www.research.hsbc.com

Disclaimer: This report must be read with the Disclaimer, which forms part of it.

Asset // Subcategory

March 2022Disruptive Technology | ESGSmart farming world

Play video

This is a Free to View version of a report by the same title published on 03 March 2022. Please contact your HSBC

representative or email [email protected] for more information.

March 2022

By: Davey Jose, Amy Tyler, Sean McLoughlin and Jeremy Fialko

Smart farming world

Enabling sustainable growth

As global populations rise, feeding

the world won’t be the only issue

on the mind of society, companies

and investors

There is a need to address the

negative impact from crops and

livestock in agriculture, such as

emissions and other ESG factors

Smarter farming technologies,

from robotics to big data, and

synbio to genetics, can help feed

the world more sustainably

Free to View

Disruptive Technology - ESG

Global Thematic research

1

Free to View

● Disruptive Technology - ESG

March 2022

Smarter farming to feed the world sustainably

Food, glorious food! Despite global population growth set to be lower in a post pandemic age, we

believe that this factor alone may not be sufficient in alleviating the pressure to feed world

sustainably. For example, the negative issues of climate change, environmental and labour factors

from agriculture are increasingly at the top of the mind of society, companies and investors.

By 2050, we expect the global population to hit 8.5bn. The UN expects each person to consume

12% more than they did at the turn of the century. We believe this implies that total food

consumption may grow by 60% at the midpoint of the century.

In this report, we outline key data point observations, issues and pressure points for feeding the

world sustainably. This includes global population growth dynamics, food demand as well as

environmental and labour issues. This sets up the thematic motivation for the report and then

we move on to look at how various smart farming tools are being used today in making

agriculture more sustainable in the longer run.

What is smart farming? Smart farming naturally includes technologies such as robotics and

connectivity, often using Internet-of-Things to track and automate activity on farms. But in the

modern day, farms are also starting to use big data, artificial intelligence, drones and

blockchains to process and make sense of activity in real-time. However, as the farm becomes

smarter, allowing the production of crops, feeds and livestock to increase yields, reduce water

use, energy and labour, this digitisation also brings issues of cybersecurity and hacking.

We believe there is value in understanding smart farming beyond the traditional definitions of

simply pure digitisation. So we look at how innovations such as vertical farming, hydroponics,

alternative protein for human consumption, synthetic biology and animal protein/pain killers can

help with reducing water use, emissions and improving ethics in the modern agriculture setting.

We also look at the regulations landscape globally to support smarter and sustainable farming.

Did you know?

Global population set to rise to 8.5bn and world set to consume 60% more food by 2050

Food related GHG emissions are responsible for 26% of global emissions

Global AgTech to grow from about USD22bn today to nearly USD140bn by 2030

Digital farming technology increased yields up to 30% recently in trials in India

Vertical (indoor) farming uses no soil and 95% less water than traditional methods

Feeding the world

Population growth,

environment and labour

issues in food production…

Understanding smarter

farming applications today

Free to View

● Disruptive Technology - ESG

March 2022

2

21st century smart farming

Source: Finistere Ventures, HSBC

The rise of disruptive technologies …

… and their impact on sustainable growth

Technology/application

Connectivity

Robotics

AI, big data & data analysis

Drones

Blockchain

Cybersecurity

Alternative proteins

Synthetic biology

Genetics, medicines

Vertical/indoor farming

Circular economy

Key: ● Direct impact ○ Indirect impact

Emissions Crop yield Land Water Animals Labour Ethics/social

○ ● ● ● ● ●

○ ● ● ● ● ● ●

● ● ● ● ● ● ●

● ● ●

● ● ● ● ●

○ ○ ○ ○ ○ ○ ●

● ● ●

● ● ○

● ● ● ● ●

● ● ● ● ● ●

● ○ ○ ○ ●

Autonomous tractors: help to

ensure quality, reduce labour costs

and exchange harvest data Harvesting robots: machine

learning to identify specific crops

Cybersecurity: help to secure

confidential agriculture data, and prevent

disruption from ransomware attacks

Robotic milking systems: largest

and most established agricultural

robot technology

Controlled environments:

optimised growing conditions

Blockchain: traceability from

seeds to feeds, harvesting,

packaging, delivery and sales

AI & big data: robots

to manage high-tech

indoor farms, collect

data from harvest and

evaluate crop yield

Drones: precision

spraying of pesticides

and spatial mapping

Plant-derived proteins: meat and dairy

alternatives to help reduce CO

2

emissions

Synthetic biology: engineered

microbes deliver nutrients direct to

crops, increasing yield

Precision agriculture:

technology, research and big

data to increase crop yields and

limit levels of manual input

Hydroponics:

plants grown in water and provided

with exact nutrients required

Vaccines: healthier

animals should result in

better economic

outcomes, reducing

need for antibiotics

Anaesthetics &

analgesics:

pain management and

animal welfare,

genetics to improve

efficiency of animal

protein production

USD90-138bn

The smart farming sector

could grow by 15-20% through to

2030e, valuing the space at

C

o

n

n

e

c

t

i

v

i

t

y

&

r

o

b

o

t

i

c

s

A

I

,

b

i

g

d

a

t

a

&

d

a

t

a

a

n

a

l

y

s

i

s

A

l

t

e

r

n

t

i

v

e

p

r

o

t

e

i

n

s

S

y

n

t

h

e

t

i

c

s

M

e

d

i

c

a

t

i

o

n

&

g

e

n

e

t

i

c

s

C

i

r

c

u

l

a

r

e

c

o

n

o

m

y

3

Free to View

● Disruptive Technology - ESG

March 2022

Working smarter on farms…

The rise of disruptive technologies

Smart farming naturally includes technologies such as robotics, with connectivity being a crucial

part of the jigsaw. At our expert event on smart farming in 2021, the panellists highlighted how

due to farms being in rural areas, good, stable connectivity was a pressing issue to be solved.

Good connectivity is needed in these smart farms, so their systems can operate using Internet-

of-Things to track and automate activity. Farms are also starting to use big data, artificial

intelligence, drones and blockchains to process and make sense of activity in real-time.

However, as the farm becomes smarter, allowing the production of crops, feeds and livestock to

increase yields, reduce water use, energy and labour - this digitisation also brings issues of

cybersecurity and hacking.

Chart 1. HSBC Disruption Framework: Smarter farming

Source: HSBC

Early

disruption

Hype

mania

Gradient of estimated expectation vs. reality

Digital health:

Synbio, biologics, genetics

Backlash

window

Real

application

New normal

Connectivity: GPS, cellular

networks, IoT, 2/4/5G, low powered

area networks (LPWA), satellites,

cybersecurity and cyber insurance

Automation: Robotics, AI/big bata

analytics, drones, vertical and

indoor farming, aquaponics

Experiential: Blockchain, alternative

proteins, circular economy

Smarter tech to feed world

The agriculture sector presents a host of intertwined environmental

issues, which can only be exacerbated in the quest to feed the world

We look at a number of key technologies available today which we

believe can make farms and the agriculture sector smarter…

Hence addressing environmental and other concerns from

food production

21

st

century farms…

Free to View

● Disruptive Technology - ESG

March 2022

4

We believe there is value in understanding smart farming beyond the traditional definitions of simply

pure digitisation. So we look at how innovations such as vertical farming, hydroponics, alternative

protein for human consumption, synthetic biology and animal protein/pain killers can help with

reducing water use, emissions and improving ethics in the modern agriculture setting. See Chart 1

for our HSBC Disruptive Framework, to see how commercial the various technologies are today.

Our analysts around the world help us identify some of the key technology trends enabling the

farms of the 21

st

century to not only improve productivity to feed the world but also do it in a

sustainable fashion. See Table 1 giving a high level view of which sustainable themes various

technologies in this chapter tick.

Table 1. Smart farming matrix: Impact on sustainability growth themes

Technology or application

Emissions

Crop yield

Land

Water

Animals

Labour

Ethics/social

Connectivity

○

●

●

●

●

●

Robotics

○

●

●

●

●

●

●

AI, big data & data analysis

●

●

●

●

●

●

●

Drones

●

●

●

Blockchain

○

●

●

●

●

●

Cybersecurity

○

○

○

○

○

○

●

Alternative proteins

●

●

●

Synthetic biology

●

●

○

Genetics, medicines

●

●

●

●

●

Vertical/indoor farming

●

●

●

●

●

●

Circular economy

●

○

○

○

●

Source: HSBC

Key: ● = Direct impact, ○ = Indirect impact

Key: Connectivity framework = red, Automation = orange. Experiential = blue, Digital health = green

Smarter farming market size

Global GDP in 2019 was estimated to be USD87.6trn by the World Bank. It also estimated

agriculture’s percentage of global GDP to be about 4% in the same year. This implies that

global agriculture GDP in 2019 was USD3.5trn.

The chart below shows us that total R&D spend in agriculture was 10% of the total value of the

agriculture sector in 2018, with an average of 15% for the previous half decade. We

approximate that agriculture R&D spend globally was about USD350bn in 2018.

Chart 2. Agriculture infrastructure and R&D trends

Source: OECD FAO

In 2020, the smart agriculture and food tech (or AgTech) was estimated to be USD22.3bn in its

market cap by venture capital firm Finistere Ventures. This included investments ranging from

technology in precision ag to alternative proteins. From 2011 to 2020, this was a CAGR of 56%. So

approximately, this means AgTech is about 25% of agricultural R&D spend. We estimate that

AgTech could grow by 15-20% through to 2030.

0%

20%

40%

60%

80%

100%

2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Agriculture

Infrastructure

R&D and

Extension

Producer transfers

Other

Consumer

transfers

Marketing, Storage

and Inspection

Admin costs

Thinking more farming

innovations…

Agriculture is a USD3.5trn

industry

Smartening agriculture

could be a USD90-138bn

market by 2030…

5

Free to View

● Disruptive Technology - ESG

March 2022

Smarter farms through robots and connectivity

The future farm essentials: robots in disguise

Digital technologies and robotics can help create fully autonomous solutions that are

sustainable, in the sense they can be more resource-efficient, and cost effective because they

help reduce overall labour costs.

Emerging applications of robots or drones in agriculture include weed control, cloud seeding,

planting seeds, harvesting, environmental monitoring and soil analysis. Automation and robotics

for smart farming encompass a range of technologies, which include the below:

1. Autonomous tractors: allow driverless farming to help ensure quality and lower labour costs.

Further, e-tractors exchange data on use and charging needs to optimise energy consumption.

2. Harvesting robots: vegetable picking robots, equipped with machine learning to identify

and harvest a specific agricultural crop, are enabling automated harvesting.

3. Robotic milking systems: allow cattle farmers to automate the milking process. Milking

robots are the largest and most established agricultural robot technology.

4. Drones: remote-controlled consumer or prosumer drones are used for aerial image acquisition.

5. Controlled environments: using building automation solutions for vertical farms, where

optimised growing conditions for plants and other foodstuff products are created in a reliable and

energy-efficient way. Also known as Controlled Environment Agriculture (CEAS) in this domain.

Agricultural technology news site AgriTech Tomorrow pegs the global agricultural robot market

size at USD19bn in 2026e, rising at a CAGR of 10% (based on a December 2020 study).

A November 2021 UK government study estimated that the agriculture robot density in the UK

(measured in robots per million hours worked) would increase from below 1.0 by 2025 to around

8.0 by 2030 and further to 21.6 by 2035. The study also predicted that in the agriculture sector

up to 30% of tasks could technically be automated by 2035, equivalent to an estimated

GBP4.5bn of GVA, driving productivity increases of 0.9% relative to baseline by 2035, adding

an estimated 0.7% to GVA relative to baseline.

High initial investment costs are a barrier to growth for the agricultural robot market. Other

identified barriers in the agricultural sector include drone regulation; digital skills shortages; and

problems with research and testing.

The 21

st

century connected farm…

Farming optimisation and productivity gains are increasingly important given the uncertain

conditions that dictate the output, including climatic conditions or pest control, to name a few. It is

also key when considering the finite (and increasingly under constraint) resources such as water.

Farming benefits from technology through three dimensions: first, by predicting the environmental

parameters (rain, temperature, wind), second, by measuring parameters on the ground (crops,

livestock, inventories) and third by collecting and analysing data to build a decision model, which in

turn would improve productivity on the ground. From a technology standpoint, we observe a

combination of satellite and mobile technologies including 5G supported drones:

Satellites: provide the underlying data to observe and model climatic conditions but also,

through spectral analysis, help to predict the output of a specific crop and determine actions to

fix underperforming plots. GPS (Global Positioning System), from their 20km-away orbit, can

help a farming device to move with precision or to define precisely the boundaries of a field.

Mobile: cellular networks can support farming using IoT (Internet of Things) technology. Smart

farming devices can monitor climatic conditions on the ground (sensors indicate if a field needs

watering or fertilizer) or help in making decisions on when to feed and milk animals for example.

Sean McLoughlin*

EMEA Head of Industrials

Research

HSBC Bank plc

* Employed by a non-US affiliate of HSBC

Securities (USA) Inc, and is not registered/

qualified pursuant to FINRA regulations

Robots to make farms more

sustainable…

Agri bots USD19bn by 2026e

Nicolas Cote-Colisson*

Senior Analyst, TMT

HSBC Bank plc

Adam Fox-Rumley*, CFA

Analyst, Telecoms

HSBC Bank plc

* Employed by a non-US affiliate of HSBC

Securities (USA) Inc, and is not registered/

qualified pursuant to FINRA regulations

Is investment cost a barrier

to entry?

Internet of Cows?

Free to View

● Disruptive Technology - ESG

March 2022

6

Satellite technology as a support for smart farming is well known, but the development of 5G

technology could take farming to another dimension. The IoT ecosystem is currently supported

by 2/3/4G technologies but also by low powered wide area networks (LPWA) that can support

Machine to Machine and IoT devices that don’t require high data loads.

5G technology will expand the capacity of IoT. The standalone version of 5G (also called Release

16, an end-to-end 5G architecture from core to access, with a cloud-native configuration) can support

one million IoT devices per square km, with improved power and connectivity controls.

Another feature of 5G is ultra-reliable and low latency communications. This feature could be

vital for automated flying drones (checking crops and livestock) but also to support mobile

vehicles with robotic arms that could pick fruit for example: the connectivity would allow the

sensors/camera to identify the stage of development and the actions to take thanks to

computing power sitting at the edge of the network).

Software is playing a key role: the amount of data collected by satellites and mobile sensors can

be processed and supported by AI and ML processes, leading to higher productivity eventually.

New(er) fundamental tech:

Digital farming, big data/AI, drones, blockchains and cybersecurity

Digital farming

Digital farming is primarily about the use of data-driven insights to optimise farm management,

but also includes online marketplace for farm products. With AI and cloud computing systems,

the data generated at different levels through precision farming tools can be integrated to

generate region or field or even each plant specific insights to advise the farmers on the right

time of sowing and tilling, what crop to sow, how much and what fertilizers to apply and more.

For instance, field specific crop and soil conditions available through precision farming can be

combined with geospatial/satellite data and pricing information. These data can be used in

predicting weather, pest attacks and price information. The benefits are higher output and cost

savings to farmers.

Some of the advisory services are offered via mobile based apps free of charge which facilitate easy

adoption among the farming community. Paid services are available at a relatively lower cost (say

USD5-10/acre) with limited investments in hardware by farmers. The simplicity and low cost of such

mobile based services means that adoption of this type of technology is likely to be much faster.

The return on investments on the use of digital agriculture services, in general, seems

compelling. For example, Accenture has said that there is a USD55-110/acre increase in profits

due to digital agriculture. This is larger than the overall profitability per acre, which is about

USD250-300/acre for corn and soybeans in the US, while the cost for digital ag service is as low

as USD5-10/acre, depending upon the level of service.

Table 2. Return on Investment on Farm Edge’s comprehensive package at USD6/acre

Services

Details

ROI (USD/acre)

Acres tested

Variable Rate

Technology

Targeted response in select areas within the field that aids higher yields

and optimum input use

31.84

9.5m

Nitrogen-Manager

Reduces nitrogen use by 10% and increases yields by 5%

36.30

663k

Moisture Manager

Decision making on irrigation, nutrition needs and yield forecasting

27.3-49.3

172k

Analytics

Seed selection, planting dates, input efficiency etc

5-120

6.4m

Field mapping

Maps Soil and crop health, harvest, scouting etc

3.25

6.4m

Weather sensors

Hyper local weather information

1.26

12.8m

Predictive modelling

Disease and pest modelling and planning field operations

7.75

11.9m

Equipment tacking

Measuring productivity and fuel performance, speed regulation and

helps in predictive maintenance

3.0

12.8m

Source: Farmers Edge

5G IoT for sensors and

mobility

Drone as a Service or Robot

picking fruits?

Santhosh Seshadri*, CFA

Analyst

HSBC Securities and Capital

Markets (India) Private Limited

* Employed by a non-US affiliate of HSBC

Securities (USA) Inc, and is not registered/

qualified pursuant to FINRA regulations

Return on investment for

farmers…

7

Free to View

● Disruptive Technology - ESG

March 2022

The charges by Farming Business Network, a co-op in North America, is lower, with a flat

USD700 per user per year. As can be seen in the table below, the ROI for digital services range

from USD3-120/acre based on the case studies observed in over 6-13m acres by Farmers

Edge. The advantage is that some of these services can be accessed simply through mobile

apps, and a typical full package service would just require investments in basic hardware like

guidance systems and low cost sensors, that are already used widely in developed markets.

Full-suite services such as field-specific advisory require investment in hardware that could be a

challenge in most EM markets where the small size of landholding and upfront capex costs do

not justify the economics. Hence these markets are likely to be more focussed on basic services

that also limit the benefits to farmers. High speed internet connectivity in farms, a pre-requisite

for the smooth functioning of connected systems, is another barrier even in developed countries

where the 5G rollout is still in the early stage.

Regulations and policies that restrict or limit the use of UAVs/drones could increase the cost of

data collection and limit the offering of services. The key challenge for companies that are

investing in digital farming is the way to monetise of data. Those that are using the data to

improvise their core business or to upsell/cross sell products are more likely to succeed than the

companies that offer fee based services. Hence, many start-ups and companies are developing

open source platforms to gather necessary data input. Again, regulations that restrict use of

data can be a headwind in the path to monetize the data.

Drones

Specialised drones are used for image sensing and pesticide spraying which will result in cost

savings to farmers through increasing labour efficiency and reducing pesticide use. China, which is a

leader in drone manufacturing, has seen exponential growth in drone use for agriculture over the last

two years. We think drones will see an increasing adoption in the future due to the following reasons:

High efficiency and labour cost savings: Drones are much more efficient than manually

spraying of pesticides, a practice that is followed in many emerging markets such as India,

Brazil and Indonesia. Drones are much more cost and input efficient than a conventional

sprayer and can reach difficult terrain that cannot be easily accessed by machines.

Low pesticide use: According to various drone companies and testimonies by farmers as

reported in news articles, drones can save pesticides use by 30-80% depending upon the crop.

Service-based model aiding easy adoption: A farmer can hire a drone rather than

spending upfront on buying a new drone. Also, it helps overcome issues related to a lack of

training. In China, farmers can hire a drone and a pilot at CNY15 per hectare for spraying,

considerably lower than labour costs.

Aerial mapping instead of manual scouting: Drones with multispectral and hyper

spectral sensors can capture information on soil moisture, crop health, pest impact, and

nutrient absorption/deficiency. The data collected can provide insight on preventive

measures and issues can be addressed in a timely manner that prevent yield losses, and

are more efficient than manual scouting.

Regulations and policies that restrict or limit the use of UAVs/drones are the key barriers. Many

countries require a drone to be operated by a trained professional who holds the requisite

license, which could increase the cost of operations. China’s DJI, PrecisionHawk in the US and

TSX listed AgEagle are notable players in drone manufacturing.

Barriers to adoption and key

players

Santhosh Seshadri*, CFA

Analyst

HSBC Securities and Capital

Markets (India) Private Limited

* Employed by a non-US affiliate of HSBC

Securities (USA) Inc, and is not registered/

qualified pursuant to FINRA regulations

Key barriers and drone

players

Free to View

● Disruptive Technology - ESG

March 2022

8

Blockchains

Blockchain technology empowers the traceability of all kinds of information in the food supply chain

from seeding and farming to harvesting, packaging, delivering and selling. Key benefits include:

Ensuring the safety of food;

Improving efficiency as the tracing can be done in seconds; and

Enhancing famers’ income as they can get fair pricing for high quality food.

In Asia we observe that internet companies with cloud services all provide this service to

farmers, including Alibaba, JD and Tencent.

Cybersecurity and farm theft

The increased adoption of technology in any sector doesn’t come without its challenges, especially

when it comes to cybersecurity. A 2018 report from the US Department of Homeland Security looked

at a range of cyber threats that face the “precision agriculture” section, as this space adopts “new

digital technologies in crop and livestock production”. It found various cyber threats to agriculture

supply chains including: theft of confidential agriculture data, corrupting data to disrupt crop and

livestock, damage sensor networks to harm health of animals and more.

Furthermore, the FBI said in 2016 that agriculture is becoming “increasingly vulnerable to cyber-

attacks as farmers become more reliant on digitized data”, this includes threats via ransomware.

2021 saw a very high profile ransomware attack on JBS, which controls about 25% of the cattle

processing in the United States. Last year also saw a Minnesota agriculture company called Crystal

Valley Cooperative become the target of a ransomware attack, which took its operating systems

offline. It left the company unable to mix fertilizers or carry out orders for livestock feed.

1

Application of smart farming:

alternative proteins

Introduction to the technology

Alternative proteins cover the whole range of foods where plant-derived proteins are used to

replace those traditionally derived from animals. The category can broadly be split into two main

components: meat and dairy alternatives. Versions of these products e.g. tofu and rice milk

have been part of the diet in certain regions for many years but, in recent years, technological

advances have led to a huge expansion in the range and quality of products.

Within dairy we have seen the emergence of nut and oat milks but it is on the meat side where the

changes have been most starting. Products such as the Beyond and Impossible Burgers offer

virtually the taste and texture of meat but are entirely plant derived. Advances in fermentation

technology will also increasingly allow products derived from fungi to faithfully replicate meat.

How it will influence the farming industry

The growth of plant-derived proteins will influence the farming industry in a number of ways. For

a start it will lead to increased demand for a number of specific inputs which are used heavily in

the current generation of plant-derived products with pea protein and oat among the prime

examples. Moreover, the types of fungi best used in fermentation products are usually particular

varieties which can require very specific conditions to thrive and the cultivation of these could

rely increasingly on smart/precision farming techniques.

On the flip-side, consumers’ shifts away from animal protein on environmental grounds (mainly

in developed markets) places an increasing onus on the agricultural industry to find ways of

reducing its emissions as a means of winning back certain consumers.

______________________________________

1

"Minnesota grain handler targeted in ransomware attack", Agweb, September 2021.

Charlene Liu*

Head of Internet and Gaming

Research, Asia Pacific

The Hongkong and Shanghai Banking

Corporation Limited, Singapore Branch

Charlotte Wei*

Analyst, Internet Research

The Hongkong and Shanghai

Banking Corporation Limited

Peishan Wang*

Analyst, Internet Research

The Hongkong and Shanghai

Banking Corporation Limited

* Employed by a non-US affiliate of HSBC

Securities (USA) Inc, and is not registered/

qualified pursuant to FINRA regulations

Smarter farms mean more

digital threats…

Jeremy Fialko*, CFA

Head of Consumer Staples

Research, Europe

HSBC Bank plc

* Employed by a non-US affiliate of HSBC

Securities (USA) Inc, and is not registered/

qualified pursuant to FINRA regulations

What is alternative protein?

Changing farming by

changing type of inputs

And reducing emissions…

9

Free to View

● Disruptive Technology - ESG

March 2022

Current penetration and growth forecasts

Penetration of plant-based products is still very low (chart 3) with figures ranging from 0-3.5%

for meat and around 5-16% for plant-based milks (and lower for plant-based dairy as a whole).

Chart 3. Global market share of plant-based products (2020)

Source: HSBC, Euromonitor

Main barriers to adoption

After a very strong 2019 and 2020 the alternative proteins category faced more difficult

conditions in 2021, particularly on the meat side. Having tempted a lot of new consumers as the

technology emerged, certain novel products found it hard to hold onto them while attracting

additional converts also became tougher.

We attribute this to some of the drawbacks the category currently faces. For a start the products

are generally much more expensive than the traditional animal derived proteins. While,

particularly on the meat side, they face some resistance from their highly processed nature and

the long lists of ingredients they contain. Fungi-derived fermentation products in particular offer

the promise of much more concise ingredient lists.

The power to reduce CO

2

emissions

As outlined, one of the main attractions to consumers of plant-derived protein alternatives is

their lower CO

2

footprint. Particularly on the meat side, the emissions savings through switching

to plant-derived products are extremely large. Even in dairy, the average plant-based milk has

CO

2

emissions c70% below that of traditional dairy

Chart 4. GHG intensity of different foods

(CO

2

eq./kg protein)

Chart 5. GHG intensity of milk/milk

substitutes (kgCO

2

eq./lit)

Source: Our World in Data, Clark and Tilman 2017

Source: BBC citing Poore & Nemecek, 2018.

3.5%

6.9%

13.1%

0.3%

1.5%

4.7%

0.1%

1.8%

5.5%

1.4%

7.9%

15.9%

1.1%

4.1%

10.0%

2.1%

5.1%

11.4%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

16.0%

18.0%

Meat alternatives Dairy alternatives Dairy alternatives (milk only)

Asia Pacific Africa Latin America North America Europe World

221.6

35.6

35.1

31.8

24.4

21.2

4.6

4.4

0.6

0

50

100

150

200

250

Beef/mutton

Pork

Dairy

Poultry

Eggs

Rice

Wheat

Maize

Pulses

3.2

1.2

1.0

0.9

0.7

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

Cow milk

Rice milk

Soy milk

Oat milk

Almond milk

Alternative proteins could

grow from USD40bn to

USD140bn by 2030…

Will cost or processed nature

deter consumers?

Up to 70% less CO2 than

traditional dairy…

Free to View

● Disruptive Technology - ESG

March 2022

10

Application of smart farming:

Nitrogen fixation and the synthetic biology solution

The fertiliser problem

Nitrogen is essential in the growth and development of plants and while c78% of the

atmosphere is made up of nitrogen, that is not available in usable form to plants.

The synbio solution

Synthetic biology platforms can engineer and design microbes that replicate the behaviour of

naturally occurring nitrogen fixating microbes – as seen in legumes – and transfer the desired

nutrient to any targeted crop – thus providing plants access to usable nitrogen and increasing crop

yields. These genetically modified microbes outperform both organic microbes and industrial

fertilisers. Unlike natural microbes, their influence is not limited to a specific type of crop. Also, unlike

fertilisers, engineered microbes do not have a GHG footprint, do not utilise fossil fuels in the

manufacturing process and do not cause run-off water pollution. The delivery mechanism is via

seeds, with the engineered microbes coated onto seeds before they are sown.

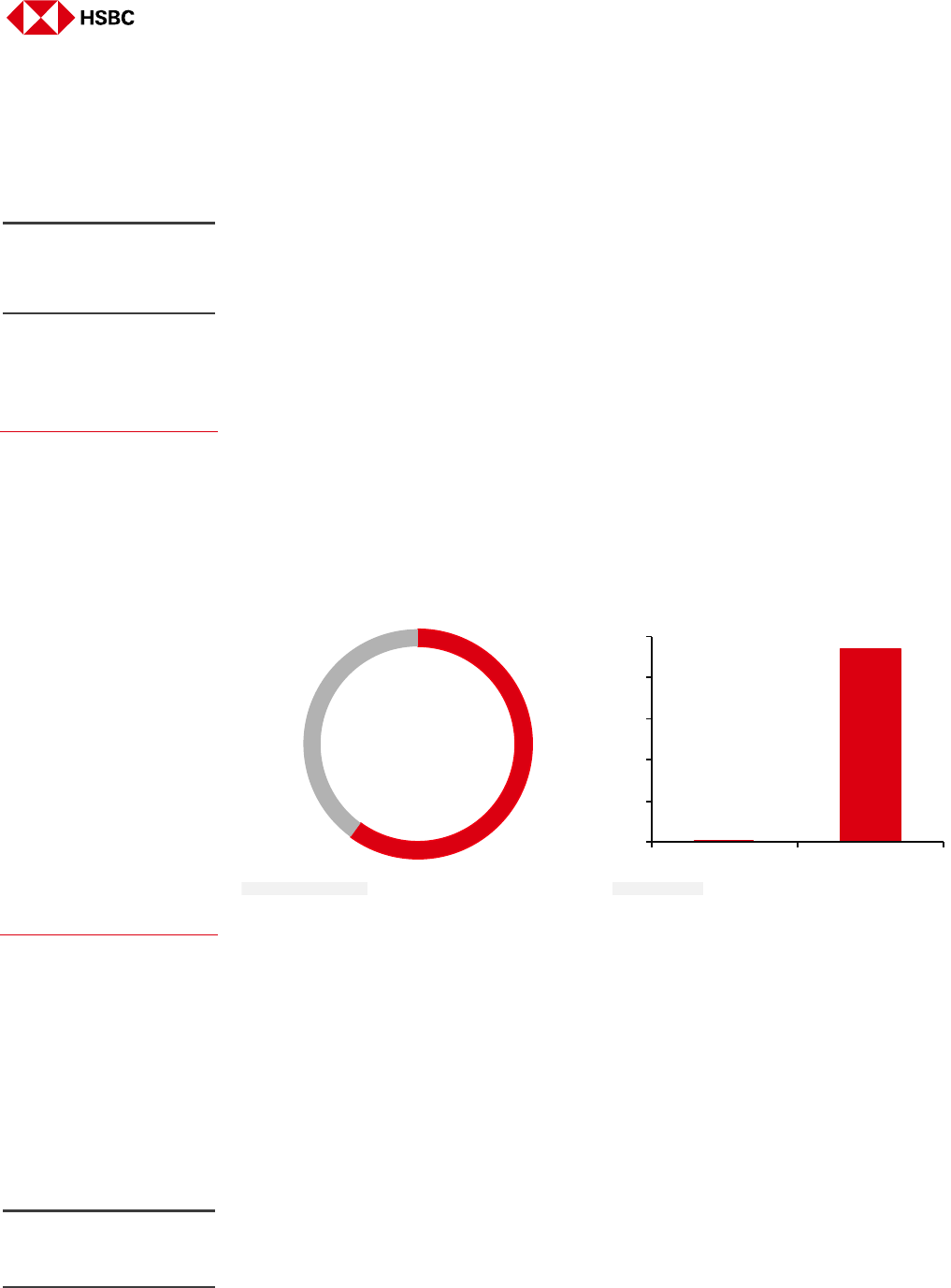

Chart 6. Global fertiliser industry market

value (2020 – cUSD200bn)

Chart 7. Carbon emission comparison:

Ammonia vs nitrogen fixating microbes

(kgCO

2

/kg)

Source: IHS Chemicals, HSBC

Source: IEA, Pivot Bio

Key challenges

We believe that scaling might be the biggest hurdle for synbio nitrogen fertilisers as the majority

of these projects are currently in the research phase and are yet to scale commercially. Also,

despite not falling under the genetically modified (GM) food classification, there remains a

possibility of poor consumer adoption since the process uses bioengineered organisms.

Additionally, crops, soil conditions, weather, temperature, water availability, seed distribution

and farming practices are significantly different from place to place. Hence designing microbes

that can work across multiple different environments poses a big challenge.

Applications of smart farming:

Medications, genetics and GM

Medicines to better Animal Health

Animal health medicine is a USD40bn+ market: Zoetis, one of the largest listed animal health

companies, cites the size of the animal medicines and vaccines sector at approximately USD40bn.

This total market is split between companion animal products (CAP, i.e. products for pets) and

farm animal products (FAP, i.e. products for farm animals). Growth in both segments is expected

to be quite robust with a number of companies and consultancies expecting multi-year industry

growth of around 4-7%.

Other

Fertilisers

USD120bn

Nitrogen

fertilisers

USD80bn

0.0

0.5

1.0

1.5

2.0

2.5

Nitrogen Fixating microbes Ammonia

Nitrogen fertilisers

responsible for c3% of

global GHGs

Sriharsha Pappu*

Head of Chemicals, Energy

Transition Coordinator

HSBC Bank plc

* Employed by a non-US affiliate of HSBC

Securities (USA) Inc, and is not registered/

qualified pursuant to FINRA regulations

Scaling synbio still an

issue…

Anand Date*, CFA

UK MidCap Equity Analyst

HSBC Bank plc

* Employed by a non-US affiliate of HSBC

Securities (USA) Inc, and is not registered/

qualified pursuant to FINRA regulations

11

Free to View

● Disruptive Technology - ESG

March 2022

Genetics to improve the efficiency of animal protein production

Companies breed for elite traits using the genome of individual animals to inform breeding decisions.

Breeding decisions are taken to maximise the prevalence and intensity of positive traits and vice

versa. In practice this means elite animals exhibit more protein per unit of feed, better health and

lower emissions than non-elite animals.

Gene editing goes one step further than genomic selection. Using CRISPR technology, genes that

already exist in a species’ genome are turned on or off to achieve desired results. For example, a

gene edit which successfully confers resistance to a specific virus would be highly attractive from an

economic and welfare point of view.

Much like the use of medicines and vaccines, the barrier to increased utilisation of elite genetics

is typically cost and awareness. In many parts of the world, farming remains relatively backyard

and informal. As average farm sizes increase however, and production consolidates and

becomes more technical, the trend is clearly towards a focus on greater efficiency which would

include incorporating elite third party genetics into the production cycle.

Genetically Modified (GM) crops

Modifying traits of crops can be seen occurring thousands of years ago and has bought benefits

to both the economy, environment and society. They have been able to increase yields

significantly, adapt to climate change and serve growing populations with both food and

commodities such as cotton. They provide an opportunity to reduce pesticide use, minimising

the impact on the environment. Additionally, the application to the energy sector remains a

promising avenue for the GM crop. With rising biofuel adaptions, modified energy crops can

assist the green transition to cleaner energy.

However, challenges with the technology remain, and can hinder their adoption globally.

Environmental hazards of GM crops include gaining a competitive advantage and reducing the

prevalence of other species, reducing biodiversity. Safety to human health also poses a

challenge due to lack of large-scale studies and the risk of unintended consequences to health,

such as antibiotic resistance. Although these challenges remain, GM crops have a role to play

in the transition to more sustainable farming.

Vertical farming

Vertical farming (aka indoor farming) is the practice of growing plants/crops in vertically stacked

layers in warehouse, containers, rooftops or even skyscrapers. These farming techniques stimulate

plant growth through artificial control of lights. The plants are grown without soil and use 95% less

water. Moreover, these farming techniques do not use pesticides as the problem of weeds/insects is

non-existent in a controlled environment. Fertilizer/nutrient use are reduced by as much as 60%.

Given the proximity to demand centres, vertical farming can save significant costs on cold storage

and transportation (c30% of cost for horticulture such as lettuce vs c10-15% for grains).

Vertical farms have an environmental benefit as they reduce stress on limited resources such as

land and water. As per Aerofarms, vertical farming in one acre of land can produce as much

food as a 390-acre traditional farm does and can be grown in urban areas on low cost real

estate. The success of vertical farming depends on overcoming cost and technological barriers.

Technology and cost economics are the key barriers

Currently, lettuce and other leafy greens are the most popularly grown plants in vertical farms as

they are easy to grow. The technology for indoor production of berries, aubergines and other

fruits and vegetables in the vertical, are in the developmental stage. Further, offsetting the

benefits are comparatively higher set-up costs and an increase in operating expenses.

Electricity to power up LEDs is the single largest operating cost. Higher operating and capex

costs relative to conventional farming makes the model viable only in specific cases that are

What is the technology?

Going forward, gene editing

may become more prevalent

Barriers to adoption

GM is not a new technology

Worries of GM crops exist

but play a role in sustainable

farming…

Santhosh Seshadri*, CFA

Analyst

HSBC Securities and Capital

Markets (India) Private Limited

* Employed by a non-US affiliate of HSBC

Securities (USA) Inc, and is not registered/

qualified pursuant to FINRA regulations

Leafy greens in vertical

farming

Free to View

● Disruptive Technology - ESG

March 2022

12

catering to niche markets where the produce can be sold at a premium and there is a need for

reliable supply, for example - supply to airlines and restaurants. Aero farms took 9 years to

make meagre profits, according to Forbes, while many vertical farming companies have also

closed their business due to high costs involved. On the bright side, investment interest in the

space has picked up recently that could foster new technologies and help bring down the costs.

Market size and recent deals

BIS research estimates the market size of vertical farming at USD5.5bn in 2020 and expects to

reach a CAGR of 24% through 2026 to reach nearly USD20bn. High growth potential and its

sustainability credentials have attracted growing investments in the space. According to

Pitchbook, cUSD1.9bn was invested in vertical farming start-up companies in 2020, almost 3x

higher than 2019 levels.

Circular economy

The standard model for an economy is a linear one, where raw materials are extracted from the

earth, processed into goods which are used, and then disposed of as waste. A circular economy is a

closed loop in value chains where materials intended for waste are reused/recycled to create new

products, minimising resource inputs, while reducing emissions. This concept is gaining traction due

to growing populations in the face of finite resources, and the growing focus on sustainable living.

The agricultural industry is responsible for roughly 70% of global water use. Utilising a circular

system can assist in reducing this number, and the potential to reuse irrigation water. This

would not only save water, but if treated properly, can provide valuable nutrients.

A third of food is wasted each year, contributing to the inefficiencies of the agricultural sector,

ultimately exacerbating land management, water use and emissions problems. In a more circular

economy, this waste can be deployed for other resources.

The key to making sure resources such as water aren’t wasted through the agricultural supply chain

is to encourage more circularity in the industry. This can be somewhat addressed in the first stage

in the supply chain. Precision farming and Hydroponics are two developments the industry can

adopt to help achieve this for the value chain and a more sustainable approach to agriculture:

Precision agriculture – This is the use of technology, research and big data to increase

crop yields while limiting the levels of inputs to ensure the correct amount of substances are

used in the right areas and times. Inputs such as water, pesticides and fertilisers can be

limited and directed to where they are required most. This reduces the impact agriculture

has on the environment via its water use, emissions and waste, as well as pollution via the

over use of harmful substances.

Hydroponics – A type of agriculture that doesn’t require soil, whereby plants are grown in water

and provided with the exact amount and type of nutrients required. Modern hydroponics utilise

data and automation to increase yields by taking control of which conditions the crop grows in.

This is sustainable and reduces waste via managed water usage and provides less risk of

pollution elsewhere. However, this type of farming has its risks. These include large amounts of

energy usage (due to it typically occurring indoors) and the economic cost incurred for the

infrastructure required, therefore, not suitable for smaller farms with lower budgets. Coupled with

hydroponics is aquaponics, which varies by the use of fish to provide a natural source of

nutrients instead of adding the fertilisers directly to the system. The plants naturally filter the

water and create a circular system benefiting both plant and fish.

Vertical farming expected to

be worth USD20bn by 2026

Creating a closed loop to

reduce waste and resource

inputs

Agriculture uses 70% of

global freshwater

Utilising waste for fertiliser

and biofuels

This is an abridged version of a report by the same title published on 03-Mar-22.

The full note is available to clients of HSBC Global Research and contains a further look at the

topic at hand.

Please contact your HSBC representative or email AskResearch@hsbc.com for more information.

13

Free to View

● Disruptive Technology - ESG

March 2022

Disclaimer

The following analyst(s), who is(are) primarily responsible for this document, certifies(y) that the opinion(s), views or forecasts expressed

herein accurately reflect their personal view(s) and that no part of their compensation was, is or will be directly or indirectly related to the

specific recommendation(s) or views contained in this research report: Davey Jose, Amy Tyler, Sean McLoughlin, Jeremy Fialko, CFA,

Nicolas Cote-Colisson, Sriharsha Pappu, Santhosh Seshadri, CFA, Anand Date, CFA, Charlene Liu, Kiri Vijayarajah, Robin Down,

Kailesh Mistry, CFA, Adam Fox-Rumley, CFA, Charlotte Wei and Peishan Wang

This document has been issued by HSBC Bank plc, which has based this document on information obtained from sources it believes to

be reliable but which it has not independently verified. Neither HSBC Bank plc nor any member of its group companies (“HSBC”) make

any guarantee, representation or warranty nor accept any responsibility or liability as to the accuracy or completeness of this document

and is not responsible for errors of transmision of factual or analytical data, nor is HSBC liable for damages arising out of any person’s

reliance on this information. The information and opinions contained within the report are based upon publicly available information at

the time of publication, represent the present judgment of HSBC and are subject to change without notice.

This document is not and should not be construed as an offer to sell or solicitation of an offer to purchase or subscribe for any investment

or other investment products mentioned in it and/or to participate in any trading strategy. It does not constitute a prospectus or other

offering document. Information in this document is general and should not be construed as personal advice, given it has been prepared

without taking account of the objectives, financial situation or needs of any particular investor. Accordingly, investors should, before acting

on it, consider the appropriateness of the information, having regard to their objectives, financial situation and needs. If necessary, seek

professional investment and tax advice.

The decision and responsibility on whether or not to purchase, subscribe or sell (as applicable) must be taken by the investor. In no event

will any member of the HSBC group be liable to the recipient for any direct or indirect or any other damages of any kind arising from or

in connection with reliance on any information and materials herein.

Past performance is not necessarily a guide to future performance. The value of any investment or income may go down as well as up

and you may not get back the full amount invested. Where an investment is denominated in a currency other than the local currency of

the recipient of the research report, changes in the exchange rates may have an adverse effect on the value, price or income of that

investment. In case of investments for which there is no recognised market it may be difficult for investors to sell their investments or to

obtain reliable information about its value or the extent of the risk to which it is exposed. Some of the statements contained in this

document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward

looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ

materially from those described in such forward-looking statements as a result of various factors.

This document is for information purposes only and may not be redistributed or passed on, directly or indirectly, to any other person, in

whole or in part, for any purpose. The distribution of this document in other jurisdictions may be restricted by law, and persons into whose

possession this document comes should inform themselves about, and observe, any such restrictions. By accepting this report, you

agree to be bound by the foregoing instructions. If this report is received by a customer of an affiliate of HSBC, its provision to the recipient

is subject to the terms of business in place between the recipient and such affiliate. The document is intended to be distributed in its

entirety. Unless governing law permits otherwise, you must contact a HSBC Group member in your home jurisdiction if you wish to use

HSBC Group services in effecting a transaction in any investment mentioned in this document.

Certain investment products mentioned in this document may not be eligible for sale in some states or countries, and they may not be

suitable for all types of investors. Investors should consult with their HSBC representative regarding the suitability of the investment

products mentioned in this document.

HSBC and/or its officers, directors and employees may have positions in any securities in companies mentioned in this document.

HSBC may act as market maker or may have assumed an underwriting commitment in the securities of companies discussed in

this document (or in related investments), may sell or buy securities and may also perform or seek to perform investment banking

or underwriting services for or relating to those companies and may also be represented on the supervisory board or any other

committee of those companies.

Free to View

● Disruptive Technology - ESG

March 2022

14

HSBC will from time to time sell to and buy from customers the securities/instruments (including derivatives) of companies covered in

HSBC Research on a principal or agency basis.

From time to time research analysts conduct site visits of covered issuers. HSBC policies prohibit research analysts from accepting

payment or reimbursement for travel expenses from the issuer for such visits.

Analysts, economists, and strategists are paid in part by reference to the profitability of HSBC which includes investment banking, sales

& trading, and principal trading revenues.

Whether, or in what time frame, an update of this analysis will be published is not determined in advance.

For disclosures in respect of any company mentioned in this report, please see the most recently published report on that company

available at www.hsbcnet.com/research.

HSBC Bank plc is registered in England No 14259, is authorised by the Prudential Regulation Authority and regulated by the Financial

Conduct Authority and the Prudential Regulation Authority and is a member of the London Stock Exchange. (070905)

Additional disclosures

1

This report is dated as at 03 March 2022.

2

All market data included in this report are dated as at close 28 February 2022, unless a different date and/or a specific time

of day is indicated in the report.

3

HSBC has procedures in place to identify and manage any potential conflicts of interest that arise in connection with its

Research business. HSBC's analysts and its other staff who are involved in the preparation and dissemination of Research

operate and have a management reporting line independent of HSBC's Investment Banking business. Information Barrier

procedures are in place between the Investment Banking, Principal Trading, and Research businesses to ensure that any

confidential and/or price sensitive information is handled in an appropriate manner.

4

You are not permitted to use, for reference, any data in this document for the purpose of (i) determining the interest payable,

or other sums due, under loan agreements or under other financial contracts or instruments, (ii) determining the price at

which a financial instrument may be bought or sold or traded or redeemed, or the value of a financial instrument, and/or (iii)

measuring the performance of a financial instrument or of an investment fund.

© Copyright 2022, HSBC Bank plc, ALL RIGHTS RESERVED. No part of this publication may be reproduced, stored in a retrieval

system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the

prior written permission of insert issuing entity name. MCI (P) 037/01/2022, MCI (P) 017/10/2021

[1187806]