5/22

How to Request a Tax Return Transcript

from the Internal Revenue Service

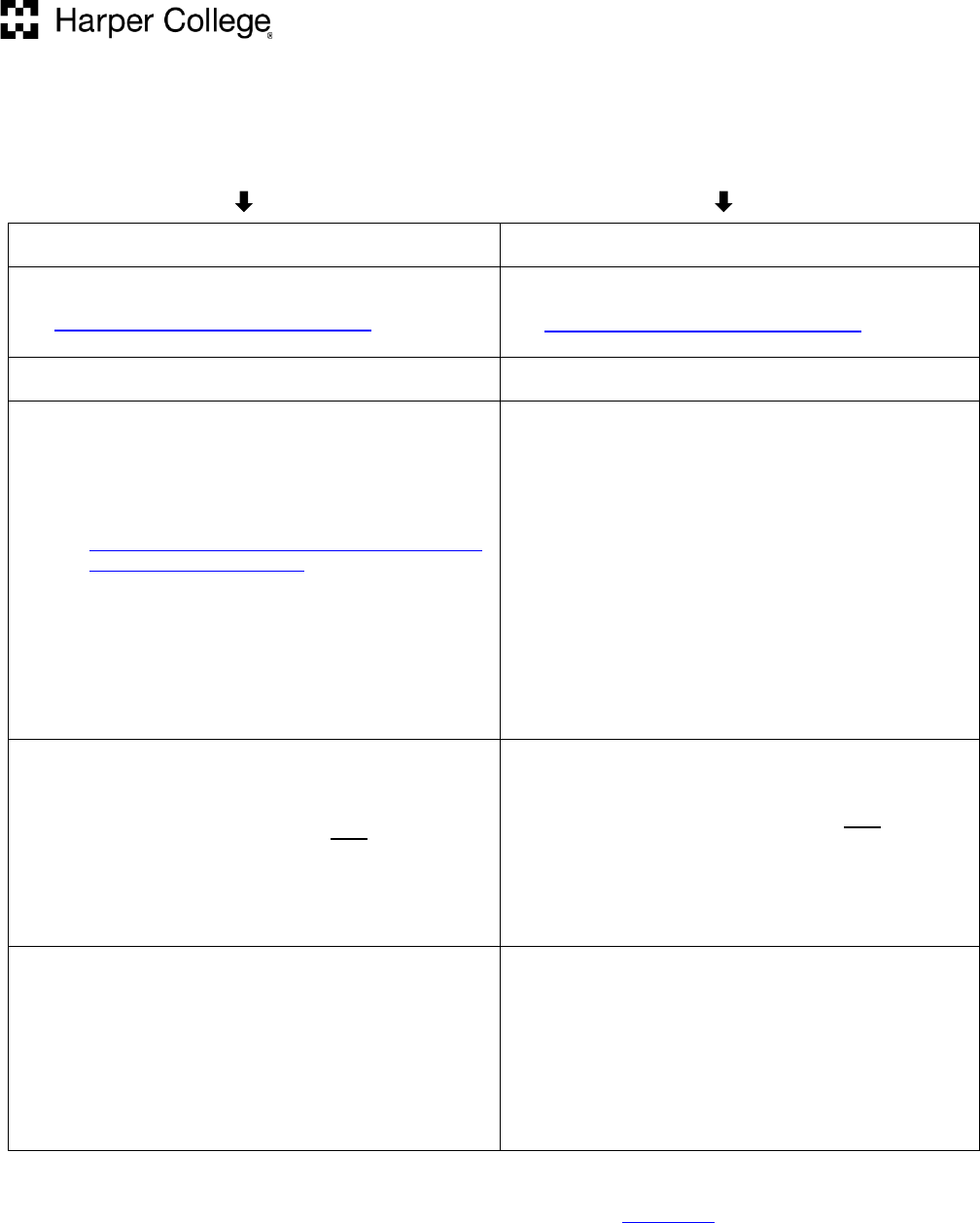

ONLINE (if available) OR MAIL

*Select the tax year you used to complete the Free Application for Federal Student Aid (FAFSA).

If you do not have access to a computer or would prefer to order your Tax Transcript from the IRS over the phone, please call 800.908.9946.

NOTE: If you cannot request a Tax Return Transcript online or by mail, complete a Form 4506-T and submit it directly to the IRS.

View and print immediately

Arrives in 5 to 10 business days

▪ Go to the IRS website at

www.irs.gov/individuals/get-transcript .

▪ Go to the IRS website at

www.irs.gov/individuals/get-transcript .

▪ Click “Get Transcript ONLINE.”

▪ Click “Get Transcript by MAIL.”

o If you have an existing IRS username, please

create a new ID.me account as soon as possible.

If you're a new user, please create an account with

ID.me (ID.me instructions available here:

https://help.id.me/hc/en-us/articles/360017922513-

How-do-I-verify-my-identity-)

▪ The tax filer completes the required fields and clicks

“Continue.” You will need your:

o Social Security Number (SSN) or Individual Tax

Identification Number (ITIN),

o date of birth, and

o mailing address from your latest tax return.

▪ Once logged into your IRS account, follow the prompts

to request a transcript. You will need a “Return

Transcript” for the specific Tax Year* for which you

would like the return transcript. Do NOT request an

Account Transcript, Record of Account Transcript

or Wages and Income Transcript. These cannot be

accepted. Select “Higher Education/Student Aid as the

reason you need a return transcript.

▪ Follow the prompts to select a “Return Transcript” for

the specific Tax Year* for which you would like the

return transcript. Click “Continue.” Do NOT request

an Account Transcript, Record of Account

Transcript or Wages and Income Transcript.

These cannot be accepted.

▪ View and print the return transcript you requested.

▪ If successfully validated, expect to receive a paper IRS

Tax Return Transcript at the address included in your

online request within 5 to 10 business days from the

time the online request was successfully transmitted to

the IRS. IRS Tax Return Transcripts requested online

cannot be mailed to an address other than the address

on file with the IRS.