One Agency, One Team, One Direction

Page | 1

Accounting System

Requirements and Pre-

Award Audits

Further information is available in the

Information for Contractors Manual under Enclosure 2

One Agency, One Team, One Direction

Prior to First Cost Type

Contract Award

Page | 2

Contracting Office or DCMA conducts Pre-award Survey to

consider responsibility of prospective contractor

Design of the Accounting System is part of the Preaward

Survey (SF 1408 Criteria)

Link: https://www.dcaa.mil/Checklists-Tools/Pre-award-Accounting-System-Adequacy-Checklist/

DCAA is requested to evaluate design of Accounting System

and report back to Contracting Office or DCMA

One Agency, One Team, One Direction

Contractor Qualifications

Responsible Prospective Contractor Criteria:

Adequate financial resources to perform the contract

Ability to comply with the required or proposed delivery or performance

schedule, considering the firm’s existing commercial and governmental

business commitments

A satisfactory performance record

A satisfactory record of integrity or business ethics

The necessary organization, experience, accounting, operational

controls, and technical skills to perform the contract

The necessary production, construction and technical equipment and

facilities

Eligibility to receive the award under applicable laws and

regulations

Page | 3

One Agency, One Team, One Direction

Pre-award Audit Objectives

Page | 4

Evaluates design of Accounting System to determine if it is

acceptable for prospective contract

Contractor should be prepared to demonstrate how

accounting system design satisfies SF 1408 during audit

fieldwork stage

DCAA Pre-Award Accounting System Audit Program:

https://www.dcaa.mil/Portals/88/Documents/Guidance/Dire

ctory%20of%20Audit%20Programs/17740%20Preaward%

20Survey%20of%20Prospective%20Contractor%20Accoun

ting%20System%20AP.pdf?ver=w0ujMZRuYOzWedf4w7EY

Vg%3d%3d

One Agency, One Team, One Direction Page | 5

Standard Form 1408 Criteria

One Agency, One Team, One Direction

Acceptable Accounting System

DFARS 252.242-7006(a)(1):

“a system that complies with the system criteria in paragraph

(c) of this clause to provide reasonable assurance that—

(i) Applicable laws and regulations are complied with;

(ii) The accounting system and cost data are reliable;

(iii)Risk of misallocations and mischarges are minimized; and

(iv)Contract allocations and charges are consistent with

billing procedures.”

Page | 6

One Agency, One Team, One Direction

Defining an Accounting System

DFARS 252.242-7006(a)(2):

“the Contractor’s system or systems for accounting methods,

procedures, and controls established to gather, record, classify,

analyze, summarize, interpret, and present accurate and timely

financial data for reporting in compliance with applicable

laws, regulations, and management decisions”

May include subsystems for specific areas such as:

Billing

Labor

Page | 7

One Agency, One Team, One Direction Page | 8

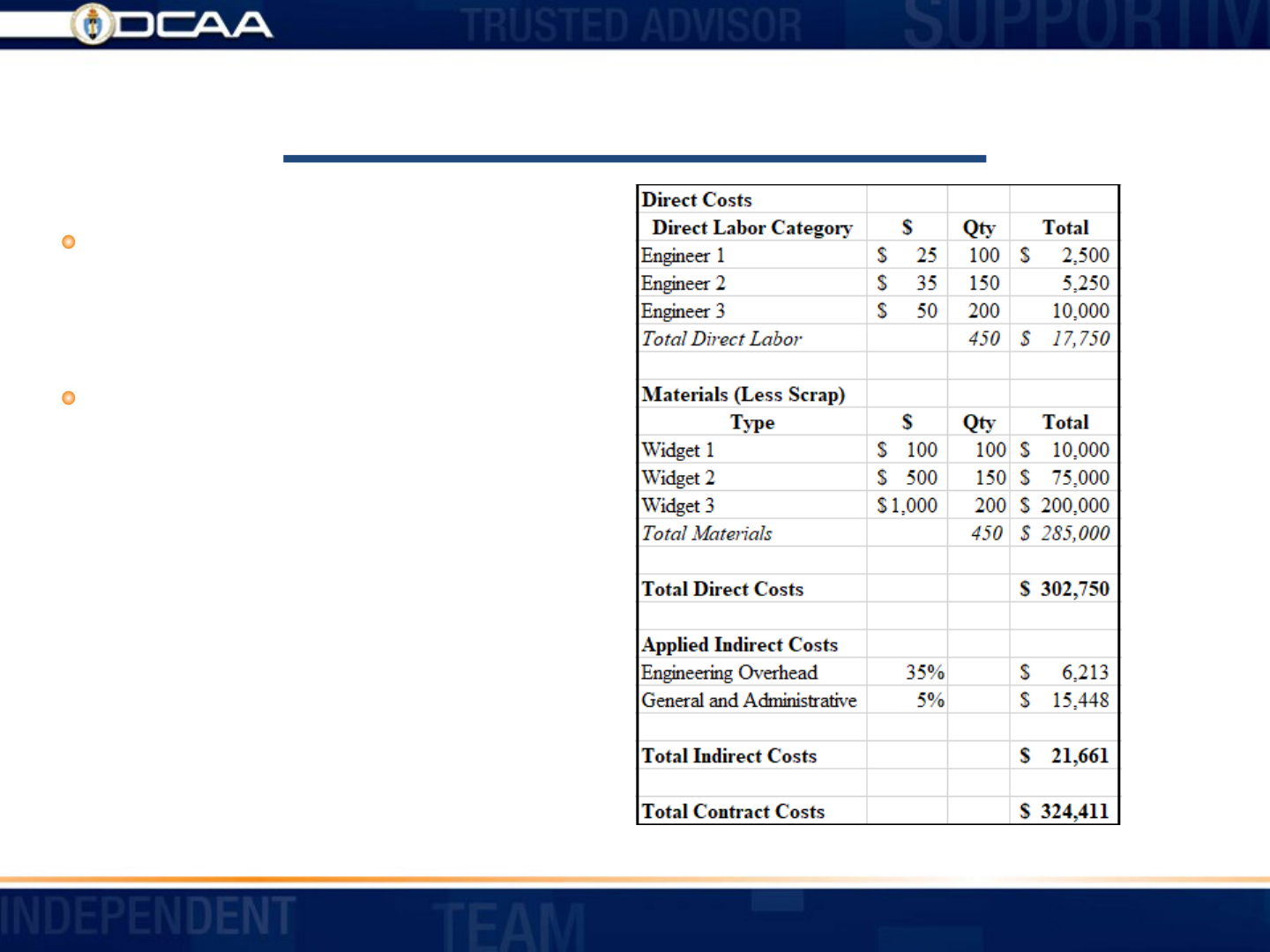

Total Contract Costs

The total cost of a contract is the

sum of the direct and indirect costs

allocable to the contract.

While the total cost of a contract

includes all costs properly

allocable to the contract, the

allowable costs to the Government

are limited to those allocable costs

which are allowable pursuant to

Part 31 and applicable agency

supplements.

One Agency, One Team, One Direction

Direct Versus Indirect Costs

Page | 9

DFARS 252.242-7006(c)(2) requires proper

segregation of direct costs from indirect costs.

Direct Cost is any cost that is identified specifically

with a particular final cost objective.

Indirect cost means any cost not directly identified

with a single, final cost objective, but identified

with two or more final cost objectives or an

intermediate cost objective

One Agency, One Team, One Direction

Defining Costs

DFARS 252.242-7006(c)(3) requires

identification and accumulation of direct costs

by contract.

DFARS 252.242-7006(c)(4) requires a logical

and consistent method for the accumulation

and allocation of indirect costs to intermediate

and final cost objectives.

Page | 10

One Agency, One Team, One Direction

Direct Cost

Page | 11

Direct costs are not limited to items that are

incorporated in the end product as material or labor.

No final cost objective shall have allocated to it as a

direct cost any cost that has been included in an

indirect cost pool.

Direct costs of the contract shall be charged directly to

the contract.

One Agency, One Team, One Direction

Definition of an Indirect Cost

Identified with two or more final cost objectives

or an intermediate cost objective.

An indirect cost is not to be allocated to a final

cost objective if other costs incurred for the same

purpose in like circumstances have been included

as a direct cost of any other final cost objective.

Page | 12

One Agency, One Team, One Direction

Indirect Cost Overview

The number of indirect cost accounts in a

single company can range from one to

hundreds.

The indirect structure needs to be tailored to

your company and how it operates.

In general, indirect cost accounts fall into two

broad categories:

Overhead

General and Administrative (G&A)

Page | 13

One Agency, One Team, One Direction

Overhead Pools

Cost related to support of specific operations

Examples of indirect cost rates include:

Material Overhead

Manufacturing Overhead

Engineering Overhead

Site Overhead

Page | 14

One Agency, One Team, One Direction

General and Administrative

These are management, financial, and other expenses

related to the general management and administration of

the business unit as a whole. To be considered a G&A

expense of a business unit, the expenditure must be

incurred by, or allocated to, the general business unit.

Examples of G&A expenses include:

Salary and other costs of the executive staff of the corporate

or home office

Salary and other costs of such staff services as legal,

accounting, public relations, and financial offices

Selling and marketing expenses

Page | 15

One Agency, One Team, One Direction

Allocation Base Overview

Indirect costs should be allocated based on benefits accrued

to intermediate and final cost objectives.

Allocation base must be reasonable.

There must be a relationship between the selected allocation

base and the pool costs.

For example, training costs in the overhead pool are not

necessarily caused by a particular cost objective, but the

cost objectives might benefit from the training of

employees. In that case, training would be related and

benefit the labor dollars incurred on contracts/final cost

objective

.

Page | 16

One Agency, One Team, One Direction

Allocation Base Examples

In general, typical allocation bases for Overhead and G&A are:

Overhead

Direct Labor Dollars

Direct Labor Hours

Direct Material Dollars

G&A

Total Cost Input (Total direct and indirect costs minus G&A)

Value Added (Total Cost Input less subcontracts and direct

materials)

Single Cost Element (e.g. Direct labor dollars)

Page | 17

One Agency, One Team, One Direction

Allowability

FAR 31.201-2

A cost is allowable only when the cost complies with

all of the following requirements:

Reasonableness

Allocability

Terms of the contract

Applicable Cost Accounting Standards (CAS)

Any Limitations Set forth in the entire Subpart

31.2

Page | 18

One Agency, One Team, One Direction Page | 19

Reasonableness

FAR 31.201-3

FAR considers a cost to be reasonable if:

In its nature and amount, it does not exceed that

which would be incurred by a prudent person in

the conduct of competitive business.

It is the contractor's responsibility to establish that

each cost is reasonable.

One Agency, One Team, One Direction Page | 20

Allocability

FAR 31.201-4

A cost is allocable to a government contract if it:

Is incurred specifically for the contract;

Benefits both the contract and other work, and can

be distributed to them in reasonable proportion to

the benefits received; or

Is necessary to the overall operation of the business,

although a direct relationship to any particular cost

objective cannot be shown.

One Agency, One Team, One Direction

Contract Terms

Specific types of cost are often addressed in a contract or

request for proposal (RFP).

However, the contract terms can only be more restrictive

than the other factors that must be considered in

determining cost allowability, not less. In other words, the

contract terms cannot allow a cost that is:

Unreasonable

Improperly measured, assigned and allocated to the

contract

Unallowable in accordance with specific cost principles

Page | 21

One Agency, One Team, One Direction

Accounting for Contract Costs

The accounting system must be able to

accumulate and report the costs for each final cost

objective; i.e., government contract.

Direct costs of the contract, plus

Allocation of applicable indirect costs, less

Unallowable Costs

Page | 22

One Agency, One Team, One Direction

DFARS Accounting Requirements

DFARS 252.242-7006(c) requirements:

(5) Accumulation of costs under general ledger control

(6) Reconciliation of subsidiary cost ledgers and cost

objectives to general ledger

(7) Approval and documentation of adjusting entries

(11) Interim (at least monthly) determination of costs charged

to a contract through routine posting of books of

accounts

Page | 23

One Agency, One Team, One Direction

Labor System

Page | 24

DFARS 252.242-7006(c) requirements:

(9) A timekeeping system that identifies employees’

labor by intermediate or final cost objectives

(10) A labor distribution system that charges direct

and indirect labor to the appropriate cost

objectives

One Agency, One Team, One Direction

Timekeeping

Labor should be charged to intermediate and final cost

objectives based on a timekeeping document (paper or

electronic timecards) completed and certified by the

employees and approved by the employees’ supervisors.

Employees should fill out timesheet on a daily basis and

include all hours worked including uncompensated

overtime.

Labor cost distribution records should reconcile to payroll

records and labor distribution records should trace to and

from the job cost ledger and general ledger accounts.

Page | 25

One Agency, One Team, One Direction

Unallowable Costs

DFARS 252.242-7006(c)(12) requires “Exclusion from costs

charged to Government contracts of amounts which are not

allowable in terms of Federal Acquisition Regulation (FAR)

part 31, Contract Cost Principles and Procedures, and other

contract provisions”

Therefore, contractors need written policies and

procedures to identify and exclude unallowable costs.

Unallowable costs need to be identified and excluded from

any billings, claims, and proposals applicable to a

Government contract.

Page | 26

One Agency, One Team, One Direction

Costs by Contract Line Item

Page | 27

DFARS 252.242-7006(c)(13) requires “Identification of costs

by contract line item and by units (as if each unit or line item

were a separate contract), if required by the contract”

Therefore, the accounting system needs to be able to

expand beyond a project number.

Each job needs to be expanded to the requisite level of

detail as determined by contract terms.

Make sure the contract is adequately briefed to determine

what this level might be.

One Agency, One Team, One Direction

Invoicing Requirements

Page | 28

DFARS 252.242-7006(c) requirements:

(16) Billings that can be reconciled to the cost

accounts for both current and cumulative

amounts claimed and comply with contract

terms

One Agency, One Team, One Direction Page | 29

Overview of Invoicing

Contractors should only bill cost which comply with FAR 52.216-7

Recorded costs that have been paid by cash, check, or other form of

actual payment for items or services purchased directly for the

contract

When the Contractor is not delinquent in paying costs of contract

performance in the ordinary course of business, costs incurred, but

not necessarily paid, for supplies and services purchased directly for

the contract and associated financing payments to subcontractors,

provided payments determined due will be made:

In accordance with the terms and conditions of a subcontract or

invoice; and

Ordinarily within 30 days of the submission of the Contractor’s

payment request to the Government

One Agency, One Team, One Direction Page | 30

Billings need to be based on current contract provisions.

The total amount billed should not exceed any contract,

work order, funding limitation, or any other contract ceiling

amount.

Important to brief contract to identify billing provisions,

including but not limited to:

Restriction of billing frequency

Special withholding provisions

Contractual unallowable costs

A contractor needs to reconcile booked costs to billed costs.

Basis of Invoiced Costs

One Agency, One Team, One Direction Page | 31

Cost Accounting Information

DFARS 252.242-7006(c)(15) requires “Cost accounting

information, as required—

(i) By contract clauses concerning limitation of cost (FAR

52.232-20), limitation of funds (FAR 52.232-22), or

allowable cost and payment (FAR 52.216-7); and

(ii) To readily calculate indirect cost rates from the books of

accounts”

Interim rates should be routinely monitored.

At least monthly, an employee needs to be responsible for

monitoring total contract expenditure against contract

limitations on price or cost.

One Agency, One Team, One Direction Page | 32

DFARS Cost Accounting

Requirements

DFARS 252.242-7006(c) requires:

(17) Adequate, reliable data for use in pricing follow-

on acquisitions; and

(18) Accounting practices in accordance with

standards promulgated by the Cost Accounting

Standards Board, if applicable, otherwise,

Generally Accepted Accounting Principles.

One Agency, One Team, One Direction

Management Reviews/Internal

Audits

Page | 33

DFARS 252.242-7006(c) requires:

(8) Management reviews or internal audits of the

system to ensure compliance with the

Contractor’s established policies, procedures, and

accounting practices

One Agency, One Team, One Direction

Common Areas of Noncompliance

Contractors not making Interim (at least monthly)

determination of costs charged through routine

posting to books of account

Failure to properly segregate direct and indirect

costs

Improper timekeeping

Failure to exclude unallowable costs

Page | 34

One Agency, One Team, One Direction Page | 35

Areas of Noncompliance

Inadequate procedures to ensure that

subcontractor and vendor costs are only included

in billings if payment to subcontractor or vendor

will be made in accordance with terms and

conditions of the subcontract or invoice and

ordinarily within 30 days of the contractor’s

payment request to the Government.

One Agency, One Team, One Direction

Frequently Asked Questions

o How do I get a DCAA approved government accounting

system?

You cannot. There is no such thing as a DCAA approved

government accounting system.

o How do I request a DCAA audit of my accounting system?

DCAA does not perform audits requested by a contractor.

DCAA only performs these audits based on a request from

a federal entity who is responsible for determining the

acceptability of a contractor’s system.

Page | 36

One Agency, One Team, One Direction

FAQs Continued

Is QuickBooks or any other accounting software

applications acceptable accounting system for

federal contracting?

An accounting system is more than just a

software package. It includes accounting

methods, procedures, and controls. Many

accounting software application can be part of an

acceptable accounting system or set up in a

manner that fails to meet the requirements of an

acceptable system.

Page | 37

One Agency, One Team, One Direction Page | 38

DCAA Internet Resources

Guidance

Audit Process Overview – Information for Contractors Manual

Directory of Audit Programs

Contract Audit Manual

Select Area of Cost Guidebook (FAR 31.205 Cost Principles)

Links to Acquisition Regulations

Checklists and Tools

Cost of Money Rates

Incurred Cost Electronically (ICE) Model

Contractor Submission Portal

Adequacy Checklists - Preaward Accounting System, Contract Pricing

Proposal, Forward Pricing Rate Proposal, Incurred Cost Submission,

Termination Settlement Proposal.

Frequently Asked Questions For Contracting Officers, Contractors and

COVID-19

One Agency, One Team, One Direction Page | 39

Small Business Outreach Survey

We would love to hear about your

recent experience with the DCAA

Small Business Program, as we are

committed to providing the best

guidance possible and

strengthening our nation's Defense

Industrial Base. By participating in

our survey, you will help us

improve our courses, content and

provide you with even better

support as we continue to grow our

program.

One Agency, One Team, One Direction

One Agency, One Team, One Direction Page | 40

Questions/Comments

Katelyn Rigle

Financial Liaison Advisor- Small Business Coordinator

Headquarters – Operations Audit Liaison Division

8725 John J. Kingman Road

Fort Belvoir, VA 22060

VoIP: (571) 448-6376

E-mail: [email protected]