Michigan Department of Treasury, 807 (Rev. 12-22), Page 1 of 5 Issued under authority of Public Act 281 of 1967 as amended.

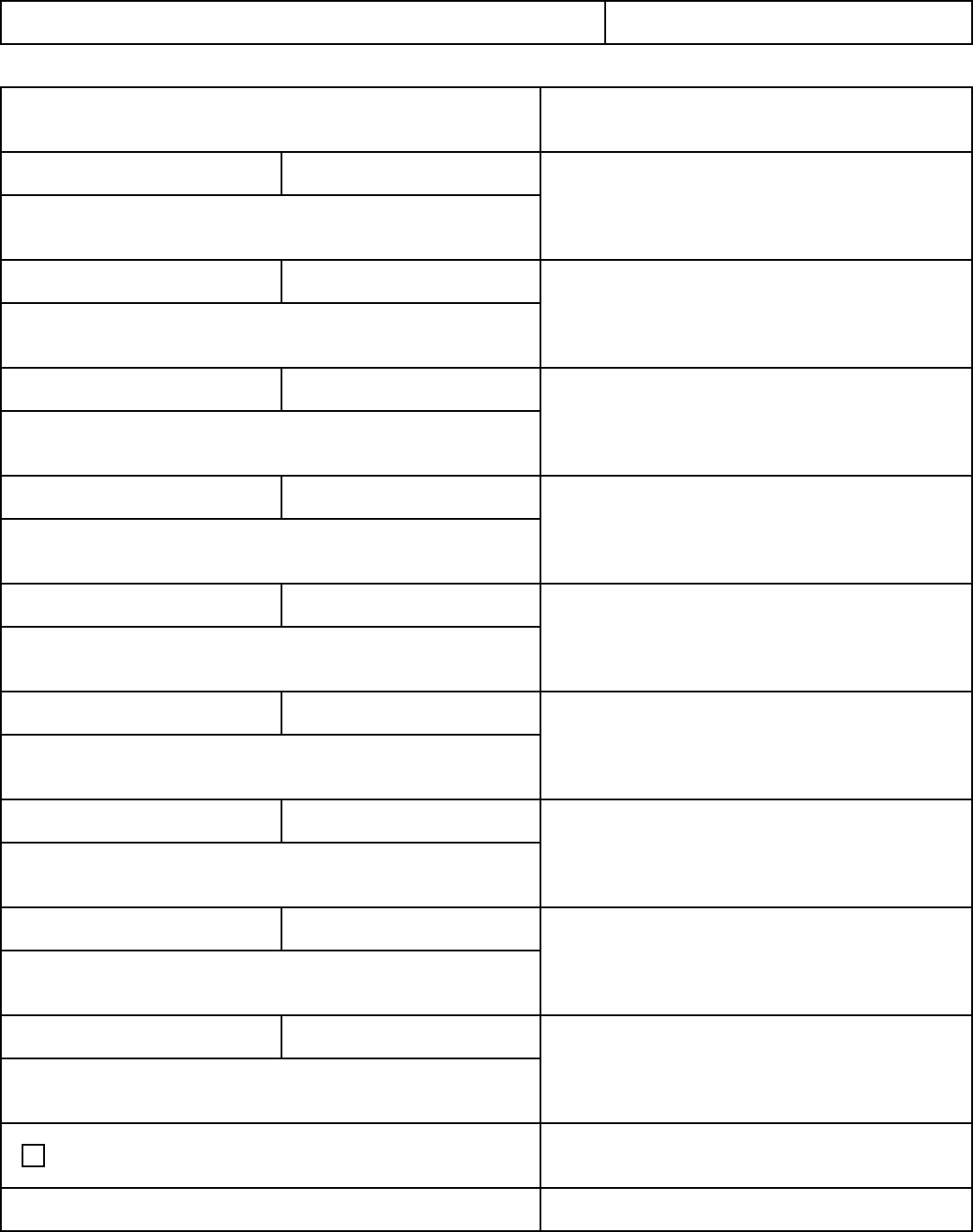

2022 MICHIGAN Composite Individual Income Tax Return

This return is due April 18, 2023. Type or print clearly in blue or black ink.

(MM-DD-YYYY) (MM-D

Amended Return

D-2022)

Return is for calendar year 2022 or for tax year beginning: and ending: - 2022

Filers whose tax year ends in 2022 should use this form. Do not use this form if the tax year ends in a year other than 2022.

1. Name of Partnership, S Corporation or Other Flow-Through Entity 2. Federal Employer Identication Number (FEIN)

3. Mailing Address (Number, Street or P.O. Box)

4. City or Town State ZIP Code

NOTE: Individual members subject to a federal excess business loss limitation may not participate in a composite ling.

5. Ordinary income or (loss) from U.S. Form 1065 or U.S. Form 1120S................................................ 5.

6. Additions from line 37......................................................................................................................... 6.

7. Subtotal. Add lines 5 and 6................................................................................................................. 7.

8. Subtractions from line 40.................................................................................................................... 8.

9. Total income subject to apportionment. Subtract line 8 from line 7 .................................................... 9.

10. Apportionment percentage from MI-1040H (see instructions)............................................................ 10.

11. Total Michigan apportioned income. Multiply line 9 by the percentage on line 10.............................. 11.

12. Michigan allocated income or (loss) from line 45 ............................................................................... 12.

13. Flow-through entity tax non-electing entity income or (loss) adjustment (see instructions) ............... 13.

14. Total Michigan income. Add lines 11, 12 and 13................................................................................. 14.

15. Michigan income attributable to Michigan residents (see instructions for Schedule C)...................... 15.

16. Michigan income attributable to nonparticipating members (see instructions for Schedule B)

.......... 16.

17. Michigan income attributable to participants (see instructions for Schedule A)..................................

17.

18. Exemption allowance from line 51

...................................................... 18. 00

19. SEP, SIMPLE or qualied plan deductions from line 54 ..................... 19. 00

20. Add lines 18 and 19............................................................................................................................ 20.

21. Taxable income. Subtract line 20 from line 17.................................................................................... 21.

22. Tax. Multiply line 21 by 4.25% (0.0425) ............................................................................................. 422.

23.

Credit for participants’ allocated share of ow-through entity tax reported by ler from Schedule A

(see instructions) ............................................................................................................................... 423.

24. Michigan extension payments and estimated tax payments .............................................................. 424.

25. 2022 AMENDED RETURNS ONLY. See instructions ........................................................................ 425.

26.

If the total of lines 23, 24 and 25 is less than line 22, enter TAX DUE.

Include interest ______________ and penalty _____________ , if applicable .........................

PAY 426.

27. Overpayment. If the total of lines 23, 24 and 25 is more than line 22, enter overpayment .............. 27.

28. Credit Forward. Amount of line 27 to apply to 2023 estimated tax ................................................... 428.

29. Subtract line 28 from line 27..............................................................................................

REFUND 429.

00

00

00

00

00

%

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

TAXPAYER CERTIFICATION.

I declare under penalty of perjury that the information in this

return and attachments is true and complete to the best of my knowledge. I have obtained the required

power of attorney from each of the members of this composite return and the entity will resolve the issue

of any tax liability.

PREPARER CERTIFICATION. I declare under penalty of

perjury that this return is based on all information of which I have

any knowledge.

Filer’s Signature Date Preparer’s PTIN, FEIN or SSN

By checking this box, I authorize Treasury to discuss my return with my preparer.

Preparer’s Name (print or type)

Mailing: Make check payable to “State of Michigan.”

Write the entity’s FEIN, “Composite Return” and tax year on the check.

Mail completed returns to:

Michigan Department of Treasury

P.O. Box 30058

Lansing, MI 48909

Preparer’s Signature

Preparer’s Business Name, Address and Telephone Number

Continued on Page 2.

Reset Form

2022 807, Page 2 of 5

Name of Partnership, S Corporation or Other Flow-Through Entity Federal Employer Identication Number

ADDITIONS

30. Net income or (loss) from rental real estate activities......................................................................... 30.

31. Net income or (loss) from other rental activities ................................................................................. 31.

32. Portfolio Income or (loss):

a. Interest income

.............................................................................................................................. 32a.

b. Dividend income............................................................................................................................ 32b.

c. Royalty income.............................................................................................................................. 32c.

d. Net short-term capital gain or (loss) (from U.S. Schedule K) ........................................................ 32d.

e. Net long-term capital gain or (loss) (from U.S. Schedule K).......................................................... 32e.

f. Other portfolio income

................................................................................................................... 32f.

33. Net gain or (loss) under Section 1231................................................................................................ 33.

34. Other income from U.S. Schedule K .................................................................................................. 34.

35.

State or local taxes measured by income, including any allocated share of tax paid by an electing

ow-through entity (see instructions).................................................................................................. 35.

36. Other miscellaneous additions (include a supporting statement) ...................................................... 36.

37. Total additions. Add lines 30 through 36. Enter here and on line 6 .................................................... 37.

SUBTRACTIONS

38. Income or (loss) from other partnerships, S corporations and duciaries .......................................... 38.

39. Other miscellaneous subtractions (include a supporting statement). Describe: ________________ 39.

40. Total subtractions. Add lines 38 and 39. Enter here and on line 8 ..................................................... 40.

MICHIGAN ALLOCATED INCOME OR (LOSS)

41. Guaranteed payments to all members allocated to Michigan:

a. Participating nonresidents - for services performed in Michigan................................................... 41a.

b. Nonparticipating nonresidents - for services performed in Michigan............................................. 41b.

c. Michigan residents - total payments .............................................................................................. 41c.

42. Income attributable to other Michigan partnerships, S corporations or duciaries............................. 42.

43. Net Michigan capital gains or (losses) not subject to apportionment (from U.S. Schedule D) ........... 43.

44. Other Michigan allocated income or (loss) (see instructions)............................................................. 44.

45.

Total Michigan allocated income or (loss).

Add lines 41a through 44. Enter here and on line 12 ......................................................................... 45.

EXEMPTION ALLOWANCE. See instructions for completing this section.

46. Michigan income to participants from line 17 ..................................................................................... 46.

47. Total income from Participants’ Total Income Worksheet, page 9 ...................................................... 47.

48.

Percent of income attributable to Michigan.

Divide line 46 by line 47 (must be between 0 and 100%)................................................................... 48.

49.

Prorated exemption allowance per participant.

Multiply line 48 by $5,000 (exemption allowance).

............................................................................. 49.

50. Number of participants included in this return .................................................................................... 50.

51. Total prorated exemption.................................................................................................................... 51.

SEP, SIMPLE OR QUALIFIED PLAN DEDUCTIONS (PARTNERS ONLY)

52. SEP, SIMPLE or qualied plan deductions for participants (include a schedule) ............................... 52.

53. Percent of income attributable to Michigan from line 48..................................................................... 53.

54.

SEP, SIMPLE or qualied plan deductions attributable to Michigan.

Multiply line 52 by the percentage on line 53. Enter here and on line 19

........................................... 54.

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

%

00

00

00

%

00

2022 807, Page 3 of 5

Name of Partnership, S Corporation or Other Flow-Through Entity Federal Employer Identication Number

SCHEDULE A: SCHEDULE OF PARTICIPANTS (Must have at least two participants, see instructions)

Column 1

Participant Information

Column 2

Distributive Share of

Michigan Income and

Michigan Guaranteed

Payments

Column 3

Share of Michigan Tax

Column 4

Allocated Share of

Flow-Through Entity Tax

Credit

Participant Name

Participant FEIN/SSN

Participant Address

Participant Name

Participant FEIN/SSN

Participant Address

Participant Name

Participant FEIN/SSN

Participant Address

Participant Name

Participant FEIN/SSN

Participant Address

Participant Name

Participant FEIN/SSN

Participant Address

Participant Name

Participant FEIN/SSN

Participant Address

Check here if additional page(s) used.

Enter totals from additional page(s),

if applicable.

Total Columns 2, 3 and 4. Carry total from

Column 2 to page 1, line 17. Carry total from

Column 4 to page 1, line 23.

2022 807, Page 4 of 5

Name of Partnership, S Corporation or Other Flow-Through Entity Federal Employer Identication Number

SCHEDULE B: SCHEDULE OF NONPARTICIPANTS

Column 1

Nonparticipant Information

Column 2

Distributive Share of Michigan Income*

and Michigan Guaranteed Payments

Nonparticipant Name Nonparticipant FEIN/SSN

Nonparticipant Address

Nonparticipant Name Nonparticipant FEIN/SSN

Nonparticipant Address

Nonparticipant Name Nonparticipant FEIN/SSN

Nonparticipant Address

Nonparticipant Name Nonparticipant FEIN/SSN

Nonparticipant Address

Nonparticipant Name Nonparticipant FEIN/SSN

Nonparticipant Address

Nonparticipant Name Nonparticipant FEIN/SSN

Nonparticipant Address

Nonparticipant Name Nonparticipant FEIN/SSN

Nonparticipant Address

Nonparticipant Name Nonparticipant FEIN/SSN

Nonparticipant Address

Nonparticipant Name Nonparticipant FEIN/SSN

Nonparticipant Address

Check here if additional page(s) used. Enter totals from additional page(s),

if applicable.

Total Column 2. Carry total from Column 2 to page 1, line 16

* The income of C corporation members reported here is for reconciliation purposes of this form and is not

used to compute a CIT liability.

2022 807, Page 5 of 5

Name of Partnership, S Corporation or Other Flow-Through Entity Federal Employer Identication Number

SCHEDULE C: SCHEDULE OF MICHIGAN RESIDENTS

Column 1

Resident Information

Column 2

Distributive Share of Michigan Income and

Michigan Guaranteed Payments

Resident Name Resident FEIN/SSN

Resident Address

Resident Name Resident FEIN/SSN

Resident Address

Resident Name Resident FEIN/SSN

Resident Address

Resident Name Resident FEIN/SSN

Resident Address

Resident Name Resident FEIN/SSN

Resident Address

Resident Name Resident FEIN/SSN

Resident Address

Resident Name Resident FEIN/SSN

Resident Address

Resident Name Resident FEIN/SSN

Resident Address

Resident Name Resident FEIN/SSN

Resident Address

Check here if additional page(s) used. Enter totals from additional page(s),

if applicable.

Total Column 2 and carry to page 1, line 15

2022 807, Page 6

Instructions for Form 807, Michigan Composite Individual Income Tax Return

Denitions

The following are definitions for the purposes of this form.

Flow-through entity (FTE): An S corporation; partnership;

limited partnership; limited liability partnership; or limited

liability company that is not taxed as a C corporation for

federal income tax purposes. FTE does not include a publicly

traded partnership.

Intermediate FTE: An FTE in a tiered structure, that has an

interest in another FTE.

Member of an FTE: An individual; estate; trust; or

intermediate FTE.

Nonresident member: An individual who is not domiciled in

this state; nonresident estate or trust; or intermediate FTE with

a nonresident ultimate owner.

Participant: A nonresident member who has elected to

participate in a composite return.

Ultimate owner: An individual, estate or trust that has an

interest in an FTE or intermediate FTE.

Filing a Return

A Composite Individual Income Tax Return (Form 807) is

a collective individual income tax filing for two or more

nonresident members filed by the FTE. This form is used to

report and pay individual income tax under Part 1 of Public

Act 281 of 1967, as amended. This return is not an entity-level

filing for tax imposed on the FTE.

An FTE is not required to file Form 807. The filing FTE

and participants must agree to comply with the provisions

described in the sections “Filing and Participation

Requirements” and “Reporting to Participants.” An FTE may

choose to file Form 807 on behalf of its nonresident members

who elect to participate. An intermediate FTE may also be

eligible to file a composite return (see “Tiered Entities”).

Participation on a composite return will eliminate the need

for an individual ultimate owner to file a Michigan Individual

Income Tax Return (Form MI-1040) when the ultimate owner

has no other Michigan-sourced income. If the composite return

does not eliminate the ultimate owner’s requirement to file

an MI-1040, the individual ultimate owner would claim their

share of tax paid on the composite return as withholding on the

MI-1040. See “Composite Filer Participants” in the MI-1040

instruction book for more information.

Flow-through Entity Tax

The flow-through entity tax is levied and imposed on certain

electing entities with business activity in Michigan. Generally,

the flow-through entity tax allows the entity to elect to pay

tax on certain income at the individual income tax rate. The

members of that entity are eligible to receive a refundable

income tax credit equal to the tax previously paid on that

income by the flow-through entity.

The filing of a flow-through entity tax return will not satisfy

the respective filing obligations of members, as it neither

reports the income of members nor claims the refundable tax

credit that may be applicable for that income. The filing of a

composite return is a separate and distinct obligation from the

filing of a flow-through entity tax return.

Electing flow-through entities must file the Michigan

flow-through entity tax annual return and pay any tax due

before filing the composite return.

A member of flow-through entity that elected to pay the

Michigan flow-through entity tax may claim a refundable

credit, and will report an addition. See instructions for lines 23

and 35 on pages 8 and 9, respectively.

Tiered Entities

An FTE is part of a tiered structure if it has one or more

members that are also FTEs. A tiered structure consists

of a source FTE and one or more intermediate FTEs. The

intermediate FTE receives income from the source FTE and

the income is passed through to the ultimate owner(s).

The intermediate FTE may not participate in the composite

return if:

• The composite filer cannot identify the intermediate FTE’s

participating ultimate owner(s)

• The intermediate FTE has elected to pay the flow-through

entity tax and paid tax on a non-electing entity’s income

A C corporation or an entity that files federally as a

C corporation is not eligible to participate in the composite

return.

An intermediate FTE that generated its own income or loss

and has two or more nonresident members may file its own

composite return even if it participated on another composite

return. If an intermediate FTE participated on another FTE’s

composite return, it should not include any income or tax paid

on its behalf with the other FTE’s composite return.

For each participating intermediate FTE include a Tiered

Structure Schedule from the source FTE to the ultimate owner,

with the following:

• Details for each tier of the tiered structure:

• FTE name, FEIN and ownership percentage for each tier

• Details for each participating ultimate owner:

• Name, address, account number, distributive share of

Michigan income, tax and ownership percentage

Filing and Participation Requirements

Two or more participating nonresident members are required

for an FTE to file a composite return. An intermediate

FTE may participate in a composite return unless it has

elected to pay the flow-through entity tax and paid tax on a

non-electing entity’s income. Further, the intermediate FTE

may only participate in a composite return if the filing FTE is

able to include with the composite return the Tiered Structure

Schedule, which provides the details for each tier from the

source FTE to the ultimate owner, including the intermediate

FTE’s participating ultimate owner’s name, address, account

number, distributive share of Michigan income and tax (see

“Tiered Entities”).

All of the following conditions must apply to the nonresident

ultimate owner for participation in a composite return. The

nonresident ultimate owner:

• Is subject to Michigan individual income tax

• Was not a Michigan resident (full-year or part-year)

• Agrees to claim only one Michigan exemption

2022 807, Page 7

• Does not have a federal excess business loss limitation

• Is not a C corporation or has not elected to file federally as

a C corporation.

Due Date of Return

The 2022 composite return is for filers whose tax year ends in

2022. If the FTE’s tax year does not end in 2022, do not use

this form. Use the appropriate year that corresponds to the

year the ultimate owner will include the income in their federal

individual income tax filing.

The composite return for any tax period ending in 2022 is due

April 18, 2023. The return for any period ending in 2023 will

be due April 16, 2024.

If the FTE cannot file by the due date, a request for an

extension can be filed before the original due date. See

“Requesting an Extension”.

Requesting an Extension

The filer may request an extension of time to file by filing

an Application for Extension of Time to File Michigan Tax

Returns (Form 4) on or before the original due date of the

composite return. The remaining estimated annual tax liability

that has not been satisfied by estimated payments must be

remitted with Form 4. A Michigan extension, Form 4, must be

filed even if the FTE files a federal extension. An extension of

time to file is NOT an extension of time to pay.

When completing Form 4, line 1, check “Fiduciary Tax

(includes Composite Filers)” and use the filing FTE’s name and

FEIN to ensure the payment is properly credited to the filing

FTE’s account. When the composite return is filed, include a

copy of Form 4.

Required Documentation

Include only the following items, as applicable, with the

composite return:

• Copy of U.S. Form 1065 (5 pages) or U.S. Form 1120S

(5 pages)

• Michigan Schedule of Apportionment (Form MI-1040H)

• Completed Schedule A, Schedule of Participants

• Tiered Structure Schedule (see “Tiered Entities”)

• Completed Schedule B, Schedule of Nonparticipants

• Completed Schedule C, Schedule of Michigan Residents

• Statement signed by an authorized officer or general partner

certifying that each participant has been informed of the

terms and conditions of this program of participation

• Include supporting documentation to support the

flow-through entity tax credit, if applicable.

• A copy of Form 4.

Reporting to Participants

An FTE filing Form 807 must report the following information

to each participant on the composite return:

• FEIN of the FTE

• Tax year of the FTE

• The participant’s distributive share of income allocated or

apportioned to Michigan from Schedule A, Schedule of

Participants, Column 2

• The participant’s share of tax liability on the composite

return filed by the FTE from Schedule A, Schedule of

Participants, Column 3

• The participant’s allocated share of flow-through entity tax

credit from Schedule A, Schedule of Participants, Column 4.

Specify that this credit should not be claimed on any other

income tax return.

• The FTE’s Michigan sales and the FTE’s total sales

everywhere

• The participant’s prorated exemption allowance as computed

on line 49 of the composite return.

The FTE may use any method to report the necessary

information to the participants so long as it conveys the

information listed above. Treasury recommends that the FTE

provides the information to the participants as a supplemental

attachment to their federal Schedule K-1, which provides the

participant with the information necessary to file an MI-1040 if

the ultimate owner has other Michigan-sourced income.

2023 Estimated Tax Payments

Estimated income tax payments must be remitted with

an Estimated Income Tax Voucher for Fiduciary and

Composite Filers (Form MI-1041ES). For each quarter,

file one Form MI-1041ES with the quarterly estimated

payment for all participants whose share of annual

income tax liability is expected to exceed $500 after

exemptions and credits. Form MI-1041ES must be

completed with the name and FEIN of the FTE that

will claim the estimated payments on their composite

return. Do not submit estimated payments with Form

MI-1041ES for members who are not participating in the

composite return.

FTEs using a calendar tax year must remit quarterly estimated

payments with Form MI-1041ES by April 18, 2023; June 15,

2023; September 15, 2023; and January 16, 2024. FTEs with a

fiscal tax year must remit quarterly estimated payments with

Form MI-1041ES using the due date that corresponds with its

fiscal tax year end. The first estimated payment is due on the

15th day of the fourth month after the prior fiscal tax year ends.

Quarterly estimated payment due dates for a fiscal tax year

filer apply regardless of the participants’ filing tax year.

Amended Returns

To amend, file Form 807 and check the Amended Return box

at the top of page 1 of the form. Provide a statement to explain

the reason(s) for amending. Include all applicable schedules and

supporting documentation. It is not necessary to include a copy

of the original return.

Schedules

Schedule A, Schedule of Participants:

Complete this schedule for all participants. See “Filing and

Participation Requirements” for additional information.

If an intermediate FTE is participating on the composite

return, the filer must only report the income attributable to the

participating ultimate owner(s) of that intermediate FTE on

Schedule A. See “Tiered Entities” for information about the

required Tiered Structure Schedule.

If the filer elected to pay FTE tax, enter in Column 4 each

participant’s credit that is reported on the filer’s Schedule for

Reporting Member Information for a Flow-Through Entity

2022 807, Page 8

that is accompanied with the Michigan flow-through entity tax

annual return. However, participants’ credits for this tax year

are limited to only credits generated by the flow-through entity

filing this composite return based on the filer’s FTE annual tax

return. Do not include credits generated by any other electing

flow-through entity. The credits should include the following:

1. For FTE tax levied on the filer’s current tax year, report

each participant’s share of FTE tax paid by the filer

through the fifteenth day of the third month after the filer’s

tax year end.

2. For FTE tax levied on the filer for any previous tax year,

report each participant’s share of that tax paid during the

current tax year excluding any amount reported in item

number 1.

Example: FTE is a calendar year taxpayer and timely paid

$1,000 in quarterly estimated tax payments for Year 1. FTE also

requested and received an extension of time to file the Year 1

FTE tax annual return. When filing the Year 1 FTE tax annual

return on September 30, Year 2, FTE determined that tax was

owed and paid an additional $600 in tax, plus $200 in combined

penalty and interest. Members X and Y each own 50% of FTE

and participate on a composite return for Year 1. Their credits

are based on each member’s share of the $1,000 in taxes levied

for Year 1 and paid as of March 15, Year 2, $500 each. Even

though the additional $600 tax payment was paid toward FTE’s

Year 1 liability and by the extended due date of that return, that

payment is not eligible for a Year 1 credit. Instead, that payment

may be claimed as a credit by members on their Year 2 annual

return. The $200 payment attributable to penalty and interest is

not eligible to be claimed for the credit in any tax year.

Complete additional copies of Schedule A as needed. Subtotal

each schedule and include the grand totals of Columns 2, 3

and 4 on the first page of the schedule. Carry the grand total

of Column 2 to line 17. The grand total of Column 3 should

reconcile to line 22. Carry the grand total of Column 4 to

line 23.

Schedule B, Schedule of Nonparticipants:

Complete this schedule for all nonparticipants that are not

Michigan residents. If intermediate FTEs are participating

on the composite return, the filer must only report the

income attributable to nonparticipants on Schedule B. If a

C corporation or an entity that files federally as a

C corporation has an interest in the filing FTE, report the

income here. Reporting this income is for reconciliation

purposes only and is not used to compute a Corporate Income

Tax (CIT) liability. Complete additional copies of Schedule B

as needed. Subtotal each schedule and include the grand total

of Column 2 on the first page of the schedule. Carry the grand

total of Column 2 to line 16.

Schedule C, Schedule of Michigan Residents:

Complete this schedule for Michigan residents. A Michigan

resident may not participate on a composite return. If

intermediate FTEs are participating on the composite return,

the filer must only report the income attributable to Michigan

residents on Schedule C. Reporting this income is for

reconciliation purposes only. Complete additional copies of

Schedule C as needed. Subtotal each schedule and include the

grand total of Column 2 on the first page of the schedule. Carry

the grand total of Column 2 to line 15.

Line-by-Line Instructions

Lines not listed are explained on the form.

Line 5: Enter ordinary income or (loss) from U.S. Form 1065,

line 22 or U.S. Form 1120S, line 21.

Line 10: Enter the apportionment percentage from

Form MI-1040H. See MI-1040H instructions on determining

the apportionment percentage and for information regarding

income tax nexus standards.

Line 13: Enter the Michigan-sourced income from

non-electing flow-through entities, if any, that was reported

on the filer’s Michigan flow-through entity tax annual return.

Line 14: The amount on this line should equal the total of

lines 15, 16 and 17.

Complete Schedule A, Schedule of Participants and if

applicable, Schedule B,

Schedule of Nonparticipants

and Schedule C, Schedule of Michigan Residents before

continuing to line 15.

Line 15: Carry the total from Column 2 of the Schedule C,

Schedule of Michigan Residents to this line.

Line 16: Carry the total from Column 2 of the Schedule B,

Schedule of Nonparticipants

to this line.

Line 17: Carry the total from Column 2 of the Schedule A,

Schedule of Participants to this line.

Line 22: Multiply line 21 by the tax rate on line 22. The tax

should reconcile to the grand total from Column 3 of the

Schedule A, Schedule of Participants.

Line 23: Enter the total of participants’ allocated share of

flow-through entity tax reported on Schedule A, Schedule of

Participants, Column 4.

Line 25: This line is for amended returns only. Enter the

refund and/or credit forward amount received on the original

return as a negative number. Enter the amount paid with

the original return as a positive number. Do not include any

interest or penalty paid with the original return.

Line 26: Pay. If the total of lines 23, 24 and 25 is less than

line 22, enter the balance of the tax due. This is the tax owed

with the return. Enter any applicable penalties and interest in

the spaces provided. Add tax, penalty and interest together and

enter the total on this line. Make the check payable to “State of

Michigan.” Write the ling company’s FEIN, “Composite

Return” and the tax year on the front of the check. To ensure

accurate processing of the return, remit payment for this return

only. Estimated tax payments should be remitted separately

with MI-1041ES vouchers. If the balance due is less than $1, no

payment is required. To compute applicable penalty and interest

visit www.michigan.gov/iit.

Line 29: Refund. If the total of lines 23, 24 and 25 is more

than line 22, the overpayment will be refunded. Treasury will

not refund amounts less than $1.

Mail completed returns to:

Michigan Department of Treasury

P.O. Box 30058

Lansing, MI 48909

2022 807, Page 9

Additions

Lines 30 through 34: Enter income from lines 2,

3c, 5, 6a, 7, 8, 9a, 10 and 11 of U.S. Form 1065

Schedule K or from lines 2, 3c, 4, 5a, 6, 7, 8a, 9 and 10 of

U.S. Form 1120S Schedule K. Guaranteed payments, income

attributable to other Michigan duciaries or FTEs should be

allocated to Michigan on lines 41 through 44.

Line 35: Enter the amounts of state and local income tax

used to determine ordinary income on U.S. Form 1065,

line 22 or U.S. Form 1120S, line 21. Add the participants’

share of Michigan flow-through entity taxes paid and

deducted from income on the filer’s federal tax return for this

tax year.

Line 36: Enter other additions to income, such as gross

interest and dividends from obligations or securities of states

and their political subdivisions other than Michigan. Include

gross expenses from the production of Michigan oil and gas

and nonferrous metallic minerals extraction subject to Michigan

severance tax. Adjustments for bonus depreciation are not

required. For purposes of individual income tax, Michigan

treatment of bonus depreciation conforms with federal law. If

line 38 results in a net loss, enter here as a positive number.

Subtractions

Note: Charitable contributions and other amounts reported

as itemized deductions on U.S. Schedule A are not allowed

as subtractions when determining Michigan taxable income.

Do not adjust for bonus depreciation.

Line 38: Enter the net income or (loss) from other fiduciaries

or other FTEs included in income. If line 38 results in a net

loss, do not enter here but on line 36 as a positive number

instead.

Line 39: Enter amounts, such as interest from U.S.

obligations that are included in line 32a and other deductions

used to compute AGI, that were not included in determining

ordinary income. This includes section 179 depreciation

and other deductions included line 11 and 12 of U.S. Form

1120S Schedule K and on line 12 and 13 of U.S. Form 1065

Schedule K to the extent reportable in determining AGI. Also

include pension benefits paid to nonresident partners that are

included in ordinary income but are excluded from Michigan

tax under section 114 of Title 4 of the U.S. Code. Also include

gross income and related expenses from producing Michigan

oil and gas and nonferrous metallic minerals extraction to

the extent subject to Michigan severance tax and included

in federal taxable income. Subtract the participants’ share of

Michigan flow-through entity taxes refunded and included in

income on the filer’s federal tax return for this tax year. Include

a schedule of all subtractions.

Michigan Allocated Income or Loss

Line 41: Enter all guaranteed payments attributable to

Michigan. This includes all payments to Michigan residents and

payments to nonresidents for services performed in Michigan.

Line 42: Enter income or (loss) from other fiduciaries or

other FTEs attributable to Michigan that have not been reported

on another composite return. Include a schedule showing the

amount of income or (loss) attributable to each.

Line 43: Enter gains or (losses) from the sale of real

or personal property located in Michigan not subject to

apportionment.

Line 44: Enter any other income or (loss) allocated to

Michigan.

Include any Michigan net operating loss (NOL) deduction.

The NOL deduction may be taken only to the extent that it is

attributable to the same participants from the loss year, and the

participants have the same percentage of ownership. Include all

supporting documentation.

Include any Michigan standard deduction as a negative number.

The standard deduction cannot exceed the qualified participants

share of Michigan tax. The standard deduction of $20,000

against taxable income before personal exemptions is available

to a participant who was born during the period January 1,

1946 through December 31, 1952 (Tier 2) and reached age 67.

A participant that is in Tier 2 and eligible for the Michigan

standard deduction may increase the $20,000 deduction to

$35,000 if the participant received retirement or pension

benefits from employment with a governmental agency that

was not covered by the federal Social Security Act.

A participant born during the period January 1, 1953 through

January 1, 1956 (Tier 3), and reached the age of 67 on or before

December 31, 2022, would be entitled to the standard deduction

but would not be entitled to a personal exemption.

Although participants may be eligible for a standard deduction,

nonresidents are not subject to tax on retirement and pension

benefits and therefore participants may not deduct such

benefits.

For more information on retirement tiers, refer to the MI-1040

booklet.

2022 807, Page 10

Exemption Allowance

Michigan’s personal exemption allowance

is prorated for all nonresident participants

based on Michigan income to total

income.

If the entity claims a Tier 3 standard

deduction for a participant, remove all

income related to that participant from

the computations in lines 46 and 47

and do not include those participants in

line 50.

Line 47: Enter the participants’ total

income as determined using the

Participants’ Total Income Worksheet.

Line 48: Compute the percentage of

participants’ income that is attributable

to Michigan by dividing Michigan

income (line 46) by total income

(line 47). This figure may not exceed 100

percent.

Line 49: Multiply the percent of

Michigan income to total income as

determined on line 48 by $5,000 in 2022.

The result is the maximum exemption

Participants’ Total Income Worksheet

Column A refers to Distributive Income categories from Schedule K form(s). Columns B and C refer to lines

on the U.S. Form 1065 Schedule K and U.S. Form 1120S Schedule K. Column D is the list of amounts that

are added to arrive at participants’ total income that is reported on Form 807, line 47.

A

Distributive Income Categories

B

U.S. Form 1065

Schedule K

C

U.S. Form 1120S

Schedule K

D

Participants’

Distribute Income

Amounts

Ordinary income or (loss) from trade or business

activity

1 1

Net income or (loss) from rental real estate activity

2 2

Net income or (loss) from other rental activity

3c 3c

Portfolio income or (loss):

Interest income

5 4

Dividend income

6a 5a

Royalty income

7 6

Net short-term capital gain or (loss)

8 7

Net long-term capital gain or (loss)

9a 8a

Guaranteed payments

4a

Net gain or (loss) under section 1231

10 9

Other income or (loss)

11 10

TOTAL INCOME

Add all amounts in Column D and carry total to Form 807, line 47.

allowance a participant may be eligible to claim on this form.

Line 51: For each participant listed on Schedule A, Schedule of

Participants determine the lesser of:

• The amount on line 49, or

• That participant’s Distributed Share of Michigan Income

from Column 2 of the Schedule A, Schedule of Participants.

Enter on line 51 the sum of the result above for all participants.

The amount entered on line 51 may not exceed the product of

lines 49 and 50.

SEP, SIMPLE or Qualied Plan Subtractions

(PARTNERS ONLY)

Line 52: Figure the portions of Simplied Employee Pensions

(SEP), Savings Incentive Match Plan for Employees (SIMPLE),

or qualied plan deductions which are attributable to the

participants. Include a schedule showing calculations.

Signing Return/Correspondence

By signing Form 807, the signing partner or officer declares

that the filer has power of attorney from each participant to file

a composite return on the participant’s behalf. Treasury will

mail refund checks, assessments and all correspondence to the

filer at the address indicated on the return. The filer must agree

to be responsible for the payment of any additional tax, interest

and penalties as finally determined. Any issues that arise as a

result of the filed composite return will be resolved with the

filer. However, Treasury may find it necessary to contact the

participants.

When You Have Finished

Sign the return

A tax preparer must include the name, address, telephone

number of the firm he or she represents, and preparer tax

identification number or federal employer identification

number. Check the box to indicate if Treasury may discuss your

return with your preparer.

The Taxpayer Protection Act requires paid preparers to sign

the return and provide his or her preparer tax identification

number. Additional information on the Taxpayer Protection

Act is available at www.michigan.gov/taxes.

A paid preparer must not engage in any fraudulent tax activity.

Any concerns related to fraudulent activity of a paid preparer

may be reported to the Michigan Department of Treasury,

Fraud Unit, P.O. Box 30140, Lansing, MI 48909.

Forms

Michigan tax forms are available at www.michigan.gov/taxes.