Project-based Administrative Plan

1-1

Project-based Section 8

Administrative Plan

King County Housing Authority

This is the latest version as of: 5/14/2024

Project-based Administrative Plan

1-2

TABLE OF CONTENTS

INTRODUCTION .....................................................................................................1-1

THE KING COUNTY HOUSING AUTHORITY’S MOVING TO WORK AGREEMENT ............... 1-1

DESCRIPTION OF PROJECT-BASED ASSISTANCE ............................................................... 1-1

HOW PROJECT-BASED ASSISTANCE IS FUNDED ............................................................... 1-2

MAXIMUM RESOURCES DEDICATED TO PROJECT-BASED ASSISTANCE ........................... 1-2

POLICY GOALS ................................................................................................................. 1-2

JURISDICTION RESTRICTIONS .......................................................................................... 1-3

MAXIMUM NUMBER OF PROJECT-BASED UNITS IN A DEVELOPMENT............................ 1-3

PROJECT-BASED ASSISTANCE PROGRAMS ....................................................................... 1-3

POTENTIAL PROJECT-BASED ASSISTANCE PROGRAMS .................................................... 1-5

BLOCK GRANT POLICIES ................................................................................................... 1-5

FAIR HOUSING ................................................................................................................. 1-6

ETHICAL STANDARDS....................................................................................................... 1-6

CATASTROPHIC PLANNING ............................................................................................. 1-7

DEFINITION OF TERMS ..........................................................................................2-1

ALLOCATION OF PROJECT-BASED ASSISTANCE ......................................................3-1

METHODS TO ALLOCATE PROJECT-BASED ASSISTANCE .................................................. 3-1

PUBLIC NOTICE OF PROJECT-BASED ASSISTANCE COMPETITION .................................... 3-3

PUBLIC NOTICE OF OWNER SELECTION ........................................................................... 3-3

OWNER APPLICATION REQUIREMENTS .................................................................4-1

ELIGIBLE OWNERS ........................................................................................................... 4-1

THE OWNER’S APPLICATION ........................................................................................... 4-1

HOUSING TYPE ......................................................................................................5-1

ELIGIBLE HOUSING TYPES ................................................................................................ 5-1

INELIGIBLE HOUSING TYPES ............................................................................................ 5-2

SITE SELECTION STANDARDS .................................................................................6-1

A. ALL PROJECTS .................................................................................................................. 6-1

B. ADDITIONAL SITE STANDARDS FOR NEW CONSTRUCTION ............................................. 6-2

SUPPORT SERVICES ...............................................................................................7-1

OWNER’S ABILITY TO PROVIDE SERVICES ........................................................................ 7-1

Project-based Administrative Plan

1-3

OWNER EXPERIENCE IN PROVIDING SERVICES ................................................................ 7-1

TYPES OF SUPPORTIVE SERVICES ..................................................................................... 7-1

HOUSEHOLD REQUIREMENT TO PARTICIPATE IN SERVICES ............................................ 7-2

TERMINATION OF SERVICES ............................................................................................ 7-2

MONITORING OF SERVICES ............................................................................................. 7-2

SUBSIDY LAYERING REVIEW ..................................................................................8-1

SUBSIDIZED UNITS INELIGIBLE FOR ASSISTANCE ............................................................. 8-1

OWNER DISCLOSURE ....................................................................................................... 8-2

OWNER CERTIFICATION .................................................................................................. 8-2

KCHA FEASIBILITY REVIEW ............................................................................................... 8-3

KCHA CERTIFICATION ...................................................................................................... 8-4

OTHER FEDERAL REGULATIONS .............................................................................9-1

ENVIRONMENTAL REVIEW .............................................................................................. 9-1

UNIFORM RELOCATION ACT ............................................................................................ 9-3

LABOR STANDARDS (DAVIS BACON, SECTION 3, EQUAL OPPORTUNITY) ........................ 9-4

THE AGREEMENT TO ENTER INTO A HOUSING ASSISTANCE PAYMENTS CONTRACT

(AHAP) 10-1

PURPOSE OF THE AHAP ................................................................................................. 10-1

WHEN KCHA WILL ENTER INTO AN AHAP ...................................................................... 10-1

FORM OF THE AHAP ...................................................................................................... 10-2

CONTENTS OF THE AHAP ............................................................................................... 10-2

WHEN AHAP IS EXECUTED ............................................................................................. 10-3

COMPLETION OF HOUSING DEVELOPMENT .................................................................. 10-4

EXECUTION OF HAP CONTRACT .................................................................................... 10-4

THE HOUSING ASSISTANCE PAYMENTS CONTRACT (HAP CONTRACT) ................ 11-1

PURPOSE OF HOUSING ASSISTANCE PAYMENTS CONTRACT ........................................ 11-1

FORM OF THE HAP CONTRACT ...................................................................................... 11-1

OWNER CERTIFICATION ................................................................................................ 11-2

WHEN THE HAP CONTRACT IS EXECUTED ..................................................................... 11-3

HAP CONTRACT TERM ................................................................................................... 11-3

EXTENSION OF TERM .................................................................................................... 11-4

TERMINATION BY KCHA FOR INSUFFICIENT FUNDING .................................................. 11-4

CHANGE IN OWNERSHIP ............................................................................................... 11-4

Project-based Administrative Plan

1-4

ATTACHING ASSISTANCE TO UNITS ............................................................................... 11-5

AMENDMENT TO ADD CONTRACT UNITS ...................................................................... 11-5

AMENDMENT TO DECREASE CONTRACT UNITS ............................................................ 11-6

OWNER NON-COMPLIANCE WITH HAP CONTRACT ....................................................... 11-6

CONTRACT RENTS ............................................................................................... 12-1

A. DATA USED TO DETERMINE THE CONTRACT RENT AMOUNT ....................................... 12-1

DETERMINATION OF CONTRACT RENT .......................................................................... 12-3

OWNER REQUEST TO REVISE THE CONTRACT RENT ...................................................... 12-4

OTHER FEES AND CHARGES ........................................................................................... 12-4

CONTRACT RENTS FOR SPECIAL HOUSING TYPES .......................................................... 12-5

TENANT APPLICATION PROCESS .......................................................................... 13-1

GENERAL APPLICATION REQUIREMENTS ...................................................................... 13-1

ORDER OF SELECTION- ALL PROGRAM CATEGORIES ..................................................... 13-3

TIMING/VERIFICATION OF LOCAL PREFERENCE ............................................................ 13-4

DENIAL OF LOCAL PREFERENCE ..................................................................................... 13-5

REMOVING APPLICANT NAMES FROM A WAITLIST ....................................................... 13-5

HOUSED STATUS ........................................................................................................... 13-6

APPLICATION PROCEDURES –PERMANENT REPLACEMENT HOUSING PROGRAM ........ 13-6

APPLICATION PROCEDURES- PUBLIC HOUSING REDEVELOPMENT ............................. 13-11

APPLICATION PROCEDURES-LOCAL PROGRAM (INCLUDING TAX CREDIT) .................. 13-11

APPLICATION PROCEDURES- PERMANENT SUPPORTIVE HOUSING ............................. 13-12

TENANT ELIGIBILITY .................................................................................................. 1

ELIGIBILITY FOR INITIAL SCREENING ................................................................................... 1

ELIGIBILITY OF STUDENTS ENROLLED IN INSTITUTIONS OF HIGHER EDUCATION............... 7

KCHA OPTION TO PROVIDE INFORMATION TO OWNERS ABOUT APPLICANT

HOUSEHOLDS ............................................................................................................................ 8

OWNER-DETERMINED TENANT SELECTION CRITERIA ....................................................... 8

ACCOMMODATION OF PERSONS WITH DISABILITIES .......................................... 15-1

REGULATORY BACKGROUND ......................................................................................... 15-1

DEFINITION - PERSON WITH A DISABILITY (SEE DEFINITIONS SECTION 2) ..................... 15-1

RESTRICTIONS ON QUESTIONS ASKED OF PEOPLE WITH DISABILITIES .......................... 15-2

VERIFICATION OF DISABILITY ......................................................................................... 15-3

CONFIDENTIALITY OF DISABILITY INFORMATION .......................................................... 15-4

Project-based Administrative Plan

1-5

VERIFICATION OF NEED FOR REASONABLE ACCOMMODATION ................................... 15-4

GENERAL POLICY GUIDELINES ON REASONABLE ACCOMMODATIONS ......................... 15-4

EXAMPLES OF REASONABLE ACCOMMODATIONS ........................................................ 15-5

GENERAL GUIDELINES FOR REVIEWING REASONABLE ACCOMMODATION REQUESTS . 15-6

GENERAL GUIDELINES FOR PROCESSING REASONABLE ACCOMMODATION REQUESTS . 15-

7

DISAGREEMENT WITH TYPE OF ACCOMMODATION ..................................................... 15-8

REVIEW AND/OR DISCONTINUANCE OF REASONABLE ACCOMMODATION .................. 15-9

SPECIFIC REASONABLE ACCOMMODATIONS ................................................................. 15-9

SUBSIDY STANDARDS .......................................................................................... 16-1

MINIMUM HOUSING STANDARDS ................................................................................ 16-1

GENERAL HOUSING PRINCIPLES .................................................................................... 16-1

OWNER SUBSIDY STANDARDS ....................................................................................... 16-3

INAPPROPRIATE UNIT SIZE OR ACCESSIBLE UNITS ........................................................ 16-3

GRANTING OF EXCEPTIONS TO UNIT SIZE STANDARDS ................................................. 16-5

VERIFICATIONS .................................................................................................... 17-5

VERIFICATIONS .............................................................................................................. 17-5

EFFECTIVE TERM OF VERIFICATIONS ............................................................................. 17-2

METHODS OF VERIFICATION ......................................................................................... 17-2

ENTERPRISE INCOME VERIFICATION (EIV) ..................................................................... 17-4

DISPUTED, UNREPORTED OR SUBSTANTIAL DIFFERENCES IN INCOME ......................... 17-4

SPECIFIC FORMS OF VERIFICATION ............................................................................... 17-5

EXCEPTIONS TO VERIFICATION PROCEDURES ............................................................... 17-5

PARTICIPANT BRIEFING ....................................................................................... 18-1

BRIEFING OF PARTICIPANTS .......................................................................................... 18-1

B. WHEN A BRIEFING IS CONDUCTED BY NON-KCHA STAFF .............................................. 18-1

BRIEFING TOPICS ........................................................................................................... 18-1

BRIEFING AND TENANCY INFORMATION PACKET ......................................................... 18-2

SPECIAL CIRCUMSTANCES ............................................................................................. 18-3

HOUSING QUALITY STANDARDS AND INSPECTIONS ........................................... 19-1

THE HOUSING QUALITY INSPECTION ............................................................................. 19-1

B. CORRECTION OF FAILED ITEMS ..................................................................................... 19-3

C. LEAD-BASED PAINT ........................................................................................................ 19-4

Project-based Administrative Plan

1-6

D. HOUSING QUALITY STANDARD UPGRADES ................................................................... 19-4

E. HQS ALLOWANCES SPECIFIC TO PROJECT-BASED .......................................................... 19-6

F. INFESTATION ................................................................................................................. 19-7

G. RECORD KEEPING .......................................................................................................... 19-8

H. MONITORING (THIS SECTION DOES NOT APPLY TO KCHA MANAGED PROPERTIES) ..... 19-8

I. HQS PILOT PROGRAM ................................................................................................... 19-9

RECERTIFICATION OF FAMILY INCOME, COMPOSITION, AND DEDUCTIONS ....... 20-9

REVIEW OF FAMILY ELIGIBILITY ..................................................................................... 20-9

THE RECERTIFICATION PROCESS .................................................................................... 20-2

EFFECTIVE DATE OF CHANGES FOR RECERTIFICATIONS ................................................ 20-3

OWNER REQUEST FOR RENT INCREASE ......................................................................... 20-3

RECERTIFICATION RULES SPECIFIC TO EASY RENT HOUSEHOLDS .................................. 20-3

RECERTIFICATION RULES SPECIFIC TO WIN RENT HOUSEHOLDS ................................... 20-4

INTERIM RECERTIFICATION RULES FOR EASY RENT AND WIN RENT HOUSEHOLDS ...... 20-5

SPECIAL REVIEWS .......................................................................................................... 20-7

PROCESSING INTERIM AND SPECIAL RECERTIFICATIONS .............................................. 20-7

DEBT COLLECTION PROCEDURES................................................................................. 20-10

GENERAL REVIEW PROCEDURES ................................................................................. 20-13

LEASING AND TENANCY ...................................................................................... 21-1

THE DWELLING LEASE.................................................................................................... 21-1

OWNER SECURITY DEPOSIT ........................................................................................... 21-2

DETERMINATION OF HOUSING ASSISTANCE PAYMENT ................................................ 21-3

DETERMINATION OF TENANT RENT AND TOTAL TENANT PAYMENT ............................ 21-3

RENT CALCULATIONS FOR OVER-INCOME PUBLIC HOUSING REDEVELOPMENT

PARTICIPANTS ...................................................................................................................... 21-9

RENT CALCULATIONS FOR FAMILIES WITH NONCITIZEN MEMBERS ........................... 21-10

RENT CALCULATIONS FOR GROUP HOMES AND SHARED HOUSING ........................... 21-10

DETERMINATION OF THE ENERGY ASSISTANCE SUPPLEMENT .................................... 21-12

VACANCIES .................................................................................................................. 21-13

CONTINUED ASSISTANCE .................................................................................... 22-1

A. FAMILIES ELIGIBLE FOR CONTINUED ASSISTANCE ......................................................... 22-1

B. FAMILIES CONSIDERED INELIGIBLE FOR CONTINUING ASSISTANCE WHO: ................... 22-1

C. ELIGIBILITY FOR CONTINUED SUBSIDY IN CASES WHERE A FAMILY BREAKS-UP ........... 22-1

Project-based Administrative Plan

1-7

D. ELIGIBILITY FOR CONTINUED ASSISTANCE DUE TO ABSENCE FROM THE UNIT ............. 22-2

E. TRANSFERS .................................................................................................................... 22-2

F. ALTERNATIVE FORMS OF ASSISTANCE .......................................................................... 22-3

TERMINATION OF PROJECT-BASED ASSISTANCE ................................................. 23-1

TERMINATION OF A PARTICIPANT'S HOUSING ASSISTANCE PAYMENTS BY THE

AUTHORITY ........................................................................................................................... 23-1

TERMINATION OF HAP CONTRACT BY KCHA ................................................................. 23-6

TERMINATION OF TENANCY BY THE OWNER ................................................................ 23-8

TERMINATION OF THE HAP CONTRACT BY THE OWNER ............................................. 23-10

TERMINATION OF TENANCY BY FAMILY ...................................................................... 23-10

INFORMAL REVIEW AND HEARING PROCEDURES ............................................... 24-1

INFORMAL REVIEW PROCEDURES FOR PROJECT-BASED APPLICANTS ........................... 24-1

INFORMAL HEARING PROCEDURES FOR PROJECT-BASED PARTICIPANTS (EXCEPT FOR

GREENBRIDGE AND KCHA MANAGED PROPERTIES) ............................................................. 24-2

C. INFORMAL HEARING PROCEDURES FOR A PROJECT-BASED RESIDENT (GREENBRIDGE

AND KCHA MANAGED PROPERTIES) ..................................................................................... 24-6

D. INFORMAL HEARING PROCEDURES FOR AN OWNER .................................................. 24-11

EXHIBIT A- INCOME INCLUSIONS .............................................................................. 1

EXHIBIT B - INCOME EXCLUSIONS........................................................................ 26-1

EXHIBIT C- CLARIFICATIONS ON INCOME, ASSETS AND ALLOWANCES ............... 27-1

I. ANNUAL INCOME ...................................................................................................... 27-1

II. ASSETS ....................................................................................................................... 27-7

III. ADJUSTED INCOME – ALLOWABLE EXPENSES (DEDUCTIONS) ................................. 27-10

IV. GUIDELINES FOR IMPUTING INCOME FROM ASSETS ............................................... 27-13

EXHIBIT D - PAYMENT STANDARD/INCOME LIMITS ............................................ 28-1

EXHIBIT E- ACCEPTABLE FORMS OF VERIFICATION ............................................. 29-1

I. INCOME VERIFICATION .............................................................................................. 29-1

II. ASSET VERIFICATION .................................................................................................. 29-4

III. VERIFICATION OF DEDUCTION/ALLOWANCES ........................................................... 29-6

IV. OTHER GENERAL VERIFICATION................................................................................. 29-8

V. VERIFICATION FOR TENANT SELECTION PREFERENCES ............................................. 29-9

VI. SOCIAL SECURITY DISCLOSURE AND DOCUMENTATION .......................................... 29-12

VII. VERIFICATION OF RESTRICTIONS ON ASSISTANCE TO NON-CITIZENS ...................... 29-14

Project-based Administrative Plan

1-8

EXHIBIT F- DISPOSITION OF RECORDS POLICY ..................................................... 30-1

EXHIBIT G - TRANSFER POLICY ............................................................................. 31-1

I. PURPOSE .................................................................................................................... 31-1

II. APPLICABILITY ............................................................................................................ 31-1

III. OBJECTIVES OF THE TRANSFER POLICY ...................................................................... 31-3

IV. DETERMINING THE APPROPRIATE HOUSING RESOURCE ........................................... 31-3

V. CATEGORIES OF TRANSFERS ...................................................................................... 31-4

VI. ORDER OF SELECTION ................................................................................................ 31-8

VII. INABILITY TO LOCATE AN APPROPRIATE HOUSING RESOURCE ................................. 31-8

VIII. REJECTION OF A UNIT OFFER ..................................................................................... 31-9

IX. COST OF THE FAMILY'S MOVE ................................................................................. 31-10

X. TENANTS IN GOOD STANDING ................................................................................. 31-10

XI. TENANT REQUESTED TRANSFERS ............................................................................ 31-10

XII. RIGHT OF THE HOUSING AUTHORITY IN TRANSFER POLICY .................................... 31-11

XIII. EMERGENCY TRANSFER PLAN FOR VICTIMS OF DOMESTIC VIOLENCE, DATING

VIOLENCE, SEXUAL ASSAULT, OR STALKING ....................................................................... 31-11

EXHIBIT H- CONFIDENTIALITY OF TENANT RECORDS ........................................... 32-1

I. GENERAL POLICY ........................................................................................................ 32-1

II. DATA COLLECTION AND DISCLOSURE ........................................................................ 32-1

III. SPECIAL PRIVACY AND CONFIDENTIALITY RULES RELATING TO CRIMINAL RECORDS 32-2

IV. HA GUIDELINES ON RELEASE OF INFORMATION ....................................................... 32-2

EXHIBIT I- (RESERVED) ........................................................................................ 33-1

EXHIBIT J- HOUSING CHOICE VOUCHER PROGRAM CLIENT ASSISTANCE POLICY .34-

1

EXHIBIT K- HQS GUIDELINES FOR INSPECTORS .................................................... 35-1

A. FURNACES .................................................................................................................. 35-1

B. SITE AND NEIGHBORHOOD CONDITIONS .................................................................. 35-1

EXHIBIT L- (RESERVED) ....................................................................................... 36-1

EXHIBIT M- LEAD BASED PAINT REGULATIONS.................................................... 37-1

I. GENERAL POLICY ........................................................................................................ 37-1

II. HUD STANDARDS FOR STABILIZING DETERIORATED PAINT ....................................... 37-2

III. CLEARANCE REPORT .................................................................................................. 37-5

EXHIBIT N- (RESERVED) ....................................................................................... 38-1

Project-based Administrative Plan

1-9

EXHIBIT O- LIST OF MAJOR AND MINOR FAIL ITEMS ........................................... 39-1

EXHIBIT P- HOUSING AUTHORITY CODE OF CONDUCT ........................................ 40-1

EXHIBIT Q- AFFIRMATIVELY FURTHERING FAIR HOUSING PLAN .......................... 41-1

EXHIBIT R- ORIGINAL PROJECT-BASED PROGRAM POLICY ................................... 42-1

I. BACKGROUND ........................................................................................................... 42-2

II. PROBLEM STATEMENT .............................................................................................. 42-3

III. POLICY GOALS ............................................................................................................ 42-8

IV. PROGRAM CATEGORIES ........................................................................................... 42-11

V. POLICY RECOMMENDATIONS .................................................................................. 42-12

VI. IMPLEMENTATION AND EVALUATION ..................................................................... 42-19

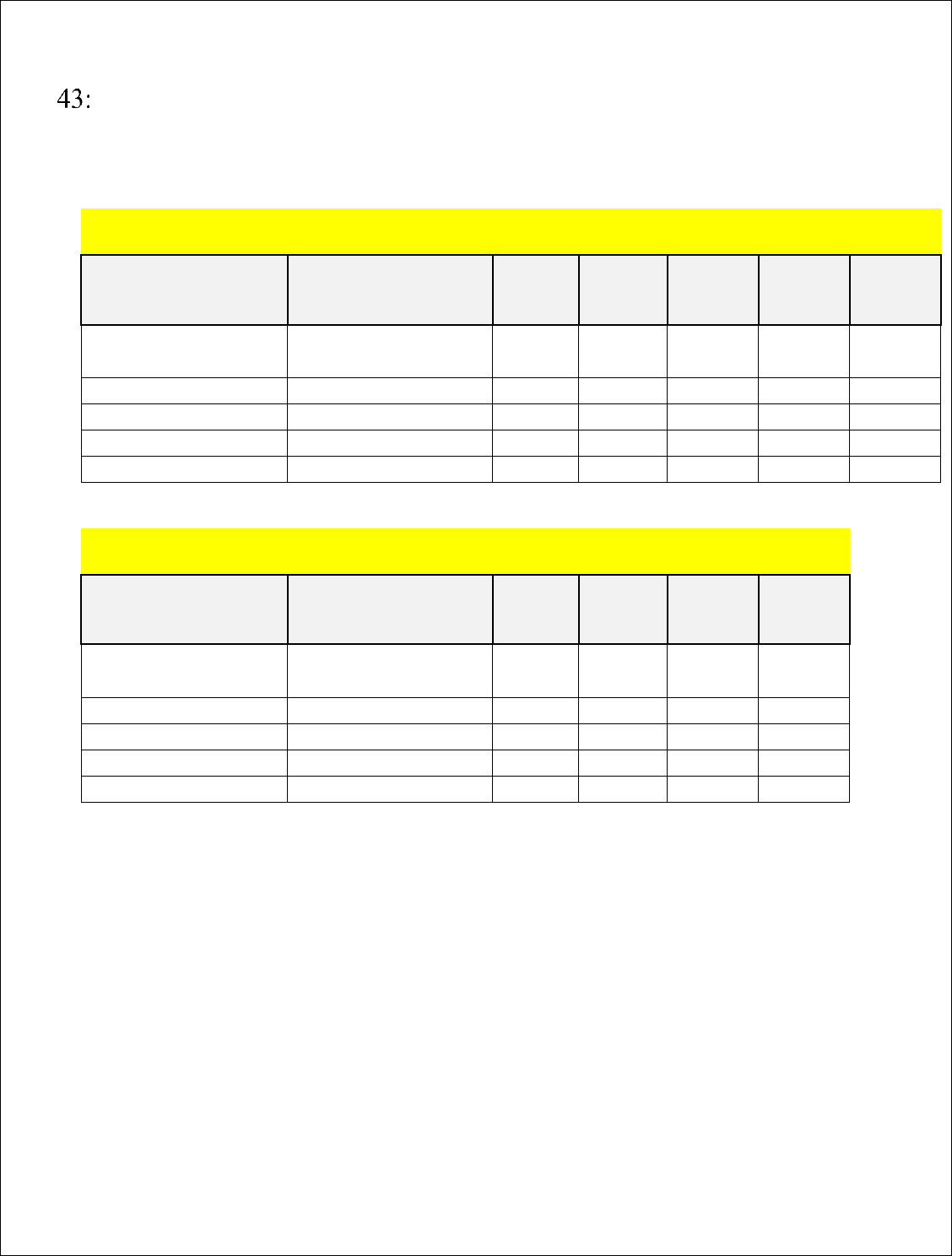

EXHIBIT S- ENERGY ASSISTANCE SUPPLEMENT TABLE ......................................... 43-1

EXHIBIT T- INCOME BAND TABLES ....................................................................... 44-1

Project-based Administrative Plan

1-1 3/17/2020

INTRODUCTION

THE KING COUNTY HOUSING AUTHORITY’S MOVING TO WORK

AGREEMENT

The US Department of Housing and Urban Development (HUD) has established a Moving to

Work Demonstration Program in which high-performing housing authorities, including the

King County Housing Authority (KCHA), have the opportunity to develop their own housing

programs and policies based on local needs and circumstances in lieu of the provisions of

the 1937 Housing Act. KCHA has established an MTW Agreement with HUD, under which

KCHA is authorized to develop a locally designed Section 8 Project-based Assistance

Program and Policy. KCHA’s Board of Commissioners adopted the “Project-based Assistance

Program Policy” on May 12, 2003 and an amendment that expanded upon this policy on

March 13, 2006. Subsequent minor revisions have been made and will continue to be made

as the program evolves.

Under the Project-based Assistance Program Policy, the Board of Commissioners

Assistance Program that outlines the administrative procedures for implementing the

policy. This Plan identifies the major Project-based Programs and outlines the procedures

for administering this funding, contracting with owners, and supporting applicants and

participants. The Plan is implemented by KCHA’s Section 8 Department, which also

administers the Housing Choice Voucher Program under a separate Administrative Plan.

The Section 8 Department will establish implementation goals for each of the Project-

based Programs in each of KCHA’s Annual MTW Plans. KCHA will annually evaluate the

outcomes of the Project-based Assistance Program against the goals and objectives

established in the policy and the annual implementation plans. These evaluations will be

included in KCHA’s Annual MTW Reports to HUD.

DESCRIPTION OF PROJECT-BASED ASSISTANCE

The term “Project-based” Assistance is used to distinguish this assistance from the “Tenant-

based” assistance provided under the Section 8 Housing Choice Voucher program. In the

Project-based Assistance Programs, the assistance is attached to the structure, rather than

to the tenant. The Project-based Assistance Program is designed to meet the housing needs

of low-income individuals not met by the Housing Choice Voucher program or other housing

programs in King County. Project-based Assistance is also used as an important tool in the

development of affordable housing. The formal and binding commitment of Project-based

Assistance to housing owners is made through either a Housing Assistance Payments (HAP)

Contract or an Agreement to enter into a HAP Contract (AHAP). During the term of the HAP

Contract, KCHA makes housing assistance payments to the Owner for units leased and

occupied by eligible Families.

Project-based Administrative Plan

1-2 3/17/2020

HOW PROJECT-BASED ASSISTANCE IS FUNDED

The Project-based Assistance program is funded with a portion of appropriated funding

(budget authority) under KCHA’s Housing Choice Voucher program Annual Contributions

Contract (ACC) with HUD. The Authority converts this funding into Project-based Assistance.

There is no special or additional funding for Project-based Assistance. HUD does not

allocate funding in the form of Project-based Assistance or provide any additional funding

for this purpose. KCHA is not required to administer a Project-based Assistance program.

KCHA is responsible for determining the amount of budget authority that is available for

Project-based Assistance and for ensuring that the amount of assistance that is attached to

each unit is within the amounts available under the ACC.

MAXIMUM RESOURCES DEDICATED TO PROJECT-BASED ASSISTANCE

Under its MTW agreement, KCHA will not be limited in the number of units assisted under

the Project-based program.

1

POLICY GOALS

The Project-based Assistance Program and Policy is designed to meet the following goals:

1. Increase the supply of the affordable housing stock in King County through the support

of new development.

2. Increase the level of affordability of existing affordable housing stock.

3. Preserve and revitalize existing affordable housing stock.

4. Increase housing choice for “special needs” Households by strengthening and expanding

the continuum of supportive housing programs in King County.

5. Focus on the needs of extremely low income Households.

6. Assist in deconcentration initiatives by replacing public housing units targeted for

demolition.

7. Reduce concentrations of subsidized households, especially families with children.

8. Enhance the opportunities for families to become economically self-sufficient.

9. Maximize coordination of Section 8 assistance, housing development and support

service resources.

1

Approved under MTW 4-11-12

Project-based Administrative Plan

1-3 3/17/2020

JURISDICTION RESTRICTIONS

2

KCHA reserves the right to enter into HAP Contracts or AHAPs with Owners in other Housing

Authorities’ jurisdictions subject to an inter-agency agreement with the other Housing

Authority.

MAXIMUM NUMBER OF PROJECT-BASED UNITS IN A DEVELOPMENT

3

Under its MTW Agreement, KCHA is not limited to the number of units to be assisted in a

development.

PROJECT-BASED ASSISTANCE PROGRAMS

4

Project-based Assistance will be allocated for a range of population groups and purposes

according to a number of individual Project-based Assistance Programs. These Programs

include both transitional and permanent housing for individuals and families with children

who may or may not need on-site support services. Because each of these Programs has

unique goals and target populations, specialized implementation procedures are identified

in this Administrative Plan for each Program as needed. The following is a list of Project-

based Programs:

1. PBA Supportive Housing Program

Permanent Supportive Housing:

Assistance will be made available for Project-basing to create or preserve service-

enriched permanent housing opportunities for homeless and/or disabled families and

individuals who need on-site support services. This model allows for a higher level of

on-site care for these households. Project-based assistance may include one-bedroom

units and group homes serving individuals, and larger bedroom units serving families.

Project-based assistance is competitively allocated in conjunction with service funding

to provide integrated housing and services. In some cases, tenant-based or sponsor-

based assistance may be reallocated as Project-based assistance to better serve the

needs of the identified special populations.

Transitional and Conditional Supportive Housing:

KCHA has attached 254 units of Project-based assistance to projects in private or KCHA-

owned buildings. KCHA transitional housing programs provide rental assistance in

support of the Sound Families Initiative in partnership with the Bill & Melinda Gates

Foundation to create new transitional housing units for families with minor children. As

2

Approved MTW Policy Section V.15

3

Approved MTW Policy Section V.3

4

Approved MTW Policy Section IV

Project-based Administrative Plan

1-4 3/17/2020

with Permanent Supportive Housing, housing with services are integrated. The focus is

on serving homeless families, primarily in two and three bedroom units. For graduates

of the transitional and conditional housing program, priority placement is given to

KCHA’s public housing.

2. PBA Local Program

KCHA will attach Project-base assistance in projects that require temporary or

permanent operating or rental Subsidies in order to continue to serve extremely low-

income households. This category provides subsidy funding to housing that was

originally funded without subsidies and is now at risk. The assistance preserves

affordable housing stock where cash flow is insufficient to maintain developments. It is

also used as a financing tool to revitalize physically distressed housing.

3. PBA Private Housing Program

KCHA will Project-base 459 replacement vouchers provided by HUD under the Park Lake

HOPE VI project in housing it owns/controls/finances, and in projects owned by

nonprofit organizations funded by A Regional Coalition for Housing or other government

funders. Project-based assistance replaces units lost through public housing

redevelopment and creates affordable units in low-poverty areas of King County.

4. PBA Public Housing Redevelopment Program

To replace or redevelop decommissioned Public Housing units while providing returning

residents a single subsidized housing program that mirrors the Public Housing it is

replacing, KCHA intends to supply subsidies to permanently replace housing that was

formerly Public Housing. KCHA may also temporarily use Project-based Assistance for

returning residents that need subsidies beyond the permanent cap. Project-based

Assistance will be removed from these temporarily Project-based units as families move

or income-graduate until the permanent number of contract units is reached.

KCHA’s Project-based Public Housing Redevelopment Program is designed to conform the

guidelines of Project-based Assistance and Public Housing into a “blended subsidy” in order

to create a common set of rules for program participants and administrators. Parts of this

blended program (generally those related to contracting) follow the Project-based

Assistance policies and procedures as outlined in this PBA Administrative Plan. Other parts

(generally those relating to operations) follow the Public Housing Admissions and Continued

Occupancy Policy (ACOP). This Administrative Plan notes where the Program defers to the

guidance of the ACOP.

Project-based Administrative Plan

1-5 3/17/2020

POTENTIAL PROJECT-BASED ASSISTANCE PROGRAMS

5

In addition to those Programs listed above, KCHA may also enter into other Project-based

contracts with owners for programs designated to address specific segments of the low

income special needs community such those listed below. This is a non-inclusive list and

additional programs may be added through changes to our MTW Annual Plan.

Demonstration Programs: KCHA reserves the right to provide Project-based assistance to a

limited number of housing projects that will serve an important public purpose, but may not

qualify under the Project-based Program’s policies.

King County’s Community Plan to End Homelessness: As a member of the Committee to

End Homelessness, KCHA reserves the right to identify new program Categories to further

the goals of the King County Plan to End Homelessness.

“Transition in Place”: If resources are available, KCHA may allocate up to 30 “transition in

place” vouchers to KCHA-subsidized Transitional Housing Programs on an annual basis.

BLOCK GRANT POLICIES

6

KCHA receives the majority of its Section 8 Housing Choice Voucher Funds in the form of a

block grant. KCHA may elect to assist in financing the acquisition or rehabilitation of

housing through a block grant to a housing owner, provided that such housing:

1. Furthers the goals set forth in the Project-based Assistance policy;

2. Meets threshold owner application criteria;

3. Is determined not to have excess public assistance as determined by a Subsidy Layering

Review;

4. Is made available to low income households under the eligibility criteria detailed in

KCHA’s admissions policies;

5. Will be dedicated to such use for a minimum of ten years;

6. Will serve at least the same number of tenants as the funding would have served under

the tenant-based program;

7. Has clearly defined program goals and measures of tenant success; and

5

Approved MTW Policy Section IV

6

Approved MTW Policy Section V.12

Project-based Administrative Plan

1-6 3/17/2020

8. KCHA may also adjust payment standards as appropriate to further the goals and

objectives of this policy for units subsidized through the block grant program.

Projects that are block granted are not required under MTW to attach assistance directly to

a specified number of contract units. The assistance may be provided to the overall project,

provided that the criteria above has been met and documented.

7

FAIR HOUSING

It is the policy of the King County Housing Authority to comply fully with all Federal, State and

local nondiscrimination laws; the Americans with Disabilities Act; and the U.S. Department of

Housing and Urban Development regulations governing Fair Housing and Equal Opportunity.

No person shall, on the grounds of race, color, sex, religion, national or ethnic origin, familial

status, sexual preference or disability be excluded from participation in, be denied the

benefits of, or be otherwise subjected to discrimination under KCHA programs.

To further its commitment to full compliance with applicable Civil Rights laws, KCHA will

provide Federal/State/local information to applicants and participants in the Section 8

Program regarding discrimination and any recourse available to them if they believe they may

be victims of discrimination. Such information will be made available with the application,

and all applicable Fair Housing Information and Discrimination Complaint Forms will be made

available at KCHA’s Section 8 office. In addition, all written information and advertisements

will contain the appropriate Equal Opportunity language and logo.

KCHA will assist any Household that believes they have suffered illegal discrimination by

providing them copies of the housing discrimination form. KCHA will also assist them in

completing the form, if requested, and will provide them with the address of the nearest

HUD Office of Fair Housing and Equal Opportunity.

ETHICAL STANDARDS

1. Conflict of Interest

In accordance with 24 CFR 982.161, neither KCHA nor any of its contractors or

subcontractors may enter into any contract or arrangement in connection with the

Project-based Programs in which any of the following classes of persons has any

interest, direct or indirect, during his or her tenure with KCHA or for one year

thereafter:

a. Any present or former member or officer of KCHA;

7

Approved MTW Policy Section V.11

Project-based Administrative Plan

1-7 3/17/2020

b. Any employee of KCHA or any contractor, subcontractor, or agent of KCHA who

formulates policy or who influences decisions with respect to the programs;

c. Any public official, member of a governing body, or State or local legislator who

exercises functions or responsibilities with respect to KCHA’s programs; or

d. Any member of Congress of the United States.

Any person described above must disclose their interest to KCHA. Exceptions to these

criteria include, but are not limited to, low-income residents of housing developments

contracted to receive Project-based Assistance who are a member of the Owner or

Service Provider’s Board of Directors.

2. Solicitation or Acceptance of Gifts

No Commissioner or KCHA employee may solicit any gift or consideration of any kind,

nor may any HA employee accept or receive a gift from any person who has an interest

in any matter proposed or pending before the HA.

KCHA Personnel policies should be consulted for more information on both Conflict of

Interest and Solicitation or Acceptance of Gifts.

3. Program Monitoring

In order to maintain the appropriate quality standards for the Section 8 and Project-

based Assistance Programs, KCHA will annually review files and records to determine if

the work documented in the files or records conforms to program requirements. A

supervisor or another qualified person other than the one originally responsible for the

work or someone subordinate to that person shall perform the monitoring.

CATASTROPHIC PLANNING

8

This policy details KCHA policies and procedures that are in place under normal day-to-day

operations. However, should a catastrophic event occur (i.e. severe flood, pandemic

sickness, etc.), KCHA may modify certain policies or procedures to help ensure health, safety

and/or security of residents, staff and the community. Changes may only be made upon

Executive Director declaration of an Emergency as a result of catastrophic event(s). At the

discretion of the Executive Director, modifications determined necessary may remain in

effect for up to 60 days following the end of the declared emergency to allow KCHA

operations to normalize. Examples of policy and procedure changes that could be

implemented include, but are not limited to, the following:

8

Approved under MTW 11/18/09

Project-based Administrative Plan

1-8 3/17/2020

1. Modified Office Hours:

In the event of a declared emergency, KCHA may limit office hours or close designated

offices to the public entirely as determined necessary by KCHA. In such instances, staff

will remain available to clients through phone and/or email. Information regarding

revised office hours – including anticipated length of the closure/modification and how

to contact KCHA staff with questions and/or concerns - will be clearly posted on all

office doors and in community areas, if appropriate. Information will also be distributed

to clients via email and direct delivery when KCHA determines such is available and

practical.

2. Modified Inspection process:

Recertification inspections scheduled during the catastrophic event may be extended

for an additional 12 months. However, upon notification of the delay, the participant

will be advised to report any necessary repairs that have not been addressed by the

owner. If the tenant reports a life threatening failure, the owner will be required to

abate or correct the condition immediately, per KCHA policy.

To help ensure client access to housing, tenant move-ins and new inspections will be

prioritized and completed as soon as possible (pending road closures or other obstacles

preventing immediate response).

3. Modified Review and Verification procedures:

In the event of a declared emergency, KCHA may modify client review schedules and/or

implement revised verification policies under the protocols listed above. For example,

should a catastrophic event occur, it may be difficult to verify tenant information

through normal documentation methods or complete reviews under the current

process. In such cases, reviews could be temporarily delayed, and verification processes

relaxed by weighting all forms of verification equally. A notation regarding any changes

authorized as a result of the Executive Director’s declaration will be noted in all affected

client files.

Project-based Administrative Plan

2-1 6/30/2022

DEFINITION OF TERMS

ACC Reserve Account: An account established by HUD from amounts by which the

maximum payment to the HA under the consolidated ACC during the HA fiscal year exceeds

the amount actually approved and paid. This account is used as the source of additional

payments for the program.

Admissions and Continued Occupancy Policy (ACOP). The plan that describes the HA

policies for the administration of KCHA Public Housing units.

Adequate Housing: The lack of adequate housing means:

• A Family is living in substandard or dilapidated housing; or

• A Family is homeless; or

• A Family is displaced by domestic violence; or

• A Family is living in an overcrowded unit.

Adjusted Annual Income:

9

Total Household Annual Income less the sum of total eligible

deductions for unreimbursed medical expenses, handicapped assistance expenses and/or

childcare expenses (as defined) which the household is determined to receive during the

recertification process and determination of tenant rent.

Adjusted Monthly Income: One-twelfth of Adjusted Income

Administrative Fee: Fee paid by HUD to the HA for administration of the program.

Administrative Fee Reserve: Account established by the HA from excess administrative fee

income. The administrative fee reserve can only be used for housing purposes.

Administrative Plan: The plan that describes HA policies for the administration of the

Section 8 Project-based programs.

Agreement to Enter into a HAP Contract (AHAP): A written contract between the HA and

the Owner in the form prescribed by HUD. The AHAP defines requirement for development

of housing to be assisted under the Project-based program.

Allowances:

10

Amounts deducted from the household’s gross annual income in

determining adjusted annual income (the income amount used in the rent calculation).

Under KCHA’s EASY Rent and WIN Rent programs, only allowances for medical expenses,

9

Approved MTW 11/1/10

10

Approved under MTW 11/1/10

Project-based Administrative Plan

2-2 6/30/2022

handicapped assistance expenses, and childcare expenses for children under 13 years of age

are allowed (as outlined in this plan).

Annual Contributions Contract (ACC): A written contract between HUD and a HA. Under

the contract HUD agrees to provide funding for operation of the program, and the HA

agrees to comply with HUD requirements of the program.

Annual Income: Annual income means all amounts, monetary or not, that: (1) go to (or on

behalf of) the Family head or spouse (even if temporarily absent) or to any other family

member, or (2) are anticipated to be received from a source outside the Family during the

12-month period following admission or recertification effective date, and (3) are not

specifically excluded from annual income (See Exhibit B).

Applicant (Applicant Family): A person or Family that has applied for admission to a

program, but is not yet a participant in the program.

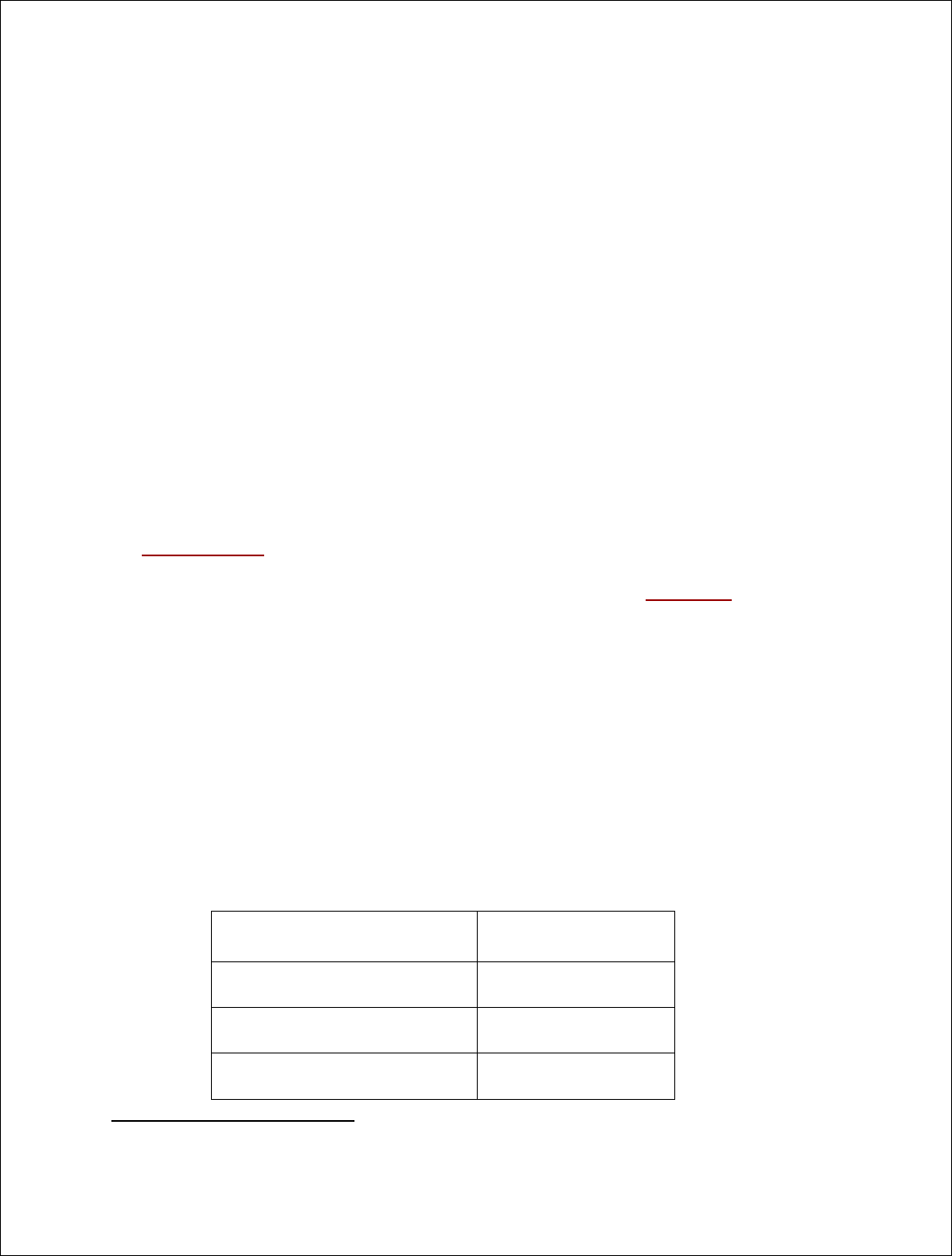

Child Care Deduction:

11

The amount allowed under KCHA’s WIN Rent program as a

reduction from Annual Income when child care expenses (as defined) are incurred by a

participating household. Households with income in excess of $75,000 and above are not

eligible for this deduction. A child care deduction is only provided when KCHA determines

no other adult in the household is available to provide care AND the amount paid (1) is not

reimbursed by another party or source; (2) is reasonable in relation to the time and hours

worked; (3) is not paid to a family member; (4) does not exceed the income received as a

result of the provision of the care. A Child Care Deduction may not be granted to a

household operating an in-home childcare facility in order to provide for the care of the

household’s own children. The actual amount of the deduction provided is established by

KCHA according to the following expense bands:

Eligible Child Care

Expenses Incurred

$ Amount of

Deduction

Below $2,500

$0

$2,500 - $4,999

$2,500

$5,000 – $7,499

$5,000

$7,500 - $9,999

$7,500

$10,000 or more

$10,000

See Section 21 and Exhibit C for additional information.

11

Approved under MTW 11/1/10

Project-based Administrative Plan

2-3 6/30/2022

Child Care Expenses:

12

(See Adjusted Income) The “out-of pocket” amount paid for (1)

the care of children in the household under 13 years of age and/or (2) attendant care

and auxiliary apparatus for a Handicapped or Disabled Family member. Under the WIN

Rent program, child care expenses must: (1) be necessary to enable a member of the

household to be gainfully employed or further his/her education; (2) not be reimbursed

by another party or source; (3) be reasonable in relation to the time and hours worked;

(4) not be paid to a family member; (5) not exceed the income received as a result of the

provision of the care.

Citizen: A citizen or national of the United States.

Consent Form: Any consent form approved by HUD to be signed by assistance

applicants and participants for the purpose of obtaining income information from

employers and SWICAs, return information from the Social Security Administration, and

return information for unearned income from the IRS. The consent forms may

authorize the collection of other information from assistance applicants or participants

to determine eligibility or level of benefits.

Contract Rent. The total amount of rent specified in the Housing Assistance Payments

Contract as payable by the HA and the Tenant to the Owner for an assisted unit.

Co-Tenant: An adult member of the Family household who is neither head nor spouse,

but who enters the lease jointly with the Head of Household. A Co-Tenant has the same

standing in the lease as would a spouse.

Dependent: A member of the Family household (excluding foster children and foster

adults) other than the Family head or spouse, who is under 18 years of age or is a

Person with disabilities. An unborn child shall not be counted as a Dependent except

when determining initial eligibility of a single pregnant woman without other children in

the household.

Domestic Violence: the term “domestic violence” will include domestic violence, dating

violence, sexual assault or stalking or the threat of physical violence against the resident

or member of the resident’s household, as defined under the Violence Against Women

and Department of Justice Reauthorization Act (VAWA) of 2013.

Dilapidated Housing Unit: For selection preference purposes, a housing unit is

considered dilapidated if it does not provide safe and adequate shelter, and in its

present condition endangers the health, safety, or well-being of a Family, or it has one

or more critical defects, or a combination of intermediate defects in sufficient number

or extent to require considerable repair or rebuilding. The defects may involve original

12

Approved under MTW 11/1/10

Project-based Administrative Plan

2-4 6/30/2022

construction, or they may result from continued neglect or lack of repair or from serious

damage to the structure.

Disability Assistance Expenses: Reasonable expenses that are anticipated during the

period for which Annual Income is computed, for attendant care and auxiliary apparatus

for a Disabled family member, and that are necessary to enable a family member

(excluding the Disabled member) to be employed, provided that the expenses are

neither paid to a member of the Family nor reimbursed by an outside source.

Disabled Family: A Family whose head (including co-head), spouse, or sole member is a

person with disabilities (see definition); or two or more persons with disabilities living

together; or one or more persons with disabilities living with one or more live-in aides.

Displaced Person or Family: For eligibility purposes, a Family in which each member, or

whose sole member, is displaced by governmental action, or whose dwelling has been

extensively damaged or destroyed as a result of a disaster declared or otherwise

formally recognized under Federal disaster relief laws.

Domicile. The legal residence of the household head or spouse as determined in

accordance with State and local law.

Drug-related Criminal Activity. The illegal manufacture, sale, distribution, or use of a

drug, or the possession of a drug with the intent to manufacture, sell, distribute or use

the drug. (As defined in section 102 of the Controlled Substances Act (21 U.S.C. 802).

Drug-trafficking: The illegal manufacture, sale or distribution, or the possession with

intent to manufacture, sell, or distribute, of a controlled substance (as defined in section

102 of the Controlled Substance Act (21 U.S.C. 802).

EASY Rent Program:

13

The rent calculation method applied by KCHA to EASY Rent

households (see definition). Under EASY Rent program rules, rent is calculated based

upon 28% of an eligible household’s adjusted gross income. Minimum rent paid by

eligible families is $0 per month, in accordance with the policies outlined in this Plan.

Households under the EASY Rent program undergo a full recertification of income and

program eligibility once every three (3) years. Unit inspections will still be performed

annually and update reviews will be performed on the off years.

EASY Rent Household:

14

Will be defined as:

A. A family in which (1) All adults in the household (excluding live-in attendants) are

Elderly or Disabled (as defined); and (2) have no source of income, or, at least 90%

of total household income is derived from a combination of the following fixed

13

Approved under MTW 11/1/10

14

Approved under MTW 11/1/10

Project-based Administrative Plan

2-5 6/30/2022

income sources: Social Security, SSI, Government Pension, Private or Public

Pensions, and/or GAU (DSHS general assistance grant). An EASY Rent Household

includes a household in which a dependent minor has turned eighteen (18) years of

age in between the established (3 year) recertification period; or

B. Any family living in, or applying for, a former Public Housing mixed population

building.

EASY Rent Households may also be referred to as a “fixed income” household in this

Plan as their income is typically from a fixed source such as Social Security or SSI.

EIV: Enterprise Income Verification system is a form of Up-front Income Verification

(UIV) used to verify and/or validate tenant reported (or unreported) income.

Elderly Person or Family: A Family whose head (including co-head) or spouse or sole

member is a person who is at least 62 years of age, or two or more persons who are at

least 62 years of age living together, or one or more of such persons living with a live-in

aide.

Eligible Immigration Status: An immigration status in one of the following categories:

1. A noncitizen lawfully admitted for permanent residence, as defined by Section

101(a)(20) of the Immigration and Nationality Act (INA), as an immigrant, as defined

by section 101(a)(15) of the INA (8 U.S.C. 1101(a)(20) and 1101(a)(15), respectively)

(immigrants). (This category includes a noncitizen admitted under section 210 or

210A of the INA (8 U.S.C. 1160 or 1161), (special agricultural worker), who has been

granted lawful temporary resident status);

2. A noncitizen who entered the United States before January 1, 1972, or such later

date as enacted by law, and has continuously maintained residence in the United

States since then, and who is not eligible for citizenship, but who is deemed to be

lawfully admitted for permanent residence as a result of an exercise of discretion by

the Attorney General under Section 249 of the INA (8 U.S.C. 1259);

3. A noncitizen who is lawfully present in the United States pursuant to an admission

under section 207 of the INA (8 U.S.C. 1157)(refugee status); pursuant to the grant

of asylum (which has not been terminated) under section 208 of the INA (8 U.S.C.

1158)(asylum status); or as a result of being granted conditional entry under Section

203(a)(7) of the INA (8 U.S.C. 1153(a)(7)) before April 1, 1980, because of

persecution or fear of persecution on account of race, religion, or political opinion or

because of being uprooted by catastrophic national calamity;

4. A noncitizen who is lawfully present in the United States as a result of an exercise of

discretion by the Attorney General for emergent reasons or reasons deemed strictly

Project-based Administrative Plan

2-6 6/30/2022

in the public interest under section 212(d)(5) of the INA (8 U.S.C. 1182(d)(5))(parole

status);

5. A noncitizen who is lawfully present in the United States as a result of the Attorney

General’s withholding deportation under section 234(h) of the INA (8 U.S.C.

1253(h))(threat to life or freedom); or

6. A noncitizen lawfully admitted for temporary or permanent residence under section

245A of the INA (8 U.S.C. 1255a)(amnesty granted under INA 245A).

Energy Assistance Supplement (EAS):

15

(Formerly known as Utility Allowance) The

amount provided by the Housing Authority as a reduction to the household’s Total

Tenant Payment, when the costs of utilities are the responsibility of the family

occupying the unit. As determined by the Housing Authority, the EAS is established

based upon the reasonable energy consumption of a reasonably conservative household

of modest means.

Tenants who reside in units for which all utilities are paid by the Landlord do not receive

an Energy Assistance Supplement.

Energy Supplement Reimbursement:

16

The amount, if any, by which the Energy

Assistance Supplement for the unit exceeds the Total Tenant Payment for the Family

occupying the unit. The amount of reimbursement may be limited by any Minimum

Rent policies established by the Housing Authority as outlined in this Plan.

Extremely Low-Income: Those families whose incomes do not exceed the higher of the

Federal poverty level or 30% of the median income for the area, as determined by the

Secretary with adjustments for smaller and larger families.

Fair Market Rent (FMR): FMRs are established by HUD for housing units of varying sizes

(number of bedrooms) and are published in the Federal Register annually.

Family:

17

Family includes, but is not limited to, the following, regardless of actual or

perceived sexual orientation, gender identity, or marital status. In all cases the Head of

Household must be at least 18 years of age, unless they have documented approval as

an Emancipated Minor pursuant to Washington State regulations (RCW 13.64.):

1. A group of two or more persons sharing residence whose income and resources are

available to meet the Family needs and who are either related by (1) Blood,

marriage, or operation of law (excluding custody of foster children), or; (2) who have

evidenced a stable family relationship.

15

Approved under MTW 11/1/10

16

Approved under MTW 11/1/10

17

Approved under MTW 7/21/08

Project-based Administrative Plan

2-7 6/30/2022

a. A group of "two or more persons" includes a single pregnant woman without

other children and individuals in the process of securing legal custody of a

dependent.

b. Members of the Family temporarily absent shall be included in the Family group.

To establish what constitutes a "temporary absence," the following clarification

is provided.

• A service member shall be classified as "temporarily absent" when away

from home due to military service. Therefore, each service member shall be

counted as part of the Family for purposes of qualifying as an eligible family

for admission or continued occupancy and for establishment of rent, but not

for determining size of unit required.

• If the Family claims a child as a family member, but does not have full

custody, or if the child lives only part time with the Family, it will be the sole

discretion of the HA as to whether to count the child as part of the Family.

• If the Family has a dependent away at school, the dependent may be

considered a member of the household if the dependent normally lives in the

household while not attending school.

• The HA may consider an absent child to be part of the Family if there is

evidence that the child would reside with the Family if the Family were

admitted to the HA's housing.

2. An Elderly Person or Family (as defined)

3. A Person with disabilities or Family (as defined)

4. A Remaining Member of a tenant family (as defined)

For purposes of determining initial eligibility a family must include at least one

household member who is disabled, elderly, or who qualifies as a dependent. Single-

persons (as defined: those who are not elderly, near-elderly or disabled) will not be

placed on the waiting list. However, such individuals may be considered eligible for

assistance and be placed on the waiting list for any specific targeted “set-aside”

program(s) established by the Housing Authority (such as programs to assist Chronically

Homeless individuals or youth transitioning out of foster care) for which they qualify.

Family Income: For purposes of qualifying for a Selection Preference, Family Income is

"Monthly Income".

Family Self-Sufficiency Program: (FSS) A program established to promote self-

sufficiency among participating families, including the coordination of "supportive

services" to these families (See Action Plan).

Project-based Administrative Plan

2-8 6/30/2022

Family Share: The portion of rent and utilities paid by the Family or the gross rent minus

the amount of the housing assistance payment.

Financial Assistance: Included in annual income is any financial assistance that a

student receives in excess of tuition and other required fees and charges (e.g., athletic

and academic scholarships) and that the student receives (1) under the Higher

Education Act, (2) from private sources, or (3) from an institution of higher education as

defined by the Higher Education Act of 1965 (See definition). Financial assistance does

not include loan proceeds.

1. Higher Education Act Assistance under the Higher Education Act of 1965 includes

Pell Grants, Federal Supplement Educational Opportunity Grants, Academic

Achievement Incentive Scholarships, and State Assistance under the Leveraging

Educational Assistance Partnership Program, the Robert G. Byrd Honors Scholarship

Program, and Federal Work Study programs.

2. Assistance from Private Sources is non-governmental sources of assistance, including

assistance that may be provided to a student from parent, guardian or other family

member, whether residing within the Family in the Section 8 assisted unit or not,

and from other persons not residing in the unit.

3. Assistance from an Institution of Higher Education requires reference to the

particular institution and the institution’s listing of financial assistance.

4. Loans Are Not Financial Assistance, and therefore, the loan programs cited in the

Higher Education Act of 1965 (the Perkins, Stafford and Plus loans) are not included

in the term “financial assistance” in determining student eligibility for Section 8

assistance.

Fixed Income Household: A Section 8 Family in which (1) All adults in the household

(excluding live-in attendants) are Elderly or Disabled (as defined); and (2) at least 90%

of total household income is derived from a fixed income source such as Social Security,

SSI, Government Pension, Private Pensions, and/or GAU (DSHS general assistance

grant). A Fixed Income Household includes a household in which a dependent minor

has turned eighteen (18) years of age in between the established (3 year) recertification

period.

18

Foster Care Payment: Payments to eligible households made by State, local, or private

agencies.

Full-time Student: A person who is carrying a subject load, which is considered full-time

for day students under the standards and practices of the educational institution

18

Approved under MTW 5/19/08

Project-based Administrative Plan

2-9 6/30/2022

attended. An educational institution includes a vocational school with a diploma or

certificate program, as well as an institution offering a college degree.

Gender Identity: The actual or perceived gender-related characteristics of a participant.

Gross Rent: The sum of the rent to an Owner, plus any utility allowance.

Handicapped Assistance Expenses: Reasonable expenses that are anticipated, during

the period for which Annual Income is computed, for attendant care or auxiliary

apparatus for a Handicapped or Disabled Family member, and that are necessary to

enable a Family member (including the Handicapped or Disabled member) to be

employed or to further his/her education, provided that the expenses are neither paid

to a member of the Family nor reimbursed by an outside source.

Head of the Household: The adult family member who is the head of the household for

purposes of determining income eligibility and rent and is held accountable for the

Family. A Head of Household must be 18 years of age or older, unless they have

documented approval as an Emancipated Minor pursuant to Washington State

regulations (RCW 13.64.).

Homeless Family: For selection preference purposes, an applicant is considered a

Homeless Family if they:

1. Lack a fixed, regular and adequate nighttime residence; AND

2. Have a primary nighttime residence that is:

a. Living outside (i.e., no fixed roof, in a park, in a tent, etc.);

b. Living in a temporary publicly or privately owned shelter; or

c. Living in an automobile or recreational vehicle.

3. Are a graduate from a KCHA funded sponsor-based program or are a graduate from

the Shelter Plus Care program.

A Homeless Family will also include an applicant living with family or friends in an

overcrowded situation (does not meet occupancy standards) AND who has been

approved for housing within a 90-day time period at a HA recognized transitional

housing program.

19

In targeted supportive housing voucher programs, a Homeless Family may also include a

Family at imminent risk of homelessness such as a Family with a pending eviction. An

alternate definition may be used based on individual targeted program requirements.

19

Approved under MTW 4/5/04

Project-based Administrative Plan

2-10 6/30/2022

As a general rule, a Homeless Family does not include any individual imprisoned or

otherwise detained pursuant to an Act of the Congress or a State law. However, in

targeted voucher programs that are designed to serve households discharged from jail

or prison, this portion of the definition will not apply. See Section 1 for an overview of

targeted voucher programs.

Housing Authority (HA): The King County Housing Authority, a public corporation.

Housing Assistance Payment (HAP): The monthly assistance payment by the HA, which

includes:

1. A payment to the Owner for rent to owner under the Family's lease; and

2. An additional payment to the Family if the total assistance payment exceeds the rent

to owner.

Housing Assistance Payments Contract (HAP Contract): A written contract between an

HA and an Owner, in which the HA agrees to make housing assistance payments to the

Owner on behalf of an eligible Family.

Housing Quality Standards (HQS): The minimum housing quality standards for housing

being assisted under the voucher program.

HUD: The U.S. Department of Housing and Urban Development.

Imputed Income: For households with net family assets of more than $50,000,

20

the

amount calculated by multiplying net family assets by a HUD-specified percentage. If

imputed income is more than actual income from assets, the imputed amount is used as

income from assets in determining annual income.

Imputed Welfare Income: The amount of annual income not actually received by a

Family, as a result of a specified welfare benefit reduction, that is nonetheless included

in the Family’s annual income for purposes of determining rent.

Income Category: Designates a Family’s income range. There are three categories: low

income, very low income, and extremely low income.

Income Limits: A schedule of incomes that do not exceed a percent of the median

income for the area as determined by HUD with adjustments for smaller or larger

Families, except that HUD may establish income limits higher or lower on the basis of its

findings that such variations are necessary because of the prevailing levels of

construction costs, unusually high or low incomes, or other factors (See Exhibit D).

20

Approved under MTW 5/14/07

Project-based Administrative Plan

2-11 6/30/2022

Independent Student: For the purpose of determining the Section 8 eligibility of a

student who is seeking assistance separately from their parents, a student will be

considered independent if they meet the definition laid out by the U.S. Department of

Education in the Higher Education Act of 1965 as amended, 20 U.S.C 1087vv(d).

Initial Lease Term: The initial term of the assisted lease. The initial lease term must be

for at least one year unless the HA, at its sole discretion, determines there is good cause

for a term shorter than 12 months.

Institution of Higher Education: Shall have the meaning given this term in the Higher

Education Act of 1965 in 20 U.S.C. 1001 and 1002.

1. Institution of higher education means an educational institution in any State that:

a. Admits as regular students only persons having a certificate of graduation from a

school providing secondary education, or the recognized equivalent of such a

certificate;

b. Is legally authorized within such State to provide a program of education beyond

secondary education;

c. Provides an educational program for which the institution awards a bachelor’s

degree or provides not less than a 2-year program that is acceptable for full

credit toward such a degree;

d. Is a public or other nonprofit institution;

e. Is accredited by a nationally recognized accrediting agency or association, or if

not so accredited, is an institution that has been granted preaccreditation status

by such an agency or association that has been recognized by the Secretary for

the granting of preaccreditation status, and the Secretary has determined that

there is satisfactory assurance that the institution will meet the accreditation

standards of such an agency or association within a reasonable time; and

2. Institution of higher education also includes:

a. Any school that provides not less than a 1-year program of training to prepare

students for gainful employment in a recognized occupation and that meets the

provision of paragraphs (a), (b), (d), and (e) of subsection (1), above, and

b. A public or nonprofit private educational institution in any State that, in lieu of

the requirement in subsection (1)(a) above, admits as regular students persons

who are beyond the age of compulsory school attendance in the State in which

the institution is located.

Project-based Administrative Plan

2-12 6/30/2022

Interim (examination) Recertification: A reexamination of family income, expenses,

and household composition conducted between the regular recertifications when a

change in a household's circumstances warrants such a reexamination.

King County Housing Authority (KCHA) Managed Properties. Properties managed by

KCHA’ s Property Management department.

Lease: A written agreement between an Owner and a tenant for the leasing of a

dwelling unit to the tenant. The lease establishes the conditions for occupancy of the

dwelling unit by a Family with housing assistance payments under a HAP Contract

between the Owner and the HA.

Lease Addendum: In the lease between the tenant and the Owner, the lease language

required by HUD.

Live-in Aide: A person who resides with one or more elderly persons, or near elderly

persons, or persons with a disability, and who: (1) is determined to be essential to the

care and well-being of the person; (2) is not obligated for the support of the person; and

would not be living in the unit except to provide the necessary supportive services. (See

Exhibit G.M.7.)

Local Preference: A preference for admission as described in Section 13 of the

Administrative Plan.

Low-income Family: A Family whose Annual Income does not exceed 80% of the

median income for the area, as determined by HUD with adjustments for smaller and

larger families.

Medical Deduction:

21

The amount allowed under KCHA’s EASY Rent program as a

reduction from Annual Income when medical expenses (as defined) are incurred by a

participating household. Households with income of $75,000 and above are not eligible

for this deduction. The actual amount of the deduction provided is established by KCHA

according to the following expense bands:

Eligible Medical

Expenses Incurred

$ Amount of

Deduction

Below $2,500

$0

$2,500 - $4,999

$2,500

$5,000 – $7,499

$5,000

21

Approved under MTW 11/1/10

Project-based Administrative Plan

2-13 6/30/2022

$7,500 - $9,999

$7,500

$10,000 or more

$10,000

Under KCHA’s Hardship Policy, a WIN Rent Household may qualify for a Medical

Deduction only when it can be demonstrated that the household’s childcare and

medical costs, and calculated Total Tenant Payment (Rent + Energy Assistance

Supplement) results in the household facing an “extraordinary cost of living”.

Medical Expenses:

22

The “out-of-pocket” amount paid by a household for (1) the

medical care of elderly and disabled household members and/or (2) attendant care or

auxiliary apparatus for a Handicapped or Disabled Family member that are necessary to

enable a Family member to be employed or further his/her education. The total

attendant and auxiliary costs included under this category must (1) be reasonable in

relation to the time and hours worked; (2) not be paid to a family member; (3) not

exceed the income received as a result of the provision of the care. Claimed expenses