Payment Services and Electronic Money –

Our Approach

The FCA’s role under the Payment Services

Regulations 2017 and the Electronic Money

Regulations 2011

November 2021 (version 5)

Moving around this document

Use your browser’s bookmarks

and tools to navigate.

To search on a PC use Ctrl+F or

Command+F on MACs.

2

The FCA’s role under the Payment Services Regulations 2017 and the Electronic Money Regulations 2011

Contents

Preface 3

1 Introduction 5

2 Scope 13

3 Authorisation and registration 25

4 Changes in circumstances of

Authorisation or registration 59

5 Appointmentofagentsanduseofdistributors 70

6 Temporary permission scheme 75

7 Status disclosure and use of the FCA logo 87

8 Conduct of business requirements 88

9 Capital resources and requirements 148

10 Safeguarding 162

11 Complaints handling 179

12 Supervision 187

13 Reportingandnotications 192

14 Enforcement 207

15 Fees 211

16 Payment service providers’ access to

payment account services 213

17 Payment initiation and account

informationservicesandconrmation

of availability of funds 220

18 Operational and security risks 251

19 Financial crime 254

20 Authentication 258

Annex 1

Useful links 274

Annex 2

Useful contact details 276

Annex 3

Status disclosure sample statements 277

Annex 4

Merchant acquiring 278

Annex 5

The Payment Process 281

Annex 6

Acknowledgement Letter 282

Glossary of Terms 285

Abbreviations and Acronyms 287

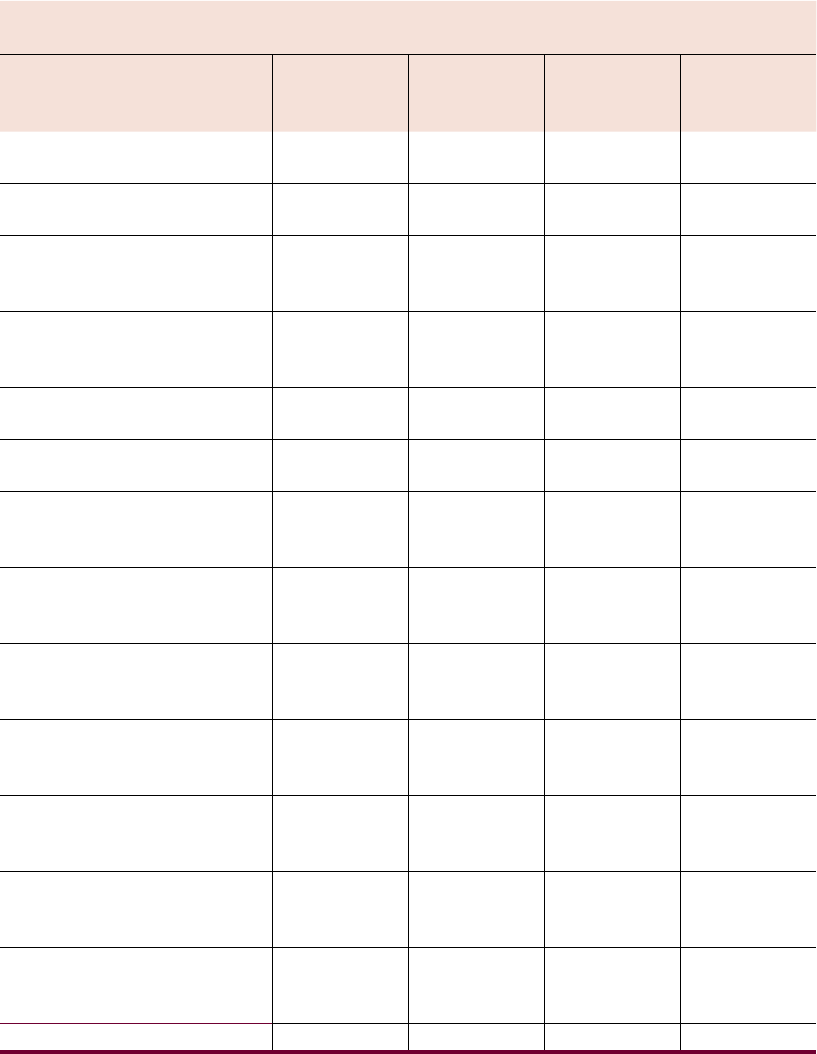

Approach Document version control

Published on Changes

November 2021

(version

5)

• Updated guidance on

safeguarding, prudential risk

management, wind-down planning,

open banking, and strong customer

authentication.Chaptersaected:

3, 6, 9, 10, 17, 20.

• New guidance on the temporary

permissions regime. Chapter

aected:6.

• Minor changes to the Approach

Document relating to the UK's

withdrawal from the EU.

June 2019

(version4)

• New Guidance on charges for

refused payments. Chapter

aected:8.

19 December

2018 (version 3)

• New Guidance on authentication

and secure communication under

PSD2.Chaptersaected17and20.

• Minor changes to clarify our

guidanceorreectlegislative

change.Chaptersaected1,3,6,

8, 13, 18, 19.

5 July 2018

(version 2)

• New Guidance on operational

and security risks under PSD2.

Chaptersaected:13and18.

• Minor changes to clarify our

guidanceorreectlegislative

change.Chaptersaected:3,4,5,

10, 15.

19 September

2017 (version 1)

• Changes to the Approach

DocumenttoreectPSD2andthe

PSRs 2017.

A tracked marked version is available on our webpage.

Sign up for our

news and publications alerts

See all our latest

press releases,

consultations

and speeches.

3

Preface

The FCA’s role under the Payment Services Regulations 2017 and the Electronic Money Regulations 2011

Preface

This document will help businesses to navigate the Payment Services Regulations

2017 (PSRs 2017) and the Electronic Money Regulations 2011 (EMRs) (together with

our relevant rules and guidance), and to understand our general approach in this area.

Itisaimedatbusinessesthatare,orareseekingtobe:

• authorised payment institutions or small payment institutions (collectively – PIs)

• authorised e-money institutions or small e-money institutions (collectively – EMIs)

• registered account information service providers (RAISPs)

• credit institutions, which must comply with parts of the PSRs 2017 and EMRs when

carrying on payment services and e-money business

• operating under the temporary permissions regime (TPR)

• operatingunderthesupervisedrun-oregime(SRO)

• operatingunderthecontractualrun-oregime(CRO)

The first version of the Payment Services Approach Document was issued in April

2009. Since then we have kept the document under review and have updated it to

clarify our interpretation of the Payment Services Regulations 2009 (PSRs 2009)

and answer businesses’ questions. When the second Electronic Money Directive

(2EMD) was implemented in the UK on 30 April 2011 through the EMRs, we produced a

separate Approach Document for the e-money regime.

In September 2017, we merged our Approach Documents on the PSRs 2017 and the

EMRs to reflect changes brought about by the introduction of the revised Payment

Services Directive (PSD2), other changes in the market since our original guidance

was issued and as a response to feedback received to our Call for Input (published in

February 2016) and to CPs 17/11 and 17/22. This Payment Services and Electronic

Money Approach Document is referred to hereafter as the “Approach Document”.

In July 2018, we published a second version of the Approach Document to incorporate

new guidance on operational and security risk under PSD2 and other minor

amendments.

4

Preface

The FCA’s role under the Payment Services Regulations 2017 and the Electronic Money Regulations 2011

InDecember2018,wepublishedathirdversionoftheApproachDocumenttoreflect:

• thenalisationofEuropeanregulatorytechnicalstandardsonpassportingand

home-host supervision

• thenalisationofEuropeanregulatorytechnicalstandardsonstrongcustomer

authentication and common and secure communication (SCA-RTS) and related

guidance

• changes to fraud reporting requirements

• minor changes to clarify our guidance

In June 2019, we published a fourth version of the Approach Document to incorporate

new guidance on payment fees consulted on in CP 18/42, and the categories of costs

that may properly be considered when setting the level of fees.

ThisNovember2021version5oftheApproachDocumentreflects:

• changes to PSRs 2017, EMRs, SCA-RTS, and related guidance, following the

completion of the EU-UK withdrawal implementation period

• additional guidance relating to the SCA-RTS

• additional guidance on safeguarding and prudential risk management

• further changes in areas of the AD to update or clarify our existing guidance

The Approach Document has not otherwise been reviewed or updated, and may be

out of date.

Our consultation papers and feedback statements can be accessed on our website.

5

Chapter 1

The FCA’s role under the Payment Services Regulations 2017 and the Electronic Money Regulations 2011

1 Introduction

1.1 This document describes our approach to implementing the Payment Services

Regulations 2017 (the PSRs 2017), the Electronic Money Regulations 2011 (the EMRs)

and the payment services and e-money-related rules in our Handbook of Rules and

Guidance (the Handbook). It gives readers a comprehensive picture of the payment

services and e-money regulatory regime in the UK. It also provides guidance for a

practical understanding of the requirements, our regulatory approach, how businesses

will experience regulatory supervision and the effect of Brexit on the payment services

and e-money regulatory regime.

1.2 We use a number of similar terms with distinct meanings in this document. The

glossary of terms, abbreviations and acronyms at the end provides a full list.

The payment services and e-money regulatory regime

1.3 The regime is set out in the PSRs 2017 and EMRs. Most e-money issuers will be

carrying on payment services in addition to issuing e-money so will need to be familiar

with both the PSRs 2017 and the EMRs.

The Handbook

1.4 The Handbook – Relevant to both payment services and e-money, the Handbook sets

out,amongotherrelevantmaterial:

• ourPrinciplesforBusinesses,thesesetoutinhigh-leveltermshowrmsshould

treat their customers, how they should run their business and how they should

interact with the regulator

• the requirements for certain PSPs, including e-money issuers, to submit returns and

certainnotications

• complaints handling procedures that PSPs and e-money issuers must have in place

• the right of certain customers to complain to the Financial Ombudsman Service

• our policy and procedures for taking decisions relating to enforcement action and

when setting penalties

• our ongoing fees

• levies for the Financial Ombudsman Service and the Money Advice Service

• rules about communications (including marketing communications) in our Banking

Conduct of Business Sourcebook (BCOBs)

6

Chapter 1

The FCA’s role under the Payment Services Regulations 2017 and the Electronic Money Regulations 2011

Payment Services

1.5 The PSRs 2017 govern the authorisation and associated requirements for authorised

or registered payment institutions (PIs). They also set the conduct of business rules for

providing payment services.

1.6 Most payment service providers (PSPs) are required to be either authorised or

registered by us under the PSRs 2017 and to comply with certain rules about providing

payment services, including specific requirements for payment transactions.

1.7 ThePSRssetout,amongstotherthings:

• the payment services in scope of the PSRs and a list of exclusions

• the persons that must be authorised or registered under the PSRs when they

provide payment services

• standards that must be met by PIs for authorisation or registration to be granted

• capital requirements and safeguarding requirements

• conduct of business requirements applicable to payment services

• our powers and functions in relation to supervision and enforcement in this area

E-money

1.8 The EMRs govern the authorisation and associated requirements electronic money

institutions (EMIs). They also set the conduct of business rules for issuing e-money.

1.9 Most e-money issuers are required to be either authorised or registered by us and to

comply with rules about issuing e-money and carrying on payment services. The rules

are set out in the EMRs, the PSRs 2017 and parts of the Handbook.

1.10 EMIs are authorised or registered to issue e-money and undertake payment services

under the EMRs, rather than under the Financial Services and Markets Act 2000

(FSMA). It should be noted, however, that issuing e-money remains a regulated activity

under article 9B of the Regulated Activities Order 2001 for credit institutions (i.e. banks

and building societies), credit unions and municipal banks, which means they will be

authorised to issue e-money under a Part 4A FSMA permission.

1.11 TheEMRssetout,amongstotherthings:

• thedenitionofe-moneyandthepersonsthatmustbeauthorisedorregistered

under the EMRs when they issue e-money

• standards that must be met by EMIs for authorisation or registration to be granted

• capital requirements and safeguarding requirements for EMIs

• rules on issuing and redeeming e-money for all e-money issuers

• our powers and functions in relation to supervision and enforcement in this area

7

Chapter 1

The FCA’s role under the Payment Services Regulations 2017 and the Electronic Money Regulations 2011

1.12 The PSRs 2017 contain conduct of business rules that are applicable to most e-money

issuers for the payment services part of their business.

Brexit

1.13 The PSRs 2017 and EMRs were amended and supplemented by statutory instruments

made under the European Union (Withdrawal) Act 2018, including the Electronic

Money, Payment Services and Payment Systems (Amendment and Transitional

Provisions) (EU Exit) Regulations 2018 (the Exit SI), ensuring that they continue to

operate effectively in the UK following the UK’s withdrawal from the EU. The changes

theymadetotheregulatoryregimeincludedthefollowing:

• AmendingthePSRs2017andEMRstoensuretheyoperateeectivelyinthe

UK after the UK left the EU. Note that these amendments are made so as to

maximise the prospects of the UK remaining in SEPA. This means that a number of

requirements will continue to apply in full to transactions in Euro within SEPA.

• AmendingthePSRs2017andEMRstoallowrmstoholdrelevantfundsin

safeguarding accounts with a credit institution outside of the UK and EEA, providing

thecreditinstitutionsmeetspeciccriteria.

1.14 The UK’s exit from the EU ended the application of the ‘passporting’ regime (whereby

a firm authorised in an EEA state can carry on activities that it has permission for in

its home state and any other EEA state by either establishing a branch or agents in

an EEA country or providing cross-border services) in the UK. To minimise disruption,

the Government established various temporary schemes to allow continued provision

of services by EEA firms in the UK. For payments and e-money firms, the Exit SI

establishesthefollowingtemporarypermissionschemes:

• The temporary permissions regime (TPR) for EEA authorised PIs, EEA registered

account information service providers (RAISPs) and EEA authorised EMIs which were

passportingintotheUKfromtheEEAbeforeIPCompletionDay(asdenedinthe

European Union (Withdrawal Agreement) Act 2020), to enable them to continue

oeringnewbusinessintheUK.Thesermsaredeemedtohaveauthorisationor

registration under the PSRs 2017 or EMRs (as applicable) for a transitional period

prior to applying for UK authorisation. In order to apply for UK authorisation, EEA

payment institutions participating in the TPR will have to establish a UK legal entity to

meet our conditions of authorisation under the PSRs 2017.

• Thesupervisedrun-oregime(SRO)whichispartoftheFinancialServices

Contracts Regime (FSCR), for EEA authorised PIs, EEA RAISPs and EEA authorised

EMIs which were passporting into the UK from the EEA, operating through a UK

branchoragent,toenablethemtorun-opre-existingcustomercontractsafterIP

CompletionDay,foruptoveyears.FirmsintheSROarenotpermittedtooernew

business in the UK.

• Thecontractualrun-oregime(CRO)whichisalsopartoftheFSCR,forEEA

authorised PIs, EEA RAISPs and EEA authorised EMIs which were passporting into

theUKfromtheEEAonaservicesbasisonlytoenablethemtorun-opre-existing

customercontractsafterIPCompletionDay,foruptoveyears.Firmsinthe

contractualrun-oregimearenotpermittedtooernewbusinessintheUK.

8

Chapter 1

The FCA’s role under the Payment Services Regulations 2017 and the Electronic Money Regulations 2011

1.15 The PSRs 2017 and EMRs were amended by the Exit SI, the Financial Services

(Electronic Money, Payment Services and Miscellaneous Amendments) (EU Exit)

Regulations 2019 and the Financial Services (Consequential Amendments) Regulations

2020 with effect from IP Completion Day.

1.16 Changes were also made to the Handbook, including to SUP reporting and PERG. We

encourage businesses to carefully review the relevant sections.

1.17 In addition, the FCA made technical standards on strong customer authentication

and common and secure methods of communication (the SCA-RTS), revoking the

European regulatory technical standards on the same.

1.18 On IP Completion Day, the FCA’s directions made under its Temporary Transitional

Power (TTP) came into effect. The TTP gives the FCA flexibility in applying post-Brexit

requirements and the FCA has applied it broadly. Where it applies firms have until 31

March 2022 to come into full compliance with the new UK regulatory framework. This

means that regulatory obligations on the firm will generally remain the same as they were

before the end of the transition period, with some exceptions, a key exception being the

requirements relating to strong customer authentication and common and secure open

standards of communication. The detail of how and to what the TTP applies to is set out

in the main FCA transitional directions and the annexes to those directions. Firms in the

TPR and SRO should note that the TPP does not apply to these regimes.

The Payment Systems Regulator’s Approach Document

1.19 The Payment Systems Regulator has published a separate Approach Document on the

aspects of the PSRs 2017 for which it is solely responsible, including access to payment

systems, and information to be provided by independent ATM deployers.

The European Banking Authority’s guidelines

1.20 The broad range of non-legislative material produced by the European Supervisory

Authorities, such as the European Banking Authority (EBA), has not been incorporated

into UK law. However, UK law will continue to reflect requirements which derive

from the European Union (EU) in the form of UK legislation implementing European

requirements and directly applicable European regulations which have largely been

retained and amended by operation of the European Union (Withdrawal) Act 2018

(the EUWA). The non-legislative material produced by the European Supervisory

Authorities relates to these EU derived laws. Therefore, we consider that the EU non-

legislative material remains relevant to the FCA and firms, and to our guidance in this

Approach Document.

1.21 We expect firms to continue to apply the EBA guidelines to the extent that they

remain relevant, interpreting them in light of the UK’s withdrawal from the EU and

the associated legislative changes that have been made to ensure the regulatory

frameworkoperatesappropriately.Moreinformationisavailableonourwebsite:

https://www.fca.org.uk/publication/corporate/brexit-our-approach-to-eu-non-

legislative-materials.pdf.

9

Chapter 1

The FCA’s role under the Payment Services Regulations 2017 and the Electronic Money Regulations 2011

Status of this document

1.22 The parts of this guidance that relate to payment services are given under regulation

120 of the PSRs 2017, while those that relate to EMIs are given under regulation 60 of

the EMRs.

1.23 This is a ‘live’ document and may be updated as we receive feedback from businesses,

trade associations and other stakeholders on additional issues they would like to see

covered, or guidance that needs to be clarified. We will also update the document in

the event of changes in the UK regulatory framework.

1.24 This document supports the legal requirements which are contained in the documents

described below. It is essential to refer to the PSRs 2017, the EMRs or relevant parts of

the Handbook for a full understanding of the obligations imposed by the regime.

1.25 Guidance is not binding on those to whom the PSRs 2017, EMRs and our rules apply.

Rather, guidance is intended to illustrate ways (but not the only ways) in which a person

can comply with the relevant regulations and rules. Guidance does not set out the

minimum standard of conduct needed to comply with the regulations or our rules, nor

is there any presumption that departing from guidance indicates a breach of these. If a

firm has complied with the regulations and rules, then it does not matter whether it has

complied with guidance we have issued.

1.26 However, if a person acts in accordance with general guidance in the circumstances

contemplated by that guidance, we will proceed as if that person has complied with

the aspects of the requirement to which the guidance relates. For the reliance that

can be placed on other guidance, see SUP 9.4 in the Handbook (Reliance on individual

guidance).

1.27 DEPP 6.2.1G(4) in the Handbook sets out how we take into consideration guidance

and other published materials when deciding to take enforcement action. Businesses

should also refer to Chapter 2 of our Enforcement Guide for further information about

the status of Handbook guidance and supporting materials.

1.28 Rights conferred on third parties (such as clients of a PSP or e-money issuer) cannot

be affected by our guidance. Guidance on the PSRs 2017, EMRs or other requirements

represents our view, and does common and secure communication to bind the courts,

e.g. in relation to an action for damages brought by a private person for breach of a

regulation. A person may need to seek his or her own legal advice.

Key documents

1.29 The requirements for payment services and e-money regulation, setting out the

rules for the new regime, can be found in the following documents, which are all

accessibleonline:

• The Payment Services Regulations 2017

• The Electronic Money Regulations 2011

10

Chapter 1

The FCA’s role under the Payment Services Regulations 2017 and the Electronic Money Regulations 2011

1.30 Where these requirements were amended by the Exit SI, the application of those

amendments may be affected by the directions under the TPP. In particular, see

paragraph 13 of Annex A to the Transitional Direction.

1.31 The requirements for the TPR, SRO and CRO can be found in Schedule 3 of the Exit SI.

1.32 The requirements for authentication and open access can be found in the Technical

Standards on Strong Customer Authentication and Common and Secure Methods of

Communication.

The relevant parts of the FCA Handbook

1.33 The Handbook is an extensive document that sets out the rules and guidance for

financial services regulation. A Reader’s Guide to the Handbook is available on the

Handbook website together with a User Guide for the online version. Most of the

Handbook does not apply to EMIs, PIs or RAISPs (unless they are authorised under

FSMA in relation to other activities), There are, however, a few areas that contain

relevantprovisions.Theseare:

• Principles for businesses (PRIN)

These are a general statement of the fundamental obligations of firms under the

regulatory system. They derive their authority from the FCA’s rule-making powers

as set out in FSMA, including as applied by the PSRs 2017 and EMRs, and reflect the

FCA’s statutory objectives.

• Glossary

This provides definitions of terms used elsewhere in the Handbook. Clicking on an

italicised term in the Handbook will open up the glossary definition.

• General Provisions (GEN)

GEN 2 contains provisions on interpreting the Handbook. GEN 2.2.36G (9-13) contains

guidance on the interpretation of the Handbook for firms in the TPR and SRO.

• Banking:ConductofBusinesssourcebook (BCOBS)

Retail deposit takers (including banks and building societies) are also required to

comply with the conduct of business rules for retail banking contained in BCOBS.

Other PSPs and e-money issuers are subject only to the rules set out in BCOBS 2.

BCOBS Chapter 1 contains further detail on which provisions apply to which type of

business, and which complement the PSRs 2017 and which provisions do not apply

to accounts where Parts 6 and 7 of the PSRs 2017 apply.

• Consumer Credit sourcebook (CONC)

This is the specialist sourcebook for credit-related regulated activities and

contains detailed obligations that are specific to credit-related regulated activities

and activities connected to those credit-related regulated activities. If PSPs are

involved in such activities, they will need to comply with CONC in addition to other

requirements which are imposed by the Consumer Credit Act 1974 and legislation

made under it.

• Fees manual (FEES)

This contains fees provisions for funding us and the Financial Ombudsman Service

relevant to PSPs.

11

Chapter 1

The FCA’s role under the Payment Services Regulations 2017 and the Electronic Money Regulations 2011

• Supervision manual (SUP)

SUP 5.3 and SUP 5.4 describe our policy on the use of skilled persons to carry out

reports (see Chapter 12 – Supervision for further information).

SUP 9 describes how people can seek individual guidance on regulatory

requirements and the reliance they can place on guidance received.

SUP 11.3 and SUP 11 Annex 6G provide guidance on Part 12 of FSMA, relating to

control over authorised EMIs and authorised PIs.

SUP 15.14 sets out the notification requirements under the PSRs 2017.

SUP 16.13 sets out the forms, content, reporting periods and due dates for the

reporting requirements under the PSRs 2017 (including annual returns).

SUP 16.15 sets out the forms, content, reporting period and due dates for the

reporting requirements under the EMRs.

• Senior Management Arrangements, Systems and Controls sourcebook (SYSC).

SYSC 9.2 includes a record keeping rule relevant to credit institutions providing

account information services or payment initiation services.

• Decision procedure and penalties manual (DEPP)

This contains the procedures we must follow for taking decisions in relation to

enforcement action and setting penalties.

• Disputeresolution:complaintssourcebook (DISP)

This contains the obligations on PSPs and e-money issuers for their own complaint

handling procedures and complaints reporting. It also sets out the rules concerning

customers’ rights to complain to the Financial Ombudsman Service.

1.34 The Handbook website also contains the following regulatory guides that are relevant

toPSPs:

• Enforcement guide (EG)

This describes our approach to exercising the main enforcement powers given to us

under FSMA and the PSRs 2017.

• FinancialCrime:aguideforrms (FC)

This contains guidance on the steps businesses can take to reduce their financial

crime risk.

• Perimeter guidance manual (PERG) – PERG 3A and PERG 15

This contains guidance aimed at helping businesses consider whether they need

to be separately authorised or registered for the purposes of providing payment

services in the UK.

• Unfair contract terms and consumer notices regulatory guide (UNFCOG)

This guide explains our powers under the Unfair Terms in Consumer Contracts

Regulations 1999 and our approach to exercising them.

12

Chapter 1

The FCA’s role under the Payment Services Regulations 2017 and the Electronic Money Regulations 2011

1.35 There is also guidance and information issued by us, the Financial Ombudsman Service

and HMRC which is likely to be relevant to readers of this document. This is referenced

in the appropriate sections of the document and gathered together in Annex 1 –

Useful links.

Contacting us

1.36 We hope this document will answer all your questions; however, if you have any

comments regarding this document or any aspect of the PSRs 2017 or EMRs, please

refer to the contacts page on our website.

1.37 Annex 2 contains a list of other useful contact details.

13

Chapter 2

The FCA’s role under the Payment Services Regulations 2017 and the Electronic Money Regulations 2011

2 Scope

Part I of this chapter sets out who and what is covered by the Payment Services

Regulations 2017 (PSRs 2017). Part II sets out who and what is covered by the

Electronic Money Regulations 2011 (EMRs), including what e-money is and information

about different types of e-money issuers. Each section sets out where to find further

information on scope-related issues.

Part I: PSRs 2017

Who the PSRs 2017 cover

2.1 The PSRs 2017 apply, with certain exceptions, to everyone who provides payment

services as a regular occupation or business activity in the UK (‘payment service

providers’ (PSPs)). They also apply in a limited way to persons that are not PSPs (see

regulations 38, 39, 57, 58 and 61 of the PSRs 2017).

2.2 Chapter 15 of our Perimeter Guidance (PERG)

1

gives guidance for firms who are unsure

whether their activities fall within the scope of the PSRs 2017.

2.3 For a fuller understanding of the scope of the PSRs 2017, the guidance should be read

in conjunction with Schedule 1 of the PSRs 2017 and the definitions in regulation 2

, and Schedule 3 of the Electronic Money, Payment Services and Payment Systems

(Amendment and Transitional Provisions) (EU Exit) Regulations 2018 (the Exit SI), which

sets out the temporary permission schemes for EEA authorised payment institutions

(PIs) and EEA registered account information service providers (RAISPs). These are

the Temporary Permissions Regime (TPR), Supervised Run-Off Regime (SRO) and

Contractual Run-Off Regime (CRO). More detail on these schemes is set out at

Chapter 6.

Payment institutions (PIs)

2.4 The PSRs 2017 establish a class of firms authorised or registered to provide

payment services. These are collectively referred to as payment institutions (PIs)

in this document. Chapter 3 – Authorisation and registration gives details of the

procedures for authorisation and registration.

2.5 We expect that the following types of firms will require authorisation or registration for

theirpaymentservicesactivities,amongstothers:

• money remitters

• certainelectroniccommunicationnetworkoperatorsoeringpaymentservices

• non-bank credit card issuers

• merchantacquiringrms

1 https://www.handbook.fca.org.uk/handbook/PERG/15/?view=chapter

14

Chapter 2

The FCA’s role under the Payment Services Regulations 2017 and the Electronic Money Regulations 2011

• payment initiation service providers

• account information service providers

2.6 Not all providers of payment services require authorisation or registration under the

PSRs 2017 (see ‘Other payment service providers’ ‘Temporary authorisations’ and

‘Exemptions’ below).

Authorised PIs

2.7 A PSP authorised under the PSRs 2017 is termed an ‘authorised PI’.

Small PIs

2.8 PSPs which meet the criteria for registration under regulation 14 of the PSRs 2017,

and choose to apply for registration rather than authorisation, are referred to as small

PIs. Small PIs cannot provide account information services (AIS) or payment initiation

services (PIS). See Chapter 17 – Payment initiation and account information

services and confirmation of availability of funds and Chapter 15 of PERG for more

information about AIS and PIS.

2.9 All PIs must comply with the conduct of business requirements of the PSRs 2017,

described in Chapter 8 – Conduct of business requirements.

Registered Account Information Service Providers

2.10 Businesses that only provide AIS are exempt from full authorisation but are subject

to a registration requirement. Once registered, they are termed ‘registered account

information service providers (RAISPs)’.

2.11 RAISPs are only required to comply with specific parts of the conduct of business

requirements. These are identified in paragraphs 8.134 and 8.144 of Chapter 8 –

Conduct of business requirements.

Temporary authorisations

2.12 Firms in the TPR or SRO (TA firms) have temporary authorisation such that they can

continue operating in the UK for a limited period after IP Completion Day. Such firms

are deemed to be PIs and RAISPs for the purposes of the PSRs 2017.

2.13 As explained in Chapter 6, in most cases the term PI in this document should be taken

to include a TA firm that is an EEA authorised PI and the term RAISP in this document

should be taken to include a TA firm that is an EEA registered account information

service provider.

2.14 Note that the transitional directions made by the FCA under Part 7 of the Financial

Services and Markets Act 2000 (Amendment) (EU Exit) Regulations 2019 do not

apply to the requirements specific to TA firms. These firms must comply with their

obligations under the PSRs 2017 and the Exit SI.

Agents

2.15 PIs may provide payment services through agents, subject to prior registration of the

agent with us. Chapter 5 – Appointment of agents gives details of the process to be

followed.

15

Chapter 2

The FCA’s role under the Payment Services Regulations 2017 and the Electronic Money Regulations 2011

2.16 It is the PI’s responsibility to ensure the agent complies with the applicable conduct of

business requirements of the PSRs 2017 and that it has the systems and controls in

place to effectively oversee the agent’s activities.

Other payment service providers

2.17 The following can provide payment services without the need for further authorisation

orregistrationbytheFCAunderthePSRs2017:

• banks [including those with a temporary permission]

• building societies

• authorisede-moneyinstitutions(AuthorisedEMIs)[includingTArms]

• registered e-money institutions (small EMIs)

• [EEAauthorisedEMIsEEAauthorisedPIsandEEARAISPs[includingTArms]

• PostOceLimited

• certain public bodies

2.18 These entities must, however, comply with the applicable conduct of business

requirements of the PSRs 2017 described in Chapter 8 – Conduct of business

requirements and the reporting and notification requirements described in Chapter

13 – Reporting and Notifications.

2.19 In the case of credit institutions, the relevant application procedures remain those

in the Financial Services and Markets Act 2000 (FSMA). Credit institutions are also

subjecttoourrulesandguidanceinourBanking:ConductofBusinessSourcebook

(BCOBS) – see Chapter 8 – Conduct of business requirements. References to credit

institutions include persons with deemed Part 4A permissions for deposit-taking and/

or issuance of electronic money (as relevant) under Part 3 (temporary permission)

or Part 6 (supervised run off) of the EEA Passport Rights (Amendment, etc., and

Transitional Provisions) (EU Exit) Regulations 2018.

2.20 Credit institutions will need to notify us if they wish to provide AIS or PIS, and existing

EMIs will need to apply to remove any requirement on their permission imposed by

regulation 78A of the EMRs, see Chapter 3 – Authorisation and registration, and

Chapter 13 – Reporting and Notifications.

Exemptions

2.21 ThefollowingbodiesarespecificallyexemptfromthescopeofthePSRs2017:

• credit unions

• municipal banks

• The National Savings Bank

2.22 Municipal banks and the National Savings Bank are also exempt from BCOBS. Municipal

banks must nevertheless notify us if they are providing, or propose to provide,

payment services. Credit unions are subject to BCOBS.

16

Chapter 2

The FCA’s role under the Payment Services Regulations 2017 and the Electronic Money Regulations 2011

2.23 EEA authorised PIs, EEA authorised EMIs and EEA RAISPs exercising passport rights

in the UK immediately before IP Completion Day (as defined in the European Union

(Withdrawal Agreement) Act 2020) on a services passport basis are also exempt from

the prohibition in regulation 138(1) of the PSRs 2017, subject to the requirements of

Schedule 3, Part 3, paragraph 36 of the Exit SI. We refer to this as “contractual run-off".

Registers

2.24 The Financial Services Register, published on our website includes information relating

to various types of PSP, together with details of the payment services that they are

entitledtoprovide.Theregisterincludesdetailsrelatingto:

• authorised PIs and EMIs and their agents

• registered small PIs and small EMIs and their agents

• registered RAISPs and their agents

• TArmsandtheiragents

• persons providing a service falling within the limited network exclusion or the

electroniccommunicationsexclusionwhohavenotiedusinlinewithregulation38

or 39 of the PSRs 2017

• credit unions, municipal banks and the National Savings Banks, where they provide

payment services

Payment services

2.25 The payment services covered by the PSRs 2017 (Part 1 of Schedule 1) are set out in

the table below, along with some examples of activities likely to be payment services.

The table is high-level and indicative in nature. If firms are in any doubt as to whether

their activities constitute payment services, they should refer to Chapter 15 of PERG.

2.26 In addition to questions and answers providing further information on payment

services, PERG also explains a number of exclusions in the PSRs 2017. These

exclusions are set out in Part 2 of Schedule 1 to the PSRs 2017 (Activities which do not

constitute payment services). For businesses that intend to rely on paragraphs 2(k) or

2(l) of Part 2 of Schedule 1 to the PSRs 2017 (i.e. the limited network exclusion or the

electronic communication network exclusion), certain notification requirements apply.

SeeChapter13–ReportingandNotifications.

17

Chapter 2

The FCA’s role under the Payment Services Regulations 2017 and the Electronic Money Regulations 2011

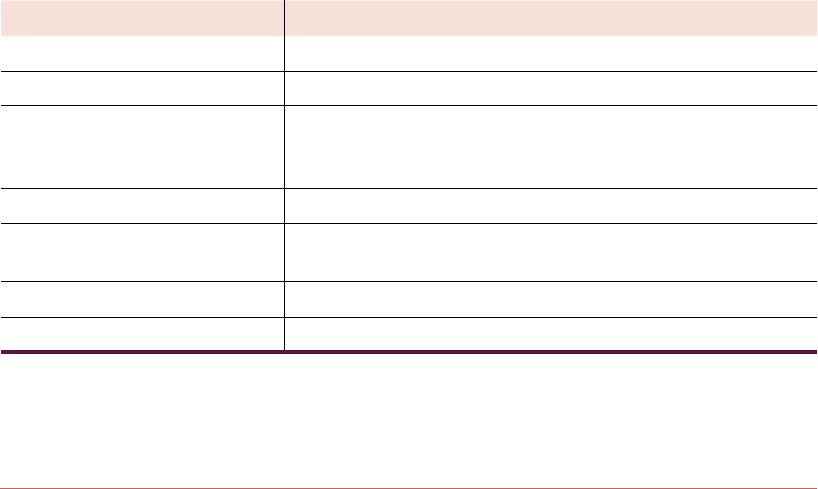

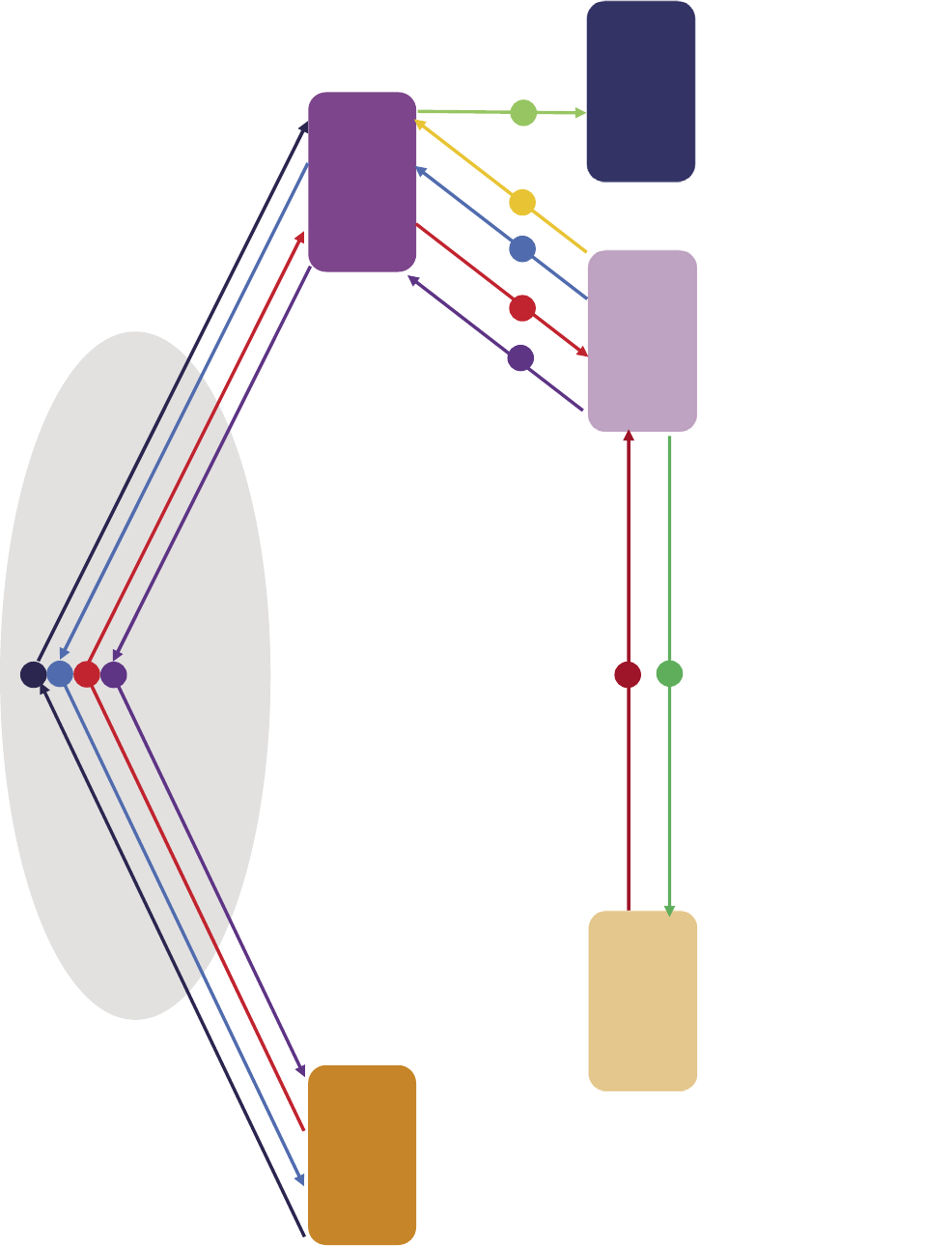

What is a payment service?

Examples (PERG 15 provides further details

about what activities constitute payment

services)

Services enabling cash to be placed on a payment

account and all of the operations required for

operating a payment account

• payments of cash into a payment account over

the counter and through an ATM

Services enabling cash withdrawals from a payment

account and all of the operations required for

operating a payment account

• withdrawals of cash from payment accounts,

e.g. through an ATM or over the counter

Execution of the following types of payment

transaction:

• directdebits,includingone-odirectdebits

• payment transactions executed through a

payment card or a similar device

• credit transfers, including standing orders

• transfers of funds with the customer’s PSP or

with another PSP

• directdebits(includingone-odirectdebits).

However, acting as a direct debit originator

would not, of itself, constitute the provision of a

payment service.

• debit card payments

• transferring e-money

• credit transfers, such as standing orders, Faster

Payments, BACS or CHAPS payments

Execution of the following types of payment

transaction where the funds are covered by a credit

lineforapaymentserviceuser:

• directdebits,includingone-odirectdebits

• payment transactions through a payment card or

a similar device

• credit transfers, including standing orders

• direct debits using overdraft facilities

• credit card payments

• debit card payments using overdraft facilities

• credit transfers using overdraft facilities

Issuing payment instruments or acquiring of

payment transactions.

• card issuing including where the card issuer

provides a card linked to an account held with

adierentPSP(seeregulation68ofthePSRs

2017) but not including mere technical service

providers who do not come into possession of

funds being transferred

• merchant acquiring services (rather than

merchants themselves)

Money remittance. • money transfer/remittances that do not involve

creation of payment accounts.

Payment initiation services. • services provided by businesses that contract

with online merchants to enable customers

to purchase goods or services through their

online banking facilities, instead of using a

payment instrument or other payment method.

Account information services. • businesses that provide users with an

electronic “dashboard” where they can view

information from various payment accounts in

a single place

• businesses that use account data to provide

users with personalised comparison services

supported by the presentation of account

information

• businesses that, on a user’s instruction, provide

information from the user’s various payment

accounts to both the user and third party

serviceproviderssuchasnancialadvisorsor

credit reference agencies

18

Chapter 2

The FCA’s role under the Payment Services Regulations 2017 and the Electronic Money Regulations 2011

Exclusions

2.27 There is a broad range of activities which do not constitute payment services. These are

setoutinSchedule1Part2ofthePSRs2017.Amongsttheseexcludedactivitiesare:

• payment transactions through commercial agents acting on behalf of either the

payer or the payee;

• cash to cash currency exchange activities (e.g. bureaux de change);

• payment transactions linked to securities asset servicing (e.g. dividend payments,

share sales or unit redemptions);

• certain services provided by technical service providers;

• payment services based on instruments used within a limited network of service

providers or for a very limited range of goods or services (“limited network

exclusion”); and

• payment transactions for certain goods or services up to certain value limits,

resulting from services provided by a provider of electronic communication

networks or services (“electronic communications exclusion”).

2.28 Chapters 3A and 15 of PERG provide more information on these exclusions. Chapter

13 – Reporting and Notifications provides information about notifications required

from businesses operating under the limited network exclusion and the electronic

communications exclusion.

Scope of the PSRs 2017: jurisdiction and currency

2.29 The table below shows the jurisdictional scope of different parts of the PSRs 2017

and their scope in terms of the currency of the payment transaction. We refer to a few

differenttypesoftransactions:

• ‘IntraUKtransactions’:transactionswhereboththepayer’sandthepayee’sPSPsare

(or the sole PSP is) located in the UK.

• ‘Onelegtransactions’:transactionswhereeitherthepayer’sorthepayee’sPSP

(rather than the payer or payee) is located outside the UK.

• ‘Qualifyingareatransactions’:transactionswherethePSP(includingEEApayment

service providers subject to PSD2) of both the payer and payee are located within

the qualifying area (the UK and the EEA) and the transaction is in euro and executed

under a payment scheme which operates across the qualifying area (for example,

the SEPA schemes).

19

Chapter 2

The FCA’s role under the Payment Services Regulations 2017 and the Electronic Money Regulations 2011

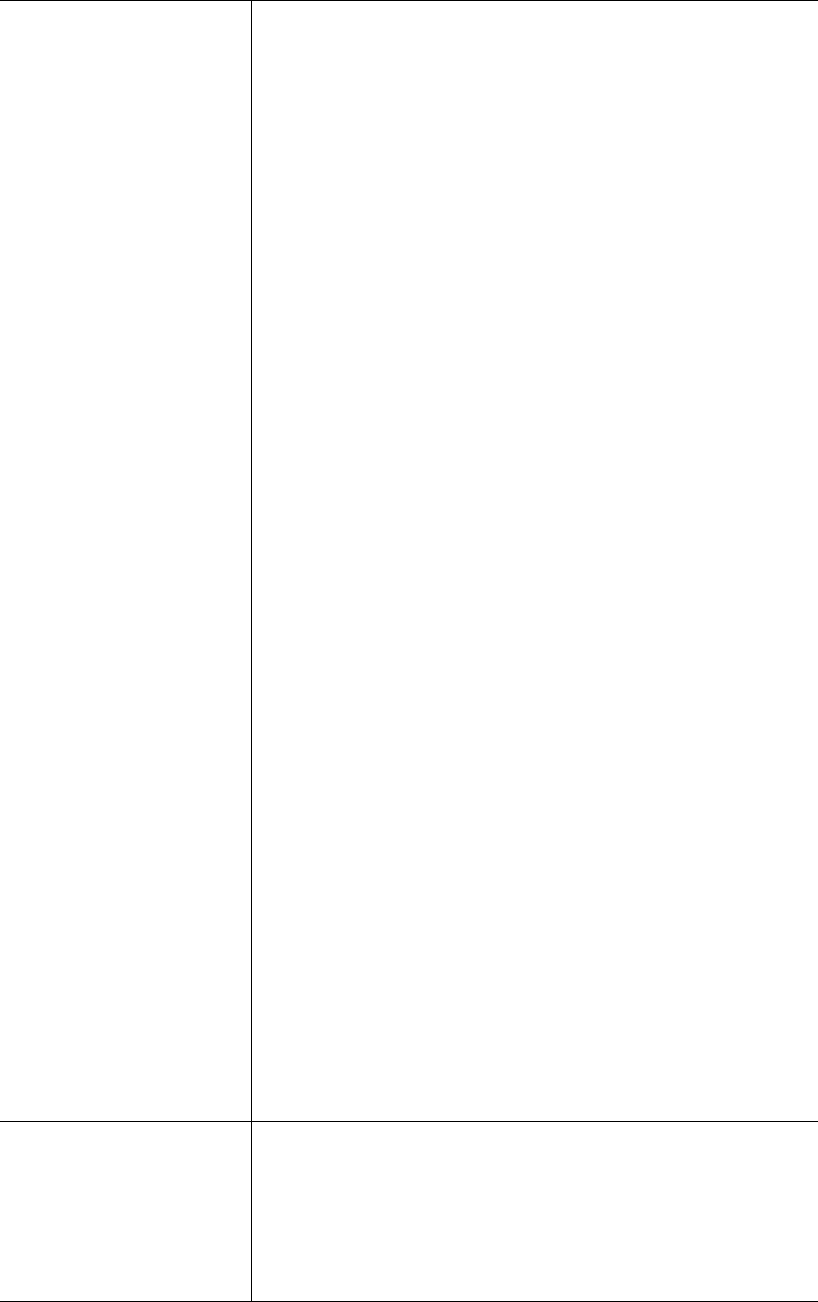

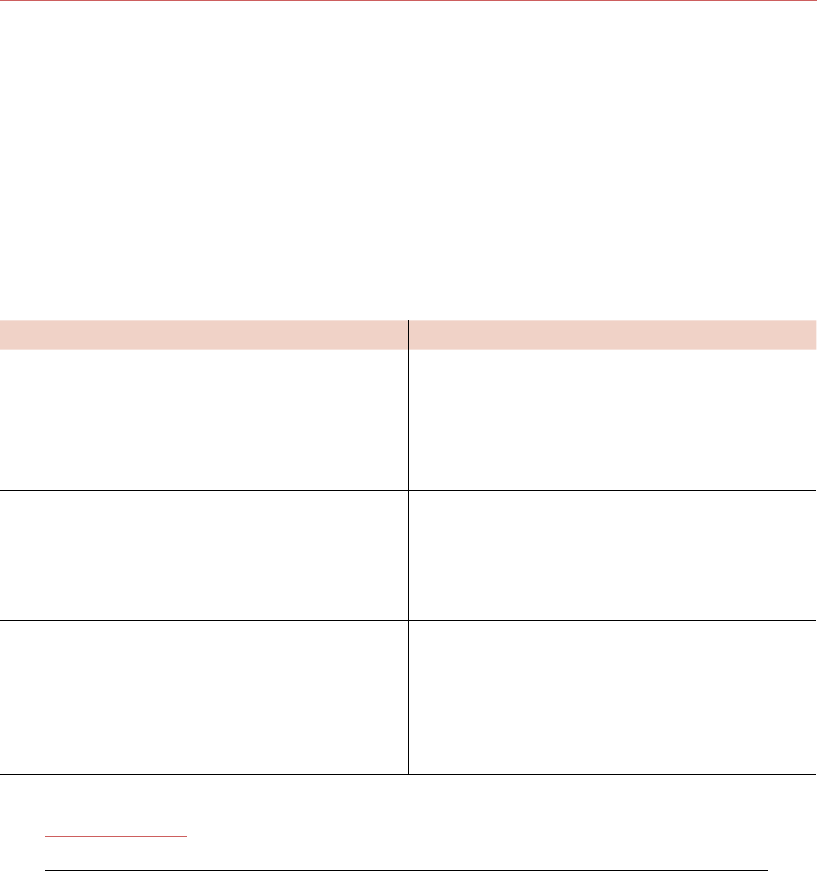

Payment services – jurisdictional and currency scope

PSRs 2017 Jurisdiction Currency

Authorisation/Registration

(including meeting capital and

safeguarding requirements).

Firms providing payment

services, as a regular occupation

or business activity in the

UK including one leg transactions

and qualifying area transactions,

unlessthermisinthelistof

‘other payment service providers’

described above.

All currencies.

Complaints that can be

considered by the Financial

Ombudsman Service (see

Chapter 11 for full details of

eligibility).

All payment services provided

from a UK establishment,

including the UK end of one leg

transactions and qualifying area

transactions.

All currencies.

Part 6 – Conduct of business

requirements (information

requirements)

In general, Part 6 applies to payment services provided from a UK

establishment including the UK end of one leg transactions in any

currency and qualifying area transactions. For one leg transactions

and transactions (other than qualifying area transactions) not in

sterling, Part 6 only applies in respect of those parts of a transaction

that are carried out in the UK. We set out other exceptions to this in a

separate table below.

Part 7 – Conduct of business

requirements (rights and

obligations in relation to the

provision of payment services)

In general, Part 7 applies to payment services provided from a UK

establishment including the UK end of one leg transactions, in any

currency and qualifying area transactions. For one leg transactions

and transactions (other than qualifying area transactions) not in

sterling, Part 7 only applies in respect of those parts of a transaction

that are carried out in the UK. We set out below other exceptions to

this in a separate table.

20

Chapter 2

The FCA’s role under the Payment Services Regulations 2017 and the Electronic Money Regulations 2011

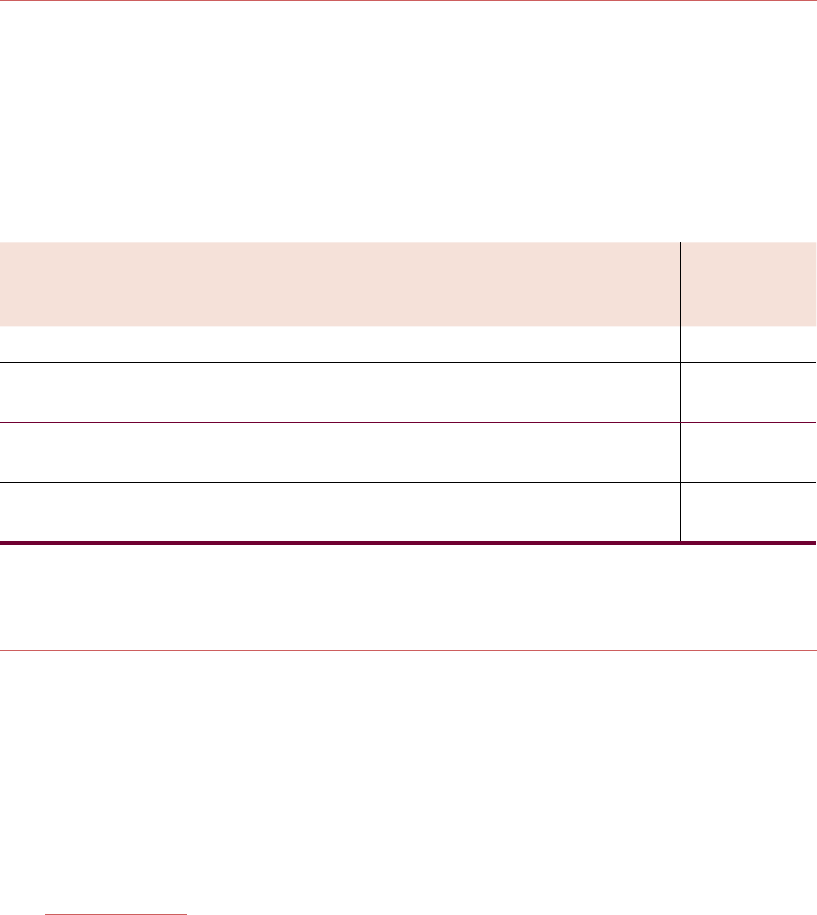

Part 6 – Exceptions to where Part 6 applies to one and two leg transactions in any currency.

Does the regulation apply?

PSRs 2017

One leg/

any

currency

Intra UK/

non-sterling/

euro

Intra UK/

sterling

Qualifying

area/euro

Regulation 43(2)

(b) – Pre-contractual

information about

execution times

for single payment

contracts

No No Yes Yes

Regulation 52(a) –

Information about

execution times prior to

execution of individual

transactions under a

framework contract

No No Yes Yes

Paragraph 2(e) of

Schedule 4 – Pre-

contractual information

about execution times

for framework contracts

No No Yes Yes

Paragraph 5(g) of

Schedule 4 – Pre-

contractual information

about the conditions

for the payment of

anyrefundunder

regulation 79.

No Yes Yes Yes

21

Chapter 2

The FCA’s role under the Payment Services Regulations 2017 and the Electronic Money Regulations 2011

Part 7 – Exceptions to where Part 7 applies to one and two leg transactions in any currency.

Does the regulation apply?

PSRs 2017

One leg/

any

currency

Intra UK/

non-sterling/

euro

Intra UK/

sterling

Qualifying

area/euro

Regulation 66(2) – charges paid

by payer and payee

No Yes Yes No

Regulation 66(2A) – charges paid

by payer and payee

No No No Yes

Regulation 79 – Refunds for

transactions initiated by or

through a payee

No Yes Yes Yes

Regulation 80 – Requests for

refunds for transactions initiated

by or through a payee

No Yes Yes Yes

Regulation 84 – Amounts

transferred and received

No No Yes Yes

Regulation 85 – Application of

Regulations 86 – 88

Yes No Yes Yes

Regulation 86(1)-(3) – Payment

transactions to a payment

account

No* No*

Yes

(subject to

regulation 85)

Yes

(subject to

regulation 85)

Regulation 86(4)-(5) – Payment

transactions to a payment

account

Yes

(subject to

regulation 85)

No

Yes

(subject to

regulation 85)

Yes

(subject to

regulation 85)

Regulation 87 – Absence of

payee’s payment account with

payment service provider

Yes

(subject to

regulation 85)

No

Yes

(subject to

regulation 85)

Yes

(subject to

regulation 85)

Regulation 88 – Cash placed on a

payment account

Yes

(subject to

regulation 85)

No

Yes

(subject to

regulation 85)

Yes

(subject to

regulation 85)

Regulation 91 – non- execution

or late execution of payment

transaction initiated by the payer

No Yes Yes Yes

Regulation 92 – non- execution

or late execution of payment

transaction initiated by the payee

No Yes Yes Yes

Regulation 94 – Liability of

service providers for charges and

interest

No Yes Yes Yes

Regulation 95 – right of recourse No Yes Yes Yes

* This means that when making transactions to a payment account the time limits for crediting a payee’s PSP’s account

will not apply to one leg in transactions or to intra-UK transactions in currencies other than sterling and euro.

2.30 The ‘corporate opt-out’ may apply to certain of the conduct of business provisions –

see Part 1 of Chapter 8 – Conduct of business requirements for further details.

22

Chapter 2

The FCA’s role under the Payment Services Regulations 2017 and the Electronic Money Regulations 2011

Part II: EMRs

Who the EMRs cover

2.31 The EMRs apply, with certain exceptions, to everyone who issues e-money in the UK.

They also apply in a limited way to persons that are not e-money issuers (see regulation

3(a) and 3(b) of the EMRs).

2.32 Chapter 3A of PERG gives guidance for firms who are unsure whether their activities

fall within the scope of the EMRs.

2.33 For a fuller understanding of the scope of the EMRs this guidance should be read in

conjunction with the definitions in regulation 2 of the EMRs and Schedule 3 of the

Exit SI, which sets out the TPR, SRO and CRO for EEA authorised EMIs. More detail on

these schemes is set out at Chapter 6.

How e-money is dened

2.34 Regulation 2 of the EMRs defines e-money as monetary value represented by a claim

ontheissuerthatis:

• stored electronically, including magnetically

• issued on receipt of funds for the purpose of making payment transactions (see

regulation 2 of the PSRs 2017)

• accepted as a means of payment by persons other than the issuer

• not excluded by regulation 3 of the EMRs (see paragraph 2.35 below)

2.35 Examples of e-money include prepaid cards that can be used to pay for goods at a

range of retailers, or virtual purses that can be used to pay for goods or services online.

Exclusions

2.36 There are two express exclusions in regulation 3 of the EMRs. Chapters 3A and 15 of

PERG provide more information on these exclusions. The exclusions mirror paragraphs

2(k) and 2(l) of Part 2 of Schedule 1 to the PSRs 2017 (i.e. the limited network exclusion

and the electronic communications exclusion).

How the EMRs dene e-money issuers

2.37 The term ‘e-money issuer’ refers to anyone issuing e-money and should be

distinguished from the term ‘e-money institution’, which refers to the type of regulated

entity, rather than the activity. E-money issuers are defined in the EMRs as any of the

following persons when they issue e-money.

E-money institutions (EMIs)

2.38 The EMRs establish a class of firms authorised or registered to issue e-money and

provide payment services called EMIs.

2.39 Not all issuers of e-money require authorisation or registration under the EMRs (see

other e-money issuers below).

2.40 An EMI which receives authorisation under the EMRs is termed an ‘authorised EMI’.

23

Chapter 2

The FCA’s role under the Payment Services Regulations 2017 and the Electronic Money Regulations 2011

2.41 EMIs that meet the criteria for registration under regulation 12 of the EMRs, and

choose to apply for registration rather than authorisation, are referred to as ‘small

EMIs’. Chapter 3 – Authorisation and registration gives details of the procedures for

authorisation and registration.

2.42 All EMIs must comply with the conduct of business requirements of the PSRs 2017 and

EMRs described in Chapter 8 – Conduct of business requirements and the reporting

and notification requirements described in Chapter 13 – Reporting and Notifications.

Temporary authorisations

2.43 TA firms have temporary authorisation such that they can continue operating in the

UK for a limited period after IP Completion Day. Such firms are deemed to be EMIs for

the purposes of the EMRs and PSRs 2017.

2.44 As explained in Chapter 6, in most cases the term EMI in this document should be

taken to include a TA firm that is an EEA authorised EMI.

2.45 Note that the transitional directions made by the FCA under Part 7 of the Financial

Services and Markets Act 2000 (Amendment) (EU Exit) Regulations 2019 do not

apply to the requirements specific to TA firms. These firms must comply with their

obligations under the EMRs, the PSRs 2017 and the Exit SI.

E-money issuers who require Part 4A permission under FSMA

2.46 Credit institutions, credit unions and municipal banks do not require authorisation or

registration under the EMRs but if they propose to issue e-money they must have a

Part 4A permission under FSMA for the activity of issuing e-money (or be deemed to

have such a permission by virtue of the EEA Passport Rights (Amendment, etc., and

Transitional Provisions) (EU Exit) Regulations 2018). When issuing e-money, they are

subject to the provisions on issuance and redeemability of e-money in the EMRs (see

Chapter 8 – Conduct of business requirements). In addition credit unions are subject

to the safeguarding requirements (see Chapter 10 – Safeguarding).

Other e-money issuers

2.47 The following can issue e-money and do not need to apply for authorisation or

registration under the EMRs but they must give us notice if they issue or propose to

issuee-money:

• PostOceLimited;

• the Bank of England, when not acting in its capacity as a monetary authority or other

public authority;

• government departments and local authorities when acting in their capacity as

public authorities; and

• the National Savings Bank.

2.48 They will be subject to the conduct of business requirements of the EMRs, the conduct

of business requirements of the PSRs 2017 for the payment service aspect, and they

will have to report to us their average outstanding e-money on a yearly basis. Certain

customers will have access to the Financial Ombudsman Service.

24

Chapter 2

The FCA’s role under the Payment Services Regulations 2017 and the Electronic Money Regulations 2011

2.49 PERG 3A gives guidance for businesses that are unsure whether their activities fall

within the scope of the EMRs.

Exemptions

2.50 EEA authorised EMIs exercising passport rights in the UK immediately before IP

Completion Day on a services basis are exempt from the prohibition in regulation

138(1) of the PSRs 2017 and in regulation 63(1) of the EMRs, subject to the

requirements of Schedule 3, Part 1A, paragraph 12L of the Exit SI. We refer to this as

“contractual run-off”.

UseofAgentsandDistributors

2.51 EMIs may distribute and redeem e-money and provide payment services through

agents, subject to prior registration of the agent by us. Chapter 5 – Appointment of

agents gives details of the process to be followed.

2.52 EMIs may engage distributors to distribute and redeem e-money. An EMI cannot

provide payment services through a distributor, and distributors do not have to be

registered by us but applicants will have to identify their proposed use of distributors.

EMIs providing payment services

2.53 All EMIs may provide payment services, including those that are not related to

the issuing of e-money (unrelated payment services). EMIs must, however, tell us

about the types of payment services they wish to provide, and EMIs who wish to

offer unrelated payment services may have to provide additional information at the

point of authorisation (see Chapter 3 – Authorisation and Registration for further

information). This will primarily be relevant where the EMI wishes to offer payment

services that are independent from its e-money products. Where the EMI proposes

simply to transfer funds from e-money accounts, such as where a customer uses their

e-money to pay a utility bill, this payment service would relate to the activity of issuing

e-money.

2.54 Small EMIs can only provide unrelated payment services if the average monthly total

of payment transactions does not exceed €3 million on a rolling 12-month basis (see

Chapter 3 – Authorisation and registration).

EMIs providing AIS and PIS

2.55 Regulation 78A of the EMRs has the effect of placing a requirement on EMIs

authorised in the UK before 13 January 2018 preventing them from providing AIS or

PIS. Authorised EMIs subject to this requirement will need to apply to us if they wish to

have it removed (see Chapter 3 – Authorisation and Registration). Small EMIs cannot

provide AIS or PIS.

25

Chapter 3

The FCA’s role under the Payment Services Regulations 2017 and the Electronic Money Regulations 2011

3 Authorisation and registration

3.1 This chapter sets out how we will apply the Payment Services Regulations 2017 (PSRs

2017)andElectronicMoneyRegulations2011(EMRs)dealingwith:

• authorisation of payment institutions (authorised PIs) and e-money institutions

(authorised EMIs) (Part I)

• registration of small payment institutions (small PIs) and small e-money institutions

(Small EMIs) (Part II)

• registration of businesses only providing account information services (registered

account information services providers – RAISPs) (Part III)

• decision-making process (Part IV)

• transitional provisions (Part V)

3.2 For information on notifications relating to exclusions please see Chapter 13 –

Reporting and notifications.

Introduction

3.3 A UK business that provides payment services (as defined in the PSRs 2017) as a

regular occupation or business activity in the UK needs to apply to us to become

either an authorised PI, a small PI or a registered account information service provider

(RAISP), unless it is already another type of payment service provider (PSP) or is

exempt or excluded.

3.4 Being a small PI is an option available to businesses with an average payment

transactions turnover that does not exceed €3 million per month and which do not

provide account information services (AIS) or payment initiation services (PIS). The

registration process is cheaper and simpler than authorisation and has no ongoing

capital requirements, but small PIs may not provide AIS or PIS. The conduct of business

requirements still apply, as does access to the Financial Ombudsman Service by small

PIs’ eligible customers (see Chapter 11 – Complaints handling for more information

on access to the Ombudsman Service).

3.5 A UK business (or a UK branch of a business with its head office outside the UK) that

intends to issue e-money needs to apply to us to become either an authorised EMI

or a small EMI, unless it has permission under Part 4A of the Financial Services and

Markets Act 2000 (FSMA) to issue e-money or is exempt. Being a small EMI is an option

available to UK businesses whose total business activities are projected to generate

average outstanding e-money that does not exceed €5 million.

3.6 In accordance with regulation 32 of the EMRs, EMIs are allowed to provide payment

services without being separately authorised under the PSRs 2017. However, small

EMIs are not permitted to provide AIS or PIS. If a small EMI provides payment services

26

Chapter 3

The FCA’s role under the Payment Services Regulations 2017 and the Electronic Money Regulations 2011

unrelated to the issuance of e-money, the limits on payment volumes are the same as

for a small PI (i.e. the monthly average, over a period of 12 months, of the total amount

of relevant payment transactions must not exceed €3 million). Regulation 78A of the

EMRs has the effect of placing a requirement on EMIs authorised before 13 January

2018 preventing them from providing AIS or PIS. Authorised EMIs will need to apply to

us to have this requirement removed (see Chapter 4 – Changes in circumstances of

authorisation and registration for more on how such applications should be made).

3.7 Agents can be appointed by a PI, RAISP or EMI (the principal) to provide payment

services on the principal’s behalf. The principal accepts responsibility for the acts

and omissions of the agent and must apply for the agent to be registered on the

Financial Services Register. More information on agents is contained in Chapter 5 –

Appointment of agents.

3.8 EMIs may also engage distributors to distribute and redeem e-money. A distributor

cannot provide payment services, and does not have to be registered by us – but

applicants will have to identify their proposed use of distributors at authorisation.

3.9 The Financial Services Register is a public record of firms, individuals and other bodies

that are, or have been, regulated by the PRA and/or FCA. The Register includes

information about PIs, RAISPs and EMIs and their agents.

Making an application for authorisation or registration

3.10 Anyone wishing to become authorised or registered needs to complete an application

form and submit it to us along with the required information and the application fee

(more information is available in Chapter 15 – Fees). Applicants that wish to operate

through agents will be charged an additional application fee.

3.11 Application forms are available after registering on Connect. No work will be done on

processing the application until the full fee is received. The fee is non-refundable and

must be paid via Connect.

Information to be provided and EBA Guidelines

3.12 The EBA has issued ‘Guidelines on the information to be provided for authorisation of

payment institutions and e-money institutions and registration as account information

service providers’ (EBA Guidelines).

2

The EBA Guidelines specify the information that

applicants for authorisation as a PI or an EMI or registration as a RAISP will be required

to submit. Details on these requirements are set out below in Part I for authorised PIs

and authorised EMIs and in Part III for RAISPs. Following the UK’s exit from the EU we

continue to expect businesses that are seeking authorisation or registration to apply

the EBA Guidelines to the extent that they remain relevant

3

. In some cases, we will

also consider relevant guidelines when specifying the information to be provided by

applicants for registration as small PIs or small EMIs. More detail on these requirements

is set out in Part II.

2 Availableat:https://www.eba.europa.eu/regulation-and-policy/payment-services-and-electronic-money/guidelines-on-

authorisation-and-registration-under-psd2

3 See our approach to EU non-legislative materials – https://www.fca.org.uk/publication/corporate/brexit-our-approach-to-eu-non-

legislative-materials.pdf

27

Chapter 3

The FCA’s role under the Payment Services Regulations 2017 and the Electronic Money Regulations 2011

3.13 Where we do not prescribe the format of information that must be given to us, we will

need to have enough information to be satisfied that the applicant meets the relevant

conditions. This does not mean that the applicant needs to enclose full copies of all

the procedures and manuals with their application; a summary of what they cover

may be enough, as long as the manuals and procedures themselves are available if

we want to investigate further. Note that supplying the information requested on the

application form will not necessarily be enough for the application to be ‘complete’. We

may need to ask additional questions or request additional documentation to clarify

the answers already given. It is only when this additional information has been received

and considered alongside the existing information that we will be able to determine

whether the application is complete.

3.14 The information provided by the applicant should be true, complete, accurate and up

to date. The level of detail should be proportionate to the applicant’s size and internal

organisation, and to the nature, scope, complexity and riskiness of the particular

service(s) the applicant intends to provide. We would expect applicants to answer

questions in full in the application form, which includes providing the requested

information in bullets under each question.

3.15 We will assess the information provided against the requirements set out in the PSRs

2017, EMRs and with regard to the EBA Guidelines (where applicable).

3.16 Applicants should note that under regulation 142 of the PSRs 2017 and regulation 66

of the EMRs it is a criminal offence to knowingly or recklessly give information that is

materially false or misleading in their application.

Requests for further information (regulations 5(4), 13(4) and 17(2) PSRs 2017 and

5(4) and 12(4) EMRs)

3.17 At any time after receiving an application for authorisation or registration (or a

variation of either of these) and before determining it, we can require the applicant to

provide such further information as we reasonably consider necessary to enable us to

determine the application. Where applications are incomplete (when they do not have

all the information we need), we will ask in writing for more information. We will then

confirm the date from which we consider the application to be complete. The timings

set out in Part IV of this chapter will run from that date.

Duty to advise of material changes in an application (regulations 20 PSRs 2017 and

17 EMRs)

3.18 We attach considerable importance to the completeness and accuracy of the

information provided to us. If there is, or is likely to be, any material change in the

information provided for an application before we have made our decision on it, the

applicant must notify us. This also applies if it becomes apparent to the applicant that

there is incorrect or incomplete information in the application. The requirements also

apply to changes to supplementary information already provided. If an applicant fails to

provide accurate and complete information it will take longer to assess the application.

In some cases, it could lead to the application being rejected.

3.19 The applicant should notify the case officer assigned to the application of details of

the change and provide the complete information or a correction of the inaccuracy (as

the case may be) without undue delay. If the applicant expects a change in the future

they must provide details as soon as they become aware of it. When providing this

information the applicant will be asked to confirm that the rest of the information in the

application remains true, accurate and complete.

28

Chapter 3

The FCA’s role under the Payment Services Regulations 2017 and the Electronic Money Regulations 2011

Part I: Becoming an authorised PI or authorised EMI

3.20 This section applies to businesses that wish to become an authorised PI or an

authorised EMI.

3.21 The conditions that must be met in order to become an authorised PI are set out in

regulation 6 of the PSRs 2017 and those that must be met to become an authorised

EMI are set out in regulation 6 of the EMRs have been met.

3.22 The information requirements for applications can be found in Schedule 2 of the PSRs

2017 with relevant guidance at section 4.1 of the EBA Guidelines (the API Guidelines)

for authorised PIs and Schedule 1 of the EMRs with relevant guidance at section 4.3 of

the EBA Guidelines (the EMI Guidelines) for authorised EMIs.

3.23 There is an application fee for firms looking to become an authorised PI or an

authorised EMI (more information is available in Chapter 15 – Fees).

3.24 For authorised PIs and authorised EMIs, the application must be signed by the

person(s) responsible for making the application on behalf of the applicant firm. The

appropriateperson(s)dependsontheapplicantfirm’stype.Theseareasfollows:

Type of applicant Appropriate signatory

Company with one director The director

Company with more than one director Two direc tors

Limited liability partnership Two members

Limited partnership The general partner or partners

Information to be provided and conditions for authorisation

3.25 Authorisation will not be granted unless we are satisfied that the conditions specified in

regulation 6 of the PSRs 2017 or regulation 6 of the EMRs (as applicable) have been met.

3.26 This section needs to be read alongside the API Guidelines or the EMI Guidelines, as

appropriate. Together, the PSRs 2017, API Guidelines, EMRs and EMI Guidelines explain

the information that you must supply with the application and the conditions that must

be satisfied.

Programme of operations (paragraph 1, Schedule 2 PSRs 2017 and paragraph 1,

Schedule 1 EMRs)

3.27 For authorised PIs, API Guideline 3 explains the information and documentation which

we require to be provided for the programme of operations. For authorised EMIs, this is

explained in EMI Guideline 3.

3.28 In both cases, we require the programme of operations to be provided by the applicant

to contain a description of the payment services envisaged, including an explanation of

how the activities and the operations fit into the list of payment services set out in Part

1 of Schedule 1 to the PSRs 2017. Some examples of the sorts of activities expected to

fall within the scope of each are described in Chapter2 – Scope, with further guidance

in Chapter 15 of our Perimeter Guidance manual (PERG). Applicants for authorisation

as an EMI must also provide an indication of the e-money services the applicant

29

Chapter 3

The FCA’s role under the Payment Services Regulations 2017 and the Electronic Money Regulations 2011

intends to provide (issuance, redemption, distribution). Guidance on e-money activities

can be found in Chapter 3A of PERG. The applicant should also describe any other

business activities it provides.

3.29 The applicant is also required to state whether they will enter into the possession of

customers’ funds. In our view, being in possession of funds includes an entitlement to

funds in a bank account in the applicant’s name, funds in an account in the applicant’s

name at another PI or EMI and funds held on trust for the applicant.

3.30 The applicant is required to provide details of how transactions will be executed

(including details of all the parties involved in the provision of the services). We may ask

for further information, which may include a request to see copies of draft contracts

between the applicant and other parties involved in the provision of the services, as

well as copies of draft framework contracts. See Chapter 8 – Conduct of business

requirements for more information on framework contracts and other conduct

requirements.

3.31 Where the applicant intends to provide AIS or PIS, we would expect the information

on the programme of operations to cover the nature of the service being provided to

the customer, how their data will be used, and how the applicant will obtain appropriate

consent(s) from the customer. See Chapter 17 – Payment initiation and account

information services and confirmation of availability of funds for more information.

Business plan (regulation 6(7)(c) and paragraph 2, Schedule 2 of the PSRs 2017 and

regulation 6(6)(c) and paragraph 2, Schedule 1 of the EMRs)

3.32 API Guideline 4 and EMI Guideline 4 explain the information and documentation which

we require to be provided in the business plan.

3.33 The business plan needs to explain how the applicant intends to carry out its

business. It should provide enough detail to show that the proposal has been carefully

thought out and that the adequacy of financial and non-financial resources has been

considered.

3.34 In accordance with regulation 7(4) of the PSRs 2017 and regulation 7(4) of the EMRs,

where an applicant wishes to carry on business activities other than the provision of

payment services and, in the case of EMIs, issuing e-money, and we think that the

carrying on of this business will, or is likely to, impair our ability to supervise it or its

financial soundness, we can require the applicant to form a separate legal entity to

provide payment services and, for EMIs, issue e-money.

3.35 As per EBA Guideline 4.2, the business plan should contain information on, and

calculation of, own funds requirements. Guidance can be found on own funds in

Chapter 9 – Capital resources and requirements. Applicants should refer to the

EBA Guidelines for other business plan requirements, including income information,

marketing plan and budget forecasts.

3.36 Applicants wishing to become authorised EMIs that intend to provide unrelated

payment services are required to submit a separate business plan for these activities.

3.37 Where the applicant intends to provide AIS, the information provided should include

how the use of customer data fits into the applicant’s business model.

30

Chapter 3

The FCA’s role under the Payment Services Regulations 2017 and the Electronic Money Regulations 2011

Structural organisation (paragraph 12 Schedule 2 of the PSRs 2017,

paragraph 7 Schedule 1 EMRs) and close links (regulation 6(9) and (10) of the

PSRs 2017 and regulation 6(8) and (9) of the EMRs)

3.38 We will require a description of the applicant’s structural organisation, which is

the plan for how the work of the business will be organised including through any

branches, agents and distributors. API Guideline 5 and EMI Guideline 5 explain out

the information and documentation which we require to be provided in relation to the

structural organisation.

3.39 The information must include a description of the applicant’s relevant outsourcing

arrangements (if any) taking into account the EBA’s guidelines on outsourcing

arrangements

4

. We may ask for further information, which may include a request to

see draft contracts with parties to whom operational functions are outsourced (see

section 18.9 on outsourcing). The PSRs 2017 (regulation 25) and EMRs (regulation 26)

make specific provisions in relation to the outsourcing to third parties of ‘important’

operational functions by authorised PIs and authorised EMIs including the provision to

itofaninformationtechnologysystem.Theseprovisionsare:

• the outsourcing is not undertaken in such a way as to impair

–

the quality of internal control

–

our ability to monitor and retrace the authorised PI’s or authorised EMI’s

compliance with the PSRs 2017 and/or the EMRs

• the outsourcing does not result in any delegation by the senior management of

responsibility for complying with the PSRs 2017 and/or the EMRs

• the relationship and obligations of the authorised PI towards its payment service

users under the PSRs 2017, or the authorised EMI towards its e-money holders

under the PSRs 2017 or EMRs, are not substantially altered

• compliance with the conditions which the PI or EMI must observe in order to be

authorisedandremainsoisnotadverselyaected

• none of the conditions of the PI’s or EMI’s authorisation require removal or variation

3.40 Regulation 25(3) of the PSRs 2017 and regulation of the 26 of the EMRs indicate what

is considered an ‘important operational function’. It is a function which, if it failed or

was defective, would materially impair an authorised PI’s or authorised EMI’s ability

to comply with the PSRs 2017 and/or EMRs and any requirements of authorisation,

its financial performance, or soundness or continuity of its payment services and/

or e-money issuance. In practice, which of an authorised PI’s or authorised EMI’s

operational functions are important will vary from business to business, according

to the nature and scale of the business. We will take these factors into consideration

when assessing an authorisation application where the business intends to outsource

important operational functions.

4 https://www.eba.europa.eu/sites/default/documents/files/documents/10180/2551996/38c80601-f5d7-4855-

8ba3-702423665479/EBA%20revised%20Guidelines%20on%20outsourcing%20arrangements.pdf

31

Chapter 3

The FCA’s role under the Payment Services Regulations 2017 and the Electronic Money Regulations 2011

3.41 Applicants must also satisfy us that any ‘close links’ they have are not likely to prevent

the effective supervision of the firm or, where a close link is located outside of the UK,

the laws of the foreign territory would not prevent effective supervision (in accordance

with regulation 6(9) and (10) of the PSRs 2017 and regulation 6(8) and (9) of the EMRs).