February 2020 1

Georgie Cosh

February 2020

GLA Housing and Land

Housing Research Note 4

Short-term and holiday letting in London

February 2020 2

Copyright

Greater London Authority

February 2020

Published by:

Greater London Authority

City Hall

The Queen’s Walk

More London

London SE1 2AA

www.london.gov.uk

enquiries 020 7983 4100

minicom 020 7983 4458

Cover image by James Gleeson

Copies of this report are available from https://data.london.gov.uk/housing

Feedback on this report or suggestions for improvements are welcomed and should be sent to

Acknowledgements

The main source of evidence for this report is data produced by Murray Cox at Inside Airbnb,

whose assistance is gratefully acknowledged.

Thanks also go to London boroughs who have contributed evidence to this report, including

Camden, Kensington and Chelsea, Southwark, Tower Hamlets, and Westminster.

February 2020 3

Executive Summary

Short-term letting is a flexible type of short-term accommodation that is popular with tourists

and holiday makers across the world. Properties in London can be booked from a single-night

stay up to a maximum of 90 nights in a calendar year without planning permission. The

platform most commonly used to book a short-term stay in London is Airbnb, but it is by no

means the only one.

There are recognisable economic benefits to short-term lettings and, generally speaking,

Londoners are of the opinion that short-term letting is good for London. However, there are

signs that short-term letting platforms are becoming increasingly commercialised and there are

concerns that removing housing supply from the market to offer it for short-term letting could

be exacerbating London’s housing shortage.

The purpose of this research note is to examine the limited data available on the supply and

characteristics of the short-term and holiday lettings market in London. The research considers

the number and type of listings across London; the estimated occupancy of listings; and the

average price per night. It also examines who the providers and the consumers of short-term

lettings are in London.

Airbnb and other short-term letting platforms do not publish data on listings, but several

technology companies have extracted data from the information available online. Inside Airbnb

provides data scraped from the Airbnb website, including the availability calendar and number

of reviews for individual listings. However, the measure of most significance – nights stayed or

occupancy – is not available and must be estimated. The occupancy model used for the purpose

of this research therefore makes assumptions about the review rate, length of stay and

occupancy rate, to provide a modelled estimate of the occupancy of an Airbnb listing.

The key findings from the analysis of the Inside Airbnb data are set out below:

• The number of Airbnb listings in London more than quadrupled in four years, growing in

all boroughs and for each listing type. While Inner London accounted for the largest

increase in numeric terms, the number of Airbnb listings recorded in Outer London

increased fifteenfold between 2015 and 2019.

• A total of 48,100 short-term lettings were actively listed on Airbnb in May 2019, 79%

of which were in Inner London

1

. 59% of actively listed short-term lettings were entire

homes / apartments and 41% were private rooms.

• The majority of the hosts identified within the Inside Airbnb data (84%) had just one

active listing linked to their unique ID. However, there were 280 hosts (1% of the total)

1

For the purpose of this research, an active listing is defined as a listing that was reviewed in the previous twelve

months, while a listing that was not reviewed in the previous twelve months is defined as inactive. Most of the

analysis within this report focuses on active listings.

February 2020 4

with more than ten property listings linked to their ID and these ‘super-hosts’ managed

15% of the active short-term lettings listed in London.

• The majority of actively listed Airbnb properties (77%) were estimated to be occupied

for under 90 nights in the year. However, the model used in this study suggests a

significant number of listings were occupied for more than 90 nights as of May 2019.

Half of the listings estimated to be occupied for over 90 nights in the year were in just

five Inner London boroughs: Camden, Kensington and Chelsea, Southwark, Tower

Hamlets and Westminster.

• The mean average price of an Airbnb stay in London was £109 per night, which is more

than the equivalent nightly rent paid for an open market rent tenancy.

In addition to the Inside Airbnb data, the GLA has obtained data from the London Borough of

Camden, which used technology from Talk&Code to monitor the activity of short-term lettings

in Camden across five platforms between April 2019 and June 2019. This data suggests the

extent of short-term letting in London is far greater than can be determined using Inside Airbnb

data alone. When data from multiple platforms is combined, a high proportion of the listings

monitored were unavailable for the entire 90 nights monitored. This could reflect instances

when the listing has been booked and occupied for use as a short-term letting, but also when a

host has blocked the listing from receiving bookings.

However, London boroughs report numerous challenges to monitoring short-term letting

activity over time for enforcement purposes. Evidence of borough monitoring and enforcement

activities, gathered from London boroughs where the number of short-term lettings is greatest,

suggests this is partly due to a lack of resource and is compounded by a lack of available data.

Some platforms have implemented caps on bookings in London above 90 nights. However, caps

on individual platforms alone are not enough. Clear and co-ordinated data on short-term

letting, over time and across platforms, is needed to fully understand the extent of home

sharing in London.

Alongside London Councils and Airbnb, the Mayor is calling on Government to introduce a

statutory registration system for short-term lettings in London. This would require hosts to

register their property before renting it and would give councils a more effective means of

monitoring short-term letting within their borough.

February 2020 5

Contents

Executive Summary ..................................................................................................................... 3

1. Background ......................................................................................................................... 6

2. Methodology ..................................................................................................................... 11

3. What is the extent of short-term lettings in London? ........................................................ 14

4. Who is in the market for short-term lettings in London? ................................................... 17

5. What is the occupancy of short-term lettings in London? ................................................. 19

6. What is the value of short-term lettings in London? .......................................................... 21

7. Borough monitoring and enforcement activities ................................................................ 24

8. Conclusions ........................................................................................................................ 27

Appendix 1: Total number of short-term rental properties listed in London (by borough) ........ 29

Appendix 2: Number and type of active short-term rental properties (by borough) .................. 30

Appendix 3: Average price per night of active short-term rental properties (by borough) ........ 31

Tables and Figures

Table 1: Number of entire homes listed on Airbnb relative to dwelling stock

Table 2: Number of hosts with one or more active Airbnb listings linked to their unique host ID

and number of listings owned/managed by those hosts

Table 3: Estimated occupancy of active Airbnb listings in London

Table 4: Number of hosts with one or more active Airbnb listings linked to their host ID that

have an estimated occupancy rate of over 90 nights

Table 5: Mean average nightly price of active Airbnb listings in Inner London and Outer London

Table 6: Comparison of the mean average nightly revenue from an Airbnb listing in London and

an open market rent tenancy

Table 7: Short-term letting enforcement in five London boroughs, 2015 to 2019

Figure 1: Do you think short-term letting is generally good or generally bad for London?

Figure 2: What is the impact of short-term letting in London?

Figure 3: Number of Airbnb listings in London boroughs, April 2015 to May 2019

Figure 4: Type of short-term lettings in London listed on Airbnb

Figure 5: Number of active Airbnb listings in London, May 2019

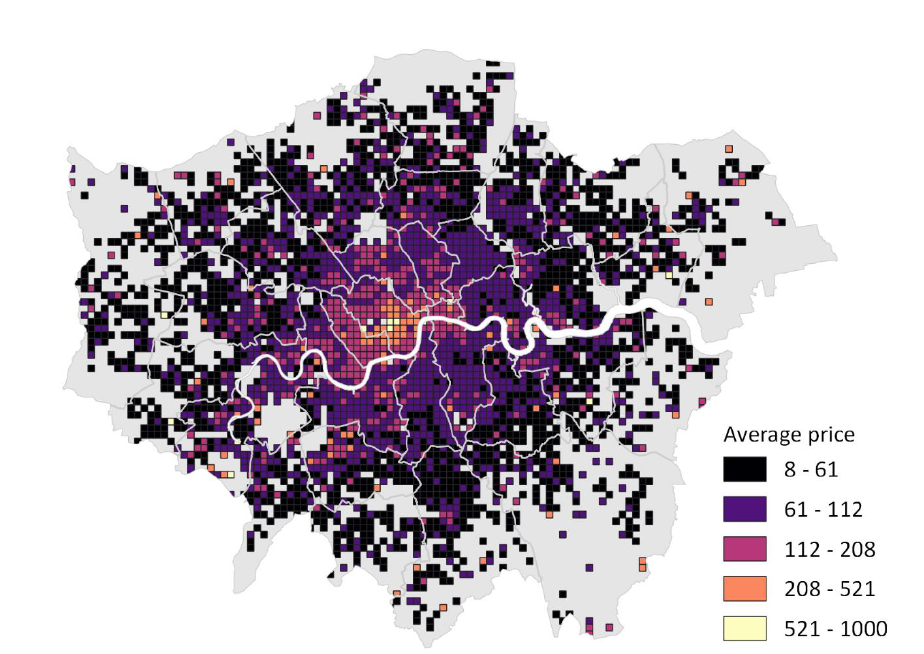

Figure 6: Average nightly price of active Airbnb listings in London, May 2019

Figure 7: Entire home listings in Camden, April 2019 to June 2019

February 2020 6

1. Background

Market overview

1.1. The most common platform used to book a short-term let stay in London is Airbnb,

which started in 2008 in San Francisco. While Airbnb is the platform most commonly

used to book a short-term let stay in London, it is by no means the only one. Other

popular platforms for short-term letting include Booking.com, TripAdvisor and

HomeAway. The number of short-term lettings listed in London varies day to day, but

Airbnb is the largest platform in London, accounting for up to 65% of the market.

i

1.2. The benefits of home sharing for London are clear: hosts receive additional income,

which helps with the cost of living; better use can be made of under-occupied housing;

and parts of London benefit from tourists who might not visit them ordinarily.

University College London (UCL)

ii

and London First

iii

have attempted to quantify the

benefits to cities of short-term lettings. London First estimate that increasing annual

international tourism by 10% in the “halo zone” where 70% of international Airbnb

guests stay, would add £268m to London’s economy and create six thousand jobs.

1.3. However, in London and in cities across the world, there are growing concerns about the

negative impacts of short-term letting. Primarily these concerns relate to the loss of

housing stock from the rental market. A survey by the Residential Landlords Association

found that 7% of London landlords had let a property on a short-term letting platform

rather than in the private rented sector

iv

. Given London’s housing crisis and the already

squeezed rental market, removing supply from the private rented sector is worrying for

policy makers and residents alike.

1.4. In addition, residents living in areas with high concentrations of short-term lettings

complain about the impact on amenity, community and safety caused by the high

turnover of visiting guests. This can have material impacts such as noise and anti-social

behaviour as well as less tangible impacts like a loss of sense of community. In addition,

this rise in short-stay visitors limits local authorities’ ability to plan effectively for

services such as rubbish collection, the need for which is significantly increased by

short-stay visitors.

1.5. As a result of these negative impacts, many cities around the world have sought to

restrict short-term letting in order to counter the potential negative effects and allow

them to plan more effectively for city services.

The legal position

1.6. In England, residential homes are classified under the Town and Country Planning (Use

Classes) Order 1987 (as amended) as C3 (dwelling houses).

1.7. In London, the Deregulation Act 2015 relaxed rules on planning permission in London

to make it easier for individuals to become ‘hosts’. It enabled Londoners to lawfully let

February 2020 7

their home on a short-term basis for up to 90 nights a year without seeking planning

permission, provided they meet certain requirements. The Government’s explanatory

note clarifies this policy is aimed at benefitting residents, not providing opportunities

for the commercial sector

v

.

1.8. The Deregulation Act introduced a new section 25A to the Greater London Council

(General Powers) Act 1973, which states that, in London, the use of residential premises

as temporary sleeping accommodation does not involve a material change of use

requiring planning permission if:

• the total number of nights that the residential premises is used as temporary

sleeping accommodation (short-term letting) does not add up to more than 90

nights in a calendar year (1 January to 31 December); and

• the person(s) providing the accommodation is liable to pay Council Tax (not

business rates) in respect of the premises where the accommodation is provided.

1.9. Any C3 residential property used for short-term lettings for more than 90 nights in a

calendar year must have planning permission from the local council in which it is based.

The use class for a short-term let over 90-nights would need to be determined by the

local authority, depending on the precise nature of the use. The use is likely to be

determined as either a C1 (hotel) use or a Sui Generis use

2

.

1.10. There is currently some inconsistency in interpretation of the legislation between

London boroughs and platform providers as to whether the 90-night cap applies to the

short-term letting of rooms as well as entire homes.

1.11. Hosts that let their property as holiday accommodation are obliged to follow health and

safety legislation, including fire safety requirements, and the common areas of a

communal building are subject to the Regulatory Reform (Fire Safety) Order 2005.

1.12. Tenants and leaseholders are may be required to obtain written consent from their

landlord or mortgage lender to sublet their property, either the entire property and/or

rooms within the property. It is also often a term of the lease or mortgage that the

household occupies the property as their only or main residence. Hosts must also make

sure that their insurance is not invalidated by short-term letting.

1.13. Exceeding the 90-night limit in London can result in local authorities taking planning

enforcement action. Further information on the work London boroughs are doing to

monitor and enforce against short-term lettings is covered in Chapter 7 of this report.

2

Serviced apartments are classified in the C1 (hotels) Use Class which includes hotels, boarding and guest houses

where no significant element of care is provided. Generally, serviced apartments are purpose-built and offer

services, such as cleaning, as part of the upfront cost of renting. There is no cap on the number of nights a

serviced apartment in C1 planning use can be rented out in a year.

February 2020 8

1.14. The definition of a short-term let and the laws governing short-term lettings vary across

the UK and other international cities. The GLA’s website provides further general

guidance on short-term and holiday lettings in London.

The policy position

1.15. The past ten years has seen a series of Government interventions to support the sharing

economy. The rent-a-room allowance was increased to £7,500 in 2015, offering higher

tax-free profit to those renting out space in their homes. In March 2016, two further

£1,000 tax allowances were introduced for property and trading income.

1.16. Relative to other international cities, the Mayor of London has little direct control over

short-term letting. Policy H9 Ensuring the best use of stock of the Intend to Publish

version of the London Plan (published December 2019) reiterates that it is unlawful for

homes in London to be used as short-term holiday rented accommodation for a

cumulative period of more than 90 nights a year without planning permission.

1.17. In response to calls by the Mayor, Airbnb introduced a cap on its website in 2017, which

automatically makes entire home listings unavailable when the 90-night limit is reached.

Presently, two other platforms (HomeAway and TripAdvisor) have also implemented a

cap. The Mayor is continuing to encourage other platforms to implement a cap on

bookings above 90 nights, except in designated C1 hotels and serviced apartments.

1.18. However, hosts (and professional management companies) can bypass the cap by

relisting properties with different addresses or photos, to avoid algorithms designed to

detect duplicates. Hosts also can advertise listings on multiple platforms and there is no

co-ordinated system to monitor listings across multiple platforms. Platforms are not

currently required to report the number of properties that exceed the 90-night limit.

1.19. The Mayor has called on Government to introduce a registration system for short-term

lettings in London. On April 23 2019, the Mayor sent a letter to the Secretary of State

for Housing, Communities and Local Government, co-signed by Airbnb and six Inner

London boroughs with high numbers of short-term lettings

3

. The letter calls for the

Government to require anyone who rents out a property as a short-term letting to

register their property. This would allow local authorities to keep track of the number of

short-term lettings within their area and effectively enforce the current 90-night limit.

Public perceptions

1.20. Using polling data collected by the GLA and YouGov, we can examine how the public

perceives short-term letting in London. A total of 1,141 adults living in London were

surveyed online between 15 and 18 April 2019

vi

.

3

Signatories to the letter were: Mayor of London; Airbnb; Westminster City Council; Royal Borough of Kensington

and Chelsea; London Borough of Tower Hamlets; London Borough of Hackney; London Borough of Camden;

London Borough of Islington; and London Councils.

February 2020 9

1.21. Generally speaking, respondents thought that short-term letting is acceptable. 78% of

respondents thought short-term letting is acceptable when a person goes away and

lettings their property out. When asked if short-term letting is acceptable when a

business rents out one or more properties they own, 60% respondents thought it was

acceptable, but 40% thought it was not acceptable or responded that they didn’t know.

1.22. Londoners were asked if they felt short-term letting is generally good or generally bad

for London. 43% of people surveyed thought that short-term letting is generally good

for London, compared to 14% who thought it is generally bad. A large proportion of

respondents (42%) were either unsure or thought that it makes no real difference:

1.23. Londoners were less positive when asked whether they thought short-term letting has a

positive or negative effect on a range of specific issues. They were four times more

likely to say that short-term letting has a negative impact on the local sense of

community than a positive impact. They were twice as likely to say it has a negative

impact on the availability of housing to rent than a positive impact:

43%

14%

17%

26%

Generally good

Generally bad

Don’t know

No real difference

Figure 1: Do you think short

-

term

letting in London is generally

good or generally bad

for London?

Source: YouGov poll, April 2019

11%

16%

7%

11%

10%

48%

36%

32%

41%

49%

34%

29%

33%

36%

33%

21%

40%

8%

20%

16%

18%

19%

15%

15%

Cost of buying or renting a house

Availability of housing to rent

Noise, rubbish and upkeep of local area

Safety in the local area

Local sense of community

Local economy

Figure 2: What is the impact short-term letting in London has on:

Positive No real difference Negative

Don’t know

Source: YouGov poll, April 2019

February 2020 10

1.24. The only category in which Londoners thought the impact of short-term letting is more

positive than negative was the impact on the local economy. 46% of respondents

thought that short-term letting had a positive effect on the local economy compared to

just 8% who thought it had a negative effect.

1.25. When asked what their biggest concern about short-term lettings was, the two concerns

cited most often by Londoners were anti-social behaviour and the impact on the cost of

buying or renting a house in London. Concerns with anti-social behaviour were cited

more often by respondents aged over 50; whereas, concerns over the impact of the cost

of housing were cited by respondents aged 18-49.

1.26. Concerns over landlords renting their properties out for longer than allowed scored low

across all demographics, which is partly explained by the fact that only 17% of

Londoners surveyed were aware of the 90-night rule on short-term lettings in London.

This lack of understanding of the law is likely to have implications for compliance.

February 2020 11

2. Methodology

Overview of methodology

2.1. To examine the characteristics of the short-term lettings market in London, this report

primarily analyses listings of properties and rooms in London on the Airbnb website.

Airbnb and other platforms do not publish data on listings, but several technology

companies and activists have extracted data from the information available online.

2.2. The data presented within this report was scraped from the Airbnb website on 5 May

2019 by Inside Airbnb, an independent and non-commercial website. Inside Airbnb

previously scraped data from Airbnb on 18 separate dates from April 2015, enabling an

analysis of trends over time.

2.3. The data scraped by Inside Airbnb includes the availability calendar for 365 nights in the

future and the reviews for each listing. Data is verified, cleansed, analysed, and

aggregated by Inside Airbnb.

2.4. The Inside Airbnb data enables analysis of the number and type of listings across

London; the average price per night; and limited information on the property host.

Inside Airbnb data limitations

2.5. Listings can be added to and removed from the Airbnb platform; therefore, listings that

were available on 5 May 2019 may not exist now. The data presented for any point in

time is a snapshot of listings available at that date only.

2.6. Not all properties listed on the Airbnb platform are ‘active’. For instance, one third of

Airbnb listings in London in May 2019 had zero availability over the next 365 nights,

which can occur when a listing is either completely inactive or completely booked out.

In addition, 22 properties were available for £0 per night, which can occur when a listing

is created by a host, but that listing is not available to rent. Most of the analysis within

this report focuses on active listings, which is defined as listings that have been

reviewed within the past year.

2.7. Listings can be duplicated on Airbnb if multiple rooms in a single home are listed

separately. Listings can also be duplicated across other short-term lettings platforms.

Airbnb provides unique property and host IDs; however, these are not the same across

other platforms such as Booking.com and TripAdvisor. For this reason, it is challenging

to monitor listings appearing on multiple platforms. Chapter 7 analyses data across

multiple platforms from one London borough.

2.8. Airbnb provides geographic coordinates to help identify individual listings however, to

protect privacy, the accuracy of the coordinates can only be guaranteed to 150 metres.

In addition, limited information is available on the hosts and host IDs cannot be verified,

making monitoring and enforcement a challenge.

February 2020 12

The occupancy model

2.9. Although Inside Airbnb provides data on availability, it does not differentiate between a

booked night and an unavailable night. Booked nights are simply viewed as unavailable.

Therefore, available nights are only those that have not been booked, and looking at

availability alone might understate the true usage of short-term lettings in London.

2.10. The measure that is of most significance – nights stayed or occupancy – is not available

and therefore has to be estimated. To estimate the occupancy of individual listings,

Inside Airbnb and other international cities have used a model termed the "San

Francisco Model”, which is as follows:

• A review rate of 50% is used to convert the average number of reviews per month

to estimated bookings per year. The actual review rate is unverifiable with the

information available publicly on Airbnb. Other sources have adopted review rates

ranging from 30.5%

vii

to 72%

viii

. This paper adopts a 50% review rate, which sits

almost exactly between 30.5% and 72%.

• An average length of stay is assumed and this, multiplied by the estimated number

of bookings per year, gives the estimated occupancy. The average length of stay

assumed within this report was taken from the London First study, which gave a

figure of 5.3 nights based on the average length of stay for international guests

using Airbnb accommodation in London. If a listing has a higher minimum nights

value than the average length of stay, the minimum nights value was used instead.

• The occupancy per year is capped at 70% or 255 nights per year, based on the

Inside Airbnb assumption and reflecting a relatively high but reasonable occupancy

rate for a highly-occupied hotel. Consultants including HVS

ix

, PWC

x

and CBRE

xi

estimate that the hotel occupancy rate for London in 2018/19 could be higher at

between 77% and 92%.

• The estimated number of nights booked per year can then be compared against

London's short-term rental limit of 90 nights.

2.11. The occupancy model relies on variable assumptions to estimate the number of nights

stayed at individual Airbnb listings in London. The model uses Airbnb data only and

does not look at short-term letting activity across other platforms, so listings duplicated

on multiple platforms are not captured. In addition, the assumptions adopted within the

model, such as the review rate and occupancy cap, are cautious. Therefore, the

occupancy model provides a conservative estimate of the extent of short-term letting

activity across London.

2.12. It must be stressed that these are modelled estimates of the occupancy of an Airbnb

listing in a year, rather than actual operational data. Few entire home listings in London

should be exceeding the 90-night limit on Airbnb, or any other platform that has

implemented a cap, with the exception of hotels and serviced apartments (C1 use class).

February 2020 13

Other short-term letting platforms

2.13. While Airbnb is the platform most commonly used to book a short-term stay in London,

and the platform for which scraped data for London is most readily available, it is by no

means the only one.

2.14. In conjunction with the London Borough of Camden, the GLA has obtained data from

Talk&Code over 90 nights from April to June 2019. For this period, Talk&Code

monitored the activity of short-term lettings in Camden across five platforms: Airbnb,

HomeAway, TripAdvisor, Niumba, and HouseTrip.

2.15. A detailed borough case study, using data from Talk&Code, is included in Chapter 7 of

this research note. Using data scraping technology, Talk&Code can provide an insight

into the proportion of short-term lettings in London that are listed across various

platforms and provide an estimate of the number of nights a listing is unavailable.

2.16. A shortcoming of the Talk&Code data is that an unavailable night is simply viewed as a

booked night and, therefore, the data does not recognise instances where a host has

blocked the listing from receiving bookings. A further shortcoming of this data is that it

does not pick up where listings are duplicated across the platforms. Talk&Code

estimates that approximately 30% of listings it identifies are found on more than one

platform. For these reasons, the total number of listings identified may be overstated.

2.17. In addition, the GLA has engaged with enforcement officers from across the five

London boroughs where short-term letting is most prevalent, to gain an understanding

of the enforcement activities London boroughs are undertaking and their effectiveness.

February 2020 14

3. What is the extent of short-term lettings in London?

Number of short-term lettings

3.1. A total of 80,770 short-term lettings in London were listed on the Airbnb website in

May 2019. The total number of listings in London has more than quadrupled in four

years, increasing from 18,440 in April 2015.

3.2. The number of listings has grown in all boroughs and among each listing type over this

period. Westminster had the biggest increase, with 6,640 additional listings recorded.

The number of listings increased by over 3,000 in Camden, Hackney, Islington,

Kensington and Chelsea, Southwark, Tower Hamlets and Wandsworth.

3.3. While Inner London accounted for the largest increase in numeric terms, the number of

Airbnb listings recorded in Outer London increased fifteenfold between 2015 and 2019.

Of the Outer London boroughs, an additional 2,230 listings were recorded in Brent and

at least 1,000 additional listings were recorded in Barnet, Croydon, Ealing, Greenwich,

Merton, Richmond upon Thames and Waltham Forest.

3.4. A table showing the total number of short-term rental properties listed in each borough,

at snapshots between 2015 and 2019, is provided at Appendix 1.

3.5. The chart below shows how the number of properties listed on Airbnb has grown in

each borough over the last four years:

Figure 3: Number of Airbnb listings in London boroughs, April 2015 to May 2019

February 2020 15

3.6. The number of entire homes listed on Airbnb in London was equivalent to 1.2% of the

total dwelling stock in December 2019. A comparison of the Airbnb 'market share' in

five international cities is provided in Table 1 below.

Table 1: Number of entire homes listed on Airbnb relative to dwelling stock

London

Paris

New York

Tokyo

Berlin

Entire homes listed on

Airbnb as of 2 Dec 2019

42,760

51,980

25,300

6,460

10,720

Latest available estimate

of dwelling stock

3,556,160

1,366,440

3,497,340

7,671,600

1,916,520

Entire home listings as

% of dwelling stock

1.2%

3.8%

0.7%

0.1%

0.6%

3.7. The number of entire home listings as a proportion of the total dwelling stock was

highest in Westminster (5.4%), Kensington and Chelsea (5.3%), Camden (3.6%) and

Tower Hamlets (3.2%). In eleven boroughs the number of entire homes listed on Airbnb

was greater than the London Plan annual housing supply target for that borough

4

.

Type of short-term lettings

3.8. Short-term lettings properties on the Airbnb website can be listed as entire homes /

apartments, private rooms and shared rooms. In May 2019, entire homes accounted for

the largest proportion of Airbnb properties in London (56% or 45,070 properties).

3.9. The proportion of short-term lettings that were listed as entire homes / apartments

increased slightly over the past four years. However, the balance of property types has

not changed significantly, as shown in Figure 4 below.

4

London Plan 2016 Policy 3.3: increasing housing supply puts the annual average housing supply monitoring

target at 42,389 homes in total across London.

Figure 4: Type of short-term lettings in London listed on Airbnb

52%

52%

50%

53%

56%

46%

46%

48%

46%

43%

0%

20%

40%

60%

80%

100%

2015 2016 2017 2018 2019

Entire home / apartment Private room Shared room

February 2020 16

Active short-term lettings

3.10. Of the 80,770 short-term lettings in London listed on Airbnb, 40% had not been

reviewed within the past year and can therefore be considered ‘inactive’. By removing

inactive listings, the number of Airbnb listings in London falls to 48,100.

3.11. Of the 48,100 ‘active’ listings, 79% of properties listed were in Inner London and 21%

were in Outer London (as defined by ONS). Westminster had the highest number of

active listings at 5,850, followed by Tower Hamlets and Camden at 4,700 and 3,630

respectively. Other boroughs with over 2,000 listings include Hackney, Hammersmith

and Fulham, Islington, Kensington and Chelsea, Lambeth, Southwark and Wandsworth.

3.12. Of the active listings, 59% or 28,160 were listed as entire homes / apartments (a

slightly higher proportion than for all listings); 41% or 19,570 were listed as private

rooms; and 1% or 365 were listed as shared rooms. Inner London had a higher

proportion of homes listed as entire homes / apartments (63%) and Outer London had

a higher proportion of homes listed as private rooms (56%).

3.13. A table setting out the number and type of active short-term rental properties listed in

each borough on the Airbnb website in May 2019 is provided at Appendix 2.

3.14. The map below identifies the location of active Airbnb listings in London and highlights

hotspots in central London around Shoreditch, West End, Bayswater and Earls Court.

Figure 5: Number of active Airbnb listings in London, May 2019

February 2020 17

4. Who is in the market for short-term lettings in London?

Who are the hosts?

4.1. There were 31,930 unique host IDs recorded on the Airbnb website for the active short-

term lettings properties listed in London. As a mean average, each host had 1.5 listings

on Airbnb that could be linked to their unique ID.

4.2. Most of the hosts identified within the Airbnb data – 84% or 26,670 hosts – had just

one active listing linked to their unique ID. A further 10% of hosts, equivalent to 3,200

hosts, had two active properties listed on Airbnb. Together, these hosts

owned/managed 69% of the properties listed in London on Airbnb.

4.3. In October 2018, there were 45,980 homes in London recorded as second homes,

around 1.3% of the total housing stock

5

. Only a very small proportion of homeowners,

therefore, own more than two properties in London, so it is reasonable to assume that

most of the hosts linked to more than two listings manage them on a commercial basis.

4.4. 2.8% of hosts, or 890 hosts, had three active properties listed on Airbnb; and a further

2.8%, or 890 hosts, had between four and ten active properties listed. These hosts

managed 16% of the active properties listed in London on Airbnb.

4.5. 0.9% of hosts, or 280 hosts, had more than ten property listings linked to their unique

ID. However, these ‘super-hosts’ managed 15% or 7,440 of the active short-term

lettings listed in London on Airbnb. One super-host was linked to 820 listings alone.

4.6. Table 2 below identifies the number of hosts with one or more Airbnb listings linked to

their unique host ID and the number of properties owned/managed by those hosts:

Table 2: Number of hosts with one or more active Airbnb listing linked to their

unique host ID and number of listings owned/managed by those hosts

No. listings linked

to host ID

Number of

hosts

Number of

listings

% of listings

owned/managed

1

26,670

26,670

55%

2

3,200

6,410

13%

3

890

2,660

6%

4 to 10

890

4,930

10%

11 to 50

260

5,120

11%

51 to 100

15

960

2%

101 to 200

4

540

1%

200 or more

1

820

2%

Total

31,930

48,110

100%

5

MHCLG Council Taxbase 2018, Table 4.

February 2020 18

4.7. Airbnb does not identify when a host is a company. However, further research into the

Inside Airbnb data on these super-hosts reveals that a significant proportion of listings

in London were managed by commercial entities as opposed to individuals. These

businesses offer a range of services including property management, short and

medium/long-term letting agency, and guest experience supervision.

4.8. Often listings can be traced back to websites for commercial organisations where

increased revenue (compared with standard open market rents) is cited as a benefit to

renting a property short-term. Few of these managing agents’ websites inform hosts of

the 90-night limit. In February 2019, a BBC Inside Out investigation found that some

property management companies were actively encouraging lettings beyond the limit

xii

.

A recent investigation by The Times uncovered the rise of short-term let management

companies further

xiii

.

4.9. Hosts with multiple listings primarily have their properties located in Inner London

boroughs. Westminster had the highest number of active listings linked to hosts with

multiple properties at 2,660 listings, followed by Tower Hamlets at 2,060. Camden,

Hackney, Hammersmith and Fulham, Islington, Kensington and Chelsea, Lambeth,

Southwark and Wandsworth each had over 1,000 listings linked to hosts with multiple

properties.

Who are the guests?

4.10. According to the UK Insights Report by Airbnb, London received 2.2 million guests

travelling with Airbnb between July 2017 and June 2018. The UK Insights Report

estimates that guests contributed £1.3 billion to the London economy over that time.

4.11. The London First study gives a median age of 33 for Airbnb guests in London between

January and December 2017. The ‘youngest’ borough for stays was Redbridge with a

median age of 29. The ‘oldest’ boroughs were Richmond Upon Thames and Kingston

Upon Thames with a median age of 42 and 41, respectively.

4.12. According to London First, the country with the largest number of Airbnb guests in

London was the USA with 365,200 guests in 2017, followed by France with 217,100

guests in the same year. Europe is the largest market for short-term lettings in London

with 530,600 guests coming from just six European countries in 2017.

February 2020 19

5. What is the occupancy of short-term lettings in London?

Estimated occupancy of active short-term lettings

5.1. The occupancy model outlined in Section 2 of this research note provides a tool to

estimate the average number of nights an Airbnb listing is rented out in a year. Based

on the output of the occupancy model, the typical actively listed short-term let in

London was estimated to be occupied for 62 nights in a year. The mean average

occupancy was below 90 nights in all boroughs.

5.2. The majority of active Airbnb listings (77%) were estimated to be occupied for between

1 and 90 nights in the year. However, 23% or 11,200 listings were estimated, using the

occupancy model, to have an occupancy rate of over 90 nights in the year.

5.3. Table 3 sets out the estimated occupancy rate per annum of the active short-term

lettings in London listed on Airbnb in May 2019.

Table 3: Estimated occupancy of active Airbnb listings in London

Occupancy

rate (nights)

Number of

listings

Percentage of

listings

1 or 2

350

1%

3 to 30

17,140

36%

31 to 90

19,420

40%

91 or more

11,200

23%

Total

48,110

100%

5.4. Again, it should be noted that these are modelled estimates, based on applying a range

of assumptions around occupancy. In addition, the planning use class of individual

listings has not been verified, so the sample may include a small number of listings that

are classed as C1 hotels or serviced apartments.

Listings estimated to have an occupancy rate over 90 nights

5.5. Of the 11,200 active listings that were estimated by the occupancy model to have an

occupancy rate of over 90 nights in the year, as at May 2019, the average estimated

occupancy was 145 nights in the year.

5.6. Of the listings that were estimated to be occupied for over 90 nights in the year, 55% or

6,140 were listed as entire homes and 45% or 5,000 were listed as private rooms.

5.7. There were 8,480 unique host IDs recorded for the 11,200 active short-term lettings

that were estimated to be occupied for over 90 nights in the year. Most of these hosts –

88% or 7,480 hosts – had just one listing linked to their unique ID that was estimated

to be occupied for over 90 nights in the year.

February 2020 20

5.8. However, 415 hosts had more than two listings linked to their host ID that were

estimated to be occupied for over 90 nights in the year. This figure is 20% of the total

number of hosts with more than two active listings. These 415 hosts managed 23% of

the active listings estimated to be occupied for over 90 nights in the year.

5.9. Table 4 below identifies the number of hosts with Airbnb listings estimated to be

occupied for over 90 nights in the year and the number of listings managed by those

hosts which were estimated to be occupied for over 90 nights.

Table 4: Number of hosts with one or more active Airbnb listing linked to their

host ID that have an estimated occupancy rate of over 90 nights

No. listings linked

to host ID

Number of

hosts

Number of

listings*

% of listings

owned/managed

1

7,480

7,480

67%

2

580

1,155

10%

3

170

520

5%

4 to 10

199

1,095

10%

11 to 50

45

740

7%

51 to 100

-

-

-

101 to 200

-

-

-

200 or more

1

210

2%

Total

8,480

11,200

* Number of entire home and private room listings estimated by the occupancy model

to have an occupancy rate of over 90 nights in the year, as of May 2019.

5.10. Of the 11,200 active listings that were estimated to be occupied for over 90 nights,

50% were located in just five boroughs: Camden, Kensington and Chelsea, Southwark,

Tower Hamlets and Westminster. Although the majority (84%) of active listings

estimated to have an occupancy rate over 90 nights were in Inner London, there were

listings in all boroughs that were estimated to have an occupancy rate over 90 nights.

5.11. The work being done by London boroughs to monitor and enforce short-term lettings is

examined further in Chapter 7 of this report.

February 2020 21

6. What is the value of short-term lettings in London?

Average price per night of active short-term lettings

6.1. To calculate the average price per night of actively listed short-term lettings in London,

22 outlier listings were removed from the sample, including 14 listings advertised for £0

per night and eight listings advertised for over £5,000 per night.

6.2. The mean average price of an Airbnb stay was £109 per night across the actively listed

short-term lettings in London. The mean average price increased by 5% in four years,

increasing from £103 per night in April 2015. For comparison, ONS estimates that open

market rents in London increased by 6% over the same period

xiv

.

6.3. The mean average price for an entire home in London, listed on Airbnb, was £149 per

night, versus £52 per night for a private room. The mean price for a shared room was

£70, which is high because of a small number of shared room listings in higher value

areas skewing the results. A table setting out the mean average price per night of

actively listed short-term rental properties in each borough is provided at Appendix 3.

6.4. The median price of an Airbnb stay in London was £81 per night. The median price for

an entire home was £120 per night and £42 per night for a private room. The median

price for a shared room was £25 per night.

6.5. The map below shows the mean average price per night for actively listed Airbnb

properties in each borough, as reported by Inside Airbnb.

Figure 6: Average nightly price of active Airbnb listings in London, May 2019

February 2020 22

6.6. Generally speaking, Inner London boroughs had more expensive listings than Outer

London boroughs. The mean average price per night for an active listing in Inner

London was £118 compared to £73 for a night in Outer London. The price per night

varies depending on listing typology, as shown in Table 5 below.

Table 5: Mean average nightly price of active Airbnb listings in Inner London

and Outer London

Region

Entire home

/ apartment

Private room

Shared room

All listing

types

Inner London

£155

£55

£79

£118

Outer London

£113

£43

£38

£73

London

£149

£52

£70

£109

6.7. For comparison, PWC, in its March 2019 UK hotels forecast, estimates that the mean

average daily rate for a hotel room in London is approximately £150 per night.

Total revenue for hosts

6.8. To assess the total revenue of hosts, we have compared the mean average price per

night for all active short-term lettings listed on Airbnb with the Valuation Office Agency

(VOA) mean monthly rent in London. Using these price points as a benchmark for the

short-term letting and private rented markets, respectively, we have assessed the

potential gross revenue for hosts and landlords over different rental periods.

Table 6: Comparison of the mean average nightly revenue from an Airbnb

listing in London and an open market rent tenancy

Price

benchmark

Rental period

per annum

Revenue per

night

Revenue per

month*

Revenue per

annum

VOA (mean)

365 nights

£58

£1,730

£20,710

STL (mean)

62 nights

£109

£563

£6,760

STL (mean)

90 nights

£109

£818

£9,810

STL (mean)

190 nights

£109

£1,730

£20,710

* Revenue per calendar month assuming the maximum rental period per annum is

spread evenly in each calendar month.

6.9. As demonstrated in Table 6 above, an open market rent tenancy is significantly more

lucrative than a short-term let rented within the legal limit of 90 nights. Therefore,

assuming the 90-night limit is enforced, there is little financial incentive for the average

Airbnb host to take their property out of the long-term rental market (where this is the

alternative).

6.10. However, if hosts exceed the 90-night limit, rewards for short-term letting can outweigh

those from an open market rent tenancy. Based on the output of the occupancy model,

February 2020 23

at a rental period of 190 nights or six months and above, the potential gross revenue

from short-term lettings (before deductions for management and depreciation) would

be greater than from an open market rent tenancy.

6.11. According to the UK Insights Report by Airbnb, the total income earned by local

households in London through Airbnb amounted to £342 million between July 2017

and June 2018, with the median annual earning for a typical host equal to £2,600

xv

. By

comparison, the annual earning estimated using the median rent and median length of

stay calculated through the occupancy model is £3,700.

February 2020 24

7. Borough monitoring and enforcement activities

Camden case study

7.1. In conjunction with the London Borough of Camden, the GLA has obtained data from

Talk&Code over 90 nights from April to June 2019. For this period, Talk&Code

monitored the activity of short-term lettings in Camden across five platforms: Airbnb,

HomeAway, TripAdvisor, Niumba, and HouseTrip.

7.2. A total of 8,160 listings were identified in Camden. Airbnb was by far the largest of the

short-term letting platforms monitored, accounting for 64% of the listings monitored by

Talk&Code over the period. There were 5,190 properties in Camden listed on Airbnb

over the three-month period. This figure is higher than the number of active listings

identified by the GLA from the Inside Airbnb data, which may be explained by the

different methodologies and time periods adopted.

7.3. 17% of the entire home listings identified by Talk&Code were unavailable for the entire

90 nights monitored. As highlighted in paragraph 2.16, this could reflect instances when

the listing has been booked and occupied for use as a short-term letting, but also when

a host has blocked the listing from receiving bookings.

7.4. The heat map in Figure 7 identifies the location of the entire homes in Camden that

were unavailable on short-term letting platforms for over 90 nights between April to

June 2019. The map shows hot spots around Hatton Garden and Farringdon, but also

highlights that this issue is across the borough and not limited to central London.

Figure 7: Entire home listings in Camden, April 2019 to June 2019

February 2020 25

7.5. If entire homes that were unavailable for 61 or more nights within the 90 nights

monitored are considered to be at risk, on the basis that they will exceed the 90-night

limit if they are let at the rate indicated by the Talk&Code data, the proportion of entire

home listings at risk of being in breach of the 90-night limit increases to 56%.

7.6. If entire homes that were unavailable for 41 or more nights within the 90 nights

monitored are considered to be at risk, the proportion of entire home listings at risk of

being in breach of the 90-night limit increases to 69%.

Other enforcement activities

7.7. The GLA has spoken with enforcement officers from London boroughs where the

number of short-term lettings is greatest – that is Camden, Kensington and Chelsea,

Southwark, Tower Hamlets and Westminster – to gain an understanding of the

enforcement activities that London boroughs are undertaking.

7.8. The five boroughs report that they have received very few planning applications for

change of use for short-term letting. In addition, there have been no approvals for

change of use for short-term letting, where the original use was residential.

7.9. The five boroughs also report that they have received numerous complaints related to

short-term letting activity. Westminster reported 194 complaints associated with short-

term letting in one year alone, relating to noise, waste and anti-social behaviour.

7.10. There were a number of planning contravention notices and, subsequently, enforcement

notices served within these five boroughs between January 2015 and June 2019, as set

out in Table 7

6

. However, the number of notices served is low compared to the number

of active listings estimated to be let for more than 90 nights. In addition, these five

boroughs reported no successful prosecutions in relation to short-term lettings.

Table 7: Short-term letting enforcement in five boroughs, 2015 to 2019

Borough

Planning

Contravention

Notices served

Enforcement

Notices served

Successful

prosecutions

Camden

21

9

0

Kensington and Chelsea

66

15

0

Southwark

-

42

0

Tower Hamlets

52

23

0

Westminster

462

24

0

7.11. These figures highlight the challenges of monitoring short-term lettings. Consolidated

data on properties that are listed for short-term letting is not available and, even if it

6

An enforcement notice cannot be served until the local authority is sure there is a breach of planning control,

which can be difficult to evidence. Guidance on enforcement and post-permission matters is provided by MHCLG.

February 2020 26

was, boroughs report that it is challenging to match online listings with actual properties

for enforcement purposes. While short-term letting platforms show an approximate

location, this is not sufficient to identify an exact property or person, especially in areas

with high numbers of flats. For these reasons, monitoring of short-term lettings can be

extremely labour intensive.

7.12. Local authorities report spending an increasing amount of time on enforcement of

short-term lettings, as the number of properties has grown in London, despite no

associated increase in resource following the introduction of the Deregulation Act 2015.

The process for taking action against unlawful letting can be time consuming, given the

evidence required to support such cases, and can still result in a limited number of

successful prosecutions.

7.13. The approach to tackling short-term letting varies between local authorities and there is

little collaboration or co-ordination at a pan-London level.

Camden short-term letting taskforce

Boroughs such as Camden have set up systems to co-ordinate information on short-term lettings

across teams. The Camden short-term lettings taskforce comprises four enforcement officers

who, in addition to their existing caseload, monitor short-term lettings. The taskforce meets

quarterly with a cross-council group comprising officers from environmental health (who monitor

reports of parties/noise linked to short-term letting); housing (who pass on complaints received,

including those relating to council tenants); and officers from waste services and council tax.

Camden is proposing a new approach to short-term letting for 2020, with pilots in small areas.

The objectives of these area-based pilots include:

• Publicity and education – educate people on the 90 night regulation and encourage

residents to report issues to the team. This will involve attending Tenant’s and Resident’s

Association meetings to communicate Camden’s approach to and actions on short-term

lettings to residents.

• Engagement – work with local resident groups and councillors to look at ways to tackle

the issues associated with short-term lettings and encourage participation in witness

statements to add to the evidence base.

• Proactive data – use data from Talk&Code to pinpoint properties and take action,

rather than relying on complaints made to the Council. This is only feasible in a small

area, due to limited resources.

• Collaboration with other services – engage with teams across the Council and within

the short-term lettings taskforce.

• Timely action – aim to collate evidence quickly to enable action to be taken as soon as

possible after 90 nights are exceeded.

• Review – regular reviews to determine the success of the pilot.

February 2020 27

8. Conclusions

8.1. Short-term letting is a flexible type of short-term accommodation that is popular with

tourists and holiday makers across the world. Properties in London can be booked from

a single-night stay up to a maximum of 90 nights in a calendar year without planning

permission.

8.2. There are recognisable economic benefits to short-term lettings, in terms of both tourist

spending and job creation. London First estimate that increasing annual international

tourism by 10% in London’s ‘halo zone’ where 70% of international Airbnb guests stay,

would add £268m to the city’s economy and create six thousand jobs.

8.3. Generally speaking, Londoners are of the opinion that short-term letting is good for the

capital and is acceptable when a person goes away and lets their property out. However,

Londoners thought that short-term letting had a negative impact on the local sense of

community, the availability of housing to rent, and the cost of buying or renting a

house.

8.4. Short-term letting was originally intended as a way for individual homeowners to rent

their property or rooms in their property, to supplement their income and meet

travellers from around the world. When introducing the Deregulation Act 2015, the

current law governing short-term lettings in London, the Government noted that the

intention of this legal framework was to benefit individual residents.

8.5. However, there are signs that short-term letting platforms are becoming increasingly

commercialised and used by property investment companies and landlords to rent

properties that would otherwise be available to long-term residents. There are concerns

that removing housing supply from the mainstream market to provide for short-term

letting could exacerbate London’s housing crisis.

8.6. The most common platform used to book a short-term let stay in London is Airbnb,

accounting for up to 65% of the market. The total number of Airbnb listings in London

more than quadrupled in four years, growing in all boroughs and among each listing

type. A total of 48,110 ‘active’ short-term lettings were listed on Airbnb in May 2019,

79% of which were listed in Inner London. 59% of actively listed short-term lettings

were entire homes / apartments and 41% were private rooms.

8.7. The majority of the hosts identified within the Airbnb data (84%) had just one active

listing linked to their unique ID. However, 280 hosts (0.9%) had more than ten property

listings linked to their unique ID and these super-hosts managed 15% of the active

short-term lettings listed in London. One super-host was linked to 820 listings alone.

This commercialisation of short-term lettings appears to be contrary to the original

intention of Government policy and legislation in this area.

8.8. The majority of actively listed Airbnb properties (77%) were estimated to be occupied

for under 90 nights in the year. However, there is evidence to suggest a significant

number of properties may have an occupancy rate of above 90 nights: 11,200 listings

February 2020 28

were estimated by the occupancy model to have an occupancy rate of over 90 nights in

the year, as at May 2019. 50% of the listings estimated to be occupied for over 90

nights were in just five Inner London boroughs: Camden, Kensington and Chelsea,

Southwark, Tower Hamlets and Westminster.

8.9. With the average price of an Airbnb stay at £109 per night, the potential revenue from

short-term lettings is greater than from an open market rent tenancy, creating a

financial incentive for hosts to exceed the 90-night limit. Until there is appropriate

regulation of short-term lettings in London, this activity is likely to continue to grow.

8.10. The occupancy model makes assumptions about the review rate, length of stay and

occupancy rate, to provide a modelled estimate of the occupancy of an Airbnb listing.

As such, the model cannot provide definitive evidence of the occupancy of short-term

lettings in London. Actual operational data is not available on the number of nights that

properties listed on Airbnb (and other home sharing platforms) are occupied.

8.11. Data obtained from the London Borough of Camden suggests the extent of short-term

letting is far greater than can be determined using Inside Airbnb data alone. When data

from multiple platforms is combined, a high proportion of the homes monitored were

unavailable for the entire 90 nights monitored.

8.12. Local authorities are tasked with planning enforcement in their boroughs, but they have

struggled to monitor and enforce against unlawful short-term letting practice. This is

partly due to a lack of resource and is compounded by a lack of available data. Local

authorities must be adequately resourced and supported to ensure they are able to

properly enforce the provisions of the Deregulation Act 2015, to hold hosts to account

where they are in breach of the 90-day rule or otherwise do not act in accordance with

the regulatory requirements governing short-term letting in the UK.

8.13. Some platforms have implemented caps on bookings in London above 90 nights.

However, caps on individual platforms alone are not enough. Clear and co-ordinated

data on short-term letting, over time and across platforms, is needed to fully

understand the extent of home sharing in London.

8.14. The Mayor announced his support for a statutory registration system in April 2019.

Alongside London Councils and Airbnb, the Mayor is calling on Government to

introduce a statutory registration system for short-term lettings in London. This system

would require hosts to register their property before renting it and would give councils a

more effective means of monitoring short-term letting within their borough.

8.15. Further ways to support borough enforcement activities could include providing clarity

on the planning laws governing the Use Class of short-term letting; increasing

awareness of the 90-night limit and associated legal obligations for hosts; implementing

caps on individual home sharing platforms; and supporting boroughs’ internal and pan-

London engagement.

February 2020 29

Appendix 1: total number of short-term rental properties listed in each borough at

snapshots between 2015 and 2019

7

Borough

2015

(Apr)

2016

(Feb)

2017

(Mar)

2018

(May)

2019

(May)

Barking and Dagenham

7

38

142

177

315

Barnet

65

285

1,012

1,283

1,534

Bexley

5

55

115

185

242

Brent

146

585

1,609

2,027

2,375

Bromley

36

171

391

521

651

Camden

1,400

2,241

3,761

4,815

5,685

City of London

120

231

306

414

436

Croydon

63

206

553

813

1,067

Ealing

192

509

1,003

1,389

1,599

Enfield

43

116

301

485

587

Greenwich

116

452

917

1,322

1,591

Hackney

2,225

3,440

4,688

5,602

5,950

Hammersmith and Fulham

1,048

1,862

2,806

3,591

4,043

Haringey

222

507

1,493

1,868

2,077

Harrow

15

152

266

391

451

Havering

-

15

99

144

219

Hillingdon

29

87

277

422

586

Hounslow

70

429

647

840

998

Islington

1,695

2,592

3,583

4,349

4,948

Kensington and Chelsea

1,552

2,562

3,476

4,919

5,723

Kingston upon Thames

38

187

316

440

526

Lambeth

1,428

2,299

3,276

4,175

4,678

Lewisham

615

864

1,502

1,934

2,246

Merton

113

402

820

1,114

1,326

Newham

198

655

1,151

1,671

1,889

Redbridge

30

151

383

520

646

Richmond upon Thames

100

489

872

1,048

1,147

Southwark

1,151

2,123

3,359

4,256

4,751

Sutton

-

53

147

193

259

Tower Hamlets

2,237

3,916

5,613

6,947

7,752

Waltham Forest

79

286

911

1,109

1,326

Wandsworth

977

1,702

2,748

3,535

4,082

Westminster

2,421

4,053

5,361

7,387

9,062

Total

18,436

33,715

53,904

69,886

80,767

7

The date at which the data is scraped from Airbnb varies between years but, in each case, is based on a snapshot

from the first or second quarter of that year. Aside from a general upward trend, there is little seasonal variation.

February 2020 30

Appendix 2: number and type of actively listed short-term rental properties in each

borough on the Airbnb website on 5 May 2019

Borough

Entire

home/apt.

Private

room

Shared

room

Total

Barking and Dagenham

52

96

3

151

Barnet

348

462

8

818

Bexley

35

81

-

116

Brent

667

723

38

1,428

Bromley

159

196

1

356

Camden

2,444

1,139

42

3,625

City of London

237

32

1

270

Croydon

233

356

2

591

Ealing

419

528

2

949

Enfield

120

184

1

305

Greenwich

482

493

6

981

Hackney

1,903

1,328

12

3,243

Hammersmith and Fulham

1,563

901

14

2,478

Haringey

521

612

9

1,142

Harrow

83

160

1

244

Havering

48

70

1

119

Hillingdon

107

249

3

359

Hounslow

242

328

2

572

Islington

1,887

1,001

11

2,899

Kensington and Chelsea

2,873

575

11

3,459

Kingston upon Thames

112

203

-

315

Lambeth

1,490

1,357

24

2,871

Lewisham

532

688

19

1,239

Merton

302

360

7

669

Newham

464

637

32

1,133

Redbridge

111

261

1

373

Richmond upon Thames

324

332

-

656

Southwark

1,711

1,191

41

2,943

Sutton

51

110

-

161

Tower Hamlets

2,499

2,174

28

4,701

Waltham Forest

375

386

4

765

Wandsworth

1,272

1,034

4

2,310

Westminster

4,490

1,327

37

5,854

Total

28,156

19,574

365

48,095

February 2020 31

Appendix 3: Mean average price per night of actively listed short-term rental

properties in each borough on the Airbnb website on 5 May 2019

To calculate the average price per night of actively listed short-term lettings in London, 22

outlier listings were removed from the sample. In addition, averages based on less than five

listings have been removed from the summary table below.

Borough

Entire

home/apt.

Private

room

Shared

room

Total

Barking and Dagenham

£93

£56

-

£69

Barnet

£103

£41

£35

£67

Bexley

£95

£38

-

£55

Brent

£118

£45

£18

£78

Bromley

£83

£38

-

£58

Camden

£157

£69

£76

£128

City of London

£159

£111

-

£153

Croydon

£88

£38

-

£58

Ealing

£120

£41

-

£76

Enfield

£105

£40

-

£66

Greenwich

£114

£46

£192

£81

Hackney

£118

£50

£111

£90

Hammersmith and Fulham

£141

£56

£304

£111

Haringey

£115

£39

£86

£74

Harrow

£122

£36

-

£65

Havering

£110

£31

-

£63

Hillingdon

£94

£43

-

£58

Hounslow

£128

£53

-

£85

Islington

£136

£57

£123

£108

Kensington and Chelsea

£191

£74

£41

£171

Kingston upon Thames

£116

£44

-

£70

Lambeth

£129

£50

£27

£90

Lewisham

£95

£44

£20

£65

Merton

£145

£44

£50

£90

Newham

£133

£44

£21

£80

Redbridge

£93

£44

-

£58

Richmond upon Thames

£148

£56

-

£101

Southwark

£137

£51

£170

£103

Sutton

£80

£37

-

£50

Tower Hamlets

£127

£48

£26

£90

Waltham Forest

£92

£36

-

£63

Wandsworth

£142

£55

-

£103

Westminster

£207

£75

£31

£176

Total

£149

£52

£70

£109

February 2020 32

References

i

Talk&Code data on short-term letting provided by the London Borough of Camden, July 2019

ii

University College London, What are the benefits and costs on cities of the short-term lettings

model? In this context, what is the optimum regulatory framework for short-term lettings

companies in London?, May 2019

iii

London First, London & Partners, Airbnb, EY and Mastercard, Tourist Information: Mapping

the local value of international visitors, May 2019

iv

Residential Landlords Association, From Long-Term Lets to Short-Term Lets: Is Airbnb

becoming the new buy-to-let?, August 2017

v

Cabinet Office, Deregulation Act 2015: Explanatory Notes, March 2015

vi

GLA and YouGov Survey Results, Short-term letting in London, April 2019

Short-term letting polling total sample size was 1,141 adults. Fieldwork was undertaken between 15 – 18

April 2019. The survey was carried out online. The figures have been weighted and are representative of

all London adults (aged 18+).

vii

San Francisco Planning Department, Amendments Relating to Short-Term Rentals, April 2015

viii

San Francisco Budget and Legislative Analyst’s Office, Analysis of the impact of short-term

rentals on housing, May 2015

ix

HVS, UK Hotel Market Tracker: Q1 2019, May 2019

x

PWC, UK hotels forecast update for 2019 and 2020, March 2019

xi

CBRE, London: the property perspective: Q4 2018, December 2018

xii

BBC News, London firms helping landlords break letting laws, February 2019

xiii

The Times, Investigation: how Airbnb has been hijacked by agencies making a huge profit,

August 2019

xiv

Office for National Statistics (ONS), Index of Private Housing Rental Prices, December 2019

xv

Airbnb Citizen, Airbnb UK Insights Report, July 2018