Have We Got the Bottle?

Implementing a Deposit Refund

Scheme in the UK

A report for the Campaign to Protect Rural England

Authors:

Dominic Hogg

Debbie Fletcher

Tim Elliott

Maxine von Eye

September 2010

Eunomia Research and Consultancy

Eunomia is an environmental consultancy that supports positive change. Our clients, from

both government and the private sector, turn to us for policy development and analysis,

service design and review, technology and market assessment, regulatory compliance and

project management.

Policy Development

Our commitment to environmental issues dates back to well before these concerns were

prominent in the national political debate. Now as then, Eunomia seeks to lead the way in

policy formulation and implementation. We are able to marry perspectives from science,

economics, politics and social science to bring forward practical proposals with the

potential to deliver cost-effective benefits. We are recognised as leaders not only in

understanding the direction of waste and energy policy, but in determining its trajectory

through commissions for Defra, Department of Energy and Climate Change, Renewable

Fuels Agency and the Committee on Climate Change.

Local Government

Our technical skills, commercial experience and local government know-how mean our

clients turn to us when they want to achieve high recycling rates and high levels of resident

satisfaction as cost effectively as possible. In recent years we have worked with over 100

local authorities, supporting them with contract procurements, partnership development,

service efficiency reviews and service design.

Private

We act on behalf of a range of organisations operating in the waste and energy sectors,

including financial institutions, utilities, property companies and technology providers.

Eunomia is recognised as a leader in understanding the direction and trajectory of

environmental policy. We are therefore able to provide key insight to ensure that our clients

are one step ahead and can make key commercial decisions quickly and effectively.

Eunomia Research and Consulting Ltd

62 Queen Square

Bristol

BS1 4JZ

United Kingdom

Tel: +44 (0)117 945 0100

Fax: +44 (0)8717 142 942

www.eunomia.co.uk

ii

Campaign to Protect Rural England

The Campaign to Protect Rural England (CPRE) is a charity that campaigns for a sustainable

future for the English countryside, a vital but undervalued environmental, economic and

social asset to the nation.

We want a beautiful, tranquil and diverse countryside that everyone can value and enjoy. We

promote positive solutions for the long-term future of the countryside, ones which respect

the character of England’s natural and built landscapes.

We aim to:

• Influence land use in town and country for people and nature.

• Protect and enchance beauty, tranquillity and local distinctiveness.

• Increase and harness public and political support for the countryside.

CPRE’s Stop the Drop campaign is working to stop the blight of litter and fly-tipping on our

countryside, cities, waterways, towns and villages.

Campaign to Protect Rural England

128 Southwark Street

London

SE1 0SW

Tel: +44 (0)20 7981 2800

Fax: +44 (0)20 7981 2899

www.cpre.org.uk

Registered charity number: 1089685

CPRE is a company limited by guarantee, registered in England, number 4302973

© Campaign to Protect Rural England 2010

Disclaimer

Eunomia Research & Consulting has taken due care in the preparation of this report to ensure that

all facts and analysis presented are as accurate as possible within the scope of the project. However

no guarantee is provided in respect of the information presented, and Eunomia Research &

Consulting is not responsible for decisions or actions taken on the basis of the content of this report.

Acknowledgements

Our thanks to Canadean Ltd, TOMRA Systems ASA, Reverse Vending Corporation, Anker Andersen

A/S, Frank LeBlanc at the Department for the Environment in New Brunswick, REPANT ASA, Pasi

Nurminen at Palpa and Bryan Howell (HBH Business Solutions Inc.) for their inputs into the

discussion on costs associated with setting up a deposit refund system and for the provision of data

where requested.

3

Contents

1.0 Introduction and Background ...................................................................................5

1.1 What are Deposit Refund Schemes ...................................................................... 7

2.0 Deposit Refund Schemes in the UK .........................................................................7

2.1 Scotland ...................................................................................................................14

2.2 Summary View ........................................................................................................15

3.0 Economic Rationale for Deposit Refund Schemes............................................. 15

3.1 Summary View ........................................................................................................17

4.0 Possible Benefits of Deposit Refund Schemes ................................................... 18

4.1 Increasing Recycling ..............................................................................................18

4.2 Effects on Littering .................................................................................................24

4.3 Implications for Transport .....................................................................................31

4.4 Summary View ........................................................................................................32

5.0 Methodology for Cost Benefit Analysis ................................................................. 33

5.1 Summary of Existing Deposit Systems Worldwide ...........................................34

5.2 Mass Flows – Baseline and Scenarios ................................................................35

5.3 UK Deposit Refund System Model.......................................................................38

5.4 Cost Reduction in Existing Waste Collection Systems......................................46

5.5 Environmental Impacts..........................................................................................50

5.6 Cost Benefit Analysis..............................................................................................52

6.0 Results from Cost Benefit Analysis....................................................................... 54

6.1 Complementary System ........................................................................................54

6.2 Parallel System .......................................................................................................65

6.3 Sensitivities..............................................................................................................68

6.4 One-Off Costs...........................................................................................................78

6.5 Single Market Considerations...............................................................................79

6.6 Cross Border Issues – Private Trade in Alcohol bringing Non-Deposit

Containers into the UK .....................................................................................................82

7.0 Summary and Conclusions..................................................................................... 84

A.1.0 Review of Deposit Refund Systems................................................................... 92

A.2.0 Cost Benefit Analysis Model .............................................................................100

A.2.1 Materials to be Included in Deposit Refund System ..................................... 102

A.2.2 Baseline...............................................................................................................103

4

A.2.3 Scenarios.............................................................................................................113

A.3.0 The Deposit Refund System Model..................................................................119

A.3.1 The Deposit and Return Rates .........................................................................123

A.3.2 Handling, Collection, Logistics, and Processing............................................. 125

A.3.3 On-Going Costs for Central System..................................................................147

A.3.4 Material Revenues .............................................................................................149

A.3.5 Administration Fee.............................................................................................149

A.3.6 Set-Up Costs........................................................................................................150

A.4.0 Additional Cost Modelling .................................................................................154

A.5.0 Environmental Impacts .....................................................................................158

5

1.0 Introduction and Background

Eunomia Research & Consulting is pleased to present this report to the Campaign to

Protect Rural England (CPRE). The report investigates the environmental and

financial implications of the introduction of a UK-wide deposit refund system (DRS).

In April 2008, CPRE launched its Stop the Drop campaign against litter and fly-

tipping, with the twin aims of getting existing litter picked up and preventing further

litter being dropped. As part of the campaign it worked with Policy Exchange in 2009

to publish Litterbugs: How to deal with the problem of littering

1

, which detailed a

suite of proposals for addressing litter.

One of the key recommendations of that report was for the introduction of a

national deposit scheme, linked into broader waste and recycling policies, in light of

the research findings that deposit refund schemes (DRSs) significantly reduce litter

and help to promote virtuous cycles of behaviour.

Discussion regarding DRSs is often polarised between the views of ardent

supporters, and those of equally vehement opponents. The available theoretical

literature, however, suggests that such schemes are an efficient means of

increasing recycling rates and reducing litter, though a key issue in moving from

theory to practice is determining the costs of administering and implementing the

scheme.

A review of secondary literature, however, does not shed much further light on the

matter. In one such review, we recently concluded:

2

Views appear to be polarised regarding the costs of introducing such a

scheme, and few studies from the available literature would appear to enable

one to confidently assert that the approach incurs costs well above the

additional benefits which might be derived. There are, however, indications

that such schemes would need to be designed with great care to ensure costs

were aligned with the hoped-for benefits.

There is, therefore, a pressing need to understand what might be the costs and

benefits of introducing such a scheme, recognising that it would provide an efficient

means to increase recycling and reduce littering.

The aim of this report, therefore, is to investigate the costs and benefits of a UK-wide

DRS and advance the debate on the benefits and disadvantages of DRSs.

3

Through

bottom-up modelling, we sought to answer the following question:

1

Policy Exchange and CPRE (2009) Litterbugs: How to deal with the problem of littering, London:

Policy Exchange, 2009.

2

Eunomia et al. (2009) International Review of Waste Management Policy: Annexes to Main Report,

Report for Department of the Environment, Heritage and Local Government, Ireland, September

2009.

6

‘How do the benefits of introducing a UK-wide DRS for certain beverage

container packaging compare with the costs of implementation and

operation?’

The report is particularly timely given the devolved administrations active

commitment to achieving zero waste economies and the publication in May 2010 of

the Coalition’s Programme for Government, which states that:

“We will work towards a ‘zero waste’ economy, encourage councils to pay

people to recycle, and work to reduce littering”.

4

This report details how DRSs can offer the opportunity to reduce littering, to increase

recycling and consequently to increase the amount of waste that is diverted from

landfill and other residual waste treatment options. Individuals are able to return

their empty containers whilst ‘on the go’ and to subsequently recoup their deposit,

with the system thus encouraging them to deal with their waste in a responsible

manner. Hence the twin objectives of reducing littering and increasing recycling can

be met.

Significantly, this study uses logistics modelling to understand how the costs of

household waste collections change when the DRS is put in place. To our

knowledge, no study has carried out this work in a satisfactory manner. It is,

however, crucial for understanding the true costs (net of savings) of introducing a

DRS.

5

Furthermore, most existing studies only assume one scenario, where the existing

kerbside collection systems remain in place. This study examines the costs and

benefits associated with introducing a DRS in the UK under two scenarios. First, it

models a complementary system, which means beverage containers are no longer

collected at the kerbside. Second, it looks at a parallel system, where the household

kerbside systems for beverage containers target the same range of materials that

are covered by the DRS.

In addition, the report looks in considerable detail at the potential environmental

benefits associated with the increase in material collection, above existing systems,

as well as the potential savings derived from removing deposit-bearing litter from

the environment. It also seeks to understand the associated negative effects – the

disamenity - of litter, though the literature here is somewhat lacking and highlights a

clear need for further research.

3

We note that this research was undertaken by the consultants on the understanding that the results

may not be favourable. The aim was always to be as objective as possible, despite the orientation of

CPRE. CPRE was also aware that the results might not support its views.

4

HM Government (2010) The Coalition: Our Programme for Government, available at

http://www.cabinetoffice.gov.uk/media/409088/pfg_coalition.pdf

5

The closest any study comes to doing this adequately is a study by BDA Group in Australia. The

study most often cited by opponents of deposit schemes is one by BIO Intelligence Service, which

includes no serious attempt to model the change in the cost of the kerbside collection logistics.

7

1.1 What are Deposit Refund Schemes

DRSs have been defined as follows:

“A deposit-refund system is the surcharge on the price of potentially polluting

products. When pollution is avoided by returning the products or their

residuals, a refund of the surcharge is granted.” OECD, Glossary of Statistical

Terms.

6

A DRS encourages the return of the materials into an organised reuse, recycling or

treatment / disposal process. The producers typically finance the process through

the payment of an administration fee on each container. Drinks containers are the

most common target of DRSs, though economic theory suggests the schemes could

be applicable to hazardous materials and other waste streams, subject to

transaction costs being minimised. The systems can encourage recycling and / or

reuse where otherwise it is easy to dispose of containers with the residual waste or

for them to be discarded as litter. The same policy mechanism can also be used to

target difficult to dispose of, or hazardous, items to ensure that these do not reach

the residual waste stream. This can be considered a waste prevention policy as it

reduces the hazardousness of materials in the waste stream.

Non-drinks container examples include:

¾ Batteries (Swedish Östhammar example) and car batteries (Germany);

7

and

¾ Tyres (Maine, USA).

Finally, some countries, such as Sweden, make use of vehicle scrapping charges,

which discourages the dumping of vehicle bodies in rural areas and ensures that

cars are returned to registered scrapping destinations at the end of their life.

8

Appendix A.1.0 details a number of countries and states which have made use of

deposit schemes.

2.0 Deposit Refund Schemes in the UK

Some readers will be old enough to remember that in the 1970’s, in the UK, one

often paid a deposit on bottles of fizzy drinks and beer. When the drink was finished,

one would return empty bottles to the store, or even have them collected from the

front door as part of the milkman service, in order to retrieve the deposit. The

system led to high return rates for glass bottles, which were typically washed for

refilling. The bottles were designed for re-use many times over.

Since the broad demise of these schemes in the UK (though they are still applied in

some notable cases, for example the A. G. Barr scheme in Scotland), there have

been various studies which have looked at the use of deposit refunds here.

6

http://stats.oecd.org/glossary/detail.asp?ID=594

7

http://www.eeb.org/activities/waste/EEB-mini-brief-deposit-schemes-for-Batteries-March2004.pdf

8

The (sometimes temporary) scrapping charges which have become popular across nations in the

context of the current economic decline have their precedent in the more permanent schemes which

some countries employ to ensure that end-of-life vehicles are returned to an appropriate recycler.

8

This Chapter critically reviews the way in which previous Governments have

appraised the potential for using DRSs in the UK. It highlights the fact that particular

views have been formed, even in the absence of the evidence which would be

required to enable one to develop such views on an objective basis.

One of the initial review studies was undertaken by ERL (now ERM) in 1992.

9

The

study’s remit was to look at the general applicability of economic instruments in the

field of waste management. Deposit refunds scored poorly in that they were not

considered applicable to the bulk of waste being managed.

In the second half of the 1990s, the UK introduced its own mechanism for seeking

to ensure compliance with the obligations placed upon EU Member States through

the Packaging Directive. The mechanism which eventually emerged, following a

protracted gestation, was based upon tradable ‘compliance notes’, though opinion is

somewhat divided as to whether the tradability of these compliance notes – the

Packaging Recovery Notes (PRNs) and the Packaging Export Recovery Note (PERNs)

- was intended at the initial design stage.

10

Since 1997, the existing system – which leads to periodic setting of new targets,

associated fluctuations in the value of the PRNs and PERNs in line with the relative

tightness of their supply relative to their demand, and periodic anxiety regarding

whether and if targets might be met - has been the focus of policy-related activity in

the UK. This is despite the fact that the system has a number of shortcomings.

Perhaps the most notable of these is that the bulk of the cost of compliance does

not fall upon those whom it should most obviously fall i.e. the producers and

consumers of ‘packaged’ products. Instead, taxpayers shoulder much of the burden

of compliance, so that there is no relationship between packaging consumption and

the contribution made to meeting the costs of compliance. There are obvious

alternatives which would readily rectify the situation, such as taking the means of

financing compliance outside the tax system and placing it upon consumption, so

effectively aligning the system with the well-established polluter-pays principle.

11

Notwithstanding the continuation of the existing policy (albeit with periodic

revisions), there have been a number of occasions where alternatives were closely

9

ERL (1992) Economic Instruments and Recovery of Resources from Wastes. HMSO, London

Environmental Resources Management (then ERL).

10

One of the authors of this report was involved in work for what was then the Department for the

Environment, Transport and the Regions (DETR) to explore the nature of the changes which might

usefully be made to capitalise on the de facto tradability of PRNs and PERNs (see ECOTEC (1998)

Packaging Regulations: gathering Evidence on PRNs and the Impact of the regulations on Local

Authority recycling, Final Report to DETR, June 1998), the point being that the scheme did not

obviously exhibit some of the fundamental prerequisites which might be expected of a rational

scheme of tradable ‘evidence’.

11

As discussed below, the Packaging Strategy claims that an independent group reviewed

alternatives and effectively determined that ‘variations’ on the existing scheme were superior. As we

discuss below, we have not been able to find the evidence referred to in the Packaging Strategy.

9

considered. In the Strategy Unit’s review of waste strategy in 2002, it was suggested

that:

12

Action is needed in the following five areas to put the right long term

economic and regulatory framework in place: […]

[…] new measures to encourage reuse, such as deposit-refund schemes and

designing civic amenity sites for re-use;

The document included a number of recommendations, one of which was as follows:

Recommendation 3: Defra and WRAP should consider the options for

increasing incentives for the re-use of goods. More work is needed to assess

the preferred means for different products and to establish where the impact

on the waste stream would be greatest.

Defra responded to the Strategy Unit’s recommendations in 2003. It noted, in

response to the recommendation regarding re-use:

13

The Strategy Unit has suggested deposit refund schemes as one way of

encouraging individuals to participate actively in reuse and recycling. Defra is

commissioning a joint study, with other interested departments, to update

previous work on the benefits and costs of such schemes with a view to

identifying the contribution they could make to increased reuse and recycling.

The study that was subsequently commissioned was undertaken by Oakdene Hollins

in 2004.

14

The findings of this study were somewhat divided, according to what the

DRS was trying to achieve. The study noted that using DRS as an effective

instrument for promoting re-use in the UK would probably not deliver the required

payback, given that the majority of packaging is already one-way in the UK, and

hence there would be significant expense associated with setting up the refillables

processing infrastructure, and producers would be likely to continue using one-way

packaging anyway.

However, on the positive side, the study reported that introduction of a DRS in the

UK on one-way packaging would generate an increase in recycling and a reduction in

litter, and that, based on their approach of calculating the expected costs associated

with achieving recycling targets using the existing policy mix, introducing a DRS was

found to generate a surplus for every option. The study noted that the overall costs

of running such a system would be highly dependent on the return rate of

containers, and that the ‘unclaimed’ deposits were the principle cause of the overall

surplus. Final positive notes from the study included the following:

12

Strategy Unit (2002) Waste Not, Want Not: A Strategy for Tackling the Waste Problem in England,

December 2002.

13

Defra (2003) Government Response to Strategy Unit Report ‘Waste Not, Want Not’, HMSO:

February 2003.

14

Oakdene Hollins (2004) Deposit Return Systems for Packaging: Applying International Experience

to the UK, report prepared for Defra, December 2004

10

A DRS targeted on light-weight containers, cans and plastic bottles, would

integrate well with the existing policy mix that provides incentives for Local

Authorities to collect heavy and/or biodegradable wastes.

Establishing a new social habit of returning containers to redeem deposits

may create a platform on which other more sustainable patterns of

consumption could be built in the future.

This study was subjected to a Peer Review by Perchards. This review made some

legitimate comments of a critical nature regarding the report. It picked apart the

distinction between European and US-type systems, and made cogent remarks

about the operations of DRSs for refillables. At the same time, it made some critical

remarks which seem slightly unfair towards the study, notably around the authors’

views regarding the effects of a DRS on the PRN market.

In conclusion, the authors noted:

15

We conclude that the report does not meet the project specification. We

cannot see how it could be used to aid policy formulation unless it was

completely rewritten.

This is a strong recommendation, and one which seems somewhat uncharitable. The

Peer Review report itself is not without flaws, some of them amounting to basic

misunderstandings. It is usually the nature of a peer review to seek to improve the

quality of a report in progress rather than to completely cast it aside. On the Oakene

Hollins recommendation that a DRS be applied to selected non-refillable beverage

containers, they state:

the information provided in the report to support this conclusion is muddled

and disjointed. Although they have recommended this option, the report

lacks a thorough discussion of how such a DRS might be structured, how it

would operate, and how it would be funded. We challenge the proposal that it

should be funded by unredeemed deposits since this would create an

economic incentive to the operators not to achieve a high return rate.

The latter comment is instructive given that elsewhere, the peer reviewers suggest

that at the specified level of deposit, the return rate proposed by Oakdene Hollins

might be too high. It is inconsistent to suggest on the one hand that the suggested

return rate is too high, yet on the other to criticise the consultants for suggesting

that a DRS might be funded through unclaimed deposits. As we highlight in the work

below, the likelihood that system costs are covered by the revenue from unclaimed

deposits becomes high at the low return rates which Perchards seem to suggest

should be used at the consultants’ proposed level of deposit.

A more recent review was carried out by ERM.

16

Although this later study does not

fully reference the Oakdene Hollins work undertaken following the Strategy Unit

review, it states, in describing the background to the project, that:

15

Perchards (2005) Deposit Return Systems for Packaging Applying International Experience to the

UK, Peer Review of a Study by Oakdene Hollins Ltd., Report to Defra 14 March 2005.

11

Defra commissioned a report on deposit schemes in 2004. Its basic findings

suggested that a deposit system would be problematic. However, there has

been renewed interest in the possible use of deposit systems and the use of

reverse vending as a collection method for beverage containers.

There is no indication as to why the previous study found DRSs to be ‘problematic’.

In passing, we note that the ERM study continued:

17

In particular, the Campaign to Protect Rural England (CPRE) supports the

introduction of a deposit system as a means to reduce litter. CPRE has

recently launched a campaign with this aim in mind.

The ERM study set out to answer a series of questions. The approach to providing

answers to these was based largely upon gathering opinion from organisations

involved in the packaging chain (see Jane Kennedy’s written statement in May

2009, quoted later in this section). There was no attempt to understand the cost

implications of the introduction of such a scheme, nor any serious attempt to

quantify potential benefits. These were considered outside the study’s scope.

Consequently, the evidence required in order to answer a number of key questions

was never provided. Somewhat surprisingly, this did not stop the authors from

offering answers to these questions, even in the absence of the necessary evidence

to support them. Furthermore, these unsubstantiated views were taken forward in

the subsequent Government thinking of the time.

ERM made the following closing comment in their study:

It is not disputed that a deposit scheme would increase recycling, but

alternative schemes could achieve the same or better results at a lower cost.

This is not demonstrated in their work, and as such can only be regarded as

speculation. The study includes no figures relating to the costs of intensifying

kerbside collection systems relative to the costs of implementing a DRS. It also

reaches the view that deposit schemes do usually achieve higher recycling rates

than other schemes, so the final comment regarding the achievement of ‘the same

or better results’ actually contradicts views expressed elsewhere in the report.

The closest the study comes to providing evidence in respect of costs is a single

paragraph containing no figures:

Providing financial support for the expansion of council collection schemes

offers a relatively cost-effective means of continuing the trend of improving

rates. Furthermore, the investment would cover a much wider range of

materials – not only certain beverage containers, but other items of

packaging, and non-packaging materials as well.

Notwithstanding the absence of evidence, the same message is restated in Defra’s

Packaging Strategy of 2009:

18

16

ERM (2008) Review of Packaging Deposits System for the UK, Final Report to Defra, December

2008.

17

ERM (2008) Review of Packaging Deposits System for the UK, Final Report to Defra, December

2008.

12

In July 2008, Defra commissioned consultants ERM to study the feasibility of

setting up a deposit scheme for drinks containers in the UK. The study

examined whether deposit schemes were likely to increase recycling and to

reduce litter. It considered the role of reverse vending, the possible impact of

deposits on existing collection systems, the issues that would need to be

considered in setting up a deposit system, and possible alternatives to

deposits. It looked at the experience of deposits in four countries – Denmark,

Germany, the Netherlands and Sweden – to draw lessons for a possible UK

scheme. The study concluded that deposit systems are likely to increase

recycling but that other measures may achieve the same goals more cheaply.

An effective deposit and return scheme could divert materials from existing

arrangements such as bottle banks or kerbside collections, which have been

developed, for the most part, with public funding.

Under a different take-back model, retailers could introduce their own bring

banks for a wide range of packaging materials. Tesco and Sainsbury’s have

both trialed this in various formats. On the positive side, this could be seen as

the logical extension of producer responsibility, relieving local authorities of

their duty to collect packaging waste. On the negative side, the ability to

provide this infrastructure is limited by space, and accessibility for

householders is likely to be an issue. Also, this would deprive local authorities

of a source of revenue by taking valuable recyclates away. Were this system

to replace local authority collections, it is likely that the amount of packaging

collected for recycling would drop, as the effort of getting the recyclates to

the collection points would be more onerous for the public than kerbside

collections.

Yet another model would be for retailers and manufacturers to complement

local authority provisions by setting up bring banks for items that may not

otherwise be widely collected by local authorities. This has been done by the

carton industry body ACE UK (Alliance for Beverage Cartons and the

Environment) to ensure that cartons, such as those made by Tetra Pak are

widely collected across the UK. Deposit and bring systems which involve

human interaction tend to result in high quality materials. The design of

unsupervised bring banks makes a significant difference to their use and

contamination.

Unless take-back provisions are made mandatory, and cover the range of

materials which is currently being collected by local authorities, local

authority collections would need to continue in parallel. Overall, the operation

of two parallel systems is likely to increase costs to consumers and

taxpayers, with uncertain results on the quantities collected.

Some of this is based on supposition, whilst other statements present only half the

picture. The statements to the effect that local authorities would lose a source of

revenue, and that the operation of two parallel systems would likely increase costs,

are both statements which reflect only part of the overall picture. They make no

18

Defra (2009) Making the Most of Packaging: A Strategy for a Low-carbon Economy, June 2009

13

reference to the possible savings on logistics, and on sorting of local authority

collected materials, which would occur if a deposit scheme was introduced. They

also fail to take into account any additional benefits the scheme could provide.

The Packaging Strategy discussed deposit schemes as an alternative means to fund

packaging recycling. It noted:

In the second half of 2008, the independent Packaging Recycling Action

Group (PRAG) set up a working group to look at funding mechanisms. It

compared variations on the last three options above [ie. including deposit

refunds] against a set of criteria including, among other things, the likely

effectiveness of each option in terms of increasing quality and quantity, value

for money, ease of implementation and visibility to consumers and local

authorities. Variations on the current system consistently scored higher than

the alternatives.

There is no report arising from the PRAG working group referenced in the Packaging

Strategy. We have not been able to track down any document which arrived at this

view, and indeed, our attempts to do so suggest that the view attributed to the PRAG

– that variations on the current system offered the best way forward – does not

accurately represent the views expressed by the PRAG.

A briefing from the Industry Council for Packaging and the Environment (INCPEN)

may be referencing the same group when it states:

19

A group advising the UK government concluded recently that a deposit

system could cost between £1 billion and £7 billion to establish, depending

on how the system was set up.

The basis for this estimate is not made clear, and again, there is no study

referenced. The breadth of the range in the cost estimate suggests that the analysis

was a cursory one.

Similar lines have been taken by Ministers in Written Answers to Parliamentary

Questions. The then Environment Minister responded as follows to a written

question on 13 May 2009:

20

Mr. Drew: To ask the Secretary of State for Environment, Food and Rural

Affairs (1) what steps he has considered to increase levels of plastic and

glass bottle recycling; if he will bring forward proposals to promote bottle

return schemes in shops; and if he will make a statement; [273465]

(2) what measures he has considered to increase levels of plastic and glass

bottle recycling; what consideration he has given to tax incentives for (a)

companies who recycle, (b) companies who do not and (c) the promotion of

bottle return schemes in shops; and if he will make a statement. [273380]

19

Incpen (2008) Mandatory Deposits on Packaging, May 2008.

20

Written Answers to Questions, Wednesday 13 May 2009 Column 757W

http://www.publications.parliament.uk/pa/cm200809/cmhansrd/cm090513/text/90513w0001.ht

m#09051353000016

14

Jane Kennedy: […] In December 2008 DEFRA published a report into

packaging deposit systems and the role they might play in increasing

recovery and recycling of single use drink containers (plastic, aluminium and

glass) in the UK. The report was completed in consultation with a range of

industry stakeholders and reviewed deposit systems in four other EU member

states to assess the implications of introducing such a system in the UK.

The report concluded that while deposit schemes would increase recycling,

alternative schemes could achieve the same or better results at a lower cost,

as the relative cost of introducing a deposit scheme system was high. For

example, the deposit scheme operating in Germany costs three times as

much per container as a household collection system.

However, the Government are keeping an open mind in regard to deposit

schemes and ‘reverse vending’, where vending machines take used bottles

and cans for recycling and usually give a reward such as supermarket loyalty

points or vouchers. A number of reverse vending systems are being set up by

major retailers and the performance of these systems is being monitored.

It is not possible to speak about what is or is not ‘relatively cost effective’ without

knowing what the relative costs are. We have seen no information from any study

which would suggest that work to understand the relative costs has actually been

undertaken.

2.1 Scotland

The Climate Change (Scotland) Bill contains powers to introduce deposit and return

schemes in Scotland. In a consultation on legislative measures to implement a zero

waste policy, the Scottish Government recommended this in 2008.

21

However, this recommendation was diluted by the time of the consultation on the

Zero Waste Plan:

22

As outlined throughout the draft Plan, the Government, working with

partners, is already taking steps to improve recycling facilities across

Scotland and plans to take further steps.

For example, section 3.6 of the draft Plan notes that the Scottish Government

is convening a round table to consider what more could be done to establish

recycling zones in public places right across Scotland. If voluntary measures

to increase recycling should not succeed, then the Scottish Government

would consider if the regulatory route should be followed.

In the final version of the plan, there is no mention of DRSs, though there is mention

of a study to review options for ‘extended producer responsibility and “take-back”

schemes in Scotland.’

23

21

Scottish Government (2008) Consultation on Legislative Measures to Implement Zero Waste, July

2008, http://www.scotland.gov.uk/Resource/Doc/1056/0063943.pdf

22

Scottish Government (2009) Scotland’s Zero Waste Plan: Consultation, Annex N - Packaging,

August 2009, http://www.scotland.gov.uk/Resource/Doc/282143/0085295.pdf

15

2.2 Summary View

The apparently established line that alternatives to deposit refunds could achieve

the same or better results at lower cost than a deposit scheme remains to be clearly

demonstrated. Although it is suggested, in the previous Minister’s response, that the

past Government retained an open mind on this matter, the ease with which its

mind seems to have been closed contrasts with this avowed openness. The view of

ERM, and the opinions subsequently expressed by Defra and its Ministers, appears

to lack any firm basis.

There is a clear need for some objective assessment of what the relative costs, and

benefits might be for DRSs. This study is intended to fill this gap with regard to the

UK.

3.0 Economic Rationale for Deposit Refund

Schemes

DRSs are a particular form of product tax/recycling subsidy. In such programmes,

also known as ‘bottle bill’ programmes, consumers pay a deposit (tax) on a

container at the time of purchase. This should, in theory, be set at the extra social

cost of improper disposal over the net recycling cost (assuming there is already an

Advance Disposal Fee (ADF) on the manufacturer equal to the net recycling cost).

This means that if the product is improperly disposed of, that individual pays the

external cost of improper disposal by foregoing the refund, which would typically be

set equal to the initial deposit. As with many environmental policy instruments, the

theory is somewhat simpler than the practice. As we discuss later in the report, for

example, the basis for valuing the social cost of improper disposal is not as strong

as one would like.

The distinction between DRSs on the one hand, and ADFs coupled with a household

recycling refund on the other, is in the re-collection of the product at the end of its

useful life. Deposit schemes generally involve a separate collection path, rather than

being collected as part of the municipal recycling system.

Several theoretical studies have argued that a deposit/refund is the best policy in

the presence of illegal disposal.

24

Palmer et al modelled paper, glass, plastic,

aluminium, and steel. They found a substantial difference in the intervention levels

necessary to achieve reductions in disposal with the various policies. A $45/ton

deposit /refund would reduce all wastes by 10%. Alternatively, the government

23

Scottish Government (2010) Scotland’s Zero Waste Plan, June 2010,

http://www.scotland.gov.uk/Resource/Doc/314168/0099749.pdf

24

T. Dinan (1993) Economic Efficiency Effects of Alternative Policies for Reducing Waste Disposal,

Journal of Environmental Economics and Management 25: 242–56; D. Fullerton and T. C. Kinnemann

(1995), Garbage Recycling and Illicit Burning or Dumping, Journal of Environmental Economics and

Management, 29 (1); Peter S. Menell (1990) Beyond the Throwaway Society: An Incentive Approach

to Regulating Municipal Solid Waste, Ecology Law Quarterly, vol. 17, pp. 655-739; Hilary Sigman

(1995) A Comparison of Public Policies for Lead Recycling, RAND Journal of Economics, vol. 26, no. 3

(Autumn), pp. 452-478.

16

could obtain a comparable reduction using an ADF of $85/ton or a recycling subsidy

of $98/ton.

A key point is that the deposit/refund creates incentives for both recycling and

source reduction, whereas an ADF or a recycling subsidy takes advantage of only

recycling or source reduction in isolation.

25

However, it is important to note that the

theoretical studies, in abstracting from the real world situation, have not taken into

account all the potential costs of administering such schemes. In fact they are not

precisely modelling existing ‘bottle bill’ programmes, but rather a more generalised

version of deposits and refunds, applied ‘upstream’ on manufacturers and recyclers.

In a further study, Palmer and Walls accept that in practice there could be

significant administrative costs associated with refunding deposits, which could

reduce the efficiency of the approach.

26

This issue is discussed by Palmer et al with

numerical estimates of the effects of administrative costs on the overall efficiency of

deposit refunds relative to product taxes and recycling subsidies.

27

Viewing their

results alongside empirical evidence from Ackerman et al., they suggest that

administrative costs may be of the same order as the cost savings from using a

deposit/refund.

28

Due to such considerations, Palmer et al., Fullerton and

Kinnaman, and Palmer and Walls all argue that deposit refunds should be imposed

upstream on producers rather than on final consumers to minimise administration

and transaction costs.

29

Most theoretical studies recommend DRSs as economically efficient mechanisms to

increase rates of recycling.

30

This includes UK-based reviews, such as that

undertaken by Turner et al (1996) which stated:

31

25

K. Palmer, H. Sigman and M. Walls (1997) The Cost of Reducing Municipal Solid Waste, Journal of

Environmental Economics and Management 33, 128-50.

26

Palmer and Walls (1997) Optimal Policies for Solid Waste Disposal Taxes, Subsidies and

Standards. Journal of Public Economics 65(8): 193-205.

27

K. Palmer, H. Sigman and M. Walls (1997) The Cost of Reducing Municipal Solid Waste, Journal of

Environmental Economics and Management 33, 128-50.

28

Frank Ackerman, Dmitri Cavander, John Stutz, and Brian Zuckerman (1995) Preliminary Analysis:

The Costs and Benefits of Bottle Bills, Draft report to U.S. EPA/Office of Solid Waste and Emergency

Response, Boston, Mass.: Tellus Institute.

29

D. Fullerton and T. C. Kinnemann (1995), Garbage Recycling and Illicit Burning or Dumping, Journal

of Environmental Economics and Management, 29 (1); Palmer et al (1997); Palmer and Walls

(1997).

30

See, for example, Dinan, T.M. (1993) Economic Efficiency Effects of Alternative Policies for

Reducing Waste Disposal, Journal of Environmental Economics and Management, 25: 242-256.;

Fullerton, D. and Kinnaman, T. (1995) Garbage, Recycling and Illicit Burning or Dumping, Journal of

Environment Economics and Management, 29: 78-91; Pearce, D.W. and R.K. Turner (1993) Market-

based approaches to solid waste management, Resources, Conservation and Recycling 8: 63-90.

Porter, R.C. (1978) A Social Benefit Cost Analysis of Mandatory Deposits on Beverage Containers,

Journal of Environmental Economics and Management, 5: 351-375. Sigman, H. (1995) A Comparison

of Public Policies for Lead Recycling, Rand Journal of Economics 26: 452-478; Thomas Skinner and

Don Fullerton (1999), The Economics of Residential Solid Waste Management, NBER Working Paper

7326 http://www.nber.org/papers/w7326

; K. Palmer and M. Walls (1999) Extended Product

Responsibility: An Economic Assessment of Alternative Policies, Discussion Paper 99-12, January

17

The environmental economics literature has analysed the relative merits, in

economic efficiency terms, of a number of economic instruments and

regulatory approaches to the solid waste disposal and recycling balance issue

(Dinan, 1993; Fullerton and Kinnaman, 1995; Sigman, 1995). The general

finding was that policies focusing only on input use or on waste outputs

cannot generate the optimal (economically efficient) balance between

recycling, disposal and production output. Thus recycling subsidies directed at

input use cannot generate the efficient amount of waste disposal unless

coupled with a tax or subsidy on consumption. Primary product taxes need to

be coupled with both an output tax and a tax on other production inputs to be

economically efficient. A regulatory measure such as a recycling content

standard also cannot generate the efficient level of output and waste disposal

unless it is augmented by taxes on other inputs to production, together with

either a tax or a subsidy on the final product. Acquiring the detailed firm-

specific information necessary in order to set the efficient levels of taxes and

standard is clearly not a practicable proposition for public policy makers.

This same body of analysis finds that the deposit-refund instrument (in which

the product tax and the refund are equal to the marginal social cost of waste

disposal) is an efficient mechanism and is equivalent to taxing disposal (for

nonreturners) but without the attendant illegal disposal problems. The

efficiency advantage of the deposit-refund instrument will in practice be

reduced the higher the administration and consumer inconvenience costs

involved. (Porter, 1978; Pearce and Turner, 1993). […]

The waste management policy area is one in which a greater use of economic

instruments does seem warranted. The combination of landfill tax and

recycling credits to be introduced in the UK is in a rough and ready way a step

in this direction. This policy reorientation is however only partial and

efficiency gains still remain untapped, given the fact that the landfill tax does

not reflect the full social costs of waste disposal in the UK. Economic analysis

finds the deposit refund instrument to be highly rated in economic efficiency

terms and also has applications in some hazardous waste problems.

The theoretical case in favour of deposit refunds appears, therefore, to be quite

compelling.

3.1 Summary View

One could be forgiven for being surprised – given the generally supportive view in

respect of the theoretical literature – that deposit schemes are not more widely

applied than they already are. However, the theoretical studies tend to be

considered abstract from reality, in that they do not fully consider the costs of

1999, Washington DC: Resources for the Future; Don Fullerton and Amy Raub (2003) Economic

Analysis of Solid Waste Management Policies, in OECD (2004) Addressing the Economics of Waste,

Paris: OECD.

31

R. Kerry Turner, J. Powell, A. Craighill (1996) Green Taxes, Waste Management And Political

Economy, CSERGE Working Paper WM 96-03.

18

administering such schemes in real terms. Once again, this highlights the need for

studies which consider the range of possible costs and benefits which may be

associated with DRSs.

4.0 Possible Benefits of Deposit Refund

Schemes

DRSs are reported, in the literature, to have a range of possible environmental

benefits. The key ones mentioned in the literature are:

1. Increasing the recycling of containers covered by deposits (for refill or

recycling);

2. Reducing the extent of littering;

3. Increasing the use of / reducing the extent of decline in the use of refillables;

and

4. Avoiding harmful chemicals being mobilised in the environment (usually not

in beverage schemes, eg. lead acid batteries, or pesticides).

In addition, there are likely to be some effects on the efficiency of logistics with

regard to both kerbside collections and the DRSs. Significantly, this study uses

logistics modelling to understand how the costs of household waste collections

change when the DRS is put in place, as well as to establish the key drivers in terms

of the logistics costs of the DRS itself. To our knowledge, no study has carried out

this work in a satisfactory manner.

In the discussion that follows, we consider the literature in respect of the first two

issues. The third, regarding refillables, is not a key aspect of the scheme we propose

(see below).

32

The fourth does not obviously apply to packaging, though there is

some evidence to suggest that the effects of packaging on the marine environment

do indeed give rise to such concerns (touched upon below in the consideration of

effects on littering).

4.1 Increasing Recycling

Ideally, one has some indication of ‘before’ and ‘after’ performance, controlling for

other variables. To some extent, this is made difficult by the absence of usable data.

Surprisingly few studies actually take this approach.

Some data allows for comparison of performance in areas with and without

deposits. In the US, in 1999, the recycling performance of states with and without

deposits in place is shown in

Figure 4-1. The recycling rates, and the number of

containers recovered per capita, were far higher in the deposit states. However, this

could simply be evidence of the absence of adequate collection infrastructure in the

no-deposit states, so it cannot be considered as robust evidence.

32

For a discussion regarding the refillables issue, see Eunomia et al. (2009) International Review of

Waste Management Policy: Annexes to Main Report, Report for Department of the Environment,

Heritage and Local Government, Ireland, September 2009.

19

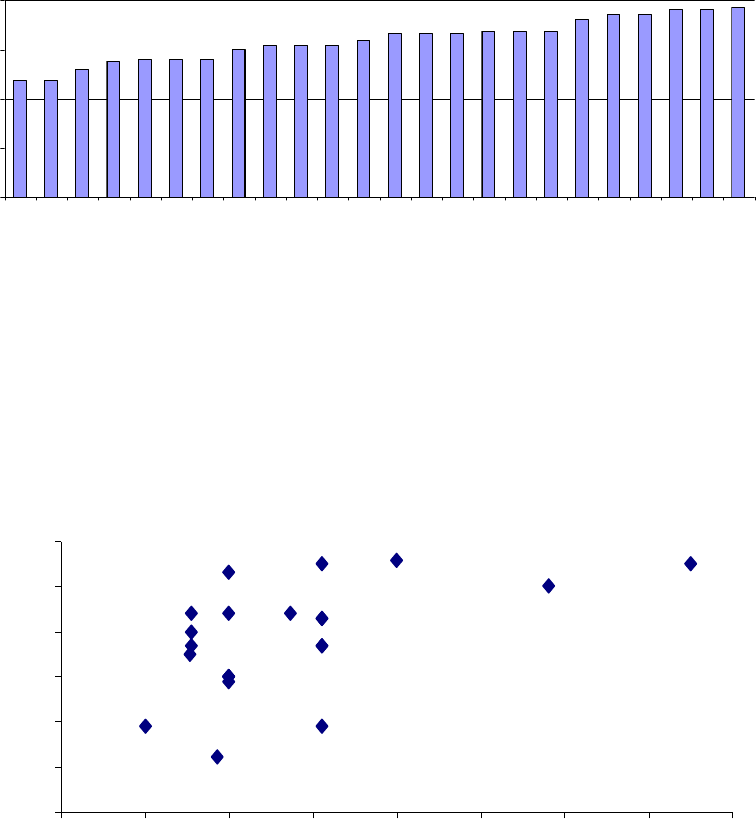

Figure 4-1: Performance of US States With and Without Deposits, 1999

Recycling rate (%) and per capita containers

recovered in the US (1999)

72

28

490

191

Deposit states (10) Non-deposit states (40)

Recycling rate Containers per capita recovered

Of some interest is the performance of deposit schemes in the context of wider

recycling systems. In Sweden, for example, the recycling rate for all plastic

packaging increased from 17% to 30% between 2003 and 2005 (44% in 2006). In

the same period, recycling rates for Polyethylene terephthalate (PET) plastics under

the deposit scheme were 77% to 82% (85% in 2007).

Once again, this, in and of itself, might not prove much. The components of plastic

packaging are many and varied, and PET bottles are readily recyclable. Perhaps

more telling, however, is the performance in respect of metals. Recycling rates for

all metal packaging were around 65% in 2004-2005, but the recycling rate for

aluminium under the DRS was 85% to 86% in the years 2002 to 2007. The return

rate for glass bottles is 99% on 33cl bottles and 90% on 50cl bottles.

33

In Denmark,

return rates in 2007 were 84% for cans, 93% for plastic bottles and 91% for glass

bottles.

34

Similarly, in Germany, recycling rates in 2005 were 50%, 85%, 76% and 79% for

plastics, tinplate, aluminium and glass respectively. The reported return rates under

the deposit scheme are 95-99%.

35,36

Figure 4-2 shows collection rates achieved in 2002 by international deposit

schemes. This shows that very few countries see low rates of return, with some

jurisdictions achieving close to 100% return rates. As would be expected under

economic theory, deposit scheme return rates increase as the deposit increases,

33

http://www.sverigesbryggerier.se/eng/1-emballage/1-index.html, accessed January 2009.

34

ERM (2008) Review of Packaging Deposit Systems for the UK, Report for DEFRA, December 2008,

accessed from http://randd.defra.gov.uk/Document.aspx?Document=WR1203_7722_FRP.pdf

35

Wolfgang Ringel (2008) The German Deposit System on One Way Beverage Packaging,

Presentation to the first Global Deposit Summit, Berlin 2008.

36

Data from the DPG (Deutsche Pfandsystem GmbH (System Operator)) in March 2010 puts

the 2009/10 return rate for PET bottles at 98.5%.

20

with higher deposits leading to an enhanced incentive (see Figure 4-3). Figures for

Denmark are shown in Figure 4-4.

Figure 4-2: Collection Rates for Non-refillable Containers in Deposit Systems, 2002

Note: Figures based on data collected from system operators, data from 2002

Source: Wolfgang Ringel (2008) Introduction on Deposit Refund Systems, Scottish Government Litter

Summit, Edinburgh 26

th

November 2008.

Figure 4-3: Relationship Between Level of Deposit and Return Rate

40

50

60

70

80

90

100

0,0 2,0 4,0 6,0 8,0 10,0 12,0 14,0 16,0

Deposit (€ cents per container)

Collection rate (% )

Source: System operators, Container Recycling Institute, Data from 1997-2002

Collection rate in deposit systems for non-refillable containers (%)

59 59

65

69

70 70 70

75

77 77 77

80

83 83 83

84 84 84

90

93 93

95 95

96

0

25

50

75

100

California

Prin ce

E

dward

New

F

oun

dland

Massachusetts

Connec

ti

cut

Maine

New Yo rk

S

ou

th A

ustr

alia

N

ew

Brunswick

On

tar

i

o

Quebec

A

lber

ta

D

enm

ark

Nova Scotia

Saska

tc

hewan

B

r

i

t

i

sh Columb

i

a

Oregon

Swed

en

Vermon t

Iowa

N

or

way

Finland

M

anitoba

Michigan

21

Figure 4-4: Return Percentages of One Way & Refillable Beverages in Denmark

Source: Christian Fischer (2008) Producer Responsibility Schemes Versus Deposits and Taxes- Danish

Experiences, PRO Europe Congress, 15 May 2008

Taiwan differs from the European context, as the deposit refund scheme started

without any other producer responsibility systems in place. The scheme therefore

acted in isolation to increase recycling, first of PET and later with a number of other

materials. Taiwan now claims a 100% PET recycling rate, using its DRS.

Some have suggested that it is not the case that recycling rates are higher under

deposit schemes. However, those who suggest this usually do so on the basis of

reviewing recycling rates for all packaging. For example, the European Organisation

for Packaging and the Environment (EUROPEN) argues:

37

There are no compensating benefits with regard to an overall improvement in

recycling performance. The Perchards report showed that overall recycling

rates in Member States with deposit systems are not higher than those of

comparable EU countries where there are no special arrangements for

beverage containers.

Deposits, however, do not apply to all packaging. The Perchards report itself

states:

38

It is certainly true that deposit systems for non-refillable beverage containers

can achieve higher recycling rates for the beverage containers affected than

when these containers are handled through general recycling systems.

However European experience shows that deposit systems do not achieve a

37

EUROPEN (2007) Economic Instruments in Packaging and Packaging Waste Policy, Brussels:

EUROPEN.

38

G. Bevington (2008) A Deposit and Refund Scheme in Ireland, Report commissioned by Repak Ltd.,

September 2008.

22

higher recycling rate for all packaging of a given material, because beverage

containers represent too small a proportion of the total tonnage of that

packaging material.

Drinks containers typically represent only about 10% of all packaging and the

recycling rate for beverage containers in general recycling systems is likely to

be higher than the recycling rate for all packaging of the same materials.

The report then alludes to the performance of Belgium in respect of the recycling of

all packaging even though this is clearly not a good comparator for reasons which

the previous extract makes clear (the targeted materials – beverage containers –

are a relatively small fraction of all packaging). In particular, the largest fraction of

the packaging stream is always paper and card, which is also an easy, and relatively

low cost, material to recycle. Consequently, in most countries, the packaging

recycling rate will be heavily influenced by capture of a material that is irrelevant to

any sensible discussion regarding DRSs.

Perchards responded to a similar criticism in a previous report, where they had

earlier suggested that the recycling rates achieved in deposit schemes were no

greater than those achieved in other countries through presenting targets related to

all packaging.

39

They responded:

We decided to make a comparison based on overall recycling rates achieved

because the Packaging and Packaging Waste Directive repealed the Directive

on containers of liquids for human consumption, reflecting that the scope of

policy has broadened out to all packaging. A further expansion and/or

restructuring of EU policy is now under consideration which may result in

targets for all products of specific materials. Thus, specific arrangements just

for beverage containers go against the trend in EU policy in this area.

GRA has challenged our line of argument, saying that the fact that deposit

systems handle only a small amount of packaging is no reason not to have a

deposit system. GRA used a medical analogy to illustrate argument – if you

have a medicine that can cure 10% of the patients, but not the other 90%, is

there a reason not to use the medicine for the 10%? However, this is not an

exact analogy, because a medicine does exist for a significant proportion of

the other 90% of packaging, namely selective collection.

Several other stakeholders have also challenged the basis of our comparison,

arguing that a clearer picture would emerge from a comparison based on

recycling rates for household packaging waste alone, or, even better, of

beverage containers between deposit states and Member States relying on

packaging recovery systems. Unfortunately, though, we were not able to

obtain data which would have enabled us to pursue this suggestion.

This argument fails to counter the possibility that it might be possible to design a

system which targets the 10% through one system and targets the remaining 90%

through another. No one advocating DRSs is necessarily arguing against ‘selective

collection’ of, for example, cardboard or wood. Equally, several successful selective

39

Perchards (2005) Study on the Progress of the Implementation and Impact of Directive 94/62/EC

on the Functioning of the Internal Market, Final Report to the European Commission, May 2005.

23

collection systems for packaging – notably the Belgian one - achieve high rates of

recycling without targeting non-bottle plastics from households.

So, the question remains open as to whether a complementary system or, when

correctly modelled, a parallel system of selective collection and DRS might be

superior to either one acting independently. The rather obvious point is that the

costs of an existing recycling system are unlikely to remain the same when

substantial quantities of generally low density beverage packaging are no longer

being collected. This question has only really been examined in one study as far as

we are aware (see later in this Section). Generally, the question regarding costs has

not been properly answered for the simple reason that the question which really

matters has not been interrogated in sufficient depth. This research attempts to

shed light upon what the implied changes in costs and benefits might actually be.

This is not to deny the possibility of high recycling rates of packaging being achieved

without DRSs. Other EU countries, such as Belgium, have achieved impressive

recycling performance without them. Based on its Fost Plus managed packaging

collection system, Belgium recycled 67% of plastic bottles in 2007 (comprising both

Polyethylene terephthalate (PET) and High-density polyethylene (HDPE)) and 97.5%

of metal packaging (steel and aluminium cans).

40

Belgium has a producer

responsibility scheme in place which is fully funded by obligated industry. It also sets

targets well above those prevailing in the UK at present, and also has near-universal

implementation of so-called ‘pay as you throw’ schemes at the household level, a

policy which the Coalition Government has clearly set itself against. One might still

argue, even in this case, that there might be room for improvement through use of a

deposit scheme where plastic bottles are concerned.

In the UK, Alupro, the aluminium industry’s trade body, says 98% of English

households have kerbside collections of aluminium cans, but capture rates can be

anywhere between 30% and 70%.

41

The ‘cans-only’ recycling rate was estimated to

be 52% in 2008.

42

Therefore, even with a ‘free to the consumer’ system (in terms of

marginal cost), and very widespread coverage, the capture rate is still much less

than is seen in countries with a DRS. This may be partly a reflection of the fact that

35% of aluminium cans are consumed away from home, in the workplace, and at

sports, leisure and travel locations, according to Alupro. Consequently, this waste

stream would be one for which DRSs may be well suited, not least since such

containers would subsequently then be less likely to arise as litter, with individuals

encouraged to recycle whilst ‘on the go’ in order to claim back their deposits.

For plastic bottles, according to RECOUP, with 18.1 million (72%) of the UK’s

26 million households receiving kerbside collections (and bring schemes also in

place), the recycling rate in 2009 was 39%. If the same average performance was

maintained, the recycling rate would increase to 55% under universal coverage by

40

Fost Plus (2007) Annual Report, http://www.fostplus.be/files/EN/8/GB_AR.pdf

41

Ends Report (2009) Defra Report Rejects the case for Bottle Deposits, January 2009

http://www.endsreport.com/index.cfm?action=report.article&articleID=20119&q=deposit%20refund

&boolean_mode=all

42

Alupro website, http://www.alupro.org.uk/facts%20and%20figures.htm, accessed May 2009.

24

kerbside services. The 55% figure appears to be well below what is routinely

achieved by DRSs, though it must be stated that the RECOUP data covers all plastic

bottles, whereas deposit schemes do not always cover 100% of all plastic bottles

(see Section 5.2 below).

4.2 Effects on Littering

There is evidence to suggest that deposit refund policies can reduce litter and even

reduce the number of lacerations caused by glass in the environment.

43

Several one-

way deposit systems were implemented with the clear objective of reducing littering

(eg. Sweden, British Columbia, California, Michigan and others, with Hawaii a more

recent example of this trend). The potential for DRSs to be effective in reducing

littering has an intuitively plausible rationale - if the deposit is significant and the

consumer does decide to litter, the possibility exists that someone else will pick up

the container to redeem the deposit. INCPEN suggests that this can worsen the litter

situation in some cases. They make the statement that:

44

Perversely, a deposit can contribute to the litter problem. There have been

reports of homeless people emptying litter bins to obtain deposit containers,

leaving other items on the street.

There is no evidence offered to support this view.

The Container Recycling Institute suggested significant reductions in littering

following the introduction of deposits in some US states (see Figure 4-5). The effects

on used beverage containers (UBCs) and on total litter are shown as being between

70-80% and 30-40%, respectively. It must be said, however, that all studies of this

nature suffer in terms of the lack of clarity about the metric used to measure the

contribution of beverage containers to total litter. It is not clear what the most

relevant indicator should be (counts, volume, hazardousness, etc.) partly because no

systematic studies have been carried out, to our knowledge, to understand the

contribution of different attributes of litter to the disamenity suffered by those who

experience litter. There is also the significant matter of cost to be considered since

clearing litter costs an ever-increasing amount of public money. Indeed, recent

figures from the Department of Communities and Local Government show that the

amount spent by local authorities in England on cleaning up litter and street

cleansing rose by almost £100M in the last year to £858M in 2009/10.

45

43

M. Douglas Baker, MD, Sally E. Moore, and Paul H. Wise, MD, PhD, MPH, "The Impact of 'Bottle Bill'

Legislation on the Incidence of Lacerations in Childhood", American Journal of Public Health, October

1986.

44

Incpen (2008) Mandatory Deposits on Packaging, May 2008.

45

http://communities.gov.uk/publications/corporate/statistics/financialstatistics202010

25

Figure 4-5: Reduction in Littering in US States Linked to Deposit Schemes

Reduction of littering in 6 US states after the introduction of container

deposit systems.

0

20

40

60

80

100

UBC litter reduced Total litter reduced

NY OR VT ME MI IA

70%~80% reduction

30%~40% reduction

• Deposit on one-way

containers reduces

UBC littering by 70-

80%

• Deposit on one-way

containers also

reduces the total

amount of littering by

30-40%

Source: Container Recycling Institute, USA

The Policy Exchange and CPRE report, Litterbugs,

46

cited a study suggesting litter in

New York State declined by 30% in the wake of the use of a DRS.

47

Over the past 25

years, according to official figures, the New York State Returnable Container Act

1983:

1. Reduced container litter by 70-80% and roadside litter by 70%;

48

2. Achieved redemption rates between 65-80%.

49

Where counter-arguments to the ‘litter reduction’ effect are put forward, these very

rarely challenge the likely reality of this effect. Indeed, the counter-arguments tend

to adopt the view that this effect is not significant because beverage containers

constitute only a small proportion of litter.

Even if one accepts the argument that this might be true, implicit in the counter-

argument appears to be an assumption that if litter ‘is there’, then the amount of it

is not a matter of any importance, or more specifically, that the reduction in the

quantity of beverage packaging in litter is of no significance. Yet none of the

literature actually offers any evidence to support this implied claim. The validity of

the implied claim is also affected by the nature of the assumption (as highlighted

above) concerning the metric used to measure ‘litter’. What the right metric might

46

Policy Exchange and CPRE (2009) Litterbugs: How to Deal with the Problem of Littering, London:

Policy Exchange, 2009.

47

New York Public Interest Research Group, www.nypirg.org/enviro/bottlebill/myths.html ; Bottle

Bill Resource Guide, www.bottlebill.org/legislation/usa/newyork.html

48

Kruman J, Bottle Bill at 25, New York State Conservationist, August 2007, New York State

Department of Environmental Conservation, www.dec.ny.gov/chemical/8500.html

49

New York State Department of Environmental Conservation Beverage Container Deposit And

Redemption Statistics: October 2004 - September 2005, 2006.

26

be has not, as discussed above, been given adequate consideration by either

advocates, or detractors, of the effects of deposit schemes.

Generally, the argument tends to be that beverage containers are a small fraction of

litter, and that therefore, eliminating this would not solve the litter problem. A

limitation of this argument is that it assumes that the relevant indicator regarding

litter is the measure used in the surveys referred to, typically, ‘counts’ of litter.

It could easily be argued that the disamenity effect of litter is as much a function of

its volume, and possibly its potential to persist, than simply the number of items (ie.

the counts). Given the relative insignificance – in volume terms – of chewing gum

and cigarette ends, it could be considered that beverage containers actually

contribute significantly to litter-related disamenity due to their contribution to the

visibility of litter.

For example, a 2008 survey by ENCAMS for INCPEN highlighted that there were

44,040 counts of cigarette butts as compared with 582 counts of beverage

containers (201 counts of ‘soft drinks cans, 188 soft drink plastic bottles, and 90

alcohol cans, 44 alcohol glass bottles, 43 drinks cartons, 9 alcohol cartons, 4

alcohol plastic bottles and 3 soft drink glass bottles (see Table 4-1)). An article by

Register suggests that 20 cigarette butts occupy a volume of 10ml.

50

The 44,040

butts would occupy, therefore, 22.02 litres. By contrast, the bottles and cans would

occupy around 163 litres in their uncompacted form. In other words, though

accounting for around 1.5% of the counts as compare with cigarette butts, they

would occupy around seven times the volume in their uncompacted form. The

plastic bottles alone (which are less readily compacted than, for example, cans)

would occupy more than three times the volume of the cigarette butts at an average

size of 330ml (which could be an underestimate). This highlights the fact that if

count data is a poor proxy for perceived impact of litter, and if volume is a more

appropriate one, then beverage packaging is a significant contributor to litter, this

being disproportionately large relative to its prevalence in surveys based only on

‘counts’.

Table 4-1: Raw Data from ENCAMS 2008 Survey for INCPEN

Type of Litter Count Type of Litter Count

Gum Staining 175,690

Drinks Cartons 43

Cigarette Ends 44,040 Comm. Warehouse Packaging 40

Sweet Wrapper 916 Other Paper Litter 38

Cigarette Related 366 Post Office Elastic Bands 34

Other Litter 335 Drinking Straws 29

Discarded Food & Drink 220 Commercial Industry

Packaging

24

Soft Drink Cans 201 Commercial Office Packaging 24

Plastic Soft Drink Bottles 188 ATM Receipt 17

50

Kathleen M. Register (2000) Cigarette Butts as Litter—Toxic as Well as Ugly, "Underwater

Naturalist", Bulletin of the American Littoral Society, Volume 25, Number 2, August 2000,

http://www.longwood.edu/cleanva/ciglitterarticle.htm

27

Fast Food Packaging 188 Lottery Related 16

Soft Drink Bottle Tops 183 Commercial Packaging 16

Snack Packaging 168 Match Boxes 14

Matches 135 Commercial Flyers 11

3D Gum 118 Other Travel Tickets 9

Tissue 93 Cartons for Alcohol 9

Alcohol Drinks Cans 90 Construction other Materials 8

Till Receipts 85 Warehousing other Materials 6

Other Materials 79 Commercial Office other

Materials

6

Carrier Bags 78 Paper Bags 4

Travel Tickets 67 Plastic Bottles for Alcohol 4

Alcoholic Bottle Tops 60 Commercial Food Other 4

Drink Cups 52 Commercial Construction Pack 4

Lolly/Ice Cream Related 51 Batteries 3

Gum Wrappers 50 Commercial other Retail 3

Discarded Newspaper 47 Soft Drink Glass Bottles 3

Glass Alcohol Bottles 44 Telephone Related 2

TOTAL 223,915

Source: ENCAMS (2009) Litter Composition Survey of England, Aug-Oct 2008, report

for Incpen, March 2009.

In their review of the Oakdene Hollins report for Defra, Perchards were critical of the

study’s examination of the effect of deposit refunds on litter even though the

principal objective of the study was, as noted by Perchards to “ascertain either of

these approaches [ie. DRS for reuse and/or for recycling of packaging] will confer

positive benefit over and above current policy approach to managing” packaging

waste.” It is difficult to understand why this would not be a legitimate area of inquiry

given the overriding objective, but Perchards state:

51

‘litter abatement was not referred to in the Defra specification, and we

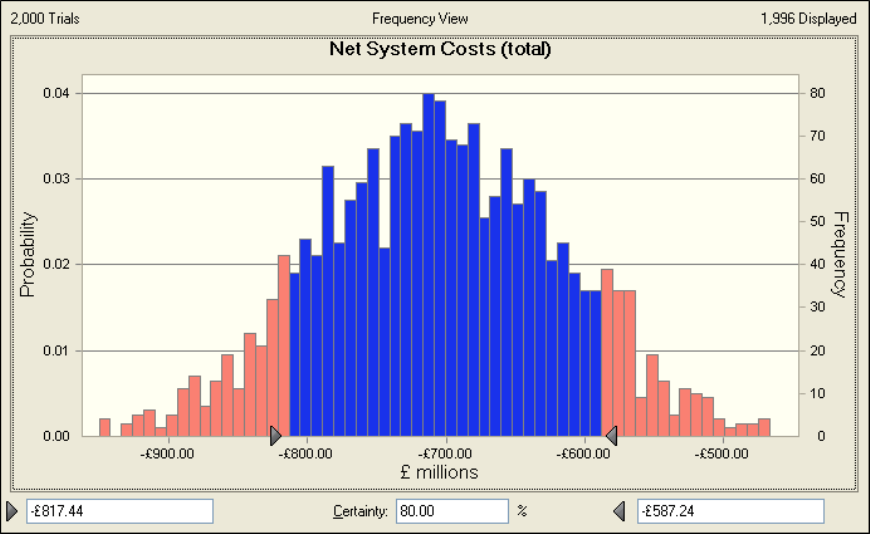

wonder why it was discussed so thoroughly’.