Insurers Monitor Shocks to Collateral:

Micro Evidence from Mortgage-backed Securities

∗

Thiemo Fetzer

University of Warwick and Bonn & CEPR

Benjamin Guin

Bank of England

Felipe Netto

Bank of England

Farzad Saidi

University of Bonn & CEPR

August 30, 2024

Abstract

This paper uncovers if and how insurance companies react to shocks to collateral in

their portfolio of securitized assets. We address this question in the context of commercial

real estate cash flow shocks, which are informationally opaque to holders of commercial

mortgage-backed securities (CMBS). Using detailed micro data, we show that cash flow

shocks during the COVID-19 pandemic predict CRE mortgage delinquency, especially

those stemming from lease expiration of offices, reflecting lower demand for these prop-

erties. Insurers react to such cash flow shocks by selling more exposed CMBS—mirrored

by a surge in small banks holding CMBS—and the composition of their CMBS portfolio

affects their trading behavior in other assets. Our results indicate that institutional in-

vestors actively monitor underlying asset risk, and even gain an informational advantage

over some banks.

JEL codes: G20, G21, G22, G23

Keywords: Insurance Sector, Risk Management, Mortgage Default, Commercial Real Es-

tate, CMBS, Work-from-home

∗

We thank David Glancy, Thorsten Martin, Ralf Meisenzahl and Lakshmi Naaraayanan, as well as seminar

participants at Queen Mary University of London, University of Leicester, the 2024 BEAR Conference at the

Bank of England, and the 2024 Conference on Regulating Financial Markets at Frankfurt School of Finance

& Management for helpful comments. Saidi acknowledges funding by the Deutsche Forschungsgemeinschaft

(DFG, German Research Foundation) under Germany’s Excellence Strategy (EXC 2126/1 – 390838866) and

through CRC TR 224 (Project C03). Fetzer acknowledges funding by the Leverhulme Prize in Economics, a

European Research Council Starting Grant (ERC, MEGEO, 101042703), and Deutsche Forschungsgemeinschaft

(DFG, EXC 2126/1 – 390838866). The paper represents the authors’ personal opinions and not necessarily the

views of the Bank of England.

1. Introduction

Growing risks in mortgage-backed securities, along with perceived failure by intermediaries

to perform due diligence and risk management, are considered some of the main causes of

the Global Financial Crisis (Chen et al., 2020). For commercial mortgage-backed securities

(CMBS), such risks arise due to the uncertainty about cash flows generated by the underlying

mortgages. Yet, monitoring these cash flows is particularly challenging in CMBS as these

securities often contain several underlying assets and complex structures (Ghent, Torous and

Valkanov, 2019). By studying how investors react to salient shocks to (expected) cash flows,

we can infer whether they monitor such risks in complex assets.

In this paper, we exploit cash flow shocks during the COVID-19 pandemic that vary by the

type of property serving as mortgage collateral. Retail properties faced shocks due to lock-

downs, leading immediately to significantly lower revenue. By contrast, the shift to hybrid

work arrangements reduced demand for office spaces, thereby affecting their current and ex-

pected revenue and value (Gupta, Mittal and Nieuwerburgh, 2023). This poses additional

challenges to CMBS investors’ monitoring efforts. Moreover, the extent to which investors

differ in their due diligence and risk-bearing capabilities also determines how commercial

real estate (CRE) risks associated with lower office demand are shared across intermediaries.

Specifically, we explore how insurers—one of the largest investor groups in mortgage-

backed securities—react to increases in CRE mortgage risks induced by cash flow shocks both

during COVID-19 and in its wake. To this end, we exploit rich data on mortgages included

in CMBS deals, containing detailed loan and property characteristics, as well as information

about the lease contracts between borrowers and their core tenants. Lease expiration has a

strong positive effect on CRE loan default for offices, especially following the COVID-19 pan-

demic, when demand for office real estate dwindled as a result of hybrid work arrangements.

We present evidence in line with the view that insurers monitor collateral characteristics such

as property type and lease expiration dates, and reduce their holdings of CMBS exposed to

these risks after the onset of the pandemic. Moreover, the composition of insurers’ CMBS

portfolio has implications for how these investors react to salient risks in the remainder of

their asset portfolio. Finally, we document how the reduction in CMBS holdings by insurers

is accompanied by a significant increase in the holdings of private-label CMBS in particular

1

by small banks.

We start out by discussing the link between borrower cash flows obtained from rental in-

come and mortgage delinquency, and how this information would influence CMBS investors’

behavior depending on monitoring. Since the value of a commercial property equals the

present discounted value of the cash flows that can be obtained from renting such property,

changes in cash flows and changes in property value are intimately connected. Lower de-

mand for CRE would affect delinquencies through their effect on cash flows obtained from

renting out properties, and risks to these cash flows are more likely to materialize once a ten-

ant agreement ends. Importantly, if lease agreement information is monitored by investors,

then these investors would be more likely to sell CMBS with a larger share of mortgages

linked to leases expiring when faced with unexpected shocks to collateral demand. More-

over, this monitoring effort could make investors less reactive to risks in other assets if their

capacity to monitor such risks is limited.

To test the relationships between information about CRE cash flow risks, loan delinquency,

and institutional investors’ trading behavior, we use comprehensive monthly panel data on

CMBS deals, bonds and loans against CRE, along with detailed information on the asset

portfolios of U.S. insurance companies. The mortgage data enable us to observe the default

status of each loan while also capturing relevant information about the underlying proper-

ties, including their location and designated use. The dataset also contains rental contract

characteristics such as lease expiration dates and tenant occupancy share for certain types

of properties. Following our discussion, we posit that changes in rental cash flows are more

common when tenant lease contracts expire, since elevated early termination fees can incen-

tivize tenants to retain their lease until it expires.

1

The lease expiration timing generates

a negative cash flow shock for borrowers if they need time to find a new tenant or if they

cannot renew the lease at a similar rent. Indeed, we find spikes in delinquency that coincide

with months in which the lease contracts of borrowers’ main tenants expire, especially for

offices, rendering the monitoring of lease expirations potentially valuable.

We next turn to differences in default for properties with and without leases expiring, be-

fore and after the COVID-19 pandemic. The underlying rationale is that cash flow shocks

1

This should hold true under the condition that the costs of terminating the rental contract early are higher

than the savings from moving to a smaller office space.

2

should be stronger following a systematic drop in demand for commercial real estate. The

COVID-19 period is characterized by structural changes in demand for office space due to

hybrid working arrangements (Barrero, Bloom and Davis, 2021). Lower demand for offices

reduces current and expected rental income, lowering the value of commercial real estate

properties. We show evidence consistent with the presence of a structural shift in demand for

office space, leading to more persistent increases in mortgage defaults, especially for mort-

gages exposed to lease expiration.

The challenge in establishing a causal link between lease expiration dates and delinquency

rates is that these dates can coincide with other shocks that cause delinquency. For example,

lease expiration can coincide with regional shocks that lower demand for CRE. Similarly,

if mortgages with leases expiring have floating interest rates, increases in reference interest

rates that coincide with lease expiration can also cause an increase in delinquency rates. We

address these challenges by leveraging the granularity of our data, which allow us to include

a rich set of fixed effects that capture several static and time-varying confounding factors

that could affect delinquency rates.

Using the beginning of the COVID-19 pandemic as the treatment period of a shock to the

demand for office space, we estimate a difference-in-differences specification, and show that

lease expiration triggers increases in delinquencies, with a stronger effect after COVID-19.

These effects are economically meaningful, with lease expiration leading to about 1.3 per-

centage points higher delinquency in the baseline period, and an additional 1.2 percentage-

point increase in the post-pandemic period. Finally, the lease expiration effect is stronger

for properties which are not fully occupied by the largest tenants, suggesting that relatively

larger tenants renew their leases more often.

The second step in our empirical analysis consists of understanding how large insurance

companies’ exposure to offices through their CMBS holdings are, and the extent to which

these investors monitor cash flow risk caused by lease expiration. First, we document that in-

surance companies are indeed a large group of investors in CMBS, holding close to one-fourth

of newly issued private-label CMBS between 2017 and 2022. We also find that the amount

of insurers’ private-label CMBS portfolio not exposed to offices peaks in 2020, and decreases

afterwards, which is consistent with lower demand for CMBS exposed to offices among those

investors. Nonetheless, insurers remain largely exposed to cash flow risks arising from lower

3

office demand. In our sample, the median insurance company has its private-label CMBS

with an average exposure of about 26% to offices. This potentially dwarfs banks’ exposure to

other CRE-related risks, often of indirect nature (Acharya et al., 2024).

We test if insurers monitor cash flow risks in their CMBS portfolio by asking if bonds more

sensitive to different cash flow shocks are more likely to be sold following the sudden, un-

expected increase in risk caused by COVID-19. Our identification strategy relies on the idea

that pandemic-driven lower demand for CRE constitutes an unexpected shock to CMBS cash

flows, with different effects across property collateral types. As with mortgage default, we

estimate a difference-in-differences specification to assess if CMBS with exposure to office-

linked loans whose main leases expire within a specific horizon are more likely to be sold

after the pandemic. The richness of our data allows us to include insurer by time and insurer

by bond fixed effects, on top of time-varying coupon type and risk classification fixed effects.

This addresses concerns that our estimates are contaminated by other time-varying insurer

shocks or bond characteristics. Moreover, it allows us to capture changes in trading behavior

within an asset class with similar capital costs for insurers.

We find that insurers infer risks from shocks to expected cash flows, affecting their trading

behavior. Insurance companies are more likely to sell CMBS which are exposed to offices,

especially those with lease expiration in the medium term. Insurers are also more likely to

sell retail-exposed CMBS, but this effect is not sensitive to underlying lease expiration. This

suggests that insurance companies can identify how different property types are affected by

the pandemic, and the nature of cash flow risks caused by lower demand for offices. Further-

more, medium-term lease expiration in four to six years has strong predictive power for sales

of office-linked CMBS. For instance, bonds exposed to office lease expiration within six years

are over two percentage points more likely to be sold by insurers in the post-COVID period.

Their sensitivity to underlying lease expiration in longer horizons indicates that the market

expects a whole asset class—commercial real estate—to be affected by the pandemic shock

for a longer duration.

Insurers adjust to risks in CMBS also along other margins. First, the share of CMBS ac-

quired by insurers with office exposure falls after 2020, along with the share of CMBS ex-

posed to cash flow shocks via lease expiration. Second, insurers demand higher coupons for

holding office-exposed CMBS originated after the pandemic, even when controlling for other

4

determinants of CMBS returns. These findings corroborate the idea that insurers monitor

risks to their CMBS portfolio, and learn about structural changes that make certain types of

collateral more prone to cash flow-induced losses.

We also consider affected insurers’ trading behavior in the remainder of their securities

portfolio. As insurers react to immediate losses in retail-exposed CMBS, this could trigger

sales of other risky assets (Ellul et al., 2022). Indeed, we find that insurance companies are

more likely to sell risky assets if they have a larger exposure to retail collateral. At the same

time, insurers put in effort to assess underlying risks in their portfolio of securitized assets

as they become more relevant, as was the case for office-linked CMBS during the COVID-

19 pandemic. By locking down valuable monitoring efforts, this gives rise to the possibility

that insurance companies are subsequently less sensitive to increases in capital requirements

or other consequences of holding on to riskier assets in the remainder of their portfolio.

Consistent with this, we find that insurers are less likely to sell riskier bonds in the post-

COVID period if they have a larger exposure to offices in their CMBS portfolio, even when

controlling for time-varying unobserved heterogeneity at the insurer and security level. The

latter effect points to the limited resources that financial institutions have at their disposal to

effectively constrain their exposure to investment with lurking risk (e.g., Chen et al., 2020).

If insurers reduce their exposure to private-label CMBS, other investors are acquiring these

risky assets. Since monitoring of securitized assets is costly, it is possible that less sophisti-

cated investors are less sensitive to lurking risk and end up holding larger shares of private-

label CMBS after the pandemic. In line with this view, we document a remarkable rise in the

holdings of private-label CMBS by banks after 2020, especially by small and medium-sized

banks. The number of small banks that hold private-label CMBS nearly doubles between 2020

and 2023. Since small banks are in general not exposed to large office-linked loans (Glancy

and Kurtzman, 2024), this could be caused by additional risk-bearing capacity. However,

to the extent that small banks have lower risk management abilities (Ellul and Yerramilli,

2013), this is also consistent with the idea that better informed insurers offload part of their

office-borne CMBS risks to less well informed small banks. Moreover, contrary to insurers,

other investors do not seem to demand higher coupons from office-exposed CMBS after the

pandemic, suggesting these investors are indeed less sensitive to such risks. Our findings

point to how investors’ ability to monitor risks in complex assets contributes to the transfer

5

of risks caused by systematic shocks.

Related literature. Our paper contributes to the literature studying securitized assets and

mortgage-backed securities in particular.

2

This literature has pointed out to how risks in

mortgage-backed securities (MBS) affected institutional investors during the Global Finan-

cial Crisis. Several papers investigate how MBS characteristics such as equity retention (Be-

gley and Purnanandam, 2017) and retention structure (Flynn, Ghent and Tchistyi, 2020)

are used by originators to signal asset quality. Ghent, Torous and Valkanov (2019) show

how more complex CMBS underperform during the Global Financial Crisis, with complexity

contributing to both obfuscating collateral quality and allowing for cash flows to be diverted

towards residual tranches. Moreover, investors do not price this complexity-induced default

risk. These studies emphasize the difficulty in assessing risks in MBS, which requires costly

infrastructure to be performed (Hanson and Sunderam, 2013). Our contribution is to show

that despite these due-diligence challenges and being typically viewed as less capable of

doing so, institutional investors monitor detailed, time-varying property and lease contract

characteristics that predict CMBS losses, and divest on the basis of such information.

As such, our paper also relates to a broad literature that studies insurance companies’

portfolio decisions, and how they react to risks in their asset portfolio.

3

This literature doc-

uments that insurance companies react to changes in observable risk such as downgrades

(Ellul, Jotikasthira and Lundblad, 2011), and highlights how regulation affects insurers’ be-

havior facing asset risk (Chen et al., 2020; Becker, Opp and Saidi, 2022; Sen, 2023). We

contribute to it by showing how insurers divest from CMBS with larger cash flow risks fol-

lowing the pandemic, even if these risks do not immediately lead to higher capital costs.

Moreover, in line with Ellul et al. (2022), we find that insurers divest from risky assets when

a large share of their CMBS portfolio suffers a devaluation shock, and that the additional

effort undertaken to monitor those cash flow risks seems to limit insurers’ ability to react

to salient risks in other assets. This finding is particularly relevant given the importance of

insurance companies in absorbing fluctuations in asset prices (Chodorow-Reich, Ghent and

2

See, for example, DeMarzo and Duffie (1999), DeMarzo (2005), Demiroglu and James (2012), Ashcraft,

Gooriah and Kermani (2019), and Aiello (2022).

3

See, among others, Ge and Weisbach (2021), Koijen and Yogo (2022), Bretscher et al. (2022), Bhardwaj, Ge

and Mukherjee (2022), and Koijen and Yogo (2023).

6

Haddad, 2021).

Finally, we relate to the literature exploring the impact of work-from-home adjustments

in CRE mortgage default risk. Thus far, this literature had not documented a direct link

between lower office demand and CRE mortgage default (Nieuwerburgh, 2022).

4

Moreover,

Jiang et al. (2023) explore how losses from CRE loan portfolios affect the solvency of U.S.

banks, and Glancy and Kurtzman (2024) considers how differences in small banks’ CRE loan

portfolios govern reduced exposure to loans whose poor performance was driven by lower

office demand. Our contribution is to provide a detailed account of how insurers are affected

by CRE risks through their CMBS holdings. Moreover, variation in how insurers react to

shocks expected to materialize in different horizons suggests market participants expect the

office demand shock to have a long duration. Finally, the exposure of small banks to CRE

risks through their holdings of CMBS has been largely ignored so far. As CRE risks shifted

across the financial sector, the number of small banks exposed to CMBS has increased sub-

stantially. In that sense, any comprehensive analysis of how CRE risks will affect financial

stability should account for both banks’ and non-banks’ CMBS exposures alike.

2. Lease Expiration, Cash Flow Shocks, and CRE Mortgage Default

In this section, we develop hypotheses that will guide our empirical analysis. First, sudden

drops in demand for office space lead to fewer occupied offices after leases expire, either

by downsizing or lack of renewal, and longer search times for new tenants. This results in

lower income from new leases, reducing overall lease revenue. As a result, to the extent that

borrowers rely on such income to repay mortgages, mortgage default rates should increase,

especially in periods of lower demand for office space.

Hypothesis 1: Lease expiration persistently increases defaults of mortgages against offices after the

COVID-19 cash flow shock, whereas other types of collateral, especially retail, see defaults imme-

diately and are, thus, less sensitive to lease expiration.

4

As in our study, Glancy and Wang (2024) highlights the importance of lease expiration in the post-COVID

period, showing that it affects office vacancies and loan performance. Both studies provide direct evidence

of the importance of cash flow-triggered mortgage default for commercial real estate. Several papers study

the relevance of strategic and cash flow motives for default of residential mortgages (Ganong and Noel, 2023;

Bhutta, Dokko and Shan, 2017; Gerardi et al., 2018), with less attention devoted to commercial mortgages.

7

Since U.S. insurers frequently hold CMBS, any increase in the riskiness of these assets

could influence their investment decisions. First, if insurance companies can observe lease

expirations, the increased likelihood of future delinquencies due to lease expirations should

make CMBS with a higher proportion of soon-to-expire mortgages less attractive to hold.

Since lower demand increases the persistence of default triggered by lease expiration, in-

vestors are more likely to monitor characteristics associated with cash flow risks following

the pandemic-linked shock to CRE demand. Consequently, they are more prone to selling

CMBS with a larger exposure to cash flow shocks after the pandemic.

Hypothesis 2: Conditional on monitoring, insurers should sell CMBS with relatively more mort-

gages against offices undergoing lease expiration after the COVID-19 cash flow shock, while their

propensity to sell CMBS with retail exposure increases immediately and is otherwise invariant to

the horizon of lease expiration.

Mortgage-backed securities are complex assets, assessing risks for these assets is costly and

often accessible only to sophisticated institutional investors (Hanson and Sunderam, 2013).

Even if insurers possess the ability to monitor the cash flow risks associated with lower CRE

demand and lease expiration, as hypothesized, other intermediaries might not. In that case,

if insurers sell CMBS with a larger exposure to cash flow risks, and if intermediaries differ

in their monitoring capacity, the sale of CMBS by insurers would be accompanied by an in-

crease in the holdings of less sophisticated investors.

Hypothesis 3: If monitoring capacity is heterogeneous, risky CMBS should, on average, flow from

insurers to less sophisticated investors.

Finally, the demand shock for office space leading to an unexpected increase in cash flow

risks to CMBS portfolios can affect insurers’ trading activity in other assets. This is possible

for two reasons. First, facing immediate losses—as is the case for retail-exposed CMBS—in

their asset portfolio caused by higher delinquencies after the onset of the pandemic, insur-

ers might de-risk by selling other, riskier assets (Ellul et al., 2022). Moreover, if insurance

8

companies’ risk assessment capacity is limited (Chen et al., 2020), insurers which exert more

effort to monitor cash flow risks—especially those linked to office collateral—to their CMBS

portfolio after the onset of the COVID-19 pandemic could become less sensitive to conse-

quences of holding riskier assets. This reduction in the salience of risk characteristics for

other bonds in insurers’ portfolios would lead to lower sales in response to changes in ob-

servable risk, such as rating downgrades or capital surcharges.

Hypothesis 4: Insurers’ holdings of CMBS affect their trading behavior in other risky assets differ-

ently depending on the type of collateral.

3. Data Description

Our data come from two main sources: Trepp and the National Association of Insurance

Companies (NAIC). Trepp is a lead provider of commercial real estate collateralized prod-

ucts data, which is established in the existing literature (Flynn, Ghent and Tchistyi, 2020).

It collects origination information from CRE mortgages, CMBS deals and bonds, which is

obtained from various sources. It includes detailed information such as property type and

location, mortgage maturity, amount, interest rates, and delinquency information for each

distribution date. We classify loans according to the use of the property which serves as col-

lateral for the loan. We distinguish between Office, Retail, and further property types.

5

The

data also contain information on lease agreements between borrowers and tenants. We focus

on the lease information for the largest tenant only. Appendix-Table A.1 shows that the avail-

ability of lease expiration data varies by property type, with Office and Retail as the only two

property types for which the date of lease expiration of the main tenant is available for more

than 50% of the observations. For this reason, we mainly consider these two property types

throughout the paper.

We obtain holdings and trades of fixed income assets of all insurance companies in the

U.S. from the National Association of Insurance Commissioners (NAIC). The holdings data

5

These are classified as Multifamily, Mixed Use, Healthcare-Nursing, Lodging-Restaurants, Industrial and Ware-

houses, and Other. The details of how these types are obtained, along with other details of our data cleaning

procedure, can be found in Appendix B.

9

are based on NAIC Schedule D Part 1, and contain CUSIP-level end-of-year holdings of fixed

income securities, including CMBS. The trading information is obtained from NAIC Sched-

ule D, Parts 3 and 4, which contain information on acquisitions and dispositions of fixed

income assets by insurance companies, respectively. We identify actual trades (sales and

purchases) using a procedure similar as in Becker, Opp and Saidi (2022), which is described

in Appendix C.

We restrict our analysis to the post-2017 period.

6

This ensures that we mitigate concerns

about the influence of the Global Financial Crisis (GFC), e.g., through elevated delinquency

rates responding to demand shocks that originated during the GFC. Table 1 shows the sum-

mary statistics of the mortgages in our sample. Panel A focuses on all properties, which have

a median lease expiring in 2024 and a median mortgage maturity of 10 years. We classify a

loan as delinquent if payments are past due for at least 90 days. On average, less than 1% of

all loans are delinquent in our sample period, around 10% of our loans have floating interest

rates, and less than 1% are recourse loans.

Finally, since our analysis mostly focuses on offices and retail CRE, we provide a break-

down of the characteristics of the mortgages used to finance these property types in Panels B

and C of Table 1, respectively. Relative to retail, offices have floating interest rates more fre-

quently, lower delinquency rates, and similar maturity. Moreover, the mean and the median

share of each property occupied by the largest tenant is smaller in offices than in retail.

4. Cash Flow Shocks and Mortgage Delinquencies

4.1. The Role of Lease Expiration

First, focusing on mortgages whose lease expiration dates occur between 2017 and 2021,

we evaluate the importance of lease expiration-induced cash flow shocks to borrowers in

driving delinquency rates. Using this sample period, we examine delinquency rates in the

time window of one year prior and one year after the expiration date of the main lease. Given

our definition of a loan being delinquent if it is at least 90 days, or about 3 months, past due,

we expect to see delinquency rates to increase comparatively more only after the third month

6

Our Trepp sample covers CMBS information until June 2022.

10

in which a lease expires.

Figure 1 shows the average delinquency rates for all property types for which such in-

formation is available. As expected, we observe that delinquency rates increase, with the

sharpest increase occurring exactly in the fourth month after the lease expiration date. This

is in line with the idea that cash flow shocks from a lease expiring induces borrowers to

stop making payments on their mortgages. This may be because the existing borrower can-

not find a new tenant immediately or the lease generates lower income than the previous

one. Moreover, delinquency rates seem to converge back to their pre-lease expiration trend

approximately 10 months after the lease expiration, which indicates that borrowers resume

their payments once a new tenancy agreement is secured. This further illustrates the impor-

tance of cash flow shocks to the default behavior of CRE borrowers.

This preliminary analysis, however, does not account for potential differences in delin-

quency rates depending on the use of the property. There are reasons to assume that such

differences exist. First, the specific use of the property might limit a borrower’s ability to

find a new tenant. For example, it may be more difficult to re-purpose office space for other

uses, which can increase search costs and lower expected revenue after an existing lease ex-

pires. Second, firms in different sectors might be more likely to renew their lease contracts,

and to the extent that these firms select into different types of properties, this would dif-

ferentially affect borrowers depending on the property they are financing with their loan.

Third, it may be borrower-specific characteristics that matter. For example, some borrowers

who take out mortgages against certain types of properties might struggle more to find new

tenants, which would be the case if search frictions are different when looking for office or

retail tenants. Against this background, we split our sample into two subsamples: offices

and other retail properties. Figure 2 shows a remarkable difference in delinquency behavior

for these different property types. The plot on the left-hand side shows sharp increases in

delinquency rates of offices following the end of the main lease agreement. By contrast, the

plot on the right-hand side suggests that increases in delinquency rates of retail properties

are more short lived, with shocks introduced by the end of lease agreements being more tran-

sitory in nature. Overall, these preliminary results indicate that cash flow shocks are strong

predictors of office delinquencies, but less so for retail properties.

So far, we have examined delinquencies focusing on the exact timing of the lease expiration

11

for a specific property, but not explicitly considering the delinquency behavior of mortgages

without leases expiring. This difference in exposure to cash flow shocks caused by lease

expiration can be particularly relevant in the post-COVID period, as lower demand for offices

could interact with these contractual terms and lead to more persistent losses to landlords. To

the extent that lower CRE demand magnifies cash flow shocks, one would expect mortgages

with leases expiring in the post-COVID period to perform worse than mortgages which are

not subject to such cash flow shocks.

We assess differences in delinquency of properties with and without leases expiring by

looking at office/retail properties for which we have lease expiration information (i.e., we

know if the main lease expires or not), and zoom in on the immediate period before/after

the start of the COVID-19 pandemic. We compare the average delinquency rate of loans

with leases expiring in 2021-2022 with the average delinquency rates of loans without leases

expiring in these two years.

The results are shown in Figure 3. The left-hand side plot shows a remarkable pattern for

office mortgages with and without leases expiring in 2021-2022. Delinquency rates for the

former group are pretty much stable throughout the entire period, whereas there is a large

spike in delinquency rates for mortgages the main leases of which expired in 2021-2022. This

further indicates that cash flow shocks are a relevant determinant of office mortgage default,

and that aggregate delinquency rates do not capture the extent to which work-from-home

arrangements trigger CRE mortgage default given its effect on office demand.

By contrast, the trajectory of retail mortgage delinquencies on the right-hand side of Figure

3 shows a different pattern. Delinquency rates spike immediately at the onset of the COVID-

19 pandemic, which coincides with lockdown periods during which retail stores did not

generate income to tenants. Following that initial shock, mortgages with leases expiring

in 2021-2022 demonstrate persistently higher delinquency rates. which suggests that lease

expiration matters for the adjustment to the initial shock. In other words, while cash flow

shocks do not seem to cause mortgages to go from performing to non-performing in the case

of retail, they do seem to affect the persistence of the initial increase in delinquency rates.

In what follows, we focus on offices rather than retail properties. This allows us to focus

on structural changes in the demand for office space without explicitly considering the im-

plications from the initial lockdowns on businesses. Furthermore, if institutional investors

12

trade before losses materialize, then one would expect their trading behavior to be based on

office exposure if these mortgages losses can be predicted by shocks to expected cash flows.

4.2. The Effect of Lease Expiration on Mortgage Delinquency

Our motivating evidence suggests a key role for lease expiration dates in driving delinquency

behavior for CRE mortgage borrowers, especially for office properties. Nevertheless, there

are a range of other factors that could be driving the delinquency dynamics we observe for

properties subject to lease expiration. For example, lease expiration dates could correlate

with systematic or region-specific shocks that affect the U.S. economy in specific times, such

as the Global Financial Crisis and the onset of the COVID-19 pandemic. Moreover, loans for

which we have lease expiration data could also have specific characteristics, such as floating

interest rates, which can make them more susceptible to increases in delinquency in times of

increases in interest rates.

To evaluate the relationship between lease expiration and mortgage default, we leverage

the richness of our data, which allow us to compare otherwise similar mortgages that have

leases expiring and not. First, we estimate the following specification:

I

D90

jrt

= α

j

+ α

rt

+ α

j(f loating)t

+

X

ι∈[−15,15]\{0}

D

ι

jt

δ

ι

+ ε

jrt

, (1)

where I

D90

jrt

is an indicator variable equal to 1 if loan j, for a property located in city r, is

delinquent for more than 90 days in month t, D

ι

jt

equals 1 if loan j is ι months after lease

expiration in month t. α

j

and α

rt

are loan and city-year fixed effects, which allow us to control

for time-invariant loan-level and time-varying regional characteristics that might influence

default rates. α

j(f loating)t

are interest rate type by year fixed effects to capture differences in

delinquency between floating and fixed interest rate loans.

The coefficients of interest δ

ι

capture the percent difference in delinquency rates ι months

before and after lease expiration, relative to the moment in which the lease expires. Impor-

tantly, the use of comprehensive fixed effects ensures this variation does not correspond to

time-varying regional shocks or to index rate characteristics of the mortgages that could also

influence delinquency behavior. We only include loans for which we have lease expiration

13

information

7

, and cluster standard errors at the loan level.

Since lower office demand caused by work-from-home (WFH) arrangements might affect

CRE mortgage default rates, we estimate (1) separately for the period before and after the

COVID-19 pandemic started (where we consider March 2020 as the beginning of the pan-

demic). Intuitively, if borrowers face lower demand for their properties as a result of struc-

tural changes associated with work-from-home preferences, then one would expect the cash

flow shocks introduced by lease expiration to be long lasting. Conversely, absent demand

shocks, the initial drop in cash flows would cease after the borrower manages to find a new

tenant, and delinquency rates would slowly transition back to their pre-lease expiration lev-

els.

The results are shown in the two plots of Figure 4, indicating that WFH demand adjust-

ment did affect the persistence of the effect of cash flow shocks on delinquency rates. While

the initial effect is similar in both periods, delinquency rates in the pre-COVID panel on

the left show that delinquency rates begin to converge back to their initial level after one

year of the lease expiration. Our point estimates indicate that relative to the lease expiration

month, a mortgage experiences a one percentage point higher delinquency 15 months after

the lease expiration. In contrast, the effects of the cash flow shock induced by lease expiration

are more long lasting in the post-COVID period, with delinquency rates gradually becoming

larger following a lease expiration. The difference in relative delinquency between the lease

expiration month and 15 months after is about three percentage points, almost three times

as the same point estimate from the pre-COVID period.

To quantify the differences in post-lease expiration delinquency behavior before and after

the onset of the COVID-19 pandemic indicated in Figure 4, we estimate a triple-differences

specification:

7

We do this to avoid including loans with leases expiring in our control group (which could happen for loans

for which we do not observe that information, but might experience a lease expiration nonetheless).

14

I

D90

jrt

= α

j

+ α

rt

+ α

j(f loating)t

+ γ

1

P ost Expiration

jt

+ β

1

P ost Expiration

jt

× P ost Covid

t

+ β

2

P ost Expiration

jt

× Ind Of f ice

j

+ β

3

P ost Covid

jt

× Ind Of f ice

j

+ β

4

P ost Expiration

jt

× P ost Covid

t

× Ind Of f ice

j

+ ε

jrt

, (2)

where P ost Covid

t

is a dummy equal to 1 after March 2020, P ost Expiration

jt

equals 1 if

loan j had its main lease expiration before or in month t, and Ind Of f ice

j

equals 1 if loan j

is linked to an office. The coefficient of interest β

4

captures the difference in the effect of lease

expiration-induced cash flow shocks on delinquency rates since the onset of the pandemic.

The results are shown in Table 2. Across all specifications, the coeficient on the triple

interaction term is positive and statistically significant, and the economic magnitude is rele-

vant. The baseline effect of lease expiration on mortgage delinquency increases by about 1.2

percentage points, meaning the effect of cash flow shocks on delinquency rates is twice as

strong after the COVID-19 pandemic. Cash flow shocks increase delinquency rates by more

than 2 percentage points when compared to the average delinquency rate of 0.6% for prop-

erties without expired leases in the post-COVID period. This is an economically significant

effect, with delinquency rates of office mortgages whose main tenancy agreement expired

being more than four times as large as delinquency rates of mortgages that do not experi-

ence such cash flow shocks. These results reinforce the notion that demand shocks caused

by hybrid work arrangements, which became prevalent after the beginning of the COVID-19

pandemic, further exacerbate the effects of cash flow shocks on CRE mortgage delinquency

rates.

CMBS exposure to regional work-from-home characteristics. Our analysis hinges on the

observation that by being relatively more affected by hybrid work arrangements, demand

for office properties is also relatively more affected by the work-from-home shock, thereby

leading to more persistent cash flow shocks to rent revenue. Importantly, another dimension

of heterogeneity in exposure to work-from-home adjustments refers to regional characteris-

tics. For instance, cities like San Francisco or New York are perceived to be more affected by

15

hybrid work arrangements than others (Gupta, Mittal and Nieuwerburgh, 2023).

While we cannot measure demand for office space, we can nevertheless assess how mort-

gages in our sample correlate with measures that have been constructed to capture regional

sensitivity to work-from-home. We use the measure of jobs that can be performed remotely

by Dingel and Neiman (2020), which should broadly indicate which areas are more likely to

be affected by work-from-home arrangements. Figure A.3 in the Appendix shows the distri-

bution of the percentage of teleworkable jobs in an MSA, for the office-linked mortgages in

our sample and for all MSAs. Relative to the distribution across all MSAs, office-linked mort-

gages in our sample are located in areas with higher sensitivity to work-from-home shocks.

4.3. Cash Flow Shocks and Relative Tenant Occupancy

Our results so far focus on the sensitivity of default rates along the extensive margin of lease

expiration—namely, whether a lease expiring is associated with increases in default—but is

silent about the intensive margin—i.e., whether the relative size of an occupant also affects

default. On the one hand, tenants which occupy a larger share of a property might also

have more bargaining power and obtain better renewal offers, rendering them more likely to

renew their contracts. On the other hand, since these tenants also represent a larger share of

the rental income obtained from a property, unexpected vacancy would have a larger impact

on borrower cash flows.

We investigate these opposing forces by analyzing how our lease expiration results interact

with tenant occupancy. Figure A.2 shows that Offices and Retail CRE have similarly shaped

distributions of the percentage occupied by a property’s largest tenant. In both cases, there is

substantial mass at 100%, with around 16% of the tenants occupying the whole rental unit.

For that reason, we re-estimate (2) and split our sample between mortgages whose underly-

ing properties are fully occupied by the largest tenant and those with partial (below 100%)

occupancy. Additionally, we estimate a version of (2) using the entire sample and adding an

additional interaction term with Full

jt

, which equals 1 if a property is fully occupied by its

largest tenant in month t.

Table 3 shows the results, with columns 1 to 3 focusing on properties fully occupied by

the largest tenant, columns 4 to 6 partially occupied by the largest tenant, and columns 7

16

to 9 with the additional interaction term using the whole sample. Consistent with the idea

that relatively larger tenants have more bargaining power and obtain more favorable condi-

tions for renewing, we observe that both the baseline effect of lease expiration and the post-

pandemic differential effect of cash flow shocks to Office CRE mortgage default are stronger

for properties partially occupied by the largest tenant. This further indicates that character-

istics of the underlying tenancy agreements of properties financed by securitized mortgages

are important for CMBS cash flows.

5. Do Insurers Monitor Cash Flow Risks?

We have documented a significant link between expected changes in the tenancy agreement

of a specific office and default rates of the mortgage linked to that property, which has im-

plications for assets whose cash flows depend on the performance of these CRE mortgages.

In particular, insurance companies’ cash flows obtained from their holdings of CMBS might

be compromised if the underlying mortgages become non-performing. This raises several

fundamental questions. What is the extent and dynamics of the exposure of insurance com-

panies to office CRE through their holdings of CMBS? Moreover, given the predictable nature

of expected cash flow shocks to mortgage payments, do insurance companies monitor such

risks and sell bonds based on such cash flow shocks to mortgage CRE? Finally, does lower

office demand introduced by work-from-home preferences in the post-pandemic period af-

fect the trading behavior of these intermediaries? We explore the answers to these questions

next.

5.1. Insurer Holdings of WFH-sensitive CMBS

We start by leveraging our data to document the importance of insurance companies for the

private-label CMBS market, and to characterize their exposure to shocks linked to office col-

lateral. We are in a unique position to do so, given our access to detailed CMBS information

(including origination dates) and granular data on the portfolio of insurance companies.

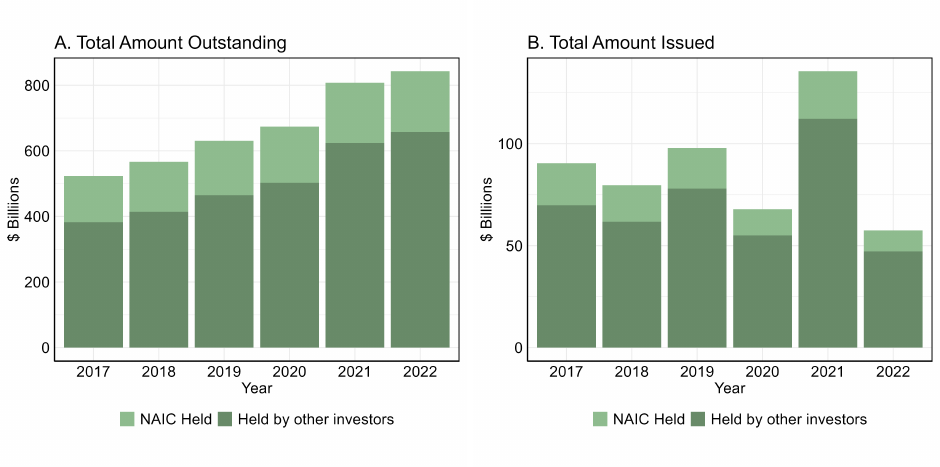

First, we collect information on end-of-year outstanding balances and amounts issued for

all private-label CMBS in our sample, and identify which bonds are held by insurance compa-

nies at the end of each year. Figure 5 shows that insurance companies are the main investors

17

in CMBS markets. By the end of 2022, insurance companies hold about $600 billion out of

$800 billion outstanding. Similarly, between 2017 and 2019, insurance companies acquired

more than 70% of the total amount of new issues of private-label CMBS. Interestingly, the

share of new CMBS originations held by NAIC insurers in the same year drops to about 65%

between 2020 and 2022. This reduction in the overall amount of CMBS held by insurance

companies is indicative of lower insurer demand, which could arise as lower office demand

leads to mortgage default rates.

We further explore how the dynamics of CMBS holdings by insurance companies varies

over time, by documenting the exposure of insurance companies’ CMBS portfolio to office

CRE collateral. We classify a bond as exposed if it has any mortgages financing office prop-

erties within its pool of collateral. We then calculate the share of CMBS that is exposed to

offices out of the entire portfolio of private-label CMBS held by insurance companies. Figure

6 shows the share invested in non-exposed bonds for each year. One can see that the share

of CMBS exposed to offices increases up until 2020, at which point this trend is reversed. In

particular, insurance companies increase the share of CMBS not exposed to offices in 2021

and 2022 by about five percentage points. This further suggests insurers reacted to risks

arising from lower demand for office space by adjusting their holdings of CMBS.

Next, we document the exposure of insurance companies to risks related to expiring ten-

ancy agreements of mortgage-financed office properties. We calculate the percent share of

mortgages against offices in each deal associated with a CMBS bond in our sample, for all of-

fices, as of June 2022. We also compute the share of this portfolio of office-linked CMBS with

underlying leases expiring between 2023 and 2026. Intuitively, this percentage represents

how exposed to office mortgages a particular bond is, abstracting from seniority consider-

ations. Figure 7 shows the resulting distributions. The left plot considers exposure to any

office properties, while the right plot considers exposure to office properties with at least one

underlying mortgage with a tenancy agreement expiring between 2023-2026. The median

insurance company has its private-label CMBS with an average exposure of about 26% to of-

fice properties, and 4.6% to office properties with tenancy agreements expiring in 2023-2026.

Importantly, there is considerable heterogeneity in the size of the average exposure of CMBS

bonds to office properties among insurance companies, with the top decile of the distribution

of insurers with an average exposure of 39% of their portfolio to offices, and 10% to offices

18

with underlying lease expiration.

5.2. CMBS Exposure to Cash Flow Shocks and Trading Behavior

We next exploit exposure heterogeneity across insurers to estimate its effect on insurers’ trad-

ing behavior. Insurance companies might anticipate the effect of work-from-home (WFH)

shocks on the cash flows and on the value of their CMBS, and attempt to sell these bonds.

Moreover, even if insurance companies do not trade CMBS based on office exposure alone,

they could still anticipate shocks to their assets caused by upcoming lease expiration.

First of all, it is instructive to understand if investors observe and trade based on the un-

derlying characteristics of mortgages included in CMBS. In particular, to the extent that lease

expirations predict delinquency rates, insurance companies might attempt to offload exposed

CMBS in anticipation of losses associated with default. Moreover, this information might be

less salient to other market participants, which could put insurance companies in a unique

position to trade at more advantageous conditions than when default risk materializes. To

test this, we estimate the following specification:

I

sold

ijt

= α

it

+ α

ij

+ α

j(coupon)t

+ α

j(NAIC)t

+ β

1

I

Y

jt

+ β

2

I

Y Of f ice

jt

+ ε

jt

, (3)

where I

sold

ijt

is a dummy variable which equals 1 if insurer i actively sold any fraction of

security j in year t.

8

I

Y

jt

and I

Y Of f ice

jt

are indicator variables capturing two measures of

exposure Y , lease expiration within one year and delinquency rates, for all properties and

only offices, respectively. α

it

and α

ij

denote insurer-year and insurer-security fixed effects.

We also include interest type by year fixed effects α

j(coupon)t

and NAIC designation by year

fixed effects α

j(NAIC)t

, to capture time-varying willingness to trade bonds with fixed interest

rates or different credit ratings. We use exposure to lease expiration in the following year

and exposure to underlying delinquency in the current year. Intuitively, these results should

indicate whether insurers are more likely to sell bonds which are currently underperforming,

or are expected to underperform, in the following year. Standard errors are clustered at the

security level.

The results are shown in Table 4. One can see that only realized, but not expected, un-

8

For details on how this variable is constructed, see Appendix C.

19

derlying losses trigger CMBS sales by insurance companies. Importantly, while most of the

variation in realized losses (columns 3 and 4) comes from office properties, the variation in

expected losses does not depend on property types. This is consistent with the notion that

insurance companies’ selling decisions generally depend on losses to the underlying collat-

eral having actually materialized. This suggests that they do not, on average, monitor bond

performance as related to pending risks.

The work-from-home shock leads to a revaluation of office properties, however. There-

fore, if insurance companies have the capacity to monitor such risks once they become more

salient, we would expect them to react to expected losses only after the onset of the COVID-19

pandemic.

To explore this possibility, the second step in our analysis is to shed light on whether in-

surance companies anticipate demand adjustments due to work-from-home shocks, which

became prevalent with the pandemic. The WFH transition reduces uncertainty regarding

which types of real estate will be affected by realized and expected shocks. This provides in-

surance companies with the opportunity to anticipate which CRE assets will be most affected

by demand-induced cash flow shocks, and to potentially trade before losses materialize. To

understand if insurance companies trade based on expected cash flow shocks, we test if they

sell private-label CMBS with larger exposure to office mortgages with leases expiring in dif-

ferent time horizons more frequently after the pandemic started. Formally, we estimate the

following specification:

I

sold

ijt

=α

it

+ α

ij

+ α

j(coupon)t

+ α

j(NAIC)t

+ β

1

P ost Covid

t

× I

Exp(τ)

jt

+ β

2

P ost Covid

t

× I

ExpOf f ice(τ)

jt

+ β

3

P ost Covid

t

× I

Of f ice

jt

+ ε

ijt

, (4)

where P ost Covid

t

equals 1 after 2019, I

Exp(τ)

jt

and I

ExpOf f ice(τ)

jt

are dummies which equal

1 if bond j is exposed to mortgages whose main lease expires within t + τ years (excluding

year t), for all properties and only offices, respectively. We do not include delinquent loans

when creating the lease expiration treatment dummies, as to avoid capturing the effect of

concurrent losses. α

it

, α

ij

, α

j(coupon)t

, and α

j(NAIC)t

are, respectively, insurer-year, insurer-

security, coupon type by year, and NAIC designation by year fixed effects. I

Of f ice(τ)

jt

is a

dummy which equals 1 for CMBS with exposure to any office CRE in the underlying pool of

20

mortgages, and should capture overall willingness to trade office-exposed CMBS in the post-

COVID period. We estimate this specification for six yearly horizons to gauge how much in

advance insurance companies react to cash flow risk on their underlying collateral.

It is worth considering the implications of having an unconditional office-exposure dummy

I

Of f ice(τ)

jt

alongside a horizon-sensitive lease-expiration dummy I

ExpOf f ice(τ)

jt

, for lease expira-

tion within τ years. A positive β

3

would indicate that shocks expected to materialize beyond

τ years are still relevant for insurers, as shocks happening within τ years would be captured

by β

2

. Thus, if insurance companies only care about the type of collateral, but not about the

expected timing of the cash flow risks, we would expect β

3

to be positive for all specifications.

If expected losses carry greater weight (e.g., if insurers consider the present discounted value

of these losses), then for sufficiently large values of τ we would expect β

3

to decrease and β

2

to be positive and significant.

The results are in Table 5, with the column numbering corresponding to τ. The differences

in the propensity of insurance companies to sell bonds more exposed to offices that expire in

the near future increase monotonically with the length of the expiration horizon. In partic-

ular, insurance companies are about one to three percentage points more likely to sell bonds

which have office mortgages that expire in the next four to six years after the COVID-19 pan-

demic than before (columns 4 to 6). For reference, the mean of the dependent variable I

sold

ijt

equals 0.087 for private-label CMBS, indicating a meaningful economic effect arising from

exposure to cash flow shocks expected to materialize in the medium term.

Importantly, these effects are significantly different from those on insurance companies’

trades in all other office properties (captured by β

3

) and in all other non-office properties

with imminent lease expirations (captured by β

1

). The coefficient on the interaction with

the unconditional office-exposure dummy, β

3

, is positive and statistically significant only in

columns 1 and 2, in part reflecting lease expirations after one or two years. Taken together,

these estimates suggest that insurance companies do react to shocks to office collateral in

their CMBS, but only if these shocks materialize within 4 to 6 years.

Furthermore, lease expirations and office properties play no role for insurance companies’

selling decisions before the onset of the COVID-19 pandemic. This lends support to the

idea that insurance companies are learning about the increase in riskiness of the underlying

collateral of CMBS posed by work-from-home demand shocks.

21

To further bolster our identification assumption that insurers react to shocks affecting the

cash flow risks of CMBS exposed to offices with leases expiring within a few years from the

COVID-19 shock, we also estimate a dynamic difference-in-differences regression:

I

sold

ijt

= α

it

+α

ij

+α

j(coupon)t

+α

j(NAIC)t

+I

ExpOf f ice(τ)

jt

+

X

ι,2019

D

ExpOf f ice(τ),ι

jt

δ

ι

+θControls

jt

+ε

ijt

,

(5)

where Controls

jt

include other interaction terms with yearly dummies, as in specification

(4).

One can see in Figure A.4 that most of the effect we are capturing takes place in 2020,

which sees a spike in sale of CMBS with more exposure to cash flow risks posed by lease ex-

piration. Reassuringly, we find no visual evidence for violation of parallel trends, supporting

our identification assumption that office lease expiration becomes a salient feature of CMBS

only after the COVID shock.

CMBS exposure to offices and retail. Our preliminary evidence in Section 4 shows con-

trasting evidence between office and retail loan delinquency rates. Loans linked to retail

experience a spike in delinquency right at the onset of the pandemic, which would also pose

a risk to holders of CMBS exposed to retail properties. Importantly, this risk is less sensi-

tive to lease expiration, meaning that characteristic would be less relevant for retail-exposed

CMBS in comparison with office-exposed CMBS. To test how different collateral types and

the underlying lease expiration for these loans affect the likelihood of a CMBS being sold by

insurers, we estimate a variant of specification (4) that incorporates sensitivity to different

types of collateral:

I

sold

ijt

=α

it

+ α

ij

+ α

j(coupon)t

+ α

j(NAIC)t

+ β

1

P ost Covid

t

× I

ExpOf f ice(τ)

jt

+ β

2

P ost Covid

t

× I

ExpRetail(τ)

jt

+ β

3

P ost Covid

t

× I

ExpOther(τ)

jt

+ β

4

P ost Covid

t

× I

Of f ice

jt

+ β

5

P ost Covid

t

× I

Retail

jt

+ ε

ijt

. (6)

Each of the variables I

ExpCollateral(τ)

jt

is defined as before, where Other is a residual category

for any loans with lease expiration information which is not linked to Of f ice or Retail units.

Moreover, I

Retail

jt

is a dummy that equals 1 if bond j has exposure to retail units in year t. By

22

further breaking down the lease expiration dummies I

Exp(τ)

jt

into mutually exclusive property

types, we can test for differences in how insurers react to changes in risks in retail mortgages.

The results are in Table 6. As before, we can see that β

1

predicts sales for most τ horizons,

indicating insurers are sensitive to cash flow risks in offices after COVID-19. In contrast,

while exposure to retail affects CMBS sales positively, as reflected by the positive and signifi-

cant coefficient on I

Retail

jt

, this is not caused by lease expiration of the underlying retail-linked

mortgages. This is in line with the idea that while retail loans experienced rising delinquency

rates at the onset of the pandemic, this rise is less sensitive to lease expiration. Overall, our

evidence supports the idea that insurers do not only monitor cash flows risks but are also

sufficiently sophisticated to disentangle how these risks affect different types of CMBS col-

lateral.

5.3. CMBS Acquisitions by Insurance Companies

Having documented that exposure to underlying cash flow shocks affects insurance compa-

nies’ trading behavior, and given the dynamics of CMBS portfolio exposure to offices shown

in Figures 5 and 6, we next consider insurers’ purchasing behavior: are insurance companies

also less willing to acquire private-label CMBS exposed to office CRE? Lower willingness to

hold office-linked CMBS can manifest itself through smaller acquisition of these assets by

insurers after COVID-19. Additionally, to the extent that insurers demand higher returns

for holding assets perceived as riskier, newly issued office-exposed CMBS held by insurers

should offer higher returns.

We start by looking at how risk characteristics of private-label CMBS acquired by insurers

change over the years, focusing on office exposure and cash flow risks represented by lease

expiration. Figure 8 shows the distribution of office exposure for all CMBS acquired by insur-

ance companies before and after COVID-19. Importantly, there is a large jump in the share of

CMBS acquired in 2020-2022 which have no underlying office-linked collateral, with close to

30% of the bonds acquired in 2022 having no exposure to office CRE. The share of acquired

CMBS collateralized by office mortgages falls from 30% in 2017-2019 to around 27.9% in

2022. We observe a similar pattern when looking at exposure to cash flow shocks repre-

sented by lease expiration taking place at different horizons. Figure 9 plots the respective

23

distribution, before and after the COVID-19 pandemic. In all cases, there is a shift towards

the left of the distribution, with a larger share of the bonds acquired in the post-COVID pe-

riod having no exposure to immediate cash flow shocks to office CRE. This variation is larger

for medium-term lease expiration time windows, with an increase of about 20% in the share

of CMBS acquired in the post-COVID period that have no mortgages linked to office CRE

whose main lease expires within six years, for example.

The drastic reduction in holdings of cash flow risk-sensitive CMBS by insurers indicates

that these investors adjust their exposure to risks along an extensive margin, by acquiring

private-label CMBS with smaller exposure to offices. This adjustment can also occur along an

intensive margin if lower willingness to hold office-exposed CMBS leads insurers to require

higher returns in order to invest in office-linked CMBS after COVID-19.

We test if this adjustment takes place by analyzing how the coupons of newly issued

private-label CMBS vary based on their exposure to offices, before and after the pandemic,

by estimating the following specification at the bond issuance level:

Coupon

jt

=α

maturity(j)t

+ β

1

P ost Covid

t

× Of f ice

j

+ β

2

Of f ice

j

× NAIC Held

jt

+ β

3

P ost Covid

t

× Of f ice

j

× NAIC Held

jt

+ β

4

X

jt

, (7)

where Coupon

jt

denotes the coupon offered by bond j issued in quarter t, P ost Covid

t

equals

1 after 2020Q1, Of f ice

j

equals 1 if bond j has underlying exposure to offices, and X

jt

is a

vector of bond-level controls. The ownership dummy, N AIC Held

jt

, equals 1 if bond j is

held by an insurance company at the end of the respective year, and reflects differences in

the pricing of risk by insurers relative to other investors. The coefficient β

1

captures how

changes in the perceived risk of CMBS exposed to offices impacts coupons after COVID.

Moreover, the coefficient β

3

captures any differences in these pricing effects between insurers

and other investors. Control variables include a dummy for investment grade bonds, the %

share of pool in the largest state, the number of loans the deal to proxy for deal complexity

(Ghent, Torous and Valkanov, 2019), a dummy for horizontal risk retention (Flynn, Ghent

and Tchistyi, 2020), the weighted average LTV and debt-service coverage ratio of the deal at

securitization, and a dummy for conduit loans.

Column 1 of Table 7 shows the results without accounting for differences between CMBS

24

held by insurers vs. other investors, assuming that changes in office risks after the pandemic

were not priced in differently by investors. However, the negative estimate masks significant

underlying heterogeneity. When we account for CMBS ownership in column 2, we find that

bonds from deals with a larger share invested in office loans command a coupon premium,

especially after COVID-19, when they are held by insurance companies as compared to bonds

held by other investors. A one percentage point increase in the office exposure of a deal

translates to approximately 15 basis points larger coupon rates. This effect is robust to the

addition of additional bond-level controls in columns 3 and 4.

Higher office percentage in general has a negative effect on coupons for CMBS, including

those held by other intermediaries. This could be explained by different risk perception by

these investors and ultimately affect the allocation of cash flow risks across intermediaries.

We analyze how risk migrates from insurers to other firms in Section 6. Overall, the changes

in acquisition behavior by insurers documented in this section further corroborate that they

do monitor work-from-home triggered changes in office loan risk.

5.4. Insurer-level Exposure to CMBS Shocks

Variation in CMBS risk introduced by higher delinquency risk in the post-pandemic period

can also affect insurer behavior beyond investors’ willingness to trade affected bonds them-

selves. In particular, Ellul et al. (2022) argue that in response to a drop in insurers’ asset

values, these investors would de-risk by selling illiquid bonds. Similarly, Becker, Opp and

Saidi (2022) show that insurers are more likely to sell downgraded assets which would trigger

higher capital requirements relative to assets that would not incur such surcharges.

In our context, a sudden increase in mortgage delinquencies at the onset of the pandemic

would trigger an immediate drop in CMBS values for bonds more exposed to retail and lodg-

ing properties, as illustrated in Figure 3. Moreover, higher delinquency can also lead to

rating downgrades and potential added capital surcharges for insurers holding those secu-

ritized bonds. In either case, we predict that insurers with larger exposure to such property

types would be more likely to sell risky, illiquid bonds.

Importantly, it is unclear how insurers’ exposure to offices would affect their trading be-

havior after COVID-19. On the one hand, the dynamic nature of the materialization of cash

25

flow risks arising from WFH suggests larger exposure to offices should not lead to immediate

short-term adjustments. On the other hand, if investors’ ability to assess risks is limited, then

a large office exposure can lead to inattention to risks in other assets, as these insurers would

have to use more of their monitoring capacity to track the materialization of cash flow risks

represented by office lease expiration.

To understand how exposure to different types of CMBS collateral affects insurers’ trading

behavior, we estimate the following specification:

I

sold

ijt

= α

it

+ α

ij

+ α

jt

+ γ

1

T

Of f ice

it−1

× I

T

jt

+ β

1

P ost Covid

t

× T

Of f ice

it−1

× I

T

jt

+ γ

2

T

Retail

it−1

× I

T

jt

+ β

2

P ost Covid

t

× T

Retail

it−1

× I

T

jt

+ γ

3

T

Lodging

it−1

× I

T

jt

+ β

3

P ost Covid

t

× T

Lodging

it−1

× I

T

jt

+ ε

ijt

, (8)

where T

prop

it−1

is the lagged exposure of insurer i to properties of type prop in year t − 1, I

T

jt

is a a time-varying dummy which equals 1 for riskier bonds, and α

jt

denotes security-year

fixed effects. Given that the relevant level of variation is now at the insurer level, we cluster

standard errors accordingly.

In particular, we estimate specification (8) using two different variables I

T

jt

: I

Risky

jt

, which

is a dummy which equals 1 for bonds with NAIC designation 2 or greater (worse) in year t,

and I

Downgrade

jt−1

, which equals 1 if bond j has been downgraded in year t − 1 such that capital

buffers have to increase.

9

Our exposure variables are the weighted average percent exposure

of insurers’ private-label CMBS portfolios to each property type, multiplied with the share of

private-label CMBS in their entire bond portfolio. Each β

i

term captures the effect of larger

exposure to a type of collateral on insurance companies’ sales of risky assets. Importantly, we

use lagged exposures to address the fact that trading within one year would affect exposure

in the same year (as it changes insurers’ portfolio composition).

The results for the two risk variables I

T

jt

are in Table 8 (columns 1-3 and columns 4-6). After

controlling for time-varying unobserved heterogeneity at the insurer and security level, we

yield a negative, albeit statistically insignificant, coefficient on β

1

in columns 1 and 4. This

reflects the idea that CMBS exposure to office buildings desensitizes insurance companies

9

We use NAIC designation to infer downgrading. Effectively, I

Downgrade

jt−1

equals 1 if bond j had a NAIC

designation in year t − 1 greater than its NAIC designation in year t − 2.

26

to risky securities with higher capital requirements, which they would otherwise sell upon

being downgraded (Ellul, Jotikasthira and Lundblad, 2011).

As post-COVID office exposure is associated with greater delinquencies, insurance compa-

nies may be preoccupied with acquiring information regarding office collateral and selling

the respective CMBS first. However, in line with higher retail and lodging mortgage delin-

quencies in Figure A.1, β

1

may be confounded with insurance companies’ portfolio rebalanc-

ing in the face of retail and lodging mortgage delinquencies, i.e., T

Of f ice

it−1

could be correlated

with insurers’ respective exposures in their CMBS portfolio. To account for this possibility,

we control for such confounding portfolio exposures by estimating (8) in columns 2 and 5 of

Table 8.

After doing so, the estimated coefficient on β

1

becomes more negative and statistically sig-

nificant. Importantly, it carries the opposite sign of the other triple interactions, thereby

ruling out that our estimated effect is governed by other, correlated portfolio exposures. In-

stead, larger exposure to retail leads to more sales of risky assets, which is in line with the

idea that facing a devaluation in their asset portfolio, insurers sell illiquid bonds first. Finally,

in columns 3 and 6, we additionally control for the triple interaction with insurers’ share of

corporate bonds more generally, which leaves our coefficient of interest virtually unaltered:

larger exposure to offices in insurers’ CMBS portfolio is associated with a lower likelihood of

selling riskier bonds in the post-COVID period.

6. Migration of CRE Cash Flow Risks from Insurance to other firms

The evidence so far suggests that insurers are able to monitor risks in securitized assets

that arise from lower office demand after the pandemic, and reduce their exposure to these

private-label CMBS. In this section, we turn to the question of who acquires these assets in

an attempt to understand which intermediaries become more exposed to WFH-borne risks

and why these other investors are willing and able to acquire more exposed CMBS.

6.1. Who Purchases Private-label CMBS from Insurers?

We first analyze the purchasers of private-label CMBS from insurance companies in our sam-

ple period. To this end, we categorize the buyers into three groups: banks, insurance compa-

27

nies, and others (which includes uncategorized buyers and instances where the buyer name

is not specified in the data). Figure A.6 illustrates the trends in these categories over time.

We notice a dip in the share of insurance buyers in 2021 although it is not persistent.

10

Im-

portantly, while banks are prominent purchasers throughout, they are even more important

for offices (Figure A.7).

To test more formally whether insurance companies sell off CRE-related cash flow risks

to banks, we re-estimate the same specifications as in Table 5, but replace the dependent

variable with a sales indicator that is equal to one only for the subset of sales to banks. That

is, the dependent variable equals zero if insurer i sold any fraction of security j in year t to

any non-bank purchaser or nothing at all.

In Table 9, the coefficient on CMBS with exposure to office lease expirations, β

2

in (4), is

positive—as in Table 5—and statistically significant at least for the two longest horizons. This

indicates that sales are more likely to banks if the CMBS is related to office properties with

expiring leases in the post-COVID period. Generally, up until the COVID period, insurance

companies are more likely to sell CMBS to banks, independent of the type of collateral and

lease expiration. This effect is, however, muted since the COVID period, but only for non-

office exposures, e.g., retail. This implies that insurance companies’ selling activity to banks

is more concentrated on CMBS exposure to office lease expirations in the post-COVID period.

For completeness, Appendix-Table A.2 examines sales from insurance companies to other

insurance companies by adjusting the dependent variable accordingly. The results suggest

some effects for sales to insurers if the CMBS in question is related to office properties with