2018 ANNUAL REPORT

2018 ANNUAL REPORT

AND FORM 20-F

2

2018

|

ANNUAL REPORT

2018

|

ANNUAL REPORT

3

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. Yes No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of

Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such

files). Yes No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company.

See definition of “large accelerated filer,” “accelerated filer,” and emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer

Accelerated filer Non-accelerated filer

Emerging growth company

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected

not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the

Exchange Act.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP

International Financial Reporting Standards as issued by the International Accounting Standards Board Other

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow:

Item 17

or Item 18 .

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange

Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes No

2018

|

ANNUAL REPORT

5

Consolidated Financial Statements

at December 31, 2018 .................................. 165

Consolidated Income Statement .......................... 167

Consolidated Statement

of Comprehensive Income ................................... 168

Consolidated Statement of Financial Position ....... 169

Consolidated Statement of Cash Flows ............... 170

Consolidated Statement of Changes in Equity ..... 171

Notes to the Consolidated Financial Statements .. 172

Company Financial Statements

at December 31, 2018 .................................. 273

Income Statement ............................................... 274

Statement of Financial Position ............................ 275

Notes to the Company Financial Statements ....... 276

Other Information ........................................ 289

Additional information for Netherlands

Corporate Governance ........................................ 290

Additional Information for U.S. Listing Purposes ... 293

Independent Auditor’s Report ..................... 307

Form 20-F Cross Reference ........................ 319

Signatures .................................................... 323

Board of Directors and Auditor ....................... 7

Message from the Chairman and the CEO ..... 9

Board Report ................................................. 13

Introduction ........................................................... 13

Management Report ............................................. 16

Selected Financial Data ...................................... 16

Group Overview ................................................. 18

Our Business Plan .............................................. 20

Overview of Our Business .................................. 21

Sales Overview .................................................. 29

Environmental and Other Regulatory Matters ...... 36

Financial Overview ............................................. 43

Results of Operations ......................................... 50

Liquidity and Capital Resources ......................... 67

Risk Management .............................................. 77

Risk Factors ....................................................... 81

Corporate Governance .......................................... 96

Remuneration Report ....................................... 132

Non-Financial Information .................................... 144

Controls and Procedures ..................................... 159

2019 Guidance ................................................... 163

Table of contents

Table of contents

2018

|

ANNUAL REPORT

7

Board of Directors and Auditor

Board of Directors

and Auditor

BOARD OF DIRECTORS

Chairman

John Elkann

(3)

Chief Executive Officer

Michael Manley

Directors

John Abbott

Andrea Agnelli

Tiberto Brandolini d’Adda

Glenn Earle

(1)

Valerie A. Mars

(1),(2)

Ruth J. Simmons

(3)

Ronald L. Thompson

(1)

Michelangelo A. Volpi

(2)

Patience Wheatcroft

(1),(3)

Ermenegildo Zegna

(2)

INDEPENDENT AUDITOR

Ernst & Young Accountants LLP (EU Annual Report filing)

Ernst & Young S.p.A (SEC 20-F filing)

(1)

Member of the Audit Committee

(2)

Member of the Compensation Committee

(3)

Member of the Governance and Sustainability Committee

8

2018

|

ANNUAL REPORT

2018

|

ANNUAL REPORT

9

Message from the Chairman

and the CEO

Message from the Chairman

and the CEO

We want to thank everyone in the FCA organization for their professional and personal contributions, during what was

an extraordinary year.

Thanks to them, we finished 2018 in the strongest financial position since FCA was created. We achieved record

results and a number of significant milestones, which have paved the way for our next phase of growth and profits.

The year was also marked by a sudden and unexpected change in leadership following the untimely passing of

Sergio Marchionne.

That was a tough moment for all of us, including on a personal level, but our organization was well prepared to

manage this unexpected transition because, from the very beginning, Sergio had the humility and wisdom to see that

the ultimate fulfillment of his role as a leader was to teach those around him also to be leaders.

Notwithstanding the difficult circumstances, we were able to move rapidly, ensuring stability in leadership and

steadiness of vision.

Keeping in mind where we came from and the journey that has brought us thus far, we will carry this organization

forward with a very clear vision of what it takes to achieve our ambitions.

We firmly believe that we have the depth and breadth of talent and skills we need to shape the future of this

organization exactly as we envision it: a company with a global horizon and unlimited possibilities, working to become

one of the most profitable automakers in the world.

This vision draws its strength from the collective spirit of our people - united by the same strong commitment to the

values that drive our business and our lives: integrity and discipline, openness to feedback and constructive debate,

and full acceptance that we are each accountable.

In 2018, we reached a net cash position for the very first time. Industrial free cash flows more than doubled to €4.3

billion

(1)

, leading to a net industrial cash position of €1.9 billion

(1)

at year-end.

On that basis, the Board of Directors is recommending, for the first time in nearly ten years, to reward our shareholders

with the reinstatement of ordinary dividends.

The agreement to sell Magneti Marelli, a transaction which is expected to close in the second quarter of 2019, will create

one of the world’s leading independent automotive component suppliers, recognizing the full strategic value of our

components business. Not only will it provide a secure and exciting future for Magneti Marelli and its employees but it will

also allow us to further strengthen our balance sheet and reward our shareholders with an extraordinary dividend.

Our consistently strong performance has resulted in ratings upgrades from each of the three major credit rating agencies.

Adjusted EBIT for the year came in at a record €7.3 billion

(1)

.

Adjusted net profit climbed 34 percent to a record level of €5.0 billion

(1)

and net profit was up 3 percent to €3.6 billion

(1)

.

Worldwide combined shipments totaled 4.8 million units and net revenues were up 4 percent to €115.4 billion

(1)

.

Looking at our mass-market operations by region, NAFTA posted a strong performance, attaining a record high

in Adjusted EBIT, up 19 percent at €6.2 billion, with a margin of 8.6 percent. In the United States, we reported the

highestretail sales in 17years, with both Jeep and Ram brands hitting new records. We also completed the most

complex and intensive phase of the realignment of our manufacturing footprint in the Region, in response to a

continued shift in demand towards trucks and SUVs.

(1)

Including Magneti Marelli, which is classified as a discontinued operation for the year ended December 31, 2018.

10

2018

|

ANNUAL REPORT

Message from the Chairman

and the CEO

LATAM posted robust growth with Adjusted EBIT more than doubling from the previous year to €359 million and

margin increasing by 250 basis points to 4.4 percent. In Brazil, we finished the year in a leading position in three of the

most important segments - pickups, light commercial vehicles and SUVs - while in Argentina we improved our market

share despite the severe economic crisis in the second half of the year.

Results in APAC were disappointing, Adjusted EBIT showed a loss of €296 million, impacted by trade and regulatory

challenges due to market weakness and increased competition and reflecting lower shipments from our Chinese joint

venture.

In EMEA, performance was adversely affected by several factors, including the transition to new emissions regulations.

Lower volumes and pricing actions in response to this transition, as well as higher advertising costs to support the

growth of Jeep brand, led to a decrease in Adjusted EBIT to €406 million. Net revenues came in at €22.8 billion, in line

with prior year.

There was also a positive contribution from Maserati, although the results were below the 2017 level, primarily due to

market challenges in China, as well as inventory management actions and lower volumes in North America and Europe.

On the product side, we increased our offering with several key vehicle launches.

Jeep launched: the all-new Grand Commander in China, a premium seven-passenger SUV exclusive to the Chinese

market; the all-new Wrangler in Europe and Japan; the new Cherokee in Europe, China and Japan; the new Renegade

in LATAM. The all-new Gladiator, the most capable mid-size pickup truck, made its worldwide debut at the Los

Angeles Auto Show.

Alfa Romeo revealed the new Stelvio and Giulia Quadrifoglio Nürburgring limited editions, with 108 models of each

produced to commemorate the 108th anniversary of the brand.

At the New York International Auto Show, Maserati debuted the Levante Trofeo V8 which will be sold in markets

around the world.

Ram launched the all-new 1500, which has already won two of the most prestigious awards in North America: 2018

North American Truck of the Year (NACTOY) and Motor Trend Truck of the Year.

And we began 2019 with the reveal of the all-new Ram Heavy Duty at the North American International Auto Show

in Detroit.

As part of our commitment to stay at the forefront of the rapid technological changes that are transforming our

industry, we are pursuing a multi-partner strategy for the development of advanced driver assistance and autonomous

driving technologies, working with companies who are leaders in their respective sectors.

With Waymo, Google’s self-driving car project, we further strengthened our partnership in 2018, announcing an

agreement to deliver up to an additional 62,000 Chrysler Pacifica Hybrid minivans to support the launch of the first

autonomous-car taxi service. We also dedicated a new facility at our Chelsea Proving Grounds in the United States for

further development and testing of autonomous vehicles and advanced safety technologies.

In addition, we are partnering with BMW for Level 3 autonomy and APTIV for advanced driver assistance retail

solutions, as these initiatives provide the opportunity to fully leverage the capabilities of each partner.

We believe that choosing the right technology at the right moment is key to our ability to lead the way in the future of

transportation, especially now as emerging technologies are revolutionizing the concept of personal mobility.

We are ready to tailor both the technologies and the platforms not only to meet but also to shape that new vision.

The other significant technological shift that we are likely to see in the near future is related to electrification, which we

also addressed in our business plan. Our expectation is to continue reducing CO

2

emissions through a combination

of technologies aligned to the vehicle mix, consumer needs and regulatory framework in each market. By 2022, we

intend to offer 12 electrified propulsion systems on global architectures spanning the full range of vehicle segments

and over 30 vehicle nameplates with electrified solutions.

2018

|

ANNUAL REPORT

11

The objectives we have set for the future, together with the significant steps already taken, are clear evidence of our

business principles and determination to ensure that the achievement of financial targets goes hand-in-hand with

respect for all stakeholders.

Among our sustainable initiatives in 2018, we implemented around 5,000 environmental projects at our plants around

the world, reducing our carbon footprint per vehicle produced by 27 percent compared with 2010 and reducing waste

generated per vehicle produced by 62 percent compared with 2010.

Our corporate citizenship efforts are rooted in the FCA Code of Conduct and are aligned with the United Nations

Sustainable Development Goals.

We strive to enrich the vitality of the communities where we live and work by creating jobs, giving back through

employee volunteering and providing financial support through our charitable initiatives.

During 2018, Group employees around the world volunteered thousands of hours in support of a wide range of social

projects.

We also aim to offer our employees an inclusive work environment, where everyone feels respected and valued, and

we are proud to have our efforts recognized by organizations such as the Thomson Reuters D&I Index, which included

FCA among the top 100 most diverse and inclusive organizations in the world.

We decided to name our FCA Student Achievement Awards in honor of Sergio Marchionne, which is a way to reaffirm

his principles and beliefs by supporting the most talented and deserving children of our employees.

The results we achieved, in terms of both growth and value, were possible because of what FCA is today.

We are a strong, competitive group that possesses some of the most innovative technologies and one of the most

extensive product ranges and strongest brands in the world.

We are a flexible yet cohesive group, with a global footprint, and solid enough to cope with any unexpected changes

in market conditions.

We wish to thank all of our shareholders and stakeholders for your support, whether you have been with us for many

years or just a few months. Your trust is fundamental for FCA as we embark on the next phase of our development.

February 22, 2019

/s/ John Elkann /s/ Mike Manley

John Elkann Mike Manley

CHAIRMAN CHIEF EXECUTIVE OFFICER

12

2018

|

ANNUAL REPORT

2018

|

ANNUAL REPORT

13

Board Report

Introduction

About this Report

This document constitutes both the Statutory annual report in accordance with Dutch legal requirements and the

Annual Report on Form 20-F in accordance with the United States Securities and Exchange Act of 1934 applicable

to Foreign Private Issuers (“FPI”) for Fiat Chrysler Automobiles N.V. for the year ended December31, 2018. A table

that cross-references the content of this report to the Form 20-F requirements is set out in the FORM 20-F CROSS

REFERENCE section included elsewhere in this report. The Annual Report and Form 20-F is filed with the Netherlands

Authority for Financial Markets (Autoriteit Financiële Markten, the “AFM”). The Annual Report and Form 20-F and other

related documents are filed with the United States Securities and Exchange Commission (“SEC”).

The following sections have been removed for our Form 20-F filing with the SEC:

MESSAGE FROM THE CHAIRMAN AND THE CEO

CORPORATE GOVERNANCE - Responsibilities in Respect to the Annual Report

NON-FINANCIAL INFORMATION

CONTROLS AND PROCEDURES - Statement by the Board of Directors

2019 GUIDANCE

FCA N.V. COMPANY FINANCIAL STATEMENTS

Independent auditor’s report (Ernst & Young Accountants LLP in respect of the AFM filing)

Without the sections referred to above, the Form 20-F filing with the SEC does not constitute a Statutory annual report

in accordance with Dutch legal requirements.

Documents on Display

You may read and copy any document we file with or furnish to the SEC at the SEC’s public reference room at 100 F

Street, N.E., Room 1580, Washington, D.C. 20549. You may also obtain documents we file with or furnish to the SEC

on the SEC’s website at www.sec.gov. The address of the SEC’s website is provided solely for information purposes

and is not intended to be an active link. You may visit the website or call the SEC at 1-800-732-0330 for further

information about its public reference room. Reports and other information concerning the business of FCA may also

be inspected at the offices of the New York Stock Exchange, 11 Wall Street, New York, New York 10005.

We also make our periodic reports, as well as other information filed with or furnished to the SEC, available free of

charge through our website, at www.fcagroup.com, as soon as reasonably practicable after those reports and other

information are electronically filed with or furnished to the SEC. The information on our website is not incorporated by

reference in this report.

Certain Defined Terms

In this report, unless otherwise specified, the terms “we”, “our”, “us”, the “Group”, the “Company” and “FCA” refer to

Fiat Chrysler Automobiles N.V., together with its subsidiaries and its predecessor prior to the completion of the merger

of Fiat S.p.A. with and into Fiat Investments N.V. on October 12, 2014 (at which time Fiat Investments N.V. was

renamed Fiat Chrysler Automobiles N.V., or “FCA NV”), the “Merger” or any one or more of them, as the context may

require. References to “Fiat” refer solely to Fiat S.p.A., the predecessor of FCA NV prior to the Merger. References to

“FCA US” refer to FCA US LLC, together with its direct and indirect subsidiaries.

Board Report

Introduction

14

2018

|

ANNUAL REPORT

Presentation of Financial and Other Data

This report includes the consolidated financial statements of the Group as of December31, 2018 and 2017 and for the

years ended December31, 2018, 2017 and 2016 prepared in accordance with International Financial Reporting Standards

(“IFRS”) as issued by the International Accounting Standards Board (“IASB”), as well as IFRS as adopted by the European

Union. There is no effect on these consolidated financial statements resulting from differences between IFRS as issued by

the IASB and IFRS as adopted by the European Union. We refer to the consolidated financial statements and the notes to

the consolidated financial statements collectively as the “Consolidated Financial Statements”.

All references in this report to “Euro” and “€” refer to the currency issued by the European Central Bank. The Group’s

financial information is presented in Euro. All references to “U.S. Dollars”, “U.S. Dollar”, “U.S.$” and “$” refer to the

currency of the United States of America (or “U.S.”).

The language of this report is English. Certain legislative references and technical terms have been cited in their original

language in order that the correct technical meaning may be ascribed to them under applicable law.

Certain totals in the tables included in this report may not add due to rounding.

Except as otherwise disclosed within this report, no significant changes have occurred since the date of the audited

Consolidated Financial Statements included elsewhere in this report.

Market and Industry Information

In this report, we include and refer to industry and market data, including market share, ranking and other data,

derived from or based upon a variety of official, non-official and internal sources, such as internal surveys and

management estimates, market research, publicly available information and industry publications. Market share,

ranking and other data contained in this report may also be based on our good faith estimates, our own knowledge

and experience and such other sources as may be available. Market share data may change and cannot always

be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of

the data-gathering process, different methods used by different sources to collect, assemble, analyze or compute

market data, including different definitions of vehicle segments and descriptions and other limitations and uncertainties

inherent in any statistical survey of market shares or size. Industry publications and surveys and forecasts generally

state that the information contained therein has been obtained from sources believed to be reliable, but there can be

no assurance as to the accuracy or completeness of included information. Although we believe that this information

is reliable, we have not independently verified the data from third-party sources. In addition, we typically estimate our

market share for automobiles and commercial vehicles based on registration data.

In markets where registration data are not available, we calculate our market share based on estimates relating to

sales to final customers. Such data may differ from data relating to shipments to our dealers and distributors. While we

believe our internal estimates with respect to our industry are reliable, our internal company surveys and management

estimates have not been verified by an independent expert, and we cannot guarantee that a third party using different

methods to assemble, analyze or compute market data would obtain or generate the same result. The market share

data presented in this report represents the best estimates available from the sources indicated as of the date hereof

but, in particular as they relate to market share and our future expectations, involve risks and uncertainties and are

subject to change based on various factors, including those discussed in the section Risk Factors in this report.

Forward-Looking Statements

Statements contained in this report, particularly those regarding possible or assumed future performance, competitive

strengths, costs, dividends, reserves and growth of FCA, industry growth and other trends and projections and

estimated company earnings are “forward-looking statements” that contain risks and uncertainties. In some cases,

words such as “may”, “will”, “expect”, “could”, “should”, “intend”, “estimate”, “anticipate”, “believe”, “remain”, “on

track”, “design”, “target”, “objective”, “goal”, “forecast”, “projection”, “outlook”, “prospects”, “plan”, or similar terms

are used to identify forward-looking statements. These forward-looking statements reflect the respective current views

of the Group with respect to future events and involve significant risks and uncertainties that could cause actual results

to differ materially.

Board Report

Introduction

2018

|

ANNUAL REPORT

15

These factors include, without limitation:

our ability to launch products successfully and to maintain vehicle shipment volumes;

changes in the global financial markets, general economic environment and changes in demand for automotive

products, which is subject to cyclicality;

changes in local economic and political conditions, changes in trade policy and the imposition of global and regional

tariffs or tariffs targeted to the automotive industry, the enactment of tax reforms or other changes in tax laws and

regulations;

our ability to expand certain of our brands globally;

our ability to offer innovative, attractive products;

our ability to develop, manufacture and sell vehicles with advanced features, including enhanced electrification,

connectivity and autonomous-driving characteristics;

various types of claims, lawsuits, governmental investigations and other contingencies affecting us, including

product liability and warranty claims and environmental claims, investigations and lawsuits;

material operating expenditures in relation to compliance with environmental, health and safety regulations;

the intense level of competition in the automotive industry, which may increase due to consolidation;

exposure to shortfalls in the funding of our defined benefit pension plans;

our ability to provide or arrange for access to adequate financing for our dealers and retail customers, and

associated risks related to the establishment and operations of financial services companies, including capital

required to be deployed to financial services;

our ability to access funding to execute our business plan and improve our business, financial condition and results

of operations;

a significant malfunction, disruption or security breach compromising our information technology systems or the

electronic control systems contained in our vehicles;

our ability to realize anticipated benefits from joint venture arrangements;

our ability to successfully implement and execute strategic initiatives and transactions, including our plans to

separate certain businesses;

disruptions arising from political, social and economic instability;

risks associated with our relationships with employees, dealers and suppliers;

increases in costs, disruptions of supply or shortages of raw materials;

developments in labor and industrial relations and developments in applicable labor laws;

exchange rate fluctuations, interest rate changes, credit risk and other market risks;

political and civil unrest;

earthquakes or other disasters; and

other factors discussed elsewhere in this report.

Furthermore, in light of the inherent difficulty in forecasting future results, any estimates or forecasts of particular periods

that are provided in this report are uncertain. We expressly disclaim and do not assume any liability in connection with

any inaccuracies in any of the forward-looking statements in this report or in connection with any use by any third party

of such forward-looking statements. Actual results could differ materially from those anticipated in such forward-looking

statements. We do not undertake an obligation to update or revise publicly any forward-looking statements.

Additional factors which could cause actual results and developments to differ from those expressed or implied by the

forward-looking statements are included in the section Risk Factors in this report.

Board Report

Introduction

16

2018

|

ANNUAL REPORT

Management Report

Selected Financial Data

The following tables set forth selected historical consolidated financial and other data of FCA and have been derived,

in part, from:

the Consolidated Financial Statements of FCA as of December31, 2018 and 2017 and for the years ended

December31, 2018, 2017 and 2016, included elsewhere in this report; and

the Consolidated Financial Statements of FCA as of December31, 2016, 2015 and 2014, for the years ended

December31, 2015 and 2014, which are not included in this report.

This data should be read in conjunction with Presentation of Financial and Other Data, Risk Factors, the FINANCIAL

OVERVIEW section and the Consolidated Financial Statements and related notes included elsewhere in this report.

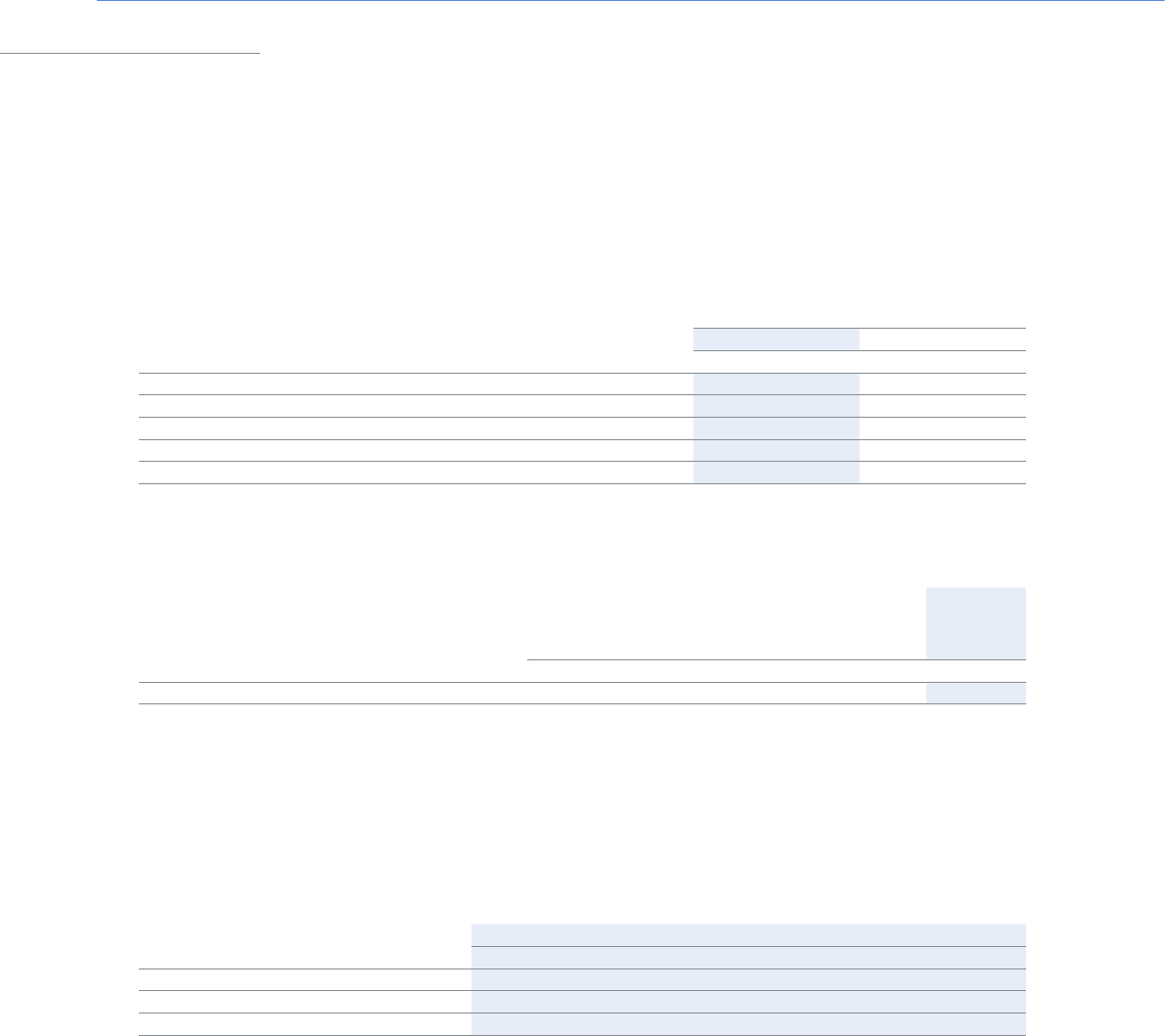

CONSOLIDATED INCOME STATEMENT DATA

Years ended December 31,

2018

(1)

2017

(1)

2016

(1)

2015

(1,2)

2014

(1,2)

(€ million, except per share amounts)

Net revenues € 110,412 € 105,730 € 105,798 € 105,859 € 89,350

Profit before taxes € 4,108 € 5,879 € 2,950 € 99 € 719

Net profit/(loss) from continuing operations € 3,330 € 3,291 € 1,713 € (15) € 269

Profit from discontinued operations, net of tax € 302 € 219 € 101 € 392 € 363

Net profit € 3,632 € 3,510 € 1,814 € 377 € 632

Net profit attributable to:

Owners of the parent € 3,608 € 3,491 € 1,803 € 334 € 568

Non-controlling interests € 24 € 19 € 11 € 43 € 64

Earnings/(Loss) per share from continuing operations

Basic earnings/(loss) per share € 2.15 € 2.14 € 1.13 € (0.01) € 0.20

Diluted earnings/(loss) per share € 2.12 € 2.11 € 1.12 € (0.01) € 0.20

Earnings per share from discontinued operations

Basic earnings per share € 0.18 € 0.14 € 0.06 € 0.23 € 0.27

Diluted earnings per share € 0.18 € 0.13 € 0.06 € 0.23 € 0.26

Earnings per share from continuing and discontinued operations

Basic earnings per share € 2.33 € 2.27 € 1.19 € 0.22 € 0.46

Diluted earnings per share € 2.30 € 2.24 € 1.18 € 0.22 € 0.46

Other Statistical Information (unaudited):

Combined shipments (in thousands of units)

(3)

4,842 4,740 4,720 4,738 4.743

Consolidated shipments (in thousands of units)

(4)

4,655 4,423 4,482 4,602 4.601

(1)

The operating results of FCA for the years ended December 31, 2018, 2017, 2016, 2015 and 2014 exclude Magneti Marelli following the

classification of Magneti Marelli as a discontinued operation for the year ended December 31, 2018; Magneti Marelli operating results were

excluded from the Group’s continuing operations and are presented as a single line within the Consolidated Income Statement data for the

years ended December 31, 2018, 2017, 2016, 2015 and 2014 presented above.

(2)

The operating results of FCA for the years ended December 31, 2015 and 2014 exclude Ferrari following the classification of Ferrari as a

discontinued operation for the year ended December 31, 2015; Ferrari operating results were excluded from the Group’s continuing operations

and are presented as a single line item within the Consolidated Income Statements for each of the years ended December 31, 2015 and 2014.

(3)

Combined shipments include shipments by the Group’s consolidated subsidiaries and unconsolidated joint ventures.

(4)

Consolidated shipments only include shipments by the Group’s consolidated subsidiaries.

Board Report

Management Report

2018

|

ANNUAL REPORT

17

CONSOLIDATED STATEMENT OF FINANCIAL POSITION DATA

At December 31,

2018

(1)

2017

(1)

2016

(1)

2015

(1,2)

2014

(1,2)

(€ million, except shares issued data)

Cash and cash equivalents € 12,450 € 12,638 € 17,318 € 20,662 € 22,840

Total assets € 96,873 € 96,299 € 104,343 € 105,753 € 101,149

Debt € 14,528 € 17,971 € 24,048 € 27,786 € 33,724

Total equity € 24,903 € 20,987 € 19,353 € 16,968 € 14,377

Equity attributable to owners of the parent € 24,702 € 20,819 € 19,168 € 16,805 € 14,064

Non-controlling interests € 201 € 168 € 185 € 163 € 313

Share capital € 19 € 19 € 19 € 17 € 17

Shares issued (in thousands):

Common

(3)(4)

1,550,618 1,540,090 1,527,966 1,288,956 1,284,919

Special Voting

(4)

408,942 408,942 408,942 408,942 408,942

(1)

The assets and liabilities of Magneti Marelli were classified as Assets held for sale and Liabilities held for sale within the Consolidated Statement

of Financial Position at December 31, 2018, while the assets and liabilities of Magneti Marelli have not been classified as such within the

comparative Consolidated Statements of Financial Position at December 31, 2017, 2016, 2015 and 2014.

(2)

The assets and liabilities of Ferrari were classified as Assets held for distribution and Liabilities held for distribution within the Consolidated

Statement of Financial Position at December 31, 2015, while the assets and liabilities of Ferrari have not been classified as such within the

comparative Consolidated Statement of Financial Position at December 31, 2014.

(3)

Book value per common share at December31, 2018 was €15.93.

(4)

Refer to Note 26, Equity, within our Consolidated Financial Statements included elsewhere in this report.

18

2018

|

ANNUAL REPORT

Group Overview

We are a global automotive group engaged in designing, engineering, manufacturing, distributing and selling vehicles,

components and production systems worldwide through 102 manufacturing facilities and 46 research and development

centers.

(1)

We have operations in more than 40 countries and sell our vehicles directly or through distributors and dealers

in more than 135 countries. We design, engineer, manufacture, distribute and sell vehicles for the mass-market under the

Abarth, Alfa Romeo, Chrysler, Dodge, Fiat, Fiat Professional, Jeep, Lancia and Ram brands and the SRT performance

vehicle designation. For our mass-market vehicle brands, we have centralized design, engineering, development and

manufacturing operations, which allow us to efficiently operate on a global scale. We support our vehicle shipments with

the sale of related service parts and accessories, as well as service contracts, worldwide under the Mopar brand name

for mass-market vehicles. In addition, we design, engineer, manufacture, distribute and sell luxury vehicles under the

Maserati brand. We make available retail and dealer financing, leasing and rental services through our subsidiaries, joint

ventures and commercial arrangements with third party financial institutions. In addition, we operate in the components

and production systems sectors under the Teksid and Comau brands.

In 2018, we shipped 4.8 million vehicles (including the group’s unconsolidated joint ventures), resulting in Net revenues

of €110.4 billion and Net profit of €3.6 billion, of which €3.3 billion was attributable to continuing operations. At

December31, 2018, including Magneti Marelli, our available liquidity was €21.1 billion (including €7.7 billion available

under undrawn committed credit lines) and our Net industrial cash was €1.9 billion (See Non-GAAP Financial Measures).

History of FCA

Fiat Chrysler Automobiles N.V. was incorporated as a public limited liability company (naamloze vennootschap) under

the laws of the Netherlands on April 1, 2014 and became the parent company of the Group on October 12, 2014.

Its principal office is located at 25 St. James’s Street, London SW1A 1HA, United Kingdom (telephone number: +44

(0) 20 7766 0311). Its agent for U.S. federal securities law purposes is Christopher J. Pardi, c/o FCA US LLC, 1000

Chrysler Drive, Auburn Hills, Michigan 48326.

Fiat, the predecessor to FCA, was founded as Fabbrica Italiana Automobili Torino on July11, 1899 in Turin, Italy as

an automobile manufacturer. In 1902, Giovanni Agnelli, Fiat’s founder, became the Managing Director of the company.

In April 2009, Fiat and Old Carco LLC, formerly known as Chrysler LLC (“Old Carco”) entered into an agreement,

pursuant to which FCA US LLC, then known as Chrysler Group LLC, (“FCA US”) agreed to purchase the principal

operating assets of Old Carco and to assume certain Old Carco liabilities. Following the closing of that transaction, Fiat

held an initial 20 percent ownership interest in FCA US. Old Carco traced its roots to the company originally founded

by Walter P. Chrysler in 1925.

Over the following years, Fiat acquired additional ownership interests in FCA US and in January 2014, Fiat purchased all

of the equity interests in FCA US that it did not then hold, resulting in FCA US becoming a 100 percent owned subsidiary.

In January 2011, the separation of Fiat’s non-automotive capital goods businesses was completed with the creation of

Fiat Industrial, now known as CNH Industrial N.V. (“CNHI”).

Corporate Reorganization

On October 12, 2014, Fiat completed a corporate reorganization resulting in the establishment in the Netherlands of

FCA NV as the parent company of the Group, with its principal executive offices in the United Kingdom.

On October 13, 2014, FCA common shares commenced trading on the Milan Mercato Telematico Azionario (“MTA”)

and the New York Stock Exchange (“NYSE”). As a result, FCA NV, as successor of Fiat S.p.A., is the parent company

of the Group.

(1)

Excluding facilities relating to Magneti Marelli.

Board Report

Group Overview

2018

|

ANNUAL REPORT

19

Ferrari Spin-off

The spin-off of Ferrari N.V. was approved on December 3, 2015 at the extraordinary general meeting of FCA

shareholders. The Group classified the Ferrari segment as a discontinued operation for the year ended December 31,

2015 and, consequently, the results of Ferrari were excluded from the Group’s continuing operations, with the after-

tax result of Ferrari’s operations shown as a single line item within the Consolidated Income Statement for the year

ended December 31, 2015.

The spin-off of Ferrari N.V. from the Group was completed on January 3, 2016. The assets and liabilities of the Ferrari

segment were distributed to holders of FCA shares and mandatory convertible securities. Since Exor N.V., which

controls and consolidates FCA, continued to control and consolidate Ferrari N.V., the spin-off of Ferrari N.V. was

accounted for at book value without any gain or loss on the distribution.

Magneti Marelli Sale

On April 5, 2018, the FCA Board of Directors announced that it had authorized FCA management to develop and

implement a plan to separate the Magneti Marelli business from the Group.

At September 30, 2018, the separation within the next twelve months became highly probable and Magneti Marelli

operations met the criteria to be classified as a disposal group held for sale. It also met the criteria to be classified as a

discontinued operation pursuant to IFRS 5 - Non-current Assets Held for Sale and Discontinued Operations.

On October, 22, 2018, FCA announced that it has entered into a definitive agreement to sell its Magneti Marelli

business to CK Holdings, Ltd. The agreement represents a transaction value of €6.2 billion, subject to certain

adjustments. The transaction is expected to close in the second quarter of 2019, subject to regulatory approvals and

other customary closing conditions.

Major Shareholders

Exor N.V. is the largest shareholder of FCA through its 28.98 percent shareholding interest in our issued common shares

(as of February 20, 2019). As a result of the loyalty voting mechanism, Exor N.V.’s voting power is 42.11 percent.

Consequently, Exor N.V. could strongly influence all matters submitted to a vote of FCA shareholders, including

approval of annual dividends, election and removal of directors and approval of extraordinary business combinations.

Exor N.V.is controlled by Giovanni Agnelli B.V. (“GA”), which holds 52.99 percent of its share capital. GA is a private

limited liability company under Dutch law with its capital divided in shares and currently held by members of the

Agnelli and Nasi families, descendants of Giovanni Agnelli, founder of Fiat. Its present principal business activity is

to purchase, administer and dispose of equity interests in public and private entities and, in particular, to ensure the

cohesion and continuity of the administration of its controlling equity interests. The directors of GA are John Elkann,

Tiberto Brandolini d’Adda, Alessandro Nasi, Andrea Agnelli, Eduardo Teodorani-Fabbri, Luca Ferrero de’ Gubernatis

Ventimiglia, Jeroen Preller and Florence Hinnen.

Based on the information in FCA’s shareholder register, regulatory filings with the AFM and the SEC and other sources

available to FCA, the following persons owned, directly or indirectly, in excess of three percent of FCA’s capital and/or

voting interest as of February 20, 2019:

FCA Shareholders

NumberofIssued

CommonShares PercentageOwned

Exor N.V.

(1)

449,410,092 28.98

Tiger Global Management LLC

(2)

81,375,000 5.25

Harris Associates L.P.

(3)

59,119,458 3.81

(1)

In addition, Exor N.V. holds 375,803,870 special voting shares; Exor N.V.’s beneficial ownership in FCA is 42.11 percent, calculated as the ratio

of (i) the aggregate number of common and special voting shares owned by Exor N.V. and (ii) the aggregate number of outstanding common

shares and issued special voting shares.

(2)

Tiger Global Management LLC,Charles P. Coleman III and Scott Shleifer beneficially own the aggregate amount of 81,375,000 common shares

(4.15 percent of the issued shares).

(3)

Harris Associates L.P. beneficially owns 59,119,458 common shares (3.02 percent of the issued shares).

20

2018

|

ANNUAL REPORT

Based on the information in FCA’s shareholder register and other sources available to us, as of January 31, 2019,

approximately 443.6 million FCA common shares, or 29 percent of the FCA common shares, were held in the United

States. As of the same date, approximately 1,100 record holders had registered addresses in the United States.

OUR BUSINESS PLAN

On June 1, 2018, FCA’s former Chief Executive Officer Sergio Marchionne, together with members of the Group’s

executive management, presented the Group’s 2018-2022 business plan (the “business plan”). On February 7, 2019,

CEO Mike Manley highlighted additional measures to improve operating results in EMEA, APAC with specific focus on

China, and in Maserati.

The business plan and the measures mentioned above build upon the strategic actions taken in the prior plan to

generate volume growth and margin expansion through the following:

Continued emphasis on building strong brands by leveraging renewals of key products and portfolio expansion;

Through new white space products with particular focus on the Jeep, Ram, Maserati and Alfa Romeo brands;

Improve positioning of Maserati as a luxury brand, bridging product gap with specialty models and redirection of

marketing to focus on Levante;

Refocus marketing in China to recently launched products, offer more efficient powertrain combinations and

product quality improvements;

Continue to focus on industrial rationalization to deliver cost savings through manufacturing and purchasing

efficiencies and implement actions to increase capacity utilization in EMEA;

Implementation of various electrified powertrain applications throughout the portfolio as part of our regulatory

compliance strategy;

Continue to explore opportunities to develop partnerships to share technologies and platforms, enhance skill set

related to autonomous driving technologies, preserve full optionality and ensure speed to market; and

Maintain a disciplined approach to the deployment of capital and re-establish consistent shareholder remuneration

actions.

We continue to assess the potential impacts of operationalizing and implementing the strategic targets set out in the

business plan, including re-allocation of our resources. The recoverability of certain of our assets or Cash-Generating

Units (“CGUs”) may be impacted in future periods. For example, our product development strategies may be affected

by regulatory changes as well as changes in the expected costs of implementing electrification, including the cost of

batteries.As relevant circumstances change, we expect to adjust our product plans which may result in changes to

the expected use of certain of the Group’s vehicle platforms.In addition, recoverability of certain vehicle platforms,

particularly in EMEA, depends on the development and launch of additional vehicles with forecasted volumes and

margins largely in line with our business plan. These uncertainties could result in either impairments of, or reductions to

the expected useful lives of, these platforms, or both.

Refer to Note 26, Equity within the Consolidated Financial Statements included elsewhere in this report for additional

detail on the proposed annual ordinary dividend distribution to holders of FCA common shares.

Board Report

Group Overview

2018

|

ANNUAL REPORT

21

OVERVIEW OF OUR BUSINESS

Our activities are carried out through the following five reportable segments:

(i) NAFTA: our operations to support distribution and sale of mass-market vehicles in the United States, Canada,

Mexico and Caribbean islands, primarily under the Jeep, Ram, Dodge, Chrysler, Fiat, Alfa Romeo and Abarth brands.

(ii) LATAM: our operations to support the distribution and sale of mass-market vehicles in South and Central America,

primarily under the Fiat, Jeep, Dodge and Ram brands, with the largest focus of our business in Brazil and Argentina.

(iii) APAC: our operations to support the distribution and sale of mass-market vehicles in the Asia Pacific region

(mostly in China, Japan, India, Australia and South Korea) carried out in the region through both subsidiaries and

joint ventures, primarily under the Jeep, Fiat, Alfa Romeo, Abarth, Fiat Professional, Ram and Chrysler brands.

(iv) EMEA: our operations to support the distribution and sale of mass-market vehicles in Europe (which includes the

28 members of the European Union and the members of the European Free Trade Association), the Middle East

and Africa, primarily under the Fiat, Fiat Professional, Jeep, Alfa Romeo, Lancia, Abarth, Ram and Dodge brands.

(v) Maserati: the design, engineering, development, manufacturing, worldwide distribution and sale of luxury vehicles

under the Maserati brand.

The results of our Magneti Marelli business were previously reported within the Components segment along with our

industrial automation systems design and production business and our cast iron and aluminum components business.

Following the classification of Magneti Marelli as a discontinued operation for the years ended December 31, 2018,

2017 and 2016, (refer to Note 3, Scope of consolidation), the remaining activities within the Components segment are

no longer considered a separate reportable segment as defined by IFRS 8 - Operating Segments and are reported

within “Other activities” described below.

We also own or hold interests in companies operating in other activities and businesses. These activities are grouped

under “Other Activities”, which primarily consists of our industrial automation systems design and production business,

under the Comau brand name, and our cast iron and aluminum business, which produces cast iron components for

engines, gearboxes, transmissions and suspension systems, and aluminum cylinder heads and engine blocks, under the

Teksid brand name, as well as companies that provide services, including accounting, payroll, tax, insurance, purchasing,

information technology, facility management and security for the Group, and manage central treasury activities.

Definitions and abbreviations

Utility vehicles (“UVs”) include sport utility vehicles (“SUVs”), which are available with four-wheel drive systems that

provide true off-road capabilities, and crossover utility vehicles, (“CUVs”), which are not designed for heavy off-road

use. UVs can be divided among six main groups, ranging from “micro” or “A segment”, defined as UVs that are less

than 3.9 meters in length, to “large” or “F segment”, defined as UVs that are greater than 5.2 meters in length. Light

trucks may be divided between vans (also known as light commercial vehicles, or “LCVs”), which typically are used for

the transportation of goods or groups of people, and pickup trucks, which are light motor vehicles with an open-top

rear cargo area.

Minivans, also known as multi-purpose vehicles (“MPVs”) typically have seating for up to eight passengers. Passenger cars

include sedans, station wagons and three- and five-door hatchbacks, that may range in size from “micro” or “A segment”

vehicles of less than 3.7 meters in length to “large” or “F segment” cars that are greater than 5.1 meters in length.

A vehicle is characterized as “all-new” if its vehicle platform is significantly different from the platform used in the prior

model year and/or it has had a full exterior renewal.

A vehicle is characterized as “significantly refreshed” if it continues its previous vehicle platform but has extensive

changes or upgrades from the prior model year.

22

2018

|

ANNUAL REPORT

Design and Manufacturing

We sell mass-market vehicles in the SUV, passenger car, truck and light commercial vehicle markets. Our SUV and

CUV portfolio includes the Jeep Grand Cherokee, Jeep Cherokee, Jeep Wrangler, Jeep Renegade, Jeep Compass,

all-new Jeep Grand Commander, Dodge Durango, Dodge Journey and Alfa Romeo Stelvio. Our passenger car

product portfolio includes vehicles such as the Fiat 500, Alfa Romeo Giulia, Dodge Challenger and Charger and

minivans such as the Chrysler Pacifica. We sell light and heavy-duty pickup trucks such as the Ram 1500 and

2500/3500, the Fiat Toro and Fiat Fullback, chassis cabs such as the Ram 3500/4500/5500 and our light commercial

vehicles include vans such as the Fiat Professional Doblò, Fiat Professional Ducato and Ram ProMaster.

Our efforts to respond to customer demand have led to a number of important initiatives, including localized

production of Jeep vehicles in Italy, China, India and Brazil.

We have deployed World Class Manufacturing (“WCM”) principles throughout our manufacturing operations. WCM

principles were developed by the WCM Association, a non-profit organization dedicated to developing superior

manufacturing standards. We are the only Original Equipment Manufacturer (“OEM”) that is a member of the WCM

Association. WCM fosters a manufacturing culture that targets improved safety, quality and efficiency, as well as the

elimination of all types of waste. Unlike some other advanced manufacturing programs, WCM is designed to prioritize

issues, focus on those initiatives believed likely to yield the most significant savings and improvements, and direct

resources to those initiatives. We also offer several types of WCM programs to our suppliers whereby they can learn

and incorporate WCM principles into their own operations.

Research and Development

We engage in research and development activities aimed at improving the design, performance, safety, fuel efficiency,

reliability, consumer perception and sustainability of our products and services. As of December31, 2018, we

operated 46 research and development centers worldwide with a combined headcount of approximately 18 thousand

employees supporting our research and development efforts.

(1)

Historically, we have concentrated the majority of our efficiency research efforts in two areas: reducing vehicle energy

demand and reducing fuel consumption and emissions. Fuel consumption and emissions reduction activities have

been primarily focused on powertrain technologies including: engines, transmissions and drivelines, hybrid and electric

propulsion and alternative fuels. In recent years, we have increased our research efforts on autonomous driving and

connectivity technologies.

Vehicle Energy Demand

Our research focuses on reducing weight, aerodynamic drag, tire rolling resistance, brake drag torque, driveline

parasitic losses, heating and air conditioning, and electrical loads. We also continue to develop both conventional and

hybrid vehicle technologies aimed at improving kinetic energy recovery and re-use of thermal energy to reduce total

energy consumption and CO

2

emissions.

We have introduced active aerodynamic devices, which activate automatically under certain operating conditions.

These active aerodynamic devices include active grille shutters, active front air dams and adjustable height

suspension. Further, we have introduced smart actuators, such as variable speed fuel pumps, variable displacement

air conditioning compressors and high efficiency brushless electric motors for cooling fans, to reduce fuel

consumption. Such smart actuators only require the energy needed for each specific working condition, avoiding

electric energy waste.

Board Report

Group Overview

(1)

Excluding facilities relating to Magneti Marelli.

2018

|

ANNUAL REPORT

23

Powertrain Technologies

Engines

We have developed global small and global medium displacement gasoline engine families to improve fuel economy

and emissions. These engine families include three and four cylinder turbocharged versions (the global small engine

family also has three and four cylinder naturally aspirated variants). Each engine family features a modular approach

using a shared cylinder design (allowing for different engine configuration, displacements, efficiency and power

outputs). Each is based on a specific cylinder configuration which provides important synergies for the engine

development (common combustion development and common design layout) and for manufacturing (common

machining, assembly features and components and subsystems). When fully deployed these engine families will cover

a large range of vehicle applications and introduce features and technologies such as direct fuel injection, downsizing,

integrated exhaust manifold, Multiair variable valve lift, turbocharging, and cooled exhaust gas recirculation. All of these

features enable the engine families to be competitive among small and medium displacement engines with respect to

fuel consumption, performance, weight and noise, vibration and harshness (“NVH”) behavior.

Both a 1.0L three cylinder and a 1.3L four cylinder naturally aspirated Firefly global small engine were launched in the

LATAM region in the third quarter of 2016 and in the second quarter of 2018 turbocharged variants of the global small

engine launched in the EMEA region (in the Jeep Renegade and Fiat 500X). Additionally, the first global medium engine

application (a 2.0L turbo four cylinder engine) launched in the Alfa Romeo Giulia in the fourth quarter of 2016 and in

2018 a dual overhead camshaft version of the global medium engine (with cooled exhaust gas recirculation) became

available in the Jeep Cherokee and Jeep Wrangler. To meet increasingly more stringent air quality standards, we have

employed the use of gasoline particulate filters with both global engine families in some EMEA and APAC markets.

Looking to the future, FCA is participating in the development of new and improved aluminum alloys for engine use.

This work has demonstrated an aluminum alloy capable of a 50 percent increase in strength at 300° Celsius when

compared to other currently used aluminum alloys. While still in very early development, this type of alloy strength

behavior has the potential to provide increased design flexibility for cylinder heads and cylinder blocks and help to

enable increased engine efficiency.

Transmissions and Driveline

Our transmission portfolio includes manual transmissions, dual dry clutch transmissions and automatic transmissions.

Our automatic transmission portfolio includes 8- and 9-speed units developed in an effort to provide our customers

with improved efficiency, performance and drive comfort. Long travel damper and pendulum damper technologies

are used to allow the engine to operate at a lower speed and higher torque - where the engine is more efficient at

converting the fuel energy to mechanical energy.

Other improvements are used to reduce the power consumption of the transmission. The second generation

TorqueFlite 8-speed improves transmission efficiency via improved line pressure control and reduced clutch drag. The

addition of transmission oil heaters allows the transmission to quickly warm up to operating temperatures and improve

transmission efficiency. We are investigating many other technologies to increase transmission system efficiency such

as selectable one-way clutches and reduced oil viscosity.

In support of global fuel consumption and CO

2

requirements, we have developed our first dedicated hybrid

transmission (the eFlite), used in the Chrysler Pacifica Hybrid. The new eFlite hybrid transmission architecture is an

electrically variable front wheel drive transaxle with a split input configuration and incorporates two electric motors,

both capable of driving in full electric mode. The lubrication and cooling system makes use of two pumps, one

electrically operated and one mechanically driven. We expect future hybrid vehicle portfolio growth with the eFlite

transmission and similar electrified propulsion systems.

24

2018

|

ANNUAL REPORT

Electric and Hybrid Technologies

FCA has developed a suite of electrification technologies, including: 12 volt engine stop/start, 48 volt mild hybrid,

plug-in hybrid, and full battery electric vehicles. These developments have occurred at FCA technical centers primarily

in Auburn Hills (Michigan, USA), Modena and Turin (Italy). However, substantial work has also been performed with

suppliers and universities located around the globe.

The 12 volt stop/start system turns off the engine and fuel flow automatically when the vehicle comes to a halt and re-

starts the engine upon the driver disengaging the brake. Phase-in of this technology began in 2013 model year and in

2018 was used in approximately 42 percent of FCA’s global production volume.

In 2018 FCA launched three applications of mild hybrids using belt starter generator (“BSG”) technology. BSG

technology offers improvements in fuel economy and a reduction in CO

2

emissions. This new 48 volt mild hybrid

technology is marketed as “eTorque” in the all-new 2018 Jeep Wrangler equipped with the 2.0L turbo engine and the

all-new 2019 Ram 1500 5.7L and 3.6L applications. The system offers faster and smoother stop/start functionality,

a real-time powertrain efficiency optimization manager which balances motor and engine torque, enhanced and

extended fuel shut-off during certain maneuvers, and regenerative braking to recharge the 48 volt battery. The

system also delivers significant gains in fuel economy. For example, the 2019 Ram 1500 5.7L HEMI V8 equipped with

eTorque has a 13 percent improvement in city fuel economy and 10 percent reduction in combined CO

2

over the base

HEMI in a 4x2 Crew Cab model.

The Chrysler Pacifica Hybrid achieves an efficiency rating of 82 miles per gallon equivalent (“MPGe”), based on U.S.

Environmental Protection Agency testing standards and has an approximately 72% reduction in CO

2

compared to the

non-hybrid Chrysler Pacifica. Power to the wheels is supplied via a 16 kWh battery through the hybrid electric drive

system which is comprised of a specially adapted new version of the award winning Pentastar 3.6-liter V-6 engine and

the new eFlite hybrid transmission.

The Fiat 500e is FCA’s full electric vehicle offering and is available only in the NAFTA market. It has an all-electric range

of 84 miles and achieves 121 MPGe City, 103 MPGe Highway and 112 MPGe Combined. Since its introduction in the

2013 model year approximately 25,000 units have been sold.

We also supplement our internal research and development activities via collaboration with academic partners. One

such example is a project in partnership with McMaster University (Canada), which focuses on developing next-

generation, energy efficient, high performance, cost effective electrified powertrain components and control systems

suitable for a range of vehicle applications.

Alternative Fuels

FCA is among the EU-market leaders in compressed natural gas (“CNG”) propulsion. From 1997 to 2018, the Company’s

output of CNG-powered vehicles in Europe exceeded 750,000 vehicles. In an experimental project, Company researchers

in Europe built a Fiat Panda that runs on biomethane derived from sewage sludge and waste water.

Autonomous Driving Technology

In 2016, we announced a collaboration with Waymo (formerly the Google self-driving car project) to integrate its self-

driving technology into the Chrysler Pacifica Hybrid. Production of the first 100 Chrysler Pacifica Hybrid minivans built

to enable fully self-driving operations was completed in late 2016. In 2018, we announced that we would expand our

partnership with an agreement to add up to 62,000 Chrysler Pacifica Hybrid minivans to Waymo’s self-driving fleet.

We have launched Highway Assist autonomous vehicle technology on several Maserati models. This system includes

Mobileye vision technology to enable autonomous driving on designated highways. We are also partnering with BMW

in the development of a Level 3 autonomous driving platform.

In 2017, we also revealed the Chrysler Portal concept, a semi-autonomous electric-powered vehicle that is designed

with a suite of sensing technologies that enable Level 3 autonomous driving, with the potential to be upgraded as

advances in technology enable higher levels of autonomy.

Board Report

Group Overview

2018

|

ANNUAL REPORT

25

Connectivity

FCA is working with its suppliers to develop a cloud-based global connectivity solution that will connect to the Internet

and an FCA-specific service delivery platform and allow the driver and passengers to interact with the car and the

outside world. The solution is intended to be scalable, increase safety and security and provide real time availability of

services and information.

Compliance-focused Initiatives by Region

The regulatory environment outlook across our four major regions shows continued consistent CO

2

reductions,

ranging from 25-30 percent between 2018 and 2024. This anticipated regulatory stringency balanced with customer

preferences guides research and development for future products and will be highlighted below by region and key

product segment.

NAFTA

The U.S. policy is complex with three separate CO

2

regulations, but it also contains a flexible array of new technology

incentives to encourage industry movement toward an electrified future. For instance, U.S. regulation includes a

tax credit to consumers of up to $7,500 to jump start demand, which is required given relatively low fuel prices and

increasing consumer preference for SUV and trucks in the market.

American consumers tend to have long commutes and ready access to charging capability at home. FCA plans,

by 2022, for 20 percent of its overall fleet (including commercial vehicles) to be high voltage, with a focus on plug-in

systems. 15 percent of the fleet to be equipped with mild hybrid systems and 65 percent to retain conventional internal

combustion engines.

LATAM

With its ability to grow sugar cane in high volume, Brazil is able to address CO

2

reduction with a different approach.

Today about 30 percent of vehicle fuel usage in Brazil consists of sugar cane produced ethanol. Sugar cane ethanol

is 80 percent renewable from “well” (or field) to wheels and provides approximately 12.5 percent CO

2

reduction on

an equivalent 30/70 fuel mix E100/E22 basis. The Brazilian government recently launched a plan (RenovaBio) to

improve quality and productiveness of ethanol, targeting an increase of share on Ethanol E100 in the fuel matrix from

the current 30 percent to 40 percent in 2022 and to 55 percent in 2030. In addition, the Brazilian government and

FCA are working very closely on research and development opportunities to further reduce CO

2

emissions through

improvements to ethanol-fueled engines.

Brazilian consumers already widely use ethanol fuel, readily available in the current retail fuel market. FCA believes that

Brazilian CO

2

fleet reduction targets will be met through 2025 with increased usage and efficiency of its ethanol based

engines and without any high voltage electrification.

APAC

China is leading the rapid change in this region. The Chinese government has stated intentions to become the global

leader in electrification in the next decade. The regulatory policies include credit multipliers and incentives for new

energy vehicles which are defined as battery electric, plug-in hybrid, or fuel cell vehicles.

Some large cities provide consumers with license plate incentives for new energy vehicles. Given these incentives can

be as high as €11,000 per vehicle, we believe they will be successful in driving the market toward electrification.

From a consumer perspective, China has the highest number of first time car buyers in the world. Since much of the

vehicle consumer demographic resides in urban areas, access to public charging is expected to be a critical element

to achieving China’s electrified objectives.

FCA’s plan is, by 2022, for 15 percent of the overall fleet (including commercial vehicles) to use high voltage

electrification, with the highest penetration of full battery electric of any region, 20 percent of the fleet to be equipped

with a hybrid system and 65 percent of the fleet to retain conventional internal combustion engines.

26

2018

|

ANNUAL REPORT

In contrast to China, India continues to be a very cost sensitive market with a developing infrastructure. As a result,

increased regulatory requirements are expected to be met through application of shared conventional technologies

with limited dependence on electrification.

EMEA

Europe represents the most challenging combination of regulatory stringency and consumer price sensitivity. The

EU is driving a step function reduction in CO

2

in 2020, and metropolitan areas are implementing low emission zones

in an attempt to improve air quality in city centers. Conventional internal combustion engine applications will likely be

restricted, especially with aging vehicles. The CO

2

financial penalty structure is very significant.

Many consumers in Europe need reduced cost of vehicle ownership given high fuel prices and pressure on disposable

income. As the demand for diesels continues to decrease, FCA intends to use mild hybrids as a replacement. The

region will need to address the development of charging infrastructure so that zero emission vehicles are more

convenient for consumers.

FCA’s plan is, by 2022, for 20 percent of the overall fleet (including commercial vehicles) to use high voltage

electrification, 40 percent of the fleet to be equipped with a mild hybrid system and 40 percent to retain conventional

internal combustion engines.

Intellectual Property

We own a significant number of patents, trade secrets, licenses, trademarks and service marks, including, in

particular, the marks of our vehicle and component and production systems brands, which relate to our products

and services. We expect the number to grow as we continue to pursue technological innovations. We file patent

applications in Europe, the U.S. and around the world to protect technology and improvements considered important

to our business. No single patent is material to our business as a whole.

Property, Plant and Equipment

As of December31, 2018, we operated 102 manufacturing facilities (including vehicle and light commercial vehicle

assembly, powertrain and components plants, excluding joint ventures and Magneti Marelli facilities), of which 27

were located in Italy, 13 in the rest of Europe, 26 in the U.S., 12 in Brazil, 9 in Mexico, 6 in Canada, 3 in Argentina and

the remaining plants in other countries. We also own other significant properties including parts distribution centers,

research laboratories, test tracks, warehouses and office buildings. The total carrying value of our property, plant and

equipment as of December31, 2018 was €26.3 billion.

A number of our manufacturing facilities and equipment, including land and industrial buildings, plant and machinery

and other assets, are subject to mortgages and other security interests granted to secure indebtedness to certain

financial institutions. As of December31, 2018, our property, plant and equipment reported as pledged as collateral

for loans amounted to approximately €2.2 billion (refer to Note 11, Property, plant and equipment).

We believe that planned production capacity is adequate to satisfy anticipated retail demand and our operations are

designed to be flexible enough to accommodate the planned product design changes required to meet global market

conditions and new product programs (such as through leveraging existing production capacity in each region for

export needs).

We are not aware of any environmental issues that would materially affect the utilization of our fixed assets. See

Industrial Environmental Control.

Board Report

Group Overview

2018

|

ANNUAL REPORT

27

Supply of Raw Materials, Parts and Components

We purchase a variety of components (including mechanical, steel, electrical and electronic, plastic components as

well as castings and tires), raw materials, supplies, utilities, logistics and other services from numerous suppliers.

Historically the purchase of raw materials, parts and components have accounted for 70-80 percent of total Cost of

revenues. Of these purchases, 10-15 percent relate to the cost of raw materials, including steel, rubber, aluminum,

resin, copper, lead, and precious metals (including platinum, palladium and rhodium).

Our focus on quality improvement, cost reduction, product innovation and production flexibility requires us to rely

upon suppliers with a focus on quality and the ability to provide cost reductions. We value our relationships with

suppliers, and in recent years, we have worked to establish closer ties with a significantly reduced number of suppliers

by selecting those that enjoy a leading position in the relevant markets. In addition, we source some of the parts

and components for our vehicles internally from Teksid. We have also agreed to a multi-year supply agreement with

Magneti Marelli in connection with our expected sale of that business. Although we have not experienced any major

loss of production as a result of material or parts shortages in recent years, because we, like most of our competitors,

regularly source some of our systems, components, parts, equipment and tooling from a single provider or limited

number of providers, we are at risk of production delays and lost production should any supplier fail to deliver goods

and services on time.

Supply of raw materials, parts and components may also be disrupted or interrupted by natural disasters. In such

circumstances, we work proactively with our suppliers to identify material and part shortages and take steps to

mitigate their impact by deploying additional personnel, accessing alternative sources of supply and managing our

production schedules. We also continue to refine our processes to identify emerging capacity constraints in the

supplier tiers given the ramp up in manufacturing volumes to meet our volume targets. Furthermore, we continuously

monitor supplier performance according to key metrics such as part quality, delivery, performance, financial solvency

and sustainability.

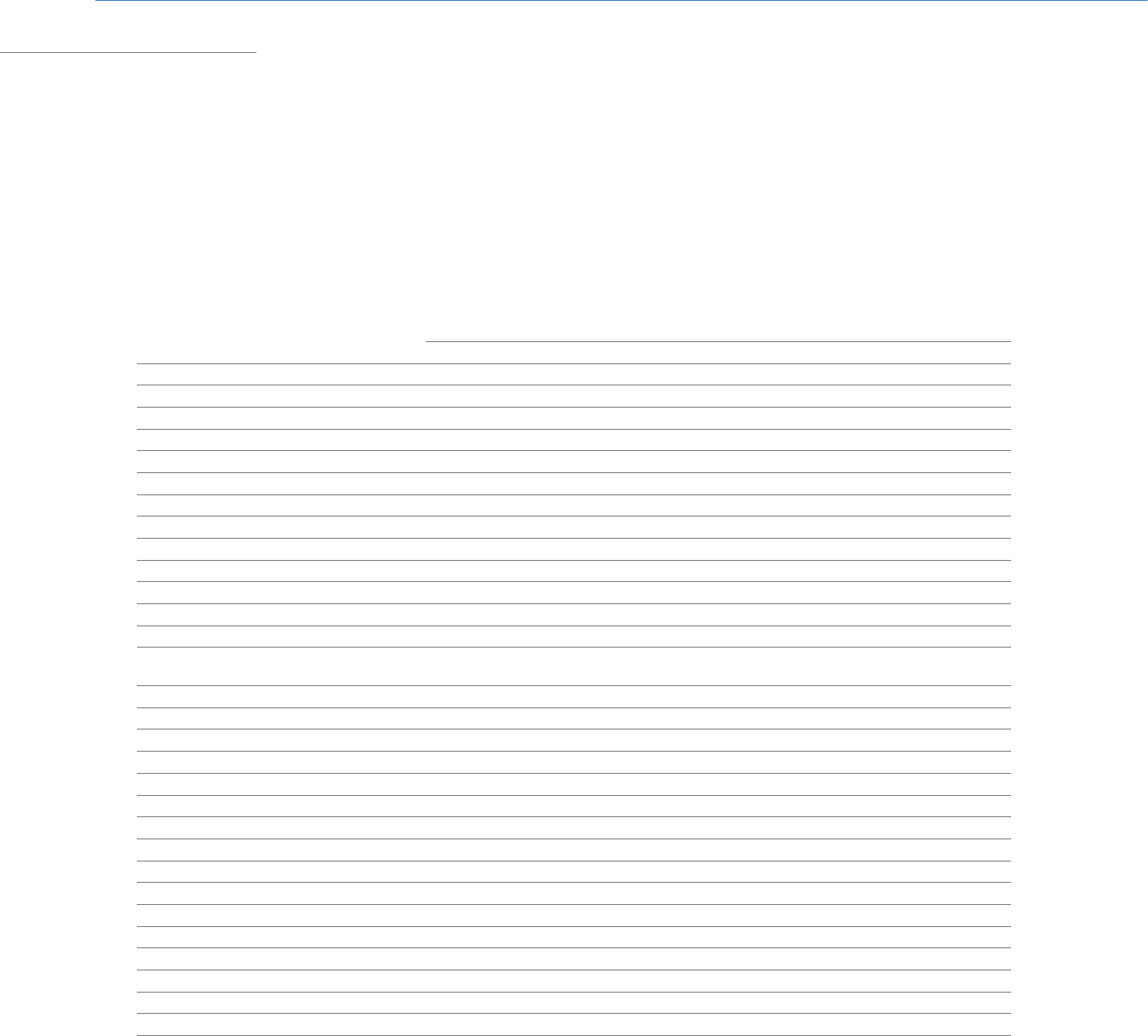

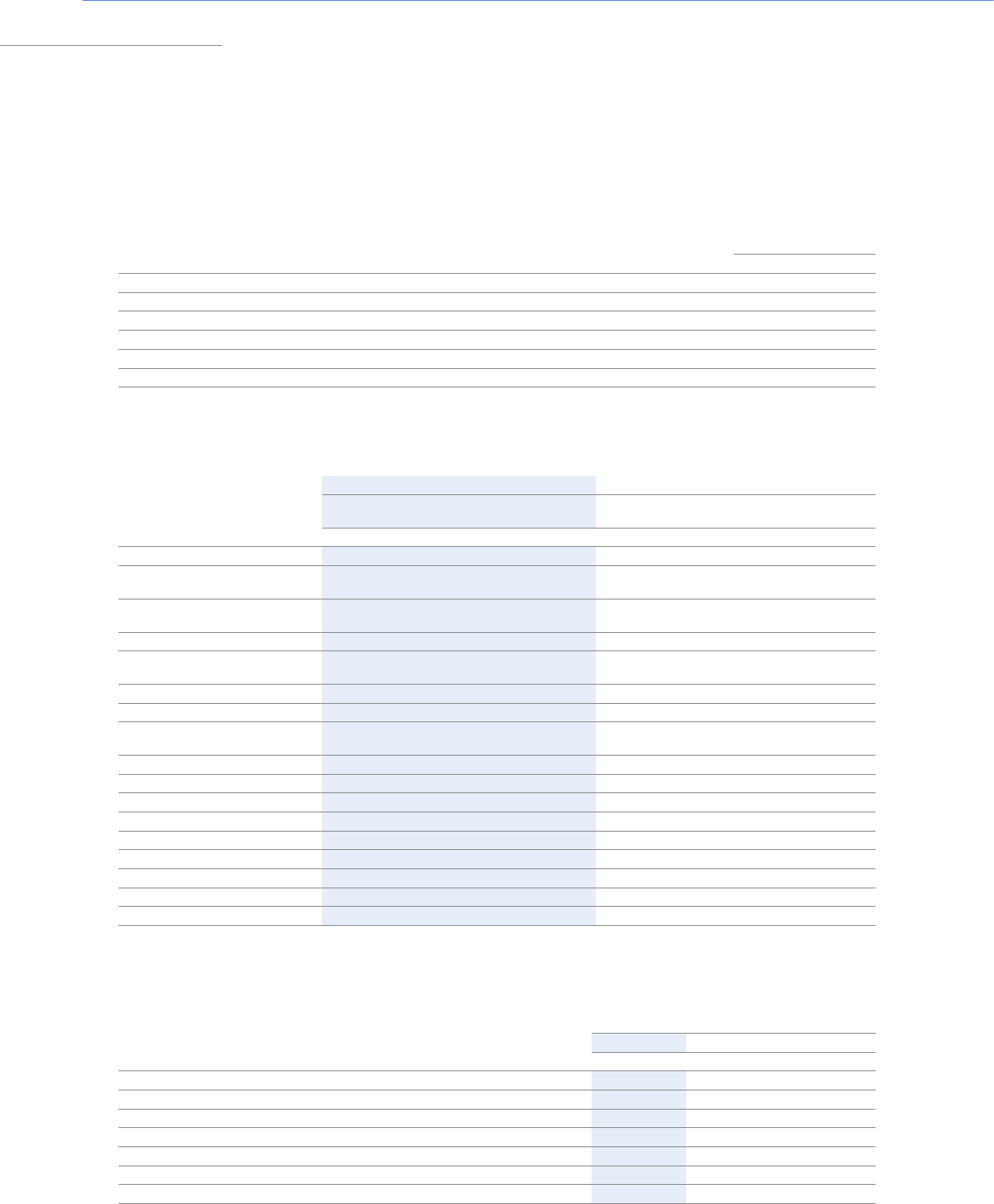

Employees

At December31, 2018, we had a total of 198,545 employees (excluding employees of certain joint ventures and of the

Magneti Marelli discontinued operation), a 1.0 percent increase from December31, 2017 and a 2.9 percent increase

over December31, 2016. The following table provides a breakdown of these employees as of December31, 2018,

2017 and 2016, indicated by type of contract and region.

Hourly Salaried Total

2018 2017

(1)

2016

(1)

2018 2017

(1)

2016

(1)

2018 2017

(1)

2016

(1)

Europe 40,446 40,910 42,257 24,170 24,920 25,306 64,616 65,830 67,563

North America 74,703 71,414 64,981 22,326 22,778 22,313 97,029 94,192 87,294

Latin America 26,004 25,634 26,171 7,062 6,917 8,138 33,066 32,551 34,309

Asia 253 271 266 3,313 3,486 3,394 3,566 3,757 3,660

Rest of the world 46 4 4 222 177 160 268 181 164

Total 141,452 138,233 133,679 57,093 58,278 59,311 198,545 196,511 192,990

(1)

Previously reported employee numbers for 2017 and 2016 have been re-presented to exclude the Magneti Marelli discontinued operation.

We maintain dialogue with trade unions and employee representatives to achieve consensus-based solutions for

responding to different market conditions in each geographic area. We have had no significant instances of labor

unrest overall, and no significant local labor actions in the past threeyears.

In Europe, we established a European Works Council (the “EWC”) in 1997 to ensure workers the right to information

and consultation as required by European Union regulations applicable to community-scale undertakings. The EWC

was established on the basis of an agreement initially signed in 1996 and subsequently revised and amended with a

further amendment executed in July 2016. The amendment increased the number of total seats from 20 to 24 so that

additional employees from new countries within the scope of the EWC are represented.

28

2018

|

ANNUAL REPORT

Trade Unions and Collective Bargaining

FCA employees are free to join any trade union provided they do so in accordance with local law and the rules of the

related trade union. The Group recognizes and respects the right of its employees to be represented by trade unions

or other representatives in accordance with local applicable legislation and practice.

A large portion of our workers in Italy, the U.S., Canada and Mexico are represented by trade unions. In addition to

the rights granted to all Italian trade unions and workers concerning freedom of association, we provide an additional

service to our Italian employees by paying the trade union dues on their behalf.

Collective bargaining at various levels resulted in major agreements being reached with trade unions on both wage

and employment conditions in several countries. Based on an average figure that includes the Sevel plant (Italy), 88.8

percent of our employees worldwide are covered by collective bargaining agreements.

In Italy, all of our employees are covered by collective bargaining agreements. In April 2015, a four-year compensation

agreement was signed by FCA companies within the automobiles business in Italy. The new compensation agreement