2018

AUSTRALIA OCEAN

SOURCE MARKET

1.35 million Australians took an ocean cruise in 2018

The Australian source market continued its long run of positive

growth in 2018, although at a lower rate than in previous

years. A total of 1.35 millon Australians took a cruise last year,

an increase of 0.9 per cent over 2017. Though positive, the

rate of growth was down from the 4.4 per cent shown in 2017,

placing Australia behind other large cruise markets such as

North America (up 9.4 per cent) and Europe (up 3.3 per cent).

This was mainly the result of lower growth in local cruising

(up just 0.1 per cent), due to well-publicised infrastructure

constraints and their impact on cruise lines’ ability to position

new capacity in this region.

One in every 17 Australians is cruising

Australia once again leads the established cruise markets in penetration rates, with 5.8 per cent of the population taking

an ocean cruise in 2018, or the equivalent of almost one in every 17 Australians. This compares to 4.0 per cent in the

USA, 3.0 per cent in the UK, and 2.8 per cent in Germany.

Future Potential

While the local industry faces growth constraints caused by a shortage of cruise infrastructure in Sydney, the

construction of a new International Cruise Terminal in Brisbane and other cruise related projects announced in Cairns,

Eden and Broome are expected to reignite growth in the homeport market.

Cruise lines have already announced signicant new vessel deployments in this region beginning from 2020/2021. At the

same time, smaller older vessels will be replaced with newer larger ships to cater to Australian passenger demand while a

solution to the Sydney infrastructure constraints is developed.

Although the reduced growth trend may continue in the short term into 2019, the future outlook for the Australian

ocean cruise passenger market remains positive. As government and local stakeholders recognise the potential for the

industry to offer an even broader and more frequent range of domestic itineraries, this will increase the contribution the

industry is able to deliver to Australia’s national and regional economies.

Globally, there are 122 new cruise ships set for delivery by 2027 at a total cost of more than US$64 billion. As the industry

continues to invest billions of dollars in new vessels, new destinations and strong source markets such as Australasia have

the potential to reap the rewards of increased deployment as long as they can meet capacity requirements.

Among the ndings of CLIA’s annual report were:

Local

Cruising

(AU/NZ/SP)

0.1%

3.4%

0.9%

2017 2018

TOTAL

Fly-Cruise

Australians Cruising

1,029

1,333

304

1,030

1,345

315

Nevertheless, Australians continued to recognise cruise as a preferred holiday choice. The number who chose y-cruise

options in destinations beyond local waters continued to perform strongly in 2018 (up 3.4 per cent), with Europe and

the Mediterranean the most popular long-haul destinations for Australian cruisers (up 21.1 per cent).

While local growth is inhibited by

capacity constraints, y-cruise

remains a popular choice for

Australian holidaymakers.

Longer, more expensive y-cruise

options remain appealing to older

passengers

NSW’s share of the source market

is falling as the popularity of cruise

grows in all states.

The average age of an Australian

ocean passenger remains steady at

49 years

The average cruise length is 8.8

days, down from 9.1 days in 2017

The growth in short domestic

cruises is driving the average cruise

length down

Australia continues to lead the

established cruise markets in

population penetration.

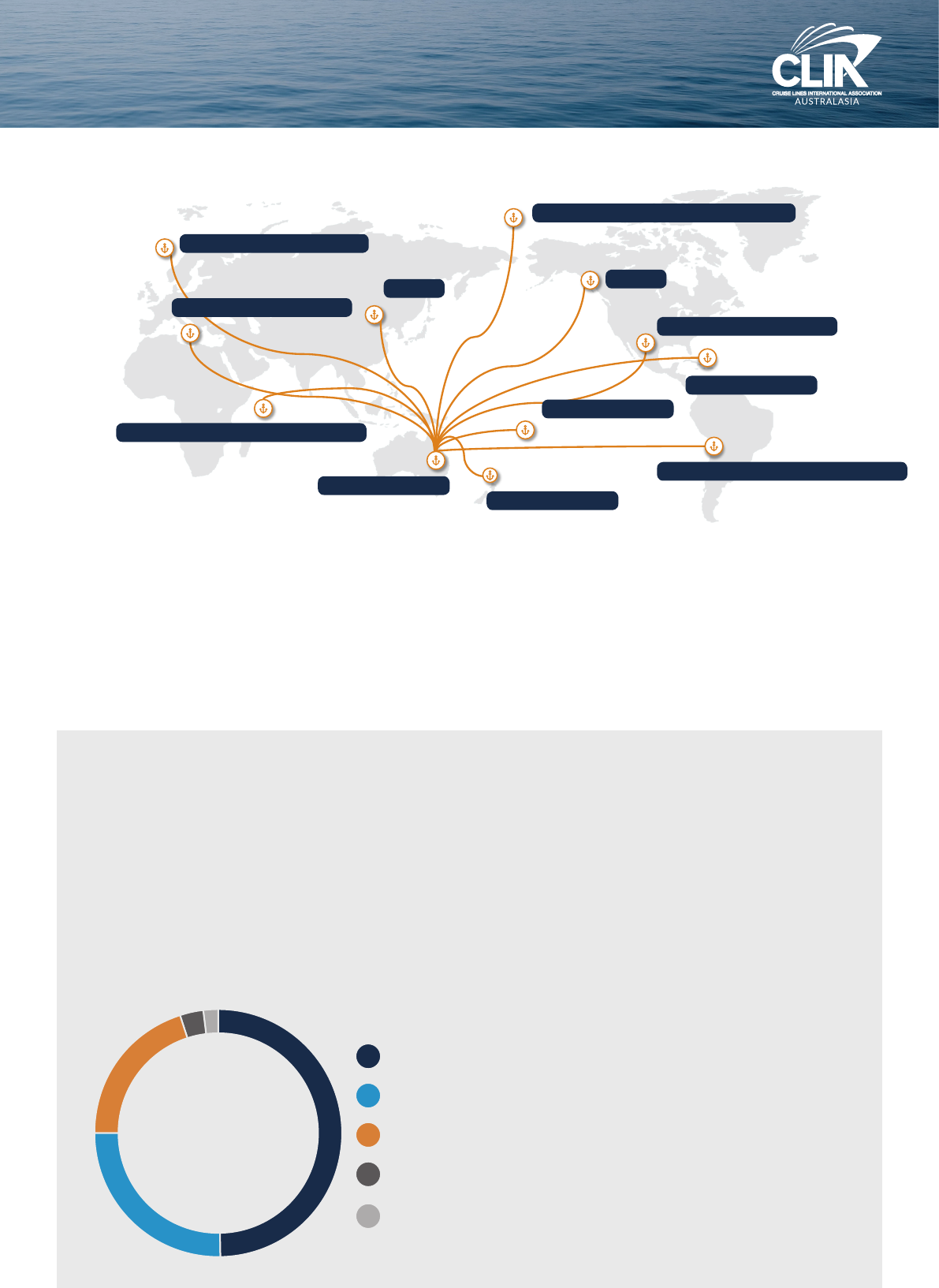

Where Are Australians Cruising?

In 2018, the majority of Australian cruisers continued to sail within Australia, New Zealand and the South Pacic

(76.6 per cent). Of these, 467,000 sailed locally on Australian cruises (up 2.2 per cent), while 434,000 cruised in the

South Pacic (down 7.9 per cent), and 129,000 sailed in New Zealand (up 27.7 per cent). As a result, regional ports

and destinations continued to benet from domestic cruise travellers, delivering signicant economic impact to local

communities including for restaurants, hotels, shops, transportation and local tour operators.

In terms of y-cruise, Europe and the Mediterranean were the most popular long-haul destinations for Australians in

2018, accounting for 8.1 per cent of cruisers. 7.3 per cent cruised in North America, the Caribbean, Alaska and Hawaii,

while Asia followed with 5.4 per cent of travellers.

World Perspective

There was a 6.7 per cent increase in the number of people

taking a cruise globally last year, with 28.5 million cruisers

worldwide. This gure is forecast to break the 30 million

barrier in 2019.

While the cruise sector represents only 2.0 per cent of the

overall global travel industry, it continues on a similar growth

pattern to international tourism worldwide. According to

the latest UNWTO World Tourism Barometer, international

tourist arrivals grew 6.0 per cent in 2018, totalling 1.4 billion,

while cruise travel grew at 6.7 per cent over the same period.

Among the ndings of CLIA’s 2018 global

statistics were:

• With 5.1 per cent of global cruise passengers

hailing from Australasia, the region was the

fourth largest source market in the world. As a

region with a comparatively small population,

Australasia punches well above its weight.

• Cruises in the Mediterranean rose in

popularity with global cruisers.

• Passengers preferred shorter cruise durations

with seven-day cruise itineraries up 9.0 per

cent and cruises of three days or less up 10 per

cent.

• Some 11.3 million cruise passengers travelled

to the Caribbean in 2018, up six per cent.

• Alaska has experienced double-digit growth

with a 13 per cent increase in 2018.

• When compared to the rapid increases of the

past, 2018 saw moderate cruise passenger

growth throughout Asia and China with a 5.0

per cent rise in cruise passengers from the

region.

2018

Global Ocean

Passengers

North America

49.9% – 14,240,000

Europe

25.1% – 7,170,000

Asia Pacic

20% – 5,701,000

South America

3.3% – 930,000

Other

1.7% – 476,000

BALTICS, NORTHERN EUROPE

WORLD, TRANSATLANTIC, EXPEDITION

ALASKA

ASIA

HAWAII, NORTH AMERICA

THE MEDITERRANEAN

THE CARIBBEAN

SOUTH PACIFIC

NEW ZEALAND

AUSTRALIA

PANAMA, CENTRAL & SOUTH AMERICA

AFRICA, MIDDLE EAST, OTHER

35k pax

74k pax

14k pax

467k pax

129k pax

8k pax

28k pax

22k pax

72k pax

37k pax

25k pax

434k pax

01

02

04

05

03

Who is cruising in Australasia?

DEMOGRAPHICS

The Australasia region continues to be an attractive cruise destination for inbound holidaymakers with around 200,000

international cruise visitors. In total, cruisers from more than 145 different countries visited the region.

In 2018, North America was the largest source of inbound cruise visitors (125,000), followed by Western Europe

(42,000). The growing source market of Asia (14,000) continues to deliver signicant cruise passengers to the region,

doubling in 2018.

Australian Passenger Origin

The strength of the Australian cruise market continues to stem from its appeal to a broad demographic and across all

age groups.

While NSW remained the biggest source of cruise passengers in 2018 and accounted for 53 per cent of all cruisers, this

was a two percentage point decrease on 2017, reecting the growth in the popularity of cruising across all states.

Queensland remained the second biggest contributor, increasing to 22 per cent of ocean cruise passengers.

NSW

QLD

VIC

WA

SA

TAS

ACT

NT

53%

22%

13%

5%

4%

1%

1%

<1%

AUSTRALIA

NORTH AMERICA

EUROPE/UK

ASIA

NEW ZEALAND

1m pax

125k pax

42k pax

14k pax

77k pax

Passenger Age

Australian cruise passengers continued to come from across the age spectrum, with an average age of 49 in 2018.

% by

Age

Range

2018

8%

8%

6%

6%

7%

8%

8%

8%

13%

13%

18%

18%

21%

21%

18%

17%

2017

<12 Years 13-19 20-29 30-39 40-49 50-59 60-69 > 70 years

Looking at the distribution of passenger age by cruise destination and duration, shorter itineraries in the South Pacic,

Caribbean and Australia appealed to younger cruisers, while middle-aged cruisers were more likely to be attracted to

New Zealand, Asia and the Mediterranean.

The average age increased to the 60s for passengers on longer cruises to Northern Europe, Alaska and Expedition

Destinations as well as on Transatlantic and world cruises.

Note: This report is based on 2018 calendar year passenger statistics provided by CLIA’s ocean Cruise Line members,

representing over 95 per cent of the global cruise industry capacity, plus additional data collected from non-CLIA Cruise

Lines. The research is based on a methodology that is used in similar studies around the world. The consistency of

approach facilitates comparisons with other major cruise markets. Data points below 2000 are not shown.

Cruise Lines International Association (CLIA) is the world’s largest cruise industry trade association, providing a unied

voice and leading authority of the global cruise community. CLIA supports policies and practices that foster a safe,

secure, healthy and sustainable cruise ship environment and is dedicated to promoting the cruise travel experience.

Economic, environmental and cultural sustainability is of the utmost importance to the cruise industry. We support local

economies not just by bringing guests and crew to their shores but by using local services and goods on our ships. We

sustain +1.1M jobs and US$134B in economic impact worldwide. Every day, the global cruise industry is hard at work

protecting the environment and strengthening local destinations through bold leadership, innovative stewardship, and

strong strategic partnerships. For more information about CLIA and the Cruise Industry visit www.cruising.org.au

% by

Duration

2018

2017

1-3 Days 4-6 Days 7 Days 8-13 Days 14 Days 15-20 Days 21+ Days

11%

12%

17%

15%

20%

18%

39%

42%

6%

6%

4%

5%

3%

3%

42

20.0

18.0

16.0

14.0

12.0

10.0

8.0

6.0

4.0

44 46

Pacic

Caribbean

Australia

NA West Coast

Hawaii

Eastern Med

Canada/New England

Expedition Destinations

Africa/Middle East/Other

Transatlantic/World Cruise

South America

China

Northern Europe

Baltics

Asia

Western Med

Central Med

Alaska

New Zealand

48 50 52 54 56 58 60 62 64 66 68 70

Avg. Length in Days

Avg. Age

Cruise Length

On average, Australians cruised for 8.8 days (down from 9.1 days in 2017). Cruises of 8-13 days remained the most

popular, accounting for 39 per cent of the market, though shorter cruises of up to seven days grew the strongest, up 10

per cent, reecting increased demand for shorter cruises.