"3.;*78.9>4+!*33*88**34=;.11*"3.;*78.9>4+!*33*88**34=;.11*

!!*33*88***8*&7(-&3)7*&9.;*!!*33*88***8*&7(-&3)7*&9.;*

=(-&3,*=(-&3,*

&89*78!-*8*8 7&):&9* (-441

425&7&9.;*3&1>8.84+&3&,*2*39((4:39.3, >89*2843425&7&9.;*3&1>8.84+&3&,*2*39((4:39.3, >89*2843

*&3251*2*39&9.43*&3251*2*39&9.43

&7:55:(-&2>&2&8&2>

"3.;*78.9>4+!*33*88**34=;.11*

4114<9-.8&3)&)).9.43&1<4708&9-995897&(*9*33*88***)::90%,7&)9-*8

&794+9-*3,.3**7.3,422438

*(422*3)*).9&9.43*(422*3)*).9&9.43

&2&8&2>&7:55:(-&2>425&7&9.;*3&1>8.84+&3&,*2*39((4:39.3, >89*2843*&3

251*2*39&9.43&89*78!-*8.8"3.;*78.9>4+!*33*88**

-995897&(*9*33*88***)::90%,7&)9-*8

!-.8!-*8.8.8'74:,-994>4:+47+7**&3)45*3&((*88'>9-*7&):&9* (-441&9!!*33*88***8*&7(-&3)

7*&9.;*=(-&3,*9-&8'**3&((*59*)+47.3(1:8.43.3&89*78!-*8*8'>&3&:9-47.?*)&)2.3.897&9474+!

!*33*88***8*&7(-&3)7*&9.;*=(-&3,*47247*.3+472&9.4351*&8*(439&(997&(*:90*):

!49-*7&):&9*4:3(.1

&28:'2.99.3,-*7*<.9-&9-*8.8<7.99*3'>&7:55:(-&2>&2&8&2>*39.91*)425&7&9.;*

3&1>8.84+&3&,*2*39((4:39.3, >89*2843*&3251*2*39&9.43-&;**=&2.3*)9-*

@3&1*1*(9743.((45>4+9-.89-*8.8+47+472&3)(439*39&3)7*(422*3)9-&9.9'*&((*59*).3

5&79.&1+:1@112*394+9-*7*6:.7*2*398+479-*)*,7**4+&89*74+ (.*3(*<.9-&2&/47.3

3):897.&13,.3**7.3,

:5> &<-3*>&/4774+*8847

$*-&;*7*&)9-.89-*8.8&3)7*(422*3).98&((*59&3(*

:0<43.2>43,***43,

((*59*)+479-*4:3(.1

&741>34),*8

#.(*74;489&3)*&34+9-*7&):&9* (-441

7.,.3&18.,3&9:7*8&7*43@1*<.9-4A(.&189:)*397*(47)8

To the Graduate Council:

I am submitting herewith a thesis written by Karuppuchamy Ramasamy entitled “A

Comparative Analysis of Management Accounting Systems on Lean Implementation”. I

have examined the final electronic copy of this thesis for form and content and

recommend that it be accepted in partial fulfillment of the requirements for the degree of

Master of Science, with a major in Industrial Engineering.

Rupy Sawhney

Major Professor

We have read this thesis

and recommend its acceptance:

Dukwon Kim

Myong-Kee Jeong

Accepted for the Council:

Anne Mayhew

Vice Chancellor and

Dean of Graduate Studies

(Original signatures are on file with official student records.)

A Comparative Analysis

of

Management Accounting Systems

on

Lean Implementation

A Thesis

Presented for the

Master of Science Degree

The University of Tennessee, Knoxville

Karuppuchamy Ramasamy

August 2005

ii

Acknowledgements

I would like to thank Dr. Rupy Sahwney for his continuous guidance, inspiration and

enthusiasm. In addition, I thank him for giving an opportunity to work with different

projects that implements the theoretical concepts into practical industrial engineering

applications in many companies. I would also like to thank my thesis committee Dr. Kim

and Dr. MK.Jeong for their continuous support and guidance to complete this thesis.

I am grateful to many people in the Department of Industrial Engineering who have

assisted me in the course of this work. I extend a very special thanks to my CPI team

members Aruna, Li and Kannan for their support to complete this thesis.

My parents have always encouraged and guided me to achieve higher levels in my life

and I am grateful to them.

iii

Abstract

The adoption of lean principles and practices has become widespread in many

industries since the early 1990’s. Companies are now beginning to realize that traditional

costing and accounting methods may conflict with lean initiatives they are implementing.

Consequently, important research questions are being raised. Which cost management

and accounting approach required for companies that adopt lean principles and practices?

The primary objective of this research is to asses the impact of different management

accounting systems on lean manufacturing as measured by performance metrics and to

investigate the development of management accounting strategy which will support lean

operations and will help to monitor the lean progress. Three management accounting

alternatives investigated in this study are traditional management accounting, activity

based costing and value stream costing. This study evaluates the overhead principles

associated with management accounting alternatives to identify real product cost that will

drive many business decisions. The financial measures commonly used are short-term

and long-term profitability.

iv

Table of Contents

Chapter I

Introduction-----------------------------------------------------

1

1.1 Introduction-------------------------------------------------------------------- 1

1.2 Problem Statement------------------------------------------------------------ 2

1.3 Background-------------------------------------------------------------------- 3

1.4 Problems with Traditional Costing and Accounting Methods---------- 7

1.5 Manufacturing Control System--------------------------------------------- 10

1.6 Operational Control – Performance Measures---------------------------- 11

1.7 Scope and Anticipated Results---------------------------------------------- 13

1.8 Aligning Cost Management and Accounting

Methods with Lean Thinking-------------------------------------15

1.9 A Management Accounting Profile that Supports

Manufacturing Excellence---------------------------------------- 15

1.10 Organization of the Thesis---------------------------------------------------16

Chapter II

Literature Review----------------------------------------------

18

2.1 Manufacturing Environment-------------------------------------------------18

2.2 Lean Manufacturing and Management Accounting Systems------------19

2.3 Management Accounting System Strategies-------------------------------23

2.3.1 Traditional Cost Accounting-----------------------------------------------23

2.3.2 Activity-Based Costing-----------------------------------------------------24

v

2.3.3 Value Stream Costing-------------------------------------------------------26

2.4 Literature Research-------------------------------------------------------------28

2.5 Conclusion for Literature Review--------------------------------------------35

Chapter III

Research Methodology----------------------------------------

36

3.1 Conceptual Design----------------------------------------------------------- 36

3.2 Experimental Setup----------------------------------------------------------- 36

3.3 Experimental Variables & Methodology---------------------------------- 38

3.4 Experimental Factors--------------------------------------------------------- 39

3.5 Manufacturing Control System (Lean Manufacturing) ----------------- 41

3.6 Management Accounting Alternatives---------------------------- -------- 42

3.6.1 Cost Structure--------------------------------------------------------------- 42

3.7 Cost Associated with Manufacturing Activities-------------------------- 44

3.8 Product Costing with Activity-Based Costing---------------------------- 45

3.9 Traditional Costing System-------------------------------------------------- 53

3.10 Lean Accounting (Value Stream Costing) --------------------------------56

3.11 Process Simulation------------------------------------------------------------ 61

3.12 Simulation Experimental Setup--------------------------------------------- 61

3.13 Number of Replications --------------------------------------------- --------- 62

3.14 Validation of Simulation Models-------------------------------------------- 65

vi

Chapter IV

Results------------------------------------------------------------

66

4.1 Presentation of Raw Data and Statistics----------------------------------- 66

4.2 Standard Absorption Costing------------------------------------------------ 68

4.3 Activity-Based Costing------------------------------------------------------- 70

4.4 Value Stream Costing (Lean Accounting) -------------------------------- 74

4.5 Performance Comparison between Management Accountings--------- 77

4.6 Pareto Chart of Overall Profit vs. Lot Size- ------------------------------ 81

4.7 Pareto Chart of Overall Profit vs. Changeover--------------------------- 82

4.8 Management Accounting Strategy during

Transition from Traditional to VSC-----------------------------83

Chapter V

Conclusion-------------------------------------------------------

86

5.1 Summary of Research-------------------------------------------------------- 86

5.2 Comparison to Previous Studies------------------------------------------- 88

5.3 Limitations/Scope of Current Study and Future Research-------------- 89

References---------------------------------------------------------------------------- 91

Vita------------------------------------------------------------------------------------101

vii

List of Tables

Table 1.1 Comparison of management accounting systems---------------------------- 6

Table 2.1 Features and functions comparison between

traditional environment and lean manufacturing----------------------- 20

Table 3.1 Life cycle costs of product and cumulative percentage---------------------- 43

Table 3.2 Overhead allocation methods for traditional and lean environment------- 44

Table 3.3 Management activities and type of cost allocation--------------------------- 46

Table 3.4 Overhead allocation using ABC------- ---------------------------------------- 50

Table 3.5 Overhead cost centers for traditional management accounting------------- 55

Table 3.6 Raw material cost and direct labor cost---------------------------------------- 59

Table 3.7 Selling price for individual products------------------------------------------- 59

Table 3.8 Forecast demand and product mix for different accountings--------------- 59

Table 3.9 Traditional standard costing-product cost---------------------------- -------- 60

Table 3.10 Activity based costing-product cost------------------------------------------ 60

Table 3.11 Lean accounting (value stream costing) – product cost------------------- 60

Table 3.12 Process time and distribution used for various work stations------------- 64

Table 4.1 Traditional standard costing---------------------------------------------------- 67

Table 4.2 Hypothesis results for standard costing--------------------------------------- 68

Table 4.3 Activity-based costing----------------------------------------------------------- 71

Table 4.4 Hypothesis results for activity-based costing--------------------------------- 72

Table 4.5 Hypothesis results for value stream costing---------------------------------- 74

Table 4.6 Lean accounting (value stream costing) -------------------------------------- 75

viii

Table 4.7 Total net income across management accountings-------------------------- 77

Table 4.8 Overall mean net incomes across different input factors-------------------- 78

Table 4.9 Comparison of overall mean and ranking------------------------------------- 80

ix

List of Figures

Fig 1 Revolution of management accounting-----------------------------------------------5

Fig 2 Performance measures of JIT---------------------------------------------------------13

Fig 3 The link between management accounting and market value------------------- 15

Fig 4 Traditional standard costing---------------------------------------------------------- 24

Fig 5 Activity-based costing---------------------------------------------------------------- 25

Fig 6 Value stream costing------------------------------------------------------------------ 27

Fig 7 The information and material flow in a typical value stream-------------------- 28

Fig 8 Research approach--------------------------------------------------------------------- 37

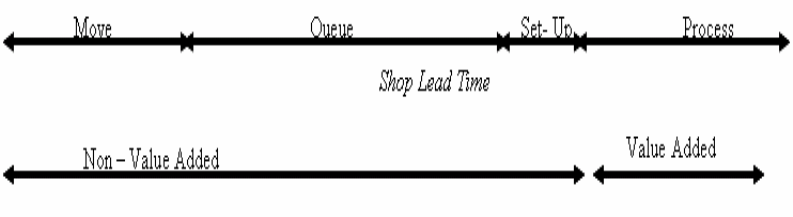

Fig 9 Components of lead time------------------------------------------------------------- 38

Fig 10 Experimental setup------------------------------ ------------------------------------39

Fig 11 Activity-based overhead cost tracing--------------------------------------------- 47

Fig 12 Overhead cost allocation based on traditional costing-------------------------- 54

Fig 13 Overhead cost allocation based on value stream costing----------------------- 57

Fig 14 Schematic diagram of simulation model------------ ----------------------------- 63

Fig 15 Profile graph for traditional standard costing----------------------------------- 69

Fig 16 Profile graph for activity-based costing------------------------------------------- 72

Fig 17 Profile graph for value stream costing-------------------------------------------- 76

Fig 18 Mean net income of management accounting across lot size------------------ 78

Fig 19 Mean net income of management accounting across changeover------------ 78

Fig 20 One way analysis of total profit by management accountings---------------- 79

Fig 21 Profile graph for overall profit across all input variables---------------------- 80

x

Fig 22 Pareto chart for lot size------------------------------------------------------------- 82

Fig 23 Pareto chart for changeover-------------------------------------------------------- 83

1

Chapter I

Introduction

This introductory chapter begins with role of management accounting systems in

manufacturing firms. It then proceeds to state the problem statement that outlines the

objective of this research. Further this chapter provides a brief description on different

costing methods, which is widely used to enrich decision-making processes. It talks about

the need for improved performance measurers that will help to transfer the shop floor

movements to the management level. The chapter concludes with a bird’s eye view of the

organization of this thesis in the subsequent chapters.

1.1 Introduction

Increasing global competitiveness worldwide has forced manufacturing

organizations to produce high-quality products more quickly and at a competitive cost. In

order to reach these goals, today’s manufacturing organizations are required to compete

with modern manufacturing paradigms such as lean manufacturing, six-sigma and supply

chain management. It is not realistic to obtain all the advantages of theses new production

paradigms such as automation, flexibility, quality and throughput without management

accounting systems that supports and sustain the new production paradigm.

In the new manufacturing environment, companies attempt to become customer

focused and concentrate on quality products at competitive prices. The recent article

study states that the most manufacturers at their facilities are not structured to meet

customer demands, and there are many roadblocks that make the transition difficult [8].

One of the most important but least understood of these roadblocks is current

management systems. These management accounting systems do not provide adequate

information to companies to manage a production transition. Under these circumstances,

many firms are interested in determining and designing management accounting systems

that assist to align the customer demands with manufacturing based improvements.

2

Various management accounting cost systems are used to provide an increased accuracy

about product costs, overhead allocation, product-mix and pricing and other investment

decision-makings. Johnson and Kaplan, who introduced the ABC-accounting, have

highlighted the fact that management accounting systems are used for three main

purposes: external reporting, operational control and product costing. Accounting is

generally classified into Financial Accounting and Management Accounting. The

Financial Accounting helps to prepare external reporting and management accounting

plays an important role in operational control and product costing. Management

accounting information systems should collect data related to performance metrics,

classifies the data, and report information to managers for the purposes of planning,

control and evaluation of production activities [16]. Planning is basically the process of

deciding about the goals of an organization as well as the means to attain those goals

[32]. Control refers to the process of influencing the behavior of people to increase the

probability that people will behave in ways that lead to the attainment of organizational

objectives [21]. It includes pricing, budgeting, performance measurement, integration

with financial accounts and investment analysis. It consists of all the information that is

officially gathered to assess the performance of the company and to guide future actions

[1].

1.2 Problem Statement

The most important contribution is to show the impact of management accounting

on lean implementation to regain the competitive advantages of firm’s short term as well

as long-term performance. Poor accounting systems by themselves will not lead to

organizational failure. Nor will excellent management accountings assure success.

However, management accounting systems must be viewed as an integral part of

implementing lean [52]. The result of this study will help the managers to identify an

appropriate management accounting alternative to sustain lean manufacturing.

3

The purpose of this study is to compare various management accounting systems

in terms of the alignment of each system to the implementation of lean concepts. This

study will compare three different management accountings, which are traditional

standard costing; Activity-based costing and Value stream-costing under lean

manufacturing environment.

Assess the impact of different management accounting systems under lean

manufacturing environment.

Investigate the overhead cost allocation of different management accountings

under lean environment on a product.

Check whether the management accounting alternatives has significant

contribution.

Identify the management accounting, which will support lean operations and

will help to monitor the lean progress.

Most researchers agree that activity based costing provides more accurate product

cost information than any other management accounting system. Most accounting

managers assume that this accurate product costs will help to make quality decisions on

various issues. This assumption is made with out examining the other non-financial

operational parameters like small batch size, resource utilization, on-time delivery, and

inventory turn over. Moreover manufacturing environments will also play an important

role in many decision making process. According to traditional accounting, the inventory

is an asset for the company and it will encourage maximizing the inventory. In contrast

modern management accounting says building an inventory is a non-value added activity.

1.3 Background

In traditionally, the costs of direct labor and materials, the most important

production factors, could be traced easily to individual products. Relatively little attention

is given to reporting and controlling overhead cost and material cost. The major portion

of the product cost is overhead cost. Traditional costing computes the product cost based

4

on direct labor, direct material and overhead allocation. This overhead allocation is based

on the percentage of direct labor usage for each product. In activity based costing, this

overhead cost allocation is traced based on activity level and resource usage of each

activity. On the other hand, value stream costing traces the overhead cost based on

product family that consumes the resources in the whole value stream.

The survey conducted by the researcher shows that majority of firms operating in

an advanced manufacturing environment still recover overheads on a direct labor basis

[2]. Consequently, management attention is directed to reducing direct labor by trivial

amounts. To reduce their allocated costs, managers are motivated to reduce direct labor,

since this is the basis by which all other costs are attached to cost centers and their

products. This process overstates the importance of direct labor and directs attention

away from controlling escalating overhead costs. A distortion from allocating the

relatively small amount of factory and corporate overhead by burden rates on direct labor

was minor. Some experiences reveal that the distortion in reported product costs and, in

turn, product pricing could be reduced by using activity-based costing (ABC). In

traditional cost accounting methods, most companies have produced a narrow range of

products. Applying the same methods for a wide range of products with low volume

products will lead to distorted cost information. Accurate cost information; such as the

production costs and other value-added activities are very important since they are used

as a decision base for management and control purposes, from production to marketing.

Modern costing methods aim not only to allocate overhead costs accurately, but also

identify the areas of waste. It considers that purchasing, receiving, setting up and running

a machine consume resources, and products consume activities. These activities trigger

the consumption of resources that are recorded as costs in the accounts. Cost management

is not confined to cost reduction, but covers enterprise wide activities across different

departments aimed at improving overall profitability performance. This involves target

costing, capital investment planning, cost maintenance and cost improvement (kaizen

costing). The new ways of thinking at Toyota that originated in the production operation

5

1850 1900 1950 2000

Figure 1 Revolution of management accounting

Source: Adopted from “the complete guide to Activity-Based Costing” O’Guin, M.C.,1991, Prentice Hall.

ended up having implications for capital planning, performance metrics, and many other

aspects of the enterprise. For most of this century, traditional costing has been the most

popular cost accounting technique for establishing and measuring the various elemental

costs within a function or department [62]. One of the major differences among three

management accounting systems (TA, ABC, and VSC) is overhead allocation.

The figure 1 illustrates the inceptions of various management accounting systems

over many decades. Each accounting system follows different allocation or tracing the

various costs that incurred during the different manufacturing stages. Table 1.1 compares

the three different management accounting from research point of view. The typical

management accounting can be evaluated based on the following criteria.

Rapid feedback, sensitivity to profit contribution of various activities and

products.

Flexible and migratory measurement systems.

First cost

accounting

system in textile

Replacement

accounting in

railroads

Production cost

reporting in

carnegie steel

Large

manufacturing

enterprises form

Development of

work Standards

Standard cost

system

Depreciation

develo

p

ed

Labor-based cost

systems widely

adopted

Product lines

proliferate

Process controls

introduced

TOC

MRP&MRP II

JIT

Lean

accounting

6

Table 1.1 Comparison of management accounting systems [62]

Characteristics Traditional costing Activity-based costing Value stream costing

Time of introduction. 1900s 1970s 2000s

Type of production

Mass production that has

volume related overhead

Any type of production Mixed model production

Variety of products

Homogeneous and limited

variety

Homogeneous and heterogeneous

Heterogeneous and high

variety

Automation/Technology

usage

Low and limited Low to high High

Overhead Allocation Usually volume related Based on activity usage Based on Value stream

Costs included in product

cost computation (the

difference between cost

and selling price is the

profit used in product mix

algorithm)

Direct material

Direct labor

Factory overhead (both

variable and fixed)

Direct material

Direct labor

Factory overhead (both variable

and fixed) sales, general and

administration

Direct material

Total value stream labor

Value stream overhead (both

variable and fixed) sales,

general and administration

The purpose of report is to

show how much the budgeted

overhead has been allocated

as a result of the actual

production within the plant.

Overhead costs charged to cost

objects and identifies capacity

wastage

Overhead directly charged to

product family and it creates

capacity to introduce new

products

7

Holistic product costing and control measures

Identification, measurement and elimination of non-value added costs

Focus on variance reduction in critical areas

Reclassification of costs based on assignability and value adding characteristics

Enhanced traceability of costs to specific products and processes to decrease

allocations and their distortions.

1.4 Problems with Traditional Costing and Accounting Methods

Adopting a lean approach promises significant improvements in productivity,

quality and delivery, resulting ultimately in substantial cost savings. However, although

many companies across a range of industrial sectors have introduced lean working

practices, lean initiatives are often not underpinned by appropriate and rigorous cost

management and accounting methods. Many authors have identified the limitations of

traditional costing and accounting methods. The more common criticisms of standard

cost include: too much focus on direct labor efficiency; concentrations on cost rather than

other competitive factors such as quality or delivery; variances too aggregate and often

too late to provide meaningful information; failure to encourage short-term expenditures

on such factors as product quality or process flexibility that have a long-term return; and

distortion of product costs [67] [52] [37] [35] [45] [8]. Despite these criticisms, standard

cost systems continue to be the most common accounting system used today [34].

Kaplan [52] argues that cost systems have been designed primarily to satisfy the

financial accounting requirements for inventory valuation and as a result, are not

appropriate for performance measurement, operational control or product costing

purposes. In addition he states that a good product cost system should produce product

cost estimates that incorporate expenses incurred in relation to that product across the

organization’s entire value chain. He claims that standard product costs usually bear no

relation to the total resources consumed by a product. This is due to the fact overheads

are allocated, often on the basis of direct labor hours, and as a result can cause distortions

8

to product costs. As overheads need not be casually related to the demands of individual

products to satisfy financial accounting requirements, many companies continue to use

direct labor as a basis for allocating overheads even though it may account for less than

10% of total manufacturing costs. Cooper [26] and maskell [68] also argue that distortion

of product costs, as result of inappropriate allocation of overheads, can lead managers to

choose a losing competitive strategy by de-emphasizing and over-pricing products that

are highly profitable and by expanding commitments to complex, unprofitable lines.

In addition to product costing, standard costing has also been used for internal

decision-making process and operational control purposes. This costing emphasizes

maximum utilization for resources (machine, human) in order to minimize the total cost

of the product and this encourage the non-lean behaviors. These non-lean behaviors

include the manufacture of over production, large batch sizes and holding huge inventory

levels to show the balance sheets. Kaplan [25] supports this view and also suggests that

cost accounting calculations such as the allocation of overheads or variance analysis

should no form part of the company’s operational control system because they obscure

the information that cost center managers need to operate effectively. As a result,

traditional costing and accounting approaches are believed to be a major impediment to

lean manufacturing [69] [1]. However, accounting is an integral part of all manufacturing

operations and control system and should be able to provide adequate information to

make managerial decisions. In order to support the above mentioned, it should include

non-financial operational metrics. Consequently, there are calls for a new costing and

accounting approach to support lean manufacturing [8] [99]. There is, no clear consensus

as to what constitutes appropriate costing and accounting methods for lean

manufacturers.

Activity-based Costing (ABC) was developed as a direct response to the problems

that can arise as a result of the allocation of overhead on the basis of direct labor. Its main

objective is to provide improved product cost information, using appropriate cost drivers

as the basis for overhead allocation [25] [26]. However, some advocates of lean

9

manufacturing do not accept that ABC provides the solution to the problems caused by

standard costing, believing that “in reality it’s just another method of allocating

overhead” [99]. The researcher wrote, “ After 15 years of studying productivity

problems in dozens of companies, I have concluded that in most companies at any given

moment, employees are working on the wrong task… the real problem is that workers

think that they are working on the right task… traditional measures create this problem.”

Performance measures are the key element in determining whether or not an

improvement effort will succeed. The reason is simple: the actions of individuals in

manufacturing are driven by the measures used to evaluate performance. If traditional

performance measures conflict with improvement ideas and them often do the measures

inevitably will inhibit improvement?

According to a survey conducted by national association of accountants (NAA)

and computer-aided manufacturing-International (CAM-I), 60 percent of all the

executives polled expressed dissatisfaction with their firms’ performance measurement

systems, while 80 percent of the executives in the electronic industry were dissatisfied.

A traditional cost-based performance measures have numerous shortcomings. Among the

shortcomings, measures [76].

Do not adequately trace costs of products, processes, activities, etc

Do not adequate isolate non-value activities

Do not penalize over-production

Do not adequately identify the cost of quality

Do not adequately evaluate the importance of non-financial measures based on

quality, customer service, flexibility and throughput etc.

Do not support the justification for investment in the program to improve non-

financial measures.

Focus on controlling processes in isolation rather than as a whole system and

often conflict with strategic goals and objectives.

10

Making decisions based solely upon resource usage (ABC) is also problematic

because there is no guarantee that the spending to supply resources will be aligned with

the new levels of resources demanded in the near future. Consequently, before making

decisions based on an ABC model, managers should analyze the resource supply

implications of such decisions.

Fry [35], who ran a study in an automotive supplier plant that was working on

reducing its operating inventories, further supported this argument. He wrote: Despite

some of the more publicized success stories such as Harley Davidson, there are an equal

or greater number of companies who have been unable to reduce their operating

inventories. The reasons for these failures are numerous. In particular, many U.S.

manufacturers have failed to successfully reduce inventories due to lack of an appropriate

performance measurement system. Many U.S. manufacturers are plagued by an

overemphasis on traditional cost-based performance measurement systems that stress the

maximization of resource utilizations, in particular, direct labor utilization. Given that

many U.S. companies employ a standard cost-accounting system, production managers

often focus their attention on controlling standard costs, often at the expense of customer

delivery and product quality. In addition, given that standard cost systems normally rely

on direct labor as the basis for allocating overhead expenses, operations managers are

acutely aware of direct labor efficiencies and direct labor variances [35].

1.5 Manufacturing Control System

Manufacturing control system plays an important role in maximizing the

performance of an enterprise. Productivity is a composite measure of everyone’s work in

the production facility. Traditional and lean manufacturing environments account this

productivity in different ways. A rigid mass production system leads to a highly

structured, centralized and inflexible command and control management system. There is

a substantial difference between traditional and lean manufacturing systems in employee

management, plant layout, material and information flow systems and production

scheduling/control methods. These differences make it difficult for organizations that

11

have historically relied on traditional manufacturing methods to predict the magnitude of

the benefits to be achieved by implementing lean principles in their unique

circumstances. For example in a traditional manufacturing environment work orders

serve as the primary documentary for driving production schedules and tracking costs.

Costs attach at various workstations and processes as products move through the factory.

But work orders are not needed in a lean environment because production takes place in a

department or workstation only if the units produced are required by the next

workstation. Small lot sizes make it impractical to attach work orders to individual. There

is no clear understanding of which costing method supports lean operations. Different

manufacturers have implemented various cost accounting systems including back-flush

costing, process costing, ABC, standard costing and value stream costing.

1.6 Operational Control – Performance Measures

Performance measures in the mass production environment primarily reflect

departmental and individual outputs, not process performance. Traditional measures

generally focused on outputs, not inputs or throughputs. On the other hand, Lean

manufacturing is an organizational philosophy, which helps to identify and eliminate

non-value added activities in manufacturing as well as non-manufacturing environments

in order to maximize organizational performance. Lean performance measurement begins

with deploying lean business policies and strategies, identify the process owners,

complete lean value-added process analysis by utilizing lean standardize/do/check/act

(SDCA), and then plan/do/check/act (PDCA) of continual improvement. This could be

achievable by identifying improved performance measures. Performance measures

provide the critical link between strategy and execution by providing a mechanism to

evaluate and communicate performance against expected results. Management

accounting system should convert this performance measures into cost information,

which allows the managers to quantify the cost of the resources consumed in executing

organizations strategies. The case study of Harris [41] on companies that were moving

toward JIT, observed that the companies modified their product costing system to meet

the JIT environment. Other authors, such as Holbrook [43], and Maskell [67] also argued

12

that the traditional cost accounting measures, especially the ones used to gauge shop floor

performance, may lead to decisions that are conflicting to the goal of JIT. Johnson [51]

assert that traditional cost accounting tends to impair JIT implementation. This is because

the features of cost accounting measures rely on standards, emphasize on variances and

efficiencies and preoccupy with direct labor. They further added, In a JIT environment,

any system for measuring performance must be designed to reflect the new production

philosophy. Such a system should be capable of measuring and reporting progress toward

total quality control, reducing inventory levels, faster setup times, reduced lead time and

new product launch times. Equally important would be measures indicating improvement

in on-time deliveries, floor space utilization and quality yield… such a system may

require the elimination of some traditional short-term financial measures and include

some new, more relevant non-financial measures of performance. [51].

Lummus and Duclos [2] go a step farther by arguing that a company should not

claim itself a complete JIT company if it continues to use traditional methods of

measuring efficiency and productivity. “Companies may claim to be practicing JIT but

continue to use employee efficiency measures as indicators of performance. If these are

the measurements reported, then the firm has not completely converted to the JIT

philosophy.”[2].

Some articles suggest specific performance measures to support individual

elements of JIT. Dhavale [30] suggests performance measures for cellular manufacturing

and focused factory system convey (1994) a performance measurement system in cross-

functional teams. On the other hand, Hendricks [42] and Mc Nair [71] suggested a new

performance measures that support a whole JIT system. In general, these authors suggest

the performance measures be linked to a company’s critical success factors, strategies,

objectives and corporate mission. Hendricks [42] also offered the hierarchical

performance measure attributes that are different at every level of the organizational

hierarchy. At lower levels of the organization hierarchy, performance should be measured

13

Figure 2 Performance measures of JIT [42]

more frequently, and specifically with more emphasis placed on operational measures

and less emphasis on financial measures.

The figure 2 illustrates the importance of performance measure from

manufacturing cell level to company in a lean manufacturing environment. The

performance measures play a vital role in deciding bench mark and future state map.

Further, good performance measure will drive for continuous improvement to achieve the

desired state.

1.7 Scope and Anticipated Results

This study is an initial effort to evaluate the impact of management accounting

alternatives, product flow, overhead allocation in lean manufacturing principles on shop

floor performance under a given experiment setup. The management accounting

performance is calculated based on the net income produced by a given product mix. This

net income varies based on the selected lean principle. Further analysis of the results

identifies the suitable management accounting for lean manufacturing. Although it

14

provides number of interesting results, it is important to recognize that this study

considers only limited variety of product routing and demand forecasting in a constrained

capacity lean environment, so the results are not readily generalizable. It is also well

known that the results of simulation study are only descriptive and should be interpreted

with caution. However, the use of simulation modeling makes it possible to predict the

behavior of different variable and it may provide insight and directions for future

research. As mentioned earlier, only a limited variety of variables taken into

consideration while assigning overhead cost to different products based on management

accounting principles in order to avoid more complications. For example it has not

considered the product complexity and structure for different bill of materials, work in

process inventory is considered to be very low because of pull system setup. This overall

experiment results are more suitable for high overhead content with low direct labor.

Different industries may have different cost structures or centers to capture the real

overhead cost that may have different impact on performance measures and selection of

management accounting alternatives. For example this study may not be suitable for

service industries because it has high labor content and less overhead cost. Further the

experiments should be conducted for a wide variety of manufacturing environments.

Many industries may not implement lean manufacturing principles and focused factory

arrangements, so the research has to be conducted on other manufacturing environments.

Another limitation of this study is that it assumes that all defective parts or poor quality

parts do not have to be reworked and will be considered as scrap. In the real

manufacturing environment, parts may be reworked and converted to good products at

lower cost than producing new product to equalize the delivery quantity. There is a

possibility that in real manufacturing environments, some unexpected delay may increase

the cycle time or lead time, all of which cannot be captured using simulation model but it

considers variation in processing time, changeover time, material handling variability and

machine down time variability. However, the model does not consider the manufacturing

cell which stops because of quality problem and other unknown downtimes.

15

The link between Management Accounting and Market value

Adapted from Ward and Patel (1990)

Figure 3 The link between management accounting and market value

1.8 Aligning Cost Management and Accounting Methods with Lean Thinking

The figure 3 indicates the importance of management accounting system in any

business environment. This management accounting should provide the flexibility to deal

with complex overhead cost base; include market profitability information and other non-

financial performance measures in order to supply adequate information to make business

decisions.

1.9 A Management Accounting Profile that Supports Manufacturing Excellence

Maskell [69] [68] and Jenson have made considerable contribution to align the

costing strategy with manufacturing excellence. Case study research across a number of

industrial sectors has enabled researchers to develop a profile of companies that

The business’s

activities

Management

Accounting

Product/service

customer

and

market

profitability

information

Financial and

non-financial

performance

measures

Investment

Decisions

Operating

Decisions

Profit and

cash flow

Efficient

market

Hypothesis

Market

value

Objective

of the firm

Attributes/Characteristics

More equitable allocation of overheads

Ability to deal with complex cost base

Ability to integrate non-accounting aspects

A control device

16

successfully align accounting systems with lean principles. Jenson found that

management accounting systems should be adapted to support manufacturing excellence

to demonstrate the following characteristics: [69]

Integrate the business and manufacturing cultures

Recognize lean manufacturing and its effect on management accounting

measurements

Emphasize continuous accounting improvement

Strive to eliminate accounting waste

Encourage a pro-active management accounting culture.

1.10 Organization of the Thesis

This chapter briefly introduces the role of management accounting systems in

lean implementation. It then proceeds to state the objective of this research. Further this

chapter addresses the problems associated with each management accounting systems in

lean environment, scope of this study and anticipated results. The first part of second

chapter compares the difference between traditional manufacturing principles with lean

manufacturing principles. It then proceeds to state the different overhead principles

associated with different management accounting systems. In addition, it discuses the

literature review. The third chapter begins with the research methodology. It consists of

sections on experimental setup, process simulation, management accounting systems and

performance measurement. Experimental setup lists the experiment variable and

background variables used in this study. Process simulation explains the construction of

simulation model and assumptions associated with that system. Management accounting

system illustrates the overhead cost allocation under each accounting and calculates the

product cost. The product cost is used to identify the individual contribution margin of

products and will thus drive product-mix decisions under each management accounting

system. The performance measure module captures the simulation output based on given

product-mix for each management accounting system. The fourth chapter discusses the

results of each management accounting system performance for different input variables.

17

It then checks the statistical significance of net income and compares the overall view

across the experimental variables, and finally, ranks the accounting system using

statistical test and benefit cost ratio. The fifth chapter summarizes the result, compares

with previous study results and future research direction.

18

Chapter II

Literature Review

In recent years, the remarkable success stories of Japanese understanding of

production planning and control systems introduced a new paradigm to production

research literature. The so-called just in time (JIT) system organizes the production such

that materials arrive just as they are needed in relatively small batches through an

attached ‘Kanban’, which identifies a standard quantity of transfer batch or size of a

container. JIT has been widely accepted and gained remarkable attention among

researchers as well as practitioners [10] [47]. Further, they suggest the contribution

margin per unit for the bottleneck capacity should be calculated for every product to

determine the optimal production schedule for utilizing bottleneck capacity. The

management cost accounting should provide adequate information in order to achieve the

above-mentioned goals. Adopting a Lean manufacturing system has a significant effect

on the nature of cost management accounting system. This system affects the traceability

of costs, enhances product-costing accuracy, diminishes the need for allocation of

service-center costs, changes the behavior and relative importance of direct labor costs,

impacts job-order and process costing systems, decrease the reliance on standards and

variance analysis, and decreases the importance of inventory tracking systems [40].

2.1 Manufacturing Environment

The organization culture plays a major role in lean manufacturing environment.

The following table compares the different features and functions between traditional

manufacturing and lean manufacturing environment. The major features that changes

organizations are process and facilities, planning and control, product development and

financial control. Mass production systems incorporate management decision and

information support processes that operate within departmental boundaries, not as cross-

functional and cross-enterprise processes across departmental and company boundaries.

This cross-functional requiring lean improvement in most mass production environments

19

include total quality management, maintenance, new product introduction and other

engineering activities. These cross-functional and cross-enterprise processes are a key to

sustain lean implementation [19]. The table 2.1 illustrates the difference between mass

production and lean manufacturing. Each face of the organization has changed in lean

environment for example; the process and facilities in traditional environment operate

with high inventory in warehouse or distribution center to manage the market

fluctuations. The manufacturing process seems less flexible to handle the demand

variation is the primary reason for the above mentioned problem. But lean environment

handles this situation by addressing the root cause of the problem. The manufacturing

process should include flexible work centers with quick changeover and mixed model

production scheduling in order to handle the demand variation. The changes in the basic

process centers will lead to reduction in work in process inventory and warehouse space.

Financially, this improvement will have a major reduction in working capital for the

company. In addition, the manufacturing environment is updated but the management

accounting system has followed the traditional way. Many lean implementation team has

least understood that management accounting system needs improvement along with

manufacturing environment. This management accounting system acts as a bridge in

terms of transferring lean improvements from shop floor to higher level. The problems

with traditional management accounting system are already discussed in chapter I.

2.2 Lean Manufacturing and Management Accounting Systems

Lean manufacturing has its roots in the automotive industry [99]. A global study

of the performance of automotive assembly plants during the 1980’s resulted in the

widespread adoption of lean practices in a variety of industries [99] [42]. The application

of lean ideas to a range of industrial sectors enabled Womack and Jones [99] to derive

five generic, over-arching lean principles. These principles are:

Precisely specify customer value by product or family: A key principle of lean

manufacturing is that the customer defines value. Value is viewed “in terms of

20

Table 2.1 Features and functions comparison between traditional environment and lean manufacturing [71]

Features& functions Manufacturing Environment –Traditional Manufacturing Environment- Lean

Process & Facilities Many discrete machines

Multiple setups

Large warehouses

Large WIP areas

Flexible machine centers

Zero setup

No warehouses

Drastic decline in space required

Planning and control Constant demand fluctuation

Infinite rescheduling of requirements

Constant engineering change

Weekly planning

Long lead times

Large lot sizes

Vendor difficulties

Demand stabilization

Minimum rescheduling

Zero change

Hourly planning

Zero lead times

Lot size of 1

Vendor synergies

Product design Life cycle declining

Constant engineering change

Many complex components

Quality improvement over cycle

Infinite options

Life cycle much shorter

Little or no engineering change

Few complex components

100% quality at first time

Limited options

Financial control Labor efficiency

Little emphasis on investment

Shop orientation

Focus on variable cost

Overhead spreading

Cost measurement

Product profitability full stream

Investment intensive

Product cost as incurred

Minimum variable cost beyond

material

Zero direct labor

Cost, flexibility, dependability and

quality measures

Organization Functional interfaces

Long lead times

Hierarchical

Product teams

Flexible and rapid decision

making

Fewer levels

21

specific products with specific capabilities offered at specific prices through a

dialogue with specific customers” [99]

Identify the value stream for each product: The value stream is defined as “ the

set of all specific actions required to bring a specific product through the three

critical management tasks of any business: the problem-solving task running from

concept through detailed design and engineering to production launch, the

information management task running from order-taking through detailed

scheduling to delivery, and the physical transformation task proceeding from raw

materials to a finished product in the hands of the customer” [99].

Make value flow without interruption: Once any obviously wasteful steps are

eliminated, the remaining value-creating steps need to be organized in such a way

that they flow. This involves a move away from the traditional functional or

departmental organization towards a holistic, customer-focused organization, laid

out along value stream-lines. Lean manufacturers usually adopt cellular

manufacturing, where each cell contains all the resources required to produce a

specific product or where a series of cell is organized to produce a specific

product. In order to enable products to flow smoothly through the factory to

customer, batch production is rejected in favor of singly-piece or continuous flow.

The emphasis moves away from the efficiency of individual machines and people

to the effectiveness of the whole value stream.

Let customer pull value from process owner: When the value-creating steps are

organized to flow, the customer can pull the value through the system. Traditional

production methods tend to push products through the system in the hope that a

customer will buy them once produced. In a pull environment, no work is

completed until required by the next downstream process.

Pursue perfection: As companies widely adopt lean practices, it becomes clear

that improvement is on-going process. Initiatives to reduce effort, time, space and

cost can be conducted continuously. As a result, lean manufacturers adopt a

continuous improvement philosophy.

22

The lean transformational principles presented here are an adaptation of those presented

by Womack and Jones in the follow-up to “The Machine That Changed the World”, the

1996 publication Lean Thinking: Banish Waste and Create in your corporation (Simon &

Schuster, New York, pp 15-26).

Many of the companies that attempt to implement lean experience difficulties and/or

are not able to achieve the anticipated benefits. One of the barriers to successful

implementation is management accounting system. The company fails to improve

performance measures in financial statements. By not communicating in the same

language as management, the department or function implementing lean doesn’t get the

support needed to continue the efforts. However, the traditional management accounting

system does not translate the lean improvements from shop floor level to management

level. A review of the current literature on the inadequacies of the traditional MAS

reveals that several aspects of the new manufacturing environment have the most far-

reaching implications for its change [71].

The relationships between “direct” and “variable” costs as well as “indirect” and

“fixed” costs are becoming blurred.

The focus has turned from a preoccupation with variance and standard costs to

source of costs (eg.. drivers).

Increased recognition of the interdependence between cost and performance

among organizational subunits has negated the traditional focus on organization

cost control.

Change in manufacturing process has shifted a significant portion of product cost

from traditional direct cost to indirect, resulting in high burden rates with distort

true product costs.

New information gathering devices and techniques have made cost traceability

possible on a more detailed level.

Compression of the life cycle has shortened the period available for recovery of

development costs, necessitating efficient and effective production techniques

from inception.

23

Recognition of the cost of inventory is placing new emphasis on measuring and

reducing cycle time.

Focus on eliminating waste is leading to increased demand for value added measurements

of performance. Many cost accounting systems divide the overhead apportionment

calculations into fixed and variable elements and allocate a little of the fixed costs to each

production job and allocate the variable costs in the traditional manner. The key issue is

that overheads are such a large amount of the total product cost that it is important to

analyze these overhead costs and develop for applying them as direct costs.

2.3 Management Accounting System Strategies

2.3.1 Traditional Cost Accounting

Traditional cost accounting system has been widely used by many industries to

measure the organization performance internally as well as report the financial

accounting to management and shareholders. This costing computes the product cost

based on direct labor, direct material and overhead allocation. This overhead allocation is

based on the percentage of direct labor usage. The figure 4 illustrates traditional cost

allocations stages in graphically. The traditional costing is summarized as follows.

Assigning all manufacturing overheads to production and service cost centers /

departments.

Reallocating the costs assigned to service cost centers to production cost centers /

departments.

Computing separate overhead rates for each production cost centre/department.

Assigning cost centre overheads to products or other chosen cost objects.

Traditional Costing is still favourite because of the following reason:

Simplicity of traditional costing over the complexity of modern costing (ABC)

Internal organisational problems such as resistance

Problems associated with implementation such as finding out cost drivers,

identify activities and lack of resources.

Lack of top management support for ABC.

24

Figure 4 Traditional standard costing

2.3.2 Activity-Based Costing

Activity-based costing is a measure of cost drivers based on resource usage by each

activity. It comprises a different, more logical approach to determine the product costs. It

emphasizes the need to obtain a better understanding of cost behavior and it divides

overhead costs into various process activities. A process could be described as logical

series of activities, which can be linked together to produce reasonably homogeneous

output. The figure 5 shows the link between cost drivers and activity drivers to trace the

overhead costs associated with the resource and work station.

Cost drivers are the casual factors that cause costs of an activity to change

Resource driver describes the relationship between cost element and the activity

Cost elements are traced to activities through the resource driver.

The steps behind Activity based costing is as follows:

Identify the major activities that take place in an organization:

Assigning costs to activity cost centre

Selecting appropriate cost drivers (ex. Transaction drivers, duration drivers)

25

Figure 5 Activity-based costing.

Assigning the cost of the activities to products:

The cost driver measure must be capable of association with specific products.

Cost driver rate must be predetermined based on estimated level of activity cost

and cost driver volumes for the current period.

Activity based costing system maintains and processes financial and operating

data on a firm’s resources, activities, cost objects, cost drivers and activity

performance measures.

Although Activity based costing has many advantages over traditional standard costing.

By comparing the success rate and failure rate of ABC, the success rate for ABC

implementation is low. Research survey (2003) conducted by Narcyz Roztoci and Sally

M. Schultz [75] showed that ABC had been “implemented” by only about 21% of

responding organization. The project success rate is low because of the following

reasons.

The project was launched from finance, not pulled through from operations.

Cost accounting is outside most everyone’s comfort zones.

26

It competes with the official regulatory accounting system as a parallel and off-

line information system.

There is an underestimated degree of employee resistance to change and of

corporate disbelief with the new costs.

Sales and marketing personnel do not know how to react to the new profit winners

and losers.

ABC/ABM does not provide all the information needed to make customer and

product decisions.

ABC/ABM competes with other improvement programs without integration.

Acting on the data involves pain-refocused strategies usually require some

different people and equipment, implying job eliminations and write-offs.

The project loses initial management buy-in by not maintaining a brisk pace and

momentum.

There is no true profit-and-loss responsibility at the pilot site.

There is minimal end-product diversity, resulting in little change in individual net

costs.

ABC/ABM’s reputation is maligned as too costly to maintain or as a wrong tool.

Training was inadequate or poorly timed and failed to include the right level of

people.

Activities are incongruently related with cost drivers, many of which are not the

cause of cost.

Scope is restricted to operations cost, not total integrated value-chain cost.

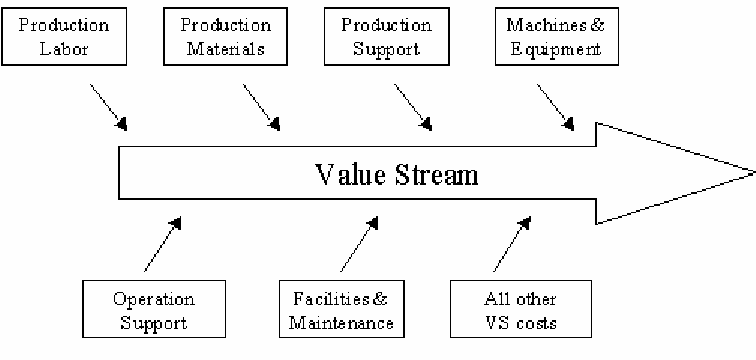

2.3.3 Value Stream Costing

A value stream is a group of products that belongs to one product family and

follows same production routing. Value stream not only consider production steps but

also it takes into account of each activity that adds value to customer from order

placement to shipping of products. Simply, It creates value to the customer along the

27

Source: Adopted from “Practical Lean Accounting” by Brain H.Maskell

Figure 6 Value stream costing

whole stream. Value stream costing allocates all the costs incurred for this stream as

direct cost. Typically, the costs include product labor, direct materials, equipment usages

and other support functions. The figure 6 shows the typical overall costs associated with

particular value stream for one or multiple product family of products.

Lean value stream costing is entirely different from traditional approach. Because

standard costing assumes that all overheads need to be assigned to the product and that

these overheads relate to the amount of direct labor required to make the product. This

costing violates the above assumption and calculates the total cost required to run the

whole value stream. It typically calculated biweekly or monthly. Production labor cost

includes all the labors who works or supports in the value stream. The total raw material

purchased for the whole value stream is considered production material. The other

activities that supports value stream will be converted in terms of cost and included in

this value stream total cost calculation. Space occupied by the value stream is allocated

based on square footage cost of the facility. Value stream costing is simple because the

detailed actual costs are not collected by production job or product. Value stream cost

reduces the overhead allocation process, which improves cost calculation and profit

28

Figure 7 The information and material flow in a typical value stream

information. The non-value stream costs are inevitably small because most of the work of

organization will be associated with value streams [70]. The value stream is far more

than just manufacturing processes. From figure 7, manufacturing is just one step in the

whole processes of serving the customer and creating value.

2.4 Literature Research

Many researchers have proposed theoretically that traditional management

accounting may undercoat the low volume complex products and may overcoat the high

volume simple products because overhead cost is allocated on direct labor hours or some

other measure of volume [51][76][20] when both types of products are manufactured.

And further it distorts the cost information. On the other hand, Activity-based costing has

gained the recognition of a more accurate cost estimation and calculation method. It

29

traces cost to products based on volume-related factors, such as unit-batch-, and product-

level cost drivers as well as non-volume-related cost drivers, such as product diversity,

complexity, and quality. Surveys and interviews with managers using ABC indicate it is

used to support a wide range of economic activities, such as product mix, pricing, and

outsourcing decisions [23]. However, evidence of enhanced "financial performance

resulting from firms adopting ABC is somewhat limited”. Low [65] and Spoede et al.

[90], using numerical examples, illustrate that the TOC leads to a more profitable product

mix than ABC. Low [65] noted that the `activity-based cost allocation procedure was a

great deal more complex than traditional costing procedures, but it was not particularly

helpful in a strategic sense. Kee [55], using a similar example, illustrates that an ABC

model integrating the cost and capacity of production activities outperforms the TOC.

The complementary nature of the TOC and ABC has been examined by various

researchers [9] [68][44]. They suggest that the TOC is appropriate for the short run, while

ABC is appropriate for longer-term decisions. However, as noted by Bakke and Hellberg

([9], there is no clear-cut demarcation between short-term and long-term decisions and

short-term decisions may have longer-term economic consequences. Time is a surrogate

in these studies for other factors in the firm operations that determine when the TOC and

ABC lead to optimal resource allocation decisions. However, the nature and impact of

these factors on ABC and the TOC were not addressed.

The primary focus of the TOC is managing bottleneck activities that restrict the

firm’s performance. As noted by Goldratt [37] any system must have at least one

constraint. The TOC consists of a set of focusing procedures for identifying a bottleneck

and managing the production system with respect to this constraint, while resources are

expended to relieve this limitation on the system. When a bottleneck is relieved, the firm

moves to a higher level of goal attainment and one or more new bottlenecks will be

encountered. The cycle of managing the firm with respect to the new bottleneck(s) is

repeated, leading to successive improvements in the firm's operations and performance.

Goldratt indicates that many of the assumptions underlying traditional cost-based

accounting systems, as well as ABC, are no longer valid and that these systems are

30

leading any companies to disaster. Consequently, he proposes using an alternative

measurement system to evaluate the impact of production-related decisions.

Kaplan [53] notes that ABC is not a system for allocating cost to products more

accurately. Rather, it attempts to identify factors underlying the production process that

cause activities to consume resources and, thereby, incur cost. The use of volume-related

cost drivers and non-volume cost drivers, such as product complexity, diversity, and

quality, enable ABC to provide a powerful and rich model of the relationship between

why costs are incurred in the production process and the products produced. Advocates of

the TOC assert that labor and overhead are a committed cost; therefore, tracing the cost

of these activities to products is irrelevant for decision-making. In the literature, many

researchers agree [25] [15] that activity based costing can measure product complexity

better than traditional management accounting or throughput accounting

John Miller summarizes this idea as follows:

A Cost Management System by itself produces no increase in productivity, no

reduction in cost, no improvement in quality, no reduction in cycle time, and no increase

in customer satisfaction. Its true benefit can be measured only in the light of

management’s actions initiated based on information provided by the new CMS. Those

actions should be directed toward continuously improving the organization’s activities

and business processes through better decision making [62].

Much of the research in the area lean/JIT has focused on the impact the

techniques on operation performance levels. In these studies, the control variables used

most often are organizational size, and hierarchical layers of the organization [2]. Further,

the authors reported the results of a distribution of respondents to their survey by

Standard Industrial Classification code, but did not analyze (or did not have enough data

to analyze) their results controlling for this variable [2].

31

Kennedy and Affleck-Graves [56] examines the link between implementation of

an activity-based costing system and the Shareholder Value Analysis (SVA). Given the

SVA framework of analyzing how business decisions affect “economic value” through

the identification of the key value drivers [98], ABC can provide information crucial to

an understanding of how a firms’ competitive advantage is generated. Shank and

Govindarajan [85] highlight such an approach by asking two questions: is the activity

necessary, and is the activity performed efficiently? They label this approach as “value

engineering the cost structure.” By more accurately attributing cost to products, services,

and customers, ABC can play an important role in providing relevant information for

management operating decisions, which, in turn, should impact on profitability and,

ultimately, shareholder value. Ward and Patel [97] also suggest that ABC provides a

sound foundation for future cash flow projections. They argue that this leads to

investment in value-added activities that support products, services, customers, and

market segments, thereby increasing shareholder value. The concept has been further

developed by the application of Activity Based Budgeting [74], Activity Based

Management [18], Activity Based Computing [12], Activity Based Cost Management

[22], and its full infusion into the business process re-engineering framework.

Bih-Ru Lea and Lawrence D.Fredendall [62] have examined the different types of

accounting systems on product mix interact with short term and long term that affect the

manufacturing performance of the firm. They considered two different product structures

(flat and deep) for this study. Further this study found that no single shop setting is best

for all performance measures. The performance measure is not constant over different

manufacturing environments. The research is conducted by developing different

hypothesis on firm performance by varying product structure and product mix algorithm.

This study suggests that ABC is more sensitive to environmental uncertainty than

traditional costing. However this study also suggests that in an uncertain environment,

given an appropriate overhead allocation rate and updated information from an integrated

information system, traditional costing is not as outdated and irrelevant as some

researchers have suggested [25][26][62][51].

32

Bakke and Hellberg [9] analyzed the potential gains of the OPT- and ABC-

models in terms of short and long term production scheduling point of view. The ABC-

philosophy constitutes a necessary basis for long term decisions about product-mix as

complete cost-structures are revealed. However the information derived from ABC-

analyzes unfortunately is not satisfactory for making short-term decisions in general.

They concluded that neither OPT (optimized production technology) nor ABC has a

relevance to all product-mix decisions and it depends on time horizon and manufacturing

environment.

Ahlstrom and Karlson [1] analyzed the role of the management accounting system

in the adoption process of implementing lean production system. That is, the focus is on

the changes takes place in the production system and the role of the management

accounting system in these changes and not the management accounting system itself.

Researchers had created hypotheses for further investigation as well as systematic

experience for practitioners to learn from. Their research concludes that the management

accounting system indeed has very important role to play in modern manufacturing

environments. Further they concluded that

The management accounting system can create impetus for changes in the

direction of lean production, but not until traditional performance measures have

reached a certain threshold. Therefore, an important managerial task will be to

influence the location of this threshold, by making it easier to reach.

Another important way to create impetus for change is to raise the level of the

unit of analysis in the management accounting system. First, there is a need to

shift the focus from single machines and/or operators to the whole production

flow. Second, there is a need to shift the focus from the operating level to the

whole production system.

When making these changes it is important to take into consideration that the

management accounting system affects the adoption process in three concurrent

ways: technically, through its design; formally, through its role in the organization

33

and cognitively, through the way in which actors think about and use the

management accounting system.

Ozbayrak and Akgun [77] have estimated the manufacturing and product costs in

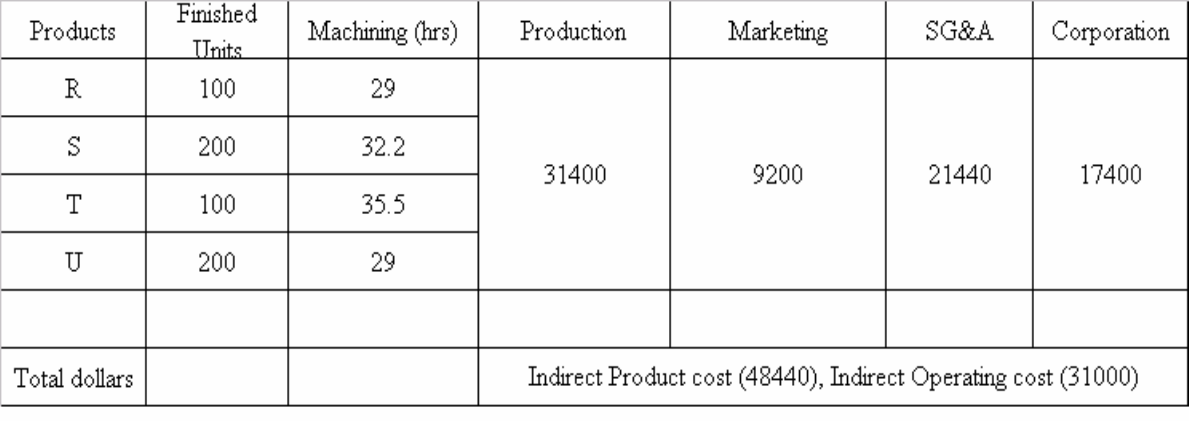

an advanced manufacturing system either MRP or JIT by using Activity-based costing

principles. Further they analyzed the potential effects of manufacturing planning and

control strategies implemented on financial structure of the production environment.

Their model assumes many non-traceable costs as indirect cost and used the proportion of

these cost while calculating the product cost. For example determining direct labor

contribution to product cost is very difficult and many times these contributions are

negligible. So, all labor costs are pooled as indirect labor cost. In this study, the indirect

resources are distributed to the main activity centers according to the utilization levels

obtained from the system simulation. Therefore, for each activity center, two cost pools

are formed as direct and indirect cost pools. The direct pool consists of raw materials,

direct energy consumed, cutting tools, fixtures, etc. The indirect cost pool consists of

externally provided service costs, indirect labor cost and other indirect cost associated

with it. They conclude that ABC is a valuable information tool, which provides

management with an unrivalled insight into the workings of the manufacturing system. In

addition, they identified buffer capacity and lead-time is to be most important cost drivers

in terms of their effect on WIP and throughput in both push- and pull-based production

environments.

Jong-min Choe [21] has studied the relationship among management accounting

information, organizational learning and production performance. His research shows a

positive correlation between management accounting information and advanced

manufacturing technology. The various researchers asserted that when advanced