Monthly

Management

Reports

VERSION: April 2017

Monthly Management Reports: State, F&A, and Trust

Purpose of These Reports

The Monthly Management Reports are a static snapshot of the previous month's

transactions, taken the night that Accounting Services closes the month, to help with your

department's month-end reconciliation.

The Monthly Management Reports are made up of five reports for each fund type:

o

State

o

F&A

o

Trust

This report... Shows...

That are similar

to the ledgers

on the...

And the

chartfield

strings...

Summary available balances for expenses and

revenue

MainLedgers

rollup tab

are broken out by

program.

Rolled Up

Summary

available balances for expenses and

revenue

Main Ledgers

rollup tab

are not broken out

by program. That is,

chartfield strings

that are the same

but have a different

program are rolled

up together.

Parent

Summary (State

and F&A only)

available balances for expenses and

revenue

Parent Ledgers

rollup tab

are not broken out

by program. This

report is similar to a

rolled-up summary.

Details budget, expense, and revenue

transactions

Transactions tab are broken out by

program.

Rolled Up

Details

budget, expense, and revenue

transactions

Transactions tab are not broken out

by program. That is,

chartfield strings

that are the same

but have a different

program are rolled

up together.

1

Who Uses These Reports

Primarily, financial staff responsible for reconciling expenses and revenue for their

departments use these reports.

When to Use These Reports

If you're reconciling the expenses and revenue from a previous month, the Monthly

Management Reports are useful because they do not change. The reports are fixed as soon

as Accounting Services closes the month and won't be affected by any financial activity

after the month-end close.

Where the Information Comes From

These reports pull information from the Commitment Control (KK)ledgers.

Where to Find the Reports

The Monthly Management Reports are generated for each department the night the

previous month closes. You can download the reports in both PDF and Excel (CSV) formats.

If you're downloading more than one report, InfoPorte creates a .zip file, which is a

compressed file format. You'll need to extract the files before you can use them. Refer to the

Extracting the Reports from the Zip File section in this document for more information.

Note: Functionality to handle zip files is part of Windows, and you don't need to

download any additional software to use them.

How to Run These Reports

Follow these steps to find the State Monthly Management Reports:

1. Open InfoPorte and navigate to:

Finance > Monthly Reports tab

2. Choose the reports you need by doing one of the following:

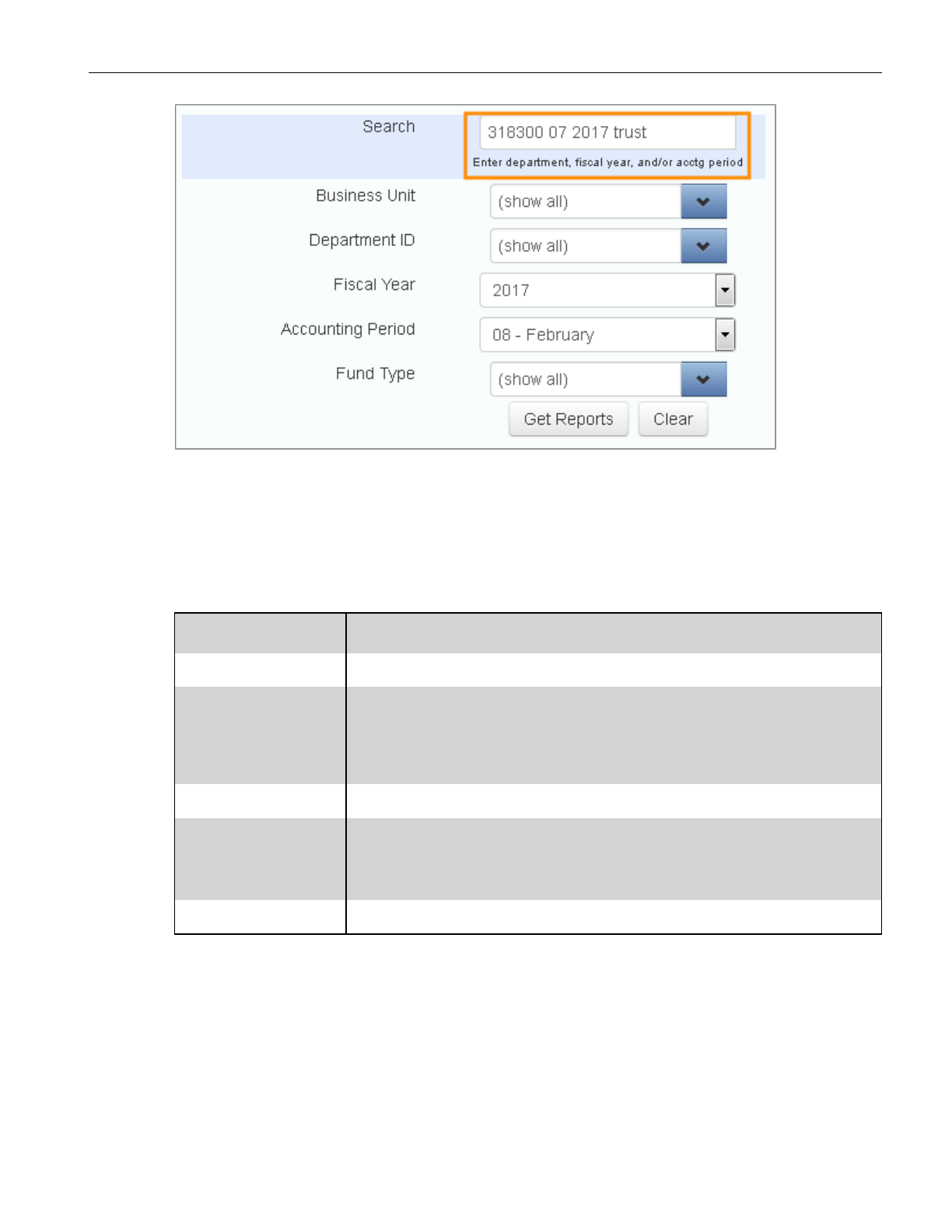

l Use the Search field if you want to find the reports you need by typing in your

department number, accounting period, fiscal year, and fund type. If you enter only

your department number, InfoPorte chooses the last closed month.

2

Note: The first State reports available are for FY2017, Accounting Period 04 (October).

The first Trust and F&A reports are available for FY2017, Accounting Period 05

(November).

l Use the report filters if you want to find the reports you need by choosing options

from a list:

In this field... Choose the following...

Business Unit UNCH, UNCGA, or the appropriate foundation business unit.

Department ID The department number. You can choose one or more departments.

Note: If you leave Department blank, the system displays the error

"Department is not set or is incorrect format".

Fiscal Year The fiscal year. You can only choose one.

Accounting Period

Enter the accounting period that corresponds to the month you need

(for example, 01 is July). Or you can leave the Accounting Period blank

to find the most recently-closed month.

Fund Type Choose F&A, STATE, or TRUST.

3

2. Click Get Reports.

Result: InfoPorte shows a list of reports that match the filters you chose, with

checkboxes to choose PDF or Excel (CSV) format.

3. Check the individual reports you want to download, or check All PDF or All Excel to

download all.

4

4. Click Download Reports.

Result: The system asks you if you want to open or save the report.

5. Do one of the following:

l If you only check one report, choose Save to save the report to your computer or

Open to view the report.

l If you check more than one report, InfoPorte creates what's called a 'zip file' which

compresses the files into one file so that it downloads more quickly. Choose Save and

then follow the steps in "Extracting Your Reports from the Zip File."

Extracting the Reports from the Zip File

If you choose to download more than one report,InfoPorte creates a .zip file and you'll need

to extract the reports to view them.

1. Open Windows Explorer and locate the .zip file you downloaded.

Note: If you didn't choose a download location in step five above, check your Downloads

folder for the .zip file.

2. Right-click on the .zip folder and choose Extract All.

5

3. Enter or browse to the place you want the files saved to.

4. Click Extract.

Result: Your computer displays the unzipped files in a new window.

6

What the Summary Reports Show

The Summary Reports show the following information for the accounting period selected.

Columns on the Summary Reports

In this column... You see this...

YTD Budget Year-to-date budget balance.

Pre/Enc Total of pre-encumbrances and encumbrances. Pre-encumbrances are the

University's intention to pay for purchase requisitions, including ePro

vendor catalog orders. Encumbrances are the University's commitment

to pay for purchase orders.

YTD Rev/Exp Year-to-date revenue or expenses.

Avail Bal Available balance is calculated as

YTD Budget - Pre/Enc - YTD Rev/Exp = Available Balance

Pay Proj Payroll projections shows projected personnel expenses. The payroll

projections are calculated automatically, outside of InfoPorte in

ConnectCarolina.

Adj Avail Bal Adjusted Available Balance calculated as

Available Balance - Payroll Projections = Adjusted Available Balance

MTD Budget This total is the sum of the changes to the budget for the month made by

budget journals and transfers.

MTD Rev/Exps Total of revenue or expenses for the month.

7

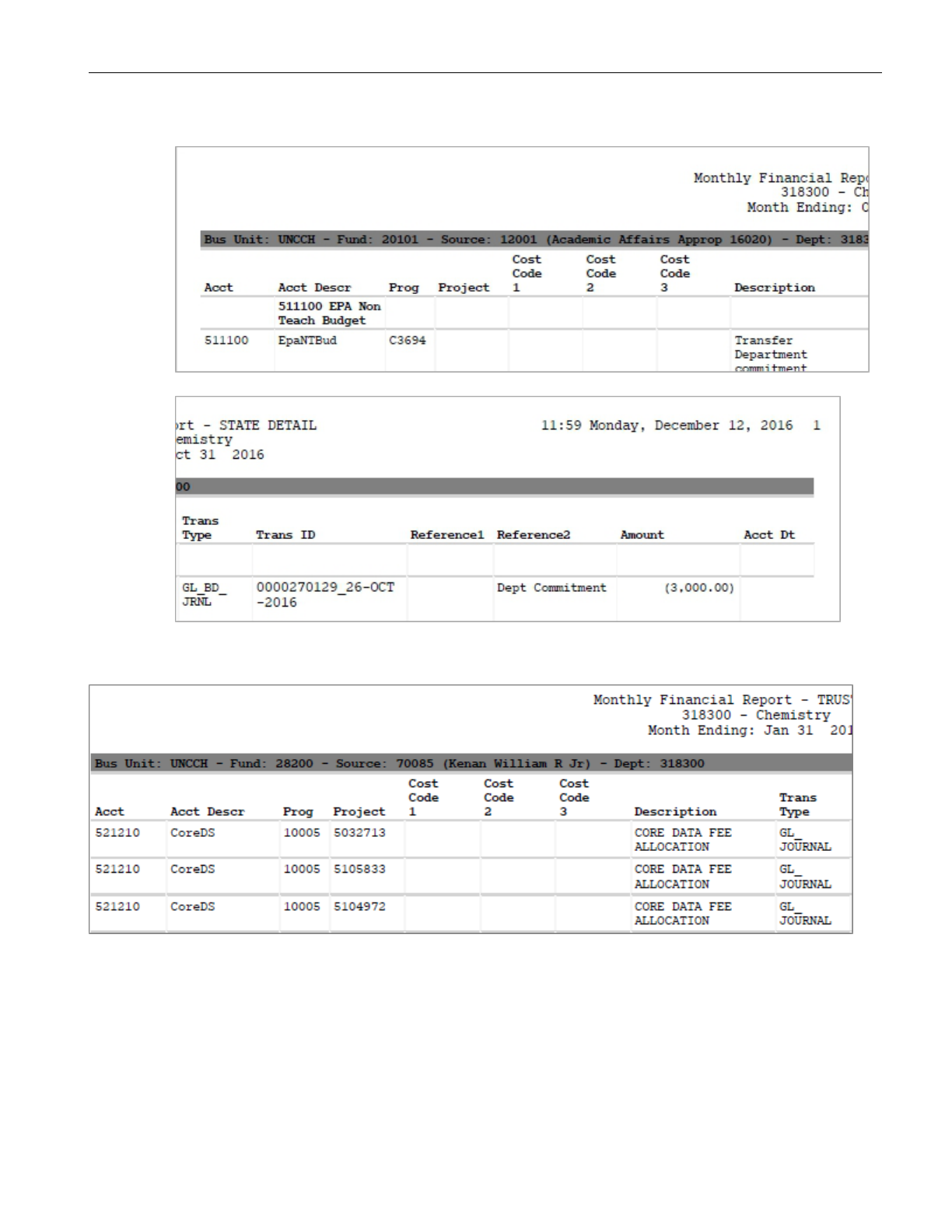

Sample State Summary Report

Sample Trust Summary Report

8

Sample F&A Summary Report

What the Detail Reports Show

The Detail Reports show the following information for each transaction during the

accounting period you chose.

9

Columns on the Detail Reports

In this column... You see this...

Account The account tells how the money was spent. The six-character account

number identifies the transaction's accounting classification. The first

digit of the Account identifies the broadest level of classification (4 for

revenue accounts, 5 for expense accounts) while the remaining digits

break down the account type into further subgroups as explained in the

Chartfield Structure quick reference card.

Acct Descr The account description identifies the name of the account.

Program The six-character program begins with one or two letters to identify the

school or division. Identifying letters for each school and division are in

the Chartfield Structure quick reference card. Program is used at your

department’s discretion to track the cost of specific activities.

Project The project number is a unique identifier, assigned by either OSR for a

grant or by Accounting Services for a capital improvement project.

Cost Code 1

Cost Code 2

Cost Code 3

Cost code contains ten characters and begins with one or two letters to

identify the school or division. Identifying letters for each school and

division are in the Chartfield Structure quick reference card. Cost

Codes are used at your department’s discretion to track the cost of

specific activities.

Description The description provides details about the transaction and is different

for each type of transaction as explained in ConnectCarolina Financial

Concepts: Reconciling in Infoporte.

Trans Type The Trans Type field identifies the kind of transaction it is, as defined

in Appendix C of the ConnectCarolina Financial Concepts: Reconciling

in Infoporte.

Trans ID The Trans ID field shows the unique identification number assigned to

each transaction. The transaction ID is determined by the kind of

transaction it is, as explained in ConnectCarolina Financial Concepts:

Reconciling in Infoporte.

Reference 1

Reference 2

This reference information about the transaction is determined by the

kind of transaction it is, as defined in Appendix C of the

ConnectCarolina Financial Concepts: Reconciling in Infoporte.

For vouchers, if you see a payment reference number and payment date

in this column, that means the transaction has been paid.

Amount This field shows the dollar amount of the transaction.

Acct Dt The accounting date indicates the date the transaction was recorded as

a commitment. This date is used as the default budget date.

10

Sample of State Detail Report

Sample of Trust Detail Report

11

Sample of F&A Detail Report

12