EXTERNAL GUIDE

TAX REFERENCE NUMBER

(TRN) ENQUIRY SERVICES ON

EFILING

EXTERNAL GUIDE

TAX REFERENCE NUMBER (TRN)

ENQUIRY SERVICES ON EFILING

GEN-ENR-01-G08

REVISION: 1

Page 2 of 13

TABLE OF CONTENTS

TABLE OF CONTENTS 1

1 PURPOSE 3

2 INTRODUCTION 3

3 REQUIREMENTS 3

4 ACTIVATION 4

4.1 TRN ACTIVATION 4

4.2 TRN ORGANISATION ACTIVIATION 6

5 BULK REQUESTS FOR TRN 7

6 STATUS DASHBOARD AND AUTHORISATION FOR BULK TRN REQUESTS 7

7 SINGLE TRN REQUEST 9

8 SINGLE TRN REQUEST HISTORY 11

9 ENQURIES 12

10 CROSS REFERENCES 13

11 DEFINITIONS AND ACRONYMS 13

EXTERNAL GUIDE

TAX REFERENCE NUMBER (TRN)

ENQUIRY SERVICES ON EFILING

GEN-ENR-01-G08

REVISION: 1

Page 3 of 13

1 PURPOSE

The purpose of the guide is to assist authorised Institutions to request or verify a clients Tax

Reference Number (TRN) for Income Tax, Value Added Tax (VAT) and Pay As You Earn (PAYE)

via eFiling.

This guide in its design, development, implementation and review phases is guided and

underpinned by the SARS values, code of conduct and the applicable legislation.

Should any aspect of this guide be in conflict with the applicable legislation the legislation will take

precedence.

2 INTRODUCTION

SARS aims to provide the best service to all stakeholders by improving the quality of reporting data

and by so doing enhance the level of compliance linked to those reporting institutions that are

obligated to fulfil their 3

rd

party data reporting requirements as per section 26 of the Tax

Administration Act (TAA).

One of these initiatives is providing an authorized reporting institution with their clients Tax

Reference Number (TRN) upon request.

This also falls in line with the SARS strategic objectives of increased tax compliance and

increased ease and fairness of doing business with SARS.

Reporting institutions have an obligation to fulfil their 3

rd

party data reporting requirements towards

SARS, which includes the submission of a TRN with their correlating data submissions. Taxpayers

are not always aware of their TRN or cannot be successfully contacted to provide this information

and this result in the data submitted by reporting institutions to be incomplete.

In view of this, SARS is committed to assisting reporting institutions by providing the TRN to

them to assist them to comply with their obligation of submitting accurate and complete 3

rd

party data to SARS.

Legislatively SARS can share this information (TRN) as set out in section 69(8)(a) of the

TAA.

Reporting institutions that want to partake in this exchange of information will have to be activated

on SARS eFiling for the bulk TRN request service.

The activation process entails a verification process to authenticate the activation request

for this service.

Once activated, the institution will be able to submit a bulk file request to SARS.

The institution must compile a bulk request via a data file submission as per the SARS

external Business Requirements Specification (BRS) for the TRN request service.

This data file must then be submitted to SARS via the existing Direct Data Flow channels

either Connect Direct or Secure Web: HTTPS channels.

The institution is required to authorise the file processing via SARS eFiling before SARS will

be able to process the file.

Once authorised the file will be processed and the institution will receive a response file once

the process has been completed.

The Tax Reference Number functionality on eFiling has been enhanced to include the ability to

request and confirm Single Requests for Tax Reference numbers as well as to indicate the history

of all Single Tax Reference Number requests.

3 REQUIREMENTS

When requesting your clients TRN the following requirements must be met:

To register for the TRN request service, the reporting institution must be:

Registered and activated for Corporate Income Tax (CIT) and/or Value Added Tax

(VAT) and/or Pay As You Earn (PAYE) on eFiling;

EXTERNAL GUIDE

TAX REFERENCE NUMBER (TRN)

ENQUIRY SERVICES ON EFILING

GEN-ENR-01-G08

REVISION: 1

Page 4 of 13

For Bulk TRN Requests the Enrolment and activation for submission of their third party

data via either Connect Direct or Secure Web: HTTPS channels

Registered for third party data submissions.

Only the eFiling administrator and/or registered representative (RR) of the reporting institution may

activate the TRN request service.

The reporting institution may verify/confirm tax reference numbers for Income Tax, Value Added

Tax (VAT) and Pay As You Earn (PAYE) for entities as indicated in the below table:

Entity type

Request

Confirm

Individual

√

√

Company

√

√

Trust

√

√

Other

X

√

Entities that have been activated successfully for the TRN Request Service will be able to request

or verify a single TRN, online via eFiling.

Some reporting institutions will automatically be registered for the TRN request service by SARS.

If your reporting institution has not been activated, proceed as per section 4 of this guide.

Refer to the following guides available on the SARS website www.sars.gov.za, on how to register

and enrol for these channels:

GEN-ENR-01-G01 - Guide for submission of third party data using the connect direct channel

GEN-ENR-01-G02 - Guide for submission of third party data using the HTTPS channel

4 ACTIVATION

4.1 TRN ACTIVATION

To activate the TRN request service –

Click Returns and Tax Reference Number Request.

Click Activation and the Tax reference number request screen will display.

EXTERNAL GUIDE

TAX REFERENCE NUMBER (TRN)

ENQUIRY SERVICES ON EFILING

GEN-ENR-01-G08

REVISION: 1

Page 5 of 13

Complete your organisation Tax Reference Number and include the motivation why the TRN

service is required.

Once completed, click Activate and the following screen will display.

Note that the status on the Tax Reference Number Request page will be “Awaiting Registration

Verification”

Once activated the status will change to “Successfully Activated”

If the TRN service is no longer required on eFiling, click the “De-activate” button on the Activation

screen. The status on the Tax Reference Number Request screen will indicate that the request was

submitted to SARS as indicated in the below screen.

EXTERNAL GUIDE

TAX REFERENCE NUMBER (TRN)

ENQUIRY SERVICES ON EFILING

GEN-ENR-01-G08

REVISION: 1

Page 6 of 13

4.2 TRN ORGANISATION ACTIVIATION

To validate that your institution is activated:

Click Organisation

Click Right Groups

Select Manage Groups and the Group Details screen will be displayed.

Click the Open hyperlink and the following screen will be displayed.

EXTERNAL GUIDE

TAX REFERENCE NUMBER (TRN)

ENQUIRY SERVICES ON EFILING

GEN-ENR-01-G08

REVISION: 1

Page 7 of 13

Select TRN (Tax Reference Number) and click Update.

5 BULK REQUESTS FOR TRN

Upon activation, the reporting institutions are required to compile and submit a request file

according to the SARS external BRS for the TRN request service to either validate an existing TRN

or request their client’s TRN.

The representative taxpayer of the institution is requested to email SARS at the following email

address bus_sys_cdsuppor[email protected].za to request the SARS TRN external BRS. Kindly ensure

that the email is headed “Requesting external BRS for SARS TRN service”

Prepare the file as per SARS external BRS and note the file size and structure requirements

stipulated.

Once completed, upload the file on either Connect Direct or Secure Web: HTTPS channels.

Once the entire file has been uploaded and validated, the registered representative of the reporting

institution will receive an email informing them that they need to authorise the TRN request file on

eFiling.

Note that failure to adhere to the notifications to authorise your TRN request file within

9 working days will result in your organisations’ request being cancelled.

6 STATUS DASHBOARD AND AUTHORISATION FOR BULK TRN REQUESTS

EXTERNAL GUIDE

TAX REFERENCE NUMBER (TRN)

ENQUIRY SERVICES ON EFILING

GEN-ENR-01-G08

REVISION: 1

Page 8 of 13

Once the file has been uploaded and email received, the registered representative of the

organisation must authorise the file.

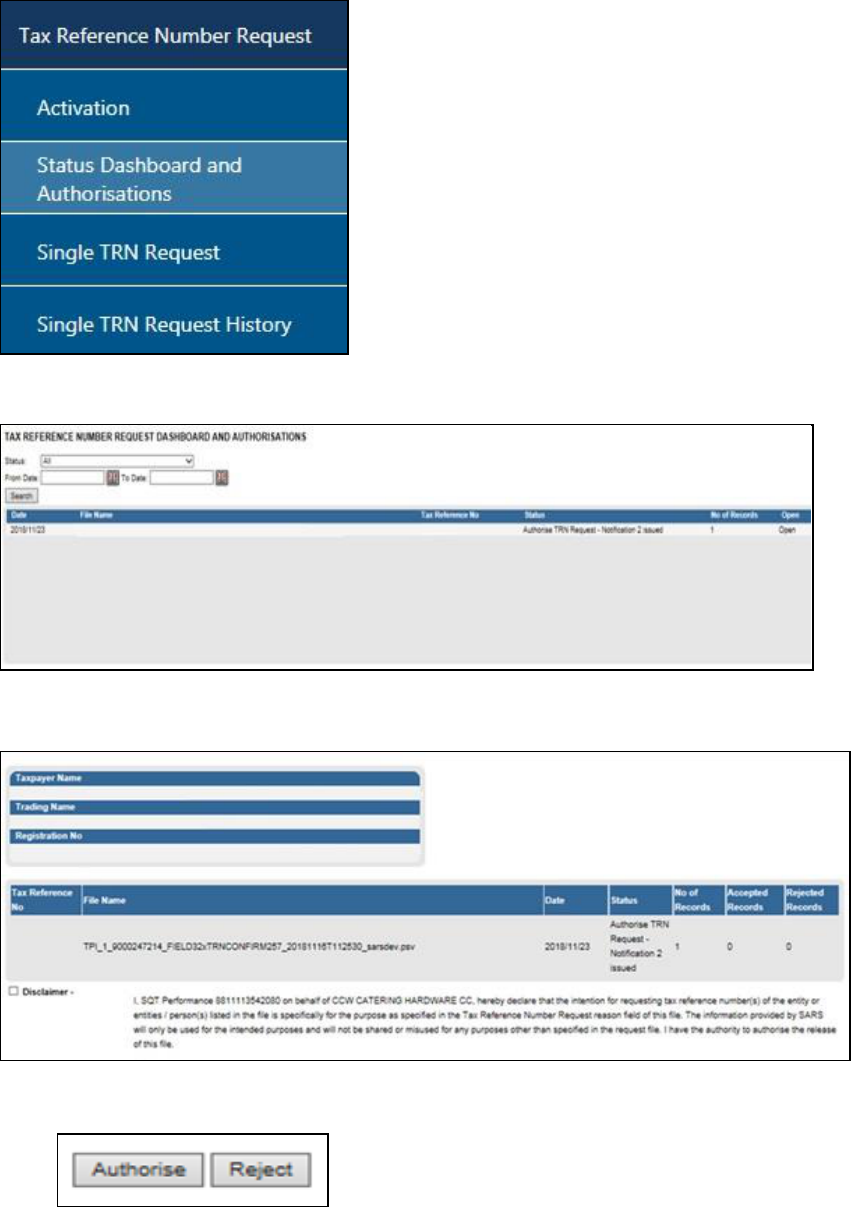

Visit the Tax Reference Number Request Dashboard and Authorisation page on eFiling.

Click Returns

Click Tax Reference Number Request

Select Status Dashboard and Authorisations

The Tax Reference Number Request Dashboard and Authorisations page will display

Click Open button and the following screen will be displayed.

Note the disclaimer. Click on the checkbox beside the disclaimer

Scroll down to the Authorise or Reject

EXTERNAL GUIDE

TAX REFERENCE NUMBER (TRN)

ENQUIRY SERVICES ON EFILING

GEN-ENR-01-G08

REVISION: 1

Page 9 of 13

To authorise the file, click Authorise.

If authorised,

The status on the Tax Reference Number Request Dashboard and Authorisation

page will change to “In Progress.”

To reject the file, click Reject.

If rejected,

The status on the Tax Reference Number Request Dashboard and Authorisation

page will change to “Void.”

Once the summary file has been authorised by the registered representative of the reporting

institution:

The correlating response file will be compiled and sent to the submission channel used by

the reporting institution.

An email will be sent to the registered representative to inform him/her that the response file

has been issued via the channel of submission.

Note the following regarding the results provided via response files to your reporting

institution:

SARS will only provide results where there is a 100% match between the data submitted and

what SARS has on record and SARS will not provide a TRN for the request if duplicate

entities are matched on the SARS systems

SARS will not provide a TRN or validate a TRN where the tax reference number has been

deactivated.

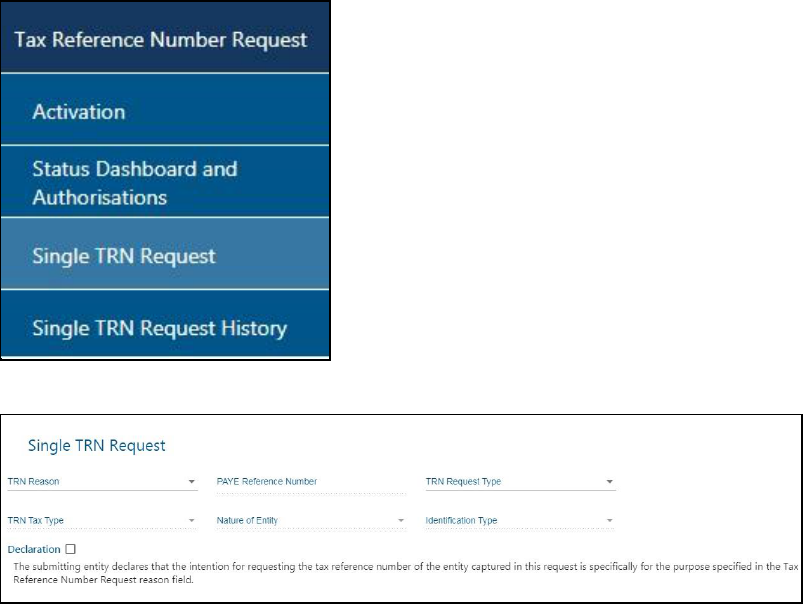

7 SINGLE TRN REQUEST

• Entities that have been activated for TRN can request or confirm a single tax reference number.

Click on Single TRN Request.

The Single TRN Request screen will be displayed.

The following fields will be displayed for completion:

EXTERNAL GUIDE

TAX REFERENCE NUMBER (TRN)

ENQUIRY SERVICES ON EFILING

GEN-ENR-01-G08

REVISION: 1

Page 10 of 13

TRN Reason – the reasons will be displayed depending if the eFiling profile is activated for

both TRN and 3

rd

party data or only for TRN.

For Purposes of FICA requirement

For Purposes of RICA requirement

For Purposes of Employer to employee relationship (Payroll, annuities, pensions and

lump sum benefits)

For Purposes of complying to SARS 3rd party data requirements (FATCA, CRS, IT3,

Insurance payments, DWT, Medical Aid submissions and any future 3rd party

submission that includes as a field tax registration number)

For Purposes of searching for a VAT vendor.

PAYE Reference Number - Note – this field will only be enabled and be mandatory

when the TRN reason, “For Purposes of Employer to employee relationship” has been

selected. The PAYE number that is captured here MUST exist, be active and belong to the

requesting entity, else the request will be rejected]

TRN Request Type

TRN Request

TRN Confirmation

TRN Tax Type – the TRN reason selected will determine which TRN tax Type to display.

PAYE

VAT

Income Tax

Nature of Entity – based on this selection, the relevant fields will be displayed on the TRN

capture screen.

Individual

Individual Foreign

Company

Trust

Other

Identification Type

South African ID number

Foreign ID number

Foreign Passport number

South African Company/Close Corporation registration number

Foreign company registration number

South African trust registration number

Foreign trust registration number

Below is an example of the TRN Capture screens based on the Nature of Entity selected as

Individual, Company and Trust:

Individual

Company:

EXTERNAL GUIDE

TAX REFERENCE NUMBER (TRN)

ENQUIRY SERVICES ON EFILING

GEN-ENR-01-G08

REVISION: 1

Page 11 of 13

Trust:

Once all the relevant fields have been completed for the TRN request, ensure that the declaration

are read and selected, before submitting the request.

If you wish to SAVE the TRN request or confirmation, select the SAVE button. This entry can be

retrieved via the Single TRN Request History function and then you can complete and submit the

request at a later stage.

If you have not selected the Declaration, a warning message will be displayed once you select the

Submit button. Click OK to proceed.

Note: One of the following messages will be displayed based on the information captured and what

SARS results have on record :

Existing tax number found: 0000000000

“SARS confirms that the demographic details and the tax number supplied, belongs to

the same entity”

“SARS confirms that according to our records the entity exists but the tax number is

currently INACTIVE”

“The information you supplied cannot be matched to an entity on our records”

“The information you supplied cannot be matched to a unique entity on our records”

“The demographic details and the tax number supplied cannot be matched to the same

entity”

The PAYE number you entered is either not ACTIVE or does not belong to the entity

making this TRN enquiry. Please correct the information and resubmit.

8 SINGLE TRN REQUEST HISTORY

The Single TRN Request History function will display a history of all the Single TRN Requests for

PAYE, VAT and Income Tax.

EXTERNAL GUIDE

TAX REFERENCE NUMBER (TRN)

ENQUIRY SERVICES ON EFILING

GEN-ENR-01-G08

REVISION: 1

Page 12 of 13

Select the TRN Tax Type, either PAYE, VAT or Income Tax.

A list of the TRN requests will be displayed as indicated in an example below.

Click View or Open button.

The View button will display the tax reference number.

The Open button will display the information captured on the TRN request

9 ENQURIES

Should the registered representative of the reporting institution require assistance regarding the

Tax Reference Number (TRN) request service activation or progress with regards to the TRN

Requests made via Connect Direct /HTTPS, a detailed request must be emailed to the “3

rd

Party

Data unit” on the following email address: bus_s[email protected]v.za.

EXTERNAL GUIDE

TAX REFERENCE NUMBER (TRN)

ENQUIRY SERVICES ON EFILING

GEN-ENR-01-G08

REVISION: 1

Page 13 of 13

DISCLAIMER

The information contained in this guide is intended as guidance only and is not considered to be a legal reference, nor

is it a binding ruling. The information does not take the place of legislation and readers who are in doubt regarding any

aspect of the information displayed in the guide should refer to the relevant legislation, or seek a formal opinion from a

suitably qualified individual.

For more information about the contents of this publication you may:

Visit the SARS website at www.sars.gov.za

Visit your nearest SARS branch

Contact your own registered tax practitioner

If calling from within South Africa, contact the SARS Contact Centre on 0800 00 7277

If calling from outside South Africa, contact the SARS Contact Centre on +27 11 602 2093 (only between 8am and

4pm South African time).

10 CROSS REFERENCES

Document #

Document Title

GEN-ENR-01-G02

Guide for submission of third party data using the HTTPS Channel

GEN-ENR-01-G01

Guide for the submission of third party data using the connect direct channel

GEN-ELEC-18-G01

How to Register for eFiling and Manage Your User Profile

11 DEFINITIONS AND ACRONYMS

AEOI

Automatic Exchange of information

CRS

Common Reporting Standard

FATCA

US Foreign Account Tax Compliance Act

HTTPS

Hyper Text Transfer Protocol Secure

PAYE

Pay As You Earn

PIT

Personal Income Tax

Reporting

Institution

This includes all institutions reporting 3

rd

party data to SARS

SARS

South African Revenue Service

TAA

Tax Administration Act No. 28 of 2011

TRN

Tax Reference Number

VAT

Value Added Tax