California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 2

TABLE OF CONTENTS

Executive Summary

Introduction

Page #

5 | Coronavirus (Covid-19) Pandemic and its Impact on the Entertainment Industry

7 | Tax Credit Program 3.0 Overview

10 | Program 3.0 Statistics

12 | Relocating Television Series

13 | Big-Budget Feature Films

13 | Regional Filming Impact

15 | Career Readiness Requirement

19 | Career Pathways Program

21 | Diversity Initiatives

22 | Infrastructure Usage and Growth

23 | Lost Productions

24 | Global Competition

31 | California Soundstage Filming Tax Credit Program

Conclusion

Sources

Appendices

ABOUT THE CALIFORNIA FILM COMMISSION

The California Film Commission (CFC) was created in 1984 as a state agency to enhance California’s position as the premier location for all

forms of media content creation.

The CFC supports film, television, and commercial productions of all sizes and budgets by providing one-stop support services including location

and troubleshooting assistance, permits for filming at state-owned facilities, and access to resources including an extensive digital location

library. The CFC also administers the state’s Film & Television Tax Credit Program and serves as the primary liaison between the production

community and all levels of government (including local, state, and federal jurisdictions) to facilitate filming in-state.

The CFC supports a production-friendly environment to retain and grow production jobs and economic activity statewide. It works in

conjunction with more than 50 local film offices/commissions (Regional Film Partners) across California to manage filming-related issues and

requests. More information is available at http://www.film.ca.gov.

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 3

EXECUTIVE SUMMARY

The California Film Commission (CFC), housed under the Governor’s Office of Business and Economic Development (GO-Biz),

administers California’s film and television tax credit programs. The programs were created as targeted economic stimulus initiatives

designed to increase film and television production, jobs, and tax revenues in California. The CFC issues an annual report to provide

the public with an assessment of each of the program’s economic benefit to the state, as well as statistical information and insights

into California’s entertainment production industry. This report provides an overview of the third iteration of California’s tax credit

program (“Program 3.0”) which wrapped its 2020-2021 fiscal year on June 30, 2021. The 48 approved projects for fiscal year one of

Program 3.0 are estimated to generate $2.6 billion in direct in‐state spending, including more than $992 million in qualified wages.

The 48 projects comprised of 14 non-independent feature films, 4 independent projects with budgets over $10 million, 13 independent

projects with $10 million budget or less, 12 recurring television series, and 5 relocating television series.

❖ Covid-19 and Filmmaking: Covid-19 continued to have a

substantial impact on filming in California during the 2020-

2021 fiscal year. Productions must follow safety protocols to

avoid the spread of Covid-19. Testing became a mandatory

part of the filmmaking process, with those crew in close

contact with talent testing daily.

❖ Big Budget Films: During the 2020-2021 fiscal year, 6 films

with budgets over $60 million were admitted into Program 3.0

resulting in an estimated $683 million in total spending in

California. Collectively, the 6 projects are estimated to

employ 1,961 cast and crew members with a $276 million in

total qualified wages in California.

❖ Regional Filming in California: More than 25 dozen feature

films and television series are projected to film 490 days out

of 894 in-state shoot days (54%) in counties throughout

California including San Bernardino, San Luis Obispo, San

Diego, and Siskiyou.

❖ Career Readiness Requirement: Approximately 85

productions under Programs 2.0 and 3.0 hired more than 200

interns to fulfill the Career Readiness Requirement, resulting

in approximately 41,000 hours of paid work. A total of 65

faculty members were invited by 33 projects to experience an

externship, while 25 productions selected to host a classroom

workshop and/or panel. Close to 400 students and teachers

participated in a professional skills tour, which were hosted

by 33 projects.

❖ Career Pathways Program: Senate Bill 878 created a

training and outreach program for individuals from

underserved communities. The program enlisted participants

despite the challenges presented by the pandemic. To date,

approved projects under fiscal year 2020-2021 have

contributed $837,000 to the Career Pathways Program.

❖ Diversity and Inclusion: New to Program 3.0, all approved

projects must submit the company’s initiatives and programs

to increase the representation of women and minorities.

Company statements reflect a desire to see diversity

improved among above and below-the-line personnel within

the entertainment industry and take affirmative measures to

ensure a diverse cast and crew.

❖ Infrastructure Usage and Growth: Per FilmLA, application

activity for Los Angeles film permits jumped 45% in March

2021 compared to February 2021. and leasing of soundstage

space is expected to soar. A significant issue currently

confronting feature and television projects wishing to film in

California/Los Angeles is a shortage of stage space.

❖ Lost Productions: Surveyed projects – mainly with smaller

budgets - that applied but ultimately filmed in California

without receiving tax credits generated $60 million in the

state. However, larger, runaway projects accounted for $266

million in production spending outside California - a loss to

the state’s below-the-line production workers and the

ancillary businesses that rely on the film and television

production industry. This disparity emphasizes the

importance of tax credits, particularly for retaining larger

budgeted productions.

❖ Global Competition: Worldwide competition continues to

siphon film and TV production from the state. The industry

continues to pursue other jurisdictions that offer robust tax

credits, significant infrastructure, and generous visual effects

incentives.

California Soundstage Filming Tax Credit Program: In July 2021, Governor Gavin Newsom signed Senate Bill 144 which creates a new

tax credit program. Under the new statute, a first-come-first-served program will allocate up to $150 million in tax credits to qualified

projects filming in CFC-certified new or renovated soundstages; no jobs ratio ranking required.

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 4

INTRODUCTION

According to an April 2021 report by the Motion Picture Association (MPA), the film and

television industry employs more people nationwide than other major industry sectors,

including mining, oil & natural gas extraction, crop production, utility system construction,

and rental & leasing services. Across the United States, the entertainment industry supported

more than 2.5 million jobs, including 331,000 direct jobs engaged in producing, marketing, and

manufacturing motion pictures, television shows, and video content; direct jobs totaling

579,000 were engaged in distributing motion pictures, television shows, and video content to

consumers.

1

The California Film Commission (CFC), part of the Governor’s Office of Business and Economic

Development, incentivizes film and TV production in the state by administering film and

television tax credit programs. First enacted in 2009, the tax credit program was created to

provide economic stimulus designed to increase film and television production, jobs, and tax

revenues in California. The CFC publishes an annual report to provide the public with an

assessment of the program’s economic benefit, as well as statistical information and insights

into California’s entertainment production industry and its competition. This report provides a

summary of approved projects from the first fiscal year of Program 3.0 – the third iteration of

the tax credit program. Data from July 1, 2020 to June 30, 2021 includes a breakdown of labor

and expenditures, an analysis of television series that relocated to California, a summary of

big-budget films, regional filming data, and career readiness requirement data. New in this

report are approved applicant summaries of diversity and inclusion initiatives and data on

the pilot career pathways program.

In addition, this report provides an analysis of productions that applied but did not receive

tax credits, and ultimately left California to film in other parts of the country and the world.

Year after year, consistent data shows that other locales entice filmmakers by offering

competitive production and post-production (including visual effects) incentives along with

new or expanded production infrastructure.

Regardless of growing infrastructure and competitive tax credits, production worldwide came

to a halt in mid-March 2020 due to the Coronavirus global pandemic.

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 5

CORONAVIRUS (COVID-19) PANDEMIC AND ITS

IMPACT ON THE ENTERTAINMENT INDUSTRY

In mid-March 2020, the coronavirus pandemic forced many productions to pause

production. Working remotely from home, CFC staff remained fully functioning to provide

regular services while adjusting to the latest industry and government developments. On

March 27, 2020, the CFC published a production alert outlining Covid-19 resources and

established Covid-19’s impact on film production as a force majeure event. This enabled

productions to apply and receive waivers for all the time-sensitive parameters in the tax

credit program, thus alleviating the fear that projects would lose their reservation of tax

credits if they could not begin or finish their projects as per program requirements. The CFC

continues to evaluate the impact of the pandemic on CFC projects and issue force majeure

waivers as appropriate.

On June 1, 2020, with combined efforts from studios and unions, the Industry-Wide Labor-

Management Safety Committee Task Force published the “white paper” – a proposed set of

health and safety guidelines for motion picture, television, and streaming projects to resume

production during the Covid-19 pandemic. Since many productions shoot predominantly in

the Los Angeles area, the Los Angeles County Department of Public Health published specific

guidelines on June 12, 2020 outlining minimum safety requirements for any Los Angeles

productions, including commercials and small independent projects. Productions filming

outside Los Angeles County were mandated to adhere to county-specific Covid-19 filming

protocols. The Producer’s Guild of America also published “COVID Safety Protocols For

Producing Independent

Productions” in August

2020. “The Safe Way

Forward,” a set of

protocols released by

the unions and guilds,

was replaced by the

“Covid-19 Return to

Work Agreement” on

September 21, 2020.

This agreement was

negotiated by the

Alliance of Motion

A fan favorite, television series

Lucifer

relocated to California from British Columbia, Canada.

Image Source: Warner Bros.

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 6

Picture and Television Producers (AMPTP) with the Director’s Guild of America (DGA),

International Alliance of Theatrical Stage Employees (IATSE), Screen Actors Guild – American

Federation of Television and Radio Artists (SAG-AFTRA), Teamsters and Basic Crafts. It was

effective until April 21, 2021, and then extended to June 30, 2021. All parties involved met

regularly to discuss possible modifications to the agreement based on changing Covid-19

conditions. On June 30, 2021, as the AMPTP, DGA, IATSE, SAG-AFTRA, Teamsters and Basic

Crafts needed to assess further modifications, the return-to-work Covid-19 safety protocols

were extended indefinitely.

Covid-19 continued to have a huge impact on filming in California during the 2020-2021 fiscal

year. Productions had to follow safety protocols in order to avoid the spread of Covid-19,

including establishing at least four different pods within the crew, which operate in concentric

circles of distance from the on-camera talent. Testing became a mandatory part of the

filmmaking process, with crew members that come in close contact with talent getting tested

daily. A whole new Covid Department came into existence, with the responsibility of ensuring

on-set health and safety. Duties of the Covid department include supervision of sanitary

conditions, enforcement of mask-wearing and the use of face shields, oversight of social

distancing within the different departments, and supervision of quarantine for new

employees and production visitors, as well as for any cast and crew testing positive or

experiencing Covid-like symptoms.

Covid departments typically range from two or three people on lower budget projects and up

to as many as 15 people on large crews with multiple units. Labor positions include Covid

Supervisor, Covid Coordinator, Covid protocol compliance managers, Set Sanitation PAs,

Covid Testers, Covid Medical personnel, and additional Drivers and Locations Assistants to

help maintain social distancing. Materials include tests, sanitation stations, face shields, PPE

masks, outside testing contractors and medical personnel, additional vehicles, and stipends

paid to crew to quarantine or work remotely.

The CFC allows all Covid-related expenditures in the state to qualify for tax credits. Project

budgets submitted for review in the tax credit program indicate that approximately 40% of

Covid expenditures go to Labor costs and 60% go to Materials. Aggregate data shows that

feature films with budgets greater than $20M in the Tax Credit Program typically anticipate

spending between 5% and 6.5% of their total budgets on Covid-related costs. This translates

to approximately 9% of their Qualified Expenditures. Low-budget films and television series

typically anticipate about 4.25% of their total budgets for Covid-related costs and about 6.2%

of their Qualified Expenditures.

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 7

The raw numbers are far more startling: 50 projects currently in the Tax Credit Program are

expecting to outlay more than $90,000,000 for Covid-related costs, in aggregated budgets

totaling $1.9 billion.

TAX CREDIT PROGRAM 3.0 OVERVIEW

The CFC developed regulations, program guidelines, and other procedures to administer a

newly extended tax credit program (“Program 3.0”) which became effective on July 1, 2020

with the signing of Senate Bill 878 (SB 878). (See Appendix A for enacting legislation.) With

$330 million per fiscal year, Program 3.0 runs from July 2020 through June 2025. SB 878 made

several modifications to Program 2.0, which had a sunset date of June 30, 2020. (See

Appendix B for comparison chart.)

Annual Tax Credit Allocation Breakdown

Each fiscal year, the $330 million in available funding is divided into five different funding

buckets that target different categories of production. Television projects (new or recurring

TV series, pilots, mini-series) and non-independent feature films are eligible to receive 20%.

Independent films (bifurcated in two categories depending on budget size) and relocating TV

series - in their first season filming in California - qualify for a 25% tax credit. The chart below

shows available funding for each category. Under SB 878, the proportion of credits for the

relocating TV category is reduced from 20% to 17%, as compared to Program 2.0. The credits

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 8

available for the independent film category increased from 5% to 8%. Funding for

independent film is split into two categories - under $10 million and over $10 million budgets -

allowing for more access to the program for smaller budgeted independent films and more

funding overall for independent films. Program Guidelines provide further details on project

eligibility requirements.

Similar to the previous program, Program 3.0 follows a Jobs Ratio Ranking system to select

projects for tax credits. Several application windows are held each fiscal year for specific

project categories. Projects compete against the same project category. A step-by-step

calculation of the jobs ratio is shown below; numerous resource materials are available to

applicants outlining the jobs ratio selection process.

The adjusted jobs ratio is comprised of the base jobs ratio and bonus points. The base jobs

ratio may be increased based on activities in three areas: out-of-zone filming, visual effects

spend, and music labor expenditures. Approved projects under Program 2.0 were able to use

filming in approved soundstages as a bonus points factor; for Program 3.0, this factor has

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 9

been eliminated and was replaced with expenditures on music wages. As a result, receiving

a 5% uplift for music labor and non-labor expenditures were eliminated.

All approved projects, regardless of the production type, are eligible to receive an additional

5% credit on wages paid to individuals who live and work on tax credit projects outside the

City of Los Angeles 30-mile zone; this is a new uplift under Program 3.0. Non-independent

productions continue to be eligible to receive 5% additional credits for visual effects. Also

new under Program 3.0, expenditures on visual effects may now be bifurcated as 70%

attributed to wages and 30% to non-wages. Applicants are advised to review the Budget

Tagging and Tracking Tips, which provide a description for each bonus point factor and uplift.

Applicants to Program 3,0 are now required to submit their company’s written policy against

unlawful harassment. This includes procedures for reporting and investigating harassment

claims. This documentation must contain a statement that the company will not retaliate

against an individual who reports harassment. In addition, applicants are required to provide

a copy of the company’s initiatives and programs to increase the representation of minorities

and women in job classifications that are excluded from qualified wages - directors,

producers, writers, actors, etc. The Diversity Initiatives section in this report outlines initiatives

submitted by approved projects.

Once a project is approved in the tax credit program, a number of interim responsibilities are

required in order to receive the final tax credit certificate. New to Program 3.0, all approved

projects are required to participate in the Pilot Career Pathways Training Program. All

applicants receiving a credit allocation letter are required to make a financial contribution to

fund a training program for individuals from underserved communities to receive training for

careers in the industry. A summary of the pilot program is outlined under the Career

Pathways Program section. The current Career Readiness requirement, in which approved

projects must provide career exposure opportunities such as paid internships and in-class

workshops, remains intact.

In addition to existing documentation for the final tax credit certificate, approved projects

under Program 3.0 are now required to submit bifurcated statistics on the gender, race, and

ethnic status of individuals with non-qualified and qualified wages. As this information is not

available until a project is completed and is audited, the CFC does not have any related data

from the first fiscal year of Program 3.0.

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 10

TAX CREDIT CERTIFICATES

The initial allocation for each selected project is treated as a reservation of tax credits. Tax

credit certificates are awarded only after selected projects: 1) complete post-production; 2)

verify in-state expenditures; and 3) provide all required documentation, including cost

reports audited by a Certified Public Accountant (CPA). Under Program 3.0, approved

applicants may now extend the date by which principal photography must begin from 180

days to 240 days for projects with budgets over $100M in qualified spending. During the audit

process, the CPA recalculates each project’s Jobs Ratio score and compares it to the

approved application Jobs Ratio score. Penalties apply if the final Jobs Ratio score has been

reduced by a specified amount. Program 3.0 reduces the jobs ratio overstatement penalty

threshold for independent productions to match non-independent productions. Tax Credits

may be utilized beginning in the tax year in which the credit certificate is issued. Independent

productions may transfer or sell tax credits to an unrelated party. Non-independent

productions must utilize the credits against state income tax liability, sales or use tax liability,

and may also assign credits to an affiliate. In July 2020, Governor Gavin Newsom imposed

new tax regulations to offset the California budget deficit due to the Covid-19 pandemic.

(See Appendix C for a summary of credit limitations when utilizing tax credits.)

PROGRAM 3.0 STATISTICS

FISCAL YEAR 2020-2021: AGGREGATE DATA

During fiscal year 2020-2021, $335 million was allocated to 48 film and television projects. In

order to provide tax credits to all the recurring TV series which were grandfathered into

Program 3.0 from 2.0, the program did not accept new TV Series, Miniseries or Pilots during its

first fiscal year. (See Appendix D for Program 2.0 statistics.)

A recurring TV series is defined as a television series or relocating television series (in its

second or subsequent season in California) that received a prior allocation of tax credits. The

48 approved projects for fiscal year one are estimated to expend $2.6 billion in direct in‐state

spending, including more than $992 million in qualified wages. The chart below shows

additional aggregate data.

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 11

Fiscal Year 2020-2021 Aggregate Data

48 APPROVED PROJECTS

12

Recurring

Television Series

5

Relocating

Television Series

14

Non-Independent

Films

4

Independent Films

> $10 Million

13

Independent Films

≤ $10 Million

EMPLOYMENT HIRES

5,000

Cast Members Hired

8,000

Crew Members Hired

91,600

Background Players in Man-Days

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 12

RELOCATING TV SERIES

During the 2020-2021 fiscal year, California gained five relocating television projects, giving the

Golden State a total of 27 series that have moved to California under the California Film and

Television Tax Credit Program: Programs 1.0-3.0. (See Appendix E for Program 1.0 statistics.) A

relocating television series is a scripted series of any episode length that filmed its most recent

season (minimum 6 episodes) outside California. This category qualifies for a 25% tax credit,

which is reduced to 20% for any subsequent seasons filmed in California.

The five most-recent relocating television series –

Chad, Hunters, In Treatment, Miracle

Workers, The Flight Attendant

- are projected to film 60 episodes, employ 492 cast, 927 crew,

and 6,093 background players, measured in man-days. Total qualified wages paid to

California workers by these projects are estimated at $174 million.

Relocating TV Series

Image Source: IMDB

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 13

BIG-BUDGET FEATURE FILMS

The 20% tax credit for non-independent productions applies only to the first $100 million in

qualified spending. For independents, the first $10 million of qualified expenditures count

toward the 25% tax credit allocation. During the 2020-2021 fiscal year, seven films with

budgets over $60 million were admitted into Program 3.0 resulting in $683 million in direct

spending within California. Projects like

Gray Man, Here Comes the Flood,

and

Bullet Train

lead

the big-budget list with an estimated total California spend of $392 million. Collectively, the

seven projects are estimated to employ 1,961 cast and crew members with a total of $276

million in qualified wages in California. Measured in man-days, the seven big-budget

features have been projected to produce as many as 17,666 jobs for background players.

Two of the seven big-budget projects plan to shoot outside the city of Los Angeles 30-mile

zone.

Big-Budget Feature Films

Project Title

Qualified Wages

Total Qualified

Expenditures

Tax Credit

Allocation

Ashley’s War

$ 29,538,000

$ 51,086,000

$ 10,709,000

Bullet Train

$ 46,700,000

$ 86,291,000

$ 10,240,000

Gray Man

$ 67,966,000

$ 101,805,000

$ 20,000,000

Here Comes the Flood

$ 46,003,000

$ 68,345,000

$ 13,777,000

Me Time

$ 23,539,000

$ 38,088,000

$ 7,643,000

Scarface

$ 28,512,000

$ 47,790,000

$ 9,852,000

Untitled Live Action Project

$ 34,349,000

$ 61,238,000

$ 12,247,000

Note: Data as of 06/30/2021 for approved projects under fiscal year 2020-2021.

REGIONAL FILMING IMPACT

New to Program 3.0, local hire labor uplift incentivizes applicants to take advantage of hiring

local talent outside the city of Los Angeles 30-mile zone. Non-independent productions -

feature films, new and recurring television series, pilots, or miniseries - are eligible to receive

an additional 10% tax credit for qualified local hire labor. Independent films and relocating

television series are eligible to receive an additional 5% tax credit for qualified local hire labor.

Documentation is required (e.g., California driver’s license, recent utility bill) to substantiate

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 14

where local labor is domiciled. Projects

may also receive up to 10 bonus points to

raise their jobs ratio score and increase

their chance of being selected based on

the percentage of filming days outside the

City of Los Angeles 30-mile zone. When

productions film on location outside the Los

Angeles area, data reflects a typical spend

$50,000 - $150,000

per day

in the local

region. With 33 million acres of forests,

seven million acres of desert, 840 miles of

coastline, 482 cities, and 58 counties,

California provides a large assortment of

location options. (See Appendix F for local

incentives offered throughout the state of

California.)

More than two dozen feature films and television series are projected to film 490 days out of

894 shoot days (54%) in counties across California, including San Bernardino, San Luis Obispo,

San Diego, and Siskiyou. Since many Program 3.0 productions have not begun principal

photography or started filming outside the zone, the CFC has not yet received local

community expenditure data. (See Appendix D for Program 2.0 Regional Filming Data.)

Sir Patrick Stewart on location for

Star Trek Picard

in Santa Ynez Valley, California. Photo Credit: CBS

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 15

CAREER READINESS REQUIREMENT

The Career Readiness requirement mandates all applicants who receive a tax credit

reservation offer or support career-based learning and training programs for students and

career-technical education teachers based in California. In collaboration with the California

Department of Education and the California Community Colleges Chancellor’s Office, the CFC

developed the structure for participation.

Career Readiness Requirement Options

The CFC also engaged non-profit organizations throughout California involved with career-

pathway opportunities for high school and post-high school students, such as

Film2Future, Bay Area Video Coalition, Los Angeles Film School, RespectaAbility,

ManifestWorks, Digital Nest, and Veterans in Media & Entertainment.

To date, about 85 productions under Programs 2.0 and 3.0 hired more than 200 interns to

fulfill the Career Readiness Requirement, totaling approximately 41,000 hours of paid work.

Sixty-five faculty members participated in career-developing externship opportunities across

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 16

33 projects, while 25 productions selected to host a classroom workshop and/or panel. Close

to 400 students and teachers participated in a professional skills tour, hosted by 33 various

projects.

Career Readiness Requirement Statistics

Program 2.0

Program 3.0

Total

Paid Internships

Participating Projects

81

4

85

Internships

198

7

205

Total Hours

38,957

2,100

41,057

Classroom Workshops

Participating Projects

22

3

25

Professional Skills Tours

Participating Projects

32

1

33

Students

358

10

368

Teachers

32

3

35

Faculty Externships

Participating Projects

21

1

22

Teachers

38

27

65

Financial Contributions

Participating Projects

70

1

71

Total Contributions

$517,345

$12,000

$529,345

Due to the pandemic, many

projects selected virtual

options, creating some of

the most unique

educational experiences

held to date. Creative and

Production department

heads from director Joel

Coen’s production of

The

Tragedy of Macbeth

,

starring Denzel Washington

and Frances McDormand,

met, and interacted

virtually with students from

Denzel Washington and Frances McDormand on set of

The Tragedy of Macbeth.

Image Source: A24

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 17

a career-based learning program, providing detailed descriptions of their creative process,

accompanied by drawings, photos, and sketches.

In June 2021, the CFC collaborated with the Arts, Media, and Entertainment (AME) career

technical education program and hosted a Visual Effects virtual event for a select group of 27

California high school teachers. AME programs prepare high school students to enter

California’s thriving creative economy and were established by the California Department of

Education in 2005. AME serves 231,000 students and is the largest career-technical education

industry sector in the state of California.

2

Externships for Los Angeles Unified School District (LAUSD) teachers given by the

Visual Effects

Society,

facilitated by the CFC and California Department of Education, took teachers through

a series of workshops and panels focused on different aspects of VFX. Teachers explored how

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 18

VFX is integrated in live action and animated films: from prep to physical production, and

post-production. The different roles of VFX personnel (design, on-set, technical, and creative)

and the future of VFX and virtual production were also discussed. During the externship,

teachers worked on a project under the supervision of VFX professionals in Adobe After

Effects, an activity that can be duplicated in the classroom. Teachers who did not have

access to this software were provided with a free 90-day trial from AME Institute sponsor

Adobe.

The virtual events noted above created so much interest that future sessions are being

planned. Video recordings of these and other sessions will eventually be added to the CFC

website for student and educator use.

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 19

CAREER PATHWAYS PROGRAM

The Career Pathways Program requirement is a pilot program under Program 3.0. Senate Bill

878 created a training and outreach program for individuals from underserved communities.

Funding is provided by projects in the Tax Credit Program. A new requirement under Program

3.0, approved projects are required to contribute 0.25% of their credit allocation to the Career

Pathways Program. To date, approved projects under Fiscal Year 2020-2021 have contributed

$837,000.

Fiscal Year 2020-2021 Funding Contributions

The program provides life skills and professional craft skills training for entry-level positions in

film and television production. The goal is to provide skills and access that leads to careers in

production and membership in the below-the-line craft unions. The Program seeks to attract

new and diverse talent, create a pathway that makes it easier for job seekers to pursue a

career in the entertainment industry, and ensure California has a trained and diverse

workforce pipeline to support the entertainment industry. The pilot program may serve as a

model for the creation of similar statewide programs.

Year one of the pilot Career Pathways Program was faced with layers of challenges in

funding, recruitment, and training logistics as a result of the COVID-19 Pandemic. Despite

these challenges, the program was able to serve 55 students in its first year. A summary of

two of the training partner organizations’ participation in year one of the Career Pathways

program, administered by the IATSE Training Trust Fund, the fiscal agent for the program,

appears below:

ManifestWorks

There were two tracks of participants from ManifestWorks in year one of the program. The

first track were 12 alumni from the ManifestWorks main program. In December of 2020, these

12 participants were accepted as Y-16a: Production Sound/Video Trainees at IATSE Local 695.

The Y-16a classification afforded trainees the opportunity to gain paid apprentice positions

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 20

before being included on the Industry Experience Roster. The IATSE Training Trust Fund also

provided trainees with LinkedIn Learning and AVIXA accounts. As of December of 2020, 11 of

the 12 trainees were employed on contracts that ranged from 1-8 months, and were earning

wages that ranged from $19.05 to $29.00 per hour. Ten of these trainees are now IATSE

members of Local 695.

The second track of 25 participants from ManifestWorks completed the main program in

spring 2021. This 12-week Set Production Assistant Training Program includes life skills and on-

set training, as well as networking skills. ManifestWorks also provides mental health and other

support services to their participants, and in doing so keeps a record of other metrics that

illustrate the challenges facing their participants. In the 25 spring cohort, 16 were formerly

incarcerated, five are currently in transitional housing, and three have experienced

homelessness. Two of the participants have disabilities and one has a history with the

military. Twenty-four of the

spring ManifestWorks

participants are currently

working in TV/Film production.

The Brotherhood Crusade

The first cohort of CFC Pilot Career Pathways Program with The Brotherhood Crusade began

in March 2021. Twenty-one participants began in the

spring cohort, however three dropped out of the

program soon thereafter. The cohort began a

unique Life Skills course tailored specifically for the

Pilot Career Pathways Program participants. Of the

18 remaining participants, eight enrolled in courses

with Hollywood CPR.

Overall Year 1 Participant Information

Before the pandemic, it was estimated that the CFC Pilot Career Pathways Program would

serve approximately 150 participants in its first year. In year one of the program, the

ManifestWorks and The Brotherhood Crusade/Hollywood CPR cohorts served 55 participants.

All training and classes were held remotely due to the pandemic.

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 21

DIVERSITY INITIATIVES

With Program 3.0, all approved projects must submit the company’s initiatives and programs

to increase the representation of women and minorities. The Diversity Initiative statement

must include a description of what the program is designed to accomplish and information

about how the program is publicized to interested parties. Diversity submissions have fallen

under one or more of these categories: directing, writing, casting, and production. Company

statements are reflective of a desire to see diversity improved among above and below-the-

line personnel within the entertainment industry and agree to adopt measures to ensure a

diverse applicant pool. The chart below shows samples of initiatives submitted to the CFC

from approved projects under year one of Program 3.0; a comprehensive list is on the CFC

website.

SAMPLE STATEMENTS: DIVERSITY INTIATIVES

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 22

INFRASTRUCTURE USAGE & GROWTH

According to FilmLA, application activity for permits jumped 45% in March 2021 compared to

February 2021 and leasing of soundstages is expected to soar.

3

A significant issue currently

confronting feature and television projects wishing to film in California and the Los Angeles

region is a shortage of stage space. Between increased demand for content with the

proliferation of streaming services

4

, and the fact that some companies reserve soundstages

even when they are not actually filming

5

, there is a substantial boom in creating additional

stage space. Far more cost-effective than building new stages from the ground up, an

increasingly popular practice within the industry is to take an existing space, such as a

warehouse, and re-purpose it.

6

Quixote North Valley Studios, opened in Pacoima in 2019, has five stages totaling

approximately 75,000 square feet. LA North Studios’ second and third Santa Clarita-based

facilities, added another stage of approximately 8,000 square feet at the second facility in

2020, and two at 44,250 and 55,750 square feet at their third facility, which opened in March

2021. Several other sound stages are currently in development with projected opening dates

through 2025.

Local Soundstage Developments

Name, Location

# of

Stages

Estimated

Square Feet

Opening

Date

Notes

8

th

and Alameda Studios

Downtown Los Angeles

17

300,000

2024

26-acre property in downtown LA, LA

Times printing facility; subject to city

approval.

7

Blackhall Studios

Santa Clarita

Up to

20

500,000

Mid-2024

Purpose-built facility on a 50-acre

parcel.

8

Echelon Studios

Hollywood

4

76,000

2025

Formerly Sears, 5-acre property.

9 .10

Jesse Street Studios

Los Angeles

4

TBD

TBD

East Los Angeles.

11

Sunset Glenoaks

Sun Valley

TBD

240,000

2023

A total investment of $170-190 million

by Hudson Pacific Properties and

Blackstone.

12

Television City TVC 2050

West Hollywood

8+

TBD

TBD

With an investment of $1.25 billion,

owner Hackman Capital plans to add

up to 1.3 million sq. ft. of total space

for total of 15 stages.

4

Quixote Studios

Hollywood

1

9,400

May 2021

Adaptive reuse of a warehouse.

5

Pacoima

4

80,000

April 2022

Adaptive reuse of a warehouse.

5

Sylmar

2

50,800

Soon

Adaptive reuse of a warehouse.

5

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 23

LOST PRODUCTIONS

The CFC conducted a detailed analysis of projects that applied for California film and

television tax credits in fiscal year 2020-2021 but ultimately did not receive tax credits.

Though the state has retained much production as a result of Tax Credit Programs 1.0 and 2.0,

data consistently shows that a large number of those projects not awarded ended up filming

outside of California, compared to those that remained in the Golden State.

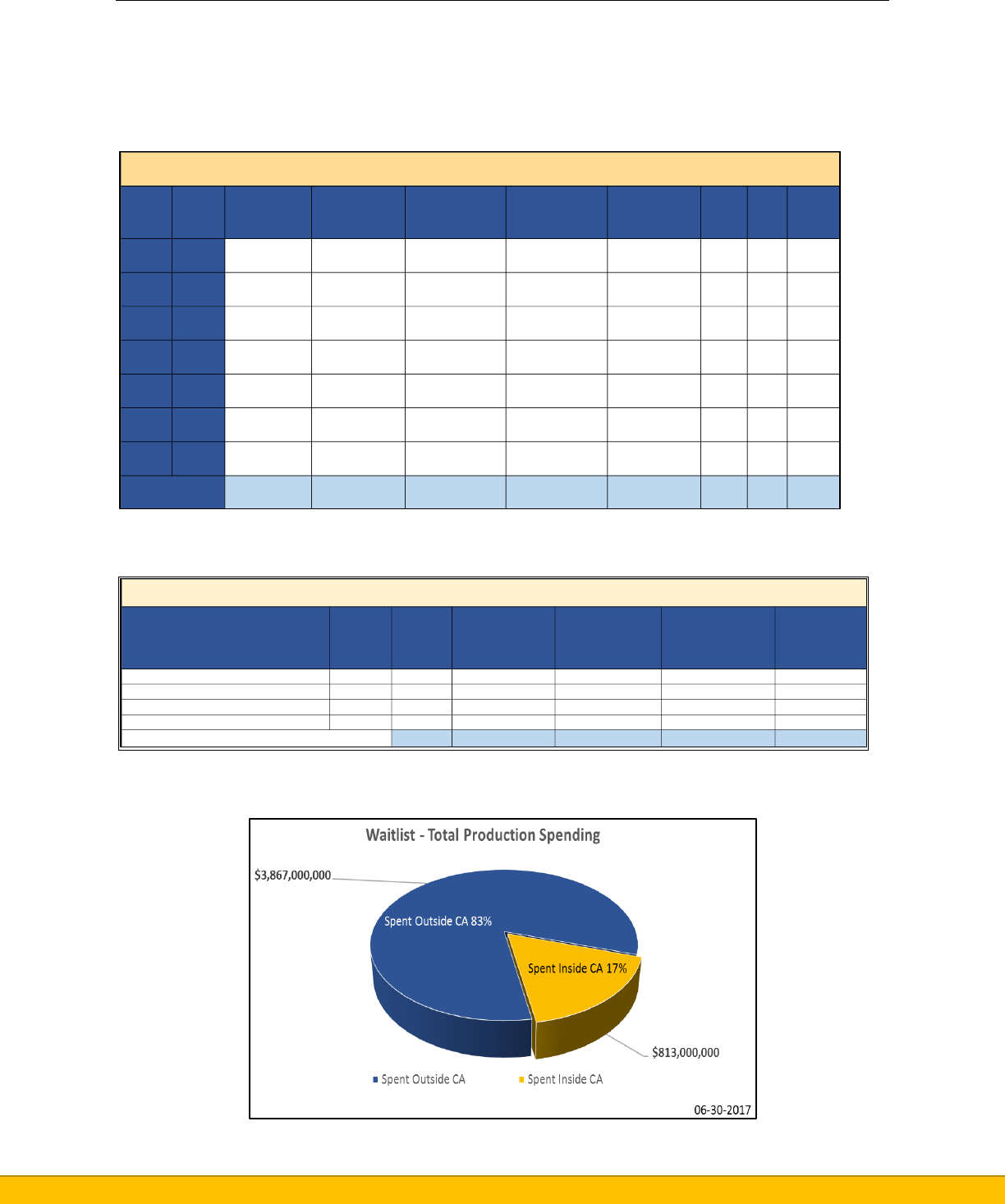

Fiscal Year 2020-2021: Lost Productions

Inside California Outside California

$60,085,000

18%

$265,661,000

82%

Surveyed projects which responded that ultimately filmed in California without receiving tax

credits generated $60 million in the state. Taking advantage of California’s skilled cast and

crew, independent projects account for 72% of the projects that remained in California. With

bigger and more flexible budgets and schedules, non-independent feature films and TV

series were more apt to leave for jurisdictions outside California. These runaway projects

accounted for $266 million in production spending - a loss to the state’s below-the-line

production workers and the ancillary businesses that rely on the film and television

production industry. For example, a $140 million budgeted television series which applied but

did not get tax credits, filmed in New York. A $28 million budgeted non-independent feature

film that had hoped to film in California selected to shoot in New Mexico where tax credits

were available.

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 24

As Program 3.0 progresses, the CFC will continue to collect further lost productions data. The

above data represents solely projects that applied during year one of Program 3.0. (See

Appendix D for Program 2.0 lost productions data.) The CFC is unable to track projects that

do not apply for California’s film and television tax credits or that are ineligible; thus, total

runaway production losses are presumed to be substantially higher.

GLOBAL COMPETITION

Although there are films and television projects produced without the benefit of tax credits,

the availability of incentives is a key factor when it comes to where projects are filmed. For

several years, the business model for feature film and scripted television production has

relied heavily on tax incentives to manage production costs. In addition, booming

infrastructure and other jurisdictions’ production and post-production incentives have

increased regional and global competition.

Competing Factor: Tax Incentives

Financing for projects by independent production companies incorporates the monetization

of tax credits (selling tax credits to third parties) as a key part of the financing structure. Non‐

independent (studio) productions factor in tax incentives heavily when considering

production locations, creating multiple budget comparisons to calculate net costs and

savings realized by virtue of tax credits. In addition to international competition from

Canada, Australia, the United Kingdom (U.K.), and most European Union nations, nearly 40 U.S.

states offer financial incentives to lure production and post‐production jobs and spending

from California.

Incentive‐rich jurisdictions such as New York, Louisiana, Massachusetts, Georgia, Toronto, and

Hungary seem committed to growing their foothold as top‐notch film and television

production centers. Once incentives take root in other states and countries, those locales, in

turn, develop long‐term infrastructure with stage construction, post‐production facilities, and

job training programs. These top competitors have built impressive multi‐studio facilities

over the past few years. Many of these jurisdictions have instituted job training programs as

well. While production companies will often relocate their relatively small creative teams

(producers, actors, directors, writers) to another state for the duration of a film shoot, very few

“below‐the‐ line” crew members (e.g., camera technicians, grips, electricians, carpenters,

make‐up artists, prop masters, drivers) from California are hired due to the additional

expense for travel and housing. The few that work on‐location out‐of‐state pay income tax in

the work state. (California receives only the differential in taxes owed based on the in‐state

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 25

versus out of state tax rate.) Furthermore, skilled California crew members end up training

the local workforce. This process helps create a growing pool of skilled local crews across

Tax Incentives: Georgia, Louisiana, New Mexico, New York

Source: Motion Picture Association

1

the country and around the world. Some film industry workers who cannot find work in

California have relocated their families to incentive states, resulting in lost tax revenue

and a steadily decreasing pool of skilled labor. Despite the success of California’s film

and television tax credit programs, the state has lost productions as competing states

that offer incentives achieve dramatic growth in production spending. In 2020 alone,

productions in Georgia, Louisiana, New Mexico, and New York spent $18 billion in motion

picture and television production - - a significant economic loss to California. More than

300 film and television projects hired 167,000 cast and crew in these jurisdictions.

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 26

2020 Regional Economic Impact

Georgia

Louisiana

New Mexico

New York

Entertainment-related wages in the

state:

$3.8 Billion

$660 Million

$280 Million

$13.1 Billion

Entertainment industry jobs in the

state:

45,830

11,670

4,990

107,730

Jobs related to production:

19,300

5,430

2,550

54,590

Jobs related to distributing movies, TV,

and other video content to consumers:

26,520

6,240

2,430

53,140

Jobs including direct and indirect

impact on local vendors and other

businesses:

159,070

25,210

10,340

290,990

Films Produced in 2020

26

8

17

40

TV Series Produced in 2020

81

19

12

143

Source: Motion Picture Association

1

Competing Factor: Infrastructure

Various jurisdictions, both regionally and globally, boosted construction of new sound-

stages to provide a competitive edge. New York, Georgia, Oklahoma, and Washington

state have built or renovated soundstages with more than 250,000 square feet between

December 2020 and to June 2021. In Canada, several soundstages in Toronto,

Vancouver, and Calgary are being built or retrofitted this year to expand existing

production space. Croatia, Iceland, Ireland, Italy, Scotland, and Spain join the United

Kingdom in developing and renovating several soundstages between 2021 and 2022 to

entice filmmakers to produce projects throughout Europe. In addition, millions of dollars

are earmarked for new soundstage construction in Australia and New Zealand.

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 27

Infrastructure Growth: United States

Infrastructure Growth: Canada

Infrastructure Growth: London

New York

•Kaufman Astoria Studios opened in December 2020. Two new large construction facilities are also in

the works. Source: New York Times

Georgia

•Tyler Perry purchased an additional 37.5 acres in Atlanta to build an entertainment unit. Source: The

Hollywood Reporter

•Savannah College of Art and Design (SCAD) is opening a Hollywood-style backlot and a state-of-the-

art XR stage for virtual production. Source: Savannah Now

Oklahoma

•In 2021, Prairie Surf launched Prairie Surf Studios in downtown Oklahoma City, with five soundstages

totaling 138,000 square feet. Source: Variety and Prairie Surf

Washington

•A a $1.5 million county project to renovate what was once the Fisher Flour Mill on Harbor Island into a

state of the art 117,000 square foot soundstage. Source: King5 NBC News Seattle

Toronto

•Plans to turn 8.9 acres of land on the waterfront into a 500,000-square-foot film studio near Pinewood

Toronto Studios, which is also building another 200,000 square feet of new soundstages and support

space. Source: The Hollywood Reporter

Vancouver

•Martini Film Studios is building a 600,000 sq. ft. facility to include 300,000 sq. ft. of new soundstages

and 300,000 sq. ft. of production support space for wardrobe, workshops and offices. Source: The

Hollywood Reporter

Calgary

•Fortress Studio in southeast Calgary targets Hollywood tentpole movie or series production as it offers

97,500 square feet of stage space with a clear height of 36 feet on around 12 acres in the city’s

downtown core. And nearby Fortress Support offers another 70,000 square feet of support space and

around 20,000 square feet in office space. Source: The Hollywood Reporter

•William F. White International, expanding in Calgary and soon into Winnipeg with two purpose-built

stages and one retrofit stage originals. Source: The Hollywood Reporter

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 28

Shinfield Studios

•Reading. 18 new soundstages in a 45,000 sq.ft. studio complex. Source: Shinfield Studios

Ashford International Film

Studios

•Kent. 80,000 square feet of film studios, with 240,000 sq.ft. of production space. Source: Deadline

Dagenham Eastbrook

•East London. Twelve sound stages totalling 140,000 sq.ft. Source: Hackman Capital

The Wharf

•Barking. Six new stages near Dagenham Eastbrook Studios, see above. Source: Hackman Capital

Sky Studios

•Elstree Hertfordshire. Set to open in 2022 with 14 new soundstages. Source: Elstree Studios

London Films Studios

(SHL)

•Enfield. Three stages. Source: London Film Studios

Raynham Hanger Studios

•Norfolk. Expansion plans are ongoing. Source: The Studio Map

Stratford

•London. TV studios, five studios plus two green screen studios. Source: The Studio Map

Mercian Studios

•Birmingham. Film & TV studios, six stages. Source: The Studio Map

The Depot

•Liverpool. 2 x 20,000 sq ft units, operational by Summer 2021. Source: The Studio Map

Littlewoods Studios

•Liverpool. Film & TV studios under the Twickenham Studios brand. Source: The Studio Map

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 29

Infrastructure Growth: Europe

Infrastructure Growth: Australia and New Zealand

Iceland

•Converted from a building that used to be a fertilizer plant, the roughly 8,000-m2 (86,000-sq ft) studio

is one of Europe’s largest. Source: Iceland Monitor

Ireland

•Recent developments such as the greenlighting of a new €150 million Studio Space and Media

Campus in Greystones, Co. Wicklow will effectively double Ireland’s studio space. Source: Irish Film and

Television Network

Italy

•Apulia Studios launched in 2021, converting a former aquatic theme park into 9 soundstages with two

water tanks. Source: Mia Market Italy

Scotland

•Scotland is to get a new film and TV studio in Glasgow's west end under an £11.9 million plan to

transform part of the historic Kelvin Hall into a new 10,000 sq ft studio facility. Source: The Scotsman

•New film studio to open in Edinburgh, after 85 years! Source: The Scotsman

Spain

•Secuoya will be the crown jewel of filming locations in Europe. Currently has 5 stages - will have 5

more open in 2022. Source: KFTV

Australia

•Russell Crowe has announced plans to back a new film studio in Australia’s Coffs Harbour, situated on

the country’s New South Wales Mid North Coast. The state-of-the-art facility, with an estimated value

of $438M, will be constructed on a sprawling pre-existing Pacific Bay resort complex and will integrate

production, post-production and accommodation and amenities. Source: Deadline

New Zealand

•Plans for a multi-million dollar film studio to be built on the south island of New Zealand have been

submitted to Christchurch City Council. Source: KFTV

•The vast TEMPLE FILM STUDIOS complex will be constructed on an old hospital site in Templeton, just

outside Christchurch and will include eight 25,402 square feet studios measuring between 42.4 to 45.9

feet, a wet stage and offices and workshops. There will also be a backlot for temporary film and video

sets. Source: KFTV

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 30

Competing Factor: Visual Effects (VFX)

Global viewers are consuming more immersive content on their ultra-high-definition TVs,

smartphones, and tablets via a myriad of platforms, including Netflix, Amazon, Hulu,

AppleTV+, Paramount +, Peacock, and Twitch, as well as YouTube, Twitter, and Facebook.

Streaming video is the fastest growing distribution channel for animation and is witnessing

double digit growth which can be attributed to the exponential growth in the number of

online video viewers throughout the world.

11

With studios including more animation and VFX

shots, moviegoers are demanding high quality productions with engaging visual effects and

realistic animation.

Many states and countries have enacted incentives that specifically target the visual effects

industry. In the United States, New York State offers a 30% tax credit for visual effects and

post-production work. In Canada, British Columbia, and Quebec each provide a 16% credit

on visual effects work produced in these provinces ‐ both of which are in addition to their

provincial (28% and 20%, respectively) and federal tax breaks of 16%. In turn, many visual

effects companies of all sizes have relocated to Vancouver, Canada ‐ taking high‐wage jobs

with them.

According to a 2019 study, the field of visual effects has accounted for the most significant

increase in jobs in the motion picture industry over the last 20 years. In 2018, visual effects

crewmembers were hired four times more compared to other crewmembers.

13

When

surveyed, VFX executives at studios and production companies told the CFC that the most

important factor they consider when awarding VFX contracts is tax incentives. The California

Tax Credit Program offers an additional 5% tax credit for VFX work, bringing the credit up to

25% for projects in the program. Even with a 25% tax credit, many projects in the program

choose to go to other locales with more generous VFX incentives. Program 2.0 projects, such

as

Call of the Wild, A Wrinkle in Time, Bumblebee, Ad Astra

, and

Captain Marvel

, spent millions

of dollars out of California for visual effects; in aggregate, Program 2.0 projects spent nearly

the same outside the state ($205 million) as they did inside the state ($235 million) for

VFX, indicating the 25% incentive is not enough to keep the work in California. It also may

indicate that due to the lack of competitive incentives, the visual effects infrastructure that

once existed in the state is no longer enough to support large visual effects projects. Tax

credit projects are but a tiny fraction of projects that film in the state, so most projects have

no incentives available to them when considering where to contract their VFX work. California

is the only major film production center that does not specifically target VFX jobs, and as a

result, much of this ever-expanding and in-demand industry has left the state.

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 31

CALIFORNIA SOUNDSTAGE FILMING TAX CREDIT

PROGRAM

In July 2021, Governor Gavin Newsom signed SB 144 which created a new tax credit program,

incentivizing projects that film in new or renovated soundstages as certified by the CFC.

The new program has $150 Million in tax credits to allocate on a first-come-first-served basis.

In order to be eligible as a qualified production entity to receive tax credits under the

California Soundstage Filming Tax Credit Program, a production entity may qualify if the

project films within three years from the date of CFC certification of the soundstage. In

addition, the production entity must film at least 50% of its principal photography stage

shooting days at a certified soundstage. The production entity, in addition, must own more

than 50% of the certified soundstage where the production is filmed or enter into a contract

or lease for 10 years with the owners of the certified studio construction project where the

production is filmed.

July 21, 2021: Governor Newsom at SB 144 bill signing with (from left) Senator Maria Elana Durazo (representing Senate District 24), Assemblymember

Wendy Carrillo (representing Assembly District 51), Sunset Gower Studios CEO Victor Coleman, Senator Anthony Portantino (representing Senate

District 52), CFC Executive Director Colleen Bell, and Assemblymember Autumn Burke (representing Assembly District 62).

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 32

Once a construction or renovation project meets a set of certification criteria as defined by

the CFC, the taxpayer may be eligible to receive tax credits. Actual construction or renovation

expenditures must be at least $25 million for construction or renovations made within five

continuous years. Additional requirements under the new bill include submission of a

diversity workplan.

The diversity workplan is required documentation submitted by the applicant indicating

diversity goals, including race and gender, when hiring above- and below-the-line

individuals. The workplan should broadly reflect California’s diversity make-up in terms of

race and gender. The CFC is in the process of creating guidelines and will have the authority

to audit final diversity reports.

As a Soundstage Filming Tax Credit project, applicants are eligible to receive additional tax

credits after successfully achieving the goals as stated in the diversity workplan. Verified by

the CFC, if the applicant has met or made a good faith effort to meet the diversity goals of

the workforce employed, the project may be eligible for up to an additional 4% tax credit.

The payment requirement from an approved Certified Studio Construction Project to fulfill the

Career Pathways Training Program, as described in the Career Pathways Training Program

section, has been modified under SB 144. The approved applicant filming on a certified

soundstage is required to pay 0.5% (up from .25%) of the approved tax credit amount.

As approved Soundstage Filming Tax Credit projects, recurring TV Series are capped to

receive $12 million in tax credits per season, while feature films are capped at $12 million in tax

credits.

CONCLUSION

The California Film Commission (CFC) has been administering the state’s film and television

tax credit programs since 2009, growing from a yearly $100 million lottery-based program to

a $330 million per year program based on a jobs ratio (jobs creation) system. Last year alone,

the CFC reserved $336 million in tax credits for an estimated return of $1.6 billion in spending

across California. Despite the programs’ success at retaining many productions and

stimulating the economy, there is growing pressure to compete globally with more film tax

incentives, job training and infrastructure.

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 33

California must continue to invest in a skilled workforce and train individuals for jobs in the

industry, and jobs must be accessible to a diverse pool of individuals. The Pilot Career

Pathways program is working to provide such opportunities to individuals from underserved

communities, as are many other diversity initiatives from studios and production

companies. The Career Readiness Initiative, as well as partnerships with the California

Department of Education and the CFC, assists teachers and students in gaining exposure and

experience in the industry. SB144, with its diversity component, is another avenue in which the

program encourages the hiring of individuals from underrepresented communities. With

Arts/Media/Entertainment as the largest sector of Career Technical Education training in the

state, it’s clear that California’s youth are very interested in careers in this industry. It is vital

that the state continue its efforts to incentivize productions and support training programs

and infrastructure growth so that a skilled workforce can support a robust entertainment

community for years to come.

With the advent of virtual production and increased demand for visual effects, California has

the potential to gain thousands of jobs in this sector. However, with the abundance of visual

effects incentive programs offered by many other locales, California’s market share of visual

effects work has steadily declined. As the only major industry hub without a stand-alone

visual effects tax credit, California is missing the opportunity to increase employment in this

sector of film production and post-production.

The ever-increasing demand for content needed to feed streaming services has created

even larger film and TV production hubs worldwide. In order for California to retain its edge

as the entertainment capital of the world, additional stages are needed to accommodate the

demand. The passage of SB144 is intended to encourage content providers to invest in

soundstages to produce their projects.

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 34

SOURCES

1. Motion Picture Association https://www.motionpictures.org/what-we-do/driving-economic-growth/

2. California Department of Education - Arts, Media, and Entertainment Industry Sector

https://www.cde.ca.gov/ci/ct/gi/ameindustrysector.asp

3. Commercial Observer https://commercialobserver.com/2021/06/la-jesse-street-studios-sound-stage-270k-sf-

office-development-filming/

4. FilmLA Soundstage Report https://www.filmla.com/filmla-updates-annual-sound-stage-production-report/

5. Phone Conversation with Cheryl Huggins Sr. VP of Quixote Studios (June 16, 2021)

6. Commercial Observer https://commercialobserver.com/2021/05/la-quixote-studios-filming-soundstages-

hollywood-san-fernando-development-streaming/

7. Los Angeles Times https://enewspaper.latimes.com/desktop/latimes/default.aspx?pubid=50435180-e58e-

48b5-8e0c-236bf740270e&edid=4b344ff6-98c4-4e36-a413-eba04271e33d&pnum=10

8. City of Santa Clarita https://www.santa-

clarita.com/home/showpublisheddocument/19892/637623647073200000

9. Urbanize Los Angeles https://urbanize.city/la/post/hollywood-bardas-bain-capital-echelon-studios

10. Los Angeles Times https://enewspaper.latimes.com/desktop/latimes/default.aspx?pubid=50435180-e58e-

48b5-8e0c-236bf740270e&edid=060e72aa-b640-4d09-abf5-78f20f6fff30&pnum=8

11. Commercial Observer https://commercialobserver.com/2021/06/la-jesse-street-studios-sound-stage-270k-sf-

office-development-filming/

12. Globe St. https://www.globest.com/2021/07/30/hudson-pacific-blackstone-plan-studio-project-in-sun-valley/

13. Stephen Follows: Film Data and Education https://stephenfollows.com/which-film-jobs-are-increasing-and-

which-are-decreasing/

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 35

APPENDIX A | Enacting Legislation

• SB 144 (Portantino). Taxes: credits: qualified motion pictures: certified studio construction projects:

reports. The Personal Income Tax Law and the Corporation Tax Law allow various credits against

the taxes imposed by those laws, including a motion picture credit for taxable years beginning on

or after January 1, 2020, to be allocated by the California Film Commission on or after July 1, 2020,

and before July 1, 2025, in an amount equal to 20% or 25% of qualified expenditures for the

production of a qualified motion picture in this state, with additional credit amounts allowed,

including for amounts equal to specified qualified expenditures and qualified wages relating to

original photography outside the Los Angeles zone, as specified.

• SB 878 (Senate Committee on the Budget and Fiscal Review), Existing law allows credits under the

Personal Income Tax Law and the Corporation Tax Law for taxable years beginning on or after or

after January 1, 2016, to be allocated by the California Film Commission on or after July 1, 2015, and

before July 1, 2020,

• AB1839 (Gatto) was enacted in September 2014 creating a new Film and Television Tax Credit

Program for five years and authorized funding at $230 million in FY 2015-16 and $330 million for each

of the next four years. It expanded eligibility to include all 1-hour scripted television series regardless

of distribution outlet (network, premium cable, internet, TV, etc.), big-budget feature films (but

restricted credits to the first $100 million in qualified expenditures), and television pilots.

• SB1197 (Calderon), identical to AB2026, was enacted in September 2012 to provide a two-year

extension to the California Film & Television Tax Credit Program through FY 2016-17. The bill sought

a five-year extension but was reduced to a two-year bill in the Senate.

• AB2026 (Fuentes) was enacted in September 2012 to provide a two-year extension to the California

Film & Television Tax Credit Program through FY 2016-17. The bill sought a five-year extension but

was reduced to a two-year bill in the Senate.

• AB1069 (Fuentes) was enacted in October 2011 to provide a one-year extension to the California Film

& Television Tax Credit Program through FY 2014-15. The original bill sought a five-year extension

but was reduced to one-year in the Senate.

• SB X3 15 (Calderon) / ABX3 15 (Krekorian) was enacted in 2009 to create the California Film and

Television Tax Credit Program, which provided a five-year, $500 million tax credit to be

administered by the CFC.

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 36

APPENDIX B | Program 3.0 vs. 2.0 Comparison Chart

Sunset Date

June 30, 2020

June 30, 2025

Funding

$330M per Fiscal Year

No change.

Funding Categories

• 40% TV Series, Pilots, Mini-series,

MOWs

• 35% Non-independent Films

• 20% Relocating TV Series

• 5% Independent Films

• 40% TV Series, Pilots, Mini-Series

• 35% Non-independent Films

• 17% Relocating TV Series

• 8% Independent Films

Independent film funding split

between projects with budgets

under $10m and over $10m.

•

Tax Credit Allocation

Percentage

• 25% Indies and Relocating TV

• 20% Non-Indies

• Additional 5% “Uplift”

• Filming Outside 30-Mile Zone

• Visual Effects Expenditures

• Music Scoring / Track

Recording Expenditures

• 25% Indies and Relocating TV

• 20% Non-Indies

• Additional 5% “Uplift”

• Filming Outside 30-Mile Zone

• Visual Effects Expenditures

• Eliminates 5% for Music Scoring /

Track Recording

• 5% or 10% Additional for Local

Hires Working Out-of-Zone

Application Selection

Jobs ratio ranking within specific

categories.

Jobs ratio ranking within specific

categories; allows VFX vendor

payments split 70% wage/30%

non-wage.

Career Readiness

Requirement

Paid internship positions for a

minimum of 75 hours each or a

combination of internships with a

minimum 225 hours in

total. Payments to career readiness

interns are not qualified. Workshops /

panels must be at a minimum of

eight (8) hours in length.

Paid internship positions for a

minimum of 100 hours each or a

combination of internships with a

minimum 300 hours in

total. Payments to career readiness

interns are considered qualified

wages. The 8-hour minimum

requirement for workshops / panels

is eliminated.

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 37

Pilot Career Pathways

Training Program

None.

Pilot skills training program for

individuals from underserved

communities for careers in

entertainment industry; fee of .25%

of estimated tax credit to be paid

within 10 business days of program

acceptance.

Deadline to Begin Filming

180-day Rule: Productions must

begin filming within 180 days of credit

allocation letter.

180-day Rule: Productions must

begin filming within 180 days of

credit allocation letter; for projects

with qualified budgets over $100M,

must begin filming within 240 days.

Penalty for

Overstatement of Jobs

Ratio

Different penalties for Non-

Independent and Independents.

Same penalty for Non-Independent

and Independents.

Bonus Points

Include facility usage as bonus point

factor.

• Eliminate facility usage as bonus

point factor.

• Add music scoring/track

recording wages as bonus point

factor.

Carry Forward

Taxpayer may carry forward tax

credit for 5 years.

Taxpayer may carry forward tax

credit for 8 years.

Recurring TV – Pick-up

Orders

Relocating TV Eligibility

No time limit as to when recurring TV

series can submit pick-up orders.

Must have filmed most recent

season outside of CA.

Maximum 140 calendar days from

date a credit allocation letter would

have been issued to submit pick-

up order.

Must have filmed at least 75% of

most recent season outside of CA.

Movies of the Week

Eligible type of production.

Omit Movie-of-the-Week; this

production type may apply in

Independent Film or Feature Film

category.

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 38

Unallocated Credits

After sunset date, CFC may not

allocate unused credits.

• CFC may allocate unused credits

from Programs 1.0 and 2.0.

• After sunset date of 3.0, CFC may

continue to allocate unused

credits from all 3 programs.

Anti-Harassment

Provision

None.

Requires approved applicants to

provide their written policy against

unlawful harassment which

includes procedures for reporting

and investigating harassment

claims. Applicants shall indicate

how policy will be distributed to

employees and include education

training resources and remedies

available.

Diversity Reporting

Requires approved applicants to

provide statistics on the diversity of

the workforce employed.

A summary of the applicant’s

voluntary programs to increase the

representation of women and

minorities including a description of

what the program is designed to

accomplish and information about

how the programs are publicized to

interested parties. This

requirement is waived for

independent films with qualified

expenditures of ten million dollars

($10,000,000) or less.

California Film Commission | Film and TV Tax Credit Program Progress Report

November 2021 | Page 39

APPENDIX C | Tax Credit Usage Limitations

In July 2020, Governor Gavin Newsom imposed new tax regulations to offset the California budget deficit as a

result of the Covid-19 pandemic (see page 42 for Covid-19 effects on California film and television productions).

For the period beginning January 1, 2020 and before January 1, 2023, Non-Independent tax credit recipients are

limited to a cap of $5 million with respect to offsetting state income tax liability and a $5 million cap with respect

to offsetting Sales and Use tax liability. This applies to projects in both Program 2.0 and Program 3.0 tax credit

programs. The cap on credits against income tax liability are at the combined reporting group level; the cap on

credits against Sales and Use tax liability can be claimed by affiliates. Independent Films are also limited to the

$5 million tax credit limitation for the next 3 years. Companies which purchase tax credits from Independent Films

have the same limitations when they elect to utilize their credits against their state income tax liability.

Qualified taxpayers, participating in the California Film & TV Tax Credit Program, or their affiliates are allowed a

credit against the net tax in the amount specified on the Tax Credit Certificate. Tax Credits are governed by the

year the credit certificate is issued. Once a taxpayer receives a Credit Certificate, they can claim it on their tax

return beginning with the year the Certificate was issued. The excess credit may be carried over to reduce the

net tax in the following taxable year and succeeding five (Program 2.0) or eight (Program 3.0), if necessary. This

means that for Program 2.0, the carryover may be extended to six years and Program 3.0 to nine years. Due to

the $5 million per year limitation the first three years of Program 3.0, the carryover may be extended from six to

nine years (2.0) and from nine to twelve years (3.0). The extension of the carryover period is only for the

number of years that the credit was limited. For example, if a taxpayer has a Program 2.0 credit for $15 million

that they are eligible to utilize in 2022, the taxpayer would be limited for only one year. Therefore, the credit

would be allowed an additional year of carryover.

Tax credits may be assigned to one or more affiliates. Affiliate Corporation is defined in the Revenue & Taxation

code as a corporation that is a member of a commonly controlled group as defined in Section 25110 subdivision