1

2

TABLE OF CONTENTS

List of common benets and credits 2-3

Overview of tax benets and other income supports 4-5

ID requirements to access benets 6-7

Tax documents check list 8

Tax Credit and Deducons

Tax Credits and Deducons for Adults and/or Children with a Disability 10-11

Income Tax Deducons and/or Credits for Adults and Seniors 12-19

Income Tax Deducons and/or Credits for Seniors 20-22

Income Support Programs

Income Supports for Children 26-30

Supports for Adopted Children/Youth 31-32

Income Supports for Children with Special Needs 33-36

Income Supports for Adults 37-43

Ulity Assistance Programs 44-45

Income Supports for Adults with a Disability 46-47

Income supports for Students 48-50

Income Supports for Seniors 51-55

Asset Builders

Asset Builders for Adults 58-59

Asset builders for Children with a Disability 60-61

Asset Builders for Children 62-64

Other Resources

Renewal of Health Card 66

Revenue Canada Phone Numbers 67-68

Services in Leeds & Grenville 69-71

3

List of common benets and credits

Benefits and refundable tax credits help with your living expenses by adding to your income.

Whether you qualify and how much you receive depends on your income which is determined by

filing your taxes and other factors such as your age. The Government of Canada website has a

Benefit Finder tool that you can use to help find the benefits and services that you can receive.

See a list of some of the common benefits and credits

Benefits and credits accessed by tax filing

Even if you have no income or do not owe taxes, it is important to keep up to date with filing your

taxes. Filing a tax return is the only way to apply for many benefits and credits or to make sure that

your payments continue. Here are some of the benefits and refundable tax credits that require tax

filing to access or to continue receiving payment:

• Canada Workers Benefit (CWB) and

Disability Supplement

• Canada Education Savings Grant (CESG)

• Canada learning bond (CLB)

• Climate action incentive (CAI)

• GST/HST credit

• GST/HST rebate for employees and

partners

• Old age security (OAS)

• Ontario energy support program (OESP)

Ontario only

• Ontario trillium benefit (OTB) – Ontario

only

• Refundable medical expense supplement

• Other tax credits by province or territory

Social assistance programs

Each province and territory offer programs that provide financial help to people living on a low

Income. Social assistance programs give people money to help pay for living expenses like food,

clothing, and shelter, and in some cases prescription drugs and dental services. Each program has

their own eligibility criteria and restrictions. In general, you must live in the province or territory and

be in financial need

• Ontario Works (OW)

• Ontario Disability Support Program (ODSP)

4

List of common benefits

and credits cont..

Benefits and credits for special

groups

Some benefits and credits are eligible for

special groups, such as individuals with chil-

dren, seniors, and people with disabilities.

Families with children

• Canada Child Benefit (CCB)

• Canada Education Savings Grant

(CESG)

• Canada Learning Bond (CLB)

• Child Disability Benefit (CDB)

• Employment Insurance, Maternity and

Parental Benefits

Individuals with disabilities

• Canada Disability savings bond

(CDSB)

• Canada disability savings grant

(CDSG)

• Canada Pension Plan (CPP) Disability

Benefits

• Child Disability Benefit (CDB)

• Disability Tax Credit (DTC)

• Excise gasoline tax refund

• Registered Disability Savings Plan

(RDSP)

Seniors

• Canada Pension Plan (CPP)

Retirement Pension

• Guaranteed Income Supplement (GIS)

• Old Age Security (OAS)

• Guaranteed Annual Income

What are tax credits and benefits?

Tax credits and benefits are financial sup-

ports provided by the government to help you

with living costs. They can reduce the tax that

you owe or add to your income. Read more

about the two types of tax credits (non-

refundable and refundable) and tax benefits

Non-refundable tax credits

Non-refundable tax credits are like coupons that

reduce the amount of tax that you have to pay.

Non-refundable tax credits can reduce your taxes

to zero, but you do not get money back if these

credits add up to more than the tax you owe. If

you do not owe any taxes, non-refundable tax

credits might not have much value for you. Even

so, it is still important to file your taxes and estab-

lish your income so that you can open access to

other financial supports.

Some examples of non-refundable tax credits in-

clude:

• Canada caregiver credit

• Disability tax credit

Refundable tax credits and benefits

Refundable tax credits not only reduce the

amount of tax that you owe but will pay you

money back if your credits add up to more than

the tax that you owe. Benefits are paid directly to

you to help with living expenses. You need to file

your taxes in order to claim these credits and

benefits and any money you get back will come

as a tax refund or as payments made to you sev-

eral times throughout the year.

Some examples of refundable tax credits and

benets include:

• Canada Child Benefit

• Canada Workers Benefit

• Climate Action Incentive

• GST/HST credit

5

Adult, Working Age Child Seniors

Adult Up to

17 years old

Young senior

(60-64)

Senior

(65 +)

Income Tax

Related Benet*

(accessed though

tax ling)

• GST/HST

• Canadian Workers Benet

• Home Buyers Amount

• Medical Expense

Supplement

• Canadian Child Benet

• Provincial child or family

benet program.

• GST / HST credit

• Medical Expenses

Supplement

• Home buyers amount

• GST / HST Credit

• Age Amount

• Pension Amount

• Home Buyers

Amount

Income

Supports*

(Other federal or

provincial income

programs with

eligibility based on

income)

• Employment Insurance (EI)

• Ontario Works (OW)

• Low Income Energy

Assistance (LEAP)

• Canada Pension Disability

• Canadian Child Benet

(CCB)

• Transion Child Benet

• Provincial Child and

Family benets programs

• Canada Pension Pro-

gram (CPP)

• Allowance for the

Survivor

• Ontario Energy

Support Program

(OESP)

• Ontario Works (OW)

• Old Age Security

(OAS)

• Guaranteed Income

Supplement (GIS)

• Ontario Guaranteed

Annual Income

Supplement (GAINS)

Asset building

• Registered Rerement

Savings Plan (RRSP)

•Tax Free Savings Account

(TFSA)

• CPP Contribuons

(Workplace)

• Registered Educaon

Savings Plan ( RESP)

• Canada Learning Bond

(CLB)

• Canada Educaon

Savings Grant ( CESG)

• Registered Disability

Savings Plan (RDSP)

• Registered Rere-

ment Savings Plan

(RRSP)

• Tax Free Savings

Account (TFSA)

• CPP Contribuons

(Workplace)

•Tax Free Savings

Account (TFSA)

Overview of Tax Benets and

other Income Supports

* Information in this Resources manual has

been adapted from material created by Prosper

Canada, Government of Canada, Government

of Ontario and various other ministries.

6

Benets for survivors People with disabilies

Adult Child Adult

Child

Income tax credits

& deducons

Related Benet*

(accessed though Tax

Filing)

• Disability Tax Credit

Cercate (DTC)

• Disability Amount

• Caregiver Amount

• Disability Support

Deducon

• Canada Workers Benet

(CWB)

• Disability Tax Credit

Cercate (DTC)

Income

Supports*

(Other federal or

provincial income

programs with

eligibility based on

income)

• Ontario Disability Support

Program (ODSP)

• Canada Pension Plan

Disability (CPP-D)

• Provincial workplace

safety wage-loss benets

due to injury (i.e. WSIB)

• Child Disability Benet

• Canada Child Benet (CCB)

• Transion Child Benet

• Assistance for Children

with Severe Disabilies

(ACSD)

• Provincial Child and Family

benets programs

• CPP Survivors

benets

• Allowance for the

Survivor (60-64)

• Workplace safety

benets (i.e. WSIB)

• CPP Survivors

benets ( 0-18 or 25)

• Workplace safety

benets (i.e. WSIB)

Asset building

• Registered Disability

Savings Plan (RDSP)

• Canada Disability Savings

Grant (CDSG)

• Canada Disability Savings

Bond (CDSB)

• Tax Free Savings Account

(TFSA)

• Canada Disability Learning

Bond (CLB)

• Canada Disability Savings

Grant ( CESG)

• Registered Disability

Savings Plan (RDSP)

Overview of tax-benets and other income supports

People with disabilities or a survivor

7

ID requirements to access benets

In order to apply for and access benefits, an individual must have a number of identification

documents.

**Note** not all benefits require documents from each category below, but different benefits

have their own requirements. Below are the categories of ID and examples of documents.

Proof of birth

Document with first name, last name and date

of birth:

• Birth certificate or birth registration

• Hospital record of birth or record of the

physician/ nurse/midwife who attended the birth

• Passport

• Record of landing or confirmation of permanent

residence issued by Immigration, Refugees and

Citizenship Canada

• Citizenship certificate- Note of decision or

temporary resident’s permit issued under the

Immigration and Refugee Protection Act

• Certificate of Indian status card

• Provincial identity card-Note of decision or

temporary resident’s permit issued under the

Immigration and Refugee Protection Act

• Certificate of Indian status card

• Provincial identity card

Proof of legal status

A document showing citizenship or immigration

status in Canada:

• Canadian birth certificate

• Citizenship card/certificate

• Confirmation document

• Record of landing, confirmation of permanent resi-

dence

• Permanent Resident Card

• Visitor Record

• Temporary resident permit

• Study Permit

• Notice of decision

• Verification of Status Document

• Registration date with Indigenous and

Northern Affairs Canada

Be aware:

Some people may have difficulty obtaining immigra-

tion papers due to inability to recall dates and infor-

mation, particularly if their arrival in Canada was

many years ago

Proof of housing situation

• Copy of rental/leasing agreement

• Letter from landlord

• Eviction notice

• Disconnection notice

• Police report

• Moving company quote or invoice

• Utility bills

Proof of residency in Canada

• Lease agreement

• Rent receipt

• Household bill (e.g. gas, electricity, cable television,

telephone)

• Driver’s license

• Vehicle registration or car insurance

• Membership in social or professional organizations

• Bank information (e.g. bank account

statements for saving or chequing accounts)

• Employment information (e.g. pay stub)

8

ID requirements to access benets

Proof of death

A document that provides the name, date, and

place of death. The document must also be on

official letterhead or contain a seal, and provide

the name and/or signature of the person or au-

thority issuing the

document.

• Burial certificate or death certificate

• Certification of death from another country

• Life or Group Insurance Claim along with a

statement signed by a medical doctor

• Medical Certification of Death

• Memorandum of Notification of Death issued by

the Chief of National Defence Staff

• Notarial copy of Letters of Probate

• Official Death Certificate

• Official Notification from the Public Trustee for a

Province

• Registration of Death

• Statement of a medical doctor, coroner, or

funeral director

• Statement of Verification of Death from the

Department of Veterans Affairs

Be aware:

Some papers obtained outside of Canada will

need to be translated.

Proof of residency in Ontario

A document that displays your name, current

home address and confirms that your primary

place of residence is in Ontario:

• Mortgage, rental or lease agreement

• Child Tax Benefit Statement

• Employer record (pay stub or letter from

employer on company letterhead)

• Income tax assessment (most recent)

• Insurance policy (home, tenant, auto or life)

• Monthly mailed bank account statements for

savings or chequing accounts (does not include

receipts, bank

books, letters or automated teller receipts)

• Ontario Motor Vehicle Permit (plate or vehicle

portions)

• Property tax bill

• School, college or university report card or

transcript

• Statement of Direct Deposit for Ontario Works

• Statement of Direct Deposit for Ontario Disability

Support Program

• Statement of Employment Insurance Benefits

Paid T4E

• Statement of Old Age Security T4A (OAS) or

Statement of Canada Pension Plan Benefits T4A

(P)

• Statement of Registered Retirement Savings

Plan (RRSP), Registered Retirement Income

Fund (RRIF), or

Registered Home Ownership Savings Plan

(RHOSP) from a financial institution

• Utility bill received by mail (home telephone,

cable TV, public utilities commission, hydro, gas,

water)

• Valid Ontario Driver’s Licence

• Temporary Driver’s Licence (you must also show

a photo license card with the same address)

• Workplace Safety and Insurance Board State-

ment of Benefits T5007

• Canada Pension Plan Statement of Contribution

• Valid Ontario Photo Card

9

Organize all your documents so

that you can get all the tax credits

and deductions. Here is a check-

list to assist you

Let’s Start!

(you will need your Social Insurance Number)

Slips

T4 Slips – from all your employers

T4 Slips – from all the businesses

T4 E Slips – Employment Insurance

Benefits

T4A – OAS – T4 AP (Old Age Security &

CPP)

T2202A- Tuition.

T3, T5, T5008 – Interest, dividends, mutual

funds.

T50007- Statement of Benefits (OW, ODSP)

Any other information slip is to you.

T5007 – Workers Compensation Benefits.

Receipts

RRSP

Professional union dues

Oher employment

Child, spouse or common law partner

support

Medical expenses

Charitable donations

Home office equipment

Adoption expenses

Childcare expenses

Teacher’s school supplies

Political contributions

Home renovations for disabled and senior

Tool expenses

Interest expenses, carrying charges

Interest on student loan

Professional certification exams

Documentation

Previous year Notice of (Re)assessment

Any outstanding matters with CRA

Stocks and bonds – Sale or deemed sale

Principle Residence sale documents if sold

Real Estate – sale or deemed sale

Unincorporated business – income and ex-

penses

Disability Tax Credit Certificate

T2201Farm or fishing – income and

expenses

Foreign Employment Income, pay rolls

Business use of vehicle, log and expenses

Slips, and foreign Notice of Assessment

T2200 – Conditions of employment

Volunteer firefighter, search, and rescue

Northern residents deductions receipts

Volunteer’s certificate

Ontario only Slips

Important to mention to your tax

preparer

Change to your material status, legal name,

Address or residency status

If you owned assets more than $100,000

outside

If you lived outside of Canada during the

year.

10

11

Tax Credit and Deducons

PROGRAM Page

Tax Credits and Deductions for Adults and/or Children with a Disability

Disability Tax Credit (DTC) 10

Amount for an Eligible Dependant 11

Amount for Infirm Dependants Age 18 and Over 11

Tuition, Education and Textbook Amounts Transferred from a Child 11

Other medical expenses that may be claimed 11

Income Tax Deductions and/or Credits for Adults and Seniors

Medical Expenses 12

Which medical expenses can you claim? 13

Refundable Medical Expense Supplement 14

GST/HST Credit 15

GST New Housing Rebate 16

Ontario Trillium Amount 17

Canada Workers Benefit 18

Home Buyers Amount 19

Income Tax Deductions and/or credits for Seniors

Seniors’ Home Safety Tax Credit 20

Senior Homeowners' Property Tax Grant 21

12

Disability Tax Credit (DTC)

The disability tax credit (DTC) is a non-

refundable tax credit that helps persons with dis-

abilities or their supporting persons reduce the

amount of income tax they may have to pay. An

individual may claim the disability amount once

they are eligible for the DTC. This amount in-

cludes a supplement for persons under 18 years

of age at the end of the year.

How much could you receive?

The purpose of the DTC is to provide for greater

tax equity by allowing some relief for disability

costs, since these are unavoidable additional

expenses that other taxpayers don’t have to face.

Who is eligible for the DTC?

There are different ways for which a person can

be eligible for the disability tax credit (DTC). The

person must meet one of the following criteria:

• be blind

• be markedly restricted in at least one of the

basic activities of daily living

• be significantly restricted in two or more or

the basic activities of daily living (can

include a vision impairment)

• need life-sustaining therapy

In addition, the person's impairment must

meet all of the following criteria:

• be prolonged, which means the impairment

has lasted, or is expected to last for a con-

tinuous period of at least 12 months

• be present all or substantially all the time

(at least 90% of the time)

**The fact that a person has a job does not

disqualify that person from the disability tax

credit.**

What do I need to apply?

You are eligible for the DTC only if we ap-

prove Form T2201, Disability Tax Credit

Certificate. A medical practitioner has to fill

out and certify that you have a severe and

prolonged impairment and must describe its

effects. Answer a few questions to find out if the

person with the disability may be eligible.

What defines “markedly restricted”?

A person is markedly restricted if, they are

unable or takes an inordinate amount of time

to do one or more of the basic activities of daily

living, even with therapy (other than life-

sustaining therapy) and the use of appropriate

devices and medication. This restriction must be

present all or substantially all the time (at least

90% of the time).

What defines “Life-sustaining therapy”?

You must meet both of the following criteria:

• The therapy is needed to support a vital

function, even if it eases the symptoms.

• The therapy is needed at least 3 times per

week, for an average of at least 14

hours a week.

For more information:

You can obtain a paper copy of Guide RC4064,

Disability-Related Information and Form T2201:

Disability Tax Credit Certificate for your medical

practitioner; from the Volunteer Centre or by

calling us at 613-499-9393 You also can visit

the Canada Revenue Agency website at

www.cra.ca. or call 1-800-387-1193

Tax Credits and Deducons for Adults and/or

Children with a Disability

13

Amount for an Eligible Dependant (line 305): If you did not have a spouse or common- law partner

and you supported a dependant with whom you lived in a home you maintained you may be able to

claim this amount.

Amount for Infirm Dependants Age 18 and Over (line 306): You may be able to claim an amount

for a dependent child or grandchild if that child had an impairment in physical or mental function and

was born in 1997 or earlier. mount

Medical Expenses (lines 330 and 331): You can claim medical expenses at line 330 for your child

under the age of 18, yourself, your spouse or common law partner for any 12-month period ending in

the year. You can claim other eligible dependants for the same 12-month period at line 331.

Tuition, Education and Textbook Amounts Transferred from a Child (line 324): If the student

with a disability does not require these amounts, all or part of the unused amounts can be transferred

to you if you are the supporting parent or grandparent. A maximum of $5,000 minus the amount used

by the student can be transferred to you

Other medical expenses that may be claimed with a medical certificate or prescription

include:

• Devices or software designed to be used by people who are blind or have a severe learning

disability to enable them to read print-prescription needed.

• Note-taking services used by someone with a physical or mental impairment and paid to

someone in the business of providing these services. A medical practitioner must certify in

writing that these services are needed.

• School for people with an impairment in physical or mental functions. A medical

practitioner must certify in writing that the equipment, facilities or personnel specially provided

by that school are needed because of the person’s mental or physical impairment.

• Tutoring services that are above the primary education of a person with a learning disability or

Impairment in mental functions. The person receiving payment must be in the business of

providing tutoring services to others who are not related to the student. A medical practitioner

must certify in writing that these services are needed.

• Talking textbooks - in connection with enrolment at a secondary school in Canada or a

designated educational institution for a person who has a perceptual disability. A medical

practitioner must certify in writing that the expense is necessary.

• Therapy– the cost of therapy received by a person who is eligible for the disability tax credit

(DTC). Therapy must be provided by someone who is not the spouse or common-law partner of

the person who is claiming the expense. The person must be 18 years of age or older when the

amounts are paid. For a mental impairment, the therapy must be prescribed and supervised by

a medical doctor or a psychologist. For physical impairment, the therapy must be prescribed and

supervised by a medical doctor or an occupational therapist.

14

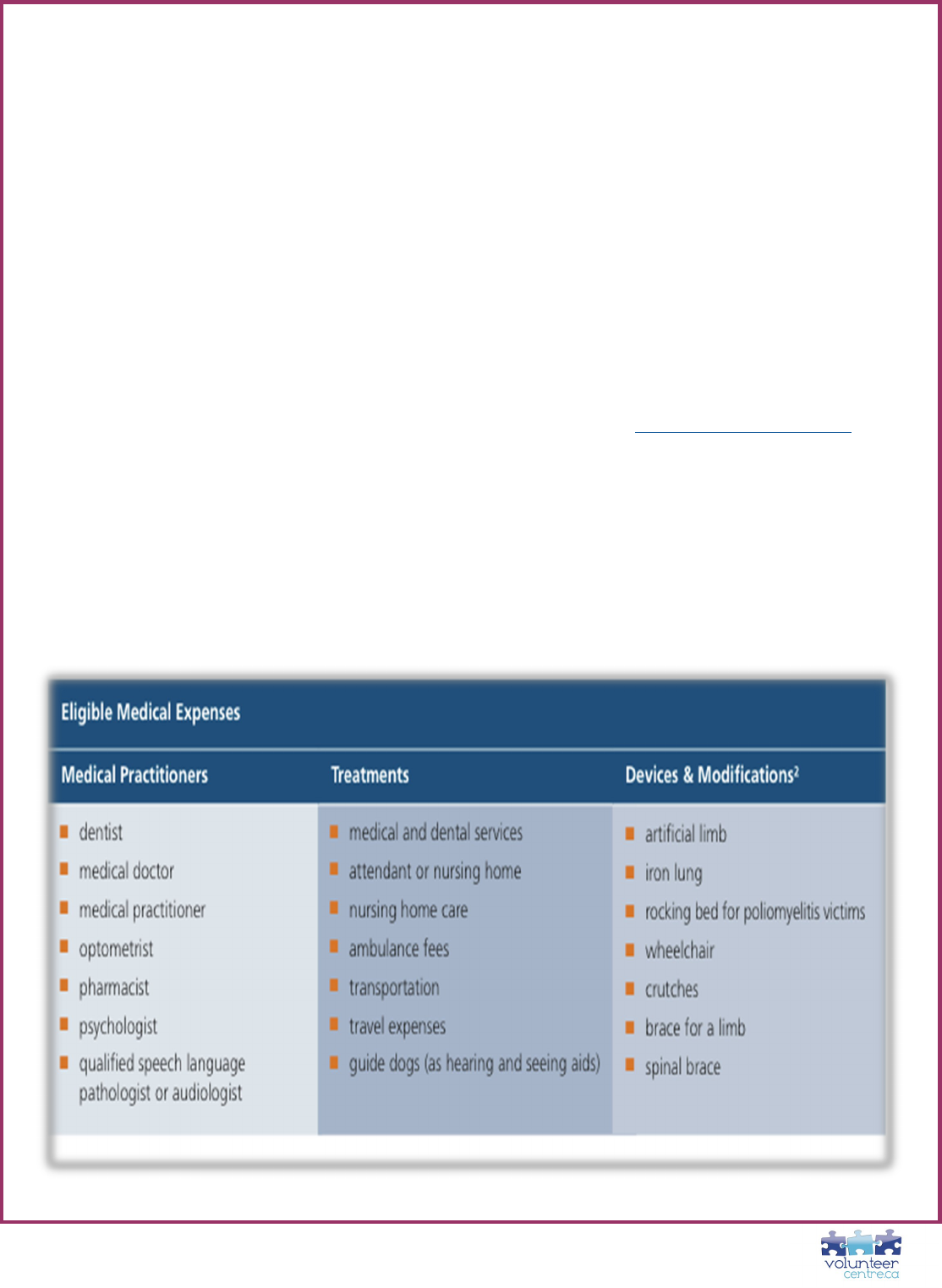

Income Tax Deducons and/or Credits for Adults

Medical Expenses; Line 33099

The medical expense tax credit is a

non-refundable tax credit that you can use to re-

duce the tax that you paid or may have to pay. If

you paid for healthcare expenses, you may be

able to claim them as eligible medical expenses

on your income tax and benefit return. These ex-

penses include a wide range of products, proce-

dures and services, such as:

• medical supplies

• dental care

• travel expenses

Generally, you can claim all amounts paid, even if

they were not paid in Canada. You can only claim

the part of an eligible expense for which you have

not been or will not be reimbursed

How do you claim medical expenses?

You can claim medical expenses on line

33099 or line 33199 of your tax return under Step

5 – Federal tax.

Line 33099 – You can claim the total eligible

medical expenses you or your spouse or common

-law partner paid for any of the following persons:

• yourself

• your spouse or common-law partner

• your or your spouse’s or common-law part-

ner’s children who were under 18 years of

age at the end of the tax year

Line 33199 – You can claim the part of eligible

medical expenses you or your spouse or common

-law partner paid for any of the following persons

who depended on you for support:

• your or your spouse’s or common-law

partner’s children who were 18 years of age

or older at the end of the tax year, or

grandchildren

• your or your spouse’s or common-law part-

ner’s parents, grandparents, brothers, sis-

ters, uncles, aunts, nephews, or nieces who

were residents of Canada at any time in the

year

What amount can you claim?

Line 33099 – You can claim the total of the eligi-

ble expenses minus the lesser of the following

amounts:

$2,397

• 3% of your net income (line 23600 of your

tax return)

Line 33199 – You can claim the total of the

eligible expenses minus the lesser of the

following amounts:

$2,397

• 3% of your dependant's net income (line

23600 of their tax return)

For which period can you claim these

expenses?

You can claim eligible medical expenses paid in

any 12-month period ending in 2020 and not

claimed by you or anyone else in 2019. For a

person who died in 2020, a claim can be made for

expenses paid in any 24-month period that in-

cludes the date of death if the expenses were not

claimed for any other year

For more information visit www.canada.ca or

call 1-800-959-8281. or call the

Volunteer Centre at 613-499-9393

15

Which medical expenses can you

claim?

• You can claim only eligible medical expens-

es on your tax return if you, or your spouse

or common-law partner:

• paid for the medical expenses in any 12-

month period

• did not claim them the previous year

Generally, you can claim all amounts paid, even if

they were not paid in Canada. For all expenses,

you can only claim the part of the expense that

you or someone else have not been and will not

be reimbursed for.

List of common medical expenses?

For a list of over 142 medical expenses that be

claimed visit www.cra.ca/medical-expenses

• types of medical expenses

• if the expense is eligible

• if you need any supporting documents

What documents do you need to support your

medical expenses claim?

• Receipts – Receipts must show the name

of the company or individual to whom the

expense was paid.

• Prescription – The List of common medical

expenses indicates if you need a prescrip-

tion to support your claim. A medical practi-

tioner can provide the prescription.

• Certification in writing – The List of com-

mon medical expenses indicates if you need

a certification in writing to support your

claim. A medical practitioner can provide the

certification.

• Form T2201, Disability Tax Credit Certifi-

cate – The List of common medical expens-

es indicates if you need to have this form

approved by the CRA for your claim. For

more information about this approval pro-

cess, see Disability Tax Credit.

If you need assistance filing your Income taxes

call the Volunteer Centre at 613-499-9393 or

visit or website at www.volunteercentre.ca

16

Refundable Medical Expense

Supplement

The refundable medical expense supplement is a

refundable tax credit available to working individ-

uals with low incomes and high medical expens-

es. You may be able to claim this credit if all of

the following conditions apply:

• You made a claim for medical expenses

on line 33200 of your tax return (Step 5 –

Federal tax) or for the disability supports

deduction on line 21500 of your tax return.

• You were resident in Canada throughout the

calendar year

• You were 18 years of age or older at the

end of the calendar year

Expenses you can claim

You may be able to claim as medical expenses

the salaries and wages paid to all employees who

do the following tasks or services:

• food preparation

• housekeeping services for a resident’s per-

sonal living space

• laundry services for a resident’s personal

items

• health care (registered nurse, practical

nurse, certified health care aide, personal

support worker)

• activities (social programmer)

• salon services (hairdresser, manicurist,

pedicurist) if included in the monthly fee

• security for a secured unit

If you are receiving attendant care services in

your home, you can only claim for the period

when you are at home and need care or help. For

an expense to be eligible as a medical expense,

you must either:

• be eligible for the disability tax credit

• have a written certification from a medical

practitioner that states the services are

necessary

Expenses you cannot claim – You cannot claim

the cost of any of the following:

• rent (except the part of rent for services that

help a person with daily tasks, such as

laundry and housekeeping)

• food

• cleaning supplies

• other operating costs (such as the

maintenance of common areas and outside

grounds)

salaries and wages paid to employees such as

administrators, receptionists, groundskeepers,

janitors (for common areas), and maintenance

staff

If you need more: information visit

www.canada.ca or call 1-800-959-8281.To

obtain a paper copy of the Disability-Related

Information Guide; call the Volunteer Centre

613-499-9393 or visit our website at

www.volunteercentre.ca

17

GST/HST credit

The goods and services tax/

harmonized sales tax (GST/HST)

credit is a tax-free quarterly payment

that helps individuals and families

with low and modest incomes offset

all or part of the GST or HST that

they pay. It may also include pay-

ments from provincial and territorial

programs. You are automatically

considered for the GST/HST credit

when you file your taxes.

How much you can expect to re-

ceive?

Your GST/HST credit payments are

based on the following:

• your family net income

• If you're single, the amount from line 23600

of your income tax return, or the amount that

it would be if you completed one

• If you have a spouse or common-law part-

ner, your net incomes are combined to get

your family net income

• the number of children under 19 years old

that you have registered for the Canada

child benefit and the GST/HST credit

Per year, you could get up to:

• $451 if you are single

• $592 if you are married or living common-

law

• $155 for each child under the age of 19

Who is eligible?

You are generally eligible for the GST/HST credit

if you are considered a Canadian resident for in-

come tax purposes the month before and at the

beginning of the month in which the Canada

Revenue Agency makes a payment. You also

need to meet one of the following criteria:

• you are at least 19 years old

• you have (or had) a spouse or common-law

partner

• you are (or were) a parent and live (or lived)

with your child

Parents in a shared custody situation may be eli-

gible for half of the GST/HST credit for that child.

This also applies to any related provincial and

territorial credit.

Go to Custody arrangements and your

benefits for more information. If, however, a

child welfare agency is legally, physically, or

financially responsible for a child, you are no t

generally eligible for the GST/HST credit for that

child.

How to apply?

In most cases, all you have to do to receive the

GST/HST credit each year is file your taxes,

even if you have no income to report.

New residents of Canada must complete a

form to apply for the credit

Complete one of the following forms:

• If you have children: fill out and sign Form

RC66, Canada Child Benefits Application to

apply for all child and family benefits, includ-

ing the GST/HST credit

• If you do not have children: fill out and

sign Form RC151, GST/HST Credit

Application for Individuals Who Become

Residents of Canada

• Mail the completed form to your tax centre

For more information: visit www.canada.ca or

call 1-800-959-8281. or call the Volunteer

Centre at 613-499-9393 ext. 23

18

GST/HST new housing rebate

The GST/HST new housing rebate allows

an individual to recover some of the GST or

the federal part of the HST paid for a new or sub-

stantially renovated house that is for use as the

individual's, or their relation's, primary place of

residence, when all of the other conditions are

met.

Eligibility for the GST/HST new housing rebate

You may be eligible for a new housing rebate for

some of the GST/HST paid if you are an individu-

al who:

purchased new or substantially renovated hous-

ing from a builder, including housing on leased

land (if the lease is for at least 20 years or gives

you the option to buy the land) for use as your (or

your relation’s) primary place of residence

• purchased shares in a co-operative housing

corporation (co-op) for the purpose of using

a unit in a new or substantially renovated

cooperative housing complex for use as

your (or your relation’s) primary place of res-

idence

• constructed or substantially renovated your

own home or hired someone else to con-

struct or substantially renovate your home

for use as your (or your relation’s) primary

place of residence, if the fair market value of

the house when the construction is substan-

tially completed is less than $450,000

If you are an individual who purchased a new or

substantially renovated mobile home (including a

modular home) or a new or substantially renovat-

ed floating home for use as your (or your rela-

tion’s) primary place of residence, you may be

eligible for a new housing rebate for some of the

GST/HST paid. In addition, for the purpose of

claiming the GST/HST new housing rebate, you

may have the option to treat the home as being

purchased from a builder or as being an owner-

built house.

GST/HST new housing rebates you can claim

The GST/HST new housing rebate allows an indi-

vidual to recover some of the GST or the federal

part of the HST paid for a new or substantially

renovated house that is for use as the individual's,

or their relation's, primary place of resi-

dence, when all of the other conditions are met. In

addition, other provincial new housing rebates

may be available for the provincial part of the

HST whether or not the GST/HST new housing

rebate for the federal part of the HST is available.

The new housing rebate is not available to a

corporation or a partnership.

Documents to include with the rebate

application and to keep for your records?

Documents you have to send

In most cases, you do not have to send support-

ing documents with your GST/HST new housing

rebate application. However, you do have to send

invoices with your worksheet if the vendor did not

charge the GST/HST on the invoice (photocopies

of these invoices will be accepted). The CRA may

contact you to ask for proof of occupancy. For

more information, see Guide RC4028, GST/HST

New Housing Rebate. Available at

www.voluntercentre.ca

Documents you have to keep

Keep a copy of the filled-out forms. You also have

to keep all your original invoices and documents

you used to fill out the forms for six years in case

the CRA asks to see them.

Only original invoices in the name of the claimant

or the co-owners are acceptable. The CRA does

not accept photocopies, credit card or Interac

slips, or account statements, without the original

invoices. The CRA does not accept estimates or

quotes as proof. If the CRA asks you to send your

invoices, they will be returned.

For more information visit :https://

www.canada.ca/en/revenue-agency/services/tax/

19

Ontario Trillium Benefit

The Ontario Trillium Benefit combines the following three credits to help pay for energy costs as well

as sales and property tax:

• Northern Ontario Energy Credit

• Ontario Energy and Property Tax Credit

• Ontario Sales Tax Credit

You need to be eligible for at least one of the three credits to receive the benefit.

What you could receive

If you're single, you could receive a maximum of $158.

Families could receive a maximum of $243.

Northern Ontarians may also get more money through the Ontario Energy and Property Tax Credit.

Who is eligible?

To qualify, you must be a resident of Northern Ontario on December 31, 2020, and at least one of the

following at some time before June 1, 2022:

• 18 years of age or older

• have or previously had a spouse or common-law partner

• a parent who lives or previously lived with your child

• and, in 2020, you:

rented or paid property tax for your main residence

lived on a reserve and paid for your home energy costs

lived in a public long-term care home (e.g., a seniors' home) and you paid for a portion of your

accommodation

Your eligibility also depends on where you live on the 1ST of each month. For example, if you live in

Sudbury on November 1, and move to London (Southern Ontario) at the end of November, you would

be eligible for the November NOEC payment, but you wouldn't be eligible for any subsequent pay-

ment.

How to apply?

If you're married or have a common-law partner

While the Ontario Sales Tax Credit component of the Ontario Trillium Benefit is paid to the person

whose return is assessed first, the Ontario Energy and Property Tax/Northern Ontario Energy Credit is

paid to the person who has applied for the credit(s) by completing Form ON-BEN. The payment will be

the same no matter who applies.

If you're turning 18 during the benefit year

If you turn 18 before June 2022, you should apply and file your tax return to be considered for the On-

tario Trillium Benefit.

How the benefit is paid

If you receive your income tax refund by direct deposit, you will receive your Ontario Trillium Benefit

payment(s) by direct deposit.

If you do not receive your tax refund by direct deposit, you will receive your Ontario Trillium Benefit

payments by mail on the 10th of each month, starting in July (e.g., if you file your income tax by April

30, you can start receiving your benefit payments in July).

For more Information: You can also visit the Canada Revenue Agency site for more information on

federal credits and benefits, or call 1-877-627-6645.

20

Canada Workers Benefit

The Canada workers benefit (CWB) is a refunda-

ble tax credit that provides tax relief for eligible

low-income individuals and families who are in the

workforce. The CWB includes a disability supple-

ment for individuals who have an approved Form

T2201, Disability Tax Credit Certificate, on file

with the CRA. If you do not have a Form T2201 on

file, send your completed form to the CRA to see

if you qualify for the disability supplement.

How much you can expect to receive

$1,381 for single individuals The CWB payment is

gradually reduced when net income is more than

$13,064. No CWB is paid when net income is

more than $24,573.

$2,379 for families The CWB payment is

gradually reduced when family net income is more

than $17,348. No CWB is paid when the family

net income is more than $37,173.

Maximum payment for the disability

supplement is:

• $713 for single individuals The CWB

disability supplement is gradually reduced

when net income is more than $24,569. No

disability supplement is paid when net in-

come is more than $30,511.

• $713 for families The CWB disability

supplement is gradually reduced when

family net income is more than $37,176. No

disability supplement is paid when the

family net income is more than $43,118.

Who is eligible?

To be eligible for the Canada workers benefit

(CWB), you must be:

• a resident of Canada for income tax purpos-

es throughout the year

• 19 years of age or older on December 31

unless, on December 31, you have a spouse

or common-law partner, or an eligible dependant*

You are not eligible for the CWB if:

• You are enrolled as a full-time student at a

designated educational institution for more

than 13 weeks in the year

unless, on December 31, you have an

eligible dependant*

• You are confined to a prison or similar insti-

tution for a period of 90 days or more in the

year

• You do not have to pay tax in Canada, be-

cause you are an officer or servant of anoth-

er country, such as a diplomat, or you are a

family member or employee of such person

How to Apply

To apply for the Canada workers benefit, you

must:

• Complete Schedule 6, Canada

workers benefit (available in your certified

tax software and tax package)

• To apply for the disability supplement,

complete Step 3 in Schedule 6

• Enter on line 45300 of your income tax and

benefit return the amount from line 42 of

Schedule 6

• Send (file) your return to the Canada

Revenue Agency (CRA)

• If you prepare your return on paper, include

your completed Schedule 6, Can-

ada workers benefit, with your

return

For more information:

www.canada.ca/en/revenue-

agency/services/child-family-

benefits or call 1-800-387-1193

21

Home buyers' amount

You can claim $5,000 for the purchase of a

qualifying home in the year if both of the following

apply:

• you or your spouse or common-law partner

acquired a qualifying home

• you did not live in another home owned by

you or your spouse or common-law partner

in the year of acquisition or in any of the four

preceding years (first-time home buyer)

Does my home qualify ?

A qualifying home must be registered in your or

your spouse's or common-law partner's name in

accordance with the applicable land registration

system and it must be located in Canada. It in-

cludes existing homes and homes under

construction.

The following are considered qualifying

homes:

• single-family houses

• semi-detached houses

• townhouses

• mobile homes

• condominium units

• apartments in duplexes, triplexes, fourplexes,

or apartment buildings

A share in a co-operative housing corporation that

entitles you to own and gives you an equity inter-

est in a housing unit located in Canada also

qualifies. However, a share that only gives you the

right to tenancy in the housing unit does not quali-

fy.

You must intend to occupy the home, or you must

intend that the related person with a disability oc-

cupy the home, as a principal place of resi-

dence no later than one year after it is acquired.

Persons with disabilities

You do not have to be a first-time home buyer

if either of the following applies to you:

• you are eligible for the disability tax credit

• you acquired the home for the benefit of a

related person who is eligible for the disa-

bility tax credit

The purchase must be made to allow the person

with the disability to live in a home that is more ac-

cessible or better suited to their needs. For the

purposes of the home buyers' amount, a person

with a disability is a person who is eligible for the

disability tax credit for the year in which the home

is acquired.

You must intend to occupy the home, or you must

intend that the related person with a disability

occupy the home, as a principal place of resi-

dence no later than one year after it is acquired.

For more information visit www.cra.ca/or call

1-800-387-1193

22

Seniors’ Home Safety Tax Credit

The Seniors’ Home Safety Tax Credit will help you

make your home safer and more accessible, help-

ing you stay in your home longer.

• This tax credit will provide an estimated

$30 million in support to about

27,000 people, including:

• seniors who are 65 by the end of 2021

• people who live with senior relatives

What you’ll get

The Seniors’ Home Safety Tax Credit is

worth 25% of up to $10,000 in eligible expenses

for a senior’s principal residence in Ontario. The

maximum credit is $2,500.

Who is eligible

You are eligible if you are a senior or if you are

someone who has senior relatives living with you.

Example 1

Olga and Olaf are a senior couple. In 2021, they

complete and together pay for a

$10,000 renovation to make the ground floor of

their home safer.

To divide the benefit between them, Olga will

claim $7,500 on her 2021 personal income tax re-

turn and receive a Seniors’ Home Safety Tax

Credit of $1,875. Olaf will claim the remaining

$2,500 of the renovation cost and receive a credit

of $625.

Example 2

Hayley, in her late thirties,

has asked her senior moth-

er to move in with her.

In 2021, Hayley

spends $1,000 to add ac-

cessibility features to her

home.

She will claim that amount

on her 2021 personal

income tax return and re-

ceive a Seniors’ Home

Safety Tax Credit of $250.

Which expenses are

eligible

Expenses are eligible if they

are for home renovations

that improve safety and accessibility or help a

senior be more functional or mobile at home, for

example:

• grab bars and related reinforcements around

the toilet, bathtub and shower

• wheelchair ramps

• stair lifts

• elevators

• renovations to permit first floor occupancy or

a secondary suite for a senior

• Expenses must be paid or payable in 2021.

How to claim it

The Seniors’ Home Safety Tax Credit is a refund-

able personal income tax credit. This means that if

you’re eligible, you can get a tax credit regardless

of your income or whether you owe income taxes

for 2021.

You can claim the credit on your 2021 Income Tax

and Benefit Return.

To claim the tax credit, seniors or their family

members should get receipts from suppliers and

contractors, helping to ensure that vendors report

these amounts for tax purposes.

For more Information: please contact the Canada

Revenue Agency: by phone, at 1-800-959-8281

Or www.canada.ca

Income Tax Deducons and/or Credits for Seniors

23

Senior Homeowners' Property Tax Grant

The Ontario Senior Homeowners’ Property Tax

Grant helps low-to-moderate income seniors with

the cost of their property taxes.

What could you receive?

If you file your personal income tax and benefit

return annually and qualify for the grant, you could

get up to $500 each year depending on

your adjusted family net income.

Who is eligible?

You qualify for this grant if you or your spouse/

common-law partner, as of December 31 of the

previous year:

• paid Ontario property tax for the year

• met either of the following income require-

ments:

• you were single, divorced or widowed and

earned less than $50,000

• you were married or living common-law and

you and your spouse/common-law partner

earned a combined income of less than

$60,000

• owned and occupied your principal residence

• were 64 years of age or older

• were a resident of Ontario.

If you are single, separated, divorced or

widowed

You could get $500 if your adjusted family net

income for the previous year was $35,000 or less.

If your income is over $35,000 but less than

$50,000, your grant will be reduced by 3.33% of

your income over $35,000.

If you are married or living common-law

You could get $500 if your adjusted family net

income for the previous year was $45,000 or less.

If your income is over $45,000, your grant will be

reduced by 3.33% of your income over $45,000.

You do not qualify for the grant if your adjusted

family net income is $60,000 or more. Only one

person per couple can receive this grant.

You need to file your tax return to apply for this

grant, even if you don't have income to report. You

may qualify for the grant even if you do not owe

income tax.

How do I apply:

complete the ON-BEN application form (which is

part of your general income tax and benefit return)

1. report the amount of property tax you

paid on line 6112 on the ON-BEN applicaon

2. submit the ON-BEN applicaon form with your

completed return

How the grant is paid?

The grant is paid four to eight weeks after you re-

ceive your notice of assessment from the Canada

Revenue Agency (CRA). The CRA is transitioning

all benefit payments to direct deposit. If you al-

ready receive your income tax refund or other

benefits or credits by direct deposit, you will also

receive your OSHPTG payment by direct deposit.

Otherwise, you will receive your payment by

cheque.

To register for direct deposit:

use the CRA My Account service online, or

complete a direct deposit enrolment form and

send it to the CRA at:

Receiver General for Canada

P.O. Box 5000 Matane,

QC G4W 4R6

If you need help setting up direct deposit, visit

the Government of Canada website, or call

the CRA at 1-800-959-8281.

For information call the Volunteer Centre

613-499-9393 ext 21 or Minister of Finance Tax

Office 1866-668-8297

24

25

PROGRAM Page

Income Supports for Children

Canada Child Benefit (CCB) 26

Ontario Child Benefit 27

CPP Disability Benefits for Children under 25 28

Ontario Child Care Fee Subsidy 28

Healthy Smiles Ontario 29

Ontario Child Care Tax Credit 30

Supports for Adopted Children/youth

Grant for Postsecondary Education 31

Health Supports 31

Financial Assistance for Adoption and Legal Custody Financial Support 32

Income Supports for Children with Special Needs

Assistance for Children with Severe Disabilities (ACSD 33

Assistive Devices 34

Special Services at Home 35

Child Disability Benefit (CDB) 36

Income Supports for Adults

Ontario Works (OW) 37

Employment Insurance Benefits and Leave 38

Employment Insurance Maternity and Parental Benefits 39

EI Sick Benefits 40

EI Caregiver Benefits 41

Workers Compensation 42

Canadian Benefit for Parents of Young Victims of Crime 43

26

PROGRAM Page

Utility Assistance Programs

Ontario Energy Support Program 44

Low Income Energy Assistance Program (LEAP) 45

Energy Affordability Program (EAP) 45

Income Supports for Adults with a Disability

Ontario Disability Support Program (ODSP) 46

Canada Pension Plan Disability (CPPD) 47

Income supports for Students

Ontario Student Assistance Program (OSAP) 48

Student Access Guarantee 49

Current and Former individuals in Extended Society Care 49

Students with Disabilities 49

Indigenous Student Bursary 50

Ontario Indigenous Travel Grant 50

Income Supports for Seniors

Canada Pension Plan (CPP) 51

Old Age Security (OAS) 52

Ontario Guaranteed Annual Income System (GAINS) 53

Guaranteed Income Supplement (GIS) 54

Ontario Seniors Dental Care Program 55

27

Income Supports for Children

Canada Child Benefit (CCB)

The Canada child benefit (CCB) is administered

by the Canada Revenue Agency (CRA). It is a tax

-free monthly payment made to eligible families to

help with the cost of raising children under 18

years of age. The CCB may include the child dis-

ability benefit and any related provincial and terri-

torial programs.

How much you could receive?

The maximum Canada child benefit you could get

is $6,765 per year for children under 6,

and $5,708 per year for children aged 6 to 17.

Your Canada child benefit is based on your

family income from the previous year, the

number of children in your care, and the age of

your children.

Who is eligible for Canada Child Benefit?

Are you eligible? To get the CCB, you must meet

all of the following conditions: You must live with

the child, and the child must be under 18 years of

age. You must be the person primarily responsi-

ble for the care and upbringing of the child

When should I apply?

You should apply for the Canada child benefit

(CCB) as soon as any of the following situations

happen:

• your child is born

• a child starts to live with you, or returns to

live with you after a temporary period with

someone else

• you begin, end, or change a shared

custody arrangement

• you get custody of a child

• you, or your spouse or common-law

partner, start to meet the eligibility

conditions under

Who can apply

• If the child started living with you more than

11 months ago, you will need to

provide additional documents.

How to apply?

1. Through birth registration—You can apply for

the CCB when you register the birth of your new-

born. In most cases, registration is done by paper

at the hospital or birthing centre.

2. Online through My account—If you didn't apply

for the CCB when you registered the birth of your

newborn, you can apply online using My Account

(your personal CRA account).

3 By Mail— Fill out and sign Form RC66,

Canada Child Benefits Application available at

the Volunteer Centre. Include any additional doc-

uments needed for the situations described below

4. Mail the form to your tax center

When I need to provide additional

documents?

• Male parent is primarily responsible for the

child

• Child's proof of birth is required

• Applying for a period that started more than

11 months ago

• You or your spouse or common-law partner

are newcomers or returning residents to

Canada

For more information visit: www.cra.ca.canada/

child/benefit or call Canada Revenue Agency at

1-800-387-1193

You can also contact the Volunteer Centre at

613-499-9393 or visit our website

www.volunteercentre.ca

28

CPP Disability Benefits for Children

under 25

The Canada Pension Plan (CPP) children's

benefits provide monthly payments to the de-

pendent children of disabled or deceased CPP

contributors.

How much you can expect to receive?

The monthly children's benefit is a flat rate that is

adjusted annually. In 2019, the rate is $250.27

There are two types of CPP children's benefits:

• A disabled contributor's child's benefit – a

monthly payment for a child of the person

receiving a CPP disability benefit.

• A surviving child's benefit – a monthly pay-

ment for a child of the deceased contributor.

For the benefit to be paid, the deceased

contributor must have made sufficient

contributions to the CPP.

A maximum of two children’s benefits can be

paid to a child.

To be eligible, the child must be:

• the natural child of the contributor

• a child adopted “legally" or "in fact" by the

contributor while under the age of 21

• a child "legally" or "in fact" in the custody

and control of the contributor while under

the age of 21

A child may be eligible if the parent or

guardian:

• is receiving a CPP disability benefit (either

the disability pension or the post-retirement

disability benefit)

• has died and met the CPP contributory

requirements for a CPP death benefit

How do I apply?

Dependent children, or their parent or guardian,

should complete an application when any of the

following happens:

• a parent or guardian has applied for a

disability benefit (you do not have to wait for

the benefit to be approved before applying);

• when a child comes into the custody and

control of a parent or guardian who receives

a disability benefit;

• a parent or guardian dies.

You should apply as soon as possible. If you

delay, you might lose benefits. The Canada

Pension Plan can only make back payments for

up to 12 months.

What documents are required?

If you are applying for a child under age 18, you

must complete one of the following and in-

clude certified true copies of the required

documentation:

• For a child of a disabled contributor -

the Application for Benefits for Under Age

18 Children of a Canada Pension Plan

Disabled Contributor

• For a contributor applying for disability

benefits - section F of the Application for

Canada Pension Plan Disability Benefits.

• For a child of a deceased contributor -

the Application for a Canada Pension Plan

Survivor's Pension and Child(ren)'s Benefits

• If you are a full-time student aged 18 to 25,

you must complete these forms and

include certified true copies of the required

documentation:

• Application for a Canada Pension Plan

Child's Benefit and

• Declaration of Attendance at School or

University

For more information: visit www.canada.ca/

services/benefits

29

Ontario Child Benet

The Ontario Child Benefit (OCB) helps low-to-

moderate income families – whether they are

working or not – to provide for their children. The

Ontario Child Benefit supports about one million

children in over 500,000 families.

What you could receive?

The Ontario Child Benefit provides up to $1,461

per child per year depending on:

• your family net income

• the number of children in your care who are

under 18 years old

• If you are eligible, you will get a payment

each month.

The Canada Revenue Agency (CRA) determines

your monthly payments. The amount you receive

depends on your adjusted family net income on

your annual income tax

Who is Eligible?

Depending on your family income, you may

qualify for the OCB, if you:

• are the primary caregiver of a child under 18

• are a resident of Ontario

• have filed and had assessed your previous

year's income tax return, and so has your

spouse or common-law partner, and

• have registered your child for the federal

Canada Child Tax Benefit

•

How to apply

To apply and receive the benefit you must apply

for the Canada Child Benefit. When you apply

for the Canada Child Benefit you are automatically

assessed for the Ontario Child Benefit.

For more information: The Canada Revenue

Agency by phone

Toll-free: 1-800-387-1193

TTY: 1-800-665-0354

Or visit https://www.ontario.ca/page/ontario-

child-benefit

Ontario child care fee subsidy

Families can apply for the Ontario child care fee

subsidy. The cost of this program is shared by the

Ontario government, municipal governments and

First Nations communities.

What you could receive?

The amount you pay for child care depends on

your family's adjusted net income.

To calculate your net income:

take your net income amount on line 236 of the

Canada Revenue Agency personal income

tax form

Then subtract:

any federal Universal Child Care Benefit (UCCB)

payments (the UCCB is not considered in

determining a family's child care fee subsidy)

Who is eligible?

You can apply if your child is under 13 years

old (or up to 18 years old if your child has special

needs and meets other criteria*) and in either:

• a licensed child care program (centre-based,

home-based or in-home services)

• a child enrolled in a “children's recreation

program”

• a camp

• a before- and after-school program operated

directly by a school board

How to apply?

The Ministry of Education provides funding for fee

subsidies. To apply for the child care subsidy or to

get more information about this program, please

contact:

United Counties of Leeds & Grenville—

Integrated Program Delivery Department

25 Central West, Suite 200

Brockville, ON K6V 4N6

Tel: (613) 342-3840 Ext. 2122 or 2372

Fax: (613) 342-8908

Toll Free: 1-800-267-8146

Email: cssadmins[email protected]

Website: www.uclg.ca

30

Healthy Smiles Ontario

Healthy Smiles Ontario is a government-funded

dental program that provides free preventive,

routine, and emergency dental services for

children and youth 17 years old and under from

low-income households.

The program includes regular visits to a licensed

dental provider and covers the costs of treatment

including:

• check-ups

• cleaning

• fillings (for a cavity)

• x-rays

• scaling

• tooth extraction

• urgent or emergency dental care (including

treatment of a child’s toothache or tooth

pain)

• Cosmetic dentistry, including teeth whitening

and braces, are not covered by the program.

Who is eligible to apply

You can apply for your children if they:

• are 17 years of age and under

• live in Ontario

• Meet the low income threshold.

Coverage period

Once your child is enrolled, they are covered:

up to one benefit year (August 1st of the current

year to July 31st of the following year), or

up to their 18th birthday. If your child turns 18

during the benefit year, they’re no longer eligible.

If your child is in the program for emergency or

essential care, they are covered for 12 months

from the date of enrolment. Clients receiving

emergency or essential care must re-enrol after

12 months.

How to enrol

You can enrol in the program online or by mail.

Once your child’s enrolment is confirmed, you will

get a Healthy Smiles Ontario dental card in the

mail. You must present your card to your dental

provider at each visit to receive services under

the program.

Before you start

Before you begin the online application, you

need:

• your child(ren)’s date(s) of birth

• a valid Ontario address

• your Social Insurance Number (SIN) or

Temporary Taxation Number (TTN)

• to have filed your taxes in the previous year

To apply by mail:

download, print and complete the application form

mail the completed form to:

Healthy Smiles Ontario

33 King Street West

PO Box 645

Oshawa, Ontario, L1H 8X1

You can also get an application form from

your local public health unit, Volunteer Centre or

at a ServiceOntario location.

If you have any questions, need to update your

account information or replace your dental card

(s), please contact the ServiceOntario INFOline:

Toll-free: 1-844-296-6306

Toll-free TTY: 1-800-387-5559

Your local public health unit can also help you

apply or find a dental provider. Please contact

them for information on preventive, emergency or

essential services.

31

Ontario Child Care Tax Credit

The Ontario Child Care Tax Credit (known as

Ontario Childcare Access and Relief from Ex-

penses (CARE) Tax Credit) will put more money

in the pockets of families and provide the flexibility

they need to choose the child care options that

work best for them.

Eligible families can claim up to 75% of their

eligible child care expenses, including services

provided by child care centres, homes and camps.

You can claim this tax credit when you file your

personal income tax return.

How much you can receive

Families could receive up to:

• $6,000 per child under the age of seven

• $3,750 per child between the ages of seven

and 16

• $8,250 per child with a severe disability

The Ontario Child Care Tax Credit is calculated as

a percentage of your Child Care Expense Deduc-

tion. The Child Care Expense Deduction provides

provincial and federal income tax relief toward

eligible child care expenses.

Who is eligible

The Ontario Child Care Tax Credit supports

families with incomes up to $150,000, particularly

those with low and moderate incomes. Learn how

the credit is calculated.

To claim the Ontario Child Care Tax Credit, you

must:

be eligible to claim the Child Care Expense De-

duction

• have a family income less than or equal to

$150,000

be an Ontario resident at the end of the tax year

Eligible expenses

Child care expenses that are eligible for the Child

Care Expense Deduction will also be eligible for

the Ontario Child Care Tax Credit.

• Eligible expenses include:

• caregivers providing child care services

• day nursery schools and child care centres

• boarding schools, overnight sports schools

or camps where lodging is involved

• educational institutions (for the part of fees

that relate to child care only)

• day camps and sports schools where the

primary goal of the camp is to care for

children

Ineligible expenses include:

• medical or hospital care, clothing or

transportation costs

• fees related to education costs at an

educational institution (such as tuition)

• fees for leisure or recreational activities (such

as tennis lessons)

• child care services provided by the eligible

child's parent or a person under 18 years of

age who is connected by a blood relationship

(such as a sibling)

How to claim

You can claim the Ontario Child Care Tax Credit

when you file your tax return.

You must keep the receipts for child care ex-

penses incurred throughout the year.

How the tax credit is calculated

The amount you could receive is calculated us-

ing your Child Care Expense Deduction, mul-

tiplied by the Ontario Child Care Tax Credit

rate that is based on your family income (that

is, the incomes of family members used in de-

termining your Child Care Expense Deduc-

tion).

For more information: Contact the Canada

Revenue Agency If you have questions about the

Ontario Child Care Tax Credit, please contact

Canada Revenue Agency's: Tax services offices

and tax centres

Individual tax enquiries line at 1-800-959-8281

More information is also available on the Canada

Revenue Agency website.

For help filing your taxes contact the

Volunteer Centre at 613-499. 9393 ext 21

32

Support for adopted youth

Youth who were adopted from extended society

care may be eligible for financial support to help

with costs of postsecondary education and health

benefits.

Grant for postsecondary education

Youth who were in extended society care and

other youth 21 to 24 years old who left the care of

a children’s aid society who are pursuing

postsecondary education may be eligible for

financial assistance through the Living and

Learning Grant (LLG) Youth can get $2,000 a

semester of full-time postsecondary studies to a

maximum of $6,000 per academic year up to a

maximum of four academic years.

Who is eligible

Youth must be enrolled full-time in an Ontario Stu-

dent Assistance Program at an institution ap-

proved for Ontario Student Grant and Ontario Stu-

dent Loan purposes and meet at least one of the

following requirements.

Option 1

Youth either:

• have received a continued care and support for

youth allowance (CCSY) from an Ontario Chil-

dren’s Aid Society when they were 18, 19 and

20

• would have been eligible to receive the con-

tinued care and support for youth allowance

Option 2

Youth:

• were in extended society care with an Ontario

Children’s Aid Society

• were adopted on or after August 1, 2013

will be or were between 18 and 24 when you

start postsecondary studies

Health benefits

Youth formerly in extended society care and youth

adopted from extended society care who do not

have access to health benefits through their em-

ployer, adoptive parents or a spouse’s plan may

be eligible for the Aftercare Benefits Initiative

(ABI).

ABI provides eligible youth from care between

the ages of 21 to 24 with access to:

• prescription drug coverage

• dental benefits

• extended health service

• employee assistance-type benefits

The ABI program is also available to a former child

in extended society care between the ages of 18

to 24 (for four consecutive years), who was

adopted on or after June 1, 2016.

The program also provides counselling and life

skills support services to ABI plan members up to

their 29th birthday.

ABI is funded by the Ministry of Children,

Community and Social Services and administered

by the Ontario Association of Children’s Aid

Societies.

For more information visit: ww.ontario.ca/page/

adoption-services-and-supports or call The

Ministry of Children, Community and Social

Services at 416-325-5666

Toll-free: 1-888-789-4199

Supports for Adopted Children,

Youth and Families

33

Financial Assistance for Adoption and

Legal Custody Financial support

The Children’s Aid Societies (CASs) provide

supports to families who give children in their

care a home through adoption, legal custody, kin-

ship and customary care. Additional financial help

is given to eligible families who are adopting or

taking legal custody of children in Extended Soci-

ety Care who are siblings or 8 years of age or

older.

The amount is $1,035 per month tax-free for each

child. Eligible families who adopt or take legal

custody of siblings or older children in extended

society care will receive subsidies from a chil-

dren’s aid society to help with the cost of care.

You will receive $1,035 per month or $12,420

annually for each eligible child up until the child

turns 21. You must apply to your society for the

subsidy.

To be eligible, families must:

• have a combined net family income of

$93,700 or less

• adopt or take legal custody of a child in ex-

tended society care who is eight years old or

older

• adopt or take legal custody of two or more

children in extended society care who are

siblings

• To learn more, contact your local children’s

aid society.

Subsidies for adopted children with identified

and special needs

Your family may be eligible for financial support to

help cover your child’s medical needs and other

needs if you are unable to pay for those costs.

Your children’s aid society will evaluate your

child’s needs on a case-by-case basis to deter-

mine if you are eligible for financial support.

For more information contact:

Family and Children services of Lanark, Leeds

& Grenville. 613-498-2100

Or visit www.fcsllg.ca

34

Income Supports for Children with Special

Needs

Children and youth with special needs

have medical, emotional, developmental,

mental or behavioural problems that re-

quire ongoing help and support. Ontario

has a number of provincial programs and

the federal government has various tax

deductions, credits and benefits available

to help families and caregivers of children

and youth with special needs. The follow-

ing pages outlines the main sources of

financial help, and provides some tax

information.

Assistance for Children with Severe

Disabilities (ACSD)

If you are a parent caring for a child with a severe

disability, you may be able to receive financial

support through the Assistance for Children with

Severe Disabilities Program. This program

provides financial support for low- to moderate-

income families to cover some of the extra costs

of caring for a child who has a severe disability.

How much you can expect to receive?

Depending on the income and size of the family,

the program may provide between $25 and $500

a month to help with costs, such as:

• travel to doctors’ appointments, hospitals

and other appointments related to the child’s

disability

• special shoes and clothes

• parental relief such as respite

• wheelchairs and other assistive devices, in-

cluding repairs

• hearing aids and batteries

• prescription drugs

• dental and vision care, including eyeglasses

Who is eligible for the (ACSD)?

A parent or a legal guardian whose child: is under

18 years of age, lives at home, and has a severe

disability may be eligible to receive help under this

program depending on the family's income.

How much a family receives will depend on:?

• the family's income

• the size of the family,

• the severity of the disability and

• the extraordinary costs related to the child’s

disability

How to apply

• The program is funded by the Ministry of

Children, Community and Social Services.

• Contact your local regional office and ask for

an application form.

• Complete the application form and return it

to the regional office along with any

documentation asked for.

• A Special Agreements Officer will review

your application and will contact you if they

need more information.

• You will receive a letter saying whether or

not you qualify for a grant and, if so, how

much you will receive.

For more information: Call the Ministry of

Community and Social Services at

Tel: 416-325-5666 Toll-free: 1-888-789-4199 or

visit; www.ontario.ca/disability_benefits

35

Assistive Devices Program

Through the Assistive Devices Program (ADP), we

help people with long-term physical disabilities pay

for customized equipment, like wheelchairs and

hearing aids.

The ADP also helps cover the cost of specialized

supplies, such as those used with ostomies.

Who qualifies?