Mortgage Field Services Pricing Discussion

An industry perspective and proposed solution to address pricing

inequities in mortgage field services

1

Fair Trade Disclaimer

Neither the National Association of Mortgage Field Services (NAMFS), nor our

members, are attempting to fix prices or create collusion with our discussions

regarding this issue. NAMFS members work separately with their respective clients

and arrive at their own pricing structure independently, without consultation or

agreement with any other party for the purpose of restricting competition; and

should never attempt to induce any other person or company to restrict fair and

open competition.

2

Presenters

National Association of Mortgage Field Services (NAMFS)

• Oldest and largest mortgage field services trade association (established 1988)

• A leader in creating innovative solutions to industry challenges (current and future)

• Contributed to the creation of the MBA Type 1 and 2 inspection forms

• Shaped investor and government guidelines/direction by providing technical direction and best

p

ractices

• Partnered in creating and implementing industry-standard vendor background checking

• Hosted educational materials on defective drywall, employee misclassification, lead-b

ased paint

identification, and the NAMFS Academy certification courses

• Created industry technology standards for photos, video, labels, tags, and reporting results

• Created industry-s

tandard Property Condition Report (PCR) and presented to MISMO (Mortgage

Industry Standards Maintenance Organization)

• Provided flexible guidelines and justification to increase allowable pricing for clear-b

oarding

(attractive alternative to plywood)

• Led effort to certify the industry as essential business during COVID 19 pandemic

3

Presenters

Gate House Strategies

• Leading experts in housing, affordable rental housing, and the mortgage market including all

aspects of the loan life cycle, from origination to claims including servicing, loss mitigation,

and property disposition

• Unmatched experience and expertise with key components of the mortgage programs at

H

UD, FHA and the Government Sponsored Enterprises, including the oversight of risk

management and policies governing execution for FHA, Ginnie Mae, Fannie Mae and Freddie

Mac

4

Agenda

NAMFS and Mortgage Field Services (MFS) Industry Goals

Industry Risks

Purpose

Background

• Problem Statement

• Timeframes, Expenses, Allowables

• Historical Comparison Summary

Proposed Solution/Next Steps

Appendix

5

NAMFS and MFS Industry Goals

• Support a strong, viable, sustainable, and efficient housing finance system

• Ensure vendor safety

• Provide a quality product

• Continue to lead innovation in property inspection and preservation

6

Industry Risks

• Property inspection and preservation is a vital component of risk management as

home values increase (median home prices have increased 133% from 2002-2022

($149,428 to $346,900))

• Ensures properties are maintained as safe, sound, and structurally secure

• Maintains accurate status/condition reporting

• Mitigates financial, legal, and reputational risks for investors

• Incorrect occupancy statuses linked to:

• Heightened losses (degraded assets, lawsuits resulting from improper clean-outs)

• Increased neighborhood/community blight (reduced property values, increased crime,

hei

ghtened risks to public health and welfare, higher costs for municipalities)

• Increased fines and assessments (code violations, lawsuits)

• Degraded business reputation

7

Purpose

The purpose of this presentation is to bring awareness to the dire state of the

mortgage field services industry including property preservation and inspections, due

to a mass exodus of over 70% of the experienced vendors since 2015, due in part to:

• No adjustment in pricing for over 10+ years to offset increased costs, additional

r

equirements, and increased risks

• Labor shortages

• Capacity issues – currently 10-15% outside completion timeframes

• Experienced providers

• Moving to industries with fair wages and less risk

• Reaching retirement

• Challenges in recruitment

• Initial cost of entry vs. business opportunity*

• Worker classification issues – 1

099 vs W2 **

8

*e.g. Entry insurance policy for industry is $2500-$3500 annually with no guarantee of work or volume

** Federal guidance has changed with each of the last three Administrations and independently several states have increased their enforcement efforts

Background: Problem Statement

No meaningful changes in industry-wide pricing for field services in over 10+ years to offset

the following drivers of increased costs:

• Increases in the inspection and preservation requirements (shorter timelines, more information/photos)

• Increasingly restrictive requirements (mandatory check-

in, proprietary software, demand to make

contact)

• Significant and continuing increase in vendor expenses (insurance, technology, licenses, supplies,

m

aterials, gas – up an additional 33% since beginning of 2022)

• Heightened risks (charge-

backs, lawsuits, claims against insurance)

• Degraded condition of properties m

ore difficult to meet expectations

• Fewer metropolitan/suburban concentrations = more rural/remote properties

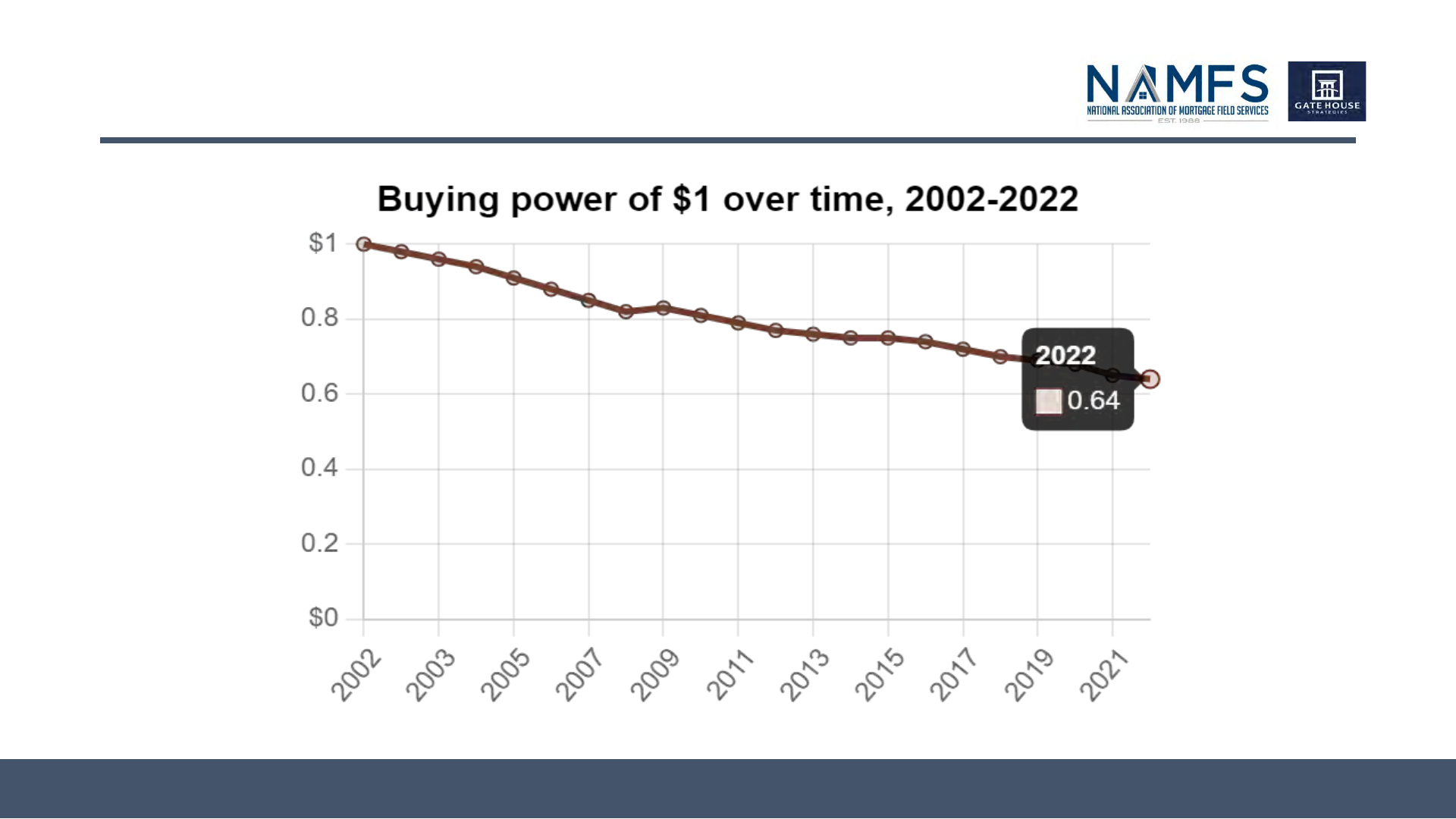

• 2021 purchasing power was ~82% of 2012 dollars and 64% of 2002 (Appendix E). 2022 annualized

i

nflation rate in January was 7.3%

Results:

• Increasingly difficult to retain qualified service providers (constant turnover and recruiting)

•

Risk to turn times and quality risks to the industry

9

Background: Timeframes and Expenses

10

Average Timeframes and Expenses* Rural

Interior***

Rural

Exterior****

Non-Rural

Interior***

Non-Rural

Exterior****

Average total time to travel to**, complete,

document, and report inspection from field

59+ minutes 33+ minutes 44+ minutes 18+ minutes

Average total supply chain expenses (Detail on

Slide 19 excludes labor and equipment)

$26.98 $24.93 $19.15 $17.10

Labor Cost – based on drive to property, time to

complete service, and submit results (Detail on

Slide 20 assumes $15/hr)

$14.93 $8.36 $11.14 $4.57

* Detail found in Appendix A and B (Source: October 2021 NAMFS Industry Survey)

**Travel to – reflects half of average travel time to and from the property (Source: October 2021 NAMFS Industry Survey)

***Subsequent Vacant Inspection (Interior and Exterior)

**** Property Identified as Occupied (Includes Non-Contact and Contact/Door Hanger)

Background: Expenses and Labor vs Allowables

• No change in pricing in 10+ years

• Significant increase in costs

• Rural inspections up three-f

old, from 10% to 30%

11

Expenses and Labor Costs vs Allowables RURAL

INTERIOR

RURAL

EXTERIOR

NON-RURAL

INTERIOR

NON-RURAL

EXTERIOR

Total Expenses and Labor Costs* (excluding

equipment)

$41.91 $33.24 $30.29 $21.67

Current Allowable (FNMA): $15.00 $15.00 $15.00 $15.00

Difference between Expenses + Labor and

Current Allowable (LOSS)

($26.91) ($18.24) ($15.29) ($6.67)

Conclusion: Current allowable ($15-20) does not support the cost of the supply chain.

* Assumes $15/Hr

Background: Historical Comparison Summary

12

• Inspection requirements standardized,

minimal (25) data fields and photos, visible

damages documented only, interior more

limited

• Limited technology,

volume/location/proximity favorable

• Limited bid/eyeball estimates

• Report visible issues ONLY

• Safety concerns documented without

financial consequences

• Pricing by investor/insurer by state

2002

2022

• Inspection requirements lack standardization,

extensive (80+) data fields and photos, visible

and non-visible damages documented,

interior on all vacant

• Complex technology with multiple systems

integrations, volume/location/proximity

disparate

• Detailed bid with cost estimator justification

• Penalties possible for non-visible issues

• Safety issues unacceptable as justification to

not complete services with a financial impact

• Pricing often by client or lowest

investor/insurer allowable

Background: Historical Comparison Summary

13

Inspection Pricing:

• Pricing by investor/insurer by state

• RUSH fees for shortened timeframes

• Recurring inspections payable $15-25 or

individual investor allowable

• Initial Inspection (Initial Secure) - $25-30

is completed by preservation contractor

2002

2022

Inspection Pricing:

• Single line-item pricing by client OR

lowest investor/insurer allowable

• No RUSH fees and shortened timeframes

• Recurring inspections paid $15 based on

lowest investor allowable

• Initial Inspection (Initial Secure) - $35 is

completed by preservation contractor

Background: Historical Comparison Summary

14

Preservation Pricing:

• Plastic (tarps and clearboard)

• Winterizations – addressed 3 types

• Dump Fees – less restrictive

• Labor

• Lumber/Boarding

2002

2022

Preservation Pricing:

• Plastic – 138% material price increase

• Winterization – eliminated radiant allowable and

no change to remaining

• Dump Fees – 84% increase PLUS heavily

regulated and increased special disposal

requirements.

• Labor – 41% Federal minimum wage increase

with additional 106% should $15 be enacted

• Lumber/Boarding – 297% material price increase

• Updates in 2016 allowables were below cost

estimator justification

• 2022 update just removes certain allowables

from spent to date, no increase in pricing

Proposed Solution/Next Steps

Partner with the industry to champion and drive the following changes:

• Increase current property inspection pricing (NAMFS Industry Pledge – Appendix

K)

• Immediately re-a

ssess current property inspection and preservation requirements,

timelines, and allowable expenses

• Institute periodic pricing reviews with industry participation

• Develop streamlined processes and a universal set of data points

15

Appendix

17

Appendix A (Data-Time)

18

FIELD INSPECTOR TIME AND MILEAGE INTERIOR EXTERIOR RURAL (30%) NON-RURAL (70%)

Average miles to drive to and from property

42.16 15.37

Average time to drive to and from property

48:39 18:05

Average time to complete inspection, document, and submit

report from the field

9:15

Average time to complete Initial FTV inspection, document, and

submit report from the field

47:00

Average time to complete subsequent vacancy inspection,

document, and submit report from the field

35:30

Source: October 2021 NAMFS Industry Survey

Appendix B (Data – Expenses)

19

EXPENSES – SUPPLY CHAIN (Inspector,

Regional, and National)

RURAL INTERIOR RURAL EXTERIOR NON-RURAL INTERIOR NON-RURAL EXTERIOR

Technology – includes integrations,

system(s) of record, etc.

$5.25 $5.25 $5.25 $5.25

Insurance – includes general liability,

errors and omissions, auto, etc.

$1.20 $1.20 $1.20 $1.20

Quality Control – includes review of

results and necessary adjustments

$2.65 $1.65 $2.65 $1.65

Admin/Management Overhead –

includes system enhancements to

address updates to requirements,

property registration/tracking, code

enforcement tracking/resolution, hazard

claim reporting/resolution, repair and

rehab tracking/resolution, etc.

$5.55 $4.50 $5.55 $4.50

Mileage to property (IRS 2022 Rate -

$0.585/mile)

$12.33 $12.33 $4.50 $4.50

TOTAL $26.98 $24.93 $19.15 $17.10

Data – Expenses (continued)

20

EXPENSES RURAL INTERIOR RURAL EXTERIOR NON-RURAL INTERIOR NON-RURAL EXTERIOR

Labor – travel time to property (assuming

$15/hour)

$6.05 $6.05 $2.26 $2.26

Labor – time to complete, report, and submit

inspection (Based on subsequent inspection

time and assume $15/hour)

$8.88 $2.31 $8.88 $2.31

TOTAL $14.93 $8.36 $11.14 $4.57

Inspections equipment - $150 (monthly

expense: phone, data plan, etc.)

Source: October 2021 NAMFS Industry Survey

Appendix C - Historical Comparison

21

Inspection Requirements:

• Standard form - MBA Type 1

• ~25 data fields

• Interior only on FHA vacant

• Additional ~20 interior data fields

Photo Requirements:

• Single photo for FTV prior to initial secure

• Document visible exterior damages

• FHA only required interior with single photo

for each room

• No labels or date stamps

2002

2022

Inspection Requirements:

• Lack of a standard form (most common is

FNMA Form 30 + client specific questions)

• ~80 data fields minimum

• Interior on ALL vacant

• Additional ~40+ interior data fields minimum

Photo Requirements:

• Average of 33 photos per interior/exterior

inspection with labeling required

• Document visible and non-visible damages

(foundations, roofs, HVAC, etc.)

• ALL Interiors – multiple photos of each room

along with those detailing damages

• Average over 250+ photos on initial secure

Historical Comparison (continued)

22

Systems Landscape:

• Fax results from field

• Polaroid were transitioning to hard copy

photos

• Limited system integrations

Volume/Location/Proximity:

• 2.24% of mortgages in delinquency with

homeownership rate of 67.8%

• <10% in defined rural zip codes

• 90+% in urban zip codes minimized travel

expense and time

2002

2022

Systems Landscape:

• Mobile required and often proprietary

• Multiple system levels

• Labeling of photos with multiple integrations

• Liability for NPPI

• Background checks required

Volume/Location/Proximity:

• 2.27% of mortgages in delinquency with

homeownership rate of 65.4% with 37%

holding no mortgage

• ~30% in defined rural zip codes

• Travel expense increase

• Rural location

• Gas price - 199% increase ($1.14 to

$3.41)

Historical Comparison (continued)

23

Business Requirements:

• Limited bid items and eyeball estimates

• Majority of inspections completed from

public right of way

• Personal Property – report only

• Evictions – more common

• Report visible issues

2002

2022

Business Requirements:

• Detailed bids with cost estimator verification

(fails to address industry tiers)

• Walk the property, photos of all sides, utility

checks required to determine occupancy

• Personal Property has own path including

storage but failing to address disposal at end

of storage period

• Significant decrease in evictions leads to

increased legal and reputational risk

• Penalties can be assessed for issues that are

not visible (foundation, storage tanks, damage

behind walls, etc.).

• Bids and repairs are scrutinized based on

subsequent conditions/information

Historical Comparison (continued)

24

Safety Risks:

• Safety concerns were documented without

financial consequences

2002

2022

Safety Risks:

• Safety concerns are not acceptable as a

reason to not complete the inspection or

preservation work. Financial consequences

are severe

• Private property has to be accessed on foot

• Photo requirements that are not represented

in the price. e.g. top-down photos of a roof

• Utility meter required or paid as a curbside

inspection…..inspectors required to walk a

potentially occupied property in area with the

Castle Doctrine

• Lack of NPPI for the inspector causes safety

risks

Appendix D - Equitable Adjustment

• Cost of living adjustment:

• From 2002 to December 2021, COLA increased 41.0%

• From 2010 to December 2021, COLA increased 20.6%

• Inspections-specific example:

• HUD ML 2002-10

• Initial inspections allowable of $30

• Recurring inspections average allowable of $20

• With COLA, these items would be $42.30 and $28.20 respectively

• Other considerations exceeding COLA:

• Materials: gasoline, lumber, etc.

• Technology: integrations, equipment, increased complexity

• Insurance: commercial general liability along with errors and omissions up 14% per year (higher in

fin

ancial sector, auto, and other (Global Insurance Market Index – 2021 Q1 from marsh.com)

• Insurance: agreements with indemnification language can invalidate policies and some specific

s

tates are difficult to write in this industry (NY, CA) due to dual path workers compensation paths

25

Appendix E – Buying Power

26

Source: BLS

Appendix F – Median Home Price

$0.00

$50,000.00

$100,000.00

$150,000.00

$200,000.00

$250,000.00

$300,000.00

$350,000.00

$400,000.00

2002 2007 2012 2017 2021

Median Home

27

Source: DQYDJ.com – Existing Home Excludes New Home Construction

Appendix G – Homeownership Rates

59.0

60.0

61.0

62.0

63.0

64.0

65.0

66.0

67.0

68.0

69.0

2002 2007 2012 2017 2021

Homeownership Rate % % of Homeowners with a Mortgage

28

Source: Mortgage Bankers Association

Appendix H – Gas and Federal Min Wage

2002 2007 2012 2017 2022

Gas

$1.14 $2.80 $3.62 $2.42 $3.41

Federal Min Wage

$5.15 $5.85 $7.25 $7.25 $15

$3.41

$0.00

$2.00

$4.00

$6.00

$8.00

$10.00

$12.00

$14.00

$16.00

Gas Federal Min Wage

29

Source: Gas – eia.gov Federal Minimum Wage – Department of Labor

Appendix I – Lumber and Plastic Pricing

$0.00

$200.00

$400.00

$600.00

$800.00

$1,000.00

$1,200.00

$1,400.00

2002 2007 2012 2017 2022

Lumber (USD/1000 board feet)

Plastics Material and Resins Manufacturing: Producer Price Index by Industry

Lumber Plastic

30

Source: St. Louis Federal Reserve

Appendix J – Insurance Premiums

31

Source: Global Insurance Market Index – 2021 Q1 from marsh.com

Appendix K – Industry Pledge

32

Our organization, _______________________________________________________, pledges to be

an active participant, along with the National Association of Mortgage Field Services, Inc. (NAMFS), in

advancing the discussion on current pricing in our industry. Specifically, we wish to ensure the

sustainability of this industry, and those who directly provide inspection and property preservation

services in it. We are willing to confirm this commitment by agreeing to share all allowable

increases equitably and fairly with those directly providing mortgage field services on our

behalf.

As further evidence of our support, we agree to at least three (3) of the following activities:

• Participate in future industry efforts led by NAMFS

• Regularly share updated information in NAMFS surveys

• Promote, encourage, and support the NAMFS Academy

• Other: ________________________________________________________