec ’18

Dec ’19

Dec ’20

Dec ’21

Source: HOX-index / Valueguard

REPORT

6

The MorTgage MarkeT in Sweden – SePTeMBer 2022

7

The MorTgage MarkeT in Sweden – SePTeMBer 2022

On the supply side, the limited housing construction relative to population growth, especially in urban

areas, has been a fundamental reason for the rise in prices. One example is Stockholm County, where

the annual net increase in population has averaged 35,000 between the years 2007 to 2019. However,

the number of housing starts has far from matched the significant increase in population. Between 2007

and 2019, only 11,000 dwellings on average were started per year (see Chart 2.4).

During 2020 and 2021, population growth slowed down significantly in Stockholm. The decreasing popu-

lation growth in Stockholm County was mainly due to changing moving patterns during the pandemic,

where a significant relocation of individuals from the County to the rest of Sweden has occurred, as well

as to diminishing immigration. The number of housing starts began to increase in Stockholm from 2013.

Housing construction has remained at a relatively high level in 2020 and 2021, at the same time as popu-

lation growth has diminished. This has meant that the supply of housing in relation to size of the popula-

tion has improved somewhat in the last two years.

Chart 2.3. Price index single-family homes, 1981=10

1981

1983

1985

1987

1989

1991

1993

1995

1997

1999

2001

2003

2005

2007

2009

2011

2013

2015

2017

2019

2021

National Greater Stockholm

100

300

500

700

900

1,100

1,300

1,500

Source: Statistics Sweden

Chart 2.4. Net population growth and housing starts in Stockholm County

1989

1991

1993

1995

1997

1999

2001

2003

2005

2007

2009

2011

2013

2015

2017

2019

2021

■ Housing starts Population growth, net

0

5,000

15,000

20,000

25,000

30,000

35,000

40,000

10,000

Source: Statistics Sweden

6

The MorTgage MarkeT in Sweden – SePTeMBer 2022

7

REPORT

The MorTgage MarkeT in Sweden – SePTeMBer 2022

The Swedish market is characterised by a number of conditions that reduce the risk of more wide-

spread problems on the mortgage market. One factor is that banks’ lending processes are stringent and

governed by well-functioning legislation. Banks have long based their credit decisions on the borrower’s

repayment capacity rather than the value of the collateral. There is also an efficient infrastructure, for

example in the form of a property register and good access to credit information about borrowers to

secure safe lending. The high employment rate means that it is common for each household to have

two incomes that can be used to repay the loan. The welfare system is another significant factor, since

households can maintain an acceptable financial position even in the event of unemployment or illness.

The Swedish market is also characterised by very limited speculation. The market share of buy-to-

let among housing is limited. Most Swedes regard their homes primarily as a residence and not as an

investment opportunity.

0 %

1 %

2 %

3 %

4 %

5 %

6 %

7 %

8 %

1993

1995

1997

1999

2001

2003

2005

2007

2009

2011

2013

2015

2017

2019

2021

Sweden Denmark Finland Norway EU 27

Chart 2.5. Residential housing investments as percentage of GDP

Source: Eurostat

Housing construction fell dramatically after the crisis in Sweden in the beginning of the 1990s, as illus-

trated by Chart 2.1. From the middle of the 1990s until 2014, and again from 2019, residential housing

investments represented a lower percentage of GDP in Sweden than in other Nordic countries and the

EU average (see Chart 2.5). Even though Swedish housing investments have decreased as a percentage

of GDP from 2019 and again are below most of the other Nordic countries and below the EU average,

they remain higher than before 2014. In 2021, Swedish housing investments amounted to 5.3 percent

of GDP and the EU average amounted to 5.6 percent. This can be compared with the 2021 figures for

Germany and Finland, which had the highest rates of residential investment in the EU at 7.2 percent of

GDP. The lowest rate of housing investments is found in Greece, at 1.3 percent of GDP.

REPORT

8

The MorTgage MarkeT in Sweden – SePTeMBer 2022

9

The MorTgage MarkeT in Sweden – SePTeMBer 2022

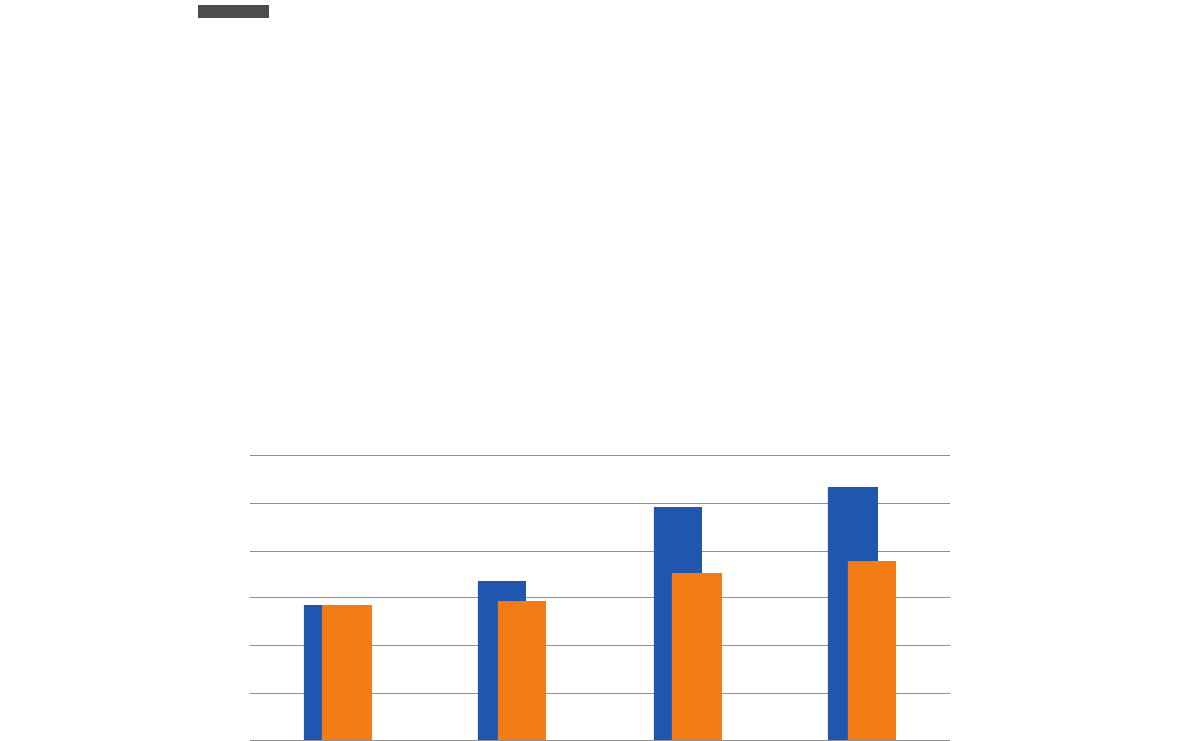

Chart 3.1. Lending secured by housing, Swedish households,

December 2012 and June 2022

26 %

23 %

15 %

16 %

7 %

5 %

4 %

1 %

3 %

23 %

21 %

14 %

13 %

9 %

7 %

4 %

2 %

8 %

0 %

5 %

10 %

15 %

20 %

25 %

30 %

■ Dec 2012 ■ Jun 2022

Swedbank

Handelsbanken

Nordea

SEB

SBAB

Länsförsäkringar

Danske Bank

Skandiabanken

Other

Source: Statistics Sweden

3. Competition on the

mortgage market

Property lending in Sweden is, to a great extent, offered by specialised housing finance institutions

(mortgage institutions), although it is also offered by banks. As of June 2022, total lending in Sweden

secured by housing amounted to SEK 5,193 billion. Mortgage deeds serve as the primary security for

home loans and tenant-owned apartment loans from banks and housing finance institutions.

The three largest housing finance institutions are owned by Swedbank (Swedbank Hypotek),

Handelsbanken (Stadshypotek) and Nordea (Nordea Hypotek). SEB has no separate housing finance

institution and residential lending is offered directly by the bank. SBAB Bank was originally a state-

owned mortgage institution that was restructured into a bank in 2010, still fully owned by the state.

Home loans are also offered by Länsförsäkringar Hypotek and by Danske Bank and Skandiabanken,

both of which are banks. In some cases, the smaller institutions may be significant participants on the

mortgage market by virtue of relatively large market shares with respect to new mortgages.

In recent years, a number of mortgage credit companies, which fund their lending by structures of

alternative investment funds (AIF), have established themselves on the market. One example is Stabelo,

which cooperates with Avanza Bank and Nordnet Bank. Another example is Hypoteket. Mortgage

credit companies may conduct mortgage lending without a banking or credit-market company licence,

which means that they are not subject to the same requirements as banks. The new companies instead

operate on the Swedish market with a different form of licence from Finansinspektionen than banks

and credit-market companies. The new companies fund their mortgage lending by creating and manag-

ing investment products on behalf of institutional investors within the framework of an AIF. AIFs are

managed by companies connected to mortgage credit companies, which in turn lend to mortgage

borrowers. Lending by mortgage credit companies is small in relation to total outstanding housing

loans, representing 1.2 percent of the total stock in June 2022. However, the new companies are signifi-

cant competitors on the mortgage market and accounted for 4.8 percent of new lending to households

in the past year.

The market share of total lending to Swedish households secured by housing in June 2022 compared

with December 2012 is illustrated in Chart 3.1. The group “Other” includes savings banks and other

institutions (including mortgage credit institutions and alternative investment funds, AIFs).

8

The MorTgage MarkeT in Sweden – SePTeMBer 2022

9

REPORT

The MorTgage MarkeT in Sweden – SePTeMBer 2022

Chart 4.1 illustrates the quarterly growth in net lending (new lending less amortisation) for housing,

broken down into single-family homes, tenant-owned apartments and multi-family buildings. The chart

shows that net lending quarterly was relatively high between the years 2017 and 2018, standing at

between SEK 54 and 77 billion. In 2019, quarterly net housing loan growth was slightly lower, between

SEK 46 and 65 billion, above all due to lower a growth rate for loans to single-family homes. During

2020 and up until the second quarter of 2022, quarterly net housing loan growth has increased again

to between SEK 60 and 94 billion. The large quarterly net increases during 2020 and 2021 coincide

with the pandemic and the increasing demand for single-family homes. The quarterly net lending for

single-family homes has been higher during this period than before, and during the fourth quarter of

2021 alone, net lending for single-family homes increased by SEK 50 billion. Net lending during the

fourth quarter of 2021 was also high for tenant-owned apartments and multi-family homes. The overall

net increase during the fourth quarter of 2021 was SEK 94 billion, the largest increase ever for a single

quarter.

Chart 4.1. Quarterly change (net increase) in lending secured by single-

family homes, tenant-owned apartments and multi-family home

Source: Statistics Sweden

0

10

20

30

40

50

60

70

80

90

100

■ Single-family homes ■ Tenant-owned apartments ■ Multi-family homes

Jun ’17

Sep ’17

Dec ’17

Mar ’18

Jun ’18

Sep ’18

Dec ’18

Mar ’19

Jun ’19

Sep ’19

Dec ’19

Mar ’20

Jun ’20

Sep ’20

Dec ’20

Mar ’21

Jun ’21

Sep ’21

Dec ’21

Mar ’22

Jun ’22

4. Residential mortgage lending

According to Statistics Sweden’s Financial Market Statistics, total lending secured by single-family

homes, tenant-owned apartments and apartment buildings amounted to SEK 5,193 billion at the end of

June 2022. Three years ago, in June 2019, the corresponding figure was SEK 4,314 billion. Lending has

thus increased by SEK 879 billion, or 20 percent, in three years.

The rate of lending to single-family homes stood at 6.8 percent in June 2022 (see Chart 4.2). The rate

of lending to tenant-owned apartments is slightly higher than for single-family homes and amounted to

7.2 percent annually. In the middle of 2016, the rate of growth for Swedish home loans was almost 9

percent annually, subsequently slowing down more or less continuously until the beginning of 2020. The

slowdown in the home loan growth rate from 2016 coincided with the introduction by Finansinspektio-

nen of the amortisation rules for new housing loans (see part 5), which is an important explanation for

the slower growth rate.

Table 4.1. Total lending secured by single-family homes, tenant-owned

apartments and multi-family homes, SEK billion, June 2022

Single-family

homes

Tenant-owned

apartments

Multi-family

homes

Total

Households 2,667 1,383 58 4,108

Companies 115 9 961 1,085

Tot a l 2,782 1,392 1,019 5,193

Source: Statistics Sweden

REPORT

10

The MorTgage MarkeT in Sweden – SePTeMBer 2022

11

The MorTgage MarkeT in Sweden – SePTeMBer 2022

Chart 4.2. The home loan portfolio, annual percentage change, monthly values

Source: Statistics Sweden

0 %

5 %

10 %

15 %

20 %

25 %

30 %

Single-family homes Tenant-owned apartments

Dec ’02

Dec ’03

Dec ’04

Dec ’05

Dec ’06

Dec ’07

Dec ’08

Dec ’09

Dec ’10

Dec ’11

Dec ’12

Dec ’13

Dec ’14

Dec ’15

Dec ’16

Dec ’17

Dec ’18

Dec ’19

Dec ’20

Dec ’21

Chart 4.3. Outstanding mortgage loan portfolio broken down

by type of security

Source: Statistics Sweden

0 %

10 %

20 %

30 %

40 %

50 %

60 %

70 %

80 %

90 %

100 %

Dec ’95 Dec ’00 Dec ’05 Dec ’10 Dec ’15 Jun ’22

■ Single-family homes ■ Tenant-owned apartments ■ Multi-family homes

The home loan growth rate has started to increase again from spring 2020. The increase in lending during

the outbreak of the pandemic in Sweden in the spring of 2020 may be explained in part by the temporary

exemption from the amortisation rules on mortgage loans that was introduced in April 2020. Another

explanation for the increase is the changing demand between different kinds of housing during the pandemic

and the fact that demand for single-family homes increased significantly.

The growth rate for loans secured for single-family homes has generally been slower and more stable than

for tenant-owned apartments. Since 2016, the difference in the rate of lending between single-family homes

and tenant-owned apartments has diminished by and large continuously. The increased rate of lending for

single-family homes during the pandemic, at the same time as the rate of lending for tenant-owned apart-

ments has been stable, means that the difference in the rates of lending between single-family homes and

tenant-owned apartments almost has disappeared in June 2022.

There are a several explanations why, for a great many years, the rate of increase as regards loans for

tenant-owned apartments has been higher than for single-family homes. A couple of reasons include the

conversion of rental apartments into tenant-owned apartments, which previously took place primarily

in the metropolitan regions, and the fact that significantly more tenant-owned apartments than single-

family homes have been built over the last ten years. Additionally, prices of tenant-owned apartments

have increased more than prices of single-family homes for long periods. Chart 4.3 illustrates how the

percentage of home loans secured by tenant-owned apartments has increased since 1995.

10

The MorTgage MarkeT in Sweden – SePTeMBer 2022

11

REPORT

The MorTgage MarkeT in Sweden – SePTeMBer 2022

One reason why lending secured by tenant-owned apartments has been higher than for single-family homes

is, as mentioned above, the conversion of rental apartments into tenant-owned apartments. The proportion

of tenant-owned apartments in the new construction of apartment buildings has also been high, amounting

to around 50 percent since 2007. In 2020 and 2021, however, the new construction of rental apartments

has increased and the share of new tenant-owned apartments therefore decreased to 36 percent of newly

constructed apartments in multi-family buildings in 2021. In the mid-1990s, the proportion of tenant-owned

apartments accounted for only 15 percent of newly constructed multi-family buildings.

Chart 4.4 illustrates the change, from 1990 until 2021, in the percentage of tenant-owned apartments as

a proportion of the multi-family housing stock. Between 1990 and 2000, the percentage of tenant-owned

apartments in the multi-family housing stock increased slightly from 28 percent to 29 percent. Between

2000 and 2010, the percentage of tenant-owned apartments increased to 35 percent and between 2010 to

2021 to 38 percent.

The percentage of tenant-owned apartments in Stockholm is higher, and in 2021 the percentage of tenant-

owned apartments in the multi-family housing stock in Stockholm stood at 54 percent. In the 1990s, the

share of tenant-owned apartments in the multi-family housing stock was largely the same in Stockholm and

nationally. The share of tenant-owned apartments in Stockholm increased much faster in the 2000s than in

many other places in the country, from 34 percent in 2000 to 49 percent in 2010.

The properties in which tenant-owned apartments are located are formally owned by tenant-owners’ asso-

ciations. A resident in a tenant-owned apartment is entitled to live in one of the tenant-owners’ associations’

apartments. Since the tenant-owners’ association owns the property, any loans secured by the property

constitute debt for the tenant-owners’ association. Tenant-owners’ associations are thus significant borrow-

ers in Sweden and, in June 2022, loans to tenant-owners’ associations amounted to SEK 557 billion (secured

by the property and all the association’s other loans). By comparison, household loans secured by tenant-

owned apartments amounted to SEK 1,383 billion.

For statistical purposes, a tenant-owners’ association is categorised as a non-financial company and the

aggregated loans of tenant-owners’ associations represent 20 percent of outstanding loans taken out by non-

financial companies. The rate of lending to tenant-owners’ associations amounted to around 9 percent during

the years 2017 and 2018. Since then, the rate of lending decreased significantly until the end of 2021. In June

2022, lending to tenant-owners’ associations stood at 7.4 percent annually. Lending to non-financial compa-

nies excluding tenant-owners’ associations amounted to 13.0 percent in June 2022 (see Chart 4.5).

For the last ten years, both variable and initial fixed housing interest rates have declined (see Chart 4.6). In

the longer term, too, interest rates have fallen. Until the beginning of 2022 the initial fixed rates have dropped

to the lowest levels since at least 1985. Variable interest rates are also at historically low levels. From

mid-2015, mortgage interest rates and especially the variable mortgage interest rates and initial fixed 1–5 year

rates have levelled out. The low interest rates have, according to most observers, been an important factor

behind the relatively high lending rate over the last several years. The spread between variable and initial fixed

mortgage rates has also been historically low.

Chart 4.4. Share of tenant-owned apartments in multi-family homes

Source: Statistics Sweden

0 %

10 %

20 %

30 %

40 %

50 %

60 %

1990 2000 2010 2021

■ Stockholm ■ National

REPORT

12

The MorTgage MarkeT in Sweden – SePTeMBer 2022

13

The MorTgage MarkeT in Sweden – SePTeMBer 2022

Chart 4.6. Lending rates to households for housing loans, new loans.

Dec’ 2005 – June 2022, broken down by interest term

Source: Statistics Sweden

0 %

1 %

2 %

3 %

4 %

5 %

6 %

7 %

Dec ’05

Dec ’06

Dec ’07

Dec ’08

Dec ’09

Dec ’10

Dec ’11

Dec ’12

Dec ’13

Dec ’14

Dec ’15

Dec ’16

Dec ’17

Dec ’18

Dec ’19

Dec ’20

Dec ’21

Variable Fixed 1–5 years Fixed ≥ 5 years

Russia’s war of aggression against Ukraine that began in February 2022 and the aftermath of the pandemic

are two reasons behind the economic uncertainty that has been created. During the first half of 2022, this

has resulted in sharply increased inflation and rising market interest rates. Mortgage interest rates started

to increase during the spring 2022, and in June 2022 variable mortgage rates averaged 2.5 percent and

mortgage rates with an initial fixed term of more than 5 years amounted to 3.5 percent.

Like Swedish mortgage interest rates, European mortgage interest rates have decreased up until 2021.

Variable mortgage interest rates in Sweden are amongst the lowest in Europe. Denmark and Finland

have the lowest variable interest rates in Europe (see Chart 4.7).

During the period from January to June 2022, 55 percent of new home loans taken out by households

had variable interest rates (see Chart 4.8). During the spring of 2022, the share of households’ new

mortgages with variable interest rate has started to increase. This coincides with the fact that mortgage

interest rates started to rise during the spring. The difference between variable and initial fixed interest

rates was previously comparatively small, but as the interest rates started to increase during the spring

of 2022, the difference between variable and initial fixed mortgage interest rates also increased. As

the initial fixed mortgage interest rates have increased more than the variable mortgage interest rates,

demand for the variable interest rates has increased.

Chart 4.5. Lending to non-financial companies and tenant-owners’ associations,

annual percentage change, monthly values

–4 %

–2 %

0 %

2 %

4 %

6 %

8 %

10 %

12 %

14 %

Dec ’11

Jun ’12

Dec ’12

Jun ’13

Dec ’13

Jun ’14

Dec ’14

Jun ’15

Dec ’15

Jun ’16

Dec ’16

Jun ’17

Dec ’17

Jun ’18

Dec ’18

Jun ’19

Dec ’19

Jun ’20

Dec ’20

Jun ’21

Dec ’21

Jun ’22

Non-financial companies. (excl. tenant-owners’ associations) Tenant-owners’ associations

Source: Statistics Sweden

12

The MorTgage MarkeT in Sweden – SePTeMBer 2022

13

REPORT

The MorTgage MarkeT in Sweden – SePTeMBer 2022

Even though the level of interest in variable mortgage interest rates has increased during 2022, the

trend in recent years has moved in the opposite direction. During 2021, the share of households’ new

mortgage loans with variable interest rates amounted to 44 percent, and this share has not been lower

since 2003. For the five years up until 2018, the share of variable interest rates amounted to 70–75

percent of new housing loans. Since then, the share of initial fixed period rates has increased consider-

ably. One reason for the reduced share of variable interest rates in recent years is the fact that initial

fixed interest rates have dropped to the same low levels as variable interest rates. The uncertainty in

the markets during the pandemic from 2020 may also have contributed to households preferring to tie

rates to a greater extent.

Even though the demand for housing loans with variable interest has varied in Sweden in recent years,

the share of variable interest rates here is higher than in many other comparable European countries.

Chart 4.9 illustrates the share of variable interest loans among new housing loans in the first quarter

of 2022 in a number of European countries. In Finland, 96 percent of new housing loans have vari-

able interest rates whereas in Sweden 48 percent of new housing loans have variable interest rates. In

Belgium, for example, housing loans with variable interest rates are rare.

Chart 4.8. New loans to households, housing finance institutions,

percentage breakdown by interest term

Source: Statistics Sweden

0 %

10 %

20 %

30 %

40 %

50 %

60 %

70 %

80 %

90 %

100 %

■ Variable ■ Fixed 1–5 years ■ Fixed ≥ 5 years

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

Jan–Jun 2022

Chart 4.7. Variable mortgage interest rates (variable and initial fixed period

rate up to 1 year), first quarter of 2022, percent

Source European Mortgage Federation.

IE BE DE NL UK ES IT SE PT FI DK

0.0 %

0.5 %

1.0 %

1.5 %

2.0 %

2.5 %

3.0 %

3.5 %

4.0 %

REPORT

14

The MorTgage MarkeT in Sweden – SePTeMBer 2022

15

The MorTgage MarkeT in Sweden – SePTeMBer 2022

5. Household indebtedness

In Sweden, 64 percent of households own their homes, see Chart 5.1. Of these households, 81 percent

have a home loan. The relatively high percentage of households (who own their own home) with a mortgage

is a sign of a mature mortgage market, as well as of a tradition of taking out loans to finance homes.

The percentage of homeowners (households) with home loans is also relatively high in the other Nordic

countries, except for Finland, which has a slightly lower percentage. A comparably high percentage of house-

holds (who own their own home) with home loans is also found in countries such as the Netherlands and

Switzerland. In Switzerland, however, only slightly over 40 percent of households own their own homes.

In many markets in Eastern Europe, as well as in Italy and Greece, the percentage of households with

home loans is relatively low. This may be due in part to the fact that the mortgage market is relatively

new, and in part to a tradition of financing housing in other ways, for example in Italy and Greece.

Although the percentage of households with home loans is low in these countries, the percentage of

households that own their homes is high and customarily exceeds 70 percent.

Chart 4.9. New housing loans with variable interest rates (fixed up to one year)

during the first quarter of 2022

0 %

10 %

20 %

30 %

40 %

50 %

60 %

70 %

80 %

90 %

100 %

FI PT SE ES DK IE IT NL DE UK BE

Source: European Mortgage Federation

Chart 5.1. Share of households who own their home,

with or without a housing loan, percent

0 %

10 %

20 %

30 %

40 %

50 %

60 %

70 %

80 %

90 %

100 %

NO NL SE DK BE FI PT CH IE DE FR ES EE AT IT LT PL LV GR

■ With housing loan ■ Without housing loan

Source: Eurostat

14

The MorTgage MarkeT in Sweden – SePTeMBer 2022

15

REPORT

The MorTgage MarkeT in Sweden – SePTeMBer 2022

Swedish household indebtedness has risen continuously since the mid-1990s, both in absolute figures and rela-

tive to disposable income. The debt ratio (loans in relation to disposable income) for Swedish households is,

on average, 200 percent. This level is relatively high when compared internationally.

At the same time, it is important to note that the debt ratio of young households and urban households is

significantly higher than the average. New borrowers have an average debt ratio amounting to 327 percent

in 2021 calculated on their gross income, according to Finansinspektionen in its yearly report on the Swedish

mortgage market. The debt ratio is higher in the metropolitan areas, and in Stockholm the average debt ratio

amounted to 397 percent in 2021.

The debt ratio for new loans declined somewhat during 2018 due to the new, stricter amortisation require-

ments, but has increased again. In the metropolitan areas a higher percentage of new borrowers are affected

by the stricter amortisation requirements. Following the introduction of the stricter amortisation requirement

in 2018, the average debt ratio declined in all parts of Sweden and above all in the metropolitan areas where

the house prices are the highest.

With the exception of a marked decrease in the debt ratio over the course of a couple of years following the

financial crisis in the beginning of the 1990s, the household debt ratio has been increasing since at least the

1950s (see Chart 5.2). Household interest payments in relation to their income, the interest ratio, is no higher

in 2021 than at the beginning of the 1960s. However, in the early 1960s, the debt ratio was only around 70

percent. The fact that the interest payments in relation to income are currently low, at the same time as the

debt ratio is at a record high level, can be explained by the historically low lending rates.

A number of measures have been taken in recent years with the aim of counteracting high indebtedness. In

2010, Finansinspektionen introduced a mortgage cap, whereby home loans may not exceed 85 percent of the

value of the home. Finansinspektionen has also introduced a risk weight floor for Swedish mortgages in order

to tie up more capital in relation to banks’ mortgage lending. The risk weight floor for mortgages is currently

25 percent.

Another measure to tackle high indebtedness is the introduction of amortisation requirements. In June 2016,

Finansinspektionen’s regulation on amortisation requirements entered into force. The regulation provides that

new mortgage loans from June 2016 with a loan-to-value (LTV) above 50 percent must be amortised. Mort-

gages with an LTV above 70 percent must be amortised by at least two percent of the original loan amount

each year. Mortgage loans with an LTV ratio between 50 and 70 percent must be amortised by a minimum of

one percent annually.

From March 2018, stricter amortisation requirements entered into force. The stricter amortisation require-

ments stipulate that new borrowers with a housing loan and whose housing debts exceed 4.5 times their gross

income must amortise at least one percent in addition to the fundamental amortisation requirements.

Chart 5.2. Household debt ratio and interest ratio (debt and interest payments,

gross, as a percentage of disposable income, net) 1950–2021

Source: Statistics Sweden

0 %

2 %

4 %

6 %

8 %

10 %

12 %

14 %

16 %

18 %

20 %

22 %

0 %

20 %

40 %

60 %

80 %

100 %

120 %

140 %

160 %

180 %

200 %

220 %

1950

1955

1960

1965

1970

1975

1980

1985

1990

1995

2000

2005

2010

2015

2020

Debt ratio Interest ratio (right axis)

REPORT

16

The MorTgage MarkeT in Sweden – SePTeMBer 2022

17

The MorTgage MarkeT in Sweden – SePTeMBer 2022

Chart 6.1. Covered bonds – outstanding and issued during each year,

SEK billion

Source: Swedish Bankers’ Association

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

0

250

500

750

1,000

1,250

1,500

1,750

2,000

2,250

2,500

■ Outstanding stock ■ Issued during the year

The outbreak of the pandemic in early 2020 has had a negative impact on large parts of the Swedish

economy. In April 2020, in order to mitigate the effects for households affected by Covid-19 and the

sharp decline in the Swedish economy, Finansinspektionen introduced an option for a general exemp-

tion from the amortisation requirements. The exemption from the amortisation rules came to an end

on 31 August 2021.

6. Funding

Currently, all of the important participants on the Swedish mortgage market have covered bonds as

a funding instrument. Following new legislation which came into force in 2004, former housing bonds

were all converted into covered bonds in the subsequent years and all new issues since then have been

covered bonds. Chart 6.1 illustrates the growth in the outstanding stock of covered bonds and the

amounts that have been issued. The increase in the outstanding stock between the years 2006–2008 is

to a large extent due to housing bonds being converted into covered bonds.

Issues of covered bonds to finance mortgage lending take place in both banks and mortgage institutions.

In tandem with the covered bonds, housing finance institutions’ lending is also funded by borrowing in the

form of loans from the parent bank. Loans from the parent bank amounted to an average of 47 percent of

the housing institutions’ total balance. On average, only a very small percentage is attributable to other

financing in mortgage institutions, such as certificates.

Since their introduction in 2004, Swedish covered bonds have proven to be a well-functioning form of financ-

ing. One of several explanations is the high credit quality of the stock of mortgages that make up the majority of

the collateral for the bonds. Unlike in many other countries, the Swedish market worked well even during the

recent financial crisis. The market for Swedish covered bonds has also functioned well following the outbreak of

the pandemic at the start of 2020. Almost 30 percent of the Swedish banks’ covered bonds are owned by foreign

investors. In addition, around 20 percent of Swedish covered bonds are held by Swedish insurance companies and

pension institutions, which thereby fulfil an important function on the mortgage market.

Since 2020, the Riksbank has purchased covered bonds as a part of the Swedish monetary policy. The Riksbank’s

holdings of covered bonds have increased continuously up until the first quarter of 2022, when the Riksbank’s

holdings amounted to SEK 418 billion, or the equivalent of 16 percent of the outstanding stock of covered bonds.

After this time, the Riksbank’s holdings of covered bonds have decreased slightly and, at the end of June 2022,

the stock of covered bonds held by the Riksbank amounted to SEK 399 billion, which corresponds to

approximately 15 percent of the total stock of covered bonds in Sweden.

16

The MorTgage MarkeT in Sweden – SePTeMBer 2022

17

REPORT

The MorTgage MarkeT in Sweden – SePTeMBer 2022

7. Other events in 2021–2022

The outbreak of the pandemic in early 2020 has had a negative impact on large parts of the Swedish

economy. The Swedish government and authorities implemented a number of measures to mitigate the

impact on the economy. In April 2020, specifically in relation to the housing market, Finansinspektionen

introduced an option for a general exemption from the amortisation requirements that the authority

had introduced in 2016 and 2018. The purpose of the amortisation exemption was to mitigate the

impact on households affected by the pandemic and the subsequent sharp decline in the Swedish

economy. The exemption from the amortisation rules came to an end on 31 August 2021.

In the spring of 2022, a government study proposed that the banks should be given the possibility to

provide a government-backed starter loan to first-time home buyers. The starter loan could amount to

ten percent of the home’s value or SEK 250,000, whichever is lower. A prerequisite for the loan is that

the first-time buyer takes out a regular mortgage with a loan-to-value ratio of 85 percent. The govern-

ment guarantee means that the bank receives compensation for any loss on the starter loan, while the

borrower receives favourable repayment terms for the part of any loss that is covered by the govern-

ment guarantee.

During the summer of 2022, another government study has put forward a proposal for a state register

of tenant-owned apartments. The register must contain basic information as well as information about

mortgages for all tenant-owned apartments in the country.

Chart 6.2. Covered bonds – outstanding stock per institution

on 31 December 2021

Source: Swedish Bankers’ Association

25 %

18 %

15 %

12 %

11 %

9 %

4 %

3 %

2 %

■ Stadshypotek

■ Swedbank

■ Nordea Hypotek

■ SEB

■ SBAB (Swedish Covered Bond Corporation)

■ Länsförsäkringar Hypotek

■ Danske Hypotek

■ Landshypotek

■ Skandiabanken

■ Sparbanken Skåne

■ Bluestep Bank

0.8 %

0.2 %

During 2006, three institutions converted their mortgage bonds into covered bonds. These institutions

were Nordea, SBAB and Stadshypotek. During 2007, they were joined by a further three institutions,

namely Landshypotek, Länsförsäkringar Hypotek and SEB. In 2008, Swedbank Hypotek began to convert

housing bonds into covered bonds and Skandiabanken followed by issuing covered bonds in 2013. During

2018, Danske Hypotek and Sparbanken Skåne started issuing covered bonds, and Bluestep Bank started

issuing them in 2020. In 2021, Borgo AB (Ltd) was also granted permission to issue covered bonds and

started issuing them during 2022. Chart 6.2 shows how the outstanding stock is distributed among these

institutions at the end of 2021.

In recent times, a number of new institutions, i.e. mortgage credit companies, have established

themselves on the Swedish market. Stabelo and Hypoteket are two examples mentioned in Chapter 3.

The new companies are funded through their mortgages, by which they create and manage investment

products on behalf of institutional investors within the framework of an alternative investment fund.

REPORT

18

The MorTgage MarkeT in Sweden – SePTeMBer 2022

18

The MorTgage MarkeT in Sweden – SePTeMBer 2022